UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09005

Name of Registrant: Vanguard Massachusetts Tax-Exempt Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2007– November 30, 2008

Item 1: Reports to Shareholders

> For the fiscal year ended November 30, 2008, Vanguard Massachusetts Tax-Exempt Fund returned –2.72%.

> The fund’s result lagged its benchmark index but outperformed the peer-group average.

> During the 12-month period, municipal yields were extremely volatile, as spillover from the subprime credit crunch seeped into all corners of the fixed income market.

Contents | |

| |

Your Fund’s Total Returns | 1 |

President’s Letter | 2 |

Advisor’s Report | 7 |

Fund Profile | 9 |

Performance Summary | 10 |

Financial Statements | 12 |

About Your Fund’s Expenses | 27 |

Glossary | 29 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Fiscal Year Ended November 30, 2008 | | |

| Ticker | Total |

| Symbol | Return |

Vanguard Massachusetts Tax-Exempt Fund | VMATX | –2.72% |

30-Day SEC Annualized Yield: 4.23% | | |

Taxable-Equivalent Yield: 6.87%1 | | |

Barclays Capital 10 Year Municipal Bond Index | | –0.42 |

Average Massachusetts Municipal Debt Fund2 | | –8.40 |

Your Fund’s Performance at a Glance | | | | |

November 30, 2007–November 30, 2008 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard Massachusetts Tax-Exempt Fund | $10.12 | $9.44 | $0.414 | $0.000 |

1 This calculation, which assumes a typical itemized tax return, is based on the maximum federal tax rate of 35% and the maximum Commonwealth of Massachusetts income tax rate. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

2 Derived from data provided by Lipper Inc.

Note: The Barclays Capital bond indexes were formerly known as Lehman Brothers indexes. The change followed Barclays’ acquisition of Lehman’s assets in September.

1

President’s Letter

Dear Shareholder,

Municipal securities experienced unusual volatility during the past 12 months as the global credit crunch reverberated through this typically sedate segment of the fixed income markets.

During this turbulent period, Vanguard Massachusetts Tax-Exempt Fund returned –2.72% for the 12 months ended November 30. As of November 30, the fund’s yield was 4.23% (up from 3.90% a year ago). For investors in the highest income tax bracket, the taxable-equivalent yield was 6.87%.

Please note: Although the fund’s income distributions are expected to be exempt from federal and Massachusetts state income taxes, a portion of these distributions may be subject to the alternative minimum tax (AMT). However, the Massachusetts Tax-Exempt Fund currently owns no bonds that would generate income subject to the AMT.

Amid economic uncertainty, bond investors preferred Treasuries

Credit markets remained unsettled throughout the 12-month period. Bond investors grew increasingly reluctant to lend to corporations and even creditworthy states and municipalities. Instead, investors preferred the liquidity and relative safety of U.S. Treasury securities. This tendency persisted throughout the year and intensified toward the close of the period, as

2

demand for Treasuries drove their prices higher and yields lower. At the end of November, the yield of the shortest-term Treasuries neared 0%, and the yield of the 10-year note dipped below 3% for the first time in five decades, indicating a remarkable level of risk aversion for investors across the maturity spectrum.

The U.S. Federal Reserve Board responded to the credit crisis by creating new lending programs and dramatically easing monetary policy. During the year, the Fed reduced its target for the federal funds rate from 4.50% to 1.00%.

For the 12 months, the broad taxable bond market returned 1.74%; the tax-exempt bond market returned –3.61%.

Stock market weakness was sharp and broad-based

Stock markets worldwide, including the U.S. stock market, registered some of the worst 12-month performances in many years. Stocks were weak throughout the year, but declines accelerated in September as the financial crisis deepened and several large financial institutions collapsed, received government assistance, or were taken over by competitors. Market volatility spiked, and daily stock market swings of several percentage points became common.

The effects of the financial crisis, which originated in the fixed income markets, continued to hamper the broader

Market Barometer | | | |

| | Average Annual Total Returns |

| Periods Ended November 30, 2008 |

| One Year | Three Years | Five Years |

Bonds | | | |

Barclays Capital U.S. Aggregate Bond Index (Broad taxable market) | 1.74% | 4.56% | 4.10% |

Barclays Capital Municipal Bond Index | –3.61 | 1.66 | 2.58 |

Citigroup 3-Month Treasury Bill Index | 2.07 | 3.86 | 3.11 |

| | | |

| | | |

Stocks | | | |

Russell 1000 Index (Large-caps) | –38.98% | –9.10% | –1.43% |

Russell 2000 Index (Small-caps) | –37.46 | –10.13 | –1.65 |

Dow Jones Wilshire 5000 Index (Entire market) | –38.84 | –8.96 | –1.16 |

MSCI All Country World Index ex USA (International) | –48.95 | –6.84 | 3.37 |

| | | |

| | | |

CPI | | | |

Consumer Price Index | 1.07% | 2.44% | 2.86% |

3

economy. Unemployment increased, consumer confidence declined, and production levels fell. Shortly after the close of the fund’s fiscal year, the National Bureau of Economic Research (the body responsible for dating the nation’s business cycles) confirmed that the U.S. economy had been in recession since December 2007.

For the fund’s fiscal year, the broad U.S. stock market returned –38.84%. International stocks fared worse, returning –48.95%.

Credit crisis weighed on the muni market

A year ago, trouble in the fixed income market seemed largely contained to securities backed by subprime mortgages, which came under severe pressure as the housing market deteriorated. As the depth and extent of the subprime market’s weakness became clear, however, distress spread to just about every segment of the fixed income market, including municipal securities.

Consequently, the Massachusetts Tax-Exempt Fund returned –2.72% for the 12-month period, as the prices of almost all bonds that weren’t issued by the U.S. Treasury declined. Prices of longer-term bonds came under greater selling pressure during the fiscal year. As prices fell, of course, yields rose. The Massachusetts Tax-Exempt Fund ended the 12-month period with a yield that was higher than it was in the beginning of the period.

Expense Ratios1 | | |

Your Fund Compared With Its Peer Group | | |

| | Average |

| | Massachusetts |

| | Municipal |

| Fund | Debt Fund |

Massachusetts Tax-Exempt Fund | 0.13% | 1.21% |

1 The fund expense ratio shown is from the prospectus dated March 28, 2008. For the fiscal year ended November 30, 2008, the fund’s expense ratio was 0.12%. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2007.

4

Although the fund’s absolute returns were generally disappointing, the fund outperformed its peer group by a substantial margin. This difference reflects the commitment of the fund’s advisor, Vanguard Fixed Income Group, to high-quality securities and prudent portfolio management strategies, which helped protect shareholders from the worst of the market’s upheaval during the past year.

Prudent management and low costs have delivered strong returns

Just as they did during the past 12 months, the advisor’s diligent credit analysis, emphasis on high quality and liquidity, and efforts to keep the portfolio’s exposure to interest rate risk generally in line with that of its market segment have led to peer-beating returns over the past ten years.

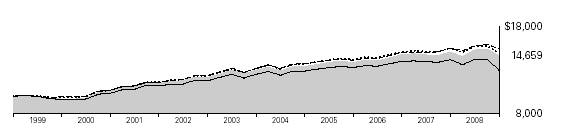

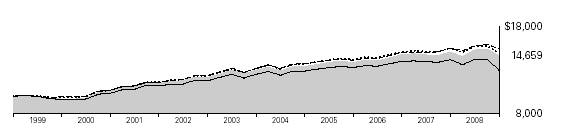

For the nearly ten-year period from the fund’s inception on December 9, 1998, to November 30, 2008, the Massachusetts Tax-Exempt Fund earned an average annual return of 3.91%, which would have transformed a hypothetical initial investment of $10,000 into $14,659. By comparison, the average return for competing funds would have produced a return of $12,971 for the same period. The Massachusetts Tax-Exempt Fund also benefited from the skill and strategy of the fund’s experienced advisor as well as Vanguard’s low costs.

Total Returns | | |

December 9, 1998,1 Through November 30, 2008 | | |

| Average Annual Return |

| | Average |

| Vanguard | Competing |

| Fund | Fund2 |

Massachusetts Tax-Exempt Fund | 3.91% | 2.64% |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1 The fund’s inception date.

2 Derived from data provided by Lipper Inc.

5

A sensible allocation plan for unsettling times

As stock markets have tumbled, and even typically staid segments of the investment markets such as municipal securities have endured high levels of volatility, the temptation to “do something” has no doubt been strong. Our experience suggests that, more often than not, such an emotional response is counterproductive.

We’ve found that a sensible approach even in turbulent markets—and it’s worth noting that, while extreme, the recent turmoil is not unprecedented—is to determine a mix of stock, bond, and money market funds appropriate for your goals and circumstances, and then stick with it through the good times and bad. A balanced, well-diversified portfolio provides you both with some protection from the stock market’s deepest swoons and the opportunity to participate in its potential for long-term growth.

The Massachusetts Tax-Exempt Fund can play an important role in such a portfolio, particularly for investors in high tax brackets. And, by keeping expenses low, your fund’s advisor enables you to capture more of the return on your investment.

As always, thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

President and Chief Executive Officer

December 15, 2008

6

Advisor’s Report

For the fiscal year ended November 30, 2008, Vanguard Massachusetts Tax-Exempt Fund returned –2.72%, as bond prices declined. The fund outperformed its peer group.

The investment environment

Credit-market problems that first surfaced in mid-2007 intensified during the past 12 months, ultimately leading to a severe disruption of the market’s normal lending and borrowing activity. By the end of the period, the Federal Reserve Board had lowered its target for the federal funds rate, a benchmark for short-term rates, to 1.00%, from 4.50% at the start. (On December 16, 2008, after the close of the fiscal period, the Fed established a rate target of 0% to 0.25%.)

As the tentacles of the subprime-loan crisis gripped the credit markets, municipal securities (and just about every other fixed income investment) underperformed U.S. Treasuries, which rallied amid a global flight to quality. Weakness in the municipal market also reflected concern about the financial strength of municipal bond insurers and forced selling by investors who had bought municipals with borrowed money. As asset prices declined, these borrowers sold municipals to meet margin requirements. The net effect was to cheapen high-quality tax-exempt bonds to extraordinarily attractive levels, particularly on an after-tax basis.

A by-product of these developments was a sharp drop in the supply of new securities. Outflows experienced by

Yields of Municipal Securities | | |

(AAA-Rated General-Obligation Issues) | | |

| November 30, | November 30, |

Maturity | 2007 | 2008 |

2 years | 3.18% | 2.13% |

5 years | 3.26 | 2.93 |

10 years | 3.62 | 4.02 |

30 years | 4.32 | 5.38 |

Source: Vanguard.

7

mutual fund companies and a lack of support from other institutional buyers made the placement of new issues difficult. As a result, issuers came to market only on an as-needed basis. Massachusetts was an exception to broader decline in new issuance. During the past 12 months, Massachusetts issuers brought $12.3 billion in new securities to market, up modestly from $11.7 billion a year ago.

Management of the fund

Vanguard Fixed Income Group has always looked through the insurance wrapper to the underlying quality of the municipal issuer. As the monoline insurers were downgraded, this long-standing approach proved beneficial, limiting our exposure to bonds that were repriced by the market to reflect their lower underlying credit quality. As usual, we maintained a quality bias in our purchases, which helped us to avoid some of the market’s pitfalls for the fiscal year.

The Massachusetts Tax-Exempt Fund’s customary focus on the market’s higher-quality securities enhanced its performance compared with that of its peer group as investors retreated from risk. During the past 12 months, the fund’s duration (a measure of interest rate sensitivity) remained within its typical range. This positioning had a modest impact on relative performance.

Outlook

Municipal governments are beginning to feel the effects of the economic slowdown. The contraction has been surprisingly swift and broad-based. Going forward, we will have to pay close attention to credit dynamics. The credit quality of issuers will become more of a focus for the market over the coming year.

We approach the new fiscal year confident that shareholders can rely on Vanguard Massachusetts Tax-Exempt Fund’s broad diversification and our experienced credit-research team to take advantage of the opportunities that arise in the municipal market. And as always, the fund’s low expense ratio enhances our clients’ share of the returns produced by these efforts.

Marlin G. Brown, Portfolio Manager Vanguard Fixed Income Group December 19, 2008

8

Massachusetts Tax-Exempt Fund

Fund Profile

As of November 30, 2008

Financial Attributes | | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Issues | 203 | 7,629 | 44,181 |

Yield3 | 4.2% | 4.8% | 4.7% |

Yield to Maturity | 4.4%4 | 4.8% | 4.7% |

Average Coupon | 4.9% | 5.0% | 5.0% |

Average Effective | | | |

Maturity | 11.1 years | 9.9 years | 12.8 years |

Average Quality | AA | AA | AA |

Average Duration | 7.0 years | 7.6 years | 8.1 years |

Expense Ratio | | | |

(11/30/2007)5 | 0.13% | — | — |

Short-Term Reserves | 4.0% | — | — |

Volatility Measures6 | |

| Fund Versus | Fund Versus |

| Comparative Index1 | Broad Index2 |

R-Squared | 0.95 | 0.98 |

Beta | 1.15 | 1.09 |

Distribution by Maturity (% of portfolio) | |

| |

Under 1 Year | 7.9% |

1–5 Years | 24.1 |

5–10 Years | 24.6 |

10–20 Years | 22.5 |

20–30 Years | 19.9 |

Over 30 Years | 1.0 |

Distribution by Credit Quality (% of portfolio) |

| |

AAA | 44.3% |

AA | 37.4 |

A | 13.0 |

BBB | 4.4 |

Other | 0.9 |

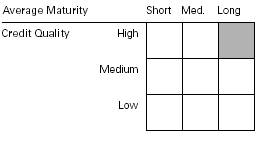

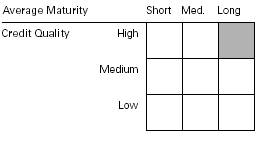

Investment Focus

1 Barclays Capital 10 Year Municipal Bond Index.

2 Barclays Capital Municipal Bond Index.

3 30-day SEC yield for the fund; index yield assumes that all bonds are called or prepaid at the earliest possible dates. See the Glossary.

4 Before expenses.

5 The expense ratio shown is from the prospectus dated March 28, 2008. For the fiscal year ended November 30, 2008, the expense ratio was 0.12%.

6 For an explanation of R-squared, beta, and other terms used here, see the Glossary.

9

Massachusetts Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: December 9, 1998–November 30, 2008

Initial Investment of $10,000

| | | |

| Average Annual Total Returns | |

| Periods Ended November 30, 2008 | Final Value |

| | | Since | of a $10,000 |

| One Year | Five Years | Inception1 | Investment |

Massachusetts Tax-Exempt Fund2 | –2.72% | 2.51% | 3.91% | $14,659 |

Barclays Capital Municipal Bond Index | –3.61 | 2.58 | 4.11 | 14,943 |

Barclays Capital 10 Year Municipal Bond Index | –0.42 | 3.24 | 4.46 | 15,451 |

Average Massachusetts Municipal Debt Fund3 | –8.40 | 0.76 | 2.64 | 12,971 |

1 Performance for the fund and its comparative standards is calculated since the fund’s inception: December 9, 1998.

2 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

3 Derived from data provided by Lipper Inc.

10

Massachusetts Tax-Exempt Fund

Fiscal-Year Total Returns (%): December 9, 1998–November 30, 2008 |

| | | | Barclays1 |

Fiscal | Capital | Income | Total | Total |

Year | Return | Return | Return | Return |

1999 | –7.5% | 4.1% | –3.4% | –0.8% |

2000 | 3.8 | 5.4 | 9.2 | 7.7 |

2001 | 3.9 | 5.0 | 8.9 | 8.2 |

2002 | 0.8 | 4.8 | 5.6 | 6.7 |

2003 | 2.2 | 4.5 | 6.7 | 6.9 |

2004 | –0.9 | 4.2 | 3.3 | 4.0 |

2005 | –0.6 | 4.1 | 3.5 | 3.0 |

2006 | 2.2 | 4.3 | 6.5 | 6.2 |

2007 | –2.0 | 4.2 | 2.2 | 3.5 |

2008 | –6.7 | 4.0 | –2.7 | –0.4 |

Average Annual Total Returns: Periods Ended September 30, 2008

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | | Since Inception |

| Inception Date | One Year | Five Years | Capital | Income | Total |

Massachusetts Tax-Exempt Fund2 | 12/09/1998 | –1.45% | 2.65% | –0.50% | 4.48% | 3.98% |

1 Barclays Capital 10 Year Municipal Bond Index.

2 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

Note: See Financial Highlights table for dividend and capital gains information.

11

Massachusetts Tax-Exempt Fund

Financial Statements

Statement of Net Assets

As of November 30, 2008

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Face | Market |

| | Maturity | Amount | Value• |

| Coupon | Date | ($000) | ($000) |

Tax-Exempt Municipal Bonds (98.9%) | | | | |

Massachusetts (94.6%) | | | | |

Beverly MA GO | 5.250% | 11/1/12 (1) | 1,925 | 2,088 |

Beverly MA GO | 5.250% | 11/1/13 (1) | 1,855 | 2,029 |

Boston MA Convention Center Rev. | 5.000% | 5/1/18 (2) | 4,975 | 5,032 |

Boston MA GO | 5.750% | 2/1/10 (Prere.) | 1,955 | 2,048 |

Boston MA GO | 5.000% | 2/1/12 (1)(Prere.) | 3,765 | 4,071 |

Boston MA GO | 5.000% | 3/1/16 | 7,295 | 7,963 |

Boston MA Housing Auth. Rev. | 5.000% | 4/1/23 (4) | 2,000 | 1,915 |

Boston MA Housing Auth. Rev. | 5.000% | 4/1/25 (4) | 5,440 | 5,115 |

Boston MA Special Obligation Rev. | | | | |

(Boston City Hosp.) | 5.000% | 8/1/17 (1) | 2,000 | 2,067 |

Boston MA Water & Sewer Comm. Rev. | 5.750% | 11/1/13 | 460 | 496 |

Chelsea MA GO | 5.500% | 6/15/09 (2) | 90 | 92 |

Foxborough MA Stadium Infrastructure | | | | |

Improvement Rev. | 5.750% | 6/1/10 (Prere.) | 2,500 | 2,674 |

Framingham MA Housing Auth. Mortgage Rev. | 6.200% | 2/20/21 | 900 | 942 |

Framingham MA Housing Auth. Mortgage Rev. | 6.350% | 2/20/32 | 2,000 | 2,025 |

Holyoke MA Gas & Electric Dept. Rev. | 5.000% | 12/1/21 (1) | 2,395 | 2,337 |

Littleton MA GO | 5.000% | 1/15/22 (1) | 1,280 | 1,264 |

Lynn MA GO | 5.250% | 6/1/13 (2) | 1,530 | 1,568 |

Massachusetts Bay Transp. Auth. Rev. | 7.000% | 3/1/09 | 2,000 | 2,029 |

Massachusetts Bay Transp. Auth. Rev. | 5.250% | 7/1/10 (Prere.) | 3,950 | 4,169 |

Massachusetts Bay Transp. Auth. Rev. | 5.250% | 7/1/10 (Prere.) | 630 | 665 |

Massachusetts Bay Transp. Auth. Rev. | 5.250% | 7/1/14 | 5,000 | 5,513 |

Massachusetts Bay Transp. Auth. Rev. | 6.200% | 3/1/16 | 5,325 | 5,901 |

Massachusetts Bay Transp. Auth. Rev. | 5.000% | 7/1/18 (Prere.) | 10,000 | 10,864 |

Massachusetts Bay Transp. Auth. Rev. | 5.500% | 7/1/22 | 5,285 | 5,624 |

Massachusetts Bay Transp. Auth. Rev. | 5.250% | 7/1/23 | 5,325 | 5,509 |

Massachusetts Bay Transp. Auth. Rev. | 5.500% | 7/1/24 | 2,500 | 2,640 |

Massachusetts Bay Transp. Auth. Rev. | 5.000% | 7/1/27 | 5,000 | 4,899 |

Massachusetts Bay Transp. Auth. Rev. | 0.000% | 7/1/29 | 1,020 | 274 |

Massachusetts Bay Transp. Auth. Rev. | 5.500% | 7/1/29 (1) | 3,000 | 3,078 |

Massachusetts Bay Transp. Auth. Rev. | 5.250% | 7/1/30 | 420 | 404 |

Massachusetts Bay Transp. Auth. Rev. | 5.250% | 7/1/34 | 2,500 | 2,431 |

Massachusetts College Building Auth. Rev. | 0.000% | 5/1/17 (10) | 3,340 | 2,157 |

Massachusetts College Building Auth. Rev. | 5.000% | 5/1/38 (12) | 15,000 | 13,451 |

Massachusetts Dev. Finance Agency | | | | |

Higher Educ. Rev. (Emerson College) | 5.000% | 1/1/18 | 2,000 | 1,943 |

Massachusetts Dev. Finance Agency | | | | |

Higher Educ. Rev. (Emerson College) | 5.000% | 1/1/20 | 3,105 | 2,901 |

12

Massachusetts Tax-Exempt Fund

| | | Face | Market |

| | Maturity | Amount | Value• |

| Coupon | Date | ($000) | ($000) |

Massachusetts Dev. Finance Agency | | | | |

Higher Educ. Rev. (Emerson College) | 5.000% | 1/1/22 | 3,985 | 3,603 |

Massachusetts Dev. Finance Agency | | | | |

Higher Educ. Rev. (Emerson College) | 5.000% | 1/1/23 | 3,710 | 3,321 |

Massachusetts Dev. Finance Agency Rev. | 5.000% | 1/1/36 (12) | 10,000 | 8,926 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Boston Univ.) | 6.000% | 5/15/29 (2) | 1,400 | 1,457 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Boston Univ.) | 5.000% | 10/1/35 (2) | 2,000 | 1,686 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Boston Univ.) | 5.375% | 5/15/39 | 1,575 | 1,408 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Boston Univ.) | 5.000% | 7/1/42 | 5,000 | 4,431 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Boston Univ.) VRDO | 0.600% | 12/1/08 LOC | 1,700 | 1,700 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Boston Univ.) VRDO | 0.600% | 12/1/08 LOC | 1,900 | 1,900 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Boston Univ.) VRDO | 0.740% | 12/1/08 LOC | 2,100 | 2,100 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(College of Pharmacy and Allied Health Services) | 5.750% | 7/1/13 (Prere.) | 1,000 | 1,143 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Deerfield Academy) | 5.000% | 10/1/28 | 1,500 | 1,468 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Draper Laboratory) | 5.750% | 9/1/25 | 5,000 | 4,910 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Jewish Philanthropies) | 5.250% | 2/1/22 | 2,750 | 2,773 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Mount Holyoke College) | 5.250% | 7/1/31 | 4,000 | 3,827 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Mount Holyoke College) | 5.000% | 7/1/36 | 5,000 | 4,503 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Neville Communities) | 6.000% | 6/20/44 | 1,500 | 1,455 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Simmons College) | 5.250% | 10/1/33 (10) | 6,000 | 4,832 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Smith College) | 5.750% | 7/1/10 (Prere.) | 1,195 | 1,275 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Smith College) | 5.750% | 7/1/10 (Prere.) | 3,000 | 3,202 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Smith College) | 5.000% | 7/1/35 | 8,000 | 7,288 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Suffolk Univ.) | 5.850% | 7/1/09 (Prere.) | 2,000 | 2,076 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Western New England College) | 5.875% | 12/1/12 (Prere.) | 600 | 657 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Western New England College) | 6.125% | 12/1/12 (Prere.) | 1,000 | 1,142 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Xaverian Brothers High School) | 5.550% | 7/1/19 | 1,000 | 895 |

Massachusetts Dev. Finance Agency Rev. | | | | |

(Xaverian Brothers High School) | 5.650% | 7/1/29 | 1,500 | 1,189 |

Massachusetts GAN | 5.125% | 12/15/10 | 1,480 | 1,498 |

Massachusetts GAN | 5.125% | 12/15/12 | 1,750 | 1,771 |

Massachusetts GAN | 5.750% | 6/15/14 | 9,665 | 10,322 |

Massachusetts GO | 5.625% | 6/1/10 (Prere.) | 1,450 | 1,534 |

Massachusetts GO | 5.500% | 11/1/11 (4) | 10,000 | 10,791 |

13

Massachusetts Tax-Exempt Fund

| | | | Face | Market |

| | Maturity | | Amount | Value• |

| Coupon | Date | | ($000) | ($000) |

Massachusetts GO | 5.000% | 8/1/12 | | 4,945 | 5,309 |

Massachusetts GO | 5.000% | 9/1/12 | | 2,170 | 2,332 |

Massachusetts GO | 5.500% | 11/1/12 | (4) | 9,000 | 9,841 |

Massachusetts GO | 5.000% | 8/1/15 | (4) | 10,000 | 10,873 |

Massachusetts GO | 5.000% | 9/1/15 | (Prere.) | 5,000 | 5,581 |

Massachusetts GO | 5.500% | 11/1/17 | | 5,000 | 5,536 |

Massachusetts GO | 5.250% | 8/1/18 | (4) | 5,060 | 5,471 |

Massachusetts GO | 5.500% | 10/1/18 | | 4,955 | 5,444 |

Massachusetts GO | 5.500% | 10/1/18 | (4) | 10,200 | 11,208 |

Massachusetts GO | 5.500% | 11/1/19 | (4) | 5,550 | 6,036 |

Massachusetts GO | 5.000% | 8/1/22 | | 4,500 | 4,537 |

Massachusetts GO | 5.250% | 8/1/22 | | 5,000 | 5,182 |

Massachusetts GO | 5.000% | 8/1/28 | | 4,535 | 4,370 |

Massachusetts GO | 5.500% | 8/1/30 | (2) | 10,000 | 10,203 |

Massachusetts GO VRDO | 0.950% | 12/1/08 | | 9,000 | 9,000 |

Massachusetts GO VRDO | 0.950% | 12/1/08 | | 1,500 | 1,500 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Baystate Medical Center) | 5.750% | 7/1/33 | | 5,000 | 4,297 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Berklee College of Music) | 5.000% | 10/1/26 | | 6,255 | 5,607 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Berklee College of Music) | 5.000% | 10/1/27 | | 5,575 | 4,979 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Boston Medical Center) | 5.000% | 7/1/19 | (1) | 50 | 43 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Boston Medical Center) | 5.000% | 7/1/28 | | 3,000 | 2,087 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Caregroup) | 5.000% | 7/1/13 | | 5,200 | 4,998 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Caregroup) | 5.125% | 7/1/33 | | 3,000 | 2,069 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Caritas Christi Obligated Group) | 6.750% | 7/1/16 | | 2,000 | 1,972 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Dana-Farber Cancer Institute) | 5.000% | 12/1/37 | | 5,000 | 3,972 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Harvard Univ.) | 6.250% | 4/1/20 | | 1,000 | 1,159 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Harvard Univ.) | 5.125% | 7/15/37 | | 9,350 | 9,043 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Lahey Clinic Medical Center) | 5.250% | 8/15/37 | | 8,000 | 6,384 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Massachusetts General Hosp.) | 6.250% | 7/1/12 | (2) | 320 | 339 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Milton Hosp.) | 5.500% | 7/1/10 | | 520 | 509 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Milton Hosp.) | 5.500% | 7/1/16 | | 1,235 | 1,128 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(MIT) | 5.250% | 7/1/21 | | 6,765 | 7,188 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(MIT) | 5.250% | 7/1/30 | | 5,000 | 5,058 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(Museum Fine) VRDO | 0.850% | 12/1/08 | | 3,800 | 3,800 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(New England Medical Center Hosp.) | 5.375% | 5/15/12 | (3)(Prere.) | 2,580 | 2,824 |

Massachusetts Health & Educ. Fac. Auth. Rev. | | | | | |

(New England Medical Center Hosp.) | 5.375% | 5/15/12 | (3)(Prere.) | 3,000 | 3,268 |

14

Massachusetts Tax-Exempt Fund

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (New England Medical Center Hosp.) | 5.375% | 5/15/13 (3) | 1,255 | 1,271 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Northeastern Univ.) | 5.000% | 10/1/33 | 3,000 | 2,608 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Partners Healthcare System) | 5.250% | 7/1/11 | 2,080 | 2,117 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Partners Healthcare System) | 5.250% | 7/1/12 | 2,850 | 2,894 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Partners Healthcare System) | 5.250% | 7/1/14 | 1,000 | 1,026 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Partners Healthcare System) | 5.250% | 7/1/15 (1) | 390 | 391 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Partners Healthcare System) | 5.250% | 7/1/15 | 3,000 | 3,078 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Partners Healthcare System) | 5.375% | 7/1/24 (1) | 1,605 | 1,523 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Simmons College) | 5.000% | 10/1/13 (3)(Prere.) | 1,090 | 1,196 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Simmons College) | 5.000% | 10/1/13 (3)(Prere.) | 1,175 | 1,289 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Sterling & Francine Clark) | 5.000% | 7/1/36 | 8,000 | 7,205 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Tufts Univ.) | 5.250% | 2/15/30 | 2,000 | 1,923 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Massachusetts Memorial | | | | |

| Health Care Inc.) | 5.250% | 7/1/14 (2) | 1,000 | 968 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Massachusetts Memorial | | | | |

| Health Care Inc.) | 6.500% | 7/1/21 | 5,000 | 4,589 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Massachusetts Memorial | | | | |

| Health Care Inc.) | 6.625% | 7/1/32 | 1,000 | 853 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Massachusetts) | 5.875% | 10/1/10 (3)(Prere.) | 4,000 | 4,336 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Massachusetts) | 5.125% | 10/1/27 (1) | 1,850 | 1,732 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Massachusetts/Worcester) | 5.125% | 10/1/11 (3)(Prere.) | 435 | 470 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Massachusetts/Worcester) | 5.250% | 10/1/12 (1)(Prere.) | 4,000 | 4,390 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Massachusetts/Worcester) | 5.125% | 10/1/23 (3) | 565 | 543 |

1 | Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Wellesley College) | 5.000% | 7/1/23 | 2,400 | 2,420 |

| Massachusetts Health & Educ. Fac. Auth. Rev. | | | | |

| (Williams College) | 5.000% | 7/1/31 | 5,000 | 4,829 |

| Massachusetts Housing Finance | | | | |

| Agency Housing Rev. | 5.125% | 12/1/28 | 4,000 | 3,613 |

| Massachusetts Muni. Wholesale Electric Co. | | | | |

| Power System Rev. | 5.000% | 7/1/10 (2)(ETM) | 815 | 838 |

| Massachusetts Muni. Wholesale Electric Co. | | | | |

| Power System Rev. | 5.250% | 7/1/12 (1) | 2,975 | 3,139 |

| Massachusetts Muni. Wholesale Electric Co. | | | | |

| Power System Rev. | 5.250% | 7/1/13 (1) | 3,255 | 3,402 |

15

Massachusetts Tax-Exempt Fund

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Muni. Wholesale Electric Co. | | | | |

| Power System Rev. | 5.250% | 7/1/16 (1) | 4,500 | 4,590 |

| Massachusetts Port Auth. Rev. | 5.750% | 7/1/10 | 1,000 | 1,055 |

| Massachusetts Port Auth. Rev. | 5.500% | 7/1/16 (4) | 10,000 | 11,042 |

| Massachusetts Port Auth. Rev. | 5.000% | 7/1/17 (4) | 9,600 | 10,209 |

| Massachusetts School Building Auth. | | | | |

| Dedicated Sales Tax Rev. | 5.000% | 8/15/18 (4) | 10,000 | 10,499 |

| Massachusetts School Building Auth. | | | | |

| Dedicated Sales Tax Rev. | 5.000% | 8/15/24 (4) | 15,000 | 15,050 |

| Massachusetts School Building Auth. | | | | |

| Dedicated Sales Tax Rev. | 5.000% | 8/15/25 (4) | 10,125 | 10,130 |

| Massachusetts School Building Auth. | | | | |

| Dedicated Sales Tax Rev. | 5.000% | 8/15/26 (4) | 8,000 | 7,807 |

| Massachusetts School Building Auth. | | | | |

| Dedicated Sales Tax Rev. | 4.500% | 8/15/27 (2) | 7,225 | 6,364 |

| Massachusetts School Building Auth. | | | | |

| Dedicated Sales Tax Rev. | 4.750% | 8/15/32 (2) | 9,360 | 8,189 |

2 | Massachusetts School Building Auth. | | | | |

| Dedicated Sales Tax Rev. TOB VRDO | 1.730% | 12/8/08 (4) | 8,175 | 8,175 |

| Massachusetts Special | | | | |

| Obligation Dedicated Tax Rev. | 5.500% | 1/1/27 (1) | 15,000 | 14,948 |

| Massachusetts Special Obligation Rev. | 5.000% | 12/15/09 (4) | 3,010 | 3,125 |

| Massachusetts Special Obligation Rev. | 5.000% | 12/15/13 (4) | 1,895 | 2,047 |

| Massachusetts Turnpike Auth. Rev. | | | | |

| (Metro. Highway System) | 0.000% | 1/1/20 (1) | 3,000 | 1,600 |

| Massachusetts Turnpike Auth. Rev. | | | | |

| (Metro. Highway System) | 0.000% | 1/1/25 (1) | 5,000 | 1,866 |

| Massachusetts Turnpike Auth. Rev. | | | | |

| (Metro. Highway System) | 0.000% | 1/1/28 (1) | 7,000 | 2,089 |

| Massachusetts Water Pollution Abatement Trust | 5.375% | 8/1/09 (Prere.) | 1,435 | 1,491 |

| Massachusetts Water Pollution Abatement Trust | 5.750% | 8/1/09 (Prere.) | 615 | 641 |

| Massachusetts Water Pollution Abatement Trust | 5.250% | 8/1/15 (Prere.) | 4,460 | 5,041 |

| Massachusetts Water Pollution Abatement Trust | 5.000% | 8/1/16 | 5,000 | 5,435 |

| Massachusetts Water Pollution Abatement Trust | 5.250% | 8/1/17 | 540 | 578 |

| Massachusetts Water Pollution Abatement Trust | 5.250% | 8/1/17 | 5,000 | 5,480 |

| Massachusetts Water Pollution Abatement Trust | 5.250% | 8/1/22 | 3,500 | 3,677 |

| Massachusetts Water Pollution Abatement Trust | 5.375% | 8/1/27 | 2,565 | 2,574 |

| Massachusetts Water Pollution Abatement Trust | 5.500% | 8/1/29 | 1,000 | 1,003 |

| Massachusetts Water Pollution Abatement Trust | 5.750% | 8/1/29 | 2,490 | 2,529 |

| Massachusetts Water Pollution Abatement Trust | 5.250% | 8/1/30 | 5,000 | 5,025 |

| Massachusetts Water Resources Auth. Rev. | 6.000% | 12/1/11 (3) | 4,120 | 4,369 |

| Massachusetts Water Resources Auth. Rev. | 5.250% | 8/1/32 (4) | 5,000 | 4,920 |

| Narragansett MA Regional School Dist. GO | 6.500% | 6/1/13 (2) | 1,210 | 1,288 |

| Newton Massachusetts School Dist. | 4.500% | 6/15/34 | 5,095 | 4,413 |

| Pittsfield MA GO | 5.000% | 4/15/18 (1) | 1,000 | 1,009 |

| Quaboag MA Regional School Dist. GO | 5.500% | 6/1/18 (4) | 1,355 | 1,415 |

| Quaboag MA Regional School Dist. GO | 5.500% | 6/1/19 (4) | 1,355 | 1,415 |

| Rail Connections Inc. Massachusetts Rev. | 5.300% | 7/1/09 (ETM) | 340 | 349 |

| Rail Connections Inc. Massachusetts Rev. | 5.400% | 7/1/09 (Prere.) | 520 | 544 |

| Rail Connections Inc. Massachusetts Rev. | 5.500% | 7/1/09 (Prere.) | 1,175 | 1,230 |

| Rail Connections Inc. Massachusetts Rev. | 6.000% | 7/1/09 (Prere.) | 570 | 598 |

| Rail Connections Inc. Massachusetts Rev. | 6.000% | 7/1/09 (Prere.) | 1,030 | 1,081 |

| Route 3 North Transp. Improvement Assn. | | | | |

| Massachusetts Lease Rev. | 5.375% | 6/15/10 (1)(Prere.) | 2,500 | 2,639 |

| Shrewsbury MA GO | 5.000% | 8/15/13 | 1,030 | 1,088 |

| Shrewsbury MA GO | 5.000% | 8/15/17 | 1,900 | 1,997 |

16

Massachusetts Tax-Exempt Fund

| | | Face | Market |

| | Maturity | Amount | Value• |

| Coupon | Date | ($000) | ($000) |

Shrewsbury MA GO | 5.000% | 8/15/18 | 3,185 | 3,274 |

Shrewsbury MA GO | 5.000% | 8/15/19 | 1,000 | 1,023 |

Tantasqua MA Regional School Dist. GO | 5.125% | 8/15/10 (4)(Prere.) | 2,575 | 2,746 |

Univ. of Massachusetts Building Auth. | | | | |

Refunding Rev. | 6.875% | 5/1/14 (ETM) | 1,000 | 1,157 |

Univ. of Massachusetts Building Auth. Rev. | 5.125% | 11/1/10 (Prere.) | 1,135 | 1,205 |

Univ. of Massachusetts Building Auth. Rev. | 5.500% | 11/1/10 (2)(Prere.) | 2,600 | 2,778 |

Univ. of Massachusetts Building Auth. Rev. | 5.500% | 11/1/10 (2)(Prere.) | 2,400 | 2,564 |

Univ. of Massachusetts Health & Educ. | | | | |

Fac. Auth. Rev. | 5.000% | 11/1/21 (2) | 5,680 | 5,664 |

Univ. of Massachusetts Health & Educ. | | | | |

Fac. Auth. Rev. | 5.000% | 11/1/22 (2) | 2,695 | 2,660 |

Univ. of Massachusetts Health & Educ. | | | | |

Fac. Auth. Rev. | 5.000% | 11/1/23 (2) | 1,760 | 1,683 |

Univ. of Massachusetts Health & Educ. | | | | |

Fac. Auth. Rev. | 5.000% | 11/1/24 (2) | 1,980 | 1,872 |

Univ. of Massachusetts Health & Educ. | | | | |

Fac. Auth. Rev. | 5.000% | 11/1/25 (2) | 1,990 | 1,862 |

Westfield MA GO | 5.000% | 5/1/10 (3)(Prere.) | 1,715 | 1,809 |

Worcester MA GO | 5.500% | 10/1/09 (1) | 1,000 | 1,025 |

Worcester MA GO | 5.750% | 4/1/10 (4)(Prere.) | 1,000 | 1,063 |

Worcester MA GO | 5.625% | 8/15/10 (3)(Prere.) | 1,640 | 1,763 |

Worcester MA GO | 5.500% | 8/15/14 (1) | 1,445 | 1,487 |

Worcester MA GO | 5.500% | 8/15/15 (1) | 1,190 | 1,219 |

Worcester MA GO | 5.250% | 8/15/21 (1) | 1,500 | 1,435 |

| | | | 671,954 |

Puerto Rico (3.7%) | | | | |

Puerto Rico Electric Power Auth. Rev. | 5.500% | 7/1/17 (1) | 5,000 | 4,826 |

Puerto Rico GO | 5.500% | 7/1/19 (2) | 2,500 | 2,339 |

Puerto Rico GO | 5.500% | 7/1/22 (3) | 3,500 | 3,120 |

Puerto Rico Highway & Transp. Auth. Rev. | 5.500% | 7/1/12 (3) | 5,080 | 5,135 |

Puerto Rico Public Buildings Auth. Govt. Fac. Rev. | 5.250% | 7/1/12 (Prere.) | 1,100 | 1,190 |

Puerto Rico Public Buildings Auth. Govt. Fac. Rev. | 5.250% | 7/1/36 | 400 | 301 |

Puerto Rico Public Finance Corp. | 5.500% | 2/1/12 (Prere.) | 2,015 | 2,182 |

Puerto Rico Public Finance Corp. | 5.500% | 2/1/12 (Prere.) | 665 | 720 |

Puerto Rico Public Finance Corp. | 5.125% | 6/1/24 (2)(ETM) | 2,155 | 2,166 |

Puerto Rico Public Finance Corp. | 6.000% | 8/1/26 (4)(ETM) | 4,000 | 4,445 |

| | | | 26,424 |

Virgin Islands (0.3%) | | | | |

Virgin Islands Public Finance Auth. Rev. | 5.000% | 10/1/09 | 1,450 | 1,463 |

Virgin Islands Public Finance Auth. Rev. | 5.250% | 10/1/20 | 1,000 | 849 |

| | | | 2,312 |

Guam (0.3%) | | | | |

Guam Econ. Dev. & Comm. Auth. Rev. | 5.250% | 6/1/32 | 2,420 | 1,700 |

Total Tax-Exempt Municipal Bonds (Cost $735,653) | | | | 702,390 |

Other Assets and Liabilities (1.1%) | | | | |

Other Assets | | | | 11,580 |

Liabilities | | | | (3,700) |

| | | | 7,880 |

Net Assets (100%) | | | | |

Applicable to 75,231,578 outstanding $.001 par value shares of | | | |

beneficial interest (unlimited authorization) | | | | 710,270 |

Net Asset Value Per Share | | | | $9.44 |

17

Massachusetts Tax-Exempt Fund

At November 30, 2008, net assets consisted of: | |

| Amount |

| ($000) |

| |

| |

Paid-in Capital | 754,787 |

Undistributed Net Investment Income | — |

Accumulated Net Realized Losses | (10,520) |

Unrealized Appreciation (Depreciation) | |

Investment Securities | (33,263) |

Futures Contracts | (734) |

Net Assets | 710,270 |

• See Note A in Notes to Financial Statements.

1 Securities with a value of $1,512,000 have been segregated as initial margin for open futures contracts.

2 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2008, the value of this security represented 1.2% of net assets.

See accompanying Notes, which are an integral part of the Financial Statements.

A key to abbreviations and other references follows the Statement of Net Assets.

18

Massachusetts Tax-Exempt Fund

Key to Abbreviations |

|

|

ARS—Auction Rate Security. |

BAN—Bond Anticipation Note. |

COP—Certificate of Participation. |

CP—Commercial Paper. |

FR—Floating Rate. |

GAN—Grant Anticipation Note. |

GO—General Obligation Bond. |

IDA—Industrial Development Authority Bond. |

IDR—Industrial Development Revenue Bond. |

PCR—Pollution Control Revenue Bond. |

PUT—Put Option Obligation. |

RAN—Revenue Anticipation Note. |

TAN—Tax Anticipation Note. |

TOB—Tender Option Bond. |

TRAN—Tax Revenue Anticipation Note. |

UFSD—Union Free School District. |

USD—United School District. |

VRDO—Variable Rate Demand Obligation. |

(ETM)—Escrowed to Maturity. |

(Prere.)—Prerefunded. |

|

Scheduled principal and interest payments are guaranteed by: |

(1) MBIA (Municipal Bond Insurance Association). |

(2) AMBAC (Ambac Assurance Corporation). |

(3) FGIC (Financial Guaranty Insurance Company). |

(4) FSA (Financial Security Assurance). |

(5) BIGI (Bond Investors Guaranty Insurance). |

(6) Connie Lee Inc. |

(7) FHA (Federal Housing Authority). |

(8) CapMAC (Capital Markets Assurance Corporation). |

(9) American Capital Access Financial Guaranty Corporation. |

(10) XL Capital Assurance Inc. |

(11) CIFG (CDC IXIS Financial Guaranty). |

(12) Assured Guaranty Corp. |

(13) National Indemnity Co. (Berkshire Hathaway). |

The insurance does not guarantee the market value of the municipal bonds. |

|

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit. |

19

Massachusetts Tax-Exempt Fund

Statement of Operations

| Year Ended |

| November 30, 2008 |

| ($000) |

Investment Income | |

Income | |

Interest | 31,600 |

Total Income | 31,600 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 70 |

Management and Administrative | 608 |

Marketing and Distribution | 193 |

Custodian Fees | 7 |

Auditing Fees | 23 |

Shareholders’ Reports | 7 |

Trustees’ Fees and Expenses | 1 |

Total Expenses | 909 |

Expenses Paid Indirectly | (5) |

Net Expenses | 904 |

Net Investment Income | 30,696 |

Realized Net Gain (Loss) | |

Investment Securities Sold | (4,784) |

Futures Contracts | (1,642) |

Realized Net Gain (Loss) | (6,426) |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities | (45,982) |

Futures Contracts | (737) |

Change in Unrealized Appreciation (Depreciation) | (46,719) |

Net Increase (Decrease) in Net Assets Resulting from Operations | (22,449) |

See accompanying Notes, which are an integral part of the Financial Statements.

20

Massachusetts Tax-Exempt Fund

Statement of Changes in Net Assets

| Year Ended November 30, |

| 2008 | 2007 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 30,696 | 26,518 |

Realized Net Gain (Loss) | (6,426) | (1,967) |

Change in Unrealized Appreciation (Depreciation) | (46,719) | (10,000) |

Net Increase (Decrease) in Net Assets Resulting from Operations | (22,449) | 14,551 |

Distributions | | |

Net Investment Income | (30,696) | (26,518) |

Realized Capital Gain | — | — |

Total Distributions | (30,696) | (26,518) |

Capital Share Transactions | | |

Issued | 300,403 | 235,045 |

Issued in Lieu of Cash Distributions | 22,957 | 19,084 |

Redeemed | (244,024) | (131,445) |

Net Increase (Decrease) from Capital Share Transactions | 79,336 | 122,684 |

Total Increase (Decrease) | 26,191 | 110,717 |

Net Assets | | |

Beginning of Period | 684,079 | 573,362 |

End of Period | 710,270 | 684,079 |

See accompanying Notes, which are an integral part of the Financial Statements.

21

Massachusetts Tax-Exempt Fund

Financial Highlights

| | | |

For a Share Outstanding | Year Ended November 30, |

Throughout Each Period | 2008 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, Beginning of Period | $10.12 | $10.33 | $10.12 | $10.18 | $10.27 |

Investment Operations | | | | | |

Net Investment Income | .414 | .424 | .427 | .417 | .418 |

Net Realized and Unrealized Gain (Loss) | | | | | |

on Investments | (.680) | (.210) | .218 | (.060) | (.090) |

Total from Investment Operations | (.266) | .214 | .645 | .357 | .328 |

Distributions | | | | | |

Dividends from Net Investment Income | (.414) | (.424) | (.427) | (.417) | (.418) |

Distributions from Realized Capital Gains | — | — | (.008) | — | — |

Total Distributions | (.414) | (.424) | (.435) | (.417) | (.418) |

Net Asset Value, End of Period | $9.44 | $10.12 | $10.33 | $10.12 | $10.18 |

| | | | | |

| | | | | |

Total Return1 | –2.72% | 2.15% | 6.54% | 3.53% | 3.25% |

| | | | | |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $710 | $684 | $573 | $497 | $450 |

Ratio of Total Expenses to | | | | | |

Average Net Assets | 0.12% | 0.13% | 0.14% | 0.14% | 0.14% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 4.17% | 4.19% | 4.22% | 4.07% | 4.08% |

Portfolio Turnover Rate | 29% | 16% | 5% | 9% | 7% |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

See accompanying Notes, which are an integral part of the Financial Statements.

22

Massachusetts Tax-Exempt Fund

Notes to Financial Statements

Vanguard Massachusetts Tax-Exempt Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the Commonwealth of Massachusetts.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Bonds, and temporary cash investments acquired over 60 days to maturity, are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value.

2. Futures Contracts: The fund uses futures contracts to invest in fixed income asset classes with greater efficiency and lower cost than is possible through direct investment, to add value when these instruments are attractively priced, or to adjust sensitivity to changes in interest rates. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of bonds held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued based upon their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken on federal income tax returns for all open tax years (tax years ended November 30, 2005–2008), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month. Annual distributions from realized capital gains, if any, are recorded on the ex-dividend date.

5. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

23

Massachusetts Tax-Exempt Fund

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At November 30, 2008, the fund had contributed capital of $73,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.07% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. The fund’s custodian bank has agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the year ended November 30, 2008, custodian fee offset arrangements reduced the fund’s expenses by $5,000 (an annual rate of 0.00% of average net assets).

D. Capital gain distributions are determined on a tax basis and may differ from realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when gains or losses are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future.

For tax purposes, the fund had available realized losses of $9,381,000 to offset future net capital gains of $99,000 through November 30, 2014, $1,612,000 through November 30, 2015, and $7,670,000 through November 30, 2016.

The fund had realized losses totaling $1,873,000 through November 30, 2008, which are deferred for tax purposes and reduce the amount of tax-basis unrealized appreciation on investment securities.

At November 30, 2008, the cost of investment securities for tax purposes was $737,526,000. Net unrealized depreciation of investment securities for tax purposes was $35,136,000, consisting of unrealized gains of $6,031,000 on securities that had risen in value since their purchase and $41,167,000 in unrealized losses on securities that had fallen in value since their purchase.

At November 30, 2008, the aggregate settlement value of open futures contracts expiring in March 2009 and the related unrealized appreciation (depreciation) were:

| | | ($000) |

| Number of | Aggregate | Unrealized |

| Long (Short) | Settlement | Appreciation |

Futures Contracts | Contracts | Value | (Depreciation) |

10-Year U.S. Treasury Note | (160) | 19,355 | (440) |

30-Year U.S. Treasury Bond | (71) | 9,051 | (294) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

E. During the year ended November 30, 2008, the fund purchased $290,917,000 of investment securities and sold $205,672,000 of investment securities, other than temporary cash investments.

24

Massachusetts Tax-Exempt Fund

F. Capital shares issued and redeemed were:

| Year Ended November 30, |

| 2008 | 2007 |

| Shares | Shares |

| (000) | (000) |

Issued | 30,292 | 23,210 |

Issued in Lieu of Cash Distributions | 2,333 | 1,887 |

Redeemed | (24,982) | (13,012) |

Net Increase (Decrease) in Shares Outstanding | 7,643 | 12,085 |

G. In September 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 157 (“FAS 157”), “Fair Value Measurements.” FAS 157 establishes a framework for measuring fair value and expands disclosures about fair value measurements in financial statements.

The various inputs that may be used to determine the value of the fund’s investments are summarized in three broad levels. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the fund’s investments as of November 30, 2008, based on the inputs used to value them:

| Investments | Futures |

| in Securities | Contracts |

Valuation Inputs | ($000) | ($000) |

Level 1—Quoted Prices | — | (734) |

Level 2—Other Significant Observable Inputs | 702,390 | — |

Level 3—Significant Unobservable Inputs | — | — |

Total | 702,390 | (734) |

25

Report of Independent Registered

Public Accounting Firm

To the Trustees and Shareholders of Vanguard Massachusetts Tax-Exempt Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Massachusetts Tax-Exempt Fund (the “Fund”) at November 30, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at November 30, 2008 by correspondence with the custodian and broker, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

January 20, 2009

Special 2008 tax information (unaudited) for Vanguard Massachusetts Tax-Exempt Fund

This information for the fiscal year ended November 30, 2008, is included pursuant to provisions of the Internal Revenue Code.

The fund designates 100% of its income dividends as exempt-interest dividends.

26

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended November 30, 2008 | | | |

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

Massachusetts Tax-Exempt Fund | 5/31/2008 | 11/30/2008 | Period1 |

Based on Actual Fund Return | $1,000.00 | $958.49 | $0.64 |

Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,024.42 | 0.66 |

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include the account service fee described in the prospectus. If such a fee were applied to your account, your costs would be higher. Your fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

1 The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period was 0.13%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

27

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

28

Glossary

Average Coupon. The average interest rate paid on the fixed income securities held by a fund. It is expressed as a percentage of face value.

Average Duration. An estimate of how much the value of the bonds held by a fund will fluctuate in response to a change in interest rates. To see how the value could change, multiply the average duration by the change in rates. If interest rates rise by 1 percentage point, the value of the bonds in a fund with an average duration of five years would decline by about 5%. If rates decrease by a percentage point, the value would rise by 5%.

Average Effective Maturity. The average length of time until fixed income securities held by a fund reach maturity and are repaid, taking into consideration the possibility that the issuer may call the bond before its maturity date. The figure reflects the proportion of fund assets represented by each security; it also reflects any futures contracts held. In general, the longer the average effective maturity, the more a fund’s share price will fluctuate in response to changes in market interest rates.

Average Quality. An indicator of credit risk, this figure is the average of the ratings assigned to a fund’s holdings by credit-rating agencies. The agencies make their judgment after appraising an issuer’s ability to meet its obligations. Quality is graded on a scale, with AAA indicating the most creditworthy bond issuers.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

29

Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (in the case of bonds) or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Yield to Maturity. The rate of return an investor would receive if the fixed income securities held by a fund were held to their maturity dates.

30

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 156 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at www.vanguard.com.

Chairman of the Board and Interested Trustee

John J. Brennan1

Born 1954. Trustee Since May 1987. Chairman of the Board. Principal Occupation(s) During the Past Five Years: Chairman of the Board and Director/Trustee of The Vanguard Group, Inc., and of each of the investment companies served by The Vanguard Group; Chief Executive Officer and President of The Vanguard Group and of each of the investment companies served by The Vanguard Group (1996–2008).

Independent Trustees

Charles D. Ellis

Born 1937. Trustee Since January 2001. Principal Occupation(s) During the Past Five Years: Applecore Partners (pro bono ventures in education); Senior Advisor to Greenwich Associates (international business strategy consulting); Successor Trustee of Yale University; Overseer of the Stern School of Business at New York University; Trustee of the Whitehead Institute for Biomedical Research.

Emerson U. Fullwood

Born 1948. Trustee Since January 2008. Principal Occupation(s) During the Past Five Years: Retired Executive Chief Staff and Marketing Officer for North America and Corporate Vice President of Xerox Corporation (photocopiers and printers); Director of SPX Corporation (multi-industry manufacturing), of the United Way of Rochester, and of the Boy Scouts of America.

Rajiv L. Gupta

Born 1945. Trustee Since December 2001.2 Principal Occupation(s) During the Past Five Years: Chairman, President, and Chief Executive Officer of Rohm and Haas Co. (chemicals); Board Member of the American Chemistry Council; Director of Tyco International, Ltd. (diversified manufacturing and services), since 2005.

Amy Gutmann

Born 1949. Trustee Since June 2006. Principal

Occupation(s) During the Past Five Years: President of the University of Pennsylvania since 2004; Professor in the School of Arts and Sciences, Annenberg School for Communication, and Graduate School of Education of the University of Pennsylvania since 2004; Provost (2001–2004) and Laurance S. Rockefeller Professor of Politics and the University Center for Human Values (1990–2004), Princeton University; Director of Carnegie Corporation of New York since 2005 and of Schuylkill River Development Corporation and Greater Philadelphia Chamber of Commerce since 2004; Trustee of the National Constitution Center since 2007.

JoAnn Heffernan Heisen

Born 1950. Trustee Since July 1998. Principal Occupation(s) During the Past Five Years: Retired Corporate Vice President, Chief Global Diversity Officer, and Member of the Executive Committee of Johnson & Johnson (pharmaceuticals/consumer products); Vice President and Chief Information Officer (1997–2005) of Johnson & Johnson; Director of the University Medical Center at Princeton and Women’s Research and Education Institute.

André F. Perold

Born 1952. Trustee Since December 2004. Principal Occupation(s) During the Past Five Years: George Gund Professor of Finance and Banking, Senior Associate Dean, and Director of Faculty Recruiting, Harvard Business School; Director and Chairman of UNX, Inc. (equities trading firm); Chair of the Investment Committee of HighVista Strategies LLC (private investment firm) since 2005.

Alfred M. Rankin, Jr.

Born 1941. Trustee Since January 1993. Principal Occupation(s) During the Past Five Years: Chairman, President, Chief Executive Officer, and Director of NACCO Industries, Inc. (forklift trucks/housewares/ lignite); Director of Goodrich Corporation (industrial products/aircraft systems and services).

J. Lawrence Wilson

Born 1936. Trustee Since April 1985. Principal Occupation(s) During the Past Five Years: Retired Chairman and Chief Executive Officer of Rohm and Haas Co. (chemicals); Director of Cummins Inc. (diesel engines) and AmerisourceBergen Corp. (pharmaceutical distribution); Trustee of Vanderbilt University and of Culver Educational Foundation.

Executive Officers

Thomas J. Higgins1

Born 1957. Chief Financial Officer Since September 2008. Principal Occupation(s) During the Past Five Years: Principal of The Vanguard Group, Inc.; Chief Financial Officer of each of the investment companies served by The Vanguard Group since 2008; Treasurer of each of the investment companies served by The Vanguard Group (1998–2008).

Kathryn J. Hyatt1

Born 1955. Treasurer Since November 2008. Principal Occupation(s) During the Past Five Years: Principal of The Vanguard Group, Inc.; Treasurer of each of the investment companies served by The Vanguard Group since 2008; Assistant Treasurer of each of the investment companies served by The Vanguard Group (1988–2008).

F. William McNabb III1

Born 1957. Chief Executive Officer Since August 2008. President Since March 2008. Principal Occupation(s) During the Past Five Years: Chief Executive Officer, Director, and President of The Vanguard Group, Inc., since 2008; Chief Executive Officer and President of each of the investment companies served by The Vanguard Group since 2008; Director of Vanguard Marketing Corporation; Managing Director of The Vanguard Group (1995–2008).

Heidi Stam1

Born 1956. Secretary Since July 2005. Principal Occupation(s) During the Past Five Years: Managing Director of The Vanguard Group, Inc., since 2006; General Counsel of The Vanguard Group since 2005; Secretary of The Vanguard Group and of each of the investment companies served by The Vanguard Group since 2005; Director and Senior Vice President of Vanguard Marketing Corporation since 2005; Principal of The Vanguard Group (1997–2006).

Vanguard Senior Management Team |

| |

| |

R. Gregory Barton | James M. Norris |

Mortimer J. Buckley | Ralph K. Packard |

Kathleen C. Gubanich | Glenn W. Reed |

Paul A. Heller | George U. Sauter |

Michael S. Miller | |

Founder

John C. Bogle

Chairman and Chief Executive Officer, 1974–1996

1 These individuals are “interested persons” as defined in the Investment Company Act of 1940.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

P.O. Box 2600

Valley Forge, PA 19482-2600

Connect with Vanguard® > www.vanguard.com

Fund Information > 800-662-7447 | All comparative mutual fund data are from Lipper Inc. |

| or Morningstar, Inc., unless otherwise noted. |

Direct Investor Account Services > 800-662-2739 | |

| You can obtain a free copy of Vanguard’s proxy voting |

Institutional Investor Services > 800-523-1036 | guidelines by visiting our website, www.vanguard.com, |

| and searching for “proxy voting guidelines,” or by |

Text Telephone for People | calling Vanguard at 800-662-2739. The guidelines are |

With Hearing Impairment > 800-952-3335 | also available from the SEC’s website, www.sec.gov. |

| In addition, you may obtain a free report on how your |

| fund voted the proxies for securities it owned during |

| the 12 months ended June 30. To get the report, visit |

This material may be used in conjunction | either www.vanguard.com or www.sec.gov. |

with the offering of shares of any Vanguard | |

fund only if preceded or accompanied by | |

the fund’s current prospectus. | |

| |

| You can review and copy information about your fund |

| at the SEC’s Public Reference Room in Washington, D.C. |

| To find out more about this public service, call the SEC |

The funds or securities referred to herein are not | at 202-551-8090. Information about your fund is also |

sponsored, endorsed, or promoted by MSCI, and MSCI | available on the SEC’s website, and you can receive |

bears no liability with respect to any such funds or | copies of this information, for a fee, by sending a |

securities. For any such funds or securities, the | request in either of two ways: via e-mail addressed to |

prospectus or the Statement of Additional Information | publicinfo@sec.gov or via regular mail addressed to the |

contains a more detailed description of the limited | Public Reference Section, Securities and Exchange |

relationship MSCI has with The Vanguard Group and | Commission, Washington, DC 20549-0102. |

any related funds. | |

| |

Russell is a trademark of The Frank Russell Company. | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| © 2009 The Vanguard Group, Inc. |

| All rights reserved. |

| Vanguard Marketing Corporation, Distributor. |

| |

| Q1680 012009 |

Item 2: Code of Ethics. The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Code of Ethics was amended during the reporting period covered by this report to make certain technical, non-material changes.

Item 3: Audit Committee Financial Expert. The following members of the Audit Committee have been determined by the Registrant’s Board of Trustees to be Audit Committee Financial Experts serving on its Audit Committee, and to be independent: Charles D. Ellis, Rajiv L. Gupta, JoAnn Heffernan Heisen, André F. Perold, Alfred M. Rankin, Jr., and J. Lawrence Wilson.

Item 4: Principal Accountant Fees and Services.

(a) Audit Fees.

Audit Fees of the Registrant

Fiscal Year Ended November 30, 2008: $23,000

Fiscal Year Ended November 30, 2007: $22,000

Aggregate Audit Fees of Registered Investment Companies in the Vanguard Group.

Fiscal Year Ended November 30, 2008: $3,055,590

Fiscal Year Ended November 30, 2007: $2,835,320

(b) Audit-Related Fees.

Fiscal Year Ended November 30, 2008: $626,240

Fiscal Year Ended November 30, 2007: $630,400