UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-09037

Nuveen Investment Trust III

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: September 30

Date of reporting period: March 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

Item 1. Reports to Stockholders.

NUVEEN INVESTMENTS MUTUAL FUNDS

| | |

| | |

Semi-Annual Report dated March 31, 2008 | | Attractive Monthly Income and Portfolio Diversification Potential |

Nuveen Investments

Taxable Bond Funds

Nuveen Short Duration Bond Fund

Nuveen Multi-Strategy Income Fund

Nuveen High Yield Bond Fund

NOW YOU CAN RECEIVE YOUR

NUVEEN INVESTMENTS FUND REPORTS FASTER.

NO MORE WAITING.

SIGN UP TODAY TO RECEIVE NUVEEN INVESTMENTS FUND INFORMATION BY E-MAIL.

It only takes a minute to sign up for E-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Investments Fund information is ready — no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report, and save it on your computer if your wish.

IT’S FAST, EASY & FREE:

www.investordelivery.com

if you get your Nuveen Investments Fund dividends and statements from your financial advisor or brokerage account.

(Be sure to have the address sheet that accompanied this report handy. You’ll need it to complete the enrollment process.)

OR

www.nuveen.com/accountaccess

if you get your Nuveen Investments Fund dividends and statements directly from Nuveen Investments.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

“No one knows what the future will bring, which is why we think a well balanced portfolio that is structured and carefully monitored with the help of an investment professional is an important component in achieving your long term financial goals.”

Dear Shareholder:

I am pleased to report that over the six-month period covered by this report your Fund continued to provide you with attractive monthly income. For more details about the performance and management strategy of your Fund, please read the Portfolio Manager’s Comments and Fund Spotlight sections of this report.

With the recent volatility in the stock market, many have begun to wonder which way the market is headed, and whether they need to adjust their holdings of investments. No one knows what the future will bring, which is why we think a well-balanced portfolio that is structured and carefully monitored with the help of an investment professional is an important component in achieving your long term financial goals. A well diversified portfolio may actually help to reduce your overall investment risk, and we believe that investments like your Nuveen Investments Fund can be important building blocks in a portfolio crafted to perform well through a variety of market conditions.

As you look through this report, be sure to review the inside front cover. This contains information on how you can receive future Fund reports and other Fund information faster by using e-mails and the internet. You may also help your Fund reduce expenses. Sign up is quick and easy – just follow the step-by-step instructions.

At Nuveen Investments, our mission continues to be to assist you and your financial advisor by offering investment services and products that can help you to secure your financial objectives. We are grateful that you have chosen us as a partner as you pursue your financial goals, and we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Timothy R. Schwertfeger

Chairman of the Board

May 15, 2008

Semi-Annual Report Page 1

Portfolio Manager’s Comments for the Nuveen Short Duration Bond Fund,

the Nuveen Multi-Strategy Income Fund1 and the Nuveen High Yield Bond Fund

These Funds feature portfolio management by the Taxable Fixed Income group of Nuveen Asset Management. We recently spoke with Andrew Stenwall, Chief Investment Officer and Co-Director of Taxable Fixed Income at Nuveen Asset Management, and the Funds’ portfolio manager, about the economic environment, performance and management of the Funds during the six-month reporting period ended March 31, 2008.

How did the Funds perform during the six-month period ended March 31, 2008?

The table on page three provides performance information for the Funds’ Class A shares for the six-month, one-year, and since inception periods ended March 31, 2008. Each Fund’s returns are compared with a comparative index and Lipper peer fund category.

The six-month total returns on net asset value (NAV) of the Nuveen Short Duration Bond Fund and the Nuveen Multi-Strategy Income Fund underperformed their respective unmanaged benchmark indexes and exceeded their Lipper peer group averages. The Nuveen High Yield Bond Fund outperformed both its unmanaged benchmark index and Lipper peer group average during the reporting period.

What strategies were used to manage the Funds during the period? How did these strategies influence performance?

We continued to manage the Nuveen Short Duration Bond Fund and the Nuveen Multi-Strategy Income Fund with similar strategies. Both Funds invested principally in U.S. government securities; mortgage-related securities issued by governments, or their agencies, or instrumentalities; corporate debt securities; foreign debt securities; and asset-backed securities. In addition, in an effort to enhance returns and manage risk, both Funds employed a variety of strategies that might at various times include the use of futures, options, swaps, and other derivative instruments to create debt or foreign currency exposures, with each position designed to take advantage of the current global economic environment and the expected relative performance of different sectors of the fixed-income market.

Our exposure to U.S. Treasury securities, which performed well during the six-month period, provided the portfolios with their largest component of absolute return. The Funds also benefited from a relative lack of exposure to securities issued by U.S. government agencies, and from some foreign currency positions as the U.S. dollar weakened. In addition, the Funds exposure to U.K. debt did relatively well as the Bank of England cut rates as expected in early December – although not as much or as quickly as some had hoped.

On the negative side, one of the largest detractors to relative performance came from the Funds’ exposure to foreign interest rates and credit markets. As one example, our long exposure to Brazilian government and corporate debt lost ground as Brazilian futures unexpectedly rose sharply, implying potential rate hikes as inflationary pressures grew faster than anticipated. Inflation concerns were also an issue in New Zealand, where our two- and ten-year positions did not perform as anticipated.

Later in the period, the Funds’ net exposure to high yield bonds, which significantly underperformed U.S. Treasuries, was a large detractor to relative performance.

Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The views expressed herein represent those of the portfolio manager as of the date of this report and are subject to change at any time, based on market conditions and other factors. The Funds disclaim any obligation to advise shareholders of such changes.

| 1 | Effective August 1, 2007, the Nuveen Core Bond Fund changed its name to Nuveen Multi-Strategy Income Fund to better reflect the investment process of the manager. There have been no changes in the Fund’s investment objectives, policies or portfolio management personnel. |

Semi-Annual Report Page 2

Class A Shares—

Total Returns as of 3/31/08

| | | | | | |

| | | | | Average Annual |

| | | Cumulative

6-Month | | 1-Year | | Since

Inception

(12/20/2004) |

Nuveen Short Duration Bond Fund

A Shares at NAV

A Shares at Offer | | 3.73% 1.63% | | 6.70% 4.59% | | 4.00% 3.36% |

Lipper Short Investment Grade Debt Funds Index2 | | 1.33% | | 3.46% | | 3.40% |

Citigroup 1-3 Year Treasury Index3 | | 5.46% | | 9.01% | | 4.82% |

| | | |

Nuveen Multi-Strategy

Income Fund

A Shares at NAV

A Shares at Offer | | 3.26% -0.61% | | 5.29% 1.32% | | 3.77% 2.57% |

Lipper Intermediate Investment Grade Debt Funds Index4 | | 2.20% | | 4.01% | | 3.77% |

Citigroup Broad Investment Grade Bond Index5 | | 5.86% | | 8.41% | | 5.33% |

| | | |

Nuveen High Yield Bond Fund

A Shares at NAV

A Shares at Offer | | -2.89% -7.48% | | -1.48% -6.17% | | 4.53% 3.00% |

Lipper High Current Yield

Funds Index6 | | -4.65% | | -4.05% | | 3.57% |

Citigroup High Yield BB/B Index7 | | -3.11% | | -2.31% | | 4.34% |

Returns quoted represent past performance, which is no guarantee of future results. Returns at NAV would be lower if the sales charge were included. Returns less than one year are cumulative. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Maximum sales charges for Class A shares of each Fund are 2.00% for Nuveen Short Duration Bond Fund, 3.75% for Nuveen Multi-Strategy Income Fund, and 4.75% for Nuveen High Yield Bond Fund. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. For the most recent month-end performance, visit www.nuveen.com or call (800) 257-8787.

Please see each Fund’s Spotlight Page later in this report for more complete performance data and expense ratios.

Despite no direct exposure to sub-prime mortgages, the Funds’ were relatively overweight in higher-coupon 30-year fixed mortgage-backed securities. These holdings suffered along with other mortgage-related securities which detracted from the Funds’ performance.

In the Nuveen High Yield Bond Fund, we generally invested at least 80% of the Fund’s assets in both domestic and foreign corporate high-yield debt securities. Generally, these securities were rated BB or below, or were unrated, at the time of purchase. The Fund focused primarily on BB and B rated credits while limiting exposure to CCC rated bonds to 10%. At times, in an effort to hedge risk, enhance returns, or substitute for a position, the Fund also invested in futures, total return swaps, credit derivatives or other fixed income derivative instruments.

| 2 | The Lipper Short Investment Grade Debt Funds Index represents the cumulative or average annualized total returns for the 30 largest funds in the Lipper Short Investment Grade Debt Funds Category for the period ended March 31, 2008. The returns account for the effects of management fees and assume reinvestment of dividends, but do not reflect any applicable sales charges. You cannot invest directly in a Lipper index. |

| 3 | The Citigroup 1-3 Year Treasury Index is an index comprised of U.S. Treasury Notes and Bonds with maturities of one year or greater, but less than three years (minimum amount outstanding is $1 billion per issue). The since inception data for the Index represents returns for the period 12/31/04 – 3/31/08, as returns for the Index are calculated on a calendar-month basis. An index is not available for direct investment. |

| 4 | The Lipper Intermediate Investment Grade Debt Funds Index represents the cumulative or average annualized total returns for the 30 largest funds in the Lipper Intermediate Investment Grade Debt Funds Category for the period ended March 31, 2008. The returns account for the effects of management fees and assume reinvestment of dividends, but do not reflect any applicable sales charges. You cannot invest directly in a Lipper index. |

| 5 | The Citigroup Broad Investment Grade Bond Index (the “BIG” Index) is an unmanaged index generally considered representative of the U.S. investment grade bond market. The since inception data for the Index represents returns for the period 12/31/04 – 3/31/08, as returns for the Index are calculated on a calendar-month basis. An index is not available for direct investment. |

| 6 | The Lipper High Current Yield Funds Index represents the cumulative or average annualized total returns for the 30 largest funds in the Lipper High Current Yield Funds Category for the period ended March 31, 2008. The returns account for the effects of management fees and assume reinvestment of dividends, but do not reflect any applicable sales charges. You cannot invest directly in a Lipper index. |

| 7 | The Citigroup High Yield BB/B Index is a market capitalization-weighted index that comprises all high-yield issues rated BB or B by Standard & Poor’s for which Citigroup calculates a monthly return. The since inception data for the Index represents returns for the period 12/31/04 – 3/31/08, as returns for the Index are calculated on a calendar-month basis. An index is not available for direct investment. |

Semi-Annual Report Page 3

In general, high yield securities did not perform as well as higher-rated or government issues, but their yields did tend to cushion some of their price volatility.

The Fund benefited from both sector and individual security selection. For example, the Fund had relative underweights in some of the period’s worst performing sectors such as autos, finance, forest & paper products and gaming. Conversely, it had relative overweights in better performing sectors such as aerospace, health care, utilities and chemicals. The portfolio also continued to benefit from investments in total return swaps.

On the negative side, the Fund also had relative overweights to sectors such as the retail, transportation, broadcasting and cable, which underperformed the broader high yield market. In addition, a relative underweight to energy and electric utilities sectors was a negative contributor to relative performance.

Dividend Information

Each Fund seeks to pay dividends at a rate that reflects the past and projected performance of the Fund. To permit a Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net investment income actually earned by the Fund during the period. If the Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if the Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. Each Fund will, over time, pay all its net investment income as dividends to shareholders.

As of March 31, 2008, the Nuveen Short Duration Bond Fund, the Nuveen Multi-Strategy Income Fund, and the Nuveen High Yield Bond Fund had a negative UNII balance for financial statement purposes and a positive UNII balance, based upon our best estimate, for tax purposes.

During this reporting period, the Short Duration Bond Fund’s A and R shares had no change in their regular monthly dividends, while the C shares had one monthly decrease. The Multi-Strategy Income Fund’s A and R shares had no change in their regular monthly dividends, while the B and C shares each had one monthly decrease. The High Yield Bond Fund’s A and R shares had one increase and one decrease in their regular monthly dividends, while the B and C share classes had no change.

Semi-Annual Report Page 4

Fund Spotlight as of 3/31/08 Nuveen Short Duration Bond Fund

| | | | | | |

| Quick Facts | | | | | | |

| | | A Shares | | C Shares | | R Shares6 |

NAV | | $19.68 | | $19.70 | | $19.66 |

Latest Monthly Dividend1 | | $0.0730 | | $0.0605 | | $0.0770 |

Inception Date | | 12/20/04 | | 12/20/04 | | 12/20/04 |

Returns quoted represent past performance which is no guarantee of future results. Returns without sales charges would be lower if the sales charge were included. Returns less than one year are cumulative. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains. Class A shares have a 2% maximum sales charge. Class C shares have a 1% CDSC for redemptions within less than one year, which is not reflected in the one-year total return. Class R shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| | | | |

Average Annual Total Returns as of 3/31/08 |

| | |

| A Shares | | NAV | | Offer |

1-Year | | 6.70% | | 4.59% |

Since Inception | | 4.00% | | 3.36% |

| | |

| C Shares | | NAV | | |

1-Year | | 5.97% | | |

Since Inception | | 3.24% | | |

| | |

| R Shares | | NAV | | |

1-Year | | 7.03% | | |

Since Inception | | 4.23% | | |

| Yields | | | | |

| | |

| A Shares | | NAV | | Offer |

Dividend Yield4 | | 4.45% | | 4.36% |

30-Day Yield4 | | 2.72% | | — |

SEC 30-Day Yield5 | | — | | 2.66% |

| | |

| C Shares | | NAV | | |

Dividend Yield4 | | 3.69% | | |

SEC 30-Day Yield5 | | 1.95% | | |

| | |

| R Shares | | NAV | | |

Dividend Yield4 | | 4.70% | | |

SEC 30-Day Yield5 | | 3.01% | | |

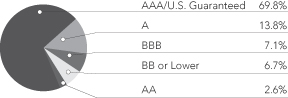

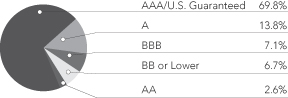

Portfolio Credit Quality 2

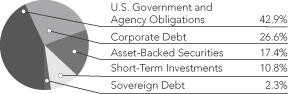

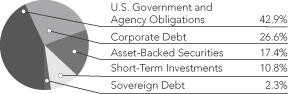

Portfolio Allocation3

| | |

Net Assets ($000) | | $26,460 |

| | | | | | |

| Expense Ratios | | | | | | |

| | | |

| Share Class | | Gross

Expense

Ratios | | Net

Expense

Ratios | | As of

Date |

Class A | | 1.93% | | 0.58% | | 9/30/07 |

Class C | | 2.42% | | 1.34% | | 9/30/07 |

Class R | | 1.34% | | 0.34% | | 9/30/07 |

The expense ratios shown factor in Total Annual Fund Operating Expenses including management fees and other fees and expenses. The Net Expense Ratios reflect a contractual commitment by the Fund’s investment adviser to waive fees and reimburse certain expenses through January 31, 2009, and a custodian fee credit whereby certain fees and expenses are reduced by credits earned of the Fund’s cash on deposit with the bank. Absent the waiver, reimbursement and credit, expenses would be higher and total returns would be less.

| 1 | Paid April 1, 2008. This is the latest monthly dividend declared during the period ended March 31, 2008. |

| 2 | As a percentage of total investments (excluding repurchase agreements, call swaptions written and derivative transactions) as of March 31, 2008. The ratings disclosed are using the higher of Standard & Poor’s Group (“Standard & Poor’s”) or Moody’s Investor Service, Inc. (“Moody’s”) rating. Ratings below BBB by Standard & Poor’s or Baa by Moody’s are considered to be below investment grade. Holdings are subject to change. |

| 3 | As a percentage of total investments (excluding call swaptions written and derivative transactions) as of March 31, 2008. Holdings are subject to change. |

| 4 | Dividend Yield is the most recent dividend per share (annualized) divided by the appropriate price per share. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The 30-Day Yield is computed under the same formula but is based on the Net Asset Value (NAV) per share. The Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium. |

| 5 | The SEC 30-Day Yield and Taxable-Equivalent Yield on A Shares at NAV applies only to A Shares purchased at no-load pursuant to the Fund’s policy permitting waiver of the A Share load in certain specified circumstances. |

| 6 | Effective May 1, 2008, Class R Shares will be renamed Class I Shares. See the Fund’s prospectus for more information. |

Semi-Annual Report Page 5

Fund Spotlight as of 3/31/08 Nuveen Short Duration Bond Fund

| | |

| Corporate Debt: Industries1 | | |

Electric Utilities | | 12.9% |

Diversified Telecommunications Services | | 7.9% |

Commercial Banks | | 6.7% |

Aerospace & Defense | | 6.1% |

Commercial Services & Supplies | | 5.6% |

Multi-Utilities | | 5.0% |

Computers & Peripherals | | 4.8% |

Diversified Financial Services | | 4.5% |

Media | | 4.2% |

Wireless Telecommunications Services | | 4.0% |

Beverages | | 3.2% |

Oil, Gas & Consumable Fuels | | 3.1% |

Food Products | | 2.9% |

Road & Rail | | 2.2% |

Energy Equipment & Services | | 2.2% |

Household Products | | 2.1% |

Electrical Equipment | | 1.9% |

Communications Equipment | | 1.9% |

Industrial Conglomerates | | 1.8% |

Software | | 1.8% |

Other | | 15.2% |

| 1 | As a percentage of total corporate debt holdings as of March 31, 2008. Corporate debt holdings include corporate bonds (high-yield investment grade rated), senior loans, and any other debt instruments issued by a corporation (or that references a corporation) held by the Fund at the end of the reporting period. Other corporate debt represents the total of all corporate debt industries that recalculated to less than 1.5% of total corporate debt holdings. Holdings are subject to change. |

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front and back end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front and back end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | Hypothetical Performance |

| | | Actual Performance | | (5% return before expenses) |

| | | | | | |

| | | A Shares | | C Shares | | R Shares | | A Shares | | C Shares | | R Shares |

Beginning Account Value (10/01/07) | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 |

Ending Account Value (3/31/08) | | $ | 1,037.30 | | $ | 1,033.40 | | $ | 1,038.60 | | $ | 1,021.90 | | $ | 1,018.20 | | $ | 1,023.20 |

Expenses Incurred During Period | | $ | 3.16 | | $ | 6.91 | | $ | 1.83 | | $ | 3.13 | | $ | 6.86 | | $ | 1.82 |

For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio of .62%, 1.36% and .36% for Classes A, C and R, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

Semi-Annual Report Page 6

Fund Spotlight as of 3/31/08 Nuveen Multi-Strategy Income Fund

| | | | | | | | |

| Quick Facts | | | | | | | | |

| | | A Shares | | B Shares6 | | C Shares | | R Shares6 |

NAV | | $19.45 | | $19.51 | | $19.47 | | $19.45 |

Latest Monthly Dividend1 | | $0.0775 | | $0.0650 | | $0.0650 | | $0.0815 |

Inception Date | | 12/20/04 | | 12/20/04 | | 12/20/04 | | 12/20/04 |

Returns quoted represent past performance which is no guarantee of future results. Returns without sales charges would be lower if the sales charge were included. Returns less than one year are cumulative. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains. Class A shares have a 3.75% maximum sales charge. Class B shares have a contingent deferred sales charge (CDSC), also known as a back-end sales charge, that for redemptions begins at 5% and declines periodically until after 6 years when the charge becomes 0%. Class B shares automatically convert to Class A shares eight years after purchase. Class C shares have a 1% CDSC for redemptions within less than one year, which is not reflected in the one-year total return. Class R shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| | | | |

Average Annual Total Returns as of 3/31/08 |

| | |

| A Shares | | NAV | | Offer |

1-Year | | 5.29% | | 1.32% |

Since Inception | | 3.77% | | 2.57% |

| | |

| B Shares | | w/o CDSC | | w/CDSC |

1-Year | | 4.60% | | 0.60% |

Since Inception | | 3.08% | | 2.24% |

| | |

| C Shares | | NAV | | |

1-Year | | 4.50% | | |

Since Inception | | 3.02% | | |

| | |

| R Shares | | NAV | | |

1-Year | | 5.61% | | |

Since Inception | | 4.04% | | |

| Yields |

| | |

| A Shares | | NAV | | Offer |

Dividend Yield4 | | 4.78% | | 4.60% |

30-Day Yield4 | | 4.48% | | — |

SEC 30-Day Yield5 | | — | | 4.31% |

| | |

| B Shares | | NAV | | |

Dividend Yield4 | | 4.00% | | |

SEC 30-Day Yield5 | | 3.72% | | |

| | |

| C Shares | | NAV | | |

Dividend Yield4 | | 4.01% | | |

SEC 30-Day Yield5 | | 3.73% | | |

| | |

| R Shares | | NAV | | |

Dividend Yield4 | | 5.03% | | |

SEC 30-Day Yield5 | | 4.74% | | |

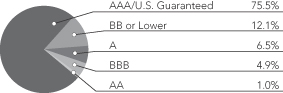

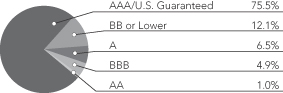

Portfolio Credit Quality2

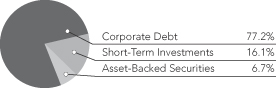

Portfolio Allocation3

| | |

Net Assets ($000) | | $20,010 |

| | | | | | |

| Expense Ratios | | | | | | |

| | | |

| Share Class | | Gross

Expense

Ratios | | Net

Expense

Ratios | | As of

Date |

Class A | | 2.32% | | 0.72% | | 9/30/07 |

Class B | | 3.14% | | 1.41% | | 9/30/07 |

Class C | | 2.98% | | 1.47% | | 9/30/07 |

Class R | | 1.86% | | 0.47% | | 9/30/07 |

The expense ratios shown factor in Total Annual Fund Operating Expenses including management fees and other fees and expenses. The Net Expense Ratios reflect a contractual commitment by the Fund’s investment adviser to waive fees and reimburse certain expenses through January 31, 2009, and a custodian fee credit whereby certain fees and expenses are reduced by credits earned of the Fund’s cash on deposit with the bank. Absent the waiver, reimbursement and credit, expenses would be higher and total returns would be less.

| 1 | Paid April 1, 2008. This is the latest monthly dividend declared during the period ended March 31, 2008. |

| 2 | As a percentage of total investments (excluding repurchase agreements, call swaptions written and derivative transactions) as of March 31, 2008. The ratings disclosed are using the higher of Standard & Poor’s Group (“Standard & Poor’s”) or Moody’s Investor Service, Inc. (“Moody’s”) rating. Ratings below BBB by Standard & Poor’s or Baa by Moody’s are considered to be below investment grade. Holdings are subject to change. |

| 3 | As a percentage of total investments (excluding call swaptions written and derivative transactions) as of March 31, 2008. Holdings are subject to change. |

| 4 | Dividend Yield is the most recent dividend per share (annualized) divided by the appropriate price per share. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The 30-Day Yield is computed under the same formula but is based on the Net Asset Value (NAV) per share. The Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium. |

| 5 | The SEC 30-Day Yield and Taxable-Equivalent Yield on A Shares at NAV applies only to A Shares purchased at no-load pursuant to the Fund’s policy permitting waiver of the A Share load in certain specified circumstances. |

| 6 | Effective May 1, 2008 Class B Shares will only be issued upon exchange of Class B Shares from another Nuveen fund or for purposes of dividend reinvestment. Effective December 31, 2008 the reinstatement privilege for Class B Shares will no longer be available. Effective May 1, 2008, Class R Shares will be renamed Class I Shares. See the Fund’s prospectus for more information. |

Semi-Annual Report Page 7

Fund Spotlight as of 3/31/08 Nuveen Multi-Strategy Income Fund

| | |

| Corporate Debt: Industries1 | | |

Electric Utilities | | 9.2% |

Media | | 7.5% |

Metals & Mining | | 7.4% |

Diversified Telecommunications Services | | 7.0% |

Oil, Gas & Consumable Fuels | | 5.9% |

Road & Rail | | 4.9% |

Wireless Telecommunications Services | | 4.2% |

Aerospace & Defense | | 4.2% |

Commercial Banks | | 4.0% |

Commercial Services & Supplies | | 3.9% |

Paper & Forest Products | | 3.7% |

Diversified Financial Services | | 3.0% |

Energy Equipment & Services | | 3.0% |

Health Care Providers & Services | | 2.4% |

Multi-Line Retail | | 2.3% |

Thrifts & Mortgage Finance | | 2.2% |

Insurance | | 2.1% |

Capital Markets | | 1.9% |

Chemicals | | 1.8% |

Independent Power Producers & Energy Traders | | 1.7% |

Pharmaceuticals | | 1.7% |

Hotels, Restaurants & Leisure | | 1.6% |

Containers & Packaging | | 1.5% |

Other | | 12.9% |

| 1 | As a percentage of total corporate debt holdings as of March 31, 2008. Corporate debt holdings include corporate bonds (high-yield investment grade rated), senior loans, and any other debt instruments issued by a corporation (or that references a corporation) held by the Fund at the end of the reporting period. Other corporate debt represents the total of all corporate debt industries that recalculated to less than 1.5% of total corporate debt holdings. Holdings are subject to change. |

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front and back end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front and back end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Hypothetical Performance |

| | | Actual Performance | | | | (5% return before expenses) |

| | | | | | | | | |

| | | A Shares | | B Shares | | C Shares | | R Shares | | | | A Shares | | B Shares | | C Shares | | R Shares |

Beginning Account Value (10/01/07) | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 |

Ending Account Value (3/31/08) | | $ | 1,032.60 | | $ | 1,029.20 | | $ | 1,029.20 | | $ | 1,034.40 | | | | $ | 1,021.35 | | $ | 1,017.55 | | $ | 1,017.60 | | $ | 1,022.65 |

Expenses Incurred During Period | | $ | 3.71 | | $ | 7.56 | | $ | 7.51 | | $ | 2.39 | | | | $ | 3.69 | | $ | 7.52 | | $ | 7.47 | | $ | 2.38 |

For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio of .73%, 1.49%, 1.48% and .47% for Classes A, B, C and R, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

Semi-Annual Report Page 8

Fund Spotlight as of 3/31/08 Nuveen High Yield Bond Fund

| | | | | | | | |

| Quick Facts | | | | | | | | |

| | | A Shares | | B Shares6 | | C Shares | | R Shares6 |

NAV | | $18.27 | | $18.26 | | $18.23 | | $18.26 |

Latest Monthly Dividend1 | | $0.1220 | | $0.1105 | | $0.1105 | | $0.1260 |

Inception Date | | 12/20/04 | | 12/20/04 | | 12/20/04 | | 12/20/04 |

Returns quoted represent past performance which is no guarantee of future results. Returns without sales charges would be lower if the sales charge were included. Returns less than one year are cumulative. Current performance may be higher or lower than the performance shown. Investment returns and principal value will flu’ctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains. Class A shares have a 4.75% maximum sales charge. Class B shares have a contingent deferred sales charge (CDSC), also known as a back-end sales charge, that for redemptions begins at 5% and declines periodically until after 6 years when the charge becomes 0%. Class B shares automatically convert to Class A shares eight years after purchase. Class C shares have a 1% CDSC for redemptions within less than one year, which is not reflected in the one-year total return. Class R shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| | | | |

Average Annual Total Returns as of 3/31/08 |

| | |

| A Shares | | NAV | | Offer |

1-Year | | -1.48% | | -6.17% |

Since Inception | | 4.53% | | 3.00% |

| | |

| B Shares | | w/o CDSC | | w/CDSC |

1-Year | | -2.17% | | -5.83% |

Since Inception | | 3.72% | | 2.95% |

| | |

| C Shares | | NAV | | |

1-Year | | -2.23% | | |

Since Inception | | 3.68% | | |

| | |

| R Shares | | NAV | | |

1-Year | | -1.24% | | |

Since Inception | | 4.76% | | |

| Yields |

| | |

| A Shares | | NAV | | Offer |

Dividend Yield4 | | 8.01% | | 7.63% |

30-Day Yield4 | | 11.32% | | — |

SEC 30-Day Yield5 | | — | | 10.77% |

| | |

| B Shares | | NAV | | |

Dividend Yield4 | | 7.26% | | |

SEC 30-Day Yield5 | | 10.55% | | |

| | |

| C Shares | | NAV | | |

Dividend Yield4 | | 7.27% | | |

SEC 30-Day Yield5 | | 10.55% | | |

| | |

| R Shares | | NAV | | |

Dividend Yield4 | | 8.28% | | |

SEC 30-Day Yield5 | | 11.57% | | |

Portfolio Credit Quality 2

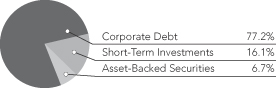

Portfolio Allocation3

| | |

Net Assets ($000) | | $77,692 |

| | | | | | |

| Expense Ratios | | | | | | |

| | | |

| Share Class | | Gross

Expense

Ratios | | Net

Expense

Ratios | | As of

Date |

Class A | | 1.83% | | 0.82% | | 9/30/07 |

Class B | | 2.50% | | 1.57% | | 9/30/07 |

Class C | | 2.54% | | 1.57% | | 9/30/07 |

Class R | | 1.43% | | 0.56% | | 9/30/07 |

The expense ratios shown factor in Total Annual Fund Operating Expenses including management fees and other fees and expenses. The Net Expense Ratios reflect a contractual commitment by the Fund’s investment adviser to waive fees and reimburse certain expenses through January 31, 2009, and a custodian fee credit whereby certain fees and expenses are reduced by credits earned of the Fund’s cash on deposit with the bank. Absent the waiver, reimbursement and credit, expenses would be higher and total returns would be less.

| 1 | Paid April 1, 2008. This is the latest monthly dividend declared during the period ended March 31, 2008. |

| 2 | As a percentage of total investments (excluding repurchase agreements and derivative transactions) as of March 31, 2008. The ratings disclosed are using the higher of Standard & Poor’s Group (“Standard & Poor’s”) or Moody’s Investor Service, Inc. (“Moody’s”) rating. Ratings below BBB by Standard & Poor’s or Baa by Moody’s are considered to be below investment grade. Holdings are subject to change. |

| 3 | As a percentage of total investments (excluding derivative transactions) as of March 31, 2008. Holdings are subject to change. |

| 4 | Dividend Yield is the most recent dividend per share (annualized) divided by the appropriate price per share. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The 30-Day Yield is computed under the same formula but is based on the Net Asset Value (NAV) per share. The Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium. |

| 5 | The SEC 30-Day Yield and Taxable-Equivalent Yield on A Shares at NAV applies only to A Shares purchased at no-load pursuant to the Fund’s policy permitting waiver of the A Share load in certain specified circumstances. |

| 6 | Effective May 1, 2008 Class B Shares will only be issued upon exchange of Class B Shares from another Nuveen fund or for purposes of dividend reinvestment. Effective December 31, 2008 the reinstatement privilege for Class B Shares will no longer be available. Effective May 1, 2008, Class R Shares will be renamed Class I Shares. See the Fund’s prospectus for more information. |

Semi-Annual Report Page 9

Fund Spotlight as of 3/31/08 Nuveen High Yield Bond Fund

| | |

| Corporate Debt: Industries1 | | |

Media | | 7.4% |

Wireless Telecommunications Services | | 7.3% |

Diversified Telecommunications Services | | 7.2% |

Energy Equipment & Services | | 6.9% |

Consumer Finance | | 5.4% |

Metals & Mining | | 5.0% |

Road & Rail | | 4.8% |

Health Care Providers & Services | | 4.6% |

Computers & Peripherals | | 3.9% |

Hotels, Restaurants & Leisure | | 3.5% |

Diversified Financial Services | | 3.4% |

Containers & Packaging | | 3.2% |

Commercial Services & Supplies | | 3.2% |

Oil, Gas & Consumable Fuels | | 3.2% |

Aerospace & Defense | | 3.0% |

Electric Utilities | | 2.9% |

Multi-Utilities | | 2.6% |

IT Services | | 2.2% |

Diversified Consumer Services | | 2.0% |

Paper & Forest Products | | 2.0% |

Auto Components | | 1.8% |

Independent Power Producers & Energy Traders | | 1.8% |

Pharmaceuticals | | 1.6% |

Thrifts & Mortgage Finance | | 1.6% |

Real Estate Investment Trust | | 1.5% |

Other | | 8.0% |

| 1 | As a percentage of total corporate debt holdings as of March 31, 2008. Corporate debt holdings include corporate bonds (high-yield investment grade rated), senior loans, and any other debt instruments issued by a corporation (or that references a corporation) held by the Fund at the end of the reporting period. Other corporate debt represents the total of all corporate debt industries that recalculated to less than 1.5% of total corporate debt holdings. Holdings are subject to change. |

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front and back end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front and back end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Hypothetical Performance |

| | | Actual Performance | | | | (5% return before expenses) |

| | | | | | | | | |

| | | A Shares | | B Shares | | C Shares | | R Shares | | | | A Shares | | B Shares | | C Shares | | R Shares |

Beginning Account Value (10/01/07) | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 | | $ | 1,000.00 |

Ending Account Value (3/31/08) | | $ | 971.10 | | $ | 967.40 | | $ | 967.40 | | $ | 972.30 | | | | $ | 1,020.90 | | $ | 1,017.15 | | $ | 1,017.15 | | $ | 1,022.15 |

Expenses Incurred During Period | | $ | 4.04 | | $ | 7.72 | | $ | 7.72 | | $ | 2.81 | | | | $ | 4.14 | | $ | 7.92 | | $ | 7.92 | | $ | 2.88 |

For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio of .82%, 1.57%, 1.57% and .57% for Classes A, B, C and R, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

Semi-Annual Report Page 10

Portfolio of Investments (Unaudited)

Nuveen Short Duration Bond Fund

March 31, 2008

| | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value |

| | | | | | | | | | | | |

| | | CORPORATE BONDS – 26.7% | | | | | | | | | |

| | | | | |

| | | Aerospace & Defense – 1.6% | | | | | | | | | |

| | | | | |

| $ | 50 | | DI Finance/DynCorp International, Series B | | 9.500% | | 2/15/13 | | B | | $ | 51,125 |

| | | | | |

| | 150 | | Honeywell International Inc. | | 7.500% | | 3/01/10 | | A | | | 161,743 |

| | | | | |

| | 200 | | Lockheed Martin Corporation | | 8.200% | | 12/01/09 | | A– | | | 214,638 |

| | 400 | | Total Aerospace & Defense | | | | | | | | | 427,506 |

| | | Auto Components – 0.1% | | | | | | | | | |

| | | | | |

| | 50 | | Goodyear Tire & Rubber Company | | 8.663% | | 12/01/09 | | BB– | | | 49,938 |

| | | Beverages – 0.9% | | | | | | | | | |

| | | | | |

| | 125 | | Diageo Fiannce BV | | 3.875% | | 4/01/11 | | A– | | | 125,525 |

| | | | | |

| | 100 | | Miller Brewing Company, 144A | | 4.250% | | 8/15/08 | | BBB+ | | | 100,412 |

| | 225 | | Total Beverages | | | | | | | | | 225,937 |

| | | Commercial Banks – 1.8% | | | | | | | | | |

| | | | | |

| | 125 | | Nationsbank Corporation | | 6.600% | | 5/15/10 | | Aa2 | | | 131,943 |

| | | | | |

| | 100 | | US Bank National Association | | 6.300% | | 7/15/08 | | AA | | | 100,778 |

| | | | | |

| | 100 | | Wachovia Corporation | | 6.250% | | 8/04/08 | | A+ | | | 100,654 |

| | | | | |

| | 135 | | Wells Fargo & Company | | 4.200% | | 1/15/10 | | AA+ | | | 137,312 |

| | 460 | | Total Commercial Banks | | | | | | | | | 470,687 |

| | | Commercial Services & Supplies – 1.5% | | | | | | | | | |

| | | | | |

| | 60 | | Allied Waste North America | | 6.500% | | 11/15/10 | | BB | | | 60,300 |

| | | | | |

| | 50 | | Interface, Inc. | | 10.375% | | 2/01/10 | | BB– | | | 52,500 |

| | | | | |

| | 150 | | International Lease Finance Corporation, Commercial Paper Notes | | 6.375% | | 3/15/09 | | AA– | | | 151,808 |

| | | | | |

| | 125 | | Waste Management Inc. | | 7.375% | | 8/01/10 | | BBB | | | 131,758 |

| | 385 | | Total Commercial Services & Supplies | | | | | | | | | 396,366 |

| | | Communications Equipment – 0.5% | | | | | | | | | |

| | | | | |

| | 125 | | Cisco Systems, Inc. | | 5.250% | | 2/22/11 | | A+ | | | 130,573 |

| | | Computers & Peripherals – 1.3% | | | | | | | | | |

| | | | | |

| | 50 | | GSC Holdings Corporation, 144A | | 8.000% | | 10/01/12 | | BB | | | 53,125 |

| | | | | |

| | 100 | | Hewlett Packard Company | | 6.500% | | 7/01/12 | | A | | | 109,275 |

| | | | | |

| | 125 | | International Business Machines Corporation (IBM) | | 4.950% | | 3/22/11 | | A+ | | | 130,857 |

| | | | | |

| | 50 | | Seagate Technology HDD Holdings | | 5.569% | | 10/01/09 | | BB+ | | | 48,500 |

| | 325 | | Total Computers & Peripherals | | | | | | | | | 341,757 |

| | | Consumer Finance – 0.1% | | | | | | | | | |

| | | | | |

| | 50 | | SLM Corporation | | 4.000% | | 1/15/09 | | Baa2 | | | 45,029 |

| | | Diversified Financial Services – 1.2% | | | | | | | | | |

| | | | | |

| | 153 | | Bank One Corporation | | 7.875% | | 8/01/10 | | Aa3 | | | 163,584 |

| | | | | |

| | 150 | | General Electric Capital Corporation | | 4.125% | | 9/01/09 | | AAA | | | 151,994 |

| | 303 | | Total Diversified Financial Services | | | | | | | | | 315,578 |

| | | Diversified Telecommunication Services – 2.1% | | | | | | | | | |

| | | | | |

| | 225 | | BellSouth Corporation | | 4.200% | | 9/15/09 | | A | | | 226,567 |

| | | | | |

| | 125 | | GTE Corporation – Verizon | | 7.510% | | 4/01/09 | | A | | | 129,296 |

| | | | | |

| | 50 | | Qwest Capital Funding Inc. | | 7.000% | | 8/03/09 | | B+ | | | 50,000 |

| | | | | |

| | 100 | | Sprint Capital Corporation, Unsecured Note | | 6.125% | | 11/15/08 | | BBB– | | | 99,265 |

| | | | | |

| | 50 | | US West Communications Inc. | | 5.625% | | 11/15/08 | | BBB– | | | 50,000 |

| | 550 | | Total Diversified Telecommunication Services | | | | | | | | | 555,128 |

11

Portfolio of Investments (Unaudited)

Nuveen Short Duration Bond Fund (continued)

March 31, 2008

| | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value |

| | | | | | | | | | | | |

| | | Electric Utilities – 3.4% | | | | | | | | | |

| | | | | |

| $ | 150 | | American Electric Power | | 5.375% | | 3/15/10 | | BBB | | $ | 153,543 |

| | | | | |

| | 100 | | Cinergy Corporation | | 6.530% | | 12/16/08 | | BBB+ | | | 101,903 |

| | | | | |

| | 100 | | FirstEnergy Corporation | | 6.450% | | 11/15/11 | | BBB– | | | 104,760 |

| | | | | |

| | 100 | | Niagara Mohawk Power Corporation, Series 1998G | | 7.750% | | 10/01/08 | | A3 | | | 101,768 |

| | | | | |

| | 100 | | Ohio Edison Company | | 4.000% | | 5/01/08 | | Baa2 | | | 99,995 |

| | | | | |

| | 150 | | Pacific Gas and Electric Company | | 3.600% | | 3/01/09 | | A3 | | | 149,662 |

| | | | | |

| | 100 | | Public Service Electric & Gas Company, Series 2003C | | 4.000% | | 11/01/08 | | A– | | | 100,082 |

| | | | | |

| | 100 | | Puget Sound Energy Inc. | | 3.363% | | 6/01/08 | | BBB+ | | | 99,909 |

| | 900 | | Total Electric Utilities | | | | | | | | | 911,622 |

| | | Electrical Equipment – 0.5% | | | | | | | | | |

| | | | | |

| | 125 | | Emerson Electric Company, Note | | 7.125% | | 8/15/10 | | A | | | 135,629 |

| | | Energy Equipment & Services – 0.6% | | | | | | | | | |

| | | | | |

| | 150 | | El Paso Energy Corporation | | 6.750% | | 5/15/09 | | BB– | | | 152,291 |

| | | Food Products – 0.8% | | | | | | | | | |

| | | | | |

| | 100 | | Campbell Soup Company | | 5.875% | | 10/01/08 | | A | | | 101,557 |

| | | | | |

| | 100 | | Kellogg Company | | 2.875% | | 6/01/08 | | A3 | | | 99,895 |

| | 200 | | Total Food Products | | | | | | | | | 201,452 |

| | | Hotels, Restaurants & Leisure – 0.4% | | | | | | | | | |

| | | | | |

| | 100 | | Tricon Global Restaurants Inc. | | 7.650% | | 5/15/08 | | Baa2 | | | 100,534 |

| | | Household Durables – 0.3% | | | | | | | | | |

| | | | | |

| | 50 | | KB Home | | 7.750% | | 2/01/10 | | Ba2 | | | 48,063 |

| | | | | |

| | 25 | | Toll Corporation | | 8.250% | | 2/01/11 | | BB+ | | | 22,813 |

| | 75 | | Total Household Durables | | | | | | | | | 70,876 |

| | | Household Products – 0.6% | | | | | | | | | |

| | | | | |

| | 150 | | Clorox Company | | 4.200% | | 1/15/10 | | BBB+ | | | 150,587 |

| | | Industrial Conglomerates – 0.5% | | | | | | | | | |

| | | | | |

| | 125 | | Textron Financial Corporation | | 5.125% | | 2/03/11 | | A– | | | 130,085 |

| | | Insurance – 0.4% | | | | | | | | | |

| | | | | |

| | 100 | | Prudential Financial Inc. | | 3.750% | | 5/01/08 | | A+ | | | 99,992 |

| | | IT Services – 0.4% | | | | | | | | | |

| | | | | |

| | 100 | | First Data Corporation (3) | | 3.375% | | 8/01/08 | | Caa1 | | | 97,620 |

| | | Machinery – 0.4% | | | | | | | | | |

| | | | | |

| | 100 | | John Deere Capital Corporation, Series 2005D | | 4.500% | | 8/25/08 | | A | | | 100,498 |

| | | Media – 1.1% | | | | | | | | | |

| | | | | |

| | 50 | | Echostar DBS Corporation | | 5.750% | | 10/01/08 | | BB– | | | 49,875 |

| | | | | |

| | 40 | | Sinclair Broadcasting Group | | 8.000% | | 3/15/12 | | BB– | | | 40,500 |

| | | | | |

| | 75 | | Valassis Communications Inc. | | 6.625% | | 1/15/09 | | BB | | | 74,063 |

| | | | | |

| | 125 | | Walt Disney Company | | 5.700% | | 7/15/11 | | A | | | 132,680 |

| | 290 | | Total Media | | | | | | | | | 297,118 |

| | | Multi-Line Retail – 0.4% | | | | | | | | | |

| | | | | |

| | 100 | | Federated Department Stores, Inc. | | 6.625% | | 9/01/08 | | Baa2 | | | 100,475 |

12

| | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value |

| | | | | | | | | | | | |

| | | Multi-Utilities – 1.3% | | | | | | | | | |

| | | | | |

| $ | 100 | | Duke Energy Corporation | | 4.200% | | 10/01/08 | | A– | | $ | 100,364 |

| | | | | |

| | 100 | | MidAmerican Energy Holdings Company | | 3.500% | | 5/15/08 | | BBB+ | | | 99,983 |

| | | | | |

| | 150 | | Sempra Energy | | 4.750% | | 5/15/09 | | BBB+ | | | 151,389 |

| | 350 | | Total Multi-Utilities | | | | | | | | | 351,736 |

| | | Oil, Gas & Consumable Fuels – 0.8% | | | | | | | | | |

| | | | | |

| | 50 | | Alpha Natural Resources, Inc. | | 10.000% | | 6/01/12 | | B | | | 52,500 |

| | | | | |

| | 150 | | Phillips Petroleum Company | | 8.750% | | 5/25/10 | | A1 | | | 167,492 |

| | 200 | | Total Oil, Gas & Consumable Fuels | | | | | | | | | 219,992 |

| | | Paper & Forest Products – 0.1% | | | | | | | | | |

| | | | | |

| | 40 | | Rock-Tenn Company | | 8.200% | | 8/15/11 | | BB | | | 41,200 |

| | | Pharmaceuticals – 0.4% | | | | | | | | | |

| | | | | |

| | 100 | | Bristol-Myers Squibb Company | | 4.000% | | 8/15/08 | | A+ | | | 100,060 |

| | | Real Estate Investment Trust – 0.1% | | | | | | | | | |

| | | | | |

| | 50 | | Istar Financial Inc. | | 8.750% | | 8/15/08 | | BBB | | | 47,629 |

| | | Road & Rail – 0.6% | | | | | | | | | |

| | | | | |

| | 150 | | Kansas City Southern Railway Company | | 9.500% | | 10/01/08 | | BB– | | | 152,813 |

| | | Software – 0.5% | | | | | | | | | |

| | | | | |

| | 125 | | Oracle Corporation | | 5.000% | | 1/15/11 | | A | | | 128,315 |

| | | Thrifts & Mortgage Finance – 0.4% | | | | | | | | | |

| | | | | |

| | 100 | | Washington Mutual Bank | | 5.187% | | 8/25/08 | | BBB+ | | | 96,139 |

| | | Tobacco – 0.3% | | | | | | | | | |

| | | | | |

| | 75 | | Reymolds American Inc. | | 6.500% | | 7/15/10 | | BBB | | | 76,875 |

| | | Trading Companies & Distributors – 0.2% | | | | | | | | | |

| | | | | |

| | 50 | | GATX Financial Corporation | | 5.125% | | 4/15/10 | | BBB+ | | | 50,566 |

| | | Wireless Telecommunication Services – 1.1% | | | | | | | | | |

| | | | | |

| | 100 | | Airtouch Communications Inc. | | 6.650% | | 5/01/08 | | A– | | | 100,165 |

| | | | | |

| | 50 | | Rogers Wireless Communications Inc. | | 8.000% | | 12/15/12 | | BB+ | | | 52,000 |

| | | | | |

| | 125 | | Vodafone Group PLC | | 5.500% | | 6/15/11 | | A– | | | 127,210 |

| | 275 | | Total Wireless Telecommunication Services | | | | | | | | | 279,375 |

| $ | 6,903 | | Total Corporate Bonds (cost $7,035,055) | | | | | | | | | 7,051,978 |

| | | | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value |

| | | U.S. GOVERNMENT AND AGENCY OBLIGATIONS – 42.9% | | | | | | | | | |

| | | | | |

| | | U.S. Treasury Bonds/Notes – 42.9% | | | | | | | | | |

| | | | | |

| $ | 1,000 | | United States of America Treasury Bonds/Notes | | 4.500% | | 2/28/11 | | AAA | | $ | 1,077,891 |

| | | | | |

| | 3,450 | | United States of America Treasury Bonds/Notes | | 4.750% | | 11/15/08 | | AAA | | | 3,521,429 |

| | | | | |

| | 1,200 | | United States of America Treasury Bonds/Notes | | 4.875% | | 1/31/09 | | AAA | | | 1,233,095 |

| | | | | |

| | 3,350 | | United States of America Treasury Bonds/Notes | | 3.500% | | 11/15/09 | | AAA | | | 3,453,381 |

| | | | | |

| | 1,000 | | United States of America Treasury Bonds/Notes | | 6.500% | | 2/15/10 | | AAA | | | 1,089,376 |

| | | | | |

| | 920 | | United States of America Treasury Bonds/Notes | | 4.375% | | 12/15/10 | | AAA | | | 985,334 |

| $ | 10,920 | | Total U.S. Government and Agency Obligations (cost $11,144,534) | | | | | | | | | 11,360,506 |

13

Portfolio of Investments (Unaudited)

Nuveen Short Duration Bond Fund (continued)

March 31, 2008

| | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value |

| | | | | | | | | | | | | |

| | | | ASSET-BACKED SECURITIES – 17.4% | | | | | | | | | |

| | | | | |

| | | | Autos – 8.6% | | | | | | | | | |

| | | | | |

| $ | 300 | | | Banc of America Securities Auto Trust 2006-G1 | | 5.180% | | 6/18/10 | | AAA | | $ | 303,026 |

| | | | | |

| | 230 | | | Capital Auto Receivables Asset Trust, Series 2007-2-A3A | | 5.020% | | 9/15/11 | | AAA | | | 234,459 |

| | | | | |

| | 340 | | | Daimler Chrysler Auto Trust 2008-A A3 | | 3.700% | | 6/08/12 | | AAA | | | 339,438 |

| | | | | |

| | 8 | | | Daimler Chrysler Auto Trust, Class A3, Series 2005B | | 4.040% | | 9/08/09 | | AAA | | | 7,552 |

| | | | | |

| | 400 | | | Ford Credit Auto Owner Trust, 2008A-3A | | 3.960% | | 4/15/12 | | AAA | | | 401,641 |

| | | | | |

| | 450 | | | Harley-Davidson Motorcycle Trust, Series 2007-2A3 | | 5.100% | | 5/15/12 | | AAA | | | 457,028 |

| | | | | |

| | 100 | | | Hyundai Auto Receivables Trust 2007A, Class A3A | | 5.040% | | 1/17/12 | | AAA | | | 101,317 |

| | | | | |

| | 270 | | | USAA Auto Owner Trust 2006-2 | | 5.370% | | 2/15/12 | | AAA | | | 276,623 |

| | | | | |

| | 160 | | | USAA Auto Owner Trust 2007-2 | | 5.070% | | 6/15/13 | | AAA | | | 163,319 |

| | 2,258 | | | Total Autos | | | | | | | | | 2,284,403 |

| | | | Cards – 7.7% | | | | | | | | | |

| | | | | |

| | 310 | | | Bank One Issuance Trust, 2003 Class A9 | | 3.860% | | 6/15/11 | | AAA | | | 311,163 |

| | | | | |

| | 160 | | | Citibank Credit Card Issuance Trust, 2006 Class B2 | | 5.150% | | 3/07/11 | | A | | | 160,643 |

| | | | | |

| | 270 | | | Citibank Credit Card Issuance Trust, Series 2007 | | 5.000% | | 11/08/12 | | A | | | 266,716 |

| | | | | |

| | 300 | | | General Electric Master Credit Card Note Trust, Class A, Series 2006-1 | | 5.080% | | 9/15/12 | | AAA | | | 307,288 |

| | | | | |

| | 300 | | | Household Credit Card Master Note Trust, Class A, Series 2006-1 | | 5.100% | | 6/15/12 | | AAA | | | 305,055 |

| | | | | |

| | 450 | | | MBNA Master Credit Card Trust 1999-B A | | 5.900% | | 8/15/11 | | AAA | | | 461,503 |

| | | | | |

| | 210 | | | MBNA Master Credit Card Trust Class 99-J | | 7.000% | | 2/15/12 | | AAA | | | 221,275 |

| | 2,000 | | | Total Cards | | | | | | | | | 2,033,643 |

| | | | Home Equity – 1.1% | | | | | | | | | |

| | | | | |

| | 289 | | | Federal National Mortgage Association Pool 838948 | | 5.080% | | 8/01/35 | | AAA | | | 294,787 |

| | | | | |

| | (4) — | | | Master Asset Backed Securities Trust 2005-WMC1, Mortgage Pass Through Certificates, Class N-1 | | 4.940% | | 3/26/35 | | A+ | | | — |

| | 289 | | | Total Home Equity | | | | | | | | | 294,787 |

| $ | 4,547 | | | Total Asset-Backed Securities (cost $4,581,424) | | | | | | | | | 4,612,833 |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value |

| | | | SOVEREIGN DEBT – 2.3% | | | | | | | | | |

| | | | | |

| | | | Turkey – 2.3% | | | | | | | | | |

| | | | | |

| $ | 200 | | | Republic of Turkey, Government Bond | | 14.000% | | 1/19/11 | | Ba3 | | $ | 139,624 |

| | | | | |

| | 400 | | | Republic of Turkey, Government Bond | | 10.840% | | 2/15/12 | | BB | | | 324,037 |

| | | | | |

| | 200 | | | Republic of Turkey, Government Bond | | 16.000% | | 3/07/12 | | BB | | | 141,273 |

| | 800 | | | Total Turkey | | | | | | | | | 604,934 |

| $ | 800 | | | Total Sovereign Debt (cost $563,179) | | | | | | | | | 604,934 |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value |

| | | | SHORT-TERM INVESTMENTS – 10.8% | | | | | | | | | |

| | | | | |

| | | | U.S. Government and Agency Obligations – 10.0% | | | | | | | | | |

| | | | | |

| $ | 600 | | | Federal Home Loan Banks, Discount Notes | | 0.000% | | 4/09/08 | | AAA | | $ | 599,471 |

| | | | | |

| | 600 | | | Federal Home Loan Banks, Discount Notes | | 0.000% | | 4/23/08 | | AAA | | | 599,219 |

| | | | | |

| | 1,450 | | | Federal National Mortgage Association | | 0.000% | | 4/16/08 | | AAA | | | 1,448,731 |

| | 2,650 | | | Total U.S. Government and Agency Obligations | | | | | | | | | 2,647,421 |

14

| | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Value |

| | | | | | | | | | |

| | | Repurchase Agreements – 0.8% | | | | | | | |

| | | | |

| $ | 206 | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 3/31/08, repurchase price $205,697, collateralized by $145,000 U.S. Treasury Bonds, 8.750%, due 8/15/20, value $213,875 | | 1.100% | | 4/01/08 | | $ | 205,691 |

| $ | 2,856 | | Total Short-Term Investments (cost $2,853,112) | | | | | | | 2,853,112 |

| | | Total Investments (cost $26,177,304) – 100.1% | | | | | | | 26,483,363 |

| | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Description | | | | Counterparty | | Floating Rate

Index | | Pay/Receive

Floating

Rate | | Exercise

Rate | | Expiration

Date | | Notional

Amount | | Premium | | Value | |

| | | | Call Swaptions Written – 0.0% | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| OTC-10-Year Interest Rate Swap | | Lehman Brothers | | 6-Month LIBOR | | Receive | | 4.890% | | 4/14/08 | | (1,300,000) | GBP | | (3,120) GBP | | $ | (1,318) | |

| | Total Call Swaptions Written (premiums received $6,334) | | | | | | | | | | | | | | (1,318 | ) |

| | | |

| | Other Assets Less Liabilities – (0.1)% | | | | | | | | | | | | | | | | (22,509 | ) |

| | | |

| | Net Assets – 100.0% | | | | | | | | | | | | | | | $ | 26,459,536 | |

| | | |

15

Portfolio of Investments (Unaudited)

Nuveen Short Duration Bond Fund (continued)

March 31, 2008

Forward Foreign Currency Exchange Contracts outstanding at March 31, 2008:

| | | | | | | | | | | | |

| Currency Contracts to Deliver | | Amount

(Local Currency) | | In Exchange For

Currency | | Amount

(Local Currency) | | Settlement

Date | | Unrealized

Appreciation

(Depreciation)

(U.S. Dollars) | |

| Australian Dollar | | 200,000 | | Canadian Dollar | | 182,028 | | 4/22/08 | | $ | (5,013 | ) |

| Brazilian Real | | 458,600 | | U.S. Dollar | | 269,369 | | 4/02/08 | | | 8,116 | |

| Canadian Dollar | | 200,000 | | Swiss Franc | | 220,448 | | 4/08/08 | | | 27,170 | |

| Canadian Dollar | | 180,316 | | Australian Dollar | | 200,000 | | 4/22/08 | | | 6,680 | |

| Czech Koruna | | 3,914,550 | | Euro | | 157,464 | | 4/22/08 | | | 3,642 | |

| Euro | | 150,000 | | Czech Koruna | | 3,914,550 | | 4/22/08 | | | 8,132 | |

| Euro | | 40,000 | | Iceland Krona | | 3,886,800 | | 9/24/08 | | | (12,689 | ) |

| Euro | | 84,608 | | Iceland Krona | | 8,119,800 | | 9/24/08 | | | (28,143 | ) |

| Iceland Krona | | 12,006,600 | | Euro | | 105,256 | | 9/24/08 | | | 10,557 | |

| Indian Rupee | | 8,092,000 | | U.S. Dollar | | 200,000 | | 6/09/08 | | | (587 | ) |

| Indonesian Rupiah | | 1,728,780,000 | | U.S. Dollar | | 181,690 | | 4/04/08 | | | (6,058 | ) |

| Indonesian Rupiah | | 1,827,000,000 | | U.S. Dollar | | 195,401 | | 6/10/08 | | | (1,467 | ) |

| Japanese Yen | | 21,260,000 | | U.S. Dollar | | 200,000 | | 5/01/08 | | | (13,705 | ) |

| Mexican Peso | | 1,990,533 | | U.S. Dollar | | 183,481 | | 4/24/08 | | | (2,953 | ) |

| New Taiwan Dollar | | 2,415,000 | | U.S. Dollar | | 75,000 | | 4/07/08 | | | (4,634 | ) |

| New Taiwan Dollar | | 3,951,000 | | U.S. Dollar | | 122,626 | | 4/15/08 | | | (7,918 | ) |

| New Turkish Lira | | 128,530 | | U.S. Dollar | | 100,000 | | 5/14/08 | | | 5,233 | |

| New Turkish Lira | | 127,290 | | U.S. Dollar | | 100,000 | | 5/14/08 | | | 6,147 | |

| New Turkish Lira | | 669,433 | | U.S. Dollar | | 530,791 | | 5/14/08 | | | 37,208 | |

| New Zealand Dollar | | 250,000 | | U.S. Dollar | | 195,254 | | 5/05/08 | | | (89 | ) |

| Singapore Dollar | | 250,000 | | U.S. Dollar | | 176,900 | | 5/14/08 | | | (5,093 | ) |

| South African Rand | | 800,000 | | U.S. Dollar | | 98,436 | | 4/21/08 | | | 324 | |

| South Korean Won | | 159,613,000 | | U.S. Dollar | | 170,673 | | 4/22/08 | | | 9,421 | |

| Swiss Franc | | 245,110 | | Canadian Dollar | | 220,448 | | 4/08/08 | | | (32,086 | ) |

| U.S. Dollar | | 273,334 | | Brazilian Real | | 458,600 | | 4/02/08 | | | (12,081 | ) |

| U.S. Dollar | | 38,000 | | Indonesian Rupiah | | 358,530,000 | | 4/04/08 | | | 937 | |

| U.S. Dollar | | 150,000 | | Indonesian Rupiah | | 1,370,250,000 | | 4/04/08 | | | (1,189 | ) |

| U.S. Dollar | | 79,245 | | New Taiwan Dollar | | 2,415,000 | | 4/07/08 | | | 388 | |

| U.S. Dollar | | 129,882 | | New Taiwan Dollar | | 3,951,000 | | 4/15/08 | | | 662 | |

| U.S. Dollar | | 191,616 | | Colombian Peso | | 372,118,900 | | 4/18/08 | | | 10,870 | |

| U.S. Dollar | | 100,000 | | South African Rand | | 778,200 | | 4/21/08 | | | (4,561 | ) |

| U.S. Dollar | | 102,640 | | South African Rand | | 800,000 | | 4/21/08 | | | (4,528 | ) |

| U.S. Dollar | | 183,527 | | Mexican Peso | | 1,990,533 | | 4/24/08 | | | 2,907 | |

| U.S. Dollar | | 212,818 | | Japanese Yen | | 21,260,000 | | 5/01/08 | | | 888 | |

| U.S. Dollar | | 194,655 | | New Zealand Dollar | | 250,000 | | 5/05/08 | | | 688 | |

| U.S. Dollar | | 181,806 | | Singapore Dollar | | 250,000 | | 5/14/08 | | | 187 | |

| U.S. Dollar | | 200,000 | | Indonesian Rupiah | | 1,827,000,000 | | 6/10/08 | | | (3,132 | ) |

| U.S. Dollar | | 125,000 | | Argentine Peso | | 397,375 | | 6/17/08 | | | (715 | ) |

| | | | | | | | | | | $ | (6,484 | ) |

Interest Rate Swaps outstanding at March 31, 2008:

| | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Notional

Amount | | Fund

Pay/Receive

Floating Rate | | Floating Rate

Index | | Fixed Rate

(Annualized) | | Fixed Rate

Payment

Frequency | | | Termination

Date | | Value at

March 31, 2008 | | | Unrealized

Appreciation

(Depreciation)

(U.S. Dollars) | |

| BNP Paribas | | 900,000 | USD | | Pay | | 12-Month CPI-U | | 2.840% | | 3/04/15 | (5) | | 3/04/15 | | $ | (1,177 | ) | | $ | (1,177 | ) |

| BNP Paribas | | 900,000 | USD | | Receive | | 12-Month CPI-U | | 2.650 | | 3/04/10 | (5) | | 3/04/10 | | | (1,762 | ) | | | (1,762 | ) |

| Deutsche Bank AG | | 1,300,000 | GBP | | Pay | | 6-Month LIBOR | | 4.800 | | Semi-Annually | | | 1/24/10 | | | (13,008 | ) | | | (13,008 | ) |

| Goldman Sachs | | 1,550,000 | EUR | | Pay | | 6-Month EURIBOR | | 4.021 | | Annually | | | 1/26/14 | | | (5,661 | ) | | | (5,661 | ) |

| Goldman Sachs | | 650,000 | EUR | | Receive | | 6-Month EURIBOR | | 4.410 | | Annually | | | 1/26/19 | | | 914 | | | | 914 | |

| Goldman Sachs | | 900,000 | EUR | | Receive | | 6-Month EURIBOR | | 3.675 | | Annually | | | 1/26/11 | | | 6,027 | | | | 6,027 | |

| Morgan Stanley | | 12,250,000 | NOK | | Pay | | 6-Month NIBOR | | 5.625 | | Annually | | | 11/12/09 | | | (15,361 | ) | | | (15,215 | ) |

| Morgan Stanley | | 2,500,000 | NOK | | Pay | | 6-Month NIBOR | | 5.500 | | Annually | | | 11/12/17 | | | 9,179 | | | | 9,179 | |

| Morgan Stanley | | 2,625,000 | USD | | Pay | | 3-Month USD-LIBOR | | 3.198 | | Semi-Annually | | | 1/21/11 | | | 17,991 | | | | 17,991 | |

| Morgan Stanley | | 3,000,000 | BRL | | Pay | | 1-Day BZDIRA | | 12.720 | | 1/05/10 | (6) | | 1/04/10 | | | (210 | ) | | | (210 | ) |

| Morgan Stanley | | 4,000,000 | BRL | | Pay | | 1-Day BZDIRA | | 11.270 | | 1/05/10 | (6) | | 1/04/10 | | | (60,097 | ) | | | (60,097 | ) |

| Morgan Stanley | | 625,000 | USD | | Receive | | 3-Month USD-LIBOR | | 4.490 | | Semi-Annually | | | 1/21/19 | | | (8,047 | ) | | | (8,047 | ) |

| Morgan Stanley | | 9,750,000 | NOK | | Receive | | 6-Month NIBOR | | 5.423 | | Annually | | | 11/12/12 | | | (3,168 | ) | | | (3,168 | ) |

| | | | | | | | | | | | | | | | | | | | | $ | (74,234 | ) |

16

Credit Default Swaps outstanding at March 31, 2008:

| | | | | | | | | | | | | | | | | | |

| Counterparty | | Referenced Entity | | Buy/Sell

Protection | | Notional

Amount | | Fixed

Rate | | | Termination

Date | | Value at

March 31, 2008 | | Unrealized

Appreciation

(Depreciation)

(U.S. Dollars) |

| Bank of America | | Macy’s Inc. | | Buy | | $ | 125,000 | | 2.800 | % | | 3/20/13 | | $ | 153 | | $ | 153 |

| Goldman Sachs | | DJ Investment Grade CDX | | Sell | | | 742,500 | | 3.750 | | | 12/20/12 | | | (78,775) | | | (76,920) |

| Lehman Brothers | | Harrah’s Entertainment Inc. | | Sell | | | 125,000 | | 3.750 | | | 9/20/08 | | | (1,609) | | | (1,611) |

| | | | | | | | | | | | | | | | | | $ | (78,378) |

Futures Contracts outstanding at March 31, 2008:

| | | | | | | | | | | | | | | |

| Type | | Contract

Position | | Number of

Contracts | | | Contract

Expiration | | Value at

March 31,2008

(U.S. Dollars) | | | Unrealized

Appreciation

(Depreciation)

(U.S. Dollars) | |

| U.S. 2-Year Treasury Note | | Long | | 33 | | | 6/08 | | $ | 7,083,656 | | | $ | 32,901 | |

| U.S. 5-Year Treasury Note | | Long | | 9 | | | 6/08 | | | 1,028,109 | | | | (1,644 | ) |

| U.S. 10-Year Treasury Note | | Short | | (10 | ) | | 6/08 | | | (1,189,531 | ) | | | (14,093 | ) |

| | | | | | | | | | | | | | $ | 17,164 | |

| (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | | Ratings: Using the higher of Standard & Poor’s Group (“Standard & Poor’s”) or Moody’s Investor Service, Inc. (“Moody’s”) rating. Ratings below BBB by Standard & Poor’s or Baa by Moody’s are considered to be below investment grade. |

| (3) | | Investment valued at fair value using methods determined in good faith by, or at the discretion of, the Board of Trustees. |

| (4) | | Principal Amount rounds to less than $1,000. |

| (5) | | Fixed Rate Payment due upon contract termination. |

| (6) | | Fixed Rate Payment due one business day subsequent to contract termination. |

| 144A | | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration which are normally those transactions with qualified institutional buyers. |

| OTC | | Over-The-Counter market transaction. |

| BZDIRA | | Brazil Inter-Bank Deposit Rate Annualized |

| CPI-U | | USA-Non-Revised Consumer Price Index-Urban |

| EURIBOR | | Europe Inter-Bank Offered Rate |

| LIBOR | | London Inter-Bank Offered Rate |

| NIBOR | | Norwegian Inter-Bank Offered Rate |

See accompanying notes to financial statements.

17

Portfolio of Investments (Unaudited)

Nuveen Multi-Strategy Income Fund

March 31, 2008

| | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value |

| | | | | | | | | | | | |

| | | CORPORATE BONDS – 22.4% | | | | | | | | | |

| | | | | |

| | | Aerospace & Defense – 0.9% | | | | | | | | | |

| | | | | |

| $ | 12 | | Boeing Capital Corporation | | 5.800% | | 1/15/13 | | A+ | | $ | 12,963 |

| | | | | |

| | 50 | | DI Finance/DynCorp International, Series B | | 9.500% | | 2/15/13 | | B | | | 51,125 |

| | | | | |

| | 40 | | Hawker Beechcraft Acquistion Company | | 9.750% | | 4/01/17 | | B– | | | 40,000 |

| | | | | |

| | 20 | | Honeywell International Inc. | | 7.500% | | 3/01/10 | | A | | | 21,566 |

| | | | | |

| | 40 | | L-3 Communications Corporation | | 6.125% | | 1/15/14 | | BB+ | | | 39,200 |

| | | | | |

| | 10 | | Lockheed Martin Corporation | | 7.650% | | 5/01/16 | | A– | | | 11,758 |

| | | | | |

| | 8 | | United Technologies Corporation | | 7.500% | | 9/15/29 | | A | | | 9,618 |

| | 180 | | Total Aerospace & Defense | | | | | | | | | 186,230 |

| | | Auto Components – 0.1% | | | | | | | | | |

| | | | | |

| | 20 | | Lear Corporation | | 8.750% | | 12/01/16 | | B– | | | 17,175 |

| | | Beverages – 0.1% | | | | | | | | | |

| | | | | |

| | 7 | | Coca-Cola Enterprises Inc. | | 6.750% | | 9/15/28 | | A | | | 7,714 |

| | | | | |

| | 5 | | Diageo Capital, PLC | | 5.750% | | 10/23/17 | | A– | | | 5,130 |

| | | | | |

| | 10 | | Pepsi Bottling Group LLC | | 5.500% | | 4/01/16 | | A | | | 10,410 |

| | 22 | | Total Beverages | | | | | | | | | 23,254 |

| | | Building Products – 0.3% | | | | | | | | | |

| | | | | |

| | 40 | | Dayton Superior Corporation | | 13.000% | | 6/15/09 | | CCC+ | | | 34,900 |

| | | | | |

| | 4 | | Masco Corporation | | 5.875% | | 7/15/12 | | BBB+ | | | 4,036 |

| | | | | |

| | 20 | | Norcraft Holdings LP | | 9.750% | | 9/01/12 | | B– | | | 17,600 |

| | 64 | | Total Building Products | | | | | | | | | 56,536 |

| | | Capital Markets – 0.4% | | | | | | | | | |

| | | | | |

| | 80 | | JP Morgan Chase & Company | | 5.375% | | 10/01/12 | | Aa2 | | | 83,149 |

| | | | | |

| | 1 | | Merril Lynch & Company | | 3.700% | | 4/21/08 | | A+ | | | 999 |

| | 81 | | Total Capital Markets | | | | | | | | | 84,148 |