UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

(Amendment No. 1)

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005.

Commission file number: 000-30134

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of Event requiring this shell company report

CDC Corporation

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

33/F Citicorp Centre

18 Whitfield Road

Causeway Bay, Hong Kong

011-852-2893-8200

e-mail: investor_relations@cdccorporation.net

(Address of principal executive offices)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Class A common shares

Indicate the number of outstanding shares of each of the Issuer’s class of capital or common stock as of the close of the period covered by this Annual Report:

| | |

Class of shares | | Number outstanding as of March 31, 2006 |

| Class A common shares | | 111,655,585 |

| Preferred Shares | | Nil |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

TABLE OF CONTENTS

Index to Exhibits

| | |

Exhibit 12.1 | | Certification of CEO required by Rule 13a-14(a) |

Exhibit 12.2 | | Certification of CFO required by Rule 13a-14(a) |

Exhibit 13.(a).1 | | Certification of CEO pursuant to Section 906 |

Exhibit 13.(a).2 | | Certification of CFO pursuant to Section 906 |

Exhibit 15.(a).4 | | Consent of Deloitte Touche Tohmatsu dated July 2, 2007 |

Exhibit 15.(a).5 | | Consent of Ernst & Young dated July 2, 2007 |

Exhibit 15.(a).6 | | Consent of PricewaterhouseCoopers LLP dated July 2, 2007 |

Exhibit 15.(a).7 | | Consent of Deloitte Touche Tohmatsu dated June 29, 2007 |

-i-

EXPLANATORY NOTE

The purpose of this Amendment No. 1 on Form 20-F/A (“Amendment No. 1”) to the annual report on Form 20-F (the “Annual Report”) of CDC Corporation (the “Company”) for the year ended December 31, 2005, filed with the U.S. Securities and Exchange Commission (the “SEC”) on June 21, 2006 (the “Annual Report Filing Date”) is to: (i) restate the Company’s consolidated financial statements and notes related thereto for the three years ended December 31, 2005 (the “Restatement”), as more fully described below and herein; and (ii) provide separate financial statements and notes related thereto of Equity Pacific Limited, its subsidiaries and its variable interest entity (collectively, “17game Group”), including separate consolidated balance sheets for 17game Group as of December 31, 2004 and 2005 and the related consolidated statements of operations, shareholders’ equity and cash flows for the year ended December 31, 2005 and for the five month period from August 1 to December 31, 2004 and the accompanying audit report of Deloitte Touche Tohmatsu CPA Ltd. (“Deloitte”) (collectively, the “17game Group Financial Statements”), as more fully described below under the caption “Inclusion of 17game Group Financial Statements.”

The following items have been amended or added in this Amendment No. 1 as a result of the Restatement and the Inclusion of 17game Group Financial Statements:

Part I – Item 3 – Key Information

Part I – Item 4 – Information on the Company

Part I – Item 5 – Operating and Financial Review and Prospects

Part I – Item 8 – Financial Information

Part II – Item 15 – Controls and Procedures

Part III – Item 18 – Financial Statements

Part III – Item 19 – Exhibits

“Item 19. Exhibits,” has been amended to include the consents of each of Deloitte, Ernst & Young (E&Y) and PricewaterhouseCoopers LLP, the Company’s current and previous independent registered public accounting firms, as well as currently dated certifications by the Company’s Chief Executive Officer and Chief Financial Officer.

Restatement of 2003, 2004 and 2005 Financial Statements

After the Company filed the Annual Report, and as a result of review processes undertaken in connection with certain capital markets initiatives, management of the Company concluded, and the Audit Committee of the Company’s Board of Directors concurred, after consultation with the Company’s current and previous independent registered public accounting firms, that certain of the Company’s previously issued consolidated financial statements contained errors and would need to be restated.

The more significant of the identified errors, which prompted the Restatement, relates to the application of Statement of Financial Accounting Standard (“SFAS”) 109, “Accounting for Income Taxes,” in the Company’s purchase business combinations in 2004 and 2005. Additional errors were identified in the Company’s assessment of the appropriate application of US GAAP, and the Company has elected to adjust its consolidated financial statements for the three years ended December 31, 2005 for other items that management had previously evaluated as immaterial, individually and in the aggregate. Such additional items relate to certain foreign currency translation transactions, the accounting for a lease acquired in a business combination, and the presentation of pension liabilities, amortization expense related to acquired developed technologies, inter-company interest income, restructuring costs and other items.

A description of the accounting errors and the related impact of the Restatement on the Company’s consolidated financial statements is set forth in Note 2, “Restatement of Financial Statements”, in the notes to the Company’s consolidated financial statements included in this Amendment No. 1

The changes made in connection with the Restatement have resulted, in the aggregate, in increases in the Company’s net income by approximately $0.2 million, $3.4 million and $0.2 million in 2003, 2004 and 2005, respectively.

Additionally, in connection with the Restatement as well as the identification of the accounting errors referenced above, the Company has identified material weaknesses in its internal control over financial reporting as of December 31, 2005, and has reported those to its Audit Committee. For additional information, please see Part II, Item 15, “Controls and

1

Procedures,” which has been amended and restated in this Amendment No. 1 to provide a description of these matters and certain remediation measures that the Company has implemented, or plans to implement, in order to strengthen its internal control over financial reporting.

Inclusion of 17game Group Financial Statements

The Company has also amended “Item 8. Financial Information” and “Item 18. Financial Statements” of the Annual Report to provide the 17game Group Financial Statements.

This 17game Group Financial Statements are being provided in response to comments of the staff of the SEC received in connection with its review of the Annual Report.

The Company’s holdings in 17game Group met a significance test under Rule 3-09 of Regulation S-X and, as a result, the financial statements of 17game Group for 2005 and 2004 are required to be filed. The 17game Group Financial Statements begin on page FF-1 hereof. The 17game Group Financial Statements have been prepared by, and are the responsibility of, 17game Group and its management.

Other than as set forth herein, the Company has not modified or updated any other disclosures in the Annual Report. The Company has made no changes to the Items in the Annual Report other than those described herein, and accordingly, it has omitted all such unchanged information.

Other than expressly set forth herein, this Amendment No. 1 does not reflect events occurring after the Annual Report Filing Date or modify or update those disclosures affected by subsequent events. Rather, except as described above, information is unchanged and reflects the disclosures made at the time of the Annual Report Filing Date. Accordingly, this Amendment No. 1 should be read in conjunction with the Annual Report and the Company’s filings made subsequent thereto, including any amendments to those filings. The filing of this Amendment No. 1 shall not be deemed an admission that the Annual Report when made included any untrue statement of a material fact or omitted to state a material fact necessary to make a statement not misleading.

The Company has not amended, and does not anticipate amending, any of its Annual Reports on Form 20-F for any of the years prior to the year ended December 31, 2005. The information that has been previously filed or otherwise reported for those periods is superseded by the information in this Amendment No. 1. Accordingly, and as a result of the Restatement, the Company believes that its previously issued consolidated financial statements and corresponding reports of independent registered public accountants and press releases containing its financial information for the years ended December 31, 2003, 2004 and 2005 should no longer be relied upon.

2

PART I.

| A. | Selected Financial Data |

The following selected consolidated financial data of CDC and its subsidiaries should be read in conjunction with the consolidated balance sheets as of December 31, 2003, 2004 and 2005 and the related consolidated statements of operations, cash flows and shareholders’ equity for the years then ended and the notes thereto, together referred to as the Consolidated Financial Statements, included in Item 18, Financial Statements, and the information included in Item 5, Operating and Financial Review and Prospects. The selected consolidated financial data of CDC for 2001 and 2002 have been derived from our audited Consolidated Financial Statements. The Consolidated Financial Statements have been prepared and presented in accordance with US GAAP.

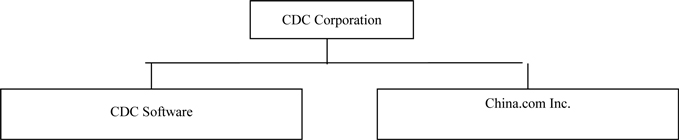

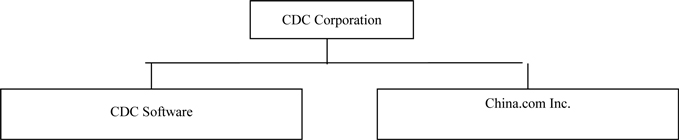

We report operating results in four business segments, “Software,” “Business Services,” “Mobile Services and Applications” and “Internet and Media”. During 2005 the Company reorganized these segments into two core business units, CDC Software and China.com Inc. The operations of Software and Business Services is included in the CDC Software business unit and the operations of Mobile Services and Applications and Internet and Media is included in the China.com Inc business unit. See “Note 28 – Segment Information” in Item 18 Financial Statements for additional disclosure of segment information.

In 2004, we reported operating results in five business segments, “Software,” “Business Services,” “Mobile Services and Applications,” “Advertising/Marketing” and “Others”. These segments were based primarily on the different production, manufacturing and other value-added processes that we performed with respect to our products and services and, to lesser extend, the differing nature of the ultimate end use of our products and services. Prior to 2004, we reported operating results in “Software and Consulting Services”, “Mobile Services and Applications”, “Advertising and Marketing Activities” and “Others”. Except for the operating results of the “Others” segment, all amounts in this Annual Report on Form 20-F reflect the reclassification of the pre-2005 segments so that they are comparable with the current year presentation. Operating results from the “Others” segment are nil in 2005 due to the discontinued operations in this segment in 2004 and earlier.

In addition, CDC discontinued the operations of certain subsidiaries. The operating results of the discontinued operating units were retroactively reclassified as a Loss from operations of discontinued subsidiaries, net of tax, in all periods presented in this Annual Report on Form 20-F.

3

INCOME STATEMENT DATA:

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, (in thousands, except share and per share data) | |

| | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | |

| | | | | | | | | (Restated)(7) | | | (Restated)(7) | | | (Restated)(7) | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

CDC Software | | | 17,806 | | | | 16,332 | | | | 53,368 | | | | 150,575 | | | | 201,490 | |

China.com | | | 11,904 | | | | 6,468 | | | | 24,483 | | | | 31,877 | | | | 43,384 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 29,710 | | | | 22,800 | | | | 77,851 | | | | 182,452 | | | | 244,874 | |

| | | | | | | | | | | | | | | | | | | | |

Cost of Revenues: | | | | | | | | | | | | | | | | | | | | |

CDC Software | | | (12,077 | ) | | | (6,828 | ) | | | (32,899 | ) | | | (74,801 | ) | | | (95,238 | ) |

China.com | | | (5,636 | ) | | | (4,197 | ) | | | (6,209 | ) | | | (7,916 | ) | | | (18,711 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | (17,713 | ) | | | (11,025 | ) | | | (39,108 | ) | | | (82,717 | ) | | | (113,949 | ) |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 11,997 | | | | 11,775 | | | | 38,743 | | | | 99,735 | | | | 130,925 | |

Selling, general and administrative expenses | | | (69,949 | ) | | | (22,307 | ) | | | (31,606 | ) | | | (80,326 | ) | | | (100,549 | ) |

Research and development expenses | | | — | | | | — | | | | — | | | | (13,825 | ) | | | (22,605 | ) |

Depreciation and amortization expenses | | | (19,007 | ) | | | (9,015 | ) | | | (6,829 | ) | | | (8,919 | ) | | | (9,937 | ) |

Restructuring expensess | | | (21,908 | ) | | | — | | | | — | | | | (3,760 | ) | | | (1,667 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | (110,864 | ) | | | (31,322 | ) | | | (38,435 | ) | | | (106,830 | ) | | | (134,758 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating gain (loss) | | | (98,867 | ) | | | (19,547 | ) | | | 308 | | | | (7,095 | ) | | | (3,833 | ) |

| | | | | | | | | | | | | | | | | | | | |

Interest income | | | 26,491 | | | | 23,631 | | | | 13,412 | | | | 9,653 | | | | 8,156 | |

Interest expense | | | (1,266 | ) | | | (2,461 | ) | | | (1,070 | ) | | | (1,895 | ) | | | (1,257 | ) |

Loss arising from share issuance of a subsidiary | | | (55 | ) | | | — | | | | — | | | | — | | | | — | |

Gain (loss) on disposal of available-for-sale securities | | | 4,411 | | | | (163 | ) | | | 4,599 | | | | 167 | | | | 525 | |

Gain (loss) on disposal of subsidiaries and cost investments | | | (1,915 | ) | | | (66 | ) | | | (1,263 | ) | | | 892 | | | | 483 | |

Other non-operating gains | | | — | | | | 508 | | | | 934 | | | | — | | | | — | |

Other non-operating losses | | | (927 | ) | | | (288 | ) | | | (143 | ) | | | — | | | | — | |

Impairment of cost investments and available-for-sale securities | | | (12,260 | ) | | | (5,351 | ) | | | — | | | | (1,362 | ) | | | — | |

Share of income (losses) in equity investees(1) | | | (2,592 | ) | | | 682 | | | | (124 | ) | | | (467 | ) | | | (1,172 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total other income | | | 11,887 | | | | 16,492 | | | | 16,345 | | | | 6,988 | | | | 6,735 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (86,980 | ) | | | (3,055 | ) | | | 16,653 | | | | (107 | ) | | | 2,902 | |

Income tax benefit (expenses) | | | (65 | ) | | | 162 | | | | 448 | | | | (3,375 | ) | | | (4,957 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before minority interests | | | (87,045 | ) | | | (2,893 | ) | | | 17,101 | | | | (3,482 | ) | | | (2,055 | ) |

Minority interests in losses (income) of consolidated subsidiaries | | | 3,162 | | | | 248 | | | | (2,257 | ) | | | (925 | ) | | | (1,409 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (83,883 | ) | | | (2,645 | ) | | | 14,844 | | | | (4,407 | ) | | | (3,464 | ) |

Discontinued operations: | | | | | | | | | | | | | | | | | | | | |

Loss from operations of discontinued subsidiaries, net of tax | | | (40,502 | ) | | | (16,131 | ) | | | (1,203 | ) | | | (610 | ) | | | (47 | ) |

Gain (loss) on disposal/dissolution of discontinued subsidiaries, net | | | — | | | | 545 | | | | 2,127 | | | | (950 | ) | | | (3 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | (124,385 | ) | | | (18,231 | ) | | | 15,768 | | | | (5,967 | ) | | | (3,514 | ) |

| | | | | | | | | | | | | | | | | | | | |

Basic and diluted earnings (loss) per share from continuing operations(2) | | $ | (0.82 | ) | | $ | (0.03 | ) | | $ | 0.15 | | | $ | (0.04 | ) | | $ | (0.03 | ) |

Basic and diluted earnings (loss) per share(2) | | $ | (1.21 | ) | | $ | (0.18 | ) | | $ | 0.16 | | | $ | (0.06 | ) | | $ | (0.03 | ) |

Weighted average number of shares: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 102,589,760 | | | | 102,269,735 | | | | 100,532,594 | | | | 105,898,392 | | | | 111,085,657 | |

Diluted | | | 102,589,760 | | | | 102,269,735 | | | | 103,199,421 | | | | 105,898,392 | | | | 111,085,657 | |

4

The following selected consolidated financial data of CDC and its subsidiaries are derived from our audited financial data, after adjustment for the reclassification of discontinued operations and segment reporting.

BALANCE SHEET DATA:

| | | | | | | | | | |

| | | As of December 31, (in thousands, except share and per share data) |

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 |

| | | | | | | (Restated)(7) | | (Restated)(7) | | (Restated)(7) |

Cash and cash equivalents | | 20,820 | | 33,153 | | 55,508 | | 110,206 | | 93,719 |

Restricted cash | | 1,274 | | 109 | | 238 | | 3,886 | | 1,886 |

Available-for-sale debt securities(3) | | 346,980 | | 320,056 | | 282,145 | | 104,159 | | 115,881 |

Restricted available-for-sale debt securities(4) | | 134,960 | | 151,123 | | 19,803 | | 75,780 | | 32,270 |

Available-for-sale equity securities | | 2,064 | | 2,050 | | — | | 527 | | 659 |

Bank loans(5) | | 118,455 | | 127,384 | | 26,826 | | 63,781 | | 26,249 |

Working capital(6) | | 359,412 | | 340,476 | | 270,451 | | 177,602 | | 75,447 |

Total assets | | 596,494 | | 580,957 | | 553,074 | | 693,871 | | 633,032 |

Common stock | | 26 | | 25 | | 25 | | 28 | | 28 |

Total shareholders’ equity | | 389,861 | | 377,700 | | 395,701 | | 449,976 | | 446,498 |

| (1) | The term “equity investees” refers to CDC’s investments in which it has the ability to exercise significant influence (generally 20% to 50% owned investments). |

| (2) | The computation of diluted earnings (loss) per share did not assume the conversion of the Company’s warrants for 2001, 2002 and 2003 and its stock options for 2001, 2002, 2004 and 2005 because their inclusion would have been antidilutive. |

| (3) | Available-for-sale debt securities includes short and long-term available-for-sale debt securities. |

| (4) | Restricted available-for-sale debt securities include short and long-term restricted debt securities. |

| (5) | Bank loans include short and long-term bank loans. |

| (6) | Working capital represents current assets less current liabilities. |

| (7) | See Note 2, “Restatement of Financial Statements”, to the Company’s consolidated financial statements which is included in this Amendment No.1. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Risks Relating to our Overall Business

Because our business model and strategy have evolved, we lack experience and have a limited operating history in our new markets and cannot assure you that we will be successful in meeting the needs of customers in these markets. Our operating results could fall below expectations, resulting in a decrease in our stock price.

We began in June 1997 as a pan-Asian integrated Internet company. Our business model and strategy has evolved with a new focus and goal to be a global company focused on enterprise software, through our CDC Software business unit, and on mobile applications and online games through our China.com Inc. business unit. You will not be able to evaluate our prospects solely by reviewing our past businesses and results, but should consider our prospects in light of the changes in our business focus. Each of our targeted markets is rapidly changing, and we cannot assure you that we can successfully address the challenges in our new lines of business or adapt our business model and strategy to meet the needs of customers in these markets. If we fail to modify our business model or strategy to adapt to these markets, our business could suffer.

We have incurred losses in prior periods, may incur losses in the future and cannot provide any assurance that we can achieve or sustain profitability.

5

We have incurred operating losses and net losses in each of our last 5 fiscal years (except for fiscal year 2003) as follows:

| | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, (in Thousands) | |

| | | 2001 | | | 2002 | | | 2003 | | 2004 | | | 2005 | |

| | | | | | | | | (Restated)(1) | | (Restated)(1) | | | (Restated)(1) | |

Operating Gain/(loss) | | $ | (98,867 | ) | | $ | (19,547 | ) | | $ | 308 | | $ | (7,095 | ) | | $ | (3,833 | ) |

Net income Gain/(loss) | | $ | (124,385 | ) | | $ | (18,231 | ) | | $ | 15,768 | | $ | (5,967 | ) | | $ | (3,514 | ) |

| (1) | See Note 2, “Restatement of Financial Statements”, to the Company’s consolidated financial statements which is included in this Amendment No.1. |

Our operating losses and net losses may increase in the future, and we may never regain or sustain operating profitability or net profitability. We may continue to incur operating losses and post net losses in the future due to several factors, including:

| | • | | planned acquisition activities related to the growth and development of both of our core business units, CDC Software and China.com Inc.; |

| | • | | continuing effects of acquisition-related adjustments including intangible asset amortization, stock compensation and deferred tax expense; |

| | • | | a high level of planned operating expenditures, including costs we expect to incur as a result of our ongoing efforts to comply with the regulations promulgated under the Sarbanes-Oxley Act of 2002; |

| | • | | increased investment activities related to our new businesses as we seek to achieve organic growth, which may include; |

| | • | | increased sales and marketing costs; |

| | • | | greater levels of product development expenses; |

In addition, while we experienced sequential quarterly increases in revenues in 2005 (except for the third quarter), we cannot be certain that revenue growth will continue in the future. We may see a reversal of the recent sequential growth in quarterly revenues due to several factors, including:

| | • | | any decisions to dispose of business units or subsidiaries which we no longer believe to be central to our new business model and strategy, which would shrink our revenue base; |

| | • | | a substantial portion of our software license revenue is recognized in the last month of a quarter, and often in the last weeks or days of a quarter, which may result in increased volatility in quarterly revenues if customers decide to defer or cancel orders or implementations, particularly large orders or implementations, from one quarter to the next; |

| | • | | delay of new software product releases which can result in a customer’s decision to delay execution of a contract or, for contracts that include the new software release as an element of the contract, will result in deferral of revenue recognition until such release; |

| | • | | the imposition of penalties, such as a temporary suspension of service, for violation of current or future Chinese laws, rules or regulations regarding Internet related services and telecom related activities, such as that experienced by our Go2joy subsidiary during 2004; |

| | • | | the potential or actual loss of key clients and key personnel; |

6

| | • | | decisions to discontinue products and services which would shrink our revenue base; |

| | • | | our failure to increase market awareness of our company, our brands and our products and services; and |

| | • | | a slowdown in the U.S., European, Asian and other economic markets. |

These factors could also adversely affect our ability to regain or sustain profitability. We cannot assure you that we will generate sufficient revenue to regain or sustain profitability, or that we can regain, sustain or increase profitability on a quarterly or annual basis. Even though our revenue is difficult to predict, we base our decisions regarding our operating expenses on anticipated revenue trends. Many of our expenses are relatively fixed, and we cannot quickly reduce spending in response to the lower revenue growth than expected. As a result, revenue shortfalls could result in significantly lower income or result in a greater loss than anticipated for any given period, which could result in a decrease in our stock price. If revenue does not meet our expectations, or if operating expenses exceed what we anticipate or cannot be reduced accordingly, our business, results of operations and financial condition will be materially and adversely affected.

As part of our 2005 reorganization into two core business units, we may incur future restructuring costs and increase our potential liabilities as we continue to transition financial and administrative functions to our business units.

During 2005 we reorganized our business into two core business units, CDC Software and China.com Inc. As part of this reorganization we initiated a series of restructurings of our operations involving, among other things, the reduction of overlapping personnel predominately from our Hong Kong office in financial and administrative functions and the transition of those financial and administrative functions to our two business units. As we continue with this transition, we need to ensure that all operational, managerial and financial controls, procedures and policies are fully and completely transitioned. Significant risks relating to this transition could cause us to continue to incur costs and potential liability which may outweigh the benefits of these restructurings. The failure to successfully transition our financial and administrative functions to our business units could materially and adversely affect our business and financial condition.

Further, as a result of this transition, we have ceased to use certain of our leased facilities and, accordingly, we are negotiating certain lease terminations and/or subleases of our facilities. We cannot predict when or if we will be successful in negotiating lease terminations and/or subleases of our facilities on terms acceptable to us. If we are not successful at negotiating terms acceptable to us, or at all, we may be required to increase our restructuring and related expenses in future periods.

As part of our 2005 strategic review, we have discovered certain instances of possible corporate misconduct by some of our former executive which may result in the company filing suits against such former executives which could be expensive and divert management’s attention away from the operations.

As part of our 2005 strategic review, we have discovered certain instances of possible corporate misconduct by some of our former executives. On January 19, 2006, we filed suit in the High Court of Hong Kong against a former officer in our Hong Kong office for breach of fiduciary duties and failure to comply with our corporate governance and compliance policies. The former executive has denied the allegations and has indicated his intention to defend against the suit and potentially file a cross-claim against us. The proceeding is at its preliminary stages. Our discovery of such instances of possible corporate misconduct, may identify possible weaknesses in our internal controls. Although our internal testing, as well as our independent registered accounting firm’s report, identified no material weaknesses in our internal controls, certain weaknesses may be discovered in relation to such corporate misconduct that will require remediation. This remediation may require implementing additional controls, the costs of which could have an adverse effect on our operating results. Subsequently, we have identified material weaknesses in our internal controls over financial reporting which are discussed further in “Item 15, Controls and Procedures” herein. Further, should we determine to continue our claims against such former officers for identified instances of alleged corporate misconduct, we could incur substantial costs associated with the litigations, increase the risk of cross claims by such officers against us and divert our managements’ attention from our operations. We cannot estimate the possible costs associated with these current or future litigations at this time.

Our strategy of expansion through acquisitions or investments has been and will continue to be costly and may not be effective, and we may realize losses on our investments.

7

As a key component of our business and growth strategy, we have acquired and invested in, and intend to continue to acquire and invest in, companies and assets that we believe will enhance our business model, revenue base, operations and profitability, particularly relating to our strategy in enterprise software, outsourced software development and mobile services. Our acquisitions and investments have resulted in, and will continue to result in, the use of significant amounts of cash, dilutive issuances of our common shares and amortization expenses related to certain intangible assets, each of which could materially and adversely affect our business, results of operations and financial condition.

Our continued international acquisitions and investments may expose us to additional regulatory and political risks, and could negatively impact our business prospects.

Our expansion throughout international markets exposes us to the following risks, any of which could negatively impact our business prospects:

| | • | | adverse changes in regulatory requirements, including export restrictions or controls; |

| | • | | potentially adverse tax and regulatory consequences; |

| | • | | differences in accounting practices; |

| | • | | different cultures which may be relatively less accepting of our business; |

| | • | | difficulties in staffing and managing operations; |

| | • | | greater legal uncertainty; |

| | • | | tariffs and other trade barriers; |

| | • | | changes in the general economic and investment climate affecting valuations and perception of our business sectors; |

| | • | | political instability and fluctuations in currency exchange rates; and |

| | • | | different seasonal trends in business activities. |

During each of 2003 and 2004, we were dependent on acquisitions for our increase in revenues rather than organic growth of our businesses.

During each of 2003 and 2004, we acquired several businesses material to our results for those years.

| | • | | During 2003, our material acquisitions included the acquisition of Praxa, an Australian information technology outsourcing and professional services organization; the acquisition of Palmweb Inc. which operates Newpalm, a provider of mobile services and applications in China; and the acquisition of IMI, an international provider of software to the supply chain management sector principally in Europe and the United States. |

| | • | | During 2004, our material acquisitions included the acquisition of Pivotal Corporation (“Pivotal”), a customer relationship management (CRM) company focused on mid-sized enterprises; the acquisition of Group Team Investments Limited, which holds Beijing He He Technology Co. Ltd. which operates Go2joy, a mobile services and applications provider based in Beijing, China; and the acquisition of Ross Systems, Inc. (“Ross”), an ERP company focused on the food and beverage, life sciences, chemicals, metals and natural products industries. |

| | • | | During 2005 we did not have any material acquisitions. |

8

Between 2003 and 2004, our consolidated net revenues increased 134%, or approximately $104.6 million, from $77.9 million in 2003 to $182.5 million in 2004 primarily due to the acquisitions of Ross, Pivotal, and Go2joy, as well as the inclusion of a full year of results from acquisitions made in 2003. Between 2004 and 2005, our consolidated net revenues increased 34%, or approximately $62.4 million, from $182.5 million in 2004 to $244.9 million in 2005 primarily from the inclusion of Ross, Pivotal and Go2joy for the full year in 2005 and increased sales volumes in certain key products as discussed under section “Results of Operations” in Item 5, Operating Financial Review and Prospects.

We have been expanding our business through acquisitions and may lose our investment if we do not successfully integrate the businesses we acquire.

During 2004 we expanded our operations rapidly, both in size and scope, through acquisitions, and during 2005 and in the future need to integrate, manage and protect our interests in the businesses we acquire. We may experience difficulties in integrating, assimilating and managing the operations, technologies, intellectual property, products and personnel of our acquired businesses individually and cumulatively, and may need to reorganize or restructure our operations to achieve our operating goals. This may include creating or retaining separate units or entities within each of our operating segments. Our failure to integrate and manage our acquired businesses successfully could delay the contribution to profit that we anticipate from these acquisitions, and could have a material adverse effect on our business, results of operations and financial condition.

Integration related to our past and future acquisitions requires us to implement controls, procedures and policies which divert management’s attention and may increase the costs of our acquisitions, reduce employee morale and impact the operating results of our businesses.

Our acquisitions divert management’s attention from our operations in order to focus upon integrating our acquired businesses. In addition, to realize the benefits of our acquisitions, we need to conform the operational, managerial and financial controls, procedures and policies between our corporate headquarters and the businesses we have acquired, which may divert management’s attention further, increase transaction costs, and reduce employee morale. Significant risks relating to our past and future acquisitions which could cause us to continue to incur transaction costs that may outweigh the benefits of the acquisitions, include:

| | • | | the difficulty and cost in combining the operations, technology and personnel of acquired businesses with our operations and personnel; |

| | • | | retaining and integrating key employees and managing employee morale; |

| | • | | integrating or combining different corporate cultures; |

| | • | | effectively integrating products, research and development, sales, marketing and support operations; |

| | • | | maintaining focus on our day-to-day operations; |

| | • | | impairing relationships with key customers of the acquired businesses due to changes in ownership; |

| | • | | facing potential claims filed by terminated employees and contractors; and |

| | • | | geographic complexity and adapting to local market conditions and business practices. |

Any one of these challenges could strain our management resources.Our failure to integrate and manage our acquired businesses successfully could delay the contribution to profit that we anticipate from these acquisitions, and could have a material adverse effect on our business, results of operations and financial condition.

Several of our products and services are quite disparate, and it is difficult to discern significant synergies which limits the amount of integration, cost savings and cross-selling we may be able to achieve among our business segments.

9

We are a global company focused on enterprise software, through our CDC Software business unit, and on mobile applications and online games through our China.com Inc. business unit. Several of our products and services are quite disparate, and it is difficult to discern significant synergies among some of our business segments although we are attempting to realize synergies within our individual business segments. For example, our Software segment focuses on delivering enterprise software applications and related services around the world for enterprise resource planning, supply chain management, customer relationship management, order management systems, human resource management and business intelligence. Our Mobile Services and Applications segment focuses upon providing popular news and mobile applications services targeting the consumer market in China through wireless services such as short message service, multimedia message service, wireless application protocol and interactive voice response. Because our segments are quite distinct, there may be limits to the amount of integration, cost savings and cross-selling we may be able to achieve among our business segments.

We may not be able to realize the anticipated cost savings, synergies or revenue enhancements from integrating acquired businesses into our operations, and we may incur significant integration costs to achieve these cost savings, synergies or revenue enhancements, which have and could continue to adversely affect our results of operations.

Our ability to realize cost savings, synergies or revenue enhancements may be affected by the extent, timing and efficiency with which we can consolidate operations, reduce overlapping personnel while avoiding labor disputes and achieve compatibility or integrate acquired technology, all of which are difficult to predict. We may not be able to realize cost savings, synergies or revenue enhancements from such integration, and we may not be able to realize such benefits within a reasonable time frame. Realizing these benefits is difficult because historically most of the companies we have acquired have been in poor financial condition.

In addition, our expected cost savings, synergies or revenue enhancements, may be reduced by unexpected costs in connection with our integration efforts or a slowdown in revenue growth or collection of accounts receivable, increased operating losses related to acquired businesses, or accounting charges and adjustments we are required to make as a result of our acquisitions. For example, during 2004 and 2005, our net income was adversely affected because we were required to record certain acquisition-related expenses, including the following:

| | • | | amortization of acquired intangibles; |

| | • | | write-off of acquired deferred revenue; |

| | • | | stock compensation expenses; |

| | • | | deferred tax expenses; and |

A number of these non-cash acquisition-related expenses such as amortization of acquired intangibles, deferred tax expense, and stock compensation will continue to adversely affect our results of operations in 2006 and beyond. We will continue to review our assumptions made in accounting for the acquisition of subsidiaries and will make adjustments if required. See Item 5.A. — “Operating and Financial Review and Prospects – Management’s Discussion and Analysis of Financial Condition and Results of Operations — Critical Accounting Policies and Estimates – Goodwill and Intangible Assets”, “– Business Combinations”, and “– Deferred Tax Valuation Allowance”.

While we have cash and cash equivalents of $93.7 million and total debt securities of $148.2 million as of December 31, 2005, much of this balance is held at our China.com subsidiary, and we have limited ability to use these funds at, or for the benefit of, the CDC Corporation parent or our other subsidiaries outside of the China.com chain of subsidiaries.

While we have cash and cash equivalents of $93.7 million and total debt securities of $148.2 million as of December 31, 2005, $49.4 million of the cash and cash equivalents and $80.7 million of the total debt securities are held at China.com (formerly, hongkong.com Corporation), as of April 2006, an 77% owned subsidiary listed on the Growth Enterprise Market of the Hong Kong Stock Exchange. Although we have the ability to appoint a majority of the board of directors of China.com, the board of directors of China.com owes fiduciary duties to the shareholders of China.com to act in

10

the best interests of and use the assets of China.com, including the cash and cash equivalents balance and debt securities, for the benefit of such shareholders. As a result, aside from the board of directors of China.com declaring a dividend to its shareholders for which we would receive a pro rata portion as an 77% shareholder of China.com or a related party inter-company loan or similar transaction from China.com which would likely require the approval of the minority shareholders of China.com, we have limited ability to transfer or move the cash, cash equivalents and debt securities balance to CDC Corporation at the parent entity level, or to use the amounts of cash, cash equivalents and securities balance for the benefit of non-China.com and its subsidiaries.

We have significant fixed operating expenses, which may be difficult to adjust in response to unanticipated fluctuations in revenues, and therefore could have a material adverse effect on our operations.

A significant part of our operating expenses, particularly personnel, rent, depreciation and amortization, are fixed in advance of any particular quarter. As a result, an unanticipated decrease in the number or average size of, or an unanticipated delay in the scheduling for, our engagements may cause significant variations in operating results in any particular quarter and could have a material adverse effect on operations for that quarter. In the near-term, we believe our costs and operating expenses may increase in certain areas as we fund new initiatives and continue to pay for costs related to compliance with the Sarbanes-Oxley Act of 2002. While we will strive to keep our costs and operating expenses in the near-term to be at a level that is in line with our expected revenue, we may not be able to increase our revenue sufficiently to keep pace with any growth in expenditures. As a result, we may be unable to return to profitability in future periods.

Because we rely on local management for many of our localized CDC Software and China.com Inc. businesses, our business may be adversely affected if we cannot effectively manage local officers or prevent them from acting in a manner contrary to our interests or failing to act at our direction.

In connection with our strategy to develop our enterprise software products and services, through our CDC Software business unit, and on mobile applications and online games through our China.com Inc subsidiary, we have interests in companies in local markets where we have limited experience with operating assets and businesses in such jurisdictions, including enterprise software companies in the United States, Canada and Europe, business services companies in Australia, Korea and the U.S. and mobile services and applications companies in the PRC. As a result, we rely on our local management with limited oversight. If we cannot effectively manage our local officers and management, or prevent them from acting in a manner contrary to our interests or failing to act at our direction, these problems could have a material adverse effect on our business, financial condition, results of operations and share price.

We are exposed to potential risks of noncompliance with rules and regulations under Section 404 of the Sarbanes-Oxley Act of 2002.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, we are required to furnish an internal controls report of management’s assessment of the design and effectiveness of our internal controls as part of our Annual Report on Form 20-F beginning with the fiscal year ending on or after July 15, 2006. Our independent registered accounting firm is then required to attest to, and report on, management’s assessment.

Under the supervision and with the participation of our management, we are evaluating our internal controls in order to allow management to report on, and our registered independent public accounting firm to attest to, our internal controls, as required by Section 404. We are performing the system and process evaluation and testing required in an effort to comply with the management certification and auditor attestation requirements of Section 404. As a result, we have incurred, and will continue to incur, additional expenses and a diversion of management’s time. If we are not able to meet the requirements of Section 404, we might be subject to sanctions or investigation by regulatory authorities, such as the Securities and Exchange Commission or NASDAQ. In addition, as a result of the evaluation of our internal controls, we may be required to report internal control material weaknesses. Subsequently, we have identified material weaknesses in our internal controls over financial reporting which are discussed further in “Item 15, Controls and Procedures” herein. Either of the foregoing could adversely affect our financial results and the market price of our common shares.

While we will seek to grow our businesses, including the businesses we have acquired, organically in the future, we cannot assure you that we will be successful in increasing revenues through organic growth.

11

Our ability to achieve organic growth in our businesses is subject to numerous risks and uncertainties, including the following:

| | • | | We may face difficulties in integrating, assimilating and managing the operations, technologies, intellectual property, products and personnel of our acquired businesses individually and cumulatively; |

| | • | | We will be making additional new investments, including increasing sales and marketing efforts, developing new products and providing additional training in order to generate organic growth, none of which may ultimately prove successful in generating such growth; |

| | • | | We may not be successful in introducing products and services we acquire to new markets. For example, one of our strategies in our enterprise software business is to target the markets in Japan and China for enterprise application software. Starting in late 2004 and continuing through 2005 and 2006, we are emphasizing the growth of CDC Software Asia Pacific which was formed in 2004 to sell our entire range of enterprise application software products in the Asia Pacific region, including Australia and New Zealand. However, we cannot assure you that we will be successful in this strategy; and |

| | • | | While with the completion of our acquisitions of Pivotal and Ross, we have added an additional approximate 3,200 customers to our customer base which on a combined basis totals approximately 4,000 customers which have licensed our enterprise software products worldwide as of December 31, 2005 (which does not include the addition of more than 1,000 customers added as a result of our acquisition of c360 Solutions in April 2006), we may not be successful in our strategy of leveraging upon cross-selling opportunities with respect to our expanded customer base. In addition to our customers not finding our other enterprise software products attractive, it has also been our experience that the revenues which can be generated in a sale of additional products made through a cross-sale is often less than the amount of revenues which would have been generated if the sale had been made by an independent third party software supplier. This is because often the customer views the purchase of the cross-sold software product as only a module to their existing enterprise software solution, rather than a complete standalone software product, and therefore are less willing to pay the full market price for the product than if the sale had been made by an independent third party. |

Our inability to achieve organic growth in our businesses will have a material adverse effect on our business, results of operations and financial condition.

Risks Relating to our CDC Software Business Unit

The market for enterprise software application products and services is highly competitive. We have entered this market recently, and if we fail to compete effectively, our failure could have a material adverse effect on our business, financial condition and results of operations.

The business information systems industry in general and the enterprise software industry in particular are very competitive and subject to rapid technological change. Many of our current and potential competitors have longer operating histories, significantly greater financial, technical and marketing resources, greater name recognition, larger technical staffs and a larger installed customer base than we do. A number of companies offer products that are similar to our products and that target the same markets. In addition, many of these competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements, and to devote greater resources to the development, promotion and sale of their products than we can. Furthermore, because there are relatively low barriers to entry in the software industry, we expect additional competition from other established and emerging companies. Such competitors may develop products and services that compete with our products and services or may acquire companies, businesses and product lines that compete with us. It is also possible that competitors may create alliances and rapidly acquire significant market share. Accordingly, we cannot assure you that our current or potential competitors will not develop or acquire products or services comparable or superior to those that we develop, combine or merge to form significant competitors or adapt more quickly than we can to new technologies, evolving industry trends and changing customer requirements. Competition could cause price reductions, reduced margins or loss of market share, any of which could materially and adversely affect our strategy in this market, and affect our business, operating results and financial condition.

12

Our major competitors include:

| | • | | enterprise resource planning (“ERP”) providers, including Sage Group, Epicor, Infor Global Solutions, Microsoft Corporation, Oracle/Peoplesoft, QAD, Inc., SAP AG, SSA Global Technologies, Inc., and various local providers in the Greater China market such as FlexSystem Holdings Ltd., Kingdee International Software Group Company Limited and UFIDA Software Co. Ltd.; |

| | • | | customer relationship management (“CRM”) providers, including Chordiant Software, Inc., SSA Global Technologies, Inc., Microsoft Corporation, Onyx Software Corporation, Oracle/Peoplesoft, Salesforce.com, SalesLogix (part of Best Software/Sage Group plc), SAP AG and Siebel Systems, Inc.; |

| | • | | supply chain management (“SCM”) providers, including Aspen Technologies, i2 Technologies, Inc., Manhattan Associates, Manugistics Group, Inc., Logility Inc., and Infor Global Solutions; |

| | • | | human resource management (“HRM”) providers, including Oracle/Peoplesoft, SAP AG, and various local providers in the Greater China market, including Cityray Technology (China) Ltd., UFIDA Software Co. Ltd., BenQ Group, Vanguard Software Corporation, Strategy Software Systems Co., Ltd, Shanghai Kayang Information System Co., Ltd. and Kingdee International Software Group Co., Ltd; |

| | • | | business intelligence (“BI”) providers, including Business Objects SA, Cognos, Inc., Hyperion, Inc. and SAS Institute, Inc.; and |

| | • | | information technology consulting and outsourcing service providers including Accenture Ltd., Cambridge Technology Partners Inc., Cap Gemini, Electronic Data Systems Corporation, IBM Global Services, Infosys Technologies, Wipro Ltd., and various niche local service providers specializing in IT outsourcing services. |

Many of these companies are well funded with long operating histories of profitable performance. They possess a number of tangible strengths and advantages, including high quality client lists and high numbers of highly qualified staff, complemented by extensive operating infrastructures. The principal competitive factors in the market for enterprise software application software include product reputation, product functionality, performance, quality of customer support, size of installed base, financial stability, corporate viability, hardware and software platforms supported, price, and timeliness of installation.

As we pursue our strategy of developing our enterprise software business, we are exposed to a variety of risks in this market that may affect our ability to generate revenues from the sale of enterprise application software and related support services.

As we pursue our strategy of developing our enterprise software business, we anticipate that we will continue to generate a significant portion of our revenues in the future from the sale of various enterprise software application packages and related services. Accordingly, any factor that adversely affects fees derived from the sale of such applications would have a material adverse affect on our business, results of operations and performance. For example, in 2001 and continuing through most of 2003, the market for enterprise software application products continued to be negatively impacted by challenging economic conditions in the United States, Europe and Asia. While the market has stabilized, there can be no assurances that this will continue. In addition, while we are committed to the enterprise application software market, if we are not successful in communicating our commitment or a clear strategy, and offering a vision with respect to our product roadmap and technology platforms going forward, customers and potential customers may be less inclined to make significant investments in our enterprise software products. Other such factors which could affect our enterprise software strategy may include:

| | • | | competition from other products; |

13

| | • | | incompatibility with third party hardware or software products; |

| | • | | negative publicity or valuation of our products and services; |

| | • | | obsolescence of the hardware platforms or software environments on which our products run; |

| | • | | our ability to increasingly move software development capabilities to places like India and China where costs are generally lower, but subjects us to additional risks including competition to hire qualified programmers (and a resultant upward pressure on remuneration costs), turnover risk, language barriers, and challenges to remotely manage staff due to time zone differences and distance; and |

| | • | | continuing low level expenditures in the enterprise software market. |

Our enterprise software revenues fluctuate significantly from quarter to quarter which may cause volatility in our share price.

A sale of a new license generally requires a customer to make a purchase decision that involves a significant commitment of capital. Many factors have caused and may in the future cause our enterprise software revenue to fluctuate significantly. Some of these factors are:

| | • | | the timing of significant orders, delivery and implementation of products; |

| | • | | the gain or loss of any significant customer; |

| | • | | the number, timing and significance of new product announcements and releases by us or our competitors; |

| | • | | our ability to acquire or develop (independently or through strategic relationships with third parties), introduce and market new and enhanced versions of our products on a timely basis; |

| | • | | possible delays in the shipment of new or enhanced products and purchasing delays of current products as our customers anticipate new product releases; |

| | • | | order cancellations and shipment rescheduling or delays; |

| | • | | reductions in the rate at which opportunities in our pipeline convert into license agreements, |

| | • | | patterns of capital spending and changes in budgeting cycles by our customers; |

| | • | | market acceptance of new and enhanced versions of our products; |

| | • | | changes in the pricing and the mix of products and services we sell; |

| | • | | seasonal variations in our sales cycle; |

| | • | | the level of product and price competition; |

| | • | | exchange rate fluctuations; and |

| | • | | changes in personnel and related costs. |

In addition, we expect that a substantial portion of our enterprise software revenues will continue to be derived from renewals of maintenance contracts from customers of our software applications. These maintenance contracts typically expire on an annual basis, if not renewed, and the timing of cash collections from related revenues varies from quarter to quarter.

14

Some customers are reluctant to make large purchases before they have had the opportunity to observe how our software performs in their organization, and have opted instead to make their planned purchase in stages or subject to conditions. Additional purchases, if any, may follow only if the software performs as expected. To the extent the number of customers who opt to purchase in stages or subject to conditions increases, it could adversely affect our revenue.

Our failure to successfully introduce, market and sell new products and technologies, enhance and improve existing products in a timely manner, and properly position or price our products, as well as undetected errors or delays in new products or new versions of a product or the failure of anticipated market growth could individually and/or collectively have a material adverse effect on our business, results of operations or financial position.

Our enterprise software products compete in a market characterized by rapid technological advances in hardware and software development, evolving standards in computer hardware and software technology and frequent new product introductions and enhancements. We continually seek to expand and refresh our product offerings to include newer features or products, and enter into agreements allowing integration of third-party technology into our products. The introduction of new products or updated versions of continuing products has inherent risks, including, but not limited to:

| | • | | product quality, including the possibility of software defects, which could result in claims against us or the inability to sell our software products; |

| | • | | the fit of the new products and features with the customer’s needs, which could result in the customer seeking the product elsewhere; |

| | • | | educating our sales, marketing and consulting personnel to work with the new products and features, which may strain our resources and lengthen sales cycles; |

| | • | | competition from earlier and more established entrants that may have more significant resources than us; |

| | • | | market acceptance of initial product releases; |

| | • | | marketing effectiveness; and |

| | • | | the accuracy of research or assumptions about the nature of customer demand, whereas actual demand could be limited or non-existent. |

As we or our competition introduce new or enhanced products, the market’s demand for our older products and older versions of such products declines. Declining demand reduces revenue from additional licenses and reduces maintenance revenue from past purchasers of our software. We must continually upgrade our older products in order for our customers to continue to see value in our maintenance services. If we are unable to provide continued improvements in functionality or move customers with our older products to our newer products, declining maintenance and new license revenue from older products could have a material adverse effect on our enterprise software business. In addition, because we commit substantial resources to developing new software products and services, if the markets for these new products do not develop as anticipated, or demand for our products and services in these markets does not materialize or materializes later than we expect, we will have expended substantial resources and capital without realizing sufficient revenue, and our enterprise software business and operating results could be adversely affected.

The decisions we make about which underlying technology platforms to base our products upon, particularly any eventual migration to a newer technology platform which becomes necessary or advisable to make as older technologies become obsolete and new technologies mature and become more widely accepted, subjects us to risks which could affect our business, results of operations and financial condition.

In our enterprise software line of business, we must make decisions as to which underlying technology platforms to base our products upon. During the natural evolutionary cycle of technology, as older technologies become obsolete and new technologies mature and become more widely accepted, we may eventually need to migrate our products from older technology platforms to new technology platforms. Any decisions we make with respect to making such a migration, and any such subsequent migration process, subject us to a variety of risks which could affect our business, results of operations and financial condition.

15

We may not be successful in migrating our products to new technology platforms. In the past, several software companies have been unsuccessful with such migrations for a variety of reasons, such as an inability to adapt the new technology, bugs and errors in the product resulting from a significant rewrite of the software code, the inability to complete the migration process in a timely manner, and dependence upon the functionality and timely release of the new technology platform. In addition, the migration of software products to new technology platforms also subjects existing customers who decide to upgrade to the new technology to risks, such as the functionality of our migration tools which move customers from the old technology platform to the new technology platform and the clarity of documentation for the product on the new technology platform. If customers wish to upgrade, but encounter serious problems in the upgrade process or are not successful in upgrading, it could subject us to unfavorable publicity or customer relationships which could affect future upgrade sales to these or other customers. The risks associated with migrating to new technology platforms also includes the possibility that a customer will view this as an opportunity to review whether to upgrade or instead purchase a replacement solution from another supplier or competitor based on an analysis of the benefits and costs associated with upgrading versus replacement. In addition, as the time approaches for the release of upgraded software products built on new technology platforms, there is a risk that potential customers who might otherwise buy our products will delay their purchases until the new release to take advantage of the new technology, or that some customers who agree to purchase our products will insist on free upgrades or free integration services when the upgrade is available. Any of the these risks could materially affect our business, results of operations and financial condition.

We may not be successful in growing our sales organization and sales channels which would harm our ability to grow our business. In addition, efforts to grow our indirect sales channels expose us to additional risks.

To date, we have sold our solutions primarily through our direct sales force, particularly in the North American market. Our future revenue growth will depend in large part on recruiting, training and retaining direct sales personnel and expanding our indirect distribution channels. These indirect channels include value added resellers, or VARs, original equipment manufacturing, or OEM, partners, systems integrators and consulting firms.

While we believe the acquisition of c360 Solutions will assist us in expanding our indirect sales channels by leveraging upon its network of over 450 partners through which c360 Solutions exclusively sells its products, we may nonetheless experience difficulty in recruiting and retaining qualified direct sales personnel and in establishing third-party relationships with VARs, OEM partners, systems integrators and consulting firms. If we are not successful in growing our sales organization and sales channels, it would harm our ability to grow our business. In addition, we are exposed to risk as a result of forming relationships in these indirect channels and with such third-parties in the event such third-parties do not devote sufficient time, attention and resources to learning our products, markets and potential customers or if such third-parties encounter difficulties with their customers involving our products which could then adversely affect our reputation and the reputation of our products in the market.

If we are unable to take advantage of opportunities to market and sell the products and services of our newly-acquired companies such as Ross, Pivotal and IMI, to our customers, distribution channels and business partners in Asia, the value of our investment in Ross, Pivotal and IMI could be significantly diminished.

As part of our strategy, one of the significant anticipated benefits of the acquisitions of Ross, Pivotal and IMI is expanding these businesses in the Asia-Pacific region (with our key target markets being Japan and the PRC) by leveraging our local expertise and distribution channels. In particular, we believe we can cross-sell and market Ross’, Pivotal’s and IMI’s ERP, CRM and SCM applications and implementation services in growth markets for such software in Asia. The products and services of Ross, Pivotal and IMI are highly technical, principally servicing market segments and customers in which we traditionally have limited experience, and our salespersons may not be successful in marketing Ross, Pivotal or IMI products and services. In the event that we cannot adapt the Ross, Pivotal or IMI products to the needs of the local markets, or our traditional customers and business partners are not receptive to Ross’, Pivotal’s or IMI’s products and services, we may not realize some of the expected benefits of our investment in these companies, and the value of our investment could be significantly diminished.

Our strategy of developing industry products for specific industry segments, or micro-verticals, may not be successful which could affect our business, results of operations and financial condition.

16

Many of our enterprise software products have been tailored to be industry-specific which allow businesses to immediately gain business benefits as the industry-specific customizations have already been completed. For example, with respect to Ross’ products, Ross focuses on the food and beverage, life sciences, chemicals, metals and natural products industries. Pivotal’s products have already been optimized and configured to include CRM products for the financial services (asset management, capital markets, commercial banking and private banking), healthcare provider, homebuilder, and life sciences (medical device manufacturing) markets. IMI’s products have been tailored towards order management, warehouse management and store replenishment for the grocery, specialty goods and pharmaceutical and over-the-counter drugs industries.

This strategy of developing industry products for specific industry segments may not be successful for a variety of reasons due to risks both inside and outside of our control, including the following:

| | • | | we cannot be certain that the companies in the micro-vertical markets we have selected will find our products attractive; |

| | • | | many of our micro-vertical markets are subject to their own economic cycles, regulatory considerations and other factors which are beyond our control. For example, the homebuilder micro-vertical is sensitive to interest rate movements and the healthcare micro-vertical is subject to significant governmental regulations; |

| | • | | some of our micro-vertical products have only been recently introduced, so do not have a large installed base of users or developed significant recognition in their industry; |

| | • | | we may experience difficulty in recruiting sales, business and technical personnel who have experience in a particular micro-vertical industry; |

| | • | | due to resource constraints, we have a limited number of developers who can focus upon developing for the micro-verticals; and |

| | • | | in the event we decide to devote limited resources into a micro-vertical market, such as by dedicating a sales representative, such a resource may not be available to focus on general sales. |

If our strategy of developing industry products for specific micro-vertical markets is not be successful, it could materially adversely affect our business, results of operations and financial condition.

We may not receive significant revenues from our research and development efforts for several years.

Developing, enhancing and localizing software is expensive, and the investment in product development may involve a long payback cycle. In 2005 our research and development expense was $22.6 million or approximately 9% of our total consolidated net revenues. Our future plans include significant additional investments in software research and development and related product opportunities. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts to maintain our competitive position. However, we do not expect to receive significant revenues from these investments for several years, if at all.

We have been increasingly migrating software development capabilities for our enterprise application software products to India and China, which subjects us to several risks that may affect our business.

We have been increasingly moving software development capabilities for our enterprise application software products to India and China. Pivotal has established a software development center in Bangalore, India and Ross has established a software development center in Shanghai, China. While we believe the migration of software development capabilities offshore to India and China offers several advantages, including lower software development costs principally due to the relatively lower salaries of programmers in India and China, such off-shoring also subjects us to various risks, including the following:

| | • | | Competition to hire qualified programmers and developers in these local markets; |

17

| | • | | Risks associated with turnover of programmers and developers, particularly where we have devoted time and resources to train such persons to be familiar with our enterprise application software products; |

| | • | | Challenges due to the need to remotely manage developers and programmers in India and China, particularly when the persons most familiar with the needs of the customer and the desired new functionality and features are not also located in India and China; |

| | • | | Language and other communications barriers, particularly with software development in China; and |

| | • | | Time zone differences which make liaising and communicating with persons in India and China more difficult. |

While the vast majority of our professional services engagements associated with the sale and implementation of our enterprise application software products are billed on a time and materials basis, there are certain instances when management may accept fixed price engagements for certain of our products which exposes us to various risks.

While the vast majority of our professional services engagements associated with the sale and implementation of our enterprise application software products are billed on a time and materials basis, management may occasionally accept a fixed price engagement, particularly when management believes by appropriately managing the fixed price engagement we can achieve a greater hourly rate than we normally would when the customer purchases our services by the hour. The nature of a fixed price engagement, however, is such that a failure to estimate accurately the resources and time required for an engagement, to manage client expectations effectively regarding the scope of the services to be delivered for the estimated fees or to complete fixed price engagements within budget, on time and to clients’ satisfaction could expose us to risks associated with cost overruns and penalties. This risk of needing to commit unanticipated additional resources to complete a professional services engagement billed on a fixed price basis could have a material adverse effect on our results of operations.

A substantial percentage of our business services engagements are billed on a fixed price basis which may be subject to cost overruns if we do not accurately estimate the costs of these engagements or if clients change the scope of a project.

A substantial percentage of our business services engagements consists of individual, non-recurring, short-term projects billed on a fixed price basis as distinguished from a method of billing on a time and materials basis. At times this requires us to commit unanticipated additional resources to complete business services engagements, which may result, and has in the past resulted, in losses on certain engagements. Our failure to obtain new business services business in any given quarter or estimate accurately the resources and time required for an engagement, to manage client expectations effectively regarding the scope of the services to be delivered for the estimated fees or to complete fixed price engagements within budget, on time and to clients’ satisfaction (particularly if a client changes the scope of the project) could expose us to risks associated with cost overruns and penalties, any of which could have a material adverse effect on our business, results of operations and financial condition.

Our clients could unexpectedly terminate their contracts for our services which could result in a loss of expected revenues and additional expenses for redeployment of staff and resources.

The standard terms for many of our business services contracts include a down payment of a relatively low percentage of the fee at the commencement of the contract with the balance of the payments subject to the achievement of specific milestones and deliverables. We generally do not require collateral for accounts receivable. The final payment is not due until completion of successful user acceptance testing. However, most of our business services contracts can be cancelled by the client with limited advance notice and without significant penalty. Termination by any client of a contract for our services could result in a loss of expected revenues, additional expenses for redeployment of staff and resources that were allocated to the terminated engagement, and underutilized employees and resources. The unexpected cancellation or significant reduction in the scope of any of our large business services projects could have a material adverse effect on the business of our business services companies, particularly those companies which depend upon a relatively small number of key clients for a substantial portion of their business. Should any of those key clients unexpectedly terminate their contracts for our services or determine to use other service providers for some of their services, this could result in a significant loss of revenues for such companies which, in turn, could have a material adverse effect on our business, results of operations and financial condition.

18

Our business services contracts may expose us to potential litigation and liabilities.