Investor Presentation

July 2008

1

Certain of the statements set forth in this presentation constitute "Forward looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995. We have included and from time to time

may make in our public filings, press releases or other public statements, certain forward-looking

statements. In some cases these statements are identifiable through the use of words such as

"anticipate," "believe," "estimate," "expect," "intend," "plan," "project," "target," "can," "could," "may,"

"should," "will," "would" or words or expressions of similar meaning. You are cautioned not to place undue

reliance on these forward- looking statements. In addition, our management may make forward-looking

statements to analysts, investors, representatives of the media and others. These forward-looking

statements are not historical facts and represent only our beliefs regarding future events, many of which,

by their nature, are inherently uncertain and beyond our control. There can be no assurance that such

forward-looking statements will prove to be accurate and China 3C Group undertakes no obligation to

update any forward-looking statements or to announce revisions to any of the forward-looking statements.

Safe Harbor

2

China 3C is a leading wholesale distributor and retailer of 3C merchandise: computers,

communication products and consumer electronics. The Company specializes in wholesale

distribution and retail sales of 3C products in Eastern China, focusing on products that make

life more comfortable, convenient and connected. The Company's goal is to become the

number one retailer of 3C products in China.

Stock Price Information

Ticker: CHCG (OTC)

Current Price: $1.91

52 Week Range: $1.10-$7.45

TSO: 53.1 million

Avg. Daily Trading Volume: 208,339

Market Cap: $101.4 million

Fiscal Year End: Dec. 31st

Cash (as of 3/31/08): $23.4 million

Debt: $0

Financial Overview

2Q08E Revenue: $81.5-$82.5 mm

2Q08E Net Income: $7.3-$7.4 mm

Estimated Diluted EPS: $0.14

1Q08 Revenue: $68.2 mm

1Q08 Net Income: $5.8 mm / $0.11 EPS

FY07 Revenue: $276.0 mm

FY07 Net Income: $22.9 mm / $0.44 EPS

Company Overview

3

China’s largest “store-in-store” Electronics Retailer

Over 1,000 locations in the large and fast growing Huadong region of China

Operating in multiple product categories allows 3C to more broadly penetrate retail chain partners

Large retail footprint allows company to negotiate better terms and prices from suppliers who are interested in

dealing in larger volumes

Enjoys significant advantages relative to its competition in China including size, customer and supplier relationships,

product breadth and selection, and pricing

Wholesale business provides complimentary advantages to operating model

Economies of scale which improves pricing and the relationships with suppliers

Provides 3C with broader market intelligence that allows company to make better decisions relative to retail

operations (product selection, pricing and store locations)

Compelling “Store-within-Store” Operating Performance

High level of inventory turns

Low Accounts Receivable

Strong Balance Sheet

No debt

Strong and growing cash position

Strong platform for future growth—organic and through acquisition

Corporate Summary

4

Operations

5

China 3C Group main competitiveness: precise market position, efficient

sales networking and rapid logistic system.

China 3C Group has more than 1000 retail spots – store within store. The

business model is to operate professional product terminals in mega

chain stores, electronic store, supermarket and department stores.

Operations

6

“Store within Store” Business Model

Under this model, companies such as China 3C lease their own outlets

within the larger stores, and by doing so are able to avoid the capital cost,

general management cost, and most financial and operational aspects of

running retail stores. Our retail partners, such as the department stores,

are then compensated via a management fee based on a percentage of our

gross sales in their stores.

7

How China 3C “store-in-store” concessionaire

model differs to the U.S. retail model

3C decreases the financial risk for its retail partners by assuming

responsibility for inventory and working capital associated with

distributing its products.

3C decreases operational risk for its retail partners by hiring and

managing employees and entering the logistics issues such as wholesale

purchasing, delivery, returns, and after sales service.

3C decreases merchandising risks for its retail partners by bringing

product expertise and specific market knowledge that is difficult for large

retailers to develop on their own across a broad range of product

categories.

China’s size, regional differences, logistical difficulties, managerial

challenges, underdeveloped credit market, and rapid growth rate all

increase the risk for retailers

Foreign retailers in China such as Best Buy and Walmart are adjusting their

business models and are embracing the concessionaire model

8

“Store within Store” Model

This operating model fits Chinese consumer traits and business developing

models. It connects both suppliers and mega retailers to form strategic

partnerships. This model decreases operating risks and allows for rapid scale

development.

9

Wholesale / Retail Distribution Mix

2005 2006 2007

Wholesale $13.3 $39.5 $96.1

% of growth 10% 198% 143%

Retail $19.3 $108.7* $179.9

% of growth 52% 462% 66%

Total $32.6 $148.2 $276.0

In USD $ millions

* China 3C made acquisition in 2006

10

In USD $ millions

Wholesale / Retail Gross Profit Mix

2005 2006 2007

Wholesale $1.1 $4.7 $13.5

Gross Profit 8.4% 11.9% 14%

Retail $3.2 $18.1 $35.9

Gross Profit 16.3% �� 16.7% 20.0%

Total Gross Profit $4.3 $22.8 $49.4

% of Sales 13.1% 15.4% 17.9%

11

Company current total store count 1001,

including:

Operating networking

Shanghai area 435 stores,

43% in total store count;

ZheJiang area 356 stores,

36% in total store count;

JianSu area 181 stores,

18% in total store count;

AnHui 29 stores,

3% in total store count

12

Number of Retail Locations

2005 2006 2007 2008E

Beginning of Year 207 439 826908

Acquisition of Stores 0 324 0 0

Stores Opened 259 84 156 138

Stores Closed (27) (21) (74) (26)

End of Year 439 826 908 1020

Total Locations

13

Strong Store Retail Distribution

Gome

Suning

China 3C enjoys strong distribution in leading retailers throughout the Eastern China

region

TrustMart SuperMarket Chain

Vanguard SuperMarket Chain

14

Number of Retail Locations

By Store Type

2005 2006 2007 2008E

Large Hypermarkets

Carrefour 0 13 27 27

Trustmart 26 58 65 65

Walmart 0 0 0 6

Large Electronic Chains

Suning 33 72 97 94

Gome 52 87 108 106

Yongle 0 53 58 88

Supermarkets 67 185 220 248

Independent/

Regional Chain Stores 261 358 333 386

Total: 439 826 908 1020

15

Number of Retail Locations

By Division

2005 2006 2007 2008E

WangDa 175 214 237 265

(cell phones, accessories)

YongXin 264 288 274 300

(fax machines)

SanHe 0 165 211 230

(home electronics)

Joy & Harmony

(consumer electronics) 0 159 186 225

Total: 439 826 908 1020

16

Stores mainly are within:

GoMe, SuNinG, YongLe, TrustMart,

Lotour, Auchan,CenturyMart,

Vanguard … mega chain store systems

Subsidiaries store count:

Joy&Harmony 221 stores

WangDa 254 stores

SanHe 227 stores

YongXin 299 stores.

Key Customers & Subsidiary Information

17

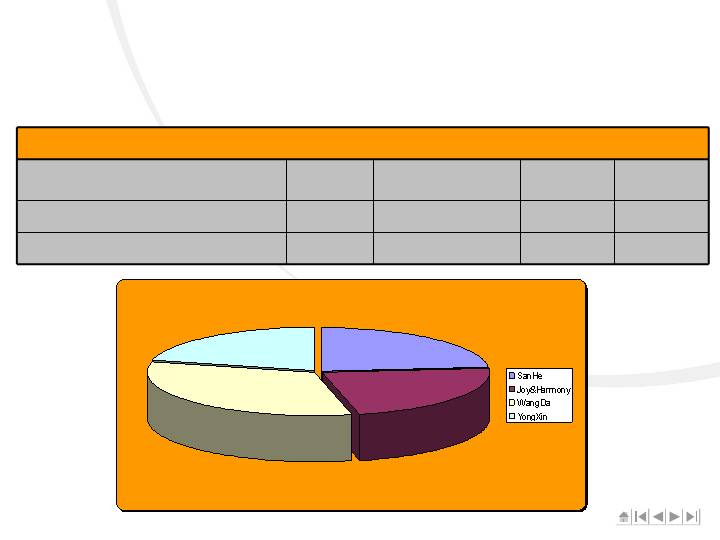

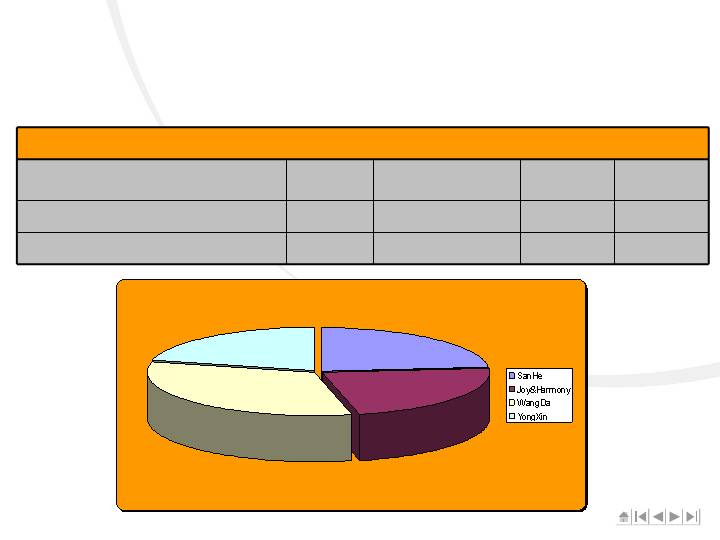

2007 Four Subsidiaries Revenue Breakdown

Subsidiaries

Appliances

Consumer Electronics

Cell Phones

Comm./

Office

revenue ( million USD)

67.15

63.98

83.5

61.38

total group revenue

24.33%

23.18%

30.25%

22.24%

Revenue Breakdown of Four Subsidiaries

2007

SanHe 07 revenue: $67.15 million USD, 24.33% of total group revenue.

Joy&Harmony 07 revenue: $63.98 million USD, 23.18% of total group revenue.

WangDa 07 revenue $83.5 million USD, 30.25% of total group revenue.

YongXin 07 revenue $61.38 million USD, 22.24% of total group revenue.

18

Revenue Breakdown of Four Subsidiaries

2008 Q1-Q2

2008 Q1-Q2 Four Subsidiaries Revenue Breakdown (estimate)

Subsidiaries

Appliances

Consumer

Electronics

Cell Phones

Comm./

Office

target revenue( million USD)

35.38

34.32

48.68

31.65

total group revenue

23.58%

22.88%

32.45%

21.10%

YongXin, $31.7 mm

SanHe, $35.38 mm

WangDa, $48.7 mm

Joy & Harmony, $34.3 mm

19

Single Store Analysis

2007 Total store count: 908

Store per month average revenue $16,400 USD.

2008 Current total store count 1001;

Target store per month average revenue 17,500 USD.

2008 Focus on internal growth. Store count won’t increase as dramatically

as in prior years. Focus on adjustments to eliminate inefficient and low

profit stores and to increase high quality store efficiencies.

20

Store Prototype

Average Size: 126 sq. ft

Avg. Sales per square foot: $1,480

Average Sales per store (annual): $182,000

Average Capital Expenditure $1,690

Average Inventory $8,270

Inventory Turn 22-24x

Average Investment $9,960

Average Store Income (annual) $17,500

Store Costs

Merchandise $150,000 / 82-83%

Lease Cost $ 9,000 / 5%

Other Store Costs $ 5,500 / 3%

21

Supplier Relationships

China 3C Group partners with well known consumer electronic brands in China.

With win win strategy and collaboration concept, we have experienced rapid

growing era. China 3C group appreciates the quality services and brands from

all suppliers.

2007 : there were 4,100 total products offered by China 3C including 600 in

office communication category; 1100 in mobile phones; 1800 in consumer

digital category; 600 in home appliances category.

2008: we plan to adjust product mix to introduce new categories and eliminate

old fashioned ones. 2008 target for total products offered by China 3C is 2,800

including 600 in office communication category; 600 in mobile phones,

1000 in consumer digital category; 600 in home appliances category.

22

Brands and Services

Current leading product brands include: Toshiba, Samsung, Brothers, Philips,

FongDa, TCL, Apple, Motorola, Nokia, Galanz

23

Current leading mega chain stores include: TrustMart, GoMe, Suning,

Best Buy, Walmart, Carrefour

Distribution

24

Wholesale clients

2005 wholesale client count: ~700

2006 wholesale client count: ~900

2007 wholesale client count: ~1300

2008 Q1-Q2 wholesale client count: 920

(total count decrease from 2007 due to company

strategy to focus on mega store customers. Increase single store revenue )

Company’s strategy is to shift focus to larger store chains and away from small

mom & pops

25

China 3C Group Financials

26

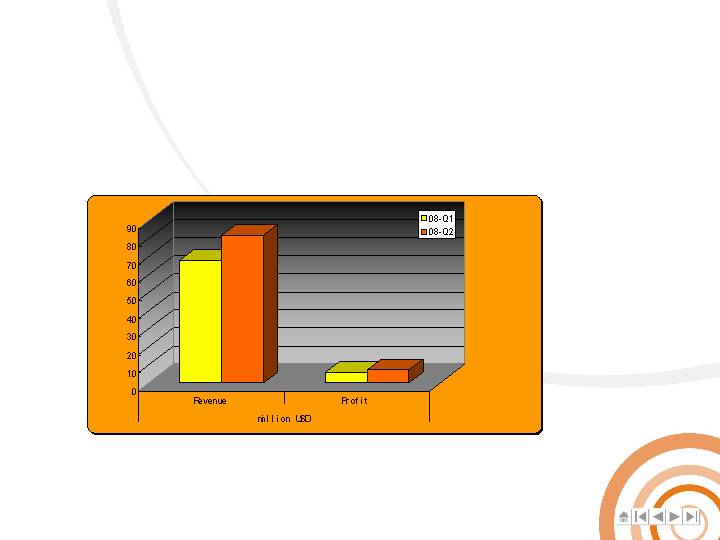

2005 Revenue: $32.6million USD, Profit: $1.5million USD, EPS: $0.04

2006 Revenue: $148.2million USD, Profit: $11.3million USD, EPS: $0.24

2007 Revenue: $276.0 million USD, Profit: $22.9 million USD, EPS $0.44

Financial Performance

27

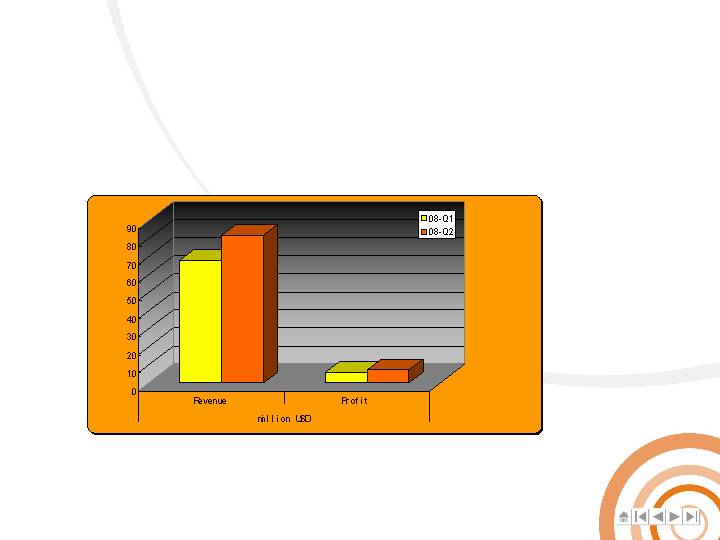

1Q08 Revenue: $68.2 million USD, Profit $5.8 million USD, EPS: $0.11

2Q08E Revenue: $81.5-$82.5 million USD, Profit: $7.3-$7.4 million USD, EPS: $0.14

Financial Performance

28

Strong Balance Sheet

(1Q08 vs. 4Q07)

ASSETS

Current Assets

Cash and cash equivalents

$

23,421,645

$

24,952,614

Accounts receivable, net

14,804,457

8,077,533

Inventory

10,977,257

6,725,371

Advance to supplier

1,645,508

2,572,285

Prepaid expenses

264,625

382,769

Total Current Assets

51,113,492

42,710,572

Property & equipment, net

85,763

89,414

Goodwill

20,348,278

20,348,278

Refundable deposits

54,468

48,541

Total Assets

$

71,602,001

$

63,196,805

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities

Accounts payable and accrued expenses

$

4,977,584

$

3,108,235

Income tax payable

1,847,239

2,684,487

Total Current Liabilities

6,824,823

5,792,722

Total Stockholders' Equity

64,777,178

57,404,083

Total Liabilities and Stockholders' Equity

$

71,602,001

$

63,196,805

1Q08 4Q07

29

With rapid economic growth, China has become the second largest

consumer electronic market after US. In 2007, total sales for 3C goods

(computers, communications productions, consumer electronics)

exceeded $113 billion USD. In 2008, the estimated size of the 3C market is

expected to be approximately $150 billion USD, representing annual growth

exceeding 30%.

0.7%

In 2007, China 3C Group achieved a revenue of $276.03 million, accounting

for 0.7% of the Eastern China market and only 0.26% of the country. We will

take advantage of the great potential and develop our company to become

the No.1 retailer of 3C products in China.

30%

It is estimated that the sales of 3C products in China will reach $150 billion in

2008, of which 30% will be in the region of Eastern China.

In 2007, China 3C Group achieved revenue of $276.0 million USD, which

represents 0.7% of the market in Eastern China and approximately 0.26% in

all of China. We still have a strong opportunity to grow our business and plan

to capture additional market share through improvements to our operating

structure, enhanced logistic integration and quality additions to our

management team. Our goal is to be a leading 3C retailer in China.

Market Opportunity for China 3C Group

30

China’s largest “store-in-store” Electronics Retailer

Over 1,000 locations in the large and fast growing Huadong region of China

Operating in multiple product categories allows 3C to more broadly penetrate retail chain partners

Large retail footprint allows company to negotiate better terms and prices from suppliers who are interested in

dealing in larger volumes

Enjoys significant advantages relative to its competition in China including size, customer and supplier relationships,

product breadth and selection, and pricing

Wholesale business provides complimentary advantages to operating model

Economies of scale which improves pricing and the relationships with suppliers

Provides 3C with broader market intelligence that allows company to make better decisions relative to retail

operations (product selection, pricing and store locations)

Compelling “Store-within-Store” Operating Performance

High level of inventory turns

Low Accounts Receivable

Strong Balance Sheet

No debt

Strong and growing cash position

Strong platform for future growth—organic and through acquisition

Corporate Summary

31

THANK

YOU

Appendix

China 3C Group enjoys strong relationships and has a great reputation with

suppliers and customers. The company is proud to be the recipient of many

notable awards.

outstanding retailer for Panasonic, Samsung

and Brother

focus partner for Philips, CJT and FengDa

special retailer for Motorola and Nokia

special retailer for apple digital product

awarded enterprise by I Wu Commerce Bureau

AAA credential enterprise by Shanghai Bank

Awards