SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO.)

Check the appropriate box:

|

| |

| [_] | Preliminary Information Statement |

| | |

| [_] | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| | |

| [X] | Definitive Information Statement |

Wisconsin Electric Power Company

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

Payment of Filing Fee (Check the appropriate box)

|

| |

| [X] | No fee required. |

| | |

| [_] | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | |

| 1) | Title of each class of securities to which transaction applies: |

| |

|

| |

| 2) | Aggregate number of securities to which transaction applies: |

| |

|

| |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

| |

| 4) | Proposed maximum aggregate value of transaction: |

| |

|

| |

| [_] | Fee paid previously with preliminary materials. |

| | |

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| |

| 1) | Amount Previously Paid: ________________________________________________________________ |

| | |

| 2) | Form, Schedule or Registration Statement No.:______________________________________________ |

| | |

| 3) | Filing Party:__________________________________________________________________________ |

| | |

| 4) | Date Filed:___________________________________________________________________________ |

|

| |

| Gale E. Klappa Chairman and Chief Executive Officer 231 W. Michigan Street Milwaukee, WI 53203 |

March 29, 2018

Dear Preferred Stockholder:

Wisconsin Electric Power Company, which does business under the trade name of We Energies, will hold its Annual Meeting of Stockholders on Thursday, April 26, 2018, at 10:00 a.m., Central time, in the Resource Center on the first floor of the Public Service Building, 231 W. Michigan Street, Milwaukee, Wisconsin 53203.

We are not soliciting proxies for this meeting, as more than 99% of the voting stock is owned, and will be voted, by Wisconsin Electric’s parent, WEC Energy Group, Inc. If you wish, you may vote your shares of preferred stock in person at the meeting; however, the business session will be very brief.

As an alternative, you might consider attending WEC Energy Group’s Annual Meeting of Stockholders to be held Thursday, May 3, 2018, at 10:00 a.m., Central time, at Concordia University Wisconsin in the R. John Buuck Field House located at 12800 North Lake Shore Drive, Mequon, Wisconsin 53097.

By attending this meeting, you would have the opportunity to meet many of the Wisconsin Electric officers and directors. Although you cannot vote your shares of Wisconsin Electric preferred stock at the WEC Energy Group meeting, you may find the activities worthwhile.

You must pre-register and present photo identification at the door to attend WEC Energy Group’s Annual Meeting. To pre-register for the meeting, please contact WEC Energy Group’s Stockholder Services, 231 W. Michigan Street, Milwaukee, Wisconsin 53203; call 800-881-5882; or email WEC.Stockholder-Services.Contact@wisconsinenergy.com and provide proof of your ownership of preferred stock, including, if applicable, a bank or brokerage firm account statement or a letter from the broker, trustee, bank, or nominee holding your shares.

The annual report of Wisconsin Electric is attached as Appendix B to this information statement. If you have any questions or would like a copy of the WEC Energy Group annual report, please call our toll-free stockholder hotline at 800-881-5882.

Thank you for your support.

Sincerely,

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

March 29, 2018

To the Stockholders of Wisconsin Electric Power Company:

The 2018 Annual Meeting of Stockholders of Wisconsin Electric Power Company will be held on Thursday, April 26, 2018, at 10:00 a.m., Central time, in the Resource Center on the first floor of the Public Service Building, 231 W. Michigan Street, Milwaukee, Wisconsin 53203, for the following purposes:

| |

| 1. | To elect the five members of the Board of Directors to hold office until the 2019 Annual Meeting of Stockholders; and |

| |

| 2. | To consider any other matters that may properly come before the meeting. |

Stockholders of record at the close of business on February 22, 2018, are entitled to vote. The following pages provide additional details about the meeting as well as other useful information.

Important Notice Regarding the Availability of Materials Related to the Stockholder Meeting to Be Held on April 26, 2018 – The Information Statement and 2017 Annual Report to Stockholders are available at:

www.wisconsinelectric.com

By Order of the Board of Directors,

Margaret C. Kelsey

Executive Vice President, General Counsel and Corporate Secretary

|

| |

| We Energies 231 W. Michigan Street Milwaukee, WI 53203 |

INFORMATION STATEMENT

This information statement is being furnished to stockholders beginning on or about March 29, 2018, in connection with the annual meeting of stockholders of Wisconsin Electric Power Company (“WE” or the “Company”), which does business under the trade name of We Energies, and all adjournments or postponements of the annual meeting, for the purposes listed in the preceding Notice of Annual Meeting of Stockholders. The annual meeting of stockholders will be held on Thursday, April 26, 2018 (the “Meeting”), at 10:00 a.m., Central time, in the Resource Center on the first floor of the Public Service Building, 231 W. Michigan Street, Milwaukee, Wisconsin 53203. The WE annual report to stockholders is attached as Appendix B to this information statement.

We are not asking you for a proxy and you are requested not to send us a proxy. However, you may vote your shares of preferred stock at the Meeting. If you would like to attend the Meeting, please contact Stockholder Services by email at wec.stockholder-services.contact@wecenergygroup.com or by telephone at 800-881-5882.

VOTING SECURITIES

As of February 22, 2018, WE had outstanding 44,498 shares of $100 par value Six Per Cent. Preferred Stock; 260,000 shares of $100 par value 3.60% Serial Preferred Stock; and 33,289,327 shares of common stock. Each outstanding share of each class is entitled to one vote. Stockholders of record at the close of business on February 22, 2018 will be entitled to vote at the Meeting. In order to conduct the Meeting, a majority of the outstanding shares entitled to vote must be represented at the Meeting. This is known as a “quorum.” All of WE’s outstanding common stock, representing more than 99% of its voting securities, is owned by its parent company, WEC Energy Group, Inc. (“WEC Energy Group”), and will be represented at the Meeting. The principal business address of WEC Energy Group is 231 W. Michigan Street, Milwaukee, Wisconsin 53203. A list of stockholders of record entitled to vote at the Meeting will be available for inspection by stockholders at WE’s principal business office at 231 W. Michigan Street, Milwaukee, Wisconsin 53203, prior to and at the Meeting.

INTERNET AVAILABILITY OF INFORMATION

The following documents can be found at wisconsinelectric.com:

| |

| • | Notice of Annual Meeting; |

| |

| • | Information Statement; and |

| |

| • | 2017 Annual Report to Stockholders. |

ELECTION OF DIRECTORS

At the Meeting, there will be an election of five directors. Based upon the recommendation of the Corporate Governance Committee of WEC Energy Group’s Board of Directors (the "Corporate Governance Committee"), the individuals named below have been nominated by the WE Board of Directors (the “Board”) to serve a one-year term expiring at the 2019 Annual Meeting of Stockholders and until they are re-elected or until their respective successors are duly elected and qualified.

Directors will be elected by a plurality of the votes cast by the shares entitled to vote, as long as a quorum is present. “Plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be chosen. Therefore, shares not voted, whether by withheld authority or otherwise, have no effect in the election of directors.

Each nominee has consented to being nominated and to serve if elected. In the unlikely event that any nominee becomes unable to serve for any reason, the Board will select a substitute nominee based upon the recommendation of the Corporate Governance Committee.

|

| | |

| Wisconsin Electric Power Company | 1 | 2018 Annual Meeting Information Statement |

Director Nominees

The Company does not have a nominating committee. The Corporate Governance Committee provides oversight for the nominating process on behalf of the Board.

Director nominees for the Board are evaluated as a whole with the goal of recommending nominees with diverse backgrounds and experience that, together, can best perpetuate the success of WE’s business and represent stockholder interests. In addition to the specific experiences and skills of the individual director nominees identified below, the Corporate Governance Committee believes that director nominees should generally possess certain characteristics and skills including: proven integrity; mature and independent judgment; vision and imagination; ability to objectively appraise problems; ability to evaluate strategic options and risks; sound business experience and acumen; relevant technological, political, economic, or social/cultural expertise; social consciousness; achievement of prominence in career; and familiarity with national and international issues affecting the Company’s business. After considering the recommendations of the Corporate Governance Committee, the Board selected the nominees listed below.

Board Diversity

The Corporate Governance Committee does not have a specific policy with regards to the consideration of diversity in identifying director nominees. However, the Corporate Governance Committee strives to recommend candidates who each bring a unique perspective to the Board in order to contribute to the collective diversity of the Board. As part of its process, in connection with the nomination of new directors to the Board, the Corporate Governance Committee considers several factors to ensure the entire Board collectively embraces a wide variety of characteristics, including professional background, experience, skills, and knowledge, as well as the criteria listed above. Each candidate will generally exhibit different and varying degrees of these characteristics.

Nominees for Election to the Board of Directors

Biographical information regarding each nominee is shown below. Ages are as of December 31, 2017. All nominees are officers of the Company and are not independent.

J. Kevin Fletcher. Age 59.

| |

| • | Wisconsin Electric Power Company – President since May 2016; Executive Vice President-Customer Service and Operations from June 2015 to April 2016; Senior Vice President-Customer Operations from October 2011 through June 2015. |

| |

| • | Director of Wisconsin Electric Power Company since June 2015. |

| |

| • | Mr. Fletcher also serves as an officer and/or director of several other major subsidiaries of WEC Energy Group. |

Based primarily upon Mr. Fletcher’s executive management experience in customer service and operations at WEC Energy Group and its utility affiliates, as well as his experience in community and economic development while at Georgia Power Company, where he held the title of Vice President-Community and Economic Development, the Board concluded that Mr. Fletcher should serve as a director of the Company.

Margaret C. Kelsey. Age 52.

| |

| • | WEC Energy Group, Inc. – Executive Vice President since September 2017; General Counsel and Corporate Secretary since January 2018. |

| |

| • | Wisconsin Electric Power Company – Executive Vice President, General Counsel, and Corporate Secretary since January 2018. |

| |

| • | Modine Manufacturing Company - Vice President-Corporate Communications from 2014 to August 2017; Vice President, General Counsel and Corporate Secretary from 2008 to August 2017; Vice President-Corporate Development from 2008 to 2014. |

| |

| • | Director of Wisconsin Electric Power Company since January 2018. |

| |

| • | Ms. Kelsey also serves as an officer and/or director of several other major subsidiaries of WEC Energy Group. |

WE's Board elected Ms. Kelsey as a director effective January 1, 2018 after giving consideration to Ms. Kelsey's position and qualifications as Executive Vice President, General Counsel, and Corporate Secretary of WEC Energy Group and its utility subsidiaries. Based upon her extensive experience in legal, governance, compliance, and regulatory matters as General Counsel and Corporate Secretary of Modine Manufacturing as well as in managing corporate communications,

|

| | |

| Wisconsin Electric Power Company | 2 | 2018 Annual Meeting Information Statement |

strategic initiatives, business/corporate development, and treasury/risk management functions at Modine, the Board concluded that Ms. Kelsey should serve as a director of the Company.

Gale E. Klappa. Age 67.

| |

| • | WEC Energy Group, Inc. – Chairman of the Board and Chief Executive Officer (“CEO”) from 2004 to May 2016 and October 2017 to present; Non-Executive Chairman of the Board from May 2016 to October 2017; President from 2003 to August 2013. |

| |

| • | Wisconsin Electric Power Company – Chairman of the Board from 2004 to May 2016 and January 2018 to present; CEO from 2003 to May 2016 and January 2018 to present; President from 2003 to June 2015. |

| |

| • | Director of WEC Energy Group since 2003; Director of Wisconsin Electric Power Company from 2003 to May 2016 and January 2018 to present. |

| |

| • | Mr. Klappa also serves as an executive officer and/or director of several other major subsidiaries of WEC Energy Group. |

Mr. Klappa has more than 40 years of experience working in the public utility industry, including 25 at a senior executive level. He retired as CEO of WEC Energy Group and Wisconsin Electric in May 2016, at which time he assumed the role of Non-Executive Chairman of WEC Energy Group's Board of Directors. In October 2017, the Company's and WEC Energy Group's then-CEO, Allen Leverett, suffered a stroke. In response, WEC Energy Group's Board of Directors activated its succession plan and appointed Mr. Klappa to serve in the role of Chairman of the Board and CEO of WEC Energy Group. WE's Board of Directors appointed Mr. Klappa Chairman of the Board and CEO of the Company effective January 1, 2018. Mr. Klappa's deep knowledge of the Company's industry, operations, customers, stockholders, and management team has allowed for continuity during Mr. Leverett's recovery.

Based upon Mr. Klappa’s extensive executive management, financial, and strategic experience as a senior executive in the utility industry, the Board concluded that Mr. Klappa should serve as director of the Company.

Scott J. Lauber. Age 52.

| |

| • | WEC Energy Group, Inc. – Executive Vice President and Chief Financial Officer (“CFO”) since April 2016; Vice President and Treasurer from February 2013 to March 2016; Assistant Treasurer from March 2011 to January 2013. |

| |

| • | Wisconsin Electric Power Company – Executive Vice President and CFO since April 2016; Vice President and Treasurer from February 2013 to March 2016; Assistant Treasurer from March 2011 to January 2013. |

| |

| • | Director of Wisconsin Electric Power Company since April 2016. |

| |

| • | Mr. Lauber also serves as an officer and/or director of several other major subsidiaries of WEC Energy Group. |

Based primarily upon Mr. Lauber’s more than 27 years of service at WEC Energy Group, including executive and financial management responsibility of its utility affiliates, with a focus on long-range financial planning and oversight of the treasury function, as well as his experience in risk and insurance matters and knowledge of the financial community, the Board concluded that Mr. Lauber should serve as director of the Company.

Tom Metcalfe. Age 50.

| |

| • | Wisconsin Electric Power Company – Executive Vice President-Generation since April 2016; Senior Vice President-Power Generation from January 2014 to March 2016; Vice President-Oak Creek Campus from February 2011 to December 2013. |

| |

| • | Director of Wisconsin Electric Power Company since January 2018. |

| |

| • | Mr. Metcalfe also serves as an officer and director of Wisconsin Public Service Corporation, another utility subsidiary of WEC Energy Group. |

WE's Board elected Mr. Metcalfe as a director effective January 15, 2018. Based primarily upon Mr. Metcalfe’s strong executive experience, considerable knowledge of the Company's industry, customers and strategic initiatives, and executive responsibility for the Company's and Wisconsin Public Service Corporation's generation operations, the Board concluded that Mr. Metcalfe should serve as a director of the Company.

|

| | |

| Wisconsin Electric Power Company | 3 | 2018 Annual Meeting Information Statement |

COMMITTEES OF THE WEC ENERGY GROUP BOARD OF DIRECTORS

WE is a wholly-owned subsidiary of WEC Energy Group, and the WE Board does not have any committees. The WEC Energy Group Board maintains the following committees, which oversee WE operations on behalf of the WEC Energy Group Board: Audit and Oversight, Compensation, Corporate Governance, and Finance. All committees operate under a charter approved by WEC Energy Group’s Board of Directors. A copy of each committee charter is posted in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com and is available in print to any stockholder who requests it in writing from the Corporate Secretary. Members and principal responsibilities of the WEC Energy Group Board committees are provided below.

|

| | |

| Members | | Principal Responsibilities; Meetings |

| | | |

Audit and Oversight Thomas J. Fischer, Chair John F. Bergstrom Barbara L. Bowles Patricia W. Chadwick Danny L. Cunningham Henry W. Knueppel | | • Oversee the integrity of the financial statements. • Oversee management compliance with legal and regulatory requirements. • Review the Company's environmental and compliance programs. • Review, approve, and evaluate the independent auditors’ services. • Oversee the performance of the internal audit function and independent auditors. • Discuss risk management and major risk exposures and steps taken to monitor and control such exposures. • Prepare the report required by the Securities and Exchange Commission (“SEC”) for inclusion in the proxy and information statements. • Establish procedures for the submission of complaints and concerns regarding WEC Energy Group’s and its subsidiaries’ accounting or auditing matters. • The Audit and Oversight Committee conducted six meetings in 2017. |

| | | |

Compensation John F. Bergstrom, Chair Thomas J. Fischer Ulice Payne, Jr. | | • Identify through succession planning potential executive officers. • Provide competitive, performance-based executive and director compensation programs. • Set performance goals for the CEO, annually evaluate the CEO’s performance against such goals, and determine compensation adjustments based on whether these goals have been achieved. • Prepare the report required by the SEC for inclusion in the proxy and information statements. • The Compensation Committee conducted six meetings in 2017 and executed two written unanimous consents. |

| | | |

Corporate Governance Barbara L. Bowles, Chair Albert J. Budney, Jr. Curt S. Culver Henry W. Knueppel | | • Establish and annually review the Corporate Governance Guidelines to verify that the WEC Energy Group Board of Directors and the Company's Board are effectively performing their fiduciary responsibilities to stockholders. • Establish and annually review director candidate selection criteria. • Identify and recommend candidates to be named as nominees of WEC Energy Group’s Board of Directors and the Company’s Board for election as directors. • Lead the WEC Energy Group Board in its performance annual review. • The Corporate Governance Committee conducted four meetings in 2017 and executed one written unanimous consent. |

| | | |

Finance Curt S. Culver, Chair William J. Brodsky Patricia W. Chadwick William M. Farrow III Ulice Payne, Jr. Mary Ellen Stanek | | • Review and monitor WEC Energy Group’s and its subsidiaries’ current and long-range financial policies and strategies, including each company’s capital structure and dividend policy. • Authorize the issuance of corporate debt within limits set by WEC Energy Group’s Board. • Discuss policies with respect to risk assessment and risk management. • Approve WEC Energy Group’s consolidated financial plan, including the capital budget. • The Finance Committee conducted five meetings in 2017 and executed one written unanimous consent. |

The WE Board met seven times during calendar year 2017 and executed nine written unanimous consents.

With the exception of Mr. Leverett, all WE Board members attended 100% of the total number of WE Board meetings during 2017. Leading up to October when Mr. Leverett suffered a stroke and took a leave of absence to recover, his attendance rate was 100%; at year-end it was 42.9%. Including Mr. Leverett, all WE Board members attended 85.7% of the total number of WE Board of Director meetings during 2017. Ms. Kelsey and Mr. Metcalfe were not directors of the Company at any time during 2017.

|

| | |

| Wisconsin Electric Power Company | 4 | 2018 Annual Meeting Information Statement |

DIRECTOR COMPENSATION

J. Kevin Fletcher, Susan H. Martin, Scott J. Lauber, and Allen L. Leverett served as directors of the Company for all of 2017. Each of these individuals is a named executive officer of WE for 2017 and were not separately compensated as directors. Any compensation received by these individuals for service as named executive officers may be found in the “Summary Compensation Table” on page 27 of this information statement.

OTHER MATTERS

The WE Board of Directors is not aware of any other matters that may properly come before the Meeting. The WE bylaws set forth the requirements that must be followed should a stockholder wish to propose any floor nominations for director or floor proposals at annual or special meetings of stockholders. In the case of annual meetings, the bylaws state, among other things, that notice and certain other documentation must be provided to WE at least 70 days and not more than 100 days before the scheduled date of the annual meeting. No such notices have been received by WE.

CORPORATE GOVERNANCE – FREQUENTLY ASKED QUESTIONS

Does WE have Corporate Governance Guidelines?

The Board follows WEC Energy Group’s Corporate Governance Guidelines that WEC Energy Group has maintained since 1996. WEC Energy Group was one of the earliest adopters of a formal set of Corporate Governance Guidelines. These Guidelines provide a framework under which the WEC Energy Group and WE Boards conduct their business.

To maintain effective Corporate Governance Guidelines, WEC Energy Group’s Corporate Governance Committee annually reviews WEC Energy Group’s and the Company’s governance practices, taking into consideration discussions with WEC Energy Group stockholders as part of the investor outreach and engagement program, industry surveys, and benchmarking studies, as well as governance guidelines published by proxy advisors.

The Guidelines are available in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com and are available in print to any stockholder who requests them in writing from the Corporate Secretary.

How are directors determined to be independent?

No director qualifies as independent unless the Board affirmatively determines that the director has no material relationship with the Company.

What are the WEC Energy Group Board’s standards of independence?

The guidelines the WEC Energy Group and WE Boards of Directors use in determining director independence are located in Appendix A of the WEC Energy Group Corporate Governance Guidelines. The Guidelines are available in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com. These standards of independence include a provision that a director will not be considered independent if he or she has been an employee of the Company for the last five years.

Who are the independent directors?

All of WE’s current Board members, as well as all directors who served on WE's Board during 2017, are or were employees of the Company and/or WEC Energy Group at the time of service and are not (or were not) independent.

Are the WEC Energy Group Audit and Oversight and Compensation Committees comprised solely of independent directors?

Yes. These committees are comprised solely of independent directors, as determined by the WEC Energy Group Board.

In addition, the WEC Energy Group Audit and Oversight Committee is a separately designated committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended.

Is the office of CEO combined with the office of Chairman of the Board?

Yes. The office of CEO is combined with the office of Chairman of the Board at WE. Consistent with WE’s bylaws and WEC Energy Group’s Corporate Governance Guidelines, the Board retains the right to exercise its discretion in combining or separating the offices of CEO and Chairman of the Board.

|

| | |

| Wisconsin Electric Power Company | 5 | 2018 Annual Meeting Information Statement |

What is the Board’s role in risk oversight?

The Board oversees the Company’s risk environment. In addition, the WEC Energy Group Audit and Oversight Committee and the WEC Energy Group Finance Committee provide risk oversight with respect to WEC Energy Group and its subsidiaries, including the Company, on behalf of the WEC Energy Group Board as described in each committee’s charter. The Board receives regular briefings from management on specific areas of risk as well as emerging risks to the enterprise.

Over the course of the year, the WEC Energy Group Audit and Oversight Committee hears reports from management on the Company’s major risk exposures in such areas as regulatory compliance, environmental, legal/litigation, technology security (cybersecurity), and ethical conduct, as well as steps taken to monitor and control such exposures. The WEC Energy Group Finance Committee discusses the Company’s financial risk assessment and risk management policies; it also provides oversight of insurance matters to support the proper function of the risk management program. Both committees have direct access to, and meet as needed with, Company representatives without other management present to discuss matters related to risk management.

The CEO, who is ultimately responsible for managing risk, regularly reports to the Board on risk-related matters. As part of this process, the business unit leaders identify existing, new, or emerging issues or changes within their business areas that could have enterprise implications and report them to senior management. Management is tasked with ensuring that these risks and opportunities are appropriately addressed.

In addition, WEC Energy Group has established an Enterprise Risk Steering Committee, comprised of senior level management employees, whose purpose is to foster an enterprise-wide approach to managing risk and compliance. The Committee regularly reviews key risk areas and provides input to the development and implementation of effective compliance and risk management practices, including external audits. The results of each of these risk-management efforts are reported to the CEO, to the Board, and to the WEC Energy Group Board or its appropriate committee.

The Board believes that its leadership structure and WEC Energy Group’s enterprise risk management program support the risk oversight function of the Board.

How can interested parties contact the members of the Board?

Correspondence may be sent to the directors in care of the Corporate Secretary, Margaret C. Kelsey, at the Company’s principal business office, 231 W. Michigan Street, P.O. Box 2046, Milwaukee, Wisconsin 53201.

All communications received as set forth above will be opened by the Corporate Secretary for the sole purpose of confirming the contents represent a message to the Company’s directors. All communication, other than advertising, promotion of a product or service, or patently offensive material, will be forwarded promptly to the addressee.

Does the Company have a written code of ethics?

Yes. All WE and WEC Energy Group directors, executive officers, and employees, including the principal executive, financial, and accounting officers, have a responsibility to comply with WEC Energy Group’s Code of Business Conduct, to seek advice in doubtful situations, and to report suspected violations.

WEC Energy Group’s Code of Business Conduct addresses, among other things: conflicts of interest; confidentiality; fair dealing; protection and proper use of Company assets; and compliance with laws, rules, and regulations (including insider trading laws). WEC Energy Group, including the Company, has not provided any waiver to the Code for any director, executive officer, or other employee.

The Code of Business Conduct is posted in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com. It is also available in print to any stockholder upon request in writing to the Corporate Secretary.

The Company has several ways employees can raise questions concerning WEC Energy Group’s Code of Business Conduct and other Company policies. As one reporting mechanism, the Company receives independent services under a contract for employees to confidentially and anonymously report suspected violations of the Code of Business Conduct or other concerns, including those regarding accounting, internal accounting controls, or auditing matters.

Does the Company have policies and procedures in place to review and approve related party transactions?

Yes. All employees of WE and WEC Energy Group, including executive officers and members of the Board, are required to comply with WEC Energy Group’s Code of Business Conduct. The Code of Business Conduct addresses, among other things, what actions are required when potential conflicts of interest may arise, including those from related party transactions. Specifically, executive officers and members of the Board are required to obtain approval of WEC Energy Group’s Audit and

|

| | |

| Wisconsin Electric Power Company | 6 | 2018 Annual Meeting Information Statement |

Oversight Committee Chair before (1) obtaining any financial interest in or participating in any business relationship with any company, individual, or concern doing business with WEC Energy Group or any of its subsidiaries, including WE; (2) participating in any joint venture, partnership, or other business relationship with WEC Energy Group or any of its subsidiaries, including WE; and (3) serving as an officer or member of the board of any substantial outside for-profit organization. Furthermore, before serving as an officer or member of the board of any substantial outside for-profit organization, the CEO must obtain the approval of WEC Energy Group’s full Board of Directors. In addition, executive officers must obtain the prior approval of the CEO before accepting a position with a substantial non-profit organization.

WEC Energy Group’s Code of Business Conduct also requires employees and directors to notify the Compliance Officer of situations where family members are a supplier or significant customer of WEC Energy Group or the Company or employed by one. To the extent the Compliance Officer deems it appropriate, the officer will consult with WEC Energy Group’s Audit and Oversight Committee Chair in situations involving executive officers and members of the Board.

Are all the members of the WEC Energy Group Audit Committee financially literate and does the committee have an “audit committee financial expert”?

Yes. The WEC Energy Group Board of Directors has determined that all of the members of WEC Energy Group’s Audit and Oversight Committee are financially literate as required by New York Stock Exchange rules and qualify as audit committee financial experts within the meaning of SEC rules.

How does WEC Energy Group’s Compensation Committee administer the executive and director compensation programs?

One of the principal responsibilities of WEC Energy Group’s Compensation Committee (the "Compensation Committee") is to provide competitive, performance-based executive and director compensation programs.

With respect to the executive compensation program, the Compensation Committee’s responsibilities include:

| |

| • | determining and annually reviewing the Compensation Committee’s compensation philosophy; |

| |

| • | reviewing and determining the compensation paid to executive officers (including base salaries, incentive compensation, and benefits); |

| |

| • | overseeing the compensation and benefits to be paid to other officers and key employees; |

| |

| • | establishing and administering the Chief Executive Officer compensation package; and |

| |

| • | reviewing the results of the most recent WEC Energy Group stockholder advisory vote on compensation of the named executive officers (“NEOs”). |

The Compensation Committee is also charged with administering the compensation package of WEC Energy Group’s non-management directors. The Compensation Committee meets with the WEC Energy Group Corporate Governance Committee annually to review the compensation package of WEC Energy Group’s non-management directors and to determine the appropriate amount of such compensation. All of the Company’s current Board members are executive officers of WE and are not separately compensated as directors.

The Compensation Committee, which has authority to retain advisers, including compensation consultants, at WEC Energy Group’s expense, retained Frederic W. Cook & Co., Inc. (“FW Cook” or the “Consultant”) to analyze and help develop the executive compensation program, and to assess whether the compensation program is competitive and supports the Committee’s objectives. FW Cook also assesses and provides recommendations on non-management director compensation.

FW Cook is engaged solely by the Compensation Committee to provide executive compensation consulting services, and does not provide any additional services to WEC Energy Group or the Company. In connection with its retention of FW Cook, the Compensation Committee reviewed FW Cook’s independence including: (1) the amount of fees received by FW Cook from WEC Energy Group as a percentage of FW Cook’s total revenue; (2) FW Cook’s policies and procedures designed to prevent conflicts of interest; and (3) the existence of any business or personal relationships that could impact independence. After reviewing these and other factors, the Compensation Committee determined that FW Cook is independent and the engagement did not present any conflicts of interest. FW Cook also determined that it was independent from WEC Energy Group’s and its subsidiaries’ management, which was confirmed in a written statement delivered to the Compensation Committee.

For more information regarding the executive compensation processes and procedures, please refer to the “Compensation Discussion and Analysis” later in this information statement.

|

| | |

| Wisconsin Electric Power Company | 7 | 2018 Annual Meeting Information Statement |

Does the Board have a nominating committee?

No. Instead, as discussed under “Director Nominees” above, WE relies upon WEC Energy Group’s Corporate Governance Committee for, among other things, identifying and evaluating director nominees.

What is the process used to identify director nominees and how do I recommend a nominee to WEC Energy Group’s Corporate Governance Committee?

Please refer to the discussion under the heading “Director Nominees” earlier in this information statement.

WEC Energy Group owns all of the Company’s common stock and, as a result, WEC Energy Group’s affirmative vote is sufficient to elect director nominees. Consequently, the Board does not accept proposals from preferred stockholders regarding potential candidates for director nominees.

What is WE’s policy regarding director attendance at annual meetings?

Directors are not expected to attend the Company’s annual meetings of stockholders, as they are only short business meetings.

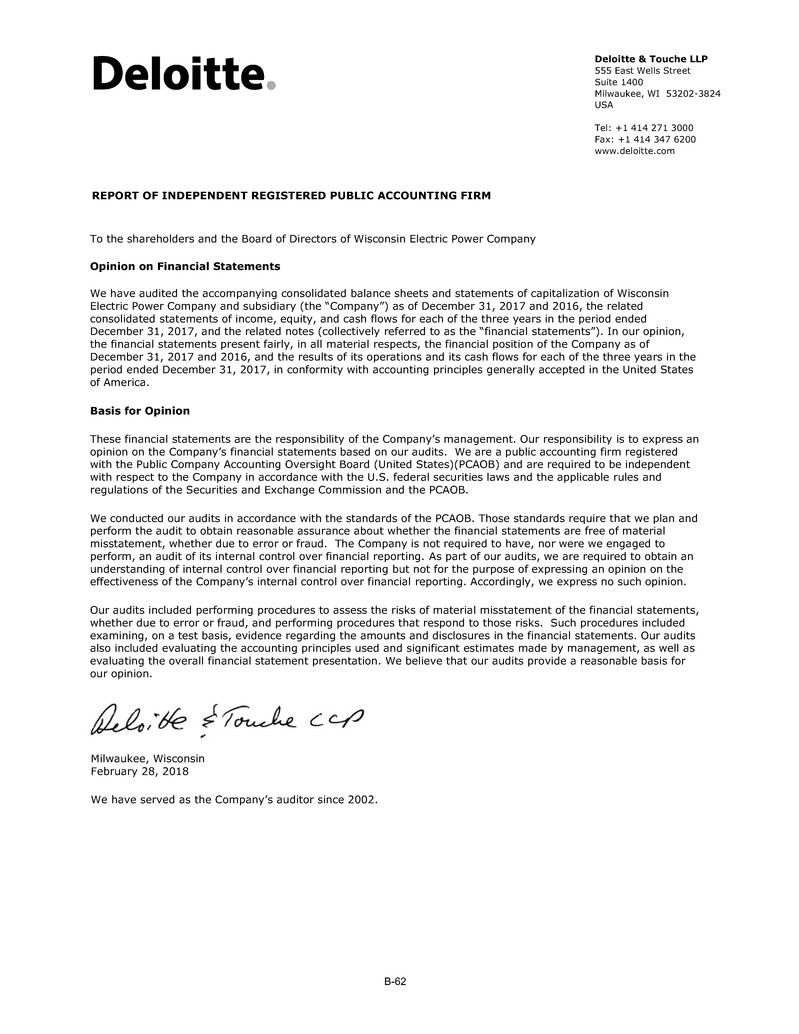

INDEPENDENT AUDITORS’ FEES AND SERVICES

Deloitte & Touche LLP served as the independent auditors for the Company for the last 16 fiscal years beginning with the fiscal year ended December 31, 2002. They have been selected by WEC Energy Group’s Audit and Oversight Committee (the “Audit and Oversight Committee”) as independent auditors for WEC Energy Group and its subsidiaries, including the Company, for the fiscal year ending December 31, 2018, subject to ratification by the stockholders of WEC Energy Group at WEC Energy Group’s Annual Meeting of Stockholders on May 3, 2018.

Representatives of Deloitte & Touche LLP are not expected to be present at the Company’s Annual Meeting, but are expected to attend WEC Energy Group’s Annual Meeting of Stockholders on May 3, 2018. They will have an opportunity to make a statement at WEC Energy Group’s Annual Meeting, if they so desire, and are expected to respond to appropriate questions that may be directed to them.

Pre-Approval Policy. The Audit and Oversight Committee has a formal policy delineating its responsibilities for reviewing and approving, in advance, all audit, audit-related, tax, and other services of the independent auditors. As such, the Audit and Oversight Committee is responsible for the audit fee negotiations associated with WEC Energy Group's and the Company’s retention of independent auditors.

The Audit and Oversight Committee is committed to ensuring the independence of the auditors, both in appearance as well as in fact. In order to assure continuing auditor independence, the Audit and Oversight Committee periodically considers whether there should be a regular rotation of the independent external audit firm. In addition, the Audit and Oversight Committee is directly involved in the selection of Deloitte & Touche LLP’s lead engagement partner.

Under the pre-approval policy, before engagement of the independent auditors for the next year’s audit, the independent auditors will submit: (1) a description of all services anticipated to be rendered, as well as an estimate of the fees for each of the services, for the Audit and Oversight Committee to approve, and (2) written confirmation that the performance of any non-audit services is permissible and will not impact the firm’s independence. Annual pre-approval will be deemed effective for a period of twelve months from the date of pre-approval, unless the Audit and Oversight Committee specifically provides for a different period. A fee level will be established for all permissible, pre-approved non-audit services. Any additional audit service, audit-related service, tax service, and other service must also be pre-approved.

The Audit and Oversight Committee delegated pre-approval authority to the Committee’s Chair. The Audit and Oversight Committee Chair is required to report any pre-approval decisions at the next scheduled Audit and Oversight Committee meeting. Under the pre-approval policy, the Audit and Oversight Committee may not delegate to management its responsibilities to pre-approve services performed by the independent auditors.

Under the pre-approval policy, prohibited non-audit services are services prohibited by the Securities and Exchange Commission or by the Public Company Accounting Oversight Board (United States) to be performed by the Company’s independent auditors. These services include: bookkeeping or other services related to the accounting records or financial statements of the Company; financial information systems design and implementation; appraisal or valuation services, fairness opinions or contribution-in-kind reports; actuarial services; internal audit outsourcing services; management functions or human resources; broker-dealer, investment advisor or investment banking services; legal services and expert services unrelated to the audit; services provided for a contingent fee or commission; and services related to planning, marketing or opining in favor of the tax treatment of a confidential transaction or an aggressive tax position transaction that was initially recommended, directly or

|

| | |

| Wisconsin Electric Power Company | 8 | 2018 Annual Meeting Information Statement |

indirectly, by the independent auditors. In addition, the Audit and Oversight Committee has determined that the independent auditors may not provide any services, including personal financial counseling and tax services, to any officer or other employee of the Company who serves in a financial reporting oversight role or to the Chair of the Audit and Oversight Committee or to an immediate family member of these individuals, including spouses, spousal equivalents, and dependents.

Fee Table. The following table shows the fees, all of which were pre-approved by the Audit and Oversight Committee, for professional audit services provided by Deloitte & Touche LLP for the audit of the annual financial statements of the Company for fiscal years 2017 and 2016 and fees for other services rendered during those periods. No fees were paid to Deloitte & Touche LLP pursuant to the “de minimus” exception to the pre-approval policy permitted under the Securities Exchange Act of 1934, as amended.

|

| | | | | | | | |

| | | 2017 | | 2016 |

Audit Fees (1) | | $ | 2,206,306 |

| | $ | 2,108,351 |

|

Audit-Related Fees (2) | | — |

| | — |

|

Tax Fees (3) | | 8,902 |

| | — |

|

All Other Fees (4) | | 2,319 |

| | 3,502 |

|

| Total | | $ | 2,217,527 |

| | $ | 2,111,853 |

|

| |

| (1) | Audit Fees consist of fees for professional services rendered in connection with the audits of the annual financial statements of the Company and its subsidiary, and other non-recurring audit work. This category also includes reviews of financial statements included in Form 10-Q filings of the Company, and services normally provided in connection with statutory and regulatory filings or engagements. |

| |

| (2) | Audit-Related Fees consist of fees for professional services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under “Audit Fees.” |

| |

| (3) | Tax Fees consist of fees for professional services rendered with respect to federal and state tax compliance and tax advice. This can include preparation of tax returns, claims for refunds, payment planning, and tax law interpretation. No such services were received from Deloitte & Touche in 2016. |

| |

| (4) | All Other Fees consist of costs for certain employees to attend accounting/tax seminars hosted by Deloitte & Touche LLP plus the subscription cost for the use of a Deloitte & Touche LLP accounting research tool. |

AUDIT AND OVERSIGHT COMMITTEE REPORT

The Audit and Oversight Committee, which is comprised solely of independent directors, oversees the integrity of the financial reporting process on behalf of the Company’s Board of Directors. In addition, the Audit and Oversight Committee oversees compliance with the Company’s legal and regulatory requirements. The Audit and Oversight Committee operates under a written charter approved by the Board of Directors of WEC Energy Group, which can be found in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com.

The Audit and Oversight Committee is also directly responsible for the appointment, compensation, retention, and oversight of the Company’s independent auditors, as well as the oversight of the Company’s internal audit function.

In order to assure continuing auditor independence, the Audit and Oversight Committee periodically considers whether there should be a regular rotation of the independent external audit firm. For 2018, the Audit and Oversight Committee has appointed Deloitte & Touche LLP to remain as the Company’s independent auditors, subject to ratification by WEC Energy Group’s stockholders. The members of the Audit and Oversight Committee and other members of WEC Energy Group’s Board believe that the continued retention of Deloitte & Touche LLP to serve as the Company’s independent external auditor is in the best interests of the Company and its stockholders.

The Audit and Oversight Committee is directly involved in the selection of Deloitte & Touche LLP’s lead engagement partner in conjunction with a mandated rotation policy and is also responsible for audit fee negotiations with Deloitte & Touche LLP.

Management is responsible for the Company’s financial reporting process, the preparation of consolidated financial statements in accordance with generally accepted accounting principles, and the system of internal controls and procedures designed to provide reasonable assurance regarding compliance with accounting standards and applicable laws and regulations. The Company’s independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and issuing a report thereon.

The Audit and Oversight Committee held six meetings during 2017. Meetings are designed to facilitate and encourage open communication among the members of the Audit and Oversight Committee, management, the internal auditors, and the

|

| | |

| Wisconsin Electric Power Company | 9 | 2018 Annual Meeting Information Statement |

Company’s independent auditors, Deloitte & Touche LLP. During these meetings, we reviewed and discussed with management, among other items, the Company’s unaudited quarterly and audited annual financial statements and the system of internal controls designed to provide reasonable assurance regarding compliance with accounting standards and applicable laws.

We have reviewed and discussed with management and the Company’s independent auditors the Company’s audited consolidated financial statements and related footnotes for the fiscal year ended December 31, 2017, and the independent auditor’s report on those financial statements. Management represented to us that the Company’s financial statements were prepared in accordance with generally accepted accounting principles. Deloitte & Touche LLP presented the matters required to be discussed with the Audit and Oversight Committee by PCAOB Auditing Standard No. 1301, Communications with Audit Committees. This review included a discussion with management and the independent auditors about the quality of the Company’s accounting principles, the reasonableness of significant estimates and judgments, and the disclosures in the Company’s financial statements, as well as the disclosures relating to critical accounting policies.

In addition, we received the written disclosures and the letter relative to the auditors’ independence from Deloitte & Touche LLP, as required by applicable requirements of the PCAOB regarding Deloitte & Touche LLP’s communications with the Audit and Oversight Committee concerning independence. The Audit and Oversight Committee discussed with Deloitte & Touche LLP its independence and also considered the compatibility of non-audit services provided by Deloitte & Touche LLP with maintaining its independence.

Based on these reviews and discussions, the Audit and Oversight Committee recommended to the Company’s Board that the audited financial statements be included in Wisconsin Electric Power Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and filed with the Securities and Exchange Commission.

Respectfully submitted to Wisconsin Electric Power Company’s stockholders by the Audit and Oversight Committee,

|

| |

| | The Audit and Oversight Committee |

| | of WEC Energy Group, Inc. |

| | |

| | Thomas J. Fischer, Committee Chair John F. Bergstrom Barbara L. Bowles Patricia W. Chadwick Danny L Cunningham Henry W. Knueppel |

|

| | |

| Wisconsin Electric Power Company | 10 | 2018 Annual Meeting Information Statement |

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion provides an overview and analysis of our executive compensation program, including the role of WEC Energy Group’s Compensation Committee (the “Compensation Committee"), the elements of our executive compensation program, the purposes and objectives of these elements, and the manner in which we established the compensation of the Company’s named executive officers (“NEOs”) for fiscal year 2017.

References to “we,” “us,” “our,” and the "Company," in this discussion and analysis mean Wisconsin Electric Power Company and its management, as applicable, and references to “WEC Energy Group” mean WEC Energy Group, Inc.

The Compensation Committee oversees the compensation program of WEC Energy Group and its subsidiaries, including the Company, on behalf of WEC Energy Group’s Board of Directors. Therefore, the Compensation Committee has responsibility for making compensation decisions regarding the NEOs of the Company. There is significant overlap between the NEOs of the Company and the NEOs of WEC Energy Group.

EXECUTIVE SUMMARY

Overview

The primary objective of our executive compensation program is to provide a competitive, performance-based plan that enables WEC Energy Group and the Company to attract and retain key individuals and to reward them for achieving both WEC Energy Group's and the Company’s short-term and long-term goals without creating an incentive for our NEOs to take excessive risks. Our program has been designed to provide a level of compensation that is strongly dependent upon the achievement of short-term and long-term goals that are aligned with the interests of WEC Energy Group's and the Company's stockholders and our customers. To that end, a substantial portion of pay is at risk, and generally, the value will only be realized upon strong corporate performance.

2017 Business Highlights

WEC Energy Group completed its second full year of combined utility operations in 2017 following the acquisition of Integrys Energy Group in June 2015. During 2017, WEC Energy Group made excellent progress in its continued efforts to integrate employees, merge and improve business processes, and consolidate its IT infrastructure. At the same time, WEC Energy Group and its utilities achieved solid results and continued to create long-term value for stockholders and customers by focusing on the following:

|

| | | |

| | • World-class reliability | • Operating efficiency | • Employee safety |

| | | | |

| | • Financial discipline | • Exceptional customer care | |

Commitment to Stockholder Value Creation. Financially, WEC Energy Group and the Company again delivered solid earnings growth, generated strong cash flow, and WEC Energy Group increased its dividend for the 14th consecutive year. In January 2017, the WEC Energy Group Board raised the quarterly dividend 5.1% to $0.5200 per share, equivalent to an annual rate of $2.08 per share. In January 2018, the WEC Energy Group Board increased the quarterly dividend to $0.5525 per share, which is equivalent to an annual rate of $2.21 per share, in line with the plan to maintain a dividend payout ratio of 65% to 70% of earnings. WEC Energy Group and the Company also turned in above target performances in customer satisfaction and network reliability during 2017.

|

| | |

| Wisconsin Electric Power Company | 11 | 2018 Annual Meeting Information Statement |

Specific achievements during 2017 of WEC Energy Group and the Company include:

|

| | |

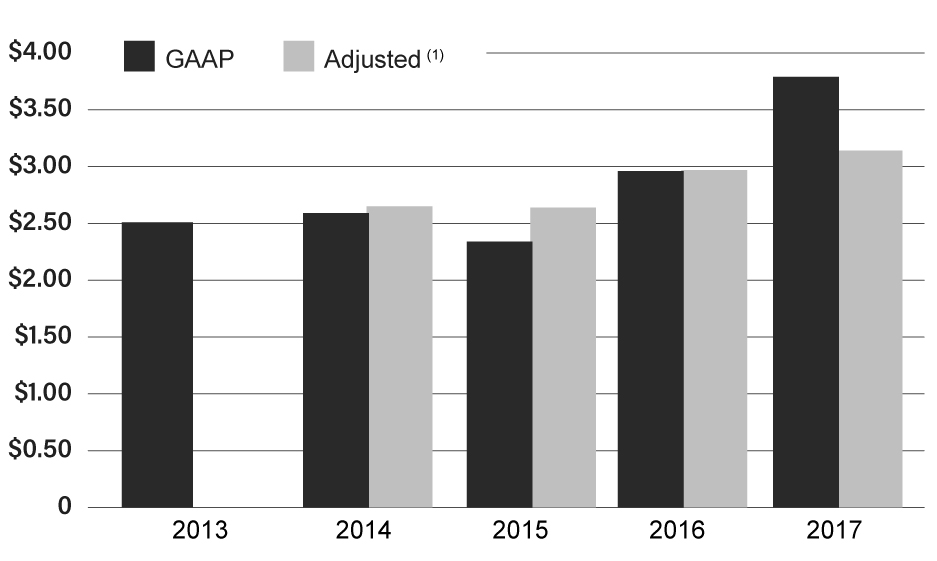

| 2017 Financial Highlights | | WEC Energy Group Diluted Earnings Per Share |

• WEC Energy Group delivered solid earnings growth again, generated strong cash flow, and increased the dividend for the 14th consecutive year.

• WEC Energy Group achieved fully diluted earnings per share and adjusted earnings per share of $3.79 and $3.14, respectively. (2)

• Each of WEC Energy Group's regulated utility subsidiaries, including the Company, earned its allowed rate of return.

• Returned approximately $656.5 million to WEC Energy Group stockholders through dividends.

• WEC Energy Group's common stock traded at an all-time high of $70.09 on November 15, 2017.

• In January 2018, the WEC Energy Group Board raised the quarterly dividend to $0.5525 per share, which is equivalent to an annual dividend rate of $2.21 per share.

| | (1) For 2017, excludes a one-time $0.65 per share gain related to a revaluation of WEC Energy Group deferred taxes as a result of the Tax Cuts and Jobs Act of 2017. For 2016, 2015, and 2014, excludes costs of $0.01, $0.30, and $0.06 per share, respectively, related to WEC Energy Group's acquisition of Integrys. See Appendix A on page A-1 for a full GAAP reconciliation and an explanation of why WEC Energy Group believes the presentation of adjusted earnings per share is relevant and useful to investors.

|

2017 Performance Highlights

| |

| • | WEC Energy Group was recognized in 2017 by Corporate Responsibility Magazine as one of the 50 best corporate citizens in America. |

| |

| • | PA Consulting Group named We Energies (the trade name of WE and Wisconsin Gas LLC) the most reliable utility in the United States in 2017, and in the Midwest for the seventh year in a row. |

| |

| • | WEC Energy Group’s utilities, including the Company, continued to balance the delivery of safe, reliable, and affordable energy with a commitment to protecting the environment. |

| |

| • | At our request, the Public Service Commission of Wisconsin approved a base rate freeze, keeping base rates flat through 2019 for our Wisconsin customers. |

| |

| • | Wisconsin Public Service Corporation, another utility subsidiary of WEC Energy Group, was named as the best midsize utility in the Midwest for business customer satisfaction.(2) |

| |

| • | All major utility subsidiaries of WEC Energy Group, including the Company, either met or exceeded their overall customer satisfaction targets.(2) |

| |

| • | Minnesota Energy Resources Corporation, another utility subsidiary of WEC Energy Group, received the Governor’s Safety Award, which recognizes companies with incident rates that are 51% to 90% better than the industry average.(2) |

| |

| • | We announced an advanced metering infrastructure program, which consists of an integrated system of smart meters, communication networks, and data management systems that enable two-way communication between utilities and customers.(2) |

| |

| • | WEC Energy Group announced a corporate strategy to reshape its generation fleet to provide a clean, reliable future. The plan includes retiring approximately 1,800 MWs of coal generation by 2020 and adding additional natural gas-fired generating units and renewable generation, including utility-scale solar projects. |

| |

| • | WEC Energy Group completed the acquisition of Bluewater Natural Gas Holding, LLC, which owns underground natural gas storage facilities in Michigan. |

| |

| • | Upper Michigan Energy Resources, another utility subsidiary of WEC Energy Group, received approval from the Michigan Public Service Commission to construct and operate approximately 180 MWs of natural gas-fired generation located in the Upper Peninsula of Michigan. |

| |

| • | WEC Energy Group announced that Wisconsin Public Service Corporation, along with two other unaffiliated utilities, agreed to purchase the Forward Wind Energy Center, which consists of 86 wind turbines located in Wisconsin with a total capacity of 129 MWs. The aggregate purchase price is $174 million, of which Wisconsin Public Service's proportionate share is 44.6%, or approximately $78 million. |

(2) This measure is a component of our short-term incentive compensation program.

|

| | |

| Wisconsin Electric Power Company | 12 | 2018 Annual Meeting Information Statement |

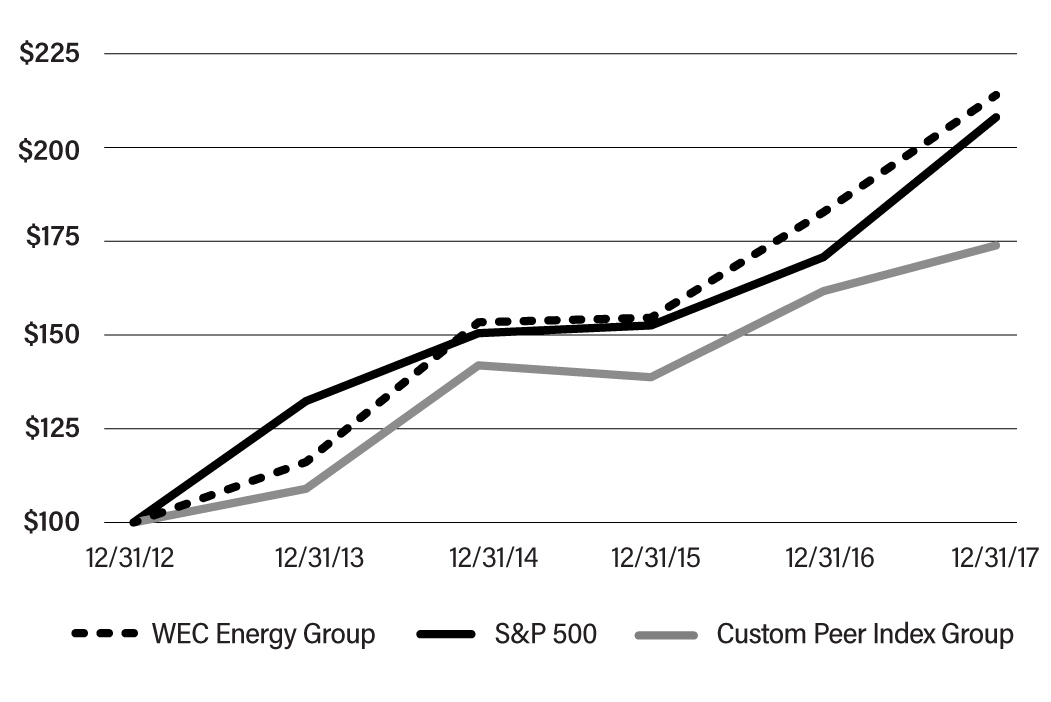

Long-Term Stockholder Returns

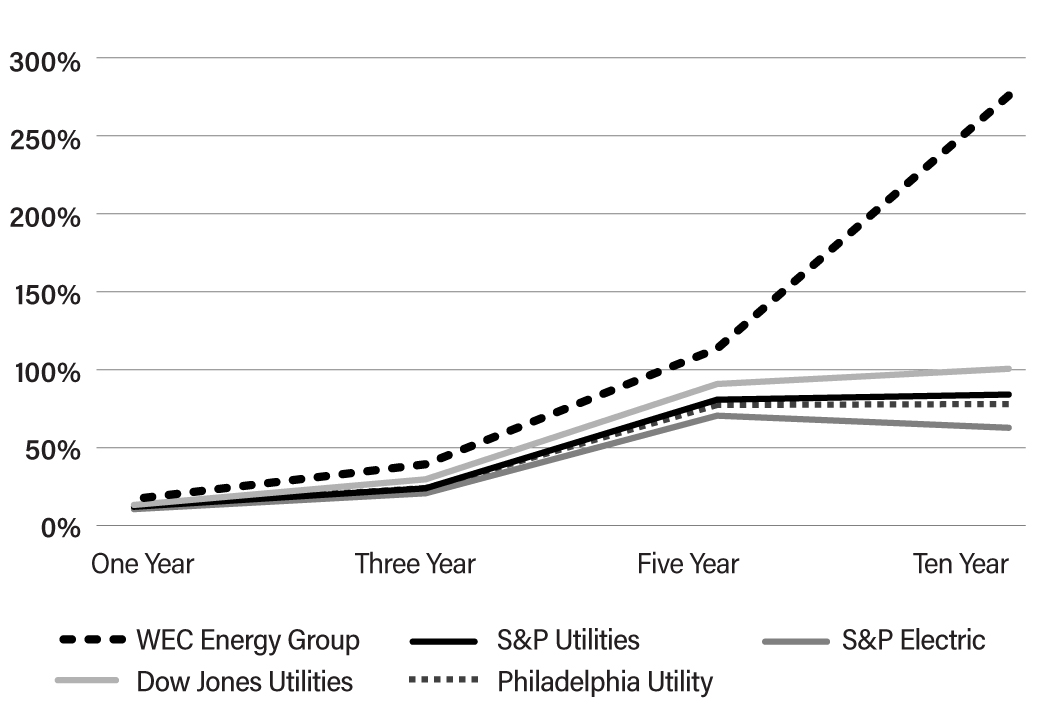

Over the past decade, WEC Energy Group has consistently delivered among the best total returns in the industry and did so again in 2017.

|

| |

WEC Energy Group Five-Year Cumulative Return | WEC Energy Group Industry Leading Total Shareholder Returns |

| |

(1) The Five-Year Cumulative Return Chart shows a comparison of WEC Energy Group's cumulative total return, assuming reinvestment of dividends, over the last five years had $100 been invested at the close of business on December 31, 2012. For information about the Custom Peer Index Group, see page 22 of this information statement. | Source: Bloomberg; assumes all dividends are reinvested and returns are compounded daily. |

Key Compensation Program Changes

We continually look for ways to refine our executive compensation program to more effectively align executive pay with performance and reflect best compensation practices. For 2017, based upon feedback received from WEC Energy Group stockholders during investor outreach efforts, the Compensation Committee amended and restated the WEC Energy Group Performance Unit Plan to provide for an Additional Performance Measure in addition to the performance measure of total stockholder return. Performance units will continue to vest in an amount between 0% and 175% of the target award based upon WEC Energy Group’s comparative total stockholder return over a three-year performance period. However, the vesting percentage may be adjusted based upon WEC Energy Group’s performance against the Additional Performance Measure(s). The Compensation Committee selected performance against the weighted average authorized return on equity of all WEC Energy Group’s utility subsidiaries, including the Company, as the Additional Performance Measure for the 2017 performance unit awards. In order for WEC Energy Group to achieve its financial goals, it is important that WEC Energy Group’s utilities, including the Company, earn at or close to their authorized return on equity.

For additional information about the performance units and Additional Performance Measures, see “Long-Term Incentive Compensation” on page 20 of this information statement.

Consideration of 2017 WEC Energy Group Stockholder Advisory Vote and Stockholder Outreach

At the 2017 WEC Energy Group Annual Meeting of Stockholders, stockholders approved the compensation of the 2016 named executive officers with almost 95% of the votes cast. The Compensation Committee considered this outcome as well as the feedback received during meetings WEC Energy Group held with a number of its institutional stockholders. During 2017, WEC Energy Group talked with 30 stockholders representing approximately 45% of WEC Energy Group’s outstanding common stock about its governance and compensation practices. In light of the significant stockholder support for the executive compensation program received in 2017, the payout levels under the performance-based program for 2017, and the changes previously made to the program in 2016, the Compensation Committee continues to believe that the compensation program is competitive, aligned with WEC Energy Group’s and our financial and operational performance, and in the best interests of WEC Energy Group and the Company, stockholders, and customers.

|

| | |

| Wisconsin Electric Power Company | 13 | 2018 Annual Meeting Information Statement |

COMPONENTS OF OUR EXECUTIVE COMPENSATION PROGRAM

We have three primary elements of total direct compensation: (1) base salary; (2) annual incentive awards; and (3) long-term incentive awards consisting of a mix of WEC Energy Group performance units, stock options, and restricted stock. The Compensation Committee retained Frederic W. Cook & Co., Inc. ("FW Cook") as its independent compensation consultant to advise the Compensation Committee with respect to our executive compensation program. The Compensation Committee generally relied on the recommendations of FW Cook as it developed the 2017 program.

As WEC Energy Group first reported in a Current Report on Form 8-K filed on October 12, 2017, Allen Leverett, then Chairman of the Board and CEO of the Company, suffered a stroke. Pursuant to our Bylaws, on October 31, 2017, the Company’s Board of Directors ordered that the duties of Chief Executive Officer would be exercised by the Company’s President, Kevin Fletcher, on an interim basis. Mr. Fletcher exercised these duties through December 31, 2017. Effective January 1, 2018, the Company’s Board appointed Gale E. Klappa to serve as Chairman of the Board and CEO while Mr. Leverett continues to recover from the stroke and until such time as he is able to re-assume those responsibilities. Mr. Fletcher did not receive any additional compensation for his service in this role.

For the remainder of 2017, we continued to compensate Mr. Leverett pursuant to the standard medical leave policy.

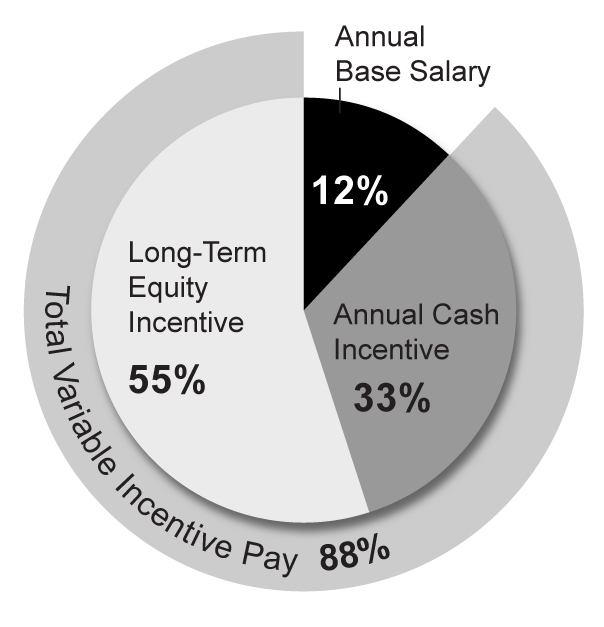

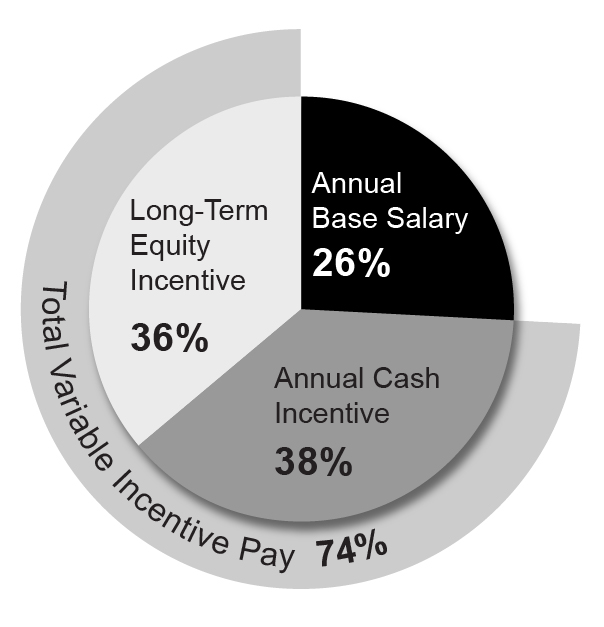

As shown in the charts below, 88% of Mr. Leverett’s 2017 total direct compensation and an average of 74% of the other NEO’s 2017 total direct compensation is tied to WEC Energy Group performance and is not guaranteed.

|

| | |

| CEO 2017 TOTAL DIRECT COMPENSATION MIX | | OTHER NEOs 2017 TOTAL DIRECT COMPENSATION MIX |

| | |

To the extent feasible, WEC Energy Group believes it is important that the compensation program not dilute the interests of current stockholders. Therefore, WEC Energy Group currently uses open market purchases to satisfy benefit plan obligations, including the exercise of stock options and vesting of restricted stock.

In addition to the components of total direct compensation identified above, retirement programs are another important component of our compensation program.

This Compensation Discussion and Analysis contains a more detailed discussion of each of the above components for 2017, including FW Cook's recommendations with respect to each component.

|

| | |

| Wisconsin Electric Power Company | 14 | 2018 Annual Meeting Information Statement |

Compensation Governance and Practices

The Compensation Committee annually reviews and considers the Company’s compensation policies and practices to ensure our executive compensation program aligns with our compensation philosophy. Highlighted below is an overview of our current compensation practices.

|

| | |

| What We Do |

| |

• Our compensation program focuses on key Company results (financial, safety, customer satisfaction, diversity) that are aligned with WEC Energy Group’s and our strategic goals.

• A substantial portion of compensation is at risk and tied to WEC Energy Group and Company performance.

• The compensation program has a long-term orientation aligned with WEC Energy Group stockholder interests.

• The Compensation Committee retains an independent compensation consultant to help design the compensation program and determine competitive levels of pay.

• The Compensation Committee's independent compensation consultant reviews competitive employment market data from two general industry surveys and a comparison group of companies similar to WEC Energy Group.

• We have implemented a clawback policy that provides for the recoupment of incentive-based compensation. (page 24) • Annual incentive-based compensation contains multiple, pre-established performance metrics aligned with WEC Energy Group’s and the Company’s stockholder and customer interests. (page 17)

| | • The WEC Energy Group Performance Unit Plan award payouts (including dividend equivalents) are based on WEC Energy Group stockholder return as compared to an appropriate peer group and Additional Performance Measure(s), selected by the Compensation Committee. (page 20)

• The WEC Energy Group Performance Unit Plan requires a separation from service following a change in control for award vesting to occur. (page 23)

• Equity award and other benefit plan obligations are satisfied through open market purchases of WEC Energy Group common stock.

• Meaningful WEC Energy Group stock ownership levels are required for senior executives. (page 24)

• Ongoing engagement with investors takes place to ensure that compensation practices are responsive to WEC Energy Group stockholder interests.

• We prohibit hedging and pledging of WEC Energy Group common stock. (page 24)

• We prohibit entry into any new arrangements that obligate WEC Energy Group or the Company to pay directly or reimburse individual tax liability for benefits provided. (page 25)

• We prohibit repricing of WEC Energy Group stock options without WEC Energy Group stockholder approval.

|

Competitive Benchmarking

As a general matter, we believe the labor market for WEC Energy Group executive officers is consistent with that of general industry. Although we recognize our business is focused on the energy services industry, our goal is to have an executive compensation program that will allow us to be competitive in recruiting the most qualified candidates to serve as executive officers of WEC Energy Group and the Company, including individuals who may be employed outside of the energy services industry. Further, in order to retain top performing executive officers, we believe our compensation practices must be competitive with those of general industry.

To confirm that our annual executive compensation is competitive with the market, FW Cook reviewed the compensation data obtained from Willis Towers Watson's 2017 Executive Compensation Data Bank as well as similar data from Aon Hewitt. FW Cook also analyzed the compensation data from a peer group of 18 companies similar to WEC Energy Group in size and business model. The methodology used by FW Cook to determine the peer group of companies is described below.

FW Cook started with U.S. companies in the Standard & Poor’s database, and then limited those companies to the same line of business as WEC Energy Group as indicated by the Global Industry Classification Standards. This list of companies was then further limited to companies with revenues between $2.45 billion and $22 billion (approximately one- third to three times the size of WEC Energy Group’s revenues), and that were within a reasonable size range in various other measures such as operating income, total assets, total employees, and market capitalization. From this list, FW Cook selected companies similar in overall size to WEC Energy Group with consideration given to companies that met one or more of the following criteria:

| |

| • | Diversified, technically sophisticated utility operations (e.g., multiple utilities, electric utilities); |

|

| | |

| Wisconsin Electric Power Company | 15 | 2018 Annual Meeting Information Statement |

| |

| • | Minimal non-regulated business; and/or |

| |

| • | Operates in the Midwest. |

These criteria resulted in a comparison group of 18 companies with median revenues and market capitalization of approximately $8.7 billion and $15.2 billion, respectively.

The comparison group utilized for purposes of 2017 compensation includes the same companies as the previous year’s comparison group, except that Dominion Resources was removed based on FW Cook’s recommendation that it no longer meets the applicable criteria. The comparison group consisted of the 18 companies listed below.

|

| | | |

• Alliant Energy Corporation • Ameren Corporation • American Electric Power Company • CMS Energy Corporation • CenterPoint Energy | • Consolidated Edison, Inc. • DTE Energy Co. • Edison International • Entergy Inc. • Eversource Energy

| • FirstEnergy Corp. • NiSource Inc. • PG&E Corporation • PPL Corp. • Pinnacle West Capital Corp.

| • SCANA Corporation • The Southern Company • Xcel Energy Inc. |

The Compensation Committee approved this revised comparison group.

DETERMINATION OF MARKET MEDIAN

In order to determine the “market median” for our NEOs, FW Cook recommended that the survey data from Willis Towers Watson and Aon Hewitt receive a 75% weighting and the comparison group of 18 companies receive a 25% weighting. The Compensation Committee agreed with this recommendation. The survey data received a higher weighting because we consider the labor market for our executives to be consistent with that of general industry. Using this methodology, FW Cook recommended, and the Compensation Committee approved, the appropriate market median for each of our NEOs.

The comparison of each component of compensation with the appropriate market median when setting the compensation levels of our NEOs drives the allocation of cash versus non-cash compensation and short-term versus long-term incentive compensation.

ANNUAL BASE SALARY

The annual base salary component of our executive compensation program provides each executive officer with a fixed level of annual cash compensation. We believe that providing annual cash compensation through a base salary is an established market practice and is a necessary component of a competitive compensation program.

Based upon the market data analyzed by FW Cook, we generally target base salaries to be within (plus or minus) 15% of the market median for each NEO. However, the Compensation Committee may, in its discretion, adjust base salaries outside of this 15% band when the Compensation Committee deems it appropriate.

Actual salary determinations are made taking into consideration factors such as the relative levels of individual experience, performance, responsibility, and contribution to the results of WEC Energy Group’s and the Company’s operations. At the beginning of each year, the WEC Energy Group CEO develops a list of goals for WEC Energy Group and its utility subsidiaries, including the Company, and their employees to achieve during the upcoming year. At the end of the year, the CEO measures the performance of WEC Energy Group and the Company against each stated goal and reports the results to the WEC Energy Group Board. The Compensation Committee then takes WEC Energy Group’s and the Company’s performance into consideration when establishing the compensation of WEC Energy Group’s CEO. The CEO undertakes a similar process with the NEOs, who develop individual goals related to the achievement of WEC Energy Group’s and the Company’s goals developed by the CEO. At the end of the year, each officer’s performance is measured against these goals. Compensation recommendations and determinations for the upcoming year for each executive officer also take into consideration the level of such performance.

The Compensation Committee increased Mr. Leverett’s annual base salary to $1,161,000 for 2017, which was within our targeted range of the market median.

With respect to each other NEO, in December 2016, Mr. Leverett recommended an annual base salary to the Compensation Committee based upon a review of the market compensation data provided by FW Cook and the factors described above. The Compensation Committee approved the recommendations, which represented an average increase in annual base salary of approximately 3% for Messrs. Fletcher and Garvin, and Mmes. Martin and Shafer, and an increase in annual base salary of approximately 16% for Mr. Lauber.

|

| | |

| Wisconsin Electric Power Company | 16 | 2018 Annual Meeting Information Statement |

Upon his appointment as Executive Vice President and Chief Financial Officer, Mr. Lauber’s base salary was previously increased effective April 1, 2016, but was set below the target range because of how significant such an increase would have been in order to bring his salary within the range. As we previously reported, the Compensation Committee’s intent was to continue increasing Mr. Lauber’s salary in multiple steps to move it within the target range. As a result, effective July 1, 2017, the Compensation Committee increased Mr. Lauber’s annual base salary by an additional 16% to provide an aggregate base salary of $496,165 in 2017. The annual base salary of each NEO was within our targeted range of the market median as discussed above.

ANNUAL CASH INCENTIVE COMPENSATION

We provide annual cash incentive compensation through WEC Energy Group’s Short-Term Performance Plan (“STPP”). The STPP provides for annual cash awards to NEOs based upon the achievement of pre-established stockholder-, customer-, and employee- focused objectives. All payments under the STPP are at risk. Payments are made only if performance goals are achieved, and awards may be less or greater than targeted amounts based upon actual performance. Payments under the STPP are intended to reward achievement of short-term goals that contribute to WEC Energy Group stockholder and customer (including our customers) value, as well as individual contributions to successful operations.

2017 Target Awards. Each year, the Compensation Committee approves a target level of compensation under the STPP for each of our NEOs. This target level of compensation is expressed as a percentage of base salary.

The year-end 2017 target awards for each NEO are set forth in the chart below.

|

| |

| Executive Officer | Target STPP Award as a Percentage of Base Salary |

| Mr. Leverett | 125% |

| Mr. Fletcher | 70% |

| Mr. Lauber | 80% |

| Ms. Martin | 70% |

| Mr. Garvin | 65% |

| Ms. Shafer | 65% |

The target award levels of each officer named in this table reflect median incentive compensation practices as indicated by the market data. The Compensation Committee increased Mr. Leverett's and Mr. Lauber’s targets to move them into the median target range for their positions

For 2017, the possible payout for any NEO ranged from 0% of the target award to 210% of the target award, based upon performance.

2017 Financial Goals under the STPP. The Compensation Committee adopted the 2017 STPP with a continued principal focus on financial results. In December 2016, the Compensation Committee approved WEC Energy Group’s earnings per share (75% weight) and cash flow (25% weight) as the primary performance measures to be used in 2017. For those officers whose positions primarily relate to utility operations in Wisconsin, the Compensation Committee approved WEC Energy Group’s earnings per share (25% weight) and cash flow (25% weight), as well as aggregate net income of WEC Energy Group’s Wisconsin utility operations (50% weight), as the primary performance measures to be used in 2017. We believe earnings per share and cash flow are key indicators of financial strength and performance and are recognized as such by the investment community. Utility net income is an important financial measure as it is an indicator of the return on equity earned by WEC Energy Group’s utilities, including us, and in order to meet WEC Energy Group’s earnings per share targets it is important that the utilities earn at or close to their allowed rates of return.

In January 2017, the Compensation Committee approved the performance goals under the STPP for WEC Energy Group’s earnings per share as set forth in the chart below.

|

| | |

| Earnings Per Share Performance Goal | Earnings Per Share CAGR | Payout Level |

| $2.96 | 4.3% | 25% |

| $2.98 | 4.7% | 50% |

| $3.00 | 5.0% | 100% |

| $3.06 | 6.1% | 135% |

| $3.12 | 7.1% | 200% |

If WEC Energy Group performance falls between these levels, the payout level with respect to earnings per share is determined by interpolating on a straight line basis the appropriate payout level.

|

| | |

| Wisconsin Electric Power Company | 17 | 2018 Annual Meeting Information Statement |

WEC Energy Group’s growth plan, which has been communicated to the public, calls for a long-term compound annual growth rate (“CAGR”) in earnings per share of 5.0% to 7.0% off of a 2015 base of $2.72 per share. At the time the Compensation Committee was establishing targets for 2017, we believed that this CAGR, plus WEC Energy Group’s continued growth in dividends would support a premium valuation as compared to WEC Energy Group’s peers. Therefore, the Compensation Committee tied the target (100%) payout level to achievement of the low end of the target CAGR range (5.0%), and the above target payout level to the mid-point of the target range (6.1%). The Compensation Committee tied the maximum payout level (200%) to achievement of a 7.1% CAGR. The Compensation Committee determined that WEC Energy Group’s CAGR should exceed the high end of the target range to achieve the maximum payout level.

In January 2017, the Compensation Committee approved the performance goals under the STPP for WEC Energy Group’s cash flow below ($ in millions).

|

| |

| Cash Flow | Payout Level |

| $1,750 | 25% |

| $1,800 | 50% |

| $1,850 | 100% |

| $1,900 | 135% |

| $2,000 | 200% |