SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO.)

Check the appropriate box:

| [_] | Preliminary Information Statement |

| | |

| [_] | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| | |

| [X] | Definitive Information Statement |

Wisconsin Electric Power Company

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

Payment of Filing Fee (Check the appropriate box)

| [X] | No fee required. |

| | |

| [_] | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | |

| 1) | Title of each class of securities to which transaction applies: |

___________________________________________________________________________

| 2) | Aggregate number of securities to which transaction applies: |

___________________________________________________________________________

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

___________________________________________________________________________

| 4) | Proposed maximum aggregate value of transaction: |

___________________________________________________________________________

___________________________________________________________________________

| [_] | Fee paid previously with preliminary materials. |

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: _____________________________________________________ |

| | |

| 2) | Form, Schedule or Registration Statement No.:____________________________________ |

| | |

| 3) | Filing Party:_______________________________________________________________ |

| | |

| 4) | Date Filed:________________________________________________________________ |

| Allen L. Leverett Chairman and

Chief Executive Officer

231 W Michigan Street

Milwaukee, WI 53203 |

March 30, 2017

Dear Preferred Stockholder:

Wisconsin Electric Power Company, which does business under the trade name of We Energies, will hold its Annual Meeting of Stockholders on Thursday, April 27, 2017, at 10:00 a.m., Central time in the Resource Center on the first floor of the Public Service Building, 231 West Michigan Street, Milwaukee, Wisconsin 53203.

We are not soliciting proxies for this meeting, as more than 99% of the voting stock is owned, and will be voted, by Wisconsin Electric’s parent, WEC Energy Group, Inc. If you wish, you may vote your shares of preferred stock in person at the meeting; however, the business session will be very brief.

As an alternative, you might consider attending WEC Energy Group’s Annual Meeting of Stockholders to be held Thursday, May 4, 2017, at 10:00 a.m., Central time, at Concordia University Wisconsin in the R. John Buuck Field House located at 12800 North Lake Shore Drive, Mequon, Wisconsin 53097.

By attending this meeting, you would have the opportunity to meet many of the Wisconsin Electric officers and directors. Although you cannot vote your shares of Wisconsin Electric preferred stock at the WEC Energy Group meeting, you may find the activities worthwhile.

You must pre-register and present photo identificationat the door to attend WEC Energy Group’s Annual Meeting. To pre-register for the meeting, please contact WEC Energy Group’s Stockholder Services, 231 West Michigan Street, Milwaukee, Wisconsin 53203; call 800-881-5882; or emailWEC.Stockholder-Services.Contact@wisconsinenergy.com and provide proof of your ownership of preferred stock, including, if applicable, a bank or brokerage firm account statement or a letter from the broker, trustee, bank, or nominee holding your shares.

The annual report of Wisconsin Electric is attached as Appendix B to this information statement. If you have any questions or would like a copy of the WEC Energy Group annual report, please call our toll-free stockholder hotline at 800-881-5882.

Thank you for your support.

Sincerely,

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

March 30, 2017

To the Stockholders of Wisconsin Electric Power Company:

The 2017 Annual Meeting of Stockholders of Wisconsin Electric Power Company will be held on Thursday, April 27, 2017, at 10:00 a.m., Central time, in the Resource Center on the first floor of the Public Service Building, 231 West Michigan Street, Milwaukee, Wisconsin 53203, for the following purposes:

| 1. | To elect the four members of the Board of Directors to hold office until the 2018 Annual Meeting of Stockholders; and |

| 2. | To consider any other matters that may properly come before the meeting. |

Stockholders of record at the close of business on February 23, 2017, are entitled to vote. The following pages provide additional details about the meeting as well as other useful information.

Important Notice Regarding the Availability of Materials Related to the Stockholder Meeting to Be Held on April 27, 2017 – The Information Statement and 2016 Annual Report to Stockholders are available at:

www.wisconsinelectric.com

By Order of the Board of Directors,

Susan H. Martin

Executive Vice President, General Counsel and Corporate Secretary

| | We Energies

231 West Michigan Street

Milwaukee, Wisconsin 53203 |

INFORMATION STATEMENT

This information statement is being furnished to stockholders beginning on or about March 30, 2017, in connection with the annual meeting of stockholders of Wisconsin Electric Power Company (“WE” or the “Company”), which does business under the trade name of We Energies, and all adjournments or postponements of the annual meeting, for the purposes listed in the preceding Notice of Annual Meeting of Stockholders. The annual meeting of stockholders will be held on Thursday, April 27, 2017 (the “Meeting”), at 10:00 a.m., Central time, in the Resource Center on the first floor of the Public Service Building, 231 West Michigan Street, Milwaukee, Wisconsin 53203. The WE annual report to stockholders is attached as Appendix B to this information statement.

We are not asking you for a proxy and you are requested not to send us a proxy.However, you may vote your shares of preferred stock at the Meeting.

VOTING SECURITIES

As of February 23, 2017, WE had outstanding 44,498 shares of $100 par value Six Per Cent. Preferred Stock; 260,000 shares of $100 par value 3.60% Serial Preferred Stock; and 33,289,327 shares of common stock. Each outstanding share of each class is entitled to one vote. Stockholders of record at the close of business on February 23, 2017 will be entitled to vote at the Meeting. In order to conduct the Meeting, a majority of the outstanding shares entitled to vote must be represented at the Meeting. This is known as a “quorum.” All of WE’s outstanding common stock, representing more than 99% of its voting securities, is owned by its parent company, WEC Energy Group, Inc. (“WEC Energy Group”), and will be represented at the Meeting. The principal business address of WEC Energy Group is 231 West Michigan Street, Milwaukee, Wisconsin 53203. A list of stockholders of record entitled to vote at the Meeting will be available for inspection by stockholders at WE’s principal business office at 231 West Michigan Street, Milwaukee, Wisconsin 53203, prior to and at the Meeting.

INTERNET AVAILABILITY OF INFORMATION

The following documents can be found at wisconsinelectric.com:

| • | Notice of Annual Meeting; |

| • | Information Statement; and |

| • | 2016 Annual Report to Stockholders. |

ELECTION OF DIRECTORS

At the Meeting, there will be an election of four directors. Based upon the recommendation of the Corporate Governance Committee of WEC Energy Group’s Board of Directors, the individuals named below have been nominated by the WE Board of Directors (the “Board”) to serve a one-year term expiring at the 2018 Annual Meeting of Stockholders and until they are re-elected or until their respective successors are duly elected and qualified.

Directors will be elected by a plurality of the votes cast by the shares entitled to vote, as long as a quorum is present. “Plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be chosen. Therefore, shares not voted, whether by withheld authority or otherwise, have no effect in the election of directors.

Each nominee has consented to being nominated and to serve if elected. In the unlikely event that any nominee becomes unable to serve for any reason, the Board will select a substitute nominee based upon the recommendation of the Corporate Governance Committee of WEC Energy Group’s Board of Directors.

| Wisconsin Electric Power Company | 1 | 2017 Annual Meeting Information Statement |

Director Nominees

The Company does not have a nominating committee. The Corporate Governance Committee of WEC Energy Group (the “Corporate Governance Committee”) provides oversight for the nominating process on behalf of the Board. Director nominees for the Board are evaluated as a whole with the goal of recommending nominees with diverse backgrounds and experience that, together, can best perpetuate the success of WE’s business and represent stockholder interests. In addition to the specific experiences and skills of the individual director nominees identified below, the Corporate Governance Committee believes that director nominees should generally possess certain characteristics and skills including: proven integrity; mature and independent judgment; vision and imagination; ability to objectively appraise problems; ability to evaluate strategic options and risks; sound business experience and acumen; relevant technological, political, economic, or social/cultural expertise; social consciousness; achievement of prominence in career; and familiarity with issues affecting the Company’s business. After considering the recommendations of the Corporate Governance Committee, the Board selected the nominees listed below.

Board Diversity. The Corporate Governance Committee does not have a specific policy with regards to the consideration of diversity in identifying director nominees. However, the Corporate Governance Committee strives to recommend candidates who each bring a unique perspective to the Board in order to contribute to the collective diversity of the Board. As part of its process in connection with the nomination of new directors to the Board, the Corporate Governance Committee considers several factors to ensure the entire Board collectively embraces a wide variety of characteristics, including professional background, experience, skills, and knowledge, as well as the criteria listed above. Each candidate will generally exhibit different and varying degrees of these characteristics.

Nominees for Election to the Board of Directors.Biographical information regarding each nominee is shown below. Ages are as of December 31, 2016. All nominees are officers of the Company and are not independent.

J. Kevin Fletcher.Age 58.

| • | Wisconsin Electric Power Company – President since May 2016; Executive Vice President-Customer Service and Operations from June 2015 to April 2016; Senior Vice President-Customer Operations from October 2011 through June 2015. |

| • | Director of Wisconsin Electric Power Company since June 2015. |

| • | Mr. Fletcher also serves as an officer and/or director of several other major subsidiaries of WEC Energy Group. |

Based primarily upon Mr. Fletcher’s executive management experience in customer service and operations at WEC Energy Group and its utility affiliates, as well as his experience in community and economic development while at Georgia Power Company, where he held the title of Vice President-Community and Economic Development, the Board concluded that Mr. Fletcher should serve as a director of the Company.

Scott J. Lauber.Age 51.

| • | WEC Energy Group, Inc. – Executive Vice President and Chief Financial Officer (“CFO”) since April 2016; Vice President and Treasurer from February 2013 to March 2016; Assistant Treasurer from March 2011 to January 2013. |

| • | Wisconsin Electric Power Company – Executive Vice President and CFO since April 2016; Vice President and Treasurer from February 2013 to March 2016; Assistant Treasurer from March 2011 to January 2013. |

| • | Director of Wisconsin Electric Power Company since April 2016. |

| • | Mr. Lauber also serves as an officer and/or director of several other major subsidiaries of WEC Energy Group. |

Based primarily upon Mr. Lauber’s more than 25 years of service at WEC Energy Group, including executive and financial management responsibility of its utility affiliates, with a focus on long-range financial planning and oversight of the treasury function, as well as his experience in risk and insurance matters and knowledge of the financial community, the Board concluded that Mr. Lauber should serve as director of the Company.

Allen L. Leverett.Age 50.

| • | WEC Energy Group, Inc. – Chief Executive Officer (“CEO”) since May 2016; President since August 2013; Executive Vice President from May 2004 to July 2013; CFO from July 2003 until February 2011. Mr. Leverett also served as the principal executive officer of WEC Energy Group’s generation operations from February 2011 to May 2016. |

| • | Wisconsin Electric Power Company – Chairman of the Board and CEO since May 2016; President from June 2015 to May 2016; Executive Vice President from May 2004 until June 2015; CFO from July 2003 until February 2011. |

| • | Director of WEC Energy Group since January 2016; Director of Wisconsin Electric Power Company since June 2015. |

| • | Mr. Leverett also serves as an officer and/or director of several other major subsidiaries of WEC Energy Group. |

Based primarily upon Mr. Leverett’s extensive executive management, financial, and strategic experience as a senior executive in the utility industry, including serving as President and CEO of WEC Energy Group, as Chairman and/or

| Wisconsin Electric Power Company | 2 | 2017 Annual Meeting Information Statement |

CEO of WEC Energy Group’s principal utility subsidiaries, and as Executive Vice President and CFO of Georgia Power prior to joining WEC Energy Group, the Board concluded that Mr. Leverett should serve as a director of the Company.

Susan H. Martin.Age 64.

| • | WEC Energy Group, Inc. – Executive Vice President and General Counsel since March 2012; Corporate Secretary since December 2007; Vice President and Associate General Counsel from December 2007 to February 2012. |

| • | Wisconsin Electric Power Company – Executive Vice President and General Counsel since March 2012; Corporate Secretary since December 2007; Vice President and Associate General Counsel from December 2007 to February 2012. |

| • | Director of Wisconsin Electric Power Company since June 2015. |

| • | Ms. Martin also serves as an officer and/or director of several other major subsidiaries of WEC Energy Group. |

Based primarily upon Ms. Martin’s executive management and strategic experience as Executive Vice President, General Counsel and Corporate Secretary of WEC Energy Group and its utility subsidiaries, as well as her extensive experience in legal, environmental and governance matters, the Board concluded that Ms. Martin should serve as a director of the Company.

COMMITTEES OF THE WEC ENERGY GROUP BOARD OF DIRECTORS

WE is a wholly-owned subsidiary of WEC Energy Group, and the WE Board does not have any committees. The WEC Energy Group Board maintains the following committees which oversee WE operations on behalf of the WEC Energy Group Board: Audit and Oversight, Compensation, Corporate Governance, and Finance. All committees operate under a charter approved by WEC Energy Group’s Board of Directors. A copy of each committee charter is posted in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com and is available in print to any stockholder who requests it in writing from the Corporate Secretary. Members and principal responsibilities of the WEC Energy Group Board committees are provided below.

| Members | | Principal Responsibilities; Meetings |

| | | |

Audit and Oversight. Thomas J. Fischer, Chair

John F. Bergstrom

Barbara L. Bowles

Patricia W. Chadwick

Paul W. Jones

Henry W. Knueppel | | • Oversee the integrity of the financial statements. • Oversee management compliance with legal and regulatory requirements. • Review, approve, and evaluate the independent auditors’ services. • Oversee the performance of the internal audit function and independent auditors. • Discuss risk management and major risk exposures and steps taken to monitor and control such exposures. • Prepare the report required by the Securities and Exchange Commission (“SEC”) for inclusion in the proxy and information statements. • Establish procedures for the submission of complaints and concerns regarding WEC Energy Group’s and its subsidiaries’ accounting or auditing matters. • The Audit and Oversight Committee conducted six meetings in 2016. |

| | | |

Compensation. John F. Bergstrom, Chair

Thomas J. Fischer

Ulice Payne, Jr. | | • Identify through succession planning potential executive officers. • Provide competitive, performance-based executive and director compensation programs. • Set performance goals for the CEO, annually evaluate the CEO’s performance against such goals, and determine compensation adjustments based on whether these goals have been achieved. • Prepare the report required by the SEC for inclusion in the proxy and information statements. • The Compensation Committee conducted seven meetings in 2016 and executed two written unanimous consents. |

| | | |

Corporate Governance. Barbara L. Bowles, Chair

Albert J. Budney, Jr.

Curt S. Culver

Henry W. Knueppel | | • Establish and annually review the Corporate Governance Guidelines to verify that the Board is effectively performing its fiduciary responsibilities to stockholders. • Establish and annually review director candidate selection criteria. • Identify and recommend candidates to be named as nominees of WEC Energy Group’s Board and the Company’s Board for election as directors. • Lead the WEC Energy Group Board in its annual review of its performance. • The Corporate Governance Committee conducted three meetings in 2016 and executed one written unanimous consent. |

| Wisconsin Electric Power Company | 3 | 2017 Annual Meeting Information Statement |

| Members | | Principal Responsibilities; Meetings |

| | | |

Finance. Curt S. Culver, Chair

William J. Brodsky

Patricia W. Chadwick

Ulice Payne, Jr.

Mary Ellen Stanek | | • Review and monitor WEC Energy Group’s and its subsidiaries’ current and long-range financial policies and strategies, including each company’s capital structure and dividend policy. • Authorize the issuance of corporate debt within limits set by WEC Energy Group’s Board. • Discuss policies with respect to risk assessment and risk management. • Approve WEC Energy Group’s consolidated financial plan, including the capital budget. • The Finance Committee conducted four meetings in 2016 and executed one written unanimous consent. |

The WE Board met four times during calendar year 2016 and executed 18 written unanimous consents.

Board meeting attendance during the year was 100% for all of the current directors.

DIRECTOR COMPENSATION

All of the Company’s current Board members are named executive officers of WE and are not separately compensated as directors. Compensation received by the directors for their service as officers of WEC Energy Group and its subsidiaries, including WE, is reported in the “Summary Compensation Table” on page 29.

OTHER MATTERS

The WE Board of Directors is not aware of any other matters that may properly come before the Meeting. The WE bylaws set forth the requirements that must be followed should a stockholder wish to propose any floor nominations for director or floor proposals at annual or special meetings of stockholders. In the case of annual meetings, the bylaws state, among other things, that notice and certain other documentation must be provided to WE at least 70 days and not more than 100 days before the scheduled date of the annual meeting. No such notices have been received by WE.

CORPORATE GOVERNANCE – FREQUENTLY ASKED QUESTIONS

Does WE have Corporate Governance Guidelines?

The Board follows WEC Energy Group’s Corporate Governance Guidelines that WEC Energy Group has maintained since 1996. WEC Energy Group was one of the earliest adopters of a formal set of Corporate Governance Guidelines. These Guidelines provide a framework under which the WEC Energy Group and WE Boards conduct their business.

To maintain effective Corporate Governance Guidelines, WEC Energy Group’s Corporate Governance Committee annually reviews WEC Energy Group’s and the Company’s governance practices, taking into consideration discussions with WEC Energy Group stockholders as part of the investor outreach program, industry surveys, and benchmarking studies, as well as governance guidelines published by proxy advisers.

The Guidelines are available in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com and are available in print to any stockholder who requests them in writing from the Corporate Secretary.

How are directors determined to be independent?

No director qualifies as independent unless the Board affirmatively determines that the director has no material relationship with the Company.

What are the WEC Energy Group Board’s standards of independence?

The guidelines the WEC Energy Group and WE Boards of Directors use in determining director independence are located in Appendix A of the WEC Energy Group Corporate Governance Guidelines. The Guidelines are available in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com. These standards of independence include a provision that a director will not be considered independent if he or she has been an employee of the Company for the last five years.

| Wisconsin Electric Power Company | 4 | 2017 Annual Meeting Information Statement |

Who are the independent directors?

All of WE’s Board members are employees of the Company and are not independent.

Are the WEC Energy Group Audit and Oversight and Compensation Committees comprised solely of independent directors?

Yes. These committees are comprised solely of independent directors, as determined by the WEC Energy Group Board.

In addition, the WEC Energy Group Audit and Oversight Committee is a separately designated committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended.

Is the office of CEO combined with the office of Chairman of the Board?

Yes. The office of CEO is combined with the office of Chairman of the Board at WE. Consistent with WE’s bylaws and WEC Energy Group’s Corporate Governance Guidelines, the Board retains the right to exercise its discretion in combining or separating the offices of CEO and Chairman of the Board.

What is the Board’s role in risk oversight?

The Board oversees the Company’s risk environment. In addition, the WEC Energy Group Audit and Oversight Committee and the WEC Energy Group Finance Committee provide risk oversight with respect to WEC Energy Group and its subsidiaries, including the Company, on behalf of the WEC Energy Group Board as described in each committee’s charter. The Board periodically receives briefings from management on specific areas of risk as well as emerging risks to the enterprise. Over the course of the year, the WEC Energy Group Audit and Oversight Committee hears reports from management on the Company’s major risk exposures in such areas as compliance, environmental, legal/litigation, technology security (cybersecurity), and ethical conduct, as well as steps taken to monitor and control such exposures. The WEC Energy Group Finance Committee discusses the Company’s risk assessment and risk management policies; it also provides oversight of insurance matters to ensure that its risk management program is functioning properly. Both committees have direct access to, and meet as needed with, Company representatives without other management present to discuss matters related to risk management.

The CEO, who is ultimately responsible for managing risk, routinely reports to the Board, as well as to WEC Energy Group’s Audit and Oversight and Finance Committees, on risk-related matters. As part of this process, the business unit leaders identify existing, new, or emerging issues or changes within their business areas that could have enterprise implications and report them to senior management. Management is tasked with ensuring that these risks and opportunities are appropriately addressed. In addition, WEC Energy Group has established an Enterprise Risk Steering Committee, comprised of senior level management employees, whose purpose is to foster an enterprise-wide approach to managing risk and compliance. The results of each of these risk-management efforts are reported to the CEO, to the Board, and to the WEC Energy Group Board or its appropriate committee.

The Board believes that its leadership structure and WEC Energy Group’s enterprise risk management program support the risk oversight function of the Board.

How can interested parties contact the members of the Board?

Correspondence may be sent to the directors in care of the Corporate Secretary, Susan H. Martin, at the Company’s principal business office, 231 West Michigan Street, P.O. Box 2046, Milwaukee, Wisconsin 53201.

All communications received as set forth above will be opened by the Corporate Secretary for the sole purpose of confirming the contents represent a message to the Company’s directors. All communication, other than advertising, promotion of a product or service, or patently offensive material, will be forwarded promptly to the addressee.

Does the Company have a written code of ethics?

Yes. All WE and WEC Energy Group directors, executive officers, and employees, including the principal executive, financial, and accounting officers, have a responsibility to comply with WEC Energy Group’s Code of Business Conduct, to seek advice in doubtful situations, and to report suspected violations.

WEC Energy Group’s Code of Business Conduct addresses, among other things: conflicts of interest; confidentiality; fair dealing; protection and proper use of Company assets; and compliance with laws, rules, and regulations (including insider trading laws). The Company has not provided any waiver to the Code for any director, executive officer, or other employee.

| Wisconsin Electric Power Company | 5 | 2017 Annual Meeting Information Statement |

The Code of Business Conduct is posted in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com. It is also available in print to any stockholder upon request in writing to the Corporate Secretary.

The Company has several ways employees can raise questions concerning WEC Energy Group’s Code of Business Conduct and other Company policies. As one reporting mechanism, the Company receives independent services under a contract for employees to confidentially and anonymously report suspected violations of the Code of Business Conduct or other concerns, including those regarding accounting, internal accounting controls, or auditing matters.

Does the Company have policies and procedures in place to review and approve related party transactions?

Yes. All employees of WE and WEC Energy Group, including executive officers and members of the Board, are required to comply with WEC Energy Group’s Code of Business Conduct. The Code of Business Conduct addresses, among other things, what actions are required when potential conflicts of interest may arise, including those from related party transactions. Specifically, executive officers and members of the Board are required to obtain approval of WEC Energy Group’s Audit and Oversight Committee Chair before (1) obtaining any financial interest in or participating in any business relationship with any company, individual, or concern doing business with WEC Energy Group or any of its subsidiaries, including WE; (2) participating in any joint venture, partnership, or other business relationship with WEC Energy Group or any of its subsidiaries, including WE; and (3) serving as an officer or member of the board of any substantial outside for-profit organization. Furthermore, before serving as an officer or member of the board of any substantial outside for-profit organization, the CEO must obtain the approval of WEC Energy Group’s full Board of Directors before serving in such a position. In addition, executive officers must obtain the prior approval of the CEO before accepting a position with a substantial non-profit organization.

WEC Energy Group’s Code of Business Conduct also requires employees and directors to notify the Compliance Officer of situations where family members are a supplier or significant customer of WEC Energy Group or the Company or employed by one. To the extent the Compliance Officer deems it appropriate, she will consult with WEC Energy Group’s Audit and Oversight Committee Chair in situations involving executive officers and members of the Board.

Are all the members of the WEC Energy Group Audit Committee financially literate and does the committee have an “audit committee financial expert”?

Yes. The WEC Energy Group Board of Directors has determined that all of the members of WEC Energy Group’s Audit and Oversight Committee are financially literate as required by New York Stock Exchange rules and qualify as audit committee financial experts within the meaning of SEC rules.

How does WEC Energy Group’s Compensation Committee administer the executive and director compensation programs?

One of the principal responsibilities of WEC Energy Group’s Compensation Committee is to provide competitive, performance-based executive and director compensation programs.

With respect to the executive compensation program, the WEC Energy Group Compensation Committee’s responsibilities include:

| • | determining and annually reviewing the WEC Energy Group Compensation Committee’s compensation philosophy; |

| • | reviewing and determining the compensation paid to executive officers (including base salaries, incentive compensation, and benefits); |

| • | overseeing the compensation and benefits to be paid to other officers and key employees; |

| • | establishing and administering the Chief Executive Officer compensation package; and |

| • | reviewing the results of the most recent WEC Energy Group stockholder advisory vote on compensation of the Named Executive Officers (“NEOs”). |

The WEC Energy Group Compensation Committee is also charged with administering the compensation package of WEC Energy Group’s non-management directors. The Compensation Committee meets with the WEC Energy Group Corporate Governance Committee annually to review the compensation package of WEC Energy Group’s non-management directors and to determine the appropriate amount of such compensation. All of the Company’s current Board members are executive officers of WE and are not separately compensated as directors.

| Wisconsin Electric Power Company | 6 | 2017 Annual Meeting Information Statement |

The WEC Energy Group Compensation Committee, which has authority to retain advisers, including compensation consultants, at WEC Energy Group’s expense, retained Frederic W. Cook & Co. (“Frederic Cook” or the “Consultant”) to analyze and help develop the executive compensation program, and to assess whether the compensation program is competitive and supports the Committee’s objectives. Frederic Cook also assesses and provides recommendations on non-management director compensation.

Frederic Cook is engaged solely by the WEC Energy Group Compensation Committee to provide executive compensation consulting services, and does not provide any additional services to WEC Energy Group or the Company. In connection with its retention of Frederic Cook, the WEC Energy Group Compensation Committee reviewed Frederic Cook’s independence including: (1) the amount of fees received by Frederic Cook from WEC Energy Group as a percentage of Frederic Cook’s total revenue; (2) Frederic Cook’s policies and procedures designed to prevent conflicts of interest; and (3) the existence of any business or personal relationships that could impact independence. After reviewing these and other factors, the WEC Energy Group Compensation Committee determined that Frederic Cook is independent and the engagement did not present any conflicts of interest. Frederic Cook also determined that it was independent from WEC Energy Group’s and its subsidiaries’ management, which was confirmed in a written statement delivered to the WEC Energy Group Compensation Committee.

For more information regarding the executive compensation processes and procedures, please refer to the “Compensation Discussion and Analysis” later in this information statement.

Does the Board have a nominating committee?

No. Instead, as discussed under “Director Nominees” above, WE relies upon WEC Energy Group’s Corporate Governance Committee for, among other things, identifying and evaluating director nominees.

What is the process used to identify director nominees and how do I recommend a nominee to WEC Energy Group’s Corporate Governance Committee?

Please refer to the discussion under the heading “Director Nominees” earlier in this information statement.

WEC Energy Group owns all of the Company’s common stock and, as a result, WEC Energy Group’s affirmative vote is sufficient to elect director nominees. Consequently, the Board does not accept proposals from preferred stockholders regarding potential candidates for director nominees.

What is WE’s policy regarding director attendance at annual meetings?

Directors are not expected to attend the Company’s annual meetings of stockholders, as they are only short business meetings.

| Wisconsin Electric Power Company | 7 | 2017 Annual Meeting Information Statement |

INDEPENDENT AUDITORS’ FEES AND SERVICES

Deloitte & Touche LLP served as the independent auditors for the Company for the last fifteen fiscal years beginning with the fiscal year ended December 31, 2002. They have been selected by WEC Energy Group’s Audit and Oversight Committee (the “Audit and Oversight Committee”) as independent auditors for WEC Energy Group and its subsidiaries, including the Company, for the fiscal year ending December 31, 2017, subject to ratification by the stockholders of WEC Energy Group at WEC Energy Group’s Annual Meeting of Stockholders on May 4, 2017.

Representatives of Deloitte & Touche LLP are not expected to be present at the Company’s Annual Meeting, but are expected to attend WEC Energy Group’s Annual Meeting of Stockholders on May 4, 2017. They will have an opportunity to make a statement at WEC Energy Group’s Annual Meeting, if they so desire, and are expected to respond to appropriate questions that may be directed to them.

Pre-Approval Policy.The Audit and Oversight Committee has a formal policy delineating its responsibilities for reviewing and approving, in advance, all audit, audit-related, tax, and other services of the independent auditors. As such, the Audit and Oversight Committee is responsible for the audit fee negotiations associated with the Company’s retention of independent auditors.

The Audit and Oversight Committee is committed to ensuring the independence of the auditors, both in appearance as well as in fact. In order to assure continuing auditor independence, the Audit and Oversight Committee periodically considers whether there should be a regular rotation of the independent external audit firm. In addition, the Audit and Oversight Committee is directly involved in the selection of Deloitte & Touche LLP’s lead engagement partner.

Under the pre-approval policy, before engagement of the independent auditors for the next year’s audit, the independent auditors will submit: (i) a description of all services anticipated to be rendered, as well as an estimate of the fees for each of the services, for the Audit and Oversight Committee to approve, and (ii) written confirmation that the performance of any non-audit services is permissible and will not impact the firm’s independence. Annual pre-approval will be deemed effective for a period of twelve months from the date of pre-approval, unless the Audit and Oversight Committee specifically provides for a different period. A fee level will be established for all permissible, pre-approved non-audit services. Any additional audit service, audit-related service, tax service, and other service must also be pre-approved.

The Audit and Oversight Committee delegated pre-approval authority to the Committee’s Chair. The Audit and Oversight Committee Chair is required to report any pre-approval decisions at the next scheduled Audit and Oversight Committee meeting. Under the pre-approval policy, the Audit and Oversight Committee may not delegate to management its responsibilities to pre-approve services performed by the independent auditors.

Under the pre-approval policy, prohibited non-audit services are services prohibited by the Securities and Exchange Commission or by the Public Company Accounting Oversight Board (United States) to be performed by the Company’s independent auditors. These services include: bookkeeping or other services related to the accounting records or financial statements of the Company; financial information systems design and implementation; appraisal or valuation services; fairness opinions or contribution-in-kind reports; actuarial services; internal audit outsourcing services; management functions, or human resources, broker-dealer, investment advisor or investment banking services; legal services and expert services unrelated to the audit; services provided for a contingent fee or commission; and services related to planning, marketing or opining in favor of the tax treatment of a confidential transaction or an aggressive tax position transaction that was initially recommended, directly or indirectly, by the independent auditors. In addition, the Audit and Oversight Committee has determined that the independent auditors may not provide any services, including personal financial counseling and tax services, to any officer or other employee of the Company who serves in a financial reporting oversight role or to the Chair of the Audit and Oversight Committee or to an immediate family member of these individuals, including spouses, spousal equivalents, and dependents.

Fee Table.The following table shows the fees, all of which were pre-approved by the Audit and Oversight Committee, for professional audit services provided by Deloitte & Touche LLP for the audit of the annual financial statements of the Company for fiscal years 2016 and 2015 and fees for other services rendered during those periods. No fees were paid to Deloitte & Touche LLP pursuant to the “de minimus” exception to the pre-approval policy permitted under the Securities Exchange Act of 1934, as amended.

| Wisconsin Electric Power Company | 8 | 2017 Annual Meeting Information Statement |

| | | 2016 | | | 2015 | |

| Audit Fees(1) | | | $2,108,351 | | | | $1,545,408 | |

| Audit-Related Fees(2) | | | -- | | | | 8,000 | |

| Tax Fees | | | -- | | | | -- | |

| All Other Fees(3) | | | 3,502 | | | | 1,980 | |

| Total | | | $2,111,853 | | | | $1,555,388 | |

| (1) | Audit Feesconsist of fees for professional services rendered in connection with the audits of the annual financial statements of the Company and its subsidiary, and other non-recurring audit work. This category also includes reviews of financial statements included in Form 10-Q filings of the Company, and services normally provided in connection with statutory and regulatory filings or engagements. |

| | |

| (2) | Audit-Related Feesconsist of fees for professional services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under “Audit Fees.” |

| | |

| (3) | All Other Feesconsist of costs for certain employees to attend accounting/tax seminars hosted by Deloitte & Touche LLP plus the subscription cost for the use of a Deloitte & Touche LLP accounting research tool. |

AUDIT AND OVERSIGHT COMMITTEE REPORT

The Audit and Oversight Committee, which is comprised solely of independent directors, oversees the integrity of the financial reporting process on behalf of the Company’s Board of Directors. In addition, the Audit and Oversight Committee oversees compliance with the Company’s legal and regulatory requirements. The Audit and Oversight Committee operates under a written charter approved by the Board of Directors of WEC Energy Group, which can be found in the “Governance” section of WEC Energy Group’s Website at wecenergygroup.com.

The Audit and Oversight Committee is also directly responsible for the appointment, compensation, retention, and oversight of the Company’s independent auditors, as well as the oversight of the Company’s internal audit function. In order to assure continuing auditor independence, the Audit and Oversight Committee periodically considers whether there should be a regular rotation of the independent external audit firm. For 2017, the Audit and Oversight Committee has appointed Deloitte & Touche LLP to remain as the Company’s independent auditors, subject to ratification by WEC Energy Group’s stockholders. The members of the Audit and Oversight Committee and other members of WEC Energy Group’s Board believe that the continued retention of Deloitte & Touche LLP to serve as the Company’s independent external auditor is in the best interests of the Company and its stockholders.

The Audit and Oversight Committee is directly involved in the selection of Deloitte & Touche LLP’s lead engagement partner in conjunction with a mandated rotation policy and are also responsible for audit fee negotiations with Deloitte & Touche LLP.

Management is responsible for the Company’s financial reporting process, the preparation of consolidated financial statements in accordance with generally accepted accounting principles, and the system of internal controls and procedures designed to provide reasonable assurance regarding compliance with accounting standards and applicable laws and regulations. The Company’s independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and issuing a report thereon.

The Audit and Oversight Committee held six meetings during 2016. Meetings are designed to facilitate and encourage open communication among the members of the Audit and Oversight Committee, management, the internal auditors, and the Company’s independent auditors, Deloitte & Touche LLP. During these meetings, we reviewed and discussed with management, among other items, the Company’s unaudited quarterly and audited annual financial statements and the system of internal controls designed to provide reasonable assurance regarding compliance with accounting standards and applicable laws.

We have reviewed and discussed with management and the Company’s independent auditors the Company’s audited consolidated financial statements and related footnotes for the fiscal year ended December 31, 2016, and the independent auditor’s report on those financial statements. Management represented to us that the Company’s financial statements were prepared in accordance with generally accepted accounting principles. Deloitte & Touche LLP presented the matters required to be discussed with the Audit and Oversight Committee by PCAOB Auditing Standard No. 16,Communications with Audit Committees. This review included a discussion with management and the independent

| Wisconsin Electric Power Company | 9 | 2017 Annual Meeting Information Statement |

auditors about the quality of the Company’s accounting principles, the reasonableness of significant estimates and judgments, and the disclosures in the Company’s financial statements, as well as the disclosures relating to critical accounting policies.

In addition, we received the written disclosures and the letter relative to the auditors’ independence from Deloitte & Touche LLP, as required by applicable requirements of the PCAOB regarding Deloitte & Touche LLP’s communications with the Audit and Oversight Committee concerning independence. The Audit and Oversight Committee discussed with Deloitte & Touche LLP its independence and also considered the compatibility of non-audit services provided by Deloitte & Touche LLP with maintaining its independence.

Based on these reviews and discussions, the Audit and Oversight Committee recommended to the Company’s Board that the audited financial statements be included in Wisconsin Electric Power Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and filed with the Securities and Exchange Commission.

Respectfully submitted to Wisconsin Electric Power Company’s stockholders by the Audit and Oversight Committee,

| | WEC Energy Group |

| | Audit and Oversight Committee |

| | |

| | Thomas J. Fischer, Committee Chair

John F. Bergstrom

Barbara L. Bowles

Patricia W. Chadwick

Paul W. Jones

Henry W. Knueppel |

| Wisconsin Electric Power Company | 10 | 2017 Annual Meeting Information Statement |

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion provides an overview and analysis of our executive compensation program, including the role of WEC Energy Group’s Compensation Committee (the “Compensation Committee”), the elements of our executive compensation program, the purposes and objectives of these elements, and the manner in which we established the compensation of the Company’s NEOs for fiscal year 2016.

References to “we,” “us,” “our,” and the “Company” in this discussion and analysis mean Wisconsin Electric Power Company and its management, as applicable, and references to “WEC Energy Group” mean WEC Energy Group, Inc.

The Compensation Committee oversees the compensation program of WEC Energy Group and its subsidiaries, including the Company, on behalf of WEC Energy Group’s Board of Directors. Therefore, the Compensation Committee has responsibility for making compensation decisions regarding the NEOs of the Company. The NEOs of the Company are the same as the NEOs of WEC Energy Group.

EXECUTIVE SUMMARY

Overview

The primary objective of our executive compensation program is to provide a competitive, performance-based plan that enables WEC Energy Group and the Company to attract and retain key individuals and to reward them for achieving both short-term and long-term goals without creating an incentive for our NEOs to take excessive risks. Our program has been designed to provide a level of compensation that is strongly dependent upon the achievement of short-term and long-term goals that are aligned with the interests of WEC Energy Group and the Company’s stockholders and our customers. To that end, a substantial portion of pay is at risk, and generally, the value will only be realized upon strong corporate performance.

2016 Business Highlights

WEC Energy Group completed its first full year of combined utility operations in 2016 following the acquisition of Integrys Energy Group in June 2015. Following the acquisition, WEC Energy Group delivers electricity and natural gas to approximately 4.4 million customers in four states - Wisconsin, Illinois, Michigan, and Minnesota.

During 2016, WEC Energy Group made excellent progress in its efforts to integrate employees, merge and improve business processes, and consolidate IT infrastructure. At the same time, WEC Energy Group and its utilities, including the Company, achieved solid results and continued to create long-term value for stockholders and customers by focusing on the following:

| | • World-class reliability | • Operating efficiency | • Employee safety |

| | | | |

| | • Financial discipline | • Exceptional customer care | |

Commitment to Stockholder Value Creation. Financially, WEC Energy Group and the Company again delivered solid earnings growth, generated strong cash flow, and WEC Energy Group increased its dividend for the 13th consecutive year. In January 2016, the WEC Energy Group Board raised the quarterly dividend 8.2% to $0.4950 per share of its common stock, equivalent to an annual rate of $1.98 per share. In January 2017, the WEC Energy Group Board increased the quarterly dividend to $0.5200 per share of its common stock, which is equivalent to an annual rate of $2.08 per share, in line with the plan to maintain a dividend payout ratio of 65% to 70% of earnings. WEC Energy Group and the Company also turned in strong performances in employee safety, customer satisfaction, and network reliability during 2016. Specific achievements during 2016 of WEC Energy Group and the Company include the following.

| Wisconsin Electric Power Company | 11 | 2017 Annual Meeting Information Statement |

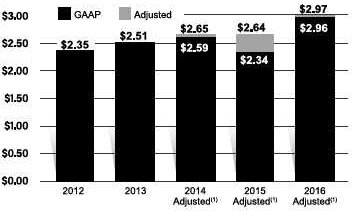

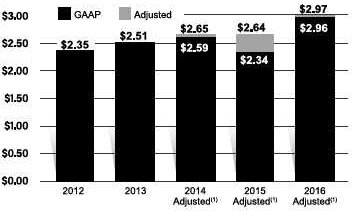

2016 Financial Highlights

• WEC Energy Group delivered solid earnings growth again, generated strong cash flow, and increased the dividend for the 13th consecutive year. • WEC Energy Group achieved fully diluted earnings and adjusted earnings per share of $2.96 and $2.97, respectively.(2) • Each of WEC Energy Group’s regulated utility subsidiaries, including the Company, earned its allowed rate of return. • Returned approximately $625 million to WEC Energy Group stockholders through dividends. • In January 2017, the WEC Energy Group Board raised the quarterly dividend to $0.52 per share, which is equivalent to an annual dividend rate of $2.08 per share. | | WEC Energy Group

Diluted Earnings Per Share

|

| (1) | Excludes costs of $0.01, $0.30, and $0.06 per share of WEC Energy Group common stock for 2016, 2015, and 2014, respectively, related to WEC Energy Group’s acquisition of Integrys. See Appendix A on page A-1 for a full GAAP reconciliation and an explanation of why WEC Energy Group believes the presentation of adjusted earnings per share is relevant and useful to investors. |

| | |

| (2) | This measure is a component of our short-term incentive compensation program. |

2016 Operational Performance

| • | WEC Energy Group was recognized in 2016 by Corporate Responsibility Magazine in its annual “Most Responsible Companies Ranked by Industry Sector” in the Utility category. |

| • | WEC Energy Group’s utilities, including the Company, continued to balance the delivery of safe, reliable, and affordable energy with a commitment to protecting the environment. |

| • | We Energies (the trade name of WE and Wisconsin Gas LLC) was named the most reliable utility in the Midwest for the sixth year by PA Consulting Group and also received the first-ever Outstanding Customer Reliability Experience Award for effective customer service and communications. |

| • | We received the best results in our history for large customer satisfaction as surveyed by TQS Research and achieved a third place national ranking.(2) |

| • | All major utility subsidiaries of WEC Energy Group, including the Company, either met or exceeded their overall customer satisfaction targets.(2) |

| • | WEC Energy Group’s utility companies, including the Company, experienced growing employee participation in health and wellness programs, as well as increased proactive safety reporting, helping to reduce the number of OSHA-reportable incidents and lost-time incidents by almost 17% on a year-over-year basis.(2) |

| • | We Energies Supplier Diversity Initiative was recognized by the National Association of Minority Contractors-Wisconsin Chapter for outreach, support, commitment, and leadership in minority business development in the Wisconsin construction industry.(2) |

2016 Strategic Performance

| • | Continued the successful integration of Integrys Energy Group into WEC Energy Group. |

| • | Transitioned leadership of WEC Energy Group and the Company, from Gale E. Klappa to Allen L. Leverett as CEO, effective May 1, 2016. |

| • | WEC Energy Group formed a stand-alone utility (Upper Michigan Energy Resources Corporation) to serve customers in Michigan’s Upper Peninsula and to facilitate a long-term generation solution for the region. |

| • | Sold the Company’s Milwaukee County Power Plant, a coal-fired power plant, in 2016 as part of WEC Energy Group’s long-term strategy to restructure the WEC Energy Group generation portfolio to meet changing demands and regulations. |

| • | WEC Energy Group sold the compressed natural gas business, Trillium CNG, thereby exiting a significant non-regulated business. |

| • | WEC Energy Group announced a plan to work with industry partners, environmental groups, and the state of Wisconsin with a goal of reducing CO2emissions from its electric generating fleet by approximately 40% below 2005 levels by 2030. |

| Wisconsin Electric Power Company | 12 | 2017 Annual Meeting Information Statement |

| • | WEC Energy Group deployed capital during 2016 to focus on strengthening and modernizing the reliability of WEC Energy Group’s generation and distribution networks. Highlights include: |

| ▪ | At year-end 2016, implementation of the Improved Customer Experience project was 80% complete; when fully implemented, this $100-plus million customer care software project will provide customers, including our customers with a common experience, while also improving business capability and service delivery across all of WEC Energy Group’s utility subsidiaries, including us. |

| ▪ | The new powerhouse at the Company’s Twin Falls hydroelectric plant went into commercial operation in July 2016; forecasted at $64 million, this capital project was completed on schedule and under budget, and has increased plant capacity by 50%. |

| ▪ | We completed the expansion of the coal storage facilities at our Oak Creek Power Plant site; this $62 million project, finished under budget, was placed into service ahead of schedule in December 2016 and is already providing fueling flexibility benefits that lower costs for customers. |

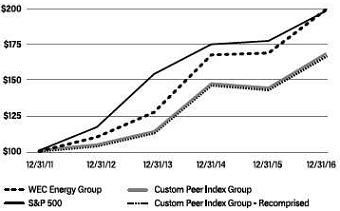

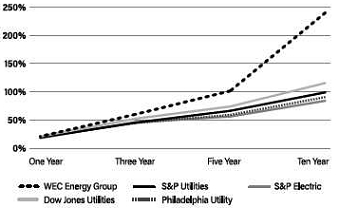

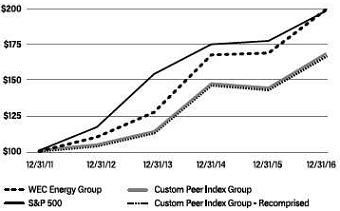

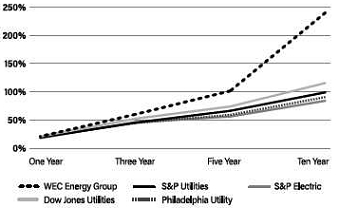

Long-Term Stockholder Returns

Over the past decade, WEC Energy Group has consistently delivered among the best total returns in the industry and did so again in 2016.

WEC Energy Group

Five-Year Cumulative Return(3) | | WEC Energy Group

Industry-Leading Total Shareholder Returns |

| |  |

| (3) The Five-Year Cumulative Return Chart shows a comparison of WEC Energy Group’s cumulative total return, assuming reinvestment of dividends, over the last five years had $100 been invested at the close of business on December 31, 2011. For information about the Custom Peer Index Group and the Recomprised Custom Peer Index Group, see page 24. | | Source: Bloomberg; assumes all dividends are reinvested and returns are compounded daily. |

Key Compensation Program Changes

In 2016, WEC Energy Group made some changes to the compensation program that followed from WEC Energy Group’s stockholder engagement efforts and focus on continually refining the executive compensation program to more effectively align executive pay with performance and reflect best compensation practices.

Competitive Benchmarking - Recomprised Market Data Sources. Based upon a recommendation from the independent compensation consultant, Frederic Cook, the Compensation Committee revised the data sources used to benchmark executive compensation. Instead of considering just market data obtained from Willis Towers Watson’s Executive Compensation Data Bank, Frederic Cook also considered survey data from Aon Hewitt and a comparison group of 19 companies comparable in size to WEC Energy Group that share similar traits with WEC Energy Group. For additional information on the benchmarking methodology, see “Competitive Benchmarking” on page 15 of this information statement.

Long-Term Incentive Awards - Performance Unit Plan - Short-Term Dividend Equivalents. The Compensation Committee amended and restated the WEC Energy Group Performance Unit Plan effective January 1,

| Wisconsin Electric Power Company | 13 | 2017 Annual Meeting Information Statement |

2016, to provide that short-term dividend equivalents are paid out at the end of a three-year performance period based on WEC Energy Group’s total stockholder return over the three-year performance period as compared to the stockholder return of a peer group of companies. Short-term dividend equivalents granted prior to January 1, 2016 were paid out annually on unearned performance units if WEC Energy Group met applicable earnings per share targets. For additional information on the short-term dividend equivalents, see “Short-Term Dividend Equivalents” on page 21 of this information statement.

Long-Term Incentive Awards - Performance Unit Plan - Additional Performance Measure. On December 1, 2016, based upon feedback received from stockholders during WEC Energy Group’s investor outreach efforts, the Compensation Committee amended and restated the WEC Energy Group Performance Unit Plan effective January 1, 2017, to provide for an “Additional Performance Measure” (in addition to total stockholder return), which is defined as the performance criterion or criteria (if any) that the Compensation Committee selects at the time of the award, in its sole discretion, against which WEC Energy Group’s performance will be measured. For additional information regarding the change, see “Long-Term Incentive Compensation - Performance Units” on page 21 of this information statement.

Consideration of 2016 WEC Energy Group Stockholder Advisory Vote and Stockholder Outreach

At the 2016 WEC Energy Group Annual Meeting of Stockholders, stockholders approved the compensation of our named executive officers with 85.8% of the votes cast. The Compensation Committee considered this outcome as well as the feedback received during meetings held with a number of WEC Energy Group institutional stockholders and determined that additional changes should be made to the executive compensation program. As indicated above, the Compensation Committee amended WEC Energy Group’s Performance Unit Plan to provide for an Additional Performance Measure. In light of the significant WEC Energy Group stockholder support our executive compensation program received in 2015, the payout levels under our performance-based program for 2016, and the additional changes made to the program, the Compensation Committee continues to believe that the compensation program is competitive, aligned with WEC Energy Group’s and our financial and operational performance, and in the best interests of WEC Energy Group and the Company, stockholders, and customers.

COMPONENTS OF OUR EXECUTIVE COMPENSATION PROGRAM

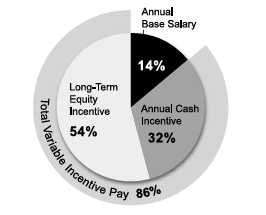

We have three primary elements of total direct compensation: (1) base salary; (2) annual incentive awards; and (3) long-term incentive awards consisting of a mix of WEC Energy Group performance units, stock options, and restricted stock. The Compensation Committee retained Frederic Cook as its independent compensation consultant to advise the Compensation Committee with respect to our executive compensation program. The Compensation Committee generally relied on the recommendations of Frederic Cook as it developed the 2016 program.

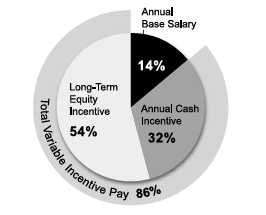

On January 27, 2016, the WEC Energy Group Board appointed Mr. Leverett to serve as WEC Energy Group CEO effective upon Mr. Gale E. Klappa’s retirement on May 1, 2016. Mr. Klappa continues to serve as the WEC Energy Group Non-Executive Chairman of the Board. In addition, Mr. Leverett was appointed to serve as the Company’s CEO and Chairman of the Board. As shown in the charts below, 86% of Mr. Leverett’s 2016 total direct compensation as CEO and an average of 74% of the other NEO’s (other than Mr. Klappa) 2016 total direct compensation is tied to WEC Energy Group performance and is not guaranteed.

| CEO 2016 TOTAL DIRECT COMPENSATION MIX | | OTHER NEOs 2016 TOTAL DIRECT COMPENSATION MIX |

| | | |

| |  |

| Wisconsin Electric Power Company | 14 | 2017 Annual Meeting Information Statement |

The other NEOs total direct compensation mix does not include Mr. Klappa’s compensation as his compensation mix was based upon his position as CEO and significantly changes the reported NEO mix. If Mr. Klappa is included in the calculation of the other NEOs total compensation mix, the amounts reported in the chart above change as follows: Annual Base Salary (15%); Annual Cash Incentive (24%); and Long-Term Equity Incentive (61%).

To the extent feasible, WEC Energy Group believes it is important that the compensation program not dilute the interests of its current stockholders. Therefore, WEC Energy Group currently uses open market purchases to satisfy benefit plan obligations, including the exercise of stock options and vesting of restricted stock.

In addition to the components of total direct compensation identified above, retirement programs are another important component of our compensation program.

This Compensation Discussion and Analysis contains a more detailed discussion of each of the above components for 2016, including Frederic Cook’s recommendations with respect to each component.

Compensation Governance and Practices

The Compensation Committee annually reviews and considers the Company’s compensation policies and practices to ensure our executive compensation program aligns with our compensation philosophy. Highlighted below is an overview of our current compensation practices.

| What We Do |

• Our compensation program focuses on key Company results (financial, safety, customer satisfaction, diversity) that are aligned with WEC Energy Group’s and our strategic goals. • A substantial portion of compensation is at risk and tied to WEC Energy Group and Company performance. • The compensation program has a long-term orientation aligned with WEC Energy Group stockholder interests. • The Compensation Committee’s independent compensation consultant reviews competitive employment market data from two general industry surveys and a comparison group of companies similar to WEC Energy Group. • We have implemented a clawback policy that provides for the recoupment of incentive-based compensation. (page 25) • Annual incentive-based compensation contains multiple, pre-established performance metrics aligned with WEC Energy Group stockholder and customer interests. (page 17) • The WEC Energy Group Performance Unit Plan award payouts (including dividend equivalents) are based on WEC Energy Group stockholder return as compared to an appropriate peer group and, beginning with the 2017 award, Additional Performance Measure(s), if any, selected by the Compensation Committee. | | • The WEC Energy Group Performance Unit Plan requires a separation from service following a change in control for award vesting to occur. (page 24) �� Equity award and other benefit plan obligations are satisfied through open market purchases of WEC Energy Group common stock. • Meaningful WEC Energy Group stock ownership levels are required for senior executives. (page 25) • Ongoing engagement with investors takes place to ensure that compensation practices are responsive to WEC Energy Group stockholder interests. • We prohibit hedging and pledging of WEC Energy Group common stock. (page 26) • We have a policy that prohibits entry into any new arrangements that obligate WEC Energy Group or the Company to pay directly or reimburse individual tax liability for benefits provided. (page 27) • We prohibit repricing of WEC Energy Group stock options without WEC Energy Group stockholder approval. • The Compensation Committee retains an independent compensation consultant to help design the compensation program and determine competitive levels of pay. |

Competitive Benchmarking

As a general matter, we believe the labor market for WEC Energy Group executive officers is consistent with that of general industry. Although we recognize our business is focused on the energy services industry, our goal is to have an executive compensation program that will allow us to be competitive in recruiting the most qualified candidates to serve as executive officers of WEC Energy Group and the Company, including individuals who may be employed outside of the energy services industry. Further, in order to retain top performing executive officers, we believe our compensation practices must be competitive with those of general industry.

| Wisconsin Electric Power Company | 15 | 2017 Annual Meeting Information Statement |

To confirm that our annual executive compensation is competitive with the market, Frederic Cook reviewed the compensation data obtained from Willis Towers Watson’s 2016 Executive Compensation Data Bank as well as similar data from Aon Hewitt. Frederic Cook also analyzed the compensation data from a peer group of 19 companies similar to WEC Energy Group in size and business model. The methodology used by Frederic Cook to determine the peer group of companies is described below.

Frederic Cook started with U.S. companies in the Standard & Poor’s database, and then limited those companies to the same line of business as WEC Energy Group as indicated by the Global Industry Classification Standards. This list of companies was then further limited to companies with revenues between $3 billion and $30 billion (approximately one-third to three times the size of WEC Energy Group’s revenues), and that were within a reasonable size range in various other measures such as operating income, total assets, total employees, and market capitalization. From this list, Frederic Cook selected companies similar in overall size to WEC Energy Group with consideration given to companies that met one or more of the following criteria:

| • | Diversified, technically sophisticated utility operations (e.g., multiple utilities, electric utilities); |

| • | Minimal non-regulated business; and/or |

| • | Operates in the Midwest. |

These criteria resulted in a comparison group of 20 companies with median revenues and market capitalization of approximately $12 billion and $17 billion, respectively.

After reviewing the proposed comparison group, the Compensation Committee requested Frederic Cook to conduct additional analysis of the group because the Compensation Committee wanted WEC Energy Group to be positioned closer to the median of the group in various measures of company size besides market capitalization. Based upon this feedback, Frederic Cook removed the two largest companies and added NiSource resulting in a revised comparison group consisting of the 19 companies listed below.

• Alliant Energy Corporation • Ameren Corporation • American Electric Power Company • CMS Energy Corporation • CenterPoint Energy | • Consolidated Edison, Inc. • DTE Energy Co. • Dominion Resources • Edison International • Entergy Inc. | • Eversource Energy • FirstEnergy Corp. • NiSource Inc. • PG&E Corporation • PPL Corp. | • Pinnacle West Capital Corp. • SCANA Corporation • The Southern Company • Xcel Energy Inc. |

The Compensation Committee approved this revised comparison group.

DETERMINATION OF MARKET MEDIAN

In order to determine the “market median” for our NEOs, Frederic Cook recommended that the survey data from Willis Towers Watson and Aon Hewitt receive a 75% weighting and the comparison group of 19 companies receive a 25% weighting. The Compensation Committee agreed with this recommendation. The survey data received a higher weighting because we consider the labor market for our executives to be consistent with that of general industry. Using this methodology, Frederic Cook recommended, and the Compensation Committee approved, the appropriate market median for each of our NEOs.

The comparison of each component of compensation with the appropriate market median when setting the compensation levels of our NEOs drives the allocation of cash versus non-cash compensation and short-term versus long-term incentive compensation.

ANNUAL BASE SALARY

The annual base salary component of our executive compensation program provides each executive officer with a fixed level of annual cash compensation. We believe that providing annual cash compensation through a base salary is an established market practice and is a necessary component of a competitive compensation program.

Based upon the market data analyzed by Frederic Cook, we generally target base salaries to be within (plus or minus) 15% of the market median for each NEO. However, the Compensation Committee may, in its discretion, adjust base salaries outside of this 15% band when the Compensation Committee deems it appropriate.

| Wisconsin Electric Power Company | 16 | 2017 Annual Meeting Information Statement |

Actual salary determinations are made taking into consideration factors such as the relative levels of individual experience, performance, responsibility, and contribution to the results of WEC Energy Group’s and the Company’s operations. At the beginning of each year, the WEC Energy Group CEO develops a list of goals for WEC Energy Group and its utility subsidiaries, including the Company, and their employees to achieve during the upcoming year. At the end of the year, the CEO measures the performance of WEC Energy Group and the Company against each stated goal and reports the results to the WEC Energy Group Board. The Compensation Committee then takes WEC Energy Group’s and the Company’s performance into consideration when establishing WEC Energy Group CEO’s compensation for the upcoming year. The CEO undertakes a similar process with the NEOs, who develop individual goals related to the achievement of WEC Energy Group’s and the Company’s goals developed by the CEO. At the end of the year, each officer’s performance is measured against these goals. Compensation recommendations and determinations for the upcoming year for each executive officer also take into consideration the level of such performance.

Mr. Klappa served as executive Chairman and CEO of WEC Energy Group and the Company until his retirement on May 1, 2016. As a result, he received $455,710, which represents a pro-rata portion of his annual base salary that had been established by the Compensation Committee in December 2015. Mr. Klappa’s annual base salary reflected the fact that his tenure of 13 years was longer than many of those in the traditional market median. Following his retirement, Mr. Klappa no longer received base salary and instead received compensation for his service as a WEC Energy Group director, including service as Non-Executive Chairman of the WEC Energy Group Board.

Mr. Leverett’s base salary was initially set at $825,000. However, in April 2016, in recognition of Mr. Leverett’s new positions as WEC Energy Group’s CEO and as the Company’s Chairman of the Board and CEO, the Compensation Committee increased Mr. Leverett’s annual base salary by 21.2% to $1,000,000 effective May 1, 2016.

With respect to each other NEO, in December 2015, Mr. Klappa, then WEC Energy Group CEO, recommended an annual base salary to the Compensation Committee based upon a review of the market compensation data provided by Frederic Cook and the factors described above. The Compensation Committee approved the recommendations, which represented an average increase in annual base salary of approximately 3% for Messrs. Keyes and Garvin, and Ms. Martin.

In recognition of his appointment as WEC Energy Group Executive Vice President and CFO, the Compensation Committee increased Mr. Lauber’s annual base salary by 35% to $376,165, effective April 1, 2016. In addition, in recognition of his appointment as President of WEC Energy Group’s Wisconsin utilities, including the Company, the Compensation Committee increased Mr. Fletcher’s annual base salary by 6.6% to $420,000, effective May 1, 2016.

Other than with respect to Mr. Lauber, the annual base salary of each NEO was within our targeted range of the market median as discussed above. Mr. Lauber’s base salary was set below the target range because of how significant the one-time increase would have been in order to bring his salary within the range. Therefore, the Compensation Committee intends to increase Mr. Lauber’s salary in multiple steps to move it within the target range.

ANNUAL CASH INCENTIVE COMPENSATION

We provide annual cash incentive compensation through WEC Energy Group’s Short-Term Performance Plan (“STPP”). The STPP provides for annual cash awards to NEOs based upon the achievement of pre-established stockholder, customer, and employee focused objectives. All payments under the STPP are at risk. Payments are made only if performance goals are achieved, and awards may be less or greater than targeted amounts based on actual performance. Payments under the STPP are intended to reward achievement of short-term goals that contribute to WEC Energy Group stockholder and customer (including our customers) value, as well as individual contributions to successful operations.

2016 Target Awards. Each year, the Compensation Committee approves a target level of compensation under the STPP for each of our NEOs. This target level of compensation is expressed as a percentage of base salary.

In the first quarter of 2016, the target award levels for Messrs. Leverett and Lauber were increased to 110% and 75% of base salary, respectively, in each case in recognition of appointment to their new positions. Therefore, Mr. Leverett’s STPP payout level reflects a 90% target level for four months and a 110% target level for eight months; Mr. Lauber’s STPP payout level reflects a 45% target level for three months and a 75% target level for nine months.

| Wisconsin Electric Power Company | 17 | 2017 Annual Meeting Information Statement |

The year-end 2016 target awards for each NEO (other than Mr. Klappa) were as follows:

Executive

Officer | Target STPP Award as a

Percentage of Base Salary |

| Mr. Leverett | 110% |

| Mr. Lauber | 75% |

| Mr. Keyes | 75% |

| Ms. Martin | 70% |

| Mr. Garvin | 60% |

| Mr. Fletcher | 70% |

The target award levels of each officer named in the table above reflect median incentive compensation practices as indicated by the market data.

Based upon the market data provided by Frederic Cook, Mr. Klappa’s annual incentive target was set at 120% of his base salary. As a result of his retirement as executive Chairman and CEO effective May 1, 2016, Mr. Klappa was entitled to a pro rata amount of his annual incentive, or $1,134,718.

For 2016, the possible payout for any NEO ranged from 0% of the target award to 210% of the target award, based on performance.

2016 Financial Goals under the STPP. The Compensation Committee adopted the 2016 STPP with a continued principal focus on financial results. In December 2015, the Compensation Committee approved WEC Energy Group’s earnings per share (75% weight) and cash flow (25% weight) as the primary performance measures to be used in 2016. For those officers whose positions primarily relate to utility operations in Wisconsin, the Compensation Committee approved WEC Energy Group’s earnings per share (25% weight) and cash flow (25% weight), as well as aggregate net income of WEC Energy Group’s Wisconsin utility operations (50% weight), as the primary performance measures to be used in 2016. We believe earnings per share and cash flow are key indicators of financial strength and performance and are recognized as such by the investment community. Utility net income is an important financial measure as it is an indicator of the return on equity earned by WEC Energy Group’s utilities, including us, and in order to meet WEC Energy Group’s earnings per share targets it is important that the utilities earn at or close to their authorized rate of return.

In January 2016, the Compensation Committee approved the performance goals under the STPP for WEC Energy Group’s earnings per share as follows:

Earnings Per Share

Performance Goal | Earnings

Per Share CAGR | Payout Level |

| $2.81 | 3.4% | 25% |

| $2.83 | 4.2% | 50% |

| $2.86 | 5.1% | 100% |

| $2.88 | 5.9% | 135% |

| $2.94 | 8.0% | 200% |

If WEC Energy Group performance falls between these levels, the payout level with respect to earnings per share is determined by interpolating on a straight line basis the appropriate payout level.

WEC Energy Group’s growth plan, which has been communicated to the public, calls for a long-term compound annual growth rate (“CAGR”) in earnings per share of 5.0% to 7.0% off of a 2015 base of $2.72 per share, with 6.0% to 8.0% growth in 2016. At the time the Compensation Committee was establishing targets for 2016, we believed that this CAGR plus WEC Energy Group’s continued growth in dividends would support a premium valuation as compared to WEC Energy Group’s peers. Therefore, the above target (135%) and maximum payout levels (200%) were tied to achievement of the 6.0% to 8.0% growth in 2016. The target (100%) payout level was tied to a 5.1% CAGR as the Compensation Committee thought it appropriate that the NEOs and other WEC Energy Group employees (including our employees) be awarded for achieving a CAGR within WEC Energy Group’s long-term CAGR range in 2016. The CAGR at each of the threshold (25%) and below target (50%) payout levels recognizes that the acquisition of Integrys would still have achieved one of WEC Energy Group’s criteria for entering into the transaction - that it be accretive to WEC Energy Group earnings in the first full year after the acquisition.