UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-00216

| |

| Nicholas High Income Fund, Inc. |

|

| (Exact Name of Registrant as specified in charter) |

| |

| 700 North Water Street, Milwaukee, Wisconsin 53202 |

| (Address of Principal Executive Offices) | (Zip Code) |

| |

| Jeffrey T. May, Senior Vice President, Secretary and Treasurer |

| 700 North Water Street |

| Milwaukee, Wisconsin 53202 |

|

| (Name and Address of Agent for Service) |

Registrant's telephone number, including area code: 414-272-4650

Date of fiscal year end: 12/31/2014

Date of reporting period: 06/30/2014

Item 1. Report to Stockholders.

SEMIANNUAL REPORT

June 30, 2014

|

| 700 NORTH WATER STREET |

| MILWAUKEE, WISCONSIN 53202 |

| WWW.NICHOLASFUNDS.COM |

NICHOLAS HIGH INCOME FUND, INC.

August 2014

Report to Fellow Shareholders:

Market Overview

Based on most analyst estimates at the beginning of the year, high yield bonds generated a better than expected total return of 5.64% for the six-month period ended June 30, 2014 as measured by the Bank of America Merrill Lynch (“BAML”) U.S. High Yield Constrained Index. The modest outlook for the high yield (“HY”) market was based on the outsized returns from 2009 to 2013, and the near-historic valuation for HY bonds. During the first half of 2014, the BAML U.S. High Yield Index reached an all-time low yield of 4.82% before investors began taking profits. The record low yield in HY has been accompanied by an equally surprising rally in the Treasury market as the yield on the 10-year Treasury Note fell from over 3% at the end of 2013 to a low of 2.44% in May. The rally in Treasuries and HY corporate bonds definitely caught many market participants off balance.

The primary drivers for the push to higher valuations of HY corporate bonds continued to be a modestly improving economy, rising corporate earnings, historically low default rates, ample market liquidity and a dearth of alternative yield investments. This lack of other options ranks as the primary concern that investors are simply chasing yield without considering all risks. The Federal Reserve’s near-zero interest rate policy has encouraged investors to seek higher returns in riskier investments just at the time when valuations are reaching new peaks. Nevertheless, timing markets, whether bonds or equities, can often prove to be a difficult exercise. Other than some minor pullbacks, the HY market generated a six-month return generally greater than what most market strategists expected for all of 2014. We fell into the camp that expected returns of 4 – 5% for the year. Having attained that after six months, we are more cautious for the balance of the year.

The high yield market returns including the six-months ended on June 30, 2014 are shown in the chart below:

| | | | | | | | | | |

| | Six Months | | | | | | | | | |

| | Ended | | | | | | | | | |

| | June 30, | | | | Calendar Years | | | |

| | 2014 | | 2013 | | 2012 | | 2011 | | 2010 | |

| BAML U.S. Bond Indices: | | | | | | | | | | |

| BB-B Non-Distressed High Yield | 5.54 | % | 6.19 | % | 14.29 | % | 5.72 | % | 13.93 | % |

| High Yield Constrained | 5.64 | % | 7.41 | % | 15.55 | % | 4.37 | % | 15.07 | % |

| CCC & Lower High Yield | 6.08 | % | 12.96 | % | 20.27 | % | -1.40 | % | 18.42 | % |

| Single B High Yield | 5.03 | % | 7.47 | % | 15.02 | % | 4.65 | % | 13.99 | % |

| BB High Yield | 5.99 | % | 5.19 | % | 14.36 | % | 6.12 | % | 14.93 | % |

| BBB Corporate Bond | 7.09 | % | -0.95 | % | 11.98 | % | 8.12 | % | 10.88 | % |

| Equity Indices: | | | | | | | | | | |

| Russell 2000 | 3.19 | % | 38.82 | % | 16.35 | % | -4.18 | % | 26.85 | % |

| S&P 500 | 7.14 | % | 32.39 | % | 16.00 | % | 2.11 | % | 15.06 | % |

| |

| | | | | | | | Annualized | |

| | | | | | | | 3 | Year | 5 | Year |

| BAML U.S. Bond Indices: | | | | | | | | | | |

| BB-B Non-Distressed High Yield | | | | | | | 8.92 | % | 12.05 | % |

| High Yield Constrained | | | | | | | 9.24 | % | 13.89 | % |

| CCC & Lower High Yield | | | | | | | 10.41 | % | 18.58 | % |

| Single B High Yield | | | | | | | 9.10 | % | 12.51 | % |

| BB High Yield | | | | | | | 8.81 | % | 12.58 | % |

| BBB Corporate Bond | | | | | | | 7.28 | % | 9.85 | % |

| Equity Indices: | | | | | | | | | | |

| Russell 2000 | | | | | | | 14.57 | % | 20.21 | % |

| S&P 500 | | | | | | | 16.59 | % | 18.83 | % |

Outlook

Our outlook for the balance of the year remains cautious based on current market valuations hovering near all-time highs. Recently, the market has been subject to increasing volatility and market flows which will weigh heavy on investor sentiment. While we are cautious, we do not expect the market to experience any significant sell-off due to corporate fundamentals or market valuations. However, with market valuations at such lofty levels our focus is on higher quality companies that should offer greater stability should the market enter a corrective phase.

Performance

Nicholas High Income Fund – Class I produced a net return of 4.32% for the six-month period ended June 30, 2014. Returns for Nicholas High Income Fund, Inc. –Class I and N and selected indices are provided in the chart below for the periods ended June 30, 2014. The Fund and Morningstar performance data is net of fees, while the BAML Indices are gross of fees.

| | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | 1 | Year | | 3 | Year | | 5 | Year | | 10 | Year |

| Nicholas High Income Fund, Inc. – Class I | | 8.95 | % | | 8.07 | % | | 11.26 | % | | 6.63 | % |

| Nicholas High Income Fund, Inc. – | | | | | | | | | | | | |

| Class N (linked to Class I) | | 8.50 | % | | 7.71 | % | | 10.84 | % | | 6.19 | % |

| BAML U.S. High Yield Constrained Index | | 11.79 | % | | 9.24 | % | | 13.89 | % | | 8.90 | % |

| BAML U.S. High Yield BB-B Bond Index | | 11.35 | % | | 8.99 | % | | 12.58 | % | | 8.25 | % |

| Morningstar High Yield Bond Funds Category | | 10.62 | % | | 8.24 | % | | 12.57 | % | | 7.60 | % |

| Ending value of $10,000 invested in | | | | | | | | | | | | |

| Nicholas High Income Fund, Inc. – Class I | $ | 11,336 | | $ | 13,440 | | $ | 14,071 | | $ | 21,422 | |

| Ending value of $10,000 invested in | | | | | | | | | | | | |

| Nicholas High Income Fund, Inc. – Class N | $ | 11,296 | | $ | 13,281 | | $ | 13,863 | | $ | 20,652 | |

| Fund’s Class I Expense Ratio (from 04/30/14 Prospectus): 0.66% | | | | | | | | | | |

| Fund’s Class N Expense Ratio (from 04/30/14 Prospectus): 1.01% | | | | | | | | | | |

The Fund’s expense ratios for the period ended June 30, 2014 can be found in the financial highlights included within this report.

Performance data quoted represents past performance and is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.nicholasfunds.com/returns.html.

The ending values above illustrate the performance of a hypothetical $10,000 investment made in the Fund over the timeframes listed. Assumes reinvestment of dividends and capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. These figures do not imply any future performance.

Class N of the Fund commenced operations on February 28, 2005. Class I shares and Class N because both classes of shares are invested in the same portfolio of securities. Annual returns will generally differ only to the extent that the classes do not have the same expenses. Please see the respective prospectus for details.

The returns earned by the Fund in 2014 are consistent with our investment philosophy and style. Our approach has been to identify undervalued securities using rigorous financial analysis to verify that the fundamental outlook is properly aligned with current valuations. An analysis of trends in earnings, EBITDA, leverage and asset coverage are critical for making a sound investment. Security valuation is the primary gatekeeper in deciding whether to add or eliminate a holding from the portfolio. Financially sound companies with fully priced securities do not necessarily represent a good value, while companies that have stumbled financially should not automatically be dismissed as bad investments if we believe the valuations offer a sufficient margin of safety. This process suggests a more conservative approach to investing in high yield bonds, which we believe has the potential to allow for more consistent returns with potentially less downside risk.

We remain committed to the Fund’s long-term strategy, which is based on a process that seeks to identify value opportunities in out-of-favor or poorly followed securities of financially sound companies. Opportunities tend to arise over time in securities of companies that fall temporarily out-of-favor due to specific company or industry issues that may taint the issuers. Often times these companies are in a period of transition or restructuring where market sentiment is overly harsh or negative resulting in an undervalued situation. We are keenly aware that a cheap price alone does not guarantee a good investment; therefore, we seek to identify a catalyst we believe will allow the company and its securities to regain favor and potentially be rewarded with higher valuations. We believe that investing in securities trading below their fair values due to non-fundamental short-term issues, emotion or misunderstanding could offer significant long-term potential returns.

Thank you for your investment in the Nicholas High Income Fund.

Regards,

Lawrence J. Pavelec, CFA

Senior Vice President

Portfolio Manager

The information above represents the opinions of the Fund manager, is subject to change, and any forecasts made cannot be guaranteed.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

Please refer to the schedule of investments in the report for complete Fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Current and future portfolio holdings are subject to risk.

Index Definitions – You cannot invest directly in an index.

The Bank of America Merrill Lynch U.S. High Yield Index is a market value-weighted index of all domestic and yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. The Bank of America Merrill Lynch U.S. High Yield Constrained Index limits any individual issuer to a maximum of 2% benchmark exposure.

The Bank of America Merrill Lynch U.S. High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have at least one year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $250 million.

The Bank of America Merrill Lynch BB-B U.S. Non-Distressed High Yield Index is a subset of the Bank of America Merrill Lynch U.S. High Yield Index including all securities rated BB1 through B3, inclusive, with an option-adjusted spread less than 1,000 basis points.

The Bank of America Merrill Lynch Single-B U.S. High Yield Index is a subset of the Bank of America Merrill Lynch U.S. High Yield Index including all securities rated B1 through B3.

The Bank of America Merrill Lynch U.S. High Yield BB Index is a subset of the Bank of America Merrill Lynch U.S. High Yield Index including all securities rated BB1 through BB3.

The Bank of America Merrill Lynch U.S. High Yield CCC and Lower Rated Index is a subset of the Merrill Lynch US High Yield Index including all securities rated CCC1 or lower.

The Bank of America Merrill Lynch U.S. Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market. Qualifying securities must have an investment grade rating, at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of a rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million.

The Bank of America Merrill Lynch BBB U.S. Corporate Index is a subset of the Bank of America Merrill Lynch U.S. Corporate Index including all securities rated BBB1 through BBB3.

The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index. The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

Each Morningstar Category average represents a universe of Funds with similar invest objectives.

Basis Point – One hundredth of a percentage point. For example, 50 basis points equals .50%

Margin of Safety – Buying with a “margin of safety,” a phrase popularized by Benjamin Graham and Warren Buffet, is when a security is purchased for less than its estimated value. This helps protect against permanent capital loss in the case of an unexpected event or analytical mistake. A purchase made with a “margin of safety” does not guarantee the security will not decline in price.

Yield-to-Worst – The lowest potential yield that can be received on a bond without the issuer actually defaulting.

EBITDA – Earnings Before Interest, Taxes, Depreciation and Amortization.

Must be preceded or accompanied by a prospectus.

The Nicholas Funds are distributed by Quasar Distributors, LLC.

Financial Highlights Class I (NCINX)

For a share outstanding throughout each period

| | | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | 06/30/2014 | | | | | | Years Ended December 31, | | | | |

| | | (unaudited) | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| NET ASSET VALUE, | | | | | | | | | | | | | | | | | | |

| BEGINNING OF PERIOD | $ | 9.86 | | $ | 9.86 | | $ | 9.28 | | $ | 9.52 | | $ | 9.09 | | $ | 7.18 | |

| INCOME (LOSS) FROM | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | |

| Net investment income | | .28 | | | .58 | | | .64 | | | .69 | | | .74 | | | .66 | |

| Net gain (loss) on securities | | | | | | | | | | | | | | | | | | |

| (realized and unrealized) | | .14 | | | .00 | (1) | | .58 | | | (.22 | ) | | .41 | | | 1.91 | |

| Total from | | | | | | | | | | | | | | | | | | |

| investment operations | | .42 | | | .58 | | | 1.22 | | | .47 | | | 1.15 | | | 2.57 | |

| LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | |

| From net investment income | | (.13 | ) | | (.58 | ) | | (.64 | ) | | (.71 | ) | | (.72 | ) | | (.66 | ) |

| NET ASSET VALUE, | | | | | | | | | | | | | | | | | | |

| END OF PERIOD | $ | 10.15 | | $ | 9.86 | | $ | 9.86 | | $ | 9.28 | | $ | 9.52 | | $ | 9.09 | |

| |

| TOTAL RETURN | | 4.32 | %(2) | | 5.91 | % | | 13.36 | % | | 4.93 | % | | 12.99 | % | | 36.42 | % |

| |

| SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | | | | | |

| period (millions) | $ | 105.8 | | $ | 103.8 | | $ | 103.0 | | $ | 93.8 | | $ | 91.6 | | $ | 88.6 | |

| Ratio of expenses | | | | | | | | | | | | | | | | | | |

| to average net assets | | .69 | %(3) | | .66 | % | | .66 | % | | .72 | % | | .74 | % | | .73 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | |

| to average net assets | | 5.54 | %(3) | | 5.74 | % | | 6.52 | % | | 7.44 | % | | 7.74 | % | | 8.12 | % |

| Portfolio turnover rate | | 58.28 | %(3) | | 51.47 | % | | 62.31 | % | | 61.19 | % | | 78.23 | % | | 88.33 | % |

| (1) | The amount rounds to $0.00. |

| (2) | Not annualized. |

| (3) | Annualized. |

The accompanying notes to financial statements are an integral part of these highlights.

– 6–

Financial Highlights Class N (NNHIX)

For a share outstanding throughout each period

| | | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | 06/30/2014 | | | | | | Years Ended December 31, | | | | |

| | | (unaudited) | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| NET ASSET VALUE, | | | | | | | | | | | | | | | | | | |

| BEGINNING OF PERIOD | $ | 9.99 | | $ | 9.98 | | $ | 9.39 | | $ | 9.64 | | $ | 9.18 | | $ | 7.24 | |

| INCOME (LOSS) FROM | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | |

| Net investment income | | .27 | | | .54 | | | .61 | | | .66 | | | .69 | | | .63 | |

| Net gain (loss) on securities | | | | | | | | | | | | | | | | | | |

| (realized and unrealized) | | .14 | | | .01 | | | .59 | | | (.23 | ) | | .44 | | | 1.94 | |

| Total from | | | | | | | | | | | | | | | | | | |

| investment operations | | .41 | | | .55 | | | 1.20 | | | .43 | | | 1.13 | | | 2.57 | |

| LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | |

| From net investment income | | (.12 | ) | | (.54 | ) | | (.61 | ) | | (.68 | ) | | (.67 | ) | | (.63 | ) |

| NET ASSET VALUE, | | | | | | | | | | | | | | | | | | |

| END OF PERIOD | $ | 10.28 | | $ | 9.99 | | $ | 9.98 | | $ | 9.39 | | $ | 9.64 | | $ | 9.18 | |

| |

| TOTAL RETURN | | 4.17 | %(1) | | 5.54 | % | | 12.96 | % | | 4.45 | % | | 12.56 | % | | 36.15 | % |

| |

| SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | | | | | |

| period (millions) | $ | 6.1 | | $ | 6.3 | | $ | 9.3 | | $ | 2.6 | | $ | 3.4 | | $ | 16.2 | |

| Ratio of expenses | | | | | | | | | | | | | | | | | | |

| to average net assets | | 1.04 | %(2) | | 1.01 | % | | 1.01 | % | | 1.06 | % | | 1.06 | % | | 1.06 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | |

| to average net assets | | 5.20 | %(2) | | 5.45 | % | | 6.15 | % | | 7.07 | % | | 7.34 | % | | 7.67 | % |

| Portfolio turnover rate | | 58.28 | %(2) | | 51.47 | % | | 62.31 | % | | 61.19 | % | | 78.23 | % | | 88.33 | % |

| (1) | Not annualized. |

| (2) | Annualized. |

The accompanying notes to financial statements are an integral part of these highlights.

– 7–

| | |

| Top Ten Portfolio Issuers | | |

| June 30, 2014 (unaudited) | | |

| |

| | Percentage | |

| Name | of Net Assets | |

| Chesapeake Energy Corporation | 3.25 | % |

| Florida East Coast Holdings Corp | 2.36 | % |

| CEMEX, S.A.B. de C.V | 1.93 | % |

| Scientific Games International, Inc | 1.76 | % |

| Landry’s, Inc | 1.74 | % |

| NCR Escrow Corp | 1.65 | % |

| Ball Corporation | 1.60 | % |

| Six Flags Entertainment Corporation | 1.60 | % |

| Goodyear Tire & Rubber Company (The) | 1.48 | % |

| American Axle & Manufacturing, Inc | 1.47 | % |

| Total of top ten | 18.84 | % |

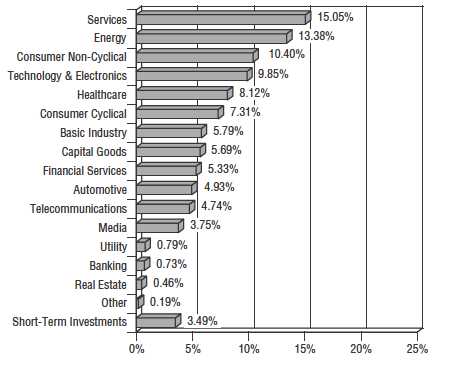

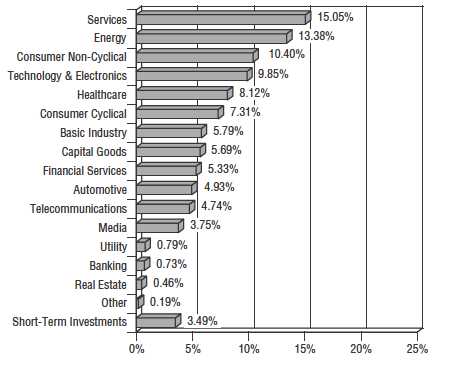

Sector Diversification (as a percentage of portfolio)

June 30, 2014 (unaudited)

– 8–

Fund Expenses

For the six month period ended June 30, 2014 (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other operating expenses. The following table is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with those of other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period.

The first line of the table below for each share class of the Fund provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios for each class of the Fund and an assumed rate of return of 5% per year before expenses, which are not the Fund’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as wire fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | |

| Class I | | | | | | |

| | | Beginning | | Ending | | |

| | | Account | | Account | | Expenses Paid |

| | | Value | | Value | | During Period* |

| | | 12/31/13 | | 06/30/14 | | 01/01/14 - 06/30/14 |

| Actual | $ | 1,000.00 | $ | 1,043.20 | $ | 3.50 |

| Hypothetical | | 1,000.00 | | 1,021.58 | | 3.46 |

| (5% return before expenses) | | | | | | |

| * | Expenses are equal to the Class I six-month annualized expense ratio of 0.69%, multiplied by the average account value over the period, multiplied by 181 then divided by 365 to reflect the one- half year period. |

– 9–

Fund Expenses (continued)

For the six month period ended June 30, 2014 (unaudited)

| | | | | | |

| Class N | | | | | | |

| | | Beginning | | Ending | | |

| | | Account | | Account | | Expenses Paid |

| | | Value | | Value | | During Period** |

| | | 12/31/13 | | 06/30/14 | | 01/01/14 - 06/30/14 |

| Actual | $ | 1,000.00 | $ | 1,041.70 | $ | 5.26 |

| Hypothetical | | 1,000.00 | | 1,019.84 | | 5.21 |

| (5% return before expenses) | | | | | | |

| ** | Expenses are equal to the Class N six-month annualized expense ratio of 1.04%, multiplied by the average account value over the period, multiplied by 181 then divided by 365 to reflect the one-half year period. |

– 10 –

| | | | |

| | Schedule of Investments | | |

| | June 30, 2014 (unaudited) | | |

| |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | | Value |

| NON-CONVERTIBLE BONDS — 91.77% | | |

| | | Automotive – Auto Makers — 1.92% | | |

| $ | 1,000,000 | Chrysler Group LLC 8.25%, 06/15/21 | $ | 1,130,000 |

| | 1,000,000 | General Motors Company 144A restricted, 3.50%, 10/02/18 | | 1,022,500 |

| | | | | 2,152,500 |

| | | Automotive – Parts & Equipment — 2.94% | | |

| | 1,500,000 | American Axle & Manufacturing, Inc. 6.625%, 10/15/22 | | 1,642,500 |

| | 1,000,000 | Goodyear Tire & Rubber Company (The) 8.25%, 08/15/20 | | 1,097,500 |

| | 500,000 | Goodyear Tire & Rubber Company (The) 7.00%, 05/15/22 | | 555,000 |

| | | | | 3,295,000 |

| | | Banking — 0.72% | | |

| | 1,000,000 | BAC Capital Trust XIV Floating Rate Preferred Hybrid | | |

| | | Income Term Securities 4.00%, 09/29/49(1) | | 805,000 |

| | | Basic Industry – Building Materials — 1.93% | | |

| | 1,045,000 | CEMEX, S.A.B. de C.V. 144A restricted, | | |

| | | Floating Rate Senior Notes, 5.2336%, 09/30/15(2) | | 1,086,800 |

| | 1,000,000 | CEMEX, S.A.B. de C.V. 144A restricted, 9.00%, 01/11/18 | | 1,075,000 |

| | | | | 2,161,800 |

| | | Basic Industry – Forestry & Paper — 0.52% | | |

| | 500,000 | Potlatch Corporation 144A restricted, 7.50%, 11/01/19 | | 579,375 |

| | | Basic Industry – Metal/Mining Excluding Steel — 2.77% | | |

| | 1,000,000 | Ausdrill Finance Pty Ltd 6.875%, 11/01/19 | | 932,500 |

| | 500,000 | Cloud Peak Energy Resources LLC 8.50%, 12/15/19 | | 535,625 |

| | 1,500,000 | FMG Resources (August 2006) Pty, Ltd. | | |

| | | 144A restricted, 8.25%, 11/01/19 | | 1,633,125 |

| | | | | 3,101,250 |

| | | Basic Industry – Steel Producers & Products — 0.49% | | |

| | 500,000 | United States Steel Corporation 7.375%, 04/01/20 | | 551,250 |

| | | Capital Goods – Aerospace & Defense — 0.91% | | |

| | 1,000,000 | Spirit AeroSystems, Inc. 144A restricted, 5.25%, 03/15/22 | | 1,015,000 |

| | | Capital Goods – Diversified — 0.99% | | |

| | 1,000,000 | Park-Ohio Industries, Inc. 8.125%, 04/01/21 | | 1,102,500 |

| | | Capital Goods – Machinery — 0.89% | | |

| | 1,000,000 | CNH Industrial Capital LLC 144A restricted, 3.375%, 07/15/19 | | 992,500 |

| | | Capital Goods – Packaging — 2.83% | | |

| | 1,750,000 | Ball Corporation 5.00%, 03/15/22 | | 1,793,750 |

| | 1,250,000 | Sealed Air Corporation 144A restricted, 8.125%, 09/15/19 | | 1,376,562 |

| | | | | 3,170,312 |

The accompanying notes to financial statements are an integral part of this schedule.

– 11 –

Schedule of Investments (continued)

June 30, 2014 (unaudited)

| | | | |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | | Value |

| | NON-CONVERTIBLE BONDS — 91.77% (continued) | | |

| | | Consumer Cyclical – Apparel and Textiles — 0.96% | | |

| $ | 1,000,000 | Levi Strauss & Co. 7.625%, 05/15/20 | $ | 1,076,250 |

| | | Consumer Cyclical – Restaurants — 3.89% | | |

| | 1,775,000 | Landry’s, Inc. 144A restricted, 9.375%, 05/01/20 | | 1,952,500 |

| | 1,220,000 | NPC International, Inc. 10.50%, 01/15/20 | | 1,375,550 |

| | 1,000,000 | Wok Acquisition Corp. 144A restricted, 10.25%, 06/30/20 | | 1,020,000 |

| | | | | 4,348,050 |

| | | Consumer Cyclical – Specialty Retail — 2.37% | | |

| | 1,000,000 | Men’s Wearhouse, Inc. (The) 144A restricted, 7.00%, 07/01/22 | | 1,035,000 |

| | 500,000 | Party City Holdings Inc. 8.875%, 08/01/20 | | 553,750 |

| | 1,120,000 | Rent-A-Center, Inc. 4.75%, 05/01/21 | | 1,058,400 |

| | | | | 2,647,150 |

| | | Consumer Non-Cyclical – Beverage — 1.00% | | |

| | 1,000,000 | Constellation Brands, Inc. 6.00%, 05/01/22 | | 1,122,500 |

| | | Consumer Non-Cyclical – Food-Wholesale — 7.09% | | |

| | 1,000,000 | Diamond Foods, Inc. 144A restricted, 7.00%, 03/15/19 | | 1,047,500 |

| | 1,000,000 | H.J. Heinz Company 4.25%, 10/15/20 | | 1,006,250 |

| | 500,000 | KeHE Distributors, LLC 144A restricted, 7.625%, 08/15/21 | | 545,000 |

| | 500,000 | Pinnacle Foods Finance LLC 4.875%, 05/01/21 | | 511,250 |

| | 1,000,000 | Post Holdings, Inc. 7.375%, 02/15/22 | | 1,081,250 |

| | 1,250,000 | Smithfield Foods, Inc. 144A restricted, 5.875%, 08/01/21 | | 1,321,875 |

| | 1,000,000 | Southern States Cooperative, Incorporated | | |

| | | 144A restricted, 10.00%, 08/15/21 | | 1,015,000 |

| | 750,000 | TreeHouse Foods, Inc. 4.875%, 03/15/22 | | 770,625 |

| | 602,000 | Wells Enterprises, Inc. 144A restricted, 6.75%, 02/01/20 | | 632,853 |

| | | | | 7,931,603 |

| | | Consumer Non-Cyclical – Products — 2.17% | | |

| | 1,465,000 | FGI Operating Company, LLC 7.875%, 05/01/20 | | 1,560,225 |

| | 1,000,000 | Sun Products Corporation (The) 144A restricted, 7.75%, 03/15/21 | | 870,000 |

| | | | | 2,430,225 |

| | | Energy – Exploration & Production — 5.68% | | |

| | 2,000,000 | Chesapeake Energy Corporation | | |

| | | Floating Rate Senior Notes, 3.48785%, 04/15/19(3) | | 2,022,500 |

| | 1,500,000 | Chesapeake Oilfield Operating, L.L.C. 6.625%, 11/15/19 | | 1,612,500 |

| | 1,000,000 | Cimarex Energy Co. 5.875%, 05/01/22 | | 1,105,000 |

| | 1,000,000 | Halcon Resources Corporation 8.875%, 05/15/21 | | 1,075,000 |

| | 500,000 | LINN Energy, LLC 8.625%, 04/15/20 | | 540,000 |

| | | | | 6,355,000 |

| | | Energy – Gas-Distribution — 0.95% | | |

| | 974,000 | MarkWest Energy Partners, L.P. 6.25%, 06/15/22 | | 1,064,095 |

The accompanying notes to financial statements are an integral part of this schedule.

– 12 –

Schedule of Investments (continued)

June 30, 2014 (unaudited)

| | | | |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | | Value |

| | NON-CONVERTIBLE BONDS — 91.77% (continued) | | |

| | | Energy – Oil Field Equipment & Services — 4.60% | | |

| $ | 1,350,000 | CHC Helicopter S.A. 9.25%, 10/15/20 | $ | 1,471,500 |

| | 1,000,000 | Hercules Offshore, Inc. 144A restricted, 7.50%, 10/01/21 | | 992,500 |

| | 1,000,000 | Hornbeck Offshore Services, Inc. 5.00%, 03/01/21 | | 997,500 |

| | 500,000 | Offshore Group Investment Limited 7.50%, 11/01/19 | | 528,750 |

| | 600,000 | Parker Drilling Company 144A restricted, 6.75%, 07/15/22 | | 624,000 |

| | 500,000 | Petroleum Geo-Services ASA 144A restricted, 7.375%, 12/15/18 | | 533,750 |

| | | | | 5,148,000 |

| | | Energy – Oil Refining & Marketing — 0.93% | | |

| | 1,000,000 | Tesoro Corporation 5.375%, 10/01/22 | | 1,045,000 |

| | | Financial Services – Brokerage — 2.33% | | |

| | 1,500,000 | Jefferies Finance LLC 144A restricted, 7.375%, 04/01/20 | | 1,575,000 |

| | 968,000 | Oppenheimer Holdings Inc. 8.75%, 04/15/18 | | 1,033,340 |

| | | | | 2,608,340 |

| | | Financial Services – Investments & | | |

| | | Miscellaneous Financial Services — 2.92% | | |

| | 1,000,000 | Icahn Enterprises L.P. 4.875%, 03/15/19 | | 1,030,000 |

| | 1,000,000 | Neuberger Berman Group LLC 144A restricted, 5.625%, 03/15/20 | | 1,057,500 |

| | 1,000,000 | Nuveen Investments, Inc. 9.50%, 10/15/20 | | 1,185,000 |

| | | | | 3,272,500 |

| | | Healthcare – Facilities — 3.32% | | |

| | 500,000 | Aviv Healthcare Properties Limited Partnership 6.00%, 10/15/21 | | 530,000 |

| | 1,000,000 | CHS/Community Health Systems, Inc. | | |

| | | 144A restricted, 6.875%, 02/01/22 | | 1,060,000 |

| | 1,500,000 | DaVita Inc. 5.75%, 08/15/22 | | 1,603,125 |

| | 500,000 | Sabra Health Care Limited Partnership 5.50%, 02/01/21 | | 525,000 |

| | | | | 3,718,125 |

| | | Healthcare – Medical Products — 2.41% | | |

| | 1,030,000 | Fresenius Medical Care US Finance II, Inc. | | |

| | | 144A restricted, 5.625%, 07/31/19 | | 1,122,700 |

| | 500,000 | Grifols Worldwide Operations Limited | | |

| | | 144A restricted, 5.25%, 04/01/22 | | 518,750 |

| | 475,000 | Physio-Control International, Inc. | | |

| | | 144A restricted, 9.875%, 01/15/19 | | 524,875 |

| | 500,000 | Teleflex Incorporated 6.875%, 06/01/19 | | 528,750 |

| | | | | 2,695,075 |

| | | Healthcare – Pharmaceuticals — 1.39% | | |

| | 1,000,000 | Endo Finance Co. 144A restricted, 5.75%, 01/15/22 | | 1,020,000 |

| | 500,000 | Salix Pharmaceuticals, Ltd. 144A restricted, 6.00%, 01/15/21 | | 536,250 |

| | | | | 1,556,250 |

The accompanying notes to financial statements are an integral part of this schedule.

– 13 –

Schedule of Investments (continued)

June 30, 2014 (unaudited)

| | | | |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | | Value |

| | NON-CONVERTIBLE BONDS — 91.77% (continued) | | |

| | | Media – Cable — 0.95% | | |

| $ | 1,000,000 | UPCB Finance III Limited 144A restricted, 6.625%, 07/01/20 | $ | 1,065,000 |

| | | Media – Printing & Publishing — 1.36% | | |

| | 500,000 | Deluxe Corporation 6.00%, 11/15/20 | | 525,000 |

| | 1,000,000 | Quad/Graphics, Inc. 144A restricted, 7.00%, 05/01/22 | | 1,000,000 |

| | | | | 1,525,000 |

| | | Media – Services — 1.38% | | |

| | 1,500,000 | Nielsen Company (Luxembourg) S.ar.l. (The) | | |

| | | 144A restricted, 5.50%, 10/01/21 | | 1,548,750 |

| | | Real Estate – Development & Management — 0.45% | | |

| | 500,000 | CBRE Services, Inc. 5.00%, 03/15/23 | | 505,000 |

| | | Services – Gaming — 3.31% | | |

| | 500,000 | Boyd Gaming Corporation 9.125%, 12/01/18 | | 531,875 |

| | 1,000,000 | MGM Resorts International 8.625%, 02/01/19 | | 1,191,250 |

| | 1,000,000 | Scientific Games International, Inc. 6.25%, 09/01/20 | | 985,000 |

| | 1,000,000 | Scientific Games International, Inc. | | |

| | | 144A restricted, 6.625%, 05/15/21 | | 990,000 |

| | | | | 3,698,125 |

| | | Services – Hotels — 0.48% | | |

| | 500,000 | FelCor Escrow Holdings, L.L.C. 6.75%, 06/01/19 | | 531,875 |

| | | Services – Leisure — 1.60% | | |

| | 1,750,000 | Six Flags Entertainment Corporation | | |

| | | 144A restricted, 5.25%, 01/15/21 | | 1,793,750 |

| | | Services – Railroads — 2.36% | | |

| | 2,000,000 | Florida East Coast Holdings Corp. | | |

| | | 144A restricted, 6.75%, 05/01/19 | | 2,112,500 |

| | 500,000 | Florida East Coast Industries, LLC | | |

| | | 144A restricted, 9.75%, 05/01/20 | | 528,125 |

| | | | | 2,640,625 |

| | | Services – Support & Services — 5.22% | | |

| | 1,500,000 | ADT Corporation (The) 3.50%, 07/15/22 | | 1,365,000 |

| | 500,000 | APX Group, Inc. 6.375%, 12/01/19 | | 518,750 |

| | 500,000 | Avis Budget Car Rental, LLC 144A restricted, 5.125%, 06/01/22 | | 500,625 |

| | 250,000 | Avis Budget Car Rental, LLC 5.50%, 04/01/23 | | 255,625 |

| | 500,000 | NESCO, LLC 144A restricted, 6.875%, 02/15/21 | | 510,000 |

| | 1,500,000 | ServiceMaster Company (The) 8.00%, 02/15/20 | | 1,616,250 |

| | 1,000,000 | United Rentals (North America), Inc. 6.125%, 06/15/23 | | 1,072,500 |

| | | | | 5,838,750 |

| | | Services – Theaters & Entertainment — 0.46% | | |

| | 500,000 | Cinemark USA, Inc. 5.125%, 12/15/22 | | 511,875 |

The accompanying notes to financial statements are an integral part of this schedule.

– 14 –

Schedule of Investments (continued)

June 30, 2014 (unaudited)

| | | | |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | | Value |

| | NON-CONVERTIBLE BONDS — 91.77% (continued) | | |

| | | Services – Transportation Excluding Air & Rail — 1.43% | | |

| $ | 500,000 | Great Lakes Dredge & Dock Corporation 7.375%, 02/01/19 | $ | 525,000 |

| | 1,000,000 | Swift Services Holdings, Inc. 10.00%, 11/15/18 | | 1,070,000 |

| | | | | 1,595,000 |

| | | Technology & Electronics – Computer Hardware — 3.03% | | |

| | 500,000 | Brocade Communications Systems, Inc. 4.625%, 01/15/23 | | 485,000 |

| | 1,000,000 | Dell Inc. 144A restricted, 5.625%, 10/15/20 | | 1,060,000 |

| | 1,750,000 | NCR Escrow Corp. 144A restricted, 5.875%, 12/15/21 | | 1,846,250 |

| | | | | 3,391,250 |

| | | Technology & Electronics – Electronics — 1.62% | | |

| | 250,000 | Micron Technology, Inc. 144A restricted, 5.875%, 02/15/22 | | 268,125 |

| | 1,000,000 | NXP B.V. 144A restricted, 3.50%, 09/15/16 | | 1,018,750 |

| | 500,000 | NXP B.V. 144A restricted, 5.75%, 02/15/21 | | 525,625 |

| | | | | 1,812,500 |

| | | Technology & Electronics – Software & Services — 2.38% | | |

| | 1,500,000 | Activision Blizzard, Inc. 144A restricted, 5.625%, 09/15/21 | | 1,616,250 |

| | 1,000,000 | SunGard Data Systems Inc. 6.625%, 11/01/19 | | 1,052,500 |

| | | | | 2,668,750 |

| | Technology & Electronics – Telecommunications Equipment — 1.37% | | |

| | 1,500,000 | CommScope, Inc. 144A restricted, 5.00%, 06/15/21 | | 1,530,000 |

| | | Telecommunications – Integrated & Services — 3.75% | | |

| | 809,000 | Cincinnati Bell Inc. 8.375%, 10/15/20 | | 886,866 |

| | 500,000 | CyrusOne LP 6.375%, 11/15/22 | | 538,750 |

| | 1,000,000 | Frontier Communications Corporation 8.50%, 04/15/20 | | 1,180,000 |

| | 1,500,000 | Intelsat Jackson Holdings S.A. 7.25%, 04/01/19 | | 1,595,625 |

| | | | | 4,201,241 |

| | | Telecommunications – Wireless — 0.92% | | |

| | 1,000,000 | Digicel Limited 144A restricted, 6.00%, 04/15/21 | | 1,032,500 |

| | | Utility – Electric-Generation — 0.78% | | |

| | 800,000 | Calpine Corporation 144A restricted, 7.875%, 07/31/20 | | 868,000 |

| | | TOTAL NON-CONVERTIBLE BONDS | | |

| | | (cost $99,610,309) | | 102,702,641 |

| | BANK LOANS — 2.21% | | |

| | | Healthcare – Medical Products — 0.89% | | |

| | 1,000,000 | Grifols Worldwide Operations USA, Inc. 3.15%, 02/27/21(4) | | 998,130 |

| | Technology & Electronics – Telecommunications Equipment — 1.32% | | |

| | 1,492,465 | CDW LLC Term Loan B 3.25%, 04/29/20(5) | | 1,475,675 |

| | | TOTAL BANK LOANS | | |

| | | (cost $2,480,599) | | 2,473,805 |

The accompanying notes to financial statements are an integral part of this schedule.

– 15 –

Schedule of Investments (continued)

June 30, 2014 (unaudited)

| | | | |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | | Value |

| | COMMON STOCKS — 1.22% | | |

| | | Energy — 1.04% | | |

| | 38,000 | Dorchester Minerals, L.P | $ | 1,160,520 |

| | | Other — 0.18% | | |

| | 1,500 | iShares iBoxx $ High Yield Corporate Bond Fund(6) | | 142,800 |

| | 1,500 | SPDR Barclays Capital High Yield Bond ETF(6) | | 62,595 |

| | | | | 205,395 |

| | | TOTAL COMMON STOCKS | | |

| | | (cost $1,091,685) | | 1,365,915 |

| SHORT-TERM INVESTMENTS — 3.44% | | |

| | | Commercial Paper — 2.30% | | |

| $ | 525,000 | Integrys Energy Group, Inc. 0.21%, 07/01/14 | | 525,000 |

| | 500,000 | Bacardi-Martini B.V. 0.25%, 07/02/14 | | 499,996 |

| | 451,000 | Time Warner Cable Inc. 0.25%, 07/02/14 | | 450,997 |

| | 445,000 | Kroger Co. (The) 0.23%, 07/07/14 | | 444,983 |

| �� | 650,000 | Integrys Energy Group, Inc. 0.22%, 07/08/14 | | 649,972 |

| | | | | 2,570,948 |

| | | Variable Rate Security — 1.14% | | |

| | 1,277,101 | Fidelity Institutional Money Market Fund – Class I | | 1,277,101 |

| | | TOTAL SHORT-TERM INVESTMENTS | | |

| | | (cost $3,848,049) | | 3,848,049 |

| | | TOTAL INVESTMENTS | | |

| | | (cost $107,030,642) – 98.64% | | 110,390,410 |

| | | OTHER ASSETS, NET OF LIABILITIES – 1.36% | | 1,522,651 |

| | | TOTAL NET ASSETS | | |

| | | (basis of percentages disclosed above) – 100% | $ | 111,913,061 |

| (1) | The greater of (i) 3-month LIBOR plus 0.40% and (ii) 4.00%, such rate being reset quarterly. |

| (2) | Resets quarterly, equal to 3-month LIBOR plus 5.00%. |

| (3) | Resets quarterly, equal to 3-month LIBOR plus 3.25%. |

| (4) | Resets quarterly, equal to 1-month LIBOR plus 3.00%. |

| (5) | The greater of (i) 3-month LIBOR plus 2.25% and (ii) 3.25%, such rate being reset quarterly. |

| (6) | Exchange traded fund. |

The accompanying notes to financial statements are an integral part of this schedule.

– 16 –

Statement of Assets and Liabilities

June 30, 2014 (unaudited)

| | | |

| ASSETS | | | |

| Investments in securities at value (cost $107,030,642) | $ | 110,390,410 | |

| Interest receivable | | 1,599,259 | |

| Other | | 17,006 | |

| Total assets | | 112,006,675 | |

| |

| LIABILITIES | | | |

| Payables — | | | |

| Due to adviser — | | | |

| Management fee | | 38,437 | |

| Accounting and administrative fee | | 3,973 | |

| Total due to adviser | | 42,410 | |

| 12b-1 and servicing fee | | 15,008 | |

| Other payables and accrued expense | | 36,196 | |

| Total liabilities | | 93,614 | |

| Total net assets | $ | 111,913,061 | |

| |

| NET ASSETS CONSIST OF | | | |

| Paid in capital | $ | 114,689,178 | |

| Net unrealized appreciation on investments | | 3,359,768 | |

| Accumulated net realized loss on investments | | (7,601,236 | ) |

| Accumulated undistributed net investment income | | 1,465,351 | |

| Total net assets | $ | 111,913,061 | |

| |

| Class I: | | | |

| Net assets | $ | 105,839,440 | |

| Shares outstanding | | 10,425,376 | |

| NET ASSET VALUE PER SHARE ($.05 par value, 75,000,000 | | | |

| shares authorized), offering price and redemption price | $ | 10.15 | |

| |

| Class N: | | | |

| Net assets | $ | 6,073,621 | |

| Shares outstanding | | 590,759 | |

| NET ASSET VALUE PER SHARE ($.05 par value, 25,000,000 | | | |

| shares authorized), offering price and redemption price | $ | 10.28 | |

The accompanying notes to financial statements are an integral part of this statement.

– 17 –

| | |

| Statement of Operations | | |

| For the six months ended June 30, 2014 (unaudited) | | |

| |

| INCOME | | |

| Interest | $ | 3,179,158 |

| Other | | 229,585 |

| Total income | | 3,408,743 |

| |

| EXPENSES | | |

| Management fee | | 238,486 |

| Transfer agent fees | | 25,953 |

| Registration fees | | 25,878 |

| Accounting and administrative fees | | 24,795 |

| Audit and tax fees | | 14,663 |

| Accounting system and pricing service fees | | 14,457 |

| Printing | | 9,836 |

| 12b-1 fees – Class N | | 6,699 |

| Directors’ fees | | 6,250 |

| Legal fees | | 6,059 |

| Servicing fees – Class N | | 2,679 |

| Insurance | | 2,676 |

| Postage and mailing | | 2,339 |

| Custodian fees | | 1,792 |

| Other operating expenses | | 2,830 |

| Total expenses | | 385,392 |

| Net investment income | | 3,023,351 |

| |

| NET REALIZED GAIN ON INVESTMENTS | | 433,817 |

| |

| CHANGE IN NET UNREALIZED APPRECIATION/DEPRECIATION | | |

| ON INVESTMENTS | | 1,225,139 |

| Net realized and unrealized gain on investments | | 1,658,956 |

| Net increase in net assets resulting from operations | $ | 4,682,307 |

The accompanying notes to financial statements are an integral part of this statement.

– 18 –

Statements of Changes in Net Assets

For the six months ended June 30, 2014 (unaudited) and the year ended December 31, 2013

| | | | | | |

| | | Six Months Ended | | | | |

| | | 06/30/2014 | | | Year Ended | |

| | | (unaudited) | | | 12/31/2013 | |

| INCREASE (DECREASE) IN | | | | | | |

| NET ASSETS FROM OPERATIONS | | | | | | |

| Net investment income | $ | 3,023,351 | | $ | 6,361,049 | |

| Net realized gain on investments | | 433,817 | | | 1,981,943 | |

| Change in net unrealized | | | | | | |

| appreciation/depreciation on investments | | 1,225,139 | | | (1,837,614 | ) |

| Net increase in net assets resulting | | | | | | |

| from operations | | 4,682,307 | | | 6,505,378 | |

| |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | |

| From net investment income – Class I | | (1,390,775 | ) | | (5,949,615 | ) |

| From net investment income – Class N | | (64,562 | ) | | (382,362 | ) |

| Total distributions | | (1,455,337 | ) | | (6,331,977 | ) |

| |

| CAPITAL SHARE TRANSACTIONS | | | | | | |

| Proceeds from shares issued – Class I | | | | | | |

| (231,223 and 911,938 shares, respectively) | | 2,306,542 | | | 9,111,023 | |

| Reinvestment of distributions - Class I | | | | | | |

| (120,678 and 516,374 shares, respectively) | | 1,209,198 | | | 5,137,252 | |

| Cost of shares redeemed – Class I | | | | | | |

| (456,187 and 1,343,287 shares, respectively) | | (4,560,603 | ) | | (13,475,944 | ) |

| Proceeds from shares issued - Class N | | | | | | |

| (257,704 and 958,528 shares, respectively) | | 2,629,639 | | | 9,724,684 | |

| Reinvestment of distributions – Class N | | | | | | |

| (6,244 and 37,104 shares, respectively) | | 63,372 | | | 375,506 | |

| Cost of shares redeemed – Class N | | | | | | |

| (302,808 and 1,299,185 shares, respectively) | | (3,062,442 | ) | | (13,242,955 | ) |

| Change in net assets derived from | | | | | | |

| capital share transactions | | (1,414,294 | ) | | (2,370,434 | ) |

| Total increase (decrease) in net assets | | 1,812,676 | | | (2,197,033 | ) |

| |

| NET ASSETS | | | | | | |

| Beginning of period | | 110,100,385 | | | 112,297,418 | |

| End of period (including accumulated | | | | | | |

| undistributed net investment income of | | | | | | |

| $1,465,351 and $61,372, respectively) | $ | 111,913,061 | | $ | 110,100,385 | |

The accompanying notes to financial statements are an integral part of these statements.

– 19 –

Notes to Financial Statements

June 30, 2014 (unaudited)

These financial statements have been prepared pursuant to reporting rules for interim financial statements. Accordingly, these financial statements do not include all of the information and footnotes required by generally accepted accounting principles (“GAAP”) for annual financial statements. These financial statements should be read in conjunction with the financial statements and financial highlights and notes in the Fund’s Annual Report on Form N-CSR for the year ended December 31, 2013.

These financial statements have not been audited. Management believes that these financial statements include all adjustments (which, unless otherwise noted, include only normal recurring adjustments) necessary for a fair presentation of the financial results for each period shown.

(1) Summary of Significant Accounting Policies —

Nicholas High Income Fund, Inc. (the “Fund”) is organized as a Maryland corporation and is registered as an open-end, diversified management investment company under the Investment Company Act of 1940, as amended. The primary objective of the Fund is high current income consistent with the preservation and conservation of capital values. The following is a summary of the significant accounting policies of the Fund: (a) Equity securities traded on a stock exchange will ordinarily be valued on the basis of the last sale price on the date of valuation on the securities principal exchange, or if in the absence of any sale on that day, the closing bid price. For securities principally traded on the NASDAQ market, the Fund uses the NASDAQ Official Closing Price. Debt securities, excluding short-term investments, are valued at their current evaluated bid price as determined by an independent pricing service, which generates evaluations on the basis of dealer quotes for normal institutional-sized trading units, issuer analysis, bond market activity and various other factors.

Securities for which market quotations may not be readily available are valued at their fair value as determined in good faith by procedures adopted by the Board of Directors. Short-term investments purchased at par are valued at cost, which approximates market value. Short-term investments purchased at a premium or discount are stated at amortized cost, which approximates market value. The Fund did not maintain any positions in derivative instruments or engage in hedging activities during the year. Investment transactions for financial statement purposes are recorded on trade date.

In accordance with Accounting Standards Codification (“ASC”) 820-10, “Fair Value Measurements and Disclosures” (“ASC 820-10”), fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. ASC 820-10 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value such as a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the

– 20 –

Notes to Financial Statements (continued)

June 30, 2014 (unaudited)

assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

Level 1 – quoted prices in active markets for identical investments Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, benchmark yields, bids, offers, transactions, spreads and other relationships observed in the markets among market securities, underlying equity of the issuer, proprietary pricing models, credit risk, etc.) Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2014 in valuing the Fund’s investments carried at value:

| | |

| | | Investments |

| Valuation Inputs | | in Securities |

| Level 1 – | | |

| Common Stocks(1) | $ | 1,365,915 |

| Variable Rate Security | | 1,277,101 |

| Level 2 – | | |

| Non-Convertible Bonds(1) | | 102,702,641 |

| Bank Loans(1) | | 2,473,805 |

| Commercial Paper | | 2,570,948 |

| Level 3 – | | |

| None | | — |

| Total | $ | 110,390,410 |

| (1) See Schedule of Investments for further detail by industry. | | |

There were no transfers between levels during the period ended June 30, 2014 and the Fund did not hold any Level 3 investments during the period.

(b) Net realized gain (loss) on portfolio securities was computed on the basis of specific identification.

(c) Dividend income is recorded on the ex-dividend date, and interest income is recognized on an accrual basis. Non-cash dividends, if any, are recorded at value on date of distribution. Generally, discounts and premiums on long-term debt security purchases, if any, are amortized over the expected lives of the respective securities using the effective yield method.

– 21 –

Notes to Financial Statements (continued)

June 30, 2014 (unaudited)

(d) Provision has not been made for federal income taxes or excise taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment income and net realized capital gains on sales of investments to its shareholders and otherwise comply with the provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

Investment income, net capital gains (losses) and all expenses incurred by the Fund are allocated based on the relative net assets of each class, except for service fees and certain other fees and expenses related to one class of shares.

Class N shares are subject to a 0.25% 12b-1 fee and a 0.10% servicing fee, as described in its prospectus. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative net asset value of outstanding shares.

(e) Dividends and distributions paid to shareholders are recorded on the ex-dividend date. Distributions from net investment income are generally declared and paid at least quarterly. Distributions of net realized capital gain, if any, are declared and paid at least annually.

The amount of distributions from net investment income and net realized capital gain are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles (“U.S. GAAP”) for financial reporting purposes. Financial reporting records are adjusted for permanent book-to-tax differences to reflect tax character. At June 30, 2014, reclassifications were recorded to decrease accumulated undistributed net investment income and decrease accumulated net realized loss on investments by $164,035.

The tax character of distributions paid during the six months ended June 30, 2014 and the year ended December 31, 2013 was as follows:

| | | | |

| | | 06/30/2014 | | 12/31/2013 |

| Distributions paid from: | | | | |

| Ordinary income | $ | 1,455,337 | $ | 6,331,977 |

As of June 30, 2014, investment cost for federal tax purposes was $107,030,642 and the tax basis components of net assets were as follows:

| | | |

| Unrealized appreciation | $ | 3,838,739 | |

| Unrealized depreciation | | (478,971 | ) |

| Net unrealized appreciation | $ | 3,359,768 | |

There were no differences between the book-basis and tax-basis components of net assets.

The Fund had no material uncertain tax positions and has not recorded a liability for unrecognized tax benefits as of June 30, 2014. Also, the Fund recognized no interest and penalties related to uncertain tax benefits during the period ended June 30, 2014. At June 30, 2014, the fiscal years 2010 through 2013 remain open to examination in the Fund’s major tax jurisdictions.

– 22 –

Notes to Financial Statements (continued)

June 30, 2014 (unaudited)

(f) The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from estimates.

(g) In the normal course of business the Fund enters into contracts that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

(h) In connection with the preparation of the Fund’s financial statements, management evaluated subsequent events after the date of the Statement of Assets and Liabilities of June 30, 2014. There have been no significant subsequent events since June 30, 2014 that would require adjustment to or additional disclosure in these financial statements.

(2) Related Parties —

(a) Investment Adviser and Management Agreement —

The Fund has an agreement with Nicholas Company, Inc. (with whom certain officers and directors of the Fund are affiliated) (the “Adviser”) to serve as investment adviser and manager. Under the terms of the agreement, a monthly fee is paid to the Adviser based on an annualized fee of 0.50% of the average net asset value up to and including $50 million, 0.40% of the average net asset value in excess of $50 million and up to and including $100 million and 0.30% of the average net asset value in excess of $100 million.

The Adviser may be paid for accounting and administrative services rendered by its personnel, subject to the following guidelines: (i) up to five basis points, on an annual basis, of the average net asset value of the Fund up to and including $2 billion and up to three basis points, on an annual basis, of the average net asset value of the Fund greater than $2 billion, based on the average net asset value of the Fund as determined by valuations made at the close of each business day of each month, and (ii) where the preceding calculation results in an annual payment of less than $50,000, the Adviser, in its discretion, may charge the Fund up to $50,000 for such services.

(b) Legal Counsel —

A director of the Adviser is affiliated with a law firm that provides services to the Fund. The Fund incurred expenses of $3,627 for the period ended June 30, 2014 for legal services rendered by this law firm.

(3) Investment Transactions —

For the period ended June 30, 2014, the cost of purchases and the proceeds from sales of investment securities, other than short-term obligations, aggregated $33,139,995 and $30,290,825, respectively.

– 23 –

Notes to Financial Statements (continued)

June 30, 2014 (unaudited)

(4) Concentration of Risk —

The Fund invests primarily in high yield debt securities. The market values of these high yield debt securities tend to be more sensitive to economic conditions and individual corporate developments than those of higher rated securities. In addition, the market for these securities is generally less liquid than for higher rated securities.

– 24 –

| | | | | | | |

| Historical Record(1) | | | | | |

| (unaudited) | | | | | | | |

| |

| | | Net | | Net Investment | | | Growth of an |

| | | Asset Value | | Income Distributions | | | Initial $10,000 |

| Class I | | Per Share | | Per Share | | | Investment(3) |

| November 21, 1977(2) | $ | 25.50 | $ | — | | $ | 10,000 |

| December 31, 1992 | | 16.90 | | 1.4775 | | | 35,143 |

| December 31, 1993 | | 17.60 | | 1.4450 | | | 39,695 |

| December 31, 1994 | | 16.05 | | 1.5050 | | | 39,626 |

| December 31, 1995 | | 17.10 | | 1.4750 | | | 46,029 |

| December 31, 1996 | | 17.65 | | 1.4800 | | | 51,721 |

| December 31, 1997 | | 18.45 | | 1.4515 | | | 58,514 |

| December 31, 1998 | | 16.95 | | 1.5775 | | | 58,788 |

| December 31, 1999 | | 15.30 | | 1.6560 | | | 58,749 |

| December 31, 2000 | | 12.00 | | 1.5300 | | | 51,620 |

| December 31, 2001 | | 11.80 | | 1.2150 | | | 56,144 |

| December 31, 2002 | | 9.65 | | 0.9925 | | | 50,459 |

| December 31, 2003 | | 10.95 | | 0.8450 | | | 61,937 |

| December 31, 2004 | | 11.15 | | 0.8200 | | | 67,915 |

| December 31, 2005 | | 10.50 | | 0.7895 | | | 68,849 |

| December 31, 2006 | | 10.70 | | 0.7455 | | | 75,221 |

| December 31, 2007 | | 10.18 | | 0.7502 | | | 76,820 |

| December 31, 2008 | | 7.18 | | 0.7140 | | | 58,955 |

| December 31, 2009 | | 9.09 | | 0.6581 | | | 80,426 |

| December 31, 2010 | | 9.52 | | 0.7230 | | | 90,876 |

| December 31, 2011 | | 9.28 | | 0.7070 | | | 95,354 |

| December 31, 2012 | | 9.86 | | 0.6375 | | | 108,095 |

| December 31, 2013 | | 9.86 | | 0.5757 | | | 114,488 |

| June 30, 2014 | | 10.15 | | 0.1340 | (a) | | 119,431 |

| Class N | | | | | | | |

| February 28, 2005(2) | $ | 11.20 | $ | — | | $ | 10,000 |

| December 31, 2005 | | 10.40 | | 0.7320 | | | 9,947 |

| December 31, 2006 | | 10.60 | | 0.7140 | | | 10,846 |

| December 31, 2007 | | 10.06 | | 0.7119 | | | 11,018 |

| December 31, 2008 | | 7.24 | | 0.5238 | | | 8,448 |

| December 31, 2009 | | 9.18 | | 0.6323 | | | 11,501 |

| December 31, 2010 | | 9.64 | | 0.6683 | | | 12,946 |

| December 31, 2011 | | 9.39 | | 0.6782 | | | 13,522 |

| December 31, 2012 | | 9.98 | | 0.6062 | | | 15,275 |

| December 31, 2013 | | 9.99 | | 0.5367 | | | 16,121 |

| June 30, 2014 | | 10.28 | | 0.1249 | (a) | | 16,793 |

| (1) | Per share amounts presented for the periods prior to December 31, 2007 in this historical record have been restated or adjusted to reflect a reverse stock split of one share for every five shares outstanding effected on January 29, 2007. |

| (2) | Initial date under Nicholas Company, Inc. management. |

| (3) | Assuming reinvestment of distributions. |

| (a) | Paid on April 29, 2014 to shareholders of record on April 28, 2014. The Fund distributed no capital gains for the time periods listed. |

– 25 –

Approval of Investment Advisory Contract

(unaudited)

In February 2014, the Board of Directors of the Fund renewed the one-year term of the Investment Advisory Agreement by and between the Fund and the Adviser through February 2015. In connection with the renewal of the Investment Advisory Agreement, no changes to the amount or manner of calculation of the management fee or the terms of the agreement were proposed by the Adviser or adopted by the Board. For the fiscal year ended December 31, 2013, the management fee was 0.43% and the Fund’s Class I and Class N total expense ratios (including the management fee) were 0.66% and 1.01%, respectively. In renewing the Investment Advisory Agreement, the Board carefully considered the following factors on an absolute basis and relative to the Fund’s peer group: (i) the Fund’s Class I expense ratio, which was the lowest in its overall peer group; (ii) the Fund’s performance on a short-term and long-term basis; (iii) the Fund’s management fee; and (iv) the range and quality of the services offered by the Adviser. The peer group fund data included high-yield bond funds with similar asset sizes, credit quality and number of holdings. In terms of the peer group data used for performance comparisons, the Fund’s Class I was ranked 5th, 4th, 7th and 5th out of 8 funds for the one-, three-, five- and ten-year periods ending December 31, 2013. The Fund’s Class I had the lowest expense ratio among its peer group and ranked 3rd in terms of 12-month yield out of the 8 funds.

The Board considered the range of services to be provided by the Adviser to the Fund under the Advisory Agreement. The Board discussed the nature, extent, and quality of the services to be provided by the Adviser and concluded that the services provided were consistent with the terms of the advisory agreement and the needs of the Fund, and that the services provided were of a high quality.

The Board considered the investment performance of the Fund and the Adviser. Among other things, the Board noted its consideration of the Fund’s performance relative to peer funds. The Board reviewed the actual relative short-term and long-term performance of the Fund. The Board agreed that the Fund demonstrated satisfactory performance relative to its peers. The Board also discussed the extent to which economies of scale would be realized, and whether such economies were reflected in the Fund’s fee levels and concluded that the Adviser had been instrumental in holding down Fund costs, citing consistently low fees.

The Board considered the cost of services provided by the Adviser. The Board also considered the profits realized by the Adviser in connection with the management and distribution of the Fund, as expressed by the Adviser’s management in general terms. The Board expressed the opinion that given the Board’s focus on performance and maintaining a low fee structure, the Adviser’s profits were not relevant.

The Board determined that the Adviser had fully and adequately carried out the terms and conditions of its contract with the Fund. The Board discussed the Fund’s relatively low fees, historical returns and risk profile and management’s strategies to improve the absolute and relative performance of the Fund. The Board agreed that the Adviser had the resources, financial management and administrative capacity to continue to provide quality services. The Board expressed satisfaction with the Fund’s performance, management’s control of expenses and the rate of the management fee for the Fund and the overall level of services provided to the Fund by the Adviser.

– 26 –

Information on Proxy Voting

(unaudited)

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request by calling 800-544-6547 or 414-276-0535. It also appears in the Fund’s Statement of Additional Information, which can be found on the SEC’s website, www.sec.gov. A record of how the Fund voted its proxies for the most recent twelve-month period ended June 30, also is available on the Fund’s website, www.nicholasfunds.com, and the SEC’s website, www.sec.gov.

Quarterly Portfolio Schedule

(unaudited)

The Fund files its complete schedule of investments with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q’s are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

– 27 –

Privacy Policy

(unaudited)

Nicholas High Income Fund, Inc. respects each shareholder’s right to privacy. We are committed to safeguarding the information that you provide us to maintain and execute transactions on your behalf.

We collect the following non-public personal information about you:

| * | Information we receive from you on applications or other forms, whether we receive the form in writing or electronically. This includes, but is not limited to, your name, address, phone number, tax identification number, date of birth, beneficiary information and investment selection. |

| * | Information about your transactions with us and account history with us. This includes, but is not limited to, your account number, balances and cost basis information. This also includes transaction requests made through our transfer agent. |

| * | Other general information that we may obtain about you such as demographic information. |

WE DO NOT SELL ANY NON-PUBLIC PERSONAL INFORMATION ABOUT CURRENT OR FORMER SHAREHOLDERS.

INFORMATION SHARED WITH OUR TRANSFER AGENT, A THIRD PARTY COMPANY, ALSO IS NOT SOLD.

We may share, only as permitted by law, non-public personal information about you with third party companies. Listed below are some examples of third parties to whom we may disclose non-public personal information. While these examples do not cover every circumstance permitted by law, we hope they help you understand how your information may be shared.

We may share non-public personal information about you:

| * | With companies who work for us to service your accounts or to process transactions that you may request. This would include, but is not limited to, our transfer agent to process your transactions, mailing houses to send you required reports and correspondence regarding the Fund and its Adviser, the Nicholas Company, Inc., and our dividend disbursing agent to process fund dividend checks. |

| * | With a party representing you, with your consent, such as your broker or lawyer. |

| * | When required by law, such as in response to a subpoena or other legal process. |

The Fund and its Adviser maintain policies and procedures to safeguard your non-public personal information. Access is restricted to employees who the Adviser determines need the information in order to perform their job duties. To guard your non-public personal information we maintain physical, electronic, and procedural safeguards that comply with federal standards.

In the event that you hold shares of the Fund with a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary would govern how your non-public personal information would be shared with non-affiliated third parties.

– 28 –

Nicholas Funds Services Offered

(unaudited)

| | |

| • | IRAs | |

| | • Traditional | • SIMPLE |

| | • Roth | • SEP |

| • | Coverdell Education Accounts |

| • | Automatic Investment Plan |

| • | Direct Deposit of Dividend and Capital Gain Distributions |

| • | Systematic Withdrawal Plan |

| • | Monthly Automatic Exchange between Funds |

| • | Telephone Purchase and Redemption |

| • | Telephone Exchange | |

| • | 24-hour Automated Account Information (800-544-6547) |

| • | 24-hour Internet Account Access (www.nicholasfunds.com) |

Please call a shareholder representative for further information on the above services or with any other questions you may have regarding the Nicholas Funds (800-544-6547).

– 29 –

Directors and Officers

DAVID O. NICHOLAS, President and Director

ROBERT H. BOCK, Director

TIMOTHY P. REILAND, Director

JAY H. ROBERTSON, Director

ALBERT O. NICHOLAS, Executive Vice President

DAVID L. JOHNSON, Executive Vice President

JEFFREY T. MAY, Senior Vice President, Secretary,

Treasurer and Chief Compliance Officer

LAWRENCE J. PAVELEC, Senior Vice President

CANDACE L. LESAK, Vice President

Investment Adviser

NICHOLAS COMPANY, INC.

Milwaukee, Wisconsin

www.nicholasfunds.com

414-276-0535 or 800-544-6547

Transfer Agent

U.S. BANCORP FUND SERVICES, LLC

Milwaukee, Wisconsin

414-276-0535 or 800-544-6547

Distributor

QUASAR DISTRIBUTORS, LLC

Milwaukee, Wisconsin

Custodian

U.S. BANK N.A.

Milwaukee, Wisconsin

Independent Registered Public Accounting Firm

DELOITTE & TOUCHE LLP

Milwaukee, Wisconsin

Counsel

MICHAEL BEST & FRIEDRICH LLP

Milwaukee, Wisconsin

This report is submitted for the information of shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Item 2. Code of Ethics.

Applicable only to annual reports.

Item 3. Audit Committee Financial Expert.

Applicable only to annual reports.

Item 4. Principal Accountant Fees and Services.

Applicable only to annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to this filing.

Item 6. Schedule of Investments.

The schedule of investments in securities of unaffiliated issuers is included as part of the report to shareholders filed under Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Applicable only to annual reports filed by closed-end funds.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Applicable only to annual reports filed by closed-end funds.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers.

Applicable only to closed-end funds.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable to this filing.

Item 11. Controls and Procedures.

The Fund's principal executive officer and principal financial officer have concluded that the Fund's disclosure controls and procedures are sufficient to ensure that information required to be disclosed by the Fund in this Form N-CSR was recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, based upon such officers' evaluation of these controls and procedures as of a date within 90 days of the filing date of the report. There were no significant changes or corrective actions with regard to significant deficiencies or material weaknesses in the Fund's internal controls or in other factors that could significantly affect the Fund's internal controls subsequent to the date of their evaluation.

Item 12. Exhibits.

(a)(1) Code of Ethics -- Any code of ethics, or amendments thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit.

Not applicable to this filing.

(a)(2) Certifications of Principal Executive Officer and Principal Financial Officer pursuant to Section 302 of the Sarbannes-Oxley Act of 2002, attached hereto as part of EX-99.CERT.

(a)(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more person.

Applicable only to closed-end funds.

(b) Certifications of Principal Executive Officer and Principal Financial Officer pursuant to Section 906 of the Sarbannes-Oxley Act of 2002, attached hereto as part of EX-99.906CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Nicholas High Income Fund, Inc.

By: /s/ David O. Nicholas

Name: David O. Nicholas

Title: Principal Executive Officer

Date: August 28, 2014

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ David O. Nicholas

Name: David O. Nicholas

Title: Principal Executive Officer

Date: August 28, 2014

By: /s/ Jeffrey T. May

Name: Jeffrey T. May

Title: Principal Financial Officer

Date: August 28, 2014