UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-643-9691

Date of fiscal year end: October 31, 2010

Date of reporting period: April 30, 2011

ITEM 1. REPORT TO SHAREHOLDERS

Semi-Annual Report

April 30, 2011

WELLS FARGO ADVANTAGE INTERNATIONAL STOCK FUNDS

| n | | Wells Fargo Advantage Asia Pacific Fund |

| n | | Wells Fargo Advantage Disciplined Global Equity Fund |

| n | | Wells Fargo Advantage Diversified International Fund |

| n | | Wells Fargo Advantage Emerging Markets Equity Fund |

| n | | Wells Fargo Advantage Global Opportunities Fund |

| n | | Wells Fargo Advantage International Equity Fund |

| n | | Wells Fargo Advantage Intrinsic World Equity Fund |

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at www.wellsfargo.com/advantagedelivery

Contents

The views expressed are as of April 30, 2011, and are those of the Fund managers. Any reference to a specific security in this report is not a recommendation to purchase or sell any specific security or adopt any investment strategy. The views are subject to change at any time in response to changing circumstances in the market and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally, or the Wells Fargo Advantage International Stock Funds.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

WELLS FARGO INVESTMENT HISTORY

| | |

| |

| 1932 | | Keystone creates one of the first mutual fund families. |

| |

| 1971 | | Wells Fargo & Company introduces one of the first institutional index funds. |

| |

| 1978 | | Wells Fargo applies Markowitz and Sharpe’s research on Modern Portfolio Theory to introduce one of the industry’s first Tactical Asset Allocation (TAA) models in institutional separately managed accounts. |

| |

| 1984 | | Wells Fargo Stagecoach Funds launches its first asset allocation fund. |

| |

| 1989 | | The Tactical Asset Allocation (TAA) Model is first applied to Wells Fargo’s asset allocation mutual funds. |

| |

| 1994 | | Wells Fargo introduces the LifePath Funds, one of the first suites of target date funds (now the Wells Fargo Advantage Dow Jones Target Date FundsSM ). |

| |

| 1996 | | Evergreen Investments and Keystone Funds merge. |

| |

| 1997 | | Wells Fargo launches Wells Fargo Advantage WealthBuilder PortfoliosSM, a fund-of-funds suite of products that includes the use of quantitative models to shift assets among investment styles. |

| |

| 1999 | | Norwest Advantage Funds and Stagecoach Funds are reorganized into Wells Fargo Funds after the merger of Norwest and Wells Fargo. |

| |

| 2002 | | Evergreen Retail and Evergreen Institutional companies form the umbrella asset management company, Evergreen Investments. |

| |

| 2005 | | The integration of Strong Funds with Wells Fargo Funds creates Wells Fargo Advantage Funds, resulting in one of the top 20 mutual fund companies in the United States. |

| |

| 2006 | | Wells Fargo Advantage Funds relaunches the target date product line as Wells Fargo Advantage Dow Jones Target Date Funds. |

| |

| 2010 | | The mergers and reorganizations of Evergreen and Wells Fargo Advantage mutual funds are completed, unifying the families under the brand of Wells Fargo Advantage Funds. |

Wells Fargo Advantage Funds®

Wells Fargo Advantage Funds skillfully guides institutions, financial advisors, and individuals through the investment terrain to help them reach their financial objectives. Everything we do on behalf of investors is backed by our unique combination of qualifications.

Strength

Our organization is built on the standards of integrity and service established by our parent company—Wells Fargo & Company—more than 150 years ago. And, because we’re part of a highly diversified financial enterprise, we offer the depth of resources to help investors succeed.

Expertise

Our multi-boutique model offers investors access to the independent thinking of premier investment managers that have been chosen for their time-tested strategies. While each team specializes in a specific investment strategy, collectively they provide investors a wide choice of distinct investment styles. Our dedication to investment excellence doesn’t end with our expertise in manager selection—risk management, analysis, and rigorous ongoing review seek to ensure each manager’s investment process remains consistent.

Partnership

Our collaborative approach is built around understanding the needs and goals of our clients. By adhering to core principles of sound judgment and steady guidance, we support you through every stage of the investment decision process.

Carefully consider the investment objectives, risks, charges, and expenses before investing. For a current prospectus for Wells Fargo Advantage Funds containing this and other information, visit wellsfargo.com/advantagefunds. Read it carefully before investing.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds®. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

The “Dow Jones Target Date Indexes” are a product of Dow Jones Indexes, a licensed trademark of CME Group Index Services LLC (“CME”). “Dow Jones” and “Dow Jones Target Date Indexes” are service marks of Dow Jones Trademark Holdings, LLC, and have been licensed for use for certain purposes by CME and sublicensed for use by Global Index Advisors, Inc., and Wells Fargo Funds Management, LLC. The Dow Jones Target Date Indexes are based in part on the Barclays Capital Bond Indexes, which are published by Barclays Capital Inc. The Wells Fargo Advantage Dow Jones Target Date Funds, based on the Dow Jones Target Date Indexes, are not sponsored, endorsed, sold, or promoted by Dow Jones, CME or Barclays Capital or any of their respective affiliates, and neither Dow Jones, CME nor Barclays Capital nor any of their respective affiliates makes any representation regarding the advisability of investing in such product(s) and/or about the quality, accuracy, and/or completeness of the Dow Jones Target Date Indexes or the Barclays Capital Bond Indexes. IN NO EVENT SHALL DOW JONES, CME, BARCLAYS CAPITAL, OR ANY OF THEIR LICENSORS HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, IN DIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Not part of the semi-annual report.

Wells Fargo Advantage Funds offers more than 120 mutual funds across a wide range of asset classes, representing over $241 billion in assets under management, as of April 30, 2011.

| | | | |

| Equity Funds | | | | |

Asia Pacific Fund | | Enterprise Fund† | | Opportunity Fund† |

C&B Large Cap Value Fund | | Equity Value Fund | | Precious Metals Fund |

C&B Mid Cap Value Fund | | Global Opportunities Fund | | Premier Large Company Growth Fund |

Capital Growth Fund | | Growth Fund | | Small Cap Growth Fund |

Classic Value Fund | | Growth Opportunities Fund | | Small Cap Opportunities Fund |

Common Stock Fund | | Health Care Fund | | Small Cap Value Fund |

Core Equity Fund | | Index Fund | | Small Company Growth Fund |

Disciplined Global Equity Fund | | International Equity Fund | | Small Company Value Fund |

Disciplined U.S. Core Fund | | International Value Fund | | Small/Mid Cap Core Fund |

Disciplined Value Fund | | Intrinsic Small Cap Value Fund | | Small/Mid Cap Value Fund |

Discovery Fund† | | Intrinsic Value Fund | | Social Sustainability Fund† |

Diversified Equity Fund | | Intrinsic World Equity Fund | | Special Mid Cap Value Fund |

Diversified International Fund | | Large Cap Core Fund | | Special Small Cap Value Fund |

Diversified Small Cap Fund | | Large Cap Growth Fund | | Specialized Technology Fund |

Emerging Growth Fund | | Large Company Value Fund | | Strategic Large Cap Growth Fund |

Emerging Markets Equity Fund | | Mid Cap Growth Fund | | Traditional Small Cap Growth Fund |

Endeavor Select Fund† | | Omega Growth Fund | | Utility and Telecommunications Fund |

| Bond Funds | | | | |

Adjustable Rate Government Fund | | Inflation-Protected Bond Fund | | Short-Term Bond Fund |

California Limited-Term Tax-Free Fund | | Intermediate Tax/AMT-Free Fund | | Short-Term High Yield Bond Fund |

California Tax-Free Fund | | International Bond Fund | | Short-Term Municipal Bond Fund |

Colorado Tax-Free Fund | | Minnesota Tax-Free Fund | | Strategic Municipal Bond Fund |

Government Securities Fund | | Municipal Bond Fund | | Total Return Bond Fund |

High Income Fund | | North Carolina Tax-Free Fund | | Ultra Short-Term Income Fund |

High Yield Bond Fund | | Pennsylvania Tax-Free Fund | | Ultra Short-Term Municipal Income Fund |

Income Plus Fund | | Short Duration Government Bond Fund | | Wisconsin Tax-Free Fund |

| Asset Allocation Funds | | | | |

Asset Allocation Fund | | WealthBuilder Equity Portfolio† | | Target 2020 Fund† |

Conservative Allocation Fund | | WealthBuilder Growth Allocation Portfolio† | | Target 2025 Fund† |

Diversified Capital Builder Fund | | WealthBuilder Growth Balanced Portfolio† | | Target 2030 Fund† |

Diversified Income Builder Fund | | WealthBuilder Moderate Balanced Portfolio† | | Target 2035 Fund† |

Growth Balanced Fund | | WealthBuilder Tactical Equity Portfolio† | | Target 2040 Fund† |

Index Asset Allocation Fund | | Target Today Fund† | | Target 2045 Fund† |

Moderate Balanced Fund | | Target 2010 Fund† | | Target 2050 Fund† |

WealthBuilder Conservative Allocation Portfolio† | | Target 2015 Fund† | | |

| Money Market Funds | | | | |

100% Treasury Money Market Fund | | Minnesota Money Market Fund | | New Jersey Municipal Money Market Fund |

California Municipal Money Market Fund | | Money Market Fund | | New York Municipal Money Market Fund |

Cash Investment Money Market Fund | | Municipal Cash Management Money Market Fund | | Pennsylvania Municipal Money Market Fund |

Government Money Market Fund | | Municipal Money Market Fund | | Prime Investment Money Market Fund |

Heritage Money Market Fund† | | National Tax-Free Money Market Fund | | Treasury Plus Money Market Fund |

| Variable Trust Funds1 | | | | |

VT Core Equity Fund | | VT Intrinsic Value Fund | | VT Small Cap Value Fund |

VT Discovery Fund† | | VT Omega Growth Fund | | VT Total Return Bond Fund |

VT Index Asset Allocation Fund | | VT Opportunity Fund† | | |

VT International Equity Fund | | VT Small Cap Growth Fund | | |

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Advantage Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

| 1. | The Variable Trust Funds are generally available only through insurance company variable contracts. |

| † | In this report, the Wells Fargo Advantage Discovery FundSM, Wells Fargo Advantage Endeavor Select FundSM, Wells Fargo Advantage Enterprise FundSM, Wells Fargo Advantage Opportunity FundSM, Wells Fargo Advantage Social Sustainability FundSM, Wells Fargo Advantage WealthBuilder Conservative Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Equity PortfolioSM , Wells Fargo Advantage WealthBuilder Growth Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Moderate Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Tactical Equity PortfolioSM , Wells Fargo Advantage Dow Jones Target Today FundSM, Wells Fargo Advantage Dow Jones Target 2010 FundSM, Wells Fargo Advantage Dow Jones Target 2015 FundSM, Wells Fargo Advantage Dow Jones Target 2020 FundSM, Wells Fargo Advantage Dow Jones Target 2025 FundSM, Wells Fargo Advantage Dow Jones Target 2030 FundSM , Wells Fargo Advantage Dow Jones Target 2035 FundSM, Wells Fargo Advantage Dow Jones Target 2040 FundSM, Wells Fargo Advantage Dow Jones Target 2045 FundSM, Wells Fargo Advantage Dow Jones Target 2050 FundSM, Wells Fargo Advantage Heritage Money Market FundSM, Wells Fargo Advantage VT Discovery FundSM, and Wells Fargo Advantage VT Opportunity FundSM are referred to as the Discovery Fund, Endeavor Select Fund, Enterprise Fund, Opportunity Fund, Social Sustainability Fund, WealthBuilder Conservative Allocation Portfolio, WealthBuilder Equity Portfolio, WealthBuilder Growth Allocation Portfolio, WealthBuilder Growth Balanced Portfolio, WealthBuilder Moderate Balanced Portfolio, WealthBuilder Tactical Equity Portfolio, Target Today Fund, Target 2010 Fund, Target 2015 Fund, Target 2020 Fund, Target 2025 Fund, Target 2030 Fund, Target 2035 Fund, Target 2040 Fund, Target 2045 Fund, Target 2050 Fund, Heritage Money Market Fund, VT Discovery Fund, and VT Opportunity Fund, respectively. |

Not part of the semi-annual report.

| | | | |

| 2 | | Wells Fargo Advantage International Stock Funds | | Letter to Shareholders |

Karla M. Rabusch,

President

Wells Fargo Advantage Funds

There certainly were a rash of geopolitical and geological issues that provided headwinds, but overall, many areas across both the global equity and bond markets showed resilience and posted solid annual returns.

Dear Valued Shareholder,

We are pleased to provide you with this semi-annual report for the Wells Fargo Advantage International Stock Funds for the six-month period that ended April 30, 2011. After a series of extraordinary financial and economic events that affected the financial markets in the United States and throughout the world—dating back to the beginning of the financial crisis in 2008—it seemed the global economy continued to move toward a more sustainable recovery throughout the period. There certainly were a rash of geopolitical and geological issues that provided headwinds, but overall, many areas across both the global equity and bond markets showed resilience and posted solid annual returns, suggesting that the most underlying fundamentals of the economy continue to strengthen.

The global economic recovery moved toward expansion.

The global economic recovery that began in mid-2009, especially within the developed countries, gained further momentum throughout the period, particularly toward the end of 2010. For example, within the U.S., gross domestic product (GDP) grew at an annualized rate of 3.1% in the fourth quarter of 2010—capping a streak of six consecutive quarters of positive GDP growth—and 2.8% for the full year. Although the path of recovery within the U.S. has been uneven at times and growth remains subpar compared with previous recoveries, the general consensus among economists is that the economy will likely continue to move toward a sustainable expansion.

Jobs and housing remained troublesome.

By the end of the reporting period, the unemployment rate in the U.S. stood at 9.0%, down from 9.8% a year earlier but still notably higher than historical averages. Unfortunately, the drop may be more attributable to a decline in the labor force than to a meaningful uptick in hiring. In fact, employers added just 1.1 million jobs during the entire 2010 calendar year, below the historical average of 1.4 million jobs created each year over the past 80 years, suggesting that the improving economy has yet to translate into widespread hiring. Meanwhile, the beleaguered housing market was an ongoing source of concern, despite some tentative late-year signs of stabilization. That said, persistent weakness in the labor and housing markets bears close watching in the months ahead.

Other economic data in the U.S. was more encouraging, reflecting greater confidence in the sustainability of the expansion on the part of both consumers and businesses. Retail sales came in strong at certain points during the period, including the critical holiday shopping season, and industrial production and new orders have picked up. Although still reluctant to hire, businesses have gradually increased spending in other areas, such as equipment and technology. Core inflation, which excludes volatile food and energy prices, remained benign.

The Federal Reserve continued to do its part.

With inflation subdued, the Federal Reserve (Fed) held its target range for the federal funds rate—a proxy for short-term interest rates—steady at 0.00% to 0.25%. On April 27, 2011, in its final statement of the six-month period, the Fed noted that economic recovery “is proceeding at a moderate pace,” while the employment situation is “improving gradually.” With regard to inflation, the Fed noted that the rate of inflation increased but that “longer-term inflation

| | | | | | |

| Letter to Shareholders | | Wells Fargo Advantage International Stock Funds | | | 3 | |

expectations have remained stable and measures of underlying inflation are still subdued.” As a result, the Fed indicated that it intends to keep short-term rates at historically low levels for as long as necessary to ensure a sustainable recovery and expansion.

The Fed also stated that “to promote a stronger pace of economic recovery,” it plans to proceed with other stimulus measures, including its second round of quantitative easing (QE2)—a plan to purchase $600 billion in long-term Treasury securities by mid-2011. The launch of QE2 in the third quarter of 2010 marked a turning point for the equity markets in that it ushered in a favorable shift in investor sentiment. Largely, investors interpreted the plan as further evidence of the Fed’s commitment to avoiding deflation and spurring economic growth.

Central banks focused on balancing the need for sustainable growth with ongoing sovereign debt concerns.

The coordinated efforts of the developed markets’ central banks to quell the worldwide financial crisis were effective in restoring order to the capital markets, and the stimulus packages provided a significant underpinning to economies, helping to restore them to growth. As a result, throughout the six-month period, stock markets in the United States and worldwide rebounded dramatically from their March 2009 lows.

While many emerging markets were not as affected by the same problems as the U.S. and eurozone economies, several emerging economies did face headwinds of their own, such as higher levels inflation and tightening monetary policies. This dynamic was most evident in China and India, which were among the poorer performing countries within the index. The best performing countries within the emerging markets index included Russia, which benefitted from rising energy prices; Taiwan and Korea, whose performance was driven by strong export activity; and South Africa, which was supported by rising commodity prices throughout the period.

After working through the eurozone sovereign debt crisis, equities rallied for the rest of 2010.

After the global equity markets stumbled during the late spring of 2010, primarily due to concerns that the global economic recovery would slide back into recession, but also in part due to the Greek sovereign debt crisis, the markets rebounded during the summer and fall of 2010. Part of the explanation for the rally lies in the precarious nature of the markets after the second quarter. By the start of the third quarter, investors had already priced in the potential effects of the sovereign debt crisis. The repricing reduced stock valuations to extremely attractive levels. When combined with earnings yields that were better than what investors were getting in the bond market, the lowered valuations were enough to convince many investors to add more risk to their portfolios. Stocks in the higher-yielding telecommunication services sector advanced due to their ability to balance risk and potential yield, driving investors back into the markets.

The coordinated efforts of the developed markets’ central banks to quell the worldwide financial crisis were effective in restoring order to the capital markets, and the stimulus packages provided a significant underpinning to economies, helping to restore them to growth.

| | | | |

| 4 | | Wells Fargo Advantage International Stock Funds | | Letter to Shareholders |

During the last three months of 2010, investors continued to struggle with a number of macroeconomic factors, most notably the continuing sovereign debt crisis in Europe and rising inflation in the emerging markets. On the plus side, the U.S. economy continued to show signs of improvement. The reaffirmation of quantitative easing by the Fed initially caused the value of the U.S. dollar to decline relative to other major currencies; however, it stabilized during the final month of the year.

Entering the new year, central banks attempted to balance growth with inflation pressures.

2011 began moderately well, building on the momentum established during the fourth quarter of 2010. Investors focused on signs of sustainable economic growth and low volatility in many countries. In step with stronger economic conditions, corporate earnings continued to improve, further bolstering investor confidence. However, during the period, investors shifted their focus away from these developments to the political unrest in the Middle East and the tragedy affecting Japan, which prompted concerns about the impact on oil prices and the supply chain. In response, investors began to rotate out of small-cap stocks and growth stocks and into larger-cap value stocks that they perceived as offering lower levels of risk.

In the developed markets, Europe and the U.S. are good examples of how many countries are attempting to balance the effects of higher inflation with the need to firmly establish sustainable economic expansion. These governments believe that this can best be achieved through an exceptionally accommodative monetary policy. In an effort to stave off the effects of rising inflation, China, India, and Brazil have already been tightening their monetary policies through rate increases and a more restrictive approach to money supply. It is possible that if the rate of inflation in those emerging markets countries begins to stabilize or even subside, particularly in China, these countries may be nearing the end of their monetary tightening cycle.

Concerns about sovereign debt re-emerged across the European peripheral countries, especially as Portugal became the third country to seek a bailout from the European Union and the International Monetary Fund. In addition, Ireland’s four largest banks failed another round of stress tests in March, forcing them to seek another 24 billion euros from public and private entities. Nevertheless, in spite of these renewed challenges, the peripheral countries, led by Greece, Italy, and Spain, had remarkable stock performance to start 2011. They outperformed their larger, more developed European neighbors, such as Germany and the United Kingdom. Last year, when the sovereign debt issue first came to the forefront, it brought along with it a high level of investor anxiety, which translated into higher volatility. However, after the bailouts of Greece and Ireland, investors may have become comfortable with how policymakers have been able to handle these problems and mitigate the risks of contagion.

A broadly diversified portfolio gives exposure to many areas of potential recovery.

As global economies continue to move toward more sustainable growth and manageable levels of inflation, there can still be moments of volatility. These periods can present both challenges and opportunities, and experience has

| | | | | | |

| Letter to Shareholders | | Wells Fargo Advantage International Stock Funds | | | 5 | |

taught us that maintaining a long-term investment strategy based on individual goals and risk tolerance can be an effective way to plan for the future.

The Wells Fargo Advantage International Stock Funds provide investment solutions across a broad range of asset classes and investment styles, giving you an opportunity to create a diversified investment portfolio. While diversification may not prevent losses in a downturn, it may help to reduce them and provide you with one way of managing risk. And, in a potential upturn, diversification can give you exposure to many areas of economic recovery.

Thank you for choosing Wells Fargo Advantage Funds. We appreciate your confidence in us. Through each market cycle, we are committed to helping you meet your financial needs. If you have any questions about your investment, please contact your investment professional or call us at 1-800-222-8222. You may also visit our website at www.wellsfargo.com/advantagefunds.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

| | | | |

| 6 | | Wells Fargo Advantage International Stock Funds | | Performance Highlights |

Wells Fargo Advantage Asia Pacific Fund

INVESTMENT OBJECTIVE

The Fund seeks long-term capital appreciation

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Wells Capital Management Incorporated

PORTFOLIO MANAGER

Anthony L.T. Cragg

FUND INCEPTION

December 31, 1993

| | | | |

TEN LARGEST EQUITY HOLDINGS1 (AS OF APRIL 30, 2011) | |

Newcrest Mining Limited | | | 2.67% | |

Mitsubishi UFJ Financial Group Incorporated | | | 2.01% | |

Industrial & Commercial Bank of China Class H | | | 2.01% | |

Nippon Telegraph & Telephone Corporation | | | 1.99% | |

Sumitomo Mitsui Financial Group Incorporated | | | 1.98% | |

Toray Industries Incorporated | | | 1.97% | |

China Construction Bank | | | 1.97% | |

Mitsubishi Corporation | | | 1.96% | |

Mitsubishi Electric Corporation | | | 1.80% | |

Mitsui Fudosan Company Limited | | | 1.73% | |

| | |

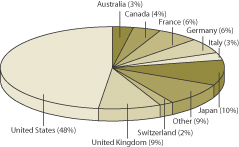

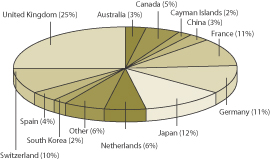

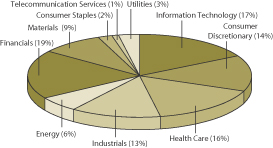

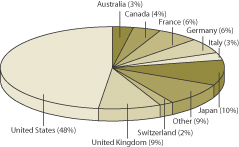

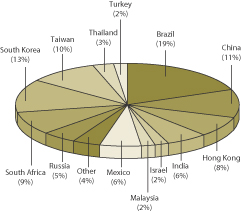

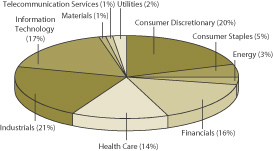

COUNTRY ALLOCATION2 (AS OF APRIL 30, 2011) |

|

|

| 1. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the dates specified. |

| 2. | Country allocation is subject to change and is calculated based on the total investments of the Fund, excluding cash and cash equivalents. |

| | | | | | |

| Performance Highlights | | Wells Fargo Advantage International Stock Funds | | | 7 | |

Wells Fargo Advantage Asia Pacific Fund (continued)

AVERAGE ANNUAL TOTAL RETURN3 (%) (AS OF APRIL 30, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Including Sales Charge | | | Excluding Sales Charge | | | Expense Ratios4 | |

| | | Inception Date | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | Gross | | | Net5 | |

Class A (WFAAX) | | | 07/31/2007 | | | | (0.49 | ) | | | 10.37 | | | | 0.06 | | | | 9.87 | | | | 5.59 | | | | 17.13 | | | | 1.26 | | | | 10.53 | | | | 1.92% | | | | 1.62% | |

Class C (WFCAX) | | | 07/31/2007 | | | | 4.16 | | | | 15.12 | | | | 0.47 | | | | 9.79 | | | | 5.16 | | | | 16.12 | | | | 0.47 | | | | 9.79 | | | | 2.67% | | | | 2.37% | |

Administrator Class (WFADX) | | | 07/30/2010 | | | | | | | | | | | | | | | | | | | | 5.73 | | | | 17.29 | | | | 1.29 | | | | 10.55 | | | | 1.76% | | | | 1.42% | |

Institutional Class (WFPIX) | | | 07/30/2010 | | | | | | | | | | | | | | | | | | | | 5.77 | | | | 17.33 | | | | 1.29 | | | | 10.56 | | | | 1.49% | | | | 1.27% | |

Investor Class (SASPX) | | | 12/31/1993 | | | | | | | | | | | | | | | | | | | | 5.62 | | | | 17.05 | | | | 1.19 | | | | 10.50 | | | | 1.99% | | | | 1.67% | |

MSCI All Country Asia Pacific Net Index6 | | | | | | | | | | | | | | | | | | | | | | | 8.93 | | | | 13.49 | | | | 2.53 | | | | 6.81 | | | | | | | | | |

| * | Returns for periods of less than one year are not annualized. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted. Current month-end performance is available on the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class, Institutional Class and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to regional risk, and smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

| 3. | Historical performance shown for Class A shares prior to their inception reflects the performance of the Investor Class shares, and includes the higher expenses applicable to the Investor Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for Class C shares prior to their inception reflects the performance of the Investor Class shares, adjusted to reflect the higher expenses applicable to Class C shares. Historical performance shown for the Administrator and Institutional Class shares prior to their inception reflects the performance of the Class A shares, and includes the higher expenses applicable to the Class A shares. If these expenses had not been included, returns would be higher. |

| 4. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 5. | The Adviser has committed through February 29, 2012 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at 1.60% for Class A, 2.35% for Class C, 1.40% for Administrator Class, 1.25% for Institutional Class and 1.65% for Investor Class. Without this cap, the Fund’s returns would have been lower. |

| 6. | The Morgan Stanley Capital International All Country Asia Pacific (MSCI AC Asia Pacific) Net Index is a total return, capitalization-weighted index that measures the performance of stock markets in 15 Pacific region countries, including Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, New Zealand, Pakistan, the Philippines, Singapore, Sri Lanka, Taiwan and Thailand. You cannot invest directly in an index. |

| | | | |

| 8 | | Wells Fargo Advantage International Stock Funds | | Performance Highlights |

Wells Fargo Advantage Disiplined Global Equity Fund

INVESTMENT OBJECTIVE

The Fund seeks long-term capital appreciation

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Wells Capital Management Incorporated

PORTFOLIO MANAGER

Amit Chandra PhD., CFA

(Effective March 1, 2011)

FUND INCEPTION

November 1, 1995

| | | | |

TEN LARGEST EQUITY HOLDINGS1 (AS OF APRIL 30, 2011) | |

International Business Machines Corporation | | | 1.53% | |

Exxon Mobil Corporation | | | 1.52% | |

Chevron Corporation | | | 1.45% | |

BHP Bilton plc | | | 1.41% | |

Microsoft Corporation | | | 1.30% | |

Oracle Corporation | | | 1.15% | |

Vodafone Group plc | | | 1.14% | |

Royal Dutch Shell plc Class B | | | 1.11% | |

Sanofi-Aventis SA | | | 1.00% | |

BASF SE | | | 0.98% | |

| | |

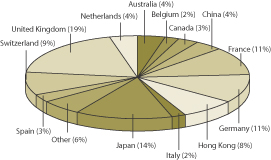

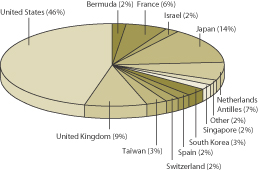

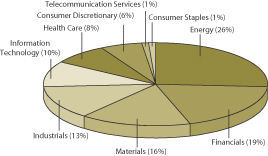

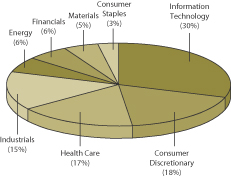

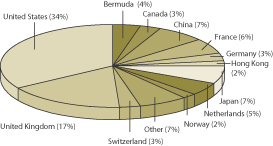

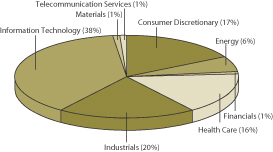

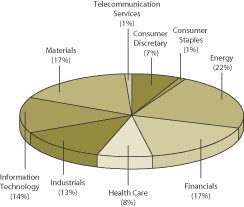

COUNTRY ALLOCATION2 (AS OF APRIL 30, 2011) |

|

|

| 1. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the dates specified. |

| 2. | Country allocation is subject to change and is calculated based on the total investments of the Fund, excluding cash and cash equivalents. |

| | | | | | |

| Performance Highlights | | Wells Fargo Advantage International Stock Funds | | | 9 | |

Wells Fargo Advantage Disiplined Global Equity Fund (continued)

AVERAGE ANNUAL TOTAL RETURN3 (%) (AS OF APRIL 30, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Including Sales Charge | | | Excluding Sales Charge | | | Expense Ratios4 | |

| | | Inception Date | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | Gross | | | Net5 | |

Class A (EAGLX) | | | 06/03/1996 | | | | 8.77 | | | | 11.86 | | | | 0.89 | | | | 1.86 | | | | 15.41 | | | | 18.69 | | | | 2.10 | | | | 2.47 | | | | 1.61% | | | | 1.40% | |

Class C (ECGLX) | | | 06/03/1996 | | | | 13.98 | | | | 16.74 | | | | 1.33 | | | | 1.72 | | | | 14.98 | | | | 17.74 | | | | 1.33 | | | | 1.72 | | | | 2.36% | | | | 2.15% | |

Administrator Class (EYGLX) | | | 11/01/1995 | | | | | | | | | | | | | | | | | | | | 15.52 | | | | 18.97 | | | | 2.36 | | | | 2.74 | | | | 1.45% | | | | 1.15% | |

Institutional Class (EIGLX) | | | 07/30/2010 | | | | | | | | | | | | | | | | | | | | 15.65 | | | | 19.19 | | | | 2.40 | | | | 2.76 | | | | 1.18% | | | | 0.95% | |

MSCI World Free Index (Net)6 | | | | | | | | | | | | | | | | | | | | | | | 14.75 | | | | 18.25 | | | | 2.32 | | | | 3.90 | | | | | | | | | |

| * | Returns for periods of less than one year are not annualized. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted. Current month-end performance is available on the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to country concentration risk and smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

| 3. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for all classes of the Fund prior to July 19, 2010 is based on the performance of the Fund’s predecessor, Evergreen Global Large Cap Equity Fund. |

| 4. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 5. | The Adviser has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amount shown above. Without this cap, the Fund’s returns would have been lower. |

| 6. | The Morgan Stanley Capital International World Free Index (Net) (MSCI World Free Index (Net)) is an unmanaged market capitalization index designed to measure the performance of securities within developed equity markets. You cannot invest directly in an index. |

| | | | |

| 10 | | Wells Fargo Advantage International Stock Funds | | Performance Highlights |

Wells Fargo Advantage Diversified International Fund

INVESTMENT OBJECTIVE

The Fund seeks long-term capital appreciation

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISERS

Artisan Partners Limited Partnership

LSV Asset Management

Wells Capital Management Incorporated

PORTFOLIO MANAGERS

Francis X. Claró, CFA

Josef Lakonishok

Puneet Mansharamani, CFA

Menno Vermeulen, CFA

Mark L. Yockey, CFA

FUND INCEPTION

September 24, 1997

| | | | |

TEN LARGEST EQUITY HOLDINGS1 (AS OF APRIL 30, 2011) | |

Nestle SA | | | 1.65% | |

Sands China Limited | | | 1.48% | |

Bayer AG | | | 1.47% | |

Daimler AG | | | 1.29% | |

BASF SE | | | 1.16% | |

Siemens AG | | | 1.16% | |

Pernod-Ricard | | | 1.10% | |

WPP plc | | | 1.06% | |

Vodafone Group plc | | | 1.04% | |

ING Group NV | | | 1.04% | |

| | |

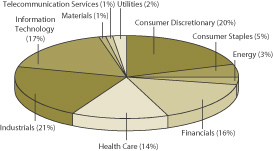

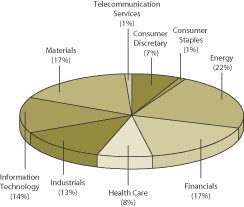

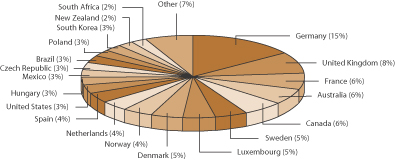

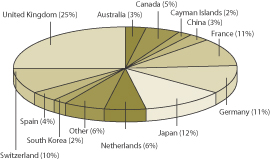

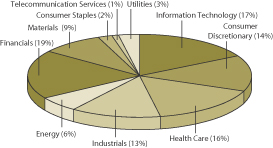

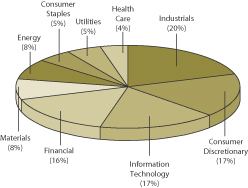

COUNTRY ALLOCATION2 (AS OF APRIL 30, 2011) |

|

|

| 1. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the dates specified |

| 2. | Country allocation is subject to change and is calculated based on the total investments of the Fund, excluding cash and cash equivalents. |

| | | | | | |

| Performance Highlights | | Wells Fargo Advantage International Stock Funds | | | 11 | |

Wells Fargo Advantage Diversified International Fund (continued)

AVERAGE ANNUAL TOTAL RETURN3 (%) (AS OF APRIL 30, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Including Sales Charge | | | Excluding Sales Charge | | | Expense Ratios4 | |

| | | Inception Date | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | Gross | | | Net5 | |

Class A (SILAX) | | | 09/24/1997 | | | | 6.62 | | | | 14.82 | | | | (0.90 | ) | | | 1.73 | | | | 13.15 | | | | 21.79 | | | | 0.29 | | | | 2.34 | | | | 1.54% | | | | 1.41% | |

Class B (SILBX)** | | | 09/24/1997 | | | | 7.63 | | | | 15.82 | | | | (0.86 | ) | | | 1.77 | | | | 12.63 | | | | 20.82 | | | | (0.44 | ) | | | 1.77 | | | | 2.29% | | | | 2.16% | |

Class C (WFECX) | | | 04/01/1998 | | | | 11.67 | | | | 19.86 | | | | (0.41 | ) | | | 1.57 | | | | 12.67 | | | | 20.86 | | | | (0.41 | ) | | | 1.57 | | | | 2.29% | | | | 2.16% | |

Administrator Class (WFIEX) | | | 11/08/1999 | | | | | | | | | | | | | | | | | | | | 13.23 | | | | 22.01 | | | | 0.51 | | | | 2.55 | | | | 1.38% | | | | 1.25% | |

Institutional Class (WFISX) | | | 08/31/2006 | | | | | | | | | | | | | | | | | | | | 13.36 | | | | 22.27 | | | | 0.72 | | | | 2.66 | | | | 1.11% | | | | 0.99% | |

Investor Class (WIEVX) | | | 07/18/2008 | | | | | | | | | | | | | | | | | | | | 13.05 | | | | 21.71 | | | | 0.28 | | | | 1.96 | | | | 1.61% | | | | 1.46% | |

MSCI EAFE® Net Index6 | | | | | | | | | | | | | | | | | | | | | | | 12.71 | | | | 19.18 | | | | 1.54 | | | | 5.29 | | | | | | | | | |

| * | Returns for periods of less than one year are not annualized. |

| ** | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted. Current month-end performance is available on the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class, Institutional Class and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

| 3. | Historical performance shown for the Investor Class shares prior to their inception reflects the performance of Class A shares, adjusted to reflect the higher expenses applicable to the Investor Class shares. Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns would be higher. |

| 4. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 5. | The Adviser has committed through February 29, 2012 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amount shown above. Without this cap, the Fund’s returns would have been lower. |

| 6. | The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Net Index is an unmanaged group of securities widely regarded by investors to be representations of the stock markets of Europe, Australasia, and the Far East. You cannot invest directly in an index. |

| | | | |

| 12 | | Wells Fargo Advantage International Stock Funds | | Performance Highlights |

Wells Fargo Advantage Emerging Markets Equity Fund

INVESTMENT OBJECTIVE

The Fund seeks long-term capital appreciation

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Wells Capital Management Incorporated

PORTFOLIO MANAGER

Yi (Jerry) Zhang, PhD, CFA

FUND INCEPTION

September 6, 1994

| | | | |

TEN LARGEST EQUITY HOLDINGS1

(AS OF APRIL 30, 2011) | | | |

China Mobile Limited ADR | | | 3.50% | |

Sina Corporation | | | 3.41% | |

Petroleo Brasileiro SA ADR | | | 3.28% | |

Samsung Electronics Company Limited | | | 2.44% | |

Grupo Televisa SA ADR | | | 2.15% | |

KT&G Corporation | | | 2.10% | |

Taiwan Semiconductor Manufacturing Company Limited ADR | | | 2.00% | |

KT Corporation ADR | | | 1.99% | |

Banco Bradesco SA ADR | | | 1.68% | |

ICICI Bank Limited ADR | | | 1.47% | |

| | |

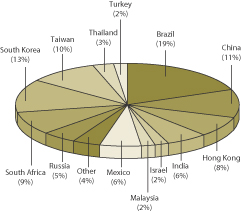

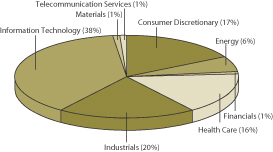

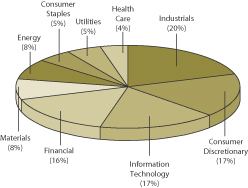

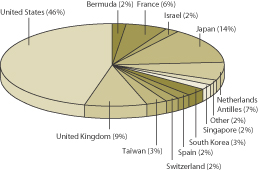

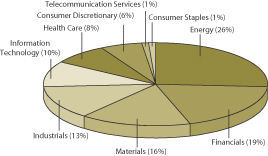

COUNTRY ALLOCATION2

(AS OF APRIL 30, 2011) | | |

|

|

| 1. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the dates specified |

| 2. | Country allocation is subject to change and is calculated based on the total investments of the Fund, excluding cash and cash equivalents. |

| | | | | | |

| Performance Highlights | | Wells Fargo Advantage International Stock Funds | | | 13 | |

Wells Fargo Advantage Emerging Markets Equity Fund (continued)

AVERAGE ANNUAL TOTAL RETURN3 (%) (AS OF APRIL 30, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Including Sales Charge | | | Excluding Sales Charge | | | Expense Ratios4 | |

| | | Inception Date | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | Gross | | | Net5 | |

Class A (EMGAX) | | | 09/06/1994 | | | | 3.71 | | | | 17.02 | | | | 10.65 | | | | 17.52 | | | | 10.03 | | | | 24.15 | | | | 11.98 | | | | 18.21 | | | | 1.84% | | | | 1.82% | |

Class B (EMGBX)** | | | 09/06/1994 | | | | 4.62 | | | | 18.24 | | | | 10.89 | | | | 17.65 | | | | 9.62 | | | | 23.24 | | | | 11.15 | | | | 17.65 | | | | 2.59% | | | | 2.57% | |

Class C (EMGCX) | | | 09/06/1994 | | | | 8.64 | | | | 22.23 | | | | 11.14 | | | | 17.36 | | | | 9.64 | | | | 23.23 | | | | 11.14 | | | | 17.36 | | | | 2.59% | | | | 2.57% | |

Administrator Class (EMGYX) | | | 09/06/1994 | | | | | | | | | | | | | | | | | | | | 10.13 | | | | 24.39 | | | | 12.25 | | | | 18.55 | | | | 1.68% | | | | 1.61% | |

Institutional Class (EMGNX) | | | 07/30/2010 | | | | | | | | | | | | | | | | | | | | 10.28 | | | | 24.73 | | | | 12.31 | | | | 18.58 | | | | 1.41% | | | | 1.31% | |

MSCI Emerging Markets Net Index6 | | | | | | | | | | | | | | | | | | | | | | | 9.84 | | | | 21.00 | | | | 10.17 | | | | 16.92 | | | | | | | | | |

| * | Returns for periods of less than one year are not annualized. |

| ** | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted. Current month-end performance is available on the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to regional risk and smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

| 3. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for all classes of the Fund prior to July 19, 2010 is based on the performance of the Fund’s predecessor, Evergreen Emerging Markets Growth Fund. |

| 4. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 5. | The Adviser has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at 1.81% for Class A, 2.56% for Class B, 2.56% for Class C, 1.60% for Administrator Class and 1.30% for Institutional Class. Without this cap, the Fund’s returns would have been lower. |

| 6. | The Morgan Stanley Capital International Emerging Markets (MSCI Emerging Markets) Net Index is a free float-adjusted market capitalization index designed to measure the equity market performance in the global emerging markets. The index is currently comprised of 25 emerging market country indices. You cannot invest directly in an index. |

| | | | |

| 14 | | Wells Fargo Advantage International Stock Funds | | Performance Highlights |

Wells Fargo Advantage Global Opportunities Fund

INVESTMENT OBJECTIVE

The Fund seeks long-term capital appreciation

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Wells Capital Management Incorporated

PORTFOLIO MANAGERS

Francis X. Claró, CFA

James M. Tringas, CFA

FUND INCEPTION

March 16, 1988

| | | | |

TEN LARGEST EQUITY HOLDINGS1

(AS OF APRIL 30, 2011) | | | |

51job Incorporated ADR | | | 2.72% | |

Ashtead Group plc | | | 2.48% | |

USG People NV | | | 2.07% | |

Persimmon plc | | | 1.63% | |

Bovis Homes Group plc | | | 1.50% | |

Travis Perkins plc | | | 1.38% | |

Isuzu Motors Limited | | | 1.36% | |

Dice Holdings Incorporated | | | 1.34% | |

Pandora AS | | | 1.29% | |

Sumitomo Heavy Industries Limited | | | 1.21% | |

| | |

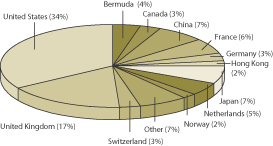

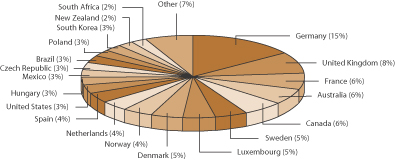

COUNTRY ALLOCATION2

(AS OF APRIL 30, 2011) | | |

|

|

| 1. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the dates specified |

| 2. | Country allocation is subject to change and is calculated based on the total investments of the Fund, excluding cash and cash equivalents. |

| | | | | | |

| Performance Highlights | | Wells Fargo Advantage International Stock Funds | | | 15 | |

Wells Fargo Advantage Global Opportunities Fund (continued)

AVERAGE ANNUAL TOTAL RETURN3 (%) (AS OF APRIL 30, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Including Sales Charge | | | Excluding Sales Charge | | | Expense Ratios4 | |

| | | Inception Date | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | Gross | | | Net5 | |

Class A (EKGAX) | | | 03/16/1988 | | | | 12.00 | | | | 18.89 | | | | 4.23 | | | | 9.75 | | | | 18.83 | | | | 26.15 | | | | 5.47 | | | | 10.41 | | | | 1.63% | | | | 1.59% | |

Class B (EKGBX)** | | | 02/01/1993 | | | | 13.36 | | | | 20.17 | | | | 4.35 | | | | 9.84 | | | | 18.36 | | | | 25.17 | | | | 4.68 | | | | 9.84 | | | | 2.38% | | | | 2.34% | |

Class C (EKGCX) | | | 02/01/1993 | | | | 17.38 | | | | 24.15 | | | | 4.69 | | | | 9.60 | | | | 18.38 | | | | 25.15 | | | | 4.69 | | | | 9.60 | | | | 2.38% | | | | 2.34% | |

Administrator Class (EKGYX) | | | 01/13/1997 | | | | | | | | | | | | | | | | | | | | 18.94 | | | | 26.43 | | | | 5.73 | | | | 10.67 | | | | 1.47% | | | | 1.41% | |

Institutional Class (EKGIX) | | | 07/30/2010 | | | | | | | | | | | | | | | | | | | | 19.07 | | | | 26.68 | | | | 5.78 | | | | 10.70 | | | | 1.20% | | | | 1.16% | |

S&P Developed SmallCap Index6 | | | | | | | | | | | | | | | | | | | | | | | 20.69 | | | | 25.15 | | | | 4.20 | | | | 9.44 | | | | | | | | | |

| * | Returns for periods of less than one year are not annualized. |

| ** | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted. Current month-end performance is available on the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please keep in mind that high double-digit returns were primarily achieved during favorable market conditions. You should not expect that such favorable returns can be consistently achieved. A Fund’s performance, especially for very short time periods, should not be the sole factor in making your investment decision.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to country concentration risk, regional risk and smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

| 3. | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for all classes of the Fund prior to July 19, 2010 is based on the performance of the Fund’s predecessor, Evergreen Global Opportunities Fund. |

| 4. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 5. | The Adviser has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at 1.58% for Class A, 2.33% for Class B, 2.33% for Class C, 1.40% for Administrator Class and 1.15% for Institutional Class. Without this cap, the Fund’s returns would have been lower. |

| 6. | The S&P Developed SmallCap Index is a float-adjusted market capitalization index designed to measure the equity market performance of small capitalization companies located in developed markets. The index is comprised of companies within the bottom 15% of the cumulative market capitalization in developed markets. The index covers all publicly listed equities with float-adjusted market values of US $100 million or more and annual dollar value traded of at least US $50 million in all included countries. You cannot invest directly in an index. |

| | | | |

| 16 | | Wells Fargo Advantage International Stock Funds | | Performance Highlights |

Wells Fargo Advantage International Equity Fund

INVESTMENT OBJECTIVE

The Fund seeks long-term capital appreciation

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Wells Capital Management Incorporated

PORTFOLIO MANAGER

Francis X. Claró, CFA

FUND INCEPTION

September 6, 1979

| | | | |

TEN LARGEST EQUITY HOLDINGS1

(AS OF APRIL 30, 2011) | | | |

Sina Corporation | | | 1.83% | |

Toyota Motor Corporation | | | 1.82% | |

HSBC Holdings plc | | | 1.77% | |

Nestle SA | | | 1.77% | |

Vodafone Group plc | | | 1.74% | |

BHP Billiton plc | | | 1.67% | |

Randstad Holdings NV | | | 1.59% | |

Royal Dutch Shell plc Class A | | | 1.57% | |

Rio Tinto plc | | | 1.57% | |

Repsol YPF SA | | | 1.51% | |

| | |

COUNTRY ALLOCATION2

(AS OF APRIL 30, 2011) | | |

|

|

| 1. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the dates specified |

| 2. | Country allocation is subject to change and is calculated based on the total investments of the Fund, excluding cash and cash equivalents. |

| | | | | | |

| Performance Highlights | | Wells Fargo Advantage International Stock Funds | | | 17 | |

Wells Fargo Advantage International Equity Fund (continued)

AVERAGE ANNUAL TOTAL RETURN3 (%) (AS OF APRIL 30, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Including Sales Charge | | | Excluding Sales Charge | | | Expense Ratios4 | |

| | | Inception Date | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | Gross | | | Net5 | |

Class A (WFEAX) | | | 01/20/1998 | | | | 7.93 | | | | 15.26 | | | | (0.34 | ) | | | 5.01 | | | | 14.56 | | | | 22.28 | | | | 0.85 | | | | 5.63 | | | | 1.51% | | | | 1.09% | |

Class B (WFEBX)** | | | 09/06/1979 | | | | 9.13 | | | | 16.46 | | | | (0.20 | ) | | | 5.13 | | | | 14.13 | | | | 21.46 | | | | 0.11 | | | | 5.13 | | | | 2.26% | | | | 1.84% | |

Class C (WFEFX) | | | 03/06/1998 | | | | 13.16 | | | | 20.39 | | | | 0.11 | | | | 4.89 | | | | 14.16 | | | | 21.39 | | | | 0.11 | | | | 4.89 | | | | 2.26% | | | | 1.84% | |

Class R (WFERX) | | | 10/10/2003 | | | | | | | | | | | | | | | | | | | | 14.42 | | | | 22.02 | | | | 0.58 | | | | 5.37 | | | | 1.76% | | | | 1.34% | |

Administrator Class (WFEDX) | | | 07/16/2010 | | | | | | | | | | | | | | | | | | | | 14.51 | | | | 22.36 | | | | 1.07 | | | | 5.92 | | | | 1.35% | | | | 1.09% | |

Institutional Class (WFENX) | | | 03/09/1998 | | | | | | | | | | | | | | | | | | | | 14.65 | | | | 22.57 | | | | 1.11 | | | | 5.93 | | | | 1.08% | | | | 0.84% | |

MSCI EAFE® Free Net Index6 | | | | | | | | | | | | | | | | | | | | | | | 12.71 | | | | 19.18 | | | | 1.54 | | | | 5.29 | | | | | | | | | |

| * | Returns for periods of less than one year are not annualized. |

| ** | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted. Current month-end performance is available on the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

| 3. | Historical performance shown for the Administrator Class shares prior to their inception reflects the performance of the Institutional Class shares, adjusted to reflect the higher expenses applicable to the Administrator Class shares. Historical performance shown for Class R shares prior to their inception reflects the performance of Class A shares, adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for all classes of the Fund prior to July 19, 2010 is based on the performance of the Fund’s predecessor, Evergreen International Equity Fund. |

| 4. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 5. | The Adviser has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amount shown above. Without this cap, the Fund’s returns would have been lower. |

| 6. | The Morgan Stanley Capital International Europe, Australasia, and Far East Free (“MSCI EAFE Free”) Net Index is an unmanaged group of securities widely regarded by investors to be representative of the stock markets of Europe, Australasia, and the Far East. MSCI Free Indices are constructed to reflect investment opportunities for global investors to account for local market restrictions on stock ownership by international investors. You cannot invest directly in an index. |

| | | | |

| 18 | | Wells Fargo Advantage International Stock Funds | | Performance Highlights |

Wells Fargo Advantage Intrinsic World Equity Fund

INVESTMENT OBJECTIVE

The Fund seeks long-term capital appreciation

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Metropolitan West Capital Management, LLC

PORTFOLIO MANAGERS

David Graham

Gary Lisenbee

Jeffrey Peck

FUND INCEPTION

April 30, 1996

| | | | |

TEN LARGEST EQUITY HOLDINGS1

(AS OF APRIL 30, 2011) | | | |

Apple Incorporated | | | 3.43% | |

Oracle Corporation | | | 3.26% | |

Enersis SA ADR | | | 2.80% | |

Unilever NV | | | 2.69% | |

Samsung Electronics Company Limited | | | 2.66% | |

EMC Corporation | | | 2.58% | |

UDR Incorporated | | | 2.43% | |

Vodafone Group plc | | | 2.43% | |

JPMorgan Chase & Company | | | 2.40% | |

Baxter International Incorporated | | | 2.35% | |

| | |

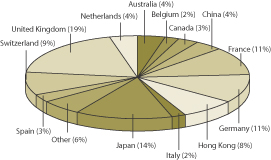

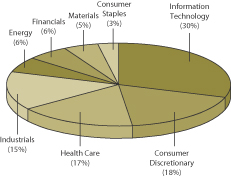

COUNTRY ALLOCATION2

(AS OF APRIL 30, 2011) |

|

|

| 1. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the dates specified |

| 2. | Country allocation is subject to change and is calculated based on the total investments of the Fund, excluding cash and cash equivalents. |

| | | | | | |

| Performance Highlights | | Wells Fargo Advantage International Stock Funds | | | 19 | |

Wells Fargo Advantage Intrinsic World Equity Fund (continued)

AVERAGE ANNUAL TOTAL RETURN3 (%) (AS OF APRIL 30, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Including Sales Charge | | | Excluding Sales Charge | | | Expense Ratios4 | |

| | | Inception Date | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | 6-Months* | | | 1-Year | | | 5-Year | | | 10-Year | | | Gross | | | Net5 | |

Class A (EWEAX) | | | 04/30/1996 | | | | 7.78 | | | | 12.65 | | | | 0.92 | | | | 4.57 | | | | 14.37 | | | | 19.52 | | | | 2.12 | | | | 5.20 | | | | 1.59% | | | | 1.40% | |

Class C (EWECX) | | | 05/18/2007 | | | | 12.97 | | | | 17.65 | | | | 1.36 | | | | 4.42 | | | | 13.97 | | | | 18.65 | | | | 1.36 | | | | 4.42 | | | | 2.34% | | | | 2.15% | |

Administrator Class (EWEIX) | | | 05/18/2007 | | | | | | | | | | | | | | | | | | | | 14.49 | | | | 19.83 | | | | 2.30 | | | | 5.29 | | | | 1.43% | | | | 1.15% | |

Institutional Class (EWENX) | | | 07/30/2010 | | | | | | | | | | | | | | | | | | | | 14.65 | | | | 20.01 | | | | 2.33 | | | | 5.31 | | | | 1.16% | | | | 0.95% | |

MSCI World Index (Net)6 | | | | | | | | | | | | | | | | | | | | | | | 14.75 | | | | 18.25 | | | | 2.32 | | | | 3.90 | | | | | | | | | |

| * | Returns for periods of less than one year are not annualized. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted. Current month-end performance is available on the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

| 3. | Historical performance shown for Class C shares prior to their inception reflects the performance of Class A shares, adjusted to reflect the higher expenses applicable to Class C shares. Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for the Administrator Class shares prior to their inception reflects the performance of Class A shares, and includes the higher expenses applicable to Class A shares. If these expenses had not been included, returns would be higher. Historical performance shown for all classes of the Fund prior to July 19, 2010 is based on the performance of the Fund’s predecessor, Evergreen Intrinsic World Equity Fund. |

| 4. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 5. | The Adviser has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amount shown above. Without this cap, the Fund’s returns would have been lower. |

| 6. | The Morgan Stanley Capital International World Index (the “MSCI World Index (Net)”) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. You cannot invest directly in an index. |

| | | | |

| 20 | | Wells Fargo Advantage International Stock Funds | | Fund Expenses |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees (if any) and exchange fees (if any); and (2) ongoing costs, including management fees; distribution (12b-1) and/or shareholder service fees; and other Fund expenses. This example is in tended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from November 1, 2010 to April 30, 2011.

Actual Expenses

The “Actual” line of the table below provides in formation about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses Paid During Period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetic al Example for Comparison Purposes

The “Hypothetical” line of the table below provides in formation about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| Wells Fargo Advantage Asia Pacific Fund | | Beginning

Account Value

11-01-2010 | | | Ending

Account Value

04-30-2011 | | | Expenses

Paid During

the Period1 | | | Net Annual

Expense Ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,055.88 | | | $ | 8.16 | | | | 1.60 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,016.86 | | | $ | 8.00 | | | | 1.60 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.58 | | | $ | 11.95 | | | | 2.35 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,013.14 | | | $ | 11.73 | | | | 2.35 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,057.33 | | | $ | 7.14 | | | | 1.40 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,017.85 | | | $ | 7.00 | | | | 1.40 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,057.68 | | | $ | 6.38 | | | | 1.25 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,018.60 | | | $ | 6.26 | | | | 1.25 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,056.19 | | | $ | 8.41 | | | | 1.65 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,016.61 | | | $ | 8.25 | | | | 1.65 | % |

| | | | | | |

| Fund Expenses | | Wells Fargo Advantage International Stock Funds | | | 21 | |

| | | | | | | | | | | | | | | | |

| Wells Fargo Advantage Disciplined Global Equity Fund | | Beginning

Account Value

11-01-2010 | | | Ending

Account Value

04-30-2011 | | | Expenses

Paid During

the Period1 | | | Net Annual

Expense Ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,154.05 | | | $ | 7.48 | | | | 1.40 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,017.85 | | | $ | 7.00 | | | | 1.40 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,149.76 | | | $ | 11.46 | | | | 2.15 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,014.13 | | | $ | 10.74 | | | | 2.15 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,155.25 | | | $ | 6.15 | | | | 1.15 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,019.09 | | | $ | 5.76 | | | | 1.15 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,156.52 | | | $ | 5.08 | | | | 0.95 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,020.08 | | | $ | 4.76 | | | | 0.95 | % |

| Wells Fargo Advantage Diversified International Fund | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,131.47 | | | $ | 7.45 | | | | 1.41 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,017.80 | | | $ | 7.05 | | | | 1.41 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,126.28 | | | $ | 11.39 | | | | 2.16 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,014.08 | | | $ | 10.79 | | | | 2.16 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,126.70 | | | $ | 11.39 | | | | 2.16 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,014.08 | | | $ | 10.79 | | | | 2.16 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,132.27 | | | $ | 6.61 | | | | 1.25 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,018.60 | | | $ | 6.26 | | | | 1.25 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,133.62 | | | $ | 5.24 | | | | 0.99 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,019.89 | | | $ | 4.96 | | | | 0.99 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,130.51 | | | $ | 7.71 | | | | 1.46 | % |

Hypothetical | | $ | 1,000.00 | | | $ | 1,017.55 | | | $ | 7.30 | | | | 1.46 | % |

| Wells Fargo Advantage Emerging Markets Equity Fund | | | | | | | |