UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-643-9691

Date of fiscal year end: January 31, 2011

Date of reporting period: July 31, 2011

| ITEM 1. | REPORT TO SHAREHOLDERS |

Wells Fargo Advantage

100% Treasury Money Market Fund

Semi-Annual Report

July 31, 2011

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at www.wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of July 31, 2011, unless otherwise noted and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC, disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

WELLS FARGO INVESTMENT HISTORY

| | |

| |

| 1932 | | Keystone creates one of the first mutual fund families. |

| |

| 1971 | | Wells Fargo & Company introduces one of the first institutional index funds. |

| |

| 1978 | | Wells Fargo applies Markowitz and Sharpe’s research on Modern Portfolio Theory to introduce one of the industry’s first Tactical Asset Allocation (TAA) models in institutional separately managed accounts. |

| |

| 1984 | | Wells Fargo Stagecoach Funds launches its first asset allocation fund. |

| |

| 1989 | | The Tactical Asset Allocation (TAA) Model is first applied to Wells Fargo’s asset allocation mutual funds. |

| |

| 1994 | | Wells Fargo introduces the LifePath Funds, one of the first suites of target date funds (now the Wells Fargo Advantage Dow Jones Target Date FundsSM ). |

| |

| 1996 | | Evergreen Investments and Keystone Funds merge. |

| |

| 1997 | | Wells Fargo launches Wells Fargo Advantage WealthBuilder PortfoliosSM, a fund-of-funds suite of products that includes the use of quantitative models to shift assets among investment styles. |

| |

| 1999 | | Norwest Advantage Funds and Stagecoach Funds are reorganized into Wells Fargo Funds after the merger of Norwest and Wells Fargo. |

| |

| 2002 | | Evergreen Retail and Evergreen Institutional companies form the umbrella asset management company, Evergreen Investments. |

| |

| 2005 | | The integration of Strong Funds with Wells Fargo Funds creates Wells Fargo Advantage Funds, resulting in one of the top 20 mutual fund companies in the United States. |

| |

| 2006 | | Wells Fargo Advantage Funds relaunches the target date product line as Wells Fargo Advantage Dow Jones Target Date Funds. |

| |

| 2010 | | The mergers and reorganizations of Evergreen and Wells Fargo Advantage mutual funds are completed, unifying the families under the brand of Wells Fargo Advantage Funds. |

Wells Fargo Advantage Funds®

Wells Fargo Advantage Funds skillfully guides institutions, financial advisors, and individuals through the investment terrain to help them reach their financial objectives. Everything we do on behalf of investors is backed by our unique combination of qualifications.

Strength

Our organization is built on the standards of integrity and service established by our parent company—Wells Fargo & Company—more than 150 years ago. And, because we’re part of a highly diversified financial enterprise, we offer the depth of resources to help investors succeed.

Expertise

Our multi-boutique model offers investors access to the independent thinking of premier investment managers that have been chosen for their time-tested strategies. While each team specializes in a specific investment strategy, collectively they provide investors a wide choice of distinct investment styles. Our dedication to investment excellence doesn’t end with our expertise in manager selection—risk management, analysis, and rigorous ongoing review seek to ensure each manager’s investment process remains consistent.

Partnership

Our collaborative approach is built around understanding the needs and goals of our clients. By adhering to core principles of sound judgment and steady guidance, we support you through every stage of the investment decision process.

Carefully consider the investment objectives, risks, charges, and expenses before investing. For a current prospectus for Wells Fargo Advantage Funds containing this and other information, visit wellsfargo.com/advantagefunds. Read it carefully before investing.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds®. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

The “Dow Jones Target Date Indexes” are a product of Dow Jones Indexes, a licensed trademark of CME Group Index Services LLC (“CME”). “Dow Jones” and “Dow Jones Target Date Indexes” are service marks of Dow Jones Trademark Holdings, LLC, and have been licensed for use for certain purposes by CME and sublicensed for use by Global Index Advisors, Inc., and Wells Fargo Funds Management, LLC. The Dow Jones Target Date Indexes are based in part on the Barclays Capital Bond Indexes, which are published by Barclays Capital Inc. The Wells Fargo Advantage Dow Jones Target Date Funds, based on the Dow Jones Target Date Indexes, are not sponsored, endorsed, sold, or promoted by Dow Jones, CME or Barclays Capital or any of their respective affiliates, and neither Dow Jones, CME nor Barclays Capital nor any of their respective affiliates makes any representation regarding the advisability of investing in such product(s) and/or about the quality, accuracy, and/or completeness of the Dow Jones Target Date Indexes or the Barclays Capital Bond Indexes. IN NO EVENT SHALL DOW JONES, CME, BARCLAYS CAPITAL, OR ANY OF THEIR LICENSORS HAVE ANY LIABILITY IN CONNECTION WITH THE Wells Fargo Advantage Dow Jones Target Date Funds INCLUDING, WITHOUT LIMITATION, FOR ANY SPECIAL, PUNITIVE, IN DIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Not part of the semi-annual report.

Wells Fargo Advantage Funds offers more than 110 mutual funds across a wide range of asset classes, representing over $221 billion in assets under management, as of July 31, 2011.

| | | | |

| Equity Funds | | | | |

Asia Pacific Fund | | Global Opportunities Fund | | Premier Large Company Growth Fund |

C&B Large Cap Value Fund | | Growth Fund | | Small Cap Opportunities Fund |

C&B Mid Cap Value Fund | | Health Care Fund | | Small Cap Value Fund |

Capital Growth Fund | | Index Fund | | Small Company Growth Fund |

Common Stock Fund | | International Equity Fund | | Small Company Value Fund |

Disciplined U.S. Core Fund | | International Value Fund | | Small/Mid Cap Core Fund |

Discovery Fund† | | Intrinsic Small Cap Value Fund | | Small/Mid Cap Value Fund |

Diversified Equity Fund | | Intrinsic Value Fund | | Social Sustainability Fund† |

Diversified International Fund | | Intrinsic World Equity Fund | | Special Mid Cap Value Fund |

Diversified Small Cap Fund | | Large Cap Core Fund | | Special Small Cap Value Fund |

Emerging Growth Fund | | Large Cap Growth Fund | | Specialized Technology Fund |

Emerging Markets Equity Fund | | Large Company Value Fund | | Strategic Large Cap Growth Fund |

Endeavor Select Fund† | | Omega Growth Fund | | Traditional Small Cap Growth Fund |

Enterprise Fund† | | Opportunity Fund† | | Utility and Telecommunications Fund |

Equity Value Fund | | Precious Metals Fund | | |

| Bond Funds | | | | |

Adjustable Rate Government Fund | | Inflation-Protected Bond Fund | | Short-Term Bond Fund |

California Limited-Term Tax-Free Fund | | Intermediate Tax/AMT-Free Fund | | Short-Term High Yield Bond Fund |

California Tax-Free Fund | | International Bond Fund | | Short-Term Municipal Bond Fund |

Colorado Tax-Free Fund | | Minnesota Tax-Free Fund | | Strategic Municipal Bond Fund |

Government Securities Fund | | Municipal Bond Fund | | Total Return Bond Fund |

High Income Fund | | North Carolina Tax-Free Fund | | Ultra Short-Term Income Fund |

High Yield Bond Fund | | Pennsylvania Tax-Free Fund | | Ultra Short-Term Municipal Income Fund |

Income Plus Fund | | Short Duration Government Bond Fund | | Wisconsin Tax-Free Fund |

| Asset Allocation Funds | | | | |

Asset Allocation Fund | | WealthBuilder Equity Portfolio† | | Target 2020 Fund† |

Conservative Allocation Fund | | WealthBuilder Growth Allocation Portfolio† | | Target 2025 Fund† |

Diversified Capital Builder Fund | | WealthBuilder Growth Balanced Portfolio† | | Target 2030 Fund† |

Diversified Income Builder Fund | | WealthBuilder Moderate Balanced Portfolio† | | Target 2035 Fund† |

Growth Balanced Fund | | WealthBuilder Tactical Equity Portfolio† | | Target 2040 Fund† |

Index Asset Allocation Fund | | Target Today Fund† | | Target 2045 Fund† |

Moderate Balanced Fund | | Target 2010 Fund† | | Target 2050 Fund† |

WealthBuilder Conservative Allocation Portfolio† | | Target 2015 Fund† | | Target 2055 Fund† |

| Money Market Funds | | | | |

100% Treasury Money Market Fund | | Minnesota Money Market Fund | | New Jersey Municipal Money Market Fund |

California Municipal Money Market Fund | | Money Market Fund | | New York Municipal Money Market Fund |

Cash Investment Money Market Fund | | Municipal Cash Management Money Market Fund | | Pennsylvania Municipal Money Market Fund |

Government Money Market Fund | | Municipal Money Market Fund | | Prime Investment Money Market Fund |

Heritage Money Market Fund† | | National Tax-Free Money Market Fund | | Treasury Plus Money Market Fund |

| Variable Trust Funds1 | | | | |

VT Discovery Fund† | | VT Intrinsic Value Fund | | VT Small Cap Growth Fund |

VT Index Asset Allocation Fund | | VT Omega Growth Fund | | VT Small Cap Value Fund |

VT International Equity Fund | | VT Opportunity Fund† | | VT Total Return Bond Fund |

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Advantage Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

| 1. | The Variable Trust Funds are generally available only through insurance company variable contracts. |

| † | In this report, the Wells Fargo Advantage Discovery FundSM, Wells Fargo Advantage Endeavor Select FundSM, Wells Fargo Advantage Enterprise FundSM, Wells Fargo Advantage Opportunity FundSM, Wells Fargo Advantage Social Sustainability FundSM, Wells Fargo Advantage WealthBuilder Conservative Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Equity PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Moderate Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Tactical Equity PortfolioSM, Wells Fargo Advantage Dow Jones Target Today FundSM, Wells Fargo Advantage Dow Jones Target 2010 FundSM, Wells Fargo Advantage Dow Jones Target 2015 FundSM, Wells Fargo Advantage Dow Jones Target 2020 FundSM, Wells Fargo Advantage Dow Jones Target 2025 FundSM, Wells Fargo Advantage Dow Jones Target 2030 FundSM, Wells Fargo Advantage Dow Jones Target 2035 FundSM, Wells Fargo Advantage Dow Jones Target 2040 FundSM, Wells Fargo Advantage Dow Jones Target 2045 FundSM, Wells Fargo Advantage Dow Jones Target 2050 FundSM, Wells Fargo Advantage Dow Jones Target 2055 FundSM, Wells Fargo Advantage Heritage Money Market FundSM, Wells Fargo Advantage VT Discovery FundSM, and Wells Fargo Advantage VT Opportunity FundSM are referred to as the Discovery Fund, Endeavor Select Fund, Enterprise Fund, Opportunity Fund, Social Sustainability Fund, WealthBuilder Conservative Allocation Portfolio, WealthBuilder Equity Portfolio, WealthBuilder Growth Allocation Portfolio, WealthBuilder Growth Balanced Portfolio, WealthBuilder Moderate Balanced Portfolio, WealthBuilder Tactical Equity Portfolio, Target Today Fund, Target 2010 Fund, Target 2015 Fund, Target 2020 Fund, Target 2025 Fund, Target 2030 Fund, Target 2035 Fund, Target 2040 Fund, Target 2045 Fund, Target 2050 Fund, Target 2055 Fund, Heritage Money Market Fund, VT Discovery Fund, and VT Opportunity Fund, respectively. |

Not part of the semi-annual report.

| | | | |

| 2 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Letter to Shareholders |

Karla M. Rabusch,

President

Wells Fargo Advantage Funds

Dear Valued Shareholder,

We’re pleased to offer you this semi-annual report for the Wells Fargo Advantage 100% Treasury Money Market Fund for the six-month period that ended July 31, 2011. Upon reviewing the report, you may notice a few changes from past reports, the most significant of which is the change from a multi-fund report to a single-fund report. We believe this change will give you more convenient access to your fund data.

The period began modestly as improving economic optimism generally shifted investors toward equities and riskier assets and away from U.S. Treasuries and lower-yielding fixed-income securities. Returns from fixed income were modest in the opening months of 2011 but were generally still positive as U.S. Treasury yields incrementally climbed higher. But after the slow start, bond prices once again strongly improved, sparked by a sharp decline in U.S. Treasury prices in April that carried into May. Late in the period, lower-rated bonds declined in price more than the higher credit-quality tiers but not enough to outweigh the stronger performance from lower-rated securities during the period. Lower-quality and longer-maturity fixed-income securities generally outperformed higher-quality and shorter-maturity securities over the full period.

The activity within the broader bond market also resonated with money market participants. As the economic and credit environment reverberated from the ongoing sovereign debt concerns and softening economic data, many participants continued to balance a need for stability and desire for higher yields. The result has been good demand for domestic commercial paper and certificate of deposits. Also, in spite of all the discussion about sovereign debt, many money market participants continue to maintain some exposures to foreign banks based on the quality of their fundamentals. By focusing more on the fundamentals and taking a more selective approach to the short-term security market helped the markets avoid the severe yield volatility or significant flight-to-quality experienced during the spring of 2010, when the Greek sovereign debt crisis first emerged.

The global economic “recovery” hit a snag, but the end of 2011 could regain momentum.

The U.S. economic recovery that began in mid-2009 and gained further momentum throughout 2010, particularly during the fourth quarter, has failed to maintain that level of growth through the first seven months of 2011. For example, gross domestic product (GDP), the broadest measure of economic activity, grew at an annualized rate of 3.1% in the fourth quarter of 2010, only to slow dramatically during the first quarter of 2011. The latest revision to first-quarter GDP data during the period indicated that the economy grew at an annualized rate of 0.4% during the first quarter of 2011. While still positive, it’s a much slower pace of growth than experienced in the second half of 2010 and notably lower than consensus forecasts. Nevertheless, the advance estimate of second-quarter 2011 GDP, which was released on July 29, 2011, was 1.3%, suggesting that the U.S. economy continues to expand, though at a slow and uneven pace.

Jobs and housing remained troublesome.

The July 2011 unemployment rate in the U.S. was reported at 9.1%, down from 9.5% a year earlier but still notably higher than historical averages. Unfortunately,

| | | | | | |

| Letter to Shareholders | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 3 | |

the drop may be more attributable to a decline in the labor force than to a meaningful uptick in hiring. The level of job creation in 2011 has been trending below historical averages, suggesting that the improving economy has yet to translate into widespread hiring. Meanwhile, the beleaguered housing market was an ongoing source of concern, despite some tentative late-year signs of stabilization. That said, persistent weakness in the labor and housing markets bears close watching in the months ahead.

Other economic data in the U.S. has been more encouraging, reflecting greater confidence in the sustainability of the expansion on the part of both consumers and businesses. Retail sales came in strong at certain points during the period and industrial production and new orders have picked up. Although still reluctant to hire, businesses have gradually increased spending in other areas, such as equipment and information technology. Core inflation, which excludes volatile food and energy prices, remained benign.

The Federal Reserve believes the economic recovery will accelerate in future quarters.

With inflation subdued, the Federal Open Market Committee (FOMC) held its target range for the federal funds rate—a proxy for short-term interest rates—steady at 0.00% to 0.25%. On June 22, 2011, in its final statement of the six-month period, the Fed reiterated that the economic recovery “is proceeding at a moderate pace,” but that “recent labor market indicators have been weaker than anticipated.” It described the recent increase in inflation as temporary, suggesting that inflation pressures will ease going forward. While the FOMC explained that it “expects the pace of recovery to pick up over coming quarters,” it indicated that the federal funds rate will remain at an exceptionally low level for as long as necessary to ensure a sustainable recovery and expansion.

As recent headwinds subside, it is reasonable to expect markets to regain focus.

Now that it appears the debt ceiling has been increased and a U.S. default will be averted, money market participants and the broader bond market can get back to more fundamental and lasting concerns—chiefly, the economy. After avoiding short-term Treasuries in late July 2011, ahead of pending U.S. debt ceiling deadline, money market participants have returned to the U.S. short-term markets1. Economic indicators released in the second half of 2011 might not be as soft as those reported during the first half of the year. While that would not mean that the economy is robust, it might remind the markets that the first half of the slowdown was transitory. Most indicators still point toward real GDP growth in the 2% to 3% range in the second half of 2011. While that is not enough to produce big employment gains, it might be sufficient to cause Treasury yields to retrace some of the late-July declines.

Don’t let short-term uncertainty derail long-term investment goals.

While periods of uncertainty can present challenges, experience has taught us that maintaining a long-term investment strategy based on individual goals and risk tolerance can be an effective way to plan for the future. As a whole, Wells Fargo Advantage Funds represents investments across a broad range of asset classes and investment styles with more than 110 mutual funds, giving you an

| 1. | Comments expressed that do not fall within the reporting period are as of August 2, 2011. |

While the FOMC explained that it “expects the pace of recovery to pick up over coming quarters,” it indicated that the federal funds rate will remain at an exceptionally low level for as long as necessary to ensure a sustainable recovery and expansion.

Economic indicators released in the second half of 2011 might not be as soft as those reported during the first half of the year. While that would not mean that the economy is robust, it might remind the markets that the first half of the slowdown was transitory.

| | | | |

| 4 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Letter to Shareholders |

opportunity to create a diversified investment portfolio. While diversification may not prevent losses in a downturn, it may help to reduce them and provide you with one way of managing risk.

In our opinion, diligent and earnest assessment of the fundamental characteristics of money market eligible securities will be a key differentiating factor between which investment strategies meet client expectations and which do not. At Wells Fargo Advantage Funds, we intend to continue the emphasis of principal preservation and high liquidity across our lineup of Wells Fargo Advantage Money Market Funds. In changing markets, we believe it is particularly important to have diligent investment analysts in charge of investor assets.

Thank you for choosing Wells Fargo Advantage Funds. We appreciate your confidence in us and are committed to helping you meet your financial needs. If you have any questions about your investments, please contact your investment professional, call us at 1-800-222-8222, or visit www.wellsfargo.com/advantagefunds.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

| | | | | | |

| Performance Highlights (Unaudited) | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 5 | |

INVESTMENT OBJECTIVE

The Fund seeks current income exempt from most state and local individual income taxes, while preserving capital and liquidity.

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Wells Capital Management Incorporated

PORTFOLIO MANAGERS

David D. Sylvester

Laurie White

FUND INCEPTION

December 3, 1990

| | |

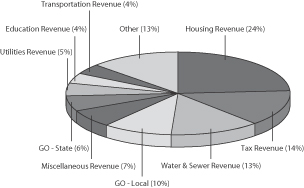

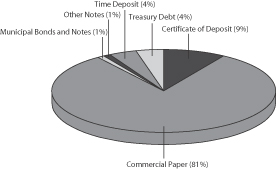

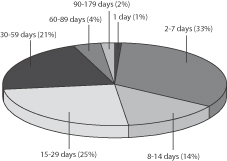

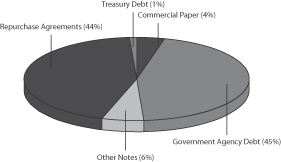

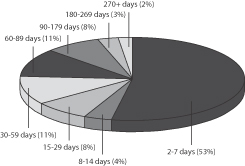

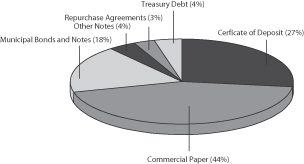

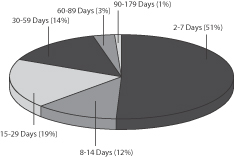

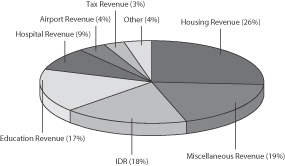

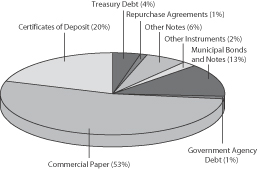

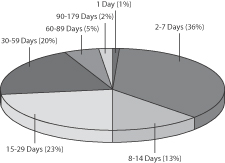

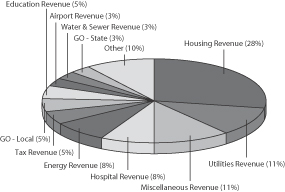

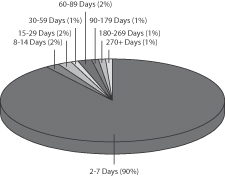

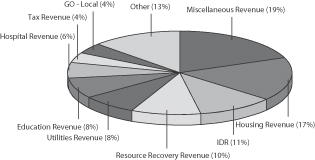

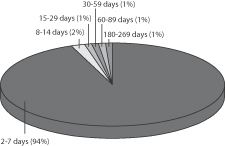

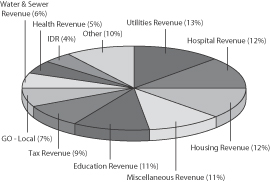

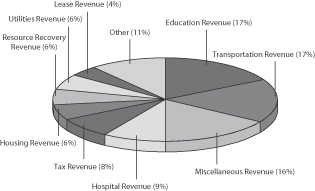

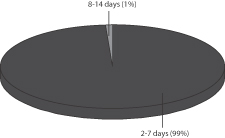

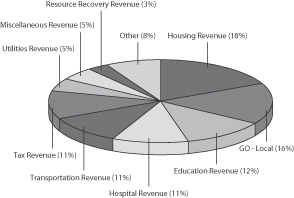

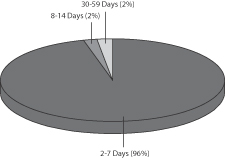

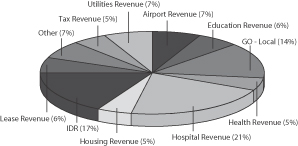

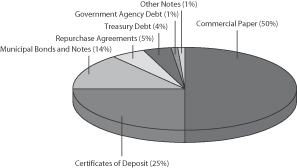

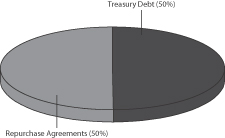

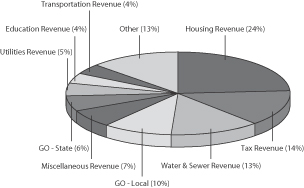

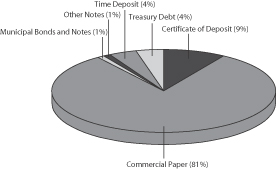

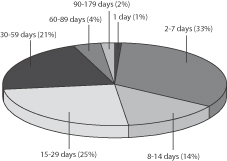

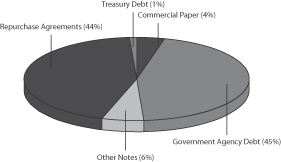

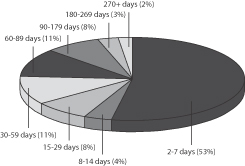

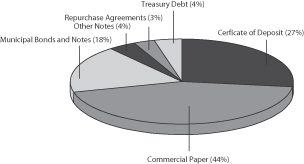

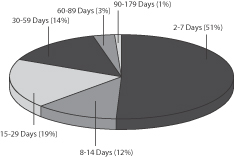

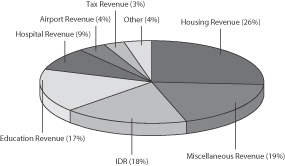

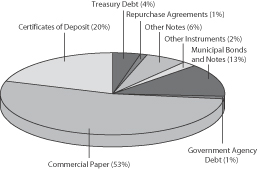

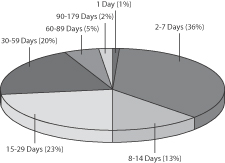

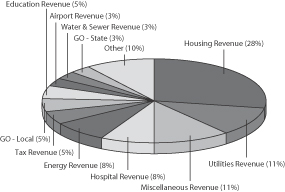

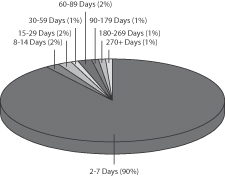

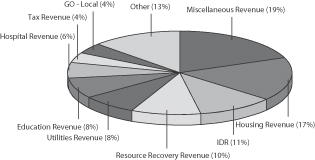

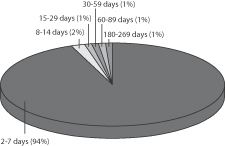

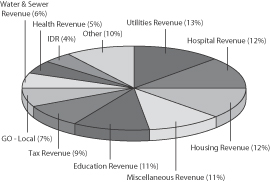

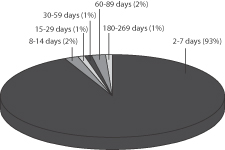

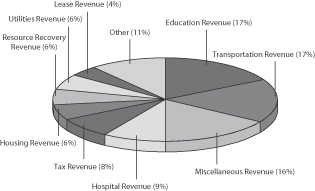

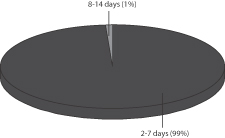

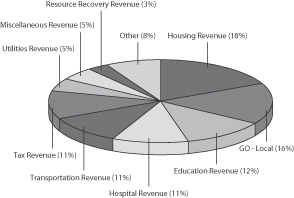

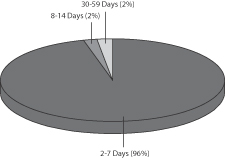

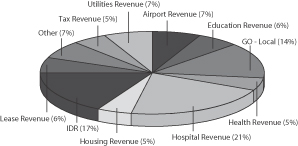

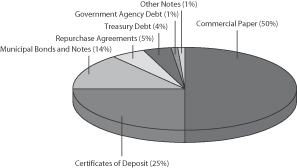

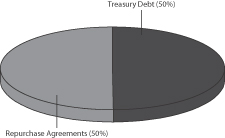

PORTFOLIO COMPOSITION1 (AS OF JULY 31, 2011) |

|

|

|

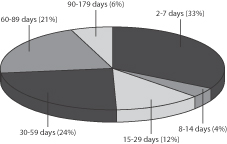

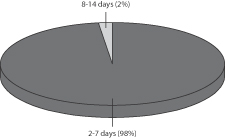

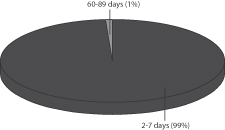

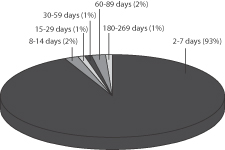

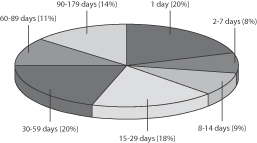

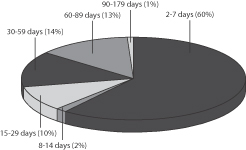

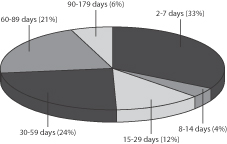

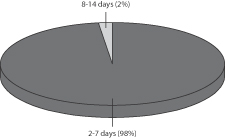

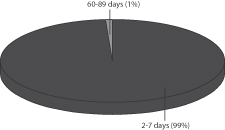

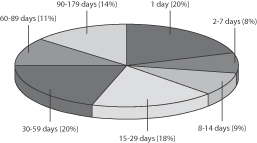

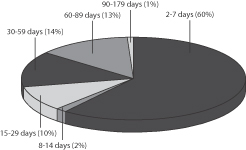

EFFECTIVE MATURITY DISTRIBUTION1 (AS OF JULY 31, 2011) |

|

|

| | |

WEIGHTED AVERAGE MATURITY2 (AS OF JULY 31, 2011) | | |

36 Days |

| | |

WEIGHTED AVERAGE FINAL MATURITY3 (AS OF

JULY 31, 2011) | | |

36 Days |

| 1. | Portfolio composition and effective maturity distribution are subject to change and are calculated based on the total investments of the Fund. Effective maturity distribution is based on the weighted average maturity of each security. |

| 2. | Weighted Average Maturity (WAM): WAM calculates an average time to maturity of all of the securities held in the portfolio, weighted by each security’s percentage of net assets. The calculation takes into account the final maturity of a fixed-income security and the interest rate reset date for floating-rate securities held in the portfolio. This is a way to measure a fund’s sensitivity to potential interest rate changes. |

| 3. | Weighted Average Final Maturity (WAFM): WAFM calculates a fund’s average time to maturity for all of the securities held in the portfolio, weighted to their percentage of assets in the Fund. In contrast to WAM, the WAFM calculation takes into account the final maturity date for each security held in the portfolio. This is a way to measure a fund’s potential sensitivity to credit spread changes. |

| | | | |

| 6 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Performance Highlights (Unaudited) |

AVERAGE ANNUAL TOTAL RETURN4 (%) (AS OF JULY 31, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Expense Ratios5 | |

| | | Inception Date | | | 6 Months* | | | 1 Year | | | 5 Year | | | 10 Year | | | Gross | | | Net6 | |

Class A (WFTXX) | | | 11/08/1999 | | | | 0.00 | | | | 0.01 | | | | 1.42 | | | | 1.49 | | | | 0.80% | | | | 0.65% | |

Administrator Class (WTRXX) | | | 06/30/2010 | | | | 0.00 | | | | 0.01 | | | | 1.49 | | | | 1.61 | | | | 0.53% | | | | 0.30% | |

Service Class (NWTXX) | | | 12/03/1990 | | | | 0.00 | | | | 0.01 | | | | 1.49 | | | | 1.61 | | | | 0.70% | | | | 0.50% | |

Sweep Class | | | 06/30/2010 | | | | 0.00 | | | | 0.01 | | | | 1.49 | | | | 1.61 | | | | 1.15% | | | | 1.05% | |

| * | Returns for periods of less than one year are not annualized. |

| | | | | | | | | | | | | | | | |

FUND YIELD SUMMARY6 (AS OF JULY 31, 2011) | | Class A | | | Administrator Class | | | Service Class | | | Sweep Class | |

7-Day Current Yield | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

7-Day Compound Yield | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

30-Day Simple Yield | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

30-Day Compound Yield | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. Current performance may be lower or higher than the performance data quoted. Current month-end performance is available at the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Each class is sold without a front-end sales charge or contingent deferred sales charge. Other fees and expenses apply to an investment in the Fund and are described in the Fund’s current prospectus.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund. The U.S. Government guarantee applies to certain of the underlying securities held by the Fund and not to shares of the Fund itself.

| 4. | Historical performance shown for the Administrator Class shares prior to their inception reflects the performance of the Service Class shares, and includes the higher expenses applicable to the Service Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for the Sweep Class shares prior to their inception reflects the performance of the Service Class shares, and has not been adjusted to reflect the higher expenses applicable to the Sweep Class shares. If these expenses had been adjusted, returns would be lower. |

| 5. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 6. | The Adviser has committed through July 11, 2013 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amount shown above. Without this cap, the Fund’s returns would have been lower. Without waived fees and/or reimbursed expenses, the Fund’s 7-day current yield would have been (0.75)%, (0.48)%, (0.65)% and (1.10)% for Class A, Administrator Class, Service Class and Sweep Class, respectively. |

| | | | | | |

| Fund Expenses | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 7 | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including contingent deferred sales charges (if any) and (2) ongoing costs, including management fees; distribution (12b-1) and/or shareholder service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from February 1, 2011 to July 31, 2011.

Actual Expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses Paid During Period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as any contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

02-01-2011 | | | Ending

Account Value

07-31-2011 | | | Expenses

Paid During

the Period¹ | | | Net Annual

Expense Ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.05 | | | $ | 0.40 | | | | 0.08 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.40 | | | $ | 0.40 | | | | 0.08 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.05 | | | $ | 0.35 | | | | 0.07 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.45 | | | $ | 0.35 | | | | 0.07 | % |

Service Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.05 | | | $ | 0.40 | | | | 0.08 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.40 | | | $ | 0.40 | | | | 0.08 | % |

Sweep Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,000.05 | | | $ | 0.35 | | | | 0.07 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.45 | | | $ | 0.35 | | | | 0.07 | % |

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half year period). |

| | | | |

| 8 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Portfolio of Investments—July 31, 2011 (Unaudited) |

| | | | | | | | | | | | | | | | |

| Security Name | | Yield | | | Maturity Date | | | Principal | | | Value | |

| | | | |

Treasury Debt: 70.55% | | | | | | | | | | | | | | | | |

US Treasury Bill | | | 0.01 | % | | | 08/04/2011 | | | $ | 370,000,000 | | | $ | 369,999,655 | |

US Treasury Bill | | | 0.01 | | | | 08/11/2011 | | | | 409,540,000 | | | | 409,536,399 | |

US Treasury Bill | | | 0.01 | | | | 08/25/2011 | | | | 678,575,000 | | | | 678,563,899 | |

US Treasury Bill | | | 0.01 | | | | 09/01/2011 | | | | 650,000,000 | | | | 649,978,551 | |

US Treasury Bill | | | 0.01 | | | | 09/22/2011 | | | | 708,470,000 | | | | 708,429,836 | |

US Treasury Bill | | | 0.01 | | | | 10/20/2011 | | | | 570,000,000 | | | | 569,976,000 | |

US Treasury Bill | | | 0.02 | | | | 08/18/2011 | | | | 632,590,000 | | | | 632,584,129 | |

US Treasury Bill | | | 0.02 | | | | 09/29/2011 | | | | 540,000,000 | | | | 539,977,384 | |

US Treasury Bill | | | 0.03 | | | | 10/06/2011 | | | | 487,490,000 | | | | 487,465,422 | |

US Treasury Bill | | | 0.03 | | | | 10/13/2011 | | | | 580,000,000 | | | | 579,966,136 | |

US Treasury Bill | | | 0.04 | | | | 09/08/2011 | | | | 567,070,000 | | | | 567,042,446 | |

US Treasury Bill | | | 0.05 | | | | 09/15/2011 | | | | 570,000,000 | | | | 569,960,464 | |

US Treasury Bill | | | 0.06 | | | | 10/27/2011 | | | | 630,000,000 | | | | 629,912,456 | |

| | | | | | | | |

| Total Investments in Securities | | | | | | | | |

| (Cost $7,393,392,777)* | | | 70.55 | % | | | 7,393,392,777 | |

Other Assets and Liabilities, Net | | | 29.45 | | | | 3,085,557,101 | |

| | | | | | | | |

| Total Net Assets | | | 100.00 | % | | $ | 10,478,949,878 | |

| | | | | | | | |

| * | Cost for federal income tax purposes is substantially the same as for financial reporting purposes. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of Assets and Liabilities—July 31, 2011 (Unaudited) | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 9 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities, at amortized cost | | $ | 7,393,392,777 | |

Cash | | | 3,093,085,376 | |

Receivable for Fund shares sold | | | 3,216,591 | |

Receivable from adviser | | | 3,762,523 | |

Prepaid expenses and other assets | | | 206,042 | |

| | | | |

Total assets | | | 10,493,663,309 | |

| | | | |

| |

Liabilities | | | | |

Dividends payable | | | 53,474 | |

Payable for Fund shares redeemed | | | 10,217,670 | |

Distribution fees payable | | | 74,304 | |

Due to other related parties | | | 1,639,472 | |

Shareholder servicing fees payable | | | 2,268,494 | |

Accrued expenses and other liabilities | | | 460,017 | |

| | | | |

Total liabilities | | | 14,713,431 | |

| | | | |

Total net assets | | $ | 10,478,949,878 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 10,478,278,699 | |

Overdistributed net investment income | | | (5,010 | ) |

Accumulated net realized gains on investments | | | 676,189 | |

| | | | |

Total net assets | | $ | 10,478,949,878 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE PER SHARE1 | | | | |

Net assets – Class A | | $ | 218,047,650 | |

Shares outstanding – Class A | | | 218,020,853 | |

Net asset value per share – Class A | | | $1.00 | |

Net assets – Administrator Class | | $ | 1,421,234,141 | |

Shares outstanding – Administrator Class | | | 1,421,137,378 | |

Net asset value per share – Administrator Class | | | $1.00 | |

Net assets – Service Class | | $ | 8,582,303,225 | |

Shares outstanding – Service Class | | | 8,581,256,660 | |

Net asset value per share – Service Class | | | $1.00 | |

Net assets – Sweep Class | | $ | 257,364,862 | |

Shares outstanding – Sweep Class | | | 257,352,513 | |

Net asset value per share – Sweep Class | | | $1.00 | |

| 1. | The Fund has an unlimited number of authorized shares. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Statement of Operations—Six Months Ended July 31, 2011 (Unaudited) |

| | | | |

| | | | |

| |

Investment income | | | | |

Interest | | $ | 4,886,671 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 14,188,493 | |

Administration fees | | | | |

Fund level | | | 2,354,599 | |

Class A | | | 229,749 | |

Administrator Class | | | 498,221 | |

Service Class | | | 5,650,625 | |

Sweep Class | | | 145,984 | |

Shareholder servicing fees | | | | |

Class A | | | 140,316 | |

Administrator Class | | | 493,664 | |

Service Class | | | 11,672,757 | |

Sweep Class | | | 165,890 | |

Distribution fees | | | | |

Sweep Class | | | 232,246 | |

Custody and accounting fees | | | 215,987 | |

Professional fees | | | 17,195 | |

Registration fees | | | 53,956 | |

Shareholder report expenses | | | 34,772 | |

Trustees’ fees and expenses | | | 8,592 | |

Other fees and expenses | | | 73,527 | |

| | | | |

Total expenses | | | 36,176,573 | |

Less: Fee waivers and/or expense reimbursements | | | (31,827,650 | ) |

| | | | |

Net expenses | | | 4,348,923 | |

| | | | |

Net investment income | | | 537,748 | |

Net realized gains on investments | | | 669,962 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 1,207,710 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statements of Changes in Net Assets | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 11 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended July 31, 2011 (Unaudited) | | | Year Ended January 31, 20111 | | | Year Ended February 28, 2010 | |

| | | | | | |

Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 537,748 | | | | | | | $ | 783,699 | | | | | | | $ | 683,644 | |

Net realized gains on investments | | | | | | | 669,962 | | | | | | | | 402,741 | | | | | | | | 360,468 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | | | | | 1,207,710 | | | | | | | | 1,186,440 | | | | | | | | 1,044,112 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | (10,442 | ) | | | | | | | (23,261 | ) | | | | | | | (26,382 | ) |

Administrator Class | | | | | | | (49,819 | ) | | | | | | | (31,383 | )2 | | | | | | | NA | |

Service Class | | | | | | | (470,851 | ) | | | | | | | (727,528 | ) | | | | | | | (657,259 | ) |

Sweep Class | | | | | | | (6,636 | ) | | | | | | | (1,527 | )2 | | | | | | | NA | |

Net realized gains | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | 0 | | | | | | | | (5,976 | ) | | | | | | | (61,610 | ) |

Administrator Class | | | | | | | 0 | | | | | | | | (16,757 | )2 | | | | | | | NA | |

Service Class | | | | | | | 0 | | | | | | | | (225,828 | ) | | | | | | | (1,569,437 | ) |

Sweep Class | | | | | | | 0 | | | | | | | | (1,348 | )2 | | | | | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | | | | | (537,748 | ) | | | | | | | (1,033,608 | ) | | | | | | | (2,314,688 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | Shares | | | | | | Shares | | | | | | Shares | | | | |

| | | | | | |

Capital share transactions | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | 114,107,492 | | | | 114,107,492 | | | | 344,729,879 | | | | 344,729,879 | | | | 373,885,007 | | | | 373,885,007 | |

Administrator Class | | | 2,068,944,842 | | | | 2,068,944,842 | | | | 1,512,300,388 | 2 | | | 1,512,300,388 | 2 | | | NA | | | | NA | |

Service Class | | | 19,920,607,260 | | | | 19,920,607,260 | | | | 37,849,862,686 | | | | 37,849,862,686 | | | | 18,506,252,685 | | | | 18,506,252,685 | |

Sweep Class | | | 856,448,361 | | | | 856,448,361 | | | | 204,563,566 | 2 | | | 204,563,566 | 2 | | | NA | | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 22,960,107,955 | | | | | | | | 39,911,456,519 | | | | | | | | 18,880,137,692 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | 9,882 | | | | 9,882 | | | | 28,088 | | | | 28,088 | | | | 85,089 | | | | 85,089 | |

Administrator Class | | | 25,683 | | | | 25,683 | | | | 25,081 | 2 | | | 25,081 | 2 | | | NA | | | | NA | |

Service Class | | | 192,564 | | | | 192,564 | | | | 368,241 | | | | 368,241 | | | | 757,091 | | | | 757,091 | |

Sweep Class | | | 6,636 | | | | 6,636 | | | | 2,875 | 2 | | | 2,875 | 2 | | | NA | | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 234,765 | | | | | | | | 424,285 | | | | | | | | 842,180 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | (121,581,973 | ) | | | (121,581,973 | ) | | | (391,614,560 | ) | | | (391,614,560 | ) | | | (407,974,452 | ) | | | (407,974,452 | ) |

Administrator Class | | | (1,310,673,795 | ) | | | (1,310,673,795 | ) | | | (1,356,794,570 | )2 | | | (1,356,794,570 | )2 | | | NA | | | | NA | |

Service Class | | | (19,774,250,916 | ) | | | (19,774,250,916 | ) | | | (37,668,051,986 | ) | | | (37,668,051,986 | ) | | | (17,985,525,624 | ) | | | (17,985,525,624 | ) |

Sweep Class | | | (711,746,649 | ) | | | (711,746,649 | ) | | | (91,922,276 | )2 | | | (91,922,276 | )2 | | | NA | | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | (21,918,253,333 | ) | | | | | | | (39,508,383,392 | ) | | | | | | | (18,393,500,076 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value of shares issued in acquisition | | | | | | | | | | | | | | | | | | | | | | | | |

Administrator Class | | | 0 | | | | 0 | | | | 507,309,749 | | | | 507,326,387 | | | | 0 | | | | 0 | |

Service Class | | | 0 | | | | 0 | | | | 91,148,028 | | | | 91,202,804 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 0 | | | | | | | | 598,529,191 | | | | | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase in net assets resulting

from capital share transactions | | | | | | | 1,042,089,387 | | | | | | | | 1,002,026,603 | | | | | | | | 487,479,796 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total increase in net assets | | | | | | | 1,042,759,349 | | | | | | | | 1,002,179,435 | | | | | | | | 486,209,220 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 9,436,190,529 | | | | | | | | 8,434,011,094 | | | | | | | | 7,947,801,874 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

End of period | | | | | | $ | 10,478,949,878 | | | | | | | $ | 9,436,190,529 | | | | | | | $ | 8,434,011,094 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Overdistributed net investment income | | | | | | $ | (5,010 | ) | | | | | | $ | (5,010 | ) | | | | | | $ | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 1. | For the eleven months ended January 31, 2011. The Fund changed its fiscal year ended from February 28 to January 31, 2011. |

| 2. | Class commenced operations on June 30, 2010. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Financial Highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

July 31, 2011

(Unaudited) | | | Year Ended

January 31,

20111 | | | Year Ended February 28, | |

| Class A | | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

Net investment income | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.01 | | | | 0.04 | | | | 0.04 | | | | 0.02 | |

Net realized gains (losses) on investments | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.01 | | | | 0.04 | | | | 0.04 | | | | 0.02 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.01 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.02 | ) |

Net realized gains | | | 0.00 | | | | (0.00 | )2 | | | (0.00 | )2 | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.01 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.02 | ) |

Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

Total return3 | | | 0.00 | % | | | 0.01 | % | | | 0.03 | % | | | 0.74 | % | | | 3.81 | % | | | 4.29 | % | | | 2.50 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.67 | % | | | 0.75 | % | | | 0.80 | % | | | 0.83 | % | | | 0.83 | % | | | 0.84 | % | | | 0.83 | % |

Net expenses | | | 0.08 | % | | | 0.14 | % | | | 0.18 | % | | | 0.58 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

Net investment income | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.68 | % | | | 3.75 | % | | | 4.23 | % | | | 2.72 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | | $218,048 | | | | $225,499 | | | | $272,399 | | | | $306,451 | | | | $298,220 | | | | $256,430 | | | | $201,384 | |

| 1. | For the eleven months ended January 31, 2011. The Fund changed its fiscal year end from February 28 to January 31, effective January 31, 2011. |

| 2. | Amount represents less than $0.005. |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial Highlights | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 13 | |

(For a share outstanding throughout each period)

| | | | | | | | |

| Administrator Class | | Six Months Ended

July 31, 2011

(Unaudited) | | | Year Ended

January 31,

20111 | |

Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | |

Net investment income | | | 0.00 | 2 | | | 0.00 | 2 |

Net realized gains (losses) on investments | | | 0.00 | 2 | | | 0.00 | 2 |

| | | | | | | | |

Total from investment operations | | | 0.00 | 2 | | | 0.00 | 2 |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.00 | )2 | | | (0.00 | )2 |

Net realized gains | | | (0.00 | )2 | | | (0.00 | )2 |

| | | | | | | | |

Total distributions to shareholders | | | (0.00 | )2 | | | (0.00 | )2 |

Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | |

Total return3 | | | 0.00 | % | | | 0.01 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses | | | 0.51 | % | | | 0.52 | % |

Net expenses | | | 0.07 | % | | | 0.14 | % |

Net investment income | | | 0.01 | % | | | 0.01 | % |

Supplemental data | | | | | | | | |

Net assets, end of period (000’s omitted) | | | $1,421,234 | | | | $662,873 | |

| 1. | For the period from June 30, 2010 (commencement of class operations) to January 31, 2011. |

| 2. | Amount represents less than $0.005. |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Financial Highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

July 31, 2011

(Unaudited) | | | Year Ended

January 31,

20111 | | | Year Ended February 28, | |

| Service Class | | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

Net investment income | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.01 | | | | 0.04 | | | | 0.04 | | | | 0.03 | |

Net realized gains (losses) on investments | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.01 | | | | 0.04 | | | | 0.04 | | | | 0.03 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.01 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.03 | ) |

Net realized gains | | | 0.00 | | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.00 | )2 | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.01 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.03 | ) |

Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

Total return3 | | | 0.00 | % | | | 0.01 | % | | | 0.03 | % | | | 0.86 | % | | | 3.97 | % | | | 4.44 | % | | | 2.64 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.68 | % | | | 0.70 | % | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % | | | 0.74 | % | | | 0.73 | % |

Net expenses | | | 0.08 | % | | | 0.14 | % | | | 0.17 | % | | | 0.46 | % | | | 0.50 | % | | | 0.50 | % | | | 0.50 | % |

Net investment income | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.74 | % | | | 3.85 | % | | | 4.36 | % | | | 2.89 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | | $8,582,303 | | | | $8,435,170 | | | | $8,161,612 | | | | $7,641,351 | | | | $6,039,209 | | | | $4,049,964 | | | | $3,581,797 | |

| 1. | For the eleven months ended January 31, 2011. The Fund changed its fiscal year end from February 28 to January 31, effective January 31, 2011. |

| 2. | Amount represents less than $0.005. |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial Highlights | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 15 | |

(For a share outstanding throughout each period)

| | | | | | | | |

| Sweep Class | | Six Months Ended

July 31, 2011

(Unaudited) | | | Year Ended

January 31,

20111 | |

Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | |

Net investment income | | | 0.00 | 2 | | | 0.00 | 2 |

Net realized gains (losses) on investments | | | 0.00 | 2 | | | 0.00 | 2 |

| | | | | | | | |

Total from investment operations | | | 0.00 | 2 | | | 0.00 | 2 |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.00 | )2 | | | (0.00 | )2 |

Net realized gains | | | 0.00 | | | | (0.00 | )2 |

| | | | | | | | |

Total distributions to shareholders | | | (0.00 | )2 | | | (0.00 | )2 |

Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | |

Total return3 | | | 0.00 | % | | | 0.01 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses | | | 1.13 | % | | | 1.14 | % |

Net expenses | | | 0.07 | % | | | 0.14 | % |

Net investment income | | | 0.01 | % | | | 0.01 | % |

Supplemental data | | | | | | | | |

Net assets, end of period (000’s omitted) | | | $257,365 | | | | $112,648 | |

| 1. | For the periods from June 30, 2010 (commencement of class operations) to January 31, 2011. |

| 2. | Amount represents less than $0.005. |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Notes to Financial Statements (Unaudited) |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on Wells Fargo Advantage 100% Treasury Money Market Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

As permitted under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value.

The valuation techniques used by the Fund to measure fair value are consistent with the market approach, income approach and/or cost approach, where applicable, for each security type.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are reported on the basis of identified cost of securities delivered.

Interest income is accrued daily and bond discounts are accreted and premiums are amortized daily based on the effective interest method. To the extent debt obligations are placed on non-accrual status, any related interest income may be reduced by writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. If the issuer subsequently resumes interest payments or when the collectability of interest is reasonably assured, the debt obligation is removed from non-accrual status.

Distributions to shareholders

Distributions to shareholders from net investment income are accrued daily and paid monthly. Distributions from net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities.

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

Class allocations

The separate classes of shares offered by the Fund differ principally in distribution, shareholder servicing and administration fees. Shareholders of each class bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of the Fund, earn income from the portfolio, and are allocated unrealized gains and losses pro rata based on the average daily net assets of each class, without distinction between share classes. Dividends are determined separately for each class based on income and expenses allocable to each class. Realized gains and losses are allocated to each class pro rata based upon the net assets of each class on the date realized. Differences in per share

| | | | | | |

| Notes to Financial Statements (Unaudited) | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 17 | |

dividend rates generally result from the relative weightings of pro rata income and realized gain allocations and from differences in separate class expenses, including distribution, shareholder servicing and administration fees.

3. FAIR VALUATION MEASUREMENTS:

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | | Level 1 – quoted prices in active markets for identical securities |

| n | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| n | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

At July 31, 2011, all of the Fund’s investments in securities carried at fair value were designated as Level 2 since the primary inputs include credit quality of the issuer and short-term interest rates which are observable.

Further details on the major security types can be found in the Fund’s Portfolio of Investments.

4. TRANSACTIONS WITH AFFILIATES AND OTHER EXPENSES

Advisory fee

The Trust has entered into an advisory contract with Wells Fargo Funds Management, LLC (“Funds Management”), an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). The adviser is responsible for implementing investment policies and guidelines and for supervising the sub-adviser, who is responsible for day-to-day portfolio management of the Fund.

Pursuant to the contract, Funds Management is entitled to receive an annual advisory fee starting at 0.30% and declining to 0.20% as the average daily net assets of the Fund increase. For the six months ended July 31, 2011, the advisory fee was equivalent to an annual rate of 0.26% of the Fund’s average daily net assets.

Funds Management may retain the services of certain sub-advisers to provide daily portfolio management to the Fund. The fees related to sub-advisory services are borne directly by the adviser and do not increase the overall fees paid by the Fund to the adviser. Wells Capital Management Incorporated, an affiliate of Funds Management, is the sub-adviser to the Fund and is entitled to receive a fee from the adviser at an annual rate starting at 0.05% and declining to 0.01% as the average daily net assets of the Fund increase.

Administration and transfer agent fees

The Trust has entered into an administration agreement with Funds Management. Under this agreement, for providing administrative services, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers, Funds Management is entitled to receive from the Fund an annual fund level administration fee starting at 0.05% and declining to 0.03% as the average daily net assets of the Fund increase and a class level administration fee which is calculated based on the average daily net assets of each class as follows:

| | | | |

| | | Class Level Administration Fee | |

Class A, Sweep Class | | | 0.22 | % |

Administrator Class | | | 0.10 | |

Service Class | | | 0.12 | |

| | | | |

| 18 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Notes to Financial Statements (Unaudited) |

Funds Management has contractually waived and/or reimbursed advisory and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses.

Distribution fees

The Trust has adopted a Distribution Plan for Sweep Class shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are charged to the Sweep Class shares and paid to Wells Fargo Funds Distributor, LLC, the principal underwriter, at an annual rate of 0.35% of the average daily net assets.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Service Class and Sweep Class of the Fund is charged a fee at an annual rate of 0.25% of the respective average daily net assets of each class. Administrator Class is charged a fee at an annual rate of 0.10% of its average daily net assets.

A portion of these total shareholder servicing fees were paid to affiliates of Wells Fargo.

5. ACQUISITION

After the close of business on July 9, 2010, the Fund acquired the net assets of Evergreen Institutional 100% Treasury Money Market Fund. The purpose of the transaction was to combine two funds with similar investment objectives and strategies. The acquisition was accomplished by a tax-free exchange of all of the shares of Evergreen Institutional 100% Treasury Money Market Fund for 598,457,777 shares of the Fund valued at $598,529,191 at an exchange ratio of 1.00 for each class. Shareholders holding Class I and Class IS shares of Evergreen Institutional 100% Treasury Money Market Fund received Administrator Class and Service Class shares, respectively, of the Fund in the reorganization. The investment portfolio of Evergreen Institutional the Fund with a fair value of $598,561,496 and amortized cost of $598,561,496 at July 9, 2010 were the principal assets acquired by the Fund. The aggregate net assets of Evergreen Institutional 100% Treasury Money Market Fund and the Fund immediately prior to the acquisition were $598,529,191 and $8,130,274,496, respectively. The aggregate net assets of the Fund immediately after the acquisition were $8,728,803,687. For financial reporting purposes, assets received and shares issued by the Fund were recorded at fair value; however, the cost basis of the investments received from Evergreen Institutional 100% Treasury Money Market Fund was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes.

Assuming the acquisition had been completed March 1, 2010, the beginning of the annual reporting period for the Fund, the pro forma results of operations for the period ended January 31, 2011 would have been:

| | | | |

Net investment income | | $ | 889,744 | |

Net realized gains on investments | | $ | 421,602 | |

Net increase in net assets resulting from operations | | $ | 1,311,346 | |

6. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and directors are indemnified against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

7. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs”. ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP. The ASU is effective prospectively for interim and annual periods beginning after December 15, 2011.

| | | | | | |

| Notes to Financial Statements (Unaudited) | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 19 | |

In April 2011, FASB issued ASU No. 2011-03 “Reconsideration of Effective Control for Repurchase Agreements”. ASU No. 2011-03 amends FASB ASC Topic 860, Transfers and Servicing, specifically the criteria required to determine whether a repurchase agreement (repo) and similar agreements should be accounted for as sales of financial assets or secured borrowings with commitments. ASU No. 2011-03 changes the assessment of effective control by focusing on the transferor’s contractual rights and obligations and removing the criterion to assess its ability to exercise those rights or honor those obligations. This could result in changes to the way entities account for certain transactions including repurchase agreements, mortgage dollar rolls and reverse repurchase agreements. The ASU will become effective on a prospective basis for new transfers and modifications to existing transactions as of the beginning of the first interim or annual period beginning on or after December 15, 2011.

As of July 31, 2011, management of the Fund is currently assessing the potential impact, in addition to expanded financial statement disclosure, that may result from adopting these ASUs.

| | | | |

| 20 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Other Information (Unaudited) |

PORTFOLIO HOLDINGS INFORMATION

The complete portfolio holdings for the Fund are publicly available on the Fund’s Web site (www.wellsfargo.com/advantagefunds) on a monthly, seven-day delayed basis. The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available without charge by visiting the SEC Web site at www.sec.gov. In addition, the Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and at regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330.

PROXY VOTING INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-222-8222, visiting our Web site at www.wellsfargo.com/advantagefunds, or visiting the SEC Web site at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Fund’s Web site at www.wellsfargo.com/advantagefunds or by visiting the SEC Web site at www.sec.gov.

| | | | | | |

| Other Information (Unaudited) | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 21 | |

BOARD OF TRUSTEES

The following table provides basic information about the Board of Trustees (the “Trustees”) of the Trust and Officers of the Trust. This table should be read in conjunction with the Prospectus and the Statement of Additional Information1 of the Fund. Each of the Trustees and Officers listed below acts in identical capacities for the Wells Fargo Advantage family of funds, which consists of 144 funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). All of the Trustees are also Members of the Audit and Governance Committees of each Trust in the Fund Complex. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

| | | | | | |

Name and Year of Birth | | Position Held and Length of Service | | Principal Occupations During Past Five Years | | Other Directorships During

Past Five Years |

Peter G. Gordon

(Born 1942) | | Trustee, since 1998; Chairman, since 2005 | | Co-Founder, Chairman, President and CEO of Crystal Geyser. Water Company. Trustee Emeritus, Colby College | | Asset Allocation Trust |

Isaiah Harris, Jr.

(Born 1952) | | Trustee, since 2009 | | Retired. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Mr. Harris is a certified public accountant. | | CIGNA Corporation; Deluxe Corporation; Asset Allocation Trust |

Judith M. Johnson

(Born 1949) | | Trustee, since 2008 | | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | | Asset Allocation Trust |

Leroy Keith, Jr.

(Born 1939) | | Trustee, since 2010 | | Chairman, Bloc Global Services (development and construction), Trustee of the Evergreen Funds from 1983 to 2010. Former Managing Director, Almanac Capital Management (commodities firm), former Partner, Stonington Partners, Inc. (private equity fund), former Director, Obagi Medical Products Co. and former Director, Lincoln Educational Services. | | Trustee, Virtus Fund Complex (consisting of 45 portfolios as of 12/31/10); Director, Diversapack Co. (packaging company); Asset Allocation Trust |

David F. Larcker

(Born 1950) | | Trustee, since 2009 | | James Irvin Miller Professor of Accounting at the Graduate School of Business, Stanford University, Director of Corporate Governance Research Program and Co-Director of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | | Asset Allocation Trust |

Olivia S. Mitchell

(Born 1953) | | Trustee, since 2006 | | International Foundation of Employee Benefit Plans Professor and Chair of the Department of Insurance and Risk Management, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | | Asset Allocation Trust |

| | | | |

| 22 | | Wells Fargo Advantage 100% Treasury Money Market Fund | | Other Information (Unaudited) |

| | | | | | |

Name and Year of Birth | | Position Held and Length of Service | | Principal Occupations During Past Five Years | | Other Directorships During

Past Five Years |

Timothy J. Penny

(Born 1951) | | Trustee, since 1996 | | President and CEO of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007 and Senior Fellow at the Humphrey Institute Policy Forum at the University of Minnesota since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | | Asset Allocation Trust |

Michael S. Scofield

(Born 1943) | | Trustee, since 2010 | | Currently serves on the Investment Company Institute’s Board of Governors and Executive Committee as well the In dependent Director’s Counsel Board of Governors and Executive Committee. Former Chairman of the Independent Directors Counsel. Trustee of the Evergreen Funds from 1984 to 2010. Retired Attorney, Law Offices of Michael S. Scofield and former Director and Chairman, Branded Media Corporation (multi-media branding company). | | Asset Allocation Trust |

Donald C. Willeke

(Born 1940) | | Trustee, since 1996 | | Principal of the law firm of Willeke & Daniels. General Counsel of the Minneapolis Employees Retirement Fund from 1984 until its consolidation into the Minnesota Public Employees Retirement Association on June 30, 2010. | | Asset Allocation Trust |

Officers

| | | | | | |

Name and Year of Birth | | Position Held and

Length of Service | | Principal Occupations During Past Five Years | | |

Karla M. Rabusch

(Born 1959) | | President, since 2003 | | Executive Vice President of Wells Fargo Bank, N.A. and President of Wells Fargo Funds Management, LLC since 2003. Senior Vice President and Chief Administrative Officer of Wells Fargo Funds Management, LLC from 2001 to 2003. | | |

C. David Messman

(Born 1960) | | Secretary, since 2000; Chief Legal Counsel, since 2003 | | Senior Vice President and Secretary of Wells Fargo Funds Management, LLC since 2001. Vice President and Managing Counsel of Wells Fargo Bank, N.A. since 1996. | | |

Kasey Phillips

(Born 1970) | | Treasurer, since 2008 | | Senior Vice President of Wells Fargo Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2006 to 2010. Treasurer of the Evergreen Funds from 2005 to 2010. Vice President and Assistant Vice President of Evergreen Investment Services, Inc. from 1999 to 2006. | | |

David Berardi

(Born 1975) | | Assistant Treasurer, since 2009 | | Vice President of Wells Fargo Funds Management, LLC since 2009 . Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010. Assistant Vice President of Evergreen Investment Services, Inc. from 2004 to 2008. Manager of Fund Reporting and Control for Evergreen Investment Management Company, LLC from 2004 to 2010. | | |

Jeremy DePalma

(Born 1974) | | Assistant Treasurer, since 2009 | | Senior Vice President of Wells Fargo Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010. Vice President, Evergreen Investment Services, Inc. from 2004 to 2007. Assistant Vice President, Evergreen Investment Services, Inc. from 2000 to 2004 and the head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. | | |

Debra Ann Early

(Born 1964) | | Chief Compliance Officer, since 2007 | | Chief Compliance Officer of Wells Fargo Funds Management, LLC since 2007. Chief Compliance Officer of Parnassus Investments from 2005 to 2007. Chief Financial Officer of Parnassus Investments from 2004 to 2007 and Senior Audit Manager of PricewaterhouseCoopers LLP from 1998 to 2004. | | |

| 1. | The Statement of Additional Information includes additional information about the Fund’s Trustees and is available, without charge, upon request, by calling 1-800-222-8222 or by visiting the Fund’s Web site at www.wellsfargo.com/advantagefunds. |

| | | | | | |

| Other Information (Unaudited) | | Wells Fargo Advantage 100% Treasury Money Market Fund | | | 23 | |

BOARD CONSIDERATION OF INVESTMENT ADVISORY AND SUB-ADVISORY AGREEMENTS: