UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-643-9691

Date of fiscal year end: March 31, 2011

Date of reporting period: September 30, 2011

| ITEM 1. | REPORT TO SHAREHOLDERS |

Wells Fargo Advantage Health Care Fund

Semi-Annual Report

September 30, 2011

WELLS FARGO INVESTMENT HISTORY

| | |

| |

| 1932 | | Keystone creates one of the first mutual fund families. |

| |

| 1971 | | Wells Fargo & Company introduces one of the first institutional index funds. |

| |

| 1978 | | Wells Fargo applies Markowitz and Sharpe’s research on Modern Portfolio Theory to introduce one of the industry’s first Tactical Asset Allocation (TAA) models in institutional separately managed accounts. |

| |

| 1984 | | Wells Fargo Stagecoach Funds launches its first asset allocation fund. |

| |

| 1989 | | The Tactical Asset Allocation (TAA) Model is first applied to Wells Fargo’s asset allocation mutual funds. |

| |

| 1994 | | Wells Fargo introduces the LifePath Funds, one of the first suites of target date funds (now the Wells Fargo Advantage Dow Jones Target Date FundsSM ). |

| |

| 1996 | | Evergreen Investments and Keystone Funds merge. |

| |

| 1997 | | Wells Fargo launches Wells Fargo Advantage WealthBuilder PortfoliosSM, a fund-of-funds suite of products that includes the use of quantitative models to shift assets among investment styles. |

| |

| 1999 | | Norwest Advantage Funds and Stagecoach Funds are reorganized into Wells Fargo Funds after the merger of Norwest and Wells Fargo. |

| |

| 2002 | | Evergreen Retail and Evergreen Institutional companies form the umbrella asset management company, Evergreen Investments. |

| |

| 2005 | | The integration of Strong Funds with Wells Fargo Funds creates Wells Fargo Advantage Funds, resulting in one of the top 20 mutual fund companies in the United States. |

| |

| 2006 | | Wells Fargo Advantage Funds relaunches the target date product line as Wells Fargo Advantage Dow Jones Target Date Funds. |

| |

| 2010 | | The mergers and reorganizations of Evergreen and Wells Fargo Advantage mutual funds are completed, unifying the families under the brand of Wells Fargo Advantage Funds. |

Wells Fargo Advantage Funds®

Wells Fargo Advantage Funds skillfully guides institutions, financial advisors, and individuals through the investment terrain to help them reach their financial objectives. Everything we do on behalf of investors is backed by our unique combination of qualifications.

Strength

Our organization is built on the standards of integrity and service established by our parent company—Wells Fargo & Company—more than 150 years ago. And, because we’re part of a highly diversified financial enterprise, we offer the depth of resources to help investors succeed.

Expertise

Our multi-boutique model offers investors access to the independent thinking of premier investment managers that have been chosen for their time-tested strategies. While each team specializes in a specific investment strategy, collectively they provide investors a wide choice of distinct investment styles. Our dedication to investment excellence doesn’t end with our expertise in manager selection—risk management, analysis, and rigorous ongoing review seek to ensure each manager’s investment process remains consistent.

Partnership

Our collaborative approach is built around understanding the needs and goals of our clients. By adhering to core principles of sound judgment and steady guidance, we support you through every stage of the investment decision process.

Carefully consider the investment objectives, risks, charges, and expenses before investing. For a current prospectus for Wells Fargo Advantage Funds containing this and other information, visit wellsfargo.com/advantagefunds. Read it carefully before investing.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds®. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

The “Dow Jones Target Date Indexes” are a product of Dow Jones Indexes, a licensed trademark of CME Group Index Services LLC (“CME”). “Dow Jones” and “Dow Jones Target Date Indexes” are service marks of Dow Jones Trademark Holdings, LLC, and have been licensed for use for certain purposes by CME and sublicensed for use by Global Index Advisors, Inc., and Wells Fargo Funds Management, LLC. The Dow Jones Target Date Indexes are based in part on the Barclays Capital Bond Indexes, which are published by Barclays Capital Inc. The Wells Fargo Advantage Dow Jones Target Date Funds, based on the Dow Jones Target Date Indexes, are not sponsored, endorsed, sold, or promoted by Dow Jones, CME or Barclays Capital or any of their respective affiliates, and neither Dow Jones, CME nor Barclays Capital nor any of their respective affiliates makes any representation regarding the advisability of investing in such product(s) and/or about the quality, accuracy, and/or completeness of the Dow Jones Target Date Indexes or the Barclays Capital Bond Indexes. IN NO EVENT SHALL DOW JONES, CME, BARCLAYS CAPITAL, OR ANY OF THEIR LICENSORS HAVE ANY LIABILITY IN CONNECTION WITH THE Wells Fargo Advantage Dow Jones Target Date Funds INCLUDING, WITHOUT LIMITATION, FOR ANY SPECIAL, PUNITIVE, IN DIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Not part of the semi-annual report.

Wells Fargo Advantage Funds offers more than 110 mutual funds across a wide range of asset classes, representing over $213 billion in assets under management, as of September 30, 2011.

| | | | |

| Equity Funds | | | | |

Asia Pacific Fund | | Global Opportunities Fund | | Premier Large Company Growth Fund |

C&B Large Cap Value Fund | | Growth Fund | | Small Cap Opportunities Fund |

C&B Mid Cap Value Fund | | Health Care Fund | | Small Cap Value Fund |

Capital Growth Fund | | Index Fund | | Small Company Growth Fund |

Common Stock Fund | | International Equity Fund | | Small Company Value Fund |

Disciplined U.S. Core Fund | | International Value Fund | | Small/Mid Cap Core Fund |

Discovery Fund† | | Intrinsic Small Cap Value Fund | | Small/Mid Cap Value Fund |

Diversified Equity Fund | | Intrinsic Value Fund | | Social Sustainability Fund† |

Diversified International Fund | | Intrinsic World Equity Fund | | Special Mid Cap Value Fund |

Diversified Small Cap Fund | | Large Cap Core Fund | | Special Small Cap Value Fund |

Emerging Growth Fund | | Large Cap Growth Fund | | Specialized Technology Fund |

Emerging Markets Equity Fund | | Large Company Value Fund | | Strategic Large Cap Growth Fund |

Endeavor Select Fund† | | Omega Growth Fund | | Traditional Small Cap Growth Fund |

Enterprise Fund† | | Opportunity Fund† | | Utility and Telecommunications Fund |

Equity Value Fund | | Precious Metals Fund | | |

| Bond Funds | | | | |

Adjustable Rate Government Fund | | Inflation-Protected Bond Fund | | Short-Term Bond Fund |

California Limited-Term Tax-Free Fund | | Intermediate Tax/AMT-Free Fund | | Short-Term High Yield Bond Fund |

California Tax-Free Fund | | International Bond Fund | | Short-Term Municipal Bond Fund |

Colorado Tax-Free Fund | | Minnesota Tax-Free Fund | | Strategic Municipal Bond Fund |

Government Securities Fund | | Municipal Bond Fund | | Total Return Bond Fund |

High Income Fund | | North Carolina Tax-Free Fund | | Ultra Short-Term Income Fund |

High Yield Bond Fund | | Pennsylvania Tax-Free Fund | | Ultra Short-Term Municipal Income Fund |

Income Plus Fund | | Short Duration Government Bond Fund | | Wisconsin Tax-Free Fund |

| Asset Allocation Funds | | | | |

Asset Allocation Fund | | WealthBuilder Equity Portfolio† | | Target 2020 Fund† |

Conservative Allocation Fund | | WealthBuilder Growth Allocation Portfolio† | | Target 2025 Fund† |

Diversified Capital Builder Fund | | WealthBuilder Growth Balanced Portfolio† | | Target 2030 Fund† |

Diversified Income Builder Fund | | WealthBuilder Moderate Balanced Portfolio† | | Target 2035 Fund† |

Growth Balanced Fund | | WealthBuilder Tactical Equity Portfolio† | | Target 2040 Fund† |

Index Asset Allocation Fund | | Target Today Fund† | | Target 2045 Fund† |

Moderate Balanced Fund | | Target 2010 Fund† | | Target 2050 Fund† |

WealthBuilder Conservative Allocation Portfolio† | | Target 2015 Fund† | | Target 2055 Fund† |

| Money Market Funds | | | | |

100% Treasury Money Market Fund | | Minnesota Money Market Fund | | New Jersey Municipal Money Market Fund |

California Municipal Money Market Fund | | Money Market Fund | | New York Municipal Money Market Fund |

Cash Investment Money Market Fund | | Municipal Cash Management Money Market Fund | | Pennsylvania Municipal Money Market Fund |

Government Money Market Fund | | Municipal Money Market Fund | | Prime Investment Money Market Fund |

Heritage Money Market Fund† | | National Tax-Free Money Market Fund | | Treasury Plus Money Market Fund |

| Variable Trust Funds1 | | | | |

VT Discovery Fund† | | VT Intrinsic Value Fund | | VT Small Cap Growth Fund |

VT Index Asset Allocation Fund | | VT Omega Growth Fund | | VT Small Cap Value Fund |

VT International Equity Fund | | VT Opportunity Fund† | | VT Total Return Bond Fund |

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Advantage Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

| 1. | The Variable Trust Funds are generally available only through insurance company variable contracts. |

| † | In this report, the Wells Fargo Advantage Discovery FundSM, Wells Fargo Advantage Endeavor Select FundSM, Wells Fargo Advantage Enterprise FundSM, Wells Fargo Advantage Opportunity FundSM, Wells Fargo Advantage Social Sustainability FundSM, Wells Fargo Advantage WealthBuilder Conservative Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Equity PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Moderate Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Tactical Equity PortfolioSM, Wells Fargo Advantage Dow Jones Target Today FundSM, Wells Fargo Advantage Dow Jones Target 2010 FundSM, Wells Fargo Advantage Dow Jones Target 2015 FundSM, Wells Fargo Advantage Dow Jones Target 2020 FundSM, Wells Fargo Advantage Dow Jones Target 2025 FundSM, Wells Fargo Advantage Dow Jones Target 2030 FundSM, Wells Fargo Advantage Dow Jones Target 2035 FundSM, Wells Fargo Advantage Dow Jones Target 2040 FundSM, Wells Fargo Advantage Dow Jones Target 2045 FundSM, Wells Fargo Advantage Dow Jones Target 2050 FundSM, Wells Fargo Advantage Dow Jones Target 2055 FundSM, Wells Fargo Advantage Heritage Money Market FundSM, Wells Fargo Advantage VT Discovery FundSM, and Wells Fargo Advantage VT Opportunity FundSM are referred to as the Discovery Fund, Endeavor Select Fund, Enterprise Fund, Opportunity Fund, Social Sustainability Fund, WealthBuilder Conservative Allocation Portfolio, WealthBuilder Equity Portfolio, WealthBuilder Growth Allocation Portfolio, WealthBuilder Growth Balanced Portfolio, WealthBuilder Moderate Balanced Portfolio, WealthBuilder Tactical Equity Portfolio, Target Today Fund, Target 2010 Fund, Target 2015 Fund, Target 2020 Fund, Target 2025 Fund, Target 2030 Fund, Target 2035 Fund, Target 2040 Fund, Target 2045 Fund, Target 2050 Fund, Target 2055 Fund, Heritage Money Market Fund, VT Discovery Fund, and VT Opportunity Fund, respectively. |

Not part of the semi-annual report.

| | | | |

| 2 | | Wells Fargo Advantage Health Care Fund | | Letter to Shareholders |

Karla M. Rabusch,

President

Wells Fargo Advantage Funds

All major areas of the global stock market ended with losses, with most of the decline occurring in the second half of the period.

Dear Valued Shareholder,

We’re pleased to offer you this semi-annual report for the Wells Fargo Advantage Health Care Fund for the six-month period that ended September 30, 2011. Upon reviewing the report, you may notice a few changes from past reports, the most significant of which is the change from a multi-fund report to a single-fund report. We believe this change will give you more convenient access to your fund data.

The period was marked by growing pessimism about the economy and, consequently, increased market volatility as a variety of macroeconomic events—including the ongoing European sovereign debt crisis and the downgrade of the U.S. credit rating by Standard & Poor’s—caused investors to question the strength of the economic recovery. All major areas of the global stock market ended with losses, with most of the decline occurring in the second half of the period.

Market sentiment darkened as economic numbers weakened.

Prior to the period, economic numbers seemed to support the view of a gradual global economic recovery. However, growth in gross domestic product (GDP) for the first quarter of 2011 was initially reported at 1.8% but was later revised significantly downward to 0.4%. The amount of the downward revision not only reawakened fears that the economy was slowing, but also caused investors to put less of an emphasis on the 1.3% estimate for second-quarter GDP growth. The prolonged debate in the summer of 2011 over increasing the U.S. debt ceiling, which raised the possibility of the country defaulting on its debt, further weakened investor sentiment. Although the debate was resolved in time to prevent a default, Standard & Poor’s later cited the country’s dysfunctional political climate as one reason why it lowered the U.S. credit rating to AA+ from AAA1.

Persistent weakness in jobs and housing slowed economic growth.

The unemployment rate remained stubbornly high throughout the six-month period, beginning the period at 9.0% in April 2011 and ending the period modestly higher at 9.1% in September 2011. Widespread frustration over the continued weakness in the labor market was one factor behind the “Occupy Wall Street” protest movement that began in September 2011. Persistent weakness in the housing market remained another source of concern. By September, some market analysts were openly discussing the possibility of a return to recession; even those analysts who forecasted a continued recovery believed that it would occur only gradually. The end result was a U.S. stock market that weakened in June and recovered in July, then fell sharply in August and September to end the period with significant losses.

Europe’s sovereign debt problems continued to weigh on confidence.

The ongoing drama of the European sovereign debt crisis returned to center stage, as it became increasingly likely that eurozone member Greece would default on its sovereign debt, despite receiving aid from the European Union and the International Monetary Fund. Because many eurozone banks owned Greek debt, and many U.S. banks had financial ties to eurozone banks, investors worried

| 1. | The ratings indicated are from Standard & Poor’s. Credit quality ratings apply to underlying holdings of the fund and not the fund itself. Standard and Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. |

| | | | | | |

| Letter to Shareholders | | Wells Fargo Advantage Health Care Fund | | | 3 | |

about the effect of such an event on the global economy and financial system. Meanwhile, market participants increasingly worried about the debt burdens of Italy—which also had its credit rating downgraded by Standard & Poor’s—and later of France. Although France maintained its AAA rating as of the end of the period, French banks were heavily exposed to weaker sovereign credits, leading to fears of a state bailout and a resulting increase in France’s required expenditures. Partly because of the debt worries, European stock markets generally ended the period with losses.

Central banks continued to provide stimulus.

Throughout the reporting period, the Federal Open Market Committee kept its key interest rates at effectively zero in order to support the financial system. As previously planned, the Federal Reserve (Fed) ended its second round of quantitative easing (QE2)—in which it purchased a total of $600 billion in long-term U.S. Treasuries from November 2010 through June 2011—as well as reinvested an additional $250 billion to $300 billion in Treasuries with the proceeds from earlier investments. However, in response to extreme market volatility and signs of a weakening economy, in early August 2011, the Fed announced its intention to keep interest rates low until 2013. In September, the Fed implemented a program to sell $400 billion in short-term Treasuries in exchange for longer-term bonds—so-called “Operation Twist”—with the goal of pushing down long-term yields.

At the beginning of the period, the European Central Bank (ECB) had a key rate of 1.00%, but it raised it to 1.25% in April and then to 1.50% in July in an attempt to keep inflation in check. The ECB continued to provide unlimited liquidity for banks and, in August, after a sell-off in the sovereign bonds of Spain and Italy, announced plans to purchase the debt of those countries.

Global stock markets sold off during the period.

Stocks began the period rallying on hopes of a continued economic recovery, only to sell off sharply in late summer. For the period, economically sensitive stocks generally posted the deepest losses. As a result, the stocks of smaller companies—which generally have lesser access to capital and less diversified revenue streams than larger companies—performed the worst. The weaker economy also renewed concerns about potential loan losses at banks and other financial institutions. Among both large caps and small caps, growth stocks posted narrower losses than value stocks, largely because of weakness in financials (which are typically considered part of the value space). More defensive sectors such as health care and utilities generally outperformed. In addition, a rally in gold helped gold-related stocks post better returns than the broader market.

Many variables are at work in the market.

The full effect of the credit crisis remains unknown. Elevated unemployment and debt defaults continue to pressure consumers and businesses alike.

In this environment, experience tells us that strict adherence to time-tested strategies has its rewards. Wells Fargo Advantage Funds represents investments across a range of asset classes and investment styles, giving you an opportunity to create a diversified investment portfolio. While diversification may not prevent losses in a downturn, it does provide you with one way of managing risk.

Stocks began the period rallying on hopes of a continued economic recovery, only to sell off sharply in late summer.

| | | | |

| 4 | | Wells Fargo Advantage Health Care Fund | | Letter to Shareholders |

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at www.wellsfargo.com/advantagefunds, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

| | | | | | |

| Performance Highlights (Unaudited) | | Wells Fargo Advantage Health Care Fund | | | 5 | |

INVESTMENT OBJECTIVE

The Fund seeks long-term capital appreciation.

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Wells Capital Management Incorporated

PORTFOLIO MANAGER

Robert Junkin, CPA

FUND INCEPTION

December 22, 1999

| | | | |

TEN LARGEST EQUITY HOLDINGS1

(AS OF SEPTEMBER 30, 2011) | |

Pfizer Incorporated | | | 3.47% | |

Amgen Incorporated | | | 3.39% | |

Celgene Corporation | | | 3.03% | |

Careview Communications Incorporated | | | 2.84% | |

Alexion Pharmaceuticals Incorporated | | | 2.83% | |

Gilead Sciences Incorporated | | | 2.60% | |

UnitedHealth Group Incorporated | | | 2.47% | |

Sanofi-Aventis SA | | | 2.26% | |

Aetna Incorporated | | | 2.23% | |

Allergan Incorporated | | | 2.17% | |

| | |

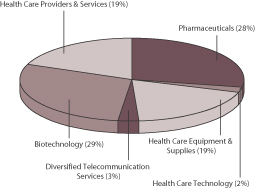

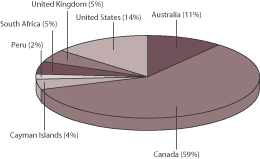

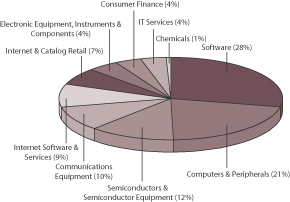

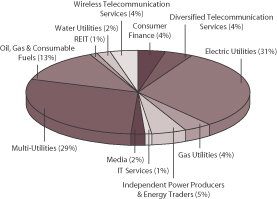

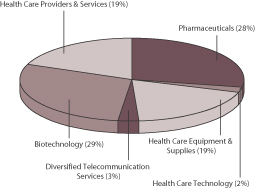

INDUSTRY DISTRIBUTION2 (AS OF SEPTEMBER 30, 2011) | | |

| |

| | |

| 1. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 2. | Industry distribution is subject to change and is calculated based on the total long-term investments of the Fund. |

| | | | |

| 6 | | Wells Fargo Advantage Health Care Fund | | Performance Highlights (Unaudited) |

AVERAGE ANNUAL TOTAL RETURN3 (%) (AS OF SEPTEMBER 30, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Including Sales Charge | | | Excluding Sales Charge | | | Expense Ratios4 | |

| | | Inception Date | | | 6 Months* | | | 1 Year | | | 5 Year | | | 10 Year | | | 6 Months* | | | 1 Year | | | 5 Year | | | 10 Year | | | Gross | | | Net5 | |

Class A (EHABX) | | | 12/22/1999 | | | | (15.64 | ) | | | (5.41 | ) | | | (1.93 | ) | | | 3.99 | | | | (10.50 | ) | | | 0.34 | | | | (0.77 | ) | | | 4.61 | | | | 1.61% | | | | 1.47% | |

Class B (EHCBX) ** | | | 12/22/1999 | | | | (15.31 | ) | | | (5.42 | ) | | | (1.85 | ) | | | 4.08 | | | | (10.85 | ) | | | (0.44 | ) | | | (1.50 | ) | | | 4.08 | | | | 2.36% | | | | 2.22% | |

Class C (EHCCX) | | | 12/22/1999 | | | | (11.81 | ) | | | (1.38 | ) | | | (1.50 | ) | | | 3.85 | | | | (10.81 | ) | | | (0.38 | ) | | | (1.50 | ) | | | 3.85 | | | | 2.36% | | | | 2.22% | |

Administrator Class (EHCYX) | | | 12/22/1999 | | | | | | | | | | | | | | | | | | | | (10.35 | ) | | | 0.61 | | | | (0.51 | ) | | | 4.89 | | | | 1.45% | | | | 1.24% | |

S&P 1500 Supercomposite Healthcare Sector Index6 | | | | | | | | | | | | | | | | | | | | | | | (4.33 | ) | | | 6.45 | | | | 1.60 | | | | 2.09 | | | | | | | | | |

S&P 500 Index7 | | | | | | | | | | | | | | | | | | | | | | | (13.78 | ) | | | 1.14 | | | | (1.18 | ) | | | 2.82 | | | | | | | | | |

| * | Returns for periods of less than one year are not annualized. |

| ** | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s Web site – www.wellsfargo.com/advantagefunds.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. The use of derivatives may reduce returns and/or increase volatility. Funds that concentrate their investments in limited sectors may be susceptible to financial, economic or market events impacting those sectors. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to foreign investment risk, non-diversification risk, and smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

| 3. | Historical performance shown for all classes of the Fund prior to July 19, 2010 is based on the performance of the Fund’s predecessor, Evergreen Health Care Fund. |

| 4. | Reflects the expense ratios as stated in the most prospectuses. |

| 5. | The Adviser has committed through July 18, 2013 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at 1.46% for Class A, 2.21% for Class B, 2.21% for Class C and 1.23% for Administrator Class. Without this cap, the Fund’s returns would have been lower. |

| 6. | The S&P 1500 Supercomposite Healthcare Sector Index is an unmanaged capitalization-weighted index tracking the performance of health care stocks within the S&P 500, S&P MidCap 400 Index and S&P 600 Index. S&P indices are unmanaged and track the performance of publicly-traded U.S. stocks. They are often used to indicate the performance of specific market capitalizations and/or the overall U.S. stock market. You cannot invest directly in an index. |

| 7. | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| | | | | | |

| Fund Expenses (Unaudited) | | Wells Fargo Advantage Health Care Fund | | | 7 | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) and/or shareholder service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from April 1, 2011 to September 30, 2011.

Actual Expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses Paid During Period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

04-01-2011 | | | Ending

Account Value

09-30-2011 | | | Expenses

Paid During

the Period1 | | | Net Annual

Expense Ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 894.98 | | | $ | 6.87 | | | | 1.45 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.75 | | | $ | 7.31 | | | | 1.45 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 891.46 | | | $ | 10.40 | | | | 2.20 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.00 | | | $ | 11.08 | | | | 2.20 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 891.91 | | | $ | 10.41 | | | | 2.20 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.00 | | | $ | 11.08 | | | | 2.20 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 896.48 | | | $ | 5.83 | | | | 1.23 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.85 | | | $ | 6.21 | | | | 1.23 | % |

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half year period). |

| | | | |

| 8 | | Wells Fargo Advantage Health Care Fund | | Portfolio of Investments—September 30, 2011 (Unaudited) |

| | | | | | | | | | | | |

| Security Name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

Common Stocks: 97.14% | | | | | | | | | | | | |

| | | | |

Health Care : 94.30% | | | | | | | | | | | | |

| | | | |

| Biotechnology : 28.58% | | | | | | | | | | | | |

Acorda Therapeutics Incorporated† | | | | | | | 67,672 | | | $ | 1,350,733 | |

Alexion Pharmaceuticals Incorporated† | | | | | | | 39,061 | | | | 2,502,248 | |

Amgen Incorporated | | | | | | | 54,538 | | | | 2,996,863 | |

Biogen Idec Incorporated† | | | | | | | 4,807 | | | | 447,772 | |

Celgene Corporation†« | | | | | | | 43,267 | | | | 2,679,093 | |

Cubist Pharmaceuticals Incorporated†« | | | | | | | 14,513 | | | | 512,599 | |

Dendreon Corporation†« | | | | | | | 88,549 | | | | 796,941 | |

Gilead Sciences Incorporated† | | | | | | | 59,281 | | | | 2,300,103 | |

Human Genome Sciences Incorporated† | | | | | | | 75,625 | | | | 959,681 | |

Idenix Pharmaceuticals Incorporated†« | | | | | | | 346,007 | | | | 1,726,575 | |

Incyte Corporation†« | | | | | | | 46,141 | | | | 644,590 | |

Novavax Incorporated†« | | | | | | | 390,762 | | | | 629,127 | |

NPS Pharmaceuticals Incorporated†« | | | | | | | 89,611 | | | | 583,368 | |

Onyx Pharmaceuticals Incorporated†« | | | | | | | 5,592 | | | | 167,816 | |

Pharmasset Incorporated†« | | | | | | | 21,172 | | | | 1,743,938 | |

Regeneron Pharmaceutical Incorporated†« | | | | | | | 19,896 | | | | 1,157,947 | |

Theratechnologies Incorporated†« | | | | | | | 462,974 | | | | 1,378,451 | |

United Therapeutics Corporation†« | | | | | | | 22,099 | | | | 828,492 | |

Vertex Pharmaceuticals Incorporated†« | | | | | | | 42,069 | | | | 1,873,753 | |

| | | | |

| | | | | | | | | | | 25,280,090 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies : 18.33% | | | | | | | | | | | | |

Alere Incorporated†« | | | | | | | 78,739 | | | | 1,547,221 | |

ArthroCare Corporation† | | | | | | | 43,964 | | | | 1,264,844 | |

Atricure Incorporated† | | | | | | | 68,670 | | | | 668,846 | |

CareFusion Corporation† | | | | | | | 60,347 | | | | 1,445,311 | |

Covidien plc | | | | | | | 21,030 | | | | 927,423 | |

Fresenius SE | | | | | | | 12,058 | | | | 1,071,797 | |

Genmark Diagnostics Incorporated† | | | | | | | 127,545 | | | | 733,384 | |

HeartWare International Incorporated† | | | | | | | 17,591 | | | | 1,133,036 | |

Hospira Incorporated† | | | | | | | 29,783 | | | | 1,101,971 | |

NuVasive Incorporated†« | | | | | | | 69,977 | | | | 1,194,507 | |

SonoSite Incorporated†« | | | | | | | 30,866 | | | | 936,474 | |

Thoratec Corporation†« | | | | | | | 43,973 | | | | 1,435,279 | |

TSO3 Incorporated† | | | | | | | 500,000 | | | | 663,231 | |

Wright Medical Group Incorporated†« | | | | | | | 64,735 | | | | 1,157,462 | |

Zimmer Holdings Incorporated†« | | | | | | | 17,417 | | | | 931,810 | |

| | | | |

| | | | | | | | | | | 16,212,596 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 18.42% | | | | | | | | | | | | |

Aetna Incorporated | | | | | | | 54,283 | | | | 1,973,187 | |

CIGNA Corporation | | | | | | | 42,789 | | | | 1,794,571 | |

Express Scripts Incorporated† | | | | | | | 43,645 | | | | 1,617,920 | |

Fresenius Medical Care AG & Company | | | | | | | 16,636 | | | | 1,128,572 | |

Hanger Orthopedic Group Incorporated† | | | | | | | 76,566 | | | | 1,446,332 | |

HCA Holdings Incorporated† | | | | | | | 49,035 | | | | 988,546 | |

Health Management Associates Incorporated Class A† | | | | | | | 77,911 | | | | 539,144 | |

Health Net Incorporated† | | | | | | | 61,010 | | | | 1,446,547 | |

| | | | | | |

| Portfolio of Investments—September 30, 2011 (Unaudited) | | Wells Fargo Advantage Health Care Fund | | | 9 | |

| | | | | | | | | | | | | | |

| Security Name | | | | | | | Shares | | | Value | |

| | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: (continued) | | | | | | | | | | | | | | |

McKesson Corporation | | | | | | | | | 23,334 | | | $ | 1,696,382 | |

Medipattern Corporation† | | | | | | | | | 1,524,387 | | | | 465,506 | |

UnitedHealth Group Incorporated« | | | | | | | | | 47,308 | | | | 2,181,845 | |

Vanguard Health Systems Incorporated† | | | | | | | | | 100,000 | | | | 1,016,000 | |

| | | | |

| | | | | | | | | | | | | 16,294,552 | |

| | | | | | | | | | | | | | |

| | | | |

| Health Care Technology: 1.54% | | | | | | | | | | | | | | |

Allscripts Healthcare Solutions Incorporated† | | | | | | | | | 75,700 | | | | 1,364,114 | |

| | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 27.43% | | | | | | | | | | | | | | |

Allergan Incorporated« | | | | | | | | | 23,324 | | | | 1,921,431 | |

Bristol-Myers Squibb Company« | | | | | | | | | 31,962 | | | | 1,002,968 | |

Elan Corporation plc ADR† | | | | | | | | | 180,374 | | | | 1,899,338 | |

Eli Lilly & Company | | | | | | | | | 24,312 | | | | 907,321 | |

Endo Pharmaceuticals Holdings Incorporated† | | | | | | | | | 41,470 | | | | 1,160,745 | |

Forest Laboratories Incorporated†« | | | | | | | | | 28,074 | | | | 864,398 | |

Jazz Pharmaceuticals Incorporated† | | | | | | | | | 30,411 | | | | 1,262,665 | |

Johnson & Johnson« | | | | | | | | | 16,699 | | | | 1,063,893 | |

Map Pharmaceuticals Incorporated†« | | | | | | | | | 109,282 | | | | 1,597,703 | |

Mylan Laboratories Incorporated† | | | | | | | | | 83,077 | | | | 1,412,309 | |

Optimer Pharmaceuticals Incorporated†« | | | | | | | | | 87,148 | | | | 1,206,128 | |

Pfizer Incorporated | | | | | | | | | 173,608 | | | | 3,069,389 | |

Roche Holding AG Genusschein | | | | | | | | | 5,527 | | | | 898,323 | |

Salix Pharmaceuticals Limited†« | | | | | | | | | 38,013 | | | | 1,125,185 | |

Sanofi-Aventis SA | | | | | | | | | 30,430 | | | | 2,001,586 | |

Teva Pharmaceutical Industries Limited ADR | | | | | | | | | 44,535 | | | | 1,657,593 | |

Valera Pharmaceuticals Incorporated Escrow†(a)(i) | | | | | | | | | 410,964 | | | | 0 | |

Warner Chilcott Limited | | | | | | | | | 85,264 | | | | 1,219,275 | |

| | | | |

| | | | | | | | | | | | | 24,270,250 | |

| | | | | | | | | | | | | | |

| | | | |

Telecommunication Services: 2.84% | | | | | | | | | | | | | | |

| | | | |

| Diversified Telecommunication Services: 2.84% | | | | | | | | | | | | | | |

Careview Communications Incorporated†« | | | | | | | | | 1,599,642 | | | | 2,511,438 | |

| | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $79,034,626) | | | | | | | | | | | | | 85,933,040 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | Expiration Date | | | | | | | |

| Rights: 0.03% | | | | | | | | | | | | | | |

| | | | |

Health Care: 0.03% | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.03% | | | | | | | | | | | | | | |

Sanofi-Aventis SA† | | | | | 12/31/2020 | | | | 23,418 | | | | 24,823 | |

| | | | | | | | | | | | | | |

| | | | |

Total Rights (Cost $51,988) | | | | | | | | | | | | | 24,823 | |

| | | | | | | | | | | | | | |

| | | | |

| 10 | | Wells Fargo Advantage Health Care Fund | | Portfolio of Investments—September 30, 2011 (Unaudited) |

| | | | | | | | | | | | | | | | |

| Security Name | | | | | Expiration Date | | | Shares | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

Warrants: 0.05% | | | | | | | | | | | | | | | | |

| | | | |

Health Care: 0.05% | | | | | | | | | | | | | | | | |

| | | | |

| Biotechnology: 0.05% | | | | | | | | | | | | | | | | |

Novavax Incorporated†(a)(i) | | | | | | | 07/31/2013 | | | | 158,377 | | | $ | 41,178 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Warrants (Cost $0) | | | | | | | | | | | | | | | 41,178 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Yield | | | | | | | | | | |

| Short-Term Investments: 31.14% | | | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 31.14% | | | | | | | | | | | | | | | | |

Wells Fargo Advantage Cash Investment Money Market Fund, Institutional Class(l)(u) | | | 0.06 | % | | | | | | | 3,113,644 | | | | 3,113,644 | |

Wells Fargo Securities Lending Cash Investments, LLC(l)(r)(u)(v) | | | 0.20 | | | | | | | | 24,435,695 | | | | 24,435,695 | |

| | | | |

Total Short-Term Investments (Cost $27,549,339) | | | | | | | | | | | | | | | 27,549,339 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total Investments in Securities | | | | | | | | |

| (Cost $106,635,953)* | | | 128.36 | % | | | 113,548,380 | |

Other Assets and Liabilities, Net | | | (28.36 | ) | | | (25,086,059 | ) |

| | | | | | | | |

| Total Net Assets | | | 100.00 | % | | $ | 88,462,321 | |

| | | | | | | | |

| † | Non-income earning security. |

| « | All or a portion of this security is on loan. |

| (a) | Security is fair valued by the Management Valuation Team, and in certain instances by the Board of Trustees, in accordance with procedures approved by the Board of Trustees. |

| (l) | Investment in an affiliate. |

| (u) | Rate shown is the 7-day annualized yield at period end. |

| (v) | Security represents investment of cash collateral received from securities on loan. |

| (r) | The investment company is exempt from registration under Section 3(c)(7) of the 1940 Act. |

| * | Cost for federal income tax purposes is $107,400,040 and net unrealized appreciation (depreciation) consists of: |

| | | | |

Gross unrealized appreciation | | $ | 15,829,360 | |

Gross unrealized depreciation | | | (9,681,020 | ) |

| | | | |

Net unrealized appreciation | | $ | 6,148,340 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of Assets and Liabilities—September 30, 2011 (Unaudited) | | Wells Fargo Advantage Health Care Fund | | | 11 | |

| | | | |

| | |

Assets | | | | |

Investments | | | | |

In unaffiliated securities (including securities on loan), at value | | $ | 85,999,041 | |

In affiliated securities, at value | | | 27,549,339 | |

| | | | |

Total investments, at value (see cost below) | | | 113,548,380 | |

Foreign currency, at value (see cost below) | | | 39 | |

Receivable for investments sold | | | 1,626,013 | |

Receivable for Fund shares sold | | | 5,605 | |

Receivable for dividends | | | 20,933 | |

Receivable for securities lending income | | | 13,862 | |

Prepaid expenses and other assets | | | 29,784 | |

| | | | |

Total assets | | | 115,244,616 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 1,821,035 | |

Payable for Fund shares redeemed | | | 293,426 | |

Payable upon receipt of securities loaned | | | 24,435,695 | |

Advisory fee payable | | | 69,163 | |

Distribution fees payable | | | 23,889 | |

Due to other related parties | | | 25,822 | |

Accrued expenses and other liabilities | | | 113,265 | |

| | | | |

Total liabilities | | | 26,782,295 | |

| | | | |

Total net assets | | $ | 88,462,321 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 81,823,688 | |

Undistributed net investment loss | | | (566,272 | ) |

Accumulated net realized gains on investments | | | 290,454 | |

Net unrealized gains on investments | | | 6,914,451 | |

| | | | |

Total net assets | | $ | 88,462,321 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE1 | | | | |

Net assets – Class A | | $ | 52,200,844 | |

Shares outstanding – Class A | | | 2,986,578 | |

Net asset value per share – Class A | | | $17.48 | |

Maximum offering price per share – Class A2 | | | $18.55 | |

Net assets – Class B | | $ | 12,928,731 | |

Shares outstanding – Class B | | | 819,438 | |

Net asset value per share – Class B | | | $15.78 | |

Net assets – Class C | | $ | 19,113,012 | |

Shares outstanding – Class C | | | 1,212,387 | |

Net asset value per share – Class C | | | $15.76 | |

Net assets – Administrator Class | | $ | 4,219,734 | |

Shares outstanding – Administrator Class | | | 233,101 | |

Net asset value per share – Administrator Class | | | $18.10 | |

| |

Total investments, at cost | | $ | 106,635,953 | |

| | | | |

Securities on loan, at value | | $ | 23,764,412 | |

| | | | |

Foreign currency, at cost | | $ | 43 | |

| | | | |

| 1. | The Fund has an unlimited number of authorized shares. |

| 2. | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Advantage Health Care Fund | | Statement of Operations—Six Months Ended September 30, 2011 (Unaudited) |

| | | | |

| | |

Investment income | | | | |

Dividends* | | $ | 253,087 | |

Securities lending income, net | | | 96,756 | |

Income from affiliated securities | | | 1,895 | |

| | | | |

Total investment income | | | 351,738 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 425,551 | |

Administration fees | | | | |

Fund level | | | 26,597 | |

Class A | | | 79,700 | |

Class B | | | 21,663 | |

Class C | | | 29,692 | |

Administrator Class | | | 2,788 | |

Shareholder servicing fees | | | | |

Class A | | | 76,157 | |

Class B | | | 20,830 | |

Class C | | | 28,550 | |

Administrator Class | | | 6,582 | |

Distribution fees | | | | |

Class B | | | 62,490 | |

Class C | | | 85,649 | |

Custody and accounting fees | | | 6,537 | |

Professional fees | | | 12,841 | |

Registration fees | | | 7,945 | |

Shareholder report expenses | | | 13,264 | |

Trustees’ fees and expenses | | | 1,000 | |

Other fees and expenses | | | 4,625 | |

| | | | |

Total expenses | | | 912,461 | |

Less: Fee waivers and/or expense reimbursements | | | (1,303 | ) |

| | | | |

Net expenses | | | 911,158 | |

| | | | |

Net investment loss | | | (559,420 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains on investments | | | 9,602,429 | |

Net change in unrealized gains (losses) investments | | | (19,612,078 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | (10,009,649 | ) |

| | | | |

Net decrease in net assets resulting from operations | | $ | (10,569,069 | ) |

| | | | |

| |

* Net of foreign dividend withholding taxes of | | | $6,679 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statements of Changes in Net Assets | | Wells Fargo Advantage Health Care Fund | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended September 30, 2011

(Unaudited) | | | Year Ended March 31, 20111 | | | Year Ended October 31, 20102 | |

| | | | | | |

Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | | | | $ | (559,420 | ) | | | | | | $ | (370,404 | ) | | | | | | $ | (549,964 | ) |

Net realized gains on investments | | | | | | | 9,602,429 | | | | | | | | 3,963,912 | | | | | | | | 5, 234,549 | |

Net change in unrealized gains (losses) on investments | | | | | | | (19,612,078 | ) | | | | | | | 6,803,706 | | | | | | | | 13,845,174 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | | | | | (10,569,069 | ) | | | | | | | 10,397,214 | | | | | | | | 18,529,759 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | 198,917 | | | | 3,903,993 | | | | 137,633 | | | | 2,523,285 | | | | 280,789 | | | | 4,815,150 | |

Class B | | | 619 | | | | 11,654 | | | | 386 | | | | 6,529 | | | | 18,318 | | | | 286,395 | |

Class C | | | 20,487 | | | | 369,851 | | | | 16,840 | | | | 284,288 | | | | 31,646 | | | | 495,682 | |

Administrator Class | | | 14,596 | | | | 300,092 | | | | 127,754 | | | | 2,363,718 | | | | 33,994 | 3 | | | 6,01,485 | 3 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 4,585,590 | | | | | | | | 5,177,820 | | | | | | | | 6,198,712 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | (402,128 | ) | | | (7,833,416 | ) | | | (748,947 | ) | | | (13,622,132 | ) | | | (1,600,428 | ) | | | (27,382,655 | ) |

Class B | | | (234,423 | ) | | | (4,136,092 | ) | | | (178,385 | ) | | | (2,986,898 | ) | | | (374,283 | ) | | | (5,824,189 | ) |

Class C | | | (132,805 | ) | | | (2,323,797 | ) | | | (170,692 | ) | | | (2,842,039 | ) | | | (444,695 | ) | | | (6,906,077 | ) |

Administrator Class | | | (69,578 | ) | | | (1,378,533 | ) | | | (62,746 | ) | | | (1,208,005 | ) | | | (192,388 | )3 | | | (3,370,161 | )3 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | (15,671,838 | ) | | | | | | | (20,659,074 | ) | | | | | | | (43,483,082 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net decrease in net assets resulting

from capital share transactions | | | | | | | (11,086,248 | ) | | | | | | | (15,481,254 | ) | | | | | | | (37,284,370 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total decrease in net assets | | | | | | | (21,655,317 | ) | | | | | | | (5,084,040 | ) | | | | | | | (18,754,611 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 110,117,638 | | | | | | | | 115,201,678 | | | | | | | | 133,956,289 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

End of period | | | | | | $ | 88,462,321 | | | | | | | $ | 110,117,638 | | | | | | | $ | 115,201,678 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Undistributed net investment loss | | | | | | $ | (566,272 | ) | | | | | | $ | (6,852 | ) | | | | | | $ | (6,591 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 1. | For the five months ended March 31, 2011. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2011. |

| 2. | After the close of business on July 16, 2010, the Fund acquired the net assets of Evergreen Health Care Fund which became the accounting and performance survivor in this transaction. The information for the period prior to July 19, 2010 is that of Evergreen Health Care Fund. |

| 3. | Class I shares of Evergreen Health Care Fund became Administrator Class shares on July 19, 2010. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Advantage Health Care Fund | | Financial Highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

September 30, 2011 (Unaudited) | | | Year Ended

March 31, 20111 | | | Year Ended October 31, | |

| Class A | | | | 20102 | | | 20092 | | | 20082 | | | 20072 | | | 20062 | |

Net asset value, beginning of period | | $ | 19.52 | | | $ | 17.74 | | | $ | 15.40 | | | $ | 14.59 | | | $ | 23.09 | | | $ | 20.93 | | | $ | 19.38 | |

Net investment loss | | | (0.08 | )3 | | | (0.04 | )3 | | | (0.03 | )3 | | | (0.11 | )3 | | | (0.13 | )3 | | | (0.09 | ) | | | (0.12 | )3 |

Net realized and unrealized gains (losses) on investments | | | (1.96 | ) | | | 1.82 | | | | 2.37 | | | | 0.92 | | | | (6.58 | ) | | | 2.86 | | | | 2.80 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (2.04 | ) | | | 1.78 | | | | 2.34 | | | | 0.81 | | | | (6.71 | ) | | | 2.77 | | | | 2.68 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (1.79 | ) | | | (0.61 | ) | | | (1.13 | ) |

Net asset value, end of period | | $ | 17.48 | | | $ | 19.52 | | | $ | 17.74 | | | $ | 15.40 | | | $ | 14.59 | | | $ | 23.09 | | | $ | 20.93 | |

Total return4 | | | (10.50 | )% | | | 10.03 | % | | | 15.19 | % | | | 5.55 | % | | | (31.30 | )% | | | 13.57 | % | | | 14.46 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.45 | % | | | 1.59 | % | | | 1.77 | % | | | 1.81 | % | | | 1.68 | % | | | 1.66 | % | | | 1.70 | % |

Net expenses | | | 1.45 | % | | | 1.46 | % | | | 1.73 | % | | | 1.81 | % | | | 1.66 | % | | | 1.64 | % | | | 1.69 | % |

Net investment loss | | | (0.78 | )% | | | (0.52 | )% | | | (0.16 | )% | | | (0.81 | )% | | | (0.68 | )% | | | (0.41 | )% | | | (0.63 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 32 | % | | | 33 | % | | | 42 | % | | | 49 | % | | | 47 | % | | | 71 | % | | | 41 | % |

Net assets, end of period (000’s omitted) | | | $52,201 | | | | $62,261 | | | | $67,434 | | | | $78,860 | | | | $96,713 | | | | $161,559 | | | | $148,460 | |

| 1. | For the five months ended March 31, 2011. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2011. |

| 2. | After the close of business on July 16, 2010, the Fund acquired the net assets of Evergreen Health Care Fund which became the accounting and performance survivor in this transaction. The information for the periods prior to July 19, 2010 is that of Class A of Evergreen Health Care Fund. |

| 3. | Calculated based upon average shares outstanding. |

| 4. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial Highlights | | Wells Fargo Advantage Health Care Fund | | | 15 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class B | | Six Months Ended September 30, 2011 (Unaudited) | | | Year Ended March 31, 20111 | | | Year Ended October 31, | |

| | | | 20102 | | | 20092 | | | 20082 | | | 20072 | | | 20062 | |

Net asset value, beginning of period | | $ | 17.69 | | | $ | 16.13 | | | $ | 14.10 | | | $ | 13.46 | | | $ | 21.60 | | | $ | 19.76 | | | $ | 18.47 | |

Net investment loss | | | (0.14 | )3 | | | (0.09 | )3 | | | (0.14 | )3 | | | (0.20 | )3 | | | (0.26 | ) | | | (0.31 | ) | | | (0.26 | ) |

Net realized and unrealized gains (losses) on investments | | | (1.77 | ) | | | 1.65 | | | | 2.17 | | | | 0.84 | | | | (6.09 | ) | | | 2.76 | | | | 2.68 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (1.91 | ) | | | 1.56 | | | | 2.03 | | | | 0.64 | | | | (6.35 | ) | | | 2.45 | | | | 2.42 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (1.79 | ) | | | (0.61 | ) | | | (1.13 | ) |

Net asset value, end of period | | $ | 15.78 | | | $ | 17.69 | | | $ | 16.13 | | | $ | 14.10 | | | $ | 13.46 | | | $ | 21.60 | | | $ | 19.76 | |

Total return4 | | | (10.85 | )% | | | 9.67 | % | | | 14.40 | % | | | 4.75 | % | | | (31.83 | )% | | | 12.73 | % | | | 13.72 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.20 | % | | | 2.35 | % | | | 2.52 | % | | | 2.57 | % | | | 2.40 | % | | | 2.35 | % | | | 2.40 | % |

Net expenses | | | 2.20 | % | | | 2.21 | % | | | 2.48 | % | | | 2.57 | % | | | 2.40 | % | | | 2.35 | % | | | 2.39 | % |

Net investment loss | | | (1.53 | )% | | | (1.28 | )% | | | (0.91 | )% | | | (1.56 | )% | | | (1.43 | )% | | | (1.12 | )% | | | (1.32 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 32 | % | | | 33 | % | | | 42 | % | | | 49 | % | | | 47 | % | | | 71 | % | | | 41 | % |

Net assets, end of period (000’s omitted) | | | $12,929 | | | | $18,629 | | | | $19,854 | | | | $22,384 | | | | $37,393 | | | | $88,967 | | | | $97,682 | |

| 1. | For the five months ended March 31, 2011. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2011. |

| 2. | After the close of business on July 16, 2010, the Fund acquired the net assets of Evergreen Health Care Fund which became the accounting and performance survivor in this transaction. The information for the periods prior to July 19, 2010 is that of Class B of Evergreen Health Care Fund. |

| 3. | Calculated based upon average shares outstanding. |

| 4. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Advantage Health Care Fund | | Financial Highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | Six Months Ended September 30, 2011 (Unaudited) | | | Year Ended March 31, 20111 | | | Year Ended October 31, | |

| | | | 20102 | | | 20092 | | | 20082 | | | 20072 | | | 20062 | |

Net asset value, beginning of period | | $ | 17.67 | | | $ | 16.11 | | | $ | 14.09 | | | $ | 13.45 | | | $ | 21.58 | | | $ | 19.74 | | | $ | 18.46 | |

Net investment loss | | | (0.14 | ) 3 | | | (0.09 | ) 3 | | | (0.14 | ) 3 | | | (0.20 | ) 3 | | | (0.25 | ) | | | (0.26 | ) | | | (0.23 | ) |

Net realized and unrealized gains (losses) on investments | | | (1.77 | ) | | | 1.65 | | | | 2.16 | | | | 0.84 | | | | (6.09 | ) | | | 2.71 | | | | 2.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (1.91 | ) | | | 1.56 | | | | 2.02 | | | | 0.64 | | | | (6.34 | ) | | | 2.45 | | | | 2.41 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (1.79 | ) | | | (0.61 | ) | | | (1.13 | ) |

Net asset value, end of period | | $ | 15.76 | | | $ | 17.67 | | | $ | 16.11 | | | $ | 14.09 | | | $ | 13.45 | | | $ | 21.58 | | | $ | 19.74 | |

Total return4 | | | (10.81 | )% | | | 9.68 | % | | | 14.34 | % | | | 4.76 | % | | | (31.81 | )% | | | 12.74 | % | | | 13.67 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.20 | % | | | 2.35 | % | | | 2.52 | % | | | 2.56 | % | | | 2.40 | % | | | 2.35 | % | | | 2.40 | % |

Net expenses | | | 2.20 | % | | | 2.21 | % | | | 2.48 | % | | | 2.56 | % | | | 2.40 | % | | | 2.35 | % | | | 2.39 | % |

Net investment loss | | | (1.54 | )% | | | (1.29 | )% | | | (0.90 | )% | | | (1.56 | )% | | | (1.43 | )% | | | (1.12 | )% | | | (1.33 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 32 | % | | | 33 | % | | | 42 | % | | | 49 | % | | | 47 | % | | | 71 | % | | | 41 | % |

Net assets, end of period (000’s omitted) | | | $19,113 | | | | $23,411 | | | | $23,823 | | | | $26,656 | | | | $38,178 | | | | $66,280 | | | | $65,655 | |

| 1. | For the five months ended March 31, 2011. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2011. |

| 2. | After the close of business on July 16, 2010, the Fund acquired the net assets of Evergreen Health Care Fund which became the accounting and performance survivor in this transaction. The information for the periods prior to July 19, 2010 is that of Class C of Evergreen Health Care Fund. |

| 3. | Calculated based upon average shares outstanding. |

| 4. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial Highlights | | Wells Fargo Advantage Health Care Fund | | | 17 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Administrator Class | | Six Months Ended September 30, 2011 (Unaudited) | | | Year Ended March 31, 20111 | | | Year Ended October 31, | |

| | | | 20102 | | | 20092 | | | 20082 | | | 20072 | | | 20062 | |

Net asset value, beginning of period | | $ | 20.19 | | | $ | 18.33 | | | $ | 15.88 | | | $ | 15.00 | | | $ | 23.64 | | | $ | 21.36 | | | $ | 19.70 | |

Net investment income (loss) | | | (0.06 | )3 | | | (0.03 | )3 | | | 0.01 | 3 | | | (0.08 | )3 | | | (0.08 | )3 | | | (0.02 | )3 | | | (0.07 | )3 |

Net realized and unrealized gains (losses) on investments | | | (2.03 | ) | | | 1.89 | | | | 2.44 | | | | 0.96 | | | | (6.77 | ) | | | 2.91 | | | | 2.86 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (2.09 | ) | | | 1.86 | | | | 2.45 | | | | 0.88 | | | | (6.85 | ) | | | 2.89 | | | | 2.79 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (1.79 | ) | | | (0.61 | ) | | | (1.13 | ) |

Net asset value, end of period | | $ | 18.10 | | | $ | 20.19 | | | $ | 18.33 | | | $ | 15.88 | | | $ | 15.00 | | | $ | 23.64 | | | $ | 21.36 | |

Total return4 | | | (10.35 | )% | | | 10.15 | % | | | 15.43 | % | | | 5.87 | % | | | (31.15 | )% | | | 13.86 | % | | | 14.80 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.27 | % | | | 1.42 | % | | | 1.54 | % | | | 1.56 | % | | | 1.41 | % | | | 1.35 | % | | | 1.40 | % |

Net expenses | | | 1.23 | % | | | 1.23 | % | | | 1.49 | % | | | 1.56 | % | | | 1.41 | % | | | 1.35 | % | | | 1.39 | % |

Net investment income (loss) | | | (0.57 | )% | | | (0.37 | )% | | | 0.04 | % | | | (0.56 | )% | | | (0.43 | )% | | | (0.11 | )% | | | (0.33 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 32 | % | | | 33 | % | | | 42 | % | | | 49 | % | | | 47 | % | | | 71 | % | | | 41 | % |

Net assets, end of period (000’s omitted) | | | $4,220 | | | | $5,817 | | | | $4,090 | | | | $6,057 | | | | $6,466 | | | | $9,535 | | | | $14,210 | |

| 1. | For the five months ended March 31, 2011. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2011. |

| 2. | After the close of business on July 16, 2010, the Fund acquired the net assets of Evergreen Health Care Fund which became the accounting and performance survivor in this transaction. The information for the periods prior to July 19, 2010 is that of Class I of Evergreen Health Care Fund. |

| 3. | Calculated based upon average shares outstanding. |

| 4. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Advantage Health Care Fund | | Notes to Financial Statements (Unaudited) |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on Wells Fargo Advantage Health Care Fund (the “Fund”) which is a non-diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

Investments in securities are valued each business day as of the close of regular trading on the New York Stock Exchange, which is usually 4:00 p.m. (Eastern Time). Securities which are traded on a national or foreign securities exchange are valued at the last reported sales price, except that securities listed on The Nasdaq Stock Market, Inc. (“Nasdaq”) are valued at the Nasdaq Official Closing Price (“NOCP”), and if no NOCP is available, then at the last reported sales price. If no sales price is shown on the Nasdaq, the bid price will be used. In the absence of any sale of securities listed on the Nasdaq, and in the case of other securities, including U.S. Government obligations, but excluding debt securities maturing in 60 days or less, the price will be deemed “stale” and the valuations will be determined in accordance with the Fund’s Fair Value Procedures.

Securities denominated in foreign currencies are translated into U.S. dollars using the closing rates of exchange in effect on the day of valuation.

Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange and therefore may not fully reflect trading or events that occur after the close of the principal exchange in which the foreign investments are traded but before the close of the New York Stock Exchange. If such trading or events are expected to materially affect the value of the investments, then those investments are fair valued following procedures approved by the Board of Trustees. These procedures take into account multiple factors including movements in U.S. securities markets after foreign exchanges close. Depending on market activity, such fair valuations may be frequent. Such fair value pricing may result in NAVs that are higher or lower than NAVs based on the closing price or latest quoted bid price.

Debt securities of sufficient credit quality with original maturities of 60 days or less generally are valued at amortized cost which approximates fair value. The amortized cost method involves valuing a security at its cost, plus accretion of discount or minus amortization of premium over the period until maturity.

Investments in open-end mutual funds and non-registered investment companies are generally valued at net asset value.

Certain investments which are not valued using any of the methods discussed above, are valued at their fair value, as determined by procedures established in good faith and approved by the Board of Trustees.

Foreign currency translation

The accounting records of the Fund are maintained in U.S. dollars. Assets, including investment securities, and liabilities denominated in foreign currency are translated into U.S. dollars at the prevailing rates of exchange at the date of valuation. Purchases and sales of securities, and income and expenses are translated at the prevailing rate of exchange on the respective dates of such transactions. Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded and the U.S. dollar equivalent of the amounts actually paid or received. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities other than investments in securities resulting in changes in exchange rates.

| | | | | | |

| Notes to Financial Statements (Unaudited) | | Wells Fargo Advantage Health Care Fund | | | 19 | |

The changes in net assets arising from changes in exchange rates and the changes in net assets resulting from changes in market prices of securities are not separately presented. Such changes are recorded with net realized and unrealized gains or losses from investments. Gains and losses from certain foreign currency transactions are treated as ordinary income for U.S. federal income tax purposes.

Security loans

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In the event of default or bankruptcy by the borrower, the Fund could experience delays and costs in recovering the loaned securities or in gaining access to the collateral. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Wells Fargo Securities Lending Cash Investments, LLC (the “Cash Collateral Fund”). The Cash Collateral Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Wells Fargo Funds Management LLC (“Funds Management”) and is sub-advised by Wells Capital Management Incorporated (“Wells Capital Management”). Funds Management receives an investment advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Cash Collateral Fund increase. All of the fees received by Funds Management are paid to Wells Capital Management for its services as sub-adviser. The Cash Collateral Fund seeks to provide a positive return compared to the daily Fed Funds Open rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Cash Collateral Fund investments are fair valued based upon the amortized cost valuation technique. Income earned from investment in the Cash Collateral Fund is included in securities lending income on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are reported on the basis of identified cost of securities delivered.

Dividend income is recognized on the ex-dividend date, except for certain dividends from foreign securities, which are recorded as soon as the Fund is informed of the ex-dividend date. Dividend income from foreign securities is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities.

As of March 31, 2011, the Fund had estimated net capital loss carryforwards, which were available to offset future net realized capital gains, in the amount of $8,451,228 expiring in 2017.

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any

| | | | |

| 20 | | Wells Fargo Advantage Health Care Fund | | Notes to Financial Statements (Unaudited) |

losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing and administration fees. Shareholders of each class bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of the Fund, earn income from the portfolio, and are allocated unrealized gains and losses pro rata based on the average daily net assets of each class, without distinction between share classes. Dividends are determined separately for each class based on income and expenses allocable to each class. Realized gains and losses are allocated to each class pro rata based upon the net assets of each class on the date realized. Differences in per share dividend rates generally result from the relative weightings of pro rata income and realized gain allocations and from differences in separate class expenses, including distribution, shareholder servicing and administration fees.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | | Level 1 – quoted prices in active markets for identical securities |

| n | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| n | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of September 30, 2011, the inputs used in valuing the Fund’s assets, which are carried at fair value, were as follows:

| | | | | | | | | | | | | | | | |

| Investments in Securities | | Quoted Prices (Level 1) | | | Significant Other

Observable Inputs (Level 2) | | | Significant Unobservable Inputs (Level 3) | | | Total | |

| | | | |

Equity securities | | | | | | | | | | | | | | | | |

Common stocks | | $ | 85,933,040 | | | $ | 0 | | | $ | 0 | | | $ | 85,933,040 | |

Rights | | | 0 | | | | 24,823 | | | | 0 | | | | 24,823 | |

Warrants | | | 0 | | | | 0 | | | | 41,178 | | | | 41,178 | |

| | | | |

Short-term investments | | | | | | | | | | | | | | | | |

Investment companies | | | 3,113,644 | | | | 24,435,695 | | | | 0 | | | | 27,549,339 | |

| | | $ | 89,046,684 | | | $ | 24,460,518 | | | $ | 41,178 | | | $ | 113,548,380 | |

Further details on the major security types listed above can be found in the Fund’s Portfolio of Investments.

Transfers in and transfers out are recognized at the end of the reporting period. For the six months ended September 30, 2011, the Fund did not have any significant transfers into/out of Level 1 and Level 2.

| | | | | | |

| Notes to Financial Statements (Unaudited) | | Wells Fargo Advantage Health Care Fund | | | 21 | |

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | |

| | | Warrants | |

Balance as of March 31, 2011 | | $ | 107,696 | |

Accrued discounts (premiums) | | | 0 | |

Realized gains (losses) | | | 0 | |

Change in unrealized gains (losses) | | | (66,518 | ) |

Purchases | | | 0 | |

Sales | | | 0 | |

Transfers into Level 3 | | | 0 | |

Transfers out of Level 3 | | | 0 | |

Balance as of September 30, 2011 | | $ | 41,178 | |

Change in unrealized gains (losses) relating to securities still held at September 30, 2011 | | $ | (66,518 | ) |

4. TRANSACTIONS WITH AFFILIATES AND OTHER EXPENSES

Advisory fee

The Trust has entered into an advisory contract with Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). The adviser is responsible for implementing investment policies and guidelines and for supervising the sub-adviser, who is responsible for day-to-day portfolio management of the Fund.

Pursuant to the contract, Funds Management is entitled to receive an annual advisory fee starting at 0.80% and declining to 0.65% as the average daily net assets of the Fund increase. For the six months ended September 30, 2011, the advisory fee was equivalent to an annual rate of 0.80% of the Fund’s average daily net assets.