UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Matthew Prasse

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: February 28

Registrant is making a filing for 23 of its series:

Wells Fargo Dynamic Target Today Fund, Wells Fargo Dynamic Target 2015 Fund, Wells Fargo Dynamic Target 2020 Fund, Wells Fargo Dynamic Target 2025 Fund, Wells Fargo Dynamic Target 2030 Fund, Wells Fargo Dynamic Target 2035 Fund, Wells Fargo Dynamic Target 2040 Fund, Wells Fargo Dynamic Target 2045 Fund, Wells Fargo Dynamic Target 2050 Fund, Wells Fargo Dynamic Target 2055 Fund, Wells Fargo Dynamic Target 2060 Fund, Wells Fargo Target Today Fund, Wells Fargo Target 2010 Fund, Wells Fargo Target 2015 Fund, Wells Fargo Target 2020 Fund, Wells Fargo Target 2025 Fund, Wells Fargo Target 2030 Fund, Wells Fargo Target 2035 Fund, Wells Fargo Target 2040 Fund, Wells Fargo Target 2045 Fund, Wells Fargo Target 2050 Fund, Wells Fargo Target 2055 Fund, and Wells Fargo Target 2060 Fund.

Date of reporting period: August 31, 2021

| ITEM 1. | REPORT TO STOCKHOLDERS |

Semi-Annual Report

August 31, 2021

Target Date Retirement Funds

| ■ | Wells Fargo Target Today Fund |

| ■ | Wells Fargo Target 2010 Fund |

| ■ | Wells Fargo Target 2015 Fund |

| ■ | Wells Fargo Target 2020 Fund |

| ■ | Wells Fargo Target 2025 Fund |

| ■ | Wells Fargo Target 2030 Fund |

| ■ | Wells Fargo Target 2035 Fund |

| ■ | Wells Fargo Target 2040 Fund |

| ■ | Wells Fargo Target 2045 Fund |

| ■ | Wells Fargo Target 2050 Fund |

| ■ | Wells Fargo Target 2055 Fund |

| ■ | Wells Fargo Target 2060 Fund |

The views expressed and any forward-looking statements are as of August 31, 2021, unless otherwise noted, and are those of the Fund's portfolio managers and/or Wells Fargo Asset Management. Discussions of individual securities or the markets generally are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ■ NO BANK GUARANTEE ■ MAY LOSE VALUE

Target Date Retirement Funds | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Wells Fargo Funds

Dear Shareholder:

We are pleased to offer you this semi-annual report for Wells Fargo Target Date Funds for the six-month period that ended August 31, 2021. Global stocks continued to rally as the global economy continued to emerge from the haze of COVID-19. Tailwinds were provided by global stimulus programs, a rapid vaccination rollout, and recovering consumer and corporate sentiment. Bonds were mixed during the period, with municipal bonds and high-yield bonds delivering positive returns.

For the six-month period, U.S. stocks, based on the S&P 500 Index,1 gained 19.52%. International stocks, as measured by the MSCI ACWI ex USA Index (Net),2 returned 7.05%, while the MSCI EM Index (Net),3 trailed its developed market counterparts with a 0.98% loss. Among bond indexes, the Bloomberg U.S. Aggregate Bond Index,4 returned 1.49%, the Bloomberg Global Aggregate ex-USD Index (unhedged),5 returned -0.65%, the Bloomberg Municipal Bond Index,6 returned 2.51%, and the ICE BofA U.S. High Yield Index,7 gained 3.88%.

Vaccination rollout drove the stock markets to new highs.

The passage of the massive domestic stimulus bill highlighted March activity, leading to increased forecasts for U.S. growth in 2021. Domestic employment surged as COVID-19 vaccinations and an increasingly open economy spurred hiring. A majority of U.S. small companies reported they were operating at pre-pandemic capacity or higher. Value stocks continued their outperformance of growth stocks in the month, continuing the trend that started in late 2020. Meanwhile, most major developed global equity indexes were up month to date on the back of rising optimism regarding the outlook for global growth. While the U.S. and the U.K. have been the most successful in terms of the vaccine rollout, even in markets where the vaccine has lagged, such as in the eurozone and Japan, equity indexes in many of those countries have also been in positive territory this year.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

2 | Target Date Retirement Funds

Letter to shareholders (unaudited)

Equity markets produced another strong showing in April. Domestically, the continued reopening of the economy had a strong impact on positive equity performance, as people started leaving their households and jobless claims continued to fall. Domestic corporate bonds performed well and the U.S. dollar weakened. Meanwhile, the U.S. government continued to seek to invest in the recovery, this time by outlining a package of over $2 trillion to improve infrastructure. The primary headwind in April was inflation, as investors tried to determine the breadth and longevity of recent price increases. Developed Europe has been supported by a meaningful increase in the pace of vaccinations. Unfortunately many emerging market countries have not been as successful. India in particular has seen COVID-19 cases surge, serving as an example of the need to get vaccinations rolled out to less developed nations.

Vaccine rollouts continued in May, leading to loosened restrictions globally. As a result, equity markets in general saw a minor increase in returns. Concerns that the continued economic rebound could result in inflation increases becoming more than transitory were supported by the higher input costs businesses were experiencing. Meanwhile, those inflation concerns were tempered by the U.S. Federal Reserve (Fed), which stayed steady on its view of the economy and eased fears of a sudden and substantial policy change. Positive performance in the emerging market equity space was supported this month by steady consumer demand and strong commodity prices. Fixed-income markets were also slightly positive for the month, driven by inflation uncertainty and a softer U.S. dollar.

June witnessed the S&P 500 Index reach a new all-time high. 2021 economic growth and inflation forecasts were revised higher to reflect a strong economic recovery and some supply and demand imbalances. Late June saw a deal reached on a U.S. infrastructure package of approximately $1 trillion for road, bridge, and broadband network upgrades over the next eight years. The Fed’s June meeting yielded no change to policy, but its projections pointed to a possible interest rate rise in 2023. This, combined with a rebound in economic activity and investors searching for yield, led to U.S. Treasury yields being down for the month. Many European and Asian countries saw vaccination momentum increase, while the U.K. dealt with a rise in COVID-19 infections, specifically the Delta variant. Meanwhile, crude oil jumped over 10% in June on the back of the pickup in global economic activity and the Organization of the Petroleum Exporting Countries’ (OPEC) slow pace of supply growth.

July began the month seeing vaccinations making progress, as several major developed countries eased restrictions, only to be threatened again by the spread of COVID-19’s Delta variant. Inflation continued to climb, aided by the continued supply bottleneck in the face of high demand. As it pertains to the equity area of the market, U.S. equities led the way in positive return territory, followed by international developed markets. In contrast, emerging markets were well in negative territory for the month, hindered by China’s plans for new regulations on a number of sectors, specifically education and technology. The U.S. 10-Year Treasury bond yield continued to decline, as strong demand swallowed up supply. After hitting a multi-year high earlier in the month, oil prices leveled off following an agreement by OPEC to raise oil production starting in August.

The Delta variant of COVID-19 produced outbreaks globally in August, increasing the potential for increased market volatility and bringing into question the ongoing economic recovery. Domestically, the U.S. economy continued to stay strong in the face of the Delta variant, continued inflationary pressures, and worries over Hurricane Ida. Emerging market equities experienced elevated volatility, largely influenced by China’s regulatory stance. Emerging market equities started the month with poor performance but rebounded to end the month in positive territory. Municipal debt experienced its first monthly performance drop since February of this year, slowing a rally that made it one of the best-performing sectors of the bond market. In the commodity segment of the market, crude oil fell sharply during the month on the back of dampened expectations as a result of the Delta variant but was still a leading asset class performer for the year.

“2021 economic growth and inflation forecasts were revised higher to reflect a strong economic recovery and some supply and demand imbalances.”

“Municipal debt experienced its first monthly performance drop since February of this year, slowing a rally that made it one of the best-performing sectors of the bond market.”

Target Date Retirement Funds | 3

Letter to shareholders (unaudited)

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

For further information about your Fund, contact your investment professional, visit our website at wfam.com, or call us directly at 1-800-222-8222.

4 | Target Date Retirement Funds

Letter to shareholders (unaudited)

Preparing for LIBOR Transition

The global financial industry is preparing to transition away from the London Interbank Offered Rate (LIBOR), a key benchmark interest rate, to new alternative rates. LIBOR underpins trillions of dollars of financial contracts. It is the benchmark rate for a wide spectrum of products ranging from residential mortgages to corporate bonds to derivatives. Regulators have called for a market-wide transition away from LIBOR to successor reference rates by the end of 2021 (by June 30, 2023 for most tenors of the U.S. dollar LIBOR), which requires proactive steps be taken by issuers, counterparties, and asset managers to identify impacted products and adopt new reference rates.

Each Fund invests in at least one underlying fund that holds at one or more securities that use LIBOR as a floating reference rate and has a maturity date after December 31, 2021.

Although the transition process away from LIBOR has become increasingly well-defined in advance of the anticipated discontinuation date, there remains uncertainty regarding the nature of successor reference rates, and any potential effects of the transition away from LIBOR on investment instruments that use it as a benchmark rate. The transition process may result in, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR and could negatively impact the value of certain instruments held by each Fund.

Wells Fargo Asset Management is monitoring LIBOR exposure closely and has put resources and controls in place to manage this transition effectively. Each Fund’s portfolio management team is evaluating LIBOR holdings to understand what happens to those securities when LIBOR ceases to exist, including examining security documentation to identify the presence or absence of fallback language identifying a replacement rate to LIBOR.

While the pace of transition away from LIBOR will differ by asset class and investment strategy, the portfolio management team will monitor market conditions for those holdings to identify and mitigate deterioration or volatility in pricing and liquidity and ensure appropriate actions are taken in a timely manner.

Further information regarding the potential risks associated with the discontinuation of LIBOR can be found in the Funds' Statement of Additional Information.

Target Date Retirement Funds | 5

Wells Fargo Target Date Funds

Investment objective

Each Fund seeks total return over time, consistent with its strategic target asset allocation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management, LLC

Portfolio managers

Kandarp R. Acharya, CFA®‡, FRM

Petros N. Bocray, CFA®‡, FRM

Christian L. Chan, CFA®‡

The target date represents the year in which investors may likely begin withdrawing assets. The Funds gradually seek to reduce market risk as the target date approaches and after it arrives by decreasing equity exposure and increasing fixed income exposure. The principal value is not guaranteed at any time, including at the target date.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by each Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on each Fund and its share price can be sudden and unpredictable. High-yield securities have a greater risk of default and tend to be more volatile than higher-rated debt securities. The use of derivatives may reduce returns and/or increase volatility. Securities issued by U.S. government agencies or government-sponsored entities may not be guaranteed by the U.S. Treasury. The Funds will indirectly be exposed to all of the risks of an investment in the underlying funds and will indirectly bear expenses of the underlying funds. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Funds are exposed to foreign investment risk, mortgage- and asset-backed securities risk, regulatory risk, and smaller-company investment risk. Consult the Funds’ prospectus for additional information on these and other risks.

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

6 | Target Date Retirement Funds

Wells Fargo Target Today Fund

| Average annual total returns (%) as of August 31, 2021 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (STWRX) | 3-1-1994 | 2.77 | 3.79 | 3.07 | | 9.04 | 5.02 | 3.68 | | 0.96 | 0.60 |

| Class C (WFODX) | 12-1-1998 | 7.29 | 4.25 | 2.91 | | 8.29 | 4.25 | 2.91 | | 1.71 | 1.35 |

| Class R (WFRRX)3 | 6-28-2013 | – | – | – | | 8.79 | 4.91 | 3.52 | | 1.21 | 0.85 |

| Class R4 (WOTRX)4 | 11-30-2012 | – | – | – | | 9.37 | 5.25 | 4.01 | | 0.68 | 0.29 |

| Class R6 (WOTDX) | 6-30-2004 | – | – | – | | 9.53 | 5.49 | 4.18 | | 0.53 | 0.14 |

| Administrator Class (WFLOX) | 11-8-1999 | – | – | – | | 9.21 | 5.14 | 3.82 | | 0.88 | 0.49 |

| S&P Target Date Retirement Income Index5 | – | – | – | – | | 8.83 | 6.31 | 5.68 | | – | – |

| Target Today Blended Index6 | – | – | – | – | | 9.58 | – | – | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.10% of acquired fund fees and expenses representing the net expenses from the affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through June 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 1.35% for Class C, 0.85% for Class R, 0.29% for Class R4, 0.14% for Class R6, and 0.49% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the underlying affiliated master portfolios invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R4 shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class R4 shares. |

| 5 | The S&P Target Date Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, corresponding to the target retirement date. This index is representative of the investment opportunity available to investors for the target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. You cannot invest directly in an index. |

| 6 | Source: Wells Fargo Funds Management, LLC. The Target Blended Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, each corresponding to the target retirement date. The index weightings among the major asset classes are adjusted annually. The inception date of the index is July 14, 2017. See Appendix I for additional information. You cannot invest directly in an index. |

Target Date Retirement Funds | 7

Wells Fargo Target Today Fund (continued)

| Ten largest holdings (%) as of August 31, 20211 |

| Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 34.56 |

| Wells Fargo Investment Grade Corporate Bond Portfolio | 17.96 |

| Wells Fargo Strategic Retirement Bond Portfolio | 11.67 |

| Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio | 11.67 |

| Wells Fargo Factor Enhanced International Equity Portfolio | 6.05 |

| Wells Fargo Factor Enhanced U.S. Low Volatility Equity Portfolio | 5.00 |

| Wells Fargo Emerging Markets Bond Portfolio | 2.95 |

| Wells Fargo High Yield Corporate Bond Portfolio | 2.95 |

| Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio | 2.89 |

| Wells Fargo U.S. REIT Portfolio | 2.52 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

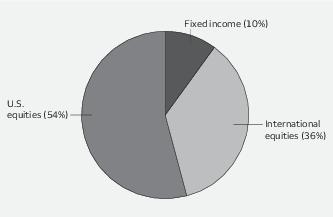

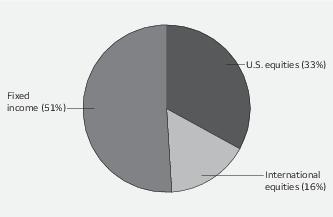

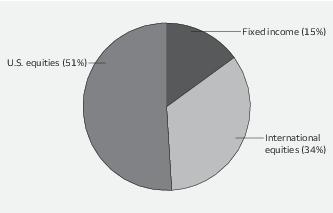

| Portfolio allocation as of August 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Volatility metrics as of August 31, 20211 |

| | Beta 2 | Standard

deviation3 | R-squared 4 |

| Class A | 1.00 | 6.48 | 0.96 |

| Class C | 1.00 | 6.49 | 0.96 |

| Class R | 1.00 | 6.47 | 0.96 |

| Class R4 | 1.00 | 6.47 | 0.96 |

| Class R6 | 1.01 | 6.52 | 0.96 |

| Administrator Class | 1.00 | 6.49 | 0.96 |

| 1 | These metrics show the degree and timing of the Fund’s fluctuations compared to S&P Target Date Retirement Income Index over 36 months. |

| 2 | Beta measures fund volatility relative to general market movements. It is a standardized measure of systematic risk in comparison with a specified index. The benchmark beta is 1.00 by definition. Beta is based on historical performance and does not represent future results. |

| 3 | Standard deviation is the square root of the sum of squared deviations from the mean. It is often used as a measure of volatility, variability, or risk. Standard deviation is based on historical performance and does not represent future results. |

| 4 | R-squared (R2) is a statistical measure that reflects the percentage of a fund’s movements that can be explained by movements in its benchmark index. The measure ranges from 0.0, which means that the fund’s performance bears no relationship to the performance of the index, to 1.0, which means that the fund’s performance was perfectly synchronized with the performance of the benchmark. R2 is based on historical performance and does not represent future results. |

8 | Target Date Retirement Funds

Performance highlights (unaudited)

Wells Fargo Target 2010 Fund

| Average annual total returns (%) as of August 31, 2021 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (STNRX) | 3-1-1994 | 2.93 | 3.92 | 3.44 | | 9.24 | 5.15 | 4.05 | | 1.00 | 0.60 |

| Class C (WFOCX) | 12-1-1998 | 7.39 | 4.35 | 3.27 | | 8.39 | 4.35 | 3.27 | | 1.75 | 1.35 |

| Class R (WFARX)3 | 6-28-2013 | – | – | – | | 8.98 | 5.10 | 3.92 | | 1.25 | 0.85 |

| Class R4 (WFORX)4 | 11-30-2012 | – | – | – | | 9.61 | 5.48 | 4.42 | | 0.72 | 0.29 |

| Class R6 (WFOAX) | 6-30-2004 | – | – | – | | 9.72 | 5.63 | 4.55 | | 0.57 | 0.14 |

| Administrator Class (WFLGX) | 11-8-1999 | – | – | – | | 9.30 | 5.25 | 4.18 | | 0.92 | 0.49 |

| S&P Target Date 2010 Index5 | – | – | – | – | | 10.87 | 7.21 | 6.60 | | – | – |

| Target 2010 Blended Index6 | – | – | – | – | | 9.73 | – | – | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.10% of acquired fund fees and expenses representing the net expenses from the affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through June 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 1.35% for Class C, 0.85% for Class R, 0.29% for Class R4, 0.14% for Class R6, and 0.49% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the underlying affiliated master portfolios invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R4 shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class R4 shares. |

| 5 | The S&P Target Date Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, corresponding to the target retirement date. This index is representative of the investment opportunity available to investors for the target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. You cannot invest directly in an index. |

| 6 | Source: Wells Fargo Funds Management, LLC. The Target Blended Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, each corresponding to the target retirement date. The index weightings among the major asset classes are adjusted annually. The inception date of the index is July 14, 2017. See Appendix I for additional information. You cannot invest directly in an index. |

Target Date Retirement Funds | 9

Performance highlights (unaudited)

Wells Fargo Target 2010 Fund (continued)

| Ten largest holdings (%) as of August 31, 20211 |

| Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 34.47 |

| Wells Fargo Investment Grade Corporate Bond Portfolio | 17.94 |

| Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio | 11.68 |

| Wells Fargo Strategic Retirement Bond Portfolio | 11.65 |

| Wells Fargo Factor Enhanced International Equity Portfolio | 6.06 |

| Wells Fargo Factor Enhanced U.S. Low Volatility Equity Portfolio | 5.00 |

| Wells Fargo Emerging Markets Bond Portfolio | 2.95 |

| Wells Fargo High Yield Corporate Bond Portfolio | 2.94 |

| Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio | 2.89 |

| Wells Fargo U.S. REIT Portfolio | 2.52 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

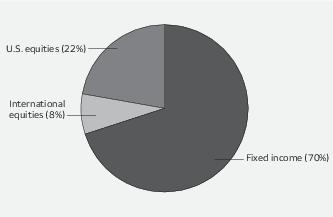

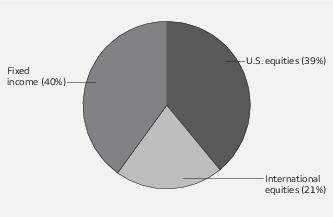

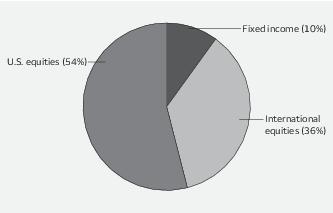

| Portfolio allocation as of August 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Volatility metrics as of August 31, 20211 |

| | Beta 2 | Standard

deviation3 | R-squared 4 |

| Class A | 0.90 | 6.62 | 0.96 |

| Class C | 0.90 | 6.62 | 0.96 |

| Class R | 0.90 | 6.66 | 0.96 |

| Class R4 | 0.90 | 6.62 | 0.95 |

| Class R6 | 0.90 | 6.61 | 0.95 |

| Administrator Class | 0.90 | 6.61 | 0.95 |

| 1 | These metrics show the degree and timing of the Fund’s fluctuations compared to S&P Target Date 2010 Index over 36 months. |

| 2 | Beta measures fund volatility relative to general market movements. It is a standardized measure of systematic risk in comparison with a specified index. The benchmark beta is 1.00 by definition. Beta is based on historical performance and does not represent future results. |

| 3 | Standard deviation is the square root of the sum of squared deviations from the mean. It is often used as a measure of volatility, variability, or risk. Standard deviation is based on historical performance and does not represent future results. |

| 4 | R-squared (R2) is a statistical measure that reflects the percentage of a fund’s movements that can be explained by movements in its benchmark index. The measure ranges from 0.0, which means that the fund’s performance bears no relationship to the performance of the index, to 1.0, which means that the fund’s performance was perfectly synchronized with the performance of the benchmark. R2 is based on historical performance and does not represent future results. |

10 | Target Date Retirement Funds

Performance highlights (unaudited)

Wells Fargo Target 2015 Fund

| Average annual total returns (%) as of August 31, 2021 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (WFACX)3 | 11-30-2012 | 4.63 | 4.37 | 4.21 | | 10.96 | 5.61 | 4.83 | | 0.97 | 0.60 |

| Class R (WFBRX)4 | 6-28-2013 | – | – | – | | 10.60 | 5.59 | 4.68 | | 1.22 | 0.85 |

| Class R4 (WFSRX)5 | 11-30-2012 | – | – | – | | 11.21 | 5.95 | 5.17 | | 0.69 | 0.29 |

| Class R6 (WFSCX) | 6-29-2007 | – | – | – | | 11.34 | 6.08 | 5.29 | | 0.54 | 0.14 |

| Administrator Class (WFFFX) | 6-29-2007 | – | – | – | | 10.85 | 5.74 | 4.93 | | 0.89 | 0.49 |

| S&P Target Date 2015 Index6 | – | – | – | – | | 12.70 | 7.95 | 7.42 | | – | – |

| Target 2015 Blended Index7 | – | – | – | – | | 11.37 | – | – | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.10% of acquired fund fees and expenses representing the net expenses from the affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through June 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 0.85% for Class R, 0.29% for Class R4, 0.14% for Class R6, and 0.49% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the underlying affiliated master portfolios invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class A shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class A shares. |

| 4 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to the Class R shares. |

| 5 | Historical performance shown for the Class R4 shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class R4 shares. |

| 6 | The S&P Target Date Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, corresponding to the target retirement date. This index is representative of the investment opportunity available to investors for the target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. You cannot invest directly in an index. |

| 7 | Source: Wells Fargo Funds Management, LLC. The Target Blended Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, each corresponding to the target retirement date. The index weightings among the major asset classes are adjusted annually. The inception date of the index is July 14, 2017. See Appendix I for additional information. You cannot invest directly in an index. |

Target Date Retirement Funds | 11

Performance highlights (unaudited)

Wells Fargo Target 2015 Fund (continued)

| Ten largest holdings (%) as of August 31, 20211 |

| Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 32.07 |

| Wells Fargo Investment Grade Corporate Bond Portfolio | 16.68 |

| Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio | 14.58 |

| Wells Fargo Strategic Retirement Bond Portfolio | 10.84 |

| Wells Fargo Factor Enhanced International Equity Portfolio | 7.55 |

| Wells Fargo Factor Enhanced U.S. Low Volatility Equity Portfolio | 4.00 |

| Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio | 3.61 |

| Wells Fargo U.S. REIT Portfolio | 2.95 |

| Wells Fargo Emerging Markets Bond Portfolio | 2.74 |

| Wells Fargo High Yield Corporate Bond Portfolio | 2.74 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

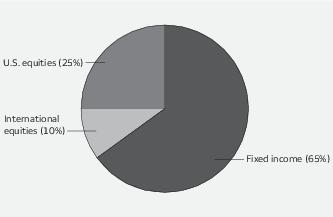

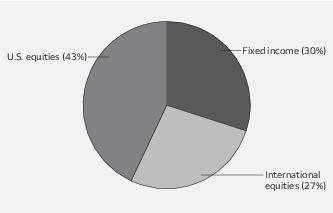

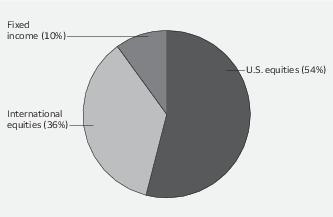

| Portfolio allocation as of August 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Volatility metrics as of August 31, 20211 |

| | Beta 2 | Standard

deviation3 | R-squared 4 |

| Class A | 0.88 | 7.44 | 0.96 |

| Class R | 0.89 | 7.44 | 0.97 |

| Class R4 | 0.89 | 7.46 | 0.96 |

| Class R6 | 0.88 | 7.39 | 0.96 |

| Administrator Class | 0.88 | 7.39 | 0.96 |

| 1 | These metrics show the degree and timing of the Fund’s fluctuations compared to S&P Target Date 2015 Index over 36 months. |

| 2 | Beta measures fund volatility relative to general market movements. It is a standardized measure of systematic risk in comparison with a specified index. The benchmark beta is 1.00 by definition. Beta is based on historical performance and does not represent future results. |

| 3 | Standard deviation is the square root of the sum of squared deviations from the mean. It is often used as a measure of volatility, variability, or risk. Standard deviation is based on historical performance and does not represent future results. |

| 4 | R-squared (R2) is a statistical measure that reflects the percentage of a fund’s movements that can be explained by movements in its benchmark index. The measure ranges from 0.0, which means that the fund’s performance bears no relationship to the performance of the index, to 1.0, which means that the fund’s performance was perfectly synchronized with the performance of the benchmark. R2 is based on historical performance and does not represent future results. |

12 | Target Date Retirement Funds

Performance highlights (unaudited)

Wells Fargo Target 2020 Fund

| Average annual total returns (%) as of August 31, 2021 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (STTRX) | 3-1-1994 | 6.18 | 5.20 | 5.11 | | 12.68 | 6.45 | 5.73 | | 0.73 | 0.60 |

| Class C (WFLAX) | 12-1-1998 | 10.86 | 5.64 | 4.94 | | 11.86 | 5.64 | 4.94 | | 1.48 | 1.35 |

| Class R (WFURX)3 | 6-28-2013 | – | – | – | | 12.42 | 6.26 | 5.54 | | 0.98 | 0.85 |

| Class R4 (WFLRX)4 | 11-30-2012 | – | – | – | | 13.07 | 6.78 | 6.11 | | 0.45 | 0.29 |

| Class R6 (WFOBX) | 6-30-2004 | – | – | – | | 13.15 | 6.93 | 6.23 | | 0.30 | 0.14 |

| Administrator Class (WFLPX) | 11-8-1999 | – | – | – | | 12.76 | 6.55 | 5.86 | | 0.65 | 0.49 |

| S&P Target Date 2020 Index5 | – | – | – | – | | 13.79 | 8.51 | 8.09 | | – | – |

| Target 2020 Blended Index6 | – | – | – | – | | 13.16 | – | – | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.10% of acquired fund fees and expenses representing the net expenses from the affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through June 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 1.35% for Class C, 0.85% for Class R, 0.29% for Class R4, 0.14% for Class R6, and 0.49% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the underlying affiliated master portfolios invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R4 shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class R4 shares. |

| 5 | The S&P Target Date Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, corresponding to the target retirement date. This index is representative of the investment opportunity available to investors for the target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. You cannot invest directly in an index. |

| 6 | Source: Wells Fargo Funds Management, LLC. The Target Blended Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, each corresponding to the target retirement date. The index weightings among the major asset classes are adjusted annually. The inception date of the index is July 14, 2017. See Appendix I for additional information. You cannot invest directly in an index. |

Target Date Retirement Funds | 13

Performance highlights (unaudited)

Wells Fargo Target 2020 Fund (continued)

| Ten largest holdings (%) as of August 31, 20211 |

| Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 29.53 |

| Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio | 17.52 |

| Wells Fargo Investment Grade Corporate Bond Portfolio | 15.36 |

| Wells Fargo Strategic Retirement Bond Portfolio | 9.98 |

| Wells Fargo Factor Enhanced International Equity Portfolio | 9.07 |

| Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio | 4.34 |

| Wells Fargo U.S. REIT Portfolio | 3.37 |

| Wells Fargo Factor Enhanced U.S. Low Volatility Equity Portfolio | 3.00 |

| Wells Fargo Factor Enhanced Emerging Markets Equity Portfolio | 2.79 |

| Wells Fargo Emerging Markets Bond Portfolio | 2.53 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

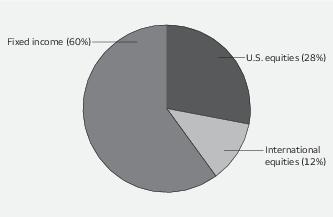

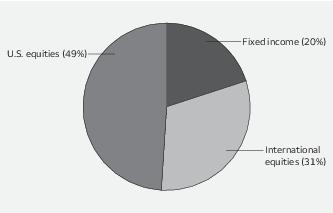

| Portfolio allocation as of August 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Volatility metrics as of August 31, 20211 |

| | Beta 2 | Standard

deviation3 | R-squared 4 |

| Class A | 0.91 | 8.38 | 0.98 |

| Class C | 0.91 | 8.39 | 0.98 |

| Class R | 0.91 | 8.37 | 0.98 |

| Class R4 | 0.91 | 8.42 | 0.97 |

| Class R6 | 0.91 | 8.40 | 0.98 |

| Administrator Class | 0.91 | 8.41 | 0.98 |

| 1 | These metrics show the degree and timing of the Fund’s fluctuations compared to S&P Target Date 2020 Index over 36 months. |

| 2 | Beta measures fund volatility relative to general market movements. It is a standardized measure of systematic risk in comparison with a specified index. The benchmark beta is 1.00 by definition. Beta is based on historical performance and does not represent future results. |

| 3 | Standard deviation is the square root of the sum of squared deviations from the mean. It is often used as a measure of volatility, variability, or risk. Standard deviation is based on historical performance and does not represent future results. |

| 4 | R-squared (R2) is a statistical measure that reflects the percentage of a fund’s movements that can be explained by movements in its benchmark index. The measure ranges from 0.0, which means that the fund’s performance bears no relationship to the performance of the index, to 1.0, which means that the fund’s performance was perfectly synchronized with the performance of the benchmark. R2 is based on historical performance and does not represent future results. |

14 | Target Date Retirement Funds

Performance highlights (unaudited)

Wells Fargo Target 2025 Fund

| Average annual total returns (%) as of August 31, 2021 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (WFAYX)3 | 11-30-2012 | 8.91 | 6.31 | 6.24 | | 15.56 | 7.58 | 6.88 | | 0.77 | 0.60 |

| Class R (WFHRX)4 | 6-28-2013 | – | – | – | | 15.24 | 7.26 | 6.58 | | 1.02 | 0.85 |

| Class R4 (WFGRX)5 | 11-30-2012 | – | – | – | | 15.95 | 7.91 | 7.23 | | 0.49 | 0.29 |

| Class R6 (WFTYX) | 6-29-2007 | – | – | – | | 16.11 | 8.08 | 7.36 | | 0.34 | 0.14 |

| Administrator Class (WFTRX) | 6-29-2007 | – | – | – | | 15.75 | 7.72 | 6.99 | | 0.69 | 0.49 |

| S&P Target Date 2025 Index6 | – | – | – | – | | 16.96 | 9.61 | 8.93 | | – | – |

| Target 2025 Blended Index7 | – | – | – | – | | 16.10 | – | – | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.11% of acquired fund fees and expenses representing the net expenses from the affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through June 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 0.85% for Class R, 0.29% for Class R4, 0.14% for Class R6, and 0.49% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the underlying affiliated master portfolios invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class A shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class A shares. |

| 4 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to the Class R shares. |

| 5 | Historical performance shown for the Class R4 shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class R4 shares. |

| 6 | The S&P Target Date Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, corresponding to the target retirement date. This index is representative of the investment opportunity available to investors for the target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. You cannot invest directly in an index. |

| 7 | Source: Wells Fargo Funds Management, LLC. The Target Blended Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, each corresponding to the target retirement date. The index weightings among the major asset classes are adjusted annually. The inception date of the index is July 14, 2017. See Appendix I for additional information. You cannot invest directly in an index. |

Target Date Retirement Funds | 15

Performance highlights (unaudited)

Wells Fargo Target 2025 Fund (continued)

| Ten largest holdings (%) as of August 31, 20211 |

| Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 26.62 |

| Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio | 23.26 |

| Wells Fargo Investment Grade Corporate Bond Portfolio | 13.85 |

| Wells Fargo Factor Enhanced International Equity Portfolio | 12.60 |

| Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio | 5.76 |

| Wells Fargo Strategic Retirement Bond Portfolio | 5.00 |

| Wells Fargo Factor Enhanced Emerging Markets Equity Portfolio | 3.88 |

| Wells Fargo U.S. REIT Portfolio | 2.53 |

| Wells Fargo Emerging Markets Bond Portfolio | 2.26 |

| Wells Fargo High Yield Corporate Bond Portfolio | 2.25 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

| Portfolio allocation as of August 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Volatility metrics as of August 31, 20211 |

| | Beta 2 | Standard

deviation3 | R-squared 4 |

| Class A | 0.91 | 9.95 | 0.98 |

| Class R | 0.93 | 10.12 | 0.98 |

| Class R4 | 0.91 | 9.94 | 0.98 |

| Class R6 | 0.93 | 10.11 | 0.98 |

| Administrator Class | 0.92 | 10.05 | 0.98 |

| 1 | These metrics show the degree and timing of the Fund’s fluctuations compared to S&P Target Date 2025 Index over 36 months. |

| 2 | Beta measures fund volatility relative to general market movements. It is a standardized measure of systematic risk in comparison with a specified index. The benchmark beta is 1.00 by definition. Beta is based on historical performance and does not represent future results. |

| 3 | Standard deviation is the square root of the sum of squared deviations from the mean. It is often used as a measure of volatility, variability, or risk. Standard deviation is based on historical performance and does not represent future results. |

| 4 | R-squared (R2) is a statistical measure that reflects the percentage of a fund’s movements that can be explained by movements in its benchmark index. The measure ranges from 0.0, which means that the fund’s performance bears no relationship to the performance of the index, to 1.0, which means that the fund’s performance was perfectly synchronized with the performance of the benchmark. R2 is based on historical performance and does not represent future results. |

16 | Target Date Retirement Funds

Performance highlights (unaudited)

Wells Fargo Target 2030 Fund

| Average annual total returns (%) as of August 31, 2021 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (STHRX) | 3-1-1994 | 11.71 | 7.48 | 7.29 | | 18.53 | 8.76 | 7.93 | | 0.72 | 0.60 |

| Class C (WFDMX) | 12-1-1998 | 16.59 | 7.93 | 7.12 | | 17.59 | 7.93 | 7.12 | | 1.47 | 1.35 |

| Class R (WFJRX)3 | 6-28-2013 | – | – | – | | 18.19 | 8.60 | 7.75 | | 0.97 | 0.85 |

| Class R4 (WTHRX)4 | 11-30-2012 | – | – | – | | 18.83 | 9.08 | 8.31 | | 0.44 | 0.29 |

| Class R6 (WFOOX) | 6-30-2004 | – | – | – | | 19.02 | 9.24 | 8.44 | | 0.29 | 0.14 |

| Administrator Class (WFLIX) | 11-8-1999 | – | – | – | | 18.61 | 8.86 | 8.06 | | 0.64 | 0.49 |

| S&P Target Date 2030 Index5 | – | – | – | – | | 19.98 | 10.60 | 9.71 | | – | – |

| Target 2030 Blended Index6 | – | – | – | – | | 19.01 | – | – | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.11% of acquired fund fees and expenses representing the net expenses from the affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through June 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 1.35% for Class C, 0.85% for Class R, 0.29% for Class R4, 0.14% for Class R6, and 0.49% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the underlying affiliated master portfolios invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R4 shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class R4 shares. |

| 5 | The S&P Target Date Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, corresponding to the target retirement date. This index is representative of the investment opportunity available to investors for the target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. You cannot invest directly in an index. |

| 6 | Source: Wells Fargo Funds Management, LLC. The Target Blended Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, each corresponding to the target retirement date. The index weightings among the major asset classes are adjusted annually. The inception date of the index is July 14, 2017. See Appendix I for additional information. You cannot invest directly in an index. |

Target Date Retirement Funds | 17

Performance highlights (unaudited)

Wells Fargo Target 2030 Fund (continued)

| Ten largest holdings (%) as of August 31, 20211 |

| Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio | 29.23 |

| Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 22.84 |

| Wells Fargo Factor Enhanced International Equity Portfolio | 16.49 |

| Wells Fargo Investment Grade Corporate Bond Portfolio | 11.90 |

| Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio | 7.25 |

| Wells Fargo Factor Enhanced Emerging Markets Equity Portfolio | 5.08 |

| Wells Fargo Emerging Markets Bond Portfolio | 1.92 |

| Wells Fargo High Yield Corporate Bond Portfolio | 1.92 |

| Wells Fargo Strategic Retirement Bond Portfolio | 1.33 |

| Wells Fargo U.S. REIT Portfolio | 1.01 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

| Portfolio allocation as of August 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Volatility metrics as of August 31, 20211 |

| | Beta 2 | Standard

deviation3 | R-squared 4 |

| Class A | 0.92 | 11.64 | 0.99 |

| Class C | 0.92 | 11.64 | 0.99 |

| Class R | 0.92 | 11.71 | 0.99 |

| Class R4 | 0.92 | 11.66 | 0.99 |

| Class R6 | 0.92 | 11.67 | 0.99 |

| Administrator Class | 0.92 | 11.68 | 0.99 |

| 1 | These metrics show the degree and timing of the Fund’s fluctuations compared to S&P Target Date 2030 Index over 36 months. |

| 2 | Beta measures fund volatility relative to general market movements. It is a standardized measure of systematic risk in comparison with a specified index. The benchmark beta is 1.00 by definition. Beta is based on historical performance and does not represent future results. |

| 3 | Standard deviation is the square root of the sum of squared deviations from the mean. It is often used as a measure of volatility, variability, or risk. Standard deviation is based on historical performance and does not represent future results. |

| 4 | R-squared (R2) is a statistical measure that reflects the percentage of a fund’s movements that can be explained by movements in its benchmark index. The measure ranges from 0.0, which means that the fund’s performance bears no relationship to the performance of the index, to 1.0, which means that the fund’s performance was perfectly synchronized with the performance of the benchmark. R2 is based on historical performance and does not represent future results. |

18 | Target Date Retirement Funds

Performance highlights (unaudited)

Wells Fargo Target 2035 Fund

| Average annual total returns (%) as of August 31, 2021 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (WFQBX)3 | 11-30-2012 | 14.68 | 8.55 | 8.24 | | 21.64 | 9.84 | 8.89 | | 0.78 | 0.60 |

| Class R (WFKRX)4 | 6-28-2013 | – | – | – | | 21.09 | 9.56 | 8.60 | | 1.03 | 0.85 |

| Class R4 (WTTRX)5 | 11-30-2012 | – | – | – | | 21.93 | 10.17 | 9.24 | | 0.50 | 0.29 |

| Class R6 (WFQRX) | 6-29-2007 | – | – | – | | 22.05 | 10.34 | 9.37 | | 0.35 | 0.14 |

| Administrator Class (WFQWX) | 6-29-2007 | – | – | – | | 21.56 | 9.94 | 8.98 | | 0.70 | 0.49 |

| S&P Target Date 2035 Index6 | – | – | – | – | | 23.45 | 11.65 | 10.45 | | – | – |

| Target 2035 Blended Index7 | – | – | – | – | | 22.02 | – | – | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.12% of acquired fund fees and expenses representing the net expenses from the affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through June 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 0.85% for Class R, 0.29% for Class R4, 0.14% for Class R6, and 0.49% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the underlying affiliated master portfolios invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class A shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class A shares. |

| 4 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to the Class R shares. |

| 5 | Historical performance shown for the Class R4 shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class R4 shares. |

| 6 | The S&P Target Date Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, corresponding to the target retirement date. This index is representative of the investment opportunity available to investors for the target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. You cannot invest directly in an index. |

| 7 | Source: Wells Fargo Funds Management, LLC. The Target Blended Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, each corresponding to the target retirement date. The index weightings among the major asset classes are adjusted annually. The inception date of the index is July 14, 2017. See Appendix I for additional information. You cannot invest directly in an index. |

Target Date Retirement Funds | 19

Performance highlights (unaudited)

Wells Fargo Target 2035 Fund (continued)

| Holdings (%) as of August 31, 20211 |

| Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio | 34.69 |

| Wells Fargo Factor Enhanced International Equity Portfolio | 20.47 |

| Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 17.75 |

| Wells Fargo Investment Grade Corporate Bond Portfolio | 9.22 |

| Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio | 8.65 |

| Wells Fargo Factor Enhanced Emerging Markets Equity Portfolio | 6.23 |

| Wells Fargo Emerging Markets Bond Portfolio | 1.50 |

| Wells Fargo High Yield Corporate Bond Portfolio | 1.50 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

| Portfolio allocation as of August 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Volatility metrics as of August 31, 20211 |

| | Beta 2 | Standard

deviation3 | R-squared 4 |

| Class A | 0.92 | 13.24 | 0.99 |

| Class R | 0.92 | 13.29 | 0.99 |

| Class R4 | 0.92 | 13.30 | 0.99 |

| Class R6 | 0.92 | 13.26 | 0.99 |

| Administrator Class | 0.92 | 13.29 | 0.99 |

| 1 | These metrics show the degree and timing of the Fund’s fluctuations compared to S&P Target Date 2035 Index over 36 months. |

| 2 | Beta measures fund volatility relative to general market movements. It is a standardized measure of systematic risk in comparison with a specified index. The benchmark beta is 1.00 by definition. Beta is based on historical performance and does not represent future results. |

| 3 | Standard deviation is the square root of the sum of squared deviations from the mean. It is often used as a measure of volatility, variability, or risk. Standard deviation is based on historical performance and does not represent future results. |

| 4 | R-squared (R2) is a statistical measure that reflects the percentage of a fund’s movements that can be explained by movements in its benchmark index. The measure ranges from 0.0, which means that the fund’s performance bears no relationship to the performance of the index, to 1.0, which means that the fund’s performance was perfectly synchronized with the performance of the benchmark. R2 is based on historical performance and does not represent future results. |

20 | Target Date Retirement Funds

Performance highlights (unaudited)

Wells Fargo Target 2040 Fund

| Average annual total returns (%) as of August 31, 2021 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (STFRX) | 3-1-1994 | 17.18 | 9.35 | 8.90 | | 24.32 | 10.66 | 9.55 | | 0.74 | 0.60 |

| Class C (WFOFX) | 7-1-1998 | 22.45 | 9.83 | 8.73 | | 23.45 | 9.83 | 8.73 | | 1.49 | 1.35 |

| Class R (WFMRX)3 | 6-28-2013 | – | – | – | | 24.05 | 10.50 | 9.37 | | 0.99 | 0.85 |

| Class R4 (WTFRX)4 | 11-30-2012 | – | – | – | | 24.72 | 11.00 | 9.94 | | 0.46 | 0.29 |

| Class R6 (WFOSX) | 6-30-2004 | – | – | – | | 24.97 | 11.17 | 10.08 | | 0.31 | 0.14 |

| Administrator Class (WFLWX) | 11-8-1999 | – | – | – | | 24.56 | 10.79 | 9.69 | | 0.66 | 0.49 |

| S&P Target Date 2040 Index5 | – | – | – | – | | 25.91 | 12.38 | 10.97 | | – | – |

| Target 2040 Blended Index6 | – | – | – | – | | 25.00 | – | – | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.13% of acquired fund fees and expenses representing the net expenses from the affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through June 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 1.35% for Class C, 0.85% for Class R, 0.29% for Class R4, 0.14% for Class R6, and 0.49% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the underlying affiliated master portfolios invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R4 shares prior to their inception reflects the performance of the Class R6 shares and has been adjusted to reflect the higher expenses applicable to the Class R4 shares. |

| 5 | The S&P Target Date Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, corresponding to the target retirement date. This index is representative of the investment opportunity available to investors for the target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. You cannot invest directly in an index. |

| 6 | Source: Wells Fargo Funds Management, LLC. The Target Blended Index is designed as a benchmark for multi-asset class portfolios with risk profiles that become more conservative over time, each corresponding to the target retirement date. The index weightings among the major asset classes are adjusted annually. The inception date of the index is July 14, 2017. See Appendix I for additional information. You cannot invest directly in an index. |

Target Date Retirement Funds | 21

Performance highlights (unaudited)

Wells Fargo Target 2040 Fund (continued)

| Holdings (%) as of August 31, 20211 |

| Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio | 39.00 |

| Wells Fargo Factor Enhanced International Equity Portfolio | 23.96 |

| Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 11.83 |

| Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio | 9.69 |

| Wells Fargo Factor Enhanced Emerging Markets Equity Portfolio | 7.37 |

| Wells Fargo Investment Grade Corporate Bond Portfolio | 6.15 |

| Wells Fargo Emerging Markets Bond Portfolio | 1.00 |

| Wells Fargo High Yield Corporate Bond Portfolio | 1.00 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |