UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: August 31

Registrant is making a filing for 10 of its series:

Allspring Managed Account CoreBuilder® Shares - Series CP, Allspring Adjustable Rate Government Fund, Allspring Conservative Income Fund, Allspring Government Securities Fund, Allspring High Yield Bond Fund, Allspring Core Plus Bond Fund, Allspring Short Duration Government Bond Fund, Allspring Short-Term Bond Plus Fund, Allspring Short-Term High Income Fund, and Allspring Ultra Short-Term Income Fund.

Date of reporting period: February 28, 2023

ITEM 1. REPORT TO STOCKHOLDERS

===============================================

Adjustable Rate Government Fund

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2023. ICE Data Indices, LLC. All rights reserved. |

| 1 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

President

Allspring Funds

| Investment objective | The Fund seeks current income consistent with capital preservation. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments, LLC |

| Portfolio managers | Christopher Y. Kauffman, CFA®‡, Michal Stanczyk |

| Average annual total returns (%) as of February 28, 2023 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (ESAAX) | 6-30-2000 | -1.16 | 0.86 | 0.57 | 0.84 | 1.26 | 0.78 | 0.82 | 0.74 | ||

| Class C (ESACX) | 6-30-2000 | -0.74 | 0.60 | 0.15 | 0.26 | 0.60 | 0.15 | 1.57 | 1.49 | ||

| Administrator Class (ESADX) | 7-30-2010 | – | – | – | 0.98 | 1.38 | 0.92 | 0.76 | 0.60 | ||

| Institutional Class (EKIZX) | 10-1-1991 | – | – | – | 1.23 | 1.52 | 1.05 | 0.49 | 0.46 | ||

| Bloomberg 6-Month Treasury Bill Index3 | – | – | – | – | 2.03 | 1.47 | 0.97 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through December 31, 2023, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.74% for Class A, 1.49% for Class C, 0.60% for Administrator Class, and 0.46% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | The Bloomberg 6-Month Treasury Bill Index tracks the performance and attributes of recently issued 6-Month U.S. Treasury bills. The index follows Bloomberg monthly rebalancing conventions. You cannot invest directly in an index. |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| Ten largest holdings (%) as of February 28, 20231 | |

| FHLMC Series 350 Class F2, 3.34%, 9-15-2040 | 1.58 |

| FRESB Mortgage Trust Series 2022-SB94 Class A5H, 1.72%, 11-25-2041 | 1.56 |

| FHLMC, 3.82%, 9-1-2036 | 1.55 |

| FHLMC, 4.05%, 7-1-2038 | 1.53 |

| FNMA Series 2017-M9 Class F, 5.10%, 5-25-2029 | 1.31 |

| FNMA Series 2016-40 Class AF, 3.71%, 7-25-2046 | 1.20 |

| FHLMC Series 4915 Class FE, 3.83%, 2-15-2038 | 1.09 |

| FNMA Series 2002-66 Class A3, 3.97%, 4-25-2042 | 1.07 |

| FNMA Series 2021-85 Class EF, 4.23%, 12-25-2051 | 1.06 |

| Navient Student Loan Trust Series 2018-4A Class A2, 5.30%, 6-27-2067 | 1.02 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

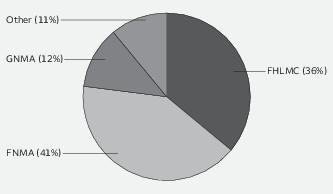

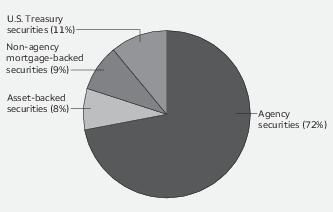

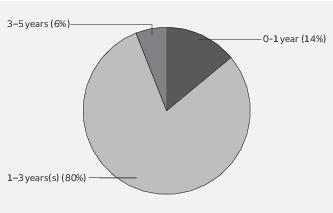

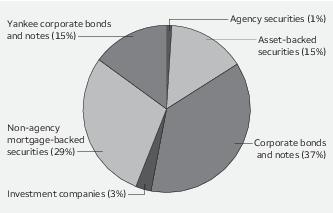

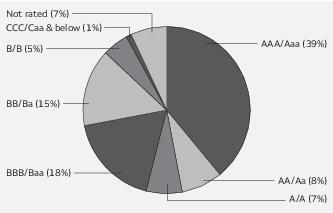

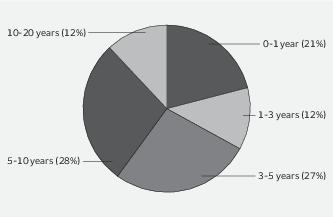

| Portfolio composition as of February 28, 20231 |

| 1 | Figures represent the percentage of the Fund's long-term investments. Allocations are subject to change and may have changed since the date specified. |

| Beginning account value 9-1-2022 | Ending account value 2-28-2023 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $1,014.70 | $3.70 | 0.74% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.12 | $3.71 | 0.74% |

| Class C | ||||

| Actual | $1,000.00 | $1,010.95 | $7.43 | 1.49% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.41 | $7.45 | 1.49% |

| Administrator Class | ||||

| Actual | $1,000.00 | $1,015.41 | $3.00 | 0.60% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.82 | $3.01 | 0.60% |

| Institutional Class | ||||

| Actual | $1,000.00 | $1,017.26 | $2.30 | 0.46% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.51 | $2.31 | 0.46% |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities: 88.02% | |||||

| FHLMC (12 Month LIBOR +1.67%) ± | 2.17% | 8-1-2035 | $ 111,954 | $ 109,441 | |

| FHLMC (12 Month LIBOR +1.81%) ± | 2.43 | 4-1-2035 | 457,543 | 450,876 | |

| FHLMC (1 Year Treasury Constant Maturity +0.85%) ± | 2.46 | 4-1-2030 | 10,769 | 10,532 | |

| FHLMC (12 Month Treasury Average +1.90%) ± | 2.51 | 5-1-2028 | 65,812 | 64,333 | |

| FHLMC (2 Year Treasury Constant Maturity +2.44%) ± | 2.57 | 8-1-2029 | 2,807 | 2,777 | |

| FHLMC (11th District COFI +1.25%) ± | 2.60 | 1-1-2030 | 1,508 | 1,456 | |

| FHLMC (11th District COFI +1.25%) ± | 2.60 | 1-1-2030 | 351 | 339 | |

| FHLMC (11th District COFI +1.25%) ± | 2.60 | 7-1-2030 | 76,078 | 73,341 | |

| FHLMC (3 Year Treasury Constant Maturity +2.44%) ± | 2.61 | 5-1-2032 | 67,382 | 66,273 | |

| FHLMC (12 Month LIBOR +1.86%) ± | 2.61 | 4-1-2037 | 130,112 | 128,442 | |

| FHLMC (1 Year Treasury Constant Maturity +0.00%) | 2.63 | 4-1-2023 | 1,856 | 1,843 | |

| FHLMC (12 Month LIBOR +1.91%) ± | 2.64 | 3-1-2032 | 104,036 | 101,909 | |

| FHLMC (12 Month LIBOR +1.64%) ± | 2.64 | 6-1-2050 | 2,544,408 | 2,302,787 | |

| FHLMC (12 Month LIBOR +2.06%) ± | 2.72 | 3-1-2038 | 465,167 | 472,671 | |

| FHLMC (1 Year Treasury Constant Maturity +2.48%) ± | 2.73 | 10-1-2024 | 11,048 | 10,926 | |

| FHLMC (1 Year Treasury Constant Maturity +2.48%) ± | 2.73 | 2-1-2030 | 19,842 | 19,530 | |

| FHLMC (1 Year Treasury Constant Maturity +2.44%) ± | 2.82 | 4-1-2029 | 16,502 | 16,134 | |

| FHLMC (1 Year Treasury Constant Maturity +2.23%) ± | 2.82 | 4-1-2034 | 74,977 | 73,359 | |

| FHLMC (11th District COFI +1.28%) ± | 2.86 | 2-1-2035 | 22,726 | 22,376 | |

| FHLMC (1 Year Treasury Constant Maturity +2.52%) ± | 2.87 | 11-1-2029 | 41,156 | 39,473 | |

| FHLMC (12 Month LIBOR +1.62%) ± | 2.88 | 11-1-2047 | 2,395,968 | 2,295,229 | |

| FHLMC (12 Month LIBOR +1.75%) ± | 2.91 | 5-1-2033 | 45,917 | 44,858 | |

| FHLMC (1 Year Treasury Constant Maturity +2.03%) ± | 2.92 | 3-1-2025 | 6,321 | 6,187 | |

| FHLMC (1 Year Treasury Constant Maturity +2.48%) ± | 2.93 | 6-1-2030 | 52,395 | 50,988 | |

| FHLMC (1 Year Treasury Constant Maturity +2.44%) ± | 2.93 | 4-1-2034 | 79,776 | 77,604 | |

| FHLMC (1 Year Treasury Constant Maturity +2.29%) ± | 2.94 | 9-1-2033 | 138,614 | 135,688 | |

| FHLMC (1 Year Treasury Constant Maturity +2.61%) ± | 2.99 | 9-1-2030 | 25,060 | 23,876 | |

| FHLMC (12 Month Treasury Average +2.46%) ± | 3.02 | 10-1-2029 | 53,784 | 52,749 | |

| FHLMC (12 Month LIBOR +1.75%) ± | 3.02 | 4-1-2035 | 77,220 | 76,161 | |

| FHLMC (1 Year Treasury Constant Maturity +2.25%) ± | 3.10 | 4-1-2038 | 314,310 | 317,470 | |

| FHLMC (1 Year Treasury Constant Maturity +2.24%) ± | 3.15 | 8-1-2027 | 2,396 | 2,350 | |

| FHLMC (12 Month LIBOR +1.73%) ± | 3.16 | 5-1-2037 | 487,806 | 490,871 | |

| FHLMC (12 Month LIBOR +1.83%) ± | 3.21 | 4-1-2037 | 44,568 | 43,977 | |

| FHLMC (1 Year Treasury Constant Maturity +2.23%) ± | 3.23 | 4-1-2034 | 59,694 | 58,920 | |

| FHLMC (1 Year Treasury Constant Maturity +2.17%) ± | 3.23 | 5-1-2037 | 19,980 | 19,782 | |

| FHLMC (1 Year Treasury Constant Maturity +2.24%) ± | 3.24 | 3-1-2027 | 20,707 | 20,388 | |

| FHLMC (1 Year Treasury Constant Maturity +2.25%) ± | 3.25 | 5-1-2034 | 100,336 | 99,035 | |

| FHLMC (12 Month LIBOR +1.62%) ± | 3.25 | 7-1-2045 | 486,057 | 487,314 | |

| FHLMC (1 Year Treasury Constant Maturity +2.36%) ± | 3.36 | 4-1-2038 | 586,182 | 580,939 | |

| FHLMC (12 Month LIBOR +1.87%) ± | 3.37 | 5-1-2035 | 18,171 | 17,847 | |

| FHLMC (12 Month LIBOR +1.77%) ± | 3.40 | 10-1-2036 | 155,260 | 157,225 | |

| FHLMC (11th District COFI +2.57%) ± | 3.43 | 12-1-2025 | 36,435 | 36,015 | |

| FHLMC (1 Year Treasury Constant Maturity +2.40%) ± | 3.46 | 7-1-2029 | 16,055 | 15,844 | |

| FHLMC (6 Month LIBOR +1.68%) ± | 3.49 | 1-1-2037 | 390,536 | 391,252 | |

| FHLMC (1 Year Treasury Constant Maturity +2.33%) ± | 3.51 | 7-1-2031 | 66,107 | 64,233 | |

| FHLMC (1 Year Treasury Constant Maturity +1.87%) ± | 3.51 | 5-1-2035 | 223,210 | 219,002 | |

| FHLMC (1 Year Treasury Constant Maturity +2.40%) ± | 3.53 | 11-1-2029 | 52,347 | 51,338 | |

| FHLMC (12 Month LIBOR +1.80%) ± | 3.56 | 8-1-2037 | 683,736 | 691,339 | |

| FHLMC (5 Year Treasury Constant Maturity +2.44%) ± | 3.57 | 8-1-2027 | 17,947 | 17,360 | |

| FHLMC (12 Month LIBOR +1.77%) ± | 3.59 | 10-1-2035 | 378,595 | 374,235 | |

| FHLMC (1 Year Treasury Constant Maturity +2.60%) ± | 3.60 | 6-1-2032 | 117,156 | 115,624 | |

| FHLMC (1 Year Treasury Constant Maturity +2.49%) ± | 3.61 | 6-1-2035 | 141,785 | 139,968 | |

| FHLMC (1 Year Treasury Constant Maturity +2.26%) ± | 3.62 | 2-1-2036 | 2,032,659 | 2,055,539 | |

| FHLMC (3 Year Treasury Constant Maturity +2.83%) ± | 3.63 | 6-1-2035 | 196,390 | 192,647 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FHLMC (1 Year Treasury Constant Maturity +2.25%) ± | 3.63% | 6-1-2035 | $ 28,709 | $ 29,102 | |

| FHLMC (1 Year Treasury Constant Maturity +2.00%) ± | 3.66 | 8-1-2033 | 380,179 | 372,344 | |

| FHLMC (6 Month LIBOR +1.42%) ± | 3.67 | 2-1-2037 | 1,546 | 1,541 | |

| FHLMC (12 Month LIBOR +1.77%) ± | 3.69 | 9-1-2039 | 688,819 | 695,970 | |

| FHLMC (12 Month LIBOR +1.75%) ± | 3.70 | 6-1-2033 | 159,242 | 158,060 | |

| FHLMC (12 Month LIBOR +1.77%) ± | 3.71 | 9-1-2037 | 141,629 | 143,000 | |

| FHLMC (12 Month LIBOR +1.61%) ± | 3.75 | 7-1-2044 | 89,365 | 89,879 | |

| FHLMC (12 Month LIBOR +1.51%) ± | 3.76 | 2-1-2037 | 42,669 | 41,665 | |

| FHLMC (12 Month Treasury Average +2.52%) ± | 3.77 | 6-1-2028 | 18,880 | 18,467 | |

| FHLMC (1 Year Treasury Constant Maturity +2.23%) ± | 3.77 | 5-1-2038 | 244,914 | 241,165 | |

| FHLMC (1 Year Treasury Constant Maturity +2.04%) ± | 3.78 | 12-1-2035 | 221,050 | 216,759 | |

| FHLMC (12 Month LIBOR +1.80%) ± | 3.78 | 10-1-2043 | 2,539,154 | 2,562,689 | |

| FHLMC (1 Year Treasury Constant Maturity +2.19%) ± | 3.79 | 1-1-2037 | 303,573 | 296,794 | |

| FHLMC (1 Year Treasury Constant Maturity +2.16%) ± | 3.80 | 6-1-2033 | 256,941 | 250,398 | |

| FHLMC (6 Month LIBOR +1.83%) ± | 3.81 | 6-1-2037 | 126,054 | 123,028 | |

| FHLMC (12 Month LIBOR +1.82%) ± | 3.81 | 5-1-2039 | 213,134 | 209,477 | |

| FHLMC (1 Year Treasury Constant Maturity +2.19%) ± | 3.82 | 6-1-2036 | 265,978 | 268,797 | |

| FHLMC (1 Year Treasury Constant Maturity +2.26%) ± | 3.82 | 9-1-2036 | 5,220,276 | 5,314,616 | |

| FHLMC (12 Month LIBOR +1.85%) ± | 3.82 | 7-1-2038 | 554,723 | 559,560 | |

| FHLMC (1 Year Treasury Constant Maturity +2.26%) ± | 3.83 | 4-1-2037 | 1,059,833 | 1,076,321 | |

| FHLMC (12 Month LIBOR +1.83%) ± | 3.89 | 6-1-2043 | 2,842,443 | 2,892,570 | |

| FHLMC (1 Year Treasury Constant Maturity +2.34%) ± | 3.91 | 4-1-2032 | 836,030 | 834,231 | |

| FHLMC (6 Month LIBOR +2.12%) ± | 3.91 | 5-1-2037 | 20,128 | 19,648 | |

| FHLMC (1 Year Treasury Constant Maturity +2.43%) ± | 3.93 | 6-1-2025 | 16,754 | 16,420 | |

| FHLMC (1 Year Treasury Constant Maturity +2.40%) ± | 3.94 | 1-1-2037 | 524,987 | 534,013 | |

| FHLMC (1 Year Treasury Constant Maturity +2.37%) ± | 3.96 | 2-1-2034 | 1,440,695 | 1,447,403 | |

| FHLMC (12 Month LIBOR +1.85%) ± | 3.96 | 9-1-2036 | 202,075 | 199,723 | |

| FHLMC (12 Month LIBOR +1.80%) ± | 3.96 | 9-1-2037 | 135,159 | 136,862 | |

| FHLMC (1 Year Treasury Constant Maturity +2.10%) ± | 3.97 | 10-1-2037 | 317,122 | 316,595 | |

| FHLMC (12 Month LIBOR +1.79%) ± | 3.97 | 1-1-2040 | 1,018,970 | 1,033,477 | |

| FHLMC (6 Month LIBOR +1.73%) ± | 3.98 | 6-1-2024 | 1,149 | 1,135 | |

| FHLMC (12 Month LIBOR +1.73%) ± | 3.98 | 1-1-2035 | 148,456 | 145,620 | |

| FHLMC (12 Month LIBOR +1.74%) ± | 3.99 | 12-1-2036 | 111,692 | 112,795 | |

| FHLMC (1 Year Treasury Constant Maturity +2.26%) ± | 3.99 | 9-1-2038 | 1,720,433 | 1,743,768 | |

| FHLMC (1 Year Treasury Constant Maturity +2.34%) ± | 4.02 | 10-1-2033 | 321,456 | 315,275 | |

| FHLMC (12 Month LIBOR +1.77%) ± | 4.02 | 6-1-2035 | 123,292 | 121,526 | |

| FHLMC (12 Month LIBOR +1.78%) ± | 4.03 | 11-1-2035 | 98,235 | 98,616 | |

| FHLMC (1 Year Treasury Constant Maturity +2.26%) ± | 4.05 | 7-1-2038 | 5,192,229 | 5,255,303 | |

| FHLMC (1 Year Treasury Constant Maturity +2.39%) ± | 4.06 | 6-1-2035 | 256,757 | 257,418 | |

| FHLMC (1 Year Treasury Constant Maturity +2.76%) ± | 4.08 | 9-1-2030 | 16,180 | 15,945 | |

| FHLMC (1 Year Treasury Constant Maturity +2.32%) ± | 4.09 | 7-1-2027 | 116,244 | 115,198 | |

| FHLMC (1 Year Treasury Constant Maturity +1.99%) ± | 4.11 | 11-1-2034 | 151,091 | 147,500 | |

| FHLMC (1 Year Treasury Constant Maturity +2.28%) ± | 4.14 | 7-1-2034 | 104,476 | 101,939 | |

| FHLMC (6 Month LIBOR +2.16%) ± | 4.17 | 6-1-2026 | 153,809 | 151,211 | |

| FHLMC (U.S. Treasury H15 Treasury Bill 6 Month Auction High Discount +1.94%) ± | 4.19 | 7-1-2024 | 3,356 | 3,327 | |

| FHLMC (1 Year Treasury Constant Maturity +2.36%) ± | 4.19 | 1-1-2028 | 886 | 871 | |

| FHLMC (12 Month LIBOR +1.93%) ± | 4.20 | 4-1-2035 | 476,739 | 469,186 | |

| FHLMC (1 Year Treasury Constant Maturity +2.48%) ± | 4.21 | 6-1-2030 | 137,947 | 135,940 | |

| FHLMC (1 Year Treasury Constant Maturity +2.22%) ± | 4.22 | 8-1-2033 | 14,093 | 13,856 | |

| FHLMC (1 Year Treasury Constant Maturity +2.47%) ± | 4.22 | 7-1-2034 | 93,143 | 91,535 | |

| FHLMC (1 Year Treasury Constant Maturity +2.23%) ± | 4.23 | 11-1-2026 | 32,235 | 31,717 | |

| FHLMC (12 Month LIBOR +1.99%) ± | 4.24 | 7-1-2036 | 187,020 | 183,517 | |

| FHLMC (1 Year Treasury Constant Maturity +2.25%) ± | 4.27 | 9-1-2033 | 43,530 | 44,520 | |

| FHLMC (11th District COFI +2.29%) ± | 4.29 | 12-1-2025 | 1,354 | 1,346 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FHLMC (1 Year Treasury Constant Maturity +2.24%) ± | 4.31% | 4-1-2036 | $ 112,321 | $ 111,035 | |

| FHLMC (1 Year Treasury Constant Maturity +2.22%) ± | 4.34 | 12-1-2033 | 278,301 | 271,730 | |

| FHLMC (1 Year Treasury Constant Maturity +2.23%) ± | 4.35 | 2-1-2034 | 229,974 | 224,672 | |

| FHLMC (1 Year Treasury Constant Maturity +2.28%) ± | 4.35 | 10-1-2036 | 109,096 | 107,195 | |

| FHLMC (1 Year Treasury Constant Maturity +2.35%) ± | 4.35 | 7-1-2038 | 136,455 | 134,687 | |

| FHLMC (1 Year Treasury Constant Maturity +2.23%) ± | 4.36 | 2-1-2034 | 34,302 | 33,387 | |

| FHLMC (1 Year Treasury Constant Maturity +2.25%) ± | 4.36 | 1-1-2037 | 25,362 | 25,792 | |

| FHLMC (1 Year Treasury Constant Maturity +2.29%) ± | 4.37 | 11-1-2027 | 152,550 | 150,139 | |

| FHLMC (1 Year Treasury Constant Maturity +2.25%) ± | 4.37 | 12-1-2034 | 104,756 | 102,803 | |

| FHLMC (1 Year Treasury Constant Maturity +2.25%) ± | 4.38 | 5-1-2034 | 27,449 | 27,520 | |

| FHLMC (1 Year Treasury Constant Maturity +2.25%) ± | 4.38 | 2-1-2036 | 135,628 | 133,774 | |

| FHLMC (1 Year Treasury Constant Maturity +2.27%) ± | 4.40 | 11-1-2029 | 26,094 | 25,584 | |

| FHLMC (1 Year Treasury Constant Maturity +2.40%) ± | 4.40 | 7-1-2031 | 34,359 | 33,811 | |

| FHLMC (1 Year Treasury Constant Maturity +2.40%) ± | 4.40 | 9-1-2031 | 27,882 | 27,401 | |

| FHLMC (1 Year Treasury Constant Maturity +2.36%) ± | 4.41 | 1-1-2028 | 4,800 | 4,729 | |

| FHLMC (1 Year Treasury Constant Maturity +2.28%) ± | 4.41 | 1-1-2035 | 117,364 | 114,448 | |

| FHLMC (1 Year Treasury Constant Maturity +2.36%) ± | 4.46 | 2-1-2035 | 253,823 | 248,321 | |

| FHLMC (11th District COFI +1.25%) ± | 4.47 | 11-1-2030 | 7,564 | 7,338 | |

| FHLMC (5 Year Treasury Constant Maturity +2.13%) ± | 4.50 | 8-1-2029 | 5,859 | 5,845 | |

| FHLMC (1 Year Treasury Constant Maturity +2.69%) ± | 4.53 | 5-1-2028 | 61,815 | 60,485 | |

| FHLMC (30 Day Average U.S. SOFR +0.26%) ± | 4.56 | 7-1-2031 | 3,500,000 | 3,462,358 | |

| FHLMC (1 Year Treasury Constant Maturity +2.48%) ± | 4.60 | 6-1-2030 | 16,904 | 16,535 | |

| FHLMC (1 Year Treasury Constant Maturity +2.49%) ± | 4.60 | 12-1-2032 | 53,907 | 52,851 | |

| FHLMC (1 Year Treasury Constant Maturity +2.55%) ± | 4.67 | 9-1-2029 | 18,037 | 17,607 | |

| FHLMC (12 Month LIBOR +1.77%) ± | 5.04 | 8-1-2042 | 110,897 | 113,765 | |

| FHLMC (3 Year Treasury Constant Maturity +2.40%) ± | 5.16 | 5-1-2031 | 57,144 | 55,981 | |

| FHLMC (6 Month LIBOR +3.83%) ± | 5.21 | 11-1-2026 | 11,104 | 10,914 | |

| FHLMC Multifamily Structured Pass-Through Certificates Series KF46 Class A (1 Month LIBOR +0.22%) ± | 4.79 | 3-25-2028 | 107,238 | 105,500 | |

| FHLMC Multifamily Structured Pass-Through Certificates Series KF85 Class AL (1 Month LIBOR +0.30%) ± | 4.87 | 8-25-2030 | 241,347 | 237,817 | |

| FHLMC Multifamily Structured Pass-Through Certificates Series KX04 Class AFL (1 Month LIBOR +0.33%) ± | 4.90 | 3-25-2030 | 1,808,827 | 1,789,879 | |

| FHLMC Multifamily Structured Pass-Through Certificates Series Q016 Class APT2 ±± | 1.48 | 5-25-2051 | 3,689,590 | 3,233,997 | |

| FHLMC Series 1671 Class QA (Enterprise 11th District COFI Institutional Replacement +0.95%) ± | 2.79 | 2-15-2024 | 92,202 | 92,341 | |

| FHLMC Series 1686 Class FE (Enterprise 11th District COFI Institutional Replacement +1.10%) ± | 2.94 | 2-15-2024 | 746 | 748 | |

| FHLMC Series 1709 Class FA (10 Year Treasury Constant Maturity -0.85%) ± | 2.59 | 3-15-2024 | 14,750 | 14,642 | |

| FHLMC Series 1730 Class FA (10 Year Treasury Constant Maturity -0.60%) ± | 2.84 | 5-15-2024 | 10,941 | 10,885 | |

| FHLMC Series 20 Class F ±± | 2.54 | 7-1-2029 | 1,395 | 1,398 | |

| FHLMC Series 2315 Class FW (1 Month LIBOR +0.55%) ± | 5.14 | 4-15-2027 | 18,609 | 18,621 | |

| FHLMC Series 2391 Class EF (1 Month LIBOR +0.50%) ± | 5.09 | 6-15-2031 | 25,051 | 25,009 | |

| FHLMC Series 2454 Class SL (-1 Month LIBOR +8.00%) ♀± | 3.41 | 3-15-2032 | 54,525 | 5,410 | |

| FHLMC Series 2461 Class FI (1 Month LIBOR +0.50%) ± | 5.09 | 4-15-2028 | 31,207 | 31,201 | |

| FHLMC Series 2464 Class FE (1 Month LIBOR +1.00%) ± | 5.59 | 3-15-2032 | 35,538 | 36,077 | |

| FHLMC Series 2466 Class FV (1 Month LIBOR +0.55%) ± | 5.14 | 3-15-2032 | 68,276 | 68,461 | |

| FHLMC Series 2538 Class F (1 Month LIBOR +0.60%) ± | 5.19 | 12-15-2032 | 144,969 | 144,310 | |

| FHLMC Series 264 Class F1 (1 Month LIBOR +0.55%) ± | 5.14 | 7-15-2042 | 584,933 | 577,469 | |

| FHLMC Series 2682 Class FK (1 Month LIBOR +1.47%) ± | 6.06 | 1-15-2033 | 2,898,679 | 2,999,107 | |

| FHLMC Series 3067 Class FA (1 Month LIBOR +0.35%) ± | 4.94 | 11-15-2035 | 518,043 | 513,055 | |

| FHLMC Series 3114 Class FT (1 Month LIBOR +0.35%) ± | 4.94 | 9-15-2030 | 198,105 | 197,577 | |

| FHLMC Series 3140 Class GF (1 Month LIBOR +0.35%) ± | 4.94 | 3-15-2036 | 404,752 | 400,677 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FHLMC Series 3146 Class FP (1 Month LIBOR +0.35%) ± | 4.94% | 4-15-2036 | $ 370,120 | $ 366,642 | |

| FHLMC Series 3149 Class FB (1 Month LIBOR +0.35%) ± | 4.94 | 5-15-2036 | 661,001 | 656,873 | |

| FHLMC Series 319 Class F1 (1 Month LIBOR +0.45%) ± | 5.04 | 11-15-2043 | 859,249 | 843,805 | |

| FHLMC Series 3240 Class FM (1 Month LIBOR +0.35%) ± | 4.94 | 11-15-2036 | 671,593 | 664,329 | |

| FHLMC Series 3284 Class CF (1 Month LIBOR +0.37%) ± | 4.96 | 3-15-2037 | 452,636 | 445,190 | |

| FHLMC Series 3286 Class FA (1 Month LIBOR +0.40%) ± | 4.99 | 3-15-2037 | 50,657 | 49,784 | |

| FHLMC Series 3311 Class KF (1 Month LIBOR +0.34%) ± | 4.93 | 5-15-2037 | 775,691 | 763,401 | |

| FHLMC Series 3312 Class FN (1 Month LIBOR +0.22%) ± | 4.81 | 7-15-2036 | 657,892 | 647,355 | |

| FHLMC Series 3436 Class A ±± | 4.09 | 11-15-2036 | 234,864 | 236,817 | |

| FHLMC Series 350 Class F2 (1 Month LIBOR +0.35%) ± | 3.34 | 9-15-2040 | 5,563,182 | 5,418,784 | |

| FHLMC Series 3684 Class FM (1 Month LIBOR +0.35%) ± | 3.98 | 11-15-2036 | 960,644 | 947,075 | |

| FHLMC Series 3753 Class FA (1 Month LIBOR +0.50%) ± | 5.09 | 11-15-2040 | 1,063,550 | 1,049,983 | |

| FHLMC Series 3757 Class PF (1 Month LIBOR +0.50%) ± | 5.09 | 8-15-2040 | 242,082 | 241,818 | |

| FHLMC Series 3822 Class FY (1 Month LIBOR +0.40%) ± | 4.99 | 2-15-2033 | 469,238 | 468,235 | |

| FHLMC Series 3827 Class DF (1 Month LIBOR +0.45%) ± | 5.04 | 3-15-2041 | 236,703 | 234,491 | |

| FHLMC Series 3925 Class FL (1 Month LIBOR +0.45%) ± | 5.04 | 1-15-2041 | 50,053 | 49,930 | |

| FHLMC Series 3997 Class FQ (1 Month LIBOR +0.50%) ± | 5.09 | 2-15-2042 | 458,458 | 451,813 | |

| FHLMC Series 4013 Class QF (1 Month LIBOR +0.55%) ± | 5.14 | 3-15-2041 | 213,999 | 213,625 | |

| FHLMC Series 4039 Class FA (1 Month LIBOR +0.50%) ± | 5.09 | 5-15-2042 | 721,178 | 716,724 | |

| FHLMC Series 4136 Class DF (1 Month LIBOR +0.30%) ± | 4.89 | 11-15-2042 | 456,452 | 444,371 | |

| FHLMC Series 4143 Class KF (1 Month LIBOR +0.35%) ± | 3.65 | 9-15-2037 | 1,360,490 | 1,337,937 | |

| FHLMC Series 4248 Class FL (1 Month LIBOR +0.45%) ± | 5.04 | 5-15-2041 | 187,075 | 185,219 | |

| FHLMC Series 4316 Class JF (1 Month LIBOR +0.40%) ± | 4.99 | 1-15-2044 | 644,946 | 634,909 | |

| FHLMC Series 4474 Class WF (1 Month LIBOR +0.35%) ± | 3.58 | 12-15-2036 | 1,072,175 | 1,042,997 | |

| FHLMC Series 4477 Class FG (1 Month LIBOR +0.30%) ± | 3.47 | 10-15-2040 | 995,299 | 973,520 | |

| FHLMC Series 4503 Class FA (1 Month LIBOR +0.35%) ± | 3.63 | 2-15-2042 | 1,226,236 | 1,204,808 | |

| FHLMC Series 4515 Class FA (1 Month LIBOR +0.37%) ± | 3.83 | 8-15-2038 | 181,978 | 179,079 | |

| FHLMC Series 4604 Class PA | 3.00 | 1-15-2044 | 134,032 | 131,659 | |

| FHLMC Series 4624 Class FA (1 Month LIBOR +0.45%) ± | 3.64 | 12-15-2038 | 2,088,006 | 2,062,314 | |

| FHLMC Series 4628 Class KF (1 Month LIBOR +0.50%) ± | 5.09 | 1-15-2055 | 1,198,590 | 1,167,965 | |

| FHLMC Series 4678 Class AF (1 Month LIBOR +0.40%) ± | 3.61 | 12-15-2042 | 903,945 | 895,480 | |

| FHLMC Series 4691 Class FA (1 Month LIBOR +0.35%) ± | 4.94 | 6-15-2047 | 450,210 | 425,756 | |

| FHLMC Series 4707 Class FD (1 Month LIBOR +0.35%) ± | 3.76 | 9-15-2044 | 2,642,838 | 2,632,761 | |

| FHLMC Series 4754 Class FM (1 Month LIBOR +0.30%) ± | 4.89 | 2-15-2048 | 1,146,237 | 1,109,522 | |

| FHLMC Series 4779 Class WF (1 Month LIBOR +0.35%) ± | 3.56 | 7-15-2044 | 1,288,309 | 1,267,501 | |

| FHLMC Series 4821 Class FA (1 Month LIBOR +0.30%) ± | 4.89 | 7-15-2048 | 342,105 | 331,865 | |

| FHLMC Series 4831 Class FD (1 Month LIBOR +0.30%) ± | 4.89 | 10-15-2048 | 1,133,161 | 1,098,069 | |

| FHLMC Series 4842 Class FA (1 Month LIBOR +0.35%) ± | 4.94 | 11-15-2048 | 837,935 | 815,625 | |

| FHLMC Series 4906 Class WF (1 Month LIBOR +0.40%) ± | 3.81 | 12-15-2038 | 1,523,489 | 1,507,737 | |

| FHLMC Series 4908 Class FA (1 Month LIBOR +0.44%) ± | 3.66 | 12-15-2042 | 1,499,839 | 1,484,111 | |

| FHLMC Series 4915 Class FE (1 Month LIBOR +0.40%) ± | 3.83 | 2-15-2038 | 3,713,439 | 3,742,803 | |

| FHLMC Series 4921 Class FN (1 Month LIBOR +0.45%) ± | 5.07 | 10-25-2049 | 884,464 | 865,068 | |

| FHLMC Series 4925 Class FY (1 Month LIBOR +0.45%) ± | 5.07 | 10-25-2049 | 342,118 | 334,036 | |

| FHLMC Series 4925 Class WF (1 Month LIBOR +0.40%) ± | 3.92 | 8-15-2038 | 3,360,446 | 3,346,496 | |

| FHLMC Series 4927 Class FG (1 Month LIBOR +0.50%) ± | 5.12 | 11-25-2049 | 1,327,987 | 1,300,618 | |

| FHLMC Series 4933 Class FA (1 Month LIBOR +0.50%) ± | 5.12 | 12-25-2049 | 951,099 | 931,951 | |

| FHLMC Series 5062 Class FC (30 Day Average U.S. SOFR +0.20%) ± | 4.68 | 1-25-2051 | 1,290,518 | 1,230,276 | |

| FHLMC Series T-15 Class A6 (1 Month LIBOR +0.40%) ± | 5.02 | 11-25-2028 | 194,029 | 193,590 | |

| FHLMC Series T-16 Class A (1 Month LIBOR +0.35%) ± | 4.97 | 6-25-2029 | 780,977 | 762,642 | |

| FHLMC Series T-20 Class A7 (1 Month LIBOR +0.30%) ± | 4.92 | 12-25-2029 | 1,872,028 | 1,843,728 | |

| FHLMC Series T-21 Class A (1 Month LIBOR +0.36%) ± | 4.98 | 10-25-2029 | 582,107 | 581,288 | |

| FHLMC Series T-24 Class A (1 Month LIBOR +0.30%) ± | 4.92 | 6-25-2030 | 196,760 | 195,168 | |

| FHLMC Series T-27 Class A (1 Month LIBOR +0.30%) ± | 4.92 | 10-25-2030 | 721,852 | 717,672 | |

| FHLMC Series T-30 Class A7 (1 Month LIBOR +0.24%) ± | 4.86 | 12-25-2030 | 574,556 | 554,473 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FHLMC Series T-35 Class A (1 Month LIBOR +0.28%) ± | 4.90% | 9-25-2031 | $1,133,064 | $ 1,126,988 | |

| FHLMC Series T-48 Class 2A ±± | 3.82 | 7-25-2033 | 1,007,178 | 933,281 | |

| FHLMC Series T-54 Class 4A ±± | 3.93 | 2-25-2043 | 579,156 | 530,207 | |

| FHLMC Series T-55 Class 1A1 | 6.50 | 3-25-2043 | 32,176 | 32,519 | |

| FHLMC Series T-56 Class 3AF (1 Month LIBOR +1.00%) ± | 5.62 | 5-25-2043 | 783,338 | 778,103 | |

| FHLMC Series T-62 Class 1A1 (12 Month Treasury Average +1.20%) ± | 3.99 | 10-25-2044 | 1,462,318 | 1,380,884 | |

| FHLMC Series T-63 Class 1A1 (12 Month Treasury Average +1.20%) ± | 3.42 | 2-25-2045 | 1,295,377 | 1,291,054 | |

| FHLMC Series T-66 Class 2A1 ±± | 4.21 | 1-25-2036 | 851,988 | 829,300 | |

| FHLMC Series T-67 Class 1A1C ±± | 3.68 | 3-25-2036 | 1,937,047 | 1,882,100 | |

| FHLMC Series T-67 Class 2A1C ±± | 3.74 | 3-25-2036 | 1,989,973 | 1,944,507 | |

| FNMA (Enterprise 11th District COFI Institutional Replacement +1.40%) ± | 2.17 | 4-1-2024 | 120,329 | 119,299 | |

| FNMA (12 Month LIBOR +1.60%) ± | 2.23 | 8-1-2050 | 2,216,681 | 1,988,742 | |

| FNMA (12 Month LIBOR +1.62%) ± | 2.39 | 8-1-2050 | 2,731,312 | 2,448,407 | |

| FNMA (3 Year Treasury Constant Maturity +2.15%) ± | 2.40 | 10-1-2024 | 5,375 | 5,332 | |

| FNMA (12 Month LIBOR +1.62%) ± | 2.53 | 4-1-2050 | 1,313,664 | 1,227,401 | |

| FNMA (11th District COFI +1.92%) ± | 2.59 | 9-1-2030 | 118,411 | 115,994 | |

| FNMA (11th District COFI +1.82%) ± | 2.60 | 5-1-2028 | 20,536 | 20,075 | |

| FNMA (11th District COFI +1.08%) ± | 2.67 | 10-1-2034 | 4,896 | 4,872 | |

| FNMA (11th District COFI +1.27%) ± | 2.86 | 3-1-2033 | 37,629 | 36,221 | |

| FNMA (12 Month LIBOR +1.75%) ± | 2.88 | 4-1-2034 | 147,985 | 144,711 | |

| FNMA (12 Month LIBOR +1.65%) ± | 2.88 | 11-1-2038 | 82,839 | 81,830 | |

| FNMA (3 Year Treasury Constant Maturity +2.15%) ± | 2.90 | 8-1-2031 | 21,275 | 20,720 | |

| FNMA (12 Month LIBOR +1.75%) ± | 2.93 | 5-1-2035 | 295,169 | 291,623 | |

| FNMA (1 Year Treasury Constant Maturity +2.21%) ± | 3.01 | 5-1-2037 | 282,099 | 277,368 | |

| FNMA (1 Year Treasury Constant Maturity +1.96%) ± | 3.08 | 3-1-2032 | 12,972 | 12,813 | |

| FNMA (11th District COFI +1.26%) ± | 3.09 | 1-1-2035 | 132,447 | 128,217 | |

| FNMA (11th District COFI +1.29%) ± | 3.09 | 9-1-2037 | 709,228 | 683,944 | |

| FNMA (12 Month LIBOR +1.75%) ± | 3.10 | 4-1-2033 | 258,389 | 253,344 | |

| FNMA (1 Year Treasury Constant Maturity +2.10%) ± | 3.10 | 7-1-2035 | 37,003 | 36,361 | |

| FNMA (11th District COFI +1.25%) ± | 3.11 | 11-1-2023 | 1,851 | 1,839 | |

| FNMA (1 Year Treasury Constant Maturity +2.12%) ± | 3.12 | 3-1-2031 | 15,622 | 15,411 | |

| FNMA (11th District COFI +1.25%) ± | 3.13 | 11-1-2024 | 39 | 38 | |

| FNMA (6 Month LIBOR +1.03%) ± | 3.15 | 2-1-2033 | 90,890 | 88,975 | |

| FNMA (1 Year Treasury Constant Maturity +1.50%) ± | 3.16 | 8-1-2030 | 260,542 | 257,005 | |

| FNMA (6 Month LIBOR +1.31%) ± | 3.18 | 10-1-2037 | 279,143 | 277,771 | |

| FNMA (1 Year Treasury Constant Maturity +2.10%) ± | 3.19 | 9-1-2036 | 158,193 | 155,492 | |

| FNMA (1 Year Treasury Constant Maturity +1.58%) ± | 3.24 | 3-1-2034 | 172,625 | 168,449 | |

| FNMA (11th District COFI +1.26%) ± | 3.33 | 1-1-2038 | 7,597 | 7,473 | |

| FNMA (12 Month LIBOR +1.59%) ± | 3.34 | 6-1-2044 | 426,398 | 431,433 | |

| FNMA (6 Month LIBOR +1.51%) ± | 3.35 | 11-1-2034 | 266,102 | 261,128 | |

| FNMA (1 Year Treasury Constant Maturity +2.22%) ± | 3.35 | 6-1-2035 | 173,583 | 172,760 | |

| FNMA (1 Year Treasury Constant Maturity +2.35%) ± | 3.37 | 6-1-2027 | 21,105 | 20,773 | |

| FNMA (12 Month LIBOR +1.56%) ± | 3.40 | 1-1-2040 | 59,477 | 58,720 | |

| FNMA (12 Month LIBOR +1.56%) ± | 3.40 | 6-1-2043 | 3,032,011 | 3,048,552 | |

| FNMA (1 Year Treasury Constant Maturity +2.24%) ± | 3.43 | 7-1-2028 | 43 | 42 | |

| FNMA (12 Month LIBOR +1.60%) ± | 3.44 | 3-1-2046 | 689,097 | 689,019 | |

| FNMA (1 Year Treasury Constant Maturity +2.23%) ± | 3.45 | 8-1-2026 | 10,716 | 10,569 | |

| FNMA (1 Year Treasury Constant Maturity +2.19%) ± | 3.47 | 6-1-2027 | 26,799 | 26,439 | |

| FNMA (1 Year Treasury Constant Maturity +2.22%) ± | 3.48 | 7-1-2029 | 121,645 | 117,464 | |

| FNMA (6 Month LIBOR +1.74%) ± | 3.49 | 10-1-2024 | 11,257 | 11,084 | |

| FNMA (1 Year Treasury Constant Maturity +2.12%) ± | 3.49 | 8-1-2026 | 7,800 | 7,675 | |

| FNMA (5 Year Treasury Constant Maturity +1.90%) ± | 3.49 | 9-1-2031 | 90,831 | 88,153 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FNMA (6 Month LIBOR +1.16%) ± | 3.50% | 8-1-2033 | $ 2,585 | $ 2,531 | |

| FNMA (12 Month LIBOR +1.59%) ± | 3.50 | 9-1-2044 | 657,303 | 664,768 | |

| FNMA (1 Year Treasury Constant Maturity +1.76%) ± | 3.51 | 8-1-2032 | 27,791 | 27,416 | |

| FNMA (1 Year Treasury Constant Maturity +2.11%) ± | 3.51 | 7-1-2035 | 77,626 | 76,759 | |

| FNMA (1 Year Treasury Constant Maturity +2.37%) ± | 3.52 | 9-1-2030 | 215,868 | 206,732 | |

| FNMA (1 Year Treasury Constant Maturity +1.52%) ± | 3.52 | 8-1-2033 | 361,902 | 357,116 | |

| FNMA (1 Year Treasury Constant Maturity +2.32%) ± | 3.55 | 4-1-2028 | 50,344 | 49,265 | |

| FNMA (12 Month LIBOR +1.72%) ± | 3.55 | 4-1-2034 | 233,850 | 236,065 | |

| FNMA (Federal COFI +2.45%) ± | 3.56 | 2-1-2029 | 233,392 | 231,655 | |

| FNMA (1 Year Treasury Constant Maturity +2.50%) ± | 3.57 | 9-1-2030 | 217,456 | 209,264 | |

| FNMA (11th District COFI +1.25%) ± | 3.61 | 4-1-2034 | 165,733 | 161,259 | |

| FNMA (1 Year Treasury Constant Maturity +2.49%) ± | 3.61 | 7-1-2037 | 73,566 | 72,940 | |

| FNMA (12 Month LIBOR +1.74%) ± | 3.62 | 6-1-2036 | 47,008 | 47,852 | |

| FNMA (1 Year Treasury Constant Maturity +2.58%) ± | 3.63 | 8-1-2035 | 152,111 | 148,412 | |

| FNMA (12 Month Treasury Average +2.48%) ± | 3.63 | 6-1-2040 | 397,357 | 390,373 | |

| FNMA (1 Year Treasury Constant Maturity +2.64%) ± | 3.64 | 3-1-2030 | 3,103 | 3,048 | |

| FNMA (1 Year Treasury Constant Maturity +2.18%) ± | 3.65 | 6-1-2035 | 46,398 | 45,824 | |

| FNMA (1 Year Treasury Constant Maturity +2.41%) ± | 3.67 | 5-1-2027 | 21,822 | 21,427 | |

| FNMA (1 Year Treasury Constant Maturity +1.88%) ± | 3.67 | 8-1-2031 | 29,634 | 29,266 | |

| FNMA (1 Year Treasury Constant Maturity +2.20%) ± | 3.68 | 10-1-2034 | 490,042 | 498,301 | |

| FNMA (12 Month LIBOR +1.93%) ± | 3.68 | 5-1-2037 | 506,559 | 501,218 | |

| FNMA (12 Month LIBOR +1.75%) ± | 3.69 | 7-1-2035 | 204,840 | 207,298 | |

| FNMA (1 Year Treasury Constant Maturity +2.44%) ± | 3.69 | 7-1-2037 | 680,955 | 685,670 | |

| FNMA (12 Month LIBOR +1.75%) ± | 3.69 | 9-1-2042 | 143,649 | 145,516 | |

| FNMA (1 Year Treasury Constant Maturity +1.66%) ± | 3.69 | 7-1-2048 | 387,377 | 388,649 | |

| FNMA (11th District COFI +1.86%) ± | 3.71 | 10-1-2027 | 76,774 | 76,025 | |

| FNMA (6 Month LIBOR +1.96%) ± | 3.73 | 10-1-2024 | 1,869 | 1,854 | |

| FNMA (1 Year Treasury Constant Maturity +2.03%) ± | 3.73 | 12-1-2032 | 162,555 | 159,741 | |

| FNMA (11th District COFI +1.66%) ± | 3.73 | 1-1-2036 | 103,846 | 101,113 | |

| FNMA (11th District COFI +1.70%) ± | 3.76 | 4-1-2030 | 317 | 311 | |

| FNMA (11th District COFI +1.90%) ± | 3.76 | 3-1-2033 | 117,794 | 115,316 | |

| FNMA (1 Year Treasury Constant Maturity +2.70%) ± | 3.76 | 5-1-2035 | 462,701 | 456,783 | |

| FNMA (1 Year Treasury Constant Maturity +2.20%) ± | 3.76 | 12-1-2040 | 3,096,037 | 3,143,042 | |

| FNMA (12 Month LIBOR +1.68%) ± | 3.76 | 6-1-2041 | 730,777 | 738,901 | |

| FNMA (12 Month LIBOR +1.72%) ± | 3.77 | 6-1-2035 | 42,799 | 43,667 | |

| FNMA (12 Month LIBOR +1.53%) ± | 3.78 | 9-1-2035 | 289,427 | 292,770 | |

| FNMA (12 Month LIBOR +1.54%) ± | 3.79 | 9-1-2036 | 176,753 | 174,584 | |

| FNMA (12 Month LIBOR +1.67%) ± | 3.80 | 7-1-2035 | 313,910 | 319,996 | |

| FNMA (1 Year Treasury Constant Maturity +1.70%) ± | 3.82 | 2-1-2033 | 168,892 | 165,841 | |

| FNMA (12 Month LIBOR +1.57%) ± | 3.82 | 11-1-2044 | 64,680 | 64,123 | |

| FNMA (1 Year Treasury Constant Maturity +2.07%) ± | 3.85 | 12-1-2033 | 151,086 | 148,656 | |

| FNMA (1 Year Treasury Constant Maturity +2.21%) ± | 3.85 | 9-1-2035 | 814,830 | 828,944 | |

| FNMA (12 Month LIBOR +1.60%) ± | 3.85 | 9-1-2037 | 342,144 | 338,432 | |

| FNMA (1 Year Treasury Constant Maturity +2.23%) ± | 3.85 | 4-1-2038 | 244,055 | 240,777 | |

| FNMA (6 Month LIBOR +1.74%) ± | 3.87 | 12-1-2024 | 11,804 | 11,637 | |

| FNMA (12 Month LIBOR +1.90%) ± | 3.87 | 5-1-2038 | 246,391 | 252,996 | |

| FNMA (1 Year Treasury Constant Maturity +2.35%) ± | 3.88 | 9-1-2037 | 30,027 | 29,545 | |

| FNMA (1 Year Treasury Constant Maturity +2.29%) ± | 3.89 | 5-1-2034 | 96,681 | 95,145 | |

| FNMA (11th District COFI +1.83%) ± | 3.89 | 6-1-2034 | 33,566 | 33,113 | |

| FNMA (1 Year Treasury Constant Maturity +2.29%) ± | 3.90 | 6-1-2037 | 571,276 | 578,815 | |

| FNMA (11th District COFI +1.85%) ± | 3.92 | 1-1-2036 | 8,453 | 8,247 | |

| FNMA (12 Month LIBOR +1.72%) ± | 3.92 | 7-1-2043 | 1,063,607 | 1,078,309 | |

| FNMA (12 Month LIBOR +1.77%) ± | 3.92 | 7-1-2044 | 1,421,952 | 1,451,569 | |

| FNMA (1 Year Treasury Constant Maturity +2.21%) ± | 3.94 | 1-1-2027 | 21,365 | 21,227 | |

| FNMA (1 Year Treasury Constant Maturity +2.24%) ± | 3.94 | 1-1-2037 | 307,539 | 304,869 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FNMA (1 Year Treasury Constant Maturity +2.10%) ± | 3.95% | 4-1-2040 | $ 58,490 | $ 59,184 | |

| FNMA (1 Year Treasury Constant Maturity +2.22%) ± | 3.97 | 7-1-2035 | 29,001 | 28,882 | |

| FNMA (12 Month Treasury Average +1.18%) ± | 3.97 | 10-1-2044 | 185,088 | 178,938 | |

| FNMA (U.S. Treasury H15 Treasury Bill 6 Month Auction High Discount +2.23%) ± | 3.98 | 7-1-2025 | 8 | 8 | |

| FNMA (1 Year Treasury Constant Maturity +2.17%) ± | 3.98 | 9-1-2030 | 18,804 | 18,582 | |

| FNMA (1 Year Treasury Constant Maturity +2.18%) ± | 3.98 | 1-1-2036 | 149,756 | 148,126 | |

| FNMA (1 Year Treasury Constant Maturity +2.24%) ± | 3.98 | 7-1-2038 | 1,422,300 | 1,450,048 | |

| FNMA (12 Month LIBOR +1.59%) ± | 3.98 | 8-1-2045 | 247,565 | 251,698 | |

| FNMA (12 Month LIBOR +1.78%) ± | 3.99 | 1-1-2042 | 1,063,055 | 1,082,698 | |

| FNMA (12 Month LIBOR +1.56%) ± | 3.99 | 2-1-2044 | 35,862 | 35,869 | |

| FNMA (1 Year Treasury Constant Maturity +2.31%) ± | 4.00 | 12-1-2030 | 181,354 | 178,967 | |

| FNMA (12 Month LIBOR +1.75%) ± | 4.00 | 1-1-2035 | 159,101 | 158,040 | |

| FNMA (1 Year Treasury Constant Maturity +2.23%) ± | 4.00 | 7-1-2037 | 102,127 | 104,176 | |

| FNMA (1 Year Treasury Constant Maturity +2.20%) ± | 4.00 | 12-1-2040 | 1,391,600 | 1,414,272 | |

| FNMA (1 Year Treasury Constant Maturity +2.21%) ± | 4.01 | 8-1-2035 | 205,953 | 206,158 | |

| FNMA (12 Month Treasury Average +1.21%) ± | 4.01 | 4-1-2042 | 543,482 | 517,808 | |

| FNMA (1 Year Treasury Constant Maturity +2.16%) ± | 4.03 | 5-1-2034 | 246,232 | 240,255 | |

| FNMA (1 Year Treasury Constant Maturity +1.93%) ± | 4.03 | 7-1-2038 | 389,980 | 384,072 | |

| FNMA (1 Year Treasury Constant Maturity +2.28%) ± | 4.04 | 4-1-2024 | 382 | 380 | |

| FNMA (1 Year Treasury Constant Maturity +2.30%) ± | 4.04 | 7-1-2030 | 91,481 | 90,102 | |

| FNMA (1 Year Treasury Constant Maturity +2.23%) ± | 4.04 | 11-1-2038 | 1,555,535 | 1,584,684 | |

| FNMA (6 Month LIBOR +1.93%) ± | 4.05 | 6-1-2032 | 50,602 | 49,909 | |

| FNMA (6 Month LIBOR +2.31%) ± | 4.06 | 4-1-2033 | 144,838 | 141,764 | |

| FNMA (1 Year Treasury Constant Maturity +2.22%) ± | 4.06 | 12-1-2040 | 1,169,901 | 1,188,791 | |

| FNMA (12 Month LIBOR +1.82%) ± | 4.07 | 12-1-2046 | 59,026 | 57,840 | |

| FNMA (12 Month LIBOR +1.83%) ± | 4.08 | 1-1-2033 | 50,963 | 50,122 | |

| FNMA (1 Year Treasury Constant Maturity +2.64%) ± | 4.09 | 7-1-2028 | 26,210 | 25,850 | |

| FNMA (1 Year Treasury Constant Maturity +2.19%) ± | 4.11 | 1-1-2033 | 235,164 | 233,624 | |

| FNMA (1 Year Treasury Constant Maturity +2.20%) ± | 4.11 | 9-1-2033 | 121,515 | 119,530 | |

| FNMA (1 Year Treasury Constant Maturity +2.26%) ± | 4.11 | 10-1-2036 | 218,193 | 222,191 | |

| FNMA (1 Year Treasury Constant Maturity +2.21%) ± | 4.12 | 5-1-2036 | 764,161 | 766,619 | |

| FNMA (6 Month LIBOR +2.50%) ± | 4.13 | 4-1-2033 | 131,411 | 128,389 | |

| FNMA (1 Year Treasury Constant Maturity +2.28%) ± | 4.15 | 5-1-2033 | 185,885 | 182,861 | |

| FNMA (12 Month LIBOR +1.90%) ± | 4.15 | 10-1-2034 | 220,332 | 217,599 | |

| FNMA (11th District COFI +1.93%) ± | 4.15 | 12-1-2036 | 12,962 | 12,874 | |

| FNMA (1 Year Treasury Constant Maturity +2.15%) ± | 4.16 | 2-1-2033 | 35,300 | 34,912 | |

| FNMA (1 Year Treasury Constant Maturity +2.22%) ± | 4.16 | 7-1-2035 | 174,135 | 176,152 | |

| FNMA (6 Month LIBOR +1.42%) ± | 4.17 | 12-1-2031 | 102,581 | 102,832 | |

| FNMA (12 Month Treasury Average +1.40%) ± | 4.19 | 12-1-2030 | 18,548 | 17,903 | |

| FNMA (1 Year Treasury Constant Maturity +2.19%) ± | 4.19 | 8-1-2033 | 203,905 | 201,224 | |

| FNMA (1 Year Treasury Constant Maturity +2.50%) ± | 4.22 | 10-1-2029 | 177,551 | 174,759 | |

| FNMA (1 Year Treasury Constant Maturity +2.18%) ± | 4.22 | 9-1-2035 | 411,838 | 419,755 | |

| FNMA (6 Month LIBOR +1.98%) ± | 4.23 | 9-1-2033 | 42,216 | 41,220 | |

| FNMA (1 Year Treasury Constant Maturity +2.13%) ± | 4.25 | 10-1-2025 | 10,514 | 10,362 | |

| FNMA (Federal COFI +2.00%) ± | 4.25 | 8-1-2029 | 18,695 | 18,607 | |

| FNMA (12 Month LIBOR +2.00%) ± | 4.25 | 9-1-2035 | 160,922 | 164,992 | |

| FNMA (1 Year Treasury Constant Maturity +2.28%) ± | 4.28 | 9-1-2026 | 9,654 | 9,520 | |

| FNMA (6 Month LIBOR +1.96%) ± | 4.28 | 1-1-2033 | 45,973 | 45,019 | |

| FNMA (1 Year Treasury Constant Maturity +2.29%) ± | 4.29 | 12-1-2030 | 14,206 | 14,041 | |

| FNMA (1 Year Treasury Constant Maturity +2.17%) ± | 4.29 | 12-1-2039 | 84,840 | 83,616 | |

| FNMA (1 Year Treasury Constant Maturity +2.18%) ± | 4.30 | 12-1-2024 | 7,592 | 7,500 | |

| FNMA (1 Year Treasury Constant Maturity +2.30%) ± | 4.30 | 1-1-2026 | 32,775 | 32,326 | |

| FNMA (1 Year Treasury Constant Maturity +2.40%) ± | 4.32 | 5-1-2033 | 40,425 | 39,708 | |

| FNMA (1 Year Treasury Constant Maturity +2.33%) ± | 4.35 | 11-1-2024 | 11,926 | 11,808 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FNMA (1 Year Treasury Constant Maturity +2.22%) ± | 4.35% | 8-1-2031 | $ 74,263 | $ 72,388 | |

| FNMA (1 Year Treasury Constant Maturity +2.22%) ± | 4.35 | 10-1-2034 | 89,699 | 88,062 | |

| FNMA (1 Year Treasury Constant Maturity +2.38%) ± | 4.38 | 7-1-2027 | 38,457 | 37,986 | |

| FNMA (1 Year Treasury Constant Maturity +2.18%) ± | 4.39 | 1-1-2036 | 205,236 | 204,529 | |

| FNMA (1 Year Treasury Constant Maturity +2.28%) ± | 4.40 | 7-1-2024 | 1,746 | 1,730 | |

| FNMA (1 Year Treasury Constant Maturity +2.36%) ± | 4.40 | 11-1-2034 | 125,283 | 128,004 | |

| FNMA (1 Year Treasury Constant Maturity +2.31%) ± | 4.41 | 12-1-2034 | 216,467 | 214,802 | |

| FNMA (1 Year Treasury Constant Maturity +2.32%) ± | 4.44 | 5-1-2025 | 8,524 | 8,419 | |

| FNMA (1 Year Treasury Constant Maturity +2.19%) ± | 4.44 | 3-1-2035 | 175,250 | 170,959 | |

| FNMA (5 Year Treasury Constant Maturity +2.42%) ± | 4.45 | 6-1-2028 | 10,944 | 11,032 | |

| FNMA (1 Year Treasury Constant Maturity +2.29%) ± | 4.45 | 1-1-2031 | 98,646 | 96,837 | |

| FNMA (1 Year Treasury Constant Maturity +2.47%) ± | 4.47 | 9-1-2028 | 23,487 | 23,172 | |

| FNMA (1 Year Treasury Constant Maturity +2.50%) ± | 4.50 | 3-1-2027 | 9,634 | 9,511 | |

| FNMA (1 Year Treasury Constant Maturity +2.37%) ± | 4.50 | 7-1-2027 | 9,578 | 9,407 | |

| FNMA (1 Year Treasury Constant Maturity +2.40%) ± | 4.53 | 6-1-2024 | 7,078 | 7,014 | |

| FNMA (1 Year Treasury Constant Maturity +2.54%) ± | 4.53 | 7-1-2028 | 93,648 | 92,149 | |

| FNMA (1 Year Treasury Constant Maturity +2.40%) ± | 4.53 | 9-1-2033 | 256,263 | 252,777 | |

| FNMA (6 Month LIBOR +2.25%) ± | 4.54 | 3-1-2034 | 367,280 | 362,814 | |

| FNMA (6 Month LIBOR +1.18%) ± | 4.55 | 8-1-2033 | 37,684 | 37,679 | |

| FNMA (12 Month Treasury Average +1.73%) ± | 4.55 | 6-1-2035 | 197,522 | 194,246 | |

| FNMA (12 Month Treasury Average +1.74%) ± | 4.58 | 10-1-2035 | 265,316 | 258,385 | |

| FNMA (12 Month Treasury Average +1.80%) ± | 4.60 | 11-1-2035 | 35,215 | 34,380 | |

| FNMA (1 Year Treasury Constant Maturity +2.49%) ± | 4.61 | 5-1-2035 | 291,492 | 292,893 | |

| FNMA (1 Year Treasury Constant Maturity +1.63%) ± | 4.63 | 11-1-2029 | 4,532 | 4,440 | |

| FNMA (1 Year Treasury Constant Maturity +2.50%) ± | 4.63 | 6-1-2032 | 63,895 | 62,464 | |

| FNMA (1 Year Treasury Constant Maturity +2.52%) ± | 4.64 | 11-1-2024 | 6,765 | 6,682 | |

| FNMA (12 Month Treasury Average +1.85%) ± | 4.65 | 11-1-2035 | 250,900 | 244,053 | |

| FNMA (1 Year Treasury Constant Maturity +2.89%) ± | 4.70 | 9-1-2030 | 82,302 | 81,199 | |

| FNMA (12 Month Treasury Average +1.85%) ± | 4.70 | 7-1-2035 | 279,342 | 272,656 | |

| FNMA (1 Year Treasury Constant Maturity +2.60%) ± | 4.72 | 10-1-2025 | 2,881 | 2,842 | |

| FNMA (12 Month Treasury Average +1.91%) ± | 4.72 | 7-1-2035 | 162,104 | 158,306 | |

| FNMA (6 Month LIBOR +2.48%) ± | 4.73 | 7-1-2033 | 24,814 | 24,311 | |

| FNMA (12 Month Treasury Average +1.94%) ± | 4.73 | 11-1-2035 | 11,830 | 11,623 | |

| FNMA (1 Year Treasury Constant Maturity +2.49%) ± | 4.74 | 4-1-2038 | 145,589 | 141,718 | |

| FNMA (12 Month Treasury Average +1.96%) ± | 4.75 | 11-1-2035 | 256,735 | 249,900 | |

| FNMA (6 Month LIBOR +2.66%) ± | 4.79 | 4-1-2024 | 13,602 | 13,448 | |

| FNMA (1 Year Treasury Constant Maturity +3.02%) ± | 4.79 | 1-1-2029 | 25,120 | 24,715 | |

| FNMA (6 Month LIBOR +2.37%) ± | 4.80 | 5-1-2033 | 438,858 | 432,696 | |

| FNMA (12 Month Treasury Average +2.07%) ± | 4.82 | 1-1-2035 | 214,320 | 210,595 | |

| FNMA (1 Year Treasury Constant Maturity +2.64%) ± | 4.83 | 10-1-2028 | 29,618 | 29,017 | |

| FNMA (12 Month Treasury Average +2.05%) ± | 4.84 | 10-1-2035 | 117,457 | 115,473 | |

| FNMA (12 Month Treasury Average +2.11%) ± | 4.91 | 8-1-2035 | 100,236 | 98,831 | |

| FNMA (6 Month LIBOR +1.55%) ± | 5.00 | 3-1-2034 | 77,860 | 77,914 | |

| FNMA (6 Month LIBOR +3.36%) ± | 5.07 | 12-1-2032 | 79,237 | 77,553 | |

| FNMA (12 Month Treasury Average +2.36%) ± | 5.15 | 8-1-2040 | 270,341 | 267,505 | |

| FNMA (11th District COFI +1.90%) ± | 5.25 | 5-1-2034 | 41,013 | 41,266 | |

| FNMA (6 Month LIBOR +1.55%) ± | 5.37 | 6-1-2037 | 415,804 | 422,589 | |

| FNMA (12 Month LIBOR +1.64%) ± | 5.37 | 9-1-2042 | 114,561 | 115,776 | |

| FNMA (6 Month LIBOR +1.53%) ± | 5.46 | 1-1-2035 | 379,614 | 383,435 | |

| FNMA (1 Month LIBOR +1.17%) ± | 5.55 | 5-1-2029 | 27,550 | 27,765 | |

| FNMA (6 Month LIBOR +3.57%) ± | 5.57 | 11-1-2031 | 664 | 653 | |

| FNMA | 6.50 | 8-1-2028 | 21,588 | 21,538 | |

| FNMA | 6.50 | 5-1-2031 | 21,429 | 21,969 | |

| FNMA (6 Month LIBOR +1.38%) ± | 6.50 | 8-1-2031 | 90,435 | 90,579 | |

| FNMA (6 Month LIBOR +1.38%) ± | 6.50 | 12-1-2031 | 13,257 | 13,227 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FNMA (6 Month LIBOR +1.37%) ± | 6.62% | 1-1-2032 | $ 102,943 | $ 103,060 | |

| FNMA (12 Month LIBOR +1.59%) ± | 6.80 | 2-1-2043 | 334,281 | 341,214 | |

| FNMA | 7.06 | 12-1-2024 | 7,321 | 7,302 | |

| FNMA | 7.06 | 1-1-2027 | 8,861 | 8,833 | |

| FNMA | 7.50 | 1-1-2031 | 15,126 | 15,131 | |

| FNMA | 7.50 | 1-1-2033 | 37,573 | 37,588 | |

| FNMA | 7.50 | 5-1-2033 | 37,546 | 37,559 | |

| FNMA | 7.50 | 5-1-2033 | 40,870 | 40,994 | |

| FNMA | 7.50 | 7-1-2033 | 18,518 | 18,490 | |

| FNMA | 7.50 | 8-1-2033 | 37,442 | 37,418 | |

| FNMA | 8.00 | 12-1-2026 | 16,145 | 16,168 | |

| FNMA | 8.00 | 3-1-2030 | 52 | 51 | |

| FNMA | 8.00 | 5-1-2033 | 30,559 | 30,491 | |

| FNMA | 8.50 | 8-15-2024 | 1,325 | 1,325 | |

| FNMA Series 1993-113 Class FA (10 Year Treasury Constant Maturity -0.65%) ± | 3.15 | 7-25-2023 | 1,004 | 1,004 | |

| FNMA Series 1993-247 Class FM (12 Month LIBOR +1.20%) ± | 6.64 | 12-25-2023 | 13,796 | 13,787 | |

| FNMA Series 1994-14 Class F (12 Month LIBOR +1.60%) ± | 7.04 | 10-25-2023 | 6,717 | 6,718 | |

| FNMA Series 2001-50 Class BA | 7.00 | 10-25-2041 | 55,212 | 56,400 | |

| FNMA Series 2001-63 Class FD (1 Month LIBOR +0.60%) ± | 5.20 | 12-18-2031 | 40,886 | 41,047 | |

| FNMA Series 2001-81 Class F (1 Month LIBOR +0.55%) ± | 5.17 | 1-25-2032 | 19,930 | 19,924 | |

| FNMA Series 2001-T08 Class A1 | 7.50 | 7-25-2041 | 57,817 | 57,731 | |

| FNMA Series 2001-T10 Class A2 | 7.50 | 12-25-2041 | 955,808 | 971,643 | |

| FNMA Series 2001-T12 Class A2 | 7.50 | 8-25-2041 | 73,547 | 75,281 | |

| FNMA Series 2001-T12 Class A4 ±± | 4.28 | 8-25-2041 | 1,729,205 | 1,727,479 | |

| FNMA Series 2001-W01 Class AV1 (1 Month LIBOR +0.12%) ± | 4.75 | 8-25-2031 | 16,826 | 16,025 | |

| FNMA Series 2001-W03 Class A ±± | 7.00 | 9-25-2041 | 212,194 | 206,686 | |

| FNMA Series 2002-05 Class FD (1 Month LIBOR +0.90%) ± | 5.52 | 2-25-2032 | 32,291 | 32,527 | |

| FNMA Series 2002-59 Class F (1 Month LIBOR +0.40%) ± | 5.02 | 9-25-2032 | 84,541 | 84,371 | |

| FNMA Series 2002-66 Class A3 ±± | 3.97 | 4-25-2042 | 3,766,715 | 3,689,580 | |

| FNMA Series 2002-T12 Class A3 | 7.50 | 5-25-2042 | 781,105 | 820,352 | |

| FNMA Series 2002-T12 Class A5 ±± | 4.60 | 10-25-2041 | 862,211 | 808,750 | |

| FNMA Series 2002-T18 Class A5 ±± | 4.38 | 5-25-2042 | 1,770,955 | 1,656,466 | |

| FNMA Series 2002-T19 Class A4 ±± | 4.51 | 3-25-2042 | 98,504 | 95,032 | |

| FNMA Series 2002-W01 Class 3A ±± | 3.55 | 4-25-2042 | 438,573 | 406,247 | |

| FNMA Series 2002-W04 Class A6 ±± | 3.86 | 5-25-2042 | 779,750 | 745,705 | |

| FNMA Series 2003-07 Class A2 ±± | 4.00 | 5-25-2042 | 300,820 | 296,968 | |

| FNMA Series 2003-63 Class A8 ±± | 3.68 | 1-25-2043 | 561,266 | 546,316 | |

| FNMA Series 2003-T2 Class A1 (1 Month LIBOR +0.28%) ± | 4.35 | 3-25-2033 | 715,282 | 707,367 | |

| FNMA Series 2003-W02 Class 1A3 | 7.50 | 7-25-2042 | 194,770 | 205,100 | |

| FNMA Series 2003-W04 Class 5A ±± | 3.73 | 10-25-2042 | 432,975 | 389,230 | |

| FNMA Series 2003-W08 Class 4A ±± | 4.02 | 11-25-2042 | 605,144 | 561,126 | |

| FNMA Series 2003-W09 Class A (1 Month LIBOR +0.12%) ± | 4.75 | 6-25-2033 | 901,351 | 870,752 | |

| FNMA Series 2003-W10 Class 2A ±± | 3.51 | 6-25-2043 | 1,162,434 | 1,054,872 | |

| FNMA Series 2003-W18 Class 2A ±± | 3.89 | 6-25-2043 | 1,449,061 | 1,364,944 | |

| FNMA Series 2003-W6 Class 6A ±± | 3.74 | 8-25-2042 | 503,039 | 481,522 | |

| FNMA Series 2004-17 Class FT (1 Month LIBOR +0.40%) ± | 5.02 | 4-25-2034 | 415,556 | 414,263 | |

| FNMA Series 2004-T03 Class 1A3 | 7.00 | 2-25-2044 | 235,457 | 244,887 | |

| FNMA Series 2004-T03 Class 2A ±± | 3.90 | 8-25-2043 | 604,341 | 591,457 | |

| FNMA Series 2004-T1 Class 2A ±± | 3.40 | 8-25-2043 | 731,897 | 671,973 | |

| FNMA Series 2004-W01 Class 2A2 | 7.00 | 12-25-2033 | 121,762 | 127,182 | |

| FNMA Series 2004-W01 Class 3A ±± | 4.16 | 1-25-2043 | 33,105 | 31,128 | |

| FNMA Series 2004-W02 Class 5A | 7.50 | 3-25-2044 | 39,316 | 40,959 | |

| FNMA Series 2004-W12 Class 2A ±± | 3.88 | 6-25-2044 | 1,835,708 | 1,710,751 | |

| FNMA Series 2004-W15 Class 3A ±± | 3.82 | 6-25-2044 | 2,559,111 | 2,412,963 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| FNMA Series 2005-25 Class PF (1 Month LIBOR +0.35%) ± | 4.97% | 4-25-2035 | $ 547,058 | $ 540,370 | |

| FNMA Series 2005-W03 Class 3A ±± | 3.73 | 4-25-2045 | 472,668 | 452,885 | |

| FNMA Series 2006-112 Class LF (1 Month LIBOR +0.55%) ± | 5.17 | 11-25-2036 | 902,784 | 894,721 | |

| FNMA Series 2006-16 Class FA (1 Month LIBOR +0.30%) ± | 4.92 | 3-25-2036 | 367,626 | 363,838 | |

| FNMA Series 2006-44 Class FY (1 Month LIBOR +0.57%) ± | 5.19 | 6-25-2036 | 692,325 | 692,363 | |

| FNMA Series 2006-5 Class 1-A ±± | 3.19 | 8-25-2034 | 1,853,092 | 1,873,760 | |

| FNMA Series 2006-50 Class FE (1 Month LIBOR +0.40%) ± | 5.02 | 6-25-2036 | 1,171,146 | 1,164,429 | |

| FNMA Series 2006-W01 Class 3A ±± | 3.26 | 10-25-2045 | 1,649,809 | 1,608,037 | |

| FNMA Series 2007-109 Class PF (1 Month LIBOR +0.65%) ± | 5.27 | 12-25-2037 | 319,169 | 319,440 | |

| FNMA Series 2007-4 Class DF (1 Month LIBOR +0.45%) ± | 5.06 | 2-25-2037 | 535,682 | 521,435 | |

| FNMA Series 2007-86 Class FA (1 Month LIBOR +0.45%) ± | 5.07 | 9-25-2037 | 945,033 | 940,658 | |

| FNMA Series 2007-95 Class A2 (1 Month LIBOR +0.25%) ± | 4.25 | 8-27-2036 | 95,469 | 92,564 | |

| FNMA Series 2008-67 Class FG (1 Month LIBOR +1.00%) ± | 5.62 | 7-25-2038 | 498,343 | 508,190 | |

| FNMA Series 2009-106 Class FA (1 Month LIBOR +0.75%) ± | 5.37 | 1-25-2040 | 776,781 | 782,369 | |

| FNMA Series 2009-11 Class FU (1 Month LIBOR +1.00%) ± | 5.62 | 3-25-2049 | 156,273 | 156,993 | |

| FNMA Series 2010-27 Class BF (1 Month LIBOR +0.55%) ± | 5.17 | 4-25-2040 | 1,559,615 | 1,556,453 | |

| FNMA Series 2010-54 Class AF (1 Month LIBOR +0.56%) ± | 5.18 | 4-25-2037 | 213,381 | 213,112 | |

| FNMA Series 2010-54 Class FT (1 Month LIBOR +0.76%) ± | 5.38 | 4-25-2037 | 3,189,457 | 3,225,055 | |

| FNMA Series 2010-8 Class FE (1 Month LIBOR +0.79%) ± | 5.41 | 2-25-2040 | 2,543,500 | 2,567,276 | |

| FNMA Series 2011-21 Class PF (1 Month LIBOR +0.35%) ± | 4.97 | 12-25-2041 | 196,095 | 193,182 | |

| FNMA Series 2011-71 Class FA (1 Month LIBOR +0.62%) ± | 5.24 | 12-25-2036 | 1,504,671 | 1,507,222 | |

| FNMA Series 2012-122 Class FM (1 Month LIBOR +0.40%) ± | 5.02 | 11-25-2042 | 898,516 | 879,982 | |

| FNMA Series 2012-17 Class EF (1 Month LIBOR +0.45%) ± | 5.07 | 3-25-2041 | 1,162,022 | 1,161,481 | |

| FNMA Series 2012-47 Class FW (1 Month LIBOR +1.70%) ± | 6.32 | 5-25-2027 | 80,156 | 81,733 | |

| FNMA Series 2013-130 Class CF (1 Month LIBOR +0.25%) ± | 4.87 | 6-25-2043 | 301,989 | 298,933 | |

| FNMA Series 2013-23 Class LF (1 Month LIBOR +0.35%) ± | 3.92 | 3-25-2043 | 2,788,388 | 2,744,148 | |

| FNMA Series 2014-10 Class CF (1 Month LIBOR +0.30%) ± | 3.98 | 3-25-2044 | 582,833 | 570,664 | |

| FNMA Series 2014-49 Class AF (1 Month LIBOR +0.32%) ± | 3.67 | 8-25-2044 | 113,095 | 111,264 | |

| FNMA Series 2015-38 Class DF (1 Month LIBOR +0.31%) ± | 3.83 | 6-25-2055 | 1,443,867 | 1,428,468 | |

| FNMA Series 2015-4 Class FA (1 Month LIBOR +0.35%) ± | 3.81 | 2-25-2045 | 881,292 | 868,137 | |

| FNMA Series 2016-40 Class AF (1 Month LIBOR +0.45%) ± | 3.71 | 7-25-2046 | 4,181,243 | 4,121,774 | |

| FNMA Series 2016-58 Class FA (1 Month LIBOR +0.48%) ± | 3.91 | 8-25-2046 | 414,467 | 404,689 | |

| FNMA Series 2016-62 Class AF (1 Month LIBOR +0.45%) ± | 3.66 | 9-25-2046 | 536,439 | 532,174 | |

| FNMA Series 2016-64 Class KF (1 Month LIBOR +0.47%) ± | 3.82 | 9-25-2046 | 1,083,719 | 1,072,476 | |

| FNMA Series 2016-76 Class CF (1 Month LIBOR +0.45%) ± | 3.89 | 10-25-2046 | 649,781 | 640,966 | |

| FNMA Series 2016-82 Class FM (1 Month LIBOR +0.40%) ± | 3.82 | 11-25-2046 | 1,314,229 | 1,294,090 | |

| FNMA Series 2016-87 Class AF (1 Month LIBOR +0.40%) ± | 3.61 | 11-25-2046 | 286,198 | 281,046 | |

| FNMA Series 2017-45 Class FA (1 Month LIBOR +0.32%) ± | 3.75 | 6-25-2047 | 3,366,480 | 3,309,051 | |

| FNMA Series 2017-M9 Class F (1 Month LIBOR +0.48%) ± | 5.10 | 5-25-2029 | 4,593,248 | 4,513,453 | |

| FNMA Series 2018-39 Class WF (1 Month LIBOR +0.30%) ± | 3.60 | 6-25-2048 | 3,047,917 | 3,005,877 | |

| FNMA Series 2018-47 Class PC | 3.50 | 9-25-2047 | 160,052 | 150,658 | |

| FNMA Series 2019-25 Class FA (1 Month LIBOR +0.45%) ± | 5.07 | 6-25-2049 | 263,261 | 257,798 | |

| FNMA Series 2019-38 Class AF (1 Month LIBOR +0.40%) ± | 3.79 | 7-25-2049 | 3,454,267 | 3,460,113 | |

| FNMA Series 2019-41 Class F (1 Month LIBOR +0.50%) ± | 5.12 | 8-25-2059 | 2,317,658 | 2,279,995 | |

| FNMA Series 2019-42 Class MF (1 Month LIBOR +0.40%) ± | 3.75 | 8-25-2059 | 1,812,176 | 1,773,043 | |

| FNMA Series 2019-5 Class FE (1 Month LIBOR +0.45%) ± | 5.07 | 3-25-2049 | 373,481 | 365,669 | |

| FNMA Series 2019-53 Class FA (1 Month LIBOR +0.40%) ± | 3.61 | 9-25-2049 | 1,416,186 | 1,387,381 | |

| FNMA Series 2020-10 Class Q | 3.00 | 3-25-2050 | 2,714,434 | 2,418,211 | |

| FNMA Series 2020-29 Class FA (1 Month LIBOR +0.65%) ± | 3.68 | 5-25-2050 | 935,260 | 927,957 | |

| FNMA Series 2021-85 Class EF (30 Day Average U.S. SOFR +0.18%) ± | 4.23 | 12-25-2051 | 3,547,588 | 3,657,829 | |

| GNMA (1 Year Treasury Constant Maturity +1.50%) ± | 2.63 | 1-20-2034 | 812,960 | 795,833 | |

| GNMA (1 Year Treasury Constant Maturity +2.00%) ± | 3.13 | 1-20-2041 | 22,595 | 22,496 | |

| GNMA (1 Year Treasury Constant Maturity +2.00%) ± | 3.38 | 4-20-2041 | 26,082 | 25,877 | |

| GNMA (1 Month LIBOR +0.62%) ± | 5.01 | 5-20-2058 | 127,283 | 127,358 |

| Interest rate | Maturity date | Principal | Value | ||

| Agency securities (continued) | |||||

| GNMA (1 Year Treasury Constant Maturity +1.40%) ± | 6.04% | 6-20-2058 | $ 26,005 | $ 26,104 | |

| GNMA | 6.45 | 4-20-2025 | 11,369 | 11,461 | |

| GNMA | 6.45 | 9-20-2025 | 14,355 | 15,017 | |

| GNMA | 6.50 | 8-20-2034 | 114,585 | 111,723 | |

| GNMA | 9.00 | 9-20-2024 | 244 | 244 | |

| GNMA | 9.00 | 11-20-2024 | 28 | 28 | |

| GNMA | 9.00 | 1-20-2025 | 325 | 325 | |

| GNMA | 9.00 | 2-20-2025 | 1,442 | 1,445 | |

| GNMA Series 2004-80 Class FA (1 Month LIBOR +0.40%) ± | 5.00 | 10-20-2034 | 361,465 | 360,982 | |

| GNMA Series 2006-16 Class DF (1 Month LIBOR +0.11%) ± | 4.71 | 4-20-2036 | 1,826,508 | 1,810,865 | |

| GNMA Series 2008-65 Class FG (1 Month LIBOR +0.75%) ± | 5.35 | 8-20-2038 | 628,791 | 633,361 | |

| GNMA Series 2008-68 Class FA (1 Month LIBOR +0.95%) ± | 5.55 | 8-20-2038 | 775,537 | 785,018 | |

| GNMA Series 2009-12 Class FA (1 Month LIBOR +0.95%) ± | 5.55 | 3-20-2039 | 1,000,093 | 1,010,224 | |

| GNMA Series 2009-15 Class FL (1 Month LIBOR +0.95%) ± | 5.55 | 3-20-2039 | 1,000,093 | 1,008,809 | |

| GNMA Series 2009-29 Class FL (1 Month LIBOR +0.65%) ± | 5.24 | 5-16-2039 | 1,074,214 | 1,079,732 | |

| GNMA Series 2009-36 Class FE (1 Month LIBOR +0.80%) ± | 5.40 | 9-20-2038 | 1,009,353 | 1,017,138 | |

| GNMA Series 2009-50 Class FW (1 Month LIBOR +1.00%) ± | 5.60 | 7-20-2039 | 757,311 | 768,796 | |

| GNMA Series 2009-52 Class FD (1 Month LIBOR +0.95%) ± | 5.54 | 7-16-2039 | 376,870 | 381,286 | |

| GNMA Series 2010-25 Class FH (1 Month LIBOR +0.72%) ± | 5.31 | 2-16-2040 | 527,126 | 528,598 | |

| GNMA Series 2010-79 Class YF (1 Month LIBOR +0.35%) ± | 4.95 | 5-20-2035 | 1,747,207 | 1,735,662 | |

| GNMA Series 2011-117 Class FJ (1 Month LIBOR +0.87%) ± | 5.47 | 8-20-2041 | 976,661 | 990,756 | |

| GNMA Series 2011-H12 Class FA (1 Month LIBOR +0.49%) ± | 4.88 | 2-20-2061 | 402,299 | 400,595 | |

| GNMA Series 2011-H17 Class FA (1 Month LIBOR +0.53%) ± | 4.92 | 6-20-2061 | 344,363 | 343,214 | |

| GNMA Series 2012-124 Class GF (1 Month LIBOR +0.25%) ± | 4.85 | 10-20-2042 | 1,090,679 | 1,076,130 | |

| GNMA Series 2014-44 Class IA ♀ | 3.50 | 5-20-2028 | 1,711,144 | 70,518 | |

| GNMA Series 2014-H16 Class FL (1 Month LIBOR +0.47%) ± | 4.65 | 7-20-2064 | 713,281 | 704,137 | |

| GNMA Series 2014-H22 Class FC (1 Month LIBOR +0.48%) ± | 4.87 | 11-20-2064 | 1,478,511 | 1,470,503 | |

| GNMA Series 2015-H23 Class TA (1 Month LIBOR +0.47%) ± | 4.86 | 9-20-2065 | 1,437,464 | 1,428,686 | |

| GNMA Series 2016-H24 Class FD (12 Month LIBOR +0.30%) ± | 4.43 | 11-20-2066 | 349,140 | 345,583 | |

| GNMA Series 2017-130 Class FH (1 Month LIBOR +0.30%) ± | 4.90 | 8-20-2047 | 1,673,500 | 1,631,487 | |

| GNMA Series 2017-H11 Class FE (12 Month LIBOR +0.18%) ± | 2.35 | 5-20-2067 | 2,663,452 | 2,625,333 | |

| GNMA Series 2018-120 Class FL (1 Month LIBOR +0.30%) ± | 4.90 | 9-20-2048 | 244,689 | 238,729 | |

| GNMA Series 2018-49 Class FM (1 Month LIBOR +0.25%) ± | 4.85 | 4-20-2048 | 1,164,091 | 1,134,578 | |

| GNMA Series 2018-H07 Class FD (1 Month LIBOR +0.30%) ± | 4.69 | 5-20-2068 | 339,672 | 339,034 | |

| GNMA Series 2018-H13 Class FC (1 Month LIBOR +0.30%) ± | 4.69 | 7-20-2068 | 271,574 | 269,045 | |

| GNMA Series 2019-103 Class FG (1 Month LIBOR +0.45%) ± | 5.05 | 4-20-2049 | 1,030,716 | 1,013,607 | |

| GNMA Series 2019-129 Class WF (1 Month LIBOR +0.40%) ± | 4.97 | 2-20-2046 | 1,285,587 | 1,244,572 | |

| GNMA Series 2019-H06 Class FD (1 Month LIBOR +0.72%) ± | 5.11 | 1-20-2069 | 607,874 | 592,433 | |

| GNMA Series 2019-H09 Class FE (1 Month LIBOR +0.50%) ± | 4.89 | 4-20-2069 | 945,946 | 935,585 | |

| GNMA Series 2019-H10 Class FB (1 Month LIBOR +0.60%) ± | 2.97 | 6-20-2069 | 2,863,374 | 2,783,598 | |

| GNMA Series 2019-H15 Class FE (1 Month LIBOR +0.63%) ± | 5.02 | 9-20-2069 | 1,936,158 | 1,906,596 | |

| GNMA Series 2020-H12 Class F (1 Month LIBOR +0.50%) ± | 4.89 | 7-20-2070 | 742,706 | 724,088 | |

| GNMA Series 2020-H19 Class FB (1 Month LIBOR +0.45%) ± | 4.84 | 11-20-2070 | 2,330,209 | 2,273,219 | |

| GNMA Series 2021-H01 Class FC (1 Month LIBOR +0.40%) ± | 3.90 | 11-20-2070 | 1,449,895 | 1,406,845 | |

| GNMA Series 2021-H14 Class FA (30 Day Average U.S. SOFR +0.30%) ± | 2.78 | 4-20-2070 | 3,613,027 | 3,470,718 | |

| Total Agency securities (Cost $310,950,419) | 302,660,940 | ||||

| Asset-backed securities: 4.85% | |||||

| Brazos Education Funding Series 2015-1 Class A (1 Month LIBOR +1.00%) 144A± | 5.62 | 10-25-2056 | 1,490,633 | 1,478,331 | |

| Cal Dive I Title XI Incorporated | 4.93 | 2-1-2027 | 2,318,125 | 2,284,398 | |

| EFS Volunteer LLC Series 2010-1 Class A2 (3 Month LIBOR +0.85%) 144A± | 5.67 | 10-25-2035 | 298,095 | 296,789 |

| Interest rate | Maturity date | Principal | Value | ||

| Asset-backed securities (continued) | |||||

| Navient Student Loan Trust Series 2018-3A Class A2 (1 Month LIBOR +0.42%) 144A± | 5.04% | 3-25-2067 | $ 308,123 | $ 307,892 | |

| Navient Student Loan Trust Series 2018-4A Class A2 (1 Month LIBOR +0.68%) 144A± | 5.30 | 6-27-2067 | 3,589,899 | 3,513,393 | |

| Navient Student Loan Trust Series 2020-GA Class A 144A | 1.17 | 9-16-2069 | 1,102,422 | 979,268 | |

| Navient Student Loan Trust Series 2021-1A Class A1B (1 Month LIBOR +0.60%) 144A± | 5.22 | 12-26-2069 | 828,297 | 811,521 | |

| Nelnet Student Loan Trust Series 2019-2A Class A (1 Month LIBOR +0.90%) 144A± | 5.52 | 6-27-2067 | 2,840,169 | 2,801,163 | |

| Nelnet Student Loan Trust Series 2019-4A Class A (1 Month LIBOR +0.87%) 144A± | 5.49 | 9-26-2067 | 592,394 | 584,234 | |

| Nelnet Student Loan Trust Series 2019-7A Class A1 (1 Month LIBOR +0.50%) 144A± | 5.12 | 1-25-2068 | 106,231 | 106,154 | |

| SLM Student Loan Trust Series 2003-10A Class A4 (3 Month LIBOR +0.67%) 144A± | 5.44 | 12-17-2068 | 3,362,811 | 3,294,723 | |

| SLM Student Loan Trust Series 2004-10 Class A7B (3 Month LIBOR +0.60%) 144A± | 5.42 | 10-25-2029 | 207,247 | 205,194 | |

| Total Asset-backed securities (Cost $17,104,653) | 16,663,060 | ||||

| Non-agency mortgage-backed securities: 5.46% | |||||

| Angel Oak Mortgage Trust I LLC Series 2020-R1 Class A1 144A±± | 0.99 | 4-25-2053 | 662,497 | 609,771 | |

| Cascade Funding Mortgage Trust Series 2020-HB4 Class A 144A±± | 0.95 | 12-26-2030 | 759,598 | 737,966 | |

| Credit Suisse Mortgage Trust Series 2022-NQM1 Class A1 144A±± | 2.27 | 11-25-2066 | 2,747,377 | 2,373,664 | |

| FRESB Mortgage Trust Series 2022-SB94 Class A5H ±± | 1.72 | 11-25-2041 | 5,929,205 | 5,373,325 | |

| Goldman Sachs Mortgage-Backed Securities Trust Series 2020-PJ4 Class A2 144A±± | 3.00 | 1-25-2051 | 653,955 | 551,373 | |

| Imperial Fund Mortgage Trust Series 2021-NQM2 Class A2 144A±± | 1.36 | 9-25-2056 | 637,021 | 500,229 | |

| Imperial Fund Mortgage Trust Series 2022-NQM1 Class A1 144A±± | 2.49 | 2-25-2067 | 2,435,878 | 2,133,762 | |

| JPMorgan Mortgage Trust Series 2016-5 Class A1 144A±± | 5.79 | 12-25-2046 | 534,431 | 512,980 | |

| MFRA Trust Series 2020-NQM3 Class A1 144A±± | 1.01 | 1-26-2065 | 299,790 | 274,490 | |

| New Residential Mortgage Loan Trust Series 2018-4A Class A1M (1 Month LIBOR +0.90%) 144A± | 5.52 | 1-25-2048 | 1,028,113 | 1,006,614 | |

| New Residential Mortgage Loan Trust Series 2020-RPL1 Class A1 144A±± | 2.75 | 11-25-2059 | 202,424 | 187,950 | |

| Onslow Bay Financial LLC Series 2022-NQM1 Class A1 144A±± | 2.31 | 11-25-2061 | 2,871,042 | 2,390,442 | |

| Starwood Commercial Mortgage Trust Series 2022-FL3 Class A (30 Day Average U.S. SOFR +1.35%) 144A± | 5.75 | 11-15-2038 | 960,000 | 928,026 | |

| Starwood Mortgage Residential Trust Series 2021-2 Class A1 144A±± | 0.94 | 5-25-2065 | 807,338 | 743,310 | |

| Towd Point Mortgage Trust Series 2017-5 Class A1 (1 Month LIBOR +0.60%) 144A± | 4.20 | 2-25-2057 | 451,313 | 449,718 | |

| Total Non-agency mortgage-backed securities (Cost $20,996,895) | 18,773,620 |

| Yield | Shares | Value | |||

| Short-term investments: 0.88% | |||||

| Investment companies: 0.88% | |||||

| Allspring Government Money Market Fund Select Class ♠∞ | 4.39% | 3,030,873 | $ 3,030,873 | ||

| Total Short-term investments (Cost $3,030,873) | 3,030,873 | ||||

| Total investments in securities (Cost $352,082,840) | 99.21% | 341,128,493 | |||

| Other assets and liabilities, net | 0.79 | 2,707,338 | |||

| Total net assets | 100.00% | $343,835,831 |

| ± | Variable rate investment. The rate shown is the rate in effect at period end. |

| ±± | The coupon of the security is adjusted based on the principal and/or interest payments received from the underlying pool of mortgages as well as the credit quality and the actual prepayment speed of the underlying mortgages. The rate shown is the rate in effect at period end. |

| ♀ | Investment in an interest-only security that entitles holders to receive only the interest payments on the underlying mortgages. The principal amount shown is the notional amount of the underlying mortgages. The rate represents the coupon rate. |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Abbreviations: | |

| COFI | Cost of Funds Index |

| FHLMC | Federal Home Loan Mortgage Corporation |

| FNMA | Federal National Mortgage Association |

| GNMA | Government National Mortgage Association |

| LIBOR | London Interbank Offered Rate |

| SOFR | Secured Overnight Financing Rate |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |

| Short-term investments | ||||||||

| Allspring Government Money Market Fund Select Class | $1,904,979 | $92,123,631 | $(90,997,737) | $0 | $0 | $3,030,873 | 3,030,873 | $48,234 |

| Description | Number of contracts | Expiration date | Notional cost | Notional value | Unrealized gains | Unrealized losses | |

| Short | |||||||

| 10-Year U.S. Treasury Notes | (56) | 6-21-2023 | $ (6,263,212) | $ (6,252,750) | $ 10,462 | $0 | |

| 2-Year U.S. Treasury Notes | (543) | 6-30-2023 | (110,894,103) | (110,623,523) | 270,580 | 0 | |

| 5-Year U.S. Treasury Notes | (261) | 6-30-2023 | (28,009,815) | (27,941,273) | 68,542 | 0 | |

| $349,584 | $0 |

| Assets | |

Investments in unaffiliated securities, at value (cost $349,051,967) | $ 338,097,620 |

Investments in affiliated securities, at value (cost $3,030,873) | 3,030,873 |

Cash | 104,177 |

Cash at broker segregated for futures contracts | 1,146,000 |

Principal paydown receivable | 1,149,489 |

Receivable for interest | 1,091,293 |

Receivable for Fund shares sold | 57,654 |

Receivable for daily variation margin on open futures contracts | 12,142 |

Receivable for investments sold | 2,947 |

Prepaid expenses and other assets | 71,861 |

Total assets | 344,764,056 |

| Liabilities | |

Payable for Fund shares redeemed | 696,968 |

Dividends payable | 96,258 |

Management fee payable | 76,324 |

Administration fees payable | 26,624 |

Distribution fee payable | 1,753 |

Accrued expenses and other liabilities | 30,298 |

Total liabilities | 928,225 |

Total net assets | $343,835,831 |

| Net assets consist of | |

Paid-in capital | $ 351,469,006 |

Total distributable loss | (7,633,175) |

Total net assets | $343,835,831 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 76,685,238 |

Shares outstanding – Class A1 | 8,797,224 |

Net asset value per share – Class A | $8.72 |

Maximum offering price per share – Class A2 | $8.90 |

Net assets – Class C | $ 2,996,019 |

Shares outstanding – Class C1 | 344,336 |

Net asset value per share – Class C | $8.70 |

Net assets – Administrator Class | $ 4,964,285 |

Shares outstanding – Administrator Class1 | 569,269 |

Net asset value per share – Administrator Class | $8.72 |

Net assets – Institutional Class | $ 259,190,289 |

Shares outstanding – Institutional Class1 | 29,735,409 |

Net asset value per share – Institutional Class | $8.72 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/98 of net asset value. On investments of $100,000 or more, the offering price is reduced. |

| Investment income | |

Interest | $ 5,686,082 |

Income from affiliated securities | 48,234 |

Total investment income | 5,734,316 |

| Expenses | |

Management fee | 678,148 |

| Administration fees | |

Class A | 62,277 |

Class C | 2,487 |

Administrator Class | 2,865 |

Institutional Class | 120,331 |

| Shareholder servicing fees | |

Class A | 96,954 |

Class C | 3,886 |

Administrator Class | 7,131 |

| Distribution fee | |

Class C | 11,658 |

Custody and accounting fees | 19,253 |

Professional fees | 44,016 |

Registration fees | 29,969 |

Shareholder report expenses | 11,887 |

Trustees’ fees and expenses | 10,625 |

Other fees and expenses | 33,464 |

Total expenses | 1,134,951 |

| Less: Fee waivers and/or expense reimbursements | |

Fund-level | (91,896) |

Class A | (18,473) |

Class C | (749) |

Administrator Class | (3,622) |

Net expenses | 1,020,211 |

Net investment income | 4,714,105 |

| Realized and unrealized gains (losses) on investments | |

| Net realized gains (losses) on | |

Unaffiliated securities | (957,696) |

Futures contracts | 3,986,698 |

Net realized gains on investments | 3,029,002 |

| Net change in unrealized gains (losses) on | |

Unaffiliated securities | (2,294,135) |

Futures contracts | 243,719 |

Net change in unrealized gains (losses) on investments | (2,050,416) |

Net realized and unrealized gains (losses) on investments | 978,586 |

Net increase in net assets resulting from operations | $ 5,692,691 |

| Six months ended February 28, 2023 (unaudited) | Year ended August 31, 2022 | |||

| Operations | ||||

Net investment income | $ 4,714,105 | $ 2,748,623 | ||

Net realized gains on investments | 3,029,002 | 6,184,988 | ||

Net change in unrealized gains (losses) on investments | (2,050,416) | (12,024,183) | ||

Net increase (decrease) in net assets resulting from operations | 5,692,691 | (3,090,572) | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

Class A | (2,098,313) | (692,300) | ||

Class C | (69,695) | (14,135) | ||

Administrator Class | (155,834) | (71,924) | ||

Institutional Class | (8,453,964) | (4,255,890) | ||

Total distributions to shareholders | (10,777,806) | (5,034,249) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

Class A | 278,147 | 2,421,635 | 593,643 | 5,293,269 |

Class C | 115,025 | 1,007,868 | 123,328 | 1,091,402 |

Administrator Class | 27,047 | 238,640 | 804,889 | 7,188,561 |

Institutional Class | 4,888,477 | 42,976,447 | 43,022,173 | 383,515,387 |

| 46,644,590 | 397,088,619 | |||

| Reinvestment of distributions | ||||

Class A | 209,616 | 1,816,390 | 66,182 | 589,152 |

Class C | 7,942 | 68,590 | 1,573 | 14,008 |

Administrator Class | 17,715 | 153,565 | 7,992 | 71,176 |

Institutional Class | 871,988 | 7,558,244 | 415,798 | 3,699,149 |

| 9,596,789 | 4,373,485 | |||

| Payment for shares redeemed | ||||

Class A | (1,014,890) | (8,865,622) | (2,188,993) | (19,473,541) |

Class C | (131,012) | (1,144,507) | (141,789) | (1,259,441) |

Administrator Class | (196,689) | (1,718,407) | (1,017,358) | (9,065,328) |

Institutional Class | (16,093,078) | (140,895,012) | (52,928,850) | (471,262,780) |

| (152,623,548) | (501,061,090) | |||

Net decrease in net assets resulting from capital share transactions | (96,382,169) | (99,598,986) | ||

Total decrease in net assets | (101,467,284) | (107,723,807) | ||

| Net assets | ||||

Beginning of period | 445,303,115 | 553,026,922 | ||

End of period | $ 343,835,831 | $ 445,303,115 | ||

| Year ended August 31 | ||||||

| Class A | Six months ended February 28, 2023 (unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $8.82 | $8.96 | $8.92 | $8.98 | $8.93 | $8.96 |

Net investment income | 0.09 | 0.02 | 0.04 | 0.17 | 0.18 1 | 0.10 |

Net realized and unrealized gains (losses) on investments | 0.04 | (0.09) | 0.05 | (0.06) | 0.05 | (0.01) |

Total from investment operations | 0.13 | (0.07) | 0.09 | 0.11 | 0.23 | 0.09 |

| Distributions to shareholders from | ||||||

Net investment income | (0.09) | (0.03) | (0.05) | (0.17) | (0.18) | (0.12) |

Net realized gains | (0.14) | (0.04) | 0.00 | (0.00) 2 | 0.00 | 0.00 |

Total distributions to shareholders | (0.23) | (0.07) | (0.05) | (0.17) | (0.18) | (0.12) |

Net asset value, end of period | $8.72 | $8.82 | $8.96 | $8.92 | $8.98 | $8.93 |

Total return3 | 1.47% | (0.81)% | 0.99% | 1.25% | 2.64% | 0.98% |

| Ratios to average net assets (annualized) | ||||||

Gross expenses | 0.84% | 0.82% | 0.82% | 0.88% | 0.88% | 0.83% |

Net expenses | 0.74% | 0.74% | 0.74% | 0.74% | 0.74% | 0.74% |

Net investment income | 2.25% | 0.30% | 0.49% | 1.92% | 2.04% | 1.28% |

| Supplemental data | ||||||

Portfolio turnover rate | 3% | 36% | 53% | 9% | 5% | 3% |

Net assets, end of period (000s omitted) | $76,685 | $82,283 | $97,274 | $111,538 | $118,675 | $103,963 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is less than $0.005. |

| 3 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| Year ended August 31 | ||||||

| Class C | Six months ended February 28, 2023 (unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $8.81 | $8.95 | $8.91 | $8.97 | $8.93 | $8.96 |

Net investment income (loss) | 0.06 1 | 0.00 1,2 | (0.00) 1,3 | 0.10 1 | 0.10 1 | 0.05 1 |

Net realized and unrealized gains (losses) on investments | 0.03 | (0.10) | 0.04 | (0.06) | 0.06 | (0.03) |

Total from investment operations | 0.09 | (0.10) | 0.04 | 0.04 | 0.16 | 0.02 |

| Distributions to shareholders from | ||||||

Net investment income | (0.06) | (0.00) 2 | (0.00) 2 | (0.10) | (0.12) | (0.05) |

Net realized gains | (0.14) | (0.04) | 0.00 | (0.00) 2 | 0.00 | 0.00 |

Total distributions to shareholders | (0.20) | (0.04) | (0.00) 2 | (0.10) | (0.12) | (0.05) |

Net asset value, end of period | $8.70 | $8.81 | $8.95 | $8.91 | $8.97 | $8.93 |

Total return4 | 1.10% | (1.08)% | 0.48% | 0.50% | 1.76% | 0.23% |

| Ratios to average net assets (annualized) | ||||||

Gross expenses | 1.59% | 1.57% | 1.57% | 1.63% | 1.62% | 1.55% |

Net expenses | 1.49% | 1.02% * | 1.27% * | 1.49% | 1.49% | 1.49% |