UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: March 31

Registrant is making a filing for 7 of its series:

Allspring Small Cap Fund, Allspring Disciplined Small Cap Fund, Allspring Special Small Cap Value Fund, Allspring Discovery Small Cap Growth Fund, Allspring Precious Metals Fund, Allspring Discovery Innovation Fund and Allspring Utility and Telecommunications Fund.

Date of reporting period: March 31, 2023

| ITEM 1. | REPORT TO STOCKHOLDERS |

Disciplined Small Cap Fund

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| Financial statements | |

| 21 | |

| 22 | |

| 23 | |

| 24 | |

| 28 | |

| 34 | |

| 35 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2023. ICE Data Indices, LLC. All rights reserved. |

| 8 | The MSCI ACWI (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly in an index. |

| 1 | The U.S. Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

President

Allspring Funds

| 1 | The Purchasing Managers' Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. You cannot invest directly in an index. |

| Investment objective | The Fund seeks long-term capital appreciation. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments, LLC |

| Portfolio managers | Justin P. Carr, CFA, Robert M. Wicentowski, CFA |

| Average annual total returns (%) as of March 31, 2023 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (WDSAX)3 | 7-31-2018 | -12.36 | 2.93 | 7.29 | -7.01 | 4.16 | 7.93 | 1.75 | 0.93 | ||

| Class R6 (WSCJX)4 | 10-31-2016 | – | – | – | -6.98 | 4.20 | 8.07 | 1.32 | 0.50 | ||

| Administrator Class (NVSOX) | 8-1-1993 | – | – | – | -7.28 | 3.93 | 7.81 | 1.67 | 0.85 | ||

| Institutional Class (WSCOX)5 | 10-31-2014 | – | – | – | -7.09 | 4.18 | 8.04 | 1.42 | 0.60 | ||

| Russell 2000® Index6 | – | – | – | – | -11.61 | 4.71 | 8.04 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through July 31, 2023, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.93% for Class A, 0.50% for Class R6, 0.85% for Administrator Class, and 0.60% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class A shares prior to their inception reflects the performance of the Administrator Class shares, and is adjusted to reflect the higher expenses and sales charges of the Class A shares. |

| 4 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 5 | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns for the Institutional Class shares would be higher. |

| 6 | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index. You cannot invest directly in an index. |

| 1 | The chart compares the performance of Class A shares for the most recent ten years with the Russell 2000® Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| ■ | The Fund outperformed its benchmark, the Russell 2000® Index, for the 12-month period that ended March 31, 2023. |

| ■ | Stock selection was the main contributor to Fund performance, adding value in 6 out of 11 sectors. The Fund benefited from positive stock selection within the industrials, consumer discretionary, and information technology (IT) sectors. Underweights to IT and financials contributed modestly to performance. |

| ■ | Negative stock selection within consumer staples, real estate, and materials detracted from relative performance. A slight overweight to energy detracted modestly from performance. Variations in sector weights versus the Index were relatively small, as is typical for the strategy. |

| Ten largest holdings (%) as of March 31, 20231 | |

| Atkore Incorporated | 1.04 |

| Encore Wire Corporation | 0.98 |

| Mueller Industries Incorporated | 0.92 |

| EMCOR Group Incorporated | 0.91 |

| SPS Commerce Incorporated | 0.90 |

| STAG Industrial Incorporated | 0.87 |

| Commercial Metals Company | 0.83 |

| Applied Industrial Technologies Incorporated | 0.81 |

| Rambus Incorporated | 0.81 |

| Lantheus Holdings Incorporated | 0.80 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| ** | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar–denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

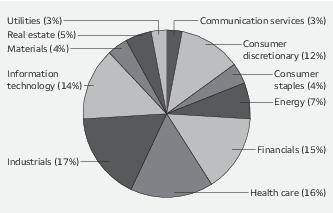

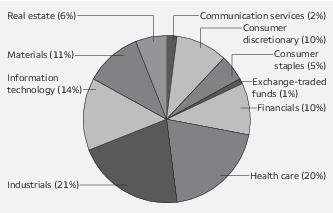

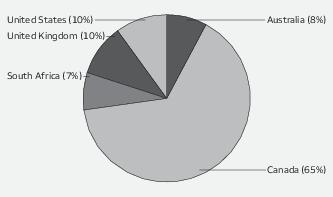

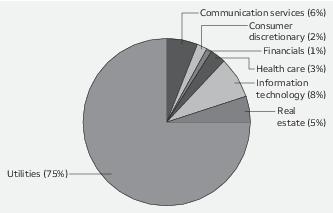

| Sector allocation as of March 31, 20231 |

| 1 | Figures represent the percentage of the Fund's long-term investments. Allocations are subject to change and may have changed since the date specified. |

| * | This security was no longer held at the end of the reporting period. |

| Beginning account value 10-1-2022 | Ending account value 3-31-2023 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $1,130.78 | $4.94 | 0.93% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.29 | $4.68 | 0.93% |

| Class R6 | ||||

| Actual | $1,000.00 | $1,129.01 | $2.65 | 0.50% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.44 | $2.52 | 0.50% |

| Administrator Class | ||||

| Actual | $1,000.00 | $1,127.04 | $4.51 | 0.85% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.69 | $4.28 | 0.85% |

| Institutional Class | ||||

| Actual | $1,000.00 | $1,128.63 | $3.18 | 0.60% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.94 | $3.02 | 0.60% |

| Shares | Value | ||||

| Common stocks: 97.85% | |||||

| Communication services: 2.51% | |||||

| Diversified telecommunication services: 1.12% | |||||

| Bandwidth Incorporated Class A † | 4,300 | $ 65,360 | |||

| Charge Enterprises Incorporated † | 12,829 | 14,112 | |||

| Echostar Corporation Class A † | 3,949 | 72,227 | |||

| Ooma Incorporated † | 2,895 | 36,216 | |||

| 187,915 | |||||

| Entertainment: 0.09% | |||||

| Playstudios Incorporated Class A † | 4,277 | 15,782 | |||

| Interactive media & services: 0.76% | |||||

| QuinStreet Incorporated † | 1,475 | 23,408 | |||

| Ziff Davis Incorporated † | 685 | 53,464 | |||

| Ziprecruiter Incorporated Class A † | 3,125 | 49,813 | |||

| 126,685 | |||||

| Media: 0.54% | |||||

| Entravision Communications Corporation Class A | 9,862 | 59,665 | |||

| Sinclair Broadcast Group Incorporated Class A | 852 | 14,620 | |||

| TechTarget Incorporated † | 441 | 15,929 | |||

| 90,214 | |||||

| Consumer discretionary: 11.62% | |||||

| Automobile components: 0.89% | |||||

| Dana Incorporated | 3,694 | 55,595 | |||

| Gentherm Incorporated † | 337 | 20,362 | |||

| Modine Manufacturing Company † | 3,151 | 72,631 | |||

| 148,588 | |||||

| Diversified consumer services: 1.10% | |||||

| Chegg Incorporated † | 2,523 | 41,125 | |||

| Perdoceo Education Corporation † | 3,949 | 53,035 | |||

| Stride Incorporated † | 2,304 | 90,432 | |||

| 184,592 | |||||

| Hotels, restaurants & leisure: 2.58% | |||||

| Bloomin' Brands Incorporated | 4,873 | 124,992 | |||

| Brinker International Incorporated † | 2,930 | 111,340 | |||

| Hilton Grand Vacations Incorporated † | 1,456 | 64,690 | |||

| International Game Technology plc | 3,647 | 97,740 | |||

| Wingstop Incorporated | 178 | 32,677 | |||

| 431,439 | |||||

| Household durables: 2.22% | |||||

| Helen of Troy Limited † | 276 | 26,267 | |||

| Installed Building Products Incorporated | 294 | 33,525 | |||

| KB Home Incorporated | 1,120 | 45,002 | |||

| M/I Homes Incorporated † | 967 | 61,008 | |||

| Meritage Corporation | 617 | 72,041 |

| Shares | Value | ||||

| Household durables (continued) | |||||

| Skyline Champion Corporation † | 362 | $ 27,233 | |||

| Taylor Morrison Home Corporation † | 2,785 | 106,554 | |||

| 371,630 | |||||

| Specialty retail: 3.74% | |||||

| Academy Sports & Outdoors Corporation | 1,898 | 123,845 | |||

| Asbury Automotive Group Incorporated † | 554 | 116,340 | |||

| Group 1 Automotive Incorporated | 348 | 78,794 | |||

| Hibbett Incorporated | 1,523 | 89,827 | |||

| Revolve Group Incorporated † | 3,117 | 81,977 | |||

| TravelCenters of America Incorporated † | 1,078 | 93,247 | |||

| Zumiez Incorporated † | 2,232 | 41,158 | |||

| 625,188 | |||||

| Textiles, apparel & luxury goods: 1.09% | |||||

| Crocs Incorporated † | 629 | 79,531 | |||

| G-III Apparel Group Limited † | 2,356 | 36,636 | |||

| Steven Madden Limited | 1,828 | 65,808 | |||

| 181,975 | |||||

| Consumer staples: 3.96% | |||||

| Beverages: 0.66% | |||||

| Coca Cola Bottling Corporation | 94 | 50,298 | |||

| Duckhorn Portfolio Incorporated † | 3,813 | 60,627 | |||

| 110,925 | |||||

| Consumer staples distribution & retail: 1.04% | |||||

| SpartanNash Company | 1,110 | 27,528 | |||

| Sprouts Farmers Market Incorporated † | 725 | 25,397 | |||

| The Andersons Incorporated | 1,530 | 63,220 | |||

| The Chef's Warehouse Incorporated † | 1,667 | 56,761 | |||

| 172,906 | |||||

| Food products: 0.94% | |||||

| John B. Sanfilippo & Son Incorporated | 353 | 34,213 | |||

| Lancaster Colony Corporation | 283 | 57,415 | |||

| The Simply Good Foods Company † | 1,632 | 64,905 | |||

| 156,533 | |||||

| Personal care products: 1.32% | |||||

| Bellring Brands Incorporated † | 2,292 | 77,928 | |||

| e.l.f. Beauty Incorporated † | 320 | 26,352 | |||

| Medifast Incorporated | 494 | 51,213 | |||

| USANA Health Sciences Incorporated † | 1,043 | 65,605 | |||

| 221,098 | |||||

| Energy: 6.58% | |||||

| Energy equipment & services: 1.63% | |||||

| Nabors Industries Limited † | 337 | 41,084 | |||

| Nextier Oilfield Solutions Incorporated † | 8,676 | 68,974 | |||

| Noble Corporation plc † | 822 | 32,444 | |||

| Oceaneering International Incorporated † | 2,321 | 40,919 | |||

| Patterson-UTI Energy Incorporated | 2,787 | 32,608 |

| Shares | Value | ||||

| Energy equipment & services (continued) | |||||

| US Silica Holdings Incorporated † | 2,437 | $ 29,098 | |||

| Weatherford International plc † | 476 | 28,251 | |||

| 273,378 | |||||

| Oil, gas & consumable fuels: 4.95% | |||||

| Arch Resources Incorporated | 274 | 36,020 | |||

| California Resources Corporation | 2,049 | 78,887 | |||

| Callon Petroleum Company † | 341 | 11,403 | |||

| Chord Energy Corporation | 320 | 43,072 | |||

| CVR Energy Incorporated | 1,760 | 57,693 | |||

| Laredo Petroleum Incorporated † | 1,219 | 55,513 | |||

| Matador Resources Company | 949 | 45,220 | |||

| Par Pacific Holdings Incorporated † | 2,266 | 66,167 | |||

| PBF Energy Incorporated Class A | 2,662 | 115,424 | |||

| Peabody Energy Corporation † | 3,799 | 97,254 | |||

| Permian Resources Corporation | 6,567 | 68,954 | |||

| Ranger Oil Corporation Class A | 2,369 | 96,750 | |||

| W&T Offshore Incorporated † | 4,247 | 21,575 | |||

| World Fuel Services Corporation | 1,300 | 33,215 | |||

| 827,147 | |||||

| Financials: 14.97% | |||||

| Banks: 7.16% | |||||

| Axos Financial Incorporated † | 2,207 | 81,482 | |||

| Bank of N.T. Butterfield & Son Limited | 1,077 | 29,079 | |||

| Brookline Bancorp Incorporated | 2,531 | 26,576 | |||

| Customers Bancorp Incorporated † | 1,502 | 27,817 | |||

| Enterprise Financial Service Corporation | 904 | 40,309 | |||

| Financial Institutions Incorporated | 1,819 | 35,070 | |||

| First Bancorp of North Carolina | 1,568 | 55,695 | |||

| First Bancorp of Puerto Rico | 5,896 | 67,332 | |||

| First Bank | 2,249 | 22,715 | |||

| First Financial Corporation | 1,510 | 56,595 | |||

| First Foundation Incorporated | 2,074 | 15,451 | |||

| Great Southern Bancorp Incorporated | 1,038 | 52,606 | |||

| Hancock Whitney Corporation | 1,535 | 55,874 | |||

| Hanmi Financial Corporation | 3,569 | 66,276 | |||

| Hilltop Holdings Incorporated | 2,325 | 68,983 | |||

| NBT Bancorp Incorporated | 1,743 | 58,757 | |||

| OFG Bancorp | 2,615 | 65,218 | |||

| Preferred Bank | 1,038 | 56,893 | |||

| RBB Bancorp | 3,013 | 46,702 | |||

| Republic Bancorp Incorporated Class A | 1,661 | 70,476 | |||

| The Bancorp Incorporated † | 2,669 | 74,332 | |||

| TriCo Bancshares | 1,449 | 60,264 | |||

| Univest Financial Corporation | 1,558 | 36,987 | |||

| Westamerica Bancorporation | 570 | 25,251 | |||

| 1,196,740 | |||||

| Capital markets: 1.70% | |||||

| Artisan Partners Asset Management Incorporated Class A | 1,219 | 38,984 | |||

| Evercore Partners Incorporated Class A | 792 | 91,381 | |||

| Open Lending Corporation Class A † | 2,448 | 17,234 | |||

| PJT Partners Incorporated Class A | 497 | 35,878 |

| Shares | Value | ||||

| Capital markets (continued) | |||||

| Stonex Group Incorporated | 528 | $ 54,664 | |||

| Victory Capital Holding Class A | 1,595 | 46,686 | |||

| 284,827 | |||||

| Consumer finance: 0.46% | |||||

| Enova International Incorporated † | 1,084 | 48,162 | |||

| Green Dot Corporation Class A † | 1,658 | 28,484 | |||

| 76,646 | |||||

| Financial services: 2.97% | |||||

| Essent Group Limited | 2,420 | 96,921 | |||

| Evertec Incorporated | 1,342 | 45,293 | |||

| International Money Express Incorporated † | 4,150 | 106,987 | |||

| Jackson Financial Incorporation Class A | 2,292 | 85,744 | |||

| Marqeta Incorporated Class A † | 13,328 | 60,909 | |||

| MGIC Investment Corporation | 3,970 | 53,277 | |||

| Radian Group Incorporated | 2,146 | 47,427 | |||

| 496,558 | |||||

| Insurance: 2.68% | |||||

| American Equity Investment Life Holding Company | 2,428 | 88,598 | |||

| CNO Financial Group Incorporated | 4,194 | 93,065 | |||

| Employers Holdings Incorporated | 1,249 | 52,071 | |||

| Genworth Financial Incorporated Class A † | 14,257 | 71,570 | |||

| Palomar Holdings Incorporated † | 533 | 29,422 | |||

| Selective Insurance Group Incorporated | 617 | 58,819 | |||

| Stewart Information Services Corporation | 1,364 | 55,037 | |||

| 448,582 | |||||

| Health care: 15.87% | |||||

| Biotechnology: 5.21% | |||||

| Agenus Incorporated † | 8,300 | 12,616 | |||

| Alector Incorporated † | 4,631 | 28,666 | |||

| ALX Oncology Holdings Incorporated † | 3,411 | 15,414 | |||

| Amicus Therapeutics Incorporated † | 3,548 | 39,347 | |||

| Arcus Biosciences Incorporated † | 2,673 | 48,756 | |||

| Arrowhead Pharmaceuticals Incorporated † | 677 | 17,196 | |||

| Bridgebio Pharma Incorporated † | 2,308 | 38,267 | |||

| CareDx Incorporated † | 3,059 | 27,959 | |||

| Catalyst Pharmaceuticals Incorporated † | 1,935 | 32,082 | |||

| Cullinan Oncology Incorporated † | 2,228 | 22,792 | |||

| Cytokinetics Incorporated † | 901 | 31,706 | |||

| Erasca Incorporated † | 5,021 | 15,113 | |||

| Halozyme Therapeutics Incorporated † | 1,388 | 53,008 | |||

| Icosavax Incorporated † | 4,219 | 24,470 | |||

| Intellia Therapeutics Incorporated † | 661 | 24,635 | |||

| Intercept Pharmaceuticals Incorporated † | 2,985 | 40,089 | |||

| Iteos Therapeutics Incorporated † | 2,633 | 35,835 | |||

| Karuna Therapeutics Incorporated † | 316 | 57,398 | |||

| Kiniksa Pharmaceuticals Limited Class A † | 3,614 | 38,887 | |||

| Kymera Therapeutics Incorporated † | 759 | 22,489 | |||

| Prothena Corporation plc † | 803 | 38,921 | |||

| Regenxbio Incorporated † | 2,034 | 38,463 | |||

| Sana Biotechnology Incorporated † | 6,708 | 21,935 |

| Shares | Value | ||||

| Biotechnology (continued) | |||||

| Stoke Therapeutics Incorporated † | 3,854 | $ 32,104 | |||

| Sutro Biopharma Incorporated † | 5,440 | 25,133 | |||

| Syndax Pharmaceuticals Incorporated † | 880 | 18,586 | |||

| Ultragenyx Pharmaceutical Incorporated † | 446 | 17,885 | |||

| VIR Biotechnology Incorporated † | 2,222 | 51,706 | |||

| 871,458 | |||||

| Health care equipment & supplies: 2.97% | |||||

| Axonics Incorporated † | 732 | 39,938 | |||

| Embecta Corporation | 1,751 | 49,238 | |||

| Lantheus Holdings Incorporated † | 1,624 | 134,077 | |||

| LivaNova plc † | 2,226 | 97,009 | |||

| Merit Medical Systems Incorporated † | 832 | 61,526 | |||

| Omnicell Incorporated † | 502 | 29,452 | |||

| Shockwave Medical Incorporated † | 192 | 41,631 | |||

| STAAR Surgical Company † | 685 | 43,806 | |||

| 496,677 | |||||

| Health care providers & services: 4.22% | |||||

| AMN Healthcare Services Incorporated † | 1,103 | 91,505 | |||

| Cross Country Healthcare Incorporated † | 2,429 | 54,215 | |||

| Hims & Hers Health Incorporated † | 2,505 | 24,850 | |||

| Modivcare Incorporated † | 474 | 39,854 | |||

| Neogenomics Incorporated † | 4,388 | 76,395 | |||

| Option Care Health Incorporated † | 4,122 | 130,956 | |||

| Progyny Incorporated † | 1,289 | 41,403 | |||

| Select Medical Holdings Corporation | 1,356 | 35,053 | |||

| Tenet Healthcare Corporation † | 1,729 | 102,737 | |||

| The Ensign Group Incorporated | 1,141 | 109,011 | |||

| 705,979 | |||||

| Health care technology: 0.50% | |||||

| Computer Programs & Systems Incorporated † | 1,625 | 49,075 | |||

| NextGen Healthcare Incorporated † | 1,938 | 33,741 | |||

| 82,816 | |||||

| Life sciences tools & services: 0.58% | |||||

| Abcellera Biologics Incorporated † | 3,234 | 24,384 | |||

| Adaptive Biotechnologies Corporation † | 1,967 | 17,369 | |||

| Medpace Holdings Incorporated † | 63 | 11,847 | |||

| Quanterix Corporation † | 3,878 | 43,705 | |||

| 97,305 | |||||

| Pharmaceuticals: 2.39% | |||||

| Amphastar Pharmaceuticals Incorporated | 1,627 | 61,013 | |||

| Corcept Therapeutics Incorporated † | 2,437 | 52,785 | |||

| Harmony Biosciences Holdings † | 1,376 | 44,926 | |||

| Intra-Cellular Therapies Incorporated † | 1,197 | 64,818 | |||

| Ligand Pharmaceuticals Incorporated | 260 | 19,126 | |||

| Pacira Biosciences Incorporated † | 605 | 24,690 | |||

| Prestige Consumer Healthcare Incorporated † | 1,572 | 98,454 | |||

| Tarsus Pharmaceuticals Incorporated † | 2,652 | 33,336 | |||

| 399,148 |

| Shares | Value | ||||

| Industrials: 16.69% | |||||

| Aerospace & defense: 1.09% | |||||

| Moog Incorporated Class A | 732 | $ 73,749 | |||

| Triumph Group Incorporated † | 3,038 | 35,210 | |||

| Vectrus Incorporated † | 1,859 | 73,839 | |||

| 182,798 | |||||

| Building products: 0.90% | |||||

| Janus International Group Incorporated † | 3,776 | 37,231 | |||

| Simpson Manufacturing Company Incorporated | 540 | 59,206 | |||

| UFP Industries Incorporated | 685 | 54,437 | |||

| 150,874 | |||||

| Commercial services & supplies: 0.93% | |||||

| Ennis Incorporated | 3,502 | 73,857 | |||

| Heritage Crystal Clean Incorporated † | 1,136 | 40,453 | |||

| SP Plus Corporation † | 1,188 | 40,737 | |||

| 155,047 | |||||

| Construction & engineering: 2.54% | |||||

| Comfort Systems Incorporated | 827 | 120,709 | |||

| EMCOR Group Incorporated | 938 | 152,509 | |||

| MYR Group Incorporated † | 886 | 111,645 | |||

| Primoris Services Corporation | 1,635 | 40,319 | |||

| 425,182 | |||||

| Electrical equipment: 2.20% | |||||

| Atkore Incorporated † | 1,232 | 173,071 | |||

| Bloom Energy Corporation Class A † | 1,127 | 22,461 | |||

| Encore Wire Corporation | 880 | 163,090 | |||

| SunPower Corporation † | 626 | 8,664 | |||

| 367,286 | |||||

| Ground transportation: 0.71% | |||||

| Arcbest Corporation | 1,278 | 118,113 | |||

| Machinery: 3.11% | |||||

| Alamo Group Incorporated | 278 | 51,196 | |||

| Hillenbrand Incorporated | 2,679 | 127,333 | |||

| Mueller Industries Incorporated | 2,089 | 153,500 | |||

| Titan International Incorporated † | 3,777 | 39,583 | |||

| Wabash National Corporation | 1,914 | 47,065 | |||

| Watts Water Technologies Incorporated | 600 | 100,992 | |||

| 519,669 | |||||

| Marine transportation: 0.72% | |||||

| Matson Incorporated | 2,028 | 121,011 | |||

| Professional services: 1.51% | |||||

| CBIZ Incorporated † | 733 | 36,276 | |||

| Insperity Incorporated | 507 | 61,626 | |||

| Kelly Services Incorporated Class A | 3,991 | 66,211 | |||

| TriNet Group Incorporated † | 1,108 | 89,316 | |||

| 253,429 |

| Shares | Value | ||||

| Trading companies & distributors: 2.98% | |||||

| Applied Industrial Technologies Incorporated | 954 | $ 135,592 | |||

| Bluelinx Holdings Incorporated † | 583 | 39,621 | |||

| Boise Cascade Company | 1,721 | 108,853 | |||

| GMS Incorporated † | 401 | 23,214 | |||

| Rush Enterprises Incorporated Class A | 1,102 | 60,169 | |||

| Titan Machinery Incorporated † | 2,612 | 79,535 | |||

| WESCO International Incorporated | 333 | 51,462 | |||

| 498,446 | |||||

| Information technology: 13.19% | |||||

| Communications equipment: 0.91% | |||||

| Calix Incorporated † | 1,983 | 106,269 | |||

| Extreme Networks Incorporated † | 2,386 | 45,620 | |||

| 151,889 | |||||

| Electronic equipment, instruments & components: 1.81% | |||||

| Advanced Energy Industries Incorporated | 545 | 53,410 | |||

| Fabrinet † | 1,031 | 122,442 | |||

| Sanmina Corporation † | 2,078 | 126,737 | |||

| 302,589 | |||||

| IT services: 0.70% | |||||

| Hackett Group Incorporated | 3,727 | 68,875 | |||

| Perficient Incorporated † | 656 | 47,357 | |||

| 116,232 | |||||

| Professional services: 0.17% | |||||

| ExlService Holdings Incorporated † | 178 | 28,806 | |||

| Semiconductors & semiconductor equipment: 4.22% | |||||

| Alpha & Omega Semiconductor † | 1,881 | 50,693 | |||

| Axcelis Technologies Incorporated † | 883 | 117,660 | |||

| Diodes Incorporated † | 1,061 | 98,418 | |||

| Maxlinear Incorporated † | 929 | 32,710 | |||

| Onto Innovation Incorporated † | 929 | 81,641 | |||

| Photronics Incorporated † | 2,488 | 41,251 | |||

| Rambus Incorporated † | 2,637 | 135,173 | |||

| Smart Global Holdings Incorporated † | 1,243 | 21,429 | |||

| Synaptics Incorporated † | 460 | 51,129 | |||

| Ultra Clean Holdings Incorporated † | 2,266 | 75,141 | |||

| 705,245 | |||||

| Software: 5.38% | |||||

| A10 Networks Incorporated | 5,780 | 89,529 | |||

| Amplitude Incorporated Class A † | 2,691 | 33,476 | |||

| Arlo Technologies Incorporated † | 6,641 | 40,244 | |||

| C3.ai Incorporated † | 1,157 | 38,840 | |||

| Clear Secure Incorporated Class A | 1,321 | 34,571 | |||

| Cvent Holding Corporation † | 13,425 | 112,233 | |||

| eGain Corporation † | 5,064 | 38,436 | |||

| InterDigital Incorporated | 1,070 | 78,003 | |||

| JFrog Limited † | 1,623 | 31,973 | |||

| Rimini Street Incorporated † | 10,843 | 44,673 | |||

| SPS Commerce Incorporated † | 992 | 151,082 |

| Shares | Value | ||||

| Software (continued) | |||||

| Tenable Holdings Incorporated † | 767 | $ 36,440 | |||

| Workiva Incorporated † | 324 | 33,181 | |||

| XPERI Incorporated † | 1,622 | 17,728 | |||

| Zeta Global Holdings Corporation Class A † | 11,081 | 120,007 | |||

| 900,416 | |||||

| Materials: 3.98% | |||||

| Chemicals: 1.04% | |||||

| Advansix Incorporated | 1,891 | 72,369 | |||

| Futurefuel Corporation | 2,653 | 19,579 | |||

| Minerals Technologies Incorporated | 1,043 | 63,018 | |||

| Tronox Holdings plc Class A | 1,356 | 19,499 | |||

| 174,465 | |||||

| Containers & packaging: 0.83% | |||||

| Greif Incorporated Class A | 988 | 62,610 | |||

| Myers Industries Incorporated | 3,544 | 75,948 | |||

| 138,558 | |||||

| Metals & mining: 2.11% | |||||

| Arconic Corporation † | 1,406 | 36,879 | |||

| Commercial Metals Company | 2,853 | 139,512 | |||

| Ryerson Holding Corporation | 1,033 | 37,581 | |||

| Schnitzer Steel Industries Incorporated Class A | 1,531 | 47,614 | |||

| Suncoke Energy Incorporated | 6,702 | 60,184 | |||

| Warrior Met Coal Incorporated | 832 | 30,543 | |||

| 352,313 | |||||

| Real estate: 5.21% | |||||

| Diversified REITs: 0.73% | |||||

| Armada Hoffler Properties Incorporated | 2,206 | 26,053 | |||

| Global Net Lease Incorporated | 6,794 | 87,371 | |||

| Star Holdings LLC † | 549 | 9,547 | |||

| 122,971 | |||||

| Health care REITs: 0.36% | |||||

| CareTrust REIT Incorporated | 2,197 | 43,017 | |||

| National Health Investors Incorporated | 351 | 18,105 | |||

| 61,122 | |||||

| Hotel & resort REITs: 0.47% | |||||

| Braemar Hotels & Resorts Incorporated | 12,241 | 47,250 | |||

| DiamondRock Hospitality | 3,784 | 30,764 | |||

| 78,014 | |||||

| Industrial REITs: 0.87% | |||||

| STAG Industrial Incorporated | 4,287 | 144,986 | |||

| Office REITs: 0.40% | |||||

| Brandywine Realty Trust | 7,925 | 37,485 | |||

| Piedmont Office Realty Trust Incorporated Class A | 3,995 | 29,164 | |||

| 66,649 |

| Shares | Value | ||||

| Real estate management & development: 0.32% | |||||

| Newmark Group Incorporated Class A | 7,519 | $ 53,235 | |||

| Residential REITs: 0.87% | |||||

| BRT Apartments Corporation REIT | 2,427 | 47,860 | |||

| NexPoint Residential Trust Incorporated | 2,240 | 97,821 | |||

| 145,681 | |||||

| Retail REITs: 0.97% | |||||

| Getty Realty Corporation | 1,298 | 46,767 | |||

| The Necessity Retail REIT Incorporated | 5,926 | 37,215 | |||

| Urban Edge Properties | 5,234 | 78,824 | |||

| 162,806 | |||||

| Specialized REITs: 0.22% | |||||

| Safehold Incorporated | 575 | 16,875 | |||

| Uniti Group Incorporated | 5,475 | 19,436 | |||

| 36,311 | |||||

| Utilities: 3.27% | |||||

| Electric utilities: 0.80% | |||||

| Otter Tail Corporation | 1,854 | 133,989 | |||

| Gas utilities: 1.28% | |||||

| Brookfield Infrastructure Corporation Class A | 2,538 | 116,900 | |||

| New Jersey Resources Corporation | 1,821 | 96,877 | |||

| 213,777 | |||||

| Independent power & renewable electricity producers: 0.50% | |||||

| Clearway Energy Incorporated Class A | 2,750 | 82,583 | |||

| Multi-utilities: 0.57% | |||||

| Black Hills Corporation | 528 | 33,317 | |||

| Northwestern Corporation | 1,081 | 62,547 | |||

| 95,864 | |||||

| Water utilities: 0.12% | |||||

| York Water Company | 456 | 20,383 | |||

| Total Common stocks (Cost $14,474,230) | 16,363,470 |

| Expiration date | |||||

| Rights: 0.00% | |||||

| Health care: 0.00% | |||||

| Biotechnology: 0.00% | |||||

| Aduro Biotech Incorporated ♦† | 10-2-2030 | 4,415 | 0 | ||

| OmniAb Incorporated Earnout Shares $12.50 ♦† | 11-2-2027 | 104 | 0 | ||

| OmniAb Incorporated Earnout Shares $15.00 ♦† | 11-2-2027 | 104 | 0 | ||

| Total Rights (Cost $0) | 0 |

| Yield | Shares | Value | |||

| Short-term investments: 1.75% | |||||

| Investment companies: 1.75% | |||||

| Allspring Government Money Market Fund Select Class ♠∞ | 4.69% | 292,998 | $ 292,998 | ||

| Total Short-term investments (Cost $292,998) | 292,998 | ||||

| Total investments in securities (Cost $14,767,228) | 99.60% | 16,656,468 | |||

| Other assets and liabilities, net | 0.40 | 66,076 | |||

| Total net assets | 100.00% | $16,722,544 |

| † | Non-income-earning security |

| ♦ | The security is fair valued in accordance with Allspring Funds Management's valuation procedures, as the Board-designated valuation designee. |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Abbreviations: | |

| REIT | Real estate investment trust |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |||

| Short-term investments | ||||||||||

| Allspring Government Money Market Fund Select Class | $561,734 | $3,980,297 | $(4,249,033) | $ 0 | $0 | $ 292,998 | 292,998 | $ 8,937 | ||

| Investments in affiliates no longer held at end of period | ||||||||||

| Securities Lending Cash Investments LLC | 360,950 | 2,468,159 | (2,829,095) | (14) | 0 | 0 | 0 | 3,319 # | ||

| $ (14) | $0 | $292,998 | $12,256 | |||||||

| # | Amount shown represents income before fees and rebates. |

| Description | Number of contracts | Expiration date | Notional cost | Notional value | Unrealized gains | Unrealized losses |

| Long | ||||||

| Micro E-Mini Russell 2000 Index | 35 | 6-16-2023 | $309,679 | $317,362 | $7,683 | $0 |

| Assets | |

Investments in unaffiliated securities, at value (cost $14,474,230) | $ 16,363,470 |

Investments in affiliated securities, at value (cost $292,998) | 292,998 |

Cash | 1,825 |

Cash at broker segregated for futures contracts | 33,640 |

Receivable from manager | 19,747 |

Receivable for dividends | 12,402 |

Receivable for daily variation margin on open futures contracts | 5,838 |

Receivable for Fund shares sold | 966 |

Receivable for securities lending income, net | 3 |

Prepaid expenses and other assets | 22,140 |

Total assets | 16,753,029 |

| Liabilities | |

Custody and accounting fees payable | 14,697 |

Shareholder report expenses payable | 4,578 |

Shareholder servicing fees payable | 3,621 |

Payable for Fund shares redeemed | 2,693 |

Administration fees payable | 2,037 |

Professional fees payable | 1,562 |

Trustees’ fees and expenses payable | 1,110 |

Accrued expenses and other liabilities | 187 |

Total liabilities | 30,485 |

Total net assets | $16,722,544 |

| Net assets consist of | |

Paid-in capital | $ 13,818,721 |

Total distributable earnings | 2,903,823 |

Total net assets | $16,722,544 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 578,230 |

Shares outstanding – Class A1 | 52,663 |

Net asset value per share – Class A | $10.98 |

Maximum offering price per share – Class A2 | $11.65 |

Net assets – Class R6 | $ 198,281 |

Shares outstanding – Class R61 | 18,393 |

Net asset value per share – Class R6 | $10.78 |

Net assets – Administrator Class | $ 15,054,688 |

Shares outstanding – Administrator Class1 | 1,387,315 |

Net asset value per share – Administrator Class | $10.85 |

Net assets – Institutional Class | $ 891,345 |

Shares outstanding – Institutional Class1 | 82,512 |

Net asset value per share – Institutional Class | $10.80 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

| Investment income | |

Dividends (net of foreign withholdings taxes of $1,012) | $ 213,220 |

Income from affiliated securities | 12,040 |

Interest | 911 |

Total investment income | 226,171 |

| Expenses | |

Management fee | 90,758 |

| Administration fees | |

Class A | 1,302 |

Class R6 | 63 |

Administrator Class | 21,296 |

Institutional Class | 1,223 |

| Shareholder servicing fees | |

Class A | 1,550 |

Administrator Class | 40,954 |

Custody and accounting fees | 25,151 |

Professional fees | 53,809 |

Registration fees | 61,173 |

Shareholder report expenses | 30,619 |

Trustees’ fees and expenses | 20,174 |

Other fees and expenses | 14,506 |

Total expenses | 362,578 |

| Less: Fee waivers and/or expense reimbursements | |

Fund-level | (210,840) |

Class A | (123) |

Class R6 | (21) |

Administrator Class | (83) |

Net expenses | 151,511 |

Net investment income | 74,660 |

| Realized and unrealized gains (losses) on investments | |

| Net realized gains (losses) on | |

Unaffiliated securities | 1,286,922 |

Affiliated securities | (14) |

Futures contracts | (55,512) |

Net realized gains on investments | 1,231,396 |

| Net change in unrealized gains (losses) on | |

Unaffiliated securities | (3,101,168) |

Futures contracts | (22,422) |

Net change in unrealized gains (losses) on investments | (3,123,590) |

Net realized and unrealized gains (losses) on investments | (1,892,194) |

Net decrease in net assets resulting from operations | $(1,817,534) |

| Year ended March 31, 2023 | Year ended March 31, 2022 | |||

| Operations | ||||

Net investment income | $ 74,660 | $ 35,192 | ||

Net realized gains on investments | 1,231,396 | 2,783,921 | ||

Net change in unrealized gains (losses) on investments | (3,123,590) | (2,322,678) | ||

Net increase (decrease) in net assets resulting from operations | (1,817,534) | 496,435 | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

Class A | (607) | 0 | ||

Class R6 | (827) | (248) | ||

Administrator Class | (36,866) | (35,284) | ||

Institutional Class | (6,230) | (9,783) | ||

Total distributions to shareholders | (44,530) | (45,315) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

Class A | 15,260 | 157,891 | 36,903 | 451,068 |

Class R6 | 2,502 | 25,730 | 8,565 | 101,266 |

Administrator Class | 90,405 | 976,883 | 88,246 | 1,054,709 |

Institutional Class | 8,916 | 97,686 | 11,224 | 134,580 |

| 1,258,190 | 1,741,623 | |||

| Reinvestment of distributions | ||||

Class A | 56 | 607 | 0 | 0 |

Class R6 | 78 | 827 | 21 | 248 |

Administrator Class | 3,445 | 36,618 | 2,936 | 35,233 |

Institutional Class | 590 | 6,230 | 817 | 9,783 |

| 44,282 | 45,264 | |||

| Payment for shares redeemed | ||||

Class A | (18,692) | (204,318) | (65,850) | (791,179) |

Class R6 | (4,449) | (44,697) | (1,858) | (22,060) |

Administrator Class | (493,159) | (5,220,002) | (402,466) | (4,858,565) |

Institutional Class | (28,806) | (301,809) | (57,438) | (686,236) |

| (5,770,826) | (6,358,040) | |||

Net decrease in net assets resulting from capital share transactions | (4,468,354) | (4,571,153) | ||

Total decrease in net assets | (6,330,418) | (4,120,033) | ||

| Net assets | ||||

Beginning of period | 23,052,962 | 27,172,995 | ||

End of period | $16,722,544 | $23,052,962 | ||

| Year ended March 31 | |||||

| Class A | 2023 | 2022 | 2021 | 2020 | 2019 1 |

Net asset value, beginning of period | $11.82 | $11.67 | $6.12 | $8.39 | $23.70 |

Net investment income (loss) | 0.04 | 0.01 2 | (0.05) 2 | (0.00) 2,3 | 0.02 |

Net realized and unrealized gains (losses) on investments | (0.86) | 0.14 | 5.60 | (2.22) | (3.37) |

Total from investment operations | (0.82) | 0.15 | 5.55 | (2.22) | (3.35) |

| Distributions to shareholders from | |||||

Net investment income | (0.01) | 0.00 | 0.00 | (0.05) | (0.04) |

Net realized gains | (0.01) | 0.00 | 0.00 | 0.00 | (11.92) |

Total distributions to shareholders | (0.02) | 0.00 | 0.00 | (0.05) | (11.96) |

Net asset value, end of period | $10.98 | $11.82 | $11.67 | $6.12 | $8.39 |

Total return4 | (7.01)% | 1.29% | 90.69% | (26.67)% | (11.52)% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 2.10% | 1.74% | 1.81% | 1.40% | 1.14% |

Net expenses | 0.91% | 0.91% | 0.93% | 0.93% | 0.92% |

Net investment income (loss) | 0.35% | 0.05% | (0.53)% | (0.05)% | 0.16% |

| Supplemental data | |||||

Portfolio turnover rate | 53% | 39% | 48% | 67% | 176% |

Net assets, end of period (000s omitted) | $578 | $662 | $991 | $102 | $34 |

| 1 | For the period from July 31, 2018 (commencement of class operations) to March 31, 2019 |

| 2 | Calculated based upon average shares outstanding |

| 3 | Amount is more than $(0.005) |

| 4 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| Year ended March 31 | |||||

| Class R6 | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $11.64 | $11.45 | $6.15 | $8.50 | $22.63 |

Net investment income | 0.08 1 | 0.06 1 | 0.04 1 | 0.08 1 | 0.06 |

Net realized and unrealized gains (losses) on investments | (0.89) | 0.14 | 5.51 | (2.35) | (2.19) |

Total from investment operations | (0.81) | 0.20 | 5.55 | (2.27) | (2.13) |

| Distributions to shareholders from | |||||

Net investment income | (0.04) | (0.01) | (0.25) | (0.08) | (0.08) |

Net realized gains | (0.01) | 0.00 | 0.00 | 0.00 | (11.92) |

Total distributions to shareholders | (0.05) | (0.01) | (0.25) | (0.08) | (12.00) |

Net asset value, end of period | $10.78 | $11.64 | $11.45 | $6.15 | $8.50 |

Total return | (6.98)% | 1.76% | 90.71% | (27.03)% | (6.75)% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.67% | 1.32% | 1.42% | 0.89% | 0.82% |

Net expenses | 0.50% | 0.50% | 0.50% | 0.50% | 0.64% |

Net investment income | 0.76% | 0.49% | 0.51% | 0.95% | 0.48% |

| Supplemental data | |||||

Portfolio turnover rate | 53% | 39% | 48% | 67% | 176% |

Net assets, end of period (000s omitted) | $198 | $236 | $155 | $141 | $4,014 |

| 1 | Calculated based upon average shares outstanding |

| Year ended March 31 | |||||

| Administrator Class | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $11.73 | $11.59 | $6.10 | $8.40 | $22.53 |

Net investment income | 0.06 | 0.02 | 0.02 | 0.02 1 | 0.03 1 |

Net realized and unrealized gains (losses) on investments | (0.91) | 0.14 | 5.47 | (2.27) | (2.21) |

Total from investment operations | (0.85) | 0.16 | 5.49 | (2.25) | (2.18) |

| Distributions to shareholders from | |||||

Net investment income | (0.02) | (0.02) | (0.00) 2 | (0.05) | (0.03) |

Net realized gains | (0.01) | 0.00 | 0.00 | 0.00 | (11.92) |

Total distributions to shareholders | (0.03) | (0.02) | (0.00) 2 | (0.05) | (11.95) |

Net asset value, end of period | $10.85 | $11.73 | $11.59 | $6.10 | $8.40 |

Total return | (7.28)% | 1.37% | 90.04% | (26.99)% | (7.01)% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 2.01% | 1.67% | 1.75% | 1.25% | 1.13% |

Net expenses | 0.85% | 0.85% | 0.85% | 0.85% | 0.95% |

Net investment income | 0.40% | 0.12% | 0.17% | 0.27% | 0.16% |

| Supplemental data | |||||

Portfolio turnover rate | 53% | 39% | 48% | 67% | 176% |

Net assets, end of period (000s omitted) | $15,055 | $20,963 | $24,318 | $17,049 | $49,911 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is less than $0.005. |

| Year ended March 31 | |||||

| Institutional Class | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $11.71 | $11.60 | $6.10 | $8.48 | $22.61 |

Net investment income | 0.07 1 | 0.04 1 | 0.04 1 | 0.06 1 | 0.07 1 |

Net realized and unrealized gains (losses) on investments | (0.90) | 0.16 | 5.47 | (2.28) | (2.22) |

Total from investment operations | (0.83) | 0.20 | 5.51 | (2.22) | (2.15) |

| Distributions to shareholders from | |||||

Net investment income | (0.07) | (0.09) | (0.01) | (0.16) | (0.06) |

Net realized gains | (0.01) | 0.00 | 0.00 | 0.00 | (11.92) |

Total distributions to shareholders | (0.08) | (0.09) | (0.01) | (0.16) | (11.98) |

Net asset value, end of period | $10.80 | $11.71 | $11.60 | $6.10 | $8.48 |

Total return | (7.09)% | 1.68% | 90.34% | (26.80)% | (6.79)% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.76% | 1.42% | 1.51% | 0.94% | 0.89% |

Net expenses | 0.60% | 0.60% | 0.60% | 0.60% | 0.71% |

Net investment income | 0.65% | 0.36% | 0.47% | 0.69% | 0.41% |

| Supplemental data | |||||

Portfolio turnover rate | 53% | 39% | 48% | 67% | 176% |

Net assets, end of period (000s omitted) | $891 | $1,192 | $1,708 | $1,586 | $25,658 |

| 1 | Calculated based upon average shares outstanding |

| Gross unrealized gains | $ 3,427,313 |

| Gross unrealized losses | (1,673,208) |

| Net unrealized gains | $ 1,754,105 |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

| Assets | ||||

| Investments in: | ||||

| Common stocks | ||||

| Communication services | $ 420,596 | $0 | $0 | $ 420,596 |

| Consumer discretionary | 1,943,412 | 0 | 0 | 1,943,412 |

| Consumer staples | 661,462 | 0 | 0 | 661,462 |

| Energy | 1,100,525 | 0 | 0 | 1,100,525 |

| Financials | 2,503,353 | 0 | 0 | 2,503,353 |

| Health care | 2,653,383 | 0 | 0 | 2,653,383 |

| Industrials | 2,791,855 | 0 | 0 | 2,791,855 |

| Information technology | 2,205,177 | 0 | 0 | 2,205,177 |

| Materials | 665,336 | 0 | 0 | 665,336 |

| Real estate | 871,775 | 0 | 0 | 871,775 |

| Utilities | 546,596 | 0 | 0 | 546,596 |

| Rights | ||||

| Health care | 0 | 0 | 0 | 0 |

| Short-term investments | ||||

| Investment companies | 292,998 | 0 | 0 | 292,998 |

| 16,656,468 | 0 | 0 | 16,656,468 | |

| Futures contracts | 7,683 | 0 | 0 | 7,683 |

| Total assets | $16,664,151 | $0 | $0 | $16,664,151 |

| Average daily net assets | Management fee |

| First $1 billion | 0.500% |

| Next $4 billion | 0.475 |

| Next $5 billion | 0.440 |

| Over $10 billion | 0.430 |

| Class-level administration fee | |

| Class A | 0.21% |

| Class R6 | 0.03 |

| Administrator Class | 0.13 |

| Institutional Class | 0.13 |

| Expense ratio caps | |

| Class A | 0.93% |

| Class R6 | 0.50 |

| Administrator Class | 0.85 |

| Institutional Class | 0.60 |

| Year ended March 31 | ||

| 2023 | 2022 | |

| Ordinary income | $35,189 | $45,315 |

| Long-term capital gain | 9,341 | 0 |

| Undistributed ordinary income | Undistributed long-term gain | Unrealized gains |

| $92,605 | $1,057,113 | $1,754,105 |

Allspring Funds Trust:

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Foundation (non-profit organization). Mr. Ebsworth is a CFA® charterholder. | N/A |

| Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

| Isaiah Harris, Jr. (Born 1952) | Trustee, since 2009; Audit Committee Chair, since 2019 | Retired. Member of the Advisory Board of CEF of East Central Florida. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | N/A |

| David F. Larcker (Born 1950) | Trustee, since 2009 | Distinguished Visiting Fellow at the Hoover Institution since 2022. James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| Olivia S. Mitchell (Born 1953) | Trustee, since 2006; Nominating and Governance Committee Chair, since 2018 | International Foundation of Employee Benefit Plans Professor since 1993, Wharton School of the University of Pennsylvania. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously taught at Cornell University from 1978 to 1993. | N/A |

| Timothy J. Penny (Born 1951) | Trustee, since 1996; Chair, since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Vice Chair of the Economic Club of Minnesota, since 2007. Co-Chair of the Committee for a Responsible Federal Budget, since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, from 2007-2022. Senior Fellow of the University of Minnesota Humphrey Institute from 1995 to 2017. | N/A |

| James G. Polisson (Born 1959) | Trustee, since 2018 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non-profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

| Pamela Wheelock (Born 1959) | Trustee, since January 2020; previously Trustee from January 2018 to July 2019 | Retired. Executive and Senior Financial leadership positions in the public, private and nonprofit sectors. Interim President and CEO, McKnight Foundation, 2020. Interim Commissioner, Minnesota Department of Human Services, 2019. Chief Operating Officer, Twin Cities Habitat for Humanity, 2017-2019. Vice President for University Services, University of Minnesota, 2012-2016. Interim President and CEO, Blue Cross and Blue Shield of Minnesota, 2011-2012. Executive Vice-President and Chief Financial Officer, Minnesota Wild, 2002-2008. Commissioner, Minnesota Department of Finance, 1999-2002. Chair of the Board of Directors of Destination Medical Center Corporation. Board member of the Minnesota Wild Foundation. | N/A |

| Name and year of birth | Position held and length of service | Principal occupations during past five years or longer |

| Andrew Owen (Born 1960) | President, since 2017 | President and Chief Executive Officer of Allspring Funds Management, LLC since 2017 and Head of Global Fund Governance of Allspring Global Investments since 2022. Prior thereto, co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, from 2019 to 2022 and Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. |

| Jeremy DePalma (Born 1974) | Treasurer, since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Fund Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. |

| Christopher Baker (Born 1976) | Chief Compliance Officer, since 2022 | Global Chief Compliance Officer for Allspring Global Investments since 2022. Prior thereto, Chief Compliance Officer for State Street Global Advisors from 2018 to 2021. Senior Compliance Officer for the State Street divisions of Alternative Investment Solutions, Sector Solutions, and Global Marketing from 2015 to 2018. From 2010 to 2015 Vice President, Global Head of Investment and Marketing Compliance for State Street Global Advisors. |

| Matthew Prasse (Born 1983) | Chief Legal Officer, since 2022; Secretary, since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

P.O. Box 219967

Kansas City, MO 64121-9967

1-800-222-8222 or visit the Fund's website at allspringglobal.com. Read the prospectus carefully before you invest or send money.

AR4335 03-23

Discovery Small Cap Growth Fund

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| Financial statements | |

| 15 | |

| 16 | |

| 17 | |

| 18 | |

| 23 | |

| 29 | |

| 30 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2023. ICE Data Indices, LLC. All rights reserved. |

| 8 | The MSCI ACWI (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly in an index. |

| 1 | The U.S. Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

President

Allspring Funds

| 1 | The Purchasing Managers' Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. You cannot invest directly in an index. |

| Investment objective | The Fund seeks long-term capital appreciation. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments, LLC |

| Portfolio managers | Michael T. Smith, CFA, Christopher J. Warner, CFA |

| Average annual total returns (%) as of March 31, 2023 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (EGWAX) | 6-5-1995 | -22.30 | 5.82 | 8.19 | -17.58 | 7.07 | 8.83 | 1.44 | 1.23 | ||

| Class C (EGWCX) | 7-30-2010 | -19.25 | 6.30 | 8.20 | -18.25 | 6.30 | 8.20 | 2.19 | 1.98 | ||

| Class R6 (EGWRX)3 | 5-29-2020 | – | – | – | -17.28 | 7.48 | 9.23 | 1.01 | 0.80 | ||

| Administrator Class (EGWDX) | 7-30-2010 | – | – | – | -17.39 | 7.45 | 9.12 | 1.36 | 1.15 | ||

| Institutional Class (EGRYX) | 11-19-1997 | – | – | – | -17.37 | 7.42 | 9.20 | 1.11 | 0.90 | ||

| Russell 2000® Growth Index4 | – | – | – | – | -10.60 | 4.26 | 8.49 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through July 31, 2023, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.23% for Class A, 1.98% for Class C, 0.80% for Class R6, 1.15% for Administrator Class, and 0.90% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 4 | The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher price/book ratios and higher forecasted growth values. You cannot invest directly in an index. |

| 1 | The chart compares the performance of Class A shares for the most recent ten years with the Russell 2000® Growth Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| ■ | The Fund underperformed its benchmark, the Russell 2000® Growth Index, for the 12-month period that ended March 31, 2023. |

| ■ | Select holdings within the materials, health care, and information technology (IT) sectors detracted from performance. |

| ■ | Security selection within the consumer discretionary and industrials sectors contributed to the Fund’s performance. |

| Ten largest holdings (%) as of March 31, 20231 | |

| Casella Waste Systems Incorporated Class A | 2.81 |

| HealthEquity Incorporated | 2.73 |

| WNS Holdings Limited ADR | 2.63 |

| Wingstop Incorporated | 2.59 |

| Rexford Industrial Realty Incorporated | 2.57 |

| Tetra Tech Incorporated | 2.44 |

| Novanta Incorporated | 2.39 |

| Saia Incorporated | 2.24 |

| Keywords Studios plc | 2.04 |

| MGP Ingredients Incorporated | 2.02 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

| * | The U.S. Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

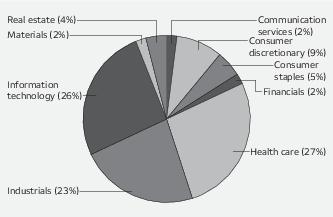

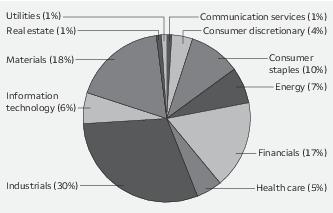

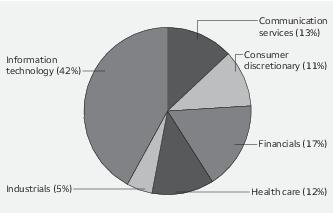

| Sector allocation as of March 31, 20231 |

| 1 | Figures represent the percentage of the Fund's long-term investments. Allocations are subject to change and may have changed since the date specified. |

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| Beginning account value 10-1-2022 | Ending account value 3-31-2023 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $1,080.93 | $ 6.38 | 1.23% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.80 | $ 6.19 | 1.23% |

| Class C | ||||

| Actual | $1,000.00 | $1,077.14 | $10.25 | 1.98% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.06 | $ 9.95 | 1.98% |

| Class R6 | ||||

| Actual | $1,000.00 | $1,083.27 | $ 4.16 | 0.80% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.94 | $ 4.03 | 0.80% |

| Administrator Class | ||||

| Actual | $1,000.00 | $1,081.29 | $ 5.97 | 1.15% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.20 | $ 5.79 | 1.15% |

| Institutional Class | ||||

| Actual | $1,000.00 | $1,082.82 | $ 4.67 | 0.90% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.44 | $ 4.53 | 0.90% |

| Shares | Value | ||||

| Common stocks: 96.79% | |||||

| Communication services: 2.09% | |||||

| Interactive media & services: 2.09% | |||||

| Bumble Incorporated Class A † | 36,016 | $ 704,113 | |||

| IAC/InterActiveCorp † | 31,869 | 1,644,440 | |||

| 2,348,553 | |||||

| Consumer discretionary: 8.73% | |||||

| Broadline retail: 1.11% | |||||

| Global-E Online Limited † | 38,887 | 1,253,328 | |||

| Hotels, restaurants & leisure: 4.41% | |||||

| Papa John's International Incorporated | 27,291 | 2,044,915 | |||

| Wingstop Incorporated | 15,870 | 2,913,415 | |||

| 4,958,330 | |||||

| Leisure products: 3.21% | |||||

| Callaway Golf Company † | 61,853 | 1,337,262 | |||

| Games Workshop Group plc | 19,033 | 2,267,036 | |||

| 3,604,298 | |||||

| Consumer staples: 5.23% | |||||

| Beverages: 2.02% | |||||

| MGP Ingredients Incorporated | 23,527 | 2,275,531 | |||

| Personal care products: 3.21% | |||||

| Bellring Brands Incorporated † | 61,299 | 2,084,166 | |||

| Coty Incorporated Class A † | 126,427 | 1,524,710 | |||

| 3,608,876 | |||||

| Financials: 3.47% | |||||

| Capital markets: 1.72% | |||||

| Morningstar Incorporated | 6,866 | 1,394,004 | |||

| Open Lending Corporation Class A † | 76,108 | 535,800 | |||

| 1,929,804 | |||||

| Financial services: 1.75% | |||||

| Shift4 Payments Incorporated Class A † | 25,991 | 1,970,118 | |||

| Health care: 25.99% | |||||

| Biotechnology: 4.63% | |||||

| Apellis Pharmaceuticals Incorporated † | 10,628 | 701,023 | |||

| Ascendis Pharma AS ADR † | 8,224 | 881,777 | |||

| CRISPR Therapeutics AG † | 7,430 | 336,059 | |||

| Geron Corporation † | 110,093 | 238,902 | |||

| Halozyme Therapeutics Incorporated † | 33,263 | 1,270,314 | |||

| Mirati Therapeutics Incorporated † | 5,700 | 211,926 | |||

| Natera Incorporated † | 14,903 | 827,415 | |||

| TG Therapeutics Incorporated † | 31,635 | 475,790 | |||

| Zentalis Pharmaceuticals Incorporated † | 15,363 | 264,244 | |||

| 5,207,450 |

| Shares | Value | ||||

| Health care equipment & supplies: 13.31% | |||||

| Axonics Incorporated † | 16,722 | $ 912,352 | |||

| Establishment Labs Holdings Incorporated † | 8,059 | 545,917 | |||

| ICU Medical Incorporated † | 7,352 | 1,212,786 | |||

| Inari Medical Incorporated † | 18,252 | 1,126,878 | |||

| Inspire Medical Systems Incorporated † | 8,090 | 1,893,626 | |||

| iRhythm Technologies Incorporated † | 15,836 | 1,964,139 | |||

| Lantheus Holdings Incorporated † | 21,964 | 1,813,348 | |||

| Shockwave Medical Incorporated † | 6,171 | 1,338,058 | |||

| TransMedics Group Incorporated † | 14,204 | 1,075,669 | |||

| Treace Medical Concepts Incorporated † | 69,784 | 1,757,859 | |||

| UFP Technologies Incorporated † | 10,214 | 1,326,186 | |||

| 14,966,818 | |||||

| Health care providers & services: 4.60% | |||||

| HealthEquity Incorporated † | 52,394 | 3,076,048 | |||

| Option Care Health Incorporated † | 66,214 | 2,103,619 | |||

| 5,179,667 | |||||

| Life sciences tools & services: 3.08% | |||||

| Azenta Incorporated † | 20,996 | 936,842 | |||

| MaxCyte Incorporated † | 152,850 | 756,608 | |||

| Stevanato Group SpA | 68,203 | 1,766,458 | |||

| 3,459,908 | |||||

| Pharmaceuticals: 0.37% | |||||

| Arvinas Incorporated † | 15,422 | 421,329 | |||

| Industrials: 22.26% | |||||

| Aerospace & defense: 1.25% | |||||

| Axon Enterprise Incorporated † | 6,280 | 1,412,058 | |||

| Building products: 1.80% | |||||

| Advanced Drainage Systems Incorporated | 12,566 | 1,058,183 | |||

| Trex Company Incorporated † | 19,779 | 962,644 | |||

| 2,020,827 | |||||

| Commercial services & supplies: 5.25% | |||||

| Casella Waste Systems Incorporated Class A † | 38,226 | 3,159,761 | |||

| Tetra Tech Incorporated | 18,715 | 2,749,421 | |||

| 5,909,182 | |||||

| Electrical equipment: 2.32% | |||||

| Allied Motion Technologies | 40,131 | 1,551,063 | |||

| Shoals Technologies Group Class A † | 46,524 | 1,060,282 | |||

| 2,611,345 | |||||

| Ground transportation: 2.24% | |||||

| Saia Incorporated † | 9,258 | 2,518,917 | |||

| Machinery: 1.61% | |||||

| RBC Bearings Incorporated † | 7,770 | 1,808,312 | |||

| Professional services: 5.59% | |||||

| FTI Consulting Incorporated † | 8,117 | 1,601,890 |

| Shares | Value | ||||

| Professional services (continued) | |||||

| ICF International Incorporated | 15,757 | $ 1,728,543 | |||

| WNS Holdings Limited ADR † | 31,705 | 2,953,955 | |||

| 6,284,388 | |||||

| Trading companies & distributors: 2.20% | |||||

| SiteOne Landscape Supply Incorporated † | 14,564 | 1,993,375 | |||

| Xometry Incorporated Class A † | 32,022 | 479,369 | |||

| 2,472,744 | |||||

| Information technology: 23.39% | |||||

| Electronic equipment, instruments & components: 5.66% | |||||

| Littelfuse Incorporated | 8,024 | 2,151,154 | |||

| Nayax Limited † | 41,887 | 711,038 | |||

| Nlight Incorporated † | 80,042 | 814,828 | |||

| Novanta Incorporated † | 16,879 | 2,685,280 | |||

| 6,362,300 | |||||

| IT services: 4.04% | |||||

| Endava plc ADR † | 18,328 | 1,231,275 | |||

| Keywords Studios plc | 67,498 | 2,296,462 | |||

| StoneCo Limited Class A † | 106,905 | 1,019,874 | |||

| 4,547,611 | |||||

| Semiconductors & semiconductor equipment: 4.63% | |||||

| Impinj Incorporated † | 14,340 | 1,943,357 | |||

| Indie Semiconductor Incorporated † | 92,903 | 980,127 | |||

| Lattice Semiconductor Corporation † | 12,295 | 1,174,173 | |||

| Sitime Corporation † | 7,806 | 1,110,247 | |||

| 5,207,904 | |||||

| Software: 9.06% | |||||

| BILL Holdings Incorporated † | 11,535 | 935,950 | |||

| CCC Intelligent Solutions † | 98,527 | 883,787 | |||

| Clearwater Analytics Holdings Incorporated Class A † | 51,891 | 828,180 | |||

| CS Disco Incorporated † | 45,033 | 299,019 | |||

| Gitlab Incorporated Class A † | 21,182 | 726,331 | |||

| Jamf Holding Corporation † | 43,695 | 848,557 | |||

| Olo Incorporated Class A † | 133,153 | 1,086,528 | |||

| Pagerduty Incorporated † | 34,391 | 1,202,997 | |||

| Sprout Social Incorporated Class A † | 26,458 | 1,610,763 | |||

| Workiva Incorporated † | 17,333 | 1,775,073 | |||

| 10,197,185 | |||||

| Materials: 2.13% | |||||

| Chemicals: 0.29% | |||||

| Aspen Aerogels Incorporated † | 44,285 | 329,923 | |||

| Containers & packaging: 0.68% | |||||

| Ranpak Holdings Corporation † | 146,299 | 763,681 | |||

| Metals & mining: 1.16% | |||||

| Allegheny Technologies Incorporated † | 32,963 | 1,300,720 |

| Shares | Value | ||||

| Real estate: 3.50% | |||||

| Industrial REITs: 2.57% | |||||

| Rexford Industrial Realty Incorporated | 48,473 | $ 2,891,414 | |||

| Real estate management & development: 0.93% | |||||

| DigitalBridge Group Incorporated | 87,159 | 1,045,036 | |||

| Total Common stocks (Cost $102,338,344) | 108,867,557 |

| Yield | |||||

| Short-term investments: 3.45% | |||||

| Investment companies: 3.45% | |||||

| Allspring Government Money Market Fund Select Class ♠∞ | 4.69% | 3,883,609 | 3,883,609 | ||

| Total Short-term investments (Cost $3,883,609) | 3,883,609 | ||||

| Total investments in securities (Cost $106,221,953) | 100.24% | 112,751,166 | |||

| Other assets and liabilities, net | (0.24) | (266,210) | |||

| Total net assets | 100.00% | $112,484,956 |

| † | Non-income-earning security |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Abbreviations: | |

| ADR | American depositary receipt |

| REIT | Real estate investment trust |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |||

| Short-term investments | ||||||||||

| Allspring Government Money Market Fund Select Class | $1,852,545 | $35,924,199 | $(33,893,135) | $ 0 | $0 | $ 3,883,609 | 3,883,609 | $ 109,845 | ||

| Investments in affiliates no longer held at end of period | ||||||||||

| Securities Lending Cash Investments LLC | 5,055,425 | 39,409,635 | (44,464,947) | (113) | 0 | 0 | 0 | 82,288 # | ||

| $ (113) | $0 | $3,883,609 | $192,133 | |||||||

| # | Amount shown represents income before fees and rebates. |

| Assets | |

Investments in unaffiliated securities, at value (cost $102,338,344) | $ 108,867,557 |

Investments in affiliated securities, at value (cost $3,883,609) | 3,883,609 |

Cash | 15 |

Foreign currency, at value (cost $376) | 350 |

Receivable for dividends | 39,761 |

Receivable for Fund shares sold | 21,900 |

Prepaid expenses and other assets | 61,494 |

Total assets | 112,874,686 |

| Liabilities | |

Payable for investments purchased | 157,560 |

Payable for Fund shares redeemed | 119,083 |

Management fee payable | 64,828 |

Administration fees payable | 18,126 |

Trustees’ fees and expenses payable | 1,537 |

Distribution fee payable | 303 |

Accrued expenses and other liabilities | 28,293 |

Total liabilities | 389,730 |

Total net assets | $112,484,956 |

| Net assets consist of | |

Paid-in capital | $ 127,284,008 |

Total distributable loss | (14,799,052) |

Total net assets | $112,484,956 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 73,660,357 |

Shares outstanding – Class A1 | 6,526,421 |

Net asset value per share – Class A | $11.29 |

Maximum offering price per share – Class A2 | $11.98 |

Net assets – Class C | $ 433,252 |

Shares outstanding – Class C1 | 48,797 |

Net asset value per share – Class C | $8.88 |

Net assets – Class R6 | $ 1,611,677 |

Shares outstanding – Class R61 | 109,250 |

Net asset value per share – Class R6 | $14.75 |

Net assets – Administrator Class | $ 351,794 |

Shares outstanding – Administrator Class1 | 24,839 |

Net asset value per share – Administrator Class | $14.16 |

Net assets – Institutional Class | $ 36,427,876 |

Shares outstanding – Institutional Class1 | 2,477,514 |

Net asset value per share – Institutional Class | $14.70 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

| Investment income | |

Dividends (net of foreign withholdings taxes of $2,609) | $ 277,529 |

Income from affiliated securities | 125,751 |

Total investment income | 403,280 |

| Expenses | |

Management fee | 961,831 |

| Administration fees | |

Class A | 163,603 |

Class C | 1,068 |

Class R6 | 609 |

Administrator Class | 468 |

Institutional Class | 42,056 |

| Shareholder servicing fees | |

Class A | 194,766 |

Class C | 1,197 |

Administrator Class | 900 |

| Distribution fee | |

Class C | 3,495 |

Custody and accounting fees | 23,332 |

Professional fees | 57,261 |