UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: May 31

Registrant is making a filing for 15 of its series: Allspring Asset Allocation Fund, Allspring C&B Large Cap Value Fund, Allspring Core Bond Fund, Allspring Emerging Growth Fund, Allspring Growth Balanced Fund, Allspring Index Fund, Allspring Moderate Balanced Fund, Allspring Real Return Fund, Allspring Small Company Growth Fund, Allspring Small Company Value Fund, Allspring Spectrum Aggressive Growth Fund, Allspring Spectrum Conservative Growth Fund, Allspring Spectrum Growth Fund, Allspring Spectrum Income Allocation Fund, and Allspring Spectrum Moderate Growth Fund

Date of reporting period: May 31, 2023

ITEM 1. REPORT TO STOCKHOLDERS

2

2 | |

6 | |

10 | |

11 | |

14 | |

16 | |

18 | |

20 | |

25 | |

31 | |

32 |

Allspring Funds

President

Allspring Funds

Notice to Shareholders |

Beginning in July 2024, the Fund will be required by the Securities and Exchange Commission to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance information and fund statistics. If you wish to receive this new tailored shareholder report electronically, please follow the instructions on the back cover of this report. |

Other information that is currently included in the shareholder report, such as the Fund’s financial statements, will be available online and upon request, free of charge, in paper or electronic format. |

Investment objective | The Fund seeks long-term total return, consisting of capital appreciation and current income. |

Manager | Allspring Funds Management, LLC |

Subadviser | Allspring Global Investments, LLC |

Portfolio managers | Kandarp R. Acharya, CFA, FRM, Petros N. Bocray, CFA, FRM, Travis L. Keshemberg, CFA, CIPM, FRM |

Average annual total returns (%) as of May 31, 2023 | |||||||||

Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||

Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net2 | |

Class A (EAAFX) | 7-29-1996 | -7.22 | 3.10 | 3.36 | -1.54 | 4.32 | 3.97 | 1.18 | 1.12 |

Class C (EACFX) | 10-3-2002 | -3.34 | 3.66 | 3.42 | -2.34 | 3.66 | 3.42 | 1.93 | 1.87 |

Class R (EAXFX) | 10-10-2003 | – | – | – | -1.81 | 4.13 | 3.76 | 1.44 | 1.38 |

Administrator Class (EAIFX) | 10-3-2002 | – | – | – | -0.39 | 4.87 | 4.35 | 1.11 | 0.95 |

Institutional Class (EAAIX) | 11-30-2012 | – | – | – | -1.21 | 4.67 | 4.36 | 0.86 | 0.80 |

Asset Allocation Blended Index3 | – | – | – | – | 0.20 | 5.51 | 6.03 | – | – |

Bloomberg U.S. Aggregate Bond Index4 | – | – | – | – | -2.14 | 0.81 | 1.39 | – | – |

MSCI ACWI ex USA Index (Net)5 | – | – | – | – | -1.41 | 2.22 | 3.83 | – | – |

Russell 3000® Index6 | – | – | – | – | 2.03 | 10.07 | 11.45 | – | – |

1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.43% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include acquired fund fees and expenses. |

2 | The manager has contractually committed through September 30, 2023 (September 30, 2024 for Class A and Class C), to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.12% for Class A, 1.87% for Class C, 1.38% for Class R, 0.95% for Administrator Class and 0.80% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the affiliated master portfolios and funds invest and from money market funds, and extraordinary expenses are excluded from the expense caps. All other acquired fund fees and expenses from the affiliated master portfolios and funds are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

3 | Source: Allspring Funds Management, LLC. The Asset Allocation Blended Index is composed 45% of the Russell 3000® Index, 35% of the Bloomberg U.S. Aggregate Bond Index and 20% of the MSCI ACWI ex USA Index (Net). Prior to June 16, 2018, it was comprised of 65% of the MSCI ACWI Index (Net) and 35% of the Bloomberg U.S. Aggregate Bond Index. You cannot invest directly in an index. |

4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar–denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

5 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

6 | The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. You cannot invest directly in an index. |

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

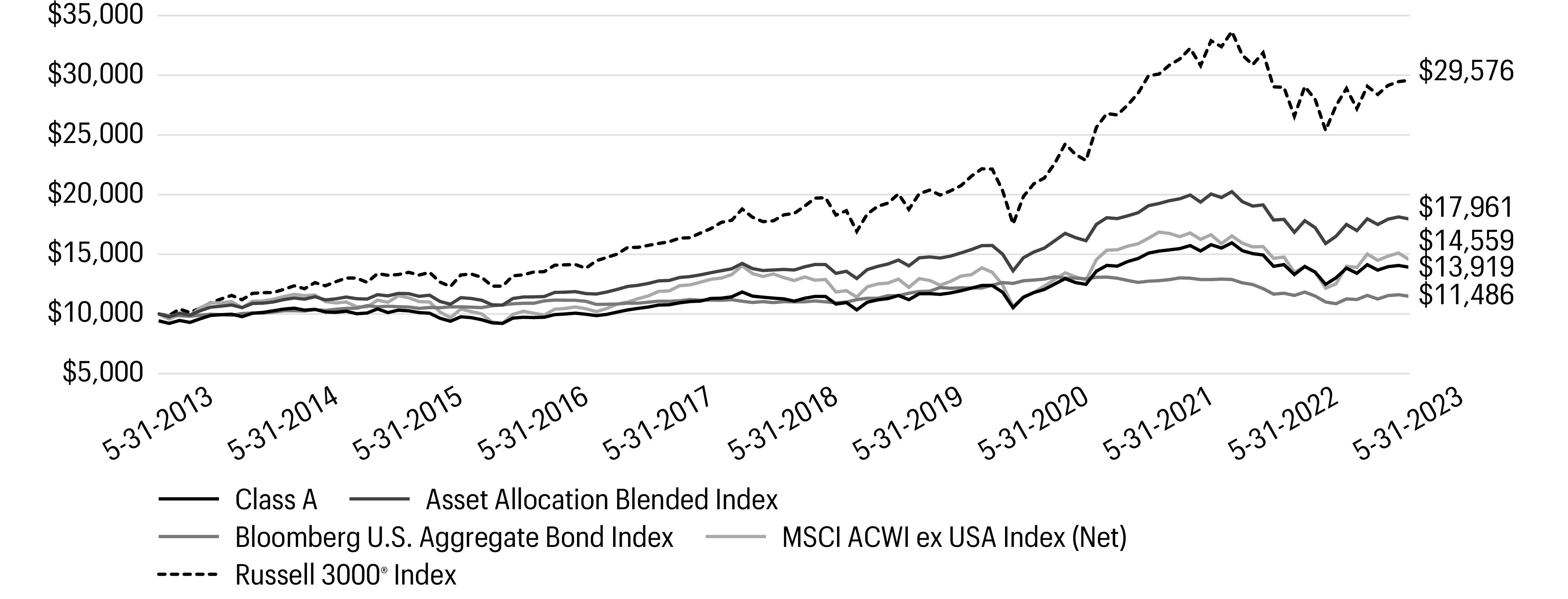

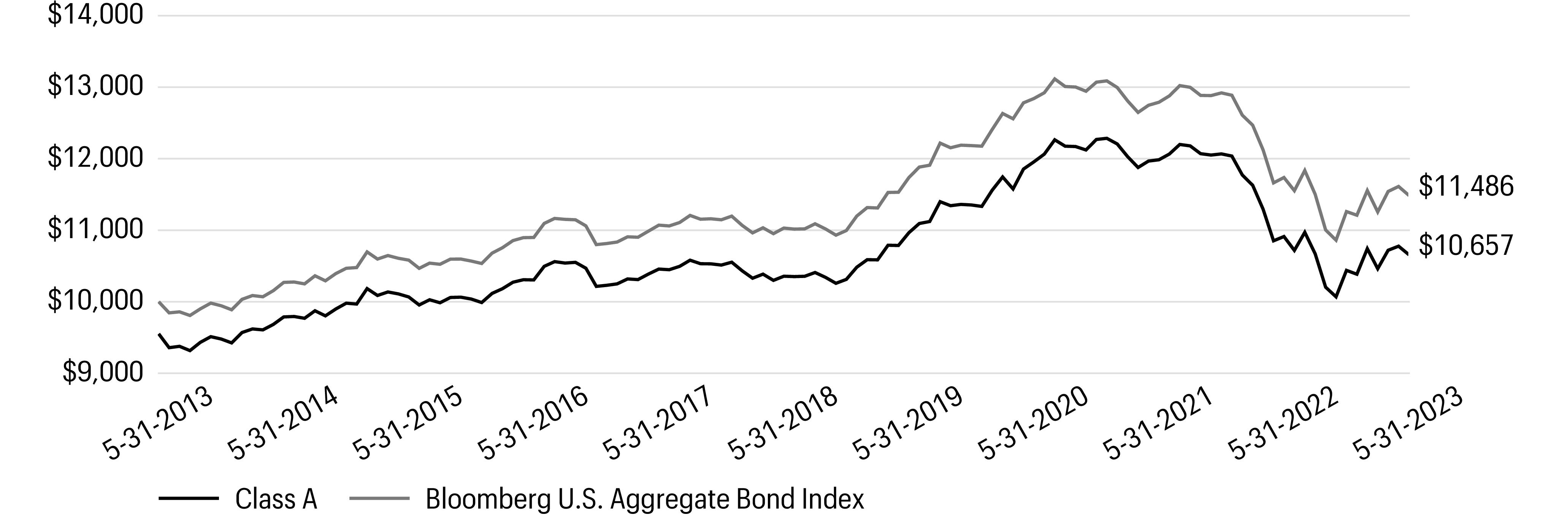

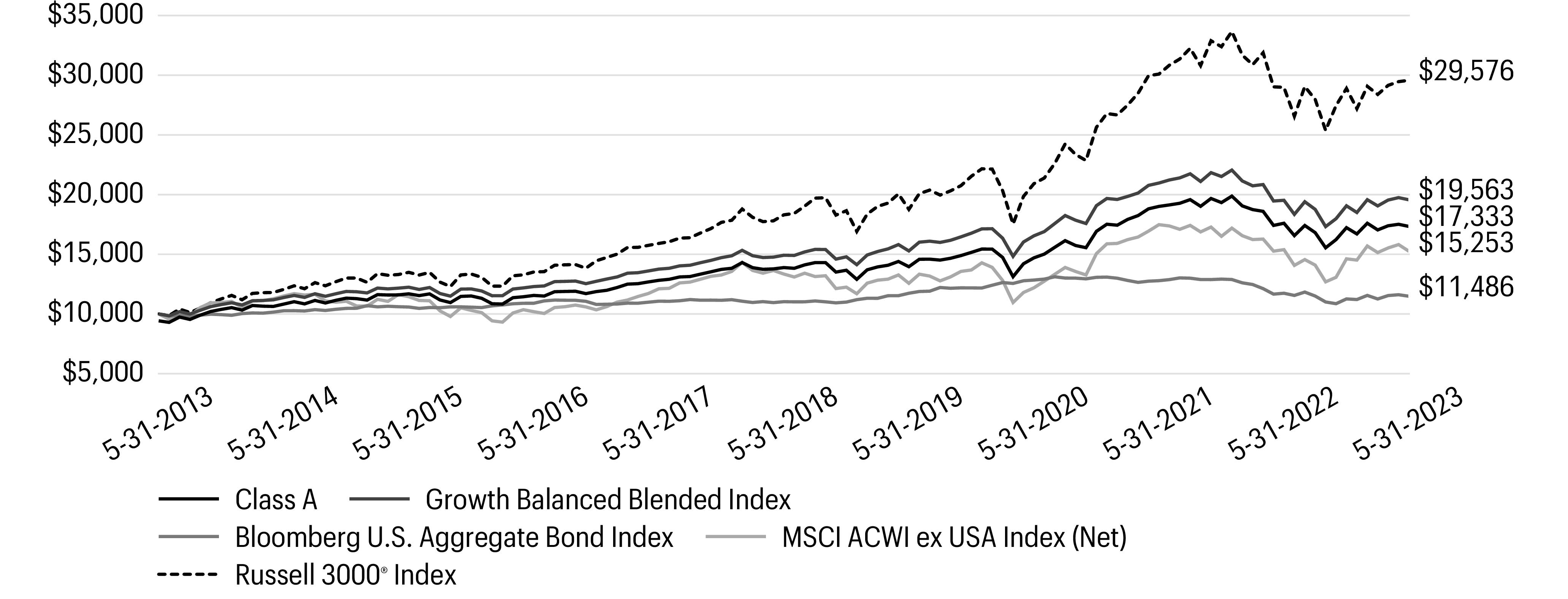

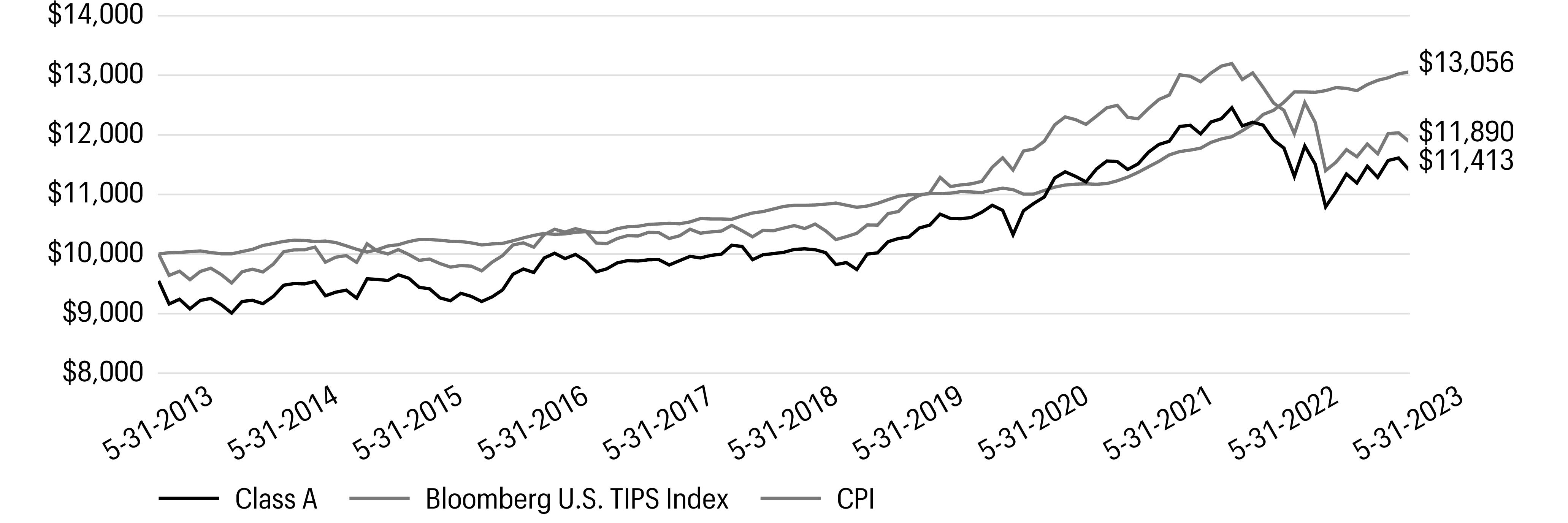

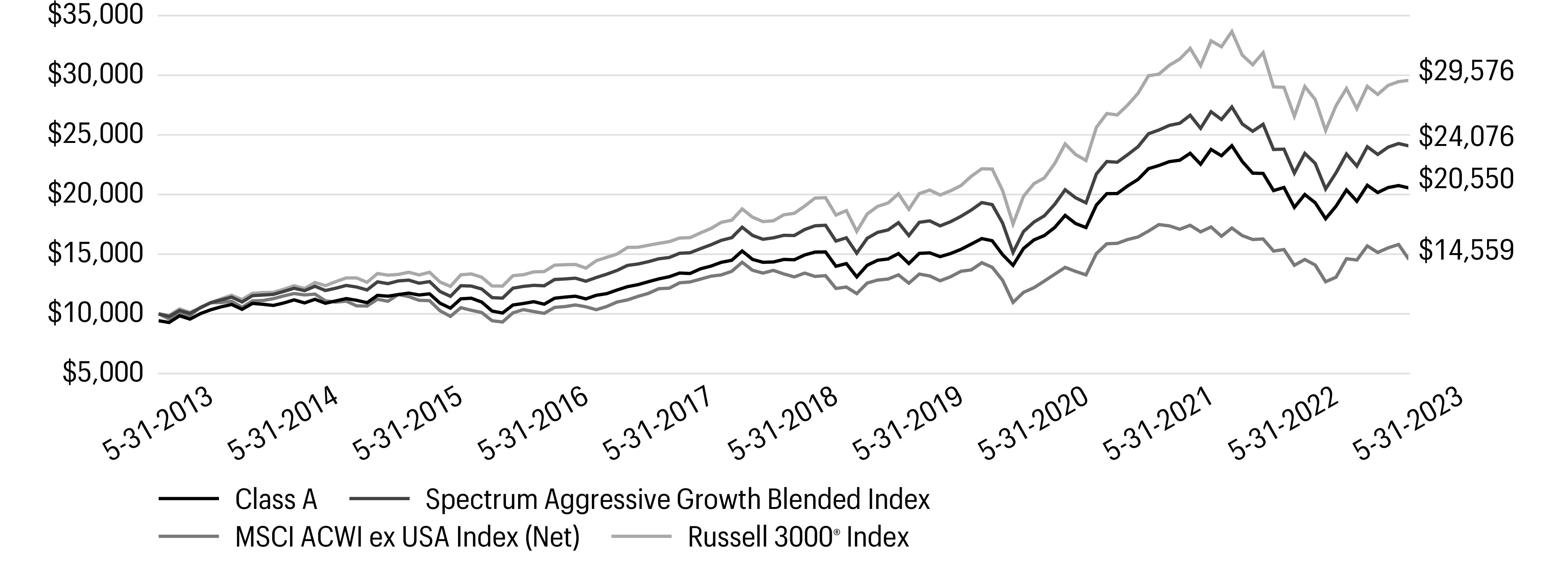

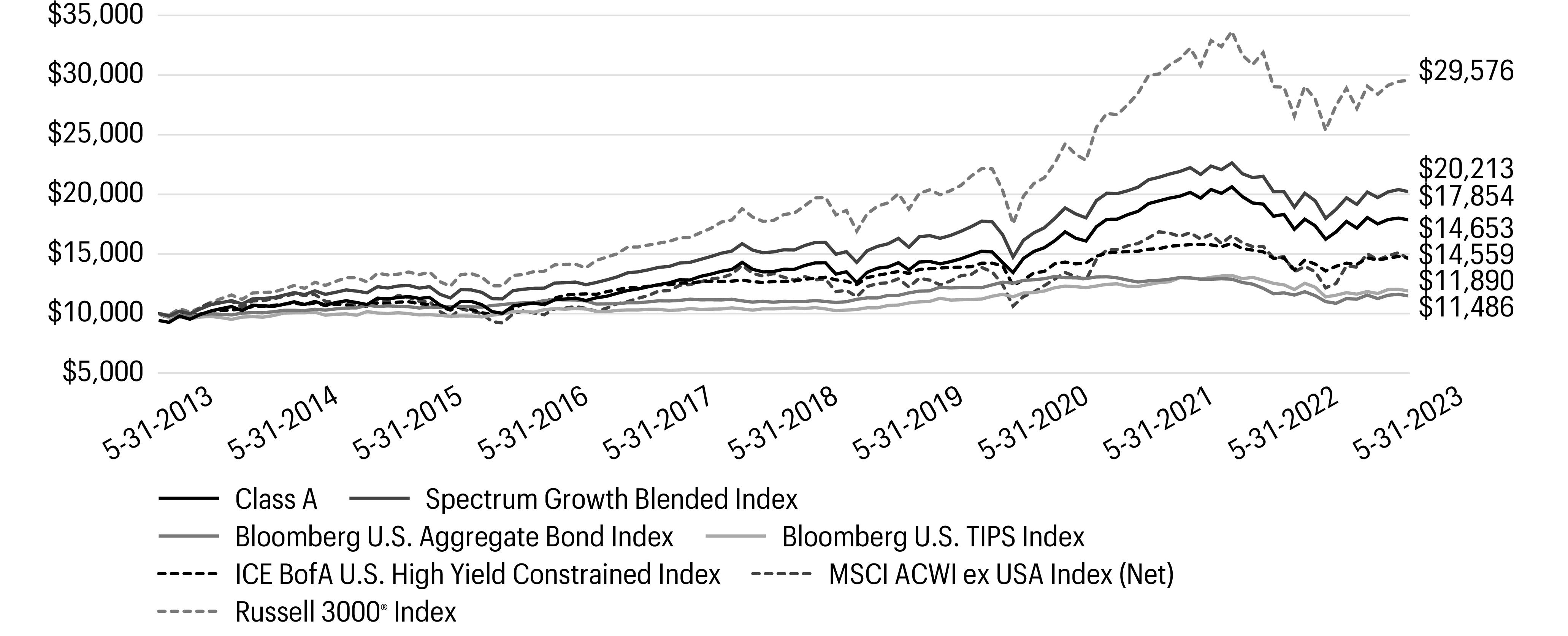

Growth of $10,000 investment as of May 31, 20231 |

1 | The chart compares the performance of Class A shares for the most recent ten years with the Asset Allocation Blended Index, Bloomberg U.S. Aggregate Bond Index, MSCI ACWI ex USA Index (Net) and Russell 3000® Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

Ten largest holdings (%) as of May 31, 20231 | |

Allspring Managed Fixed Income Portfolio | 22.38 |

Allspring Disciplined U.S. Core Fund Class R6 | 13.86 |

Allspring Large Company Value Portfolio | 11.49 |

Allspring Diversified Large Cap Growth Portfolio | 11.23 |

Allspring Disciplined International Developed Markets Portfolio | 8.49 |

Allspring Core Bond Portfolio | 6.27 |

iShares Core MSCI EAFE ETF | 3.87 |

Allspring Real Return Portfolio | 3.48 |

Allspring C&B Large Cap Value Portfolio | 3.42 |

Allspring Factor Enhanced International Equity Portfolio | 3.14 |

1 | Figures represent the percentage of the Fund’s net assets. Holdings are subject to change and may have changed since the date specified. |

Allocation (%) as of May 31, 2023 | ||

Neutral allocation | Effective allocation1 | |

Stock Funds | 65 | 45 |

Bond Funds | 35 | 38 |

International Equity Funds | 0 | 20 |

Effective Cash | 0 | (3 ) |

1 | Effective allocation reflects the effect of the tactical futures overlay that may be in place. Effective cash, if any, represents the net offset to such future positions. Effective allocations are subject to change and may have changed since the date specified. |

Beginning account value 12-1-2022 | Ending account value 5-31-2023 | Expenses paid during the period1, 2 | Annualized net expense ratio2 | |

Class A | ||||

Actual | $1,000.00 | $1,000.06 | $5.19 | 1.04 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.75 | $5.24 | 1.04 % |

Class C | ||||

Actual | $1,000.00 | $1,000.01 | $8.93 | 1.79 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,016.01 | $9.00 | 1.79 % |

Class R | ||||

Actual | $1,000.00 | $1,000.05 | $6.43 | 1.29 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,018.50 | $6.49 | 1.29 % |

Administrator Class | ||||

Actual | $1,000.00 | $1,000.07 | $4.29 | 0.86 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,020.64 | $4.33 | 0.86 % |

Institutional Class | ||||

Actual | $1,000.00 | $1,000.08 | $3.54 | 0.71 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.39 | $3.58 | 0.71 % |

Shares | Value | |||||

Investment companies: 99.14% | ||||||

Affiliated master portfolios: 76.05% | ||||||

Allspring C&B Large Cap Value Portfolio | $44,382,560 | |||||

Allspring Core Bond Portfolio | 81,323,807 | |||||

Allspring Disciplined International Developed Markets Portfolio | 110,037,004 | |||||

Allspring Diversified Large Cap Growth Portfolio | 145,527,744 | |||||

Allspring Emerging Growth Portfolio | 14,178,374 | |||||

Allspring Factor Enhanced Emerging Markets Equity Portfolio | 17,058,202 | |||||

Allspring Factor Enhanced International Equity Portfolio | 40,700,105 | |||||

Allspring Large Company Value Portfolio | 148,899,874 | |||||

Allspring Managed Fixed Income Portfolio | 290,030,242 | |||||

Allspring Real Return Portfolio | 45,059,059 | |||||

Allspring Small Company Growth Portfolio | 14,465,011 | |||||

Allspring Small Company Value Portfolio | 33,943,623 | |||||

985,605,605 | ||||||

Exchange-traded funds: 6.62% | ||||||

iShares Core MSCI EAFE ETF | 760,397 | 50,209,014 | ||||

iShares iBoxx High Yield Corporate Bond ETF | 480,729 | 35,626,826 | ||||

85,835,840 | ||||||

Stock funds: 16.47% | ||||||

Allspring Disciplined U.S. Core Fund Class R6♠ | 9,565,794 | 179,645,604 | ||||

Allspring Emerging Markets Equity Fund Class R6♠ | 710,851 | 16,968,005 | ||||

Allspring Emerging Markets Equity Income Fund Class R6♠ | 1,670,152 | 16,835,136 | ||||

213,448,745 | ||||||

Total investment companies (Cost $1,242,655,262) | 1,284,890,190 | |||||

Total investments in securities (Cost $1,242,655,262) | 99.14 % | 1,284,890,190 | ||||

Other assets and liabilities, net | 0.86 | 11,209,438 | ||||

Total net assets | 100.00 % | $1,296,099,628 | ||||

♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) on affiliated Underlying Funds | Net change in unrealized gains (losses) on affiliated Underlying Funds | Value, end of period | |

Investment companies | ||||||

Allspring Disciplined U.S. Core Fund Class R6 | $211,238,729 | $24,836,722 | $(35,322,762 ) | $(7,065,914 ) | $(14,041,171 ) | $179,645,604 |

Allspring Emerging Markets Equity Fund Class R6 | 19,242,347 | 1,718,321 | (2,715,595 ) | (285,994 ) | (991,074 ) | 16,968,005 |

Allspring Emerging Markets Equity Income Fund Class R6 | 21,014,247 | 982,899 | (2,681,684 ) | (174,098 ) | (2,306,228 ) | 16,835,136 |

$(7,526,006 ) | $(17,338,473 ) | $213,448,745 |

Shares, end of period | Dividends from affiliated Underlying Funds | Net realized gains on capital gain distributions from affiliated Underlying Funds | |

Investment companies | |||

Allspring Disciplined U.S. Core Fund Class R6 | 9,565,794 | $2,588,623 | $20,934,054 |

Allspring Emerging Markets Equity Fund Class R6 | 710,851 | 230,112 | 0 |

Allspring Emerging Markets Equity Income Fund Class R6 | 1,670,152 | 571,632 | 0 |

$3,390,367 | $20,934,054 |

% of ownership, beginning of period | % of ownership, end of period | Net realized gains (losses) on investments allocated from affiliated Master Portfolios | Net change in unrealized gains (losses) on investments allocated from affiliated Master Portfolios | Interest allocated from affiliated Master Portfolios | Dividends allocated from affiliated Master Portfolios | Affiliated Income Allocated from affiliated Master Portfolios | Value, end of period | |

Allspring C&B Large Cap Value Portfolio | 16.61 % | 17.53 % | $4,233,534 | $(7,086,441 ) | $1,125 | $1,067,976 | $31,098 | $44,382,560 |

Allspring Core Bond Portfolio | 1.96 | 1.74 | (6,191,912 ) | 1,548,543 | 2,867,207 | 0 | 71,118 | 81,323,807 |

Allspring Disciplined International Developed Markets Portfolio | 86.56 | 85.71 | (3,195,187 ) | 2,888,699 | 2,325 | 3,713,986 | 75,097 | 110,037,004 |

Allspring Diversified Large Cap Growth Portfolio | 84.39 | 83.71 | 8,551,480 | (1,507,539 ) | 3,598 | 1,556,113 | 64,836 | 145,527,744 |

Allspring Emerging Growth Portfolio | 3.85 | 4.37 | 898,357 | (912,590 ) | 348 | 34,578 | 13,968 | 14,178,374 |

Allspring Factor Enhanced Emerging Markets Equity Portfolio | 15.23 | 16.43 | (2,228,382 ) | 172,106 | 430 | 687,737 | 21,682 | 17,058,202 |

Allspring Factor Enhanced International Equity Portfolio | 9.49 | 9.71 | (3,196,449 ) | 2,124,540 | 0 | 1,376,116 | 39,673 | 40,700,105 |

Allspring Large Company Value Portfolio | 84.92 | 84.18 | (8,754,890 ) | (6,094,349 ) | 4,183 | 3,713,014 | 124,020 | 148,899,874 |

Allspring Managed Fixed Income Portfolio | 81.56 | 81.08 | (5,434,635 ) | (10,507,909 ) | 11,151,001 | 0 | 116,721 | 290,030,242 |

Allspring Real Return Portfolio | 22.84 | 21.28 | 360,620 | (4,050,399 ) | 2,164,760 | 166,494 | 16,474 | 45,059,059 |

Allspring Small Company Growth Portfolio | 2.03 | 2.02 | 533,479 | (343,309 ) | 361 | 62,503 | 14,646 | 14,465,011 |

Allspring Small Company Value Portfolio | 7.28 | 6.72 | (256,414 ) | (3,904,040 ) | 837 | 676,832 | 35,490 | 33,943,623 |

$(14,680,399 ) | $(27,672,688 ) | $16,196,175 | $13,055,349 | $624,823 | $985,605,605 |

Description | Number of contracts | Expiration date | Notional cost | Notional value | Unrealized gains | Unrealized losses |

Long | ||||||

10-Year Euro BUND Index | 241 | 6-8-2023 | $34,574,976 | $35,047,154 | $472,178 | $0 |

TOPIX | 218 | 6-8-2023 | 32,387,737 | 33,265,243 | 877,506 | 0 |

E-Mini NASDAQ 100 Index | 177 | 6-16-2023 | 43,454,607 | 50,623,770 | 7,169,163 | 0 |

E-Mini Russell 1000 Growth Index | 222 | 6-16-2023 | 27,590,138 | 28,876,650 | 1,286,512 | 0 |

Description | Number of contracts | Expiration date | Notional cost | Notional value | Unrealized gains | Unrealized losses |

Long (continued) | ||||||

Japanese Yen Futures | 550 | 6-16-2023 | $51,568,979 | $49,500,000 | $0 | $(2,068,979 ) |

10-Year U.S. Treasury Notes | 601 | 9-20-2023 | 68,632,504 | 68,795,719 | 163,215 | 0 |

Short | ||||||

2-Year Euro SCHATZ | (1,341 ) | 6-8-2023 | (150,916,226 ) | (151,395,203 ) | 0 | (478,977 ) |

E-Mini Russell 1000 Value Index | (357 ) | 6-16-2023 | (27,329,849 ) | (26,121,690 ) | 1,208,159 | 0 |

E-Mini S&P 500 Index | (222 ) | 6-16-2023 | (43,559,254 ) | (46,514,550 ) | 0 | (2,955,296 ) |

Euro STOXX 50 Index | (693 ) | 6-16-2023 | (32,044,044 ) | (31,237,338 ) | 806,706 | 0 |

$11,983,439 | $(5,503,252 ) |

Assets | |

Investments in affiliated Master Portfolio, at value (cost $952,202,035) | $985,605,605 |

Investments in unaffiliated securities, at value (cost $92,664,247) | 85,835,840 |

Investments in affiliated Underlying Funds, at value (cost $197,788,980) | 213,448,745 |

Cash | 1,103,459 |

Cash at broker segregated for futures contracts | 11,359,102 |

Receivable for daily variation margin on open futures contracts | 1,694,104 |

Receivable for Fund shares sold | 45,277 |

Prepaid expenses and other assets | 63,282 |

Total assets | 1,299,155,414 |

Liabilities | |

Payable for daily variation margin on open futures contracts | 1,280,468 |

Payable for Fund shares redeemed | 745,206 |

Management fee payable | 416,748 |

Shareholder servicing fees payable | 241,678 |

Administration fees payable | 220,926 |

Distribution fees payable | 12,555 |

Trustees’ fees and expenses payable | 1,711 |

Accrued expenses and other liabilities | 136,494 |

Total liabilities | 3,055,786 |

Total net assets | $1,296,099,628 |

Net assets consist of | |

Paid-in capital | $1,298,666,201 |

Total distributable loss | (2,566,573 ) |

Total net assets | $1,296,099,628 |

Computation of net asset value and offering price per share | |

Net assets–Class A | $1,095,066,167 |

Shares outstanding–Class A1 | 87,359,482 |

Net asset value per share–Class A | $12.54 |

Maximum offering price per share – Class A2 | $13.31 |

Net assets–Class C | $18,773,752 |

Shares outstanding–Class C1 | 1,482,524 |

Net asset value per share–Class C | $12.66 |

Net assets–Class R | $2,222,515 |

Shares outstanding–Class R1 | 177,724 |

Net asset value per share–Class R | $12.51 |

Net assets–Administrator Class | $12,949,418 |

Shares outstanding–Administrator Class1 | 998,481 |

Net asset value per share–Administrator Class | $12.97 |

Net assets–Institutional Class | $167,087,776 |

Shares outstanding–Institutional Class1 | 13,296,716 |

Net asset value per share–Institutional Class | $12.57 |

1 | The Fund has an unlimited number of authorized shares. |

2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

Investment income | |

Interest allocated from affiliated Master Portfolios | $16,196,175 |

Dividends allocated from affiliated Master Portfolios (net of foreign withholding taxes of $792,352) | 13,055,349 |

Dividends from affiliated Underlying Funds | 3,390,367 |

Dividends from unaffiliated securities | 2,831,731 |

Affiliated income allocated from affiliated Master Portfolios | 624,823 |

Interest | 178,042 |

Expenses allocated from affiliated Master Portfolios | (5,387,349 ) |

Waivers allocated from affiliated Master Portfolios | 621,670 |

Total investment income | 31,510,808 |

Expenses | |

Management fee | 3,877,758 |

Administration fees | |

Class A | 2,413,958 |

Class C | 49,327 |

Class R | 4,773 |

Administrator Class | 19,707 |

Institutional Class | 241,327 |

Shareholder servicing fees | |

Class A | 2,869,585 |

Class C | 58,443 |

Class R | 5,548 |

Administrator Class | 37,522 |

Distribution fees | |

Class C | 174,713 |

Class R | 5,414 |

Custody and accounting fees | 38,379 |

Professional fees | 21,301 |

Registration fees | 74,577 |

Shareholder report expenses | 76,106 |

Trustees’ fees and expenses | 21,213 |

Other fees and expenses | 21,600 |

Total expenses | 10,011,251 |

Less: Fee waivers and/or expense reimbursements | |

Fund-level | (688,020 ) |

Class A | (192,135 ) |

Class C | (2,001 ) |

Administrator Class | (17,337 ) |

Institutional Class | (30,853 ) |

Net expenses | 9,080,905 |

Net investment income | 22,429,903 |

Realized and unrealized gains (losses) on investments | |

Net realized gains (losses) on | |

Investments allocated from affiliated Master Portfolios | $(14,680,399 ) |

Unaffiliated securities | (8,776,157 ) |

Affiliated securities | (7,526,006 ) |

Foreign currency and foreign currency translations | (33,635 ) |

Futures contracts | (9,923,487 ) |

Capital gain distributions from affiliated Underlying Funds | 20,934,054 |

Net realized losses on investments | (20,005,630 ) |

Net change in unrealized gains (losses) on | |

Investments allocated from affiliated Master Portfolios | (27,672,688 ) |

Affiliated Underlying Funds | (17,338,473 ) |

Unaffiliated securities | 6,805,373 |

Foreign currency and foreign currency translations | (1,883 ) |

Futures contracts | 6,282,467 |

Net change in unrealized gains (losses) on investments | (31,925,204 ) |

Net realized and unrealized gains (losses) on investments | (51,930,834 ) |

Net decrease in net assets resulting from operations | $(29,500,931 ) |

Year ended May 31, 2023 | Year ended May 31, 2022 | |||

Operations | ||||

Net investment income | $22,429,903 | $21,071,267 | ||

Net realized gains (losses) on investments | (20,005,630 ) | 83,811,245 | ||

Net change in unrealized gains (losses) on investments | (31,925,204 ) | (226,564,977 ) | ||

Net decrease in net assets resulting from operations | (29,500,931 ) | (121,682,465 ) | ||

Distributions to shareholders from | ||||

Net investment income and net realized gains | ||||

Class A | (59,268,484 ) | (202,891,728 ) | ||

Class C | (417,954 ) | (5,423,558 ) | ||

Class R | (104,644 ) | (467,417 ) | ||

Administrator Class | (824,492 ) | (3,106,447 ) | ||

Institutional Class | (9,997,099 ) | (36,625,295 ) | ||

Tax basis return of capital | ||||

Class A | (10,824,660 ) | 0 | ||

Class C | (221,191 ) | 0 | ||

Class R | (21,404 ) | 0 | ||

Administrator Class | (142,749 ) | 0 | ||

Institutional Class | (1,748,098 ) | 0 | ||

Total distributions to shareholders | (83,570,775 ) | (248,514,445 ) | ||

Capital share transactions | Shares | Shares | ||

Proceeds from shares sold | ||||

Class A | 1,813,537 | 23,018,937 | 2,611,398 | 40,863,057 |

Class C | 124,931 | 1,564,255 | 182,136 | 2,833,723 |

Class R | 22,912 | 291,574 | 12,849 | 202,101 |

Administrator Class | 26,450 | 347,283 | 52,285 | 846,945 |

Institutional Class | 1,188,690 | 15,093,300 | 1,834,135 | 29,224,220 |

40,315,349 | 73,970,046 | |||

Reinvestment of distributions | ||||

Class A | 5,117,002 | 63,358,699 | 12,001,744 | 182,452,406 |

Class C | 49,303 | 621,218 | 357,553 | 5,298,942 |

Class R | 9,646 | 119,256 | 29,730 | 449,906 |

Administrator Class | 68,903 | 881,772 | 183,747 | 2,863,149 |

Institutional Class | 736,589 | 9,131,361 | 1,858,632 | 28,382,924 |

74,112,306 | 219,447,327 | |||

Shares | Shares | |||

Payment for shares redeemed | ||||

Class A | (13,420,146 ) | $(169,645,607 ) | (12,061,446 ) | $(190,070,003 ) |

Class C | (1,018,638 ) | (12,896,313 ) | (1,380,131 ) | (21,542,495 ) |

Class R | (66,642 ) | (856,905 ) | (32,919 ) | (483,592 ) |

Administrator Class | (417,160 ) | (5,415,295 ) | (366,341 ) | (5,897,327 ) |

Institutional Class | (4,693,101 ) | (59,574,954 ) | (3,378,156 ) | (52,642,800 ) |

(248,389,074 ) | (270,636,217 ) | |||

Net increase (decrease) in net assets resulting from capital share transactions | (133,961,419 ) | 22,781,156 | ||

Total decrease in net assets | (247,033,125 ) | (347,415,754 ) | ||

Net assets | ||||

Beginning of period | 1,543,132,753 | 1,890,548,507 | ||

End of period | $1,296,099,628 | $1,543,132,753 | ||

(For a share outstanding throughout each period)

Year ended May 31 | Year ended April 30 | |||||

Class A | 2023 | 2022 | 2021 | 20201 | 2020 | 2019 |

Net asset value, beginning of period | $13.56 | $16.90 | $13.57 | $13.12 | $13.49 | $14.33 |

Net investment income | 0.20 2 | 0.18 2 | 0.18 2 | 0.02 | 0.21 2 | 0.15 2 |

Payment from affiliate | 0.00 | 0.00 | 0.00 3 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.43 ) | (1.20 ) | 3.75 | 0.43 | (0.36 ) | 0.04 |

Total from investment operations | (0.23 ) | (1.02 ) | 3.93 | 0.45 | (0.15 ) | 0.19 |

Distributions to shareholders from | ||||||

Net investment income | (0.30 ) | (0.18 ) | (0.41 ) | 0.00 | (0.06 ) | (0.06 ) |

Net realized gains | (0.37 ) | (2.14 ) | (0.19 ) | 0.00 | (0.16 ) | (0.97 ) |

Tax basis return of capital | (0.12 ) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders | (0.79 ) | (2.32 ) | (0.60 ) | 0.00 | (0.22 ) | (1.03 ) |

Net asset value, end of period | $12.54 | $13.56 | $16.90 | $13.57 | $13.12 | $13.49 |

Total return4 | (1.54 )% | (7.42 )% | 29.45 %5 | 3.43 % | (1.26 )% | 1.96 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 1.11 %* | 1.09 %* | 1.14 %* | 1.21 %* | 1.22 %* | 1.18 %*,6 |

Net expenses | 1.04 %* | 1.04 %* | 1.04 %* | 1.05 %* | 1.05 %* | 1.04 %*,6 |

Net investment income | 1.60 %* | 1.15 %* | 1.19 %* | 1.22 %* | 1.54 %* | 1.08 %*,6 |

Supplemental data | ||||||

Portfolio turnover rate7 | 106 % | 111 % | 137 % | 13 % | 109 % | 189 % |

Net assets, end of period (000s omitted) | $1,095,066 | $1,272,420 | $1,542,707 | $1,287,856 | $1,253,699 | $1,472,484 |

* | Ratios include only the net expenses allocated from the affiliated Master Portfolios and do not include expenses from any other affiliated Underlying Funds. Net expenses allocated from the affiliated Master Portfolios included in the ratios were as follows: |

Year ended May 31, 2023 | 0.35% |

Year ended May 31, 2022 | 0.34% |

Year ended May 31, 2021 | 0.38% |

Year ended May 31, 20201 | 0.45% |

Year ended April 30, 2020 | 0.45% |

Year ended April 30, 2019 | 0.40% |

1 | For the one month ended May 31, 2020. The Fund changed its fiscal year end from April 30 to May 31, effective May 31, 2020. |

2 | Calculated based upon average shares outstanding |

3 | Amount is less than $0.005. |

4 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

5 | For year ended May 31, 2021, the Fund received a payment from an affiliate that had an impact of less than 0.005% on total return. |

6 | Ratios did not include any expenses from Asset Allocation Trust or its investments in underlying funds. Asset Allocation Trust did not have any net expenses. |

7 | Portfolio turnover rate is calculated by multiplying the Fund’s ownership percentage in the respective affiliated Master Portfolio by the corresponding affiliated Master Portfolio’s purchases and sales. These purchases and sales amounts are aggregated with the direct purchases and sales in the affiliated Underlying Funds and unaffiliated securities and included in the portfolio turnover calculation. |

(For a share outstanding throughout each period)

Year ended May 31 | Year ended April 30 | |||||

Class C | 2023 | 2022 | 2021 | 20201 | 2020 | 2019 |

Net asset value, beginning of period | $13.34 | $16.60 | $13.01 | $12.58 | $12.99 | $13.87 |

Net investment income | 0.11 2 | 0.06 2 | 0.06 2 | 0.01 2 | 0.11 2 | 0.03 2 |

Payment from affiliate | 0.00 | 0.00 | 0.17 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.42 ) | (1.18 ) | 3.54 | 0.42 | (0.36 ) | 0.06 |

Total from investment operations | (0.31 ) | (1.12 ) | 3.77 | 0.43 | (0.25 ) | 0.09 |

Distributions to shareholders from | ||||||

Net realized gains | (0.25 ) | (2.14 ) | (0.18 ) | 0.00 | (0.16 ) | (0.97 ) |

Tax basis return of capital | (0.12 ) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders | (0.37 ) | (2.14 ) | (0.18 ) | 0.00 | (0.16 ) | (0.97 ) |

Net asset value, end of period | $12.66 | $13.34 | $16.60 | $13.01 | $12.58 | $12.99 |

Total return3 | (2.34 )% | (8.08 )% | 29.19 %4 | 3.42 % | (2.02 )% | 1.21 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 1.85 %* | 1.83 %* | 1.89 %* | 1.96 %* | 1.97 %* | 1.92 %*,5 |

Net expenses | 1.79 %* | 1.78 %* | 1.79 %* | 1.79 %* | 1.80 %* | 1.78 %*,5 |

Net investment income | 0.83 %* | 0.38 %* | 0.43 %* | 0.47 %* | 0.82 %* | 0.23 %*,5 |

Supplemental data | ||||||

Portfolio turnover rate6 | 106 % | 111 % | 137 % | 13 % | 109 % | 189 % |

Net assets, end of period (000s omitted) | $18,774 | $31,038 | $52,586 | $118,081 | $120,029 | $237,096 |

* | Ratios include only the net expenses allocated from the affiliated Master Portfolios and do not include expenses from any other affiliated Underlying Funds. Net expenses allocated from the affiliated Master Portfolios included in the ratios were as follows: |

Year ended May 31, 2023 | 0.35% |

Year ended May 31, 2022 | 0.34% |

Year ended May 31, 2021 | 0.39% |

Year ended May 31, 20201 | 0.44% |

Year ended April 30, 2020 | 0.45% |

Year ended April 30, 2019 | 0.38% |

1 | For the one month ended May 31, 2020. The Fund changed its fiscal year end from April 30 to May 31, effective May 31, 2020. |

2 | Calculated based upon average shares outstanding |

3 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

4 | For year ended May 31, 2021, the Fund received a payment from an affiliate which had a 1.29% impact on the total return. |

5 | Ratios did not include any expenses from Asset Allocation Trust or its investments in underlying funds. Asset Allocation Trust did not have any net expenses. |

6 | Portfolio turnover rate is calculated by multiplying the Fund’s ownership percentage in the respective affiliated Master Portfolio by the corresponding affiliated Master Portfolio’s purchases and sales. These purchases and sales amounts are aggregated with the direct purchases and sales in the affiliated Underlying Funds and unaffiliated securities and included in the portfolio turnover calculation. |

(For a share outstanding throughout each period)

Year ended May 31 | Year ended April 30 | |||||

Class R | 2023 | 2022 | 2021 | 20201 | 2020 | 2019 |

Net asset value, beginning of period | $13.52 | $16.86 | $13.47 | $13.02 | $13.37 | $14.20 |

Net investment income | 0.17 2 | 0.14 2 | 0.14 2 | 0.01 2 | 0.18 2 | 0.11 2 |

Payment from affiliate | 0.00 | 0.00 | 0.07 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.44 ) | (1.19 ) | 3.71 | 0.44 | (0.37 ) | 0.05 |

Total from investment operations | (0.27 ) | (1.05 ) | 3.92 | 0.45 | 0.19 | 0.16 |

Distributions to shareholders from | ||||||

Net investment income | (0.25 ) | (0.15 ) | (0.34 ) | 0.00 | 0.00 | (0.02 ) |

Net realized gains | (0.37 ) | (2.14 ) | (0.19 ) | 0.00 | (0.16 ) | (0.97 ) |

Tax basis return of capital | (0.12 ) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders | (0.74 ) | (2.29 ) | (0.53 ) | 0.00 | (0.16 ) | (0.99 ) |

Net asset value, end of period | $12.51 | $13.52 | $16.86 | $13.47 | $13.02 | $13.37 |

Total return3 | (1.81 )% | (7.57 )% | 29.44 %4 | 3.46 % | (1.51 )% | 1.73 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 1.34 %* | 1.33 %* | 1.37 %* | 1.44 %* | 1.47 %* | 1.42 %*,5 |

Net expenses | 1.29 %* | 1.28 %* | 1.28 %* | 1.27 %* | 1.30 %* | 1.29 %*,5 |

Net investment income | 1.36 %* | 0.91 %* | 0.95 %* | 0.99 %* | 1.32 %* | 0.77 %*,5 |

Supplemental data | ||||||

Portfolio turnover rate6 | 106 % | 111 % | 137 % | 13 % | 109 % | 189 % |

Net assets, end of period (000s omitted) | $2,223 | $2,863 | $3,407 | $4,318 | $4,106 | $7,619 |

* | Ratios include only the net expenses allocated from the affiliated Master Portfolios and do not include expenses from any other affiliated Underlying Funds. Net expenses allocated from the affiliated Master Portfolios included in the ratios were as follows: |

Year ended May 31, 2023 | 0.35% |

Year ended May 31, 2022 | 0.34% |

Year ended May 31, 2021 | 0.38% |

Year ended May 31, 20201 | 0.45% |

Year ended April 30, 2020 | 0.45% |

Year ended April 30, 2019 | 0.39% |

1 | For the one month ended May 31, 2020. The Fund changed its fiscal year end from April 30 to May 31, effective May 31, 2020. |

2 | Calculated based upon average shares outstanding |

3 | Returns for periods of less than one year are not annualized. |

4 | For year ended May 31, 2021, the Fund received a payment from an affiliate which had a 0.51% impact on the total return. |

5 | Ratios did not include any expenses from Asset Allocation Trust or its investments in underlying funds. Asset Allocation Trust did not have any net expenses. |

6 | Portfolio turnover rate is calculated by multiplying the Fund’s ownership percentage in the respective affiliated Master Portfolio by the corresponding affiliated Master Portfolio’s purchases and sales. These purchases and sales amounts are aggregated with the direct purchases and sales in the affiliated Underlying Funds and unaffiliated securities and included in the portfolio turnover calculation. |

(For a share outstanding throughout each period)

Year ended May 31 | Year ended April 30 | |||||

Administrator Class | 2023 | 2022 | 2021 | 20201 | 2020 | 2019 |

Net asset value, beginning of period | $13.89 | $17.25 | $13.75 | $13.29 | $13.66 | $14.49 |

Net investment income | 0.23 2 | 0.21 2 | 0.21 2 | 0.02 2 | 0.24 2 | 0.16 2 |

Payment from affiliate | 0.00 | 0.00 | 0.12 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.31 ) | (1.22 ) | 3.81 | 0.44 | (0.37 ) | 0.06 |

Total from investment operations | (0.08 ) | (1.01 ) | 4.14 | 0.46 | (0.13 ) | 0.22 |

Distributions to shareholders from | ||||||

Net investment income | (0.33 ) | (0.21 ) | (0.45 ) | 0.00 | (0.08 ) | (0.08 ) |

Net realized gains | (0.39 ) | (2.14 ) | (0.19 ) | 0.00 | (0.16 ) | (0.97 ) |

Tax basis return of capital | (0.12 ) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders | (0.84 ) | (2.35 ) | (0.64 ) | 0.00 | (0.24 ) | (1.05 ) |

Net asset value, end of period | $12.97 | $13.89 | $17.25 | $13.75 | $13.29 | $13.66 |

Total return3 | (0.39 )%4 | (7.21 )% | 30.62 %5 | 3.46 % | (1.08 )% | 2.18 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 1.02 %* | 1.01 %* | 1.06 %* | 1.13 %* | 1.14 %* | 1.08 %*,6 |

Net expenses | 0.86 %* | 0.86 %* | 0.87 %* | 0.86 %* | 0.86 %* | 0.86 %*,6 |

Net investment income | 1.78 %* | 1.32 %* | 1.36 %* | 1.40 %* | 1.74 %* | 1.17 %*,6 |

Supplemental data | ||||||

Portfolio turnover rate7 | 106 % | 111 % | 137 % | 13 % | 109 % | 189 % |

Net assets, end of period (000s omitted) | $12,949 | $18,332 | $25,026 | $21,628 | $21,316 | $31,610 |

* | Ratios include only the net expenses allocated from the affiliated Master Portfolios and do not include expenses from any other affiliated Underlying Funds. Net expenses allocated from the affiliated Master Portfolios included in the ratios were as follows: |

Year ended May 31, 2023 | 0.35% |

Year ended May 31, 2022 | 0.34% |

Year ended May 31, 2021 | 0.38% |

Year ended May 31, 20201 | 0.45% |

Year ended April 30, 2020 | 0.44% |

Year ended April 30, 2019 | 0.38% |

1 | For the one month ended May 31, 2020. The Fund changed its fiscal year end from April 30 to May 31, effective May 31, 2020. |

2 | Calculated based upon average shares outstanding |

3 | Returns for periods of less than one year are not annualized. |

4 | During the year ended May 31, 2023, the Fund received payments from a service provider which had a 1.28% impact on the total return. |

5 | For year ended May 31, 2021, the Fund received a payment from an affiliate which had a 0.90% impact on the total return. |

6 | Ratios did not include any expenses from Asset Allocation Trust or its investments in underlying funds. Asset Allocation Trust did not have any net expenses. |

7 | Portfolio turnover rate is calculated by multiplying the Fund’s ownership percentage in the respective affiliated Master Portfolio by the corresponding affiliated Master Portfolio’s purchases and sales. These purchases and sales amounts are aggregated with the direct purchases and sales in the affiliated Underlying Funds and unaffiliated securities and included in the portfolio turnover calculation. |

(For a share outstanding throughout each period)

Year ended May 31 | Year ended April 30 | |||||

Institutional Class | 2023 | 2022 | 2021 | 20201 | 2020 | 2019 |

Net asset value, beginning of period | $13.60 | $16.94 | $13.61 | $13.14 | $13.52 | $14.36 |

Net investment income | 0.25 2 | 0.24 2 | 0.24 | 0.02 2 | 0.26 2 | 0.19 2 |

Net realized and unrealized gains (losses) on investments | (0.44 ) | (1.20 ) | 3.74 | 0.45 | (0.38 ) | 0.05 |

Total from investment operations | (0.19 ) | (0.96 ) | 3.98 | 0.47 | (0.12 ) | 0.24 |

Distributions to shareholders from | ||||||

Net investment income | (0.35 ) | (0.24 ) | (0.46 ) | 0.00 | (0.10 ) | (0.11 ) |

Net realized gains | (0.37 ) | (2.14 ) | (0.19 ) | 0.00 | (0.16 ) | 0.97 |

Tax basis return of capital | (0.12 ) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders | (0.84 ) | (2.38 ) | (0.65 ) | 0.00 | (0.26 ) | (1.08 ) |

Net asset value, end of period | $12.57 | $13.60 | $16.94 | $13.61 | $13.14 | $13.52 |

Total return3 | (1.21 )% | (7.10 )% | 29.76 % | 3.58 % | (1.01 )% | 2.39 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 0.78 %* | 0.76 %* | 0.81 %* | 0.88 %* | 0.89 %* | 0.84 %*,4 |

Net expenses | 0.71 %* | 0.71 %* | 0.71 %* | 0.72 %* | 0.72 %* | 0.69 %*,4 |

Net investment income | 1.92 %* | 1.48 %* | 1.52 %* | 1.55 %* | 1.88 %* | 1.34 %*,4 |

Supplemental data | ||||||

Portfolio turnover rate5 | 106 % | 111 % | 137 % | 13 % | 109 % | 189 % |

Net assets, end of period (000s omitted) | $167,088 | $218,479 | $266,822 | $231,652 | $227,529 | $311,958 |

* | Ratios include only the net expenses allocated from the affiliated Master Portfolios and do not include expenses from any other affiliated Underlying Funds. Net expenses allocated from the affiliated Master Portfolios included in the ratios were as follows: |

Year ended May 31, 2023 | 0.35% |

Year ended May 31, 2022 | 0.34% |

Year ended May 31, 2021 | 0.38% |

Year ended May 31, 20201 | 0.45% |

Year ended April 30, 2020 | 0.45% |

Year ended April 30, 2019 | 0.38% |

1 | For the one month ended May 31, 2020. The Fund changed its fiscal year end from April 30 to May 31, effective May 31, 2020. |

2 | Calculated based upon average shares outstanding |

3 | Returns for periods of less than one year are not annualized. |

4 | Ratios did not include any expenses from Asset Allocation Trust or its investments in underlying funds. Asset Allocation Trust did not have any net expenses. |

5 | Portfolio turnover rate is calculated by multiplying the Fund’s ownership percentage in the respective affiliated Master Portfolio by the corresponding affiliated Master Portfolio’s purchases and sales. These purchases and sales amounts are aggregated with the direct purchases and sales in the affiliated Underlying Funds and unaffiliated securities and included in the portfolio turnover calculation. |

Gross unrealized gains | $49,940,846 |

Gross unrealized losses | (23,097,446 ) |

Net unrealized gains | $26,843,400 |

Paid-in capital | Total distributable loss |

$(7,538 ) | $7,538 |

Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

Assets | ||||

Investments in: | ||||

Investment companies | $299,284,585 | $0 | $0 | $299,284,585 |

Investments measured at net asset value* | 985,605,605 | |||

299,284,585 | 0 | 0 | 1,284,890,190 | |

Futures contracts | 11,983,439 | 0 | 0 | 11,983,439 |

Total assets | $311,268,024 | $0 | $0 | $1,296,873,629 |

Liabilities | ||||

Futures contracts | $5,503,252 | $0 | $0 | $5,503,252 |

Total liabilities | $5,503,252 | $0 | $0 | $5,503,252 |

* | Investments that are measured at fair value using the net asset value per share (or its equivalent) as a practical expedient have not been categorized in the fair value hierarchy. The fair value amount presented in the table is intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. The Fund’s investments in the affiliated Master Portfolios are valued at $985,605,605. Each affiliated Master Portfolio does not have a redemption period notice, can be redeemed daily and does not have any unfunded commitments. |

Affiliated Master Portfolio | Investment objective |

Allspring C&B Large Cap Value Portfolio | Seeks maximum long-term total return (current income and capital appreciation), consistent with minimizing risk to principal |

Allspring Core Bond Portfolio | Seeks total return, consisting of income and capital appreciation |

Allspring Disciplined International Developed Markets Portfolio | Seeks long-term capital appreciation |

Allspring Diversified Large Cap Growth Portfolio | Seeks long-term capital appreciation |

Allspring Emerging Growth Portfolio | Seeks long-term capital appreciation |

Allspring Factor Enhanced Emerging Markets Equity Portfolio | Seeks long-term capital appreciation |

Allspring Factor Enhanced International Equity Portfolio | Seeks long-term capital appreciation |

Allspring Large Company Value Portfolio | Seeks long-term capital appreciation |

Allspring Managed Fixed Income Portfolio | Seeks consistent fixed-income returns |

Allspring Real Return Portfolio | Seeks returns that exceed the rate of inflation over the long-term |

Allspring Small Company Growth Portfolio | Seeks long-term capital appreciation |

Allspring Small Company Value Portfolio | Seeks long-term capital appreciation |

Average daily net assets | Management fee |

First $500 million | 0.300 % |

Next $500 million | 0.280 |

Next $2 billion | 0.260 |

Next $2 billion | 0.240 |

Next $5 billion | 0.230 |

Over $10 billion | 0.220 |

Class-level administration fee | |

Class A | 0.21 % |

Class C | 0.21 |

Class R | 0.21 |

Administrator Class | 0.13 |

Institutional Class | 0.13 |

EXPENSE RATIO CAPS | |

Class A | 1.13 % |

Class C | 1.88 |

Class R | 1.38 |

Administrator Class | 0.95 |

Institutional Class | 0.80 |

Purchases at cost | Sales proceeds | ||

U.S. government | Non-U.S. government | U.S. government | Non-U.S. government |

$257,512,113 | $1,170,878,198 | $261,898,706 | $1,300,949,694 |

Interest rate risk | Equity risk | Foreign currency risk | Total | |

Asset derivatives | ||||

Futures contracts | $635,393 * | $11,348,046 * | $0 * | $11,983,439 |

Liability derivatives | ||||

Futures contracts | $478,977 * | $2,955,296 * | $2,068,979 * | $5,503,252 |

* | Amount represents the cumulative unrealized gains (losses) as reported in the table following the Portfolio of Investments. For futures contracts, only the current day’s variation margin as of May 31, 2023 is reported separately on the Statement of Assets and Liabilities. |

Interest rate risk | Equity risk | Foreign currency risk | Total | |

Net realized gains (losses) on derivatives | ||||

Futures contracts | $(145,110 ) | $(3,851,601 ) | $(5,926,776 ) | $(9,923,487 ) |

Net change in unrealized gains (losses) on derivatives | ||||

Futures contracts | $108,058 | $8,630,221 | $(2,455,812 ) | $6,282,467 |

Year ended May 31 | ||

2023 | 2022 | |

Ordinary income | $31,441,236 | $145,194,955 |

Long-term capital gain | 39,171,437 | 103,319,490 |

Tax basis return of capital | 12,958,102 | 0 |

Unrealized gains | Capital loss carryforward |

$26,843,400 | $(29,344,768 ) |

Allspring Funds Trust:

Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Foundation (non-profit organization). Mr. Ebsworth is a CFA charterholder. | N/A |

Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

Isaiah Harris, Jr. (Born 1952) | Trustee, since 2009; Audit Committee Chair, since 2019 | Retired. Member of the Advisory Board of CEF of East Central Florida. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | N/A |

David F. Larcker (Born 1950) | Trustee, since 2009 | Distinguished Visiting Fellow at the Hoover Institution since 2022. James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

Olivia S. Mitchell (Born 1953) | Trustee, since 2006; Nominating and Governance Committee Chair, since 2018 | International Foundation of Employee Benefit Plans Professor since 1993, Wharton School of the University of Pennsylvania. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously taught at Cornell University from 1978 to 1993. | N/A |

Timothy J. Penny (Born 1951) | Trustee, since 1996; Chair, since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Vice Chair of the Economic Club of Minnesota, since 2007. Co-Chair of the Committee for a Responsible Federal Budget, since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, from 2007-2022. Senior Fellow of the University of Minnesota Humphrey Institute from 1995 to 2017. | N/A |

Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

James G. Polisson (Born 1959) | Trustee, since 2018 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non- profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

Pamela Wheelock (Born 1959) | Trustee, since January 2020; previously Trustee from January 2018 to July 2019 | Retired. Executive and Senior Financial leadership positions in the public, private and nonprofit sectors. Interim President and CEO, McKnight Foundation, 2020. Interim Commissioner, Minnesota Department of Human Services, 2019. Chief Operating Officer, Twin Cities Habitat for Humanity, 2017-2019. Vice President for University Services, University of Minnesota, 2012- 2016. Interim President and CEO, Blue Cross and Blue Shield of Minnesota, 2011-2012. Executive Vice-President and Chief Financial Officer, Minnesota Wild, 2002-2008. Commissioner, Minnesota Department of Finance, 1999-2002. Chair of the Board of Directors of Destination Medical Center Corporation. Board member of the Minnesota Wild Foundation. | N/A |

* | Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable. |

Name and year of birth | Position held and length of service | Principal occupations during past five years or longer |

Andrew Owen (Born 1960) | President, since 2017 | President and Chief Executive Officer of Allspring Funds Management, LLC since 2017 and Head of Global Fund Governance of Allspring Global Investments since 2022. Prior thereto, co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, from 2019 to 2022 and Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. |

Jeremy DePalma (Born 1974) | Treasurer, since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. |

Christopher Baker (Born 1976) | Chief Compliance Officer, since 2022 | Global Chief Compliance Officer for Allspring Global Investments since 2022. Prior thereto, Chief Compliance Officer for State Street Global Advisors from 2018 to 2021. Senior Compliance Officer for the State Street divisions of Alternative Investment Solutions, Sector Solutions, and Global Marketing from 2015 to 2018. From 2010 to 2015 Vice President, Global Head of Investment and Marketing Compliance for State Street Global Advisors. |

Matthew Prasse (Born 1983) | Chief Legal Officer, since 2022; Secretary, since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

The Board also received and considered information regarding the Fund’s net operating expense ratios and their various components, including actual management fees, custodian and other non-management fees, and Rule 12b-1 and non-Rule 12b-1 shareholder service fees. The Board considered these ratios in comparison to the median ratios of funds in class-specific expense groups that were determined by Broadridge to be similar to the Fund (the “Groups”). The Board received a description of the methodology used by Broadridge to select the mutual funds in the expense Groups and an explanation of how funds comprising expense groups and their expense ratios may vary from year-to-year. Based on the Broadridge reports, the Board noted that the net operating expense ratios of the Fund were lower than the median net operating expense ratios of the expense Groups for the Administrator Class, in range of the median net operating expense ratios of the expense Groups for the Institutional Class and higher than the median net operating expense ratios of the expense Groups for the Class R shares and the Class A shares. The Board noted that Allspring Funds Management had agreed to reduce the net operating expense caps for the Fund’s Class A shares.

The Board took into account the Fund’s investment performance and expense information provided to it among the factors considered in deciding to re-approve the Advisory Agreements.

The Board also received and considered information about the portion of the total management fee that was retained by Allspring Funds Management after payment of the fee to the Sub-Adviser for sub-advisory services. In assessing the reasonableness of this amount, the Board received and evaluated information about the nature and extent of responsibilities retained and risks assumed by Allspring Funds Management and not delegated to or assumed by the Sub-Adviser, and about Allspring Funds Management’s on-going oversight services. Given the affiliation between Allspring Funds Management and the Sub-Adviser, the Board ascribed limited relevance to the allocation of fees between them.

P.O. Box 219967

Kansas City, MO 64121-9967

AR4312 05-23

2 | |

6 | |

10 | |

11 | |

12 | |

13 | |

14 | |

15 | |

20 | |

24 | |

25 | |

29 | |

30 | |

31 | |

32 | |

33 | |

36 | |

37 |

Allspring Funds

President

Allspring Funds

Notice to Shareholders |

Beginning in July 2024, the Fund will be required by the Securities and Exchange Commission to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance information and fund statistics. If you wish to receive this new tailored shareholder report electronically, please follow the instructions on the back cover of this report. |

Other information that is currently included in the shareholder report, such as the Fund’s financial statements, will be available online and upon request, free of charge, in paper or electronic format. |

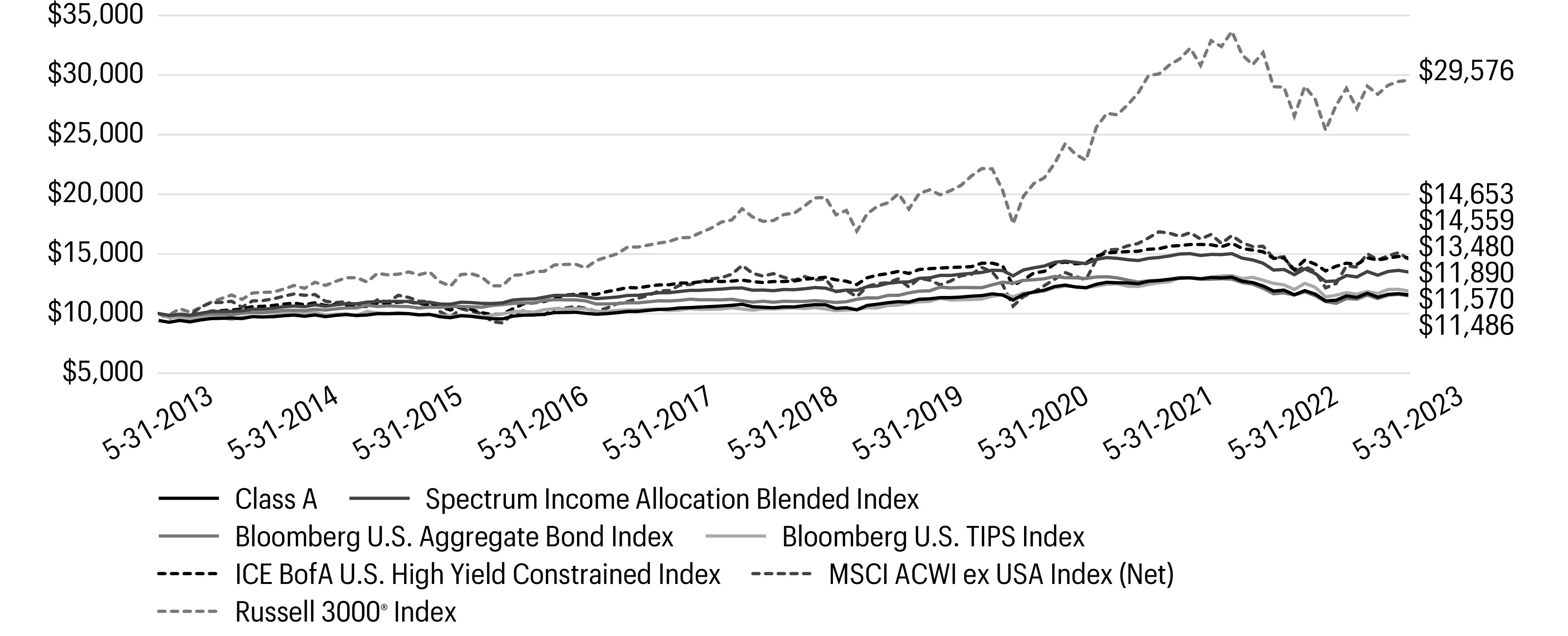

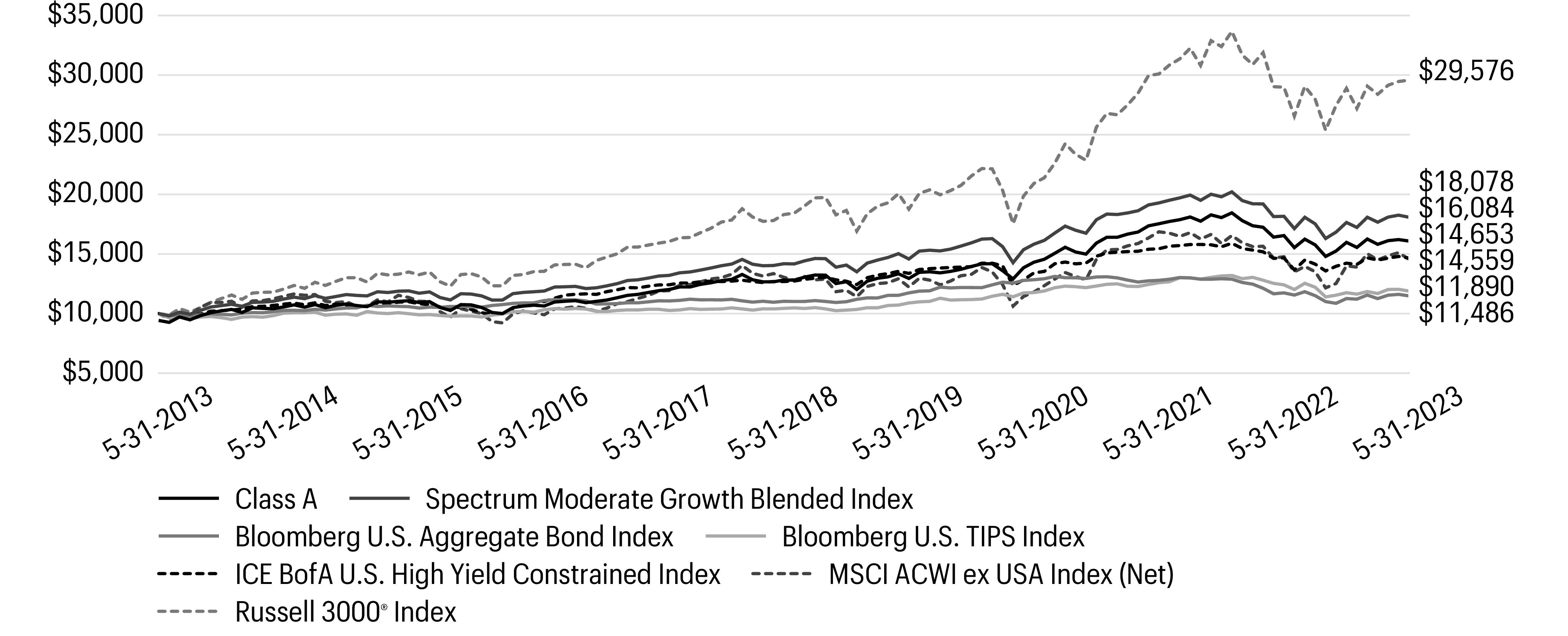

Investment objective | The Fund seeks maximum long-term total return (current income and capital appreciation), consistent with minimizing risk to principal. |

Manager | Allspring Funds Management, LLC |

Subadviser for the affiliated master portfolio* | Cooke & Bieler, L.P. |

Portfolio managers | Andrew B. Armstrong, CFA, Wesley Lim, CFA, Steve Lyons, CFA, Michael M. Meyer, CFA, Edward W. O’ Connor, CFA, R.James O’Neil, CFA, Mehul Trivedi, CFA, William Weber, CFA |

Average annual total returns (%) as of May 31, 2023 | |||||||||

Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||

Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net2 | |

Class A (CBEAX) | 7-26-2004 | -9.67 | 6.43 | 8.27 | -4.19 | 7.70 | 8.92 | 1.18 | 1.07 |

Class C (CBECX) | 7-26-2004 | -5.85 | 6.89 | 8.27 | -4.85 | 6.89 | 8.27 | 1.93 | 1.82 |

Class R6 (CBEJX)3 | 10-31-2016 | – | – | – | -3.75 | 8.16 | 9.34 | 0.76 | 0.65 |

Administrator Class (CBLLX) | 7-26-2004 | – | – | – | -4.18 | 7.77 | 9.04 | 1.11 | 1.00 |

Institutional Class (CBLSX) | 7-26-2004 | – | – | – | -3.92 | 8.03 | 9.30 | 0.86 | 0.75 |

Russell 1000® Value Index4 | – | – | – | – | -4.55 | 6.78 | 8.42 | – | – |

1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

2 | The manager has contractually committed through September 30, 2023 (September 30, 2024 for Class A and Class C), to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.07% for Class A, 1.82% for Class C, 0.65% for Class R6, 1.00% for Administrator Class and 0.75% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any) from funds in which the affiliated master portfolio invests, and extraordinary expenses are excluded from the expense caps. Net expenses from the affiliated master portfolio are included in the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

3 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

4 | The Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price/book ratios and lower forecasted growth values. You cannot invest directly in an index. |

* | The Fund is a feeder fund in a master-feeder structure that invests substantially all of its assets in a single affiliated master portfolio of the Allspring Master Trust with a substantially identical investment objective and substantially similar investment strategies. References to the investment activities of the Fund are intended to refer to the investment activities of the affiliated master portfolio in which it invests. |

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. | |

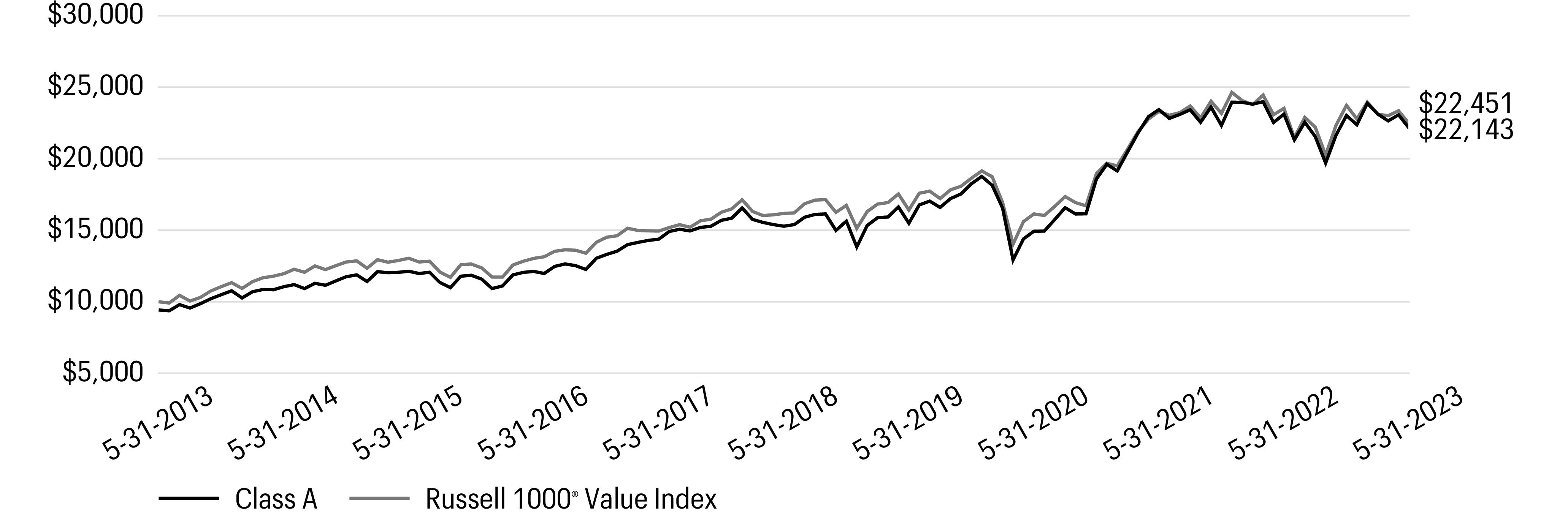

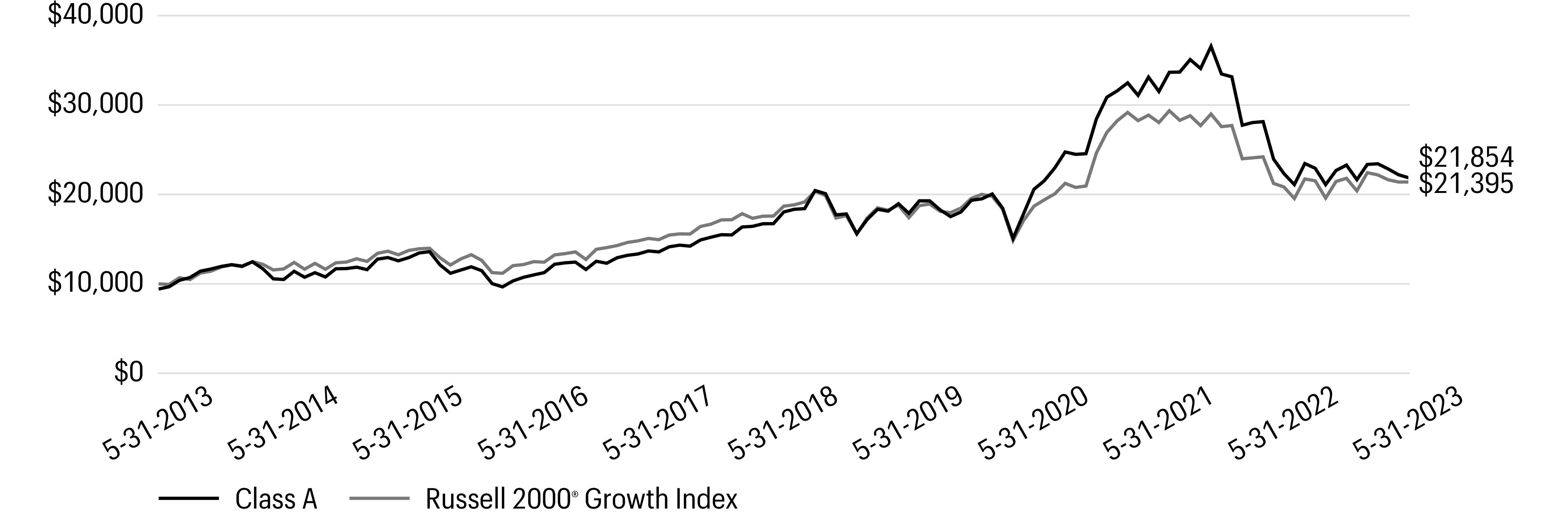

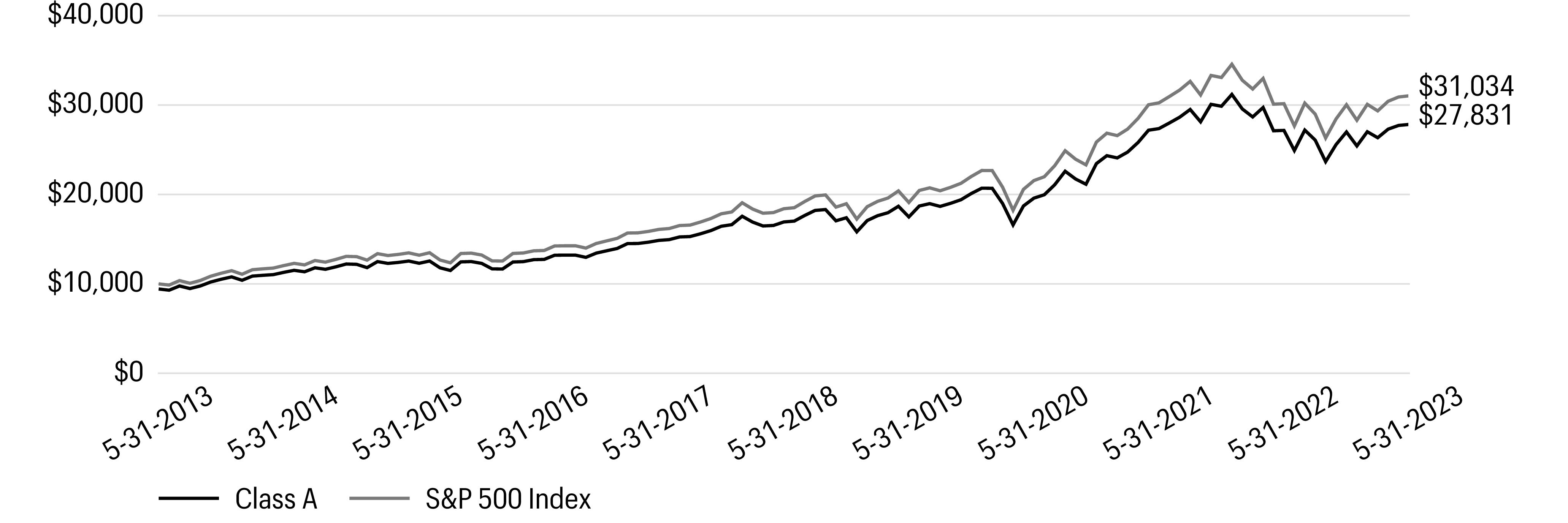

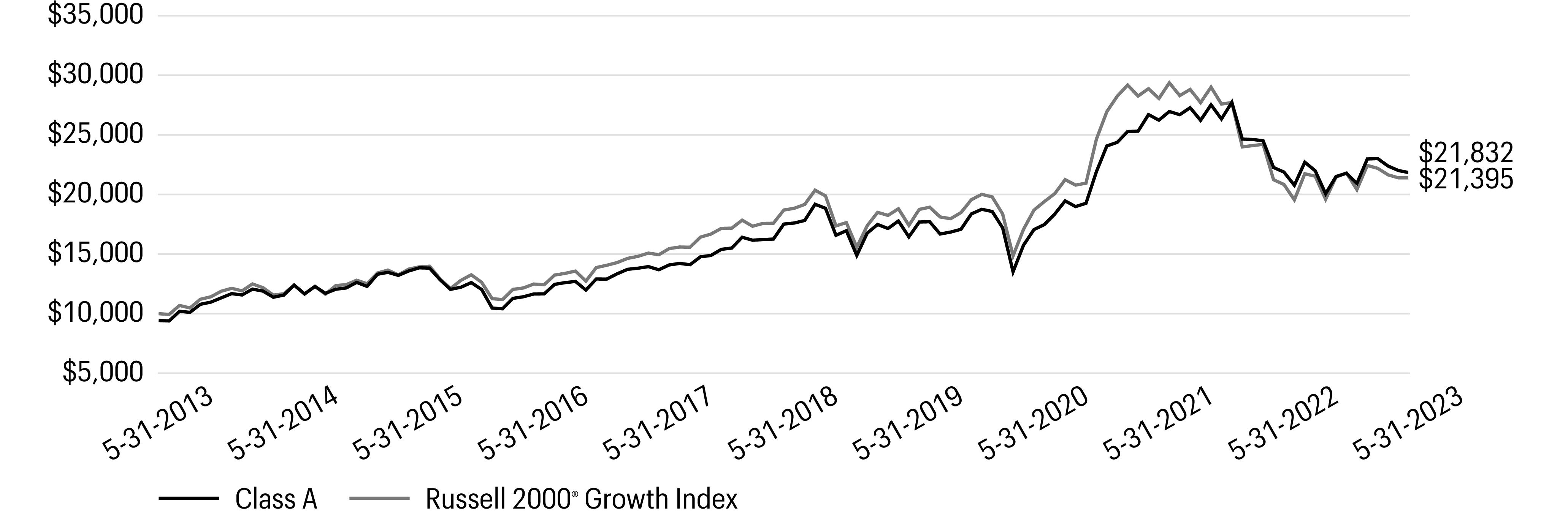

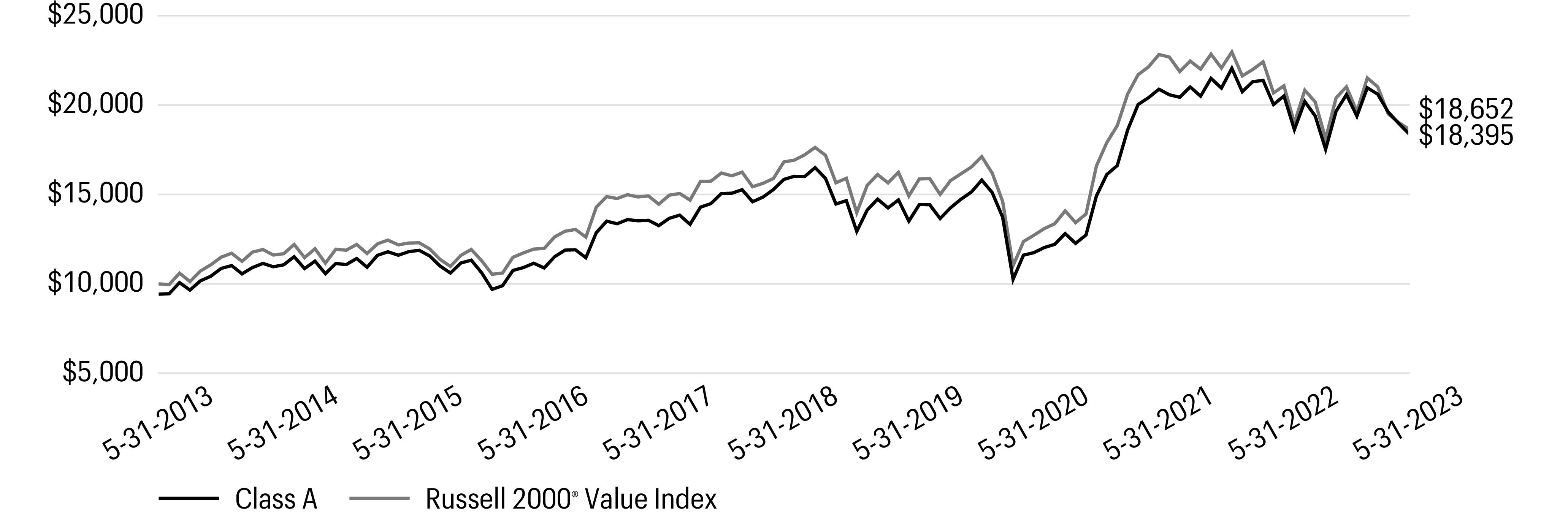

Growth of $10,000 investment as of May 31, 20231 |

1 | The chart compares the performance of Class A shares for the most recent ten years with the Russell 1000® Value Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

Ten largest holdings (%) as of May 31, 20231 | |

Brookfield Corp. Class A | 3.35 |

Arrow Electronics, Inc. | 3.21 |

AerCap Holdings NV | 3.17 |

Open Text Corp. | 3.12 |

TE Connectivity Ltd. | 2.86 |

State Street Corp. | 2.77 |

Medtronic PLC | 2.72 |

Omnicom Group, Inc. | 2.69 |

London Stock Exchange Group PLC | 2.68 |

Johnson & Johnson | 2.60 |

1 | Each holding represents the Fund’s allocable portion of the affiliated master portfolio security. Figures represent each holding as a percentage of the Fund’s net assets. Holdings are subject to change and may have changed since the date specified. |

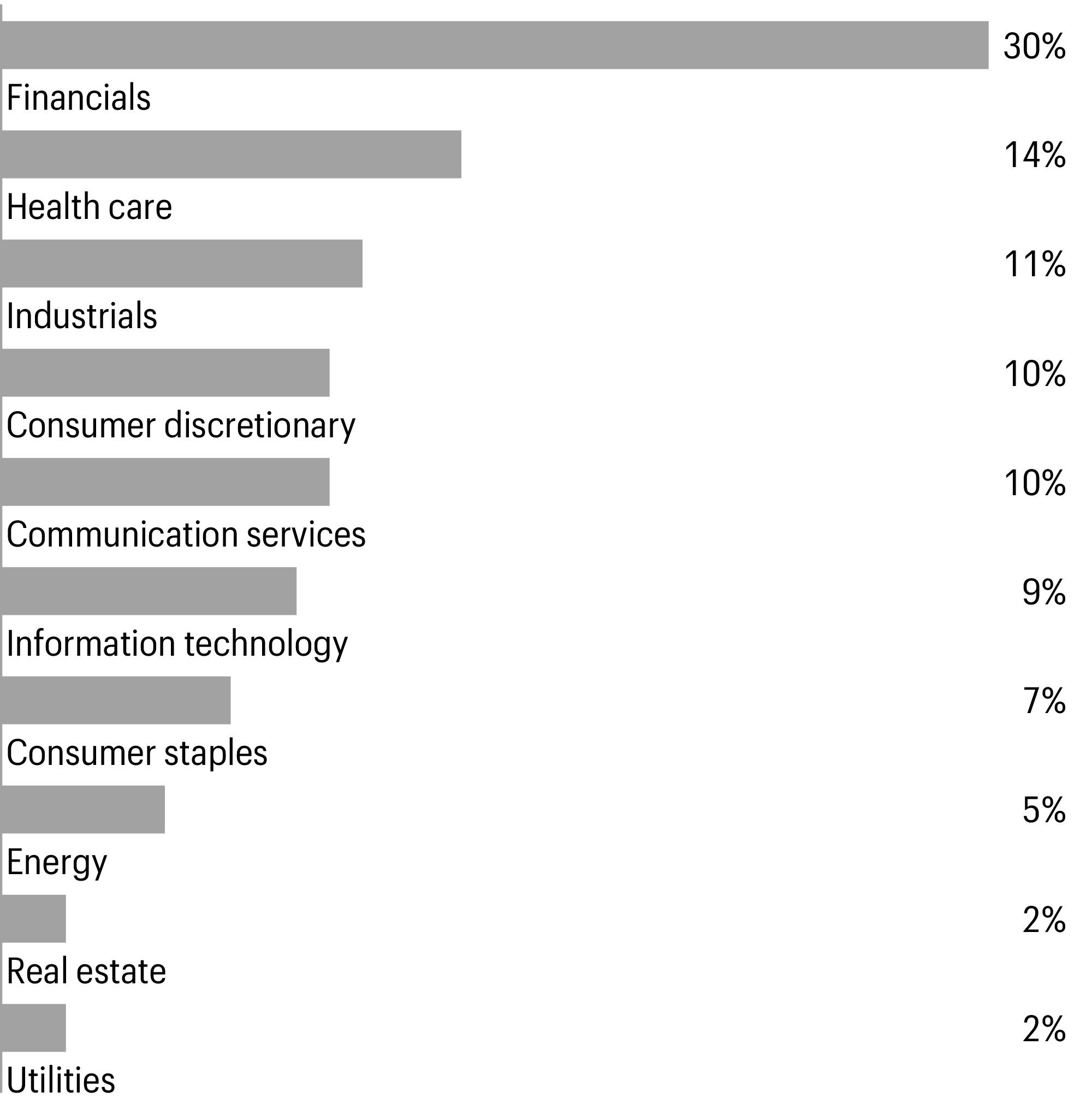

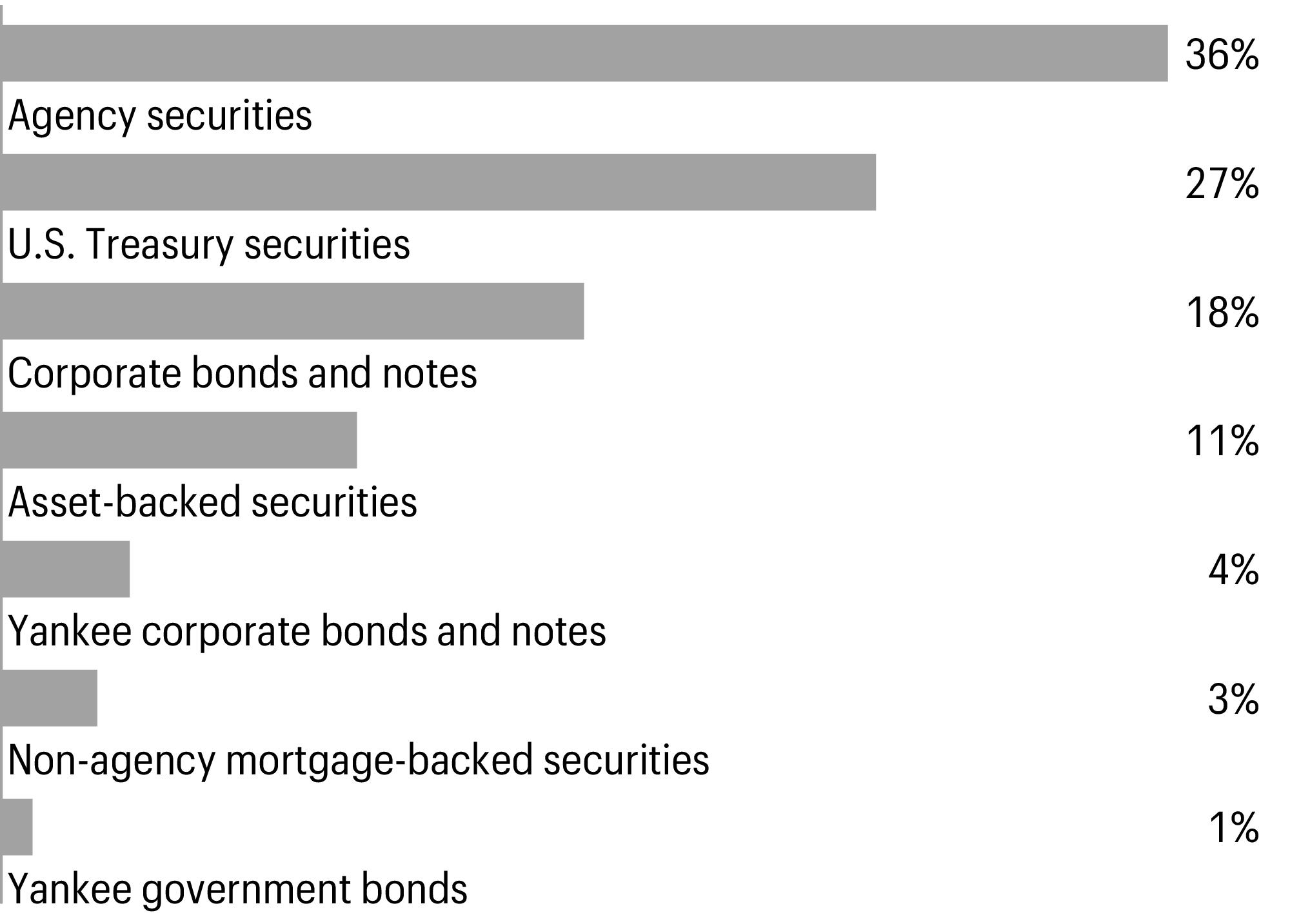

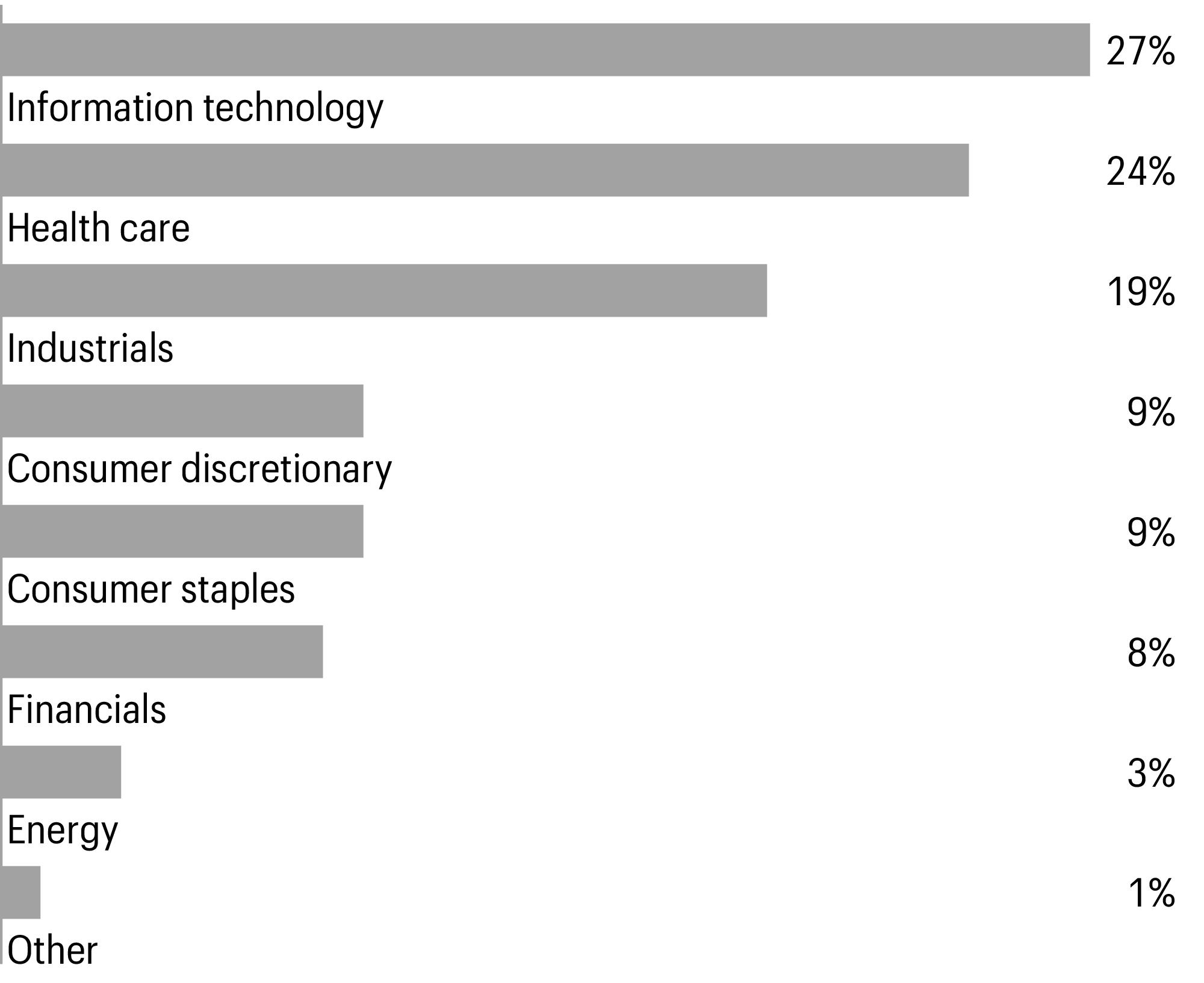

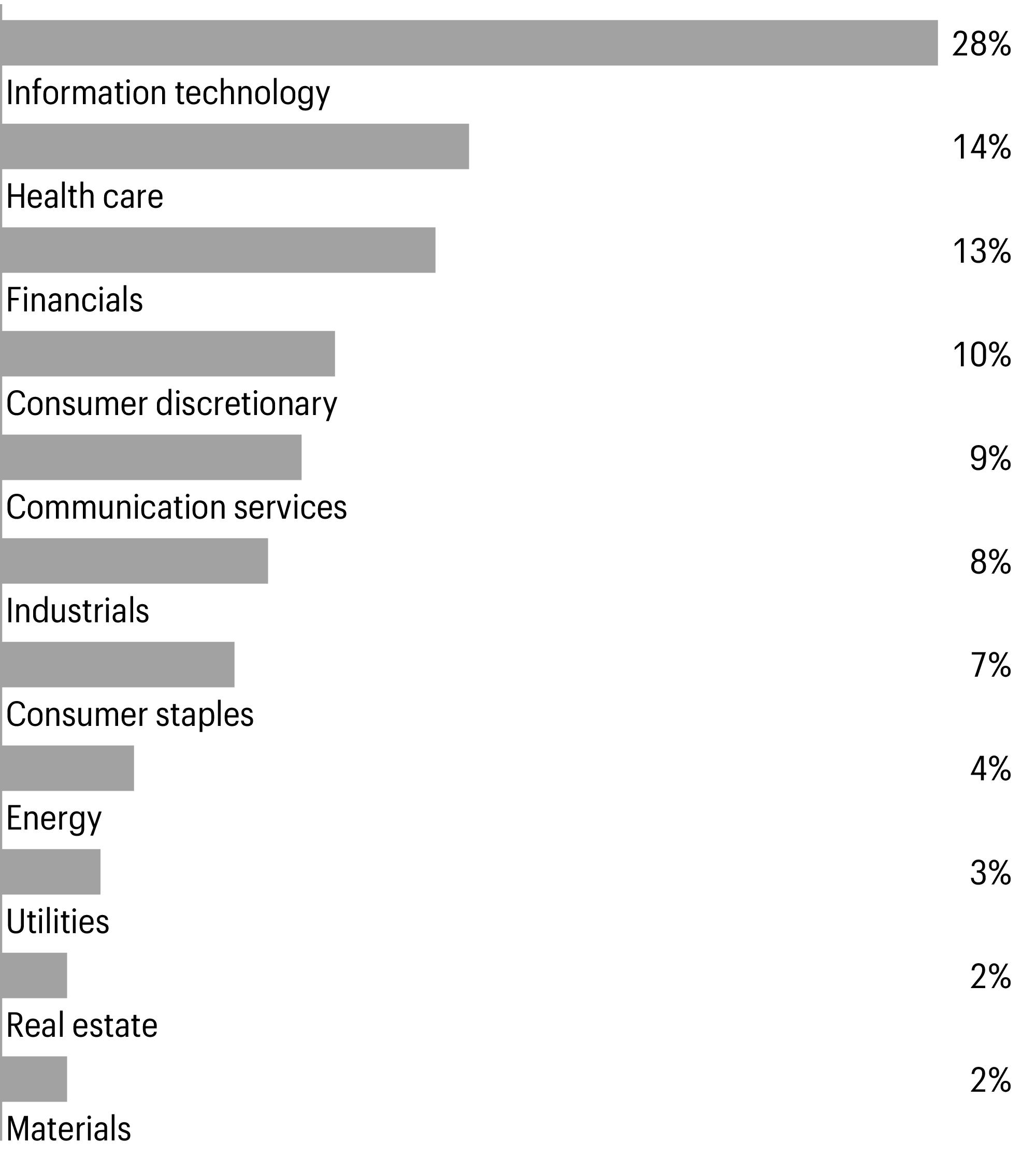

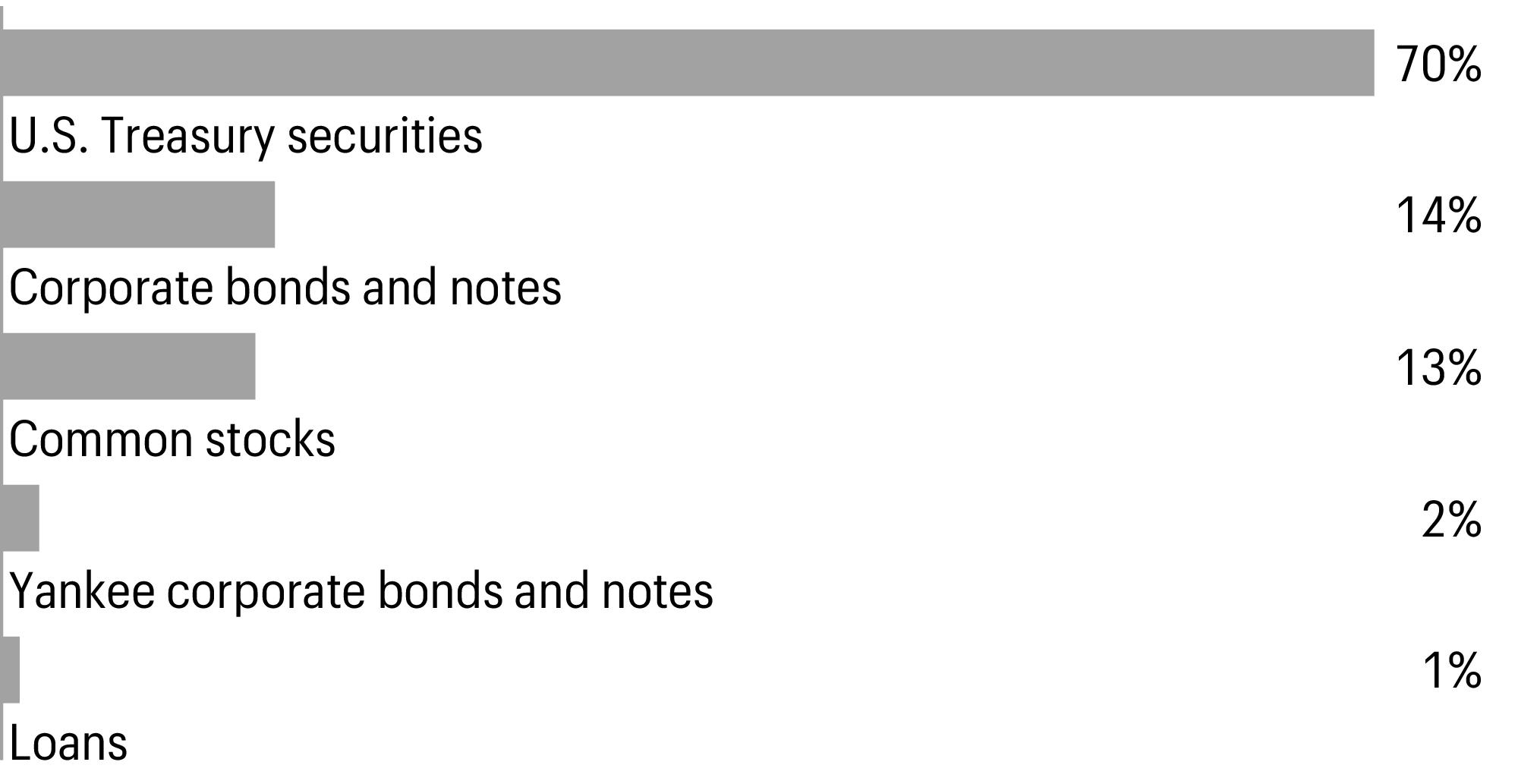

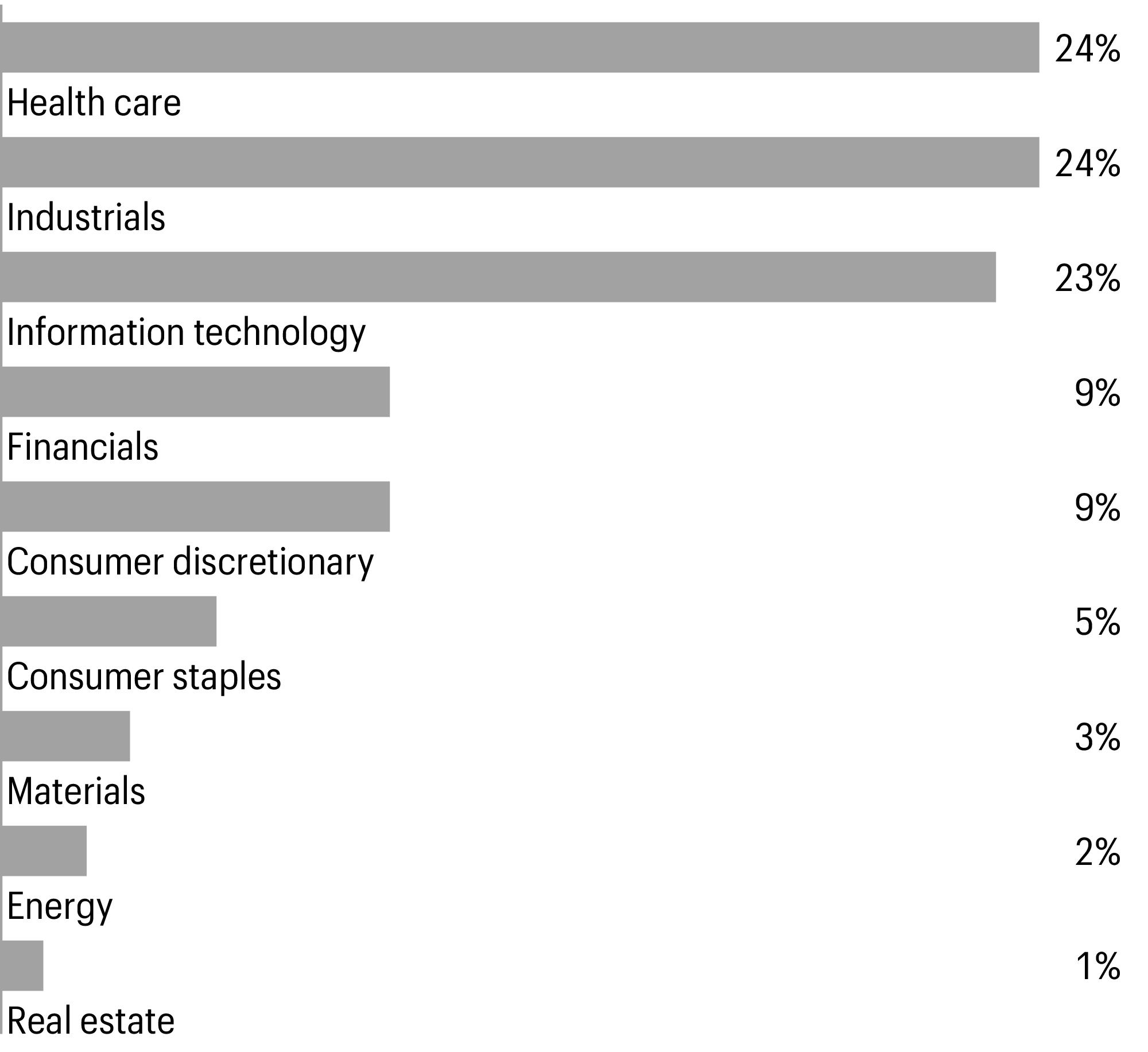

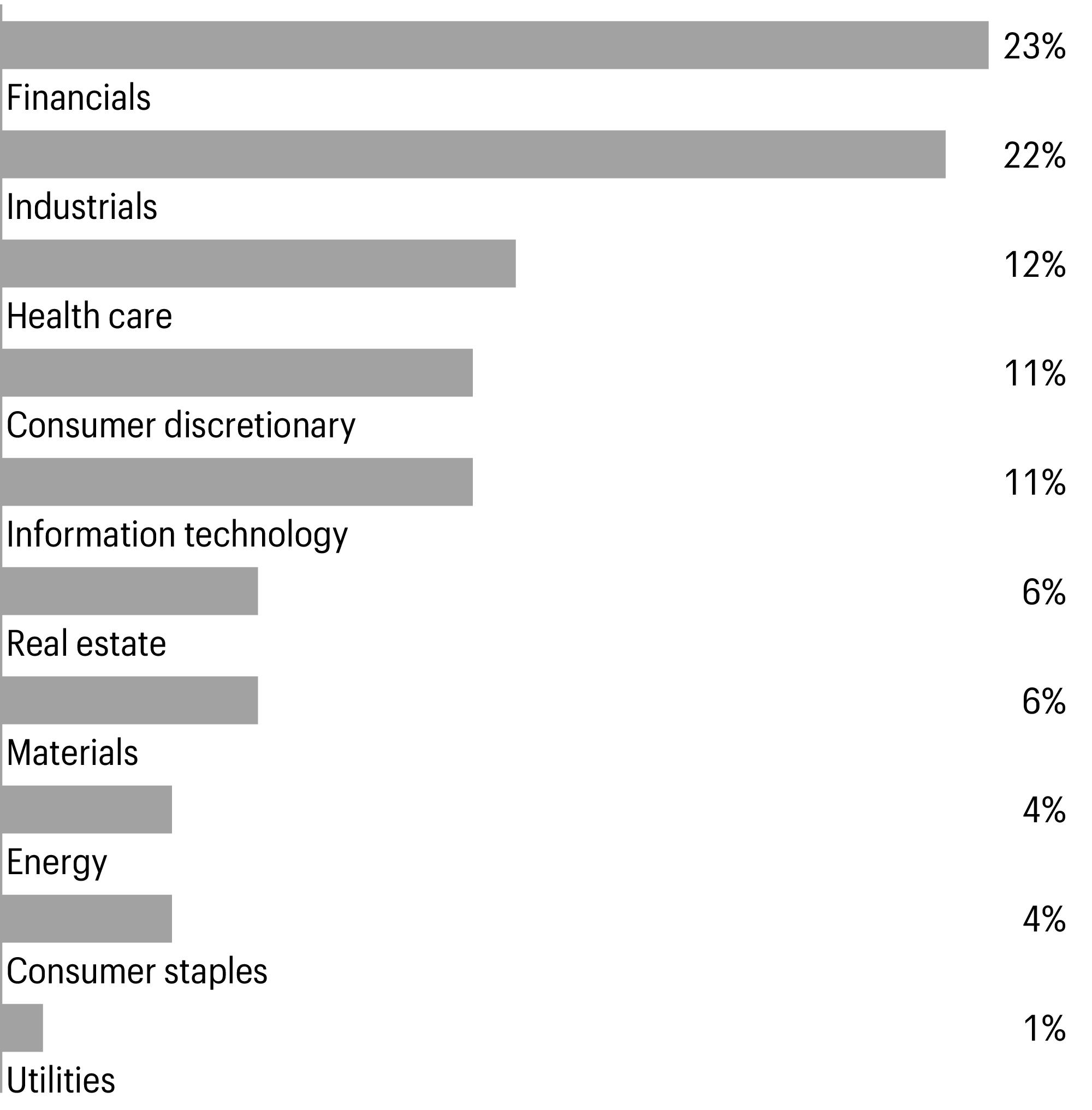

Sector allocation as of May 31, 20231 |

1 | Figures represent the sector allocation of the affiliated master portfolio as a percentage of the long-term investments of the affiliated master portfolio. These amounts are subject to change and may have changed since the date specified. |

Beginning account value 12-1-2022 | Ending account value 5-31-2023 | Expenses paid during the period1, 2 | Annualized net expense ratio2 | |

Class A | ||||

Actual | $1,000.00 | $999.62 | $5.38 | 1.08 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.55 | $5.44 | 1.08 % |

Class C | ||||

Actual | $1,000.00 | $999.59 | $9.12 | 1.83 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,015.81 | $9.20 | 1.83 % |

Class R6 | ||||

Actual | $1,000.00 | $999.64 | $3.24 | 0.65 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.69 | $3.28 | 0.65 % |

Administrator Class | ||||

Actual | $1,000.00 | $999.62 | $4.99 | 1.00 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.95 | $5.04 | 1.00 % |

Institutional Class | ||||

Actual | $1,000.00 | $999.63 | $3.74 | 0.75 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.19 | $3.78 | 0.75 % |

Value | ||||||

Investment companies: 99.94% | ||||||

Affiliated master portfolio: 99.94% | ||||||

Allspring C&B Large Cap Value Portfolio | $199,030,307 | |||||

Total investment companies (Cost $173,821,522) | 199,030,307 | |||||

Total investments in securities (Cost $173,821,522) | 99.94 % | 199,030,307 | ||||

Other assets and liabilities, net | 0.06 | 119,203 | ||||

Total net assets | 100.00 % | $199,149,510 | ||||

% of ownership, beginning of period | % of ownership, end of period | Net realized gains (losses) on investments allocated from affiliated Master Portfolio | Net change in unrealized gains (losses) on investments allocated from affiliated Master Portfolio | Dividends allocated from affiliated Master Portfolio | Interest allocated from affiliated Master Portfolio | Affiliated Income Allocated from affiliated Master Portfolio | Value, end of period | |

Allspring C&B Large Cap Value Portfolio | 79.89 % | 78.60 % | $19,848,834 | $(33,458,109 ) | $4,755,544 | $201 | $148,872 | $199,030,307 |

Assets | |

Investments in affiliated Master Portfolio, at value (cost $173,821,522) | $199,030,307 |

Receivable for Fund shares sold | 182,695 |

Receivable from manager | 25,062 |

Prepaid expenses and other assets | 81,799 |

Total assets | 199,319,863 |

Liabilities | |

Payable for Fund shares redeemed | 102,030 |

Administration fees payable | 26,895 |

Shareholder servicing fees payable | 18,575 |

Distribution fee payable | 2,359 |

Trustees’ fees and expenses payable | 504 |

Accrued expenses and other liabilities | 19,990 |

Total liabilities | 170,353 |

Total net assets | $199,149,510 |

Net assets consist of | |

Paid-in capital | $164,340,365 |

Total distributable earnings | 34,809,145 |

Total net assets | $199,149,510 |

Computation of net asset value and offering price per share | |

Net assets–Class A | $77,198,227 |

Shares outstanding–Class A1 | 6,703,862 |

Net asset value per share–Class A | $11.52 |

Maximum offering price per share – Class A2 | $12.22 |

Net assets–Class C | $3,471,192 |

Shares outstanding–Class C1 | 306,763 |

Net asset value per share–Class C | $11.32 |

Net assets–Class R6 | $15,504,522 |

Shares outstanding–Class R61 | 1,338,256 |

Net asset value per share–Class R6 | $11.59 |

Net assets–Administrator Class | $4,292,230 |

Shares outstanding–Administrator Class1 | 371,511 |

Net asset value per share–Administrator Class | $11.55 |

Net assets–Institutional Class | $98,683,339 |

Shares outstanding–Institutional Class1 | 8,513,433 |

Net asset value per share–Institutional Class | $11.59 |

1 | The Fund has an unlimited number of authorized shares. |

2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

Investment income | |

Dividends allocated from affiliated Master Portfolio (net of foreign withholding taxes of $107,495) | $4,755,544 |

Affiliated income allocated from affiliated Master Portfolio | 148,872 |

Interest allocated from affiliated Master Portfolio | 201 |

Expenses allocated from affiliated Master Portfolio | (1,571,119 ) |

Waivers allocated from affiliated Master Portfolio | 145,978 |

Total investment income | 3,479,476 |

Expenses | |

Management fee | 111,328 |

Administration fees | |

Class A | 178,189 |

Class C | 8,343 |

Class R6 | 5,862 |

Administrator Class | 6,606 |

Institutional Class | 141,971 |

Shareholder servicing fees | |

Class A | 212,130 |

Class C | 9,930 |

Administrator Class | 12,703 |

Distribution fee | |

Class C | 29,772 |

Custody and accounting fees | 7,535 |

Professional fees | 45,318 |

Registration fees | 36,664 |

Shareholder report expenses | 30,584 |

Trustees’ fees and expenses | 21,908 |

Other fees and expenses | 4,517 |

Total expenses | 863,360 |

Less: Fee waivers and/or expense reimbursements | |

Fund-level | (290,386 ) |

Class A | (8,079 ) |

Class C | (226 ) |

Administrator Class | (484 ) |

Institutional Class | (6,438 ) |

Net expenses | 557,747 |

Net investment income | 2,921,729 |

Realized and unrealized gains (losses) on investments | |

Net realized gains on investments allocated from affiliated Master Portfolio | 19,848,834 |

Net change in unrealized gains (losses) on investments allocated from affiliated Master Portfolio | (33,458,109 ) |

Net realized and unrealized gains (losses) on investments | (13,609,275 ) |

Net decrease in net assets resulting from operations | $(10,687,546 ) |

Year ended May 31, 2023 | Year ended May 31, 2022 | |||

Operations | ||||

Net investment income | $2,921,729 | $2,669,791 | ||

Net realized gains on investments | 19,848,834 | 47,346,569 | ||

Net change in unrealized gains (losses) on investments | (33,458,109 ) | (53,785,190 ) | ||

Net decrease in net assets resulting from operations | (10,687,546 ) | (3,768,830 ) | ||

Distributions to shareholders from | ||||

Net investment income and net realized gains | ||||

Class A | (16,304,617 ) | (12,919,436 ) | ||

Class C | (740,826 ) | (535,250 ) | ||

Class R6 | (3,797,016 ) | (6,057,662 ) | ||

Administrator Class | (1,047,406 ) | (841,849 ) | ||

Institutional Class | (21,328,025 ) | (17,599,026 ) | ||

Total distributions to shareholders | (43,217,890 ) | (37,953,223 ) | ||

Capital share transactions | Shares | Shares | ||

Proceeds from shares sold | ||||

Class A | 415,820 | 5,265,311 | 989,891 | 15,969,277 |

Class C | 96,897 | 1,168,445 | 43,159 | 682,181 |

Class R6 | 123,974 | 1,716,518 | 349,706 | 5,728,171 |

Administrator Class | 3,961 | 50,313 | 55,766 | 954,376 |

Institutional Class | 1,322,276 | 17,070,664 | 1,764,097 | 28,100,206 |

25,271,251 | 51,434,211 | |||

Reinvestment of distributions | ||||

Class A | 1,348,065 | 16,067,784 | 845,770 | 12,689,368 |

Class C | 63,426 | 740,826 | 36,313 | 535,250 |

Class R6 | 148,681 | 1,785,702 | 80,021 | 1,208,696 |

Administrator Class | 53,517 | 639,939 | 34,924 | 525,330 |

Institutional Class | 1,765,170 | 21,195,384 | 1,158,450 | 17,489,868 |

40,429,635 | 32,448,512 | |||

Payment for shares redeemed | ||||

Class A | (1,910,541 ) | (24,861,078 ) | (946,956 ) | (15,053,324 ) |

Class C | (134,315 ) | (1,653,300 ) | (76,840 ) | (1,207,888 ) |

Class R6 | (510,778 ) | (6,892,525 ) | (1,596,640 ) | (24,419,329 ) |

Administrator Class | (89,944 ) | (1,125,103 ) | (34,305 ) | (524,769 ) |

Institutional Class | (3,362,511 ) | (44,116,398 ) | (3,201,272 ) | (51,615,218 ) |

(78,648,404 ) | (92,820,528 ) | |||

Net decrease in net assets resulting from capital share transactions | (12,947,518 ) | (8,937,805 ) | ||

Total decrease in net assets | (66,852,954 ) | (50,659,858 ) | ||

Net assets | ||||

Beginning of period | 266,002,464 | 316,662,322 | ||

End of period | $199,149,510 | $266,002,464 | ||

(For a share outstanding throughout each period)

Year ended May 31 | |||||

Class A | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $14.82 | $17.16 | $11.49 | $13.01 | $13.91 |

Net investment income | 0.15 1 | 0.11 | 0.10 | 0.12 | 0.11 |

Net realized and unrealized gains (losses) on investments | (0.71 ) | (0.34 ) | 6.29 | (0.33 ) | 0.02 |

Total from investment operations | (0.56 ) | (0.23 ) | 6.39 | (0.21 ) | 0.13 |

Distributions to shareholders from | |||||

Net investment income | (0.14 ) | (0.11 ) | (0.11 ) | (0.13 ) | (0.12 ) |

Net realized gains | (2.60 ) | (2.00 ) | (0.61 ) | (1.18 ) | (0.91 ) |

Total distributions to shareholders | (2.74 ) | (2.11 ) | (0.72 ) | (1.31 ) | (1.03 ) |

Net asset value, end of period | $11.52 | $14.82 | $17.16 | $11.49 | $13.01 |

Total return2 | (4.19 )% | (1.37 )% | 56.98 % | (3.61 )% | 1.33 % |

Ratios to average net assets (annualized)* | |||||

Gross expenses | 1.22 % | 1.19 % | 1.24 % | 1.27 % | 1.23 % |

Net expenses | 1.08 % | 1.07 % | 1.07 % | 1.07 % | 1.08 % |

Net investment income | 1.13 % | 0.69 % | 0.73 % | 0.92 % | 0.83 % |

Supplemental data | |||||

Portfolio turnover rate3 | 29 % | 32 % | 38 % | 33 % | 47 % |

Net assets, end of period (000s omitted) | $77,198 | $101,496 | $102,332 | $70,680 | $79,172 |

* | Ratios include net expenses allocated from the affiliated Master Portfolio which were as follows: |

Year ended May 31, 2023 | 0.64% |

Year ended May 31, 2022 | 0.64% |

Year ended May 31, 2021 | 0.64% |

Year ended May 31, 2020 | 0.64% |

Year ended May 31, 2019 | 0.65% |

1 | Calculated based upon average shares outstanding |

2 | Total return calculations do not include any sales charges. |

3 | Portfolio turnover rate is calculated by multiplying the affiliated Master Portfolio’s percentage of the Fund’s total investment in securities at the end of the period by the affiliated Master Portfolio’s portfolio turnover rate. |

(For a share outstanding throughout each period)

Year ended May 31 | |||||

Class C | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $14.61 | $16.97 | $11.36 | $12.87 | $13.75 |

Net investment income (loss) | 0.05 1 | (0.01 ) | (0.03 ) | 0.02 1 | 0.01 1 |

Net realized and unrealized gains (losses) on investments | (0.69 ) | (0.35 ) | 6.25 | (0.35 ) | 0.03 |

Total from investment operations | (0.64 ) | (0.36 ) | 6.22 | (0.33 ) | 0.04 |

Distributions to shareholders from | |||||

Net investment income | (0.05 ) | 0.00 | 0.00 | 0.00 | (0.01 ) |

Net realized gains | (2.60 ) | (2.00 ) | (0.61 ) | (1.18 ) | (0.91 ) |

Total distributions to shareholders | (2.65 ) | (2.00 ) | (0.61 ) | (1.18 ) | (0.92 ) |

Net asset value, end of period | $11.32 | $14.61 | $16.97 | $11.36 | $12.87 |

Total return2 | (4.85 )% | (2.22 )% | 55.94 % | (4.41 )% | 0.61 % |

Ratios to average net assets (annualized)* | |||||

Gross expenses | 1.97 % | 1.94 % | 1.99 % | 2.02 % | 1.97 % |

Net expenses | 1.83 % | 1.83 % | 1.83 % | 1.83 % | 1.83 % |

Net investment income (loss) | 0.36 % | (0.08 )% | (0.04 )% | 0.16 % | 0.07 % |

Supplemental data | |||||

Portfolio turnover rate3 | 29 % | 32 % | 38 % | 33 % | 47 % |

Net assets, end of period (000s omitted) | $3,471 | $4,103 | $4,719 | $3,576 | $5,098 |

* | Ratios include net expenses allocated from the affiliated Master Portfolio which were as follows: |

Year ended May 31, 2023 | 0.64% |

Year ended May 31, 2022 | 0.64% |

Year ended May 31, 2021 | 0.64% |

Year ended May 31, 2020 | 0.64% |

Year ended May 31, 2019 | 0.65% |

1 | Calculated based upon average shares outstanding |

2 | Total return calculations do not include any sales charges. |

3 | Portfolio turnover rate is calculated by multiplying the affiliated Master Portfolio’s percentage of the Fund’s total investment in securities at the end of the period by the affiliated Master Portfolio’s portfolio turnover rate. |

(For a share outstanding throughout each period)

Year ended May 31 | |||||

Class R6 | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $14.90 | $17.24 | $11.53 | $13.06 | $13.97 |

Net investment income | 0.20 1 | 0.18 1 | 0.16 1 | 0.18 1 | 0.18 1 |

Net realized and unrealized gains (losses) on investments | (0.70 ) | (0.34 ) | 6.32 | (0.33 ) | 0.00 2 |

Total from investment operations | (0.50 ) | (0.16 ) | 6.48 | (0.15 ) | 0.18 |

Distributions to shareholders from | |||||

Net investment income | (0.21 ) | (0.18 ) | (0.16 ) | (0.20 ) | (0.18 ) |

Net realized gains | (2.60 ) | (2.00 ) | (0.61 ) | (1.18 ) | (0.91 ) |

Total distributions to shareholders | (2.81 ) | (2.18 ) | (0.77 ) | (1.38 ) | (1.09 ) |

Net asset value, end of period | $11.59 | $14.90 | $17.24 | $11.53 | $13.06 |

Total return | (3.75 )% | (0.98 )% | 57.75 % | (3.25 )% | 1.74 % |

Ratios to average net assets (annualized)* | |||||

Gross expenses | 0.78 % | 0.76 % | 0.82 % | 0.84 % | 0.79 % |

Net expenses | 0.65 % | 0.65 % | 0.65 % | 0.65 % | 0.65 % |

Net investment income | 1.55 % | 1.11 % | 1.14 % | 1.33 % | 1.27 % |

Supplemental data | |||||

Portfolio turnover rate3 | 29 % | 32 % | 38 % | 33 % | 47 % |

Net assets, end of period (000s omitted) | $15,505 | $23,487 | $47,301 | $37,859 | $68,366 |

* | Ratios include net expenses allocated from the affiliated Master Portfolio which were as follows: |

Year ended May 31, 2023 | 0.64% |

Year ended May 31, 2022 | 0.64% |

Year ended May 31, 2021 | 0.64% |

Year ended May 31, 2020 | 0.64% |

Year ended May 31, 2019 | 0.65% |

1 | Calculated based upon average shares outstanding |

2 | Amount is less than $0.005. |

3 | Portfolio turnover rate is calculated by multiplying the affiliated Master Portfolio’s percentage of the Fund’s total investment in securities at the end of the period by the affiliated Master Portfolio’s portfolio turnover rate. |

(For a share outstanding throughout each period)

Year ended May 31 | |||||

Administrator Class | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $14.86 | $17.20 | $11.51 | $13.03 | $13.92 |

Net investment income | 0.16 1 | 0.12 1 | 0.11 1 | 0.13 1 | 0.12 1 |

Net realized and unrealized gains (losses) on investments | (0.72 ) | (0.33 ) | 6.30 | (0.33 ) | 0.02 |

Total from investment operations | (0.56 ) | (0.21 ) | 6.41 | (0.20 ) | 0.14 |

Distributions to shareholders from | |||||

Net investment income | (0.15 ) | (0.13 ) | (0.11 ) | (0.14 ) | (0.12 ) |

Net realized gains | (2.60 ) | (2.00 ) | (0.61 ) | (1.18 ) | (0.91 ) |

Total distributions to shareholders | (2.75 ) | (2.13 ) | (0.72 ) | (1.32 ) | (1.03 ) |

Net asset value, end of period | $11.55 | $14.86 | $17.20 | $11.51 | $13.03 |

Total return | (4.18 )% | (1.29 )% | 57.12 % | (3.56 )% | 1.44 % |

Ratios to average net assets (annualized)* | |||||

Gross expenses | 1.14 % | 1.11 % | 1.17 % | 1.19 % | 1.15 % |

Net expenses | 1.00 % | 0.99 % | 0.99 % | 0.99 % | 1.00 % |

Net investment income | 1.21 % | 0.76 % | 0.81 % | 1.00 % | 0.90 % |

Supplemental data | |||||

Portfolio turnover rate2 | 29 % | 32 % | 38 % | 33 % | 47 % |

Net assets, end of period (000s omitted) | $4,292 | $6,001 | $5,980 | $6,167 | $9,274 |

* | Ratios include net expenses allocated from the affiliated Master Portfolio which were as follows: |

Year ended May 31, 2023 | 0.64% |

Year ended May 31, 2022 | 0.64% |

Year ended May 31, 2021 | 0.64% |

Year ended May 31, 2020 | 0.64% |

Year ended May 31, 2019 | 0.65% |

1 | Calculated based upon average shares outstanding |

2 | Portfolio turnover rate is calculated by multiplying the affiliated Master Portfolio’s percentage of the Fund’s total investment in securities at the end of the period by the affiliated Master Portfolio’s portfolio turnover rate. |

(For a share outstanding throughout each period)

Year ended May 31 | |||||

Institutional Class | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $14.90 | $17.24 | $11.53 | $13.05 | $13.96 |

Net investment income | 0.19 1 | 0.16 | 0.15 | 0.16 | 0.14 |

Net realized and unrealized gains (losses) on investments | (0.71 ) | (0.34 ) | 6.32 | (0.33 ) | 0.02 |

Total from investment operations | (0.52 ) | (0.18 ) | 6.47 | (0.17 ) | 0.16 |

Distributions to shareholders from | |||||

Net investment income | (0.19 ) | (0.16 ) | (0.15 ) | (0.17 ) | (0.16 ) |

Net realized gains | (2.60 ) | (2.00 ) | (0.61 ) | (1.18 ) | (0.91 ) |

Total distributions to shareholders | (2.79 ) | (2.16 ) | (0.76 ) | (1.35 ) | (1.07 ) |

Net asset value, end of period | $11.59 | $14.90 | $17.24 | $11.53 | $13.05 |