UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: June 30

Registrant is making a filing for 13 of its series: Allspring Alternative Risk Premia Fund, Allspring California Limited-Term Tax-Free Fund, Allspring California Tax-Free Fund, Allspring High Yield Municipal Bond Fund, Allspring Intermediate Tax/AMT-Free Fund, Allspring Minnesota Tax-Free Fund, Allspring Municipal Bond Fund, Allspring Municipal Sustainability Fund, Allspring Pennsylvania Tax-Free Fund, Allspring Short-Term Municipal Bond Fund, Allspring Strategic Municipal Bond Fund, Allspring Ultra Short-Term Municipal Income Fund, and Allspring Wisconsin Tax-Free Fund

Date of reporting period: June 30, 2023

ITEM 1. REPORT TO STOCKHOLDERS

2

2 | |

6 | |

10 | |

11 | |

22 | |

23 | |

24 | |

25 | |

27 | |

34 | |

35 |

Allspring Funds

President

Allspring Funds

Notice to Shareholders |

Beginning in July 2024, the Fund will be required by the Securities and Exchange Commission to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance information and fund statistics. If you wish to receive this new tailored shareholder report electronically, please follow the instructions on the back cover of this report. |

Other information that is currently included in the shareholder report, such as the Fund’s financial statements, will be available online and upon request, free of charge, in paper or electronic format. |

Investment objective | The Fund seeks long-term capital appreciation. |

Manager | Allspring Funds Management, LLC |

Subadvisers | Allspring Global Investments, LLC |

Allspring Global Investments (UK) Limited | |

Portfolio managers | Petros N. Bocray, CFA, FRM, Eddie Cheng, CFA, Monisha Jayakumar |

Average annual total returns (%) as of June 30, 2023 | |||||

Expense ratios1 (%) | |||||

Inception date | 1 year | Since inception | Gross | Net2 | |

Class R6 (WRPRX) | 1-29-2019 | 4.44 | -0.83 | 1.18 | 0.65 |

Institutional Class (WRPIX) | 1-29-2019 | 4.43 | -0.93 | 1.28 | 0.75 |

ICE BofA 3-Month U.S. Treasury Bill Index3 | – | 3.62 | 1.48 * | – | – |

* | Based on the inception date of the oldest Fund class. |

1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.03% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the Financial Highlights of this report, which do not include acquired fund fees and expenses. |

2 | The manager has contractually committed through October 31, 2023, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.62% for Class R6 and 0.72% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

3 | The ICE BofA 3-Month U.S. Treasury Bill Index is an unmanaged index that is comprised of a single U.S. Treasury issue with approximately three months to final maturity, purchased at the beginning of each month and held for one full month. You cannot invest directly in an index. Copyright 2023. ICE Data Indices, LLC. All rights reserved. |

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

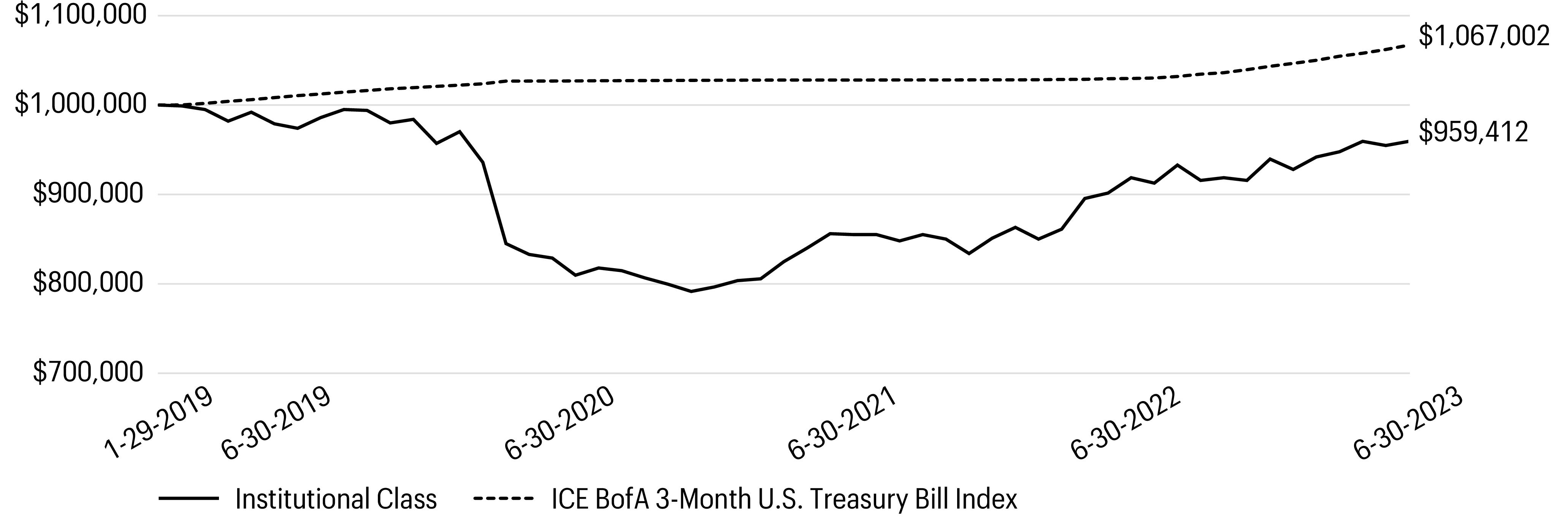

Growth of $1,000,000 investment as of June 30, 20231 |

1 | The chart compares the performance of Institutional Class shares since inception with the ICE BofA 3-Month U.S. Treasury Bill Index. The chart assumes a hypothetical investment of $1,000,000 in Institutional Class shares and reflects all operating expenses. |

Net asset exposure as of June 30, 20231 | ||

% of net assets | ||

Long positions | Short positions | |

Stocks | 55 | 42 |

Bond futures | 16 | 29 |

Commodity futures | 25 | 24 |

Currency forwards | 65 | 75 |

Equity index futures | 15 | 3 |

1 | Figures are subject to change and may have changed since the date specified. |

Beginning account value 1-1-2023 | Ending account value 6-30-2023 | Consolidated expenses paid during the period1 | Annualized net expense ratio | |

Class R6 | ||||

Actual | $1,000.00 | $1,022.28 | $3.11 | 0.62 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.72 | $3.11 | 0.62 % |

Institutional Class | ||||

Actual | $1,000.00 | $1,021.09 | $3.61 | 0.72 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.22 | $3.61 | 0.72 % |

1 | Consolidated expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by 181 divided by 365 (to reflect the one-half-year period). |

Yield | Shares | Value | ||||

Short-term investments: 76.67% | ||||||

Investment companies: 14.88% | ||||||

Allspring Government Money Market Fund Select Class♠∞* | 5.02 % | 5,629,388 | $5,629,388 | |||

Maturity date | Principal | |||||

U.S. Treasury securities: 61.79% | ||||||

U.S. Treasury Bills☼ | 3.56 | 7-13-2023 | $ | 14,900,000 | 14,879,280 | |

U.S. Treasury Bills☼# | 4.53 | 12-28-2023 | 2,750,000 | 2,678,802 | ||

U.S. Treasury Bills☼# | 5.00 | 3-21-2024 | 3,000,000 | 2,888,262 | ||

U.S. Treasury Bills☼ | 5.12 | 11-24-2023 | 3,000,000 | 2,937,818 | ||

23,384,162 | ||||||

Total short-term investments (Cost $29,033,331) | 29,013,550 | |||||

Total investments in securities (Cost $29,033,331) | 76.67 % | 29,013,550 | ||||

Other assets and liabilities, net | 23.33 | 8,828,368 | ||||

Total net assets | 100.00 % | $37,841,918 | ||||

♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

∞ | The rate represents the 7-day annualized yield at period end. |

* | A portion of the holding represents an investment held in Alt Risk Premia Special Investments (Cayman) Ltd., the consolidated entity. |

☼ | Zero coupon security. The rate represents the current yield to maturity. |

# | All or a portion of this security is segregated as collateral for investments in derivative instruments. |

Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |

Short-term investments | ||||||||

Allspring Government Money Market Fund Select Class | $26,833,161 | $60,080,200 | $(81,283,973 ) | $0 | $0 | $5,629,388 | 5,629,388 | $399,139 |

Currency to be received | Currency to be delivered | Counterparty | Settlement date | Unrealized gains | Unrealized losses | ||

USD | 5,865,651 | AUD | 8,582,000 | Goldman Sachs International | 7-19-2023 | $146,506 | $0 |

BRL | 6,842,000 | USD | 1,405,260 | Goldman Sachs International | 7-19-2023 | 20,071 | 0 |

USD | 5,173,907 | CAD | 6,871,000 | Goldman Sachs International | 7-19-2023 | 0 | (13,787 ) |

USD | 5,031,766 | CHF | 4,501,000 | Goldman Sachs International | 7-19-2023 | 0 | (4,078 ) |

CLP | 1,165,583,000 | USD | 1,451,138 | Goldman Sachs International | 7-19-2023 | 104 | 0 |

CZK | 5,356,000 | USD | 244,091 | Goldman Sachs International | 7-19-2023 | 1,619 | 0 |

EUR | 5,851,000 | USD | 6,361,465 | Goldman Sachs International | 7-19-2023 | 27,470 | 0 |

GBP | 3,223,000 | USD | 4,093,568 | Goldman Sachs International | 7-19-2023 | 23 | 0 |

HUF | 573,058,000 | USD | 1,658,959 | Goldman Sachs International | 7-19-2023 | 13,203 | 0 |

USD | 1,118,686 | INR | 91,871,000 | Goldman Sachs International | 7-19-2023 | 0 | (657 ) |

JPY | 407,713,000 | USD | 2,940,721 | Goldman Sachs International | 7-19-2023 | 0 | (109,245 ) |

USD | 1,037,011 | KRW | 1,315,510,000 | Goldman Sachs International | 7-19-2023 | 38,033 | 0 |

Currency to be received | Currency to be delivered | Counterparty | Settlement date | Unrealized gains | Unrealized losses | ||

MXN | 35,095,000 | USD | 2,037,202 | Goldman Sachs International | 7-19-2023 | $7,595 | $0 |

USD | 8,076,363 | NOK | 84,991,000 | Goldman Sachs International | 7-19-2023 | 154,269 | 0 |

USD | 1,471,982 | NZD | 2,364,000 | Goldman Sachs International | 7-19-2023 | 21,285 | 0 |

PLN | 7,261,000 | USD | 1,768,841 | Goldman Sachs International | 7-19-2023 | 15,695 | 0 |

SEK | 12,688,000 | USD | 1,191,062 | Goldman Sachs International | 7-19-2023 | 0 | (13,921 ) |

ZAR | 4,793,000 | USD | 261,423 | Goldman Sachs International | 7-19-2023 | 0 | (7,112 ) |

IDR | 3,703,715,000 | USD | 248,872 | Goldman Sachs International | 7-20-2023 | 0 | (1,867 ) |

$445,873 | $(150,667 ) | ||||||

Description | Number of contracts | Expiration date | Notional cost | Notional value | Unrealized gains | Unrealized losses |

Long | ||||||

LME Copper Futures** | 6 | 7-17-2023 | $1,257,636 | $1,248,563 | $0 | $(9,073 ) |

LME Lead Futures** | 11 | 7-17-2023 | 556,796 | 577,913 | 21,117 | 0 |

CAC 40 Index | 7 | 7-21-2023 | 555,746 | 566,044 | 10,298 | 0 |

NY Harbor ULSD Futures** | 2 | 7-31-2023 | 208,713 | 205,598 | 0 | (3,115 ) |

Reformulated Gasoline Blendstock for Oxygen Blending Futures** | 6 | 7-31-2023 | 624,783 | 641,315 | 16,532 | 0 |

Lean Hogs Futures** | 33 | 8-14-2023 | 1,200,078 | 1,222,320 | 22,242 | 0 |

Live Cattle Futures** | 5 | 8-31-2023 | 324,090 | 354,350 | 30,260 | 0 |

TOPIX Index | 4 | 9-7-2023 | 612,519 | 634,256 | 21,737 | 0 |

S&P/TSX 60 Index | 4 | 9-14-2023 | 725,153 | 735,897 | 10,744 | 0 |

DAX Index | 1 | 9-15-2023 | 443,685 | 443,900 | 215 | 0 |

E-Mini NASDAQ 100 Index | 1 | 9-15-2023 | 294,750 | 306,740 | 11,990 | 0 |

E-Mini S&P 500 Index | 3 | 9-15-2023 | 652,380 | 673,238 | 20,858 | 0 |

Euro STOXX 50 Index | 12 | 9-15-2023 | 569,173 | 579,689 | 10,516 | 0 |

FTSE 100 Index | 7 | 9-15-2023 | 674,277 | 670,439 | 0 | (3,838 ) |

S&P ASX Share Price Index 200 | 6 | 9-21-2023 | 706,565 | 715,545 | 8,980 | 0 |

Long Gilt Futures | 5 | 9-27-2023 | 618,373 | 605,155 | 0 | (13,218 ) |

Silver Futures** | 5 | 9-27-2023 | 606,467 | 575,500 | 0 | (30,967 ) |

Number 11 World Sugar Futures** | 2 | 9-29-2023 | 56,635 | 51,050 | 0 | (5,585 ) |

Soybean Futures** | 23 | 11-14-2023 | 1,531,140 | 1,544,738 | 13,598 | 0 |

Number 2 Cotton Futures** | 6 | 12-6-2023 | 239,463 | 241,110 | 1,647 | 0 |

Corn Futures** | 63 | 12-14-2023 | 1,667,945 | 1,558,462 | 0 | (109,483 ) |

Soybean Meal Futures** | 24 | 12-14-2023 | 919,873 | 953,520 | 33,647 | 0 |

10-Year U.S. Treasury Notes | 3 | 9-20-2023 | 344,399 | 336,797 | 0 | (7,602 ) |

10-Year Canadian Bond | 52 | 9-20-2023 | 4,871,719 | 4,809,632 | 0 | (62,087 ) |

Short | ||||||

LME Nickel Futures** | (2 ) | 7-17-2023 | (248,571 ) | (244,728 ) | 3,843 | 0 |

LME Primary Aluminum Futures** | (15 ) | 7-17-2023 | (869,045 ) | (795,375 ) | 73,670 | 0 |

LME Zinc Futures** | (16 ) | 7-17-2023 | (1,032,720 ) | (954,500 ) | 78,220 | 0 |

Light Sweet Crude Oil Futures** | (11 ) | 7-20-2023 | (800,654 ) | (777,040 ) | 23,614 | 0 |

Henry Hub Natural Gas Futures** | (45 ) | 7-27-2023 | (1,126,212 ) | (1,259,100 ) | 0 | (132,888 ) |

Brent Crude Oil Futures** | (10 ) | 7-31-2023 | (725,584 ) | (754,100 ) | 0 | (28,516 ) |

Gas Oil Futures** | (2 ) | 8-10-2023 | (140,245 ) | (140,500 ) | 0 | (255 ) |

Gold 100 Troy Ounces Futures** | (10 ) | 8-29-2023 | (2,002,567 ) | (1,929,400 ) | 73,167 | 0 |

10-Year Euro BUND Index | (65 ) | 9-7-2023 | (9,512,742 ) | (9,485,914 ) | 26,828 | 0 |

Cocoa Futures** | (3 ) | 9-14-2023 | (94,428 ) | (100,590 ) | 0 | (6,162 ) |

Hard Red Winter Wheat Futures** | (16 ) | 9-14-2023 | (634,338 ) | (640,000 ) | 0 | (5,662 ) |

Wheat Futures** | (2 ) | 9-14-2023 | (64,092 ) | (65,100 ) | 0 | (1,008 ) |

10-Year Australian Bond | (13 ) | 9-15-2023 | (1,011,383 ) | (1,006,047 ) | 5,336 | 0 |

Description | Number of contracts | Expiration date | Notional cost | Notional value | Unrealized gains | Unrealized losses |

Short (continued) | ||||||

E-Mini Russell 2000 Index | (5 ) | 9-15-2023 | $(471,675 ) | $(475,925 ) | $0 | $(4,250 ) |

MSCI Emerging Markets Index | (11 ) | 9-15-2023 | (554,481 ) | (548,845 ) | 5,636 | 0 |

C Coffee Futures** | (14 ) | 9-19-2023 | (960,789 ) | (834,750 ) | 126,039 | 0 |

Soybean Oil Futures** | (3 ) | 12-14-2023 | (102,030 ) | (106,146 ) | 0 | (4,116 ) |

$650,734 | $(427,825 ) |

** | Represents an investment held in Alt Risk Premia Special Investments (Cayman) Ltd., the consolidated entity. |

Reference asset/index | Counterparty | Payment frequency | Maturity date | Notional amount | Value | Unrealized gains | Unrealized losses |

Synthetic total return swap † | Goldman Sachs International | Monthly | 2-1-2024 | $4,797,823 | $4,641,640 | $0 | $(156,183 ) |

† | The Fund receives or pays the difference between the total return on a portfolio of long and short positions underlying the total return swap and the return on a specified benchmark (either the Federal Funds Effective Rate or the 1D USD-SOFR), plus or minus a spread in a typical range of 20-75 basis points (bps; 100 bps equal 1.00%). The spread is determined based upon the country and/or currency of the individual underlying positions. Certain short positions may be subject to higher market rates. |

Reference asset | Shares | Value | % of swap basket value | |

Long positions | ||||

Common stocks | ||||

Communication services | ||||

Diversified telecommunication services | ||||

Bandwidth, Inc. Class A | 6,294 | $86,102 | 1.86 % | |

IDT Corp. Class B | 2,090 | 54,026 | 1.16 | |

Liberty Global PLC Class A | 3,884 | 65,484 | 1.41 | |

Liberty Global PLC Class C | 5,390 | 95,780 | 2.06 | |

Entertainment | ||||

Bollore SE | 12,360 | 77,080 | 1.66 | |

Square Enix Holdings Co. Ltd. | 1,200 | 55,834 | 1.20 | |

Interactive media & services | ||||

Auto Trader Group PLC | 6,741 | 52,341 | 1.13 | |

QuinStreet, Inc. | 7,822 | 69,068 | 1.49 | |

Scout24 SE | 2,582 | 163,610 | 3.53 | |

Wireless telecommunication services | ||||

Tele2 AB Class B | 9,876 | 81,678 | 1.76 | |

801,003 | ||||

Consumer discretionary | ||||

Automobiles | ||||

Mazda Motor Corp. | 15,100 | 145,929 | 3.14 | |

Renault SA | 1,262 | 53,248 | 1.15 | |

Yamaha Motor Co. Ltd. | 2,500 | 71,871 | 1.55 |

Reference asset | Shares | Value | % of swap basket value | |

Long positions (continued) | ||||

Common stocks (continued) | ||||

Consumer discretionary (continued) | ||||

Broadline retail | ||||

Canadian Tire Corp. Ltd. Class A | 400 | $54,688 | 1.18 % | |

Dollarama, Inc. | 700 | 47,408 | 1.02 | |

Next PLC | 550 | 48,227 | 1.04 | |

Pan Pacific International Holdings Corp. | 6,200 | 111,040 | 2.39 | |

Hotels, restaurants & leisure | ||||

Domino’s Pizza, Inc. | 460 | 155,015 | 3.34 | |

Monogatari Corp. | 3,900 | 94,658 | 2.04 | |

Starbucks Corp. | 487 | 48,242 | 1.04 | |

Tabcorp Holdings Ltd. | 135,379 | 100,418 | 2.16 | |

Yum! Brands, Inc. | 431 | 59,715 | 1.29 | |

Household durables | ||||

NVR, Inc. | 18 | 114,311 | 2.46 | |

Specialty retail | ||||

Chewy, Inc. Class A | 2,637 | 104,082 | 2.24 | |

Haverty Furniture Cos., Inc. | 3,073 | 92,866 | 2.00 | |

PAL Group Holdings Co. Ltd. | 2,100 | 56,842 | 1.22 | |

Winmark Corp. | 299 | 99,409 | 2.14 | |

Textiles, apparel & luxury goods | ||||

Pandora AS | 976 | 87,236 | 1.88 | |

1,545,205 | ||||

Consumer staples | ||||

Beverages | ||||

Carlsberg AS Class B | 627 | 100,402 | 2.16 | |

Consumer staples distribution & retail | ||||

Empire Co. Ltd. Class A | 2,100 | 59,651 | 1.28 | |

Food products | ||||

Campbell Soup Co. | 1,566 | 71,582 | 1.54 | |

General Mills, Inc. | 894 | 68,570 | 1.48 | |

J M Smucker Co. | 386 | 57,001 | 1.23 | |

Lamb Weston Holdings, Inc. | 772 | 88,741 | 1.91 | |

Household products | ||||

Clorox Co. | 534 | 84,927 | 1.83 | |

Tobacco | ||||

Imperial Brands PLC | 2,667 | 59,033 | 1.27 | |

589,907 | ||||

Energy | ||||

Oil, gas & consumable fuels | ||||

Marathon Petroleum Corp. | 503 | 58,650 | 1.26 | |

58,650 | ||||

Financials | ||||

Banks | ||||

Bank of Ireland Group PLC | 6,053 | 57,790 | 1.24 | |

Commerzbank AG | 4,975 | 55,152 | 1.19 | |

Swedbank AB Class A | 3,288 | 55,489 | 1.19 | |

Capital markets | ||||

Amundi SA | 837 | 49,449 | 1.07 | |

BlackRock, Inc. | 68 | 46,998 | 1.01 |

Reference asset | Shares | Value | % of swap basket value | |

Long positions (continued) | ||||

Common stocks (continued) | ||||

Financials (continued) | ||||

Capital markets (continued) | ||||

Brightsphere Investment Group, Inc. | 4,906 | $102,781 | 2.21 % | |

Cboe Global Markets, Inc. | 788 | 108,752 | 2.34 | |

Hargreaves Lansdown PLC | 16,053 | 166,409 | 3.59 | |

IGM Financial, Inc. | 2,100 | 63,931 | 1.38 | |

Invesco Ltd. | 4,890 | 82,201 | 1.77 | |

MarketAxess Holdings, Inc. | 444 | 116,071 | 2.50 | |

MSCI, Inc. | 128 | 60,069 | 1.29 | |

Perella Weinberg Partners | 10,328 | 86,032 | 1.85 | |

SEI Investments Co. | 2,110 | 125,798 | 2.71 | |

StoneX Group, Inc. | 916 | 76,101 | 1.64 | |

Tradeweb Markets, Inc. Class A | 992 | 67,932 | 1.46 | |

Financial services | ||||

Element Fleet Management Corp. | 10,400 | 158,424 | 3.41 | |

Equitable Holdings, Inc. | 2,349 | 63,799 | 1.37 | |

Kinnevik AB Class B | 3,723 | 51,643 | 1.11 | |

Wendel SE | 1,030 | 105,787 | 2.28 | |

Insurance | ||||

American Financial Group, Inc. | 672 | 79,800 | 1.72 | |

Erie Indemnity Co. Class A | 743 | 156,037 | 3.36 | |

Globe Life, Inc. | 921 | 100,960 | 2.17 | |

iA Financial Corp., Inc. | 1,200 | 81,751 | 1.76 | |

Willis Towers Watson PLC | 254 | 59,817 | 1.29 | |

2,178,973 | ||||

Health care | ||||

Biotechnology | ||||

Allakos, Inc. | 15,247 | 66,477 | 1.43 | |

Gilead Sciences, Inc. | 1,426 | 109,902 | 2.37 | |

Kodiak Sciences, Inc. | 10,342 | 71,360 | 1.54 | |

Swedish Orphan Biovitrum AB | 2,767 | 54,082 | 1.17 | |

Health care equipment & supplies | ||||

DENTSPLY SIRONA, Inc. | 1,712 | 68,514 | 1.48 | |

Zynex, Inc. | 7,090 | 67,993 | 1.46 | |

Health care providers & services | ||||

Addus HomeCare Corp. | 538 | 49,873 | 1.07 | |

Life sciences tools & services | ||||

Agilent Technologies, Inc. | 408 | 49,062 | 1.06 | |

Bio-Rad Laboratories, Inc. Class A | 173 | 65,588 | 1.41 | |

Mettler-Toledo International, Inc. | 40 | 52,466 | 1.13 | |

Waters Corp. | 246 | 65,569 | 1.41 | |

Pharmaceuticals | ||||

Amneal Pharmaceuticals, Inc. | 17,281 | 53,571 | 1.15 | |

Ligand Pharmaceuticals, Inc. | 924 | 66,620 | 1.44 | |

Orion Oyj Class B | 2,604 | 108,069 | 2.33 | |

Viatris, Inc. | 10,673 | 106,517 | 2.29 | |

1,055,663 |

Reference asset | Shares | Value | % of swap basket value | |

Long positions (continued) | ||||

Common stocks (continued) | ||||

Industrials | ||||

Commercial services & supplies | ||||

Dai Nippon Printing Co. Ltd. | 2,000 | $56,811 | 1.22 % | |

TOPPAN, Inc. | 3,100 | 66,996 | 1.44 | |

Construction & engineering | ||||

Argan, Inc. | 2,061 | 81,224 | 1.75 | |

Monadelphous Group Ltd. | 9,114 | 71,299 | 1.54 | |

Electrical equipment | ||||

Hubbell, Inc. | 336 | 111,404 | 2.40 | |

Thermon Group Holdings, Inc. | 3,461 | 92,063 | 1.98 | |

TPI Composites, Inc. | 4,925 | 51,072 | 1.10 | |

Ground transportation | ||||

Covenant Logistics Group, Inc. | 1,148 | 50,317 | 1.09 | |

Keisei Electric Railway Co. Ltd. | 1,900 | 78,754 | 1.70 | |

Kintetsu Group Holdings Co. Ltd. | 2,600 | 90,044 | 1.94 | |

Industrial conglomerates | ||||

Nisshinbo Holdings, Inc. | 6,100 | 50,587 | 1.09 | |

Machinery | ||||

CIRCOR International, Inc. | 1,338 | 75,530 | 1.63 | |

Otis Worldwide Corp. | 1,095 | 97,466 | 2.10 | |

Toro Co. | 524 | 53,265 | 1.15 | |

Professional services | ||||

Barrett Business Services, Inc. | 1,329 | 115,889 | 2.50 | |

Booz Allen Hamilton Holding Corp. | 1,259 | 140,504 | 3.03 | |

Randstad NV | 1,943 | 102,473 | 2.21 | |

Trading companies & distributors | ||||

WW Grainger, Inc. | 72 | 56,778 | 1.22 | |

1,442,476 | ||||

Information technology | ||||

Electronic equipment, instruments & components | ||||

Arlo Technologies, Inc. | 5,122 | 55,881 | 1.21 | |

Arrow Electronics, Inc. | 364 | 52,136 | 1.12 | |

Azbil Corp. | 1,800 | 56,970 | 1.23 | |

Venture Corp. Ltd. | 9,300 | 101,535 | 2.19 | |

IT services | ||||

CGI, Inc. | 1,300 | 137,090 | 2.95 | |

Gartner, Inc. | 163 | 57,101 | 1.23 | |

Otsuka Corp. | 2,900 | 112,960 | 2.43 | |

VeriSign, Inc. | 428 | 96,715 | 2.08 | |

Wix.com Ltd. | 735 | 57,506 | 1.24 | |

Semiconductors & semiconductor equipment | ||||

Teradyne, Inc. | 1,063 | 118,344 | 2.55 | |

Software | ||||

Adeia, Inc. | 5,475 | 60,280 | 1.30 | |

Descartes Systems Group, Inc. | 1,000 | 80,106 | 1.72 | |

Dropbox, Inc. Class A | 8,062 | 215,013 | 4.63 | |

Fair Isaac Corp. | 199 | 161,033 | 3.47 | |

OneSpan, Inc. | 5,052 | 74,972 | 1.61 | |

Oracle Corp. Japan | 2,600 | 193,371 | 4.17 |

Reference asset | Shares | Value | % of swap basket value | |

Long positions (continued) | ||||

Common stocks (continued) | ||||

Information technology (continued) | ||||

Software (continued) | ||||

Telos Corp. | 23,027 | $58,949 | 1.27 % | |

Yext, Inc. | 8,203 | 92,776 | 2.00 | |

1,782,738 | ||||

Materials | ||||

Chemicals | ||||

Clariant AG | 3,743 | 54,148 | 1.17 | |

Johnson Matthey PLC | 5,951 | 132,110 | 2.85 | |

Koppers Holdings, Inc. | 1,928 | 65,745 | 1.42 | |

Orica Ltd. | 6,171 | 61,135 | 1.32 | |

Metals & mining | ||||

Reliance Steel & Aluminum Co. | 306 | 83,106 | 1.79 | |

396,244 | ||||

Real estate | ||||

Diversified REITs | ||||

British Land Co. PLC | 15,663 | 60,402 | 1.30 | |

H&R Real Estate Investment Trust | 11,200 | 86,658 | 1.87 | |

Stockland | 24,779 | 66,613 | 1.44 | |

Health care REITs | ||||

Medical Properties Trust, Inc. | 5,443 | 50,402 | 1.08 | |

Industrial REITs | ||||

CapitaLand Ascendas REIT | 40,600 | 81,946 | 1.77 | |

Office REITs | ||||

Covivio | 1,547 | 73,080 | 1.57 | |

Gecina SA | 535 | 57,073 | 1.23 | |

Ichigo Office REIT Investment Corp. | 95 | 58,947 | 1.27 | |

Real estate management & development | ||||

Swire Pacific Ltd. Class A | 7,000 | 53,779 | 1.16 | |

Retail REITs | ||||

CBL & Associates Properties, Inc. | 3,510 | 77,360 | 1.67 | |

Klepierre SA | 3,877 | 96,321 | 2.08 | |

Mercialys SA | 8,783 | 79,371 | 1.71 | |

RioCan Real Estate Investment Trust | 6,600 | 96,054 | 2.07 | |

Vicinity Ltd. | 57,170 | 70,406 | 1.52 | |

Waypoint REIT Ltd. | 52,189 | 90,265 | 1.95 | |

1,098,677 | ||||

Utilities | ||||

Gas utilities | ||||

Enagas SA | 2,609 | 51,276 | 1.10 | |

Independent power and renewable electricity producers | ||||

Orron Energy AB | 84,314 | 88,808 | 1.91 | |

Multi-utilities | ||||

Canadian Utilities Ltd. Class A | 2,500 | 64,748 | 1.40 | |

204,832 |

Reference asset | Dividend yield | Shares | Value | % of swap basket value |

Long positions (continued) | ||||

Preferred stocks | ||||

Consumer discretionary | ||||

Automobile components | ||||

Schaeffler AG | 0.20 % | 10,565 | $65,215 | 1.41 % |

Short positions | ||||

Common stocks | ||||

Communication services | ||||

Diversified telecommunication services | ||||

BCE, Inc. | (1,300 ) | $(59,272 ) | (1.28 )% | |

Cellnex Telecom SA | (3,614 ) | (146,019 ) | (3.14 ) | |

Entertainment | ||||

Warner Bros Discovery, Inc. | (6,571 ) | (82,400 ) | (1.78 ) | |

Media | ||||

Trade Desk, Inc. Class A | (1,631 ) | (125,946 ) | (2.71 ) | |

(413,637 ) | ||||

Consumer discretionary | ||||

Automobile components | ||||

Aptiv PLC | (696 ) | (71,055 ) | (1.53 ) | |

Denso Corp. | (1,600 ) | (107,923 ) | (2.33 ) | |

Automobiles | ||||

Rivian Automotive, Inc. Class A | (4,296 ) | (71,571 ) | (1.54 ) | |

Tesla, Inc. | (429 ) | (112,299 ) | (2.42 ) | |

Toyota Motor Corp. | (8,900 ) | (143,042 ) | (3.08 ) | |

Broadline retail | ||||

Rakuten Group, Inc. | (31,200 ) | (108,717 ) | (2.34 ) | |

Hotels, restaurants & leisure | ||||

Carnival Corp. | (5,116 ) | (96,334 ) | (2.08 ) | |

Dave & Buster’s Entertainment, Inc. | (1,302 ) | (58,017 ) | (1.25 ) | |

DoorDash, Inc. Class A | (1,286 ) | (98,276 ) | (2.12 ) | |

MGM Resorts International | (1,696 ) | (74,488 ) | (1.60 ) | |

Norwegian Cruise Line Holdings Ltd. | (2,339 ) | (50,920 ) | (1.10 ) | |

Planet Fitness, Inc. Class A | (1,499 ) | (101,093 ) | (2.18 ) | |

Royal Caribbean Cruises Ltd. | (635 ) | (65,875 ) | (1.42 ) | |

Household durables | ||||

GN Store Nord AS | (2,731 ) | (68,298 ) | (1.47 ) | |

Panasonic Holdings Corp. | (5,500 ) | (67,441 ) | (1.45 ) | |

Sony Group Corp. | (1,700 ) | (153,459 ) | (3.31 ) | |

Leisure products | ||||

Mattel, Inc. | (2,447 ) | (47,814 ) | (1.03 ) | |

Specialty retail | ||||

Floor & Decor Holdings, Inc. Class A | (987 ) | (102,609 ) | (2.21 ) | |

RH | (370 ) | (121,948 ) | (2.63 ) | |

Valvoline, Inc. | (1,380 ) | (51,764 ) | (1.11 ) | |

Textiles, apparel & luxury goods | ||||

LVMH Moet Hennessy Louis Vuitton SE | (52 ) | (49,032 ) | (1.06 ) | |

(1,821,975 ) |

Reference asset | Shares | Value | % of swap basket value | |

Short positions (continued) | ||||

Common stocks (continued) | ||||

Consumer staples | ||||

Beverages | ||||

Diageo PLC | (1,956 ) | $(84,090 ) | (1.81 )% | |

Consumer staples distribution & retail | ||||

Seven & i Holdings Co. Ltd. | (1,800 ) | (77,764 ) | (1.68 ) | |

Food products | ||||

Nestle SA | (1,003 ) | (120,652 ) | (2.60 ) | |

(282,506 ) | ||||

Energy | ||||

Oil, gas & consumable fuels | ||||

Enbridge, Inc. | (3,700 ) | (137,526 ) | (2.96 ) | |

Energy Fuels, Inc. | (8,100 ) | (50,321 ) | (1.08 ) | |

Gevo, Inc. | (36,697 ) | (55,779 ) | (1.20 ) | |

Santos Ltd. | (15,955 ) | (79,831 ) | (1.72 ) | |

TC Energy Corp. | (1,800 ) | (72,747 ) | (1.57 ) | |

(396,204 ) | ||||

Financials | ||||

Banks | ||||

National Australia Bank Ltd. | (2,881 ) | (50,671 ) | (1.09 ) | |

Royal Bank of Canada | (600 ) | (57,303 ) | (1.24 ) | |

Toronto-Dominion Bank | (1,100 ) | (68,180 ) | (1.47 ) | |

Capital markets | ||||

Brookfield Corp. | (2,100 ) | (70,700 ) | (1.52 ) | |

Coinbase Global, Inc. Class A | (1,438 ) | (102,889 ) | (2.22 ) | |

Deutsche Boerse AG | (297 ) | (54,830 ) | (1.18 ) | |

EQT AB | (5,848 ) | (112,584 ) | (2.43 ) | |

Macquarie Group Ltd. | (1,010 ) | (120,178 ) | (2.59 ) | |

S&P Global, Inc. | (387 ) | (155,144 ) | (3.34 ) | |

Consumer finance | ||||

SoFi Technologies, Inc. | (7,745 ) | (64,593 ) | (1.39 ) | |

Financial services | ||||

Apollo Global Management, Inc. | (1,427 ) | (109,608 ) | (2.36 ) | |

Berkshire Hathaway, Inc. Class B | (209 ) | (71,269 ) | (1.54 ) | |

Investor AB Class A | (3,646 ) | (72,969 ) | (1.57 ) | |

Investor AB Class B | (6,951 ) | (139,055 ) | (3.00 ) | |

Nexi SpA | (13,386 ) | (105,023 ) | (2.26 ) | |

Insurance | ||||

Brown & Brown, Inc. | (805 ) | (55,416 ) | (1.19 ) | |

Legal & General Group PLC | (37,967 ) | (109,926 ) | (2.37 ) | |

Tryg AS | (3,064 ) | (66,354 ) | (1.43 ) | |

Mortgage real estate investment trusts (REITs) | ||||

ARMOUR Residential REIT, Inc. | (11,461 ) | (61,087 ) | (1.32 ) | |

(1,647,779 ) | ||||

Health care | ||||

Biotechnology | ||||

Argenx SE | (159 ) | (62,009 ) | (1.34 ) | |

CSL Ltd. | (693 ) | (128,329 ) | (2.76 ) |

Reference asset | Shares | Value | % of swap basket value | |

Short positions (continued) | ||||

Common stocks (continued) | ||||

Health care (continued) | ||||

Health care providers & services | ||||

R1 RCM, Inc. | (3,074 ) | $(56,715 ) | (1.22 )% | |

UnitedHealth Group, Inc. | (175 ) | (84,112 ) | (1.81 ) | |

Pharmaceuticals | ||||

AstraZeneca PLC | (387 ) | (55,478 ) | (1.19 ) | |

JCR Pharmaceuticals Co. Ltd. | (6,000 ) | (53,182 ) | (1.15 ) | |

(439,825 ) | ||||

Industrials | ||||

Aerospace & defense | ||||

Safran SA | (620 ) | (97,160 ) | (2.09 ) | |

Building products | ||||

Daikin Industries Ltd. | (400 ) | (81,962 ) | (1.77 ) | |

Construction & engineering | ||||

Ferrovial SE | (1,563 ) | (49,410 ) | (1.06 ) | |

Electrical equipment | ||||

Emerson Electric Co. | (614 ) | (55,500 ) | (1.19 ) | |

ITM Power PLC | (75,203 ) | (69,175 ) | (1.49 ) | |

NIDEC Corp. | (1,100 ) | (60,616 ) | (1.31 ) | |

Ground transportation | ||||

Canadian Pacific Kansas City Ltd. | (1,800 ) | (145,386 ) | (3.13 ) | |

Grab Holdings Ltd. Class A | (50,252 ) | (172,364 ) | (3.71 ) | |

Machinery | ||||

Makita Corp. | (1,800 ) | (50,879 ) | (1.10 ) | |

SMC Corp. | (100 ) | (55,576 ) | (1.20 ) | |

Stanley Black & Decker, Inc. | (1,129 ) | (105,799 ) | (2.28 ) | |

Toyota Industries Corp. | (1,200 ) | (85,973 ) | (1.85 ) | |

Professional services | ||||

TransUnion | (805 ) | (63,056 ) | (1.36 ) | |

Trading companies & distributors | ||||

AerCap Holdings NV | (2,713 ) | (172,330 ) | (3.71 ) | |

Transportation infrastructure | ||||

Transurban Group | (5,702 ) | (54,291 ) | (1.17 ) | |

(1,319,477 ) | ||||

Information technology | ||||

Electronic equipment, instruments & components | ||||

Coherent Corp. | (2,457 ) | (125,258 ) | (2.70 ) | |

Hexagon AB Class B | (13,337 ) | (164,049 ) | (3.53 ) | |

Keyence Corp. | (100 ) | (47,516 ) | (1.02 ) | |

IT services | ||||

Nomura Research Institute Ltd. | (1,700 ) | (46,967 ) | (1.01 ) | |

Shopify, Inc. Class A | (1,100 ) | (71,094 ) | (1.53 ) | |

Snowflake, Inc. Class A | (621 ) | (109,284 ) | (2.36 ) | |

Semiconductors & semiconductor equipment | ||||

Advanced Micro Devices, Inc. | (1,166 ) | (132,819 ) | (2.86 ) | |

MKS Instruments Inc | (1,140 ) | (123,234 ) | (2.66 ) | |

Software | ||||

BILL Holdings, Inc. | (789 ) | (92,195 ) | (1.99 ) | |

Datadog, Inc. Class A | (557 ) | (54,798 ) | (1.18 ) | |

Unity Software, Inc. | (1,969 ) | (85,494 ) | (1.84 ) |

Reference asset | Shares | Value | % of swap basket value | |

Short positions (continued) | ||||

Common stocks (continued) | ||||

Information technology (continued) | ||||

Technology hardware, storage & peripherals | ||||

Fujifilm Holdings Corp. | (800 ) | $(47,666 ) | (1.03 )% | |

(1,100,374 ) | ||||

Materials | ||||

Chemicals | ||||

Air Liquide SA | (295 ) | (52,904 ) | (1.14 ) | |

Metals & mining | ||||

Agnico Eagle Mines Ltd. | (1,100 ) | (54,927 ) | (1.18 ) | |

Lithium Americas Corp. | (5,200 ) | (105,236 ) | (2.27 ) | |

Sayona Mining Ltd. | (688,044 ) | (81,134 ) | (1.75 ) | |

(294,201 ) | ||||

Real estate | ||||

Health care REITs | ||||

Welltower, Inc. | (912 ) | (73,772 ) | (1.59 ) | |

Industrial REITs | ||||

Rexford Industrial Realty, Inc. | (2,022 ) | (105,589 ) | (2.28 ) | |

Office REITs | ||||

Nippon Building Fund, Inc. | (14 ) | (55,050 ) | (1.19 ) | |

Orix JREIT, Inc. | (72 ) | (88,632 ) | (1.91 ) | |

Real estate management & development | ||||

Mitsubishi Estate Co. Ltd. | (5,100 ) | (60,590 ) | (1.30 ) | |

Vonovia SE | (4,360 ) | (85,149 ) | (1.83 ) | |

Retail REITs | ||||

Realty Income Corp. | (1,622 ) | (96,979 ) | (2.09 ) | |

(565,761 ) | ||||

Utilities | ||||

Independent power and renewable electricity producers | ||||

RWE AG | (1,496 ) | (65,190 ) | (1.41 ) | |

(65,190 ) |

Abbreviations: | |

REIT | Real estate investment trust |

Assets | |

Investments in unaffiliated securities, at value (cost $23,403,943) | $23,384,162 |

Investments in affiliated securities, at value (cost $5,629,388) | 5,629,388 |

Cash | 10 |

Cash due from broker | 168,011 |

Cash at broker segregated for futures contracts | 7,885,297 |

Segregated cash for swap contracts | 1,117,000 |

Foreign currency, at value (cost $32) | 31 |

Unrealized gains on forward foreign currency contracts | 445,873 |

Receivable for daily variation margin on open futures contracts | 273,072 |

Receivable from manager | 48,558 |

Receivable for interest | 27,685 |

Receivable for Fund shares sold | 7,018 |

Prepaid expenses and other assets | 91,338 |

Total assets | 39,077,443 |

Liabilities | |

Cash collateral due to broker for forward foreign currency contracts | 330,000 |

Payable for swap contracts | 326,494 |

Payable for daily variation margin on open futures contracts | 207,395 |

Unrealized losses on swap contracts | 156,183 |

Unrealized losses on forward foreign currency contracts | 150,667 |

Payable for Fund shares redeemed | 47,602 |

Administration fees payable | 1,088 |

Trustees’ fees and expenses payable | 292 |

Accrued expenses and other liabilities | 15,804 |

Total liabilities | 1,235,525 |

Total net assets | $37,841,918 |

Net assets consist of | |

Paid-in capital | $38,435,365 |

Total distributable loss | (593,447 ) |

Total net assets | $37,841,918 |

Computation of net asset value per share | |

Net assets–Class R6 | $36,890,522 |

Shares outstanding–Class R61 | 4,466,947 |

Net asset value per share–Class R6 | $8.26 |

Net assets–Institutional Class | $951,396 |

Shares outstanding–Institutional Class1 | 115,595 |

Net asset value per share–Institutional Class | $8.23 |

1 | The Fund has an unlimited number of authorized shares. |

Investment income | |

Interest | $1,033,331 |

Income from affiliated securities | 399,139 |

Total investment income | 1,432,470 |

Expenses | |

Management fee | 269,535 |

Administration fees | |

Class R6 | 13,195 |

Institutional Class | 1,221 |

Custody and accounting fees | 101,096 |

Professional fees | 96,954 |

Registration fees | 43,607 |

Shareholder report expenses | 27,918 |

Trustees’ fees and expenses | 20,431 |

Other fees and expenses | 93,732 |

Total expenses | 667,689 |

Less: Fee waivers and/or expense reimbursements | |

Fund-level | (387,802 ) |

Institutional Class | (428 ) |

Net expenses | 279,459 |

Net investment income | 1,153,011 |

Realized and unrealized gains (losses) on investments | |

Net realized gains (losses) on | |

Unaffiliated securities | (5,699 ) |

Foreign currency and foreign currency translations | (85,980 ) |

Payment from affiliate | 130,877 |

Forward foreign currency contracts | 1,917,523 |

Futures contracts | (669,436 ) |

Swap contracts | 124,251 |

Net realized gains on investments | 1,411,536 |

Net change in unrealized gains (losses) on | |

Unaffiliated securities | (14,840 ) |

Foreign currency and foreign currency translations | 940 |

Forward foreign currency contracts | 411,670 |

Futures contracts | (879,434 ) |

Swap contracts | (395,230 ) |

Net change in unrealized gains (losses) on investments | (876,894 ) |

Net realized and unrealized gains (losses) on investments | 534,642 |

Net increase in net assets resulting from operations | $1,687,653 |

Year ended June 30, 2023 | Year ended June 30, 2022 | |||

Operations | ||||

Net investment income (loss) | $1,153,011 | $(378,293 ) | ||

Net realized gains on investments | 1,411,536 | 3,935,291 | ||

Net change in unrealized gains (losses) on investments | (876,894 ) | 934,009 | ||

Net increase in net assets resulting from operations | 1,687,653 | 4,491,007 | ||

Distributions to shareholders from | ||||

Net investment income and net realized gains | ||||

Class R6 | (5,243,974 ) | 0 | ||

Institutional Class | (126,693 ) | 0 | ||

Total distributions to shareholders | (5,370,667 ) | 0 | ||

Capital share transactions | Shares | Shares | ||

Proceeds from shares sold | ||||

Class R6 | 2,093,518 | 19,055,274 | 104,165 | 886,741 |

Institutional Class | 0 | 0 | 100,000 | 853,000 |

19,055,274 | 1,739,741 | |||

Reinvestment of distributions | ||||

Class R6 | 638,607 | 5,243,974 | 0 | 0 |

Institutional Class | 15,484 | 126,693 | 0 | 0 |

5,370,667 | 0 | |||

Payment for shares redeemed | ||||

Class R6 | (4,204,500 ) | (38,017,325 ) | (2,679,117 ) | (23,152,340 ) |

Institutional Class | (2,389 ) | (21,716 ) | 0 | 0 |

(38,039,041 ) | (23,152,340 ) | |||

Net decrease in net assets resulting from capital share transactions | (13,613,100 ) | (21,412,599 ) | ||

Total decrease in net assets | (17,296,114 ) | (16,921,592 ) | ||

Net assets | ||||

Beginning of period | 55,138,032 | 72,059,624 | ||

End of period | $37,841,918 | $55,138,032 | ||

(For a share outstanding throughout each period)

Year ended June 30 | |||||

Class R6 | 2023 | 2022 | 2021 | 2020 | 20191 |

Net asset value, beginning of period | $9.13 | $8.46 | $8.02 | $9.75 | $10.00 |

Net investment income (loss) | 0.33 | (0.11 ) | (0.05 )2 | 0.10 | 0.07 |

Payment from affiliate | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | 0.01 | 0.78 | 0.49 | (1.73 ) | (0.32 ) |

Total from investment operations | 0.36 | 0.67 | 0.44 | (1.63 ) | (0.25 ) |

Distributions to shareholders from | |||||

Net investment income | (0.83 ) | 0.00 | 0.00 | (0.03 ) | 0.00 |

Net realized gains | (0.40 ) | 0.00 | 0.00 | (0.07 ) | 0.00 |

Total distributions to shareholders | (1.23 ) | 0.00 | 0.00 | (0.10 ) | 0.00 |

Net asset value, end of period | $8.26 | $9.13 | $8.46 | $8.02 | $9.75 |

Total return3 | 4.44 %* | 7.92 % | 5.49 % | (16.78 )% | (2.50 )% |

Ratios to average net assets (annualized) | |||||

Gross expenses | 1.48 % | 1.15 % | 1.09 % | 1.04 % | 1.56 % |

Net expenses | 0.62 % | 0.62 % | 0.62 % | 0.62 % | 0.62 % |

Net investment income (loss) | 2.56 % | (0.56 )% | (0.58 )% | 1.03 % | 1.78 % |

Supplemental data | |||||

Portfolio turnover rate | 0 % | 0 % | 0 % | 0 % | 0 % |

Net assets, end of period (000s omitted) | $36,891 | $54,205 | $72,039 | $65,765 | $38,957 |

* | For year ended June 30, 2023, the Fund received a payment from an affiliate that had an impact of 0.25% on total return. See Note 5 in the Notes to Financial Statements for additional information. |

1 | For the period from January 29, 2019 (commencement of class operations) to June 30, 2019 |

2 | Calculated based upon average shares outstanding |

3 | Returns for periods of less than one year are not annualized. |

(For a share outstanding throughout each period)

Year ended June 30 | |||||

Institutional Class | 2023 | 2022 | 2021 | 2020 | 20191 |

Net asset value, beginning of period | $9.10 | $8.44 | $8.02 | $9.74 | $10.00 |

Net investment income (loss) | 0.29 | (0.10 ) | (0.05 ) | 0.09 | 0.07 |

Payment from affiliate | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | 0.05 | 0.76 | 0.47 | (1.72 ) | (0.33 ) |

Total from investment operations | 0.36 | 0.66 | 0.42 | (1.63 ) | (0.26 ) |

Distributions to shareholders from | |||||

Net investment income | (0.83 ) | 0.00 | 0.00 | (0.02 ) | 0.00 |

Net realized gains | (0.40 ) | 0.00 | 0.00 | (0.07 ) | 0.00 |

Total distributions to shareholders | (1.23 ) | 0.00 | 0.00 | (0.09 ) | 0.00 |

Net asset value, end of period | $8.23 | $9.10 | $8.44 | $8.02 | $9.74 |

Total return2 | 4.43 %* | 7.82 % | 5.24 % | (16.87 )% | (2.60 )% |

Ratios to average net assets (annualized) | |||||

Gross expenses | 1.62 % | 1.35 % | 1.21 % | 1.15 % | 1.68 % |

Net expenses | 0.72 % | 0.72 % | 0.72 % | 0.72 % | 0.72 % |

Net investment income (loss) | 2.65 % | (0.53 )% | (0.68 )% | 0.95 % | 1.69 % |

Supplemental data | |||||

Portfolio turnover rate | 0 % | 0 % | 0 % | 0 % | 0 % |

Net assets, end of period (000s omitted) | $951 | $933 | $21 | $20 | $24 |

* | For year ended June 30, 2023, the Fund received a payment from an affiliate that had an impact of 0.25% on total return. See Note 5 in the Notes to Financial Statements for additional information. |

1 | For the period from January 29, 2019 (commencement of class operations) to June 30, 2019 |

2 | Returns for periods of less than one year are not annualized. |

The Fund may enter into total return basket swap contracts to obtain exposure to a custom basket of long and short securities without owning such securities. The Fund has the ability to trade in and out of the long and short positions within the swap and receives the economic benefits and risks equivalent to direct investments in these positions. Under the terms of the contract, the Fund and the counterparty exchange periodic payments based on the total return of reference assets within a basket for a specified interest rate. Benefits and risks include capital appreciation (depreciation), corporate actions and dividends received and paid, all of which are reflected in the swap’s market value. The market value also includes interest charges and credits (“financing fees”) related to the notional values of the long and short positions and cash balances within the swap. To the extent the total return of the reference assets exceeds or falls short of the offsetting interest rate obligation, the Fund will receive a payment from, or make a payment to, the counterparty. Positions within the swap are reset periodically. During a reset, any unrealized appreciation (depreciation) on positions and accrued financing fees become available for cash settlement between the Fund and the counterparty. The amounts that are available for cash settlement are recorded as realized gains or losses on swap contracts in the Consolidated Statement of Operations. Cash settlement in and out of the swap may occur at a reset date or any other date, at the discretion of the Fund and the counterparty, over the life of the agreement. Certain swaps have no stated expiration and can be terminated by either party at any time.

Gross unrealized gains | $98,889 |

Gross unrealized losses | (17,245 ) |

Net unrealized gains | $81,644 |

Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

Assets | ||||

Investments in: | ||||

Short-term investments | ||||

Investment companies | $5,629,388 | $0 | $0 | $5,629,388 |

U.S. Treasury securities | 23,384,162 | 0 | 0 | 23,384,162 |

29,013,550 | 0 | 0 | 29,013,550 | |

Forward foreign currency contracts | 0 | 445,873 | 0 | 445,873 |

Futures contracts | 650,734 | 0 | 0 | 650,734 |

Total assets | $29,664,284 | $445,873 | $0 | $30,110,157 |

Liabilities | ||||

Forward foreign currency contracts | $0 | $150,667 | $0 | $150,667 |

Futures contracts | 427,825 | 0 | 0 | 427,825 |

Swap contracts | 0 | 156,183 | 0 | 156,183 |

Total liabilities | $427,825 | $306,850 | $0 | $734,675 |

Average daily net assets | Management fee |

First $500 million | 0.600 % |

Next $500 million | 0.575 |

Next $2 billion | 0.550 |

Next $2 billion | 0.525 |

Next $5 billion | 0.490 |

Over $10 billion | 0.480 |

Class-level administration fee | |

Class R6 | 0.03 % |

Institutional Class | 0.13 |

EXPENSE RATIO CAPS | |

Class R6 | 0.62 % |

Institutional Class | 0.72 |

Futures contracts | |

Average notional balance on long futures | $24,899,706 |

Average notional balance on short futures | 35,814,574 |

Forward foreign currency contracts | |

Average contract amounts to buy | $20,172,757 |

Average contract amounts to sell | 28,406,580 |

Swap contracts | |

Average notional balance | $4,414,781 |

Interest rate risk | Commodity risk | Equity risk | Foreign currency risk | Total | |

Asset derivatives | |||||

Futures contracts | $32,164 * | $517,596 * | $100,974 * | $0 | $650,734 |

Forward foreign currency contracts | 0 | 0 | 0 | 445,873 | 445,873 |

$32,164 | $517,596 | $100,974 | $445,873 | $1,096,607 | |

Liability derivatives | |||||

Futures contracts | $82,907 * | $336,830 * | $8,088 * | $0 | $427,825 |

Forward foreign currency contracts | 0 | 0 | 0 | 150,667 | 150,667 |

Swap contracts | 0 | 0 | 156,183 | 0 | 156,183 |

$82,907 | $336,830 | $164,271 | $150,667 | $734,675 | |

* | Amount represents the cumulative unrealized gains (losses) as reported in the table following the Consolidated Portfolio of Investments. For futures contracts, only the current day’s variation margin as of June 30, 2023 is reported separately on the Consolidated Statement of Assets and Liabilities. |

Interest rate risk | Commodity risk | Equity risk | Foreign currency risk | Total | |

Net realized gains (losses) on derivatives | |||||

Futures contracts | $(629,956 ) | $393,170 | $(432,650 ) | $0 | $(669,436 ) |

Forward foreign currency contracts | 0 | 0 | 0 | 1,917,523 | 1,917,523 |

Swap contracts | 0 | 0 | 124,251 | 0 | 124,251 |

$(629,956 ) | $393,170 | $(308,399 ) | $1,917,523 | $1,372,338 | |

Net change in unrealized gains (losses) on derivatives | |||||

Futures contracts | $(805,872 ) | $(162,886 ) | $89,324 | $0 | $(879,434 ) |

Forward foreign currency contracts | 0 | 0 | 0 | 411,670 | 411,670 |

Swap contracts | 0 | 0 | (395,230 ) | 0 | (395,230 ) |

$(805,872 ) | $(162,886 ) | $(305,906 ) | $411,670 | $(862,994 ) | |

Counterparty | Gross amounts of assets in the Consolidated Statement of Assets and Liabilities | Amounts subject to netting agreements | Collateral received1 | Net amount of assets |

Goldman Sachs International | $445,873 | $(306,850 ) | $(139,023 ) | $0 |

Counterparty | Gross amounts of liabilities in the Consolidated Statement of Assets and Liabilities | Amounts subject to netting agreements | Collateral pledged | Net amount of liabilities |

Goldman Sachs International | $306,850 | $(306,850 ) | $0 | $0 |

1 | Collateral received within this table is limited to the collateral for the net transaction with the counterparty. |

Year ended June 30 | ||

2023 | 2022 | |

Ordinary income | $3,927,235 | $0 |

Long-term capital gain | 1,443,432 | 0 |

Undistributed ordinary income | Unrealized gains | Capital loss carryforward |

$1,195,159 | $82,634 | $(1,871,240 ) |

Allspring Funds Trust:

Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Foundation (non-profit organization). Mr. Ebsworth is a CFA charterholder. | N/A |

Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

Isaiah Harris, Jr. (Born 1952) | Trustee, since 2009; Audit Committee Chair, since 2019 | Retired. Member of the Advisory Board of CEF of East Central Florida. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | N/A |

David F. Larcker (Born 1950) | Trustee, since 2009 | Distinguished Visiting Fellow at the Hoover Institution since 2022. James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

Olivia S. Mitchell (Born 1953) | Trustee, since 2006; Nominating and Governance Committee Chair, since 2018 | International Foundation of Employee Benefit Plans Professor since 1993, Wharton School of the University of Pennsylvania. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously taught at Cornell University from 1978 to 1993. | N/A |

Timothy J. Penny (Born 1951) | Trustee, since 1996; Chair, since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Vice Chair of the Economic Club of Minnesota, since 2007. Co-Chair of the Committee for a Responsible Federal Budget, since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, from 2007-2022. Senior Fellow of the University of Minnesota Humphrey Institute from 1995 to 2017. | N/A |

Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

James G. Polisson (Born 1959) | Trustee, since 2018 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non- profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

Pamela Wheelock (Born 1959) | Trustee, since January 2020; previously Trustee from January 2018 to July 2019 | Retired. Executive and Senior Financial leadership positions in the public, private and nonprofit sectors. Interim President and CEO, McKnight Foundation, 2020. Interim Commissioner, Minnesota Department of Human Services, 2019. Chief Operating Officer, Twin Cities Habitat for Humanity, 2017-2019. Vice President for University Services, University of Minnesota, 2012- 2016. Interim President and CEO, Blue Cross and Blue Shield of Minnesota, 2011-2012. Executive Vice-President and Chief Financial Officer, Minnesota Wild, 2002-2008. Commissioner, Minnesota Department of Finance, 1999-2002. Chair of the Board of Directors of Destination Medical Center Corporation. Board member of the Minnesota Wild Foundation. | N/A |

* | Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable. |

Name and year of birth | Position held and length of service | Principal occupations during past five years or longer |

Andrew Owen (Born 1960) | President, since 2017 | President and Chief Executive Officer of Allspring Funds Management, LLC since 2017 and Head of Global Fund Governance of Allspring Global Investments since 2022. Prior thereto, co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, from 2019 to 2022 and Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. |

Jeremy DePalma (Born 1974) | Treasurer, since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. |

Christopher Baker (Born 1976) | Chief Compliance Officer, since 2022 | Global Chief Compliance Officer for Allspring Global Investments since 2022. Prior thereto, Chief Compliance Officer for State Street Global Advisors from 2018 to 2021. Senior Compliance Officer for the State Street divisions of Alternative Investment Solutions, Sector Solutions, and Global Marketing from 2015 to 2018. From 2010 to 2015 Vice President, Global Head of Investment and Marketing Compliance for State Street Global Advisors. |

Matthew Prasse (Born 1983) | Chief Legal Officer, since 2022; Secretary, since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

P.O. Box 219967

Kansas City, MO 64121-9967

AR4723 06-23

2 | |

6 | |

10 | |

11 | |

23 | |

24 | |

25 | |

26 | |

30 | |

34 | |

35 |

Allspring Funds

President

Allspring Funds

Notice to Shareholders |

Beginning in July 2024, the Fund will be required by the Securities and Exchange Commission to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance information and fund statistics. If you wish to receive this new tailored shareholder report electronically, please follow the instructions on the back cover of this report. |

Other information that is currently included in the shareholder report, such as the Fund’s financial statements, will be available online and upon request, free of charge, in paper or electronic format. |

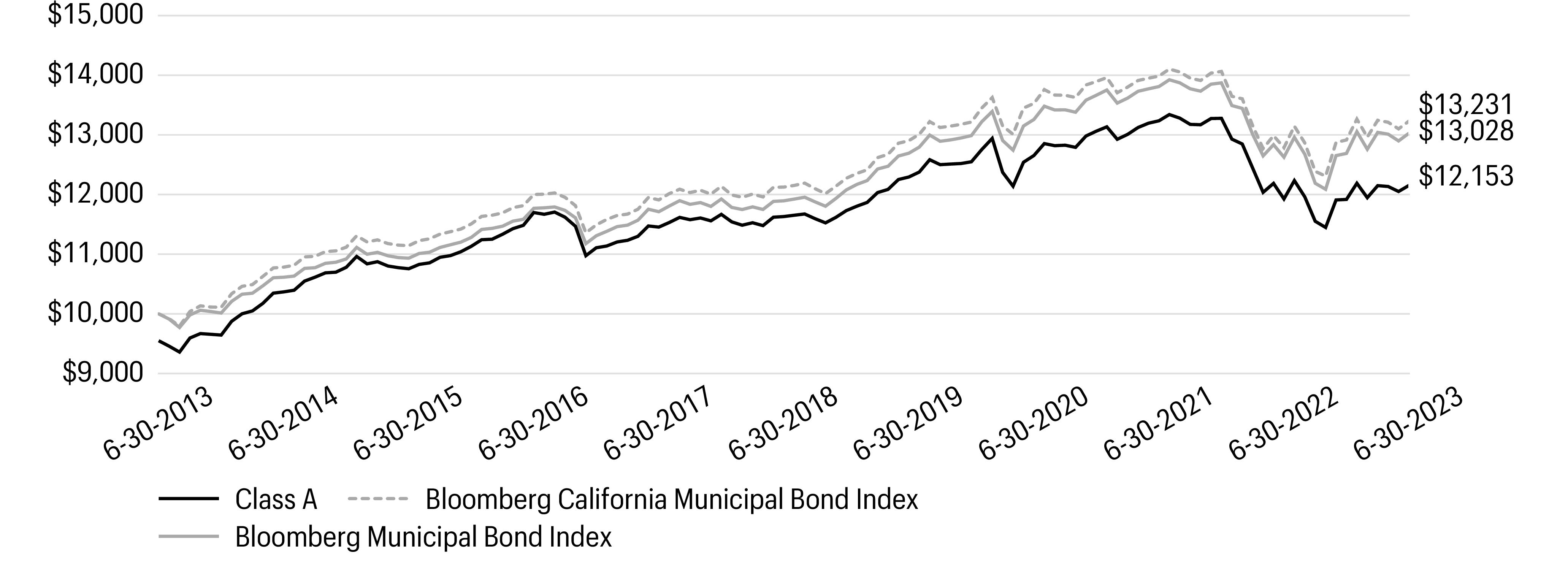

Investment objective | The Fund seeks current income exempt from federal income tax and California individual income tax, consistent with capital preservation. |

Manager | Allspring Funds Management, LLC |

Subadviser | Allspring Global Investments, LLC |

Portfolio manager | Terry J. Goode, Kim Nakahara, Adrian Van Poppel |

Average annual total returns (%) as of June 30, 2023 | |||||||||

Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||

Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net2 | |

Class A (SFCIX) | 11-18-1992 | -0.25 | 0.13 | 0.83 | 1.73 | 0.54 | 1.04 | 0.85 | 0.80 |

Class C (SFCCX) | 8-30-2002 | -0.13 | -0.23 | 0.44 | 0.87 | -0.23 | 0.44 | 1.60 | 1.55 |

Administrator Class (SCTIX) | 9-6-1996 | – | – | – | 1.83 | 0.72 | 1.24 | 0.79 | 0.60 |

Institutional Class (SFCNX)3 | 10-31-2014 | – | – | – | 2.04 | 0.84 | 1.33 | 0.52 | 0.50 |

Bloomberg Municipal Bond 1-5 Year Blend Index4 | – | – | – | – | 1.17 | 1.19 | 1.30 | – | – |

Bloomberg California Municipal 1-5 Year Blend Index5 | – | – | – | – | 1.20 | 0.98 | 1.21 | – | – |

1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the Financial Highlights of this report. |

2 | The manager has contractually committed through October 31, 2023, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.80% for Class A, 1.55% for Class C, 0.60% for Administrator Class and 0.50% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

3 | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns for the Institutional Class shares would be higher. |

4 | The Bloomberg Municipal Bond 1–5 Year Blend Index is the 1–5 Year component of the Bloomberg Municipal Bond Index. The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

5 | The Bloomberg California Municipal 1-5 Year Blend Index is the 1-5 Year component of the Bloomberg California Municipal Bond Index. You cannot invest directly in an index. |

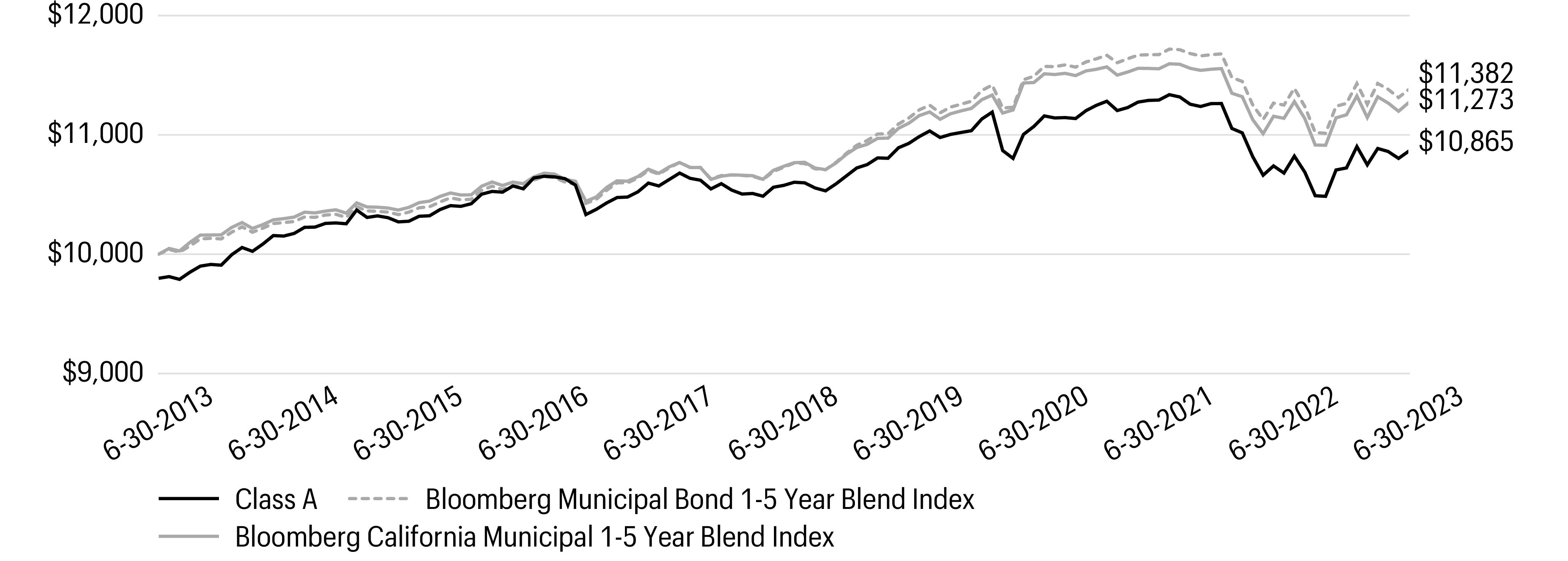

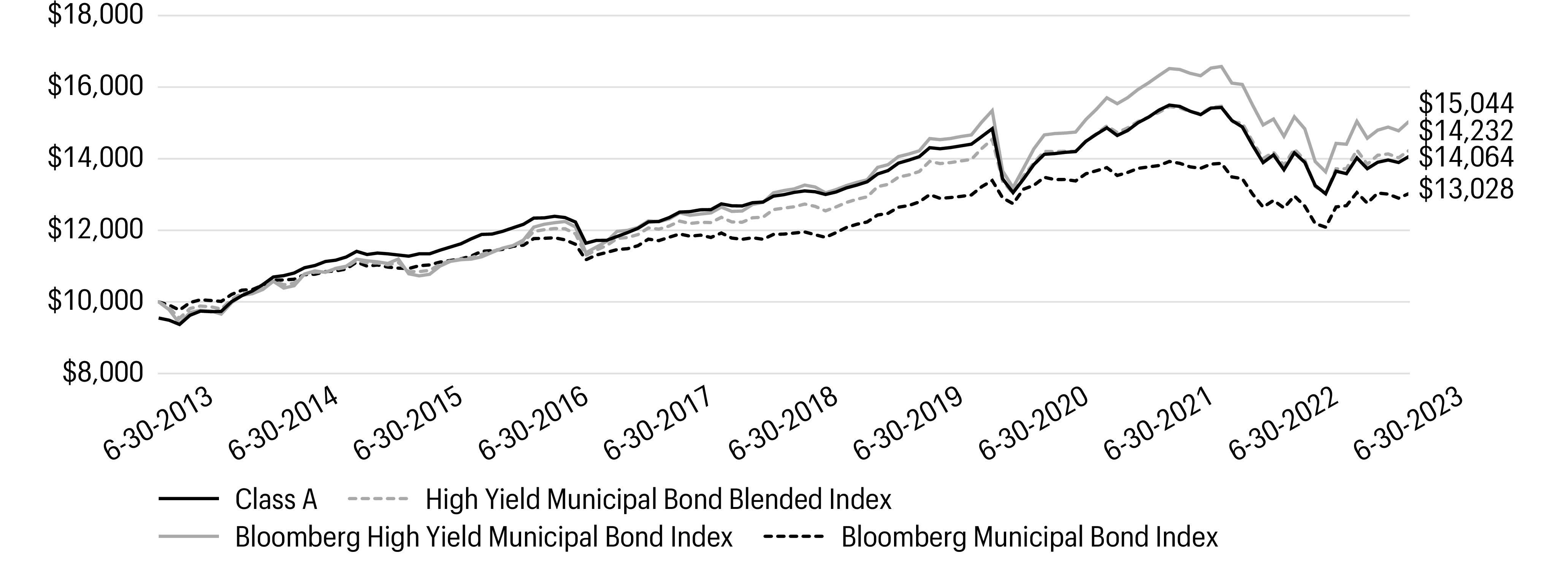

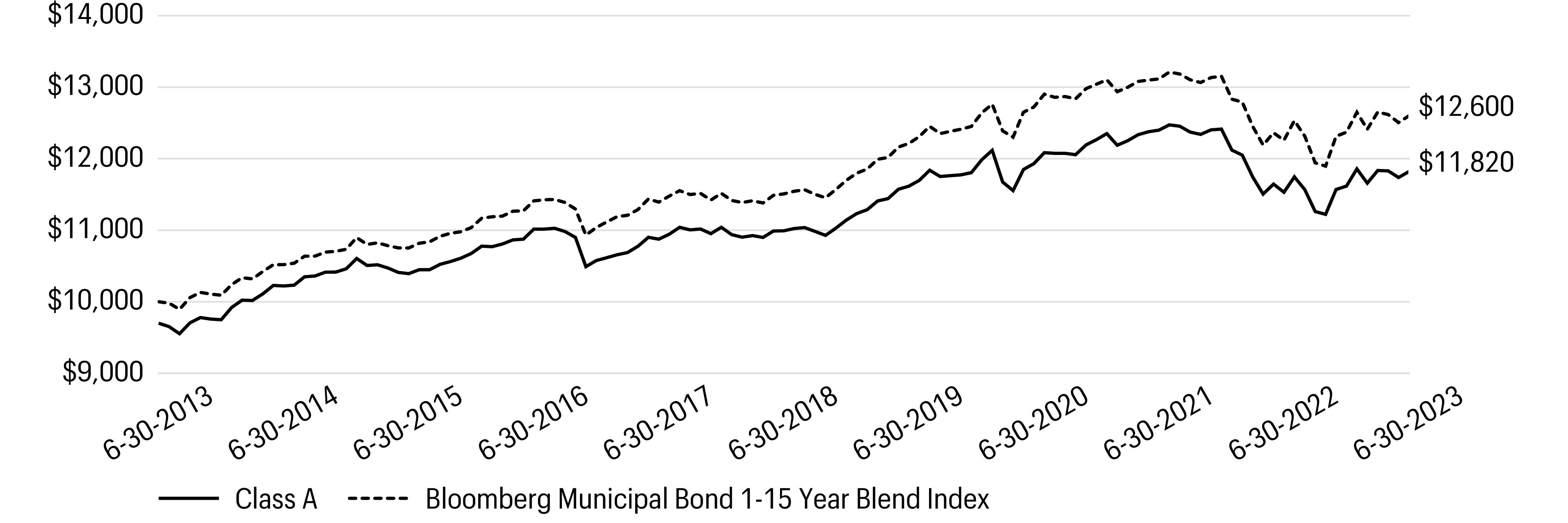

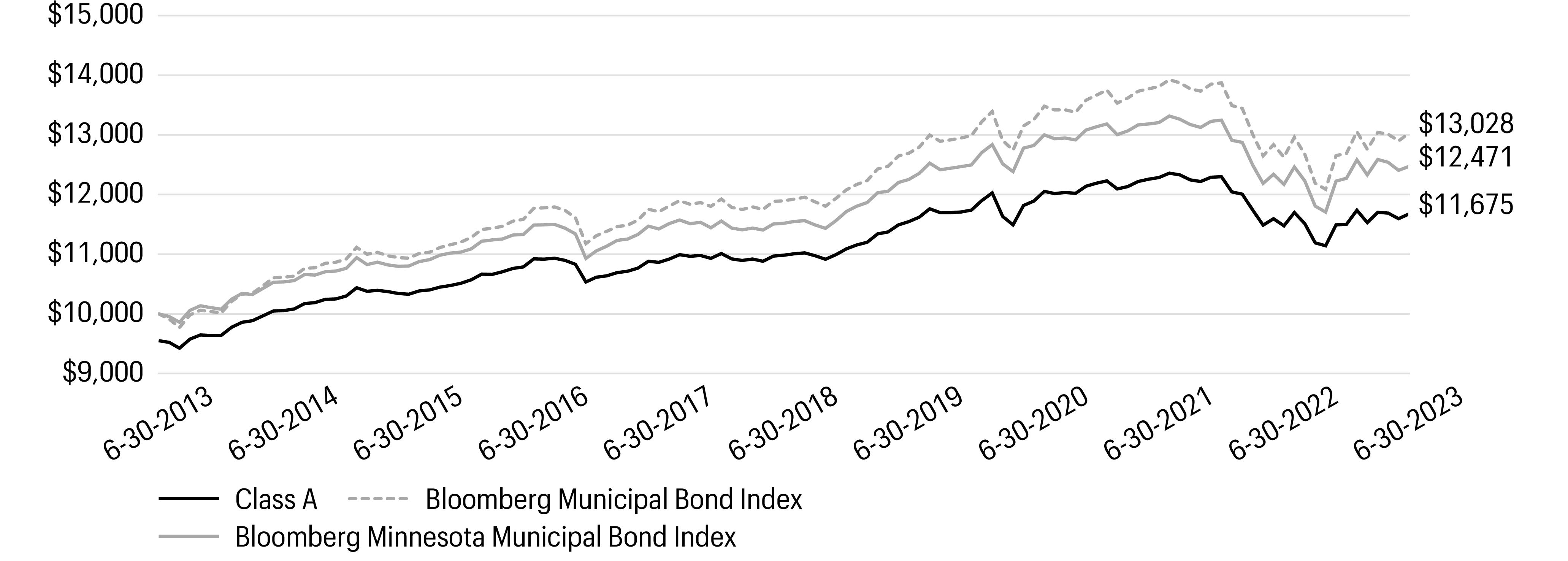

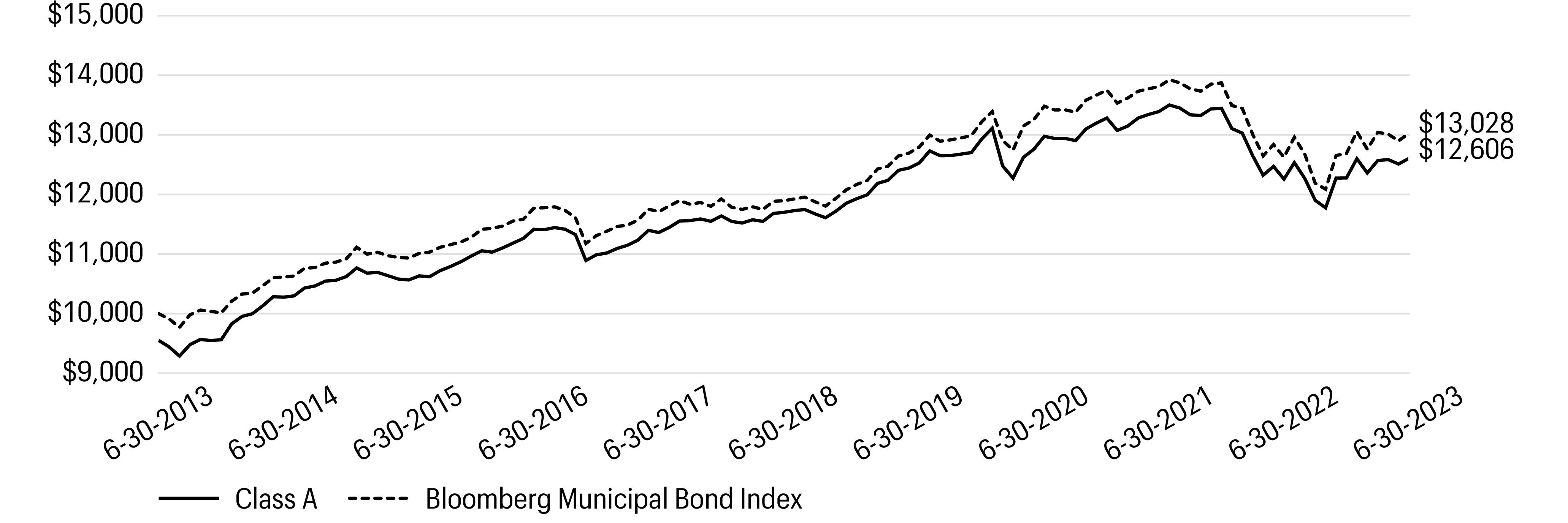

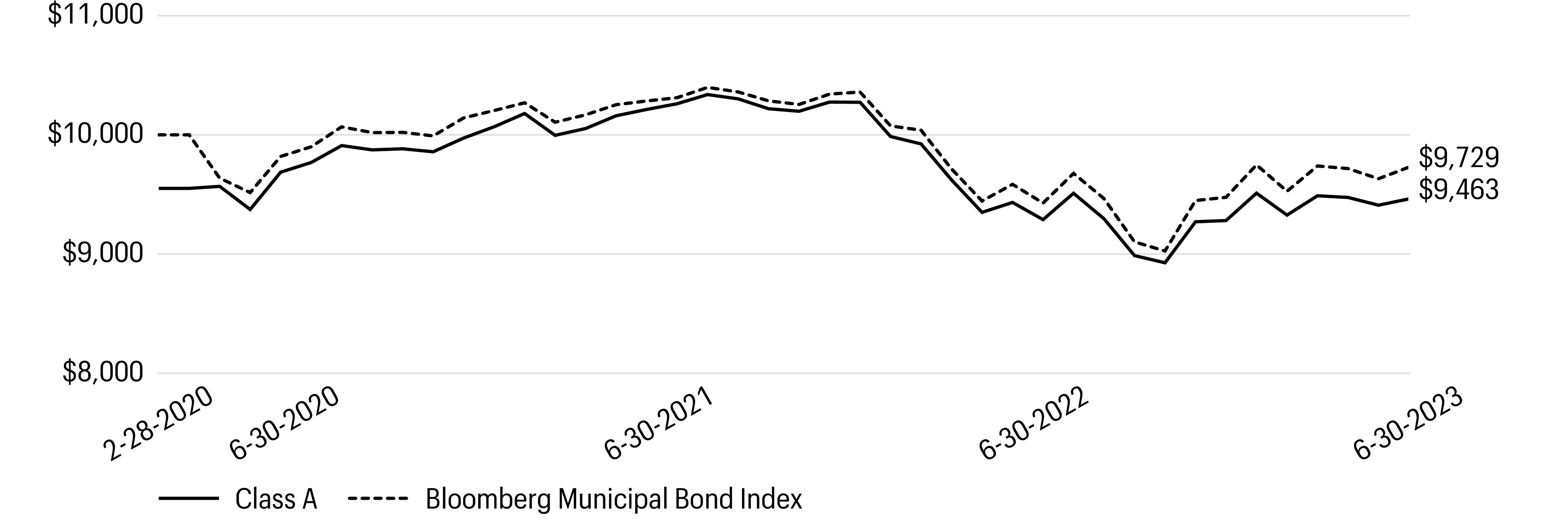

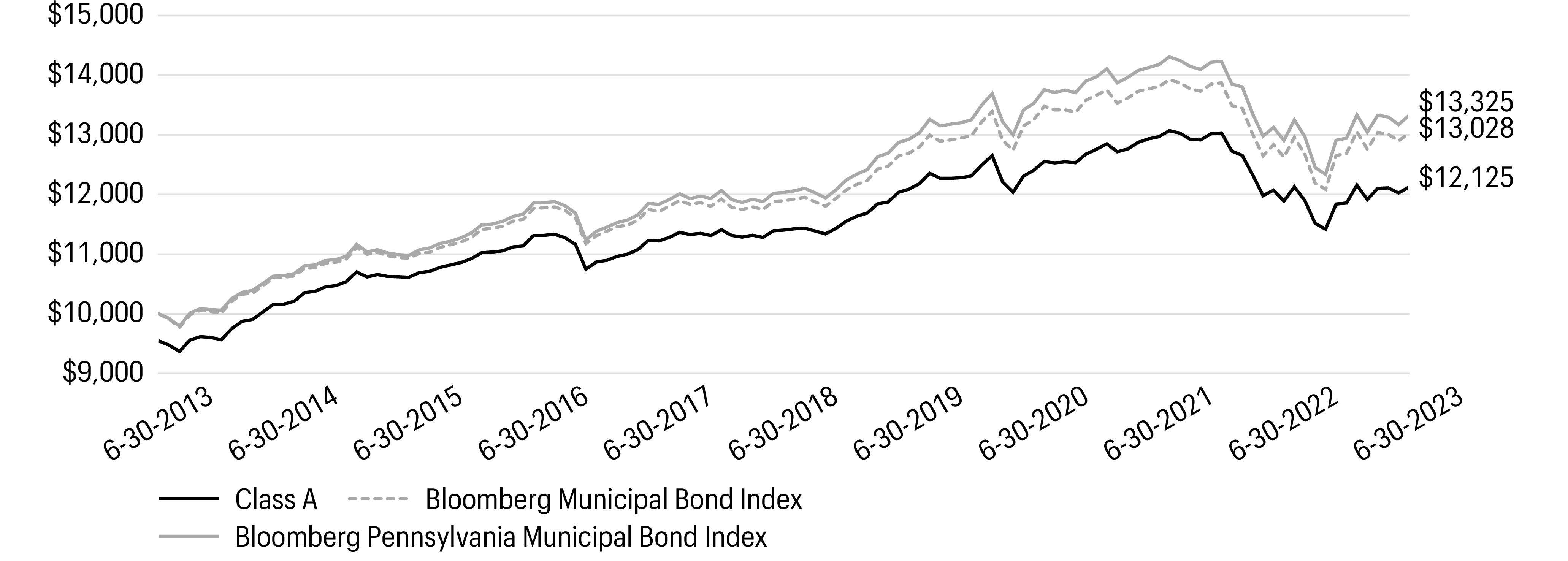

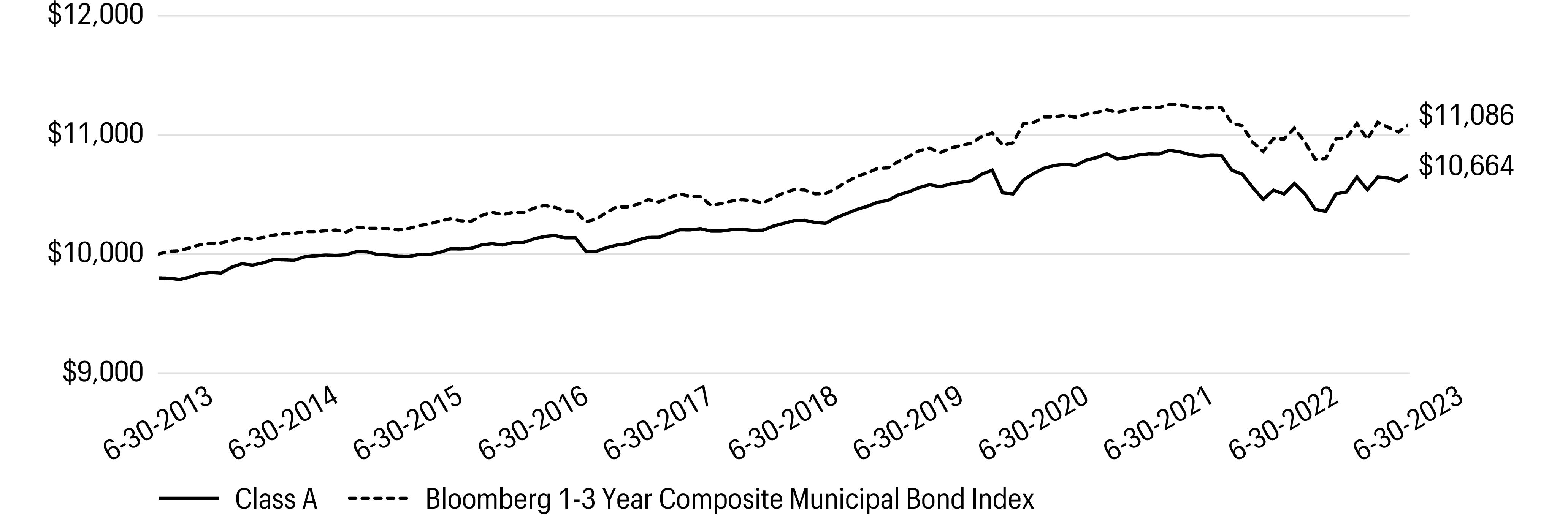

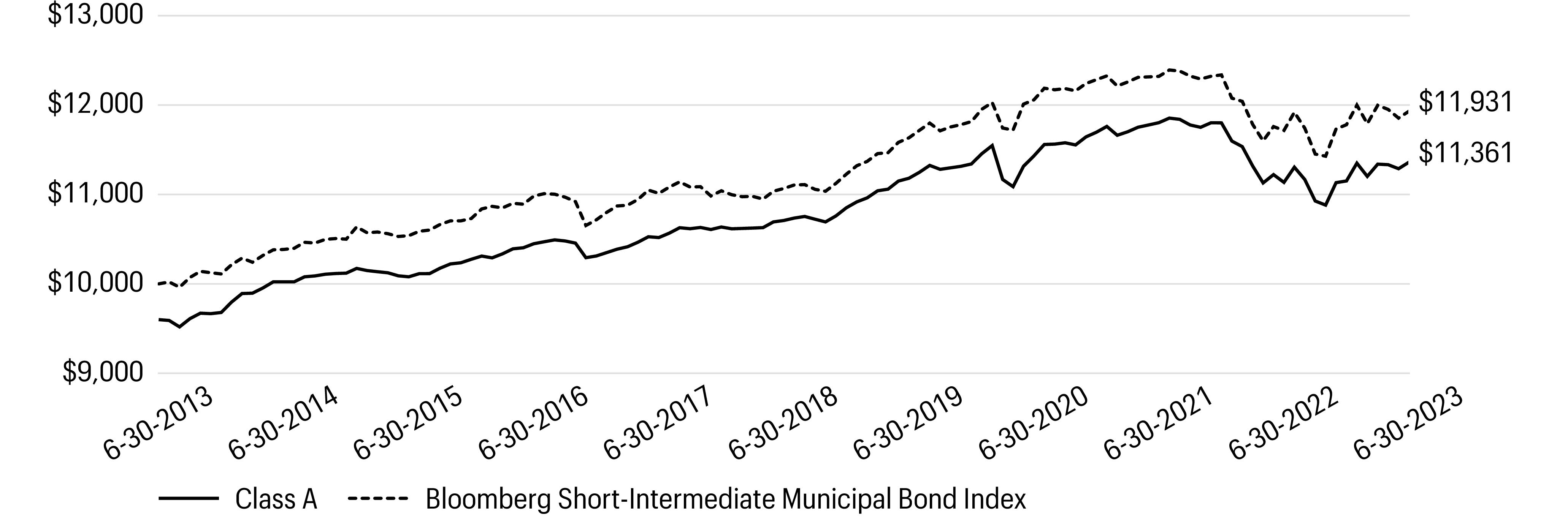

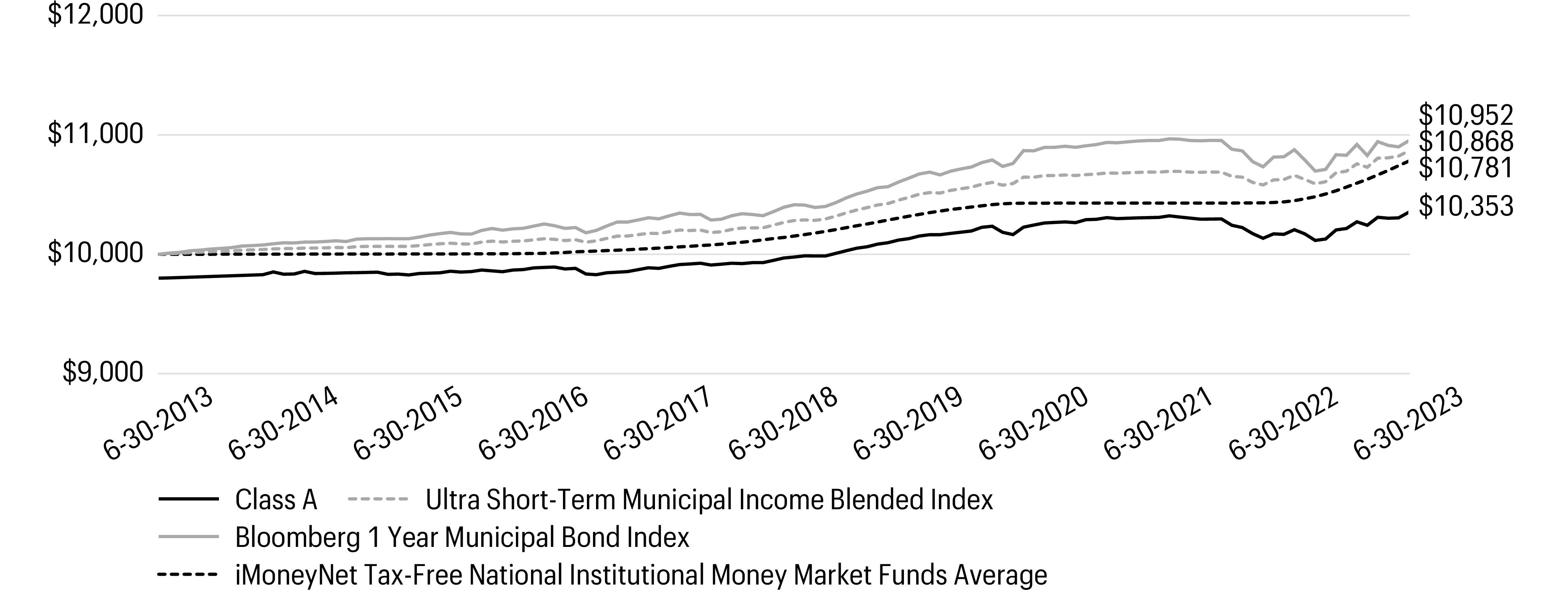

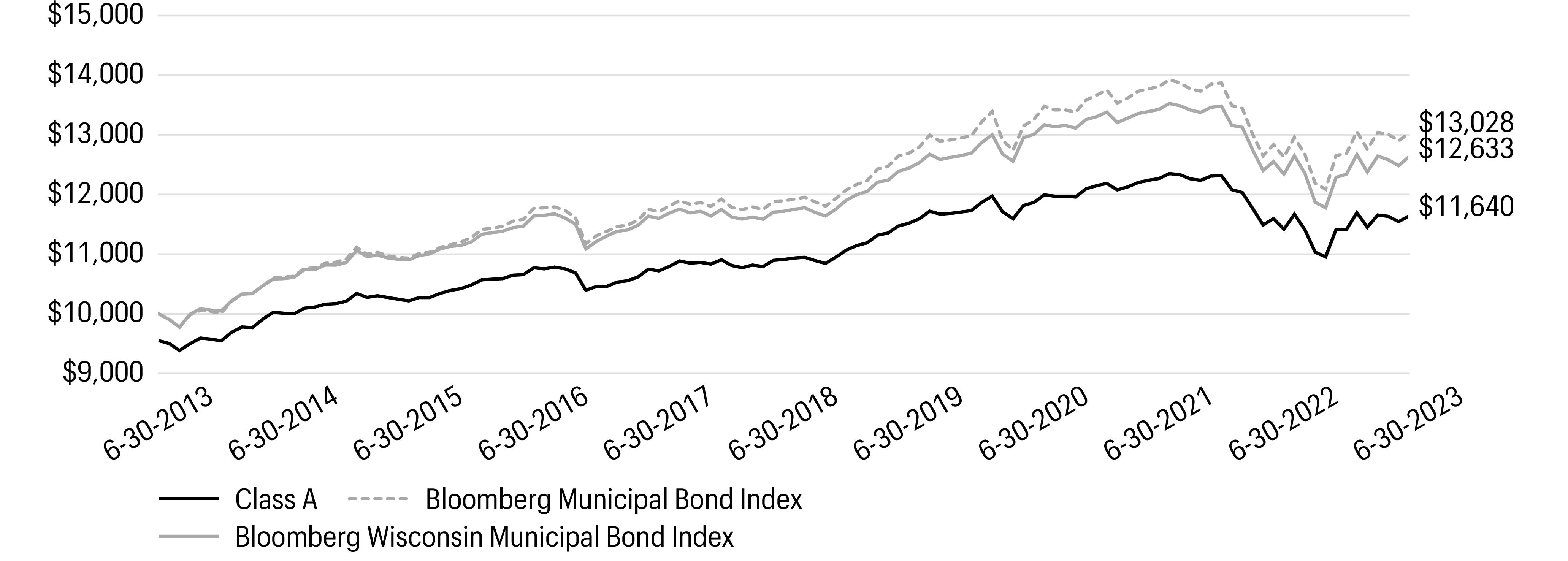

Growth of $10,000 investment as of June 30, 20231 |

1 | The chart compares the performance of Class A shares for the most recent ten years with the Bloomberg Municipal Bond 1-5 Year Blend Index and Bloomberg California Municipal 1-5 Year Blend Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 2.00%. |

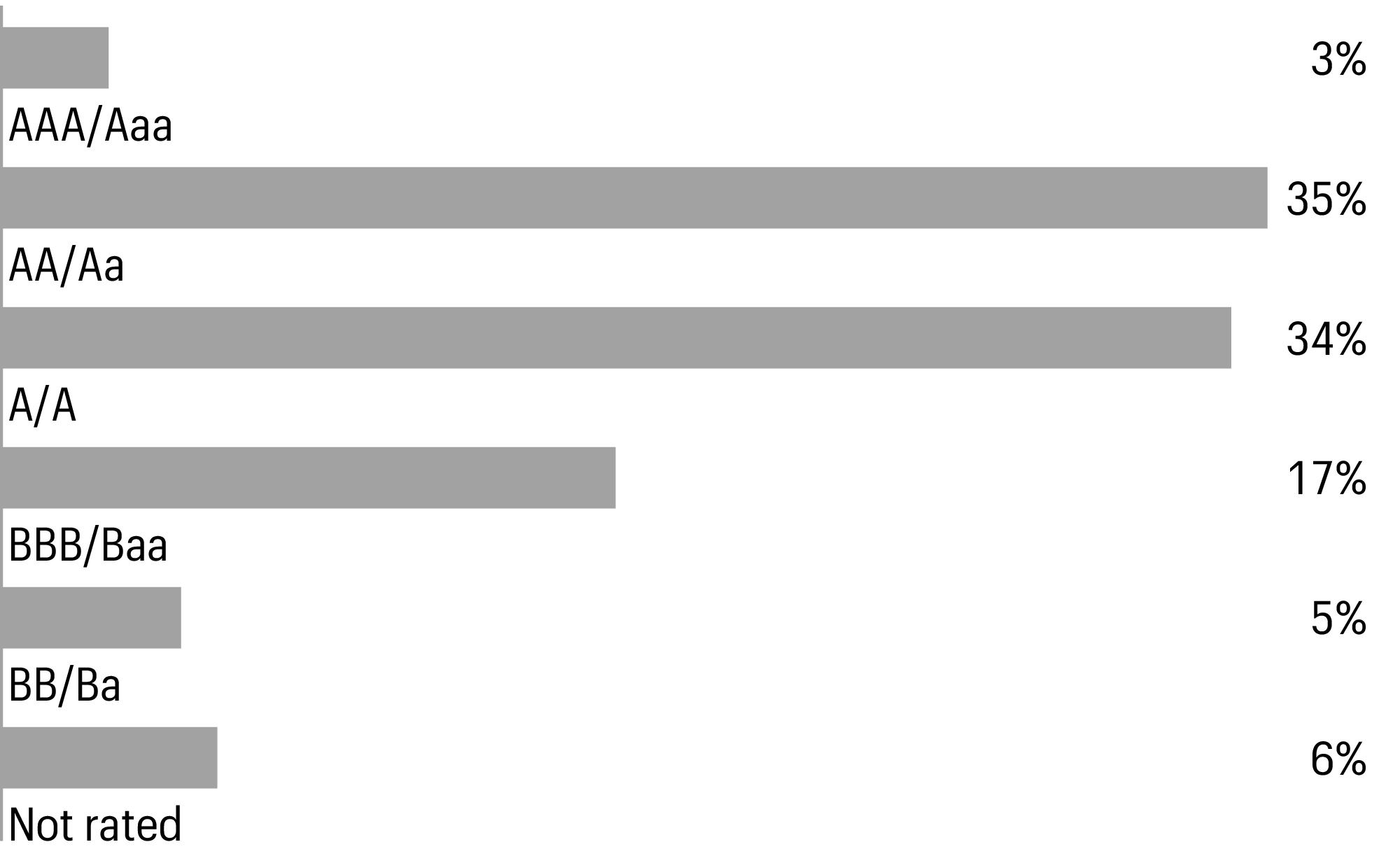

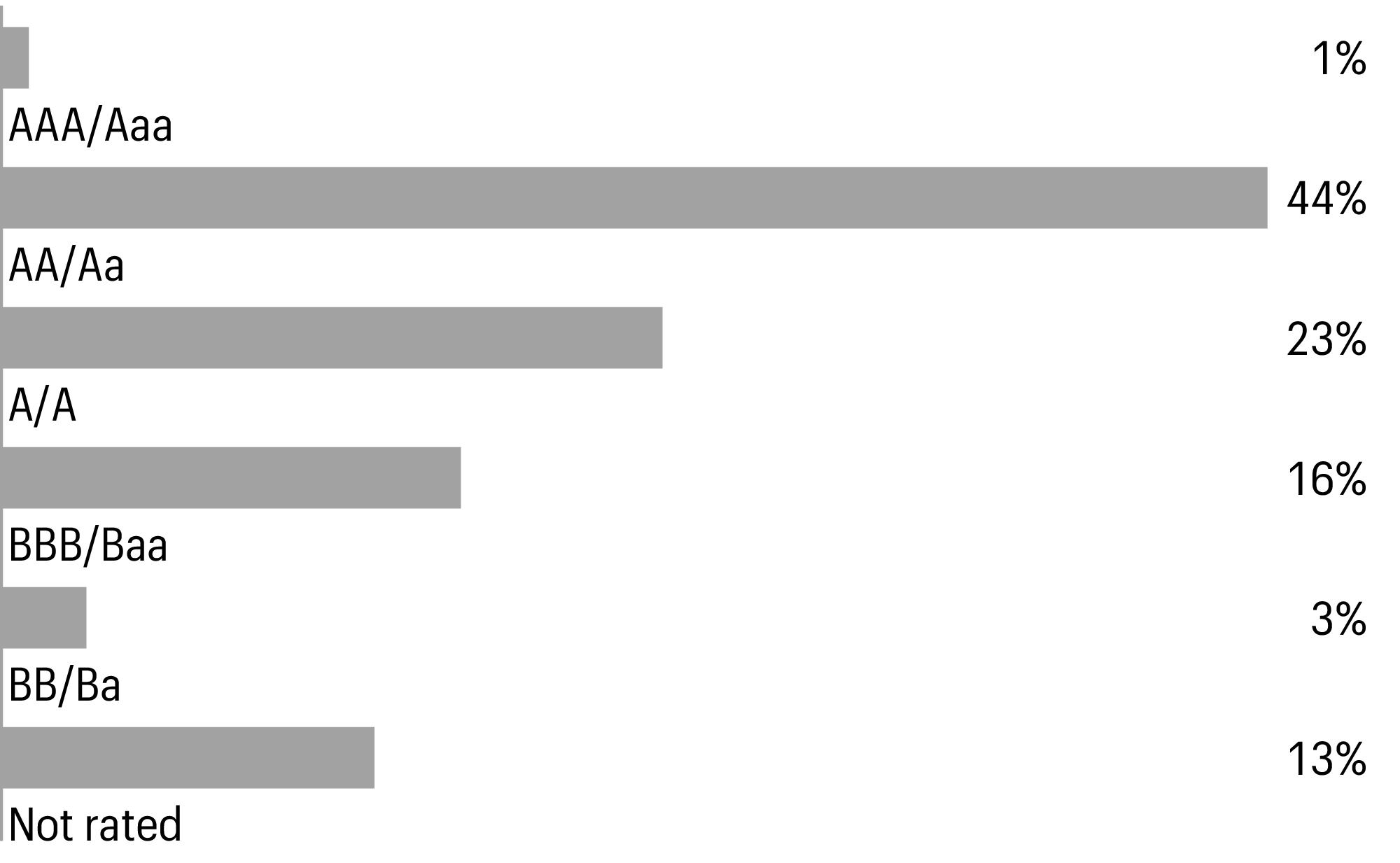

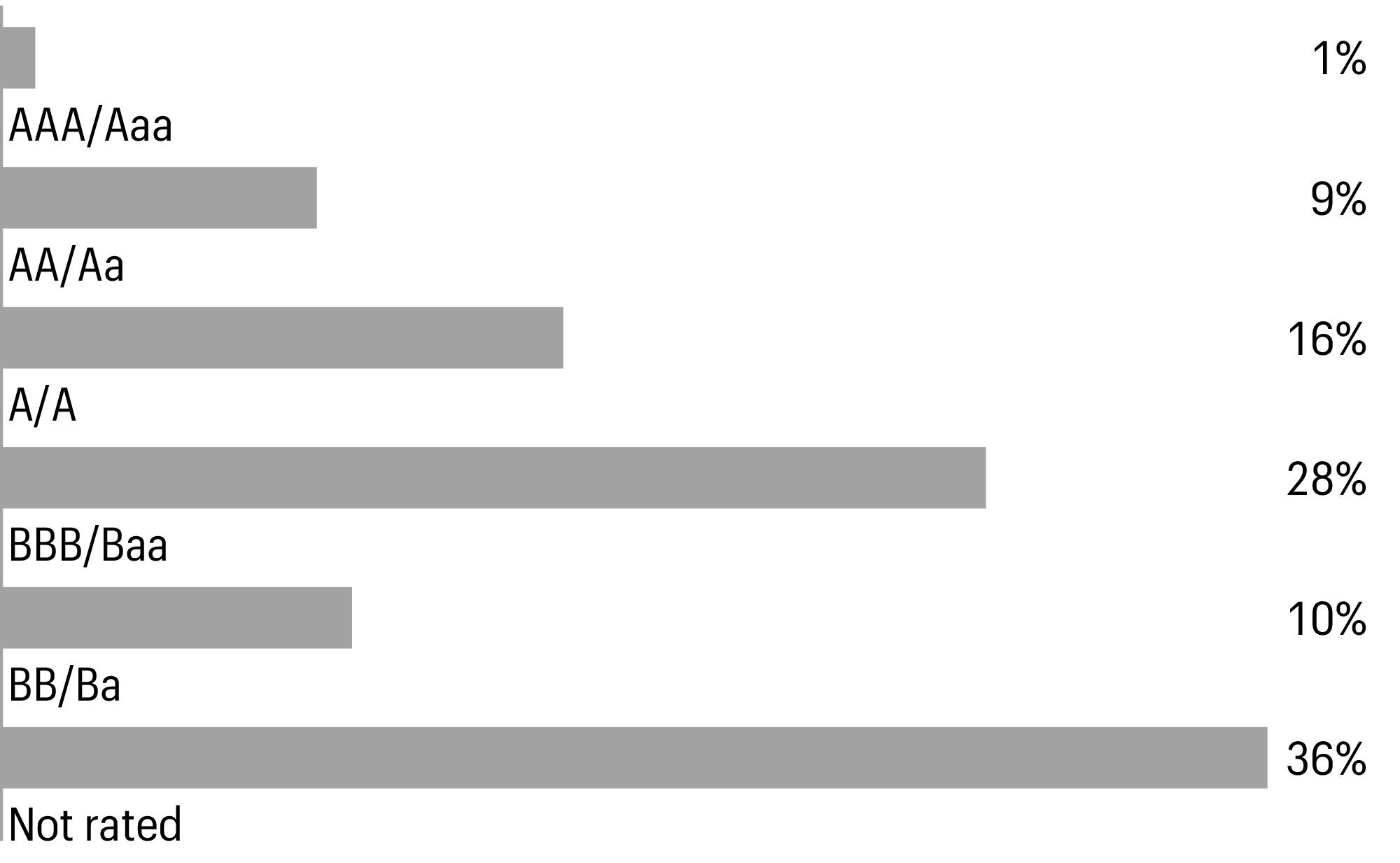

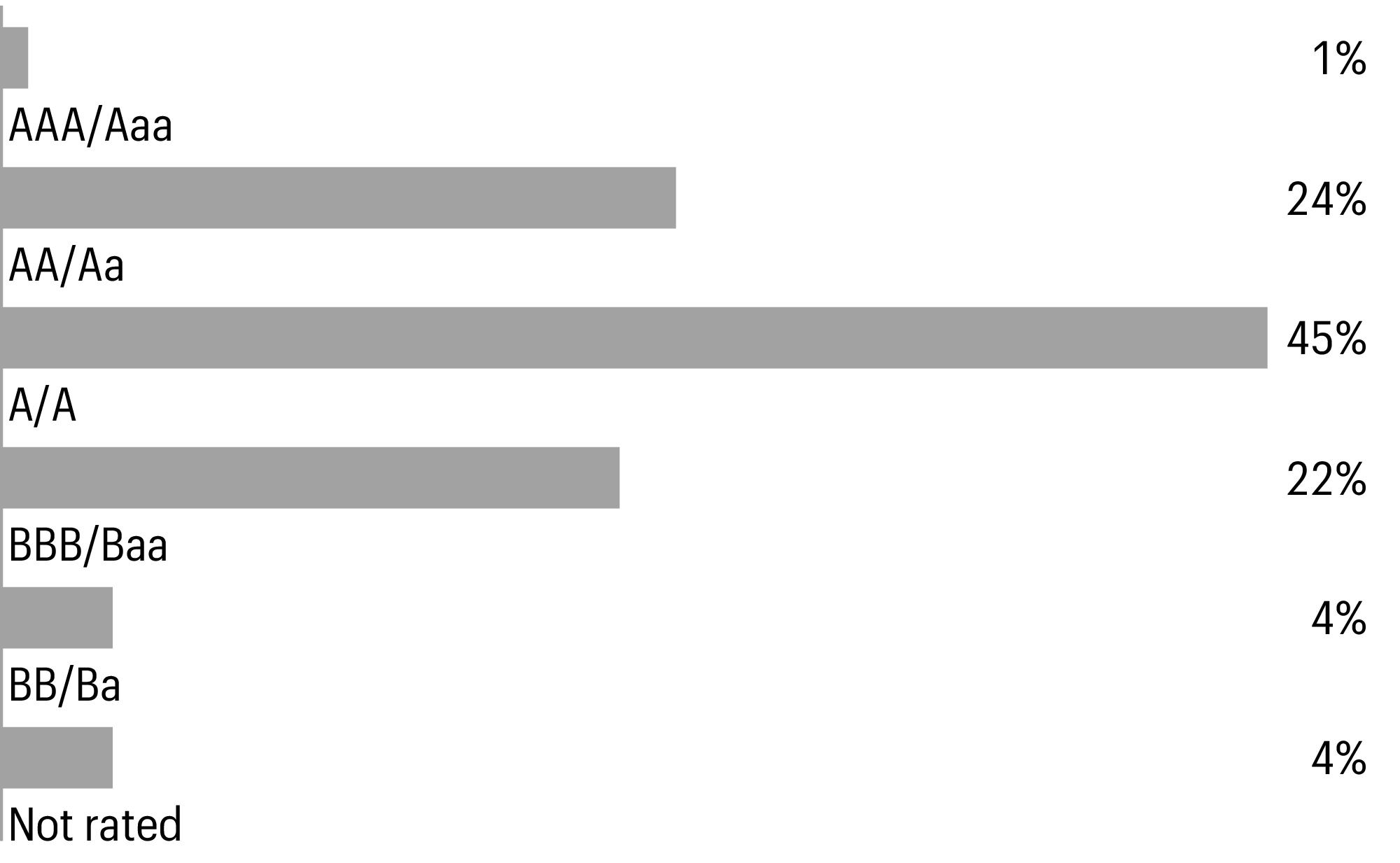

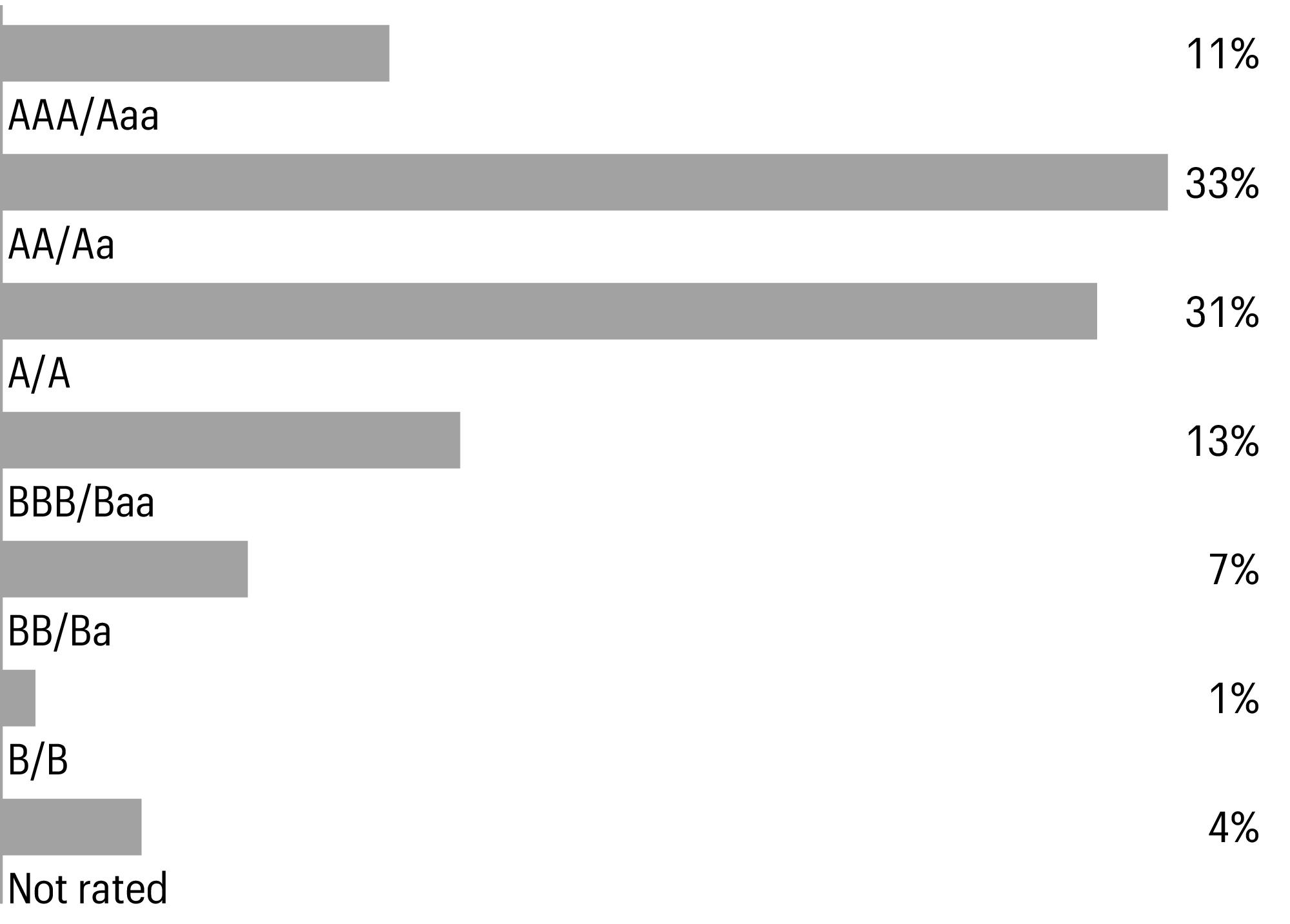

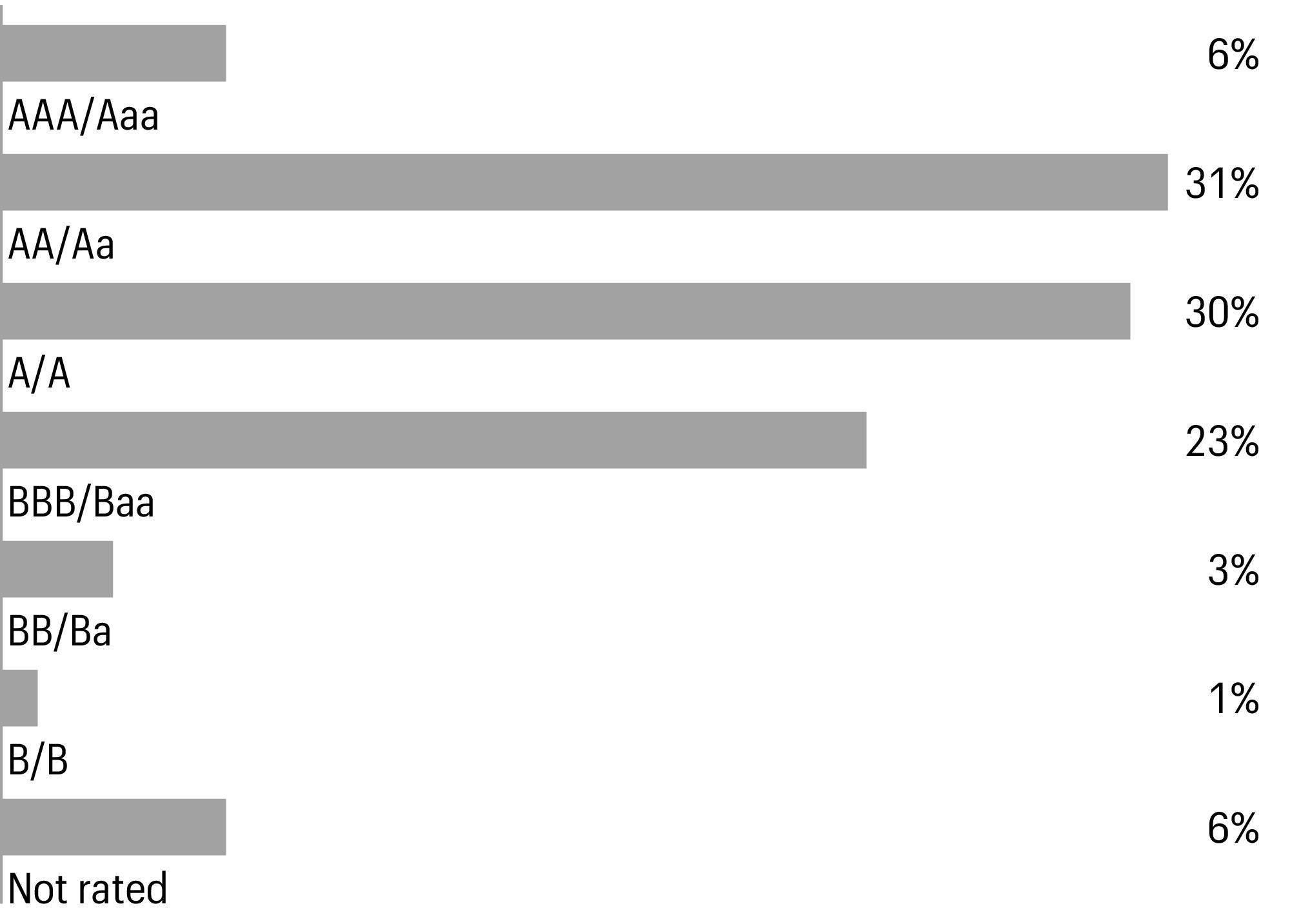

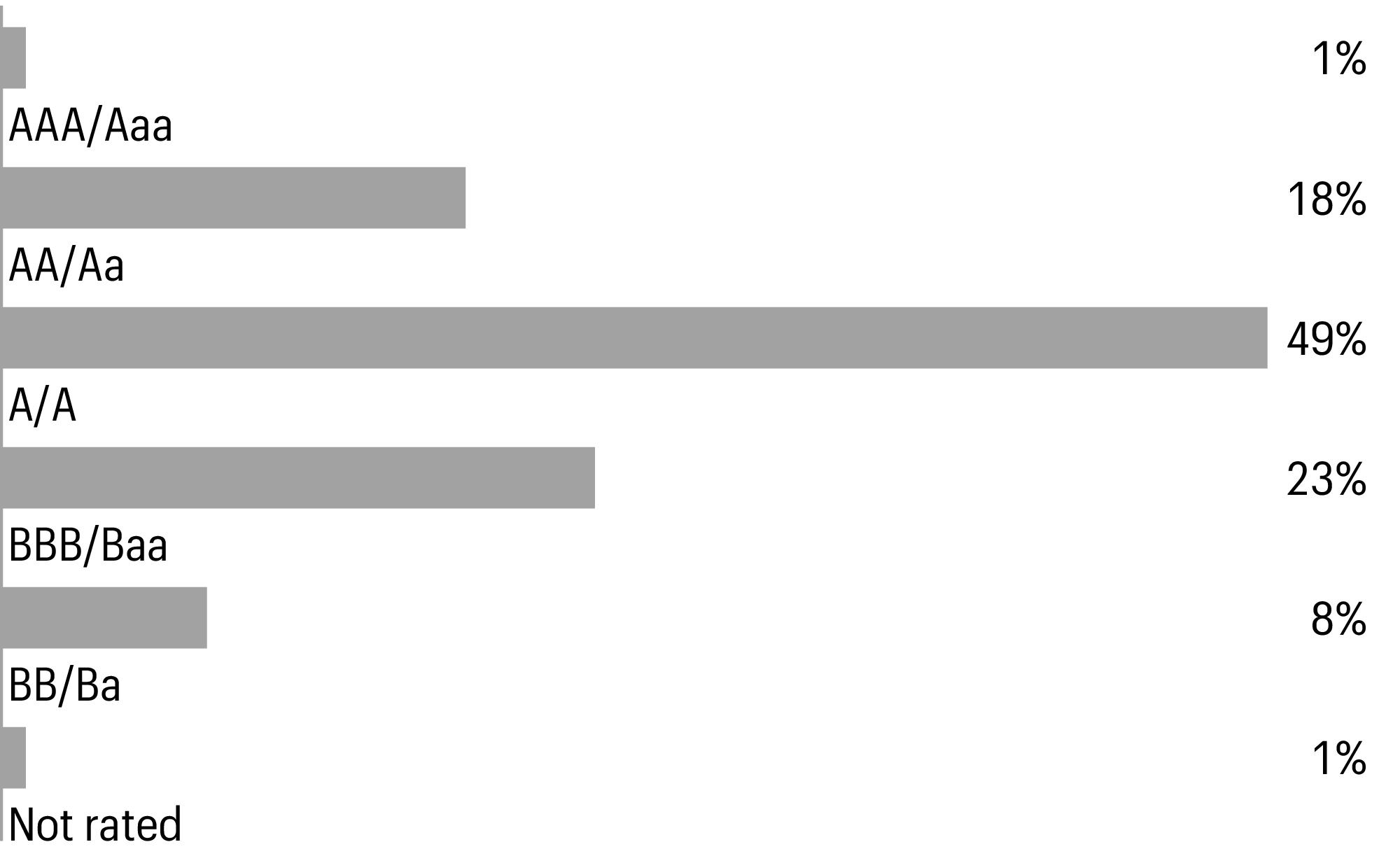

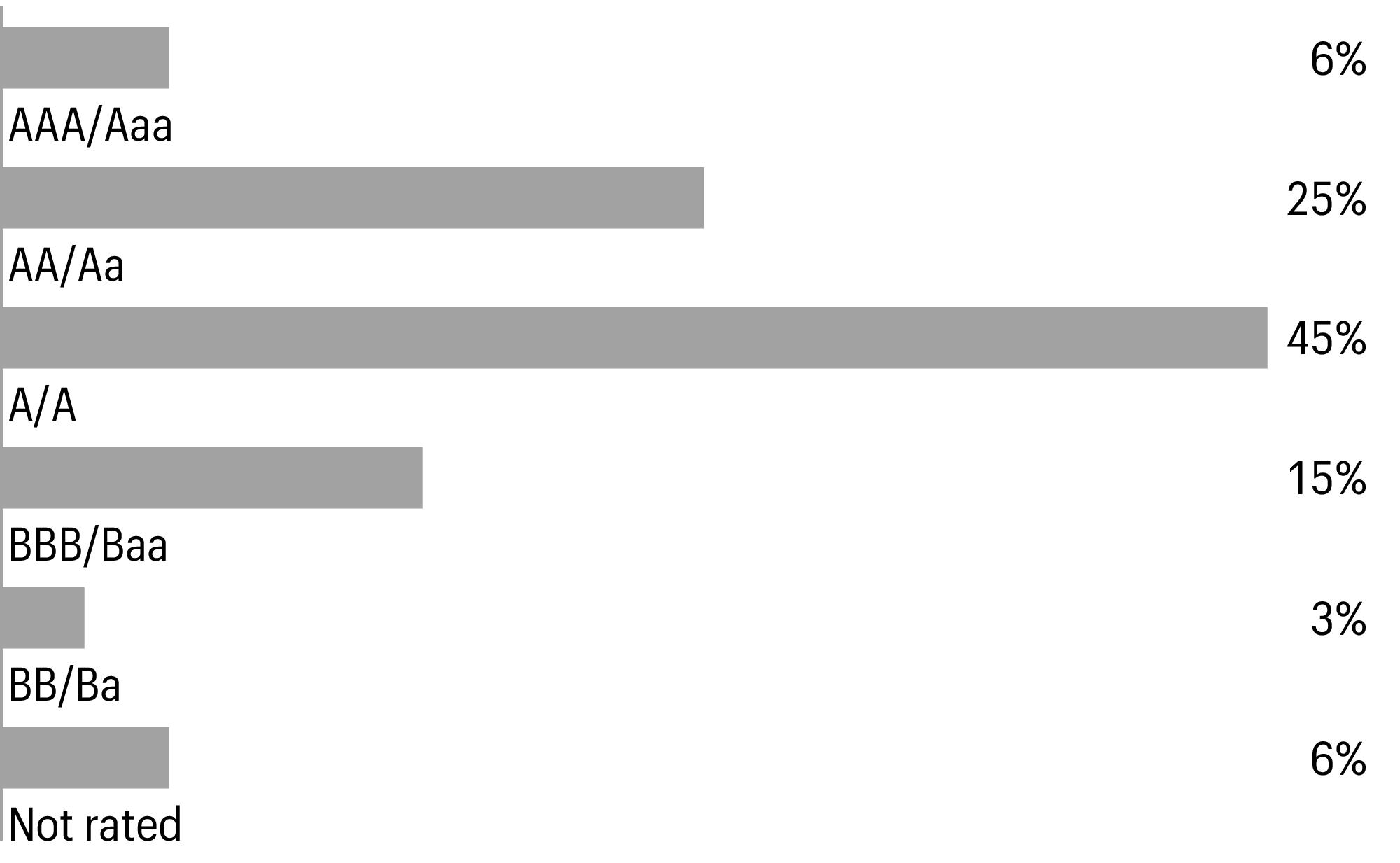

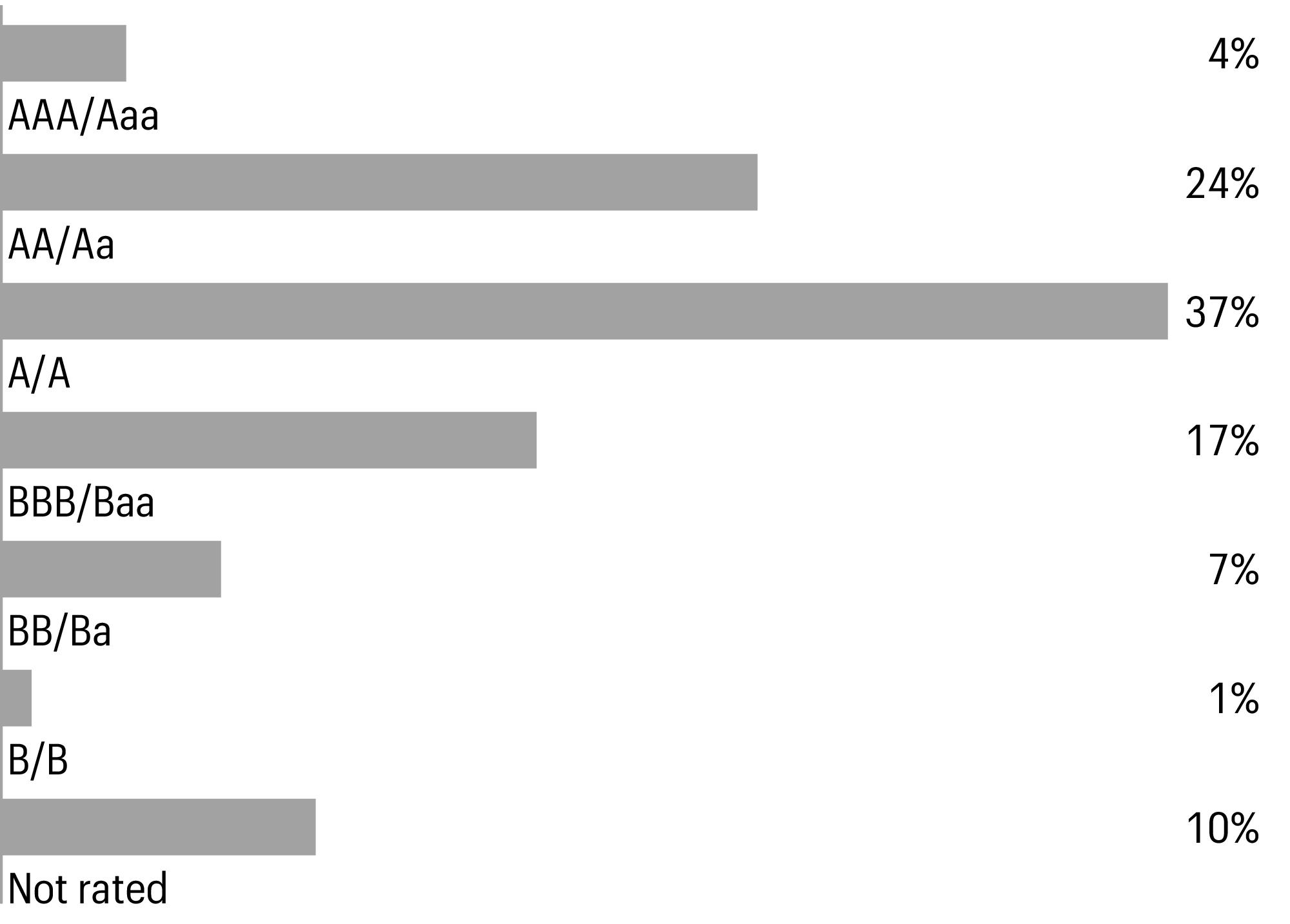

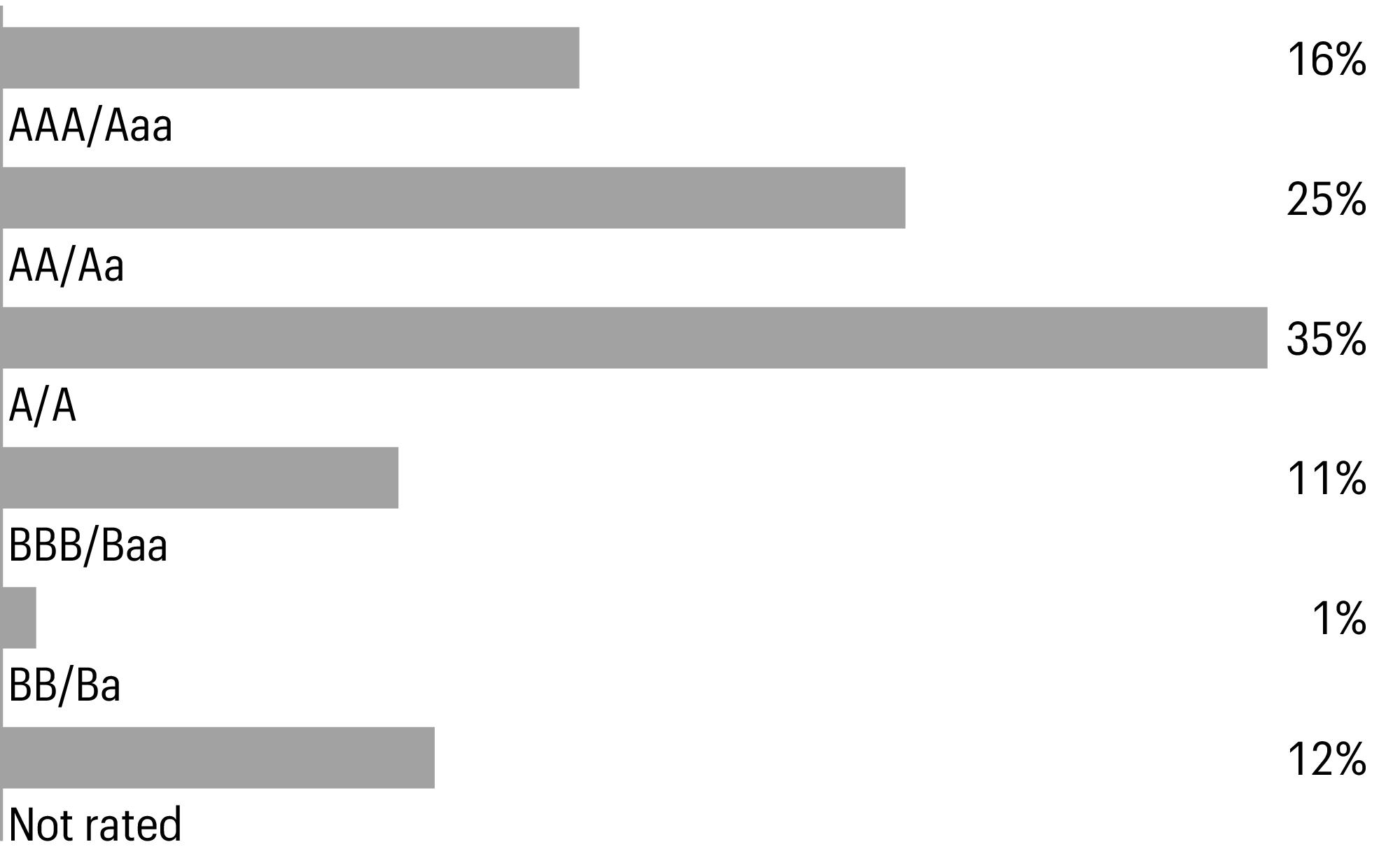

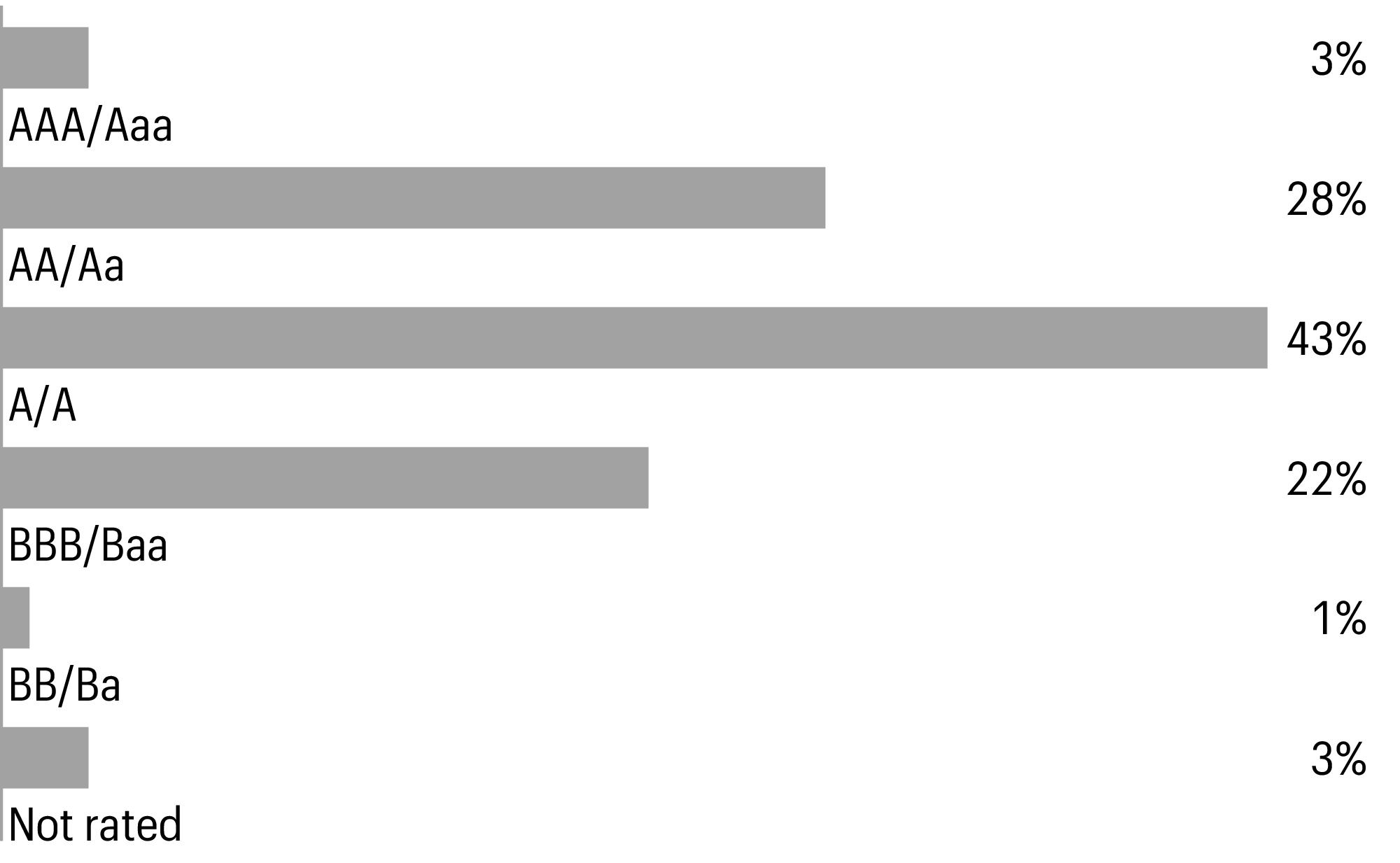

Credit quality as of June 30, 20231 |

1 | The credit quality distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not to the Fund itself. The percentages of the portfolio with the ratings depicted in the chart are calculated based on the market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of the three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes from SP-1 (highest) to SP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S. tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified. |

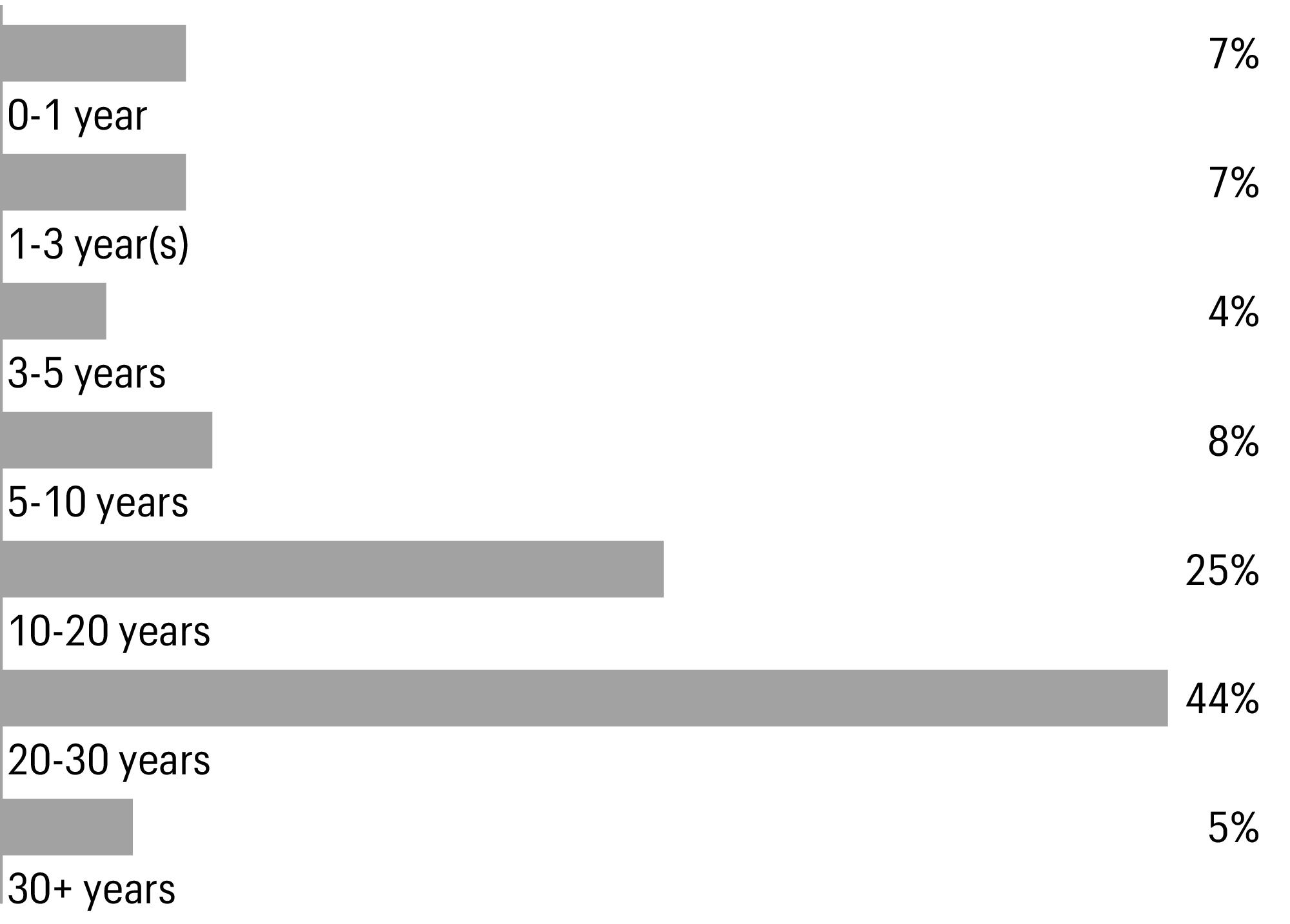

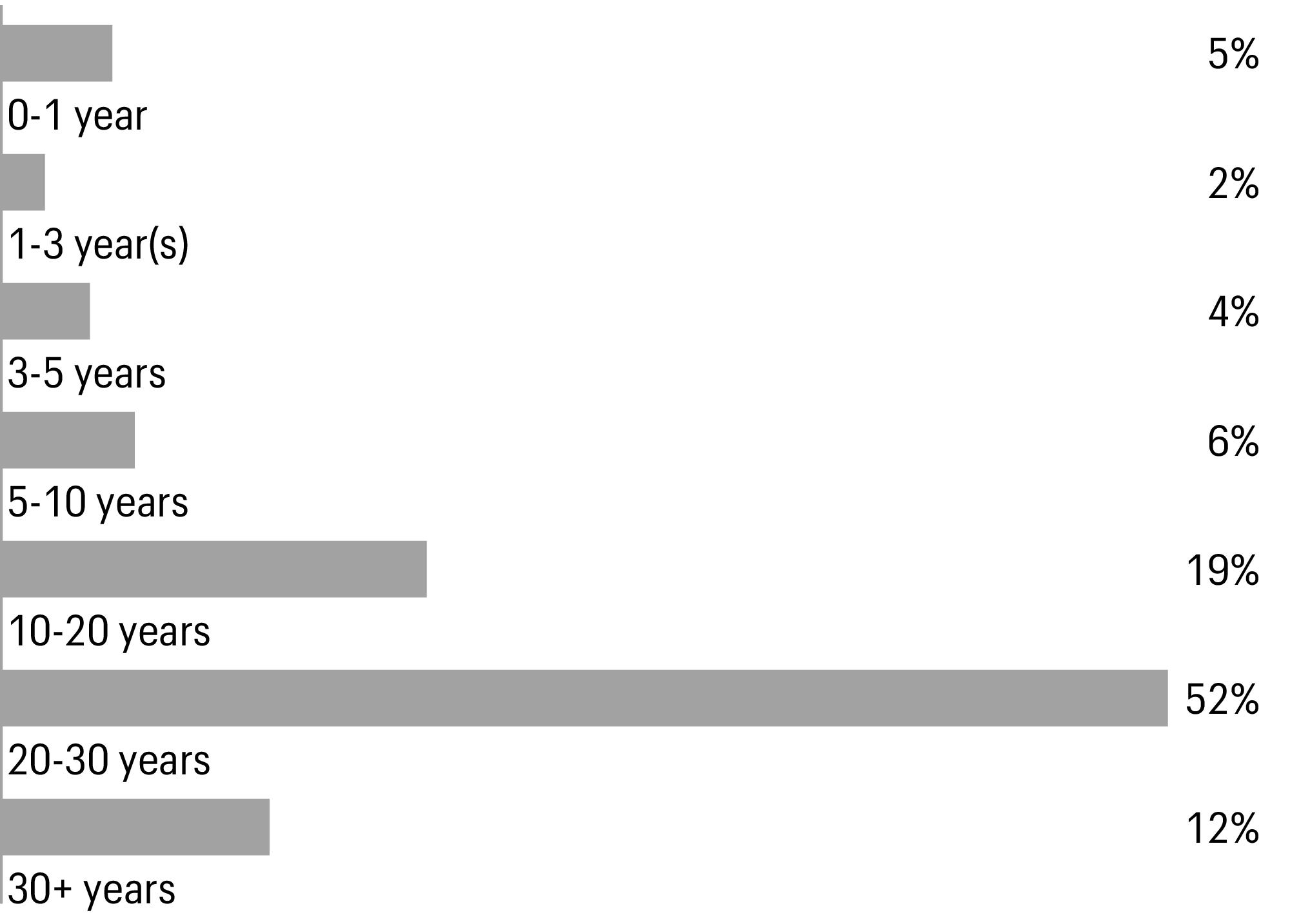

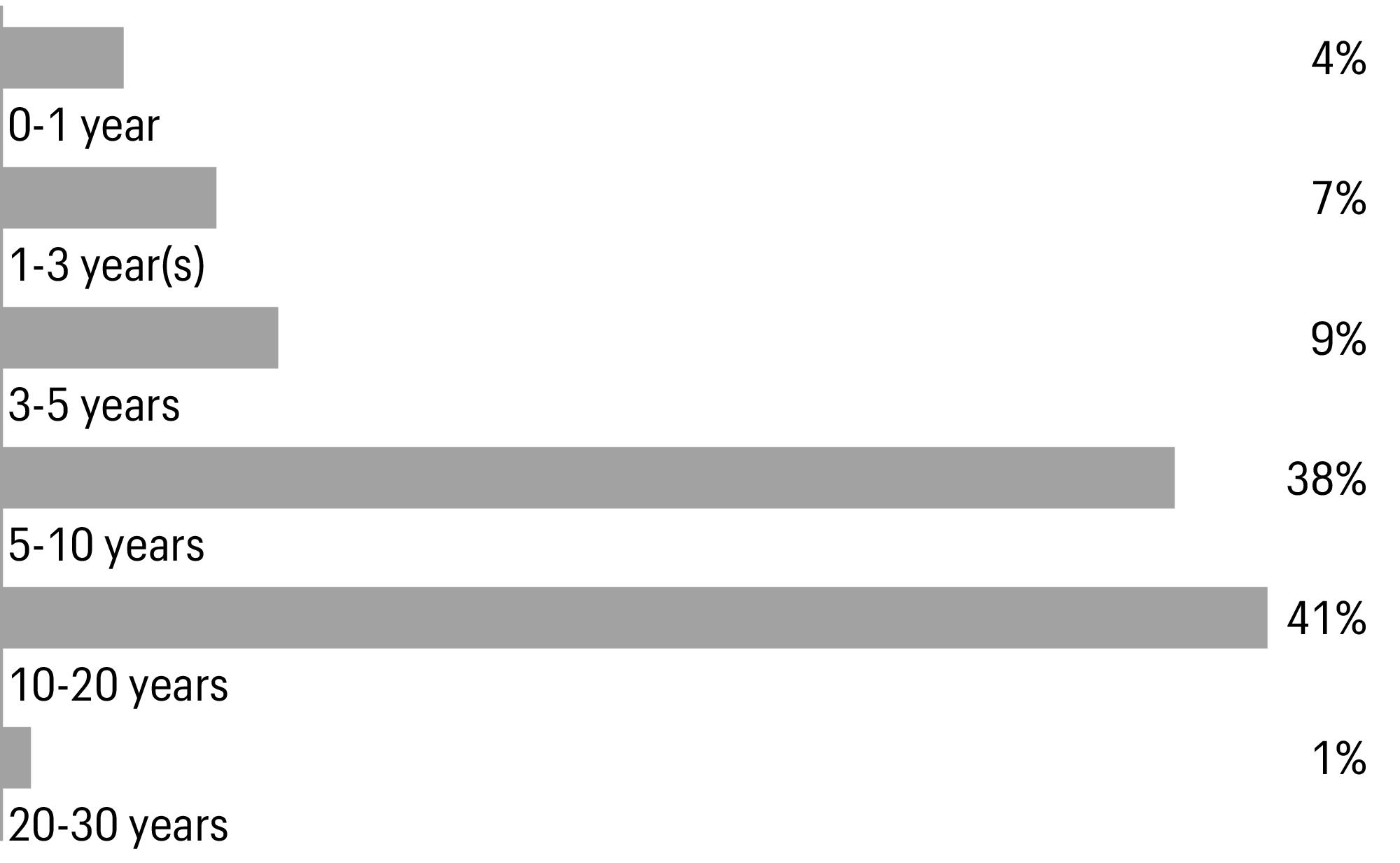

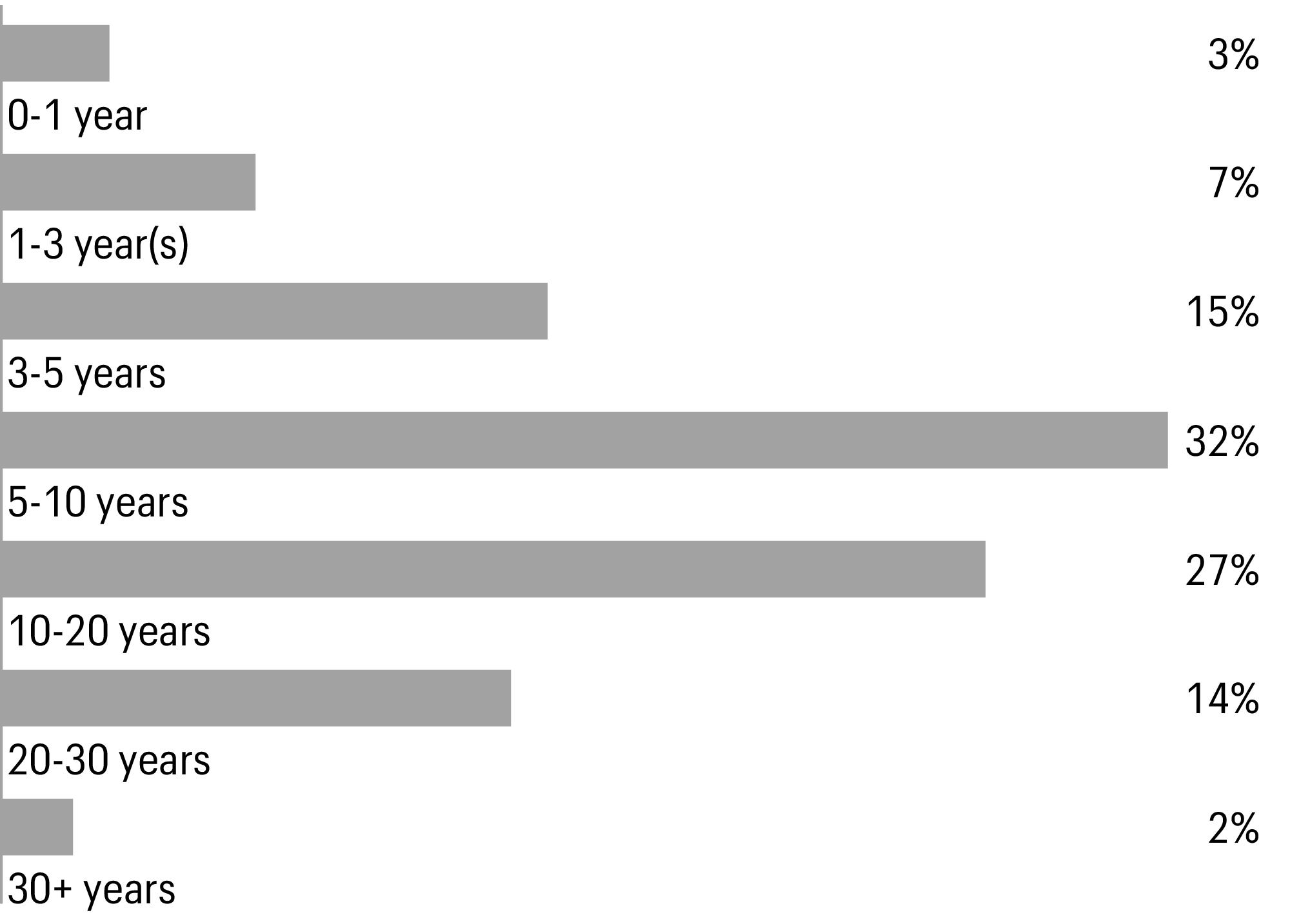

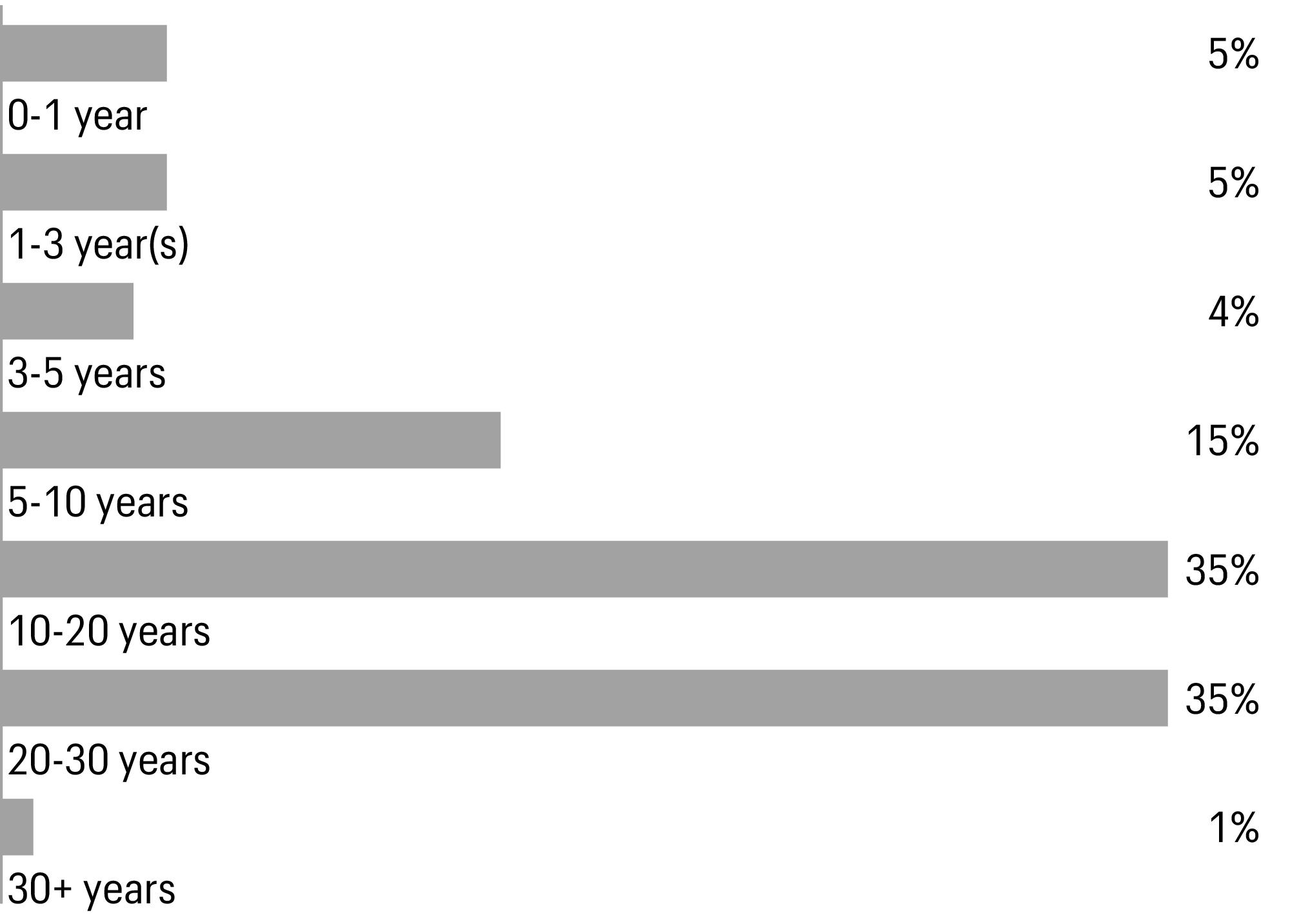

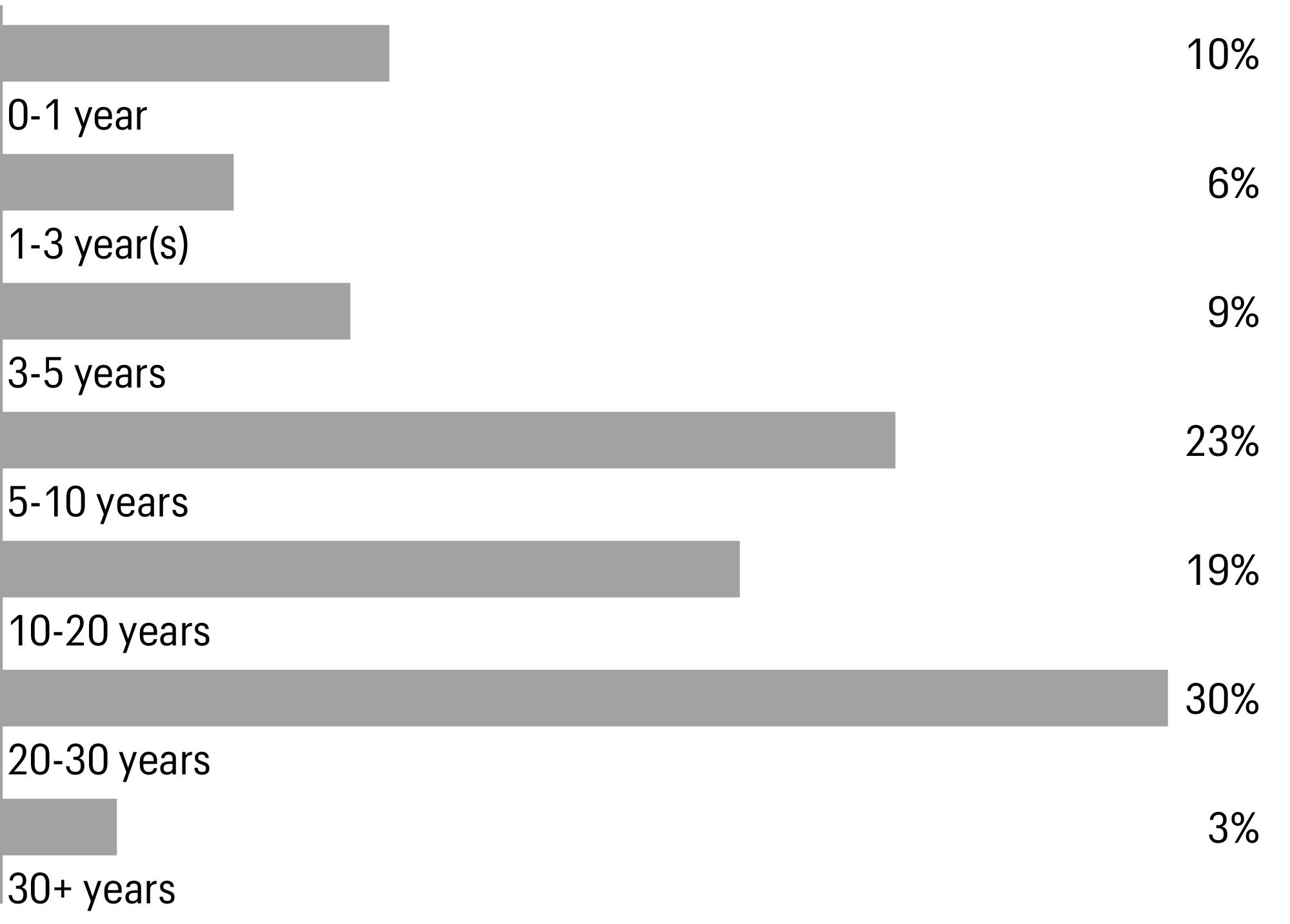

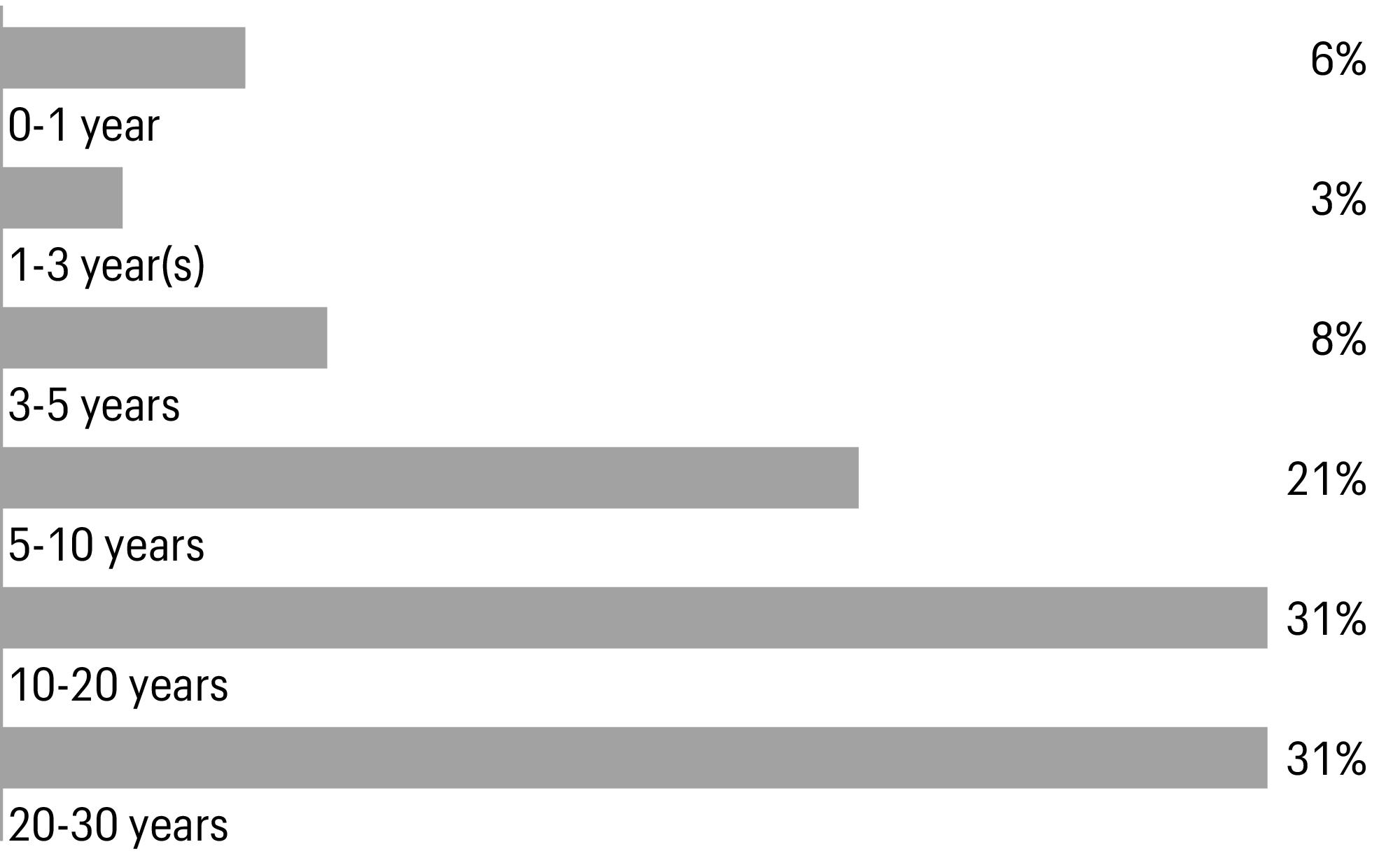

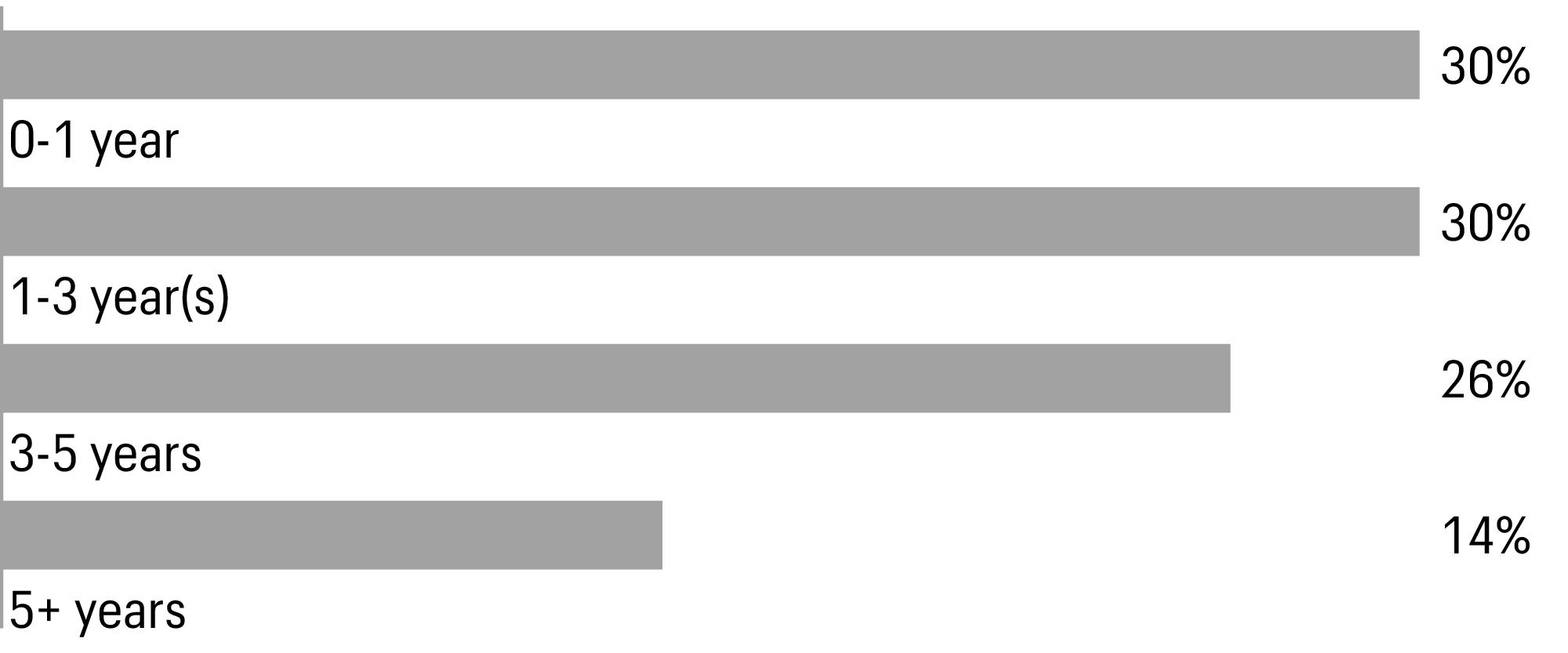

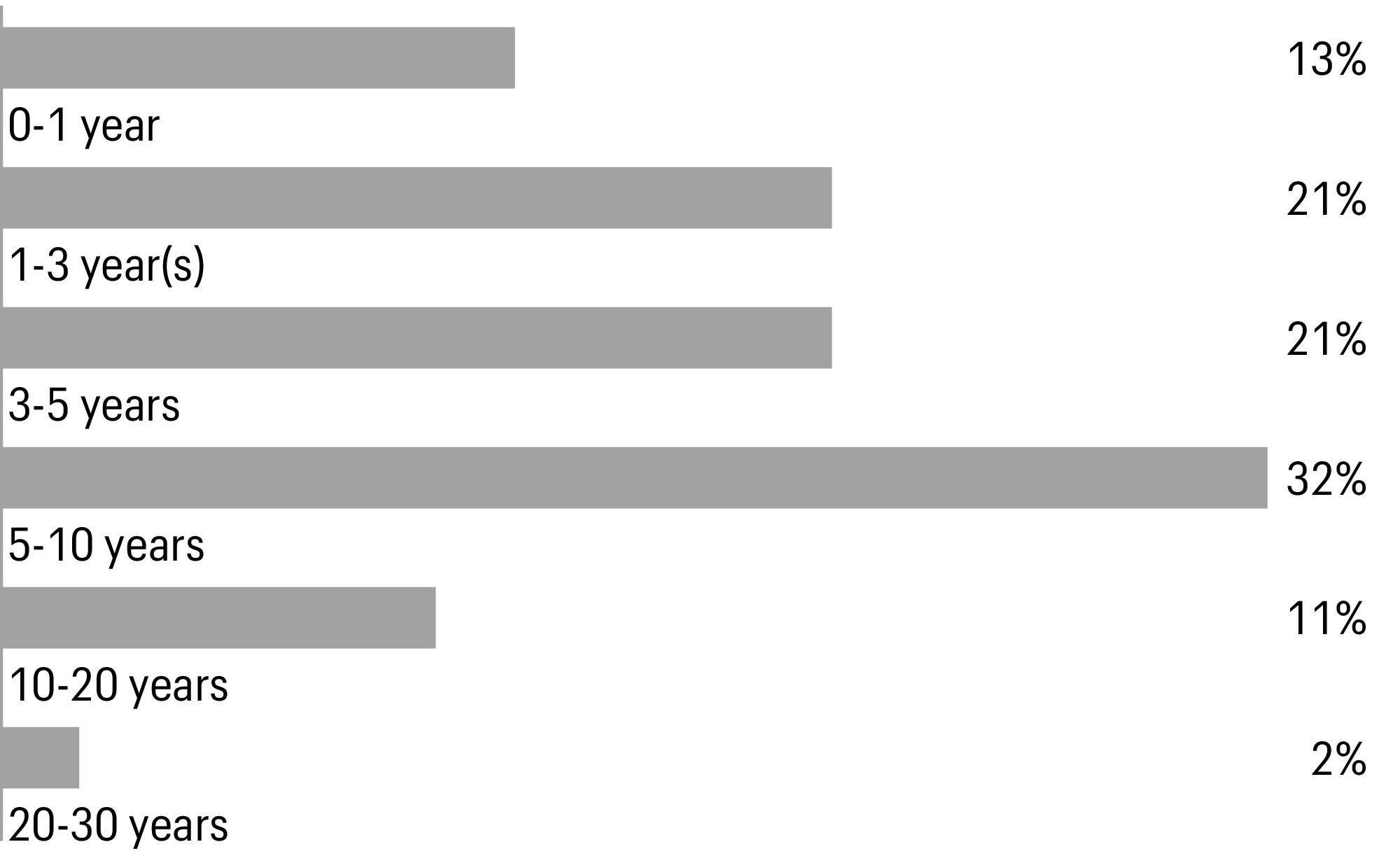

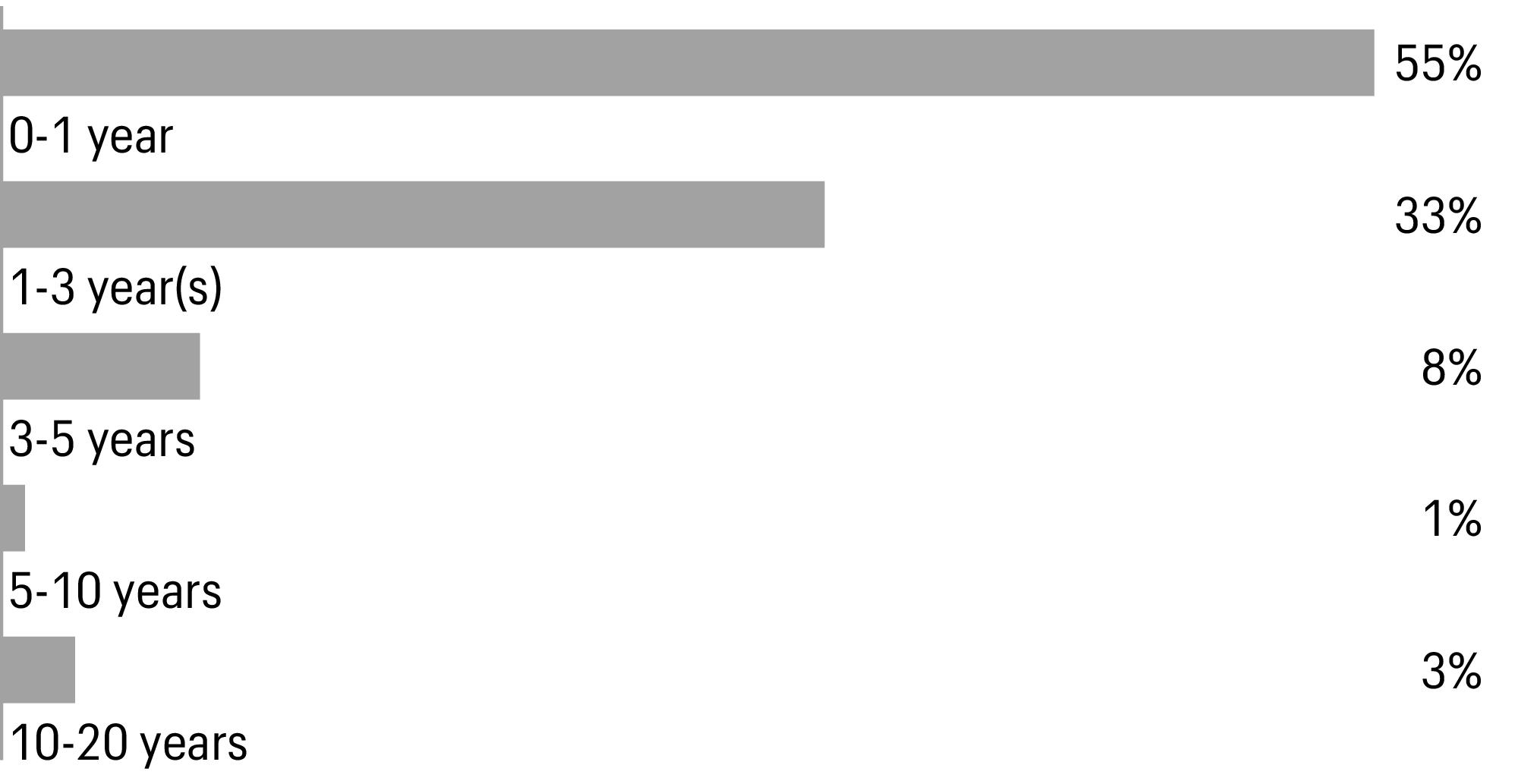

Effective maturity distribution as of June 30, 20231 |

1 | Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

Beginning account value 1-1-2023 | Ending account value 6-30-2023 | Expenses paid during the period1 | Annualized net expense ratio | |

Class A | ||||

Actual | $1,000.00 | $1,013.23 | $3.99 | 0.80 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,020.83 | $4.01 | 0.80 % |

Class C | ||||

Actual | $1,000.00 | $1,008.46 | $7.72 | 1.55 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,017.11 | $7.75 | 1.55 % |

Administrator Class | ||||

Actual | $1,000.00 | $1,013.26 | $3.00 | 0.60 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.82 | $3.01 | 0.60 % |

Institutional Class | ||||

Actual | $1,000.00 | $1,013.76 | $2.50 | 0.50 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,022.32 | $2.51 | 0.50 % |

1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by 181 divided by 365 (to reflect the one-half-year period). |

Interest rate | Maturity date | Principal | Value | |||

Municipal obligations: 93.81% | ||||||

California: 89.80% | ||||||

Airport revenue: 7.36% | ||||||

California Municipal Finance Authority LAX Integrated Express Solutions LLC Series A AMT | 5.00 % | 12-31-2023 | $ | 1,100,000 | $1,104,192 | |

California Municipal Finance Authority LAX Integrated Express Solutions LLC Series A AMT | 5.00 | 6-30-2024 | 1,115,000 | 1,124,223 | ||

California Municipal Finance Authority LAX Integrated Express Solutions LLC Series A AMT | 5.00 | 12-31-2024 | 750,000 | 759,620 | ||

California Municipal Finance Authority LAX Integrated Express Solutions LLC Series A AMT | 5.00 | 6-30-2027 | 450,000 | 469,080 | ||

California Municipal Finance Authority LAX Integrated Express Solutions LLC Series A AMT | 5.00 | 6-30-2028 | 390,000 | 411,781 | ||

California Municipal Finance Authority LAX Integrated Express Solutions LLC Series A AMT | 5.00 | 12-31-2029 | 3,815,000 | 4,039,947 | ||

City of Los Angeles Department of Airports Series B AMT | 5.00 | 5-15-2025 | 6,000,000 | 6,149,736 | ||

City of Los Angeles Department of Airports Series B AMT | 5.00 | 5-15-2026 | 2,500,000 | 2,602,630 | ||

City of Los Angeles Department of Airports Series C AMT | 5.00 | 5-15-2028 | 2,000,000 | 2,142,089 | ||

City of Los Angeles Department of Airports Series D AMT | 5.00 | 5-15-2028 | 2,705,000 | 2,897,176 | ||

City of Palm Springs Passenger Facility Charge Revenue AMT (BAM Insured) | 5.00 | 6-1-2027 | 1,205,000 | 1,233,240 | ||

County of Sacramento Airport System Revenue Series F AMT | 5.00 | 7-1-2024 | 1,760,000 | 1,778,008 | ||

Port of Oakland Series E | 5.00 | 11-1-2023 | 200,000 | 201,096 | ||

Port of Oakland Series E | 5.00 | 11-1-2026 | 1,200,000 | 1,275,773 | ||

San Diego County Regional Airport Authority Series C AMT | 5.00 | 7-1-2027 | 750,000 | 787,204 | ||

San Diego County Regional Airport Authority Series C AMT | 5.00 | 7-1-2028 | 1,000,000 | 1,062,899 | ||

San Diego County Regional Airport Authority Series C AMT | 5.00 | 7-1-2029 | 1,000,000 | 1,077,501 | ||

San Francisco City & County Airport Commission San Francisco International Airport Series A AMT | 5.50 | 5-1-2028 | 250,000 | 250,241 | ||

29,366,436 | ||||||

Education revenue: 6.99% | ||||||

California Educational Facilities Authority Loma Linda University Series A | 5.00 | 4-1-2024 | 550,000 | 556,056 | ||

California Educational Facilities Authority Loma Linda University Series A | 5.00 | 4-1-2026 | 325,000 | 337,731 | ||

California Infrastructure & Economic Development Bank Colburn School (SIFMA Municipal Swap+0.90%)± | 4.91 | 8-1-2072 | 5,000,000 | 4,848,225 | ||

California Municipal Finance Authority Albert Einstein Academy Charter School/Charter Middle School Series A | 6.00 | 8-1-2023 | 155,000 | 155,285 | ||

California Municipal Finance Authority Biola University, Inc. | 5.00 | 10-1-2027 | 790,000 | 821,667 | ||

California Municipal Finance Authority California Institute of the Arts | 4.00 | 10-1-2033 | 250,000 | 245,097 | ||

California Municipal Finance Authority California Institute of the Arts | 4.00 | 10-1-2035 | 350,000 | 337,439 | ||

California Municipal Finance Authority California Lutheran University | 5.00 | 10-1-2023 | 225,000 | 225,464 | ||

California Municipal Finance Authority California Lutheran University | 5.00 | 10-1-2024 | 275,000 | 278,213 | ||

California Municipal Finance Authority California Lutheran University | 5.00 | 10-1-2025 | 275,000 | 281,018 | ||

California Municipal Finance Authority California Lutheran University | 5.00 | 10-1-2026 | 300,000 | 310,221 | ||

California Municipal Finance Authority Palmdale Aerospace Academy, Inc. Series A144A | 3.88 | 7-1-2028 | 1,075,000 | 1,025,830 | ||

Interest rate | Maturity date | Principal | Value | |||

Education revenue (continued) | ||||||

California Municipal Finance Authority University of the Pacific Series A | 5.00 % | 11-1-2024 | $ | 600,000 | $612,568 | |

California Municipal Finance Authority University of the Pacific Series A | 5.00 | 11-1-2025 | 600,000 | 627,053 | ||

California Municipal Finance Authority University of the Pacific Series A | 5.00 | 11-1-2026 | 625,000 | 667,529 | ||

California Municipal Finance Authority University of the Pacific Series A | 5.00 | 11-1-2027 | 650,000 | 709,884 | ||

California Municipal Finance Authority University of the Pacific Series A | 5.00 | 11-1-2028 | 700,000 | 777,416 | ||

California Municipal Finance Authority University of the Pacific Series A | 5.00 | 11-1-2029 | 470,000 | 526,427 | ||

California Municipal Finance Authority University of the Pacific Series A | 5.00 | 11-1-2030 | 500,000 | 568,980 | ||

California School Finance Authority Aspire Public Schools Obligated Group Series A144A | 2.13 | 8-1-2031 | 500,000 | 425,453 | ||

California School Finance Authority Bright Star Schools Obligated Group144A | 5.00 | 6-1-2027 | 855,000 | 856,704 | ||

California School Finance Authority Classical Academy Obligated Group Series A144A | 3.00 | 10-1-2031 | 375,000 | 345,244 | ||

California School Finance Authority Granada Hills Charter High School Obligated Group Series A144A | 4.00 | 7-1-2029 | 535,000 | 532,409 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2023 | 285,000 | 285,000 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2024 | 380,000 | 382,656 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2026 | 420,000 | 426,514 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2027 | 440,000 | 448,271 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2028 | 465,000 | 475,492 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2029 | 485,000 | 497,093 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2030 | 510,000 | 521,374 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2031 | 535,000 | 545,247 | ||

California School Finance Authority Hawking STEAM Charter Schools, Inc.144A | 5.00 | 7-1-2032 | 565,000 | 574,050 | ||

California School Finance Authority Rocketship Education Obligated Group Series A144A | 5.00 | 6-1-2026 | 295,000 | 295,623 | ||

California School Finance Authority Santa Clarita Valley International Charter School Series A144A | 4.00 | 6-1-2031 | 260,000 | 245,131 | ||

California State University Series B-2øø | 0.55 | 11-1-2049 | 6,500,000 | 5,766,181 | ||

California Statewide Communities Development Authority California Baptist University Series A144A | 5.13 | 11-1-2023 | 175,000 | 175,162 | ||

Fullerton Public Financing Authority Marshall B Ketchum University Series A | 4.00 | 2-1-2029 | 360,000 | 379,544 | ||

Interest rate | Maturity date | Principal | Value | |||

Education revenue (continued) | ||||||

Fullerton Public Financing Authority Marshall B Ketchum University Series A | 4.00 % | 2-1-2031 | $ | 415,000 | $437,203 | |

Fullerton Public Financing Authority Marshall B Ketchum University Series A | 4.00 | 2-1-2033 | 325,000 | 340,909 | ||

27,867,363 | ||||||

GO revenue: 20.02% | ||||||

Aromas-San Juan Unified School District CAB BAN¤ | 0.00 | 8-1-2027 | 1,375,000 | 1,172,677 | ||

Bassett Unified School District Series B (BAM Insured) | 5.00 | 8-1-2023 | 725,000 | 725,824 | ||

Cajon Valley Union School District | 5.00 | 8-1-2026 | 340,000 | 361,658 | ||

Cajon Valley Union School District | 5.00 | 8-1-2027 | 200,000 | 217,177 | ||

Carlsbad Unified School District Series B | 3.00 | 8-1-2031 | 300,000 | 299,029 | ||

Carlsbad Unified School District Series B | 3.00 | 8-1-2032 | 350,000 | 345,995 | ||

Carlsbad Unified School District Series B | 3.00 | 8-1-2034 | 300,000 | 292,370 | ||

Carlsbad Unified School District Series B | 3.00 | 8-1-2035 | 250,000 | 237,521 | ||

Carlsbad Unified School District Series B | 3.00 | 8-1-2036 | 350,000 | 326,273 | ||

Hayward Unified School District (AGM Insured) | 5.00 | 8-1-2023 | 805,000 | 806,016 | ||

Inglewood Unified School District Series B (BAM Insured) | 5.00 | 8-1-2023 | 195,000 | 195,222 | ||

Inglewood Unified School District Series B (BAM Insured) | 5.00 | 8-1-2024 | 150,000 | 152,774 | ||

Inglewood Unified School District Series B (BAM Insured) | 5.00 | 8-1-2025 | 170,000 | 176,433 | ||

Inglewood Unified School District Series B (BAM Insured) | 5.00 | 8-1-2026 | 235,000 | 248,973 | ||

Local Public Schools Funding Authority School Improvement District No. 2016-1 Series B (AGM Insured) | 3.00 | 8-1-2033 | 225,000 | 216,304 | ||

Local Public Schools Funding Authority School Improvement District No. 2016-1 Series B (AGM Insured) | 3.00 | 8-1-2034 | 375,000 | 355,444 | ||

Local Public Schools Funding Authority School Improvement District No. 2016-1 Series B (AGM Insured) | 3.00 | 8-1-2035 | 520,000 | 483,279 | ||

Los Angeles Unified School District Series C | 4.00 | 7-1-2032 | 1,000,000 | 1,085,655 | ||

Newman-Crows Landing Unified School District CAB BAN¤ | 0.00 | 8-1-2025 | 2,000,000 | 1,856,939 | ||

Oak Valley Hospital District | 5.00 | 7-1-2023 | 755,000 | 755,000 | ||

Oakland Unified School District/Alameda County | 5.00 | 8-1-2025 | 1,540,000 | 1,596,706 | ||

Oakland Unified School District/Alameda County | 5.00 | 8-1-2029 | 10,125,000 | 10,772,891 | ||

Oakland Unified School District/Alameda County Series A | 5.00 | 8-1-2024 | 600,000 | 611,350 | ||

Oakland Unified School District/Alameda County Series B | 5.00 | 8-1-2026 | 500,000 | 528,976 | ||

Oakland Unified School District/Alameda County Series C | 5.00 | 8-1-2025 | 795,000 | 824,274 | ||

Palomar Health Obligated Group Series A (NPFGC Insured)¤ | 0.00 | 8-1-2025 | 1,000,000 | 928,092 | ||

Pittsburg Unified School District (AGM Insured) | 4.00 | 8-1-2031 | 150,000 | 159,709 | ||

Pittsburg Unified School District (AGM Insured) | 4.00 | 8-1-2032 | 250,000 | 264,267 | ||

Sacramento City Unified School District Series E | 5.00 | 8-1-2029 | 1,500,000 | 1,626,104 | ||

Sacramento City Unified School District Series G (AGM Insured) | 4.00 | 8-1-2030 | 150,000 | 159,747 | ||

Sacramento City Unified School District Series G (AGM Insured) | 4.00 | 8-1-2031 | 200,000 | 211,160 | ||

Sacramento City Unified School District Series G (AGM Insured) | 4.00 | 8-1-2032 | 200,000 | 210,010 | ||

Sacramento City Unified School District Series G (AGM Insured) | 4.00 | 8-1-2033 | 200,000 | 209,384 | ||

San Bernardino City Unified School District Series A (AGM Insured) | 1.25 | 8-1-2029 | 435,000 | 377,996 | ||

San Bernardino City Unified School District Series A (AGM Insured) | 4.00 | 8-1-2031 | 875,000 | 926,678 | ||

San Diego Unified School District Series F2 | 5.00 | 7-1-2024 | 20,000,000 | 20,403,628 | ||

San Gorgonio Memorial Health Care District | 4.00 | 8-1-2027 | 1,090,000 | 1,026,654 | ||

San Gorgonio Memorial Health Care District | 4.00 | 8-1-2030 | 580,000 | 530,652 | ||

Interest rate | Maturity date | Principal | Value | |||

GO revenue (continued) | ||||||

Sierra Kings Health Care District | 4.00 % | 8-1-2023 | $ | 405,000 | $405,107 | |

Sierra Kings Health Care District | 4.00 | 8-1-2024 | 420,000 | 422,186 | ||

State of California | 4.00 | 9-1-2026 | 6,000,000 | 6,188,876 | ||

State of California | 5.00 | 10-1-2023 | 8,400,000 | 8,439,364 | ||

State of California | 5.00 | 8-1-2025 | 3,500,000 | 3,645,331 | ||

State of California (BAM Insured) | 5.00 | 9-1-2027 | 8,500,000 | 9,082,312 | ||

79,862,017 | ||||||

Health revenue: 13.77% | ||||||

California HFFA Adventist Health System/West Obligated Group Series 2011-Aøø | 3.00 | 3-1-2041 | 6,125,000 | 6,094,139 | ||

California HFFA Adventist Health System/West Obligated Group Series Aøø | 5.00 | 3-1-2040 | 4,000,000 | 4,252,357 | ||

California HFFA CommonSpirit Health Obligated Group Series A | 5.00 | 4-1-2032 | 1,500,000 | 1,633,485 | ||

California HFFA El Camino Hospital | 5.00 | 2-1-2025 | 1,000,000 | 1,026,162 | ||

California HFFA On Lok Senior Health Services Obligated Group | 3.00 | 8-1-2025 | 475,000 | 465,549 | ||

California HFFA On Lok Senior Health Services Obligated Group | 3.00 | 8-1-2028 | 400,000 | 385,967 | ||

California HFFA On Lok Senior Health Services Obligated Group | 3.00 | 8-1-2030 | 210,000 | 199,210 | ||

California HFFA Providence St. Joseph Health Obligated Group Series B-3øø | 2.00 | 10-1-2036 | 5,000,000 | 4,815,112 | ||

California HFFA Stanford Health Care Obligated Group Series Aøø | 3.00 | 8-15-2054 | 4,700,000 | 4,692,032 | ||

California Municipal Finance Authority Aldersly Series B | 3.75 | 11-15-2028 | 2,990,000 | 2,996,739 | ||

California Municipal Finance Authority Aldersly Series B | 4.00 | 11-15-2028 | 595,000 | 596,317 | ||

California Municipal Finance Authority Carmel Valley Manor Obligated Group | 5.00 | 5-15-2024 | 185,000 | 187,652 | ||

California Municipal Finance Authority Carmel Valley Manor Obligated Group | 5.00 | 5-15-2025 | 200,000 | 206,303 | ||

California Municipal Finance Authority Carmel Valley Manor Obligated Group | 5.00 | 5-15-2026 | 185,000 | 194,398 | ||

California Municipal Finance Authority Community Hospitals of Central California Obligated Group Series A | 5.00 | 2-1-2024 | 500,000 | 505,555 | ||