UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09255

Wells Fargo Variable Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: December 31

Registrant is making a filing for 9 of its series:

Wells Fargo VT Discovery Fund, Wells Fargo VT Index Asset Allocation Fund, Wells Fargo VT International Equity Fund, Wells Fargo VT Intrinsic Value Fund, Wells Fargo VT Omega Growth Fund, Wells Fargo VT Opportunity Fund, Wells Fargo VT Small Cap Growth Fund, Wells Fargo VT Small Cap Value Fund, and Wells Fargo VT Total Return Bond Fund.

Date of reporting period: December 31, 2015

ITEM 1. REPORT TO STOCKHOLDERS

Annual Report

December 31, 2015

Wells Fargo VT Discovery Fund

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of December 31, 2015, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo VT Discovery Fund | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Funds

Although U.S. economic data generally improved during the period, ongoing global turmoil somewhat tempered

economic growth.

Dear Valued Shareholder:

We are pleased to offer you this annual report for the Wells Fargo VT Discovery Fund for the 12-month period that ended December 31, 2015. The broad U.S. stock market returned 0.48% for the reporting period (as measured by the Russell 3000® Index).1 Although U.S. economic data generally improved during the period, ongoing global turmoil somewhat tempered economic growth. Outside the U.S., many economies and markets faced ongoing challenges, such as the negative effects of China’s slowing economy and declining prices for oil, natural gas, and other commodities.

In the first quarter of 2015, U.S. stocks delivered positive results overall; major markets elsewhere generally rallied.

U.S. large-, mid-, and small-cap stocks tended to move similarly during the quarter until early March, when results began to diverge by market capitalization. Larger caps slipped that month as investor concern grew over the strengthening U.S. dollar’s potentially negative effect on the profits of large U.S. multinational firms; stocks of small and midsize companies, which tend to be less affected by movements in the dollar, performed better. A gradually improving U.S. economy supported positive stock results. The labor market continued growing, along with personal income and consumer confidence. For U.S. businesses, the quarter’s data were mixed; while many companies reported strong earnings, other data indicated potential weakening in manufacturing. Elsewhere in the world, major markets enjoyed positive returns spurred by accommodative monetary policies from major central banks and signs of improvement in some struggling economies.

Globally, stock markets experienced heightened volatility during the second quarter of 2015.

The broad U.S. stock market fluctuated widely during this quarter, eventually eking out a 0.14% gain (as measured by the Russell 3000 Index®). Larger stocks at times were pressured by ongoing investor concerns over the potentially negative effects on U.S. companies of a strengthening U.S. dollar and financially troubled overseas economies. The U.S. economy picked up traction during the quarter; consumer spending improved, construction and new-home sales enjoyed positive trends, and jobs growth remained a bright spot. Federal Reserve (Fed) officials, who continued to keep interest rates low while waiting for the U.S. jobs market to sufficiently improve and for inflation to approach their 2% target, made clear they could take action soon. Throughout the quarter, markets outside the U.S. remained volatile, largely due to uncertainty over the potential impact of financial challenges in other locations—most notably in Greece and Puerto Rico. Questions over slower growth in China also worried investors.

In the third quarter of 2015, China’s slowdown took a toll on U.S. and international markets.

U.S. stocks fluctuated significantly in the quarter as investors worried about the impact on the U.S. of China’s slowing growth. The broad U.S. stock market fell 7.25%, as measured by the Russell 3000 Index®. A number of positive economic indicators released during the quarter suggested the U.S. economy remained solid. However, the strengthening U.S. dollar coupled with ongoing global economic turmoil continued to hinder the economy. Although many investors believed the Fed would raise the federal funds rate during the quarter, at its September meeting the Fed left the rate unchanged. This decision fueled uncertainty about the U.S. economy’s stamina to remain healthy while facing the negative effects of troubles elsewhere in the world. One week later, Fed Chair

| 1 | The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo VT Discovery Fund | | | 3 | |

Janet Yellen reassured investors that, barring unpleasant surprises, the Fed still intended to raise the rate in 2015. International markets were more volatile than the domestic market and delivered even weaker quarterly results. Investors’ anxiety was driven largely by China’s weakened economy. Because China is the world’s largest importer of many commodities, a number of emerging markets—key commodities exporters—struggled under the strains of reduced demand for commodities and lower prices for the commodities sold.

The U.S. stock market rose in the fourth quarter of 2015 despite ongoing concerns.

The broad U.S. stock market bounced back in the fourth quarter, ending with a 6.27% quarterly return (as measured by the Russell 3000 Index®). Stock markets outside the U.S. failed to keep pace with the domestic market as economic concerns, including China’s ongoing slowdown, continued to affect many countries worldwide. U.S. economic data released during the quarter indicated the economy remained solid, with modest growth. However, the strong U.S. dollar and global economic turmoil continued their drag on the economy. In December, the Fed, as expected, slightly raised its target short-term interest rate to between 0.25% and 0.50% after keeping it near zero for seven years. The move, which had been well telegraphed by the Fed for months, reflected confidence in the U.S. economy’s ability to stay healthy with less central-bank support. The Fed also made clear that future interest-rate increases will be gradual.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest in Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Funds

Experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future.

Notice to shareholders

At a meeting held August 11-12, 2015, the Board of Trustees of the Fund approved a change in the name of the Fund whereby the word “Advantage” was removed from its name, effective December 15, 2015.

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-260-5969. We are available 24 hours a day, 7 days a week.

| | | | |

| 4 | | Wells Fargo VT Discovery Fund | | Performance highlights (unaudited) |

The Fund is currently closed to new insurance companies.1

Investment objective

The Fund seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Thomas J. Pence, CFA®

Michael T. Smith, CFA®

Chris Warner, CFA®

Average annual total returns (%) as of December 31, 2015

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Expense ratios2 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

| Class 2 | | 5-8-1992 | | | (1.46 | ) | | | 10.95 | | | | 9.57 | | | | 1.14 | | | | 1.14 | |

| Russell 2500™ Growth Index4 | | – | | | (0.19 | ) | | | 11.43 | | | | 8.49 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available by calling 1-800-260-5969. Performance figures of the Fund do not reflect fees charged pursuant to the terms of variable life insurance policies and variable annuity contracts. If fees had been reflected, performance would have been lower.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Smaller-company stocks tend to be more volatile and less liquid than those of larger companies. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please refer to the prospectus provided by your participating insurance company for detailed information describing the separate accounts for information regarding surrender charges, mortality and expense risk fees, and other charges that may be assessed by the participating insurance companies.

Please see footnotes on page 5.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo VT Discovery Fund | | | 5 | |

|

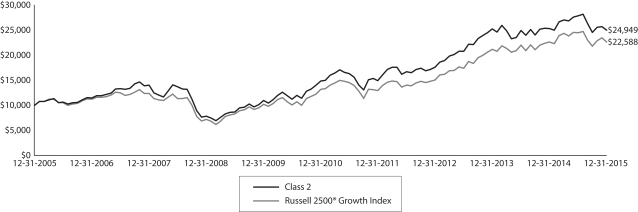

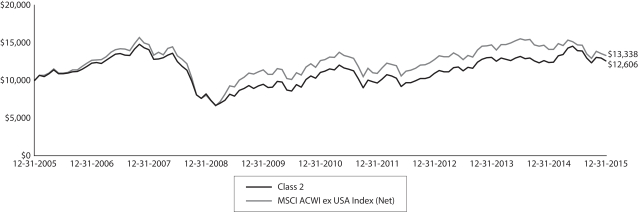

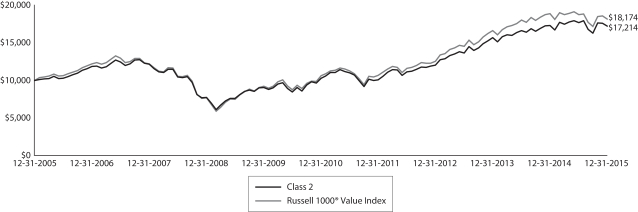

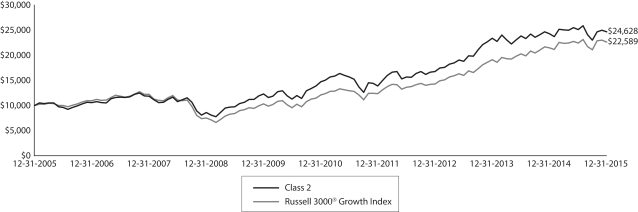

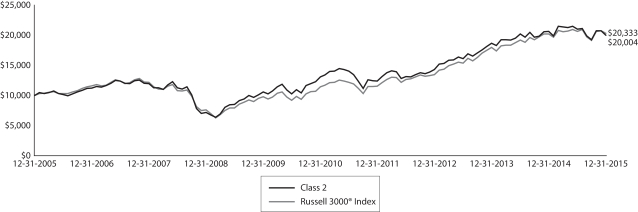

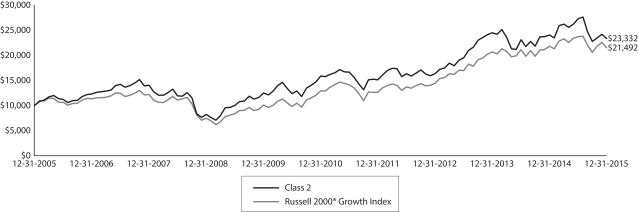

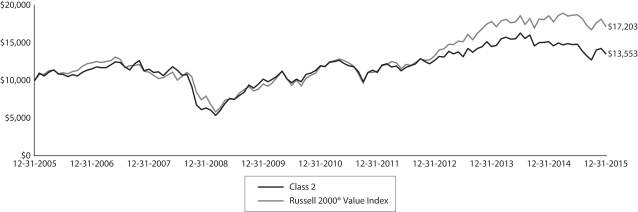

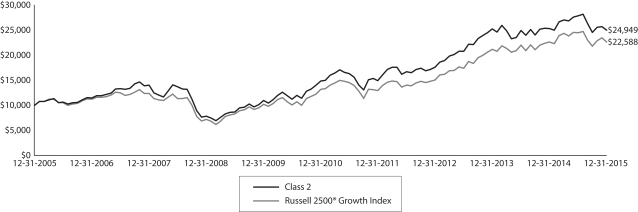

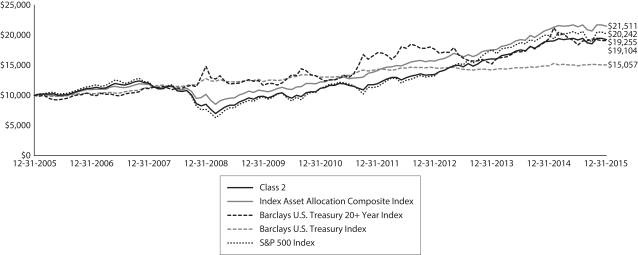

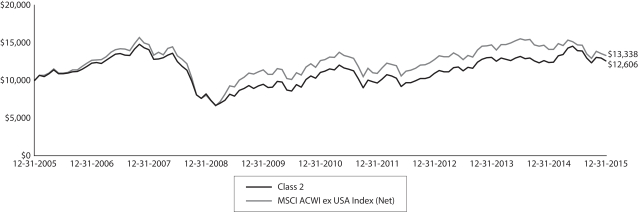

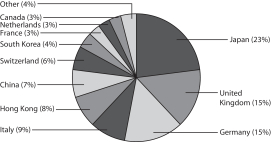

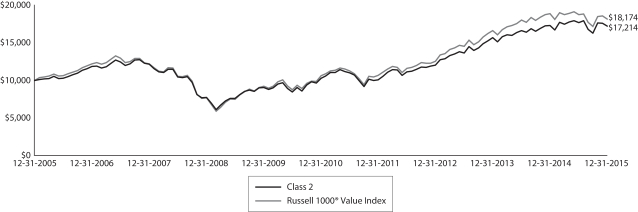

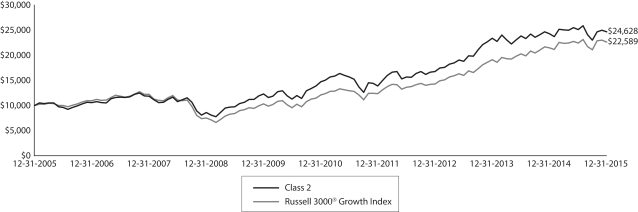

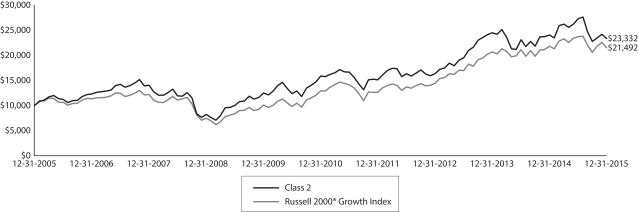

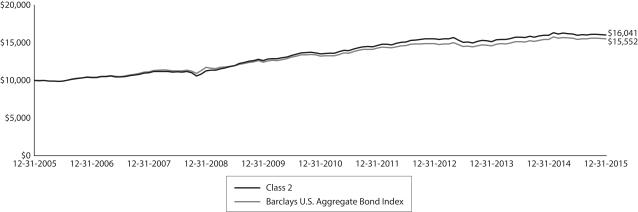

| Growth of $10,000 investment as of December 31, 20155 |

|

|

| 1 | Please see the Fund’s current Statement of Additional Information for further details. |

| 2 | Reflects the expense ratios as stated in the most recent prospectus. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 3 | The manager has committed through April 30, 2016, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at 1.15% for Class 2. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Without this cap, the Fund’s returns would have been lower. |

| 4 | The Russell 2500TM Growth Index measures the performance of those Russell 2500 companies with higher price/book ratios and higher forecasted growth values. You cannot invest directly in an index. |

| 5 | The chart compares the performance of Class 2 shares for the most recent ten years with the Russell 2500TM Growth Index. The chart assumes a hypothetical $10,000 investment and reflects all operating expenses of the Fund. Performance figures of the Fund do not reflect fees charged pursuant to the terms of variable life insurance policies and variable annuity contracts. |

| 6 | The ten largest holdings, excluding cash and cash equivalents, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

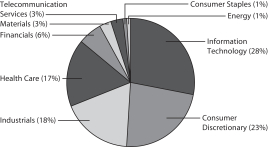

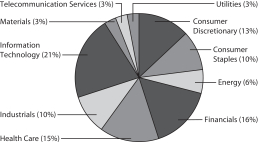

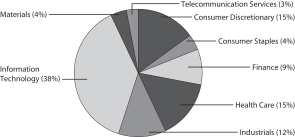

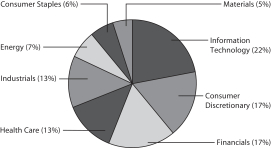

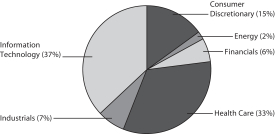

| 7 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| | | | |

| 6 | | Wells Fargo VT Discovery Fund | | Performance highlights (unaudited) |

MANAGER’S DISCUSSION

Fund highlights

| n | | The Fund underperformed its benchmark, the Russell 2500TM Growth Index, for the 12-month period that ended December 31, 2015. |

| n | | The Fund’s relative performance was most challenged by positioning in the health care sector. |

| n | | Effective stock selection in the information technology (IT) sector contributed positively to the Fund’s results. |

Overall, 2015 was a turbulent year for the U.S. stock market and the global economy.

A number of icebergs that surfaced in 2015 made navigating the U.S. stock market a tricky proposition. The first iceberg, economic weakness in China, continued to mount throughout the year. In our view, investors’ concerns over the depth of China’s economic slowdown and the effectiveness of its policy responses largely drove the defensive tone evident in the U.S. stock market during much of 2015. Worries about the negative impact of China’s slowdown coupled with OPEC’s decision not to reduce oil production further aggravated the supply/demand imbalance for oil, causing commodity prices to continue the tumble that began in the second half of 2014. 2015’s second iceberg, the U.S. Federal Reserve’s (Fed’s) long-anticipated change in monetary policy, finally occurred in December 2015. With uncertainty over timing of the rate hike resolved, stocks initially rallied. However, volatility soon resumed as investors faced a new concern: domestic economic data that continued to show a clear divergence in strength between manufacturing and consumer activity. While geopolitical risks have been prevalent for years, the size of this iceberg grew considerably in the wake of November 2015’s terror attacks in Paris. In fact, rapid and often significant fluctuations in investor risk tolerance were visible at times during 2015. The risk of geopolitical events, which are impossible to predict, has contributed to these swings in investor sentiment; recent events appear to have heightened this sensitivity.

| | | | |

| Ten largest holdings (%) as of December 31, 20156 | |

ServiceMaster Global Holdings Incorporated | | | 3.58 | |

Zayo Group Holdings Incorporated | | | 2.65 | |

CoStar Group Incorporated | | | 2.46 | |

Tyler Technologies Incorporated | | | 2.13 | |

Vail Resorts Incorporated | | | 2.06 | |

Tableau Software Incorporated Class A | | | 2.04 | |

SEI Investments Company | | | 1.90 | |

KAR Auction Services Incorporated | | | 1.89 | |

Align Technology Incorporated | | | 1.88 | |

Bright Horizons Family Solutions Incorporated | | | 1.87 | |

Portfolio construction is focused on three types of growth companies.

We believe that, in any market environment, a portfolio’s construction must balance risk and return. We strive to provide this balance through a portfolio composed of three distinct types of growth companies. Core growth holdings (typically 40%–50% of assets) are companies that we believe have stable growth records, proven management teams, and relatively low volatility. Developing situations (typically 40%–50% of assets) are firms we believe are entering a period of accelerated growth driven by a new product, business plan, or management team. The remainder of the portfolio (typically 5%–10% of assets) is dedicated to valuation

opportunities—holdings we believe carry above-average growth potential and relatively high volatility. Our conviction level drives each stock’s relative weight in the portfolio. This direct relationship helps us position our highest-conviction ideas to potentially make a significant impact on performance.

Positioning in the health care sector weighed on the Fund’s relative performance.

The innovative yet volatile biotechnology industry displayed the sector’s most apparent weakness. Clovis Oncology, Incorporated, received tough news about its initially promising lung cancer treatment; clinical data produced after the FDA moved the drug to fast-track status showed a stunning drop in its positive-response rate. Clovis’s stock dropped precipitously on the news because the much-lower level of effectiveness made the drug a weak competitor versus an existing FDA-approved drug manufactured by AstraZeneca PLC. We sold the Fund’s position in Clovis during the period. Envision Healthcare Holdings, Incorporated, was another notable Fund detractor. Envision—a leading provider of services to the U.S. health care system with an emphasis on solutions for clinics, hospitals, and emergency rooms—had been well positioned when the Affordable Care Act (ACA) led to increased insurance coverage and consumer demand for health care. We believed Envision potentially could consolidate some of this fragmented industry. However, health care utilization volumes took a surprising fall during 2015; early adopters of the ACA appeared to be slowing in usage, and growth in new users was disappointing. These factors, along with pricing pressures on new customer contracts, drove a sharp correction in the stock.

Please see footnotes on page 5.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo VT Discovery Fund | | | 7 | |

Holdings in the IT sector contributed positively to results.

Within the IT sector, stock selection delivered the top contribution to Fund performance for the period, led by results among software-as-a-service providers. Tyler Technologies, Incorporated, which develops applications for use by local governments and court systems, enjoyed a strong run of performance as the improving economy led to increased local tax revenue and greater demand for its products. Palo Alto Networks, Incorporated, a leader in IT security and beneficiary of a boom in data-protection spending by businesses, also performed strongly as its popular enterprise-security offering continued to garner market share. The Fund’s position in Palo Alto Networks was sold during the period.

| | |

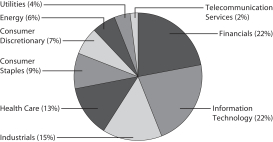

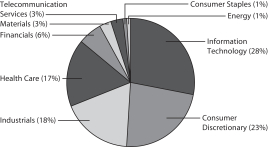

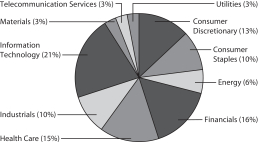

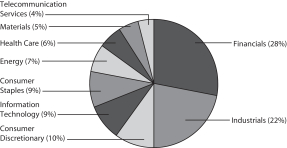

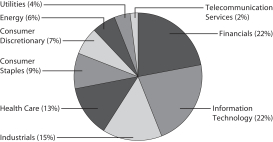

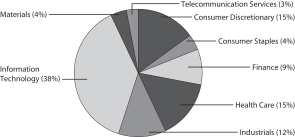

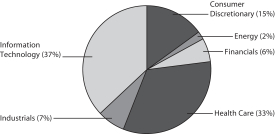

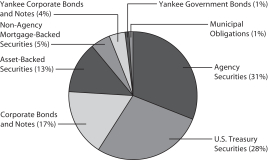

| Sector distribution as of December 31, 20157 |

|

|

We look forward to 2016.

Like a lingering storm system, many of the same issues that clouded the U.S. stock market in 2015 remain in place. Globally, growth remains questionable as China works to reignite its economy, European economies are fragile, geopolitical risk is elevated, and the negative effects of a prolonged commodity-price downturn continue. The timing and impact of further Fed action remain unknown. These issues may lead to waves of increased market volatility. We believe the best way for us to navigate this volatility is to remain focused on the

consistent execution of our investment process. Like any seasoned navigator, however, tactical adjustments could be made. One adjustment we have made is to increase the secular-growth component within the Fund. In an economic environment in which secular growth remains scarce, investors may be drawn to firms that tend to be somewhat insulated from global economic currents. Industries ripe with secular growth include e-commerce, cloud computing, network security, specialized software, and mobile/credit card payment processing. Also, to better withstand potential waves of volatility, we have added ballast by increasing the Fund’s exposure to companies with good earnings visibility. We believe these adjustments may provide even greater stability as the Fund navigates the inevitable stock-market icebergs that could lie ahead. While it likely may not be a smooth ride, we remain optimistic that 2016 could be a successful voyage.

Please see footnotes on page 5.

| | | | |

| 8 | | Wells Fargo VT Discovery Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from July 1, 2015 to December 31, 2015.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses Paid During Period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any separate account charges assessed by participating insurance companies. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges assessed by participating insurance companies were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

7-1-2015 | | | Ending

account value

12-31-2015 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class 2 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 896.62 | | | $ | 5.50 | | | | 1.15 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.41 | | | $ | 5.85 | | | | 1.15 | % |

| 1 | Expenses paid is equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half year period). |

| | | | | | |

| Portfolio of investments—December 31, 2015 | | Wells Fargo VT Discovery Fund | | | 9 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

Common Stocks: 98.35% | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 22.77% | | | | | | | | | | | | |

| | | | |

| Auto Components: 1.40% | | | | | | | | | | | | |

Gentherm Incorporated † | | | | | | | 37,469 | | | $ | 1,776,031 | |

| | | | | | | | | | | | |

| | | | |

| Diversified Consumer Services: 5.46% | | | | | | | | | | | | |

Bright Horizons Family Solutions Incorporated † | | | | | | | 35,600 | | | | 2,378,080 | |

ServiceMaster Global Holdings Incorporated † | | | | | | | 115,825 | | | | 4,544,973 | |

| | | | |

| | | | | | | | | | | 6,923,053 | |

| | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 5.58% | | | | | | | | | | | | |

Aramark | | | | | | | 73,600 | | | | 2,373,600 | |

Dave & Buster Entertainment Incorporated † | | | | | | | 50,243 | | | | 2,097,143 | |

Vail Resorts Incorporated | | | | | | | 20,400 | | | | 2,610,996 | |

| | | | |

| | | | | | | | | | | 7,081,739 | |

| | | | | | | | | | | | |

| | | | |

| Household Durables: 1.74% | | | | | | | | | | | | |

Harman International Industries Incorporated | | | | | | | 14,400 | | | | 1,356,624 | |

Newell Rubbermaid Incorporated | | | | | | | 19,400 | | | | 855,152 | |

| | | | |

| | | | | | | | | | | 2,211,776 | |

| | | | | | | | | | | | |

| | | | |

| Leisure Products: 1.22% | | | | | | | | | | | | |

The Brunswick Corporation | | | | | | | 30,700 | | | | 1,550,657 | |

| | | | | | | | | | | | |

| | | | |

| Media: 1.64% | | | | | | | | | | | | |

Cinemark Holdings Incorporated | | | | | | | 62,200 | | | | 2,079,346 | |

| | | | | | | | | | | | |

| | | | |

| Specialty Retail: 4.90% | | | | | | | | | | | | |

Caleres Incorporated | | | | | | | 45,900 | | | | 1,231,038 | |

Lithia Motors Incorporated Class A | | | | | | | 15,400 | | | | 1,642,718 | |

The Michaels Companies Incorporated † | | | | | | | 79,168 | | | | 1,750,404 | |

ULTA Salon, Cosmetics and Fragrance Incorporated † | | | | | | | 8,600 | | | | 1,591,000 | |

| | | | |

| | | | | | | | | | | 6,215,160 | |

| | | | | | | | | | | | |

| | | | |

| Textiles, Apparel & Luxury Goods: 0.83% | | | | | | | | | | | | |

Columbia Sportswear Company | | | | | | | 21,476 | | | | 1,047,170 | |

| | | | | | | | | | | | |

| | | | |

Consumer Staples: 1.31% | | | | | | | | | | | | |

| | | | |

| Beverages: 1.31% | | | | | | | | | | | | |

Constellation Brands Incorporated Class A | | | | | | | 11,700 | | | | 1,666,548 | |

| | | | | | | | | | | | |

| | | | |

Energy: 0.95% | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 0.95% | | | | | | | | | | | | |

Diamondback Energy Incorporated † | | | | | | | 17,900 | | | | 1,197,510 | |

| | | | | | | | | | | | |

| | | | |

Financials: 6.28% | | | | | | | | | | | | |

| | | | |

| Capital Markets: 4.78% | | | | | | | | | | | | |

Evercore Partners Incorporated Class A | | | | | | | 30,700 | | | | 1,659,949 | |

Raymond James Financial Incorporated | | | | | | | 34,300 | | | | 1,988,371 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo VT Discovery Fund | | Portfolio of investments—December 31, 2015 |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

| Capital Markets (continued) | | | | | | | | | | | | |

SEI Investments Company | | | | | | | 46,000 | | | $ | 2,410,400 | |

| | | | |

| | | | | | | | | | | 6,058,720 | |

| | | | | | | | | | | | |

| | | | |

| Real Estate Management & Development: 1.50% | | | | | | | | | | | | |

CBRE Group Incorporated Class A † | | | | | | | 55,100 | | | | 1,905,358 | |

| | | | | | | | | | | | |

| | | | |

Health Care: 16.19% | | | | | | | | | | | | |

| | | | |

| Biotechnology: 4.76% | | | | | | | | | | | | |

Alnylam Pharmaceuticals Incorporated † | | | | | | | 13,123 | | | | 1,235,399 | |

bluebird bio Incorporated † | | | | | | | 10,200 | | | | 655,044 | |

Cepheid Incorporated † | | | | | | | 25,353 | | | | 926,145 | |

Ligand Pharmaceuticals Incorporated † | | | | | | | 5,921 | | | | 641,955 | |

Medivation Incorporated † | | | | | | | 23,878 | | | | 1,154,263 | |

Prothena Corporation plc † | | | | | | | 5,341 | | | | 363,776 | |

Ultragenyx Pharmaceutical Incorporated † | | | | | | | 9,500 | | | | 1,065,710 | |

| | | | |

| | | | | | | | | | | 6,042,292 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 7.60% | | | | | | | | | | | | |

Alere Incorporated † | | | | | | | 51,190 | | | | 2,001,017 | |

Align Technology Incorporated † | | | | | | | 36,300 | | | | 2,390,355 | |

DexCom Incorporated † | | | | | | | 25,256 | | | | 2,068,466 | |

Hologic Incorporated † | | | | | | | 54,100 | | | | 2,093,129 | |

Integra LifeSciences Holdings Corporation † | | | | | | | 16,000 | | | | 1,084,480 | |

| | | | |

| | | | | | | | | | | 9,637,447 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 3.16% | | | | | | | | | | | | |

Envision Healthcare Holdings Incorporated † | | | | | | | 42,958 | | | | 1,115,619 | |

HealthEquity Incorporated † | | | | | | | 31,838 | | | | 798,179 | |

VCA Incorporated † | | | | | | | 38,100 | | | | 2,095,500 | |

| | | | |

| | | | | | | | | | | 4,009,298 | |

| | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.67% | | | | | | | | | | | | |

Intersect ENT Incorporated † | | | | | | | 37,711 | | | | 848,498 | |

| | | | | | | | | | | | |

| | | | |

Industrials: 17.86% | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 1.39% | | | | | | | | | | | | |

Orbital ATK Incorporated | | | | | | | 19,800 | | | | 1,768,932 | |

| | | | | | | | | | | | |

| | | | |

| Airlines: 0.87% | | | | | | | | | | | | |

Spirit Airlines Incorporated † | | | | | | | 27,600 | | | | 1,099,860 | |

| | | | | | | | | | | | |

| | | | |

| Building Products: 3.54% | | | | | | | | | | | | |

A.O. Smith Corporation | | | | | | | 27,600 | | | | 2,114,436 | |

Allegion plc | | | | | | | 36,000 | | | | 2,373,120 | |

| | | | |

| | | | | | | | | | | 4,487,556 | |

| | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 1.89% | | | | | | | | | | | | |

KAR Auction Services Incorporated | | | | | | | 64,615 | | | | 2,392,693 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2015 | | Wells Fargo VT Discovery Fund | | | 11 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 1.57% | | | | | | | | | | | | |

Acuity Brands Incorporated | | | | | | | 8,500 | | | $ | 1,987,300 | |

| | | | | | | | | | | | |

| | | | |

| Industrial Conglomerates: 1.65% | | | | | | | | | | | | |

Carlisle Companies Incorporated | | | | | | | 23,657 | | | | 2,098,139 | |

| | | | | | | | | | | | |

| | | | |

| Machinery: 2.88% | | | | | | | | | | | | |

Proto Labs Incorporated † | | | | | | | 12,400 | | | | 789,756 | |

WABCO Holdings Incorporated † | | | | | | | 11,500 | | | | 1,175,990 | |

Wabtec Corporation | | | | | | | 23,800 | | | | 1,692,656 | |

| | | | |

| | | | | | | | | | | 3,658,402 | |

| | | | | | | | | | | | |

| | | | |

| Road & Rail: 1.19% | | | | | | | | | | | | |

Old Dominion Freight Line Incorporated † | | | | | | | 25,500 | | | | 1,506,285 | |

| | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 2.88% | | | | | | | | | | | | |

Air Lease Corporation | | | | | | | 49,800 | | | | 1,667,304 | |

HD Supply Holdings Incorporated † | | | | | | | 66,039 | | | | 1,983,151 | |

| | | | |

| | | | | | | | | | | 3,650,455 | |

| | | | | | | | | | | | |

| | | | |

Information Technology: 27.64% | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 0.93% | | | | | | | | | | | | |

Harris Corporation | | | | | | | 13,600 | | | | 1,181,840 | |

| | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 0.90% | | | | | | | | | | | | |

Cognex Corporation | | | | | | | 33,600 | | | | 1,134,672 | |

| | | | | | | | | | | | |

| | | | |

| Internet Software & Services: 2.46% | | | | | | | | | | | | |

CoStar Group Incorporated † | | | | | | | 15,119 | | | | 3,124,946 | |

| | | | | | | | | | | | |

| | | | |

| IT Services: 8.29% | | | | | | | | | | | | |

Black Knight Financial Services Incorporated † | | | | | | | 31,202 | | | | 1,031,538 | |

Broadridge Financial Solutions Incorporated | | | | | | | 23,400 | | | | 1,257,282 | |

EPAM Systems Incorporated † | | | | | | | 24,019 | | | | 1,888,374 | |

Euronet Worldwide Incorporated † | | | | | | | 29,693 | | | | 2,150,664 | |

Vantiv Incorporated Class A † | | | | | | | 41,553 | | | | 1,970,443 | |

WEX Incorporated † | | | | | | | 25,000 | | | | 2,210,000 | |

| | | | |

| | | | | | | | | | | 10,508,301 | |

| | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 0.97% | | | | | | | | | | | | |

Cavium Incorporated † | | | | | | | 18,700 | | | | 1,228,777 | |

| | | | | | | | | | | | |

| | | | |

| Software: 14.09% | | | | | | | | | | | | |

CyberArk Software Limited †« | | | | | | | 37,794 | | | | 1,706,021 | |

Fleetmatics Group plc † | | | | | | | 19,766 | | | | 1,003,915 | |

Guidewire Software Incorporated † | | | | | | | 33,091 | | | | 1,990,755 | |

Imperva Incorporated † | | | | | | | 20,841 | | | | 1,319,444 | |

Paycom Software Incorporated † | | | | | | | 60,777 | | | | 2,287,039 | |

Splunk Incorporated † | | | | | | | 38,500 | | | | 2,264,185 | |

Tableau Software Incorporated Class A † | | | | | | | 27,415 | | | | 2,583,041 | |

Take-Two Interactive Software Incorporated † | | | | | | | 58,000 | | | | 2,020,720 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo VT Discovery Fund | | Portfolio of investments—December 31, 2015 |

| | | | | | | | | | | | | | |

| Security name | | | | | | | Shares | | | Value | |

| | | | | | | | | | | | | | |

| | | | |

| Software (continued) | | | | | | | | | | | | | | |

Tyler Technologies Incorporated † | | | | | | | | | 15,475 | | | $ | 2,697,602 | |

| | | | |

| | | | | | | | | | | | | 17,872,722 | |

| | | | | | | | | | | | | | |

| | | | |

Materials: 2.70% | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 1.33% | | | | | | | | | | | | | | |

Axalta Coating Systems Limited † | | | | | | | | | 63,483 | | | | 1,691,822 | |

| | | | | | | | | | | | | | |

| | | | |

| Construction Materials: 1.37% | | | | | | | | | | | | | | |

Vulcan Materials Company | | | | | | | | | 18,300 | | | | 1,737,950 | |

| | | | | | | | | | | | | | |

| | | | |

Telecommunication Services: 2.65% | | | | | | | | | | | | | | |

| | | | |

| Diversified Telecommunication Services: 2.65% | | | | | | | | | | | | | | |

Zayo Group Holdings Incorporated † | | | | | | | | | 126,400 | | | | 3,360,976 | |

| | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $112,644,770) | | | | | | | | | | | | | 124,742,231 | |

| | | | | | | | | | | | | | |

| | | | |

| | | Yield | | | | | | | | | |

| Short-Term Investments: 3.54% | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 3.54% | | | | | | | | | | | | | | |

Securities Lending Cash Investments, LLC (l)(r)(u) | | | 0.39 | % | | | | | 1,678,325 | | | | 1,678,325 | |

Wells Fargo Cash Investment Money Market Fund, Select Class (l)(u) | | | 0.33 | | | | | | 2,815,601 | | | | 2,815,601 | |

| | | | |

Total Short-Term Investments (Cost $4,493,926) | | | | | | | | | | | | | 4,493,926 | |

| | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $117,138,696) * | | | 101.89 | % | | | 129,236,157 | |

Other assets and liabilities, net | | | (1.89 | ) | | | (2,397,456 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 126,838,701 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| (r) | The investment is a non-registered investment vehicle purchased with cash collateral received from securities on loan. |

| (u) | The rate represents the 7-day annualized yield at period end. |

| * | Cost for federal income tax purposes is $117,202,128 and unrealized gains (losses) consists of: |

| | | | |

Gross unrealized gains | | $ | 17,368,077 | |

Gross unrealized losses | | | (5,334,048 | ) |

| | | | |

Net unrealized gains | | $ | 12,034,029 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of assets and liabilities—December 31, 2015 | | Wells Fargo VT Discovery Fund | | | 13 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments | | | | |

In unaffiliated securities (including $1,620,526 of securities loaned), at value (cost $112,644,770) | | $ | 124,742,231 | |

In affiliated securities, at value (cost $4,493,926) | | | 4,493,926 | |

| | | | |

Total investments, at value (cost $117,138,696) | | | 129,236,157 | |

Receivable for Fund shares sold | | | 46,047 | |

Receivable for dividends | | | 55,606 | |

Receivable for securities lending income | | | 1,886 | |

Prepaid expenses and other assets | | | 1,383 | |

| | | | |

Total assets | | | 129,341,079 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 588,753 | |

Payable for Fund shares redeemed | | | 65,105 | |

Payable upon receipt of securities loaned | | | 1,678,325 | |

Management fee payable | | | 84,216 | |

Distribution fee payable | | | 29,791 | |

Administration fee payable | | | 9,533 | |

Accrued expenses and other liabilities | | | 46,655 | |

| | | | |

Total liabilities | | | 2,502,378 | |

| | | | |

Total net assets | | $ | 126,838,701 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 105,994,319 | |

Accumulated net realized gains on investments | | | 8,746,921 | |

Net unrealized gains on investments | | | 12,097,461 | |

| | | | |

Total net assets | | $ | 126,838,701 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE PER SHARE | | | | |

Net assets – Class 2 | | $ | 126,838,701 | |

Shares outstanding – Class 21 | | | 4,880,246 | |

Net asset value per share – Class 2 | | | $25.99 | |

| 1 | The Fund has an unlimited number of authorized shares. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo VT Discovery Fund | | Statement of operations—year ended December 31, 2015 |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends | | $ | 506,703 | |

Securities lending income, net | | | 91,001 | |

Income from affiliated securities | | | 3,997 | |

| | | | |

Total investment income | | | 601,701 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 1,047,510 | |

Administration fee | | | | |

Class 2 | | | 111,734 | |

Distribution fee | | | | |

Class 2 | | | 349,170 | |

Custody and accounting fees | | | 23,830 | |

Professional fees | | | 40,311 | |

Shareholder report expenses | | | 29,452 | |

Trustees’ fees and expenses | | | 21,251 | |

Other fees and expenses | | | 12,071 | |

| | | | |

Total expenses | | | 1,635,329 | |

Less: Fee waivers and/or expense reimbursements | | | (29,147 | ) |

| | | | |

Net expenses | | | 1,606,182 | |

| | | | |

Net investment loss | | | (1,004,481 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains on investments | | | 9,025,317 | |

Net change in unrealized gains (losses) on investments | | | (9,495,134 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | (469,817 | ) |

| | | | |

Net decrease in net assets resulting from operations | | $ | (1,474,298 | ) |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of changes in net assets | | Wells Fargo VT Discovery Fund | | | 15 | |

| | | | | | | | | | | | | | | | |

| | | Year ended

December 31, 2015 | | | Year ended

December 31, 2014 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment loss | | | | | | $ | (1,004,481 | ) | | | | | | $ | (990,469 | ) |

Net realized gains on investments | | | | | | | 9,025,317 | | | | | | | | 20,144,541 | |

Net change in unrealized gains (losses) on investments | | | | | | | (9,495,134 | ) | | | | | | | (19,385,645 | ) |

| | | | |

Net decrease in net assets resulting from operations | | | | | | | (1,474,298 | ) | | | | | | | (231,573 | ) |

| | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net realized gains – Class 2 | | | | | | | (20,334,034 | ) | | | | | | | (18,974,676 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold – Class 2 | | | 505,503 | | | | 14,950,495 | | | | 363,614 | | | | 11,794,023 | |

Reinvestment of distributions – Class 2 | | | 708,256 | | | | 20,334,034 | | | | 644,301 | | | | 18,974,676 | |

Payment for shares redeemed – Class 2 | | | (843,307 | ) | | | (25,127,064 | ) | | | (999,205 | ) | | | (31,523,941 | ) |

| | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | | | | | 10,157,465 | | | | | | | | (755,242 | ) |

| | | | |

Total decrease in net assets | | | | | | | (11,650,867 | ) | | | | | | | (19,961,491 | ) |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 138,489,568 | | | | | | | | 158,451,059 | |

| | | | |

End of period | | | | | | $ | 126,838,701 | | | | | | | $ | 138,489,568 | |

| | | | |

Undistributed net investment income | | | | | | $ | 0 | | | | | | | $ | 0 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo VT Discovery Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31 | |

| CLASS 2 | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

Net asset value, beginning of period | | | $30.71 | | | | $35.20 | | | | $25.16 | | | | $21.37 | | | | $21.28 | |

Net investment loss | | | (0.21 | ) | | | (0.22 | ) | | | (0.17 | ) | | | (0.01 | ) | | | (0.18 | ) |

Net realized and unrealized gains (losses) on investments | | | 0.21 | | | | 0.16 | | | | 11.06 | | | | 3.80 | | | | 0.27 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.00 | | | | (0.06 | ) | | | 10.89 | | | | 3.79 | | | | 0.09 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | 0.00 | | | | (0.00 | )1 | | | 0.00 | | | | 0.00 | |

Net realized gains | | | (4.72 | ) | | | (4.43 | ) | | | (0.85 | ) | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (4.72 | ) | | | (4.43 | ) | | | (0.85 | ) | | | 0.00 | | | | 0.00 | |

Net asset value, end of period | | | $25.99 | | | | $30.71 | | | | $35.20 | | | | $25.16 | | | | $21.37 | |

Total return | | | (1.46 | )% | | | 0.36 | % | | | 43.80 | % | | | 17.74 | % | | | 0.42 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.17 | % | | | 1.14 | % | | | 1.16 | % | | | 1.21 | % | | | 1.18 | % |

Net expenses | | | 1.15 | % | | | 1.14 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % |

Net investment loss | | | (0.72 | )% | | | (0.68 | )% | | | (0.56 | )% | | | (0.03 | )% | | | (0.75 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 90 | % | | | 79 | % | | | 88 | % | | | 98 | % | | | 113 | % |

Net assets, end of period (000s omitted) | | | $126,839 | | | | $138,490 | | | | $158,451 | | | | $111,458 | | | | $98,099 | |

| 1 | Amount is less than $0.005. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements | | Wells Fargo VT Discovery Fund | | | 17 | |

1. ORGANIZATION

Wells Fargo Variable Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo VT Discovery Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time).

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the primary exchange or market that day, the prior day’s price will be deemed “stale” and a fair value price will be determined in accordance with the Fund’s Valuation Procedures.

Equity securities that are not listed on a foreign or domestic exchange or market, but have a public trading market, are valued at the quoted bid price from an independent broker-dealer that the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”) has determined is an acceptable source.

Investments in registered open-end investment companies are valued at net asset value. Interests in non-registered investment vehicles that are redeemable at net asset value are fair valued at net asset value when available.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team. The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the manager and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Security loans

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

| | | | |

| 18 | | Wells Fargo VT Discovery Fund | | Notes to financial statements |

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Securities Lending Cash Investments, LLC (the “Securities Lending Fund”). The Securities Lending Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Funds Management and is subadvised by Wells Capital Management Incorporated (“WellsCap”). Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Fund increase. All of the fees received by Funds Management are paid to WellsCap for its services as subadviser. The Securities Lending Fund seeks to provide a positive return compared to the daily Fed Funds Open rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Securities Lending Fund investments are fair valued based upon the amortized cost valuation technique. Income earned from investment in the Securities Lending Fund is included in securities lending income on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with federal income tax regulations, which may differ in amount or character from net investment income and realized gains recognized for purposes of U.S. generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under federal income tax regulations. U.S. generally accepted accounting principles require that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. The primary permanent difference causing such reclassification is due to net operating losses. At December 31, 2015, as a result of permanent book-to-tax differences, the following reclassification adjustments were made on the Statement of Assets and Liabilities:

| | |

| Paid-in capital | | Undistributed net investment income |

$(1,004,481) | | $1,004,481 |

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to significant unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | | Level 1 – quoted prices in active markets for identical securities |

| n | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, use of amortized cost, etc.) |

| n | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | | | | | |

| Notes to financial statements | | Wells Fargo VT Discovery Fund | | | 19 | |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of December 31, 2015:

| | | | | | | | | | | | | | | | |

| | | Quoted prices

(Level 1) | | | Other significant

observable inputs

(Level 2) | | | Significant

unobservable inputs

(Level 3) | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Investments in: | | | | | | | | | | | | | | | | |

| | | | |

Common stocks | | | | | | | | | | | | | | | | |

Consumer discretionary | | $ | 28,884,932 | | | $ | 0 | | | $ | 0 | | | $ | 28,884,932 | |

Consumer staples | | | 1,666,548 | | | | 0 | | | | 0 | | | | 1,666,548 | |

Energy | | | 1,197,510 | | | | 0 | | | | 0 | | | | 1,197,510 | |

Financials | | | 7,964,078 | | | | 0 | | | | 0 | | | | 7,964,078 | |

Health care | | | 20,537,535 | | | | 0 | | | | 0 | | | | 20,537,535 | |

Industrials | | | 22,649,622 | | | | 0 | | | | 0 | | | | 22,649,622 | |

Information technology | | | 35,051,258 | | | | 0 | | | | 0 | | | | 35,051,258 | |

Materials | | | 3,429,772 | | | | 0 | | | | 0 | | | | 3,429,772 | |

Telecommunication services | | | 3,360,976 | | | | 0 | | | | 0 | | | | 3,360,976 | |

| | | | |

Short-term investments | | | | | | | | | | | | | | | | |

Investment companies | | | 2,815,601 | | | | 1,678,325 | | | | 0 | | | | 4,493,926 | |

Total assets | | $ | 127,557,832 | | | $ | 1,678,325 | | | $ | 0 | | | $ | 129,236,157 | |

The Fund recognizes transfers between levels within the fair value hierarchy at the end of the reporting period. At December 31, 2015, the Fund did not have any transfers into/out of Level 1, Level 2, or Level 3.

4. TRANSACTIONS WITH AFFILIATES

Management fee

Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”), is the manager of the Fund and provides advisory and fund-level administrative services under an investment management agreement. Under the investment management agreement, Funds Management is responsible for, among other services, implementing the investment objectives and strategies of the Fund, supervising the applicable subadviser, providing fund-level administrative services in connection with the Fund’s operations, and providing any other fund-level administrative services reasonably necessary for the operation of the Fund. As compensation for its services under the investment management agreement, Funds Management is entitled to receive an annual management fee starting at 0.75% and declining to 0.58% as the average daily net assets of the Fund increase.

Prior to July 1, 2015, Funds Management provided advisory services pursuant to an investment advisory agreement and was entitled to receive an annual fee which started at 0.70% and declined to 0.55% as the average daily net assets of the Fund increased. In addition, fund-level administrative services were provided by Funds Management under a separate administration agreement at an annual fee which started at 0.05% and declined to 0.03% as the average daily net assets of the Fund increased. For financial statement purposes, the advisory fee and fund-level administration fee for the year ended December 31, 2015 have been included in management fee on the Statement of Operations.

For the year ended December 31, 2015, the management fee was equivalent to an annual rate of 0.75% of the Fund’s average daily net assets.

Funds Management has retained the services of a subadviser to provide daily portfolio management to the Fund. The fee for subadvisory services is borne by Funds Management. WellsCap, an affiliate of Funds Management and an indirect wholly owned subsidiary of Wells Fargo, is the subadviser to the Fund and is entitled to receive a fee from Funds Management at an annual rate starting at 0.45% and declining to 0.35% as the average daily net assets of the Fund increase.

| | | | |

| 20 | | Wells Fargo VT Discovery Fund | | Notes to financial statements |

Administration fee

Under a class-level administration agreement, Funds Management provides class-level administrative services to the Fund, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers. As compensation for its services under the class-level administration agreement, Funds Management receives a class level administration fee of 0.08% which is calculated based on the average daily net assets of Class 2 shares.

Funds Management has contractually waived and/or reimbursed management and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses. Funds Management has committed through April 30, 2016 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses at 1.15% for Class 2 shares. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

Distribution fee

The Trust has adopted a distribution plan for Class 2 shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. A distribution fee is charged to Class 2 shares and paid to Wells Fargo Funds Distributor, LLC, the principal underwriter, at an annual rate of 0.25% of the average daily net assets of Class 2 shares.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. government obligations (if any) and short-term securities, for the year ended December 31, 2015 were $122,274,759 and $134,343,329, respectively.

6. BANK BORROWINGS

The Trust and Wells Fargo Funds Trust (excluding the money market funds and certain other funds) are parties to a $200,000,000 revolving credit agreement whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.20% of the unused balance is allocated to each participating fund. Prior to September 1, 2015, the revolving credit agreement amount was $150,000,000 and the annual commitment fee was equal to 0.10% of the unused balance which was allocated to each participating fund. For the year ended December 31, 2015, the Fund paid $237 in commitment fees.

For the year ended December 31, 2015, there were no borrowings by the Fund under the agreement.

7. CONCENTRATION RISK

Concentration risks result from exposure to a limited number of sectors. A fund that invests a substantial portion of its assets in any sector may be more affected by changes in that sector than would be a fund whose investments are not heavily weighted in any sector.

8. DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid during the years ended December 31, 2015 and December 31, 2014 were as follows:

| | | | |

| | | Year ended December 31 |

| | | 2015 | | 2014 |

Ordinary income | | $ 0 | | $ 6,355,354 |

Long-term capital gain | | 20,334,034 | | 12,619,322 |

As of December 31, 2015, the components of distributable earnings on a tax basis were as follows:

| | |

Undistributed

long-term

gain | | Unrealized

gains |

$8,810,353 | | $12,034,029 |

| | | | | | |

| Notes to financial statements | | Wells Fargo VT Discovery Fund | | | 21 | |

9. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and Trustees have been granted certain indemnification rights against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

| | | | |

| 22 | | Wells Fargo VT Discovery Fund | | Report of independent registered public accounting firm |

BOARD OF TRUSTEES AND SHAREHOLDERS OF WELLS FARGO VARIABLE TRUST:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of the Wells Fargo VT Discovery Fund (formerly known as Wells Fargo Advantage VT Discovery Fund) (the “Fund”), one of the funds constituting the Wells Fargo Variable Trust, as of December 31, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2015, by correspondence with the custodian and brokers, or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Wells Fargo VT Discovery Fund as of December 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 25, 2016

| | | | | | |

| Other information (unaudited) | | Wells Fargo VT Discovery Fund | | | 23 | |

TAX INFORMATION

Pursuant to Section 852 of the Internal Revenue Code, $20,334,034 was designated as long-term capital gain distributions for the fiscal year ended December 31, 2015.

PROXY VOTING INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, upon request, by calling 1-800-260-5969, visiting our website at wellsfargofunds.com, or visiting the SEC website at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website at wellsfargofunds.com or by visiting the SEC website at sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The complete portfolio holdings for the Fund are publicly available monthly on the Fund’s website (wellsfargofunds.com), on a one-month delayed basis. In addition, top ten holdings information (excluding derivative positions) for the Fund is publicly available on the Fund’s website on a monthly, seven-day or more delayed basis. The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available by visiting the SEC website at sec.gov. In addition, the Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and at regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | |

| 24 | | Wells Fargo VT Discovery Fund | | Other information (unaudited) |

BOARD OF TRUSTEES AND OFFICERS

Each of the Trustees and Officers1 listed in the table below acts in identical capacities for each fund in the Wells Fargo family of funds, which consists of 144 mutual funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information2. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

| | | | | | |

Name and year of birth | | Position held and length of service* | | Principal occupations during past five years or longer | | Current other public company or

investment company

directorships |

William R. Ebsworth

(Born 1957) | | Trustee, since 2015 | | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief financial officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he lead a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Mr. Ebsworth is a CFA® charterholder and an Adjunct Lecturer, Finance, at Babson College. | | Asset Allocation Trust |

Jane A. Freeman

(Born 1953) | | Trustee, since 2015 | | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is Chair of Taproot Foundation (non-profit organization), a Board Member of Ruth Bancroft Garden (non-profit organization) and an inactive chartered financial analyst. | | Asset Allocation Trust |

Peter G. Gordon

(Born 1942) | | Trustee, since 1998; Chairman, since 2005 | | Co-Founder, Retired Chairman, President and CEO of Crystal Geyser Water Company. Trustee Emeritus, Colby College. | | Asset Allocation Trust |

Isaiah Harris, Jr.

(Born 1952) | | Trustee, since 2009 | | Retired. Chairman of the Board of CIGNA Corporation since 2009, and Director since 2005. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (charter school). Advisory Board Member, Child Evangelism Fellowship (non-profit). Mr. Harris is a certified public accountant (inactive status). | | CIGNA Corporation; Asset Allocation Trust |

Judith M. Johnson

(Born 1949) | | Trustee, since 2008; Audit Committee Chairman, since 2008 | | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | | Asset Allocation Trust |

David F. Larcker

(Born 1950) | | Trustee, since 2009 | | James Irvin Miller Professor of Accounting at the Graduate School of Business, Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | | Asset Allocation Trust |

| | | | | | |

| Other information (unaudited) | | Wells Fargo VT Discovery Fund | | | 25 | |

| | | | | | |

Name and year of birth | | Position held and length of service* | | Principal occupations during past five years or longer | | Current other public company or

investment company

directorships |

Olivia S. Mitchell

(Born 1953) | | Trustee, since 2006 | | International Foundation of Employee Benefit Plans Professor, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | | Asset Allocation Trust |

Timothy J. Penny

(Born 1951) | | Trustee, since 1996 | | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007 and Senior Fellow at the Humphrey Institute Policy Forum at the University of Minnesota since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | | Asset Allocation Trust |

Michael S. Scofield

(Born 1943) | | Trustee, since 2010 | | Served on the Investment Company Institute’s Board of Governors and Executive Committee from 2008-2011 as well the Governing Council of the Independent Directors Council from 2006-2011 and the Independent Directors Council Executive Committee from 2008-2011. Chairman of the IDC from 2008-2010. Institutional Investor (Fund Directions) Trustee of Year in 2007. Trustee of the Evergreen Funds complex (and its predecessors) from 1984 to 2010. Chairman of the Evergreen Funds from 2000-2010. Former Trustee of the Mentor Funds. Retired Attorney, Law Offices of Michael S. Scofield. | | Asset Allocation Trust |

Donald C. Willeke

(Born 1940) | | Trustee, since 1996** | | Principal of the law firm of Willeke & Daniels. General Counsel of the Minneapolis Employees Retirement Fund from 1984 until its consolidation into the Minnesota Public Employees Retirement Association on June 30, 2010. Director and Vice Chair of The Tree Trust (non-profit corporation). Director of the American Chestnut Foundation (non-profit corporation). | | Asset Allocation Trust |

| * | Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable. |

| ** | Donald Willeke retired as a Trustee effective December 31, 2015. |

Officers

| | | | | | |

Name and year of birth | | Position held and

length of service | | Principal occupations during past five years or longer | | |

Karla M. Rabusch

(Born 1959) | | President, since 2003 | | Executive Vice President of Wells Fargo Bank, N.A. and President of Wells Fargo Funds Management, LLC since 2003. | | |

Jeremy DePalma1

(Born 1974) | | Treasurer, since 2012; Assistant Treasurer, since 2009 | | Senior Vice President of Wells Fargo Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. | | |

C. David Messman

(Born 1960) | | Secretary, since 2000; Chief Legal Officer, since 2003 | | Senior Vice President and Secretary of Wells Fargo Funds Management, LLC since 2001. Assistant General Counsel of Wells Fargo Bank, N.A. since 2013 and Vice President and Managing Counsel of Wells Fargo Bank, N.A. from 1996 to 2013. | | |

Debra Ann Early

(Born 1964) | | Chief Compliance Officer, since 2007 | | Executive Vice President of Wells Fargo Funds Management, LLC since 2014, Senior Vice President and Chief Compliance Officer from 2007 to 2014. | | |

David Berardi