- SWKH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

SWK (SWKH) DEF 14ADefinitive proxy

Filed: 23 Apr 04, 12:00am

| OMB Number: | 3235-0059 | |

| Expires: | February 28, 2006 | |

| Estimated average burden | ||

| hours per response . . . . . | 12.75 | |

| OMB APPROVAL SEC 1913 (03-04) | ||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

KANA Software, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

Persons who are to respond to the collection of information

contained in this form are not required to respond unless the

form displays a currently valid OMB control number.

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

April 23, 2004

Dear Stockholders:

You are cordially invited to attend our 2004 annual meeting of stockholders to be held at Fenwick & West LLP, Silicon Valley Center, 801 California Street, Mountain View, California, on June 7, 2004, at 10:00 a.m. Pacific Time. The matters expected to be acted upon at our annual meeting are the election of two Class II directors to our Board of Directors, and ratification of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ending December 31, 2004. Each of these proposals is described in detail in the accompanying notice of annual meeting of stockholders and proxy statement.

Please use this opportunity to take part in our affairs by voting on the business to come before this meeting.Whether or not you plan to attend our annual meeting, please complete, date, sign and promptly return the accompanying proxy card in the enclosed postage-paid envelope prior to our meeting so that your shares will be represented at our meeting. Returning the proxy card does not deprive you of your right to attend our meeting and to vote your shares in person.

We hope to see you at our annual meeting.

Sincerely, |

| /s/ CHUCK BAY |

Chuck Bay Chief Executive Officer |

This proxy statement is dated April 23, 2004, and will first be mailed to KANA stockholders on or about April 30, 2004.

KANA SOFTWARE, INC.

181 CONSTITUTION DRIVE

MENLO PARK, CALIFORNIA 94025

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of KANA Software, Inc. will be held at Fenwick & West LLP, Silicon Valley Center, 801 California Street, Mountain View, California, on June 7, 2004, at 10:00 a.m., Pacific Time.

At our annual meeting, you will be asked to consider and vote upon the following matters:

1. The election of two Class II directors of KANA, to serve until our 2007 annual meeting of stockholders and until a successor has been elected and qualified or until earlier resignation, death or removal. Our Board of Directors intends to present Jerry Batt and Tom Galvin as nominees for election as our Class II directors.

2. A proposal to ratify the selection of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year 2004.

3. To transact such other business as may properly come before our annual meeting or any adjournment of our meeting.

The foregoing items of business are more fully described in the proxy statement accompanying this notice. Only stockholders of record at the close of business on April 14, 2004 are entitled to notice of and to vote at our annual meeting or any adjournment of our meeting.

By Order of the Board of Directors |

| /s/ CHUCK BAY |

Chuck Bay Chief Executive Officer |

Menlo Park, California

April 23, 2004

WHETHER OR NOT YOU PLAN TO ATTEND OUR ANNUAL MEETING, PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE PRIOR TO OUR MEETING SO THAT YOUR SHARES WILL BE REPRESENTED AT OUR MEETING.

KANA SOFTWARE, INC.

181 CONSTITUTION DRIVE

MENLO PARK, CALIFORNIA 94025

PROXY STATEMENT

April 23, 2004

The accompanying proxy is solicited on behalf of the Board of Directors of KANA Software, Inc., a Delaware corporation, for use at our annual meeting of stockholders to be held at Fenwick & West LLP, Silicon Valley Center, 801 California Street, Mountain View, California, on June 7, 2004, at 10:00 a.m., Pacific Time. This proxy statement and the accompanying Notice of Annual Meeting of Stockholders and form of proxy will first be mailed to stockholders on or about April 30, 2004. Stockholders are encouraged to review the information provided in this proxy statement in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2003, a copy of which also accompanies this proxy statement.

VOTING INFORMATION

Record Date and Quorum

A quorum is required for our stockholders to conduct business at the annual meeting. The holders of a majority of the shares of our common stock entitled to vote on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business. Only holders of our common stock of record at the close of business on April 14, 2004, the record date, will be entitled to vote at the annual meeting. A majority of the shares outstanding on this record date will constitute a quorum for the transaction of business at the meeting. At the close of business on the record date, we had 28,794,731 shares of common stock outstanding and entitled to vote, held by approximately 1,300 stockholders of record.

Voting Rights

Only holders of our common stock are entitled to vote and are allowed one vote for each share held as of the record date. Shares may not be voted cumulatively. If stockholders abstain from voting, including brokers holding their customers’ shares of record who cause abstentions to be recorded, these shares are considered present and entitled to vote at the meeting. These shares will count toward determining whether or not a quorum is present. However, these shares will not be counted as voting either “for” or “against” any of the proposals.

If a stockholder does not give a proxy to its broker with instructions as to how to vote the shares, the broker has authority under stock market rules to vote those shares for or against certain “routine” matters. Each of the proposals to be voted on at our annual meeting are generally considered routine for this purpose. If a broker votes shares that are not voted by its customers for or against a proposal, these shares are considered present and entitled to vote at the annual meeting, will count toward determining whether or not a quorum is present, and the brokers’ votes will be taken into account in determining the outcome of all of the proposals.

Although all of the proposals to be voted on at our annual meeting are considered “routine,” where a matter is not “routine,” a broker generally would not be entitled to vote its customers’ unvoted shares. These shares would be considered present but would not be considered entitled to vote on the matter. These shares would count toward determining whether or not a quorum is present. However, these shares would not be taken into account in determining the outcome of any of the proposals.

Required Votes

Proposal 1. Directors are elected by a plurality of the votes of the shares present in person or represented by proxy at our annual meeting and entitled to vote on the election of directors. This means that the nominees for election to the Board of Directors who receive the highest number of affirmative votes at the meeting will be elected to fill the two open seats.

Proposal 2. Ratification of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ended December 31, 2004 requires the affirmative vote of the majority of shares present in person or represented by proxy at our annual meeting.

All votes will be tabulated by the inspector of elections appointed for our annual meeting, who will separately tabulate, for each proposal, affirmative and negative votes, abstentions and broker non-votes.

Voting Electronically via the Internet

If your shares are registered in the name of a bank or brokerage you may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the ADP Investor Communication Services online program, which provides eligible stockholders who receive a paper copy of the proxy statement with the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm is participating in ADP’s program, your voting form from the bank or brokerage firm will provide instructions. If your voting form does not reference Internet or telephone information, please complete and return the accompanying paper proxy card in the enclosed self-addressed, postage paid envelope.

Voting of Proxies

The proxy card accompanying this proxy statement is solicited on behalf of our Board of Directors for use at our annual meeting. Stockholders are asked to complete, date and sign the accompanying proxy card and promptly return it in the enclosed envelope or otherwise mail it to us. All executed, returned proxies that are not revoked will be voted in accordance with the included instructions. Signed proxies that are returned without instructions as to how they should be voted on a particular proposal at our meeting will be counted as votes “for” such proposal (or, in the case of the election of directors, as a vote “for” election to the board of all of the nominees presented by our Board of Directors). We are not aware of any other matters to be brought before our meeting. However, as to any business that may properly come before our meeting, we intend that proxies that are executed and returned prior to our annual meeting will be voted in accordance with the judgment of the persons holding such proxies.

In the event that sufficient votes in favor of the proposals are not received by the date of our annual meeting, the persons named as proxies may propose one or more adjournments of our meeting to permit further solicitation of proxies. Any such adjournment would require the affirmative vote of the majority of the outstanding shares present in person or represented by proxy at our meeting.

We are paying the expenses of soliciting proxies to be voted at our annual meeting. Following the original mailing of the proxies and other soliciting materials, we will request that brokers, custodians, nominees and other record holders of our common stock forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. In these cases we may, upon their request, reimburse such record holders for their reasonable expenses. Proxies may also be solicited by some of our directors, officers and regular employees, without additional compensation, in person or by telephone.

Revocability of Proxies

Any person signing a proxy in the form accompanying this proxy statement has the power to revoke the proxy prior to the annual meeting, or at the annual meeting prior to the vote to which the proxy relates. A proxy may be revoked by any of the following methods:

| • | a written instrument delivered to us stating that the proxy is revoked; |

2

| • | a subsequent proxy that is signed by the person who signed the earlier proxy and is presented at the annual meeting; or |

| • | attendance at the annual meeting and voting in person. |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at our annual meeting, you must bring to our meeting a letter from the broker, bank or other nominee confirming your beneficial ownership of the shares and that such broker, bank or other nominee is not voting your shares.

Communicating with Members of the Board of Directors

You may submit an e-mail to KANA’s Board of Directors or any member of the Board of Directors at bod@kana.com. E-mails to this address are routed to our General Counsel, who will forward the message to the full board unless the sender indicates that they would like the message to be forwarded solely to non-management directors or the chair of a particular board committee. No members of the Board of Directors attended our 2003 annual meeting of stockholders.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Our Board of Directors presently consists of five members, two of whom are to be elected at our 2004 annual meeting. Each of the directors elected at our 2004 annual meeting will hold office until our 2007 annual meeting of stockholders or his successor is duly elected and qualified, or his earlier resignation, death or removal.

The nominees for election as Class II directors are Jerry Batt and Tom Galvin. Messrs. Batt and Galvin currently serve as Class II directors of our Board. Shares represented by the accompanying proxy will be voted “for” the election of Messrs. Batt and Galvin unless the proxy is marked in such a manner as to withhold authority so to vote. In the event that Mr. Batt or Galvin is unable to serve for any reason, the proxies may be voted for such substitute nominee as the proxy holder may determine. Both Messrs. Batt and Galvin have consented to being named in this proxy statement and to serve if elected. Messrs. Batt and Galvin will be elected by a plurality of the votes of the shares present in person or represented by proxy at our annual meeting and entitled to vote in the election of directors. Should there be more than two nominees for election as Class II directors at the meeting, the two nominees who receive the greatest number of votes cast in the election of directors at our meeting, a quorum being present, will become Class II directors at the conclusion of the tabulation of votes.

The Board of Directors recommends votesfor the election of the nominated directors.

3

BOARD OF DIRECTORS AND NOMINEES

The following table sets forth the names of the director nominees and our continuing directors and information about each (including their ages as of April 9, 2004):

Nominees

Name | Age | Committee Memberships | Principal Occupation | Director Since | ||||

Tom Galvin | 48 | Audit, Compensation | Director of Compensation and Benefits for Intel Corporation | 2002 | ||||

Jerry Batt | 53 | Compensation, Governance & Nominating | Chief Information Officer for Pulte Home Corporation | 2003 | ||||

Continuing Directors

| ||||||||

Name | Age | Committee Memberships | Principal Occupation | Director Since | ||||

| Chuck Bay | 46 | N/A | Chairman and Chief Executive Officer, KANA | 2001 | ||||

| Mark A. Bertelsen | 60 | Audit, Governance & Nominating | Senior Member, Wilson Sonsini Goodrich & Rosati, Professional Corporation, attorneys at law | 2003 | ||||

| Dixie Mills | 56 | Audit, Governance & Nominating | Dean of the College of Business at Illinois State University | 2003 | ||||

Board of Directors

Our Board of Directors is divided into three classes as nearly equal in size as possible with staggered three-year terms. The term of office of our Class II directors will next expire at the annual meeting of stockholders to be held in 2007. The terms of office of our Class I directors and Class III directors will expire at the annual meetings of stockholders to be held in 2006 and 2005, respectively. At each annual meeting of stockholders, the successors to the directors whose terms will then expire will be elected to serve from the time of their election and qualification until the third annual meeting following their election or until their successors have been duly elected and qualified, or until their earlier resignation or removal. Dr. Mills is a Class I director, Messrs. Batt and Galvin are Class II directors and Messrs. Bay and Bertelsen are Class III directors.

The Board of Directors met six times in 2003, including telephone conference meetings. During 2003, no director attended fewer than 75% of the aggregate of the total number of meetings of the board and the total number of meetings held by all committees of the board on which such director served during the time period for which each such director served on the Board of Directors. The Board of Directors has determined that Messrs. Batt, Bertelsen and Galvin and Dr. Mills each meet the requirements for independent director status under the listing standards of The NASDAQ Stock Market.

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee.

Nominees for Election—Class II Directors (Term to Expire in 2007)

Jerry R. Batt.Mr. Batt joined our Board of Directors in August 2003. Mr. Batt is currently Chief Information Officer and Vice President at Pulte Home Corporation, a national home building and construction company, since

4

September 2003. From August 2001 to July 2003, Mr. Batt was the Chief Information Officer and Vice President of Sprint PCS. From April 2000 to July 2001, Mr. Batt co-founded and became Chief Executive Officer of Foxfire Consulting, an IT consulting and systems integration firm specializing in the telecommunications industry. From 1973 to January 2000, Mr. Batt was responsible for AT&T’s consumer long distance account management, billing and customer service platform.

Tom Galvin.Mr. Galvin joined our Board of Directors in December 2002. Since 1979, Mr. Galvin has served in various positions with Intel Corporation, and currently serves as Director of Compensation and Benefits. Mr. Galvin has also served the company in Finance, Business Development, Marketing, and Human Resources at Intel. In Finance, Mr. Galvin last served as Controller for Worldwide Sales, Marketing, and Advertising, with financial responsibility for Intel’s brand investments including the Intel Inside® program. Immediately prior to managing the company’s Compensation and Benefits group, Mr. Galvin was director of Market Development for Intel’s consumer software programs in support of the Pentium®brand family of microprocessors. Mr. Galvin holds a B.S. degree in Mathematics and Economics from Miami University (Ohio), and a M.B.A. degree from the Kellogg School of Management at Northwestern University.

Continuing Class III Directors (Term to Expire in 2005)

Chuck Bay. Mr. Bay has been our Chief Executive Officer and a member of our Board of Directors since our merger with Broadbase in June 2001. He became Chairman of our Board in April 2003. Mr. Bay was formerly Chief Executive Officer of Broadbase, which he joined as Chief Financial Officer and General Counsel in January 1998. Mr. Bay also served as Executive Vice President of Operations of Broadbase. From July 1997 to January 1998, Mr. Bay served as Chief Financial Officer and General Counsel for Reasoning, Inc., a software company. From January 1995 to August 1997, Mr. Bay served as Chief Financial Officer and General Counsel, for Pure Atria Software, Inc., a software company. From April 1994 to January 1995, Mr. Bay served as President and Chief Financial Officer of Software Alliance Corporation, a software company. Mr. Bay holds a B.S. degree in Business Administration from Illinois State University and a J.D. degree from the University of Illinois.

Mark Bertelsen.Mr. Bertelsen joined our Board of Directors in March 2003. Mr. Bertelsen joined the law firm Wilson Sonsini Goodrich & Rosati in January 1972 and became a member of the firm in January 1977. Wilson Sonsini Goodrich & Rosati does not serve as KANA’s legal counsel. Mr. Bertelsen is also a member of the Board of Directors at Autodesk, Inc., a design software company, and Informatica Corporation, a data management software company. Mr. Bertelsen holds a B.A. degree in political science from the University of California, Santa Barbara and a J.D. degree from University of California, Berkeley.

Continuing Class I Director (Term to Expire in 2006)

Dr. Dixie L. Mills.Dr. Mills joined our Board of Directors in August 2003. Dr. Mills is currently the Dean of the College of Business at Illinois State University since 1997. Dr. Mills is a member of the board of trustees for the Preferred Group of Mutual Funds, managed by Caterpillar Investment Management, Ltd. Dr. Mills received her B.A. degree from Georgetown College with a major in history, and earned her M.B.A. and Ph.D. degrees in finance from the University of Cincinnati.

COMMITTEES OF THE BOARD OF DIRECTORS

Audit Committee. We have a separately-designated standing audit committee comprised of Messrs Bertelsen and Galvin and Dr. Mills, each of whom meets the independence and other requirements to serve on our Audit Committee under applicable securities laws and the rules of the SEC and listing standards of The NASDAQ Stock Market. Our Board of Directors has determined that Mr. Galvin is an “audit committee financial expert” as defined the rules of the SEC. The Audit Committee met five times during 2003. The 2003 report of the Audit Committee is provided below, beginning on page 9.

Our Board of Directors has adopted a written charter for the Audit Committee, a copy of which is attached to this proxy statement asAppendix A and posted in the Corporate Governance section of our Internet website (at www.kana.com under Investor Relations). The principal functions of the Audit Committee are to oversee our accounting and financial reporting processes and the audits of our financial statements, oversee our relationship with

5

our independent auditors, including selecting, evaluating and setting the compensation of, and approving all audit and non-audit services to be performed by, the independent auditors, and facilitate communication among our independent auditors and our financial and senior management.

Compensation Committee. The current members of our Compensation Committee are Messrs. Batt and Galvin, both of whom meet the independence requirements to serve on our compensation committee under applicable law and the rules of the SEC and listing standards of The NASDAQ Stock Market. The Compensation Committee met three times during 2003. The 2003 report of the Compensation Committee is provided below, beginning on page 14.

Our Board of Directors has adopted a written charter for the Compensation Committee, a copy of which is posted in the Corporate Governance section of our Internet website (at www.kana.com under Investor Relations). The Compensation Committee has responsibilities relating to the performance evaluation and the compensation of our CEO, the compensation of our executive officers and directors, and our significant compensation arrangements, plans, policies and programs, including our stock compensation plans. Certain of our officers, our outside counsel and consultants may occasionally attend the meetings of the Compensation Committee. However, no officer of KANA is present during discussions or deliberations regarding that officer’s own compensation.

Governance and Nominating Committee. We have a separately-designated standing Governance and Nominating Committee comprised of Messrs. Batt and Bertelsen, and Dr. Mills, each of whom meets the independence requirements to serve on our Governance and Nominating Committee under applicable securities laws and the rules of the SEC and listing standards of The NASDAQ Stock Market. The Governance and Nominating Committee did not meet in 2003.

Our Board of Directors has adopted a written charter for the Governance and Nominating Committee, a copy of which is posted in the Corporate Governance section of our Internet website (at www.kana.com under Investor Relations). The Governance and Nominating Committee considers Board performance and nominees for director positions and also evaluates and oversees corporate governance and related issues.

The goal of the Governance and Nominating Committee is to ensure that our Board of Directors possesses a variety of perspectives and skills derived from high-quality business and professional experience. The committee seeks to achieve a balance of knowledge, experience and capability on our Board. To this end, the committee seeks nominees with the highest professional and personal ethics and values, an understanding of our business and industry, diversity of business experience and expertise, a high level of education, broad-based business acumen, and the ability to think strategically. Although the committee uses these and other criteria to evaluate potential nominees, it has no stated minimum criteria for nominees. The committee does not use different standards to evaluate nominees depending on whether they are proposed by our directors and management or by our stockholders. To date, we have not paid any third parties to assist us in this process.

The Governance and Nominating Committee will consider stockholder recommendations for director candidates. The committee has established the following procedure for stockholders to submit such recommendations: the stockholder should send the name of the individual and related personal and professional information including a list of references to our Governance and Nominating Committee, in care of the Corporate Secretary at our principal executive offices, sufficiently in advance of the annual meeting to allow the committee appropriate time to consider the recommendation.

DIRECTOR COMPENSATION

We currently do not compensate any non-employee member of the board, other than through option grants. Directors who are also our employees do not receive additional compensation for serving as directors. Directors are reimbursed for direct expenses incurred in attending Board meetings.

Non-employee directors are eligible to receive discretionary option grants and stock issuances under the 1999 Stock Incentive Plan. In April 2003, Mr. Bertelsen was granted an option to purchase 100,000 shares of common stock at $4.46 per share. In August 2003, Mr. Batt was granted an option to purchase 100,000 shares of common stock at $2.95 per share. In August 2003, Dr. Mills was granted an option to purchase 100,000 shares of common

6

stock at $2.95 per share. All of these options were granted under the Kana 1999 Stock Incentive Plan and each will vest and become exercisable, for as long as the individual is serving as a director to KANA, as to 1/48th of the total shares granted each month. If there is a change of control of at least 50% of the voting stock of KANA, and, in connection with the change of control, there is an involuntary termination of the optionee’s service as a director of KANA (or its successor), then any remaining unvested shares will immediately vest. In addition, under the Kana 1999 Stock Incentive Plan, each new non-employee director will receive an automatic option grant for 4,000 shares upon his or her initial appointment or election to the Board of Directors, and continuing non-employee directors will receive an automatic option grant for 1,000 shares on the date of each annual meeting of stockholders.

In September 2003, in connection with Mr. Zarrabian’s resignation from the Board of Directors, the exercisability of his vested options as of the date of his resignation was extended from 90 days to one year.

PROPOSAL NO. 2—RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANTS

Our Board of Directors has selected PricewaterhouseCoopers LLP as KANA’s independent accountants to perform the audit of our financial statements for 2004, and our stockholders are being asked to ratify this selection. Representatives of PricewaterhouseCoopers LLP will be present at our annual meeting, will have the opportunity to make a statement at our meeting if they wish, and will be available to respond to appropriate questions.

The Board of Directors recommends a votefor the ratification of the selection of PricewaterhouseCoopers LLP as our independent accountants.

OTHER BUSINESS

Our Board of Directors does not presently intend to bring any other business before our annual meeting, and we are not aware of any matters to be brought before our meeting except as specified in the notice of our meeting. As to any business that may properly come before our meeting, however, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

RELATIONSHIP WITH OUR INDEPENDENT ACCOUNTANTS

The firm of PricewaterhouseCoopers LLP has served as our independent accountants since March 2000 and was our independent accountants for the fiscal year ended December 31, 2003. As above, the Board of Directors has recommended PricewaterhouseCoopers LLP to serve as our independent accountants for the fiscal year ending December 31, 2004.

Fiscal 2003 and 2002 Audit Firm Fee Summary

During fiscal years 2003 and 2002, we retained our principal independent accountants, PricewaterhouseCoopers, to provide services in the following categories and amounts (in thousands):

| Year Ended December 31, | ||||||

| 2003 | 2002 | |||||

Audit fees | $ | 367 | $ | 335 | ||

Audit-related fees | — | — | ||||

Tax fees | 147 | 255 | ||||

All other fees: | ||||||

Review of Form S-3 filings | 105 | 44 | ||||

Total fees | $ | 619 | $ | 634 | ||

Our Audit Committee considers at least annually whether the provision of non-audit services by PricewaterhouseCoopers is compatible with maintaining auditor independence. This process includes:

| • | Obtaining and reviewing, on at least an annual basis, a letter from the independent auditors describing all relationships between the independent auditors and the Company required to be disclosed by Independence Standards Board Standard No. 1, reviewing the nature and scope of such relationships, discussing these relationships with the independent auditors and discontinuing any relationships that the Committee believes could compromise the independence of the auditors; and |

| • | Obtaining reports of all non-audit services proposed to be performed by the independent auditors before such services are performed, reviewing and approving or prohibiting, as appropriate, any non-audit services not permitted by applicable law. The Committee may delegate authority to review and approve or prohibit non-audit services to one or more members of the Committee, and direct that any approval so granted be reported to the Committee at a following meeting of the Committee. |

All services provided by our independent accountant in fiscal 2002 and fiscal 2003 were approved in advance by the Audit Committee.

Report of the Audit Committee

The material in this report is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date of this proxy statement and irrespective of any general incorporation language therein.

The Audit Committee’s purpose is to assist the Board of Directors in its oversight of KANA’s financial accounting, reporting and controls. The Board of Directors, in its business judgment, has determined that all members of the Committee are “independent” as required by applicable listing standards of The NASDAQ Stock Market (please see “Committees of the Board of Directors” on page 5 of this proxy statement). The Committee operates pursuant to a charter, which, as amended, has been most recently approved by the Board of Directors in April 2003. The Committee meets with KANA’s management and with our independent accountants, with and without management present, to discuss the scope and plans for their audit, the results of their examinations, their evaluations of KANA’s internal controls and the overall quality of KANA’s financial reporting. The Committee held five meetings during 2003.

In performing its oversight role during the period since its last report, the Committee considered and discussed KANA’s audited financial statements with management and our independent accountants. The Committee also discussed with KANA’s independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees. The Committee received the written disclosures and the letter from our independent accountants required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees. The Committee also considered whether the provision of non-audit services by the independent accountants is compatible with maintaining their independence as KANA’s auditors, and has discussed with the independent accountants their independence as KANA’s auditors. Based on the discussions with management and the independent accountants, the Committee recommended to the Board of Directors that KANA’s audited financial statements that were reviewed by the Committee and discussed with management and our independent accountants be included in KANA’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003. The Committee and the Board of Directors also recommended, subject to stockholder approval, the selection of PricewaterhouseCoopers LLP as KANA’s independent accountants for the fiscal year ending December 31, 2004.

Members of the Committee rely on the information provided to them and on the representations made to the Committee by management and KANA’s independent accountants without conducting independent verification of the accuracy of such information and representations. Accordingly, the Committee’s oversight does not ensure that management has maintained appropriate accounting and financial reporting principles or appropriate internal

8

controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Committee’s considerations and discussions referred to above do not ensure that any audit of KANA’s financial statements conducted by independent accountants has been carried out in accordance with generally accepted auditing standards, or that the financial statements are presented in accordance with generally accepted accounting principles.

AUDIT COMMITTEE:

Mark Bertelsen

Tom Galvin

Dixie Mills

EXECUTIVE OFFICERS

In addition to Chuck Bay, an executive officer who is also a member of the Board of Directors, the following individuals are executive officers of the Company:

Tom Doyle. Mr. Doyle, age 53, has been our President in March 2003. Prior to his promotion, he was our Chief Operating Officer since our merger with Broadbase in June 2001. In May 1999, Mr. Doyle joined Broadbase and served first as Executive Vice President of Sales and then as Chief Operating Officer. From 1996 to April 1999, Mr. Doyle was Senior Vice President of Worldwide Sales at Reasoning Inc., joining Reasoning from Tandem Computers where he was Director of North American Sales Operations. At Tandem, he held numerous sales and sales management positions in Houston, Texas, Atlanta, Georgia and Cupertino, California. Before joining Tandem, Mr. Doyle participated in the start-up operations and initial channel development with Fortune Systems. Mr. Doyle serves on the board of directors of Privia, Inc. Mr. Doyle obtained his B.S. degree in Finance from the University of Missouri.

John Huyett. Mr. Huyett, age 50, has been our Executive Vice President and Chief Financial officer since June 2002. Previously, Mr. Huyett served as President and Chief Executive Officer of Clickmarks, Inc. from August 2000 through March 2002. From March 1998 to July 2000 Mr. Huyett was Chief Financial Officer and subsequently Chief Executive Officer at Magellan Corporation. Prior to Magellan, Mr. Huyett was Chief Financial Officer, Treasurer and Vice President of Financial and Administrative Services at Avant!. Mr. Huyett was a partner at KPMG where he was in charge of KPMG’s high technology practice in the Carolinas. Mr. Huyett obtained his B.S. degree in Business Administration from the University of North Carolina at Chapel Hill.

Brian Kelly.Mr. Kelly, age 38, has been our Executive Vice President of Marketing and Product Strategy since June 2003. Previously, Mr. Kelly served as Vice President of Products at Kanisa, Inc. from February 2003 to June 2003. From September 2001 to February 2003, Mr. Kelly served as Chief Executive Office of Proveer, Inc., a software and services company that provides analytical applications and business intelligence infrastructure. From December 1998 to June 2001, Mr. Kelly was Executive Vice President of Products at Broadbase, prior to the Broadbase merger in June 2001, and remained as our Executive Vice President of Products until August 2001. Mr. Kelly holds a B.S. degree in Computer Science from the University of Cincinnati.

Alan Hubbard. Mr. Hubbard, age 46, joined KANA in June 2002 and currently serves as Executive Vice President of Research & Development. Previously, Mr. Hubbard was the Vice President of Engineering for Altaworks Corporation from January 2000 to February 2002. From January 1991 to January 2000, Mr. Hubbard held various management positions at Hewlett-Packard Company, including Worldwide Technology Program Manager - Enterprise Accounts Organization. Mr. Hubbard holds a M.B.A. and B.S. degree in Computer Information Systems from Bentley College.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The members of our board of directors, our executive officers and persons who hold more than 10% of our outstanding common stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended, which require them to file reports with respect to their ownership of the common stock and their transactions in such common stock. During 2003, Mr. Wood filed a late Form 4 reporting the grant of stock options, and Dr. Mills and Messrs. Batt and Hubbard each filed a late Form 3 reporting their initial statement of

9

beneficial ownership. Based on our review of reporting forms we have received from our executive officers and board members, we believe that such persons have filed, on a timely basis, all other reports required under Section 16(a) for 2003.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth information regarding the beneficial ownership of our common stock as of April 9, 2004, by the following individuals or groups:

| • | each person or entity who is known by us to own beneficially more than five percent of our outstanding stock; |

| • | each of those officers and former officers of KANA whose summary compensation information is provided below under “Summary of Cash and Certain Other Compensation for Executive Officers” (referred to as the “Named Executive Officers”); |

| • | each of our directors; and |

| • | all current directors and executive officers as a group. |

Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. Applicable percentage ownership in the following table is based on 28,794,731 shares of common stock outstanding as of April 9, 2004, as adjusted to include options exercisable within 60 days of April 9, 2004 held by the indicated stockholder or stockholders.

Unless otherwise indicated, the principal address of each of the stockholders below is c/o KANA Software, Inc., 181 Constitution Drive, Menlo Park, CA 94025. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock held by them. To determine the number of shares beneficially owned by persons other than our directors, executive officers and their affiliates, we have relied on beneficial ownership reports filed by such persons with the SEC.

Name and Address of Beneficial Owner | Number of Shares Beneficially Owned (#) | Percentage of Shares Beneficially Owned (%) | ||

Executive Officers and Directors: | ||||

Chuck Bay(1) | 843,363 | 2.8 | ||

Tom Doyle(2) | 403,798 | 1.4 | ||

John Huyett (3) | 239,702 | * | ||

Alan Hubbard (4) | 93,528 | * | ||

Brian Kelly(5) | 78,725 | * | ||

Mark Bertelsen(6) | 29,316 | * | ||

Tom Galvin(7) | 35,000 | * | ||

Jerry Batt(8) | 20,500 | * | ||

Dr. Dixie Mills(9) | 20,500 | * | ||

All current directors and executive officers as a group (9 persons)(10) | 1,764,432 | 5.8 | ||

5% Stockholders: | ||||

S Squared Technology Corp.(11). | 1,777,000 | 6.2 |

| * | Less than one percent. |

| (1) | Represents 5,272 shares held by Mr. Bay and options that will be exercisable as to 838,091 shares as of June 8, 2004. Mr. Bay is Chief Executive Officer and Chairman of the Board of KANA. |

| (2) | Represents 7,287 shares held by Mr. Doyle and options that will be exercisable as to 396,511 shares as of June 8, 2004. Mr. Doyle is the Chief Operating Officer and President of KANA. |

10

| (3) | Represents 12,970 shares held by Mr. Huyett and options that will be exercisable as to 226,732 shares as of June 8, 2004. Mr. Huyett is the Chief Financial Officer of KANA. |

| (4) | Represents 1,350 shares held by Mr. Hubbard and options that will be exercisable as to 92,178 shares as of June 8, 2004. Mr. Hubbard is the Executive Vice President of Research & Development of KANA. |

| (5) | Represents 9,975 shares held by Mr. Kelly and options that will be exercisable as to 68,750 shares as of June 8, 2004. Mr. Kelly is the Executive Vice President of Marketing & Product Strategy of KANA. |

| (6) | Represents 316 shares held by Mr. Bertelsen and options that will be exercisable as to 29,000 shares as of June 8, 2004. Mr. Bertelsen is a director of KANA. |

| (7) | Represents options that will be exercisable as to 35,000 shares as of June 89, 2004. Mr. Galvin is a director of KANA. |

| (8) | Represents options that will be exercisable as to 20,500 shares as of June 8, 2004. Mr. Batt is a director of KANA. |

| (9) | Represents options that will be exercisable as to 20,500 shares as of June 8, 2004. Dr. Dixie Mills is a director of KANA. |

| (10) | Represents 37,170 shares held and options that will be exercisable as to 1,727,262 shares as of June 8, 2004. |

| (11) | The address of S Squared Technology Corp. is 515 Madison Avenue, New York, NY 10022. |

EQUITY COMPENSATION PLANS

We maintain the Kana 1999 Stock Incentive Plan, the Kana 1999 Employee Stock Purchase Plan, the Broadbase 1999 Equity Incentive Plan and the Broadbase 2000 Stock Incentive Plan. The Kana 1999 Stock Incentive Plan and the Kana 1999 Employee Stock Purchase Plan have been approved by our stockholders. The Broadbase 1999 Equity Incentive Plan and the Broadbase 2000 Stock Incentive Plan were assumed by Kana in connection with the Broadbase merger in June 2001 and have not been subsequently approved by our stockholders.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes our equity compensation plans as of December 31, 2003:

Plan category | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (b) Weighted- average exercise price of outstanding options, warrants and rights | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||

Equity compensation plans approved by security holders(1) | 4,193,429 | $ | 17.73 | 2,520,347 | |||

Equity compensation plans not approved by security holders(2) | 3,697,857 | 11.10 | 1,909,753 | ||||

Total | 7,891,286 | $ | 14.62 | 4,430,100 | |||

| (1) | Under the terms of our KANA 1999 Stock Incentive Plan, on the first trading day of January of each year, the aggregate number of shares of our Common Stock reserved for issuance thereunder is increased automatically by a number of shares equal to 4.25% of the total number of shares of our outstanding common stock on the last trading day in December of the immediately preceding calendar year, up to a maximum of 1,000,000 shares per year. Under |

11

the terms of our 1999 Employee Stock Purchase Plan, on the first trading day of January of each year, the aggregate number of shares of our Common Stock reserved for issuance thereunder is increased automatically by a number of shares equal to 0.75% of the total number of shares of our outstanding common stock on the last trading day in December of the immediately preceding calendar year, up to a maximum of 400,000 shares per year. |

| (2) | Please see below for a description of our equity compensation plans which do not require the approval of, and have not been approved by, our stockholders. In addition, we have assumed all the outstanding options of Broadbase Software, Silknet Software, and other companies in connection with the acquisition of those companies. As of December 31, 2003 there remained outstanding assumed options to purchase a total of approximately 201,842 shares of our common stock with a weighted exercise price of $81.14 per share, which excludes options outstanding under assumed option plans, but includes those options outstanding where only the option grants were assumed and not the plan. These options have been converted into options to purchase our shares on the terms specified in the relevant acquisition agreements. Under the terms of our Broadbase 1999 Stock Incentive Plan, on the first trading day of January of each year, the aggregate number of shares of our Common Stock reserved for issuance thereunder is increased automatically by a number of shares equal to 5% of the total number of shares of our outstanding common stock on the last trading day in December of the immediately preceding calendar year. |

Equity Compensation Plans Not Approved By Stockholders

We assumed the Broadbase 1999 Equity Incentive Plan (the “Broadbase 1999 Plan”) and the Broadbase 2000 Stock Incentive Plan (the “Broadbase 2000 Plan”) in connection with the Broadbase merger in June 2001. The Broadbase 1999 Plan permits the grant of nonqualified stock options, restricted stock and stock bonuses to our employees, consultants and directors. The Broadbase 2000 Plan permits the grant of nonqualified stock options and restricted stock to our employees, consultants and directors.

The Broadbase 1999 Plan and the Broadbase 2000 Plan allow the Compensation Committee to specify the specific conditions of grants, including but not limited to the vesting period, option period, termination provisions and transferability provisions. Options granted under both plans typically have an exercise price not less than the fair market value of our common stock on the date of grant, although both plans permit grants at lower exercise prices. Options granted under both plans generally become exercisable over a four-year period based on continued service and expire ten years after the grant date, subject to earlier termination in the event of a participant’s termination of service with Kana.

As of December 31, 2003, a total of 1,088,447 and 821,306 shares remained available for grant under the Broadbase 1999 Plan and the Broadbase 2000 Plan, respectively. Under the terms the Broadbase 1999 Plan, on the first trading day of January of each year, the aggregate number of shares of our common stock reserved for issuance thereunder is increased automatically by a number of shares equal to 5% of the total number of shares of our outstanding common stock on the last trading day in December of the immediately preceding calendar year.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation Committee Report

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933, and the Securities Exchange Act of 1934 that might incorporate future filings, including this proxy statement, in whole or in part, the following report in this document shall not be incorporated by reference in any such filings.

The Compensation Committee acts on behalf of the Board of Directors to establish KANA’s general compensation policies for all employees and to determine the compensation for the Chief Executive Officer and reviews and approves compensation for the other executive officers. It also administers KANA’s stock plans. Additionally, the Committee is routinely consulted to approve compensation packages for newly-hired executives. The Committee’s compensation policy for executive officers is designed to promote continued performance, and to attract, motivate and retain talented executives responsible for the success of KANA.

12

Executive Compensation. At the conclusion of each fiscal year the Committee meets with the Chief Executive Officer to consider executive compensation plans for the next fiscal year. The Committee determines the compensation levels for the executive officers by reviewing certain independent information sources as they are available, and from the recommendations of the Chief Executive Officer.

When reviewing with the members of the Committee, the Chief Executive Officer considers individual and corporate performance, levels of experience and responsibility, and competitive pay practices. These factors vary from individual to individual and the Chief Executive Officer does not assign relative weight or priority to any one factor. In addition, the base salaries, incentive compensation and option grants of executive officers are determined in part by the Committee reviewing data on prevailing compensation practices in companies with whom KANA competes for executive talent and by their evaluating this information in connection with KANA’s corporate goals. In addition, the Committee commissioned and reviewed the results of a report prepared by a third party executive compensation specialist.

KANA’s executive officers are paid base salaries in line with their responsibilities and based on the above factors, as determined in the discretion of the Committee. Executive officers are also eligible to receive stock option grants and cash bonuses based on achievement of performance targets established at the beginning of the fiscal year. During fiscal year 2003, the objectives used by KANA as the basis for incentive bonuses included the achievement of quarterly corporate financial goals based on KANA’s financial plan.

Long-term equity incentives for KANA’s executive officers and non-executive employees are effected through stock option grants under the 1999 Stock Incentive Plan, Broadbase Software, Inc. 1999 Equity Incentive Plan, or the Broadbase 2000 Incentive Stock Plan. The Committee believes that equity-based compensation in the form of stock options links the interests of management and employees with those of the stockholders. Substantially all of KANA’s full-time non-executive employees participate in either its 1999 Stock Incentive Plan or its Broadbase Software, Inc. 1999 Equity Incentive Plan. The number of shares subject to each stock option granted to executive officers is within the discretion of the Committee and is based on each executive’s position within KANA, past performance, anticipated future contributions, and prior option grants. Further, the Committee generally does not consider whether an executive has exercised previously granted options. During 2003, executive officers received options to purchase 1,254,876 shares of common stock.

Each grant allows the executive officer to acquire shares of KANA’s common stock at a fixed price per share (the market price on the grant date) in installments generally over a four-year period. The option grants will provide a return only if the market price of KANA’s stock appreciates over the option term. As of April 9, 2004, executive officers of KANA owned an aggregate of 26,879 shares of common stock (including restricted shares) and had the right to acquire an additional 1,553,512 shares of common stock upon the exercise of employee stock options that are exercisable within sixty days of April 9, 2004. These interests, exclusive of other outstanding options, represented in the aggregate 5.2% of KANA’s outstanding capital stock on April 9, 2004. KANA intends to continue its strategy of encouraging its executive officers to become stockholders.

CEO Compensation. The annual base salary for the Chief Executive Officer of KANA is reviewed and approved annually by the Committee. In setting Mr. Bay’s compensation for 2003, the Committee considered KANA’s financial performance for the prior fiscal year, KANA’s market capitalization, and data regarding pay practices of comparable companies as well as the results of a report prepared by a third party executive compensation specialist, in addition to Mr. Bay’s individual performance and continuing contributions to KANA. The Committee set Mr. Bay’s salary at $250,000 for 2003 and awarded Mr. Bay a bonus of $100,000, which was based on KANA’s financial and strategic performance in 2003 as well as a comparison to peer companies. At Mr. Bay’s request, as part of KANA’s company-wide costs-savings initiative, including pay reductions for most of KANA’s employees, implemented in 2001 and 2002, Mr. Bay’s total salary for 2002 was reduced to $129,196 from the $205,000 annual salary set by the Committee for the year. The Committee also awarded Mr. Bay a bonus of $100,000 for 2002, which was based on KANA’s financial and strategic performance in 2002.

In February 2003, the Committee granted Mr. Bay options to purchase up to 275,000 shares of common stock vesting over four years. In granting this option, the committee reviewed Mr. Bay’s existing outstanding options, the number of shares common stock Mr. Bay already owned, and KANA’s performance in 2003 as well as a comparison to peer companies.

13

In addition, in August 2003, the Committee approved the terms of an employment agreement for Mr. Bay which provides for (i) 18 months of acceleration of unvested stock options upon a change of control of KANA if, following such change of control, Mr. Bay is not offered a similar position in the combined entity, (ii) full acceleration of unvested stock options immediately prior to such change in control if the successor entity does not fully assume or replace such stock options with equivalent substitute stock options, and (iii) a lump sum payment of 18 months of Mr. Bay’s base salary and payment of up to 18 months of health insurance benefits if KANA is subject to a change of control and Mr. Bay is not offered a similar position in the combined entity following such change of control. In approving the terms of this employment agreement, the committee reviewed Mr. Bay’s and KANA’s performance in 2003 and KANA’s need for incentive provided to Mr. Bay by such employment agreement to vigorously pursue change of control opportunities that may provide value to KANA’s stockholders.

Tax Policy. Section 162(m) of the Internal Revenue Code of 1986 limits deductions for certain executive compensation in excess of $1 million. Certain types of compensation are deductible only if performance criteria are specified in detail and are contingent on stockholder approval of the compensation arrangement. KANA has generally endeavored to structure its compensation plans to achieve maximum deductibility under Section 162(m) with minimal sacrifices in flexibility and corporate objectives.

The Committee believes that long-term stockholder value is enhanced by corporate and individual performance achievements. Through the plans and policies described above, a significant portion of KANA’s executive compensation is based on corporate and individual performance, as well as competitive pay practices. The Committee believes equity compensation, in the form of stock options and restricted stock, is vital to the long-term success of KANA. The Committee remains committed to this policy, recognizing the competitive market for talented executives and that the cyclical nature of KANA’s business may result in highly variable compensation for a particular time period. Moreover, the Committee believes that KANA’s flexibility in implementing its compensation philosophy in 2003 has played a substantial part in enabling it to attract and retain KANA’s key executives. The Committee believes that long-term stockholder value was enhanced by the corporate and individual performance achievements of KANA’s executives.

COMPENSATION COMMITTEE:

Jerry Batt

Tom Galvin

Compensation Committee Interlocks and Insider Participation

During 2003, our compensation committee consisted of Messrs. Galvin, Harvey and Batt. Mr. Batt replaced Mr. Harvey on the compensation committee when Mr. Harvey resigned in August 2003. No members of the compensation committee were also employees of KANA or its subsidiaries during 2003 or at any time prior to 2003. None of our executive officers serves on the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

Summary of Cash and Certain Other Compensation for Executive Officers

Summary Compensation Table. The following table sets forth certain information concerning compensation earned for 2001, 2002, and 2003, by:

| • | our Chief Executive Officer; |

| • | each of our four other most highly compensated executive officers who were serving at the end of 2003 and whose salary and bonus for 2003 exceeded $100,000; and |

| • | up to two additional individuals who would have been named, but for the fact that the individual was not serving as an executive officer at the end of 2003. |

14

The listed individuals are referred to in this report as the Named Executive Officers. None of the Named Executive Officers were employed by KANA until its merger with Broadbase in June 2001. Accordingly, in each case where we have reported 2001 annual compensation, such compensation reflects only compensation paid since the merger, while the 2002 and 2003 figures represent a full year of compensation.

The salary figures include amounts the employees invested into our tax-qualified plan pursuant to Section 401(k) of the Internal Revenue Code. However, compensation in the form of perquisites and other personal benefits that constituted less than the lesser of either $50,000 or 10% of the total annual salary and bonus of each of the Named Executive Officers in 2002 is excluded. The option grants reflected in the table below for 2002 were made under our 1999 Stock Incentive Plan, Broadbase Software, Inc. 1999 Equity Incentive Plan and Broadbase Software, Inc. 2000 Stock Incentive Plan.

15

| Annual Compensation | All Other Compensation ($) | Long-Term Options (#) | |||||||||

Name and Principal Position | Year | Salary ($) | Bonus ($) | ||||||||

Chuck Bay Chief Executive Officer and | 2003 2002 2001 | 250,000 129,196 101,150 | 100,000 100,000 — | — — — | 275,000 556,625 746,651 | (1) | |||||

Tom Doyle Chief Operating Officer and President | 2003 2002 2001 | 200,000 153,333 100,483 | 100,000 100,000 29,167 | — — — | 275,000 225,000 295,750 | (1) | |||||

John Huyett (2) Chief Financial Officer | 2003 2002 2001 | 175,000 94,000 — | 115,321 40,000 — | — 40,000 — | 150,000 359,647 — | | |||||

Brian Kelly(3) Executive Vice President of Marketing and | 2003 2002 2001 | 100,401 75,000 41,682 | 70,000 — 25,000 | 150,000 — 7,212 | 300,000 — 73,500 | | |||||

Alan Hubbard(4) Executive Vice President of Research and | 2003 2002 2001 | 163,100 85,915 — | 100,000 65,000 — | — — — | 254,876 45,124 — | | |||||

| (1) | Options granted in 2001 to Messr.’s Bay and Doyle include options granted by Broadbase that we assumed. |

| (2) | Mr. Huyett joined KANA in June 2002; therefore his 2002 annual salary represents only seven months of compensation. Other compensation in 2002 represents a signing bonus. |

| (3) | Mr. Kelly’s 2002 compensation represents compensation for consulting services in connection with his termination agreement in August 2001. Mr. Kelly rejoined KANA on a full-time basis in June 2003. Other compensation in 2003 represents a signing bonus. |

| (4) | Mr. Hubbard joined KANA in June 2002 therefore his 2002 annual salary represents only seven months of compensation. |

Stock Options

Table of Option Grants in Fiscal 2003. The following table sets forth information with respect to stock options granted to each of the Named Executive Officers in 2003. We granted options to purchase up to a total of 3,686,102 shares to employees during the year and the table’s percentage column shows how much of that total was granted to the Named Executive Officers. No stock appreciation rights were granted to the Named Executive Officers during 2003.

The table includes the potential realizable value over the 10-year term of the options, based on assumed rates of stock price appreciation of 5% and 10%, compounded annually. The potential realizable value is calculated based on the closing price of the common stock on the date of grant, assuming that price appreciates at the indicated rate for the entire term of the option and that the option is exercised and sold on the last day of its term at the appreciated price. All options listed have a term of 10 years. The stock price appreciation rates of 5% and 10% are assumed pursuant to the rules of the Securities and Exchange Commission. We can give no assurance that the actual stock price will appreciate over the 10-year option term at the assumed levels or at any other defined level. Actual gains, if

16

any, on stock option exercises will be dependent on the future performance of our common stock. Unless the market price of the common stock appreciates over the option term, no value will be realized from the option grants made to the Named Executive Officers.

| Number of Securities Underlying Options Granted (#) | % of Total Options Granted to Employees in Fiscal Year | Individual Grant | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||||||||||

Name | Exercise Price ($/Sh) | Expiration Date | 5% ($) | 10% ($) | ||||||||||||

Chuck Bay | 275,000 | 6.73 | % | $ | 3.10 | 02/13/2013 | $ | 536,133 | $ | 1,358,665 | ||||||

Tom Doyle | 275,000 | 6.73 | 3.10 | 02/13/2013 | 536,133 | 1,358,665 | ||||||||||

John Huyett | 150,000 | 3.67 | 3.10 | 02/13/2013 | 292,436 | 741,090 | ||||||||||

Brian Kelly | 300,000 | 7.34 | 2.81 | 07/18/2013 | 530,158 | 1,343,525 | ||||||||||

Alan Hubbard | 154,876 100,000 | 3.79 2.45 | | | 2.81 3.32 | 07/18/2013 01/21/2013 | | 273,696 209,032 | | 693,599 529,728 | ||||||

Table of Aggregated Option Exercises and Fiscal Year-End Values.The following table sets forth the number of shares underlying exercisable and unexercisable options held by the Named Executive Officers at the end of 2003, and the value of such options. One of the Named Executive Officers exercised options during 2003. None of the Named Executive Officers held any stock appreciation rights at the end of the year.

The value realized is based on the fair market value of our common stock on the date of exercise, minus the exercise price payable for the shares, except in the event of a same day sale transaction, in which case the actual sale price is used.

Number of Exercise (#) | Value Realized ($) | # of Securities Underlying Unexercised Options/SARs at Fiscal Year-End(#) | Value of Unexercised in-the-Money Options/SARs at Fiscal Year-End($) | |||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

Chuck Bay | — | — | 663,454 | 914,875 | $ | 345,302 | $ | 696,782 | ||||||

Tom Doyle | — | 309,948 | 503,375 | 155,331 | 313,982 | |||||||||

John Huyett | — | — | 166,731 | 342,916 | 40,337 | 95,863 | ||||||||

Brian Kelly | 13,650 | 23,465 | 37,500 | 262,500 | 21,000 | 147,000 | ||||||||

Alan Hubbard | — | — | 58,237 | 241,763 | 39,422 | 123,994 | ||||||||

Employment Arrangements, Termination or Employment Arrangements and Change in Control Arrangements

Options held by our continuing Named Executive Officers provide for full acceleration of vesting and exercisability with respect to all unvested shares upon a change of controlof KANA if, following such change of control, the Named Executive Officer is not offered a similar position in the combined entity.

KANA has employment agreements with Chuck Bay and Tom Doyle that provide for 18 months of acceleration of unvested shares upon a change of control of KANA if, following such change of control, these individuals are not offered a similar position in the combined entity. They would then have 12 months from the date of such termination to exercise the options. In addition, if outstanding options held by Mr. Bay or Mr. Doyle immediately prior to such change in control are not fully assumed or replaced with equivalent substitute stock options of the successor, then all

17

options held by such individuals will be fully accelerated immediately prior to the date of such change of control. In addition, upon a change of control where Mr. Bay or Mr. Doyle is not offered a similar position in the combined entity, 18 months of such individual’s base salary will be paid in a lump sum and he may elect to receive insurance benefits under the Consolidated Budget Reconciliation Act of 1985, (COBRA) for 18 months following such termination.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Loans to and Other Arrangements with Officers and Directors

In connection with stock option exercises, Mr. Frick, a director of KANA until December 2002, delivered a five-year full recourse promissory note in 1999 in the amount of $299,997 and bearing interest at an annual rate of 6.0%. The balance of $342,898 at December 31, 2001 was fully repaid in January 2002. We have granted options to our executive officers and directors and we have assumed options granted by Broadbase to such individuals. See “Proposal No. 1—Election of Directors—Director Compensation” and “Executive Compensation and Related Information—Stock Options—Table of Option Grants in Fiscal 2003”. We have entered into an indemnification agreement with each of our executive officers and directors containing provisions that may require us, among other things, to indemnify our executive officers and directors against liabilities that may arise by reason of their status or service as executive officers or directors (other than liabilities arising from willful misconduct of a culpable nature) and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified.

Related Party Transactions

We provided support services to a company that is affiliated with Massood Zarrabian, a director of KANA until August 2003. We recognized approximately $54,800, $59,400 and $547,000 in revenue related to the company in the years ended December 31, 2003, 2002 and 2001, respectively.

In addition, we purchased software and support services from this company totaling approximately $96,000, $239,100 and $1,034,000 in the years ended December 31, 2003, 2002 and 2001, respectively. We believe that this contract had rates and terms that were comparable with those entered into with independent third parties.

CODE OF ETHICS AND CONDUCT

The Board of Directors has adopted a Code of Ethics and Conduct applicable to all directors, officers and employees of KANA, as required by applicable securities laws and the rules of the SEC and listing standards of The NASDAQ Stock Market. A copy of the Code of Ethics and Conduct is posted in the Corporate Governance section of our Internet website (at www.kana.com under Investor Relations).

18

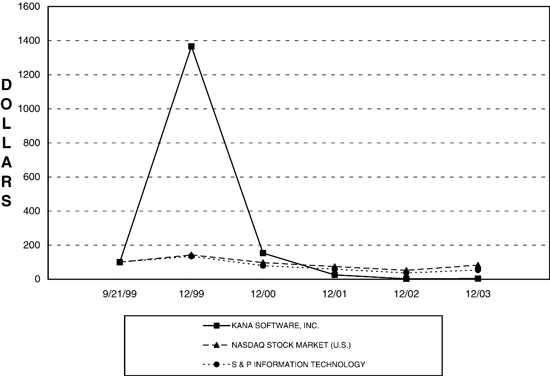

STOCK PERFORMANCE GRAPH

The stock price performance graph below is required by the SEC and should not be deemed to be incorporated by reference in any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed to be soliciting material or filed under such acts.

The following stock performance graph compares (i) the cumulative total stockholder return on our common stock from our public offering in September 1999 to December 31, 2003 (measured by the difference between closing prices on each such date) with (ii) the cumulative total return of the Nasdaq Stock Market Index and the S & P Information Technology Index, assuming an investment of $100 in our common stock and in each of the other indices on the date of the our initial public offering, and reinvestment of all dividends. No dividends have been declared or paid on KANA common stock. Stockholder returns over the period indicated should not be considered indicative of future stockholder returns.

Comparison of Cumulative Total Returns

| December 31, 1999 | December 31, 2000 | December 31, 2001 | December 31, 2002 | December 31, 2003 | |||||||||||

KANA SOFTWARE, INC. | $ | 1,366.67 | $ | 153.33 | $ | 25.95 | $ | 2.63 | $ | 4.49 | |||||

NASDAQ STOCK MARKET (U.S.) | 143.19 | 97.5 | 74.56 | 52.79 | 83.19 | ||||||||||

S & P INFORMATION TECHNOLOGY | 135.28 | 79.95 | 59.27 | 37.10 | 54.61 | ||||||||||

19

STOCKHOLDER PROPOSALS

Stockholder proposals intended to be presented at our 2005 annual meeting of stockholders must be received by KANA at its principal executive offices no later than December 25, 2004, in order to be included in KANA’s proxy materials relating to that meeting. Stockholders wishing to bring a proposal before the 2005 annual meeting of stockholders (but not include it in KANA’s proxy materials) must provide written notice of such proposal to the Secretary of KANA at the principal executive offices of KANA no later than 120 days prior to the date of our 2005 annual meeting. For more information about the procedure for submitting proposals for consideration at a stockholder meeting, you may request a copy of our bylaws from the Corporate Secretary at the address set forth above. Our bylaws have also been filed with the SEC as an exhibit to our Annual Report on Form 10-K, and are available at the SEC’s Web site at http://www.sec.gov.

Whether or not you plan to attend our annual meeting, please complete, date, sign and promptly return the accompanying proxy card in the enclosed postage-paid envelope so that your shares will be represented at our meeting.

20

APPENDIX A

KANA SOFTWARE, INC.

CHARTER OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

(Adopted April 15, 2003)

| I. | Purpose |

The principal functions of the Audit Committee (the “Committee”) of the Board of Directors (the “Board”) of Kana Software, Inc. (the “Company”) are to:

| • | Oversee the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company; |

| • | Oversee the Company’s relationship with its independent auditors, including selecting, evaluating and setting the compensation of, and approving all audit and non-audit services to be performed by, the independent auditors; and |

| • | Facilitate communication among the Company’s independent auditors and the Company’s financial and senior management. |

The Committee will fulfill these functions primarily by carrying out the activities enumerated in Part IV of this charter. In order to serve these functions, the Committee shall have unrestricted access to Company personnel and documents, shall have authority to direct and supervise an investigation into any matters within the scope of its duties, and shall have authority to retain such outside counsel, experts and other advisors as it determines to be necessary to carry out its responsibilities. The Company shall provide appropriate funding to the Committee, as determined by the Committee, for payments of compensation to (i) the independent auditors for audit services, and for any permitted non-audit services approved by the Committee, and (ii) any advisors employed by the Committee as provided by this charter.

While the Committee has the responsibilities and powers set forth in this charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of management and the Company’s independent auditors.

| II. | Membership |

All members of the Committee will be appointed by, and shall serve at the discretion of, the Board. Unless a chair is elected by the full Board, the members of the Committee may designate a Chair by majority vote of the Committee membership.

The Committee shall consist of three or more members of the Board, with the exact number being determined by the Board. Each member of the Committee shall be “independent” as defined by the rules of The Nasdaq Stock Market, as they may be amended from time to time, and by rules and regulations promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”) from time to time, except as otherwise permitted by such rules and regulations. Each member of the Committee shall have the ability to read and understand fundamental financial statements and at least one member shall be a “financial expert” (as defined in Item 401 of Regulation S-K promulgated under the Exchange Act) and have prior experience in accounting, financial management or financial oversight, as required by The Nasdaq Stock Market rules.

| III. | Meetings |

The Committee shall meet at least once each quarter and more frequently as determined to be appropriate by the Committee. The Committee shall meet at least once each quarter with the independent auditors out of the presence of management about the Company’s internal controls, and procedures for financial reporting and any

other matters that the Committee deems appropriate. The Committee members, or the Chairman of the Committee on behalf of all of the Committee members, shall communicate with management and the independent auditors at least once per quarter in connection with their review of the Company’s financial statements.

| IV. | Responsibilities and Duties |

The following shall be the principal recurring processes of the Committee in carrying out its oversight responsibilities. These processes are set forth as a guide with the understanding that the Committee may supplement them as appropriate and may establish policies and procedures from time to time that it deems necessary or advisable in fulfilling its responsibilities.

| A. | Financial Reporting |

1. Review and discuss with the Company’s management the Company’s quarterly and annual financial statements, including any report or opinion by the independent auditors, prior to distribution to the public or filing with the Securities and Exchange Commission.

2. Review the Management’s Discussion and Analysis section of the Company’s Forms 10-Q and 10-K prior to filing with the SEC and discuss with management and the independent auditors.

3. In connection with the Committee’s review of the annual financial statements:

| • | Discuss with the independent auditors and management the financial statements and the results of the independent auditors’ audit of the financial statements. |

| • | Discuss any items required to be communicated by the independent auditors in accordance with SAS 61, as amended. These discussions should include the independent auditors’ judgments about the appropriateness of the Company’s accounting principles and their assessment of the adequacy and effectiveness of its internal controls, the reasonableness of significant judgments, the procedures for financial reporting and any significant difficulties encountered during the course of the audit, including any restrictions on the scope of work or access to required information. |

4. Recommend to the Board whether the annual financial statements should be included in the Annual Report on Form 10-K, based on (i) the Committee’s review and discussion with management of the annual financial statements, (ii) the Committee’s discussion with the independent auditors of the matters required to be discussed by SAS 61, and (iii) the Committee’s review and discussion with the independent auditors of the independent auditors’ independence and the written disclosures and letter from the independent auditors required by Independence Standards Board Standard No. 1.

5. In connection with the Committee’s review of the quarterly financial statements: