- SWKH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

SWK (SWKH) DEF 14ADefinitive proxy

Filed: 24 Jun 08, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement. |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| x | Definitive Proxy Statement. |

| ¨ | Definitive Additional Materials. |

| ¨ | Soliciting Material Pursuant to §240.14a-12. |

Kana Software, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

KANA SOFTWARE, INC.

181 CONSTITUTION DRIVE

MENLO PARK, CALIFORNIA 94025

June 24, 2008

Dear Stockholders:

You are cordially invited to attend our 2008 Annual Meeting of Stockholders to be held at our headquarters, 181 Constitution Drive, Menlo Park, California, on July 29, 2008, at 10:00 a.m., Pacific Time.

The matters expected to be acted upon at our 2008 Annual Meeting of Stockholders are: (i) the election of two Class III directors to our Board of Directors and (ii) the ratification of the selection of Burr, Pilger & Mayer LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008. Each of these proposals is described in detail in the accompanying Notice of the 2008 Annual Meeting of Stockholders and Proxy Statement.

Please use this opportunity to take part in our affairs by voting on the business to come before this annual meeting.Whether or not you plan to attend our 2008 Annual Meeting of Stockholders, please complete, date, sign and promptly return the accompanying proxy card in the enclosed postage-paid envelope prior to our 2008 Annual Meeting of Stockholders so that your shares will be represented at our 2008 Annual Meeting of Stockholders. Returning the proxy card does not deprive you of your right to attend our 2008 Annual Meeting of Stockholders and to vote your shares in person.

We hope to see you at our 2008 Annual Meeting of Stockholders.

| Sincerely, | ||

/s/ Michael S. Fields | ||

Michael S. Fields | ||

| Chief Executive Officer | ||

This Proxy Statement is dated June 24, 2008 and will first be mailed to KANA stockholders on or about June 26, 2008.

KANA SOFTWARE, INC.

181 CONSTITUTION DRIVE

MENLO PARK, CALIFORNIA 94025

NOTICE OF THE 2008 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders:

NOTICE IS HEREBY GIVEN that the 2008 Annual Meeting of Stockholders of Kana Software, Inc. will be held at our headquarters, 181 Constitution Drive, Menlo Park, California, on July 29, 2008, at 10:00 a.m., Pacific Time.

At this annual meeting, you will be asked to consider and vote upon the following matters:

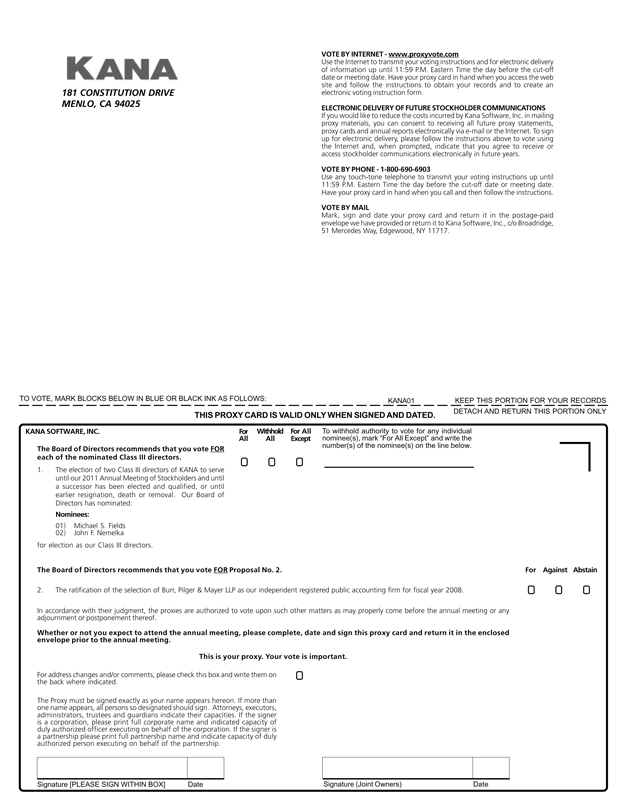

| 1. | The election of two Class III directors of KANA to serve until our 2011 Annual Meeting of Stockholders and until a successor has been elected and qualified, or until earlier resignation, death or removal. Our Board of Directors has nominated Michael S. Fields and John F. Nemelka as nominees for election as our Class III directors. |

| 2. | The ratification of the selection of Burr, Pilger & Mayer LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008. |

| 3. | To transact such other business as may properly come before our 2008 Annual Meeting of Stockholders or any adjournment of our 2008 Annual Meeting of Stockholders. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice. Only stockholders of record at the close of business on June 17, 2008 are entitled to notice of and to vote at our 2008 Annual Meeting of Stockholders or any adjournment of our 2008 Annual Meeting of Stockholders.

| By Order of the Board of Directors, | ||

/s/ Michael S. Fields | ||

Michael S. Fields | ||

| Chief Executive Officer | ||

Menlo Park, California

June 24, 2008

WHETHER OR NOT YOU PLAN TO ATTEND OUR 2008 ANNUAL MEETING OF STOCKHOLDERS, PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE PRIOR TO THE 2008 ANNUAL MEETING OF STOCKHOLDERS SO THAT YOUR SHARES WILL BE REPRESENTED AT THIS ANNUAL MEETING.

|

KANA SOFTWARE, INC.

181 CONSTITUTION DRIVE

MENLO PARK, CALIFORNIA 94025

PROXY STATEMENT

June 24, 2008

The accompanying proxy is solicited on behalf of the Board of Directors of Kana Software, Inc., a Delaware corporation, for use at our 2008 Annual Meeting of Stockholders to be held at our headquarters, 181 Constitution Drive, Menlo Park, California, on July 29, 2008, at 10:00 a.m., Pacific Time. This Proxy Statement, the accompanying Notice of the 2008 Annual Meeting of Stockholders and form of proxy will first be mailed to our stockholders on or about June 26, 2008. Our stockholders are encouraged to review the information provided in this Proxy Statement in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2007, a copy of which also accompanies this Proxy Statement. References in this Proxy Statement to “KANA,” “Company,” “we,” “our” and “us” collectively refer to Kana Software, Inc. and our subsidiaries.

VOTING INFORMATION

Record Date and Quorum

A quorum is required for our stockholders to conduct business at the annual meeting. The holders of a majority of the shares of our common stock outstanding entitled to vote on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business at the annual meeting. Only holders of our common stock of record at the close of business on June 17, 2008, the record date, will be entitled to vote at the 2008 Annual Meeting of Stockholders. At the close of business on the record date, we had 41,212,578 shares of common stock outstanding and entitled to vote that were held by approximately 1,364 stockholders of record.

Voting Rights

Only holders of our common stock are entitled to vote and are allowed one vote for each share held as of the record date. Shares may not be voted cumulatively. If stockholders abstain from voting, including brokers holding stockholders’ shares of record who cause abstentions to be recorded, these shares are considered present and entitled to vote at the annual meeting and these shares will count toward determining whether or not a quorum is present. However, these shares will not be counted as voting either “for” or “against” any of the proposals.

If a broker does not receive a proxy from the stockholder with instructions as to how to vote the shares, the broker has authority under stock market rules to vote those shares “for” or “against” certain “routine” matters. All of the proposals to be voted on at the 2008 Annual Meeting of Stockholders are generally considered “routine” matters for this purpose. If a broker votes shares that are not voted by the stockholders “for” or “against” a “routine” proposal, these shares are considered present and entitled to vote at the annual meeting, will count toward determining whether or not a quorum is present and the brokers’ votes will be taken into account in determining the outcome of all of the “routine” proposals.

1

When a matter is “non-routine,” a broker generally is not entitled to vote a stockholder’s unvoted shares. These shares would be considered present and would count toward determining whether a quorum is present, but would not be considered entitled to vote on the “non-routine” matter. Accordingly, these shares would not be taken into account in determining the outcome of any proposals that are “non-routine.”

Required Votes

Proposal One. Directors are elected by a plurality of the votes of the shares present in person or represented by proxy at the 2008 Annual Meeting of Stockholders and entitled to vote on the election of Class III directors. This means that the Class III director nominees for election to the Board of Directors who receive the two highest number of affirmative votes at the 2008 Annual Meeting of Stockholders will be elected to fill the two open seats for Class III directors.

Proposal Two. Ratification of the selection of Burr, Pilger & Mayer LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008 requires the affirmative vote of the majority of shares present in person or represented by proxy at the 2008 Annual Meeting of Stockholders.

All votes will be tabulated by the inspector of elections appointed for the 2008 Annual Meeting of Stockholders, who will separately tabulate, for each proposal, affirmative and negative votes, abstentions and broker non-votes.

Voting Electronically via the Internet

If your shares are registered in the name of a bank or brokerage, you may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the Broadridge Financial Solutions, Inc. online program, which provides eligible stockholders who receive a paper copy of the proxy statement with the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm is participating in Broadridge Financial Solutions, Inc. online program, your voting form from the bank or brokerage firm will provide instructions. If your voting form does not reference Internet or telephone information, please complete and return the accompanying paper proxy card in the enclosed self-addressed, postage paid envelope.

Voting of Proxies

The proxy card accompanying this Proxy Statement is solicited on behalf of our Board of Directors for use at the 2008 Annual Meeting of Stockholders. Our stockholders are asked to complete, date and sign the accompanying proxy card and promptly return it in the enclosed envelope or otherwise mail it to us. All executed, returned proxies that are not revoked will be voted in accordance with the included instructions. Signed proxies that are returned without instructions as to how they should be voted on a particular proposal at the 2008 Annual Meeting of Stockholders will be counted as votes “for” such proposal (or, in the case of the election of directors, as a vote “for” the election of all the director nominees presented by our Board of Directors). We are not aware of any other matters to be brought before the 2008 Annual Meeting of Stockholders. However, as to any business that may properly come before the 2008 Annual Meeting of Stockholders, the proxies that are executed and returned prior to the 2008 Annual Meeting of Stockholders will be voted in accordance with the judgment of the persons holding such proxies.

In the event that sufficient votes in favor of the proposals are not received by the date of the 2008 Annual Meeting of Stockholders, the persons named as proxies may propose one or more adjournments of the 2008 Annual Meeting of Stockholders to permit further solicitation of proxies. Any such adjournment would require the affirmative vote of the majority of the outstanding shares present in person or represented by proxy at the 2008 Annual Meeting of Stockholders.

2

We are paying the expenses of soliciting the proxies to be voted at the 2008 Annual Meeting of Stockholders. Following the original mailing of the proxies and other soliciting materials, we will request that brokers, custodians, nominees and other record holders of our common stock forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of the proxies. In these cases, we may, upon their request, reimburse such record holders for their reasonable expenses. Proxies may also be solicited by some of our directors, officers and regular employees, without additional compensation, in person or by telephone.

Revocability of Proxies

Any person signing a proxy in the form accompanying this Proxy Statement has the power to revoke the proxy prior to the 2008 Annual Meeting of Stockholders, or at the 2008 Annual Meeting of Stockholders prior to the vote to which the proxy relates. A proxy may be revoked by any of the following methods:

| • | a written instrument delivered to us stating that the proxy is revoked; |

| • | a subsequent proxy that is signed by the person who signed the earlier proxy and is presented at the 2008 Annual Meeting of Stockholders; or |

| • | attendance at the 2008 Annual Meeting of Stockholders and voting in person. |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the 2008 Annual Meeting of Stockholders, you must bring a letter to the 2008 Annual Meeting of Stockholders from the broker, bank or other nominee confirming your beneficial ownership of the shares and that such broker, bank or other nominee is not voting your shares.

Communicating with Members of the Board of Directors

You may submit an e-mail to our Board of Directors or any member of our Board of Directors at bod@kana.com. E-mails to this address are routed to our General Counsel, who will forward the message to the full Board of Directors unless the sender indicates that they would like the message to be forwarded solely to non-management members or the chairperson of a particular committee of the Board of Directors.Members of our Board of Directors may, at their option, attend our annual meetings of stockholders. None of our directors attended our 2007 Annual Meeting of Stockholders.

3

PROPOSAL ONE—ELECTION OF CLASS III DIRECTORS

Our Board of Directors is divided into three classes and consists of five members, two of whom are to be elected at the 2008 Annual Meeting of Stockholders as Class III directors. Our directors are to be elected for a full term of three years with the term expiring at the annual meeting of stockholders held in the third year following the year of their election. The nominees for election as Class III directors are Michael S. Fields and John F. Nemelka, each of whom currently serves as a Class III director on our Board of Directors. The Class III directors elected at the 2008 Annual Meeting of Stockholders will hold office until the annual meeting of stockholders in the year 2011 and until a successor has been elected and qualified, or until earlier resignation, death or removal.

Shares represented by the accompanying proxy will be voted “for” the election of Messrs. Fields and Nemelka unless the proxy is marked in such a manner as to withhold authority to so vote. In the event that either Mr. Fields or Mr. Nemelka is unable to serve for any reason, the proxies may be voted for such substitute nominee as the proxy holder may determine. Messrs. Fields and Nemelka have consented to being named in this Proxy Statement and to serve if elected. Messrs. Fields and Nemelka will be elected by a plurality of the votes of the shares present in person or represented by proxy at the 2008 Annual Meeting of Stockholders and entitled to vote in the election of Class III directors. Should there be more than two nominees for the election of the Class III directors at the 2008 Annual Meeting of Stockholders, the two nominees who receive the greatest number of votes cast in the election of the Class III directors at the 2008 Annual Meeting of Stockholders, with a quorum being present, will become our Class III directors at the conclusion of the tabulation of votes.

The Board of Directors recommends a voteFOR the election of the nominated Class III directors.

4

Director Nominees and Continuing Directors

At each annual meeting of stockholders, the successors to the directors whose terms will then expire will be elected to serve from the time of their election and qualification until the third annual meeting following their election and until their successors have been duly elected and qualified, or until their earlier resignation or removal. The term of office of our Class I director will next expire at the annual meeting of stockholders to be held in 2009. The term of office of our Class II directors will next expire at the annual meeting of stockholders to be in 2010. The term of office of our Class III directors will expire at the annual meeting of stockholders to be held in 2011.

The following table sets forth the names of the director nominees and our continuing directors and information about each (including their ages as of March 31, 2008):

Director Nominees

Name | Age | Committee | Principal Occupation | Director Since | ||||

Class III Directors: | ||||||||

Michael S. Fields | 62 | N/A | Chairman and Chief Executive Officer of KANA | 2005 | ||||

John F. Nemelka | 42 | Compensation, Governance & Nominating | Managing Principal of NightWatch Capital Group, LLC | 2005 | ||||

Continuing Directors

| ||||||||

Name | Age | Committee | Principal Occupation | Director Since | ||||

Class I Director: | ||||||||

Stephanie Vinella | 53 | Audit, Governance & Nominating | Chief Financial Officer of Panasas, Inc. | 2004 | ||||

Class II Directors: | ||||||||

Jerry R. Batt | 57 | Compensation, Governance & Nominating | Vice President and Chief Information Officer of Pulte Homes, Inc. | 2003 | ||||

William T. Clifford | 61 | Compensation, Audit | Chairman and Chief Executive Officer of Aperture Technologies, Inc. | 2005 | ||||

On February 28, 2008, Michael J. Shannahan, a Class II director, resigned from the Board of Directors and all committees of the Board of Directors and was appointed Executive Vice President and Chief Financial Officer of KANA. The Class II director seat vacated by Mr. Shannahan has been removed in accordance with our current certificate of incorporation and bylaws.

Nominees for Election—Class III Directors (Term to Expire in 2011)

Michael S. Fields.Mr. Fields joined our Board of Directors in June 2005 and since July 2005, has been serving as our Chairman of the Board of Directors. From July 2005 to August 2005, Mr. Fields served as our acting President. In August 2005, Mr. Fields was appointed as our Chief Executive Officer. Mr. Fields wasChairman and Chief Executive Officer of The Fields Group, a venture capital and management consulting firm,

5

from May 1997 to December 2005. In June 1992, Mr. Fields founded OpenVision Technologies, Inc., a supplier of computer systems management applications for open client/server computing environments, and served as its Chief Executive Officer from July 1992 to July 1995 and Chairman of its Board of Directors from July 1992 toApril 1997. Prior to these positions, Mr. Fields served as President at Oracle U.S.A., Inc., and managed sales organizations at Applied Data Research and Burroughs Corporation. Mr. Fields also serves on the Board of Directors of Imation Corporation and two privately-held companies, ViaNovus, Inc. and Crucian Global Service7, Inc. Mr. Fields is a Class III Director whose current term expires at this year’s annual meeting of stockholders.

John F. Nemelka.Mr. Nemelka joined our Board of Directors in October 2005. Mr. Nemelka founded NightWatch Capital Group, LLC, an investment management business, and has served as its Managing Principal since its incorporation in July 2001. From 1997 to 2000, Mr. Nemelka was a Principal at Graham Partners, a private investment firm and affiliate of the privately-held Graham Group. From 2000 to 2001, Mr. Nemelka was a Consultant to the Graham Group. Mr. Nemelka holds a B.S. degree in Business Administration from Brigham Young University and an M.B.A. degree from the Wharton School at the University of Pennsylvania. Mr. Nemelka also serves on the Board of Directors of a privately-held company, SANUWAVE, Inc. Mr. Nemelka is a Class III Director whose current term expires at this year’s annual meeting of stockholders.

Continuing Class I Director (Term to Expire in 2009)

Stephanie Vinella.Ms. Vinella joined our Board of Directors in November 2004. Since November 2007, Ms. Vinella has served as Chief Financial Officer of Panasas, Inc., a computer hardware company. From January 2005 to September 2007, Ms. Vinella served as Chief Financial Officer of Nextance Inc., a provider of enterprise contract management solutions. From November 1999 to August 2004, Ms. Vinella served as Chief Financial Officer of AlphaBlox Corporation, a business analytic software company. From 1990 to 1999, Ms. Vinella served as Chief Financial Officer of Edify Corporation, a software company. Ms. Vinella holds a B.S. degree in Accounting from the University of San Francisco and an M.B.A. degree from Stanford University. Ms. Vinella is a Class I Director whose current term expires at the annual meeting of stockholders to be held in 2009.

Continuing Class II Directors (Term to Expire in 2010)

Jerry R. Batt.Mr. Batt joined our Board of Directors in August 2003. Mr. Batt has served as Vice President and Chief Information Officer of Pulte Homes, Inc., a national home building and construction company, since September 2003. From July 2001 to February 2003, Mr. Batt was Chief Information Officer and Vice President of Sprint PCS, a communications company. From April 2000 to July 2001, Mr. Batt co-founded and was Chief Executive Officer of Foxfire Consulting, an IT consulting and systems integration firm specializing in the telecommunications industry. From 1973 to January 2000, Mr. Batt held various positions at AT&T, a communications company, where he was responsible for consumer long distance account management and billing and customer service platforms. Mr. Batt holds B.S. degrees in Industrial Engineering and Operations Research from Virginia Tech University. Mr. Batt is a Class II Director whose current term expires at the annual meeting of stockholders to be held in 2010.

William T. Clifford.Mr. Clifford joined our Board of Directors in December 2005. Since August 2005, Mr. Clifford has served as Chairman of the Board of Directors and Chief Executive Officer of Aperture Technologies, Inc., a data center management software solutions company. He served on the Board of Directors of Aperture Technologies, Inc. from 2003 until his appointment as Chairman of the Board of Directors and Chief Executive Officer in August 2005. From 2001 to 2003, Mr. Clifford served as a General Partner of The Fields Group. From 1993 to 2000, Mr. Clifford served as President and Chief Executive Officer of Gartner Group, Inc., an information technology research and market company. Prior to these positions, Mr. Clifford was President of the Central and National Account divisions and Corporate Vice President, Information Systems Development at Automatic Data Processing, Inc., a transaction processing and data communication services company. Mr. Clifford holds a B.A. degree in Economics from the University of Connecticut. Mr. Clifford also serves on the Board of Directors of two privately-held companies, ViaNovus, Inc. and GridApp, Inc. Mr. Clifford is a Class II Director whose current term expires at the annual meeting of stockholders to be held in 2010.

6

Board of Directors Meetings and Director Independence

Our Board of Directors met eleven times in 2007, including telephone conference meetings. During 2007, no current director attended fewer than 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which such director served during the time period for which each such director served on the Board of Directors. Our Board of Directors has determined that Messrs. Batt, Clifford and Nemelka and Ms. Vinella each meet the requirements for independent director status under the listing standards of The NASDAQ Stock Market.

Committees of the Board of Directors

Our Board of Directors has three standing committees: the audit committee, the compensation committee and the governance and nominating committee.

Audit Committee. We have a standing audit committee of the Board of Directors (the “Audit Committee”) established in accordance with Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The current members of our Audit Committee are and Ms. Vinella and Mr. Clifford. Each member of the Audit Committee meets the independence and other requirements to serve on our Audit Committee under applicable securities laws and the rules of the Securities and Exchange Commission (“SEC”) and listing standards of The NASDAQ Stock Market. In addition, our Board of Directors has determined that Mr. Clifford and Ms. Vinella are “audit committee financial experts” as defined in the rules of the SEC and meet the financial sophistication requirements of The NASDAQ Stock Market.

During 2007, Dixie L. Mills served as a member of the Audit Committee until her resignation from the Board of Directors on March 16, 2007. Mr. Shannahan also served as a member of the Audit Committee until his resignation from the Board of Directors on February 28, 2008, in connection with his appointment as KANA’s Executive Vice President and Chief Financial Officer. The Audit Committee met six times in 2007. The report of the Audit Committee is provided on page 13.

Our Board of Directors has adopted a written charter for the Audit Committee, a copy of which is posted in the Corporate Governance section of our Internet website (at http://www.kana.com under Investor Relations). The principal functions of the Audit Committee are to oversee our accounting and financial reporting processes and the audits of our financial statements, oversee our relationship with our independent auditors, including selecting, evaluating and setting the compensation of, and approving all audit and non-audit services to be performed by, the independent auditors, and facilitate communication among our independent auditors and our financial and senior management.

Compensation Committee. We have a standing compensation committee of the Board of Directors (the “Compensation Committee”). The current members of our Compensation Committee are Messrs. Batt, Clifford and Nemelka. Each of them meets the independence and other requirements to serve on our Compensation Committee under applicable laws and regulations, including the rules of the SEC and listing standards of The NASDAQ Stock Market. The Compensation Committee met five times in 2007. The report of the Compensation Committee is provided on page 26.

Our Board of Directors has adopted a written charter for the Compensation Committee, a copy of which is posted in the corporate governance section of our Internet website (at http://www.kana.com under “Investor Relations”). The Compensation Committee has responsibilities relating to the performance evaluation and the compensation of our Chief Executive Officer, the compensation of our executive officers and directors and our significant compensation arrangements, plans, policies and programs, including our stock compensation plans. Certain of our executive officers, our outside counsel and consultants may occasionally attend the meetings of the Compensation Committee. However, no officer of KANA is present during discussions or deliberations regarding that officer’s own compensation.

Governance and Nominating Committee. We have a standing governance and nominating committee of the Board of Directors (the “Governance and Nominating Committee”). The current members of our Governance and

7

Nominating Committee are Messrs. Batt and Nemelka and Ms. Vinella. Each of them meets the independence and other requirements to serve on our Governance and Nominating Committee under applicable securities laws and the rules of the SEC and listing standards of The NASDAQ Stock Market. The Governance and Nominating Committee met once in 2007.

Our Board of Directors has adopted a written charter for the Governance and Nominating Committee, a copy of which is posted in the Corporate Governance section of our Internet website (at http://www.kana.com under “Investor Relations”). The Governance and Nominating Committee considers the performance of the members of our Board of Directors and nominees for director positions and evaluates and oversees corporate governance and related issues.

The goal of the Governance and Nominating Committee is to ensure that the members of our Board of Directors possess a variety of perspectives and skills derived from high-quality business and professional experience. The Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on our Board of Directors. To this end, the Governance and Nominating Committee seeks nominees with the highest professional and personal ethics and values, an understanding of our business and industry, diversity of business experience and expertise, a high level of education, broad-based business acumen and the ability to think strategically. Although the Governance and Nominating Committee uses these and other criteria to evaluate potential nominees to our Board of Directors, it has no stated minimum criteria for such nominees. The Governance and Nominating Committee does not use different standards to evaluate nominees depending on whether they are proposed by our directors and management or by our stockholders. To date, we have not paid any third parties to assist us in this process.

The Governance and Nominating Committee will consider stockholder recommendations for director candidates. The Governance and Nominating Committee has established the following procedure for stockholders to submit such recommendations for which there has been no material change: the stockholder should send the name of the individual and related personal and professional information, including a list of references to our Governance and Nominating Committee, in care of the Corporate Secretary at our principal executive offices, sufficiently in advance of the annual meeting to allow the Governance and Nominating committee appropriate time to consider the recommendation.

Compensation for Directors

In 2007, the Company paid each non-employee director (i) an annual fee of $10,000 and (ii) an additional $2,500 for each of the four (4) regularly scheduled Board of Directors meetings that such director attends. The Company paid the chairperson of the Audit Committee an additional $15,000 and the chairpersons of the Compensation Committee and the Governance and Nominating Committee an additional $5,000.

Our non-employee directors are eligible to receive discretionary stock option grants and stock issuances pursuant to the KANA 1999 Stock Incentive Plan, as amended. When a non-employee director is first elected or appointed as a member of the Board of Directors, he or she is automatically granted a stock option grant to purchase 40,000 shares of common stock. On the date of each annual stockholders meeting, each continuing non-employee director will automatically be granted a stock option grant to purchase 10,000 shares of common stock, provided that such director has served as a non-employee director for at least six months. The non-employee directors are also eligible to receive other types of awards under the KANA 1999 Stock Incentive Plan, as amended, that are discretionary and not automatic. All options granted to non-employee directors will have an exercise price equal to the current fair market value of our common stock on the date of the grant, and will be nonqualified stock options. In the event of a merger or sale of substantially all of our assets in connection with the liquidation or dissolution of our company, all of the shares subject to the automatic initial and annual stock option grants will accelerate and become exercisable in full.

The Company reimburses its directors for reasonable travel and other expenses incurred in connection with attending the meetings of the Board of Directors.

8

DIRECTOR COMPENSATION FOR 2007

The table below summarizes the compensation paid by the Company to non–employee directors for the fiscal year ended December 31, 2007.

Name (1) | Fees Earned or Paid in Cash | Option Awards (2) | Total | ||||||

Jerry R. Batt | $ | 25,000 | $ | 44,572 | $ | 69,572 | |||

William T. Clifford | $ | 25,000 | $ | 57,756 | $ | 82,756 | |||

Dixie L. Mills (3) | $ | 0 | $ | 26,959 | $ | 26,959 | |||

John F. Nemelka | $ | 20,000 | $ | 45,637 | $ | 65,637 | |||

Michael J. Shannahan (4) | $ | 35,000 | $ | 57,424 | $ | 92,424 | |||

Stephanie Vinella | $ | 20,000 | $ | 54,918 | $ | 74,918 | |||

| (1) | Mr. Fields, KANA’s Chief Executive Officer and Chairman of the Board of Directors, is not included in this table as he is an employee of KANA and thus, received no compensation for his services as Chairman of the Board of Directors. The compensation received by Mr. Fields as an employee of KANA is shown in the Summary Compensation Table on page 27. |

| (2) | The amounts reported represent the stock-based compensation expense that was recognized for financial reporting purposes in accordance with SFAS No. 123(R), utilizing the assumptions discussed in Note 1 “Kana Software, Inc. and Summary of Significant Accounting Policies – Stock-based Compensation” and Note 7 “Stockholders’ Equity (Deficit)” to the consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2007, without giving effect to estimated forfeitures. The grant date fair value of the options granted on July 27, 2007 to Messrs. Batt, Clifford, Nemelka and Shannahan and Ms. Vinella was $26,700. |

| (3) | Ms. Mills resigned as a member of the Board of Directors effective March 16, 2007. |

| (4) | Mr. Shannahan resigned as a member of our Board of Directors effective February 28, 2008. |

The aggregate number of option awards outstanding for each of our non-employee directors as of December 31, 2007 is provided in the table below.

Non-Employee Director | Number of Options Outstanding | |

Jerry R. Batt | 150,000 | |

William T. Clifford | 80,000 | |

Dixie L. Mills (1) | 0 | |

John F. Nemelka | 60,000 | |

Michael J. Shannahan (2) | 80,000 | |

Stephanie Vinella | 135,000 |

| (1) | Ms. Mills resigned as a member of our Board of Directors effective March 16, 2007. Her option awards expired on June 17, 2007. |

| (2) | Mr. Shannahan resigned as a member of our Board of Directors effective February 28, 2008. |

9

PROPOSAL TWO—RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Board of Directors has selected Burr, Pilger & Mayer LLP as KANA’s independent registered public accounting firm to perform the audit of our financial statements for the year ending December 31, 2008, and our stockholders are being asked to ratify this selection. Our organizational documents do not require our stockholders to ratify the selection of Burr, Pilger & Mayer LLP as our independent registered public accounting firm. We are submitting the selection of Burr, Pilger & Mayer LLP to our stockholders for ratification because we believe it is a matter of good corporate practice. Representatives of Burr, Pilger & Mayer LLP may be present at the 2008 Annual Meeting of Stockholders. If present, such representatives will have the opportunity to make a statement at the 2008 Annual Meeting of Stockholders if they wish and will be available to respond to appropriate questions.

The Board of Directors recommends a voteFOR the ratification of the selection of Burr, Pilger & Mayer LLP as our independent registered public accounting firm.

10

RELATIONSHIP WITH OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Change in Certifying Independent Registered Public Accounting Firm

In January 2006, Deloitte & Touche LLP (“D&T”) informed us of their resignation as our independent registered public accounting firm upon the completion of their review of our financial statements for the quarter and six months ended June 30, 2005. D&T did not provide a report on the Company’s financial statements for the years ended December 31, 2006 and December 31, 2007.

In February 2006, we appointed Burr, Pilger & Mayer LLP as our new independent registered public accounting firm.

Fiscal 2006 and 2007 Audit Firm Fee Summary

Burr, Pilger & Mayer LLP served as our independent registered public accounting firm and audited our consolidated financial statements for the years ended December 31, 2006 and 2007. Set forth below are the aggregated fees (in thousands) billed for the services of Burr, Pilger & Mayer LLP from January 1, 2006 through December 31, 2007.

| Year Ended December 31, | ||||||

| 2007 | 2006 | |||||

Audit fees (1) | $ | 972 | $ | 479 | ||

Audit-related fees (2) | 22 | — | ||||

Tax fees | — | — | ||||

All other fees | ||||||

Total fees | $ | 994 | $ | 479 | ||

| (1) | Consists of fees billed for professional services rendered for the audit of our annual consolidated financial statements and review of our quarterly condensed consolidated financial statements and services, such as a comfort letters, consents and review of SEC comment letters that are normally provided by Burr, Pilger & Mayer LLP in connection with statutory and regulatory filing engagements. |

| (2) | Includes fees related to due diligence and accounting consultation in connection with an acquisition. |

Our Audit Committee considers at least annually whether the provision of non-audit services by our independent registered public accounting firm is compatible with maintaining auditor independence. This process includes:

| • | Obtaining and reviewing, on at least an annual basis, a letter from the independent registered public accounting firm describing all relationships between the independent registered public accounting firm and the Company required to be disclosed by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees,reviewing the nature and scope of such relationships, discussing these relationships with the independent registered public accounting firm and discontinuing any relationships that the Audit Committee believes could compromise the independence of the registered public accounting firm. |

| • | Obtaining reports of all non-audit services proposed to be performed by the independent registered public accounting firm before such services are performed, reviewing and approving or prohibiting, as appropriate, any non-audit services not permitted by applicable law. The Audit Committee may delegate authority to review and approve or prohibit non-audit services to one or more members of the Audit Committee, and direct that any approval so granted be reported to the Audit Committee at a following meeting of the Audit Committee. |

11

All services provided by the Company’s independent registered public accounting firms in fiscal years 2006 and 2007 were approved in advance by the Audit Committee.

Audit Committee Pre-Approval Policy

All audit and permitted non-audit services to be performed for the Company by its independent registered public accounting firm must be pre-approved by the Audit Committee to assure that the provision of such services do not impair the registered public accounting firm’s independence. The Audit Committee does not delegate its responsibility to pre-approve services performed by the independent auditors to management.

The annual audit services engagement terms and fees are subject to the specific pre-approval of the Audit Committee. The Audit Committee will approve, if necessary, any changes in terms, conditions and fees resulting from changes in audit scope or other matters. All other audit services not otherwise included in the annual audit services engagement must be specifically pre-approved by the Audit Committee.

12

REPORT OF THE AUDIT COMMITTEE

The material in this report is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date of this Proxy Statement and irrespective of any general incorporation language therein.

The Audit Committee’s purpose is to assist the Board of Directors in its oversight of KANA’s financial accounting, reporting and controls. The Board of Directors, in its business judgment, has determined that all members of the Audit Committee are “independent” as required by applicable listing standards of The NASDAQ Stock Market (please see “Committees of the Board of Directors” on page 6 of this Proxy Statement). The Audit Committee operates pursuant to a charter, which, as amended, was approved by the Board of Directors in April 2003. The Audit Committee meets with KANA’s management and with our independent registered public accounting firm, with and without management present, to discuss the scope and plans for their audit, the results of its examinations, its evaluations of KANA’s internal controls and the overall quality of KANA’s financial reporting. The Audit Committee held six meetings during 2007.

During fiscal year 2007, the Audit Committee consisted of Michael J. Shannahan, Dixie L. Mills and Stephanie Vinella. Ms. Mills resigned from the Audit Committee on March 16, 2007 and Mr. Shannahan resigned from the Audit Committee on February 28, 2008. The current members of the Audit Committee are Mr. Clifford and Ms. Vinella.

In performing its oversight role during the period since its last report, the Audit Committee reviewed and discussed KANA’s audited financial statements with KANA’s management and independent registered public accounting firm. The Audit Committee also discussed with KANA’s independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards,Vol. 1. AU section 380),Communication with Audit Committees. The Audit Committee received the written disclosures and the letter from Burr, Pilger & Mayer LLP required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and discussed Burr, Pilger & Mayer LLP’s independence from KANA with Burr, Pilger & Mayer LLP. Based on the discussions with management and Burr, Pilger & Mayer LLP, the Audit Committee recommended to the Board of Directors that KANA’s audited financial statements that were reviewed by the Audit Committee and discussed with management and Burr, Pilger & Mayer LLP be included in KANA’s Annual Report on Form 10-K for the year ended December 31, 2007. The Audit Committee and the Board of Directors also recommended the selection of Burr, Pilger & Mayer LLP as KANA’s independent registered public accounting firm for the fiscal year ending December 31, 2008.

The members of the Audit Committee rely on the information provided to them and on the representations made to the Audit Committee by KANA’s management and independent registered public accounting firm without conducting independent verification of the accuracy of such information and representations. Accordingly, the Audit Committee’s oversight does not ensure that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not ensure that any audit of KANA’s financial statements conducted by independent registered public accounting firm has been carried out in accordance with generally accepted auditing standards, or that the financial statements are presented in accordance with generally accepted accounting principles.

AUDIT COMMITTEE

Stephanie Vinella (Chairperson since March 2008)

William T. Clifford (Member since March 2008)

13

OTHER BUSINESS

Our Board of Directors does not presently intend to bring any other business before the 2008 Annual Meeting of Stockholders, and we are not aware of any matters to be brought before the 2008 Annual Meeting of Stockholders except as specified in the notice of the 2008 Annual Meeting of Stockholders. As to any business that may properly come before our annual meeting, however, it is intended that the proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

14

EXECUTIVE OFFICERS

In addition to Michael S. Fields, our Chief Executive Officer whose biographical information appears under “Nominees for Election—Class III Directors (Term to Expire in 2011)” on page 5, the following individuals are current executive officers of KANA:

Michael J. Shannahan.Since March 2008, Mr. Shannahan has served as our Executive Vice President and Chief Financial Officer. Mr. Shannahan was a member of our Board of Directors from June 2005 to March 2008. From February 2005 to February 2008, Mr. Shannahan served as Chief Financial Officer of Medsphere Systems Corporation, a software company in the healthcare industry. Mr. Shannahan also has served as Chief Financial Officer of Chordiant Software, Inc., a management software company, from October 2003 to September 2004; Sanctum Inc., a web applications security company, from October 2001 to November 2002; Broadband Office, Inc., a communication services company, from January 2001 to September 2001; and mySimon, Inc., an e-commerce company from August 1999 to January 2001. Prior to these positions, Mr. Shannahan spent 18 years with KPMG Peat Marwick, an accounting firm, as a Partner in the Information, Communication and Entertainment practice. Mr. Shannahan holds a B.S. degree in Business Administration with a concentration in Accounting and a B.A. degree from Rockhurst College. Mr. Shannahan also serves on the Board of Directors of Critical Path, Inc.

Mark A. Angel.Since May 2007, Mr. Angel has served as our Senior Vice President of Corporate Development and Strategy. Prior to joining KANA, from January 1998 to March 2007, he served as Chief Technology Officer of KNOVA Software Inc., a service resolution management software company that is now a division of Consona Corporation. Prior to KNOVA, Mr. Angel founded and served as Chief Executive Officer of Papyrus Technology, which was acquired by Ernst & Young, in 1997 and Kanisa Inc., which was acquired by ServiceWare Technologies, Inc. in 2005. Mr. Angel has served on the Board of Directors of Avidence, Inc., a private company, since May 2006.

William A. Bose. Mr. Bose has served as our Vice President and General Counsel since August 2006. Mr. Bose served in a number of legal positions at KANA from September 1999 to August 2006. Mr. Bose holds a B.A. degree from University of California at Santa Barbara and a J.D. degree from Santa Clara University School of Law. Mr. Bose is a member of the California Bar.

Marchai B. Bruchey.Since September 2005, Ms. Bruchey has served as our Senior Vice President and Chief Marketing Officer with responsibility for global marketing and strategic alliances. Ms. Bruchey joined KANA in January 1998 as our Senior Vice President of Strategic Alliances and served in this role until September 2005. Prior to joining KANA, Ms. Bruchey spent 18 years with Digital Equipment Corporation, a computer manufacturing company, where she held positions in sales, sales management, alliances and alliances management. Ms. Bruchey holds a B.S. degree in Finance and Marketing from Queens College.

Sham Chotai.Since June 2007, Mr. Chotai has served as our Senior Vice President of Engineering. From April 2006 to March 2007, Mr. Chotai served as Vice President of Engineering at KNOVA Software, Inc. Mr. Chotai co-founded DecisionView Software, Inc., an analytics technology company, in October 2002, and served as Chief Technology Officer of DecisionView Software, Inc. from October 2002 until October 2005. Mr. Chotai holds a B.A.Sc. degree in Electrical Engineering from the University of Toronto, with a specialty in adaptive/intelligent control systems.

Charles H. Isaacs.Since August 2004, Mr. Isaacs has served as our Chief Technology Officer. From December 1999 to August 2004, Mr. Isaacs served as the Chief Technology Officer of Primus Knowledge Solutions, an enterprise software company, where he was responsible for technology oversight. Mr. Isaacs holds a B.S. degree in Electrical Engineering from the University of California at Santa Barbara and an M.B.A. degree from California Lutheran University.

15

Jay A. Jones. Since September 2006, Mr. Jones has served as our Senior Vice President and Chief Administrative Officer. Mr. Jones served as Senior Vice President, Chief Information Officer of VERITAS Software Corporation, an enterprise storage and performance company, from September 2004 to December 2005. From January 1999 to September 2004, Mr. Jones served as Chief Administrative Officer of VERITAS Software Corporation, and from March 1993 to January 1999, he served as Vice President, General Counsel and Secretary of VERITAS Software Corporation and OpenVision Technologies, Inc., which was acquired by VERITAS Software Corporation. Prior to OpenVision Technologies, Inc., Mr. Jones was senior corporate counsel for Oracle Corporation. Mr. Jones holds a B.S. degree in architecture from Howard University, an M.S. degree in City Planning from the University of California at Berkeley and a J.D. degree from the University of California at Berkeley. Mr. Jones is a member of the California Bar.

Daniel A. Turano. Since July 2007, Mr. Turano has served as our Senior Vice President, Worldwide Field Operations. Mr. Turano joined KANA in August 2006 as our Vice President, Global Financial Services Solutions and served in that position until his promotion to Senior Vice President, Worldwide Field Operations in July 2007. From March 2005 to August 2006, Mr. Turano served as the Vice President of Sales, East of ClairMail, Inc., a software and wireless communications company. From September 2003 to March 2005, Mr. Turano served as Senior Vice President, Commercial Account Collections of Intellerisk Management Systems, a collections agency. Mr. Turano previously served as the Executive Vice President, Sales and Field Operations of Dynamic Mobile Data, a software and wireless communications company from September 2002 to September 2003. Mr. Turano has also served on the Board of Directors of The Advisory Council, a private company, since January 2003. Mr. Turano holds a B.S. degree in Business Management from Saint Peter’s College and an M.B.A. degree in Marketing from Fairleigh Dickenson University.

Chad A. Wolf. Since June 2007, Mr. Wolf has served as our Corporate Vice President and President of eVergance Partners LLC, a management consulting and systems integration company acquired by KANA in June 2007. From August 2002 to June 2007 Mr. Wolf served as President of eVergance Partners LLC. Mr. Wolf holds an M.S. degree in Industrial Engineering and Operations Management from Kansas State University and a B.S. degree in Industrial Engineering.

16

EXECUTIVE COMPENSATION AND RELATED INFORMATION

COMPENSATION DISCUSSIONAND ANALYSIS

Overview of Compensation Program

This compensation discussion and analysis describes the material elements of compensation awarded to each of four current and two former executive officers who are identified in the Summary Compensation Table on page 27 (the “named executive officers”). This discussion and analysis serves as an introduction to the 2007 executive compensation information provided in the tables, footnotes and narratives that follow. We also describe compensation actions taken in prior years to the extent it enhances the understanding of our executive compensation disclosure for 2007. Our Compensation Committee is responsible for developing and monitoring the Company’s compensation philosophy, and for implementing that philosophy with respect to our named executive officers.

Compensation Philosophy and Objectives

Our executive compensation philosophy reflects our belief in a “pay for performance” model that is intended to closely align our executive officers’ compensation with our performance on both a near- and long-term basis, which we believe can lead to increased stockholder value. Our executive compensation program aims to create value for our stockholders through the attraction, retention and motivation of a superior leadership team. We believe that the skills, experience and dedication of our executive officers are critical factors that contribute directly to our operating results. As a result, our executive compensation program is designed to attract individuals who have the skills to achieve our strategic goals, to reward those individuals fairly over time, to retain those individuals who continue to perform at or above the levels that we expect, and to encourage those individuals’ innovation and promote accountability for our performance.

Our executive compensation program currently has four primary elements: (i) base salary, (ii) cash incentives awarded over the near term under a performance-based, non-equity incentive plan, (iii) equity-based long-term incentives awarded under our equity incentive plans, and (iv) other benefits, which include benefits that are available generally to all salaried employees. We have not adopted any formal or informal policies or guidelines for allocating compensation between near- and long-term compensation and between cash and equity compensation. We seek to offer total compensation that is competitive with the compensation offered by companies with which we compete for executive talent in order to recruit and retain our executive officers. In addition, we believe that a mix of both cash and equity incentives is appropriate, as competitive cash incentives reward executive officers in the near term for achieving strategic goals and equity incentives motivate executive officers to achieve strategic goals over the longer term through the imposition of vesting conditions, which also promotes retention over a multi-year period.

The executive officers listed in the Summary Compensation Table, whose compensation is discussed in this Compensation Discussion and Analysis, are referred to as our “named executive officers.” For fiscal year 2007, our named executive officers are our Chief Executive Officer, Michael S. Fields, our former Chief Financial Officer, John M. Thompson, who retired from this position in February 2008, the three most highly compensated executive officers for 2007, Marchai B. Bruchey, Jay A. Jones and Daniel A. Turano, and our former Senior Vice President, Global Sales and Service, William A. Rowe, for whom disclosure would have been provided as one of the three most highly compensated executive officers for 2007 but for the fact that he was not serving as an executive officer on December 31, 2007.

On February 28, 2008, we entered into an employment offer letter with Michael J. Shannahan, who began serving as our Chief Financial Officer as of March 2008. Our compensation arrangement with Mr. Shannahan is described in the section “Material Terms of Employment Offer Letters” beginning on page 29.

17

How Executive Compensation Is Set

Our Board of Directors has delegated to the Compensation Committee primary authority to develop our executive compensation philosophy and to administer the executive compensation program that implements our philosophy. The Compensation Committee is composed of three non-employee members of our Board of Directors, all of whom are independent under the standards established by the NASDAQ Stock Market.

Each year, the Compensation Committee reviews, recommends, and approves the mix of compensation elements and compensation levels for each of our executive officers. To evaluate whether the balance between the different elements of compensation and overall compensation levels for our executive officers are competitive enough to further our goals of attracting, retaining and incentivizing a superior leadership team, the Compensation Committee reviews and analyzes the compensation practices of comparable companies with which we generally compete for hiring executives. For 2007, the Compensation Committee engaged Compensia, Inc. (“Compensia”), an outside compensation consulting firm that focuses primarily on technology companies, to assist with its review and analysis of comparable company compensation practices. Compensia collected market survey data on the compensation practices of comparable companies, performed an analysis of those compensation practices and provided recommendations to the Compensation Committee regarding our executive compensation program and suggested compensation level adjustments.

Our Compensation Committee uses the data provided by Compensia as one of several factors in its decisions regarding executive officer compensation. The Compensation Committee gives weight to many other factors, including, but not limited to:

| • | the scope of the executive officers’ responsibilities; |

| • | the executive officer’s performance measured against strategic goals established for that individual; |

| • | our past and current business performance and future expectations; |

| • | our long-term goals and strategies; |

| • | for each executive officer, other than our Chief Executive Officer, the evaluation and recommendation of our Chief Executive Officer; |

| • | relative pay levels among the executive officers; |

| • | the amount of base salary in the context of the executive officer’s total compensation and other benefits; |

| • | the balance between performance-based cash incentives and the other elements of the executive officer’s total compensation; |

| • | the balance between equity-based incentives and the other elements of the executive officer’s total compensation. |

The performance-based, cash incentive compensation plan approved by our Compensation Committee in 2007 and described in the section “The Executive Compensation Plan” on page 19, reflects input from certain executive officers, including our Chief Executive Officer, former Executive Vice President and Chief Financial Officer, current Senior Vice President and Chief Administrative Officer and Vice President and General Counsel.

The Elements of Executive Compensation

For 2007, the elements of compensation for our named executive officers were:

| • | base salary; |

| • | cash incentives; |

| • | equity-based long-term incentives; and |

| • | other benefits. |

18

Our Compensation Committee reviews each of the above compensation elements, as well as the overall compensation for each named executive officer.

Base Salary

We seek to provide our executive officers with a base salary that is appropriate for their roles and responsibilities and that provides them with a level of income stability. We utilize salary as the base amount necessary to retain executive talent and fix base compensation at a level we believe enables us to hire and retain individuals in our environment and to reward satisfactory individual performance and a satisfactory level of contribution to our overall business goals.

The Compensation Committee reviews base salaries annually and adjusts them from time to time in light of our financial performance, market conditions, a desire to achieve internal pay equity and individual factors including responsibilities, qualitative performance, experience, and salary history. The Compensation Committee also utilizes executive compensation salary benchmark data for the Bay Area originally compiled by Radford Surveys + Consulting, and provided to us by Compensia, when adjusting the base salary of our named executive officers to ensure that they remain competitive with market practices.

In 2007, the Compensation Committee approved base salary increases for Messrs. Thompson, Rowe and Jones of $15,000, $75,000, and $15,000, respectively. The base salary increases were intended to align the named executive officers’ base salaries more closely with competitive practices and, in the case of Mr. Rowe, as a result of his increased worldwide responsibilities in 2007. In addition, our Compensation Committee approved a base salary increase for Mr. Turano of $70,000 in conjunction with his promotion to the position of Senior Vice President, Worldwide Field Operations in July 2007 when he replaced Mr. Rowe. At that time, Mr. Rowe’s salary returned to its pre-increase level. The salaries earned by our named executive officers in 2007 are listed in the Summary Compensation Table on page 27.

Cash Incentives

The Executive Compensation Plan

In 2006 we created, and our Compensation Committee approved, a performance-based, non-equity incentive compensation plan to encourage our executive officers to reach our goals of increasing profit and operating at sustainable profit and cash levels (the “Executive Compensation Plan”). These objectives are designed to advance our strategic business goals, enhance profitability and increase stockholder value. The 2007 Executive Compensation Plan, which was discussed by the Compensation Committee in April and June 2007 and later approved in October 2007, awarded cash incentives to our executive officers based on:

| • | our achievement of annual and quarterly profit targets; |

| • | our achievement of annual and quarterly revenue targets; |

| • | our achievement of quarterly positive cash from operations targets; and |

| • | their quarterly achievement of individualized personal objectives. |

Recognizing the continued importance of expanding our cash reserves, the 2007 Executive Compensation Plan also awarded our executive officers with a special cash bonus if we achieved non-GAAP net profits that were 10% or more above the quarterly and annual targets.

The corporate financial performance targets in the 2007 Executive Compensation Plan were defined (i) for profit, as the quarterly and annual non-GAAP net profit targets in our 2007 budget, as approved by our Board of Directors, which excludes certain non-cash expenses such as stock-based compensation expense and warrant liability expense; (ii) for revenue, as the quarterly and annual total revenue targets in our 2007 budget; and (iii) for positive cash from operations, as the growth in quarter-ending net cash (gross cash and cash equivalents

19

less any draw down on the bank line of credit for operating uses) from the preceding quarter. The Compensation Committee believed that the 2007 corporate financial performance targets were sufficiently challenging to achieve because they represented a significant profit, revenue growth and cash increases compared to our performance in 2006. The Compensation Committee also acknowledged that the performance targets addressed the areas of improvement that we needed to focus on and were allocated according to importance by business area.

Mr. Rowe did not participate in the 2007 Executive Compensation Plan because he stepped down from his position prior to the Compensation Committee’s approval of the plan in October 2007. Therefore, solely for purposes of the discussion of our 2007 Executive Compensation Plan below, Mr. Rowe is not one of the “named executive officers” being discussed. In addition, although Mr. Turano participated in our 2007 Executive Compensation Plan, his cash incentive compensation plan is not based on our achievement of positive cash from operations targets or individualized personal objectives. His cash incentive compensation plan is described in the section “Commission Plan” beginning on page 22.

The individualized personal objectives or management by objectives (“MBO”) component of our 2007 Executive Compensation Plan established quarterly operational objectives for our each of our named executive officers, except for Mr. Turano, who does not have an MBO component as part of his compensation plan. The individualized objectives were set on a quarterly basis by Mr. Fields and approved by our Compensation Committee. Typically, each named executive officer has three to five MBO targets in any quarterly period that are tailored to suit the executive officer’s specific position and responsibilities and designed to further our operational goals. In 2007, the MBO targets for Mr. Fields included setting the quarterly MBO targets for our other executive officers, completing our acquisition of eVergance Partners LLC and analyzing and improving our business plan for 2007. The MBO targets for Mr. Thompson included management of his area of responsibility and the completion of a registered direct offering of 4.0 million shares of our common stock during 2007. The MBO targets for Ms. Bruchey included operational objectives within her area of responsibility including lead generation and other contributions to sales efforts and the development of our marketing plan. The MBO targets for Mr. Jones included the implementation of an internal business management system and new hire recruiting program, and managing the integration of various departments of eVergance Partners LLC after the completion of the acquisition.

Under the 2007 Executive Compensation Plan, if we had achieved 100% of the quarterly and annual profit and revenue targets and quarterly positive cash from operations targets, and each named executive officer that had an MBO component had achieved his or her quarterly MBO targets, then our named executive officers would have received a fixed, minimum cash incentive award that was equal to a certain percentage of his or her individual annual base salary (the “Base Bonus Amount”). The percentage of each named executive officer’s annual base salary that constituted the Base Bonus Amount was based on the named executive officer’s experience, position and responsibilities and our annual financial and strategic goals. The Base Bonus Amount for each of our named executive officers and the percentage that the Base Bonus Amount reflected of the named executive officer’s base salary is set forth in the table below.

For 2007, the Compensation Committee approved a Base Bonus Amount for Mr. Fields that equaled his 2006 Base Bonus Amount and approved increases to the Base Bonus Amounts for Mr. Thompson, Mr. Jones, and Ms. Bruchey in the amounts of $8,000, $20,000, and $50,000, respectively. These increases were intended to align their cash incentive levels more closely with competitive practices. In addition, the Compensation Committee reviewed and approved a Base Bonus Amount for Mr. Turano in conjunction with his promotion to the position. His eligibility for the Base Bonus Amount commenced on July 1, 2007 at the beginning of our third fiscal quarter.

20

Name | Position | Base Bonus Amount | As a Percentage of Salary | ||||

Michael S. Fields | Chief Executive Officer | $ | 234,000 | 65% | |||

John M. Thompson | Former Executive Vice President and Chief Financial Officer | $ | 125,000 | 50% | |||

Marchai B. Bruchey | Senior Vice President and Chief Marketing Officer | $ | 200,000 | 100% | |||

Jay A. Jones | Senior Vice President and Chief Administrative Officer | $ | 125,000 | 56% | |||

Daniel A. Turano | Senior Vice President, Worldwide Field Operations | $ | 225,000 | 100% | |||

William A. Rowe | Former Senior Vice President, Global Sales and Service | n/a | n/a | ||||

The allocation of the 2007 Executive Compensation Plan’s performance targets within each of our named executive officer’s Base Bonus Amounts differed according to the named executive officer’s experience, position and responsibilities. The table below sets forth the respective allocations for each of our named executive officers.

| Base Bonus Amount | ||||||||||||

Name | Position | Profit Target | Revenue Target | Positive Cash from Operations Target | MBO Target | Total | ||||||

Michael S. Fields | Chief Executive Officer | 50% | 25% | 10% | 15% | 100% | ||||||

John M. Thompson | Former Executive Vice President and Chief Financial Officer | 50% | 25% | 10% | 15% | 100% | ||||||

Marchai B. Bruchey | Senior Vice President and Chief Marketing Officer | 25% | 50% | 10% | 15% | 100% | ||||||

Jay A. Jones | Senior Vice President and Chief Administrative Officer | 50% | 25% | 10% | 15% | 100% | ||||||

Daniel A. Turano (1) | Senior Vice President, Worldwide Field Operations | 25% | 75% | n/a | n/a | 100% | ||||||

William A. Rowe (2) | Former Senior Vice President, Global Sales and Service | n/a | n/a | n/a | n/a | n/a | ||||||

| (1) | Mr. Turano did not participate in the 2007 Executive Compensation Plan until July 2007 when he was promoted to the position of Senior Vice President, Worldwide Field Operations. Unlike the other named executive officers, Mr. Turano’s revenue target was earned as commissions on revenue, and was based on our achievement of annual revenue targets within three of our operating units: license and OnDemand, maintenance and professional services. Mr. Turano’s commission-based earnings are described in more detail in the section “Commission Plan” beginning on page 22. |

| (2) | Mr. Rowe stepped down in July 2007 before the 2007 Executive Compensation Plan was formally approved by the Compensation Committee in October 2007. Therefore, Mr. Rowe did not participate in the 2007 Executive Compensation Plan. All of his variable compensation was paid in accordance with a sales compensation plan. |

21

Once the Base Bonus Amount was allocated among the four performance targets under our 2007 Executive Compensation Plan, the performance targets were allocated quarterly and annually, as applicable. The table below provides the quarterly and annual allocations for each of the performance targets, with the exception of the revenue targets for Mr. Turano, which are described in the section “Commission Plan” below. If we had achieved 100% of the quarterly and annual profit and revenue targets and quarterly positive cash from operations targets, and each named executive had achieved his or her MBO targets, then each named executive officer would have been entitled received the percentage of his or her Base Bonus Amount that was allocated to the achievement of the particular performance target. For example, if we had achieved 100% of our profit target for the first quarter of 2007, then Mr. Fields would have been entitled to receive 12.5% of the 50% of his Base Bonus Amount that was allocated to achievement of the profit target, or $14,625.

| Quarterly and Annual Allocations for Each Performance Target | ||||||||||||

Performance Targets | Q1 | Q2 | Q3 | Q4 | Annual | Total | ||||||

Profit | 12.5% | 12.5% | 12.5% | 12.5% | 50% | 100% | ||||||

Revenue | 15% | 15% | 15% | 15% | 40% | 100% | ||||||

Positive Cash from Operations | 25% | 25% | 25% | 25% | n/a | 100% | ||||||

MBO | 25% | 25% | 25% | 25% | n/a | 100% | ||||||

In addition, if we had achieved more than 110% of our quarterly and annual profit targets, the 2007 Executive Compensation Plan provided for an additional cash bonus to be paid to each of our named executive officers that was not included within their Base Bonus Amounts. An additional 5% of the portion of each named executive officer’s Base Bonus Amount that was allocated to achievement of profit targets could have been paid at the end of each quarter for each increment of 10% by which our quarterly profit exceeded the 2007 Executive Compensation Plan’s quarterly profit target. For example, if we had exceeded our quarterly profit target by 20% in the first quarter, the additional cash bonus awarded to Mr. Fields in the first quarter would have been equal to 10% of $117,000, which was the portion of Mr. Fields’ Base Bonus Amount that was allocated to the achievement of our profit target, or $11,700. The 5% multiplier was capped at 15% per quarter for each named executive officer. An additional 10% of the portion of each named executive officer’s Base Bonus Amount that was allocated to achievement of profit targets could have been paid at the end of the year for each increment of 10% by which our annual profit exceeded the 2007 Executive Compensation Plan’s annual profit target. The 10% multiplier was capped at 60% for the year for each named executive officer. Mr. Turano was not eligible for this additional cash bonus award.

In order for our named executive officers to have received cash incentive awards under the 2007 Executive Compensation Plan, our performance must have met or exceeded the quarterly and annual profit and revenue targets and quarterly cash from operations targets. In certain rare cases, our named executive officers may receive a portion of their MBO bonus award even though they do not meet their MBO targets. In 2007, we did not achieve our profit, revenue or cash from operations targets in any quarter or at year-end. Therefore, none of our named executive officers were awarded that portion of their Base Bonus Amounts that was attributable to our achievement of financial performance targets. All of the named executive officers with quarterly MBO targets met those targets during each quarter of 2007 and was awarded 100% of the portion of each of their Base Bonus Amounts that was allocated to achievement of MBO targets. Mr. Fields earned $35,100 with payment of $8,775 occurring in 2008, Mr. Thompson earned $18,750 with payment of $4,688 occurring in 2008, Mr. Jones earned $18,750 with payment of $4,688 occurring in 2008, and Ms. Bruchey earned $30,000 with payment of $7,500 occurring in 2008.

Commission Plan

Unlike our other named executive officers, Mr. Turano earns up to 75% of his Base Bonus Amount as commissions on revenue based on our achievement of annual revenue targets within three of our operating units: (i) license and OnDemand, (ii) maintenance, and (iii) professional services. The annual revenue targets for these operating units under the 2007 Executive Compensation Plan were the same as the annual operating unit revenue targets contained in our 2007 budget, as approved by our Board of Directors. For achievement of 100% of the

22

annual license and OnDemand, maintenance and service revenue targets, Mr. Turano would receive a cash commission equal to 65%, 15% and 20%, respectively, of that portion of his Base Bonus Award that is allocated to achievement of annual revenue targets. The remaining 25% of his Base Bonus Amount is based on our achievement of quarterly and annual profit targets and is subject to the quarterly and annual allocations set forth in the table above. In addition, Mr. Turano could have earned one and a half times his commissions-based earnings if our annual license revenue had exceeded the revenue target by 100% and twice his commissions-based earnings if our annual license revenue had exceeded the revenue target by 150%. Mr. Turano did not receive that portion of his Base Bonus Amount that was allocated to our achievement of the profit target because we did not reach that target in 2007, nor did Mr. Turano earn a multiple on his commissions-based earnings in 2007.

2007 Merit Review and Compensation Plan

During 2007 and continuing into 2008, the Compensation Committee and Mr. Jones reviewed and refined a merit-based compensation program (the “Merit Plan”) and compensation leveling for the Merit Plan (with input from Compensia as well as research from Radford Compensation Surveys). The Merit Plan will be a performance-based, incentive plan that includes a component for an increase in compensation of up to a maximum of 4% based on performance. The Merit Plan could also include equity awards based on performance. We anticipate compensating our executive officers under the Merit Plan in 2008.

Equity-Based Long-Term Incentives

We grant equity incentives to our executive officers in several forms, including stock options, performance-based stock options and restricted stock to assist in their retention, to motivate them to assist us with the achievement of certain corporate financial and operational goals and to align their interests with those of our stockholders by providing them with an equity stake in our company. Because our executive officers are awarded stock options with an exercise price equal to at least 100% of the fair market value of our common stock on the date of grant, options will have value to our executive officers only if the market price of our common stock increases after the date of grant.