Acquisition of Enteris BioPharma Collaborative Approach to Life Science Financing

Forward - looking and Cautionary Statements Statements in this presentation that are not strictly historical, and any statements regarding events or developments that we be lieve or anticipate will or may occur in the future are "forward - looking" statements within the meaning of the federal securities laws. There are a number of important factors that could cause actual results, dev elopments and business decisions to differ materially from those suggested or indicated by such forward - looking statements and you should not place undue reliance on any such forward - looking statements. Additional in formation regarding the factors that may cause actual results to differ materially from these forward - looking statements is available in our SEC filings, including our Annual Report on Form 10 - K for the year end ed December 31, 2018 and our Quarterly Reports on Form 10 - Q for subsequent periods. The Company does not assume any obligation to update or revise any forward - looking statement, whether as a result of n ew information, future events and developments or otherwise. Our specialty finance and asset management businesses are conducted through separate subsidiaries and the Company conducts it s o perations in a manner that is excluded from the definition of an investment company and exempt from registration and regulation under the Investment Company Act of 1940. This presentation is neither an offer to sell nor a solicitation of any offer to buy any securities, investment product or in ves tment advisory services, including such services offered by SWK Advisors LLC. This presentation does not contain all of the information necessary to make an investment decision, including, but not limited to, th e risks, fees and investment strategies of investing in life science investments. Any offering is made only pursuant to the relevant information memorandum, a relevant subscription agreement or investment manage men t agreement, and SWK Advisors LLC’s Form ADV, all of which must be read in their entirety. All investors must be “accredited investors” and/or “qualified purchasers” as defined in the securities la ws before they can invest with SWK Advisors LLC. Life science securities may rely on milestone payments and/or a royalty stream from an underlying drug, device, or product wh ich may or may not have received approval of the Food and Drug Administration (“FDA”). If the underlying drug, device, or product does not receive FDA approval, it could negatively impact the securities, in cluding the payments of principal and/or interest. In addition, the introduction of new drugs, devices, or products onto the market could negatively impact the securities, since that may decrease sales and/or pri ces of the underlying drug, device, or product. Changes to Medicare reimbursement or third party payor pricing could negatively impact the securities, since they could negatively impact the prices and/or sal es of the underlying drug, device, or product. There is also risk that the licensing agreement that governs the payment of royalties may terminate, which could negatively impact the securities. There is also th e r isk that litigation involving the underlying drug, device, or product could negatively impact the securities, including payments of principal and/or interest on any securities. 2

Agenda Acquisition Highlights and Rationale Peptelligence ® Technology & Business Model Overview Internal 505(b)(2) Pipeline Enteris Financial Overview 3

ACQUISITION HIGHLIGHTS AND RATIONALE

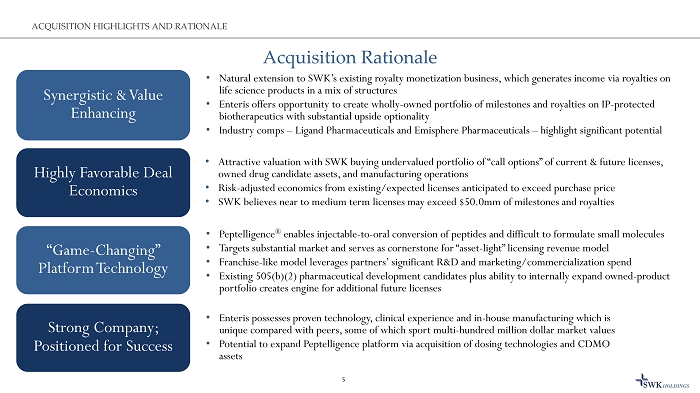

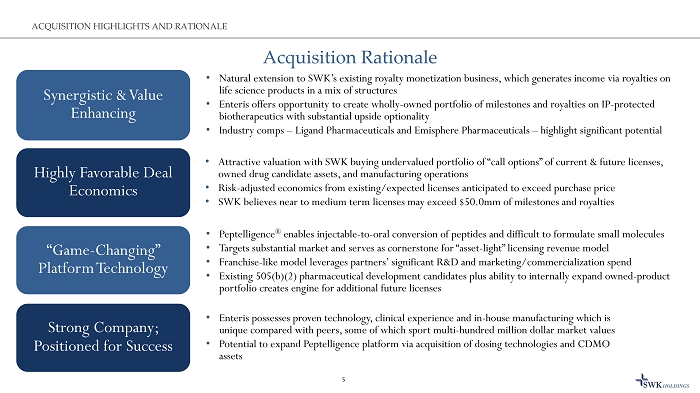

Acquisition Rationale 5 ACQUISITION HIGHLIGHTS AND RATIONALE • Natural extension to SWK’s existing royalty monetization business, which generates income via royalties on life science products in a mix of structures • Enteris offers opportunity to create wholly - owned portfolio of milestones and royalties on IP - protected biotherapeutics with substantial upside optionality • Industry comps – Ligand Pharmaceuticals and Emisphere Pharmaceuticals – highlight significant potential Synergistic & Value Enhancing • Attractive valuation with SWK buying undervalued portfolio of “call options” of current & future licenses, owned drug candidate assets, and manufacturing operations • Risk - adjusted economics from existing/expected licenses anticipated to exceed purchase price • SWK believes near to medium term licenses may exceed $50.0mm of milestones and royalties Highly Favorable Deal Economics • Peptelligence ® enables injectable - to - oral conversion of peptides and difficult to formulate small molecules • Targets substantial market and serves as cornerstone for “asset - light” licensing revenue model • Franchise - like model leverages partners’ significant R&D and marketing/commercialization spend • Existing 505(b)(2) pharmaceutical development candidates plus ability to internally expand owned - product portfolio creates engine for additional future licenses “Game - Changing” Platform Technology • Enteris possesses proven technology, clinical experience and in - house manufacturing which is unique compared with peers, some of which sport multi - hundred million dollar market values • Potential to expand Peptelligence platform via acquisition of dosing technologies and CDMO assets Strong Company; Positioned for Success

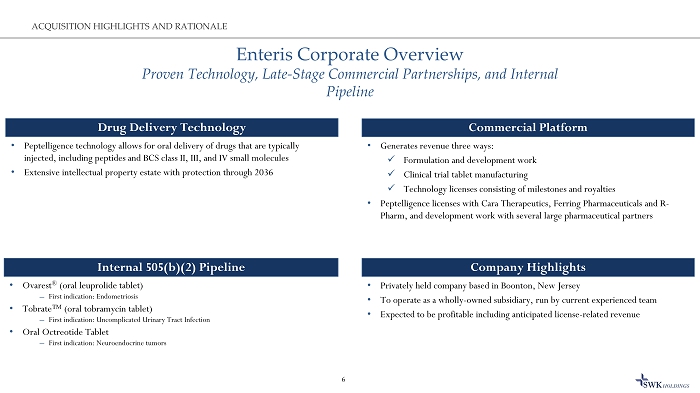

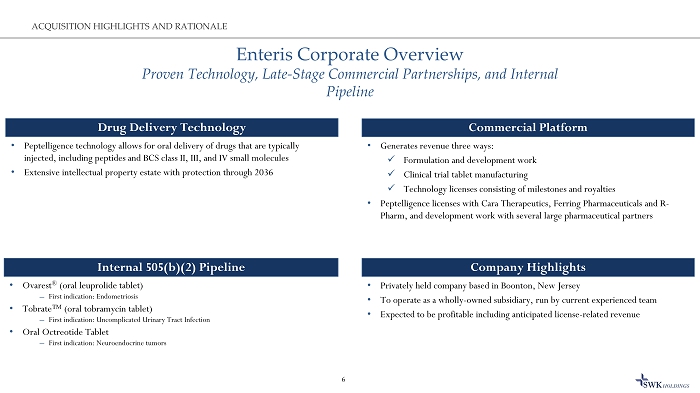

Enteris Corporate Overview Proven Technology, Late - Stage Commercial Partnerships, and Internal Pipeline 6 ACQUISITION HIGHLIGHTS AND RATIONALE Drug Delivery Technology • Peptelligence technology allows for oral delivery of drugs that are typically injected, including peptides and BCS class II, III, and IV small molecules • Extensive intellectual property estate with protection through 2036 Commercial Platform • Generates revenue three ways: x Formulation and development work x Clinical trial tablet manufacturing x Technology licenses consisting of milestones and royalties • Peptelligence licenses with Cara Therapeutics, Ferring Pharmaceuticals and R - Pharm, and development work with several large pharmaceutical partners Internal 505(b)(2) Pipeline • Ovarest ® (oral leuprolide tablet) ̶ First indication: Endometriosis • Tobrate™ (oral tobramycin tablet) ̶ First indication: Uncomplicated Urinary Tract Infection • Oral Octreotide Tablet ̶ First indication: Neuroendocrine tumors Company Highlights • Privately held company based in Boonton, New Jersey • To operate as a wholly - owned subsidiary, run by current experienced team • Expected to be profitable including anticipated license - related revenue

Transaction Overview $21.5mm paid upfront to acquire 100% of Enteris’ capital stock Proceeds from Cara Therapeutics licensing agreement, which includes milestone payments and low - single digit royalties on sales o f Oral Korsuva™: ̶ Seller will receive 100% of $8.0mm upfront payment ̶ SWK will receive 60% of the first milestone payment ̶ SWK will receive 25% of all other milestone payments until seller receives $32.75mm in aggregate consideration ̶ License revenue split 50%/50% thereafter ̶ SWK portion of this license’s economics are expected to be greater than the purchase price If out - licensed, proceeds for Enteris’ 505(b)(2) drug candidates Ovarest and Tobrate ̶ SWK to receive 40% until seller receives $3.0mm on each asset ̶ SWK to receive 70% of milestone and royalty proceeds thereafter If out - licensed, SWK will receive 90% of Enteris’ 505(b)(2) octreotide oral drug candidate proceeds Enteris to operate as a stand - alone business unit with the existing management team reporting directly to SWK CEO Winston Black 7 ACQUISITION HIGHLIGHTS AND RATIONALE

PEPTELLIGENCE ® TECHNOLOGY & BUSINESS MODEL OVERVIEW

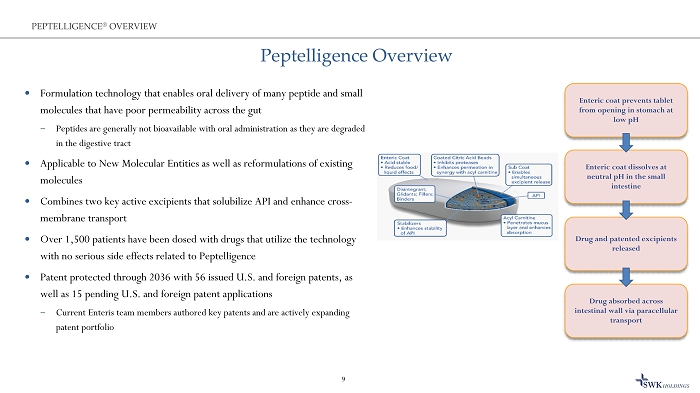

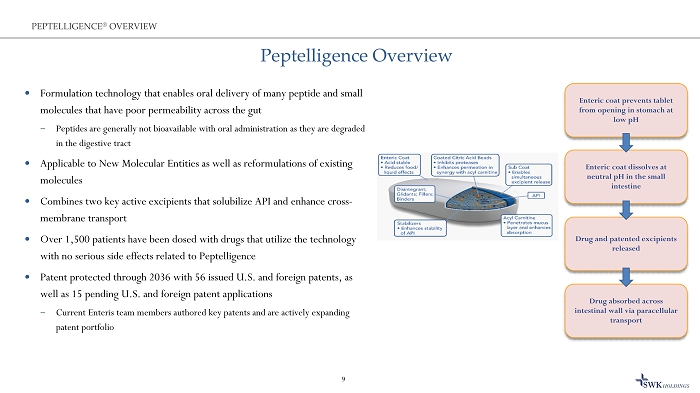

Peptelligence Overview Formulation technology that enables oral delivery of many peptide and small molecules that have poor permeability across the gut ̶ Peptides are generally not bioavailable with oral administration as they are degraded in the digestive tract Applicable to New Molecular Entities as well as reformulations of existing molecules Combines two key active excipients that solubilize API and enhance cross - membrane transport Over 1,500 patients have been dosed with drugs that utilize the technology with no serious side effects related to Peptelligence Patent protected through 2036 with 56 issued U.S. and foreign patents, as well as 15 pending U.S. and foreign patent applications ̶ Current Enteris team members authored key patents and are actively expanding patent portfolio 9 PEPTELLIGENCE ® OVERVIEW Enteric coat prevents tablet from opening in stomach at low pH Drug absorbed across intestinal wall via paracellular transport Enteric coat dissolves at neutral pH in the small intestine Drug and patented excipients released

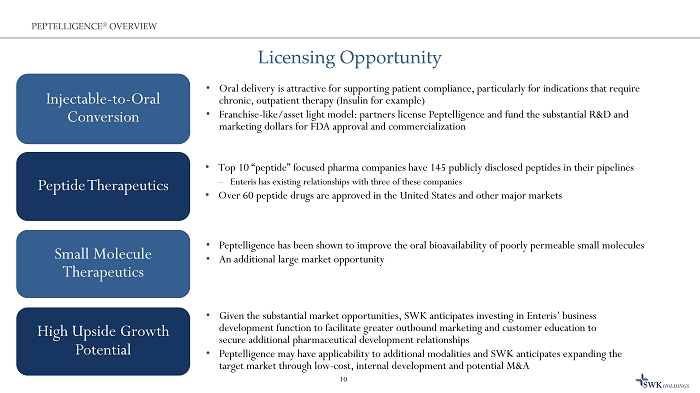

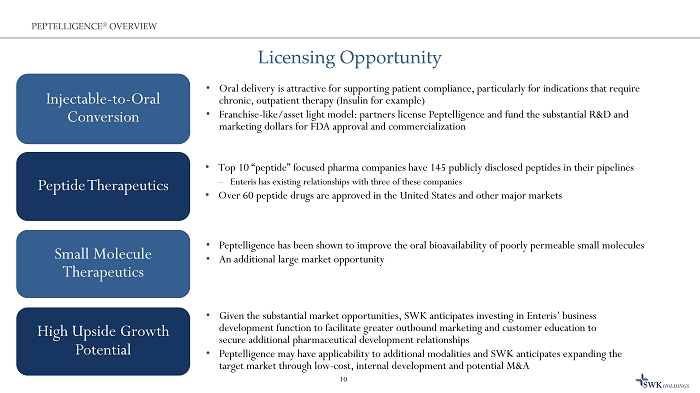

Licensing Opportunity 10 • Oral delivery is attractive for supporting patient compliance, particularly for indications that require chronic, outpatient therapy (Insulin for example) • Franchise - like/asset light model: partners license Peptelligence and fund the substantial R&D and marketing dollars for FDA approval and commercialization Injectable - to - Oral Conversion • Top 10 “peptide” focused pharma companies have 145 publicly disclosed peptides in their pipelines – Enteris has existing relationships with three of these companies • Over 60 peptide drugs are approved in the United States and other major markets Peptide Therapeutics • Peptelligence has been shown to improve the oral bioavailability of poorly permeable small molecules • An additional large market opportunity Small Molecule Therapeutics • Given the substantial market opportunities, SWK anticipates investing in Enteris’ business development function to facilitate greater outbound marketing and customer education to secure additional pharmaceutical development relationships • Peptelligence may have applicability to additional modalities and SWK anticipates expanding the target market through low - cost, internal development and potential M&A High Upside Growth Potential PEPTELLIGENCE ® OVERVIEW

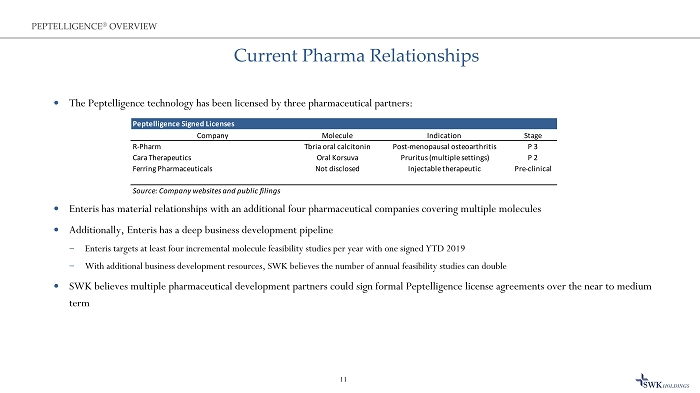

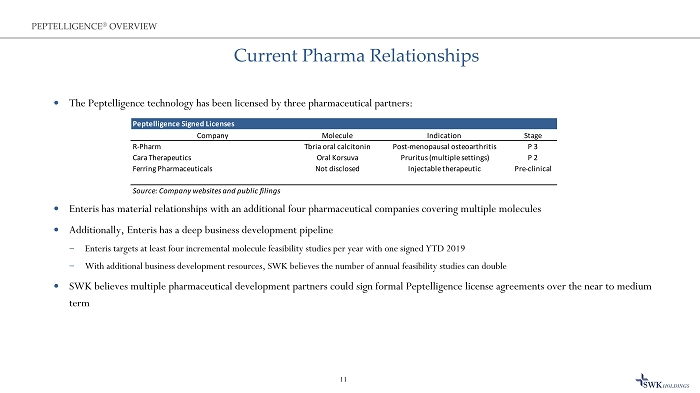

Current Pharma Relationships The Peptelligence technology has been licensed by three pharmaceutical partners: Enteris has material relationships with an additional four pharmaceutical companies covering multiple molecules Additionally, Enteris has a deep business development pipeline ̶ Enteris targets at least four incremental molecule feasibility studies per year with one signed YTD 2019 ̶ With additional business development resources, SWK believes the number of annual feasibility studies can double SWK believes multiple pharmaceutical development partners could sign formal Peptelligence license agreements over the near to me dium term 11 PEPTELLIGENCE ® OVERVIEW Peptelligence Signed Licenses Company Molecule Indication Stage R-Pharm Tbria oral calcitonin Post-menopausal osteoarthritis P 3 Cara Therapeutics Oral Korsuva Pruritus (multiple settings) P 2 Ferring Pharmaceuticals Not disclosed Injectable therapeutic Pre-clinical Source: Company websites and public filings

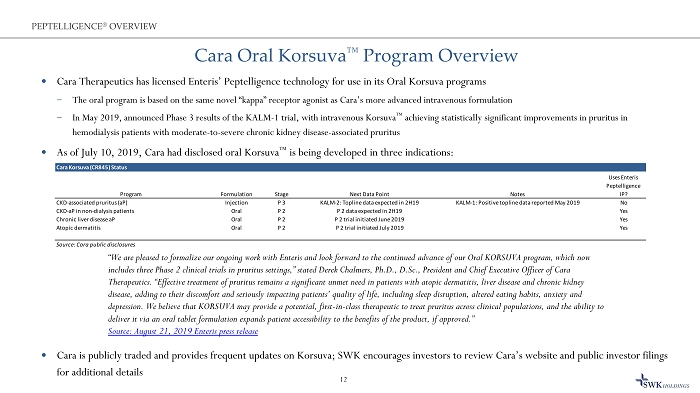

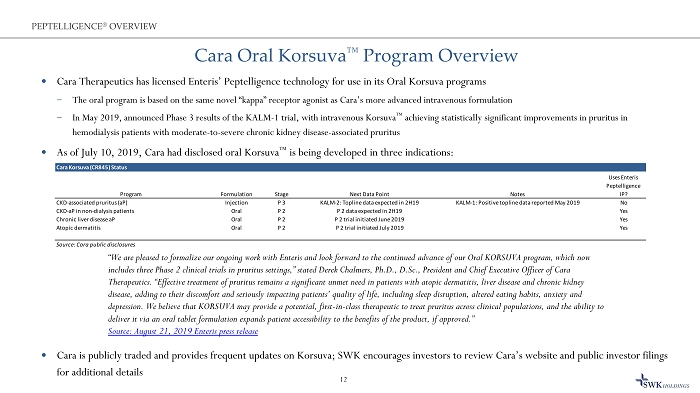

Cara Oral Korsuva ™ Program Overview Cara Therapeutics has licensed Enteris’ Peptelligence technology for use in its Oral Korsuva programs ̶ The oral program is based on the same novel “kappa” receptor agonist as Cara’s more advanced intravenous formulation ̶ In May 2019, announced Phase 3 results of the KALM - 1 trial, with intravenous Korsuva ™ achieving statistically significant improvements in pruritus in hemodialysis patients with moderate - to - severe chronic kidney disease - associated pruritus As of July 10, 2019, Cara had disclosed oral Korsuva ™ is being developed in three indications: Cara is publicly traded and provides frequent updates on Korsuva; SWK encourages investors to review Cara’s website and publi c i nvestor filings for additional details 12 PEPTELLIGENCE ® OVERVIEW “We are pleased to formalize our ongoing work with Enteris and look forward to the continued advance of our Oral KORSUVA prog ram , which now includes three Phase 2 clinical trials in pruritus settings,” stated Derek Chalmers, Ph.D., D.Sc., President and Chief Execut ive Officer of Cara Therapeutics. “Effective treatment of pruritus remains a significant unmet need in patients with atopic dermatitis, liver dis eas e and chronic kidney disease, adding to their discomfort and seriously impacting patients’ quality of life, including sleep disruption, altered ea tin g habits, anxiety and depression. We believe that KORSUVA may provide a potential, first - in - class therapeutic to treat pruritus across clinical popula tions, and the ability to deliver it via an oral tablet formulation expands patient accessibility to the benefits of the product, if approved.” Source: August 21, 2019 Enteris press release Cara Korsuva (CR845) Status Program Formulation Stage Next Data Point Notes Uses Enteris Peptelligence IP? CKD-associated pruritus (aP) Injection P 3 KALM-2: Topline data expected in 2H19 KALM-1: Positive topline data reported May 2019 No CKD-aP in non-dialysis patients Oral P 2 P 2 data expected in 2H19 Yes Chronic liver disease aP Oral P 2 P 2 trial initiated June 2019 Yes Atopic dermatitis Oral P 2 P 2 trial initiated July 2019 Yes Source: Cara public disclosures

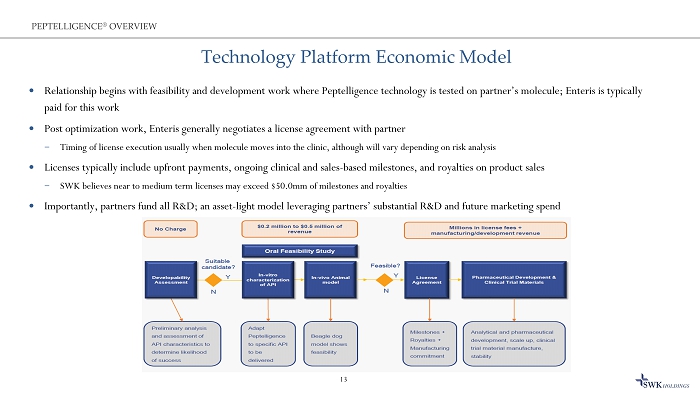

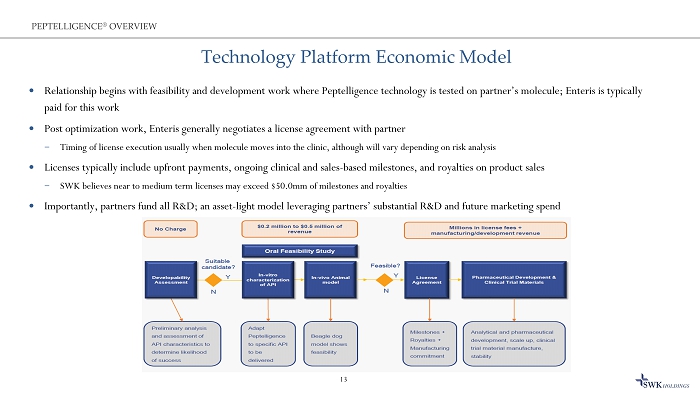

Technology Platform Economic Model Relationship begins with feasibility and development work where Peptelligence technology is tested on partner’s molecule; Ent eri s is typically paid for this work Post optimization work, Enteris generally negotiates a license agreement with partner ̶ Timing of license execution usually when molecule moves into the clinic, although will vary depending on risk analysis Licenses typically include upfront payments, ongoing clinical and sales - based milestones, and royalties on product sales ̶ SWK believes near to medium term licenses may exceed $50.0mm of milestones and royalties Importantly, partners fund all R&D; an asset - light model leveraging partners’ substantial R&D and future marketing spend 13 PEPTELLIGENCE ® OVERVIEW

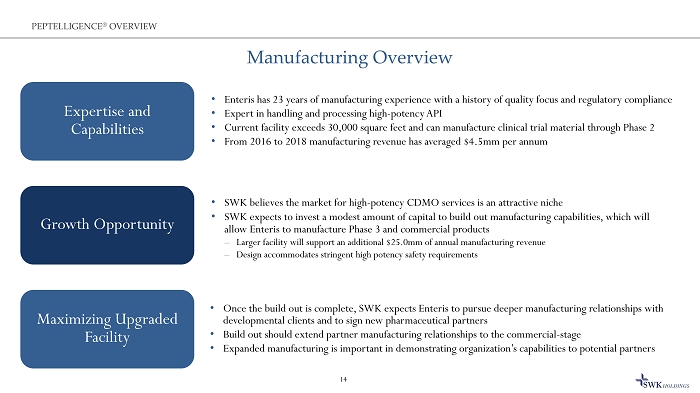

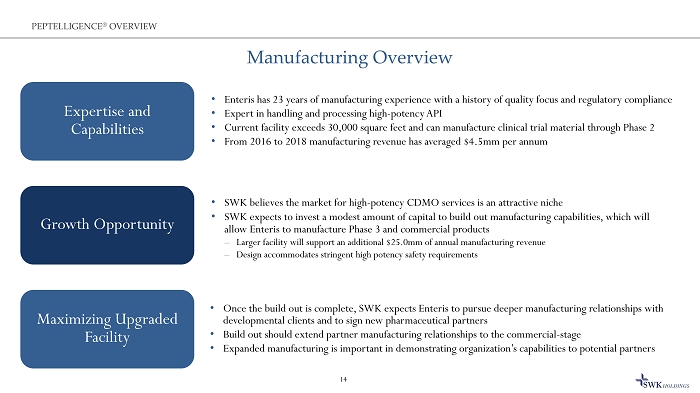

Manufacturing Overview 14 • Enteris has 23 years of manufacturing experience with a history of quality focus and regulatory compliance • Expert in handling and processing high - potency API • Current facility exceeds 30,000 square feet and can manufacture clinical trial material through Phase 2 • From 2016 to 2018 manufacturing revenue has averaged $4.5mm per annum Expertise and Capabilities • SWK believes the market for high - potency CDMO services is an attractive niche • SWK expects to invest a modest amount of capital to build out manufacturing capabilities, which will allow Enteris to manufacture Phase 3 and commercial products – Larger facility will support an additional $25.0mm of annual manufacturing revenue – Design accommodates stringent high potency safety requirements Growth Opportunity • Once the build out is complete, SWK expects Enteris to pursue deeper manufacturing relationships with developmental clients and to sign new pharmaceutical partners • Build out should extend partner manufacturing relationships to the commercial - stage • Expanded manufacturing is important in demonstrating organization’s capabilities to potential partners Maximizing Upgraded Facility PEPTELLIGENCE ® OVERVIEW

INTERNAL PIPELINE

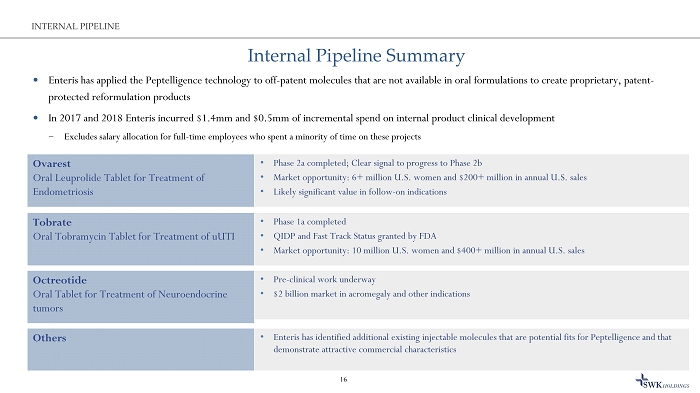

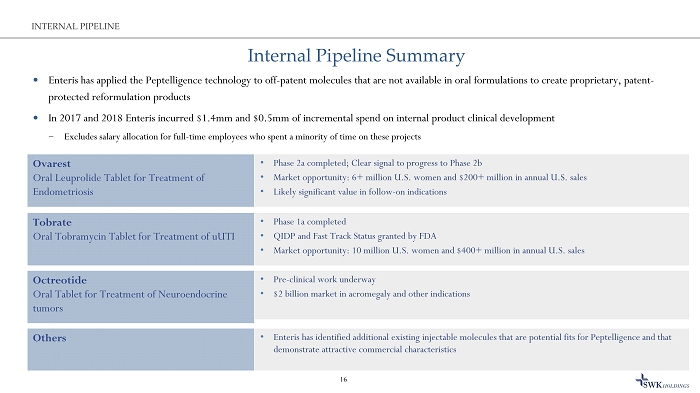

Internal Pipeline Summary Enteris has applied the Peptelligence technology to off - patent molecules that are not available in oral formulations to create p roprietary, patent - protected reformulation products In 2017 and 2018 Enteris incurred $1.4mm and $0.5mm of incremental spend on internal product clinical development ̶ Excludes salary allocation for full - time employees who spent a minority of time on these projects 16 INTERNAL PIPELINE • Phase 1a completed • QIDP and Fast Track Status granted by FDA • Market opportunity: 10 million U.S. women and $400+ million in annual U.S. sales Tobrate Oral Tobramycin Tablet for Treatment of uUTI • Phase 2a completed; Clear signal to progress to Phase 2b • Market opportunity: 6+ million U.S. women and $200+ million in annual U.S. sales • Likely significant value in follow - on indications Ovarest Oral Leuprolide Tablet for Treatment of Endometriosis • Enteris has identified additional existing injectable molecules that are potential fits for Peptelligence and that demonstrate attractive commercial characteristics Others • Pre - clinical work underway • $2 billion market in acromegaly and other indications Octreotide Oral Tablet for Treatment of N euroendocrine tumors

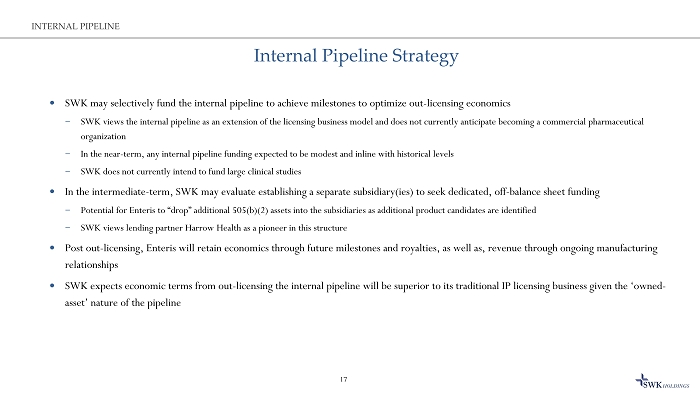

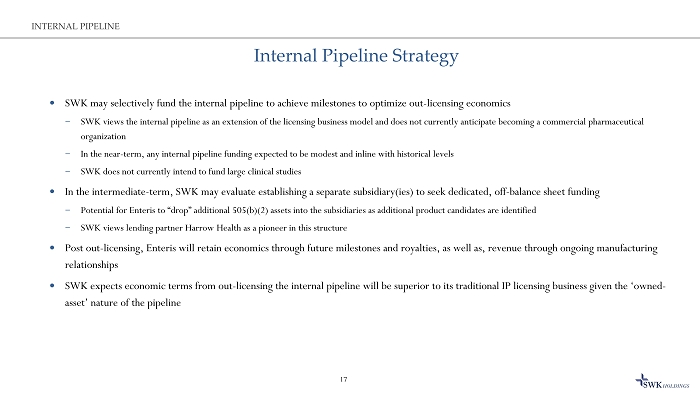

Internal Pipeline Strategy SWK may selectively fund the internal pipeline to achieve milestones to optimize out - licensing economics ̶ SWK views the internal pipeline as an extension of the licensing business model and does not currently anticipate becoming a com mercial pharmaceutical organization ̶ In the near - term, any internal pipeline funding expected to be modest and inline with historical levels ̶ SWK does not currently intend to fund large clinical studies In the intermediate - term, SWK may evaluate establishing a separate subsidiary(ies) to seek dedicated, off - balance sheet funding ̶ Potential for Enteris to “drop” additional 505(b)(2) assets into the subsidiaries as additional product candidates are identi fie d ̶ SWK views lending partner Harrow Health as a pioneer in this structure Post out - licensing, Enteris will retain economics through future milestones and royalties, as well as, revenue through ongoing m anufacturing relationships SWK expects economic terms from out - licensing the internal pipeline will be superior to its traditional IP licensing business gi ven the ‘owned - asset’ nature of the pipeline 17 INTERNAL PIPELINE

FINANCIALS

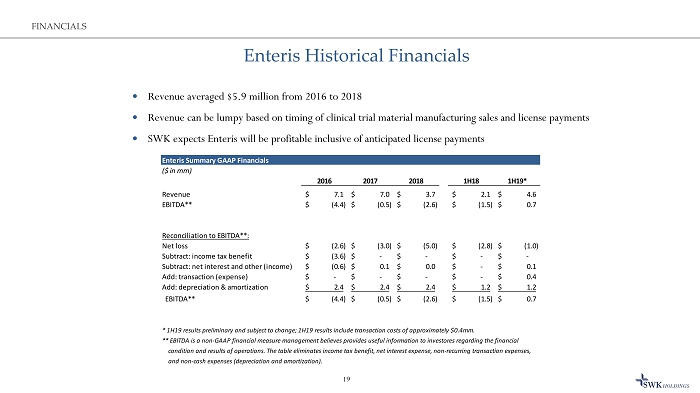

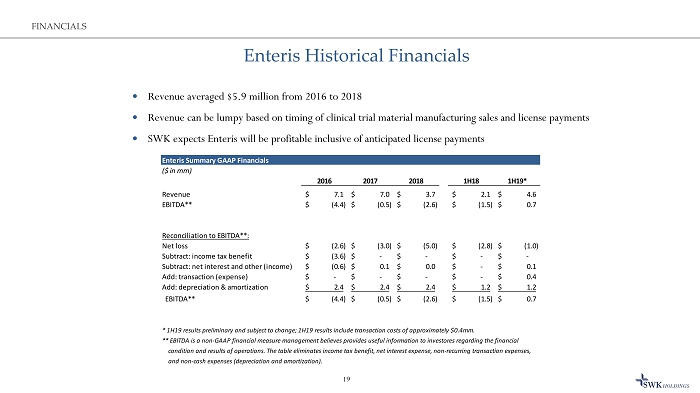

Enteris Historical Financials 19 FINANCIALS Revenue averaged $5.9 million from 2016 to 2018 Revenue can be lumpy based on timing of clinical trial material manufacturing sales and license payments SWK expects Enteris will be profitable inclusive of anticipated license payments Enteris Summary GAAP Financials ($ in mm) 2016 2017 2018 1H18 1H19* Revenue 7.1$ 7.0$ 3.7$ 2.1$ 4.6$ EBITDA** (4.4)$ (0.5)$ (2.6)$ (1.5)$ 0.7$ Reconciliation to EBITDA**: Net loss (2.6)$ (3.0)$ (5.0)$ (2.8)$ (1.0)$ Subtract: income tax benefit (3.6)$ -$ -$ -$ -$ Subtract: net interest and other (income) (0.6)$ 0.1$ 0.0$ -$ 0.1$ Add: transaction (expense) -$ -$ -$ -$ 0.4$ Add: depreciation & amortization 2.4$ 2.4$ 2.4$ 1.2$ 1.2$ EBITDA** (4.4)$ (0.5)$ (2.6)$ (1.5)$ 0.7$ * 1H19 results preliminary and subject to change; 1H19 results include transaction costs of approximately $0.4mm. ** EBITDA is a non-GAAP financial measure management believes provides useful information to investores regarding the financial condition and results of operations. The table eliminates income tax benefit, net interest expense, non-recurring transaction expenses, and non-cash expenses (depreciation and amortization).

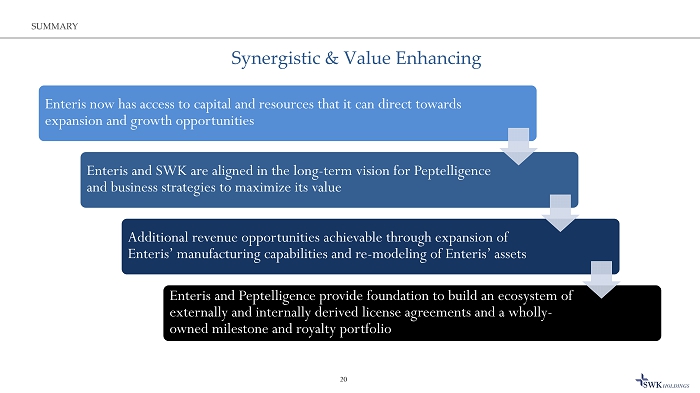

20 Synergistic & Value Enhancing Enteris now has access to capital and resources that it can direct towards expansion and growth opportunities Enteris and SWK are aligned in the long - term vision for Peptelligence and business strategies to maximize its value Additional revenue opportunities achievable through expansion of Enteris’ manufacturing capabilities and re - modeling of Enteris’ assets Enteris and Peptelligence provide foundation to build an ecosystem of externally and internally derived license agreements and a wholly - owned milestone and royalty portfolio SUMMARY

21 APPENDIX