Exhibit 99.1

1 Collaborative Approach to Life Science Financing Shareholder Presentation May 17, 2022

2 Forward - looking and Cautionary Statements Statements in this presentation that are not strictly historical, and any statements regarding events or developments that we be lieve or anticipate will or may occur in the future are "forward - looking" statements within the meaning of the federal securities laws. There are a number of important factors that could cause actual results, developments and business decisions to differ materially from those suggested or indicated by such forward - looking statements and you should not place undue reliance on any s uch forward - looking statements. Additional information regarding the factors that may cause actual results to differ materially from these forward - looking statements is available in o ur SEC filings, including our Annual Report on Form 10 - K for the year ended December 31, 2021 and our Quarterly Reports on Form 10 - Q for subsequent periods. The Company does not assume any obligatio n to update or revise any forward - looking statement, whether as a result of new information, future events and developments or otherwise. Our specialty finance and asset management businesses are conducted through separate subsidiaries and the Company conducts it s o perations in a manner that is excluded from the definition of an investment company and exempt from registration and regulation under the Investment Company Act of 1940. This presentation is neither an offer to sell nor a solicitation of any offer to buy any securities, investment product or in ves tment advisory services, including such services offered by SWK Advisors LLC. This presentation does not contain all of the information necessary to make an investment decision, including, bu t not limited to, the risks, fees and investment strategies of investing in life science investments. Any offering is made only pursuant to the relevant information memorandum, a relevant su bscription agreement or investment management agreement, and SWK Advisors LLC’s Form ADV, all of which must be read in their entirety. All investors must be “accredited investors” and/or “q ualified purchasers” as defined in the securities laws before they can invest with SWK Advisors LLC. Life science securities may rely on milestone payments and/or a royalty stream from an underlying drug, device, or product wh ich may or may not have received approval of the Food and Drug Administration (“FDA”). If the underlying drug, device, or product does not receive FDA approval, it could negatively impact the securities, including the payments of principal and/or interest. In addition, the introduction of new drugs, devices, or products onto the market could negatively impact the securities, since t hat may decrease sales and/or prices of the underlying drug, device, or product. Changes to Medicare reimbursement or third - party payor pricing could negatively impact the securities, since they could negatively impact the prices and/or sales of the underlying drug, device, or product. There is also risk that the licensing agreement that governs the payment of royalties may terminate, whic h c ould negatively impact the securities. There is also the risk that litigation involving the underlying drug, device, or product could negatively impact the securities, including payments of pr inc ipal and/or interest on any securities.

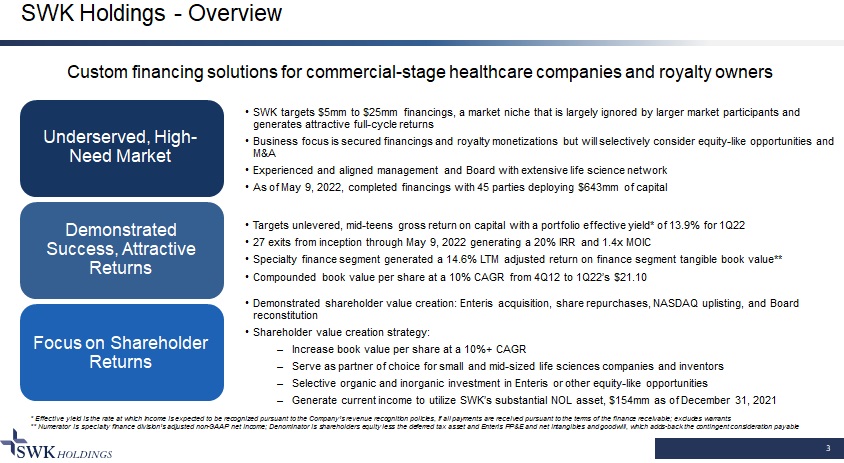

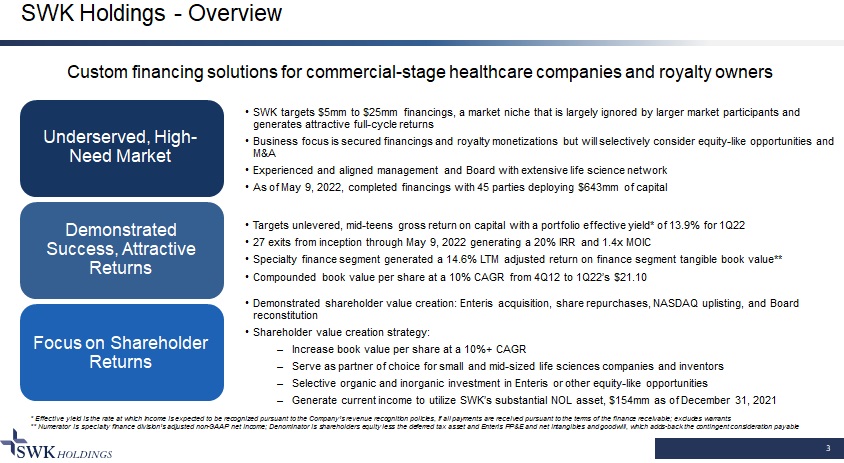

SWK Holdings - Overview 3 Underserved, High - Need Market Demonstrated Success, Attractive Returns Focus on Shareholder Returns Custom financing solutions for commercial - stage healthcare companies and royalty owners • SWK targets $5mm to $25mm financings, a market niche that is largely ignored by larger market participants and generates attractive full - cycle returns • Business focus is secured financings and royalty monetizations but will selectively consider equity - like opportunities and M&A • Experienced and aligned management and Board with extensive life science network • As of May 9, 2022, completed financings with 45 parties deploying $643mm of capital • Targets unlevered, mid - teens gross return on capital with a portfolio effective yield* of 13.9% for 1Q22 • 27 exits from inception through May 9, 2022 generating a 20% IRR and 1.4x MOIC • Specialty finance segment generated a 14.6% LTM adjusted return on finance segment tangible book value** • Compounded book value per share at a 10% CAGR from 4Q12 to 1Q22’s $21.10 • Demonstrated shareholder value creation: Enteris acquisition, share repurchases, NASDAQ uplisting , and Board reconstitution • Shareholder value creation strategy: – Increase book value per share at a 10%+ CAGR – Serve as partner of choice for small and mid - sized life sciences companies and inventors – Selective organic and inorganic investment in Enteris or other equity - like opportunities – Generate current income to utilize SWK’s substantial NOL asset, $154mm as of December 31, 2021 * Effective yield is the rate at which income is expected to be recognized pursuant to the Company’s revenue recognition poli cie s, if all payments are received pursuant to the terms of the finance receivable; excludes warrants ** Numerator is specialty finance division’s adjusted non - GAAP net income; Denominator is shareholders equity less the deferred tax asset and Enteris PP&E and net intangibles and goodwill, which adds - back the contingent consideration payable Ma3

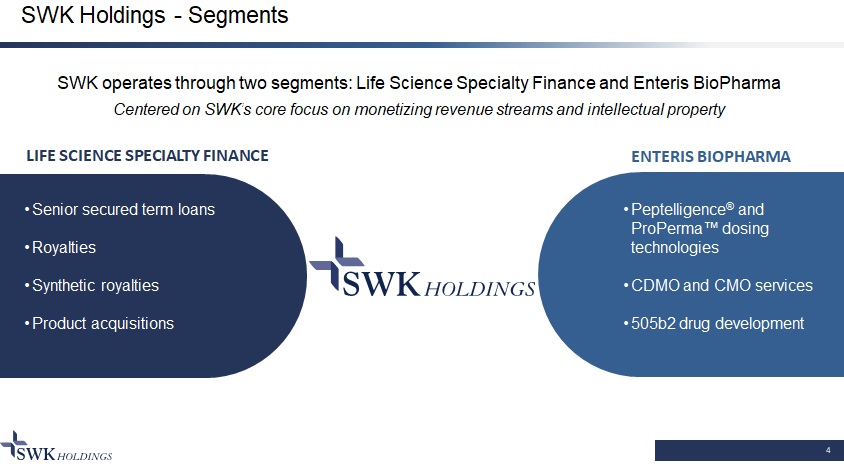

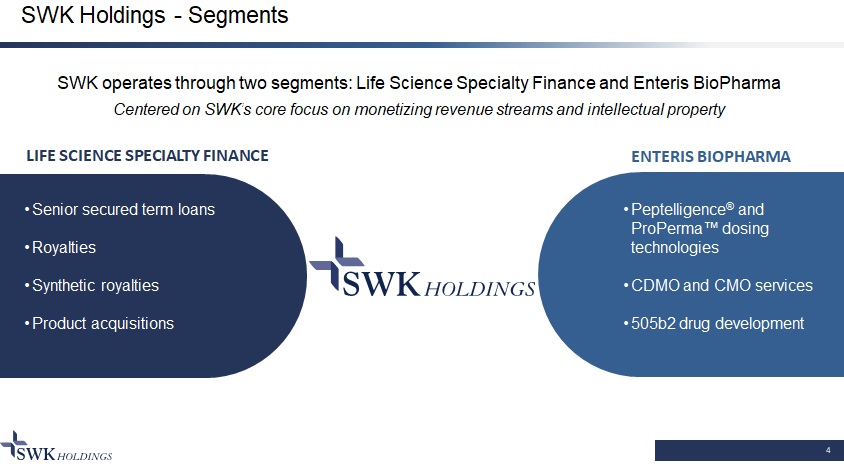

4 SWK Holdings - Segments LIFE SCIENCE SPECIALTY FINANCE ENTERIS BIOPHARMA • Senior secured term loans • Royalties • Synthetic royalties • Product acquisitions • Peptelligence ® and ProPerma Œ dosing technologies • CDMO and CMO services • 505b2 drug development SWK operates through two segments: Life Science Specialty Finance and Enteris BioPharma Centered on SWK’s core focus on monetizing revenue streams and intellectual property

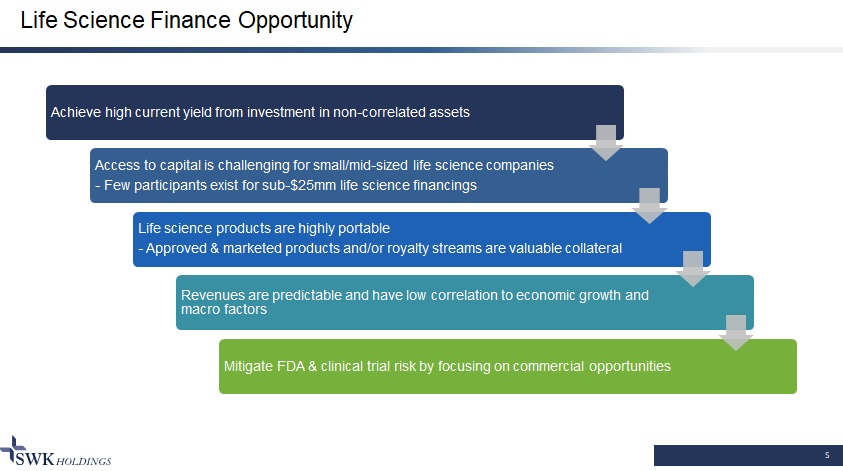

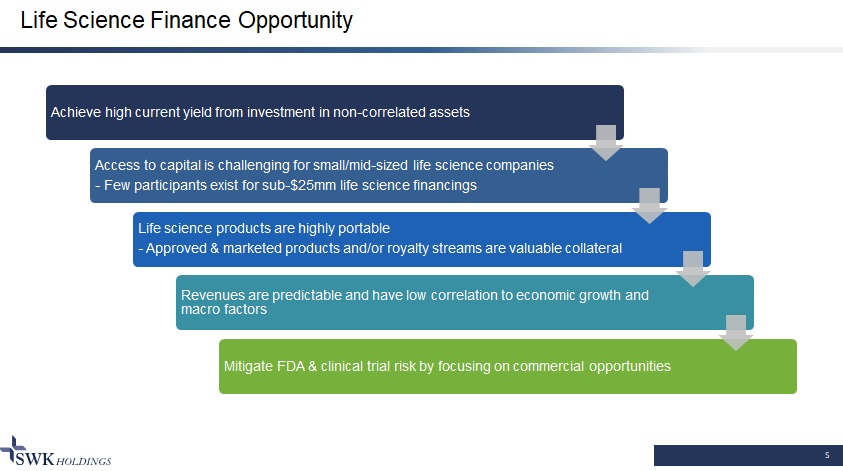

5 Life Science Finance Opportunity Achieve high current yield from investment in non - correlated assets Access to capital is challenging for small/mid - sized life science companies - Few participants exist for sub - $25mm life science financings Life science products are highly portable - Approved & marketed products and/or royalty streams are valuable collateral Revenues are predictable and have low correlation to economic growth and macro factors Mitigate FDA & clinical trial risk by focusing on commercial opportunities

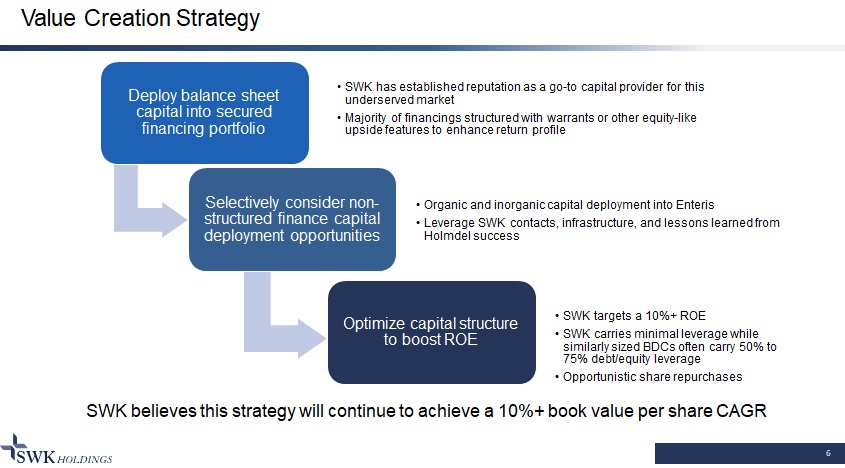

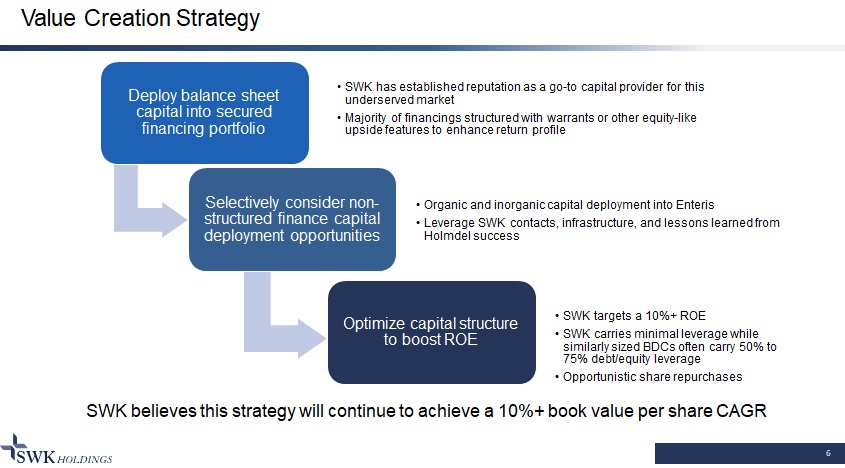

6 Value Creation Strategy Deploy balance sheet capital into secured financing portfolio • SWK has established reputation as a go - to capital provider for this underserved market • Majority of financings structured with warrants or other equity - like upside features to enhance return profile Selectively consider non - structured finance capital deployment opportunities • Organic and inorganic capital deployment into Enteris • Leverage SWK contacts, infrastructure, and lessons learned from Holmdel success Optimize capital structure to boost ROE • SWK targets a 10%+ ROE • SWK carries minimal leverage while similarly sized BDCs often carry 50% to 75% debt/equity leverage • Opportunistic share repurchases SWK believes this strategy will continue to achieve a 10%+ book value per share CAGR

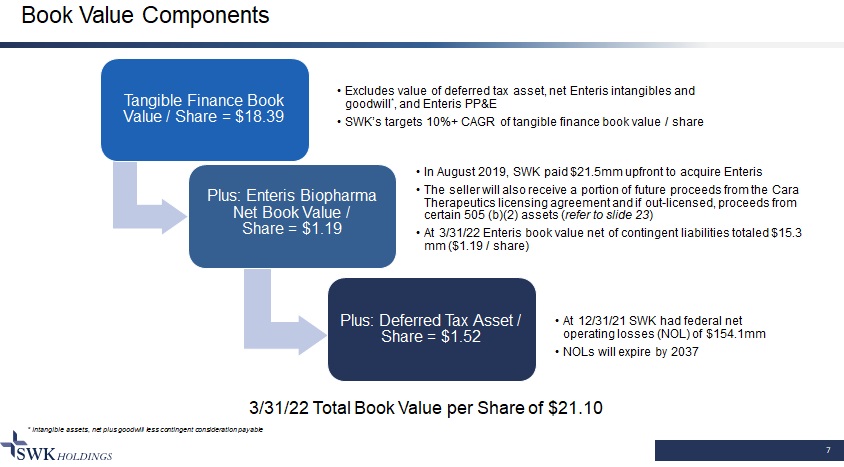

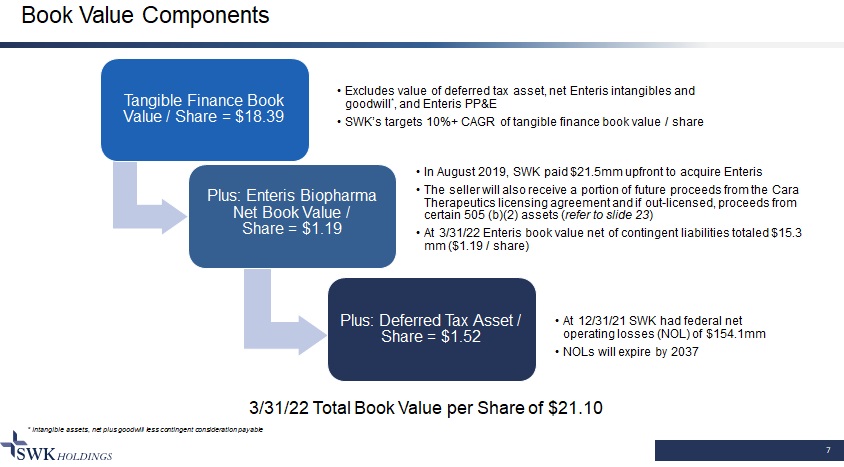

7 Book Value Components Tangible Finance Book Value / Share = $18.39 • Excludes value of deferred tax asset, net Enteris intangibles and goodwill * , and Enteris PP&E • SWK’s targets 10%+ CAGR of tangible finance book value / share Plus: Enteris Biopharma Net Book Value / Share = $1.19 • In August 2019, SWK paid $21.5mm upfront to acquire Enteris • The seller will also receive a portion of future proceeds from the Cara Therapeutics licensing agreement and if out - licensed, proceeds from certain 505 (b)(2) assets ( refer to slide 23 ) • At 3/31/22 Enteris book value net of contingent liabilities totaled $15.3 mm ($1.19 / share) Plus: Deferred Tax Asset / Share = $1.52 • At 12/31/21 SWK had federal net operating losses (NOL) of $154.1mm • NOLs will expire by 2037 3/31/22 Total Book Value per Share of $21.10 * Intangible assets, net plus goodwill less contingent consideration payable

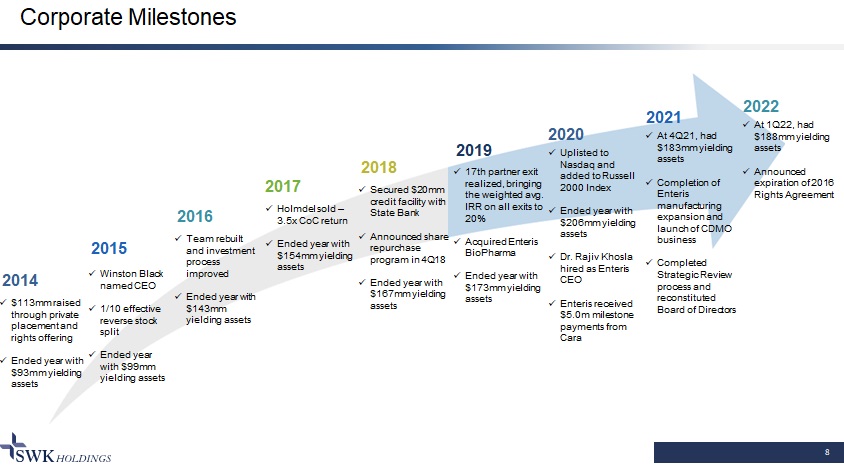

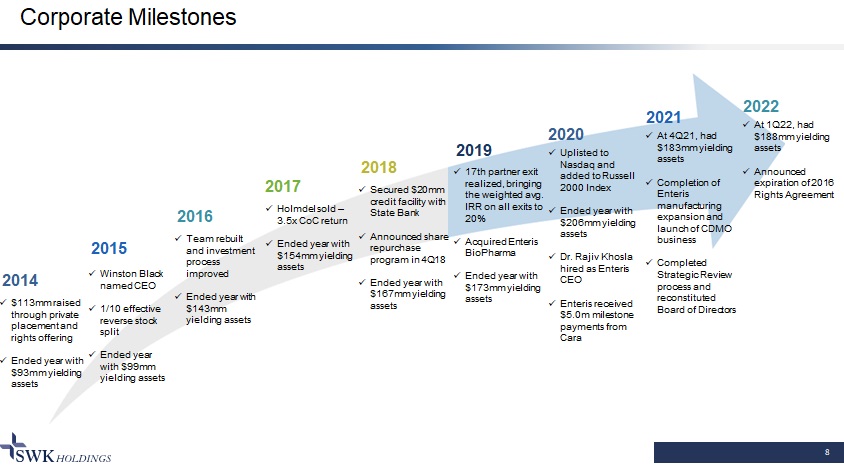

8 Corporate Milestones 2014 x $113mm raised through private placement and rights offering x Ended year with $93mm yielding assets 2015 x Winston Black named CEO x 1/10 effective reverse stock split x Ended year with $99mm yielding assets 2016 x Team rebuilt and investment process improved x Ended year with $143mm yielding assets 2017 x Holmdel sold – 3.5x CoC return x Ended year with $154mm yielding assets 2018 2019 2020 x Secured $20mm credit facility with State Bank x Announced share repurchase program in 4Q18 x Ended year with $167mm yielding assets x 17th partner exit realized, bringing the weighted avg. IRR on all exits to 20% x Acquired Enteris BioPharma x Ended year with $173mm yielding assets x Uplisted to Nasdaq and added to Russell 2000 Index x Ended year with $206mm yielding assets x Dr. Rajiv Khosla hired as Enteris CEO x Enteris received $5.0m milestone payments from Cara 2021 x At 4Q21, had $183mm yielding assets x Completion of Enteris manufacturing expansion and launch of CDMO business x Completed Strategic Review process and reconstituted Board of Directors 2022 x At 1Q22, had $188mm yielding assets x Announced expiration of 2016 Rights Agreement

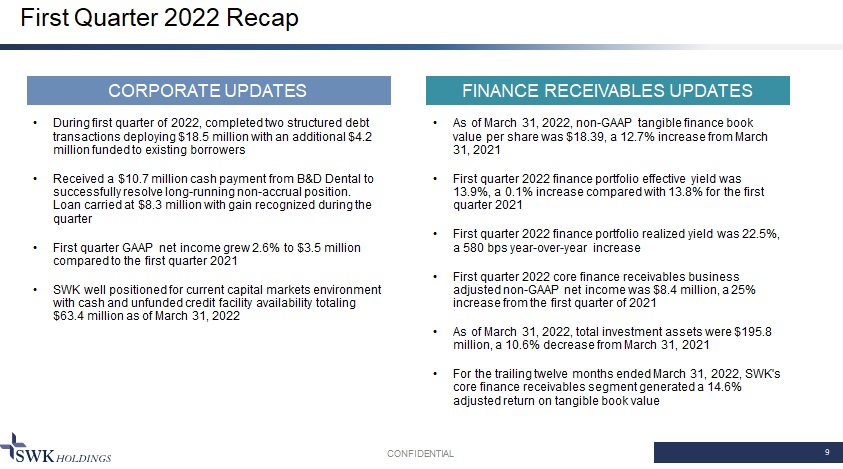

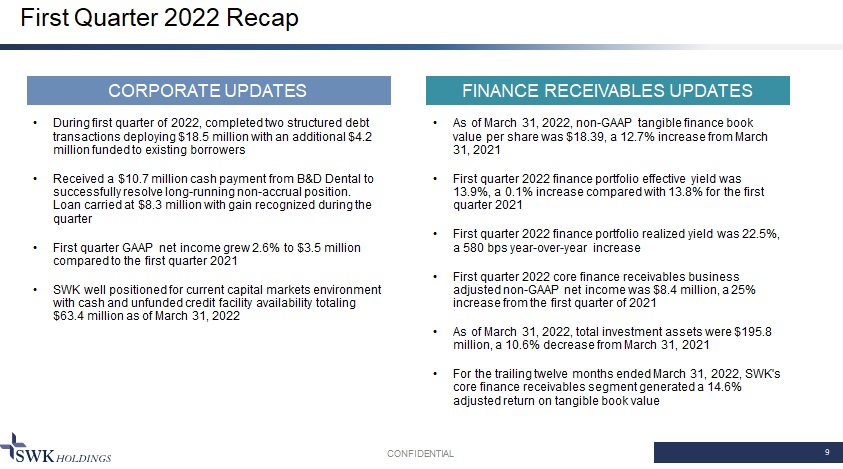

First Quarter 2022 Recap 9 CONFIDENTIAL CORPORATE UPDATES FINANCE RECEIVABLES UPDATES • During first quarter of 2022, completed two structured debt transactions deploying $18.5 million with an additional $4.2 million funded to existing borrowers • Received a $10.7 million cash payment from B&D Dental to successfully resolve long - running non - accrual position. Loan carried at $8.3 million with gain recognized during the quarter • First quarter GAAP net income grew 2.6% to $3.5 million compared to the first quarter 2021 • SWK well positioned for current capital markets environment with cash and unfunded credit facility availability totaling $63.4 million as of March 31, 2022 • As of March 31, 2022, non - GAAP tangible finance book value per share was $18.39, a 12.7% increase from March 31, 2021 • First quarter 2022 finance portfolio effective yield was 13.9%, a 0.1% increase compared with 13.8% for the first quarter 2021 • First quarter 2022 finance portfolio realized yield was 22.5%, a 580 bps year - over - year increase • First quarter 2022 core finance receivables business adjusted non - GAAP net income was $8.4 million, a 25% increase from the first quarter of 2021 • As of March 31, 2022, total investment assets were $195.8 million, a 10.6% decrease from March 31, 2021 • For the trailing twelve months ended March 31, 2022, SWK's core finance receivables segment generated a 14.6% adjusted return on tangible book value

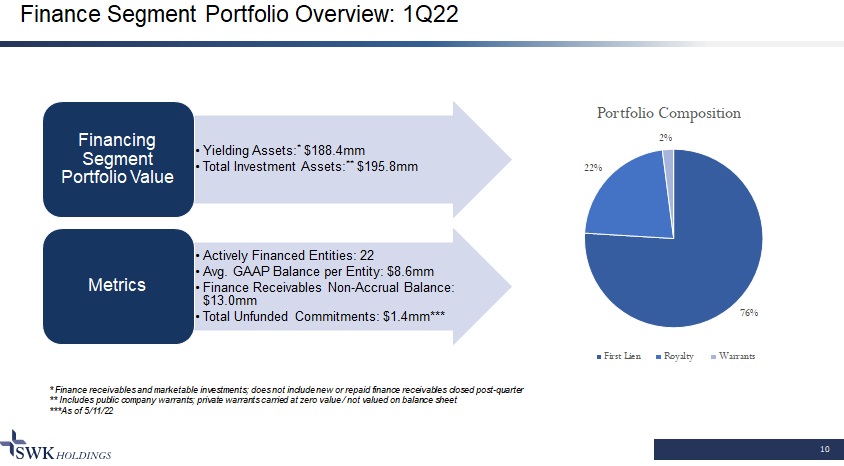

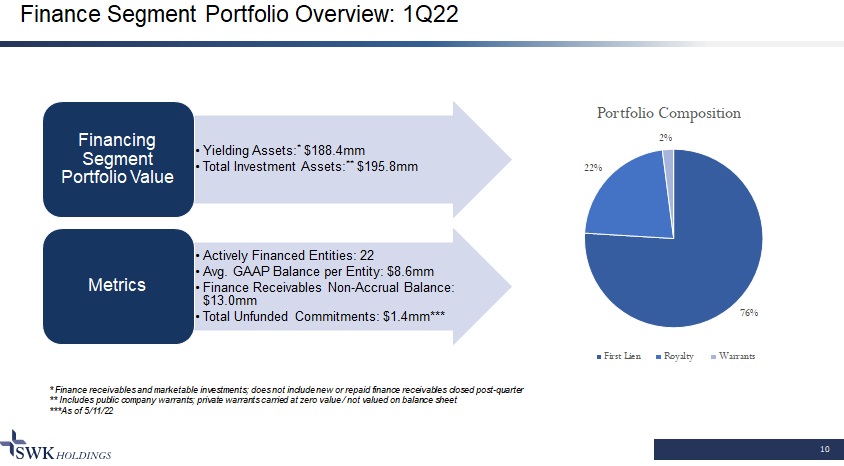

76% 22% 2% Portfolio Composition First Lien Royalty Warrants 10 Finance Segment Portfolio Overview: 1Q22 * Finance receivables and marketable investments; does not include new or repaid finance receivables closed post - quarter ** Includes public company warrants; private warrants carried at zero value / not valued on balance sheet ***As of 5/11/22 • Yielding Assets: * $188.4mm • Total Investment Assets: ** $195.8mm Financing Segment Portfolio Value • Actively Financed Entities: 22 • Avg. GAAP Balance per Entity: $8.6mm • Finance Receivables Non - Accrual Balance: $13.0mm • Total Unfunded Commitments: $ 1.4mm*** Metrics

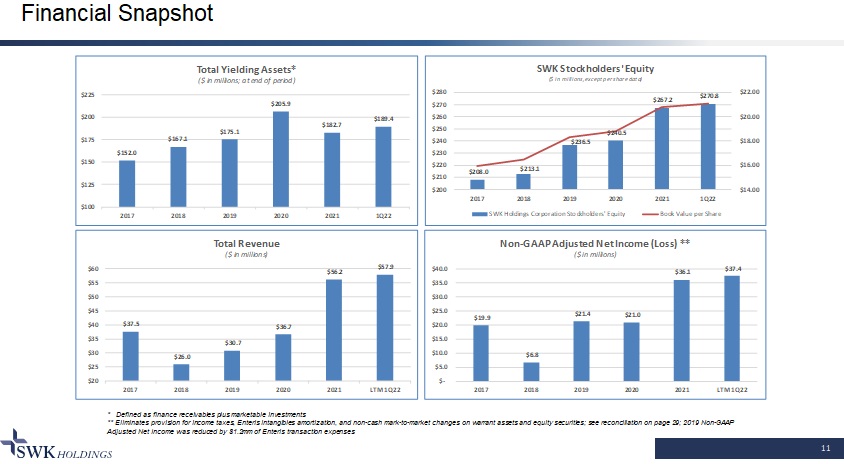

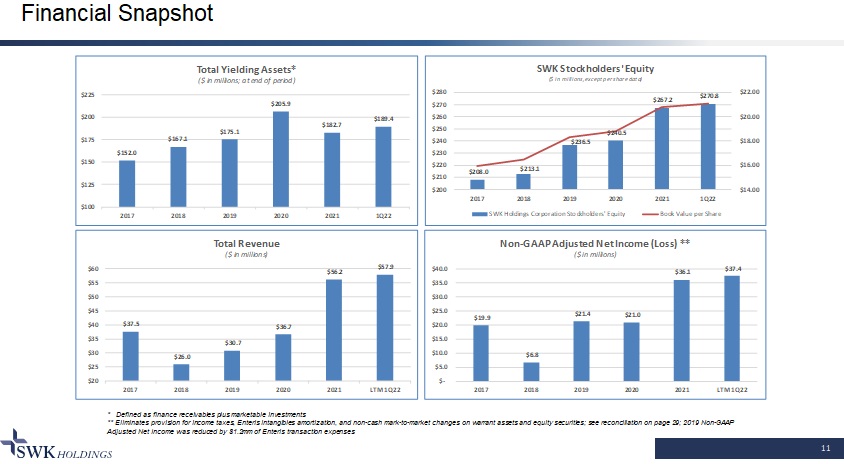

$152.0 $167.1 $175.1 $205.9 $182.7 $189.4 $100 $125 $150 $175 $200 $225 2017 2018 2019 2020 2021 1Q22 Total Yielding Assets* ($ in millions; at end of period) $37.5 $26.0 $30.7 $36.7 $56.2 $57.9 $20 $25 $30 $35 $40 $45 $50 $55 $60 2017 2018 2019 2020 2021 LTM 1Q22 Total Revenue ($ in millions) $208.0 $213.1 $236.5 $240.5 $267.2 $270.8 $14.00 $16.00 $18.00 $20.00 $22.00 $200 $210 $220 $230 $240 $250 $260 $270 $280 2017 2018 2019 2020 2021 1Q22 SWK Stockholders' Equity ($ in millions, except per share data) SWK Holdings Corporation Stockholders' Equity Book Value per Share $19.9 $6.8 $21.4 $21.0 $36.1 $37.4 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 2017 2018 2019 2020 2021 LTM 1Q22 Non - GAAP Adjusted Net Income (Loss) ** ($ in millions) 11 Financial Snapshot * Defined as finance receivables plus marketable investments ** Eliminates provision for income taxes, Enteris intangibles amortization, and non - cash mark - to - market changes on warrant asset s and equity securities; see reconciliation on page 29; 2019 Non - GAAP Adjusted Net Income was reduced by $1.2mm of Enteris transaction expenses

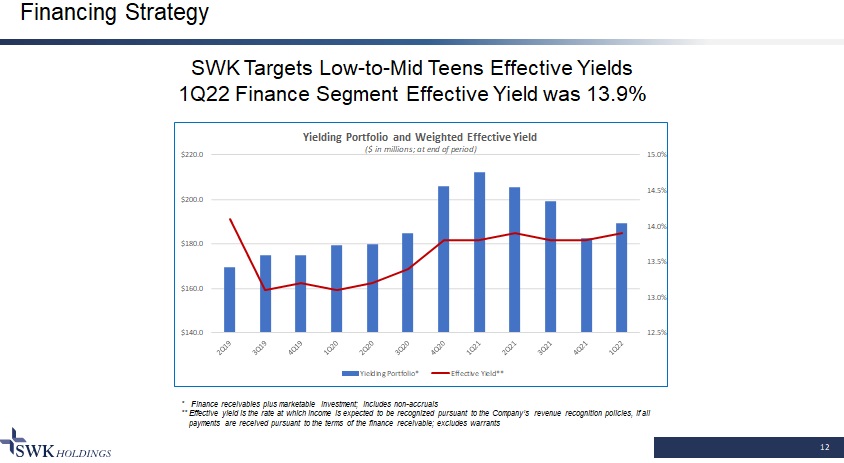

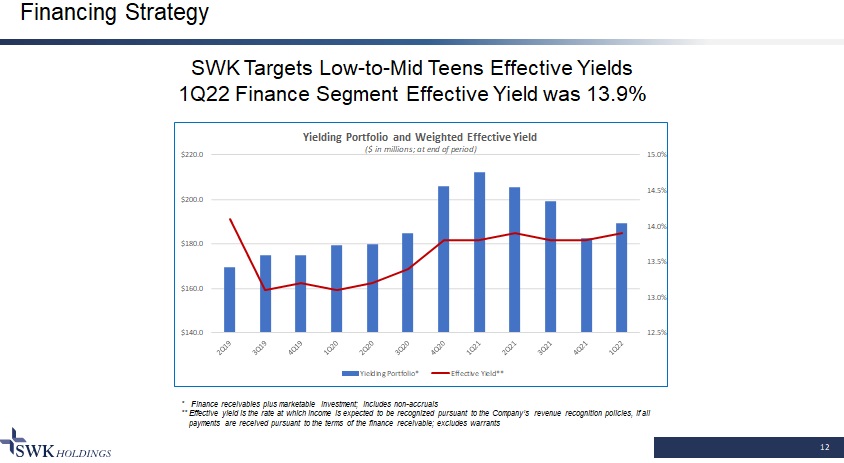

12.5% 13.0% 13.5% 14.0% 14.5% 15.0% $140.0 $160.0 $180.0 $200.0 $220.0 Yielding Portfolio and Weighted Effective Yield ($ in millions; at end of period) Yielding Portfolio* Effective Yield** 12 Financing Strategy SWK Targets Low - to - Mid Teens Effective Yields 1Q22 Finance Segment Effective Yield was 13.9% * Finance receivables plus marketable investment; includes non - accruals ** Effective yield is the rate at which income is expected to be recognized pursuant to the Company’s revenue recognition pol ici es, if all payments are received pursuant to the terms of the finance receivable; excludes warrants

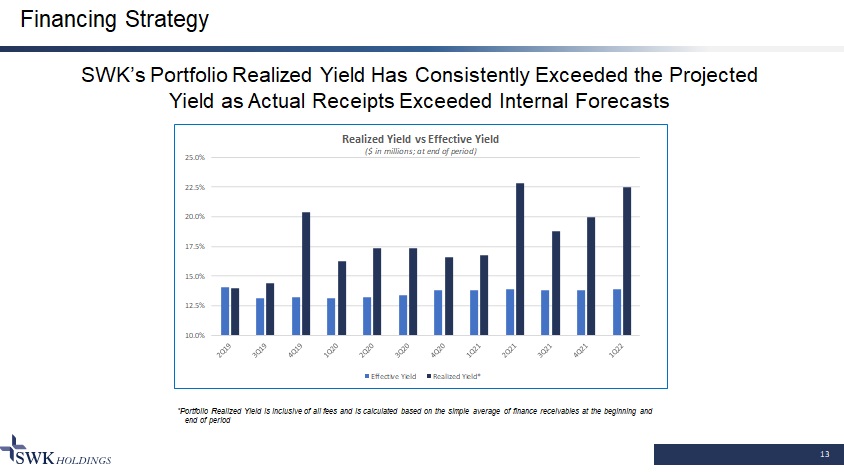

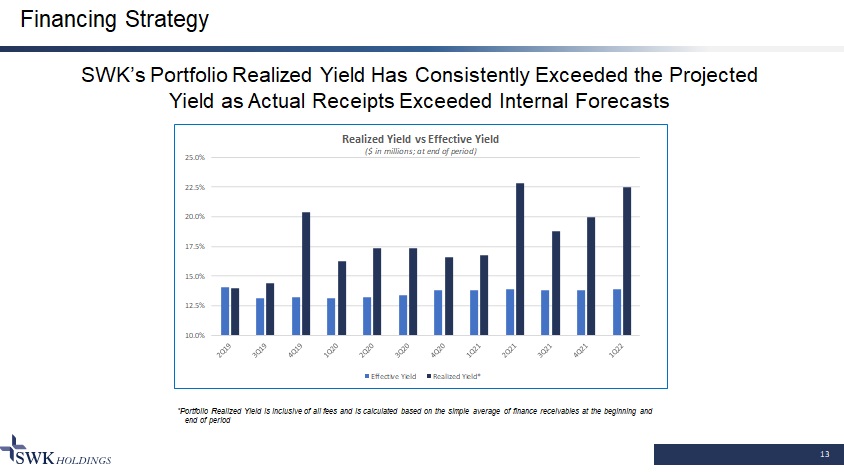

10.0% 12.5% 15.0% 17.5% 20.0% 22.5% 25.0% Realized Yield vs Effective Yield ($ in millions; at end of period) Effective Yield Realized Yield* 13 Financing Strategy SWK’s Portfolio Realized Yield Has Consistently Exceeded the Projected Yield as Actual Receipts Exceeded Internal Forecasts *Portfolio Realized Yield is inclusive of all fees and is calculated based on the simple average of finance receivables at th e b eginning and end of period

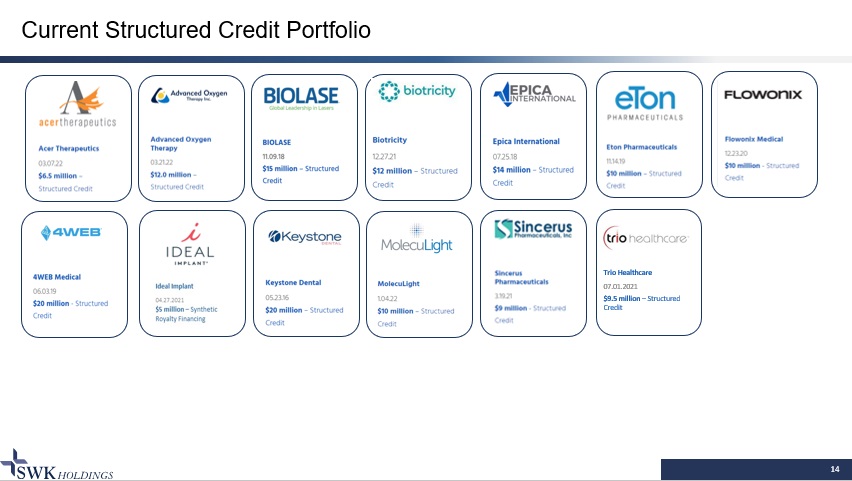

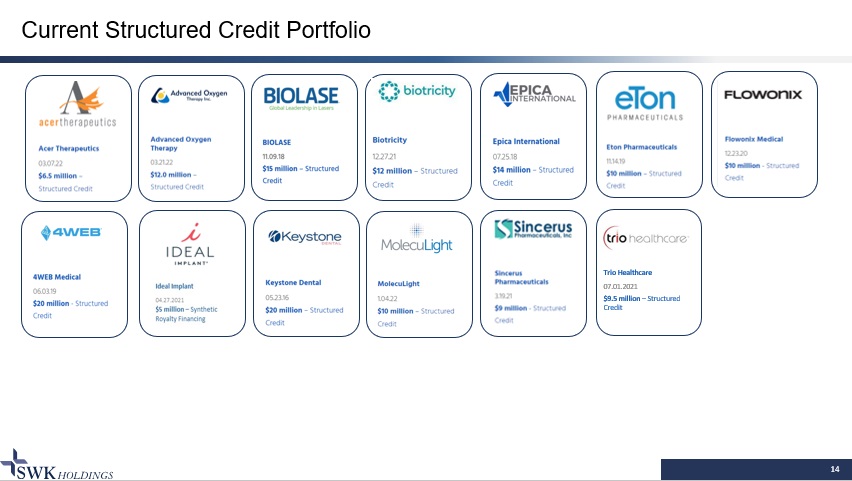

14 Current Structured Credit Portfolio Trio Healthcare 07.01.2021 $9.5 million – Structured Credit

15 Current Royalty Portfolio

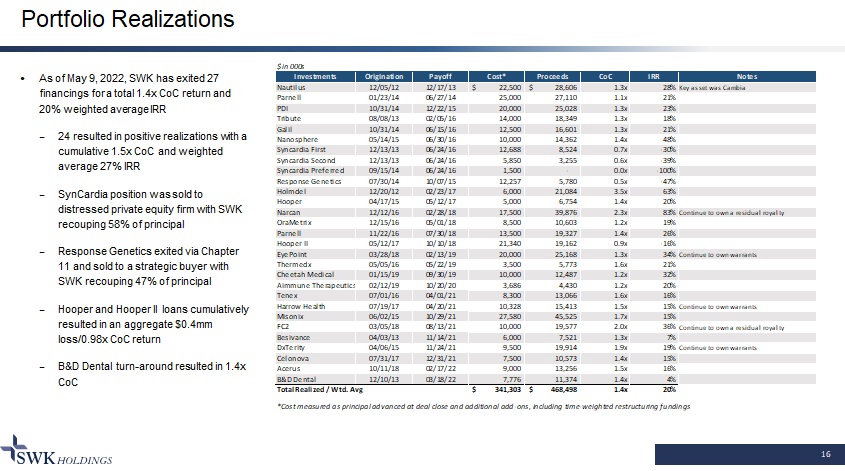

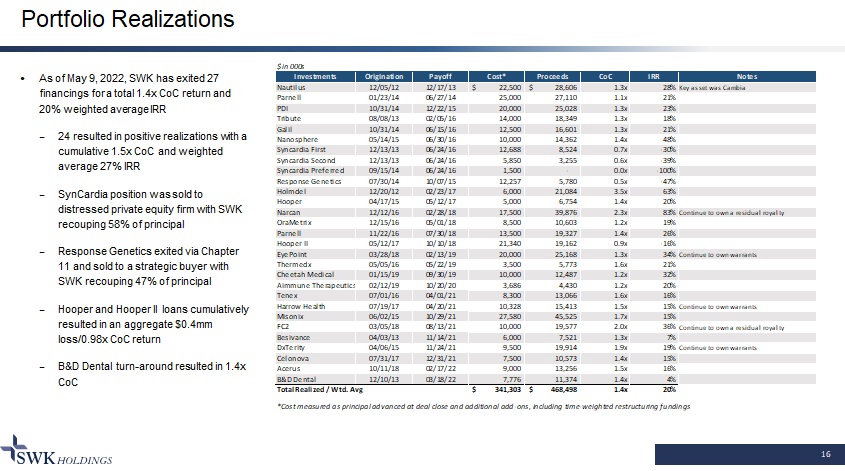

16 Portfolio Realizations As of May 9, 2022 , SWK has exited 27 financings for a total 1.4x CoC return and 20% weighted average IRR ̶ 24 resulted in positive realizations with a cumulative 1.5x CoC and weighted average 27% IRR ̶ SynCardia position was sold to distressed private equity firm with SWK recouping 58% of principal ̶ Response Genetics exited via Chapter 11 and sold to a strategic buyer with SWK recouping 47% of principal ̶ Hooper and Hooper II loans cumulatively resulted in an aggregate $0.4mm loss/0.98x CoC return ̶ B&D Dental turn - around resulted in 1.4x CoC $ in 000s Investments Origination Payoff Cost* Proceeds CoC IRR Notes Nautilus 12/05/12 12/17/13 22,500$ 28,606$ 1.3x 28% Key asset was Cambia Parnell 01/23/14 06/27/14 25,000 27,110 1.1x 21% PDI 10/31/14 12/22/15 20,000 25,028 1.3x 23% Tribute 08/08/13 02/05/16 14,000 18,349 1.3x 18% Galil 10/31/14 06/15/16 12,500 16,601 1.3x 21% Nanosphere 05/14/15 06/30/16 10,000 14,362 1.4x 48% Syncardia First 12/13/13 06/24/16 12,688 8,524 0.7x -30% Syncardia Second 12/13/13 06/24/16 5,850 3,255 0.6x -39% Syncardia Preferred 09/15/14 06/24/16 1,500 - 0.0x -100% Response Genetics 07/30/14 10/07/15 12,257 5,780 0.5x -47% Holmdel 12/20/12 02/23/17 6,000 21,084 3.5x 63% Hooper 04/17/15 05/12/17 5,000 6,754 1.4x 20% Narcan 12/12/16 02/28/18 17,500 39,876 2.3x 83% Continue to own a residual royalty OraMetrix 12/15/16 05/01/18 8,500 10,603 1.2x 19% Parnell 11/22/16 07/30/18 13,500 19,327 1.4x 26% Hooper II 05/12/17 10/10/18 21,340 19,162 0.9x -16% EyePoint 03/28/18 02/13/19 20,000 25,168 1.3x 34% Continue to own warrants Thermedx 05/05/16 05/22/19 3,500 5,773 1.6x 21% Cheetah Medical 01/15/19 09/30/19 10,000 12,487 1.2x 32% Aimmune Therapeutics 02/12/19 10/20/20 3,686 4,430 1.2x 20% Tenex 07/01/16 04/01/21 8,300 13,066 1.6x 16% Harrow Health 07/19/17 04/20/21 10,328 15,413 1.5x 15% Continue to own warrants Misonix 06/02/15 10/29/21 27,580 45,525 1.7x 15% FC2 03/05/18 08/13/21 10,000 19,577 2.0x 36% Continue to own a residual royalty Besivance 04/03/13 11/14/21 6,000 7,521 1.3x 7% DxTerity 04/06/15 11/24/21 9,500 19,914 1.9x 19% Continue to own warrants Celonova 07/31/17 12/31/21 7,500 10,573 1.4x 15% Acerus 10/11/18 02/17/22 9,000 13,256 1.5x 16% B&D Dental 12/10/13 03/18/22 7,776 11,374 1.4x 4% Total Realized / Wtd. Avg 341,303$ 468,498$ 1.4x 20% *Cost measured as principal advanced at deal close and additional add-ons, including time-weighted restructuring fundings

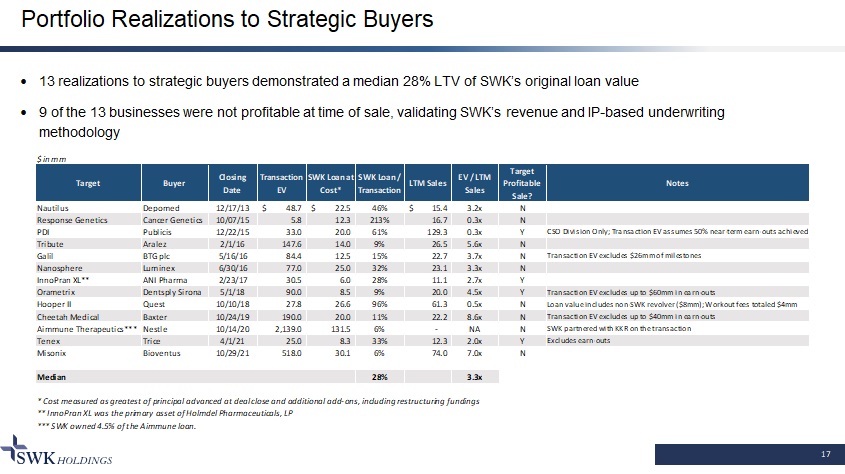

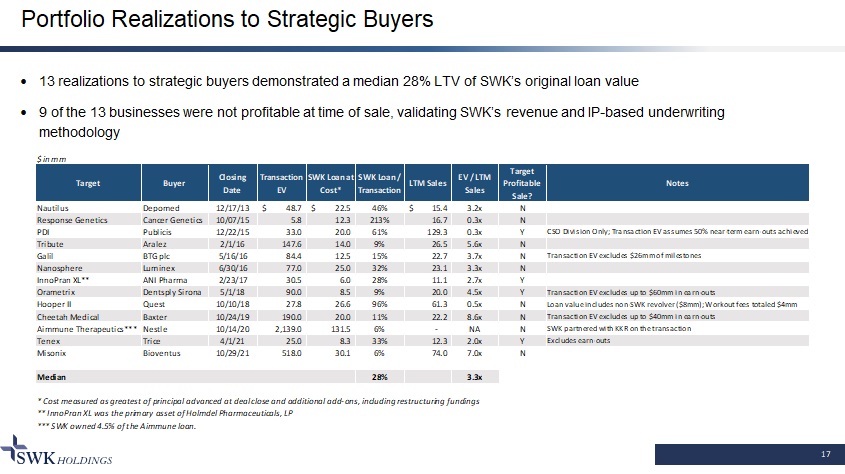

17 Portfolio Realizations to Strategic Buyers 13 realizations to strategic buyers demonstrated a median 28% LTV of SWK’s original loan value 9 of the 13 businesses were not profitable at time of sale, validating SWK’s revenue and IP - based underwriting methodology $ in mm Target Buyer Closing Date Transaction EV SWK Loan at Cost* SWK Loan / Transaction LTM Sales EV / LTM Sales Target Profitable Sale? Notes Nautilus Depomed 12/17/13 48.7$ 22.5$ 46% 15.4$ 3.2x N Response Genetics Cancer Genetics 10/07/15 5.8 12.3 213% 16.7 0.3x N PDI Publicis 12/22/15 33.0 20.0 61% 129.3 0.3x Y CSO Division Only; Transaction EV assumes 50% near-term earn-outs achieved Tribute Aralez 2/1/16 147.6 14.0 9% 26.5 5.6x N Galil BTG plc 5/16/16 84.4 12.5 15% 22.7 3.7x N Transaction EV excludes $26mm of milestones Nanosphere Luminex 6/30/16 77.0 25.0 32% 23.1 3.3x N InnoPran XL** ANI Pharma 2/23/17 30.5 6.0 28% 11.1 2.7x Y Orametrix Dentsply Sirona 5/1/18 90.0 8.5 9% 20.0 4.5x Y Transaction EV excludes up to $60mm in earn-outs Hooper II Quest 10/10/18 27.8 26.6 96% 61.3 0.5x N Loan value includes non-SWK revolver ($8mm); Workout fees totaled $4mm Cheetah Medical Baxter 10/24/19 190.0 20.0 11% 22.2 8.6x N Transaction EV excludes up to $40mm in earn-outs Aimmune Therapeutics*** Nestle 10/14/20 2,139.0 131.5 6% - NA N SWK partnered with KKR on the transaction Tenex Trice 4/1/21 25.0 8.3 33% 12.3 2.0x Y Excludes earn-outs Misonix Bioventus 10/29/21 518.0 30.1 6% 74.0 7.0x N Median 28% 3.3x * Cost measured as greatest of principal advanced at deal close and additional add-ons, including restructuring fundings ** InnoPran XL was the primary asset of Holmdel Pharmaceuticals, LP *** SWK owned 4.5% of the Aimmune loan.

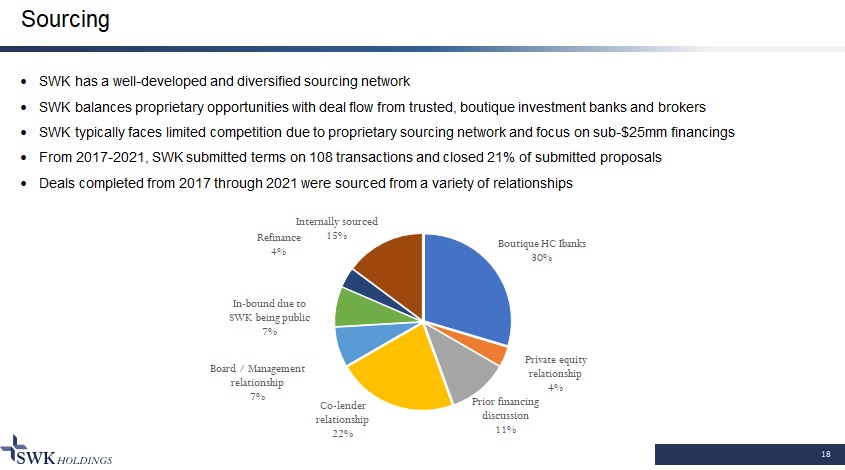

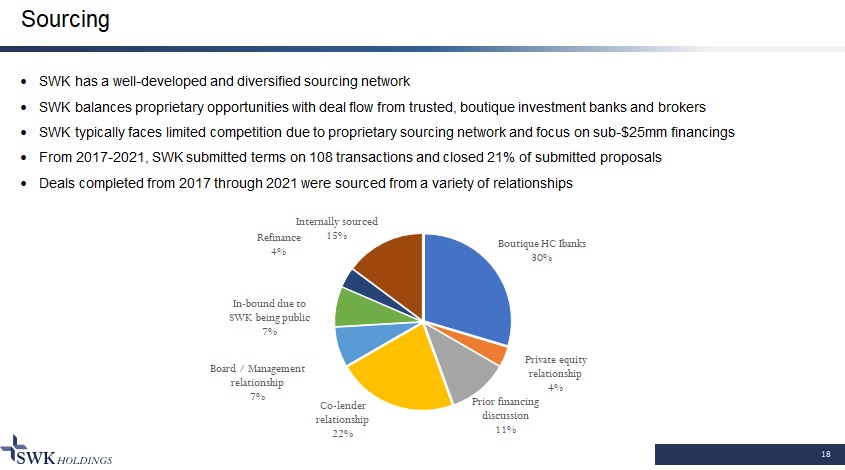

18 Sourcing SWK has a well - developed and diversified sourcing network SWK balances proprietary opportunities with deal flow from trusted, boutique investment banks and brokers SWK typically faces limited competition due to proprietary sourcing network and focus on sub - $25mm financings From 2017 - 2021, SWK submitted terms on 108 transactions and closed 21% of submitted proposals Deals completed from 2017 through 2021 were sourced from a variety of relationships Boutique HC Ibanks 30% Private equity relationship 4% Prior financing discussion 11% Co - lender relationship 22% Board / Management relationship 7% In - bound due to SWK being public 7% Refinance 4% Internally sourced 15%

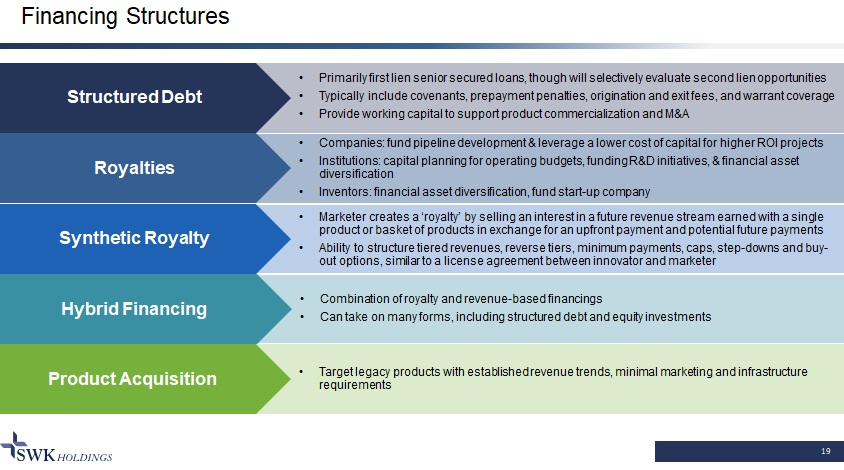

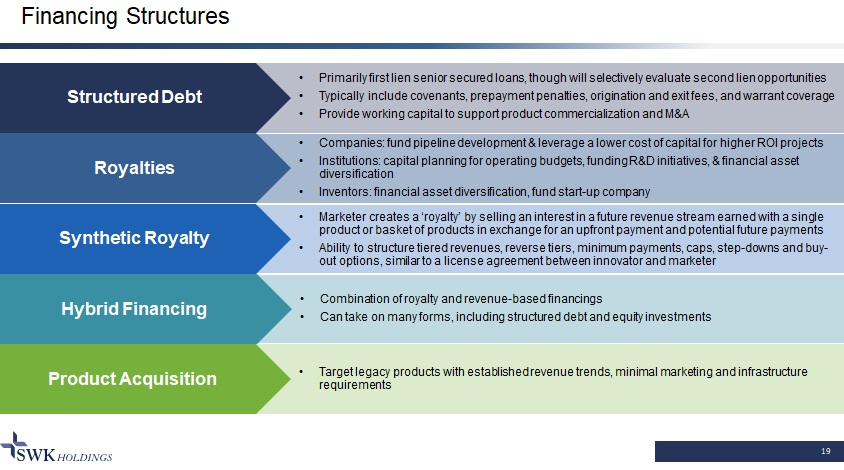

Financing Structures 19 Product Acquisition • Primarily first lien senior secured loans, though will selectively evaluate second lien opportunities • Typically include covenants, prepayment penalties, origination and exit fees, and warrant coverage • Provide working capital to support product commercialization and M&A Hybrid Financing Synthetic Royalty Royalties Structured Debt • Companies: fund pipeline development & leverage a lower cost of capital for higher ROI projects • Institutions: capital planning for operating budgets, funding R&D initiatives, & financial asset diversification • Inventors: financial asset diversification, fund start - up company • Marketer creates a ‘royalty’ by selling an interest in a future revenue stream earned with a single product or basket of products in exchange for an upfront payment and potential future payments • Ability to structure tiered revenues, reverse tiers, minimum payments, caps, step - downs and buy - out options, similar to a license agreement between innovator and marketer • Combination of royalty and revenue - based financings • Can take on many forms, including structured debt and equity investments • Target legacy products with established revenue trends, minimal marketing and infrastructure requirements

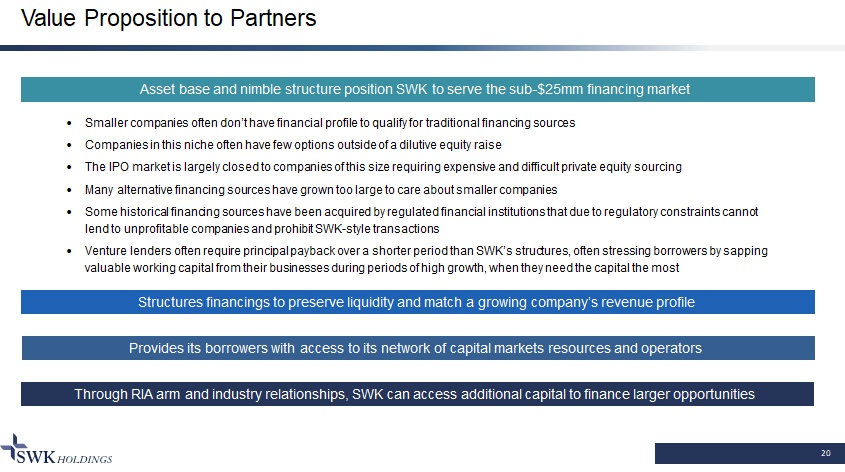

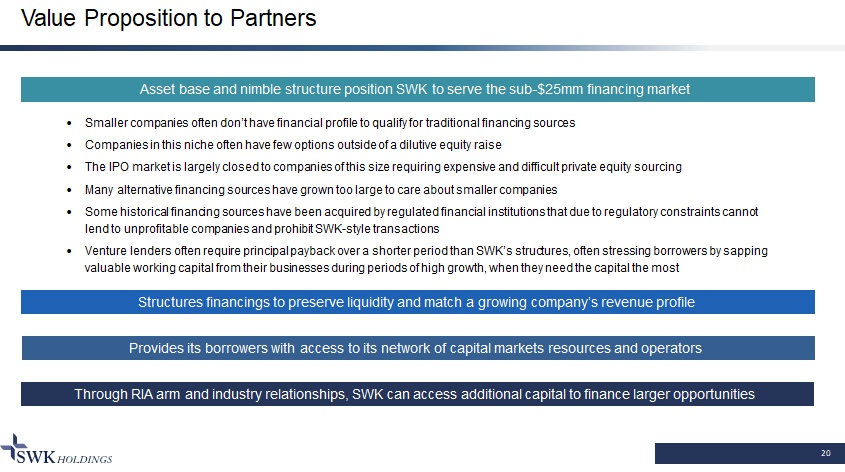

20 Value Proposition to Partners Smaller companies often don’t have financial profile to qualify for traditional financing sources Companies in this niche often have few options outside of a dilutive equity raise The IPO market is largely closed to companies of this size requiring expensive and difficult private equity sourcing Many alternative financing sources have grown too large to care about smaller companies Some historical financing sources have been acquired by regulated financial institutions that due to regulatory constraints c ann ot lend to unprofitable companies and prohibit SWK - style transactions Venture lenders often require principal payback over a shorter period than SWK’s structures, often stressing borrowers by sap pin g valuable working capital from their businesses during periods of high growth, when they need the capital the most Through RIA arm and industry relationships, SWK can access additional capital to finance larger opportunities Structures financings to preserve liquidity and match a growing company’s revenue profile Provides its borrowers with access to its network of capital markets resources and operators Asset base and nimble structure position SWK to serve the sub - $25mm financing market

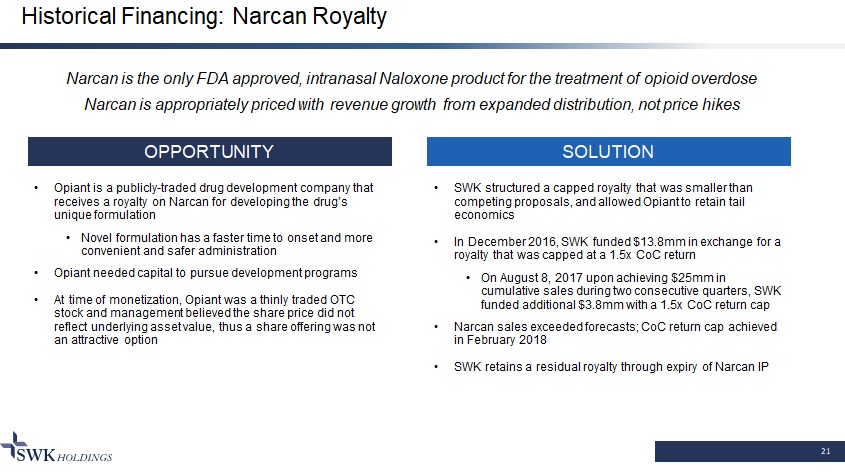

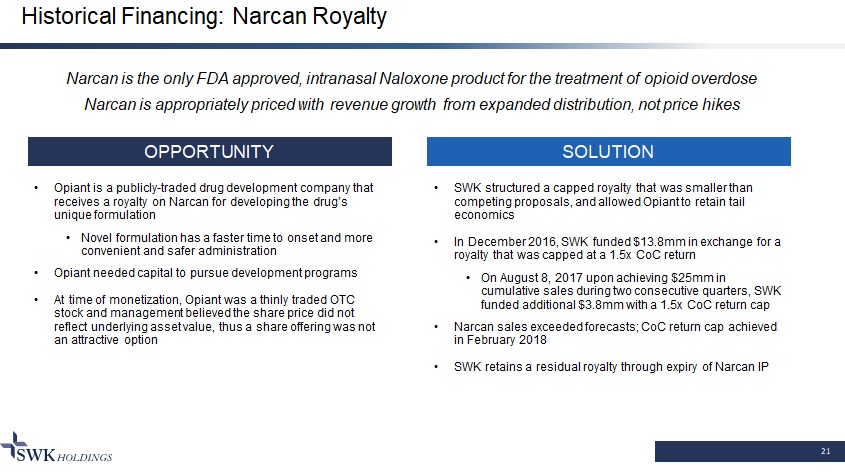

Historical Financing: Narcan Royalty 21 OPPORTUNITY SOLUTION • Opiant is a publicly - traded drug development company that receives a royalty on Narcan for developing the drug’s unique formulation • Novel formulation has a faster time to onset and more convenient and safer administration • Opiant needed capital to pursue development programs • At time of monetization, Opiant was a thinly traded OTC stock and management believed the share price did not reflect underlying asset value, thus a share offering was not an attractive option • SWK structured a capped royalty that was smaller than competing proposals, and allowed Opiant to retain tail economics • In December 2016, SWK funded $13.8mm in exchange for a royalty that was capped at a 1.5x CoC return • On August 8, 2017 upon achieving $25mm in cumulative sales during two consecutive quarters, SWK funded additional $3.8mm with a 1.5x CoC return cap • Narcan sales exceeded forecasts; CoC return cap achieved in February 2018 • SWK retains a residual royalty through expiry of Narcan IP Narcan is the only FDA approved, intranasal Naloxone product for the treatment of opioid overdose Narcan is appropriately priced with revenue growth from expanded distribution, not price hikes

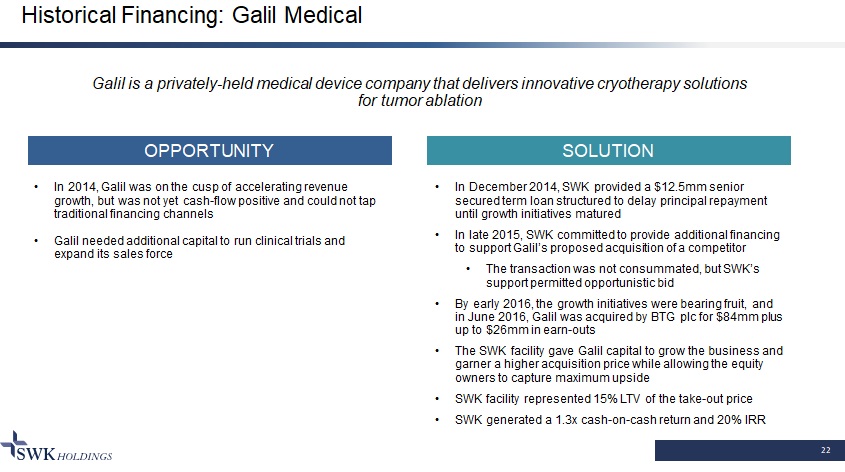

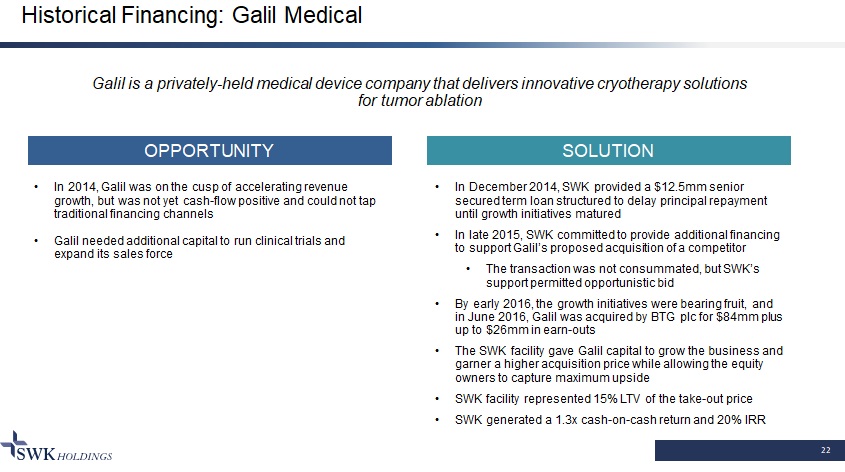

Historical Financing: Galil Medical 22 OPPORTUNITY SOLUTION • In 2014, Galil was on the cusp of accelerating revenue growth, but was not yet cash - flow positive and could not tap traditional financing channels • Galil needed additional capital to run clinical trials and expand its sales force • In December 2014, SWK provided a $12.5mm senior secured term loan structured to delay principal repayment until growth initiatives matured • In late 2015, SWK committed to provide additional financing to support Galil’s proposed acquisition of a competitor • The transaction was not consummated, but SWK’s support permitted opportunistic bid • By early 2016, the growth initiatives were bearing fruit, and in June 2016, Galil was acquired by BTG plc for $84mm plus up to $26mm in earn - outs • The SWK facility gave Galil capital to grow the business and garner a higher acquisition price while allowing the equity owners to capture maximum upside • SWK facility represented 15% LTV of the take - out price • SWK generated a 1.3x cash - on - cash return and 20% IRR Galil is a privately - held medical device company that delivers innovative cryotherapy solutions for tumor ablation

Enteris BioPharma Acquisition – A Transformational Opportunity 23 • Natural extension to SWK’s existing royalty monetization business, which generates income via royalties on life science products in a mix of structures • Enteris offers opportunity to create wholly - owned portfolio of milestones and royalties on IP - protected biotherapeutics with substantial upside optionality • Attractive valuation with SWK buying undervalued portfolio of “call options” of current & future licenses, owned drug candidate assets, and CDMO / CMO operations Synergistic & Value Enhancing Highly Favorable Deal Economics “Game - Changing” Platform Technology Strong Company; Positioned for Success • Ongoing Cara milestone payments further derisk purchase price: – Q4 2020, Enteris received milestone payments of $5.0mm from Cara with SWK retaining $3.0mm – Q2 2021, Enteris received a $10.0mm milestone payment from Cara, with SWK retaining $3.9mm – Q4 2021, Enteris received a $5.0mm milestone payment from Cara, with SWK retaining $3.0mm • Peptelligence and ProPerma enable oral conversion of peptides and difficult to formulate small molecules • Targets substantial market and serves as cornerstone for “asset - light” licensing revenue model. Four feasibility studies ongoing as of 1Q22 • Franchise - like model (“multiple shots on goal”) leverages partners’ R&D and commercialization spend • Existing 505(b)(2) pharmaceutical development candidates plus ability to internally expand owned - product portfolio creates engine for additional future licenses • Enteris possesses proven technology, clinical experience and in - house manufacturing which is unique compared with peers, some of which sport multi - hundred million dollar market values • In 2021, announced completion of manufacturing facility expansion and launch of CMO business • Experienced management team buttressed by 2020 hiring of CMO and CEO

24 Enteris Corporate Overview Commercial Platform Proven Technology, Late - Stage Commercial Partnerships, and Internal Pipeline Drug Delivery Technology Internal 505(b)(2) Pipeline Company Highlights • Peptelligence and ProPerma allow for oral delivery of drugs that are typically injected, including peptides and BCS class II, III, and IV small molecules • Extensive intellectual property estate with protection through 2036 • Peptelligence licenses, including Cara Therapeutics, and development work with several large pharmaceutical partners including four feasibility studies as of 1Q22 • Generates revenue three ways: – Formulation and development work – Clinical trial tablet manufacturing – Technology licenses consisting of milestones and royalties • Upgraded high potency manufacturing cGMP operational in 2021 • Oral leuprolide – Indications: Pediatric rare disease and female health • Other candidates currently under evaluation • Dr. Gary Shangold hired in January 2020 to optimize 505(b)(2) strategy • Privately held company based in Boonton, New Jersey • To operate as a wholly - owned subsidiary, run by experienced management • Rajiv Khosla, Ph.D. appointed as Chief Executive Officer in May 2020 • Over time SWK anticipates Enteris will develop multiple “shots on goal” value proposition

Enteris: Cara Therapeutics and Oral KORSUVA Œ 25 Oral KORSUVA Licensing Agreement Milestone Payment • Formulated with Enteris’ Peptelligence technology • Currently the subject of four late - stage clinical trials for pruritus • Phase 2 trial targeting pruritus in patients with CKD produced positive top - line results • Cara has indicated that it plans to initiate a Phase 3 program in 2022 • Licensing agreement between Enteris and Cara announced in August 2019 • Non - exclusive, royalty - bearing license for Peptelligence to develop, manufacture and commercialize Oral KORSUVA worldwide, excluding Japan and South Korea • Enteris eligible to receive milestone payments and low single - digit royalties • Enteris has received a total of $28.0mm in upfront and milestones payments from Cara to date of which $9.9mm has been retained by SWK • The latest Cara milestone payment of $5.0mm was received in Q4 2021, with SWK retaining $3.0mm • SWK eligible to receive additional potential milestone payments over the next several quarters (subject to the achievement of certain development milestones) Successful completion of Cara milestones will validate both the Peptelligence platform and the breadth and depth of Enteris’ comprehensive pharmaceutical capabilities

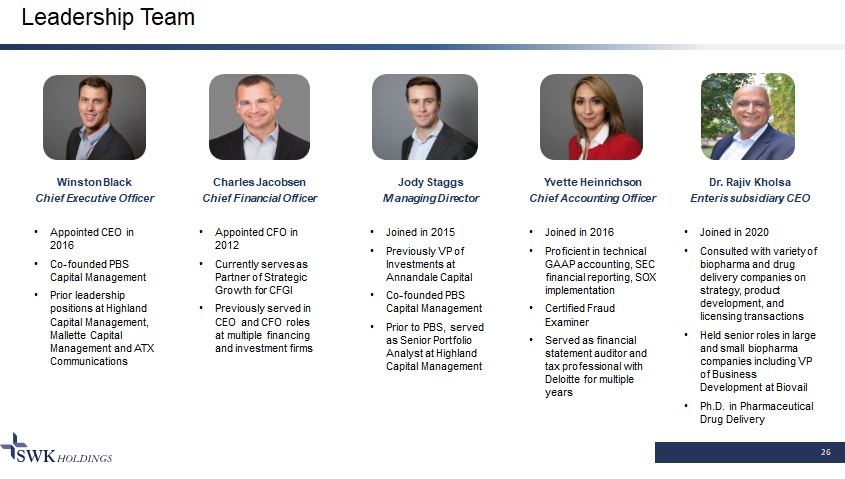

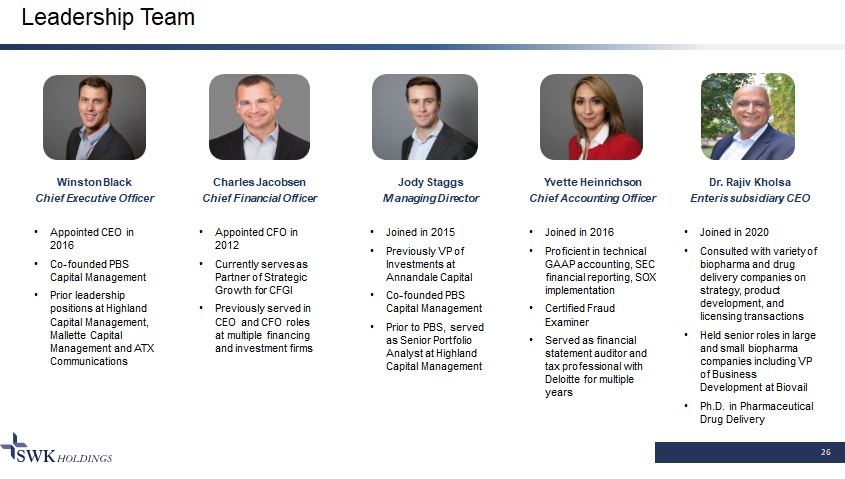

26 Leadership Team Winston Black Chief Executive Officer • Appointed CEO in 2016 • Co - founded PBS Capital Management • Prior leadership positions at Highland Capital Management, Mallette Capital Management and ATX Communications Charles Jacobsen Chief Financial Officer • Appointed CFO in 2012 • Currently serves as Partner of Strategic Growth for CFGI • Previously served in CEO and CFO roles at multiple financing and investment firms Jody Staggs Managing Director • Joined in 2015 • Previously VP of Investments at Annandale Capital • Co - founded PBS Capital Management • Prior to PBS, served as Senior Portfolio Analyst at Highland Capital Management Yvette Heinrichson Chief Accounting Officer • Joined in 2016 • Proficient in technical GAAP accounting, SEC financial reporting, SOX implementation • Certified Fraud Examiner • Served as financial statement auditor and tax professional with Deloitte for multiple years Dr. Rajiv Kholsa Enteris subsidiary CEO • Joined in 2020 • Consulted with variety of biopharma and drug delivery companies on strategy, product development, and licensing transactions • Held senior roles in large and small biopharma companies including VP of Business Development at Biovail • Ph.D. in Pharmaceutical Drug Delivery

27 Growth Opportunity LIFE SCIENCE SPECIALTY FINANCE ENTERIS BIOPHARMA • SWK’s has generated portfolio returns amongst the highest in the peer group • Deal pipeline remains strong with 2022 originations anticipated to return to historical levels • SWK confident in continued B/V per share growth of >10% per year • Evaluating larger credit facility as needed • Enhanced management team • Augmented BD function in place with four feasibility studies ongoing as of 1Q22 • Newly completed manufacturing expansion adds outsourced CDMO opportunity • Cara license remains strong 2022 setting stage for sustained period of growth and value creation at SWK

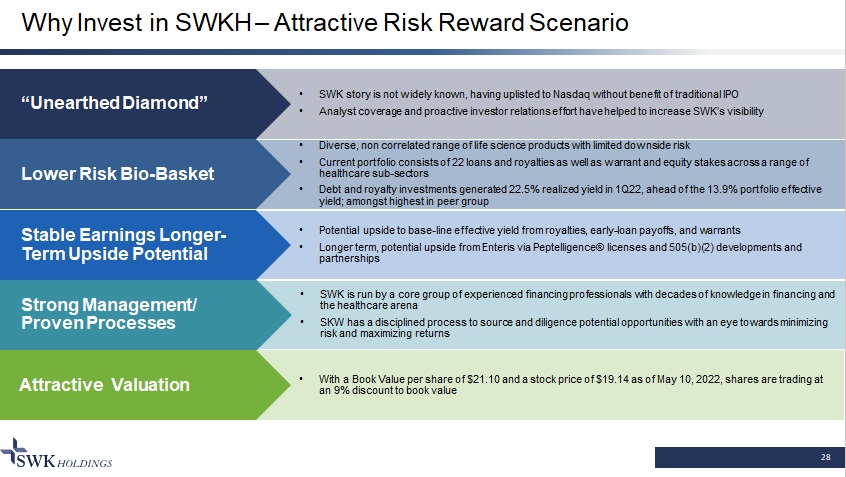

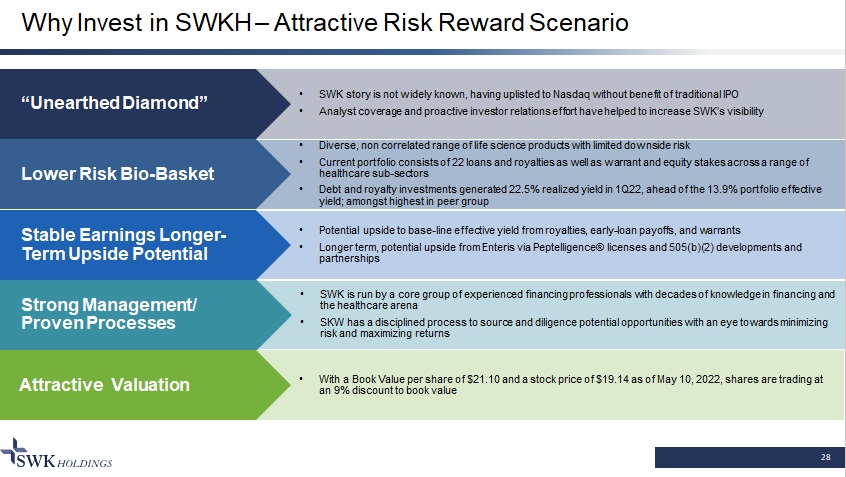

Why Invest in SWKH – Attractive Risk Reward Scenario 28 Attractive Valuation • SWK story is not widely known, having uplisted to Nasdaq without benefit of traditional IPO • Analyst coverage and proactive investor relations effort have helped to increase SWK’s visibility Strong Management/ Proven Processes Stable Earnings Longer - Term Upside Potential Lower Risk Bio - Basket “Unearthed Diamond” • Diverse, non correlated range of life science products with limited downside risk • Current portfolio consists of 22 loans and royalties as well as warrant and equity stakes across a range of healthcare sub - sectors • Debt and royalty investments generated 22.5% realized yield in 1Q22, ahead of the 13.9% portfolio effective yield; amongst highest in peer group • Potential upside to base - line effective yield from royalties, early - loan payoffs, and warrants • Longer term, potential upside from Enteris via Peptelligence® licenses and 505(b)(2) developments and partnerships • SWK is run by a core group of experienced financing professionals with decades of knowledge in financing and the healthcare arena • SKW has a disciplined process to source and diligence potential opportunities with an eye towards minimizing risk and maximizing returns • With a Book Value per share of $21.10 and a stock price of $19.14 as of May 10, 2022, shares are trading at an 9% discount to book value

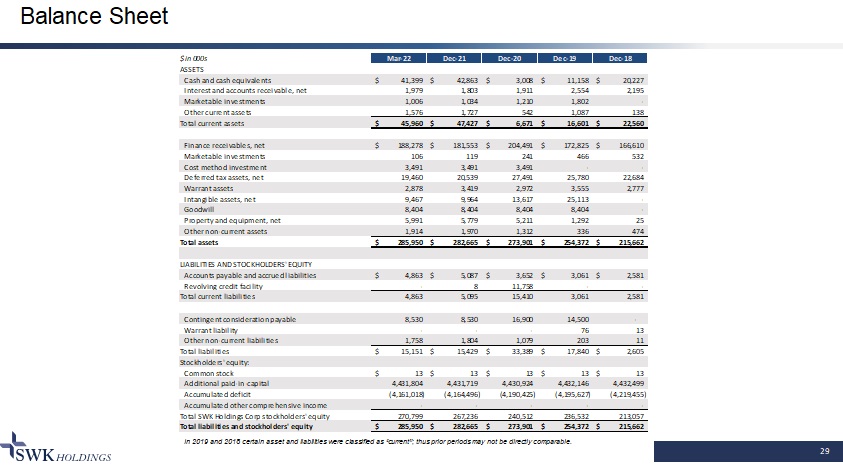

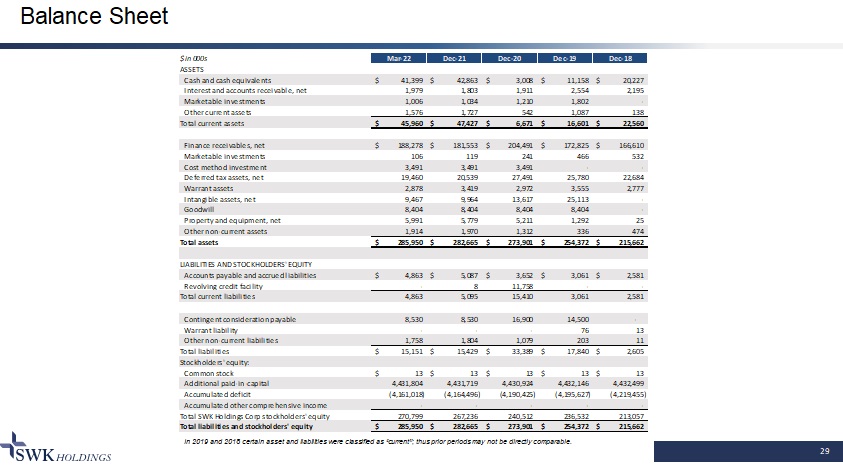

$ in 000s Mar-22 Dec-21 Dec-20 Dec-19 Dec-18 ASSETS Cash and cash equivalents 41,399$ 42,863$ 3,008$ 11,158$ 20,227$ Interest and accounts receivable, net 1,979 1,803 1,911 2,554 2,195 Marketable investments 1,006 1,034 1,210 1,802 - Other current assets 1,576 1,727 542 1,087 138 Total current assets 45,960$ 47,427$ 6,671$ 16,601$ 22,560$ Finance receivables, net 188,278$ 181,553$ 204,491$ 172,825$ 166,610$ Marketable investments 106 119 241 466 532 Cost method investment 3,491 3,491 3,491 - - Deferred tax assets, net 19,460 20,539 27,491 25,780 22,684 Warrant assets 2,878 3,419 2,972 3,555 2,777 Intangible assets, net 9,467 9,964 13,617 25,113 - Goodwill 8,404 8,404 8,404 8,404 - Property and equipment, net 5,991 5,779 5,211 1,292 25 Other non-current assets 1,914 1,970 1,312 336 474 Total assets 285,950$ 282,665$ 273,901$ 254,372$ 215,662$ LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable and accrued liabilities 4,863$ 5,087$ 3,652$ 3,061$ 2,581$ Revolving credit facility - 8 11,758 - - Total current liabilities 4,863 5,095 15,410 3,061 2,581 Contingent consideration payable 8,530 8,530 16,900 14,500 - Warrant liability - - - 76 13 Other non-current liabilities 1,758 1,804 1,079 203 11 Total liabilities 15,151$ 15,429$ 33,389$ 17,840$ 2,605$ Stockholders' equity: Common stock 13$ 13$ 13$ 13$ 13$ Additional paid-in-capital 4,431,804 4,431,719 4,430,924 4,432,146 4,432,499 Accumulated deficit (4,161,018) (4,164,496) (4,190,425) (4,195,627) (4,219,455) Accumulated other comprehensive income - - - - - Total SWK Holdings Corp stockholders' equity 270,799 267,236 240,512 236,532 213,057 Total liabilities and stockholders' equity 285,950$ 282,665$ 273,901$ 254,372$ 215,662$ 29 Balance Sheet In 2019 and 2018 certain asset and liabilities were classified as “current”; thus prior periods may not be directly comparabl e.

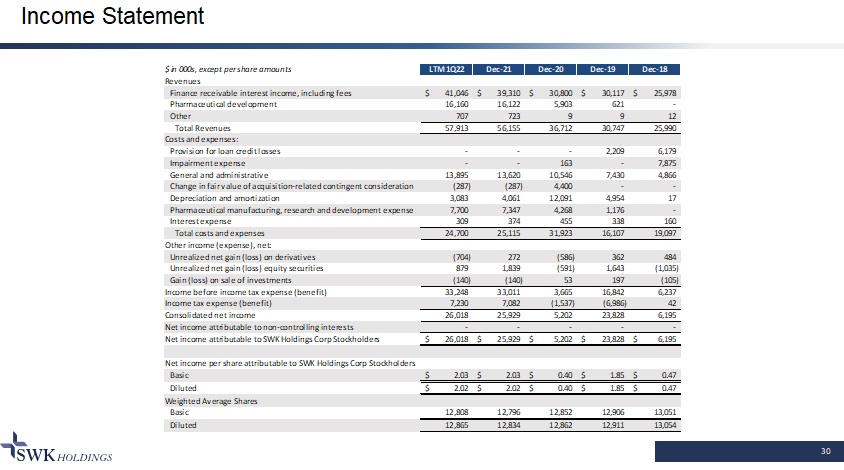

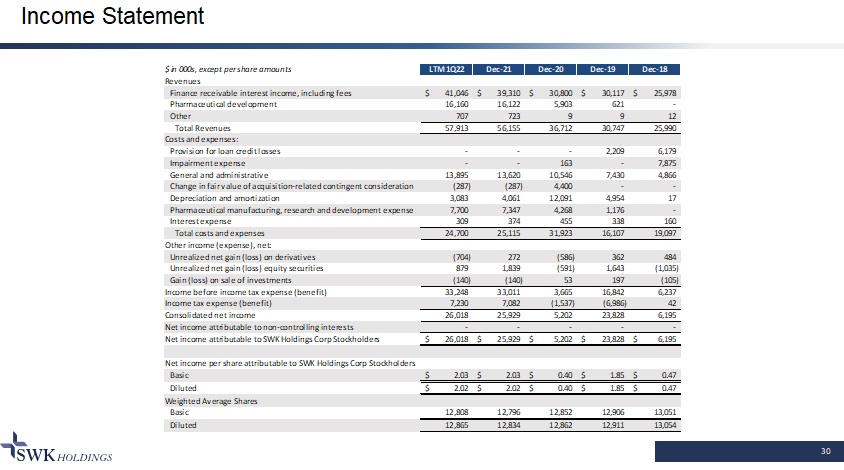

30 Income Statement $ in 000s, except per share amounts LTM 1Q22 Dec-21 Dec-20 Dec-19 Dec-18 Revenues Finance receivable interest income, including fees 41,046$ 39,310$ 30,800$ 30,117$ 25,978$ Pharmaceutical development 16,160 16,122 5,903 621 - Other 707 723 9 9 12 Total Revenues 57,913 56,155 36,712 30,747 25,990 Costs and expenses: Provision for loan credit losses - - - 2,209 6,179 Impairment expense - - 163 - 7,875 General and administrative 13,895 13,620 10,546 7,430 4,866 Change in fair value of acquisition-related contingent consideration (287) (287) 4,400 - - Depreciation and amortization 3,083 4,061 12,091 4,954 17 Pharmaceutical manufacturing, research and development expense 7,700 7,347 4,268 1,176 - Interest expense 309 374 455 338 160 Total costs and expenses 24,700 25,115 31,923 16,107 19,097 Other income (expense), net: Unrealized net gain (loss) on derivatives (704) 272 (586) 362 484 Unrealized net gain (loss) equity securities 879 1,839 (591) 1,643 (1,035) Gain (loss) on sale of investments (140) (140) 53 197 (105) Income before income tax expense (benefit) 33,248 33,011 3,665 16,842 6,237 Income tax expense (benefit) 7,230 7,082 (1,537) (6,986) 42 Consolidated net income 26,018 25,929 5,202 23,828 6,195 Net income attributable to non-controlling interests - - - - - Net income attributable to SWK Holdings Corp Stockholders 26,018$ 25,929$ 5,202$ 23,828$ 6,195$ Net income per share attributable to SWK Holdings Corp Stockholders Basic 2.03$ 2.03$ 0.40$ 1.85$ 0.47$ Diluted 2.02$ 2.02$ 0.40$ 1.85$ 0.47$ Weighted Average Shares Basic 12,808 12,796 12,852 12,906 13,051 Diluted 12,865 12,834 12,862 12,911 13,054

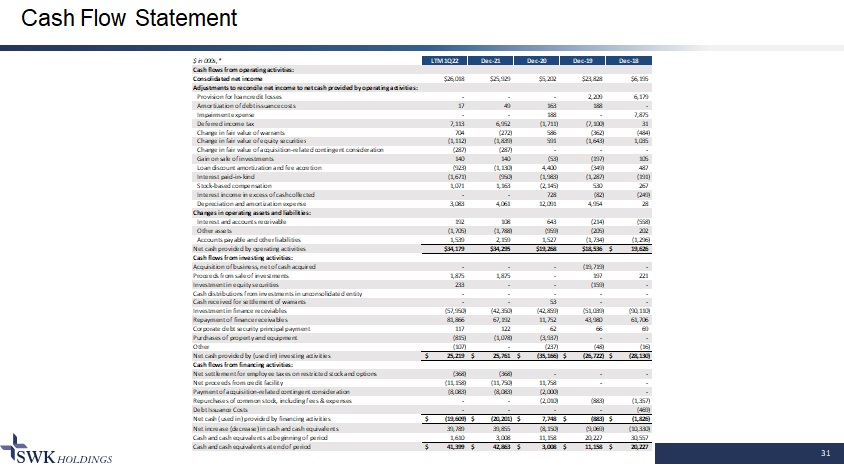

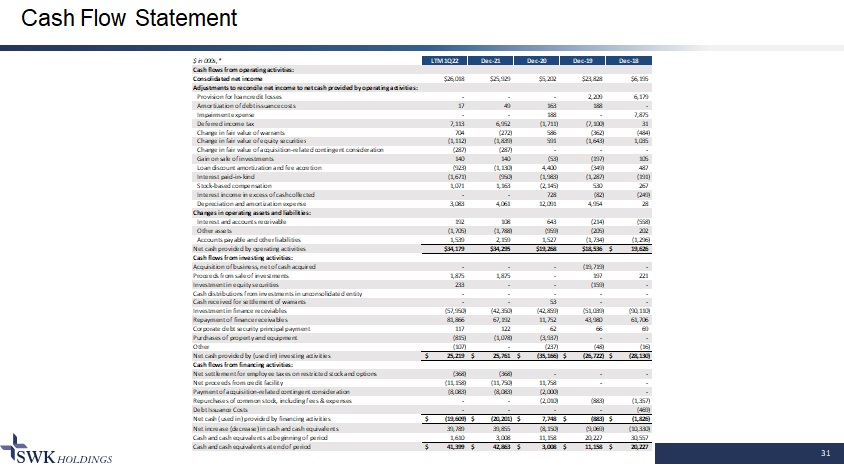

31 Cash Flow Statement $ in 000s,* LTM 1Q22 Dec-21 Dec-20 Dec-19 Dec-18 Cash flows from operating activities: Consolidated net income $26,018 $25,929 $5,202 $23,828 $6,195 Adjustments to reconcile net income to net cash provided by operating activities: Provision for loan credit losses - - - 2,209 6,179 Amortization of debt issuance costs 17 49 163 188 - Impairment expense - - 188 - 7,875 Deferred income tax 7,113 6,952 (1,711) (7,100) 31 Change in fair value of warrants 704 (272) 586 (362) (484) Change in fair value of equity securities (1,112) (1,839) 591 (1,643) 1,035 Change in fair value of acquisition-related contingent consideration (287) (287) - - - Gain on sale of investments 140 140 (53) (197) 105 Loan discount amortization and fee accretion (923) (1,130) 4,400 (349) 487 Interest paid-in-kind (1,671) (950) (1,983) (1,287) (191) Stock-based compensation 1,071 1,163 (2,145) 530 267 Interest income in excess of cash collected - - 728 (82) (249) Depreciation and amortization expense 3,083 4,061 12,091 4,954 28 Changes in operating assets and liabilities: Interest and accounts receivable 192 108 643 (214) (558) Other assets (1,705) (1,788) (959) (205) 202 Accounts payable and other liabilities 1,539 2,159 1,527 (1,734) (1,296) Net cash provided by operating activities $34,179 $34,295 $19,268 $18,536 19,626$ Cash flows from investing activities: Acquisition of business, net of cash acquired - - - (19,719) - Proceeds from sale of investments 1,875 1,875 - 197 221 Investment in equity securities 233 - - (159) - Cash distributions from investments in unconsolidated entity - - - - - Cash received for settlement of warrants - - 53 - - Investment in finance receviables (57,950) (42,350) (42,859) (51,039) (90,110) Repayment of finance receivables 81,866 67,192 11,752 43,980 61,706 Corporate debt security principal payment 117 122 62 66 69 Purchases of property and equipment (815) (1,078) (3,937) - - Other (107) - (237) (48) (16) Net cash provided by (used in) investing activities 25,219$ 25,761$ (35,166)$ (26,722)$ (28,130)$ Cash flows from financing activities: Net settlement for employee taxes on restricted stock and options (368) (368) - - - Net proceeds from credit facility (11,158) (11,750) 11,758 - - Payment of acquisition-related contingent consideration (8,083) (8,083) (2,000) - Repurchases of common stock, including fees & expenses - - (2,010) (883) (1,357) Debt Issuance Costs - - - - (469) Net cash (used in) provided by financing activities (19,609)$ (20,201)$ 7,748$ (883)$ (1,826)$ Net increase (decrease) in cash and cash equivalents 39,789 39,855 (8,150) (9,069) (10,330) Cash and cash equivalents at beginning of period 1,610 3,008 11,158 20,227 30,557 Cash and cash equivalents at end of period 41,399$ 42,863$ 3,008$ 11,158$ 20,227$

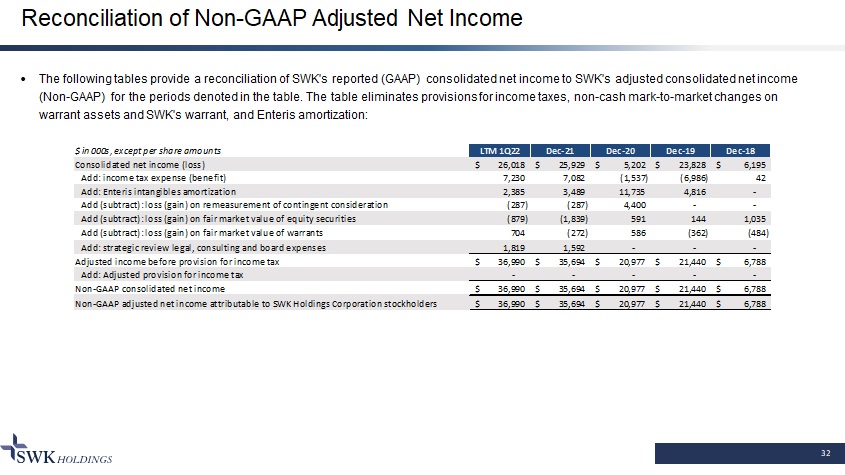

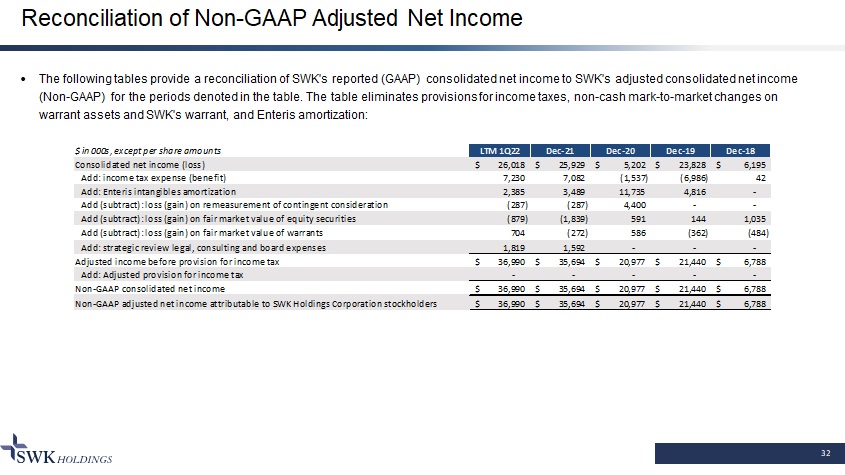

$ in 000s, except per share amounts LTM 1Q22 Dec-21 Dec-20 Dec-19 Dec-18 Consolidated net income (loss) 26,018$ 25,929$ 5,202$ 23,828$ 6,195$ Add: income tax expense (benefit) 7,230 7,082 (1,537) (6,986) 42 Add: Enteris intangibles amortization 2,385 3,489 11,735 4,816 - Add (subtract): loss (gain) on remeasurement of contingent consideration (287) (287) 4,400 - - Add (subtract): loss (gain) on fair market value of equity securities (879) (1,839) 591 144 1,035 Add (subtract): loss (gain) on fair market value of warrants 704 (272) 586 (362) (484) Add: strategic review legal, consulting and board expenses 1,819 1,592 - - - Adjusted income before provision for income tax 36,990$ 35,694$ 20,977$ 21,440$ 6,788$ Add: Adjusted provision for income tax - - - - - Non-GAAP consolidated net income 36,990$ 35,694$ 20,977$ 21,440$ 6,788$ Non-GAAP adjusted net income attributable to SWK Holdings Corporation stockholders 36,990$ 35,694$ 20,977$ 21,440$ 6,788$ 32 Reconciliation of Non - GAAP Adjusted Net Income The following tables provide a reconciliation of SWK's reported (GAAP) consolidated net income to SWK's adjusted consolidated ne t income (Non - GAAP) for the periods denoted in the table. The table eliminates provisions for income taxes, non - cash mark - to - market chang es on warrant assets and SWK's warrant, and Enteris amortization:

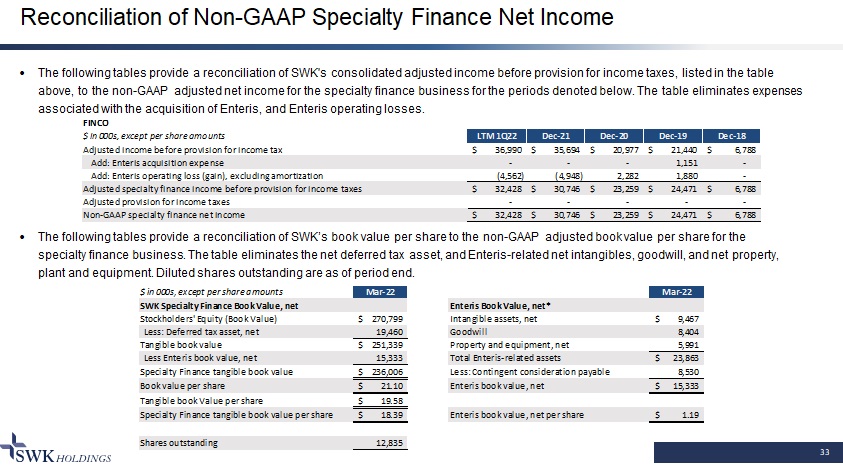

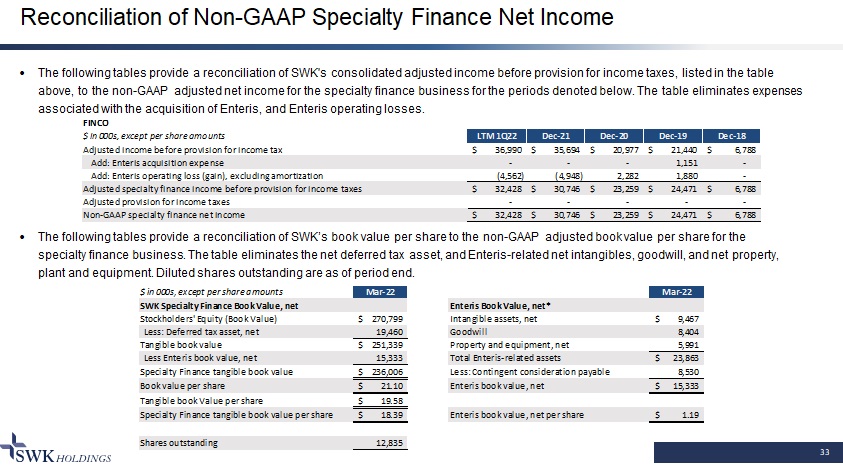

$ in 000s, except per share amounts Mar-22 Mar-22 SWK Specialty Finance Book Value, net Enteris Book Value, net* Stockholders' Equity (Book Value) 270,799$ Intangible assets, net 9,467$ Less: Deferred tax asset, net 19,460 Goodwill 8,404 Tangible book value 251,339$ Property and equipment, net 5,991 Less Enteris book value, net 15,333 Total Enteris-related assets 23,863$ Specialty Finance tangible book value 236,006$ Less: Contingent consideration payable 8,530 Book value per share 21.10$ Enteris book value, net 15,333$ Tangible book Value per share 19.58$ Specialty Finance tangible book value per share 18.39$ Enteris book value, net per share 1.19$ Shares outstanding 12,835 33 Reconciliation of Non - GAAP Specialty Finance Net Income The following tables provide a reconciliation of SWK's consolidated adjusted income before provision for income taxes, listed in the table above, to the non - GAAP adjusted net income for the specialty finance business for the periods denoted below. The table eliminate s expenses associated with the acquisition of Enteris, and Enteris operating losses. The following tables provide a reconciliation of SWK’s book value per share to the non - GAAP adjusted book value per share for th e specialty finance business. The table eliminates the net deferred tax asset, and Enteris - related net intangibles, goodwill, and net property, plant and equipment. Diluted shares outstanding are as of period end. FINCO $ in 000s, except per share amounts LTM 1Q22 Dec-21 Dec-20 Dec-19 Dec-18 Adjusted income before provision for income tax 36,990$ 35,694$ 20,977$ 21,440$ 6,788$ Add: Enteris acquisition expense - - - 1,151 - Add: Enteris operating loss (gain), excluding amortization (4,562) (4,948) 2,282 1,880 - Adjusted specialty finance income before provision for income taxes 32,428$ 30,746$ 23,259$ 24,471$ 6,788$ Adjusted provision for income taxes - - - - - Non-GAAP specialty finance net income 32,428$ 30,746$ 23,259$ 24,471$ 6,788$

34 Contact Information CONFIDENTIAL SWK Senior Management Investor & Media Relations: Tiberend Strategic Advisor • Winston Black: ̶ Phone: 972.687.7251 ̶ Email: wblack@swkhold.com • Jody Staggs: ̶ Phone: 972.687.7252 ̶ Email: jstaggs@swkhold.com • Office address: ̶ 14755 Preston Road, Ste 105 Dallas, TX 75254 • Website: www.swkhold.com • Jason Rando (Media): ̶ Email: jrando@tiberend.com

35 Collaborative Approach to Life Science Financing