UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09521

AMG FUNDS

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: September 30

Date of reporting period: OCTOBER 1, 2019 – SEPTEMBER 30, 2020

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | | | |

| | | | |

| | ANNUAL REPORT | | |

| | | | |

| | | | | | |

| |

| | AMG Funds |

| | September 30, 2020

| | |

| | |

| | AMG SouthernSun Small Cap Fund |

| | Class N: SSSFX | | | Class I: SSSIX |

| | AMG SouthernSun U.S. Equity Fund |

| | Class N: SSEFX | | | Class I: SSEIX | | |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (https://www.amgfunds.com/resources/order_literature.html), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting your financial intermediary or, if you invest directly with the Funds, by logging into your account at www.amgfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1.800.548.4539 to inform the Funds that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds in the AMG Funds Family of Funds held in your account if you invest through your financial intermediary or all funds in the AMG Funds Family of Funds held with the fund complex if you invest directly with the Funds.

| | | | |

| | | | |

| | | | | |

amgfunds.com | | | | 093020 AR076 |

| | | | |

| | | | | |

| | | AMG Funds | | |

| | | Annual Report — September 30, 2020 | | |

| | | | | | |

| | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| | | |

| | | AMG SouthernSun Small Cap Fund | | | 4 | |

| | | |

| | | AMG SouthernSun U.S. Equity Fund | | | 9 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 14 | |

| | | |

| | | Balance sheets, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 16 | |

| | | |

| | | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 17 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 18 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 22 | |

| | | |

| | | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 28 | |

| | | |

| | | OTHER INFORMATION | | | 29 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 30 | |

| | | |

| | | ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 32 | |

| | | | |

| | | Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | | |

| | | | |

| | | | |

| | Letter to Shareholders | | |

| | | | |

Dear Shareholder:

The fiscal year ending September 30, 2020, was a volatile period for financial markets marked by a dramatic selloff and extraordinary rebound amid the unprecedented global effort to stop the COVID-19 pandemic. During the first half of the fiscal year, equities achieved new record highs against the backdrop of a healthy economy and strong investor sentiment. However, a broad-based selloff occurred amid a global flight to quality as investors assessed the scope of the unfolding COVID-19 health care crisis, a deteriorating economy, and skyrocketing unemployment. An oil price war initiated between Saudi Arabia and Russia only made matters worse. From its peak in mid-February 2020, the S&P 500® Index declined -33.79% over the span of a few weeks, bringing the eleven-year bull market to an abrupt end. In response to the crisis, global central banks and governments were quick to flood the market with massive fiscal and monetary stimulus which helped to stabilize the market and led to an impressive recovery in risk assets, albeit an uneven one. So despite the volatility, the S&P 500® Index still achieved a robust 15.15% return for the fiscal year.

During the year, there was very wide dispersion in performance across sectors, with information technology stocks returning 47.22%, while companies in the energy sector fell (45.24)%. Growth stocks significantly outperformed value stocks for the period with returns of 24.33% and (11.58)% for the Russell 1000® Growth and Russell 1000® Value Indexes, respectively. Large caps also outperformed small caps as measured by the 15.15% return for the S&P 500® Index compared to 0.39% for the Russell 2000® Index. Outside the U.S., emerging markets outperformed developed markets with the 9.56% return for the MSCI Emerging Markets Index compared to the 4.80% return for the MSCI EAFE Index.

Interest rates fell dramatically and led to strong returns for bond investors as the U.S. Federal Reserve slashed short-term rates in response to the slowing economy. The 10-year Treasury yield ended the year near a historic low yield of 0.69%. The Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, returned 6.98% over the period. Riskier high yield bonds lagged the broader bond market with a 3.25% return as measured by the return of the Bloomberg Barclays U.S. Corporate High Yield Bond Index.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | |

| Average Annual Total Returns | | Periods ended September 30, 2020* | |

| | | | |

| Stocks: | | | | | 1 Year | | | | 3 Years | | | | 5 Years | |

| | | | |

| Large Cap | | (S&P 500® Index) | | | 15.15% | | | | 12.28% | | | | 14.15% | |

| | | | |

| Small Cap | | (Russell 2000® Index) | | | 0.39% | | | | 1.77% | | | | 8.00% | |

| | | | |

| International | | (MSCI All Country World Index ex USA) | | | 3.00% | | | | 1.16% | | | | 6.23% | |

| | |

| Bonds: | | | |

| | | | |

Investment Grade | | (Bloomberg Barclays U.S. Aggregate Bond Index) | | | 6.98% | | | | 5.24% | | | | 4.18% | |

| | | | |

| High Yield | | (Bloomberg Barclays U.S. Corporate High Yield Bond Index) | | | 3.25% | | | | 4.21% | | | | 6.79% | |

| | | | |

| Tax-exempt | | (Bloomberg Barclays Municipal Bond Index) | | | 4.09% | | | | 4.28% | | | | 3.84% | |

| | | | |

| Treasury Bills | | (ICE BofAML US 6-Month Treasury Bill Index) | | | 1.54% | | | | 1.92% | | | | 1.42% | |

*Source: FactSet. Past performance is no guarantee of future results.

| | | | |

| | | | | |

| | | About Your Fund’s Expenses | | |

| | | | | |

| | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | | | | | | | |

Six Months Ended September 30, 2020 | | Expense

Ratio for

the Period | | Beginning

Account

Value

04/01/20 | | | Ending

Account

Value

09/30/20 | | | Expenses

Paid

During

the Period* | |

| AMG SouthernSun Small Cap Fund | |

| |

| Based on Actual Fund Return | | | | | |

| | | | |

| Class N | | 1.25% | | | $1,000 | | | | $1,350 | | | | $7.34 | |

| | | | |

| Class I | | 1.00% | | | $1,000 | | | | $1,351 | | | | $5.88 | |

| |

| Based on Hypothetical 5% Annual Return | | | | | |

| | | | |

| Class N | | 1.25% | | | $1,000 | | | | $1,019 | | | | $6.31 | |

| | | | |

| Class I | | 1.00% | | | $1,000 | | | | $1,020 | | | | $5.05 | |

| AMG SouthernSun U.S. Equity Fund | |

| | | |

| Based on Actual Fund Return | | | | | | | | | | | | |

| | | | |

| Class N | | 1.34% | | | $1,000 | | | | $1,426 | | | | $8.13 | |

| | | | |

| Class I | | 1.09% | | | $1,000 | | | | $1,428 | | | | $6.62 | |

| |

| Based on Hypothetical 5% Annual Return | | | | | |

| | | | |

| Class N | | 1.34% | | | $1,000 | | | | $1,018 | | | | $6.76 | |

| | | | |

| Class I | | 1.09% | | | $1,000 | | | | $1,020 | | | | $5.50 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 366. |

| | | | |

| | | | | |

| | | AMG SouthernSun Small Cap Fund | | |

| | | Portfolio Manager’s Comments (unaudited) | | |

| | | | | | | | |

DEAR FELLOW SHAREHOLDERS, At the onset of this past year, we expected market volatility. What we knew. In America, we had a presidential election year in front of us, trade tensions with China escalating, arguably stretched and aggressively levered equity markets, and increased labor market tightness casting some speculation on Fed policy. In Britain and Europe, there was a deadline set for Brexit. Across the globe many economies were beginning to turn inward due to a combination of economic and political tensions. Thus, last autumn, it would have been reasonable to presume that the next twelve months might well bring with it a meaningful increase of volatility in the marketplace. What we did not know. Few, if any, imagined what some have framed as the overlapping pandemics of 2020. COVID-19, local versus regional politics, race relations, and mental health have all seized center stage, not only in America and the West, but across the globe. How then ought we think about and respond to this convergence? Increased volatility combined with broad business uncertainty, has historically produced a fertile environment for SouthernSun strategies. This time has been no different. Beginning with the uptick in volatility in late 2018 our approach has yielded increasingly attractive opportunities to buy and/or add to what we believe are outstanding businesses with prudently geared balance sheets and resilient go-to-market propositions. Whilst aware that the events of the past six to nine months are likely to produce further known and unknown outcomes, we are confident our portfolio companies, for the most, are well positioned to not only survive but thrive. It is fair to say that what many may believe are the lasting implications of the overlapping pandemics may well be far too short sighted. Further, we believe it is too early to properly gauge permanent cultural shifts that are likely to impact business behavior in the intermediate to long term. Some of the popular theories revolve around things like work from home and/or the permanent hollowing of dense urban centers. It is true that in the past such phenomena have been catalysts for major shifts in entrenched trends and may well play out similarly this time as well. | | | | For now, we remain focused on the flexibility of our portfolio company’s business models to maneuver through turbulent times. When combined with forward thinking management we believe that, irrespective of the ultimate cultural, societal, and business operating outcomes of the past twelve months events, our approach to finding businesses that create excellent value over time is well tested, showing strong resilience during such moments. In closing, and apropos to the moment, we commend Louis MacNeice’s poem Snow to you for consideration: The room was suddenly rich and the great bay-window was Spawning snow and pink roses against it Soundlessly collateral and incompatible: World is suddener than we fancy it. World is crazier and more of it than we think, Incorrigibly plural. I peel and portion A tangerine and spit the pips and feel The drunkenness of things being various. And the fire flames with a bubbling sound for world Is more spiteful and gay than one supposes -On the tongue on the eyes on the ears in the palms of one’s hands -There is more than glass between the snow and the huge roses. FUND PERFORMANCE AMG SouthernSun Small Cap Fund’s (the “Fund”) Class N shares returned (0.72%) over the trailing-twelve-months, as of September 30, 2020, versus the Russell 2000® Index, which returned 0.39% and the Russell 2000® Value Index, which returned (14.88%), over the same period. Over the trailing twelve-month period ending September 30, 2020, our underperformance versus the Russell 2000® Index was driven by our underweight allocation within the health care sector, as well as our stock selection within the industrials sector, led by, The Brink’s Co. (BCO).This was offset, in part, by our underweight allocation to the financial sector, as well as our overweight allocation to the consumer discretionary sector. On an absolute and relative basis, Darling Ingredients Inc. (DAR) was the top contributor for the period, while BCO was the top detractor. | | | | BCO, the global leader in total cash management, was the leading detractor on an absolute and relative basis during the period. Revenues showed positive trends as lockdown measures began to ease and closed the month of June at 14% below prior year. The G4S acquisition is now 80% closed and cost realignments and synergies are on-track. Although BCO’s took on additional debt for the acquisition, there are no meaningful debt maturities until 2024 and covenants seem manageable. Furthermore, management reiterated expectations of positive free cash flow in 2020 and are cautiously optimistic that 2021 EBITDA could be significantly higher if positive revenue trends continue. In October, we spent some socially distanced time with management in Dallas and we came away with increased confidence in their ability to manage through operational difficulties of the pandemic, execute on the integration of G4S with significant synergies, and deliver on future growth initiatives. DAR, a global leader in creating sustainable food, feed, and fuel ingredients from edible and inedible bio-nutrients, was the leading contributor on an absolute and relative basis during the period. Results in the core feed, food, and fuel businesses were resilient with EBITDA up year over year. The renewable diesel joint venture with Valero, Diamond Green Diesel (DGD), performed well and construction on the 400-million-gallon capacity expansion project is progressing according to plan. Management expects DGD to produce 675 million gallons of renewable diesel by 2022. At projected profitability levels, the expansion would roughly double DAR’s share of the joint venture’s earnings and eclipse the EBITDA from core Darling. We continue to believe that DGD is a competitively advantaged low-cost producer of renewable diesel with strong long-term growth prospects. We thank you for your continued trust in our ability to help you reach your investment goals. The views expressed represent the opinions of SouthernSun Asset Management, LLC as of September 30, 2020, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

| | | | |

| | | | | |

| | | AMG SouthernSun Small Cap Fund | | |

| | | Portfolio Manager’s Comments (continued) | | |

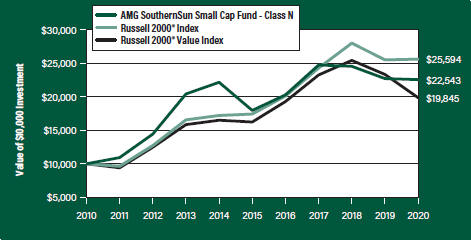

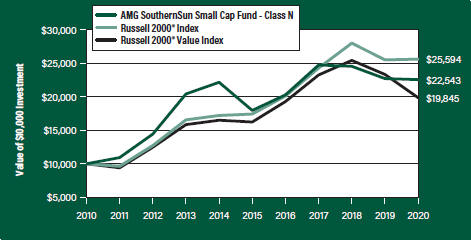

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG SouthernSun Small Cap Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG SouthernSun Small Cap Fund’s Class N shares on September 30, 2010, to a $10,000 investment made in the Russell 2000® Index and Russell 2000® Value Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG SouthernSun Small Cap Fund, the Russell 2000® Index and the Russell 2000® Value Index for the same time periods ended September 30, 2020.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One Year | | | Five

Years | | | Ten Years | |

|

AMG SouthernSun Small Cap Fund2, 3, 4, 5, 6, 7, 8 | |

| | | |

Class N | | | (0.72%) | | | | 4.65 | % | | | 8.47% | |

| | | |

Class I | | | (0.45%) | | | | 4.91 | % | | | 8.74% | |

| | | | |

Russell 2000® Index9 | | | 0.39% | | | | 8.00 | % | | | 9.85% | |

| | | |

Russell 2000® Value Index10 | | | (14.88%) | | | | 4.11 | % | | | 7.09% | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of September 30, 2020. All returns are in U.S. dollars ($). |

| | |

| 2 | | AMG SouthernSun Small Cap Fund’s inception date and returns for all periods beginning prior to March 31, 2014, reflects performance of the predecessor fund, SouthernSun Small Cap Fund, and was managed by SouthernSun Asset Management, LLC with the same investment objectives and substantially similar investment policies. |

| | |

| 3 | | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| | |

| 4 | | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| | |

| 5 | | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| | |

| 6 | | Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. |

| | |

| 7 | | Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. |

| | |

| 8 | | The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. |

| | |

| 9 | | The Russell 2000® Index is composed of the 2,000 smallest stocks in the Russell 3000® Index and is widely regarded in the industry as the premier measure of small-cap stock performance. Unlike the Fund, the Russell 2000® Index is unmanaged, is not available for investment and does not incur expenses. |

| | |

| 10 | | The Russell 2000® Value Index is an unmanaged, market-value weighted, value-oriented index comprised of small stocks that have relatively low price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 2000® Value Index is unmanaged, is not available for investment and does not incur expenses. |

| |

| The Russell Indices are a trademark of London Stock Exchange Group companies. |

| |

| Not FDIC insured, nor bank guaranteed. May lose value. |

| | | | |

| | | | | |

| | | AMG SouthernSun Small Cap Fund | | |

| | | Fund Snapshots (unaudited) September 30, 2020 | | |

PORTFOLIO BREAKDOWN

| | |

| Sector | | %of

Net Assets |

| | |

Industrials | | 38.7 |

| | |

Consumer Discretionary | | 23.0 |

| | |

Consumer Staples | | 11.1 |

| | |

Materials | | 9.3 |

| | |

Information Technology | | 7.8 |

| | |

Health Care | | 3.3 |

| | |

Energy | | 0.6 |

| | |

Short-Term Investments | | 6.1 |

| | |

Other Assets Less Liabilities | | 0.1 |

TOP TEN HOLDINGS

| | | | | | |

| Security Name | | | | | %of

Net Assets |

Darling Ingredients, Inc. | | | | | | 7.0 |

The Brink’s Co. | | | | | | 6.1 |

Dycom Industries, Inc. | | | | | | 6.1 |

AGCO Corp. | | | | | | 5.4 |

Extended Stay America, Inc. | | | | | | 5.4 |

The Timken Co. | | | | | | 5.2 |

Polaris, Inc. | | | | | | 4.4 |

Crane Co. | | | | | | 3.9 |

Broadridge Financial Solutions, Inc. | | | | | | 3.8 |

Sanderson Farms, Inc. | | | | | | 3.8 |

| | | | | | | |

Top Ten as a Group | | | | | | 51.1 |

| | | | | | | |

| | | | | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

| | | | |

| | | AMG SouthernSun Small Cap Fund | | |

| | | Schedule of Portfolio Investments | | |

| | | September 30, 2020 | | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Common Stocks - 93.8% | | | | | | | | |

| |

Consumer Discretionary - 23.0% | | | | | |

| | |

Dorman Products, Inc.* | | | 23,943 | | | | $2,163,968 | |

| | |

Extended Stay America, Inc. | | | 758,463 | | | | 9,063,633 | |

| | |

frontdoor, Inc.* | | | 70,121 | | | | 2,728,408 | |

| | |

Murphy USA, Inc.* | | | 41,548 | | | | 5,329,362 | |

| | |

Polaris, Inc. | | | 77,682 | | | | 7,328,520 | |

| | |

ServiceMaster Global Holdings, Inc.* | | | 143,193 | | | | 5,710,537 | |

| | |

Thor Industries, Inc. | | | 66,016 | | | | 6,288,684 | |

| | |

Total Consumer Discretionary | | | | | | | 38,613,112 | |

| |

Consumer Staples - 11.1% | | | | | |

| | |

Darling Ingredients, Inc.* | | | 329,168 | | | | 11,859,923 | |

| | |

MGP Ingredients, Inc. | | | 9,203 | | | | 365,728 | |

| | |

Sanderson Farms, Inc. | | | 54,027 | | | | 6,373,565 | |

| | |

Total Consumer Staples | | | | | | | 18,599,216 | |

| |

Energy - 0.6% | | | | | |

| | |

Ovintiv, Inc. | | | 127,266 | | | | 1,038,491 | |

| |

Health Care - 3.3% | | | | | |

| | |

Hill-Rom Holdings, Inc. | | | 65,879 | | | | 5,501,555 | |

| |

Industrials - 38.7% | | | | | |

| | |

Aegion Corp.* | | | 208,699 | | | | 2,948,917 | |

| | |

AGCO Corp. | | | 122,956 | | | | 9,131,942 | |

| | |

The Brink’s Co. | | | 248,700 | | | | 10,219,083 | |

| | |

Clean Harbors, Inc.* | | | 110,634 | | | | 6,198,823 | |

| | |

Crane Co. | | | 130,751 | | | | 6,554,548 | |

| | |

Dycom Industries, Inc.*,1 | | | 193,276 | | | | 10,208,838 | |

| | |

Enerpac Tool Group Corp. | | | 255,980 | | | | 4,814,984 | |

| | |

The Timken Co. | | | 160,558 | | | | 8,705,455 | |

| | |

Trinity Industries, Inc.1 | | | 318,483 | | | | 6,210,418 | |

| | |

Total Industrials | | | | | | | 64,993,008 | |

| |

Information Technology - 7.8% | | | | | |

| | |

Belden, Inc. | | | 201,795 | | | | 6,279,860 | |

| | |

Broadridge Financial Solutions, Inc. | | | 48,630 | | | | 6,419,160 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

NIC, Inc. | | | 18,920 | | | | $372,724 | |

| | |

Total Information Technology | | | | | | | 13,071,744 | |

| |

Materials - 9.3% | | | | | |

| | |

Ingevity Corp.* | | | 93,395 | | | | 4,617,449 | |

| | |

Koppers Holdings, Inc.* | | | 235,052 | | | | 4,914,937 | |

| | |

Stepan Co. | | | 56,502 | | | | 6,158,718 | |

| | |

Total Materials | | | | | | | 15,691,104 | |

| | |

Total Common Stocks

(Cost $143,505,610) | | | | | | | 157,508,230 | |

| | |

| | | Principal

Amount | | | | |

Short-Term Investments - 6.1% | | | | | | | | |

| |

Joint Repurchase Agreements - 0.3%2 | | | | | |

| | |

Citibank N.A., dated 09/30/20, due 10/01/20, 0.080% total to be received $468,211 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 4.500%, 06/15/22 - 01/01/50, totaling $477,928) | | $ | 468,210 | | | | 468,210 | |

| | |

| | | Shares | | | | |

| |

Other Investment Companies - 5.8% | | | | | |

| | |

Dreyfus Government Cash Management Fund, Institutional Shares, 0.02%3 | �� | | 3,220,206 | | | | 3,220,206 | |

| | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.04%3 | | | 3,220,206 | | | | 3,220,206 | |

| | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 0.06%3 | | | 3,317,789 | | | | 3,317,789 | |

| | |

Total Other Investment Companies | | | | | | | 9,758,201 | |

| | |

Total Short-Term Investments

(Cost $10,226,411) | | | | | | | 10,226,411 | |

| | |

Total Investments - 99.9%

(Cost $153,732,021) | | | | | | | 167,734,641 | |

| | |

Other Assets, less Liabilities - 0.1% | | | | | | | 172,488 | |

| | |

Net Assets - 100.0% | | | | | | $ | 167,907,129 | |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $4,668,940 or 2.8% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the September 30, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

|

|

| The accompanying notes are an integral part of these financial statements. |

| 7 |

| | | | |

| | | | | |

| | | AMG SouthernSun Small Cap Fund | | |

| | | Schedule of Portfolio Investments (continued) | | |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of September 30, 2020:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks† | | $ | 157,508,230 | | | | — | | | | — | | | $ | 157,508,230 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | — | | | $ | 468,210 | | | | — | | | | 468,210 | |

| | | | |

Other Investment Companies | | | 9,758,201 | | | | — | | | | — | | | | 9,758,201 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | $ | 167,266,431 | | | $ | 468,210 | | | | — | | | $ | 167,734,641 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended September 30, 2020, there were no transfers in or out of Level 3.

|

|

| The accompanying notes are an integral part of these financial statements. |

| 8 |

| | | | |

| | | | | |

| | | AMG SouthernSun U.S. Equity Fund | | |

| | | Portfolio Manager’s Comments (unaudited) | | |

| | | | | | | | |

DEAR FELLOW SHAREHOLDERS, At the onset of this past year, we expected market volatility. What we knew. In America, we had a presidential election year in front of us, trade tensions with China escalating, arguably stretched and aggressively levered equity markets, and increased labor market tightness casting some speculation on Fed policy. In Britain and Europe, there was a deadline set for Brexit. Across the globe many economies were beginning to turn inward due to a combination of economic and political tensions. Thus, last autumn, it would have been reasonable to presume that the next twelve months might well bring with it a meaningful increase of volatility in the marketplace. What we did not know. Few, if any, imagined what some have framed as the overlapping pandemics of 2020. COVID-19, local versus regional politics, race relations, and mental health have all seized center stage, not only in America and the West, but across the globe. How then ought we think about and respond to this convergence? Increased volatility combined with broad business uncertainty, has historically produced a fertile environment for SouthernSun strategies. This time has been no different. Beginning with the uptick in volatility in late 2018 our approach has yielded increasingly attractive opportunities to buy and/or add to what we believe are outstanding businesses with prudently geared balance sheets and resilient go-to-market propositions. Whilst aware that the events of the past six to nine months are likely to produce further known and unknown outcomes, we are confident our portfolio companies, for the most, are well positioned to not only survive but thrive. It is fair to say that what many may believe are the lasting implications of the overlapping pandemics may well be far too short sighted. Further, we believe it is too early to properly gauge permanent cultural shifts that are likely to impact business behavior in the intermediate to long term. Some of the popular theories revolve around things like work from home and/or the permanent hollowing of dense urban centers. It is true that in the past such phenomena have been catalysts for major shifts in entrenched trends and may well play out similarly this time as well. | | | | For now, we remain focused on the flexibility of our portfolio company’s business models to maneuver through turbulent times. When combined with forward thinking management we believe that, irrespective of the ultimate cultural, societal, and business operating outcomes of the past twelve months events, our approach to finding businesses that create excellent value over time is well tested, showing strong resilience during such moments. In closing, and apropos to the moment, we commend Louis MacNeice’s poem Snow to you for consideration: The room was suddenly rich and the great bay-window was Spawning snow and pink roses against it Soundlessly collateral and incompatible: World is suddener than we fancy it. World is crazier and more of it than we think, Incorrigibly plural. I peel and portion A tangerine and spit the pips and feel The drunkenness of things being various. And the fire flames with a bubbling sound for world Is more spiteful and gay than one supposes -On the tongue on the eyes on the ears in the palms of one’s hands -There is more than glass between the snow and the huge roses. FUND PERFORMANCE AMG SouthernSun U.S. Equity Fund’s (the “Fund”) Class N shares returned 1.64% over the trailing-twelve-months, as of September 30, 2020, versus the Russell 2500® Index, which returned 2.22% and the Russell 2500® Value Index, which returned (12.62%), over the same period. Over the trailing twelve-month period ending September 30, 2020, our underperformance versus the Russell 2500® Index was driven by stock selection within the information technology sector, led by, Knowles Corp. (KN), as well as our underweight allocation to the health care sector. This was offset, in part, by our stock selection within in the consumer staples and consumer discretionary sectors, led by Darling Ingredients, Inc. (DAR) and Thor Industries (THO), respectively. On a relative and absolute basis, DAR was the top contributor for the period, while The Brink’s Co. (BCO), was the top detractor. | | | | BCO, the global leader in total cash management, was the leading detractor on an absolute and relative basis during the period. Revenues showed positive trends as lockdown measures began to ease and closed the month of June at 14% below prior year. The G4S acquisition is now 80% closed and cost realignments and synergies are on-track. Although BCO’s took on additional debt for the acquisition, there are no meaningful debt maturities until 2024 and covenants seem manageable. Furthermore, management reiterated expectations of positive free cash flow in 2020 and are cautiously optimistic that 2021 EBITDA could be significantly higher if positive revenue trends continue. In October, we spent some socially distanced time with management in Dallas and we came away with increased confidence in their ability to manage through operational difficulties of the pandemic, execute on the integration of G4S with significant synergies, and deliver on future growth initiatives. DAR, a global leader in creating sustainable food, feed, and fuel ingredients from edible and inedible bio-nutrients, was the leading contributor on an absolute and relative basis during the period. Results in the core feed, food, and fuel businesses were resilient with EBITDA up year over year. The renewable diesel joint venture with Valero, Diamond Green Diesel (DGD), performed well and construction on the 400-million-gallon capacity expansion project is progressing according to plan. Management expects DGD to produce 675 million gallons of renewable diesel by 2022. At projected profitability levels, the expansion would roughly double DAR’s share of the joint venture’s earnings and eclipse the EBITDA from core Darling. We continue to believe that DGD is a competitively advantaged low-cost producer of renewable diesel with strong long-term growth prospects. We thank you for your continued trust in our ability to help you reach your investment goals. The views expressed represent the opinions of SouthernSun Asset Management, LLC as of September 30, 2020, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

| | | | |

| | | | | |

| | | AMG SouthernSun U.S. Equity Fund | | |

| | | Portfolio Manager’s Comments (continued) | | |

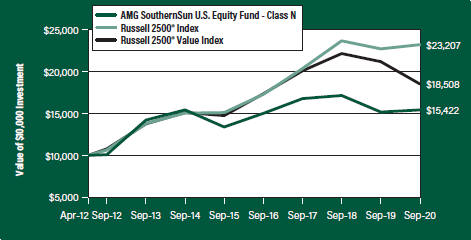

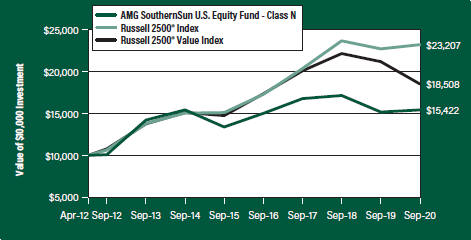

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG SouthernSun U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG SouthernSun U.S. Equity Fund’s Class N shares on April 10, 2012, to a $10,000 investment made in the Russell 2500® Index and Russell 2500® Value Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG SouthernSun U.S. Equity Fund, the Russell 2500® Index and the Russell 2500® Value Index for the same time periods ended September 30, 2020.

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Since

Inception | | | Inception

Date | |

|

AMG SouthernSun U.S. Equity Fund2, 3, 4, 5, 6, 7, 8, 9 | |

| | | | |

Class N | | | 1.64% | | | | 2.86 | % | | | 5.25 | % | | | 04/10/12 | |

| | | | |

Class I | | | 1.86% | | | | 3.12 | % | | | 5.51 | % | | | 04/10/12 | |

| | | | | |

Russell 2500® Index10 | | | 2.22% | | | | 8.97 | % | | | 10.44 | % | | | 04/10/12 | † |

| | | | |

Russell 2500® Value Index11 | | | (12.62%) | | | | 4.65 | % | | | 7.53 | % | | | 04/10/12 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of September 30, 2020. All returns are in U.S. dollars ($). |

| | |

| | |

| 2 | | AMG SouthernSun U.S Equity Fund’s inception date and returns for all periods beginning prior to March 31, 2014, reflects performance of the predecessor fund, SouthernSun U.S. Equity Fund, and was managed by SouthernSun Asset Management, LLC with the same investment objectives and substantially similar investment policies. |

| | |

| 3 | | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| | |

| 4 | | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

| | |

| 5 | | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| | |

| 6 | | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| | |

| 7 | | Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. |

| | |

| 8 | | Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. |

| | |

| 9 | | The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. |

| | |

| 10 | | The Russell 2500® Index is composed of the 2,500 smallest stocks in the Russell 3000® Index and is widely regarded in the industry as the premier measure of small/mid cap stock performance. Unlike the Fund, the Russell 2500® Index is unmanaged, is not available for investment and does not incur expenses. |

| | |

| 11 | | The Russell 2500® Value Index measures the performance of the Russell 2500® companies with lower price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 2500® Value Index is unmanaged, is not available for investment and does not incur expenses. |

| |

| The Russell Indices are trademarks of the London Stock Exchange Group companies. |

| |

Not FDIC insured, nor bank guaranteed. May lose value. |

| | | | |

| | | | | |

| | | AMG SouthernSun U.S. Equity Fund | | |

| | | Fund Snapshots (unaudited) September 30, 2020 | | |

PORTFOLIO BREAKDOWN

| | |

| Sector | | % of

Net Assets |

| | |

Industrials | | 40.2 |

| | |

Consumer Discretionary | | 23.5 |

| | |

Information Technology | | 10.0 |

| | |

Health Care | | 7.4 |

| | |

Consumer Staples | | 7.0 |

| | |

Financials | | 5.3 |

| | |

Materials | | 3.2 |

| | |

Energy | | 0.4 |

| | |

Short-Term Investments | | 2.7 |

| | |

Other Assets Less Liabilities | | 0.3 |

TOP TEN HOLDINGS

| | | | | | |

| Security Name | | | | | %of

Net Assets |

Darling Ingredients, Inc. | | | | | | 7.1 |

Dycom Industries, Inc. | | | | | | 6.1 |

The Brink’s Co. | | | | | | 6.1 |

Extended Stay America, Inc. | | | | | | 5.5 |

The Timken Co. | | | | | | 5.2 |

AGCO Corp. | | | | | | 5.0 |

Centene Corp. | | | | | | 4.7 |

Hanesbrands, Inc. | | | | | | 4.1 |

Crane Co. | | | | | | 4.0 |

Polaris, Inc. | | | | | | 3.9 |

| | | | | | | |

Top Ten as a Group | | | | | | 51.7 |

| | | | | | | |

| | | | | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

| | | | |

| | | AMG SouthernSun U.S. Equity Fund | | |

| | | Schedule of Portfolio Investments | | |

| | | September 30, 2020 | | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Common Stocks - 97.0% | | | | | | | | |

| |

Consumer Discretionary - 23.5% | | | | | |

| | |

Extended Stay America, Inc. | | | 181,859 | | | | $2,173,215 | |

| | |

Hanesbrands, Inc.1 | | | 101,458 | | | | 1,597,963 | |

| | |

Murphy USA, Inc.* | | | 8,200 | | | | 1,051,814 | |

| | |

Polaris, Inc. | | | 16,103 | | | | 1,519,157 | |

| | |

ServiceMaster Global Holdings, Inc.* | | | 34,117 | | | | 1,360,586 | |

| | |

Thor Industries, Inc. | | | 15,875 | | | | 1,512,253 | |

| | |

Total Consumer Discretionary | | | | | | | 9,214,988 | |

| |

Consumer Staples - 7.0% | | | | | |

| | |

Darling Ingredients, Inc.* | | | 76,972 | | | | 2,773,301 | |

| |

Energy - 0.4% | | | | | |

| | |

Ovintiv, Inc. | | | 20,501 | | | | 167,288 | |

| |

Financials - 5.3% | | | | | |

| | |

First Horizon National Corp. | | | 115,810 | | | | 1,092,088 | |

| | |

SEI Investments Co. | | | 19,279 | | | | 977,831 | |

| | |

Total Financials | | | | | | | 2,069,919 | |

| |

Health Care - 7.4% | | | | | |

| | |

Centene Corp.* | | | 31,922 | | | | 1,862,010 | |

| | |

Molina Healthcare, Inc.* | | | 5,635 | | | | 1,031,431 | |

| | |

Total Health Care | | | | | | | 2,893,441 | |

| |

Industrials - 40.2% | | | | | |

| | |

AGCO Corp. | | | 26,403 | | | | 1,960,951 | |

| | |

The Brink’s Co. | | | 58,362 | | | | 2,398,095 | |

| | |

Clean Harbors, Inc.* | | | 25,185 | | | | 1,411,116 | |

| | |

Crane Co. | | | 31,092 | | | | 1,558,642 | |

| | |

Dycom Industries, Inc.*,1 | | | 45,765 | | | | 2,417,307 | |

| | |

IDEX Corp. | | | 6,115 | | | | 1,115,437 | |

| | |

The Timken Co. | | | 37,636 | | | | 2,040,624 | |

| | |

Trinity Industries, Inc.1 | | | 70,513 | | | | 1,375,003 | |

| | |

Univar Solutions, Inc.* | | | 11,690 | | | | 197,327 | |

| | |

Watsco, Inc. | | | 5,581 | | | | 1,299,759 | |

| | |

Total Industrials | | | | | | | 15,774,261 | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Information Technology - 10.0% | | | | | |

| | |

Broadridge Financial Solutions, Inc. | | | 11,275 | | | | $1,488,300 | |

| | |

Knowles Corp.* | | | 81,758 | | | | 1,218,194 | |

| | |

The Western Union Co.1 | | | 57,239 | | | | 1,226,632 | |

| | |

Total Information Technology | | | | | | | 3,933,126 | |

| |

Materials - 3.2% | | | | | |

| | |

Westrock Co. | | | 36,749 | | | | 1,276,661 | |

| | |

Total Common Stocks

(Cost $32,166,277) | | | | | | | 38,102,985 | |

| | |

| | | Principal

Amount | | | | |

Short-Term Investments - 2.7% | | | | | | | | |

| |

Joint Repurchase Agreements - 0.2%2 | | | | | |

| | |

Mizuho Securities USA, LLC, dated 09/30/20, due 10/01/20, 0.060% total to be received $88,845 (collateralized by a U.S. Treasury, 2.750%, 11/30/20, totaling $90,622) | | $ | 88,845 | | | | 88,845 | |

| | |

| | | Shares | | | | |

| |

Other Investment Companies - 2.5% | | | | | |

| | |

Dreyfus Government Cash Management Fund, Institutional Shares, 0.02%3 | | | 316,778 | | | | 316,778 | |

| | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.04%3 | | | 316,779 | | | | 316,779 | |

| | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 0.06%3 | | | 326,378 | | | | 326,378 | |

| |

Total Other Investment Companies | | | | 959,935 | |

| | |

Total Short-Term Investments

(Cost $1,048,780) | | | | | | | 1,048,780 | |

| |

Total Investments - 99.7%

(Cost $33,215,057) | | | | 39,151,765 | |

| |

Other Assets, less Liabilities - 0.3% | | | | 108,141 | |

| | |

Net Assets - 100.0% | | | | | | $ | 39,259,906 | |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $3,672,974 or 9.4% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the September 30, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

|

|

| The accompanying notes are an integral part of these financial statements. |

| 12 |

| | | | |

| | | | | |

| | | AMG SouthernSun U.S. Equity Fund | | |

| | | Schedule of Portfolio Investments (continued) | | |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of September 30, 2020:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks† | | $ | 38,102,985 | | | | — | | | | — | | | $ | 38,102,985 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | — | | | $ | 88,845 | | | | — | | | | 88,845 | |

| | | | |

Other Investment Companies | | | 959,935 | | | | — | | | | — | | | | 959,935 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | $ | 39,062,920 | | | $ | 88,845 | | | | — | | | $ | 39,151,765 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended September 30, 2020, there were no transfers in or out of Level 3.

|

|

| The accompanying notes are an integral part of these financial statements. |

| 13 |

| | | | |

| | | | | |

| | | Statement of Assets and Liabilities | | |

| | | September 30, 2020 | | |

| | | | | | | | |

| | | AMG

SouthernSun

Small

Cap Fund | | | AMG

SouthernSun

U.S.

Equity Fund | |

Assets: | | | | | | | | |

| | |

Investments at value1 (including securities on loan valued at $4,668,940, and $3,672,974, respectively) | | $ | 167,734,641 | | | $ | 39,151,765 | |

| | |

Receivable for investments sold | | | 936,798 | | | | 472,789 | |

| | |

Dividend and interest receivables | | | 41,609 | | | | 24,721 | |

| | |

Securities lending income receivable | | | 645 | | | | 510 | |

| | |

Receivable for Fund shares sold | | | 267,348 | | | | 25 | |

| | |

Prepaid expenses and other assets | | | 18,762 | | | | 15,795 | |

Total assets | | | 168,999,803 | | | | 39,665,605 | |

| | |

Liabilities: | | | | | | | | |

| | |

Payable upon return of securities loaned | | | 468,210 | | | | 88,845 | |

| | |

Payable for investments purchased | | | 365,427 | | | | 199,015 | |

| | |

Payable for Fund shares repurchased | | | 73,843 | | | | 33,842 | |

| | |

Accrued expenses: | | | | | | | | |

| | |

Investment advisory and management fees | | | 105,132 | | | | 29,107 | |

| | |

Administrative fees | | | 21,026 | | | | 4,954 | |

| | |

Distribution fees | | | 6,718 | | | | 1,001 | |

| | |

Other | | | 52,318 | | | | 48,935 | |

Total liabilities | | | 1,092,674 | | | | 405,699 | |

| | | | | | | | |

Net Assets | | | $167,907,129 | | | | $39,259,906 | |

1 Investments at cost | | | $153,732,021 | | | | $33,215,057 | |

|

|

| The accompanying notes are an integral part of these financial statements. |

| 14 |

| | | | |

| | | | | |

| | | Statement of Assets and Liabilities (continued) | | |

| | | | | |

| | | | | | | | |

| | | AMG

SouthernSun

Small

Cap Fund | | | AMG

SouthernSun

U.S.

Equity Fund | |

Net Assets Represent: | | | | | | | | |

Paid-in capital | | | $154,707,480 | | | | $35,864,768 | |

Total distributable earnings | | | 13,199,649 | | | | 3,395,138 | |

Net Assets | | | $167,907,129 | | | | $39,259,906 | |

| | |

Class N: | | | | | | | | |

Net Assets | | | $31,783,916 | | | | $4,587,814 | |

Shares outstanding | | | 1,493,582 | | | | 383,049 | |

Net asset value, offering and redemption price per share | | | $21.28 | | | | $11.98 | |

Class I: | | | | | | | | |

Net Assets | | | $136,123,213 | | | | $34,672,092 | |

Shares outstanding | | | 6,263,705 | | | | 2,904,168 | |

Net asset value, offering and redemption price per share | | | $21.73 | | | | $11.94 | |

|

|

| The accompanying notes are an integral part of these financial statements. |

| 15 |

| | | | |

| | | | | |

| | | Statement of Operations | | |

| | | For the fiscal year ended September 30, 2020 | | |

| | | | | | | | |

| | | AMG

SouthernSun

Small

Cap Fund | | | AMG

SouthernSun

U.S.

Equity Fund | |

Investment Income: | | | | | | | | |

Dividend income | | | $1,847,920 | | | | $1,084,112 | |

Interest income | | | 1,042 | | | | — | |

Securities lending income | | | 12,690 | | | | 13,126 | |

Foreign withholding tax | | | (4,065 | ) | | | (2,201 | ) |

Total investment income | | | 1,857,587 | | | | 1,095,037 | |

Expenses: | | | | | | | | |

Investment advisory and management fees | | | 1,156,050 | | | | 427,476 | |

Administrative fees | | | 231,210 | | | | 85,495 | |

Distribution fees - Class N | | | 87,974 | | | | 14,359 | |

Professional fees | | | 37,651 | | | | 31,517 | |

Registration fees | | | 35,567 | | | | 38,571 | |

Reports to shareholders | | | 35,566 | | | | 18,300 | |

Custodian fees | | | 24,282 | | | | 18,939 | |

Trustee fees and expenses | | | 14,415 | | | | 5,383 | |

Transfer agent fees | | | 8,203 | | | | 5,600 | |

Miscellaneous | | | 5,385 | | | | 8,521 | |

Total expenses before offsets | | | 1,636,303 | | | | 654,161 | |

Expense reimbursements | | | — | | | | (14,467 | ) |

Expense reductions | | | — | | | | (14,023 | ) |

Net expenses | | | 1,636,303 | | | | 625,671 | |

| | | | | | | | |

Net investment income | | | 221,284 | | | | 469,366 | |

Net Realized and Unrealized Gain (Loss): | | | | | | | | |

Net realized gain on investments | | | 728,048 | | | | 8,731,687 | |

Net change in unrealized appreciation/depreciation on investments | | | (1,667,764 | ) | | | (7,123,091 | ) |

| | | | | | | | |

Net realized and unrealized gain (loss) | | | (939,716 | ) | | | 1,608,596 | |

| | | | | | | | |

| | |

Net increase (decrease) in net assets resulting from operations | | | $(718,432 | ) | | | $2,077,962 | |

|

|

| The accompanying notes are an integral part of these financial statements. |

| 16 |

| | | | |

| | | | | |

| | | Statements of Changes in Net Assets | | |

| | | For the fiscal years ended September 30, | | |

| | | | | | | | | | | | | | | | |

| | | AMG

SouthernSun

Small Cap Fund | | | AMG

SouthernSun

U.S. Equity Fund | |

| | | | |

| | | 2020 | | | 2019 | | | 2020 | | | 2019 | |

Increase (Decrease) in Net Assets Resulting From Operations: | | | | | | | | | | | | | | | | |

Net investment income | | | $221,284 | | | | $321,758 | | | | $469,366 | | | | $1,259,012 | |

Net realized gain (loss) on investments | | | 728,048 | | | | 11,004,443 | | | | 8,731,687 | | | | (3,037,805 | ) |

Net change in unrealized appreciation/depreciation on investments | | | (1,667,764 | ) | | | (34,966,325 | ) | | | (7,123,091 | ) | | | (37,527,100 | ) |

Net increase (decrease) in net assets resulting from operations | | | (718,432 | ) | | | (23,640,124 | ) | | | 2,077,962 | | | | (39,305,893 | ) |

Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Class N | | | (2,169,967 | ) | | | (1,879,621 | ) | | | (70,397 | ) | | | (303,270 | ) |

Class I | | | (6,062,517 | ) | | | (4,140,540 | ) | | | (955,671 | ) | | | (13,176,945 | ) |

Class C1 | | | — | | | | — | | | | — | | | | (411,195 | ) |

Total distributions to shareholders | | | (8,232,484 | ) | | | (6,020,161 | ) | | | (1,026,068 | ) | | | (13,891,410 | ) |

Capital Share Transactions:2 | | | | | | | | | | | | | | | | |

Net increase (decrease) from capital share transactions | | | 32,436,636 | | | | (60,021,678 | ) | | | (48,810,642 | ) | | | (153,779,289 | ) |

| | | | | | | | | | | | | | | | |

Total increase (decrease) in net assets | | | 23,485,720 | | | | (89,681,963 | ) | | | (47,758,748 | ) | | | (206,976,592 | ) |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of year | | | 144,421,409 | | | | 234,103,372 | | | | 87,018,654 | | | | 293,995,246 | |

End of year | | | $167,907,129 | | | | $144,421,409 | | | | $39,259,906 | | | | $87,018,654 | |

| 1 | Effective May 31, 2019, Class C shares were converted into Class N shares. |

| 2 | See Note 1(g) of the Notes to Financial Statements. |

|

|

| The accompanying notes are an integral part of these financial statements. |

| 17 |

| | | | |

| | | AMG SouthernSun Small Cap Fund | | |

| | | Financial Highlights | | |

| | | For a share outstanding throughout each fiscal year | | |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended September 30, | |

| | | | | |

| Class N | | 2020 | | | 2019 | | | 2018 | | | 20171 | | | 2016 | |

Net Asset Value, Beginning of Year | | | $22.59 | | | | $25.59 | | | | $25.79 | | | | $21.16 | | | | $21.09 | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2,3 | | | (0.01 | ) | | | 0.00 | 4 | | | (0.05 | ) | | | (0.04 | ) | | | 0.00 | 4,5 |

Net realized and unrealized gain (loss) on investments | | | (0.02 | ) | | | (2.10 | ) | | | (0.15 | ) | | | 4.67 | | | | 2.42 | |

| | | | | |

Total income (loss) from investment operations | | | (0.03 | ) | | | (2.10 | ) | | | (0.20 | ) | | | 4.63 | | | | 2.42 | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.01 | ) | | | — | | | | — | | | | — | | | | (0.02 | ) |

Net realized gain on investments | | | (1.27 | ) | | | (0.90 | ) | | | — | | | | — | | | | (2.33 | ) |

Total distributions to shareholders | | | (1.28 | ) | | | (0.90 | ) | | | — | | | | — | | | | (2.35 | ) |

Net Asset Value, End of Year | | | $21.28 | | | | $22.59 | | | | $25.59 | | | | $25.79 | | | | $21.16 | |

Total Return3,6 | | | (0.72 | )% | | | (7.46 | )% | | | (0.78 | )% | | | 21.88 | % | | | 12.97 | % |

Ratio of net expenses to average net assets | | | 1.25 | % | | | 1.24 | %7 | | | 1.21 | %7 | | | 1.21 | %7 | | | 1.20 | %7 |

Ratio of gross expenses to average net assets8 | | | 1.25 | % | | | 1.24 | % | | | 1.21 | % | | | 1.21 | % | | | 1.21 | % |

Ratio of net investment income (loss) to average net assets3 | | | (0.05 | )% | | | 0.02 | % | | | (0.20 | )% | | | (0.19 | )% | | | 0.01 | % |

Portfolio turnover | | | 25 | % | | | 29 | % | | | 20 | % | | | 21 | % | | | 16 | % |

| | | | | |

Net assets end of year (000’s) omitted | | | $31,784 | | | | $40,279 | | | | $60,916 | | | | $110,092 | | | | $139,603 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | AMG SouthernSun Small Cap Fund | | |

| | | Financial Highlights | | |

| | | For a share outstanding throughout each fiscal year | | |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended September 30, | |

| | | | | |

| Class I | | 2020 | | | 2019 | | | 2018 | | | 20171 | | | 2016 | |

| | | | | |

Net Asset Value, Beginning of Year | | | $23.04 | | | | $26.02 | | | | $26.16 | | | | $21.46 | | | | $21.43 | |

| | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income2,3 | | | 0.04 | | | | 0.06 | | | | 0.01 | | | | 0.01 | | | | 0.06 | 5 |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | (0.01 | ) | | | (2.14 | ) | | | (0.15 | ) | | | 4.74 | | | | 2.45 | |

| | | | | |

Total income (loss) from investment operations | | | 0.03 | | | | (2.08 | ) | | | (0.14 | ) | | | 4.75 | | | | 2.51 | |

| | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.07 | ) | | | — | | | | — | | | | (0.05 | ) | | | (0.11 | ) |

| | | | | |

Net realized gain on investments | | | (1.27 | ) | | | (0.90 | ) | | | — | | | | — | | | | (2.37 | ) |

| | | | | |

Total distributions to shareholders | | | (1.34 | ) | | | (0.90 | ) | | | — | | | | (0.05 | ) | | | (2.48 | ) |

| | | | | |

Net Asset Value, End of Year | | | $21.73 | | | | $23.04 | | | | $26.02 | | | | $26.16 | | | | $21.46 | |

| | | | | |

Total Return3,6 | | | (0.45 | )% | | | (7.25 | )% | | | (0.54 | )% | | | 22.19 | % | | | 13.23 | % |

| | | | | |

Ratio of net expenses to average net assets | | | 1.00 | % | | | 0.99 | %7 | | | 0.96 | %7 | | | 0.96 | %7 | | | 0.95 | %7 |

| | | | | |

Ratio of gross expenses to average net assets8 | | | 1.00 | % | | | 0.99 | % | | | 0.96 | % | | | 0.96 | % | | | 0.96 | % |

| | | | | |

Ratio of net investment income to average net assets3 | | | 0.20 | % | | | 0.27 | % | | | 0.05 | % | | | 0.06 | % | | | 0.27 | % |

| | | | | |

Portfolio turnover | | | 25 | % | | | 29 | % | | | 20 | % | | | 21 | % | | | 16 | % |

| | | | | |

Net assets end of year (000’s) omitted | | | $136,123 | | | | $104,143 | | | | $173,188 | | | | $250,213 | | | | $210,363 | |

| | | | | | | | | | | | | | | | | | | | | |

| 1 | Effective October 1, 2016, Investor Class and Institutional Class were renamed Class N and Class I, respectively. |

| 2 | Per share numbers have been calculated using average shares. |

| 3 | Total returns and net investment income (loss) would have been lower had certain expenses not been offset. |

| 4 | Less than $0.005 per share. |

| 5 | Includes non-recurring dividends. Without these dividends, net investment income (loss) per share would have been $(0.01) and $0.05 for Class N and Class I shares, respectively. |

| 6 | The total return is calculated using the published Net Asset Value as of fiscal year end. |

| 7 | Includes reduction from broker recapture amounting to less than 0.01% for the fiscal years ended 2019, 2018, and 2017, respectively, and 0.01% for the fiscal year ended 2016. |

| 8 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

| | | | |

| | | AMG SouthernSun U.S. Equity Fund | | |

| | | Financial Highlights | | |

| | | For a share outstanding throughout each fiscal year | | |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended September 30, | |

| | | | | |

| Class N | | 2020 | | | 2019 | | | 2018 | | | 20171 | | | 2016 | |

| | | | | |

Net Asset Value, Beginning of Year | | | $11.90 | | | | $14.40 | | | | $14.09 | | | | $12.63 | | | | $11.77 | |

| | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income2,3 | | | 0.07 | | | | 0.07 | | | | 0.02 | | | | 0.01 | | | | 0.03 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 0.14 | | | | (1.85 | ) | | | 0.29 | | | | 1.47 | | | | 1.33 | |

| | | | | |

Total income (loss) from investment operations | | | 0.21 | | | | (1.78 | ) | | | 0.31 | | | | 1.48 | | | | 1.36 | |

| | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.13 | ) | | | (0.05 | ) | | | (0.00 | )4 | | | (0.02 | ) | | | (0.02 | ) |

| | | | | |

Net realized gain on investments | | | — | | | | (0.67 | ) | | | — | | | | — | | | | (0.48 | ) |

| | | | | |

Total distributions to shareholders | | | (0.13 | ) | | | (0.72 | ) | | | (0.00 | )4 | | | (0.02 | ) | | | (0.50 | ) |

| | | | | |

Net Asset Value, End of Year | | | $11.98 | | | | $11.90 | | | | $14.40 | | | | $14.09 | | | | $12.63 | |

| | | | | |

Total Return3,5 | | | 1.64 | % | | | (11.50 | )% | | | 2.22 | % | | | 11.71 | % | | | 12.13 | % |

| | | | | |

Ratio of net expenses to average net assets6 | | | 1.32 | % | | | 1.19 | % | | | 1.19 | % | | | 1.20 | % | | | 1.20 | % |

| | | | | |

Ratio of gross expenses to average net assets7 | | | 1.37 | % | | | 1.25 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % |

| | | | | |

Ratio of net investment income to average net assets3 | | | 0.60 | % | | | 0.58 | % | | | 0.17 | % | | | 0.08 | % | | | 0.23 | % |

| | | | | |

Portfolio turnover | | | 11 | % | | | 18 | % | | | 46 | % | | | 18 | % | | | 16 | % |

| | | | | |

Net assets end of year (000’s) omitted | | | $4,588 | | | | $7,206 | | | | $8,516 | | | | $31,038 | | | | $45,902 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | AMG SouthernSun U.S. Equity Fund | | |

| | | Financial Highlights | | |

| | | For a share outstanding throughout each fiscal year | | |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended September 30, | |

| | | | | |

Class I | | | 2020 | | | | 2019 | | | | 2018 | | | | 20171 | | | | 2016 | |

| | | | | |

Net Asset Value, Beginning of Year | | | $11.86 | | | | $14.44 | | | | $14.14 | | | | $12.67 | | | | $11.83 | |

| | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income2,3 | | | 0.10 | | | | 0.10 | | | | 0.06 | | | | 0.04 | | | | 0.06 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 0.13 | | | | (1.87 | ) | | | 0.29 | | | | 1.48 | | | | 1.34 | |

| | | | | |

Total income (loss) from investment operations | | | 0.23 | | | | (1.77 | ) | | | 0.35 | | | | 1.52 | | | | 1.40 | |

| | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.15 | ) | | | (0.14 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.08 | ) |

| | | | | |

Net realized gain on investments | | | — | | | | (0.67 | ) | | | — | | | | — | | | | (0.48 | ) |

| | | | | |

Total distributions to shareholders | | | (0.15 | ) | | | (0.81 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.56 | ) |

| | | | | |

Net Asset Value, End of Year | | | $11.94 | | | | $11.86 | | | | $14.44 | | | | $14.14 | | | | $12.67 | |

| | | | | |

Total Return3,5 | | | 1.86 | % | | | (11.27 | )% | | | 2.46 | % | | | 12.02 | % | | | 12.42 | % |

| | | | | |

Ratio of net expenses to average net assets6 | | | 1.07 | % | | | 0.94 | % | | | 0.94 | % | | | 0.95 | % | | | 0.95 | % |

| | | | | |

Ratio of gross expenses to average net assets7 | | | 1.12 | % | | | 1.00 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % |

| | | | | |

Ratio of net investment income to average net assets3 | | | 0.85 | % | | | 0.81 | % | | | 0.42 | % | | | 0.33 | % | | | 0.49 | % |

| | | | | |

Portfolio turnover | | | 11 | % | | | 18 | % | | | 46 | % | | | 18 | % | | | 16 | % |

| | | | | |

Net assets end of year (000’s) omitted | | $ | 34,672 | | | $ | 79,813 | | | $ | 273,774 | | | $ | 770,603 | | | $ | 676,962 | |

| | | | | | | | | | | | | | | | | | | | | |

| 1 | Effective October 1, 2016, Investor Class and Institutional Class were renamed Class N and Class I, respectively. |

| 2 | Per share numbers have been calculated using average shares. |

| 3 | Total returns and net investment income would have been lower had certain expenses not been offset. |

| 4 | Less than $(0.005) per share. |

| 5 | The total return is calculated using the published Net Asset Value as of fiscal year end. |

| 6 | Includes reduction from broker recapture amounting to 0.02%, 0.06%, 0.01%, for the fiscal years ended 2020, 2019, and 2018, respectively, and less than 0.01% for the fiscal years ended 2017 and 2016, respectively. |

| 7 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

| | | | |

| | | | | |

| | | Notes to Financial Statements | | |

| | | September 30, 2020 | | |

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AMG Funds (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust consists of a number of different funds, each having distinct investment management objectives, strategies, risks, and policies. Included in this report are AMG SouthernSun Small Cap Fund (“Small Cap”) and AMG SouthernSun U.S. Equity Fund (“U.S. Equity”), each a “Fund” and collectively, the “Funds”.

On September 17, 2020, the Board of Trustees of the Trust (the “Board”) approved and recommended submitting to each Fund’s shareholders a proposed Agreement and Plan of Reorganization (the “Plan”) that provides for the reorganization of each Fund into a corresponding series of Advisors’ Inner Circle Fund III. The Plan sets forth the terms by which each Fund would transfer all of its assets and liabilities to its corresponding new fund of Advisors’ Inner Circle Fund III in exchange for shares of the corresponding new fund, and subsequently distribute the corresponding new fund shares to applicable Fund shareholders in complete liquidation of each Fund. Shareholders of each Fund will vote separately on the proposal to reorganize their respective Fund. Each new fund has been created to continue the investment operations of the corresponding Fund. The new funds’ investment adviser will be the current subadviser to the Funds.

Each Fund offers different classes of shares. Each Fund offers Class N and Class I shares. Effective May 31, 2019, U.S. Equity Class C shares were converted to Class N shares. Each class represents an interest in the same assets of the respective Fund. Although all share classes generally have identical voting rights, each share class votes separately when required by law. Different share classes may have different net asset values per share to the extent the share classes pay different distribution amounts and/or the expenses of such share classes differ. Each share class has its own expense structure. Please refer to a current prospectus for additional information on each share class.

The Funds are non-diversified. A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Funds at greater risk than a more diversified fund.

Market disruptions associated with the COVID-19 pandemic have had a global impact, and uncertainty exists as to the long-term implications. Such disruptions can adversely affect assets of the Funds and thus Fund performance.

The Funds’ financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including accounting and reporting guidance pursuant to Accounting Standards Codification Topic 946 applicable to investment companies. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements:

a. VALUATION OF INVESTMENTS

Equity securities traded on a national securities exchange or reported on the NASDAQ national market system (“NMS”) are valued at the last quoted sales price on the primary exchange or, if applicable, the NASDAQ official closing price or the

official closing price of the relevant exchange or, lacking any sales, at the last quoted bid price or the mean between the last quoted bid and ask prices (the “mean price”). Equity securities traded in the over-the-counter market (other than NMS securities) are valued at the mean price. Foreign equity securities (securities principally traded in markets other than U.S. markets) are valued at the official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price.