UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09521

AMG FUNDS

(Exact name of registrant as specified in charter)

One Stamford Plaza, 263 Tresser Boulevard, Suite 949, Stamford,

Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

One Stamford Plaza, 263 Tresser Boulevard, Suite 949, Stamford,

Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2020 – DECEMBER 31, 2020

(Annual Shareholder Report)

Item 1. Reports to Shareholders

| | Annual Report |

| | |

| | |

| | | AMG Funds |

| | | | |

| | | December 31, 2020 |

| | | | |

| | |  |

| | | | |

| | | AMG Yacktman Fund |

| | | Class I: YACKX |

| | | | |

| | | AMG Yacktman Focused Fund |

| | | Class N: YAFFX | Class I: YAFIX |

| | | | |

| | | AMG Yacktman Focused Fund - Security Selection Only |

| | | Class N: YFSNX | Class I: YFSIX |

| | | | |

| | | AMG Yacktman Special Opportunities Fund |

| | | Class I: YASSX | Class Z: YASLX |

| | | | |

| | | | |

| | | | |

| | |

| | |

| | AMG Funds |

| | Annual Report — December 31, 2020 |

| | |

| | |

| | TABLE OF CONTENTS | PAGE |

| | LETTER TO SHAREHOLDERS | 2 |

| | ABOUT YOUR FUND’S EXPENSES | 3 |

| | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULES OF PORTFOLIO INVESTMENTS | |

| | AMG Yacktman Fund | 4 |

| | AMG Yacktman Focused Fund | 13 |

| | AMG Yacktman Focused Fund - Security Selection Only | 22 |

| | AMG Yacktman Special Opportunities Fund | 30 |

| | FINANCIAL STATEMENTS | |

| | Statement of Assets and Liabilities | 41 |

| | Balance sheets, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | |

| | Statement of Operations | 43 |

| | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | |

| | Statements of Changes in Net Assets | 44 |

| | Detail of changes in assets for the past two fiscal years | |

| | Financial Highlights | 46 |

| | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | |

| | Notes to Financial Statements | 53 |

| | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | |

| | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 61 |

| | OTHER INFORMATION | 62 |

| | TRUSTEES AND OFFICERS | 63 |

| Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. |

| Letter to Shareholders |

Dear Shareholder:

The fiscal year ending December 31, 2020, was a volatile period for financial markets that featured a dramatic selloff and extraordinary rebound amid the unprecedented global effort to stop the COVID-19 pandemic. Early in the year, equities achieved new record highs against the backdrop of a healthy economy and strong investor sentiment. However, a broad-based selloff occurred amid a global flight to quality as investors assessed the scope of the unfolding COVID-19 pandemic, a deteriorating economy, and skyrocketing unemployment. An oil price war initiated between Saudi Arabia and Russia only made matters worse. From its peak in mid-February 2020, the S&P 500® Index declined (33.79)% over the span of a few weeks, halting the eleven-year equity bull market. In response to the crisis, global central banks and governments were quick to flood the market with massive fiscal and monetary stimulus which helped to stabilize the market and led to an impressive recovery in risk assets, albeit a very uneven one. So despite the volatility, the S&P 500® Index still achieved an 18.40% return for 2020 while effective COVID-19 vaccines and further government stimulus bolstered investor optimism for a brighter future in 2021.

During the year there was very wide dispersion in performance across sectors, with information technology and consumer discretionary sectors leading the market with returns of 43.88% and 33.30%, respectively. On the other hand, companies in the energy sector fell (33.69)%, and financials and real estate also produced slightly negative returns. Growth stocks significantly outperformed value stocks for the period with returns of 38.49% and 2.80% for the Russell 1000® Growth and Russell 1000® Value Indexes, respectively. Small cap stocks endured a wild ride in 2020 as the Russell 2000® Index experienced both its best quarter (fourth quarter 2020) and worst quarter (first quarter 2020) on record. For the year as a whole, small cap returns were relatively in line with the broader market as the Russell 2000® Index gained 19.96% in 2020. Outside the U.S., emerging markets outperformed developed markets with an 18.31% return for the MSCI Emerging Markets Index compared to a 7.82% return for the MSCI EAFE Index.

Interest rates fell dramatically and led to strong returns for bond investors as the U.S. Federal Reserve (the Fed) slashed short-term rates in response to the slowing economy. The 10-year Treasury yield ended the year near a historic low yield of 0.93%. The Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, returned 7.51% over the period. Investment grade corporate bonds rebounded from the selloff early in the year and returned 9.89% in 2020. Riskier high yield bonds lagged the investment grade market with a 7.11% return as measured by the return of the Bloomberg Barclays U.S. Corporate High Yield Bond Index.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| Average Annual Total Returns | Periods ended

December 31, 2020* |

| Stocks: | | 1 Year | 3 Years | 5 Years |

| Large Cap | (S&P 500® Index) | 18.40% | 14.18% | 15.22% |

| Small Cap | (Russell 2000® Index) | 19.96% | 10.25% | 13.26% |

| International | (MSCI All Country World Index ex USA) | 10.65% | 4.88% | 8.93% |

| Bonds: | | | | |

| Investment Grade | (Bloomberg Barclays U.S. Aggregate Bond Index) | 7.51% | 5.34% | 4.44% |

| | | | | |

| High Yield | (Bloomberg Barclays U.S. Corporate High Yield Bond Index) | 7.11% | 6.24% | 8.59% |

| | | | | |

| Tax-exempt | (Bloomberg Barclays Municipal Bond Index) | 5.21% | 4.64% | 3.91% |

| | | | | |

| Treasury Bills | (ICE BofAML U.S. 6-Month Treasury Bill Index) | 1.05% | 1.84% | 1.43% |

*Source: FactSet. Past performance is no guarantee of future results.

| | |

| | |

| | About Your Fund’s Expenses |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

Six Months Ended

December 31, 2020 | Expense

Ratio for

the Period | Beginning

Account

Value

07/01/20 | Ending

Account

Value

12/31/20 | Expenses

Paid

During

the Period* |

| AMG Yacktman Fund |

| Based on Actual Fund Return | | | |

| Class I | 0.70% | $1,000 | $1,269 | $3.99 |

| Based on Hypothetical 5% Annual Return | | |

| Class I | 0.70% | $1,000 | $1,022 | $3.56 |

| | | | | |

| AMG Yacktman Focused Fund |

| Based on Actual Fund Return | | | |

| Class N | 1.25% | $1,000 | $1,280 | $7.16 |

| Class I | 1.06% | $1,000 | $1,281 | $6.08 |

| Based on Hypothetical 5% Annual Return | | |

| Class N | 1.25% | $1,000 | $1,019 | $6.34 |

| Class I | 1.06% | $1,000 | $1,020 | $5.38 |

| | | | | |

| AMG Yacktman Focused Fund - Security Selection Only |

| Based on Actual Fund Return |

| Class N | 1.24% | $1,000 | $1,343 | $7.30 |

| Class I | 1.08% | $1,000 | $1,344 | $6.36 |

| Based on Hypothetical 5% Annual Return | | |

| Class N | 1.24% | $1,000 | $1,019 | $6.29 |

| Class I | 1.08% | $1,000 | $1,020 | $5.48 |

Six Months Ended

December 31, 2020 | Expense

Ratio for the

Period | Beginning

Account

Value

07/01/20 | Ending

Account

Value

12/31/20 | Expenses

Paid

During

the Period* |

| AMG Yacktman Special Opportunities Fund |

| Based on Actual Fund Return | | | |

| Class I | 1.48%† | $1,000 | $1,325 | $8.65 |

| Class Z | 1.38%† | $1,000 | $1,326 | $8.07 |

| Based on Hypothetical 5% Annual Return |

| Class I | 1.48%† | $1,000 | $1,018 | $7.51 |

| Class Z | 1.38%† | $1,000 | $1,018 | $7.00 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 366. |

| † | Includes a performance fee adjustment amounting to (0.26)% of average daily net assets which is not annualized. (See Note 2 of Notes to Financial Statements.) |

| | |

| | |

| | AMG Yacktman Fund |

| | Portfolio Manager’s Comments (unaudited) |

We hope you have managed through the difficulties of 2020 as safely and healthily as possible. In 2020, the AMG Yacktman Fund (the Fund) Class I shares delivered strong results compared to the Russell 1000® Value Index with the Fund appreciating 15.28%, significantly outperforming the Russell 1000® Value benchmark, which was up 2.80% (but modestly underperformed the secondary S&P 500® Index which returned 18.40% for the year). During the year we were able to make many new investments, especially during the steep declines of the first quarter, reducing cash meaningfully in 2020. While we were aggressive purchasers during the market drop, had the declines lasted for more than a few weeks or been even sharper we would have been able to put even more cash to work. Overall, we are pleased to have delivered the strong outperformance versus our value benchmark last year. Recently, Mutual Fund Observer looked at risk-adjusted returns for the 2,076 equity-oriented mutual funds that have a 20-year track record and placed the Fund at the top of their risk-adjusted list, declaring, “Yacktman and Yacktman Focused are almost freakishly successful, year and year, by almost every measure. They’re sort of the (pre-2020) New England Patriots of investing. Adam Sabban at Morningstar characterizes them as ‘half equity fund, half absolute-return hedge fund,’ which favors great core businesses but is willing to hold cash, buy during panics and shop overseas.”1 While investors have enjoyed high rates of return for the last decade, they have likely set up low returns for the major indices over the long term. Many have forgotten the pain that paying crazy prices in the late 1990s technology bubble led to and should be highly concerned about the valuations of today’s latest story stock. Like the last technology bubble, index funds will likely add many of these speculative companies at the wrong time and price, causing some benchmarks, which are supposed to be passive, to actively cause long-term pain for investors. Getting Growth at Value Prices Many of our favorite investments today continue to be in complicated, mispriced, owner-operated conglomerates like Samsung Electronics Co., Ltd., Bollore SA, News Corp., and Associated British Foods PLC. Each of these companies has business units that are powerful and growing rapidly, along with other businesses that are substantial contributors to cash flow and sell at significant discounts to what we think they are worth. Several of these companies are in the process of unlocking value through better | disclosure or separation of the stronger business units. Often these mispriced securities require a great deal of time and patience, which are qualities we take great pride in possessing, especially in an industry that affords few a true long-term approach. Contributors for the year included Samsung, Brenntag, and Microsoft Samsung was the top contributor to results last year, and is our largest position. The company has a strong market position in high growth markets, including foundry, sensors, and 5G equipment, and a good position in emerging industries like artificial intelligence, autonomous driving, and internet of things, yet it sells at an extremely low multiple of earnings and cash flow and has a significant amount of net excess net cash and securities on the balance sheet. Samsung’s core semiconductor business is set up for high growth over the next few years, and we think the stock could be in an early phase of positive re-rating, which is a period where a stock goes from a low multiple to a substantially higher one that better reflects the company’s business prospects. Brenntag AG, which is the global leader in distribution of chemicals to small and mid-sized businesses, produced strong returns last year as the company demonstrated remarkable business consistency, despite the significant economic headwinds. We think the shares remain attractive and the company has a strong market position and management team, which should enable Brenntag to produce strong results over time. Microsoft Corp. continued to deliver strong business and share price results last year. The company continues to benefit from strong customer growth, especially in its cloud business, and remains attractively priced, given the potential for solid long-term cash flow growth. Detractors included Weatherford, Macy’s, and Fox Weatherford International PLC’s equity and debt detracted from results due to general weakness in the energy sector. Although fundamentals were challenging during the year, management was able to downsize the business and navigate through the challenges reasonably well. We expect to see better results as the economy improves in 2021. | Macy’s, Inc. suffered from shutdowns in 2020 much like Weatherford. Its core retail business suffered and the value of its real estate was impaired, especially in cities like New York and San Francisco. Due to the huge price swings in the stock, we were able to purchase additional shares at low prices during the declines and then reduce our holding as the stock nearly doubled in the fourth quarter alone. Have the rules of investing changed? At times, a long-term change in rules can create a significant impact. Perhaps we are in an environment where securities sell at higher prices versus prior eras due to central banking, but the net result of the higher prices will be lower long-term returns. In 1968 baseball pitchers dominated hitters, causing low-scoring games that were less popular with fans. The following year, the height of the pitcher’s mound was reduced from 15 inches to 10 inches, where it remains today, and hitters and average runs per game increased from 3.42 to 4.07, although some of the increase likely came from new teams being added to the league (ESPN article, March 8, 2019). Fox Corp. declined last year due to advertising weakness and challenges with Fox News and lower viewership of sports. The shares sell at a low valuation and the company has significant value in tax shields, real estate, and gaming investments that we think are underappreciated. Conclusion Stock returns are largely a result of free cash flow, growth, and multiple change, with most of the returns in recent years from the last variable. With the high-priced index offering a low free-cash-flow yield and likely a continuation of low growth, long-term index returns look challenging. We believe our approach of finding individual securities that we believe are mispriced and offer solid risk-adjusted returns is more important than ever when equities are expensive as they are today. Even if the rules have changed—and we would not argue they have—we have moved to prices where those who stopped thinking about risk will likely regret that decision at some point in the future. We will continue to work hard to find mispriced opportunities to deliver results over the long term while also considering risk. The time to be most aware of potential risks is when others completely ignore them. We never forget that the price you pay matters both for potential return and to mitigate losses if things turn out worse than you expected. |

| | |

| | |

| | AMG Yacktman Fund |

| | Portfolio Manager’s Comments (CONTINUED) |

We wish everyone the best for the new year and, as always, will be objective, patient, and diligent when managing the AMG Yacktman Fund. 1 Source: 21st Century Champions, Jan. 2021. | The views expressed represent the opinions of Yacktman Asset Management LP as of December 31, 2020, are not intended as a forecast or guarantee of future results, and are subject to change without notice. | |

| | |

| | |

| | AMG Yacktman Fund |

| | Portfolio Manager’s Comments (CONTINUED) |

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Yacktman Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Yacktman Fund’s Class I shares on December 31, 2010 to a $10,000 investment made in the Russell 1000® Value Index and the S&P 500® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Yacktman Fund, the Russell 1000® Value Index and the S&P 500® Index for the same time periods ended December 31, 2020.

| Average Annual Total Returns1 | One Year | Five

Years | Ten Years |

| AMG Yacktman Fund2, 3, 4, 5, 6, 7, 8, 9, 10 | | | |

| Class I | 15.28% | 12.86% | 11.39% |

| Russell 1000® Value Index11 | 2.80% | 9.74% | 10.50% |

| S&P 500® Index12 | 18.40% | 15.22% | 13.88% |

Effective June 30, 2020, the Yacktman Fund’s primary and secondary benchmarks were changed to the Russell 1000® Value Index becoming the primary benchmark and S&P 500® Index the secondary benchmark from the S&P 500® Index as the primary benchmark and the Russell 1000® Value Index as the secondary benchmark previously.

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

| | | capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2020. All returns are in U.S. dollars ($). |

| | | |

| | 2 | From time to time the Fund’s investment manager has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| | | |

| | 3 | The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. |

| | | |

| | 4 | High-yield bonds (also known as “junk bonds”) may be subject to greater levels of interest rate, credit, and liquidity risk than investments in higher rated securities. These securities are considered predominantly speculative with respect to the issuer’s continuing ability to make principal and interest payments. The issuers of the Fund’s holdings may be involved in bankruptcy proceedings, reorganizations, or financial restructurings, and are not as strong financially as higher-rated issuers. |

| | | |

| | 5 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| | | |

| | 6 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

| | | |

| | 7 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| | | |

| | 8 | Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. |

| | | |

| | 9 | Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. |

| | |

| | |

| | AMG Yacktman Fund |

| | Portfolio Manager’s Comments (CONTINUED) |

10 The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. 11 The Russell 1000® Value Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 1000® | | Value Index is unmanaged, is not available for investment and does not incur expenses. 12 The S&P 500® Index is a capitalization-weighted index of 500 stocks. The S&P 500® Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Unlike the Fund, the S&P 500® Index is unmanaged, is not available for investment and does not incur expenses. | The Russell 1000® Value Index is a trademark of the London Stock Exchange Group companies. The S&P 500® Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. Not FDIC insured, nor bank guaranteed. May lose value. |

| | | | |

| | AMG Yacktman Fund |

| | Fund Snapshots (unaudited) |

| | December 31, 2020 |

| PORTFOLIO BREAKDOWN | |

| | |

| Sector | % of

Net Assets |

| Consumer Staples | 19.2 |

| Information Technology | 17.7 |

| Communication Services | 17.1 |

| Consumer Discretionary | 9.5 |

| Financials | 9.1 |

| Industrials | 6.9 |

| Health Care | 3.3 |

| Energy | 1.6 |

| Materials | 1.2 |

| Short-Term Investments | 14.3 |

| Other Assets Less Liabilities | 0.1 |

| TOP TEN HOLDINGS | |

| | | |

| Security Name | % of

Net Assets |

| Samsung Electronics Co., Ltd., 1.340% (South Korea) | 10.1 |

| Bollore SA (France) | | 5.3 |

| Brenntag AG (Germany) | | 3.7 |

| Sysco Corp. | | 2.9 |

| PepsiCo, Inc. | | 2.9 |

| Alphabet, Inc., Class C | | 2.9 |

| News Corp., Class A | | 2.8 |

| The Walt Disney Co. | | 2.7 |

| The Procter & Gamble Co. | | 2.6 |

| Microsoft Corp. | | 2.6 |

| Top Ten as a Group | | 38.5 |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

| | |

| | |

| | AMG Yacktman Fund |

| | Fund Snapshots (continued) |

| | For the six months ended December 31, 2020 |

| NEW EQUITY POSITIONS |

| |

| New Purchases | Current

Shares Held |

| The Charles Schwab Corp. | 1,825,000 |

| Hyundai Mobis Co., Ltd. (South Korea) | 550,000 |

| Tyson Foods, Inc., Class A | 1,460,000 |

| CORPORATE BONDS & NOTES SALES |

| | | |

| Sales | Net Principal

Sold | Current Principal

Held |

| Service Properties Trust, 4.350%, 10/01/24 | $13,505,000 | $20,678,000 |

| Service Properties Trust, 4.500%, 03/15/25 | 7,623,000 | — |

| Service Properties Trust, 4.650%, 03/15/24 | 11,665,000 | — |

| Six Flags Entertainment Corp., 5.500%, 04/15/27 | 18,720,000 | — |

| EQUITY PURCHASES & SALES |

| | | |

| Purchases | Net Shares

Purchased | Current Shares

Held |

| Ingredion, Inc. | 760,000 | 1,150,000 |

| KT&G Corp. (South Korea) | 600,000 | 1,100,000 |

| Sales | Net Shares

Sold | Current Shares

Held |

| Alphabet, Inc., Class C | 5,000 | 125,000 |

| Booking Holdings, Inc. | 5,000 | 85,000 |

| Continental AG (Germany) | 1,040,000 | 900,000 |

| Fox Corp., Class A | 2,100,000 | 4,200,000 |

| Johnson & Johnson | 50,000 | 1,000,000 |

| Macy’s, Inc. | 5,700,000 | 13,800,000 |

| Microsoft Corp. | 100,000 | 900,000 |

| Oracle Corp. | 100,000 | 1,000,000 |

| PepsiCo, Inc. | 100,000 | 1,500,000 |

| Qurate Retail, Inc., Series A | 1,900,000 | — |

| Samsung Electronics Co., Ltd., 1.340% (South Korea) | 4,600,000 | 11,400,000 |

| The Walt Disney Co. | 400,000 | 1,150,000 |

| | |

| | AMG Yacktman Fund |

| | Schedule of Portfolio Investments |

| | December 31, 2020 |

| | Shares | Value |

| Common Stocks - 72.8% | | |

| Communication Services - 17.1% | | |

| Alphabet, Inc., Class C* | 125,000 | $218,985,000 |

| Bollore SA (France) | 97,075,700 | 401,907,946 |

| Comcast Corp., Class A | 1,100,000 | 57,640,000 |

| Fox Corp., Class A1 | 4,200,000 | 122,304,000 |

| Fox Corp., Class B | 3,100,000 | 89,528,000 |

| News Corp., Class A | 11,700,000 | 210,249,000 |

| The Walt Disney Co.* | 1,150,000 | 208,357,000 |

| Total Communication Services | | 1,308,970,946 |

| Consumer Discretionary - 9.5% | | |

| Booking Holdings, Inc.* | 85,000 | 189,317,950 |

| Continental AG (Germany) | 900,000 | 133,951,750 |

| Hyundai Mobis Co., Ltd. (South Korea) | 550,000 | 129,451,389 |

| Macy’s, Inc. | 13,800,000 | 155,250,000 |

| Ralph Lauren Corp. | 404,000 | 41,910,960 |

| Rinnai Corp. (Japan) | 620,000 | 72,070,128 |

| Stanley Electric Co., Ltd. (Japan) | 166,668 | 5,376,618 |

| Total Consumer Discretionary | | 727,328,795 |

| Consumer Staples - 19.2% | | |

| Associated British Foods PLC (United Kingdom)* | 4,550,000 | 140,479,816 |

| Beiersdorf AG, ADR (Germany) | 4,305,280 | 100,958,816 |

| The Coca-Cola Co. | 3,000,000 | 164,520,000 |

| Colgate-Palmolive Co. | 1,100,000 | 94,061,000 |

| Hengan International Group Co., Ltd. (China) | 6,935,400 | 49,106,762 |

| Ingredion, Inc. | 1,150,000 | 90,470,500 |

| KT&G Corp. (South Korea)* | 1,100,000 | 84,222,202 |

| PepsiCo, Inc. | 1,500,000 | 222,450,000 |

| The Procter & Gamble Co. | 1,450,000 | 201,753,000 |

| Sysco Corp. | 3,000,000 | 222,780,000 |

| Tyson Foods, Inc., Class A | 1,460,000 | 94,082,400 |

| Total Consumer Staples | | 1,464,884,496 |

| Energy - 1.1% | | |

| ConocoPhillips | 650,000 | 25,993,500 |

| Exxon Mobil Corp. | 600,000 | 24,732,000 |

| Weatherford International PLC* | 5,443,901 | 32,663,406 |

| Total Energy | | 83,388,906 |

| Financials - 8.8% | | |

| The Bank of New York Mellon Corp. | 2,300,000 | 97,612,000 |

| The Charles Schwab Corp. | 1,825,000 | 96,798,000 |

| First Hawaiian, Inc. | 1,530,000 | 36,077,400 |

| FirstCash, Inc. | 460,000 | 32,218,400 |

| The Goldman Sachs Group, Inc. | 180,000 | 47,467,800 |

| | Shares | Value |

| State Street Corp. | 1,900,000 | $138,282,000 |

| U.S. Bancorp | 2,800,000 | 130,452,000 |

| Wells Fargo & Co. | 3,050,000 | 92,049,000 |

| Total Financials | | 670,956,600 |

| Health Care - 3.3% | | |

| Anthem, Inc. | 300,000 | 96,327,000 |

| Johnson & Johnson | 1,000,000 | 157,380,000 |

| Total Health Care | | 253,707,000 |

| Industrials - 5.0% | | |

| Aggreko PLC (United Kingdom) | 3,848,864 | 32,993,041 |

| Brenntag AG (Germany) | 3,600,000 | 279,941,521 |

| GrafTech International, Ltd. | 2,500,621 | 26,656,620 |

| MSC Industrial Direct Co., Inc., Class A | 530,000 | 44,726,700 |

| Valmont Industries, Inc. | 3,529 | 617,328 |

| Total Industrials | | 384,935,210 |

| Information Technology - 7.6% | | |

| Cisco Systems, Inc. | 1,400,000 | 62,650,000 |

| Cognizant Technology Solutions Corp., Class A | 2,300,000 | 188,485,000 |

| Corning, Inc. | 1,100,000 | 39,600,000 |

| Infosys, Ltd., Sponsored ADR (India) | 1,265,000 | 21,441,750 |

| Microsoft Corp. | 900,000 | 200,178,000 |

| Oracle Corp. | 1,000,000 | 64,690,000 |

| Total Information Technology | | 577,044,750 |

| Materials - 1.2% | | |

| Huntsman Corp. | 3,500,000 | 87,990,000 |

| Total Common Stocks | | |

| (Cost $3,830,597,729) | | 5,559,206,703 |

| | | |

| | Principal

Amount | |

| Corporate Bonds and Notes - 2.7% | | |

| Energy - 0.5% | | |

W&T Offshore, Inc.

9.750%, 11/01/232 | $51,359,000 | 36,336,492 |

| Financials - 0.3% | | |

Service Properties Trust

4.350%, 10/01/24 | 20,678,000 | 20,419,525 |

| Industrials - 1.9% | | |

| Macy’s Retail Holdings, LLC | | |

| 2.875%, 02/15/23 | 14,800,000 | 14,226,500 |

| 3.625%, 06/01/24 | 3,748,000 | 3,560,600 |

| Weatherford International, Ltd. (Bermuda) | | |

| 11.000%, 12/01/241,2 | 166,485,000 | 129,858,300 |

| Total Industrials | | 147,645,400 |

| Total Corporate Bonds and Notes | | |

| (Cost $253,352,851) | | 204,401,417 |

The accompanying notes are an integral part of these financial statements.

| | |

| | AMG Yacktman Fund |

| | Schedule of Portfolio Investments (continued) |

| | Shares | Value |

| Preferred Stock - 10.1% | | |

| Information Technology - 10.1% | | |

| Samsung Electronics Co., Ltd., 1.340% (South Korea) | 11,400,000 | $773,341,384 |

| Total Preferred Stock | | |

| (Cost $218,846,116) | | 773,341,384 |

| | | |

| | Principal

Amount | |

| Short-Term Investments - 14.3% | | |

| Joint Repurchase Agreements - 0.0%#,3 | | |

| Nomura Securities International, Inc., dated 12/31/20, due 01/04/21, 0.070% total to be received $309,511 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 8.500%, 01/31/21 - 01/15/56, totaling $315,699) | $309,509 | 309,509 |

| | | |

| | Shares | Value |

| Other Investment Companies - 14.3% | | |

| | | |

| Dreyfus Government Cash Management Fund, Institutional Shares, 0.03%4 | 375,295,256 | $375,295,256 |

| JPMorgan U.S. Government Money Market Fund, IM Shares, 0.03%4 | 712,350,265 | 712,350,265 |

| Total Other Investment Companies | | 1,087,645,521 |

| Total Short-Term Investments | | |

| (Cost $1,087,955,030) | | 1,087,955,030 |

| Total Investments - 99.9% | | |

| (Cost $5,390,751,726) | | 7,624,904,534 |

| Other Assets, less Liabilities - 0.1% | | 11,234,393 |

| Net Assets - 100.0% | | $7,636,138,927 |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $1,731,047 or less than 0.1% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2020, the value of these securities amounted to $166,194,792 or 2.2% of net assets. |

| 3 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 4 | Yield shown represents the December 31, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

ADR American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

| | |

| | AMG Yacktman Fund |

| | Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of December 31, 2020:

| | | Level 1 | | Level 21 | | Level 3 | | Total |

| Investments in Securities | | | | | | | | |

| Common Stocks | | | | | | | | |

| Consumer Staples | | $1,191,075,716 | | $273,808,780 | | — | | $1,464,884,496 |

| Communication Services | | 907,063,000 | | 401,907,946 | | — | | 1,308,970,946 |

| Consumer Discretionary | | 386,478,910 | | 340,849,885 | | — | | 727,328,795 |

| Financials | | 670,956,600 | | — | | — | | 670,956,600 |

| Information Technology | | 577,044,750 | | — | | — | | 577,044,750 |

| Industrials | | 72,000,648 | | 312,934,562 | | — | | 384,935,210 |

| Health Care | | 253,707,000 | | — | | — | | 253,707,000 |

| Materials | | 87,990,000 | | — | | — | | 87,990,000 |

| Energy | | 83,388,906 | | — | | — | | 83,388,906 |

| Corporate Bonds and Notes† | | — | | 204,401,417 | | — | | 204,401,417 |

| Preferred Stock† | | — | | 773,341,384 | | — | | 773,341,384 |

| Short-Term Investments | | | | | | | | |

| Joint Repurchase Agreements | | — | | 309,509 | | — | | 309,509 |

| Other Investment Companies | | 1,087,645,521 | | — | | — | | 1,087,645,521 |

| Total Investments in Securities | | $5,317,351,051 | | $2,307,553,483 | | — | | $7,624,904,534 |

| † | All corporate bonds and notes and preferred stocks held in the Fund are level 2 securities. For a detailed breakout of corporate bonds and notes and preferred stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

| 1 | An external pricing service is used to reflect any impact on security value due to market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. |

For the fiscal year ended December 31, 2020, there were no transfers in or out of Level 3.

The country allocation in the Schedule of Portfolio Investments at December 31, 2020, was as follows:

| Country | % of Long-Term

Investments |

| Bermuda | 2.0 |

| China | 0.7 |

| France | 6.1 |

| Germany | 7.9 |

| India | 0.3 |

| Japan | 1.2 |

| South Korea | 15.1 |

| United Kingdom | 2.7 |

| United States | 64.0 |

| | 100.0 |

The accompanying notes are an integral part of these financial statements.

| | |

| | AMG Yacktman Focused Fund |

| | Portfolio Manager’s Comments (unaudited) |

We hope you have managed through the difficulties of 2020 as safely and healthily as possible. In 2020, the AMG Yacktman Focused Fund (the Fund) Class N shares delivered strong results compared to the Russell 1000® Value Index with the Fund appreciating 17.26%, significantly outperforming the Russell 1000® Value benchmark, which was up 2.80% (but modestly underperforming the secondary S&P 500® Index which returned 18.40% for the year). During the year we were able to make many new investments, especially during the steep declines of the first quarter, reducing cash meaningfully in 2020. While we were aggressive purchasers during the market drop, had the declines lasted for more than a few weeks or been even sharper we would have been able to put even more cash to work. Overall, we are pleased to have delivered the strong outperformance versus our value benchmark last year. Recently, Mutual Fund Observer looked at risk-adjusted returns for the 2,076 equity-oriented mutual funds that have a 20-year track record and placed the Fund at the top of their risk-adjusted list, declaring, “Yacktman and Yacktman Focused are almost freakishly successful, year and year, by almost every measure. They’re sort of the (pre-2020) New England Patriots of investing. Adam Sabban at Morningstar characterizes them as ‘half equity fund, half absolute-return hedge fund,’ which favors great core businesses but is willing to hold cash, buy during panics and shop overseas.”1 While investors have enjoyed high rates of return for the last decade, they have likely set up low returns for the major indices over the long term. Many have forgotten the pain that paying crazy prices in the late-1990s technology bubble led to and should be highly concerned about the valuations of today’s latest story stock. Like the last technology bubble, index funds will likely add many of these speculative companies at the wrong time and price, causing some benchmarks, which are supposed to be passive, to actively cause long-term pain for investors. Getting Growth at Value Prices Many of our favorite investments today continue to be in complicated, mispriced, owner-operated conglomerates like Samsung Electronics Co., Ltd., Bollore SA, News Corp., and Associated British Foods PLC. Each of these companies has business units that are powerful and growing rapidly, along with other businesses that are substantial contributors to cash flow and sell at significant discounts to what | we think they are worth. Several of these companies are in the process of unlocking value through better disclosure or separation of the stronger business units. Often these mispriced securities require a great deal of time and patience, which are qualities we take pride in possessing, especially in an industry that affords few a true long-term approach. Contributors for the year included Samsung, Brenntag, and Microsoft Samsung was the top contributor to results last year, and is our largest position. The company has a strong market position in high growth markets, including foundry, sensors, and 5G equipment, and a good position in emerging industries like artificial intelligence, autonomous driving, and internet of things, yet it sells at an extremely low multiple of earnings and cash flow and has a significant amount of net excess net cash and securities on the balance sheet. Samsung’s core semiconductor business is set up for high growth over the next few years, and we think the stock could be in an early phase of positive re-rating, which is a period where a stock goes from a low multiple to a substantially higher one that better reflects the company’s business prospects. Brenntag AG, which is the global leader in distribution of chemicals to small and mid-sized businesses, produced strong returns last year as the company demonstrated remarkable business consistency, despite the significant economic headwinds. We think the shares remain attractive and the company has a strong market position and management team, which should enable Brenntag to produce strong results over time. Microsoft Corp. continued to deliver strong business and share price results last year. The company continues to benefit from strong customer growth, especially in its cloud business, and remains attractively priced, given the potential for solid long-term cash flow growth. Detractors included Weatherford, Macy’s, and Fox Weatherford International PLC’s equity and debt detracted from results due to general weakness in the energy sector. Although fundamentals were challenging during the year, management was able to downsize the business and navigate through the challenges reasonably well. We expect to see better results as the economy improves in 2021. | Macy’s, Inc. suffered from shutdowns in 2020 much like Weatherford. Its core retail business suffered and the value of its real estate was impaired, especially in cities like New York and San Francisco. Due to the huge price swings in the stock, we were able to purchase additional shares at low prices during the declines and then reduce our holding as the stock nearly doubled in the fourth quarter alone. Have the rules of investing changed? At times, a long-term change in rules can create a significant impact. Perhaps we are in an environment where securities sell at higher prices versus prior eras due to central banking, but the net result of the higher prices will be lower long-term returns. In 1968 baseball pitchers dominated hitters, causing low-scoring games that were less popular with fans. The following year, the height of the pitcher’s mound was reduced from 15 inches to 10 inches, where it remains today, and hitters and average runs per game increased from 3.42 to 4.07, although some of the increase likely came from new teams being added to the league (ESPN article, March 8, 2019). Fox Corp. declined last year due to advertising weakness and challenges with Fox News and lower viewership of sports. The shares sell at a low valuation and the company has significant value in tax shields, real estate, and gaming investments that we think are underappreciated. Conclusion Stock returns are largely a result of free cash flow, growth, and multiple change, with most of the returns in recent years from the last variable. With the high-priced index offering a low free-cash-flow yield and likely a continuation of low growth, long-term index returns look challenging. We believe our approach of finding individual securities that we believe are mispriced and offer solid risk-adjusted returns is more important than ever when equities are expensive as they are today. Even if the rules have changed—and we would not argue they have—we have moved to prices where those who stopped thinking about risk will likely regret that decision at some point in the future. We will continue to work hard to find mispriced opportunities to deliver results over the long term while also considering risk. The time to be most aware of potential risks is when others completely ignore them. We never forget that the price you pay matters both for potential return and to mitigate losses if things turn out worse than you expected. |

| | |

| | AMG Yacktman Focused Fund |

| | Portfolio Manager’s Comments (continued) |

We wish everyone the best for the new year and, as always, will be objective, patient, and diligent when managing the AMG Yacktman Focused Fund. 1 Source: 21st Century Champions, Jan. 2021. | The views expressed represent the opinions of Yacktman Asset Management LP as of December 31, 2020, are not intended as a forecast or guarantee of future results, and are subject to change without notice. | |

| | |

| | AMG Yacktman Focused Fund |

| | Portfolio Manager’s Comments (continued) |

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Yacktman Focused Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Yacktman Focused Fund’s Class N shares on December 31, 2010 to a $10,000 investment made in the Russell 1000® Value Index and the S&P 500® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Yacktman Focused Fund, the Russell 1000® Value Index and the S&P 500® Index for the same time periods ended December 31, 2020.

| Average Annual Total Returns1 | One

Year | Five

Years | Ten

Years | Since

Inception | Inception

Date |

| AMG Yacktman Focused Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13 |

| Class N | 17.26% | 13.93% | 11.77% | 10.12% | 05/01/97 |

| Class I | 17.52% | 14.14% | — | 12.79% | 07/24/12 |

| Russell 1000® Value Index14 | 2.80% | 9.74% | 10.50% | 8.08% | 05/01/97† |

| S&P 500® Index15 | 18.40% | 15.22% | 13.88% | 8.79% | 05/01/97† |

Effective June 30, 2020, the Yacktman Fund’s primary and secondary benchmarks were changed to the Russell 1000® Value Index becoming the primary benchmark and S&P 500® Index the secondary benchmark from the S&P 500® Index as the primary benchmark and the Russell 1000® Value Index as the secondary benchmark previously.

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| | 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2020. All returns are in U.S. dollars ($). |

| | | |

| | 2 | From time to time the Fund’s investment manager has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| | | |

| | 3 | The Fund may suffer significant losses on assets that it sells short. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. |

| | | |

| | 4 | The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. |

| | | |

| | 5 | The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| | | |

| | 6 | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| | | |

| | 7 | High-yield bonds (also known as “junk bonds”) may be subject to greater levels of interest rate, credit, and liquidity risk than investments in higher rated securities. These securities are considered predominantly speculative with respect to the issuer’s continuing ability to make principal and interest payments. The issuers of the Fund’s holdings may be involved in bankruptcy proceedings, reorganizations, or financial restructurings, and are not as strong financially as higher-rated issuers. |

| | | |

| | 8 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| | | |

| | 9 | Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. |

| | |

| | AMG Yacktman Focused Fund |

| | Portfolio Manager’s Comments (continued) |

10 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 11 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. 12 The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. | | 13 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. 14 The Russell 1000® Value Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 1000® Value Index is unmanaged, is not available for investment and does not incur expenses. 15 The S&P 500® Index is a capitalization-weighted index of 500 stocks. The S&P 500® Index is | designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Unlike the Fund, the S&P 500® Index is unmanaged, is not available for investment and does not incur expenses. The Russell 1000® Value Index is a trademark of the London Stock Exchange Group companies. The S&P 500® Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. Not FDIC insured, nor bank guaranteed. May lose value. |

| | AMG Yacktman Focused Fund Fund Snapshots (unaudited) December 31, 2020 |

| PORTFOLIO BREAKDOWN |

| |

| Sector | % of

Net Assets |

| Consumer Staples | 19.5 | |

| Information Technology | 18.8 | |

| Communication Services | 16.3 | |

| Consumer Discretionary | 12.2 | |

| Industrials | 7.3 | |

| Financials | 5.7 | |

| Health Care | 1.9 | |

| Materials | 1.6 | |

| Energy | 1.5 | |

| Short-Term Investments | 15.0 | |

| Other Assets Less Liabilities | 0.2 | |

TOP TEN HOLDINGS

| Security Name | | % of

Net Assets |

| Samsung Electronics Co., Ltd., 1.340% (South Korea) | | 13.1 |

| Bollore SA (France) | | 5.4 |

| Brenntag AG (Germany) | | 3.5 |

| Associated British Foods PLC (United Kingdom) | | 3.1 |

| Sysco Corp. | | 2.9 |

| The Walt Disney Co. | | 2.7 |

| Fox Corp., Class B | | 2.7 |

| Alphabet, Inc., Class C | | 2.7 |

| PepsiCo, Inc. | | 2.6 |

| News Corp., Class A | | 2.6 |

| Top Ten as a Group | | 41.3 |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

| | AMG Yacktman Focused Fund Fund Snapshots (continued) For the six months ended December 31, 2020 |

NEW EQUITY POSITIONS

| New Purchases | Current

Shares Held |

| The Charles Schwab Corp. | 855,000 |

| Hyundai Mobis Co., Ltd. (South Korea) | 260,000 |

| Tyson Foods, Inc., Class A | 700,000 |

CORPORATE BONDS & NOTES SALES

| Sales | Net Principal

Sold | Current Principal

Held |

| Service Properties Trust, 4.350%, | | |

| 10/01/24 | $3,495,000 | $12,174,000 |

| Service Properties Trust, 4.500%, | | |

| 03/15/25 | 3,505,000 | — |

| Service Properties Trust, 4.650%, | | |

| 03/15/24 | 5,335,000 | — |

| Six Flags Entertainment Corp., 5.500%, | | |

| 04/15/27 | 8,485,000 | — |

EQUITY PURCHASES & SALES

| Purchases | Net Shares

Purchased | Current Shares

Held |

| Ingredion, Inc. | 360,000 | 540,000 |

| KT&G Corp. (South Korea) | 665,000 | 900,000 |

| Yuasa Trading Co., Ltd. (Japan) | 81,500 | 332,500 |

| Sales | Net Shares

Sold | Current Shares

Held |

| Alphabet, Inc., Class C | 3,000 | 56,000 |

| Booking Holdings, Inc. | 6,000 | 40,000 |

| Cisco Systems, Inc. | 300,000 | 300,000 |

| Continental AG (Germany) | 470,000 | 400,000 |

| Fox Corp., Class B | 1,000,000 | 3,450,000 |

| Johnson & Johnson | 20,000 | 430,000 |

| Macy’s, Inc. | 2,500,000 | 6,500,000 |

| Microsoft Corp. | 20,000 | 410,000 |

| Oracle Corp. | 280,000 | 250,000 |

| Qurate Retail, Inc., Series A | 900,000 | — |

| Samsung Electronics Co., Ltd., 1.340% (South Korea) | 3,350,000 | 7,050,000 |

| The Walt Disney Co. | 100,000 | 550,000 |

| | AMG Yacktman Focused Fund Schedule of Portfolio Investments December 31, 2020 |

| | Shares | Value | |

| Common Stocks - 68.7% | | | |

| Communication Services - 16.3% | | | |

| Alphabet, Inc., Class C* | 56,000 | $98,105,280 | |

| Bollore SA (France) | 47,746,528 | 197,677,781 | |

| Fox Corp., Class B | 3,450,000 | 99,636,000 | |

| News Corp., Class A | 5,145,915 | 92,472,093 | |

| News Corp., Class B | 200,000 | 3,554,000 | |

| The Walt Disney Co.* | 550,000 | 99,649,000 | |

| Total Communication Services | | 591,094,154 | |

| Consumer Discretionary - 12.2% | | | |

| Booking Holdings, Inc.* | 40,000 | 89,090,800 | |

| Continental AG (Germany) | 400,000 | 59,534,111 | |

| Hyundai Home Shopping Network Corp. (South Korea) | 547,254 | 41,166,715 | |

| Hyundai Mobis Co., Ltd. (South Korea) | 260,000 | 61,195,202 | |

| Macy’s, Inc. | 6,500,000 | 73,125,000 | |

| Ralph Lauren Corp. | 183,000 | 18,984,420 | |

| Rinnai Corp. (Japan) | 276,000 | 32,082,831 | |

| Sodexo, S.A. (France) | 800,000 | 67,658,986 | |

| Stanley Electric Co., Ltd. (Japan) | 75,832 | 2,446,299 | |

| Total Consumer Discretionary | | 445,284,364 | |

| Consumer Staples - 19.1% | | | |

| Ambev S.A., ADR (Brazil) | 7,000,000 | 21,420,000 | |

| Associated British Foods PLC (United Kingdom)* | 3,700,000 | 114,236,334 | |

| The Coca-Cola Co. | 1,300,000 | 71,292,000 | |

| |

| Hengan International Group Co., Ltd. (China) | 5,872,300 | 41,579,381 | |

| Ingredion, Inc. | 540,000 | 42,481,800 | |

| |

| KT&G Corp. (South Korea)* | 900,000 | 68,909,074 | |

| PepsiCo, Inc. | 650,000 | 96,395,000 | |

| |

| The Procter & Gamble Co. | 630,000 | 87,658,200 | |

| |

| Sysco Corp. | 1,400,000 | 103,964,000 | |

| Tyson Foods, Inc., Class A | 700,000 | 45,108,000 | |

| |

| Total Consumer Staples | | 693,043,789 | |

| Energy - 1.0% | | | |

| ConocoPhillips | 300,000 | 11,997,000 | |

| Exxon Mobil Corp. | 250,000 | 10,305,000 | |

| |

| Weatherford International PLC* | 2,421,818 | 14,530,908 | |

| |

| Total Energy | | 36,832,908 | |

| |

| Financials - 5.4% | | | |

| The Bank of New York Mellon Corp. | 650,000 | 27,586,000 | |

| The Charles Schwab Corp. | 855,000 | 45,349,200 | |

| |

| First Hawaiian, Inc. | 696,000 | 16,411,680 | |

| |

| State Street Corp. | 800,000 | 58,224,000 | |

| | | | |

| | | Shares | Value | |

| U.S. Bancorp | | 750,000 | $34,942,500 | |

| Wells Fargo & Co. | | 500,000 | 15,090,000 | |

| Total Financials | | | 197,603,380 | |

| Health Care - 1.9% | | | |

| Johnson & Johnson | | 430,000 | 67,673,400 | |

| Industrials - 5.5% | | | |

| Aggreko PLC (United Kingdom) | 2,890,601 | 24,778,667 | |

| Brenntag AG (Germany) | 1,650,000 | 128,306,530 | |

| Mitsuboshi Belting, Ltd. (Japan) | 91,535 | 1,508,901 | |

| MSC Industrial Direct Co., Inc., Class A | 220,000 | 18,565,800 | |

| Societe BIC, S.A. (France) | 300,000 | 16,970,733 | |

| Yuasa Trading Co., Ltd. (Japan) | 332,500 | 10,693,680 | |

| Total Industrials | | | 200,824,311 | |

| Information Technology - 5.7% | | | |

| Cisco Systems, Inc. | | 300,000 | 13,425,000 | |

| Cognizant Technology Solutions Corp., Class A | 1,050,000 | 86,047,500 | |

| Microsoft Corp. | | 410,000 | 91,192,200 | |

| Oracle Corp. | | 250,000 | 16,172,500 | |

| Total Information Technology | | 206,837,200 | |

| Materials - 1.6% | | | | |

| Huntsman Corp. | | 1,600,000 | 40,224,000 | |

| Nihon Parkerizing Co., Ltd. (Japan) | 1,868,100 | 19,376,951 | |

| Total Materials | | | 59,600,951 | |

| Total Common Stocks | | | |

| (Cost $1,891,685,903) | | 2,498,794,457 | |

| | | | | |

| | | Principal | | |

| | | Amount | | |

| Corporate Bonds and Notes - 2.6% | | | |

| Energy - 0.5% | | | | |

| W&T Offshore, Inc. | | | | |

| 9.750%, 11/01/231 | | $22,824,000 | 16,147,980 | |

| Financials - 0.3% | | | |

| Service Properties Trust | | | |

| 4.350%, 10/01/24 | | 12,174,000 | 12,021,825 | |

| Industrials - 1.8% | | | |

| Macy’s Retail Holdings, LLC | | | |

| 2.875%, 02/15/23 | | 6,823,000 | 6,558,609 | |

| 3.625%, 06/01/24 | | 1,720,000 | 1,634,000 | |

| Weatherford International, Ltd. (Bermuda) | | | |

| 11.000%, 12/01/241 | | 74,388,000 | 58,022,640 | |

| Total Industrials | | | 66,215,249 | |

| Total Corporate Bonds and Notes | | |

| (Cost $115,601,423) | | | 94,385,054 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

| | AMG Yacktman Focused Fund Schedule of Portfolio Investments (continued) |

| | Shares | Value | |

| Preferred Stocks - 13.5% | | | |

| Consumer Staples - 0.4% | | | |

| Amorepacific Corp., 1.060% (South Korea) | 250,000 | $14,288,758 | |

| |

| Information Technology - 13.1% | | | |

| Samsung Electronics Co., Ltd., 1.340% (South | | | |

| Korea) | 7,050,000 | 478,250,593 | |

| Total Preferred Stocks | | | |

| (Cost $137,074,156) | | 492,539,351 | |

| Short-Term Investments - 15.0% | | | |

| Other Investment Companies - 15.0% | | | |

| Dreyfus Government Cash Management Fund, | | | |

| Institutional Shares, 0.03%2 | 228,482,486 | 228,482,486 | |

| JPMorgan U.S. Government Money Market Fund, | | | |

| IM Shares, 0.03%2 | 319,225,119 | 319,225,119 | |

| Total Short-Term Investments | | | |

| (Cost $547,707,605) | | 547,707,605 | |

| | | | |

| | Value | |

| Total Investments - 99.8% | | |

| (Cost $2,692,069,087) | $3,633,426,467 | |

| Other Assets, less Liabilities - 0.2% | 5,810,525 | |

| Net Assets - 100.0% | $3,639,236,992 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| * | Non-income producing security. |

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2020, the value of these securities amounted to $74,170,620 or 2.0% of net assets. |

| 2 | Yield shown represents the December 31, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

ADR American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

| | AMG Yacktman Focused Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of December 31, 2020:

| | | Level 1 | | Level 21 | | Level 3 | | Total |

| Investments in Securities | | | | | | | | |

| Common Stocks | | | | | | | | |

| Consumer Staples | | $468,319,000 | | $224,724,789 | | — | | $693,043,789 |

| Communication Services | | 393,416,373 | | 197,677,781 | | — | | 591,094,154 |

| Consumer Discretionary | | 181,200,220 | | 264,084,144 | | — | | 445,284,364 |

| Information Technology | | 206,837,200 | | — | | — | | 206,837,200 |

| Industrials | | 18,565,800 | | 182,258,511 | | — | | 200,824,311 |

| Financials | | 197,603,380 | | — | | — | | 197,603,380 |

| Health Care | | 67,673,400 | | — | | — | | 67,673,400 |

| Materials | | 40,224,000 | | 19,376,951 | | — | | 59,600,951 |

| Energy | | 36,832,908 | | — | | — | | 36,832,908 |

| Corporate Bonds and Notes† | | — | | 94,385,054 | | — | | 94,385,054 |

| Preferred Stocks† | | — | | 492,539,351 | | — | | 492,539,351 |

| Short-Term Investments | | | | | | | | |

| Other Investment Companies | | 547,707,605 | | — | | — | | 547,707,605 |

| Total Investments in Securities | | $2,158,379,886 | | $1,475,046,581 | | — | | $3,633,426,467 |

| † | All corporate bonds and notes and preferred stocks held in the Fund are level 2 securities. For a detailed breakout of corporate bonds and notes and preferred stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

| 1 | An external pricing service is used to reflect any impact on security value due to market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. |

For the fiscal year ended December 31, 2020, there were no transfers in or out of Level 3.

The country allocation in the Schedule of Portfolio Investments at December 31, 2020, was as follows:

| Country | % of Long-Term

Investments |

| | | |

| Bermuda | 1.9 | |

| Brazil | 0.7 | |

| China | 1.3 | |

| France | 9.2 | |

| Germany | 6.1 | |

| Japan | 2.1 | |

| South Korea | 21.5 | |

| United Kingdom | 4.5 | |

| United States | 52.7 | |

| | 100.0 | |

The accompanying notes are an integral part of these financial statements.

| | AMG Yacktman Focused Fund - Security Selection Only Portfolio Manager’s Comments (unaudited) |

We hope you have managed through the difficulties of 2020 as safely and healthily as possible. In 2020, the AMG Focused Fund – Security Selection Only (the Fund) Class N shares delivered strong results compared to the Russell 1000® Value Index with the Fund appreciating 18.32% compared to a 2.80% return for the benchmark (and with a return in line with the secondary benchmark, the S&P 500® Index, which returned 18.40%). We were able to use market declines to bargain hunt and add many new positions to the Fund. Due to its flexible mandate and smaller asset base, the Fund is able to own smaller market cap companies than some of our other funds, and we utilized that capability in 2020. While investors have enjoyed high rates of return for the last decade, they have likely set up low returns for the major indices over the long term. These high market prices do not concern us much for the Fund because we have a very flexible mandate that allows us to invest in bargains we are able to find without too much concern about market cap or geography. Getting Growth at Value Prices Many of our favorite investments today continue to be in complicated, mispriced, owner-operated conglomerates like Samsung Electronics Co., Ltd., Bollore SA, News Corp., and Associated British Foods PLC. Each of these companies has business units that are powerful and growing rapidly, along with other businesses that are substantial contributors to cash flow and sell at significant discounts to what we think they are worth. Several of these companies are in the process of unlocking value through better disclosure or separation of the stronger business units. Often these mispriced securities require a great deal of time and patience, which are qualities we take great pride in possessing, especially in an industry that affords few a true long-term approach. Contributors for the year included Samsung, HI-LEX Corp., and Waddell & Reed Samsung was the top contributor to results last year, and is our largest position. The company has a strong market position in high growth markets, including foundry, sensors, and 5G equipment, and a good position in emerging industries like artificial intelligence, autonomous driving, and internet of | things, yet it sells at an extremely low multiple of earnings and cash flow and has a significant amount of net excess net cash and securities on the balance sheet. Samsung’s core semiconductor business is set up for high growth over the next few years, and we think the stock could be in an early phase of positive re-rating, which is a period where a stock goes from a low multiple to a substantially higher one that better reflects the company’s business prospects. HI-LEX Corp., a small but super-inexpensive manufacturer of control cables for automobiles, had strong results in 2020. At the modest fund size, we are able to take positions in smaller market cap companies, and HI-LEX is an example of how that flexibility can provide strong rewards. Waddell & Reed Financial, Inc., a small diversified financial services company, was another contributor to results. We bought the shares at an extremely low valuation during the first quarter declines and were pleased when the company agreed to be acquired by Macquaire for a significant premium. Detractors included Weatherford, Amorepacific, and Macy’s Weatherford International PLC’s equity and debt detracted from results due to general weakness in the energy sector. Although fundamentals were challenging during the year, management was able to downsize the business and navigate through the challenges reasonably well. We expect to see better results as the economy improves in 2021. Amorepacific Corp. preferred declined last year as the discount to common shares increased. At the preferred price, Amorepacific trades at less than 1 X sales, which is a remarkable discount to global peers like Estee Lauder and L’Oreal, which are at approximately 6x price to sales. Macy’s, Inc. suffered from shutdowns in 2020 much like Weatherford. Its core retail business suffered and the value of its real estate was impaired, especially in cities like New York and San Francisco. Due to the huge price swings in the stock, we were able to purchase additional shares at low prices during the declines and then reduce our holding as the stock nearly doubled in the fourth quarter alone. | Have the rules of investing changed? At times, a long-term change in rules can create a significant impact. Perhaps we are in an environment where securities sell at higher prices versus prior eras due to central banking, but the net result of the higher prices will be lower long-term returns. In 1968 baseball pitchers dominated hitters, causing low-scoring games that were less popular with fans. The following year, the height of the pitcher’s mound was reduced from 15 inches to 10 inches, where it remains today, and hitters and average runs per game increased from 3.42 to 4.07, although some of the increase likely came from new teams being added to the league (ESPN article, March 8, 2019). Stock returns are largely a result of free cash flow, growth, and multiple change, with most of the returns in recent years from the last variable. With the high-priced index offering a low free-cash-flow yield and likely a continuation of low growth, long-term index returns look challenging. We believe our approach of finding individual securities that we believe are mispriced and offer solid risk-adjusted returns is more important than ever when equities are expensive as they are today. Even if the rules have changed—and we would not argue they have—we have moved to prices where those who stopped thinking about risk will likely regret that decision at some point in the future. We will continue to work hard to find mispriced opportunities to deliver results over the long term while also considering risk. The time to be most aware of potential risks is when others completely ignore them. We never forget that the price you pay matters both for potential return and to mitigate losses if things turn out worse than you expected. We wish everyone the best for the new year and, as always, will be objective, patient, and diligent when managing the AMG Yacktman Focused Fund – Security Selection Only. The views expressed represent the opinions of Yacktman Asset Management LP as of December 31, 2020, are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

| | AMG Yacktman Focused Fund - Security Selection Only Portfolio Manager’s Comments (continued) |

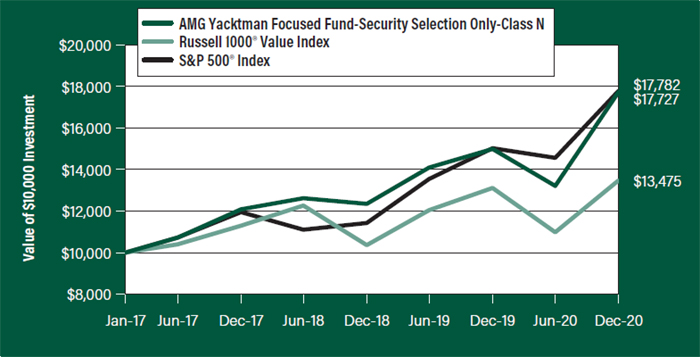

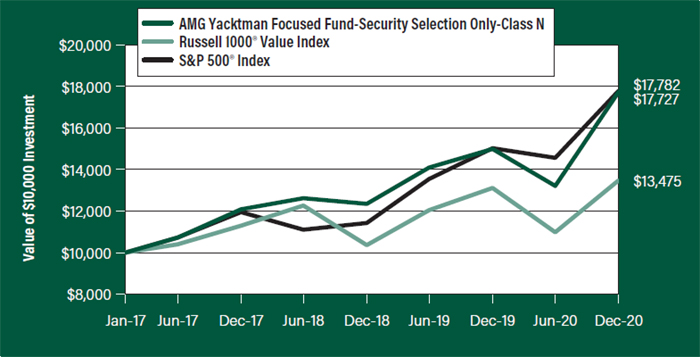

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Yacktman Focused Fund - Security Selection Only’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Yacktman Focused Fund - Security Selection Only’s Class N shares on January 30, 2017 (inception date), to a $10,000 investment made in the Russell 1000® Value Index and the S&P 500® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Yacktman Focused Fund - Security Selection Only, the Russell 1000® Value Index and the S&P 500® Index for the same time periods ended December 31, 2020.

| Average Annual Total Returns1 | One

Year | Since

Inception | Inception

Date |

| AMG Yacktman Focused Fund - Security Selection Only2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14 |

| Class N | 18.32% | 15.74% | 01/30/17 |

| Class I | 18.47% | 15.76% | 01/30/17 |

| Russell 1000® Value Index15 | 2.80% | 7.91% | 01/30/17† |

| S&P 500® Index16 | 18.40% | 15.83% | 01/30/17† |

Effective June 30, 2020, the Yacktman Fund’s primary and secondary benchmarks were changed to the Russell 1000® Value Index becoming the primary benchmark and S&P 500® Index the secondary benchmark from the S&P 500® Index as the primary benchmark and the Russell 1000® Value Index as the secondary benchmark previously.

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2020. All returns are in U.S. dollars ($). |

| 2 | From time to time the Fund’s investment manager has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund may invest greater than 5% of its assets in money market securities, cash, or cash equivalents as a temporary defensive measure in response to adverse market, economic, political or other conditions. |

| 4 | The Fund may suffer significant losses on assets that it sells short. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. |

| 5 | The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. |