UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09521

AMG Funds

(Exact name of registrant as specified in charter)

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: October 31

Date of reporting period: November 1, 2020 – October 31, 2021

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

| | | | | | | | |

| | | | | AMG Funds October 31, 2021

AMG GW&K Core Bond ESG Fund |

| | | | | |

| | | | | Class N: MBGVX | | Class I: MBDFX | | Class Z: MBDLX |

| | | | | |

| | | |

| | | | | AMG GW&K Emerging Markets Equity Fund |

| | | | | |

| | | | | Class N: TLEVX | | Class I: TLESX | | Class Z: TLEIX |

| | | |

| | | | | AMG GW&K Emerging Wealth Equity Fund |

| | | | | |

| | | | | Class N: TYWVX | | Class I: TYWSX | | Class Z: TYWIX |

| | | | | AMG GW&K Small/Mid Cap Growth Fund (formerly AMG GW&K Small Cap Fund II, which was formerly AMG Managers LMCG Small Cap Growth Fund) |

| | | | | |

| | | | | Class N: ACWDX | | Class I: ACWIX | | Class Z: ACWZX |

| | | | | |

| | | | | | | | | |

| | |

| amgfunds.com | | 103121 AR069 |

| | |

| | | AMG Funds Annual Report — October 31, 2021 |

| | | | | | |

| | | |

| | | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| | | |

| | | AMG GW&K Core Bond ESG Fund | | | 4 | |

| | | |

| | | AMG GW&K Emerging Markets Equity Fund | | | 12 | |

| | | |

| | | AMG GW&K Emerging Wealth Equity Fund | | | 19 | |

| | | |

| | | AMG GW&K Small/Mid Cap Growth Fund | | | 25 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 31 | |

| | | |

| | | Balance sheets, net asset value (NAV) per share computations

and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 33 | |

| | | |

| | | Detail of sources of income, expenses, and realized and

unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 34 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 36 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income

and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 48 | |

| | | |

| | | Accounting and distribution policies, details of agreements and

transactions with Fund management and affiliates, and descriptions

of certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 57 | |

| | | |

| | | OTHER INFORMATION | | | 58 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 60 | |

| | | |

| | | ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 63 | |

| | | | | | | |

|

| Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | |

| | Letter to Shareholders |

Dear Shareholder:

The fiscal year ended October 31, 2021, was marked by the continued extraordinary recovery amid an unprecedented global effort to stop the COVID-19 pandemic. Equities rallied to new record highs amid better-than-expected corporate earnings, colossal fiscal and monetary stimulus programs, and an improving economic backdrop. Since the market bottom on March 23, 2020, the S&P 500® Index has gained over 111%. Businesses and consumers contended with disrupted supply chains and rising prices on a wide range of goods such as lumber and gasoline, and outbreaks of coronavirus variants kept the world on edge. Volatility increased in September as investors grew more concerned about rising inflation and more hawkish global central bank policies, but equities were resilient and finished the fiscal year with a strong rally.

The S&P 500® gained 42.91% during the period and all sectors produced double-digit returns, but there was very wide dispersion in performance. Energy and financials led the market with returns of 111.38% and 72.14%, respectively. On the other hand, utilities and consumer staples lagged with returns of 10.64% and

19.02%, respectively. Value stocks edged out Growth stocks as the Russell 1000® Value Index returned 43.76% compared to the 43.21% return for the Russell 1000® Growth Index. Small cap stocks outperformed as the Russell 2000® Index experienced its best quarter (fourth quarter 2020) on record. Within small caps, the Value-Growth disparity was much more pronounced as the Russell 2000® Value Index returned 64.30% compared to 38.45% for the Russell 2000® Growth Index. Outside the U.S., foreign developed markets lagged their U.S. counterparts with a 34.18% return for the MSCI EAFE Index. A major regulatory crackdown in China shook investor confidence in Chinese equities and caused emerging markets to underperform with a 16.96% return for the MSCI Emerging Markets Index.

Interest rates lifted off from near-historic lows as the vaccine rollout initiated a return to normalcy and the economic outlook improved. The 10-year Treasury yield rose 69 basis points to 1.55% and ended the fiscal year not far off its post-pandemic high. The Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, lost 0.48% over the period. Healthy risk appetite drove credit spreads tighter and helped investment-grade corporate bonds produce a modestly positive 2.18% return. The global search for yield helped high-yield bonds outperform the investment-grade market with a 10.53% return as measured by the return of the Bloomberg U.S. Corporate High Yield Bond Index. Municipal bonds benefited from a strong technical backdrop and drove a 2.64% return for the Bloomberg Municipal Bond Index.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended October 31, 2021* | |

| | | | |

| Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

| | | | |

Large Cap | | (S&P 500® Index) | | | 42.91 | % | | | 21.48% | | | | 18.93% | |

| | | | |

Small Cap | | (Russell 2000® Index) | | | 50.80 | % | | | 16.47% | | | | 15.52% | |

| | | | |

International | | (MSCI All Country World Index ex USA) | | | 29.66 | % | | | 12.00% | | | | 9.77% | |

| Bonds: | | | | | | | | | | | |

| | | | |

Investment Grade | | (Bloomberg U.S. Aggregate Bond Index) | | | (0.48 | )% | | | 5.63% | | | | 3.10% | |

| | | | |

High Yield | | (Bloomberg U.S. Corporate High Yield Bond Index) | | | 10.53 | % | | | 7.43% | | | | 6.40% | |

| | | | |

Tax-exempt | | (Bloomberg Municipal Bond Index) | | | 2.64 | % | | | 5.17% | | | | 3.41% | |

| | | | |

Treasury Bills | | (ICE BofAML U.S. 6-Month Treasury Bill Index) | | | 0.11 | % | | | 1.37% | | | | 1.32% | |

*Source: FactSet. Past performance is no guarantee of future results.

2

|

About Your Fund’s Expenses |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| |

| | | | | | | | |

| | | | |

Six Months Ended October 31, 2021 | | Expense

Ratio for

the Period | | Beginning

Account

Value

05/01/21 | | Ending

Account

Value

10/31/21 | | Expenses

Paid

During

the Period* |

AMG GW&K Core Bond ESG Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 0.88% | | $1,000 | | $1,007 | | $4.45 |

| | | | |

Class I | | 0.56% | | $1,000 | | $1,008 | | $2.83 |

| | | | |

Class Z | | 0.48% | | $1,000 | | $1,009 | | $2.43 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 0.88% | | $1,000 | | $1,021 | | $4.48 |

| | | | |

Class I | | 0.56% | | $1,000 | | $1,022 | | $2.85 |

| | | | |

Class Z | | 0.48% | | $1,000 | | $1,023 | | $2.45 |

AMG GW&K Emerging Markets Equity Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.27% | | $1,000 | | $904 | | $6.09 |

| | | | |

Class I | | 0.96% | | $1,000 | | $905 | | $4.61 |

| | | | |

Class Z | | 0.87% | | $1,000 | | $905 | | $4.18 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.27% | | $1,000 | | $1,019 | | $6.46 |

| | | | |

Class I | | 0.96% | | $1,000 | | $1,020 | | $4.89 |

| | | | |

Class Z | | 0.87% | | $1,000 | | $1,021 | | $4.43 |

AMG GW&K Emerging Wealth Equity Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.24% | | $1,000 | | $860 | | $5.81 |

| | | | |

Class I | | 0.94% | | $1,000 | | $861 | | $4.41 |

| | | | |

Class Z | | 0.84% | | $1,000 | | $862 | | $3.94 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.24% | | $1,000 | | $1,019 | | $6.31 |

| | | | |

Class I | | 0.94% | | $1,000 | | $1,020 | | $4.79 |

| | | | |

Class Z | | 0.84% | | $1,000 | | $1,021 | | $4.28 |

| | | | | | | | |

| | | | |

Six Months Ended October 31, 2021 | | Expense

Ratio for

the Period | | Beginning

Account

Value

05/01/21 | | Ending

Account

Value

10/31/21 | | Expenses

Paid

During

the Period* |

AMG GW&K Small/Mid Cap Growth Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.07% | | $1,000 | | $1,109 | | $5.69 |

| | | | |

Class I | | 0.93% | | $1,000 | | $1,110 | | $4.95 |

| | | | |

Class Z** | | 0.82% | | $1,000 | | $1,031 | | $1.39 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.07% | | $1,000 | | $1,020 | | $5.45 |

| | | | |

Class I | | 0.93% | | $1,000 | | $1,021 | | $4.74 |

| | | | |

Class Z** | | 0.82% | | $1,000 | | $1,021 | | $4.18 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| ** | Commencement of operations was August 31, 2021. Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days since inception (61), then divided by 365. |

3

|

AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (unaudited) |

| | | | | | | | |

THE YEAR IN REVIEW For the 12 months ending October 31, 2021, AMG GW&K Core Bond ESG Fund’s (the “Fund”) Class I shares returned 0.15%, compared to the return of (0.48%) for the Bloomberg U.S. Aggregate Bond Index (the “Index”). OVERVIEW GW&K Investment Management, LLC (“GWK”) believes that responsible corporate behavior with respect to ESG (environmental, social, and governance) factors can lead to positive and sustainable long-term financial performance and aligns with our pursuit of quality investments. GW&K has been incorporating ESG factors into our equity and fixed income analysis process for several years, and as a signatory of the UN Principles for Responsible Investment, we are committed to incorporating the assessment of ESG issues into our fundamental research process. We believe ESG investing adds value to our investment process by improving our assessment of risk and enhancing our ability to identify high-quality credits; aids our up-in-quality bias by improving identification of credits with less long-term volatility; limits our exposure to credit ratings downgrades and negative events that are difficult to quantify; and deepens our fundamental credit analysis and leads to better outcomes by providing a more nuanced and complete picture. ESG considerations have long informed our process. We focus on business and credit fundamentals, relative valuation, and technical considerations. We believe ESG factors are important considerations in analyzing a company’s business and financial policy and that they highlight non-financial risks that can significantly affect a company’s financial health over the long term. Just as with credit risks, investors require additional compensation for ESG risks, leading to potential inefficiencies in valuation. MARKET OVERVIEW The beginning of the fiscal year in late 2020 represented a major inflection point for fixed income markets, as the most dominant trading narratives of 2020 were either resolved or significantly advanced. The closely contested U.S. election was decided, another round of fiscal stimulus was passed, and, most importantly, several COVID-19 vaccines were approved for worldwide distribution. But while some of 2020’s most salient overhangs have been removed, the year ahead promised challenges of its own. On the political front, the incoming administration certainly had its work cut out for itself | | | | in advancing meaningful legislation, with implications ranging from additional stimulus to changes in the regulatory landscape. The speed at which vaccines were distributed is likewise a point of uncertainty, to say nothing of how effective it will ultimately be at slowing the spread of the virus. Meanwhile, the economy continued its slow climb out of the recent downturn as businesses and consumers adapt to a post-COVID-19 world. Importantly for the bond market, the possibility of adverse outcomes is likely to be mitigated by the U.S. Federal Reserve (Fed). The central bank continues to exert massive influence over capital markets, and policymakers remain clear in their intentions to ensure their smooth functioning. Fixed income markets posted their worst returns since 1981 in the first quarter of 2021 amid a sharp rebound in growth expectations and burgeoning fears of higher inflation. The success of the nationwide vaccine rollout, a rapidly healing labor market, and swelling consumer confidence continued to drive the reflation narrative. Further support came in the form of a $1.9 trillion fiscal stimulus package on top of a commitment to ultra-loose monetary policy from the Fed. And beyond that, investors were confronted with the possibility of yet more fiscal support with a proposal of infrastructure spending. This combination of factors amounted to nothing less than a wholesale regime shift for a bond market that until just a few months ago struggled with an anemic growth outlook and fears of deflation. Fixed income markets rebounded solidly in the second quarter of 2021 following their worst selloff in decades. The most prominent catalyst behind the first-quarter rout—the threat of sharply faster economic growth and elevated inflation—proved far less menacing in light of lackluster data and a less dovish the Fed. In addition to the overhang of COVID-19, including fears of new variants and the elusiveness of herd immunity, signs began to emerge that the pace of the recovery had peaked. Nonfarm payrolls posted successive disappointing results, the manufacturing resurgence stalled, and retail sales slipped. Some of the more sensational commodity price spikes began to roll over as well, casting further doubt on the persistence of recent inflationary pressures. None of this suggests that the recovery is off track, but the bond market’s stubborn resilience points to a marked revision of the timeframe for normalization. Fixed income markets were essentially unchanged in the third quarter of 2021 despite a steady succession of headlines related to COVID-19, geopolitics, and | | | | price increases. Bond investors’ largely sanguine response to these challenges suggests they have been able to look beyond near-term headwinds toward the next stage of the recovery. The Delta variant drove a massive surge in cases across much of the U.S., even as new prevention and treatment options continued to emerge and data suggest cases have crested. Chinese authorities enacted assertive regulatory changes and pursued efforts to reduce systemic leverage, while nevertheless framing both as necessary to achieve long-term stability and prosperity. Supply-chain constraints, energy shortages, and limited labor availability threatened to weigh on growth around the world, but there have been few indications that these market failures reflect any weakness in aggregate demand. On balance, these various obstacles seem to have been relegated to the category of one-time items, and the bond market has demonstrated little concern that they represent a meaningful threat to the current trading regime. The Treasury yield curve flattened significantly in the month of October. The front end moved sharply higher amid elevated inflation fears, as the yield on the two-year jumped to a new post-pandemic high. Rates farther out the curve were more subdued, with the long end even enjoying a slight rally, as investors tempered their longer-term growth outlook. Inflation breakevens closed at the top of a multi-decade range. FUND REVIEW The Fund modestly outperformed the Index for the one-year period ended October 31, 2021. The above-benchmark allocation to spread product was the main contributor to returns. Specifically, an overweight to investment-grade corporate bonds helped as did an overweight to taxable municipals. An out of benchmark allocation to fixed-to-floating bonds also added to performance. The Fund’s notable underweight was to the Treasury sector, which underperformed. Security selection also helped returns, with positive results experienced in consumer cyclicals and consumer non-cyclicals as well as agency mortgage-backed securities (MBS) and taxable municipals. On the negative side, selection in capital goods, communications, and agency Collateralized MBS detracted. The Fund’s duration positioning also contributed. Rates rose during the period and the Fund’s shorter duration compared to the Index proved favorable. On the other hand, yield curve positioning subtracted from performance, as the Fund had modest underweights |

4

|

AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

to the short and long ends of the curve. The former saw yields fall in some spots, while the latter did not rise as much as other maturities. ESG continues to be a growing area of focus for the corporate bond market. The range of companies publishing sustainability reports and setting related goals and targets increased significantly this year. Large companies in even some of the highest emitting industries, like autos, oil & gas, and steel, set long-term reduction targets and committed to significant sustainability investments. Following this trend, 2021 will be another record-shattering year for ESG-labeled bond issuance, with green bonds dominating the market as investors clamor for ESG-related investments. While we continue to selectively add ESG-labeled bonds, we remain focused on avoiding corporate issuers with weaker ESG-related practices. We conducted the following trades based on ESG factors over the period: We purchased a Republic of Chile bond, a green bond that also allowed for diversification. The position was subsequently sold on potential for elevated political risk. We sold Cheniere on ESG concerns regarding its carbon profile. | | | | We exited T-Mobile due to ESG concerns surrounding its data breach. OUTLOOK The increasingly hawkish tone of commentary from central banks around the world has raised the temperature of rhetoric on both sides of the transitory versus structural inflation debate. In the former camp are those who caution that responding too hastily to one-time supply side-related shortages would result in a policy error; those in the latter camp fret that authorities are already behind the curve and that tapering should have begun months ago. The slope of the yield curve offers little clarity and points to a stalemate for now, sitting at or very near its multi-decade average (depending on which tenors you consider). While we recognize merits on both sides of the argument, we continue to see more risk to the upside in rates than the downside and thus remain broadly shorter than our benchmarks. We also see a more appealing risk profile in intermediate maturities in comparison to the long end, which would experience the greatest volatility in the event of a sharp move higher in rates. Our outlook for corporate credit remains constructive and we believe the space offers the most compelling value in the fixed income market. Insofar as Treasury yields sit near historic lows, corporates offer an attractive yield advantage, and in the event that | | | | rates begin to rise they offer a potential buffer. Additionally, as the recovery continues to unfold, we see opportunities in credit-improvement stories that could benefit from spread compression and that would generate further excess returns. The higher-rated segments of the high yield market in particular are rich in these opportunities, given the number of issuers downgraded from Investment Grade (“IG”) last year that are poised to regain their former IG status. We also anticipate further outperformance in select segments of the consumer-oriented sectors, while remaining wary of potential challenges posed by supply chain stresses. We are still neutral on the mortgage space in advance of the Fed’s tapering, but the recent uptick in mortgage rates offers a first step toward improving our confidence in the prepayment outlook. Our preference for higher-coupon, seasoned pools has already begun paying off as duration for the benchmark has lengthened into the rates selloff. Given that we expect this trend to persist, we maintain this preference within the MBS space. The views expressed represent the opinions of GW&K Investment Management, LLC as of October 31, 2021, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

5

|

AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

|

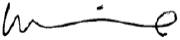

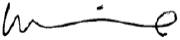

CUMULATIVE TOTAL RETURN PERFORMANCE AMG GW&K Core Bond ESG Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG GW&K Core Bond ESG Fund’s Class I shares on October 31, 2011, to a $10,000 investment made in the Bloomberg U.S. Aggregate Bond Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG GW&K Core Bond ESG Fund and the Bloomberg U.S. Aggregate Bond Index for the same time periods ended October 31, 2021. |

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

AMG GW&K Core Bond ESG Fund2, 3, 4, 5, 6, 7, 8, 9 | | | | | |

| | | | | |

Class N | | | (0.27 | %) | | | 2.69 | % | | | – | | | | 2.63 | % | | | 05/08/15 | |

| | | | | |

Class I | | | 0.15 | % | | | 3.03 | % | | | 3.25% | | | | 5.64 | % | | | 04/30/93 | |

| | | | | |

Class Z | | | 0.13 | % | | | 3.11 | % | | | – | | | | 3.05 | % | | | 05/08/15 | |

| | | | | |

Bloomberg U.S. Aggregate Bond Index10 | | | (0.48 | %) | | | 3.10 | % | | | 3.00% | | | | 5.13 | % | | | 04/30/93 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

|

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2021. All returns are in U.S. dollars($). 2 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 3 To the extent that the Fund invests in asset-backed or mortgage-backed securities, its exposure to prepayment and extension risks may be greater than investments in other fixed income securities. 4 Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. 5 The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. 6 The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

7 Many bonds have call provisions which allow the debtors to pay them back before maturity. This is especially true with mortgage securities, which can be paid back anytime. Typically debtors prepay their debt when it is to their advantage (when interest rates drop making a new loan at current rates more attractive), and thus likely to the disadvantage of bondholders, who may have to reinvest prepayment proceeds in securities with lower yields. Prepayment risk will vary depending on the provisions of the security and current interest rates relative to the interest rate of the debt. 8 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. 9 Applying the Fund’s ESG investment criteria may result in the selection or exclusion of securities of certain issuers for reasons other than performance, and the Fund may underperform funds that do not utilize an ESG investment strategy. The application of this strategy may affect the Fund’s exposure to certain companies, sectors, regions, countries or types of investments, which could negatively impact the Fund’s performance depending on whether such investments are in or out of favor. Applying ESG criteria to investment decisions is qualitative and subjective by nature, and there is no guarantee that the criteria utilized by the Subadviser or any judgment exercised by the |

| |

6

|

AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

Subadviser will reflect the beliefs or values of any particular investor. 10 The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds. Unlike the Fund, the Bloomberg U.S. Aggregate Bond Index is unmanaged, is not available for investment, and does not incur expenses. | | | | “Bloomberg®” and Bloomberg U.S. Aggregate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by AMG Funds LLC. Bloomberg is not affiliated with AMG Funds LLC, and Bloomberg does not approve, endorse, review, or recommend the AMG GW&K Core Bond ESG Fund. | | | | Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the AMG GW&K Core Bond ESG Fund. Not FDIC insured, nor bank guaranteed. May lose value. |

7

|

AMG GW&K Core Bond ESG Fund Fund Snapshots (unaudited) October 31, 2021 |

PORTFOLIO BREAKDOWN

| | | | | |

| Category | | % of

Net Assets |

| | |

U.S. Government and Agency Obligations | | | | 46.6 | |

| | |

Corporate Bonds and Notes | | | | 40.5 | |

| | |

Municipal Bonds | | | | 7.6 | |

| | |

Foreign Government Obligations | | | | 0.7 | |

| | |

Other Assets Less Liabilities | | | | 4.6 | |

| |

| Rating | | % of Market Value1 |

| | |

U.S. Government and Agency Obligations | | | | 48.9 | |

| | |

Aaa/AAA | | | | 3.4 | |

| | |

Aa/AA | | | | 13.4 | |

| | |

A | | | | 8.7 | |

| | |

Baa/BBB | | | | 25.6 | |

|

| |

TOP TEN HOLDINGS

| | |

| Security Name | | % of

Net Assets |

| | |

U.S. Treasury Bonds, 2.250%, 05/15/41 | | 3.5 |

| | |

United States Treasury Notes, 2.000%, 11/30/22 | | 3.0 |

| | |

U.S. Treasury Bonds, 6.250%, 08/15/23 | | 2.8 |

| | |

FHLMC, 3.500%, 10/01/45 | | 2.7 |

| | |

U.S. Treasury Bonds, 1.875%, 02/15/51 | | 2.2 |

| | |

California State General Obligation, School Improvements, 7.550%, 04/01/39 | | 2.1 |

| | |

The Bank of Nova Scotia, 0.594%, 03/02/26 (Canada) | | 2.0 |

| | |

FHLMC, 3.000%, 11/01/49 | | 2.0 |

| | |

Verizon Communications, Inc., 3.875%, 02/08/29 | | 1.9 |

| | |

FHLMC, 2.500%, 10/01/34 | | 1.8 |

| | | |

| | |

Top Ten as a Group | | 24.0 |

| | |

| 1 | Includes market value of long-term fixed-income securities only. |

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by any of the rating agencies. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

|

AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments October 31, 2021 |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Corporate Bonds and Notes - 40.5% | | | | | |

| | |

Financials - 16.5% | | | | | | | | |

| | |

Air Lease Corp.

MTN, 3.000%, 02/01/30 | | | $2,113,000 | | | | $2,137,099 | |

| | |

Ally Financial, Inc.

8.000%, 11/01/31 | | | 1,404,000 | | | | 2,010,281 | |

| | |

American Express Co. | | | | | | | | |

(3.550% to 09/15/26 then U.S. Treasury Yield Curve CMT 5 year + 2.854%), 3.550%, 09/15/261,2,3 | | | 1,423,000 | | | | 1,430,115 | |

| | |

Bank of America Corp. | | | | | | | | |

MTN, (4.330% to 03/15/49 then 3 month LIBOR + 1.520%), 4.330%, 03/15/501,3 | | | 1,600,000 | | | | 1,990,795 | |

| | |

The Bank of New York Mellon Corp. | | | | | | | | |

MTN, 2.450%, 08/17/26 | | | 937,000 | | | | 979,113 | |

Series G, (4.700% to 09/20/25 then U.S. Treasury Yield Curve CMT 5 year + 4.358%), 4.700%, 09/20/251,2,3 | | | 910,000 | | | | 990,262 | |

| | |

The Bank of Nova Scotia (Canada) | | | | | | | | |

(SOFR + 0.545%), 0.594%, 03/02/263 | | | 3,986,000 | | | | 3,985,123 | |

| | |

Boston Properties, LP 3.400%, 06/21/29 | | | 1,841,000 | | | | 1,973,935 | |

| | |

The Charles Schwab Corp. | | | | | | | | |

Series I, (4.000% to 06/01/26 then U.S. Treasury Yield Curve CMT 5 year + 3.168%), 4.000%, 06/01/261,2,3 | | | 1,975,000 | | | | 2,032,571 | |

| | |

Crown Castle International Corp.

4.000%, 03/01/27 | | | 1,800,000 | | | | 1,981,047 | |

| | |

The Goldman Sachs Group, Inc.

3.500%, 11/16/26 | | | 2,726,000 | | | | 2,920,775 | |

| | |

JPMorgan Chase & Co. | | | | | | | | |

(SOFR + 0.580%), 0.629%, 03/16/243 | | | 1,962,000 | | | | 1,968,607 | |

(SOFR + 0.765%), 0.814%, 09/22/273 | | | 1,928,000 | | | | 1,940,773 | |

| | |

MetLife, Inc. | | | | | | | | |

Series G, (3.850% to 09/15/25 then U.S. Treasury Yield Curve CMT 5 year + 3.576%), 3.850%, 09/15/251,2,3 | | | 2,009,000 | | | | 2,084,338 | |

| | |

The Toronto-Dominion Bank, MTN (Canada) | | | | | | | | |

(SOFR + 0.350%), 0.399%, 09/10/243 | | | 1,951,000 | | | | 1,954,371 | |

| | |

Wells Fargo & Co. | | | | | | | | |

MTN, (5.013% to 04/04/50 then SOFR + 4.502%), 5.013%, 04/04/511,3 | | | 1,411,000 | | | | 1,948,827 | |

| | |

Total Financials | | | | | | | 32,328,032 | |

| | |

Industrials - 22.5% | | | | | | | | |

| | |

Ashtead Capital, Inc.

1.500%, 08/12/264 | | | 986,000 | | | | 967,528 | |

| | |

AT&T, Inc.

4.300%, 12/15/42 | | | 1,710,000 | | | | 1,935,581 | |

| | |

Block Financial LLC

3.875%, 08/15/30 | | | 1,767,000 | | | | 1,882,539 | |

| | |

Broadcom Corp./Broadcom Cayman Finance, Ltd.

3.875%, 01/15/27 | | | 1,808,000 | | | | 1,959,937 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

Charter Communications Operating LLC/Charter Communications Operating Capital 2.250%, 01/15/29 | | | $2,000,000 | | | | $1,963,350 | |

| | |

Comcast Corp.

4.150%, 10/15/28 | | | 1,656,000 | | | | 1,889,650 | |

| | |

CommonSpirit Health

3.347%, 10/01/29 | | | 2,317,000 | | | | 2,470,593 | |

| | |

CVS Health Corp.

5.125%, 07/20/45 | | | 1,735,000 | | | | 2,282,812 | |

| | |

Dell International LLC/EMC Corp.

6.200%, 07/15/30 | | | 1,512,000 | | | | 1,929,690 | |

| | |

Discovery Communications LLC

3.950%, 03/20/28 | | | 1,766,000 | | | | 1,944,659 | |

| | |

Fiserv, Inc.

4.200%, 10/01/28 | | | 1,703,000 | | | | 1,928,084 | |

| | |

The Ford Foundation | | | | | | | | |

Series 2020, 2.415%, 06/01/50 | | | 2,207,000 | | | | 2,161,857 | |

| | |

GLP Capital LP/GLP Financing II, Inc. 5.375%, 04/15/26 | | | 2,610,000 | | | | 2,943,271 | |

| | |

HCA, Inc.

4.125%, 06/15/29 | | | 1,762,000 | | | | 1,951,560 | |

4.500%, 02/15/27 | | | 874,000 | | | | 969,902 | |

| | |

Microsoft Corp.

2.525%, 06/01/50 | | | 2,195,000 | | | | 2,158,960 | |

| | |

Parker-Hannifin Corp.

3.250%, 06/14/29 | | | 1,773,000 | | | | 1,899,937 | |

| | |

ServiceNow, Inc.

1.400%, 09/01/30 | | | 2,080,000 | | | | 1,946,733 | |

| | |

Smith & Nephew PLC (United Kingdom)

2.032%, 10/14/30 | | | 1,010,000 | | | | 981,752 | |

| | |

Sysco Corp.

2.400%, 02/15/30 | | | 2,324,000 | | | | 2,353,051 | |

| | |

Verizon Communications, Inc.

3.875%, 02/08/29 | | | 3,403,000 | | | | 3,792,188 | |

| | |

Walgreens Boots Alliance, Inc.

4.800%, 11/18/44 | | | 1,593,000 | | | | 1,929,537 | |

| | |

Total Industrials | | | | | | | 44,243,171 | |

| | |

Utilities - 1.5% | | | | | | | | |

Dominion Energy, Inc. | | | | | | | | |

| | |

Series B, (4.650% to 12/15/24 then U.S. Treasury Yield Curve CMT 5 year + 2.993%), 4.650%, 12/15/241,2,3 | | | 978,000 | | | | 1,041,570 | |

| | |

National Rural Utilities Cooperative Finance Corp.

1.350%, 03/15/31 | | | 2,024,000 | | | | 1,866,557 | |

| | |

Total Utilities | | | | | | | 2,908,127 | |

| | |

Total Corporate Bonds and Notes | | | | | | | | |

(Cost $78,090,151) | | | | | | | 79,479,330 | |

| | |

Municipal Bonds - 7.6% | | | | | | | | |

| | |

California State General Obligation, School Improvements 7.550%, 04/01/39 | | | 2,410,000 | | | | 4,058,434 | |

The accompanying notes are an integral part of these financial statements.

9

|

AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments (continued) |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Municipal Bonds - 7.6% (continued) | | | | | |

| | |

JobsOhio Beverage System | | | | | | | | |

| | |

Series B, 4.532%, 01/01/35 | | | $1,705,000 | | | | $2,085,404 | |

| | |

Los Angeles Unified School District, School Improvements

5.750%, 07/01/34 | | | 2,635,000 | | | | 3,479,937 | |

| | |

Massachusetts School Building Authority Series B,

1.753%, 08/15/30 | | | 2,017,000 | | | | 1,989,370 | |

| | |

University of California, University & College Improvements Series BD, 3.349%, 07/01/29 | | | 2,935,000 | | | | 3,253,498 | |

| | |

Total Municipal Bonds | | | | | | | | |

(Cost $13,515,528) | | | | | | | 14,866,643 | |

| | |

U.S. Government and Agency Obligations - 46.6% | | | | | | | | |

| | |

Fannie Mae - 18.5% | | | | | | | | |

| | |

FNMA

2.000%, 02/01/36 to 10/01/50 | | | 2,356,564 | | | | 2,407,874 | |

3.000%, 06/01/38 | | | 506,000 | | | | 536,799 | |

3.500%, 03/01/30 to 03/01/48 | | | 9,354,688 | | | | 10,083,594 | |

4.000%, 03/01/44 to 01/01/51 | | | 9,809,275 | | | | 10,741,556 | |

4.500%, 04/01/39 to 06/01/41 | | | 9,694,635 | | | | 10,827,526 | |

5.000%, 07/01/47 | | | 1,498,060 | | | | 1,699,049 | |

Total Fannie Mae | | | | | | | 36,296,398 | |

| | |

Freddie Mac - 10.9% | | | | | | | | |

| | |

FHLMC

2.500%, 10/01/34 to 08/01/50 | | | 5,058,018 | | | | 5,287,019 | |

3.000%, 11/01/49 to 03/01/50 | | | 4,976,618 | | | | 5,287,481 | |

3.500%, 10/01/45 | | | 4,812,983 | | | | 5,211,500 | |

4.000%, 07/01/48 to 09/01/50 | | | 1,806,785 | | | | 1,967,470 | |

5.000%, 07/01/44 | | | 1,582,897 | | | | 1,797,638 | |

| 1 | Fixed to variable rate investment. The rate shown reflects the fixed rate in effect at October 31, 2021. Rate will reset at a future date. |

| 2 | Perpetuity Bond. The date shown represents the next call date. |

| 3 | Variable rate security. The rate shown is based on the latest available information as of October 31, 2021. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| 4 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2021, the value of this security amounted to $967,528 or 0.5% of net assets. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

FHLMC Gold Pool 3.500%, 07/01/32 to 05/01/44 | | | $1,685,017 | | | | $1,822,361 | |

| | |

Total Freddie Mac | | | | | | | 21,373,469 | |

| | |

U.S. Treasury Obligations - 17.2% | | | | | | | | |

| | |

U.S. Treasury Bonds

1.875%, 02/15/51 | | | 4,292,000 | | | | 4,222,255 | |

2.250%, 05/15/41 | | | 6,587,000 | | | | 6,875,181 | |

3.125%, 05/15/48 | | | 1,598,000 | | | | 1,991,445 | |

4.500%, 02/15/36 | | | 2,589,000 | | | | 3,557,953 | |

6.250%, 08/15/23 | | | 4,918,000 | | | | 5,429,203 | |

6.750%, 08/15/26 | | | 1,506,000 | | | | 1,897,325 | |

| | |

U.S. Treasury Floating Rate Note | | | | | | | | |

(U.S. Treasury 3 month Bill Money Market Yield + 0.049%), 0.099%, 01/31/233 | | | 1,964,000 | | | | 1,964,606 | |

| | |

United States Treasury Notes 2.000%, 11/30/22 | | | 5,852,000 | | | | 5,967,440 | |

2.875%, 05/15/28 | | | 1,763,000 | | | | 1,924,356 | |

| | |

Total U.S. Treasury Obligations | | | | | | | 33,829,764 | |

Total U.S. Government and Agency Obligations | | | | | | | | |

(Cost $89,913,118) | | | | | | | 91,499,631 | |

| | |

Foreign Government Obligation - 0.7% | | | | | | | | |

The Korea Development Bank (South Korea) | | | | | | | | |

0.500%, 10/27/23

(Cost $1,382,683) | | | 1,385,000 | | | | 1,378,156 | |

| | |

Total Investments - 95.4% | | | | | | | | |

(Cost $182,901,480) | | | | | | | 187,223,760 | |

| | |

Other Assets, less Liabilities - 4.6% | | | | | | | 8,931,825 | |

| | |

Net Assets - 100.0% | | | | | | $ | 196,155,585 | |

| | |

| CMT | | Constant Maturity Treasury |

| FHLMC | | Freddie Mac |

| FNMA | | Fannie Mae |

| LIBOR | | London Interbank Offered Rate |

| MTN | | Medium-Term Note |

| SOFR | | Secured Overnight Financing Rate |

The accompanying notes are an integral part of these financial statements.

10

|

AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2021:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Corporate Bonds and Notes† | | | – | | | | $79,479,330 | | | | – | | | | $79,479,330 | |

| | | | |

Municipal Bonds† | | | – | | | | 14,866,643 | | | | – | | | | 14,866,643 | |

| | | | |

U.S. Government and Agency Obligations† | | | – | | | | 91,499,631 | | | | – | | | | 91,499,631 | |

| | | | |

Foreign Government Obligation | | | – | | | | 1,378,156 | | | | – | | | | 1,378,156 | |

| | | | |

Total Investments in Securities | | | – | | | | $187,223,760 | | | | – | | | | $187,223,760 | |

| | | | | | | | | | | | | | | | |

| | † | All corporate bonds and notes, municipal bonds, and U.S. government and agency obligations held in the Fund are Level 2 securities. For a detailed breakout of corporate bonds and notes, municipal bonds, and U.S. government and agency obligations by major industry or agency classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended October 31, 2021, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

11

|

AMG GW&K Emerging Markets Equity Fund Portfolio Manager’s Comments (unaudited) |

| | | | |

MARKET OVERVIEW Emerging markets (“EM”) advanced during the fiscal year ended October 2021, as global business activity accelerated thanks to effective COVID-19 vaccines, improved virus treatments, and pent-up demand. Commodity prices also rallied on favorable supply and demand dynamics. The MSCI Emerging Markets Index (“MSCI EM Index”) gained 16.96% but trailed developed markets (DM) considerably, as the MSCI World Index advanced 40.4%. That represents the second worst one-year underperformance of EM versus DM since 1999, eclipsed only by the “taper tantrum” period of late 2013. The performance gap appears to reflect EM’s incomplete and uneven recovery from the pandemic along with tighter financial conditions in EM. There was a notable change in regional leadership this year, as commodity-rich countries finished in the lead and an otherwise resilient Asia fell victim to disappointing returns from index heavyweight China. What seemed like a ceaseless flow of worrying news from the country—Beijing’s far-reaching regulatory offensive, the demise of heavily indebted real estate developer China Evergrande, and surprising power shortages—saw the MSCI China Index fall (9.2)%. South Korea and Taiwan delivered a second consecutive year of strong performance due to ongoing demand for semiconductors, and India quickly recovered from a dire outbreak of the Delta variant to end the year as the top Asian market. The EMEA region’s oil producing countries—Russia and the Gulf Corporation Council markets—were standout performers as Brent crude oil soared past $80/bbl. Eastern Europe rallied on unexpectedly good earnings across the continent. Higher commodity prices also drove gains in Latin America, though Brazil struggled later in the period as inflation took hold amid aggressive fiscal spending. Energy and materials outperformed substantially as commodity prices rallied, financials gained on a more favorable margin outlook in several markets, and record earnings in the semiconductor industry supported information technology. China-specific factors triggered negative returns in the consumer discretionary, communication services, and real estate sectors. | | FUND REVIEW For the fiscal year ending October 31, 2021, AMG GW&K Emerging Markets Equity Fund (the “Fund”) Class Z shares returned 10.15%, underperforming the 16.96% return for the MSCI EM Index. Sector exposure was a key factor in the performance shortfall, as investors shifted from structural growth companies in consumer-related industries to value cyclicals like mining and energy producers, where the Fund is typically underweight. Pressure on the Fund’s positions in China, where regulatory changes engulfed a number of industries, also detracted from relative performance. Proposed changes to casino licensing conditions caused a sharp fall in Macau-based Sands China Ltd., and Tencent Holdings Ltd., Tencent Music Entertainment Group, and Kuaishou Technology Class B also declined on uncertainty surrounding expected regulatory changes governing video gaming and social media content. Sands China and Kuaishou Technology were sold during the period. Similar concerns and signs of decelerating consumption weighed on Alibaba Group Holdings Ltd. Aside from the situation in China, several holdings performed quite well during the period. Russian gas producer Novatek PJSC gained on record prices for natural gas in Europe and Asia. Sberbank of Russia PJSC, the country’s largest financial services company, reported better-than-expected earnings and increased its profit target for 2021. Taiwan Semiconductor Manufacturing Co., LTD. reported consistently strong earnings throughout the past year due to robust worldwide demand for semiconductors. Samsung Electronics Co., Ltd. also advanced on record sales in its semiconductor division. Financials, led by Sberbank of Russia and India’s HDFC Bank, Ltd. and Housing Development Finance Corp. Ltd., was the Fund’s top performing sector. OUTLOOK AND PORTFOLIO POSITIONING EM equity performance stands in stark contrast to DM over the past 12 months. The uneven post-pandemic economic recovery across countries, | | earlier tightening of monetary policy in several markets, and China-specific factors have all contributed to this divergence in returns. As a result, EM are trading at a 33% discount to DM based on forward PE multiples. Undoubtedly, earnings growth will be the most important driver of future performance, but the ever-widening discount, particularly relative to the U.S. market, should provide a measure of downside support. Over the next three years, bottom-up analysts project EM earnings compounding at about 9% annually compared to 10% for DM earnings. The relatively modest advantage for DM earnings appears to reflect EM’s incomplete recoveries from the pandemic. The notable valuation discount suggests to us that any positive surprises for EM, like monetary and fiscal policy stimulus from China or an easing of its regulatory environment, could easily provide fuel for EM equities to substantially recover lost ground from DM equities over the year ahead. With respect to the Fund’s structure, trading and market activity during the fiscal year resulted in increased exposures to the financials, consumer discretionary, and energy sectors while our weights in industrials, consumer staples, and communication services decreased. At the close of the period, the Fund had overweight positions in the consumer discretionary, information technology, financials, consumer staples, and communication services sectors and underweight positions in the materials, energy, real estate, industrials, utilities, and health care sectors relative to the benchmark. Geographically, the portfolio finished the fiscal year with 76% in Asia, 12% in the EMEA region, and 12% in Latin America. The views expressed represent the opinions of GW&K Investment Management, LLC as of October 31, 2021, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

12

|

AMG GW&K Emerging Markets Equity Fund Portfolio Manager’s Comments (continued) |

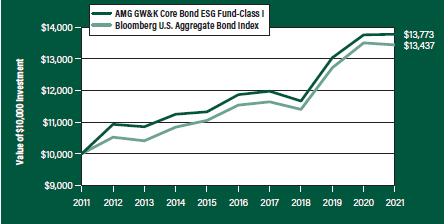

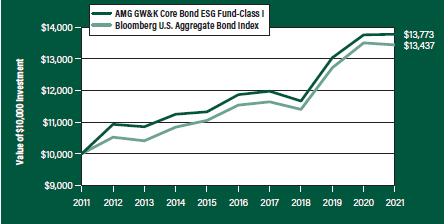

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG GW&K Emerging Markets Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG GW&K Emerging Markets Equity Fund’s Class Z shares on October 31, 2011, to a $10,000 investment made in the MSCI Emerging Markets Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG GW&K Emerging Markets Equity Fund and the MSCI Emerging Markets Index for the same time periods ended October 31, 2021.

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

| | |

AMG GW&K Emerging Markets Equity Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12 | | | | | | | | | |

| | | | | |

Class N | | | 9.85% | | | | 8.29% | | | | – | | | | 2.58% | | | | 03/01/12 | |

| | | | | |

Class I | | | 10.13% | | | | 8.63% | | | | 3.67% | | | | 2.00% | | | | 03/01/11 | |

| | | | | |

Class Z | | | 10.15% | | | | 8.72% | | | | 3.77% | | | | 2.10% | | | | 03/01/11 | |

| | | | | |

MSCI Emerging Markets Index13 | | | 16.96% | | | | 9.39% | | | | 4.88% | | | | 3.69% | | | | 03/01/11† | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

|

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2021. All returns are in U.S. dollars ($). |

|

2 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

|

3 The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar investment when converted back to U.S. Dollars. |

|

4 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. |

|

5 The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

|

6 The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets. |

|

7 The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. |

|

8 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

|

9 Investing in initial public offerings (IPOs) is risky and the prices of stocks purchased in IPOs tend to fluctuate more widely than stocks of companies that have been publicly traded for a longer period of time. Stocks purchased in IPOs generally do not have a trading history, and information about the companies may be available for very limited periods. |

|

10 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

|

11 Companies that are in similar industry sectors may be similarly affected by particular economic or |

|

|

13

|

AMG GW&K Emerging Markets Equity Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 12 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. | | | | 13 The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. Please go to msci.com for most current list of countries represented by the index. Unlike the Fund, the MSCI Emerging Markets Index is unmanaged, is not available for investment and does not incur expenses. | | | | All MSCI data is provided “as is.” The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. Not FDIC insured, nor bank guaranteed. May lose value. |

14

|

AMG GW&K Emerging Markets Equity Fund Fund Snapshots (unaudited) October 31, 2021 |

PORTFOLIO BREAKDOWN

| | |

Sector | | %of

Net Assets |

| | |

Financials | | 25.6 |

| | |

Information Technology | | 22.8 |

| | |

Consumer Discretionary | | 20.8 |

| | |

Communication Services | | 9.1 |

| | |

Consumer Staples | | 7.7 |

| | |

Energy | | 4.5 |

| | |

Health Care | | 3.2 |

| | |

Industrials | | 1.3 |

| | |

Real Estate | | 0.7 |

| | |

Short-Term Investments | | 3.4 |

| | |

Other Assets Less Liabilities | | 0.9 |

| | | | |

TOP TEN HOLDINGS | | | | |

| Security Name | | %of

Net Assets | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | | | 8.2 | |

| | |

Samsung Electronics Co., Ltd. (South Korea) | | | 4.5 | |

| | |

Alibaba Group Holding, Ltd., Sponsored ADR (China) | | | 4.0 | |

| | |

Sberbank of Russia PJSC, Sponsored ADR (Russia) | | | 3.7 | |

| | |

Housing Development Finance Corp., Ltd. (India) | | | 3.5 | |

| | |

HDFC Bank, Ltd. (India) | | | 3.5 | |

| | |

Baidu, Inc., Sponsored ADR (China) | | | 3.0 | |

| | |

China International Capital Corp., Ltd., Class H (China) | | | 2.9 | |

| | |

Tencent Holdings, Ltd. (China) | | | 2.8 | |

| | |

Reliance Industries, Ltd. (India) | | | 2.5 | |

| | | | | |

| | |

Top Ten as a Group | | | 38.6 | |

| | | | | |

| | | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

15

|

AMG GW&K Emerging Markets Equity Fund Schedule of Portfolio Investments October 31, 2021 |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Common Stocks - 95.7% | | | | | | | | |

| | |

Communication Services - 9.1% | | | | | | | | |

| | |

Baidu, Inc., Sponsored ADR (China)* | | | 10,777 | | | | $1,748,461 | |

| | |

MultiChoice Group (South Africa) | | | 70,458 | | | | 560,297 | |

| | |

NetEase, Inc., ADR (China) | | | 5,965 | | | | 582,124 | |

| | |

Tencent Holdings, Ltd. (China) | | | 26,906 | | | | 1,636,686 | |

| | |

Tencent Music Entertainment Group, ADR (China)* | | | 104,272 | | | | 819,578 | |

| | |

Total Communication Services | | | | | | | 5,347,146 | |

| | |

Consumer Discretionary - 20.8% | | | | | | | | |

| | |

Alibaba Group Holding, Ltd., Sponsored ADR (China)* | | | 14,291 | | | | 2,357,158 | |

| | |

Feng TAY Enterprise Co., Ltd. (Taiwan) | | | 87,355 | | | | 679,716 | |

| | |

Galaxy Entertainment Group, Ltd. (Hong Kong)* | | | 148,000 | | | | 796,348 | |

| | |

Huazhu Group, Ltd., ADR (China)* | | | 12,200 | | | | 565,592 | |

| | |

JD Health International, Inc. (China)*,1,2 | | | 14,800 | | | | 129,921 | |

| | |

JD.com, Inc., ADR (China)* | | | 6,450 | | | | 504,906 | |

| | |

MakeMyTrip, Ltd. (India)* | | | 27,648 | | | | 875,612 | |

| | |

Midea Group Co., Ltd., Class A (China) | | | 75,485 | | | | 809,698 | |

| | |

Naspers, Ltd., N Shares (South Africa) | | | 6,799 | | | | 1,151,436 | |

| | |

Ozon Holdings PLC, ADR (Russia)* | | | 10,089 | | | | 454,005 | |

| | |

Pepco Group, N.V. (United Kingdom)*,1 | | | 3,830 | | | | 45,311 | |

| | |

Prosus, N.V. (Netherlands)2 | | | 12,612 | | | | 1,110,903 | |

| | |

Shenzhou International Group Holdings, Ltd. (China) | | | 10,660 | | | | 229,661 | |

| | |

Trip.com Group, Ltd., ADR (China)* | | | 37,077 | | | | 1,058,919 | |

| | |

Yum China Holdings, Inc. (China) | | | 24,617 | | | | 1,405,138 | |

| | |

Total Consumer Discretionary | | | | | | | 12,174,324 | |

| | |

Consumer Staples - 7.7% | | | | | | | | |

| | |

Angel Yeast Co., Ltd., Class A (China) | | | 34,000 | | | | 295,697 | |

| | |

Bid Corp., Ltd. (South Africa) | | | 46,393 | | | | 995,711 | |

| | |

CP All PCL (Thailand) | | | 156,468 | | | | 302,305 | |

| | |

Dino Polska, S.A. (Poland)*,1 | | | 3,851 | | | | 344,014 | |

| | |

Fomento Economico Mexicano, S.A.B de CV (Mexico) | | | 52,196 | | | | 429,905 | |

| | |

LG Household & Health Care, Ltd. (South Korea) | | | 212 | | | | 212,188 | |

| | |

Orion Corp. (South Korea) | | | 5,685 | | | | 574,946 | |

| | |

Vietnam Dairy Products JSC (Vietnam) | | | 44,800 | | | | 178,597 | |

| | |

Wal-Mart de Mexico, S.A.B. de CV (Mexico) | | | 340,138 | | | | 1,185,064 | |

| | |

Total Consumer Staples | | | | | | | 4,518,427 | |

| | |

Energy - 4.5% | | | | | | | | |

| | |

Novatek PJSC, Sponsored GDR (Russia) | | | 4,641 | | | | 1,178,210 | |

| | |

Reliance Industries, Ltd. (India) | | | 42,488 | | | | 1,441,838 | |

| | |

Total Energy | | | | | | | 2,620,048 | |

| | | | | | | | |

| | | Shares | | | Value | |

Financials - 25.6% | | | | | | | | |

| | |

AIA Group, Ltd. (Hong Kong) | | | 82,968 | | | | $929,823 | |

| | |

B3, S.A. - Brasil Bolsa Balcao (Brazil) | | | 175,900 | | | | 372,133 | |

| | |

Banco Bradesco, S.A., ADR (Brazil) | | | 236,385 | | | | 827,348 | |

| | |

Bank Mandiri Persero Tbk PT (Indonesia) | | | 1,297,416 | | | | 655,938 | |

| | |

Bank Rakyat Indonesia Persero Tbk PT (Indonesia) | | | 2,413,636 | | | | 724,535 | |

| | |

BDO Unibank, Inc. (Philippines) | | | 314,090 | | | | 773,041 | |

| | |

China International Capital Corp., Ltd., Class H (China)1 | | | 697,200 | | | | 1,726,106 | |

| | |

China Merchants Bank Co., Ltd., Class H (China) | | | 44,000 | | | | 368,726 | |

| | |

Grupo Financiero Banorte, S.A.B de CV, Class O (Mexico) | | | 157,742 | | | | 997,112 | |

| | |

HDFC Bank, Ltd. (India) | | | 97,940 | | | | 2,074,746 | |

| | |

Housing Development Finance Corp., Ltd. (India) | | | 54,569 | | | | 2,080,535 | |

| | |

Itau Unibanco Holding, S.A., Sponsored ADR (Brazil) | | | 57,600 | | | | 234,432 | |

| | |

OTP Bank Plc (Hungary)* | | | 16,673 | | | | 1,001,838 | |

| | |

Sberbank of Russia PJSC, Sponsored ADR (Russia) | | | 108,485 | | | | 2,175,670 | |

| | |

XP, Inc., Class A (Brazil)* | | | 2,614 | | | | 85,765 | |

| | |

Total Financials | | | | | | | 15,027,748 | |

| | |

Health Care - 3.2% | | | | | | | | |

| | |

China Resources Sanjiu Medical & | | | | | | | | |

| | |

Pharmaceutical Co., Ltd., Class A (China) | | | 167,700 | | | | 632,226 | |

| | |

Fleury, S.A. (Brazil) | | | 136,422 | | | | 453,467 | |

| | |

Jinxin Fertility Group, Ltd. (China)*,1 | | | 100,000 | | | | 141,043 | |

| | |

Lepu Medical Technology Beijing Co., Ltd., Class A (China) | | | 53,500 | | | | 178,156 | |

| | |

Odontoprev, S.A. (Brazil) | | | 199,311 | | | | 470,396 | |

| | |

Total Health Care | | | | | | | 1,875,288 | |

| | |

Industrials - 1.3% | | | | | | | | |

| | |

Grupo Aeroportuario del Pacifico, S.A.B de CV, Class B (Mexico)2 | | | 59,655 | | | | 753,366 | |

| |

Information Technology - 22.8% | | | | | |

| | |

Advantech Co., Ltd. (Taiwan) | | | 24,727 | | | | 323,380 | |

| | |

Beijing Kingsoft Office Software, Inc., Class A (China) | | | 18,800 | | | | 870,927 | |

| | |

Delta Electronics, Inc. (Taiwan) | | | 62,100 | | | | 548,180 | |

| | |

GDS Holdings, Ltd., ADR (China)* | | | 3,450 | | | | 204,930 | |

| | |

Infosys, Ltd., Sponsored ADR (India) | | | 27,276 | | | | 607,709 | |

| | |

MediaTek, Inc. (Taiwan) | | | 39,000 | | | | 1,283,595 | |

| | |

Pagseguro Digital, Ltd., Class A (Brazil)*,2 | | | 9,488 | | | | 343,466 | |

| | |

Samsung Electronics Co., Ltd. (South Korea) | | | 43,767 | | | | 2,620,467 | |

| | |

SK Hynix, Inc. (South Korea) | | | 13,184 | | | | 1,162,178 | |

The accompanying notes are an integral part of these financial statements.

16

|

AMG GW&K Emerging Markets Equity Fund Schedule of Portfolio Investments (continued) |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| |

Information Technology - 22.8% (continued) | | | | | |

| | |

Sunny Optical Technology Group Co., Ltd. (China)2 | | | 8,576 | | | | $230,124 | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | | | 226,632 | | | | 4,809,201 | |

| | |

Tata Consultancy Services, Ltd. (India) | | | 8,460 | | | | 384,545 | |

| | |

Total Information Technology | | | | | | | 13,388,702 | |

| | |

Real Estate - 0.7% | | | | | | | | |

| | |

Greentown Service Group Co., Ltd. (China) | | | 376,023 | | | | 372,235 | |

| | |

Total Common Stocks | | | | | | | | |

(Cost $43,493,634) | | | | | | | 56,077,284 | |

| | |

| | | Principal

Amount | | | | |

| | |

Short-Term Investments - 3.4% | | | | | | | | |

| |

Joint Repurchase Agreements - 3.4%3 | | | | | |

| | |

Bank of America Securities, Inc., dated 10/29/21, due 11/01/21, 0.050% total to be received $1,000,004 (collateralized by various U.S. Government Agency Obligations, 1.500% - 5.000%, 09/01/28 - 01/01/59, totaling $1,020,000) | | $ | 1,000,000 | | | | 1,000,000 | |

| * | Non-income producing security. |

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2021, the value of these securities amounted to $2,386,395 or 4.1% of net assets. |

| 2 | Some of these securities, amounting to $2,242,295 or 3.8% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

HSBC Securities USA, Inc., dated 10/29/21, due 11/01/21, 0.050% total to be received $15,149 (collateralized by various U.S. Treasuries, 0.000% - 5.500%, 11/30/22 - 05/15/48, totaling $15,452) | | | $15,149 | | | | $15,149 | |

| | |

RBC Dominion Securities, Inc., dated 10/29/21, due 11/01/21, 0.050% total to be received $1,000,004 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 6.000%, 11/01/21 - 07/20/51, totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

| |

Total Short-Term Investments | | | | | |

(Cost $2,015,149) | | | | | | | 2,015,149 | |

| | |

Total Investments - 99.1% | | | | | | | | |

(Cost $45,508,783) | | | | | | | 58,092,433 | |

| |

Other Assets, less Liabilities - 0.9% | | | | 540,984 | |

| | |

Net Assets - 100.0% | | | | | | $ | 58,633,417 | |

| 3 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

ADR American Depositary Receipt

GDR Global Depositary Receipt

The accompanying notes are an integral part of these financial statements.

17

|

AMG GW&K Emerging Markets Equity Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2021:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 21 | | | Level 3 | | | Total | |

| | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks | | | | | | | | | | | | | | | | |

| | | | |

Financials | | $ | 2,516,790 | | | $ | 12,510,958 | | | | – | | | $ | 15,027,748 | |

| | | | |

Information Technology | | | 1,156,105 | | | | 12,232,597 | | | | – | | | | 13,388,702 | |

| | | | |

Consumer Discretionary | | | 7,266,641 | | | | 4,907,683 | | | | – | | | | 12,174,324 | |

| | | | |

Communication Services | | | 3,710,460 | | | | 1,636,686 | | | | – | | | | 5,347,146 | |

| | | | |

Consumer Staples | | | 3,133,291 | | | | 1,385,136 | | | | – | | | | 4,518,427 | |

| | | | |

Energy | | | – | | | | 2,620,048 | | | | – | | | | 2,620,048 | |

| | | | |

Health Care | | | 923,863 | | | | 951,425 | | | | – | | | | 1,875,288 | |

| | | | |

Industrials | | | 753,366 | | | | – | | | | – | | | | 753,366 | |

| | | | |

Real Estate | | | – | | | | 372,235 | | | | – | | | | 372,235 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | – | | | | 2,015,149 | | | | – | | | | 2,015,149 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | $ | 19,460,516 | | | $ | 38,631,917 | | | | – | | | $ | 58,092,433 | |

| | | | | | | | | | | | | | | | |

| 1 | An external pricing service is used to reflect any impact on security value due to market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. |

For the fiscal year ended October 31, 2021, there were no transfers in or out of Level 3.

The country allocation in the Schedule of Portfolio Investments at October 31, 2021, was as follows:

| | | | | |

| Country | | % of Long-Term

Investments |

| |

Brazil | | | | 5.0 | |

| |

China | | | | 30.1 | |

| |

Hong Kong | | | | 3.1 | |

| |

Hungary | | | | 1.8 | |

| |

India | | | | 13.3 | |

| |

Indonesia | | | | 2.5 | |

| |

Mexico | | | | 6.0 | |

| |

Netherlands | | | | 2.0 | |

| |

Philippines | | | | 1.4 | |

| |

Poland | | | | 0.6 | |

| | |

| Country | | % of Long-Term

Investments |

| |

Russia | | 6.8 |

| |

South Africa | | 4.8 |

| |

South Korea | | 8.1 |

| |

Taiwan | | 13.6 |

| |

Thailand | | 0.5 |

| |

United Kingdom | | 0.1 |

| |

Vietnam | | 0.3 |

| | |

| |

| | | 100.0 |

| | |

The accompanying notes are an integral part of these financial statements.

18

|

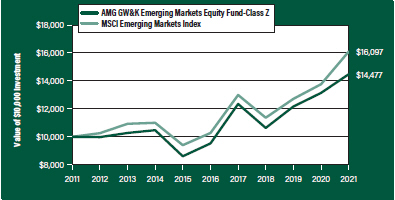

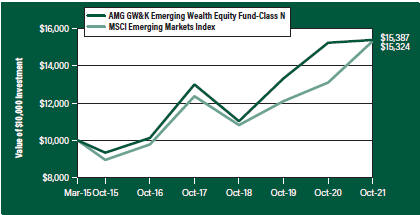

AMG GW&K Emerging Wealth Equity Fund Portfolio Manager’s Comments (unaudited) |

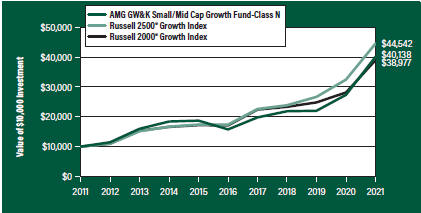

| | | | |