UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09521

AMG FUNDS

(Exact name of registrant as specified in charter)

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2023 – DECEMBER 31, 2023

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

| | |

| | | AMG Funds December 31, 2023 |

| | |

| | |  |

| | |

| | | AMG TimesSquare Small Cap Growth Fund |

| | |

| | | Class N: TSCPX | Class I: TSQIX | Class Z: TSCIX |

| | |

| | | AMG TimesSquare Mid Cap Growth Fund |

| | |

| | | Class N: TMDPX | Class I: TQMIX | Class Z: TMDIX |

| | |

| | | AMG TimesSquare International Small Cap Fund |

| | |

| | | Class N: TCMPX | Class I: TQTIX | Class Z: TCMIX |

| | |

| | | AMG TimesSquare Emerging Markets Small Cap Fund |

| | |

| | | Class N: TQENX | Class I: TQEIX | Class Z: TQEZX |

| | |

| | | AMG TimesSquare Global Small Cap Fund |

| | |

| | | Class N: TSYNX | Class I: TSYIX | Class Z: TSYZX |

| | | | |

| | | |

| wealth.amg.com | | | | 123123 AR012 |

| | |

| | | AMG Funds Annual Report — December 31, 2023 |

| | | | | | |

| | | |

| | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| | | |

| | | AMG TimesSquare Small Cap Growth Fund | | | 4 | |

| | | |

| | | AMG TimesSquare Mid Cap Growth Fund | | | 11 | |

| | | |

| | | AMG TimesSquare International Small Cap Fund | | | 19 | |

| | | |

| | | AMG TimesSquare Emerging Markets Small Cap Fund | | | 27 | |

| | | |

| | | AMG TimesSquare Global Small Cap Fund | | | 35 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 43 | |

| | | |

| | | Balance sheets, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 45 | |

| | | |

| | | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 46 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 48 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 63 | |

| | | |

| | | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 72 | |

| | | |

| | | OTHER INFORMATION | | | 73 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 74 | |

| | | | | | | |

|

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | |

| | Letter to Shareholders |

Dear Shareholder:

We are pleased to provide this annual report for your investment with AMG Funds. Our foremost goal is to provide investment solutions that help our shareholders successfully achieve their long-term investment goals. We appreciate the privilege of providing you with investment tools.

Throughout most of the year, markets wrestled with uncertainties around tighter monetary policy, increased geopolitical tension, instability in the regional banking sector, and political handwringing over the U.S. debt ceiling. However, investors remained optimistic for an economic “soft landing” as inflation continued to ease and risk assets finally surged in the fourth quarter following a dovish pivot in the U.S. Federal Reserve (the “Fed”) policy. Bonds finished with a positive return; a remarkable development after struggling to move higher for most of the year as global central banks raised interest rates.

The S&P 500® Index gained 26.29% for the fiscal year ended December 31, 2023, fully recouping losses suffered in 2022. Large-cap stocks diverged from small-cap stocks, particularly driven by a handful of mega-cap technology and consumer discretionary stocks. The Russell 1000® Index gained 26.53% compared to the 16.93% return for the Russell 2000® Index. Nine out of eleven sectors posted positive returns, with information technology (60.93%), communication services (55.86%), and consumer discretionary (43.22%) leading the way. The weakest sectors were utilities (-7.08%), energy (-1.33%), and consumer staples (+0.55%). The strength in information technology drove growth stocks to strongly outperform value stocks with the Russell 1000® Growth Index gaining 42.68% compared to a 11.46% return for the Russell 1000® Value Index. Outside the U.S., foreign equity markets underperformed domestic equities, delivering a 15.62% return, as measured by the MSCI All Country World Index ex USA benchmark.

The Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, rebounded with a 5.53% return over the period. The 10-year Treasury yield climbed to post-GFC (Global Financial Crisis) highs through October as the Fed tightened policy throughout the year, leading many to expect another year of negative bond returns. However, investors received much needed relief as interest rates fell sharply in the final two months of the year following the Fed’s message signaling rate cuts in 2024. Looking across the broadest sectors of the market, investment-grade corporate bonds gained 8.52% for the year, while agency mortgage-backed securities rose 5.05%. High yield bonds were the best performing sector with a 13.44% return as measured by the return of the Bloomberg U.S. Corporate High Yield Bond Index. Municipal bonds outperformed the broader market with a 6.40% gain for the Bloomberg Municipal Bond Index. Outside the U.S., foreign bonds were also positive as the Bloomberg Global Aggregate ex-USD Index gained 5.72%.

AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit. For more information about AMG Funds’ wide range of products and resources, please visit wealth.amg.com. We thank you for your investment and continued trust in AMG Funds.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | |

| | | | | Periods ended | |

| Average Annual Total Returns | | December 31, 2023* | |

| | | | |

| Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

| | | | |

Large Cap | | (S&P 500® Index) | | | 26.29% | | | | 10.00% | | | | 15.69% | |

| | | | |

Small Cap | | (Russell 2000® Index) | | | 16.93% | | | | 2.22% | | | | 9.97% | |

| | | | |

International | | (MSCI ACWI ex USA) | | | 15.62% | | | | 1.55% | | | | 7.08% | |

| | | | |

Bonds: | | | | | | | | | | | | | | |

| | | | |

Investment Grade | | (Bloomberg U.S. Aggregate Bond Index) | | | 5.53% | | | | (3.31)% | | | | 1.10% | |

| | | | |

High Yield | | (Bloomberg U.S. Corporate High Yield Bond Index) | | | 13.44% | | | | 1.98% | | | | 5.37% | |

| | | | |

Tax-exempt | | (Bloomberg Municipal Bond Index) | | | 6.40% | | | | (0.40)% | | | | 2.25% | |

| | | | |

Treasury Bills | | (ICE BofAML U.S. 6-Month Treasury Bill Index) | | | 5.14% | | | | 2.17% | | | | 2.02% | |

*Source: FactSet. Past performance is no guarantee of future results.

2

| | |

| | | About Your Fund’s Expenses |

| | | |

| | | |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first section of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second section of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | | | |

Six Months Ended December 31, 2023 | | Expense

Ratio for

the Period | | Beginning

Account

Value

07/01/23 | | Ending

Account

Value

12/31/23 | | | Expenses

Paid

During

the Period* |

AMG TimesSquare Small Cap Growth Fund |

|

Based on Actual Fund Return |

Class N | | 1.19% | | $1,000 | | | $1,053 | | | $6.16 |

Class I | | 1.07% | | $1,000 | | | $1,054 | | | $5.54 |

Class Z | | 0.99% | | $1,000 | | | $1,054 | | | $5.12 |

|

Based on Hypothetical 5% Annual Return |

Class N | | 1.19% | | $1,000 | | | $1,019 | | | $6.06 |

Class I | | 1.07% | | $1,000 | | | $1,020 | | | $5.45 |

Class Z | | 0.99% | | $1,000 | | | $1,020 | | | $5.04 |

AMG TimesSquare Mid Cap Growth Fund |

|

Based on Actual Fund Return |

Class N | | 1.19% | | $1,000 | | | $1,087 | | | $6.26 |

Class I | | 1.04% | | $1,000 | | | $1,087 | | | $5.47 |

Class Z | | 0.99% | | $1,000 | | | $1,088 | | | $5.21 |

|

Based on Hypothetical 5% Annual Return |

Class N | | 1.19% | | $1,000 | | | $1,019 | | | $6.06 |

Class I | | 1.04% | | $1,000 | | | $1,020 | | | $5.30 |

Class Z | | 0.99% | | $1,000 | | | $1,020 | | | $5.04 |

AMG TimesSquare International Small Cap Fund |

|

Based on Actual Fund Return |

Class N | | 1.23% | | $1,000 | | | $1,030 | | | $6.29 |

Class I | | 1.07% | | $1,000 | | | $1,030 | | | $5.48 |

Class Z | | 0.98% | | $1,000 | | | $1,031 | | | $5.02 |

|

Based on Hypothetical 5% Annual Return |

Class N | | 1.23% | | $1,000 | | | $1,019 | | | $6.26 |

Class I | | 1.07% | | $1,000 | | | $1,020 | | | $5.45 |

Class Z | | 0.98% | | $1,000 | | | $1,020 | | | $4.99 |

| | | | | | | | | | |

Six Months Ended December 31, 2023 | | Expense

Ratio for

the Period | | Beginning

Account

Value

07/01/23 | | Ending

Account

Value

12/31/23 | | | Expenses

Paid

During

the Period* |

AMG TimesSquare Emerging Markets Small Cap Fund |

|

Based on Actual Fund Return |

Class N | | 1.65% | | $1,000 | | | $1,093 | | | $8.70 |

Class I | | 1.25% | | $1,000 | | | $1,095 | | | $6.60 |

Class Z | | 1.25% | | $1,000 | | | $1,095 | | | $6.60 |

|

Based on Hypothetical 5% Annual Return |

Class N | | 1.65% | | $1,000 | | | $1,017 | | | $8.39 |

Class I | | 1.25% | | $1,000 | | | $1,019 | | | $6.36 |

Class Z | | 1.25% | | $1,000 | | | $1,019 | | | $6.36 |

AMG TimesSquare Global Small Cap Fund |

|

Based on Actual Fund Return |

Class N | | 1.25% | | $1,000 | | | $1,053 | | | $6.47 |

Class I | | 1.00% | | $1,000 | | | $1,055 | | | $5.18 |

Class Z | | 1.00% | | $1,000 | | | $1,055 | | | $5.18 |

|

Based on Hypothetical 5% Annual Return |

Class N | | 1.25% | | $1,000 | | | $1,019 | | | $6.36 |

Class I | | 1.00% | | $1,000 | | | $1,020 | | | $5.09 |

Class Z | | 1.00% | | $1,000 | | | $1,020 | | | $5.09 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

| | |

| | | AMG TimesSquare Small Cap Growth Fund Portfolio Manager’s Comments (unaudited) |

| | | |

| | | |

| | | | |

The Year In Review For the year ended December 31, 2023, AMG TimesSquare Small Cap Growth Fund (the “Fund”) Class N shares returned 16.41%, while the benchmark, the Russell 2000® Growth Index, returned 18.66%. 2023 started off with a rollercoaster ride for global equity markets in the first quarter, followed by a steady climb in the second quarter, a decline in the third quarter, and ended the year with a strong rebound in the fourth quarter. The fourth quarter was bolstered by central banks pausing rates increases, but it may be premature to declare victory over inflation and plot a near-term pivot to monetary easing. That speculation led to a rally benefiting global equities—especially small & microcaps and emerging markets. Concerns surrounding wage inflation and access to skilled workers generally subsided across markets, with the notable exception of Japan where that remains a significant challenge. Most factors finished the year in positive territory. However, it was Beta that significantly outpaced other style factors in 2023. Among U.S. small- to mid- cap growth stocks better performance was found in the information technology, industrials, and consumer discretionary sectors. Utilities and energy generally lagged. As our investment team meets with companies, reviews recent earnings reports, and surveys the global landscape, they note several investment dynamics that inform our positioning: • Technology: Cybersecurity remains a top priority for companies, propelled by recent well publicized cyberattacks and new SEC disclosure rules on cyber risks which took effect in December 2023. Our channel checks indicate that information technology (IT) budgets will continue growing, with cybersecurity becoming an increasing percentage. Interest continues to grow in machine learning and generative artificial intelligence (AI) tools and applications, though companies approach this area cautiously given the costs and fast paced changes. • Industrials: Many years of prior underinvestment leave significant ground to recover that recent government programs have only begun to address. Industrial capital expenditures may continue to be a bright spot for several years as structural labor challenges are addressed with greater automation and supply chains move closer to home, particularly away from China. | | • China: Localization and import substitution are major trends, either due to geopolitical concerns in the case of the technology industry, or trading down to cheaper domestic products due to consumer weakness. Meanwhile, both Chinese and multinational companies continue to seek other manufacturing centers in the region, or re-shore them completely, which should benefit Southeast Asia, Mexico, and India. Fund Performance Review At the start of 2023, the Fund lagged the Russell 2000® Growth Index during the market’s jump in January following 2022’s negative market. As the market tide ebbed, our relative performance improved, and we were ahead of the benchmark by early spring. Then market hype surrounding generative AI or GLP 1 (Glucagon-like peptide 1) obesity drugs lifted riskier small cap growth stocks far higher than our holdings. By the fall, we regained our relative performance lead when quality was favored while risk and high valuation were shunned. In the last two months of the year, the market rebounded sharply with expectations for both an economic soft landing and a near term pivot on monetary policy, leaving us behind the benchmark for the year. Our preferences in the consumer oriented sectors lean toward value oriented or specialty retailers, franchise models, or premium brands. This year, however, that proved challenging. We exited our positions in Planet Fitness and National Vision—each had a negative impact on performance. The fitness center franchisor Planet Fitness was down -39% while we held it in 2023. Early in the year, investors were disappointed that the company’s initial expectation for 160 new store openings was below expectations for 175. That pace continued to lag in subsequent quarters, and we trimmed our position. Then in September, the company’s board discharged its CEO over differing views on how best to move the company forward. In our follow up discussion with the CFO and interim CEO, we were not convinced a positive change was near, so we sold our remaining position. We left behind National Vision in early March with its shares down -40%. Earnings came up short versus expectations, though revenues were in line for this value oriented optical retail chain providing eye exams, eyeglasses, and contact lenses. The company’s management cited a difficult | | operating environment, particularly for their lower income customers. The company’s 2023 outlook was slightly below estimates, incorporating continuing constraints on eye exam capacity due to a shortage of optometrists. Faring far better was Wingstop, Inc., the franchisor and operator of quick service restaurants for cooked-to-order chicken wings. The company began the year with better-than-anticipated results thanks to higher levels of customer traffic and many recently opened locations. As its price rose in the spring, we trimmed our position. Late in the summer its share price faded, somewhat from market sentiment that the GLP 1 weight loss drugs would curb customer appetites for wings, and we added to our holdings. Toward the end of the year, Wingstop reported revenues and earnings well above expectations as transactions increased meaningfully with significant growth of digital sales. At the same time, chicken costs decreased, which led Wingstop’s management to increase its guidance for the balance of the year. We trimmed our position on that price strength, and Wingstop ended 2023 with a 78% gain. In the financials sector, we tend to avoid banks that face credit deterioration or rising deposit costs, preferring either asset managers or specialized insurance companies. That included private markets investment service provider Hamilton Lane and its 81% return. Quarter after quarter, the company exceeded expectations with ever-rising fee income. Fundraising was on track, especially for its new Evergreen products (most private investment funds have finite lifespans). That led to steady growth in the firm’s assets under management and fee earnings, and we trimmed our position during the second half of the year. Offsetting that was the 21% showing from ProAssurance. In May, the company’s underwriting results were lower than anticipated, caused by an atypical adverse reserve development that stemmed from a business ProAssurance acquired in 2021. Its shares gradually recovered, but then retreated again in November. Although its primary malpractice insurance business was good, its smaller workers’ compensation business fared poorly as it faced notable medical cost inflation. That was enough to weigh on overall underwriting results. We had trimmed the position prior to the report in the face of potential risks, and did so again afterward, though the company’s valuation based on the malpractice business remained very attractive. |

4

| | |

| | | AMG TimesSquare Small Cap Growth Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | |

Our preferences among health care stocks are those companies providing novel therapies for unmet needs that deserve premium pricing, or specialized service providers. One of our top contributors had a short stay in the strategy this year, though during that time Reata Pharmaceuticals posted an 88% gain. In April we initiated a position in this biotechnology developer of therapies for types of chronic kidney and neurological diseases. At that time we had been following the company for some time and it recently gained Food and Drug Administration (FDA) approval for treating Friedreich’s Ataxia, an inherited genetic disorder affecting the nervous system. We saw a long-term opportunity and the company was moving toward more attractive profitability under a new CFO. Then in July it agreed to be acquired by Biogen and we subsequently exited the stock. Detracting from results was Treace Medical, an orthopedic medical device company focused on treating bunions. At the start of the year, Treace contributed to performance after reporting that business momentum was strong across several channels and the company soon preannounced better-than-expected revenues. Later its shares pulled back when the market seemed concerned about the pace of Treace’s quarterly sales, a slippage in its average selling price (“ASP”) for devices, and a wave of obesity treatments lessening the need for orthopedic devices. In our view, Treace should see a later reacceleration of sales, higher demand for more complex devices will lift its ASP, and podiatrists note that obesity does not drive the occurrence of bunions. Thus, we added to our holdings following Treace’s 45% price decline. Many of our industrials positions provide necessary business to business operational services, highly technical components, automation and efficiency improvements, or essential infrastructure services. One steady contributor throughout the year was the global welding company Esab Corporation. Business activity from Esab’s end customers—especially in the emerging markets—markedly improved during 2023. At the same time, ESAB was about to increase pricing, which led its management to repeatedly increase its forward guidance. We regularly trimmed | | our holdings as Esab’s shares climbed by 85%. At the other end of the scale was a -48% decline for Driven Brands, an automotive services company meeting a range of needs, including paint, collision, glass, vehicle repair, oil change, maintenance, and car washes. Midyear, the company reported fewer-than-expected new business openings (though same store sales were better than expected). Later there was a marked decline in car wash volumes, with management citing poor weather conditions as the culprit. Driven also noted competition was growing in that segment. Also challenged this year was WNS Holdings, which provides business process management services—including customer interaction, finance and accounting, and data analytics—to a variety of industries. The mania surrounding generative AI and its possibilities created volatility in several industries. AI has been a productivity tool for business process outsourcing companies. Therefore, it seemed to us there was an overreaction on the potential disruption for businesses such as WNS that provide value added services, enabling customers to save costs. However, later in the year WNS’s management reduced guidance for the balance of its fiscal year. Although the core business continued generating significant cash flows, WNS noted that a recently signed contract for a captive insurance operation was taking longer than expected to start—and generate revenues. The company also saw hesitancy from a travel industry client who projected more conservative growth levels. Out of caution, recognizing some of these one-offs need to clear before its shares reaccelerate, we trimmed our position, which had retreated by -21%. Among the wide variety of information technology companies, we prefer critical system providers, specialized component designers, systems that improve productivity or efficiency for their clients, and others that are closely tied to increasing shares of corporate IT budgets. One holding that consistently climbed in 2023 was Onto Innovation, which develops inspection technologies for use across the entire semiconductor fabrication process. Onto’s management was conservative with its initial | | guidance for 2023 and actively worked to cut costs, which investors rewarded. End market demand, growing complexity for semiconductors, and higher volume needs translated into a 125% gain for Onto. Also picking up new business was Vertex, Inc. Providing end-to-end tax compliance software for large businesses, Vertex’s rates of annual recurring revenues initially were stable and later increased in 2023. It also benefited from its partnership with SAP, Oracle, Workday, Microsoft, and Salesforce.com—all of which drive additional sales momentum. Then at the end of the year Vertex announced the end of its two year cycle of internal investments—including a new Enterprise resource planning (ERP) system—which should lead to improving margins in the future. Combined, that led to an 86% return for Vertex, and we trimmed our position at year end. Looking forward into 2024 markets will keep a close eye on central banks and the polls. Early indications are for some monetary easing, though there is a wide divergence on when that may occur. This year will also be one of the biggest for global elections. Including the U.S., Taiwan, India, Mexico, and expectations for the U.K., there will be nearly 40 national elections. That all but guarantees shifting fiscal policies as over 40% of the world’s population heads to the voting booths. With those influences beyond our control, we focus on how our portfolio companies plan to navigate this environment. Many showed improving fundamentals toward the end of 2023 that we expect to continue into 2024 and beyond. As bottom up investors, we seek underpinnings to near term valuations in the form of expected earnings growth and other business fundamentals. We continuously review the business models and management teams of current and potential holdings, and fine tune our own valuation models on an ongoing basis, as we endeavor to protect the assets you have entrusted with us. The views expressed represent the opinions of TimesSquare Capital Management, LLC as of December 31, 2023, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

5

| | |

| | | AMG TimesSquare Small Cap Growth Fund Portfolio Manager’s Comments (continued) |

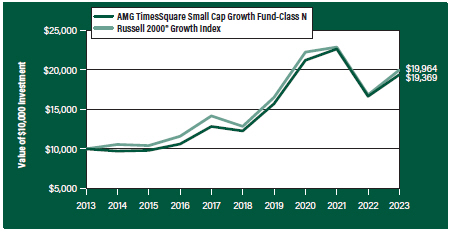

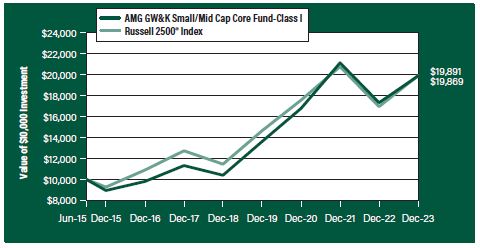

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG TimesSquare Small Cap Growth Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG TimesSquare Small Cap Growth Fund’s Class N shares on December 31, 2013 to a $10,000 investment made in the Russell 2000® Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG TimesSquare Small Cap Growth Fund and the Russell 2000® Growth Index for the same time periods ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | |

| | | One | | | Five | | | Ten | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Years | | | Years | | | Inception | | | Date | |

AMG TimesSquare Small Cap Growth Fund2, 3, 4, 5, 6, 7, 8 | |

| | | | | |

Class N | | | 16.41 | % | | | 9.57 | % | | | 6.84% | | | | 8.47 | % | | | 01/21/00 | |

| | | | | |

Class I | | | 16.64 | % | | | 9.71 | % | | | — | | | | 8.67 | % | | | 02/24/17 | |

| | | | | |

Class Z | | | 16.73 | % | | | 9.80 | % | | | 7.07% | | | | 8.65 | % | | | 01/21/00 | |

| | | | | |

Russell 2000® Growth Index9 | | | 18.66 | % | | | 9.22 | % | | | 7.16% | | | | 5.12 | % | | | 01/21/00 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at wealth.amg.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

|

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2023. All returns are in U.S. Dollars ($). 2 From time to time, the Fund’s Investment Manager has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 3 The prices of equity securities of companies that are expected to experience relatively rapid earnings growth, or “growth stocks,” may be more sensitive to market movements because the prices tend to reflect future investor expectations rather than just current profits. 4 Issuers and companies that are in similar industry sectors may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 5 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of factors, including economic, political, or market conditions, or other factors including terrorism, war, natural disasters and the spread of infectious illness or other public health issues, including epidemics or pandemics, or in response to events that affect particular industries or companies. 6 Because the Fund is an actively managed investment portfolio, security selection or focus on securities in a particular style, market sector or group of companies may cause the Fund to incur losses or underperform relative to its benchmarks or other funds with a similar investment objective. There can be no guarantee that the Subadviser’s investment techniques and risk analysis will produce the desired result. 7 The stocks of small-capitalization companies often have greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 8 The Fund may not be able to dispose of particular investments, such as illiquid securities, readily at favorable times or prices or the Fund may have to sell them at a loss. 9 The Russell 2000® Growth Index measures the performance of the Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 2000® Growth Index is unmanaged, is not available for investment and does not incur expenses. The Russell 2000® Growth Index is a trademark of the London Stock Exchange Group companies. Not FDIC insured, nor bank guaranteed. May lose value. |

6

| | |

| | | AMG TimesSquare Small Cap Growth Fund Fund Snapshots (unaudited) December 31, 2023 |

PORTFOLIO BREAKDOWN

| | | | | |

| Sector | | % of

Net Assets |

| | |

Industrials | | 26.0 |

| | |

Information Technology | | 24.5 |

| | |

Health Care | | 16.7 |

| | |

Consumer Discretionary | | 8.3 |

| | |

Financials | | 8.0 |

| | |

Energy | | 4.4 |

| | |

Communication Services | | 3.6 |

| | |

Consumer Staples | | 2.8 |

| | |

Exchange Traded Funds | | 1.7 |

| | |

Real Estate | | 1.6 |

| | |

Materials | | 1.0 |

| | |

Short-Term Investments | | 2.5 |

| | |

Other Assets, less Liabilities | | (1.1) |

TOP TEN HOLDINGS

| | |

| Security Name | | % of Net Assets |

| | |

Casella Waste Systems, Inc., Class A | | 3.0 |

| | |

JFrog, Ltd. (Israel) | | 2.3 |

| | |

Hexcel Corp. | | 2.1 |

| | |

PowerSchool Holdings, Inc., Class A | | 2.1 |

| | |

Synaptics, Inc. | | 2.0 |

| | |

Esab Corp. | | 1.9 |

| | |

BJ’s Wholesale Club Holdings, Inc. | | 1.9 |

| | |

CyberArk Software, Ltd. (Israel) | | 1.9 |

| | |

Smartsheet, Inc., Class A | | 1.8 |

| | |

Vertex, Inc., Class A | | 1.8 |

| | |

| | | |

| | |

Top Ten as a Group | | 20.8 |

| | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

7

| | |

| | | AMG TimesSquare Small Cap Growth Fund Schedule of Portfolio Investments December 31, 2023 |

| | | | | | | | |

| | |

Shares | | | Value | |

| |

Common Stocks - 96.9% | | | | | |

| |

Communication Services - 3.6% | | | | | |

| | |

Bumble, Inc., Class A* | | | 112,500 | | | | $1,658,250 | |

| | |

IAC, Inc.* | | | 31,000 | | | | 1,623,780 | |

| | |

Integral Ad Science Holding Corp.* | | | 185,000 | | | | 2,662,150 | |

| | |

Total Communication Services | | | | | | | 5,944,180 | |

| | |

Consumer Discretionary - 8.3% | | | | | | | | |

| | |

Adtalem Global Education, Inc.* | | | 26,500 | | | | 1,562,175 | |

| | |

Boot Barn Holdings, Inc.* | | | 23,500 | | | | 1,803,860 | |

| | |

European Wax Center, Inc., Class A*,1 | | | 87,718 | | | | 1,192,088 | |

| | |

Global-e Online, Ltd. (Israel)* | | | 56,000 | | | | 2,219,280 | |

| | |

Savers Value Village, Inc.*,1 | | | 70,000 | | | | 1,216,600 | |

| | |

Topgolf Callaway Brands Corp.* | | | 97,400 | | | | 1,396,716 | |

| | |

Visteon Corp.* | | | 13,900 | | | | 1,736,110 | |

| | |

Warby Parker, Inc., Class A* | | | 49,700 | | | | 700,770 | |

| | |

Wingstop, Inc. | | | 7,600 | | | | 1,950,008 | |

| | |

Total Consumer Discretionary | | | | | | | 13,777,607 | |

| | |

Consumer Staples - 2.8% | | | | | | | | |

| | |

BJ’s Wholesale Club Holdings, Inc.* | | | 46,900 | | | | 3,126,354 | |

| | |

The Simply Good Foods Co.* | | | 38,500 | | | | 1,524,600 | |

| | |

Total Consumer Staples | | | | | | | 4,650,954 | |

| | |

Energy - 4.4% | | | | | | | | |

| | |

Cactus, Inc., Class A | | | 64,000 | | | | 2,905,600 | |

| | |

Magnolia Oil & Gas Corp., Class A | | | 75,300 | | | | 1,603,137 | |

| | |

Matador Resources Co. | | | 49,800 | | | | 2,831,628 | |

| | |

Total Energy | | | | | | | 7,340,365 | |

| | |

Financials - 8.0% | | | | | | | | |

| | |

AvidXchange Holdings, Inc.* | | | 154,000 | | | | 1,908,060 | |

| | |

Flywire Corp.* | | | 31,000 | | | | 717,650 | |

| | |

Hamilton Lane, Inc., Class A | | | 26,220 | | | | 2,974,397 | |

| | |

MVB Financial Corp. | | | 43,100 | | | | 972,336 | |

| | |

PJT Partners, Inc., Class A1 | | | 16,500 | | | | 1,680,855 | |

| | |

ProAssurance Corp. | | | 106,600 | | | | 1,470,014 | |

| | |

Safety Insurance Group, Inc. | | | 15,800 | | | | 1,200,642 | |

| | |

Victory Capital Holdings, Inc., Class A | | | 65,000 | | | | 2,238,600 | |

| | |

Total Financials | | | | | | | 13,162,554 | |

| | |

Health Care - 16.7% | | | | | | | | |

| | |

Addus HomeCare Corp.* | | | 22,000 | | | | 2,042,700 | |

| | |

Ascendis Pharma A/S, ADR (Denmark)* | | | 23,800 | | | | 2,997,610 | |

| | |

AtriCure, Inc.* | | | 72,900 | | | | 2,601,801 | |

| | |

Certara, Inc.* | | | 43,500 | | | | 765,165 | |

| | |

Day One Biopharmaceuticals, Inc.* | | | 135,900 | | | | 1,984,140 | |

| | |

HealthEquity, Inc.* | | | 22,600 | | | | 1,498,380 | |

| | | | | | | | |

| | |

Shares | | | Value | |

| | |

Intra-Cellular Therapies, Inc.* | | | 35,300 | | | | $2,528,186 | |

| | |

Krystal Biotech, Inc.* | | | 18,100 | | | | 2,245,486 | |

| | |

MoonLake Immunotherapeutics (Switzerland)*,1 | | | 35,300 | | | | 2,131,767 | |

| | |

Phreesia, Inc.* | | | 65,000 | | | | 1,504,750 | |

| | |

RAPT Therapeutics, Inc.* | | | 37,025 | | | | 920,071 | |

| | |

Shockwave Medical, Inc.* | | | 10,500 | | | | 2,000,880 | |

| | |

Treace Medical Concepts, Inc.* | | | 134,500 | | | | 1,714,875 | |

| | |

Xenon Pharmaceuticals, Inc. (Canada)* | | | 58,900 | | | | 2,712,934 | |

| | |

Total Health Care | | | | | | | 27,648,745 | |

| | |

Industrials - 26.0% | | | | | | | | |

| | |

ACV Auctions, Inc., Class A* | | | 106,000 | | | | 1,605,900 | |

| | |

Applied Industrial Technologies, Inc. | | | 5,100 | | | | 880,719 | |

| | |

The AZEK Co., Inc.* | | | 52,500 | | | | 2,008,125 | |

| | |

Casella Waste Systems, Inc., Class A* | | | 58,600 | | | | 5,007,956 | |

| | |

Comfort Systems USA, Inc. | | | 5,800 | | | | 1,192,886 | |

| | |

Driven Brands Holdings, Inc.* | | | 108,000 | | | | 1,540,080 | |

| | |

EMCOR Group, Inc. | | | 13,500 | | | | 2,908,305 | |

| | |

Esab Corp. | | | 36,700 | | | | 3,178,954 | |

| | |

Exponent, Inc. | | | 34,000 | | | | 2,993,360 | |

| | |

Hexcel Corp. | | | 46,400 | | | | 3,422,000 | |

| | |

ICF International, Inc. | | | 10,100 | | | | 1,354,309 | |

| | |

ITT, Inc. | | | 14,000 | | | | 1,670,480 | |

| | |

Marten Transport, Ltd. | | | 90,000 | | | | 1,888,200 | |

| | |

Paycor HCM, Inc.* | | | 62,400 | | | | 1,347,216 | |

| | |

RBC Bearings, Inc.*,1 | | | 5,932 | | | | 1,689,967 | |

| | |

Regal Rexnord Corp. | | | 19,200 | | | | 2,841,984 | |

| | |

Saia, Inc.* | | | 1,300 | | | | 569,686 | |

| | |

Tetra Tech, Inc. | | | 15,400 | | | | 2,570,722 | |

| | |

WillScot Mobile Mini Holdings Corp.* | | | 35,900 | | | | 1,597,550 | |

| | |

WNS Holdings, Ltd., ADR (India)* | | | 42,000 | | | | 2,654,400 | |

| | |

Total Industrials | | | | | | | 42,922,799 | |

| | |

Information Technology - 24.5% | | | | | | | | |

| | |

Allegro MicroSystems, Inc.* | | | 28,000 | | | | 847,560 | |

| | |

Clearwater Analytics Holdings, Inc., Class A* | | | 129,000 | | | | 2,583,870 | |

| | |

Cohu, Inc.* | | | 60,000 | | | | 2,123,400 | |

| | |

CyberArk Software, Ltd. (Israel)* | | | 14,000 | | | | 3,066,700 | |

| | |

FormFactor, Inc.* | | | 31,500 | | | | 1,313,865 | |

| | |

HashiCorp, Inc., Class A* | | | 58,900 | | | | 1,392,396 | |

| | |

JFrog, Ltd. (Israel)* | | | 111,000 | | | | 3,841,710 | |

| | |

Kulicke & Soffa Industries, Inc. (Singapore) | | | 51,000 | | | | 2,790,720 | |

| | |

MACOM Technology Solutions Holdings, Inc.* | | | 20,000 | | | | 1,859,000 | |

| | |

Onto Innovation, Inc.* | | | 13,500 | | | | 2,064,150 | |

| | |

PowerSchool Holdings, Inc., Class A*,1 | | | 144,000 | | | | 3,392,640 | |

The accompanying notes are an integral part of these financial statements.

8

| | |

| | | AMG TimesSquare Small Cap Growth Fund Schedule of Portfolio Investments (continued) |

| | | | | | | | |

| | |

Shares | | | Value | |

| | |

Information Technology - 24.5%

(continued) | | | | | | | | |

| | |

Q2 Holdings, Inc.* | | | 37,700 | | | | $1,636,557 | |

| | |

Smartsheet, Inc., Class A* | | | 64,000 | | | | 3,060,480 | |

| | |

Sprout Social, Inc., Class A*,1 | | | 21,000 | | | | 1,290,240 | |

| | |

Synaptics, Inc.* | | | 28,500 | | | | 3,251,280 | |

| | |

Vertex, Inc., Class A* | | | 112,000 | | | | 3,017,280 | |

| | |

Workiva, Inc.* | | | 28,502 | | | | 2,893,808 | |

| | |

Total Information Technology | | | | | | | 40,425,656 | |

| | |

Materials - 1.0% | | | | | | | | |

| | |

Avient Corp. | | | 40,500 | | | | 1,683,585 | |

| | |

Real Estate - 1.6% | | | | | | | | |

| | |

National Storage Affiliates Trust, REIT | | | 64,000 | | | | 2,654,080 | |

| |

Total Common Stocks | | | | | |

(Cost $135,217,055) | | | | | | | 160,210,525 | |

| | |

Exchange Traded Funds - 1.7% | | | | | | | | |

| | |

iShares Russell 2000 Growth ETF

(Cost $2,766,924) | | | 11,500 | | | | 2,900,530 | |

| | |

| | | Principal

Amount | | | | |

| |

Short-Term Investments - 2.5% | | | | | |

| |

Joint Repurchase Agreements - 1.2%2 | | | | | |

| | |

Daiwa Capital Markets America, dated 12/29/23, due 01/02/24, 5.380% total to be received $1,000,598 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 7.500%, 03/22/24 - 01/01/54, totaling $1,020,123) | | | $1,000,000 | | | | 1,000,000 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

Deutsche Bank Securities, Inc., dated 12/29/23, due 01/02/24, 5.350% total to be received $20,787 (collateralized by various U.S. Government Agency Obligations, 2.000% -6.500%, 09/01/46 - 06/01/62, totaling $21,191) | | | $20,775 | | | | $20,775 | |

| | |

RBC Dominion Securities, Inc., dated 12/29/23, due 01/02/24, 5.340% total to be received $1,000,593 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 7.500%, 01/15/24 -12/01/53, totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

| |

Total Joint Repurchase Agreements | | | | 2,020,775 | |

| | |

| | | Shares | | | | |

| |

Other Investment Companies - 1.3% | | | | | |

| | |

Dreyfus Government Cash Management Fund, Institutional Shares, 5.25%3 | | | 837,739 | | | | 837,739 | |

| | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 5.32%3 | | | 1,256,608 | | | | 1,256,608 | |

| |

Total Other Investment Companies | | | | 2,094,347 | |

| |

Total Short-Term Investments | | | | | |

(Cost $4,115,122) | | | | | | | 4,115,122 | |

| |

Total Investments - 101.1% | | | | | |

(Cost $142,099,101) | | | | | | | 167,226,177 | |

| |

Other Assets, less Liabilities - (1.1)% | | | | (1,873,610 | ) |

| |

Net Assets - 100.0% | | | | $165,352,567 | |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $8,292,535 or 5.0% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the December 31, 2023, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

|

ADR American Depositary Receipt |

ETF Exchange Traded Fund |

| REIT Real Estate Investment Trust |

The accompanying notes are an integral part of these financial statements.

9

| | |

| | | AMG TimesSquare Small Cap Growth Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of December 31, 2023:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks† | | $ | 160,210,525 | | | | — | | | | — | | | $ | 160,210,525 | |

| | | | |

Exchange Traded Funds | | | 2,900,530 | | | | — | | | | — | | | | 2,900,530 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | — | | | $ | 2,020,775 | | | | — | | | | 2,020,775 | |

| | | | |

Other Investment Companies | | | 2,094,347 | | | | — | | | | — | | | | 2,094,347 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | $ | 165,205,402 | | | $ | 2,020,775 | | | | — | | | $ | 167,226,177 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended December 31, 2023, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

10

| | |

| | | AMG TimesSquare Mid Cap Growth Fund Portfolio Manager’s Comments (unaudited) |

| | | |

| | | |

| | | | |

The Year In Review For the year ended December 31, 2023, AMG TimesSquare Mid Cap Growth Fund (the “Fund”) Class N shares returned 24.82%, while its benchmark, the Russell Midcap® Growth Index, returned 25.87%. 2023 started off with a rollercoaster ride for global equity markets in the first quarter, followed by a steady climb in the second quarter, a decline in the third quarter, and ended the year with a strong rebound in the fourth quarter. The fourth quarter rebound was bolstered by central banks pausing rates increases, but it may be premature to declare victory over inflation and plot a near-term pivot to monetary easing. That speculation led to a rally benefiting global equities—especially small & microcaps and emerging markets. Concerns surrounding wage inflation and access to skilled workers generally subsided across markets, with the notable exception of Japan where that remains a significant challenge. Most factors finished the year in positive territory. However, it was Beta that significantly outpaced other style factors in 2023. Among U.S. small to mid cap growth stocks better performance was found in the information technology, industrials, and consumer discretionary sectors. Utilities and energy generally lagged. As our investment team meets with companies, reviews recent earnings reports, and surveys the global landscape, they note several investment dynamics that inform our positioning: • Technology: Cybersecurity remains a top priority for companies, propelled by recent well publicized cyberattacks and new SEC disclosure rules on cyber risks that took effect in December 2023. Our channel checks indicate that information technology (IT) budgets will continue growing, with cybersecurity becoming an increasing percentage. Interest continues to grow in machine learning and generative artificial intelligence (AI) tools and applications, though companies approach this area cautiously given the costs and fast paced changes. • Industrials: Many years of prior underinvestment leave significant ground to recover that recent government programs have only begun to address. Industrial capital expenditures may continue to be a bright spot for several years as structural labor challenges are addressed with greater automation and supply chains move closer to home, particularly away from China. | | • China: Localization and import substitution are major trends, either due to geopolitical concerns in the case of the technology industry, or trading down to cheaper domestic products due to consumer weakness. Meanwhile, both Chinese and multinational companies continue to seek other manufacturing centers in the region, or re-shore them completely, which should benefit Southeast Asia, Mexico, and India. Fund Performance Review Amid this environment, the Fund performed behind the Russell Midcap® Growth Index for the full year. The Fund experienced mixed performance across sectors. Relative weakness was found in consumer discretionary, industrials, financials, and real estate. This was partially offset by strength in health care, information technology, materials, and energy. In consumer-oriented sectors, we lean toward value-oriented or specialty retailers, franchise models, as well as premium brands. In our view, the timeshare space represents a better investment option to hotels due to the annual maintenance fee requirement from customers/owners. Another driver has been an increase in leisure travel post-pandemic. These were the underpinnings to the thesis for Marriott Vacations Worldwide, a timeshare and resort property management company. We held the stock up until their second quarter earnings report. The combination of weak results and lower forward guidance caused us to exit the position, which was down -16% for the time it was held during the year. Aptiv Plc designs and manufactures vehicle components focused on electronics and vehicle safety. The United Auto Workers’ strike, which occurred in the fall, had an adverse impact on demand for the company’s products, causing its stock to slide by -4%. We trimmed the position in the latter part of the year. Tractor Supply Co. is the largest retailer in the U.S. focused on the farm and ranch market, with over 2,000 stores. Customer service is a strong differentiator with knowledgeable sales staff. They have an extensive mix of products to care for home, land, pets, and animals. During the year, results were impacted by adverse weather conditions and economic headwinds that hampered consumer spending. This caused a -3% pullback in Tractor Supply. Turning to positives, shares of Floor & Decor Holdings gained 60%. They operate as a multi channel specialty retailer of hard surface flooring and related accessories. The company enjoys a | | strong position in a fragmented market. While it was aided by meaningful enrollment increases in its Premier rewards program (PRO), higher interest rates impacted the housing market and associated businesses. Of note, gross margins have improved along with lower supply chain costs. Brunswick, a manufacturer of recreational marine products including boats and engines, surged ahead by 37%. Management, while acknowledging a tough industry backdrop, remains upbeat about the long-term prospects for their business. Premium level customers remain resilient as evidenced by sales at a recent boat show. There was strong demand for Boston Whaler and Sea Ray boats and Mercury propulsion systems. There are also healthy usage trends in its Freedom Boat Club. Value-oriented consumers are demonstrating hesitancy around purchases as they are more sensitive to rising interest rates. In the industrials sector, we gravitate toward business service companies, those focused on automation and efficiency improvements, and essential infrastructure services. Paylocity Holding offers cloud-based human capital management and payroll software solutions. Its results were steady for most of the year up its their fiscal first quarter earnings report. In that early November release, management noted weakness with existing client headcounts and prompted fears among investors. That in turn triggered a 15% selloff. Booz Allen Hamilton Holding is a management and technology consulting services provider to U.S. government departments and agencies. We decided to exit the position, which was down -11% while we held it during the first quarter. While recent revenues and earnings were in line with expectations, delays in some large orders caused us to reassess the position and exit. Better performance was found in some of our business service companies. Copart, a provider of online auctions and vehicle remarketing, rallied 61%. These services are offered to insurance companies, rental car companies, local municipalities, financial institutions, and charities. There has been a continued pickup in total loss frequency for vehicles as repair costs remain high and used car pricing has declined. Cintas supplies uniforms and facilities services to approximately one million customers. The current penetration rate for ancillary products and services within the company’s uniform rental customer base is less than 20%. This implies a runway for growth. Customer |

11

| | |

| | | AMG TimesSquare Mid Cap Growth Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | |

retention remains slightly above 95%. Operating margin has expanded due to higher utilization, route density, improved supply chain capabilities, and cost controls. The latest quarter exceeded expectations. This included beats to revenues and earnings estimates, as well as an increase in forward guidance. These developments lifted the stock of Cintas by 35% for the year. Verisk Analytics supplies data analytics solutions to the insurance industry. Its latest quarter represented the third consecutive period of higher-than-expected growth across Underwriting and Claims. That served to boost its shares by 36%. Verisk is focused on adding deeper and more extensive data to its products. Management believes its highly proprietary data assets position the company to capitalize on the benefits of AI and generative AI. In financials, we prefer well placed insurance companies and niche businesses while tending to avoid banks which face credit deterioration and rising deposit costs. The troubles for Silicon Valley Bank weighed on the rest of the banking industry, including our position in Signature Bank, a commercial bank serving businesses and private clients, predominantly in the New York metropolitan area. As concerns grew in early March about potential deposit outflows, we sold our remaining shares. Signature’s share price fell -35% during the first quarter while we owned it, though we exited before regulators closed the bank. Nasdaq operates as a technology company that serves capital markets and other industries worldwide. Earnings outpaced consensus estimates due to the combination of stronger revenues and lower operating expenses. We decided to sell out of the position due to the upcoming close on their Adenza acquisition. We question the merits of this deal and prefer to watch from the sidelines for the time being. Nasdaq’s shares dropped by -17% before we liquidated the position during the fourth quarter. Turning to credits, TPG operates as an alternative asset manager. Third quarter earnings were well above Street estimates, driven by management and performance fees. During the year they acquired Angelo Gordon. This significantly expands their product offering. Angelo Gordon is a well established and successful manager of private credit and real estate. TPG’s legacy business includes private equity, credit, growth equity, impact investing, real estate, public market solutions, and capital markets services. This deal along with a more bullish outlook for fundraising in 2024 lifted its shares by 62%. Brown & Brown, a marketer of insurance products and services, gained 26%. Its business lines include | | Retail, National Programs, Wholesale Brokerage, and Services. The latest quarter’s results included growth, with strong new business and retention across Retail, National Programs, and Wholesale. Its Services segment was driven by an increase in claims processing revenues. Within real estate, SBA Communications is a leading independent owner and operator of wireless communications infrastructure including towers and distributed antenna systems. We sold the stock during the third quarter due to interest rate sensitivity tied to its levered balance sheet and a slower-than-expected ramp in 5G spending by some wireless carriers. The stock tumbled by -21% while we owned it this year. Our preference within health care is for novel therapies to address unmet medical needs, specialized providers, and innovators. Envista Holdings develops and manufactures dental products. We exited the position during the fourth quarter on the combination of disappointing third quarter results and lowered forward guidance. They reported softness in adult orthodontics and high end implants. Its stock sold off by -32% while it was held during the year. Royalty Pharma Plc, a buyer of drug therapy royalties and funder of innovation in the biopharmaceutical space, declined by -31%. The stock has not been given credit for its differentiated business model and additions to its royalty stream. We decided to sell out of the position during the third quarter and potentially revisit Royalty Pharma in the future. Shockwave Medical is a medical device company that utilizes intravascular lithotripsy technology for treating calcified plaque in patients suffering from coronary disease. The company is well positioned and continues to expand its product offerings. It appears the stock has been caught up in the market’s medical technology unwind. While third quarter results were in line with expectations, management did not raise guidance for the first time since the pandemic. Two headwinds impaired the outlook: private insurers are increasing the need for preauthorization for treating peripheral arterial disease and the China anti corruption campaign is impacting restocking in their joint venture. Shockwave was added to the Fund in the third quarter and its shares lost -29% since then. The stock was sold in the fourth quarter. Better was the 36% return for IDEXX Laboratories. They develop, manufacture, and distribute products and services for veterinary, livestock, poultry, and dairy markets. Results were solid up until the third quarter. In that period, revenues missed estimates on weaker | | clinical veterinarian visits in the companion animal segment. Clinical vet visit softness was not entirely unexpected this quarter given publicly available VetSource data and management expects this to improve as capacity constraints ease. Operating margins improved. Pharmaceutical product distributor Cencora climbed 25%. It consistently posted strong results. Its mix is heavily weighted to specialty drugs and that continues to drive above market growth. The increased interest in GLP 1 (Glucagon-like peptide 1) drugs also served to benefit Cencora’s revenues, but they are a slight drag on operating margins due to the refrigeration requirement for shipping. During the third quarter, DexCom was added to the Fund. This is a medical device company focused on the design and development of continuous glucose monitoring systems. While GLP 1 drugs can help with weight loss, individuals with type 1 diabetes would remain insulin dependent. We used share price weakness as an opportunity to initiate the position. The stock rose 19% since then. Across the IT universe, we seek companies possessing differentiated capabilities, products, and services. Palo Alto Networks was the leading contributor for the year with its 111% return. This company supplies cybersecurity solutions worldwide. Revenues and earnings were continually higher than expected, although in the latter part of the year they fell short on billings growth. Management stressed that they are not seeing any change in the demand environment and that pipeline visibility remains high. Higher interest rates may well mean that customers are less willing to sign multi-year contracts. CrowdStrike Holdings, a provider of cybersecurity products and services to stop network breaches, jumped 142%. Its results were consistently solid throughout the year. Management noted increased momentum driven by strong product platform leading to vendor consolidation opportunities and go-to-market partnerships with Amazon, Dell, and others. Sales reps from the hiring spree 9 to 12 months ago have fully ramped up, and that further supports expectations. Annualized recurring revenues have accelerated. Synopsys provides electronic design automation software products used to design and test integrated circuits. The company continually has delivered quarterly results that were above the guidance and consensus range. Operating margins expanded. EDA (electronic design automation) and IP (intellectual property) solutions continue to be key growth drivers for the company and the momentum |

12

| | |

| | | AMG TimesSquare Mid Cap Growth Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | |

is clearly sustaining into 2024. Its shares advanced 61%. Synopsys is well positioned to benefit from increasing complexity of AI chip development. Keysight Technologies supplies electronic design and test solutions to the communications, networking, aerospace, defense, automotive, energy, and semiconductor industries. We decided to sell the stock during the fourth quarter with the ongoing malaise in the telecommunications industry. That end market lacks visibility, and near-term estimates are being cut. Nevertheless, Keysight’s shares were down (28)% for the time the position was held. We used share price weakness to add HashiCorp during the third quarter. It provides multi-cloud infrastructure automation solutions and is well positioned to benefit long term from a myriad of secular tailwinds and architectural shifts in software. These include increasing adoption of infrastructure automation tools, sustained growth in the pace of applications development, and ongoing shifts of workloads to the cloud. In December, it reported fiscal third quarter results. Revenues beat estimates, but short-term bookings derived from backlog were soft and current subscription billings slowed. That caused an -18% pullback. Within materials we seek well positioned companies that are less susceptible to swings in commodity prices. FMC is an agricultural sciences company offering solutions in areas such as crop protection, plant health, professional pest, and turf management. Although the company’s outlook on revenues improved in the first quarter results, there were concerns surrounding FMC’s ability to recover | | from past margin weakness. That combination was repeated, with management counting on a significant upturn in the second half to meet its unflinching outlook for the year. In our view, this is too optimistic, and we sold our remaining shares during the second quarter, with the stock falling -13% for the time it was held. Martin Marietta Materials, a supplier of aggregates to the construction industry, surged ahead by 49%. Its third quarter included higher-than-expected earnings with inline revenues. Across its product lineup aggregate volumes declined, cement volumes were flat, ready mix volumes were up, and asphalt volumes were up. Its profit guidance was also increased. The company is well positioned to benefit from increased infrastructure spending measures including the Inflation Reduction Act and state highway programs. We often see the ebb and flow of the energy sector tied to underlying commodity prices. In this area we seek low cost exploration and production companies with high yielding acreage or specialized service providers. Antero Resources is an exploration and production company with operations in the Appalachian Basin. We sold out of the position in the second quarter due to continued deterioration of the U.S. natural gas market inclusive of pricing and declining rig count. Its shares slid -29% for the time it was held. Moving in the opposite direction with its 15% return was Cheniere Energy. This energy infrastructure company operates liquefied natural gas (“LNG”) terminals in Louisiana and Texas. Third quarter results were solid with lower-than-anticipated levels of expected capital | | expenditures, and management maintained full year guidance. Two important business drivers for its business include increased use of LNG as it represents a cleaner alternative to coal, and the export of LNG to areas such as Europe in their search for alternative energy sources. Looking forward into 2024, markets will keep a close eye on central banks and the polls. Early indications are for some monetary easing, though there is a wide divergence on when that may occur. This year will also be one of the biggest for global elections. Including the U.S., Taiwan, India, Mexico, and expectations for the U.K., there will be nearly 40 national elections. That all but guarantees shifting fiscal policies as over 40% of the world’s population heads to the voting booths. With those influences beyond our control, we focus on how our portfolio companies plan to navigate this environment. Many showed improving fundamentals toward the end of 2023 that we expect to continue into 2024 and beyond. As bottom up investors, we seek underpinnings to near term valuations in the form of expected earnings growth and other business fundamentals. We continuously review the business models and management teams of current and potential holdings, and fine tune our own valuation models on an ongoing basis, as we endeavor to protect the assets you have entrusted with us. The views expressed represent the opinions of TimesSquare Capital Management, LLC as of December 31, 2023, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

13

|

AMG TimesSquare Mid Cap Growth Fund Portfolio Manager’s Comments (continued) |

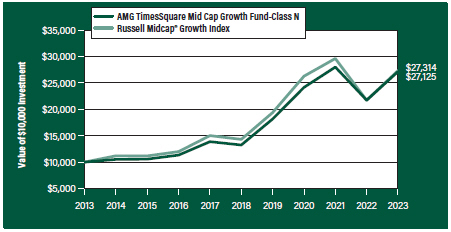

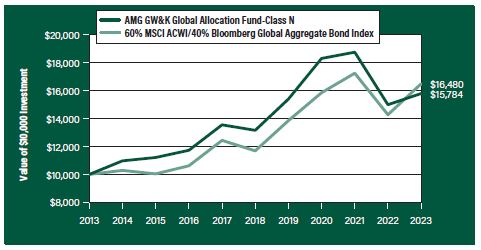

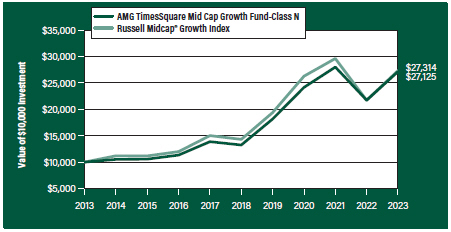

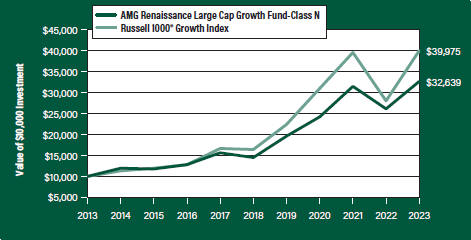

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG TimesSquare Mid Cap Growth Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG TimesSquare Mid Cap Growth Fund’s Class N shares on December 31, 2013 to a $10,000 investment made in the Russell Midcap® Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG TimesSquare Mid Cap Growth Fund and the Russell Midcap® Growth Index for the same time periods ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | |

| | | One | | | Five | | | Ten | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Years | | | Years | | | Inception | | | Date | |

| | |

AMG TimesSquare Mid Cap Growth Fund2, 3, 4, 5, 6, 7 | | | | | | | | | |

| | | | | |

Class N | | | 24.82 | % | | | 15.43 | % | | | 10.49% | | | | 10.49% | | | | 03/04/05 | |

| | | | | |

Class I | | | 24.94 | % | | | 15.59 | % | | | — | | | | 12.73% | | | | 02/24/17 | |

| | | | | |

Class Z | | | 25.03 | % | | | 15.66 | % | | | 10.72% | | | | 10.70% | | | | 03/04/05 | |

| | | | | |

Russell Midcap® Growth Index8 | | | 25.87 | % | | | 13.81 | % | | | 10.57% | | | | 9.93% | | | | 03/04/05 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at wealth.amg.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

† Date reflects inception date of the Fund, not the index.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

|

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2023. All returns are in U.S. Dollars ($). 2 From time to time, the Fund’s Investment Manager has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 3 The prices of equity securities of companies that are expected to experience relatively rapid earnings growth, or “growth stocks,” may be more sensitive to market movements because the prices tend to reflect future investor expectations rather than just current profits. 4 Issuers and companies that are in similar industry sectors may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 5 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of factors, including economic, political, or market conditions, or other factors including terrorism, war, natural disasters and the spread of infectious illness or other public health issues, including epidemics or pandemics, or in response to events that affect particular industries or companies. 6 Because the Fund is an actively managed investment portfolio, security selection or focus on securities in a particular style, market sector or group of companies may cause the Fund to incur losses or underperform relative to its benchmarks or other funds with a similar investment objective. There can be no guarantee that the Subadviser’s investment techniques and risk analysis will produce the desired result. 7 The stocks of mid-capitalization companies often have greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 8 The Russell Midcap® Growth Index measures the performance of those Russell Midcap® companies with higher price/book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000® Growth Index. Unlike the Fund, the Russell Midcap® Growth Index is unmanaged, is not available for investment and does not incur expenses. The Russell Midcap® Growth Index is a trademark of the London Stock Exchange Group companies. Not FDIC insured, nor bank guaranteed. May lose value. |

14

| | |

| | | AMG TimesSquare Mid Cap Growth Fund Fund Snapshots (unaudited) December 31, 2023 |

PORTFOLIO BREAKDOWN

| | | | | |

| Sector | | % of Net Assets |

| | |

Information Technology | | | | 28.9 | |

| | |

Industrials | | | | 20.3 | |

| | |

Health Care | | | | 18.9 | |

| | |

Consumer Discretionary | | | | 10.8 | |

| | |

Financials | | | | 7.3 | |

| | |

Communication Services | | | | 3.4 | |

| | |

Energy | | | | 3.2 | |

| | |

Materials | | | | 2.3 | |

| | |

Consumer Staples | | | | 1.5 | |

| | |

Real Estate | | | | 1.4 | |

| | |

Short-Term Investments | | | | 3.2 | |

| | |

Other Assets, less Liabilities | | | | (1.2 | ) |

TOP TEN HOLDINGS

| | | | | |

| Security Name | | % of Net Assets |

| | |

Cintas Corp. | | | | 2.8 | |

| | |

O’Reilly Automotive, Inc. | | | | 2.5 | |

| | |

Crowdstrike Holdings, Inc., Class A | | | | 2.4 | |

| | |

Gartner, Inc. | | | | 2.4 | |

| | |

Cencora, Inc. | | | | 2.4 | |

| | |

Waste Connections, Inc. (Canada) | | | | 2.3 | |

| | |

Chemed Corp. | | | | 2.1 | |

| | |

Cheniere Energy, Inc. | | | | 2.1 | |

| | |

Dexcom, Inc. | | | | 2.1 | |

| | |

Veeva Systems, Inc., Class A | | | | 2.1 | |

| | |

| | | | | | |

| | |

Top Ten as a Group | | | | 23.2 | |

| | | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

15

| | |

| | | AMG TimesSquare Mid Cap Growth Fund Schedule of Portfolio Investments December 31, 2023 |

| | | | | | | | |

| | |

| | |

Shares | | | Value | |

| | |

Common Stocks - 98.0% | | | | | | | | |

| |

Communication Services - 3.4% | | | | | |

| | |

IAC, Inc.* | | | 254,500 | | | | $13,330,710 | |

| | |

Pinterest, Inc., Class A* | | | 558,400 | | | | 20,683,136 | |

| | |

Take-Two Interactive Software, Inc.* | | | 62,300 | | | | 10,027,185 | |

| | |

Total Communication Services | | | | | | | 44,041,031 | |

| | |

Consumer Discretionary - 10.8% | | | | | | | | |

| | |

Aptiv PLC (Ireland)* | | | 97,200 | | | | 8,720,784 | |

| | |

Brunswick Corp. | | | 197,500 | | | | 19,108,125 | |

| | |

Five Below, Inc.* | | | 56,300 | | | | 12,000,908 | |

| | |

Floor & Decor Holdings, Inc., Class A*,1 | | | 133,200 | | | | 14,859,792 | |

| | |

O’Reilly Automotive, Inc.* | | | 34,000 | | | | 32,302,720 | |

| | |

Pool Corp. | | | 43,275 | | | | 17,254,175 | |

| | |

Ross Stores, Inc. | | | 182,600 | | | | 25,270,014 | |

| | |

Tractor Supply Co. | | | 46,300 | | | | 9,955,889 | |

| | |

Total Consumer Discretionary | | | | | | | 139,472,407 | |

| | |

Consumer Staples - 1.5% | | | | | | | | |

| | |

BJ’s Wholesale Club Holdings, Inc.* | | | 291,900 | | | | 19,458,054 | |

| | |

Energy - 3.2% | | | | | | | | |

| | |

Cheniere Energy, Inc. | | | 162,200 | | | | 27,689,162 | |

| | |

Pioneer Natural Resources Co. | | | 62,100 | | | | 13,965,048 | |

| | |

Total Energy | | | | | | | 41,654,210 | |

| | |

Financials - 7.3% | | | | | | | | |

| | |

Brown & Brown, Inc. | | | 156,300 | | | | 11,114,493 | |

| | |

Interactive Brokers Group, Inc., Class A | | | 233,200 | | | | 19,332,280 | |

| | |

RenaissanceRe Holdings, Ltd. (Bermuda) | | | 122,200 | | | | 23,951,200 | |

| | |

TPG, Inc. | | | 566,320 | | | | 24,448,034 | |

| | |

WEX, Inc.* | | | 78,100 | | | | 15,194,355 | |

| | |

Total Financials | | | | | | | 94,040,362 | |

| | |

Health Care - 18.9% | | | | | | | | |

| | |

Argenx SE, ADR (Netherlands)* | | | 32,050 | | | | 12,192,781 | |

| | |

Ascendis Pharma A/S, ADR (Denmark)* | | | 126,800 | | | | 15,970,460 | |

| | |

Cencora, Inc. | | | 148,400 | | | | 30,478,392 | |

| | |

Charles River Laboratories International, Inc.* | | | 8,600 | | | | 2,033,040 | |

| | |

Chemed Corp. | | | 47,425 | | | | 27,731,769 | |

| | |

Dexcom, Inc.* | | | 220,400 | | | | 27,349,436 | |

| | |

Encompass Health Corp. | | | 286,500 | | | | 19,115,280 | |

| | |