As filed with the Securities and Exchange Commission on May 8, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09447

Jacob Funds Inc.

(Exact name of Registrant as specified in charter)

C/O Jacob Asset Management of New York LLC

653 Manhattan Beach Blvd. # J

Manhattan Beach, CA 90266

(Address of principal executive offices) (Zip code)

Ryan Jacob

C/O Jacob Asset Management of New York LLC

653 Manhattan Beach Blvd. # J

Manhattan Beach, CA 90266

(Name and address of agent for service)

(424)-237-2164

Registrant's telephone number, including area code

Date of fiscal year end: August 31

Date of reporting period: February 28, 2014

Item 1. Reports to Stockholders.

Jacob Internet Fund

Jacob Small Cap Growth Fund

Jacob Micro Cap Growth Fund

Jacob Wisdom Fund

Semi-Annual Report

February 28, 2014

The Jacob Internet Fund, Jacob Small Cap Growth Fund and

Jacob Micro Cap Growth Fund are mutual funds with the

primary investment objective of long-term growth of capital.

The Jacob Wisdom Fund is a mutual fund with the primary investment

objective to maximize total investment return consisting of a

combination of income and capital appreciation.

The Jacob Internet Fund has current income as a secondary objective.

Investment Adviser

Jacob Asset Management of New York LLC

TABLE OF CONTENTS

| | Letter From the Manager | | | 1 | |

| | | | | | |

| | Industry Breakdown | | | 4 | |

| | | | | | |

| | Schedules of Investments | | | 8 | |

| | | | | | |

| | Statements of Assets and Liabilities | | | 20 | |

| | | | | | |

| | Statements of Operations | | | 22 | |

| | | | | | |

| | Statements of Changes in Net Assets | | | 24 | |

| | | | | | |

| | Financial Highlights | | | 28 | |

| | | | | | |

| | Notes to the Financial Statements | | | 37 | |

| | | | | | |

| | Additional Information on Fund Expenses | | | 51 | |

| | | | | | |

| | Additional Information | | | 54 | |

Dear Fellow Investors,

Stocks performed surprisingly well over the past six months, despite a range of difficult fiscal and political issues—from the Fed’s bond tapering, to extreme weather patterns in the U.S., and conflicts in Syria and Ukraine. Seemingly shrugging off worldwide turmoil, the markets continued to grind higher, exhibiting impressive resiliency.

Though the U.S. economy is still underperforming compared to past recoveries, the stock market has been buoyed by continued low interest rates and modest earnings growth. Companies have been improving their financial positions by rationalizing expenses and remaining tentative with new spending and hiring. As such, we are cautious about investing in companies for which growth is tied to a robust U.S. economy. We continue to focus our sights on secular growth stories, particularly in tech, healthcare, and to some extent, energy.

Jacob Internet Fund

The Jacob Internet Fund returned 19.95% for the six months ended February 28, 2014, relatively in line with the Nasdaq Composite Index, which returned 20.78%. Our best performers were our core holdings of Internet leaders: Expedia, Facebook, Google, Tencent and Yahoo; all of which returned more than 40% during the period. LogMeIn, TripAdvisor and Yelp also performed well during the period.

Although core holdings performed well, overall fund returns were held back by newer portfolio additions. One example is LinkedIn, a company that we’ve admired for some time—the business-focused social website enjoys a huge network effect and strong subscription revenue base—and which we started adding to the portfolio on recent weakness. We also bought Rally Software, a provider of cloud-based solutions for managing software development. With an increasingly broader range of products incorporating software, this market has been growing far beyond solely technology companies.

Our Chinese digital media stock Sina Corp performed weakly during the period, but we held on to a large position in anticipation of an Initial Public Offering (IPO) filing from the company for its very valuable Twitter-like micro blogging service, Weibo. After the close of the fiscal period, Sina did indeed file to take Weibo public.

Jacob Small Cap Growth Fund

The Jacob Small Cap Growth Fund Institutional Class returned 15.00%, versus the Russell 2000 Growth Index which returned 19.20% for the six month period ended February 28, 2014. It was a strong period for the benchmark, and many of our stocks performed well. However, overall performance was hampered by three biotech holdings: Amarin Corp, Coronado Biosciences, and Achillion Pharmaceuticals, each of which suffered poorer than expected drug development results.

In particular, Amarin’s prospects took a turn for the worse after the FDA appeared to change its criteria midway through the process for granting approval of its promising fish oil-based drug for high triglycerides. Achillion faced clinical holds on its Hepatitis C product, while Coronado had unfortunate results with its Crohn’s disease treatment. We sold each of these positions during the fourth quarter.

We also sold our Yelp position after a strong run up caused it to outgrow our small cap mandate. Similarly, Liberty Ventures appreciated to such an extent that we took profits as well.

As far as new additions to the portfolio, we purchased three promising new biotech stocks: Merrimack Pharmaceuticals, Omeros Corp and Tetraphase Pharmaceuticals. (See Jacob Micro Cap Growth Fund for details.) We also added Penn Virginia, an independent oil and gas company with valuable assets in Texas.

Jacob Micro Cap Growth Fund

The Jacob Micro Cap Growth Fund Institutional Class was up 12.69% for the six month period ended February 28, 2014, compared to 26.17% for the Russell Microcap Growth Index. The underperformance was due in part to significant weightings in the same three biotech stocks held in the Small Cap Growth Fund—Amarin, Coronado and Achillion (see above for details).

We took positions in biotech stocks Merrimack, Omeros, and Tetraphase (also held in Jacob Small Cap Growth Fund). To counter the volatility that naturally accompanies this sector, our biotech strategy takes smaller positions in a

diversified range of names that have a broad pipeline of products in development and the financial resources (either internally or through partnerships) to fund clinical trials.

Merrimack is developing oncology drugs, including two compounds in late-stage trials for pancreatic and ovarian/breast cancer (with partner Sanofi), around the theme of interrupting the signaling between cancer cells that allows them to communicate with each other and grow.

Omeros has a drug discovery program that is focused on GPCRs (G protein-coupled receptors), proteins that are associated with specific diseases, and which are the basis for approximately half of the commercialized drugs available today. In addition, they are close to receiving FDA approval on a drug for reducing complications from cataract surgery, and have early-stage candidates for Huntington’s disease and Alzheimer’s disease.

Tetraphase is a clinical-stage biopharma company developing new antibiotics to fight drug-resistant bacteria. The FDA has started to fast-track new antibiotics in light of urgent global need, due to increasing antibiotic resistance and the emergence of ‘superbugs’, while Congress has provided enticing financial incentives for developing such drugs. Tetraphase has proprietary chemistry technology for creating synthetic tetracyclines, a common class of antibiotics, and has thousands of compounds in various stages of development. Its lead drug candidate, a treatment for complicated abdominal and urinary tract infections, is in Phase 3 trials.

Aside from biotech, we achieved a quick success with our new position in Coastal Contacts, a Canadian online purveyor of contact lenses and eyeglasses. A European company quickly acquired them at a premium. (Jacob Internet Fund also held a small position.)

Jacob Wisdom Fund

The Jacob Wisdom Fund returned 10.52% for the six month period ended February 28, 2014, about two-thirds of the performance of the S&P 500 Index, which was up 15.07%. We attempt to be conservative when executing our investment strategy and are always mindful of risk with an eye toward capital preservation.

We culled some positions to make room for six new stocks: Panera Bread, Eli-Lilly, Union Pacific, Viacom, DaVita HealthCare Partners, and Direct TV.

Panera is a growth stock that we were able to purchase at bargain prices in October 2013, after the company stumbled on earnings. We bought it for its strong return on invested capital and share buyback program. Eli-Lilly was attractively priced in early 2014, due to some major drugs coming off patent. We believe the company will bring valuable new products to market in the near future that can help offset that revenue loss.

To highlight a few others, Union Pacific is an extremely well managed company with the best operating profit margins in its industry, at 33%, and appears to be poised to profit from the new domestic energy boom. Viacom is a media company in the catbird seat with its varied mix of entertainment assets—ranging from Nickelodeon and VH1 to Paramount Pictures. Demand for quality content has been exploding across multiple distribution channels, including cable and internet.

Going forward, looking at our entire Fund family, we anticipate a continuing gradual economic recovery, likely accompanied by a rising interest rate environment. For this reason, we seek to invest in companies that can lead their industries and grow their market shares regardless of the strength or weakness of the broader economic picture.

As always, thank you for entrusting us with your investments.

Ryan Jacob

Chairman and Chief Investment Officer

Darren Chervitz

Portfolio Manager

Frank Alexander

Portfolio Manager

Past performance is not a guarantee of future results.

Must be accompanied or preceded by a prospectus.

The opinions expressed above are those of the portfolio manager and are subject to change. Forecasts cannot be guaranteed.

Mutual fund investing involves risk; loss of principal is possible. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. There are more specific risks inherent in investing in the Internet area, particularly with respect to smaller capitalized companies and the high volatility of Internet stocks. The Funds can invest in small-and mid-cap securities which involve additional risks such as limited liquidity and greater volatility. Investments in micro capitalization companies may involve greater risks, as these companies tend to have limited product lines, markets and financial or managerial resources. Micro cap stocks often also have a more limited trading market, such that the Adviser may not be able to sell stocks at an optimal time or price. In addition, less frequently-traded securities may be subject to more abrupt price movements than securities of larger capitalized companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investments in real estate related instruments may be affected by economic, legal, cultural, environmental or technological factors that affect property values, rents or occupancies of real estate related to the Fund’s holdings. The performance of REITs depends on how well the REIT manages the properties it owns. Diversification does not assure a profit or protect against loss in a declining market.

Fund holdings are subject to change and should not be construed as a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

Please refer to the schedule of investments for complete Fund holdings information.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The NASDAQ Composite Index is a market capitalization weighted index that is designed to represent performance of the National Market System which includes over 5,000 stocks traded only over-the-counter and not on an exchange. The Russell 2000 Growth Index measures the performance of the small cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell Microcap Growth Index measures the performance of the microcap growth segment of the U.S. equity market. It includes those Russell Microcap Index companies with higher price-to-book ratios and higher forecasted growth values. It is not possible to invest directly in an index.

Performance data reflects fee waivers and in the absence of these waivers performance would be reduced.

The Funds are distributed by Quasar Distributors, LLC.

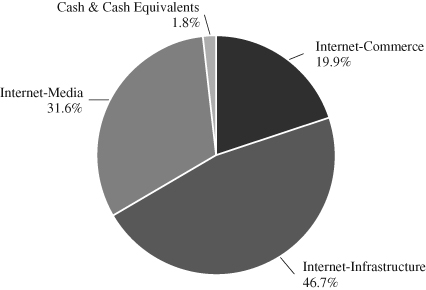

INDUSTRY BREAKDOWN AS OF FEBRUARY 28, 2014

(as a percentage of total investments)

(Unaudited)

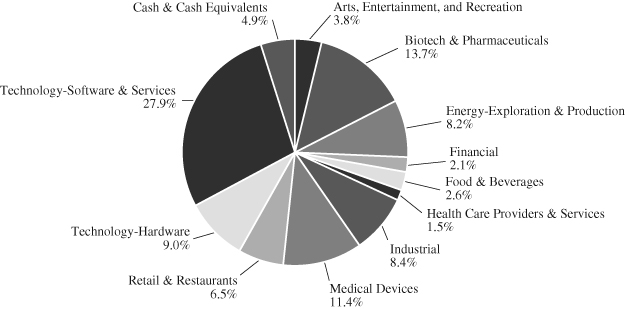

JACOB SMALL CAP GROWTH FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 28, 2014

(as a percentage of total investments)

(Unaudited)

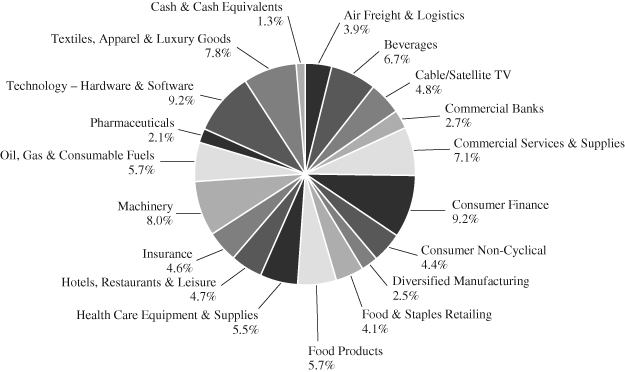

JACOB MICRO CAP GROWTH FUND INDUSTRY BREAKDOWN AS OF FEBRUARY 28, 2014

(as a percentage of total investments)

(Unaudited)

JACOB WISDOM FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 28, 2014

(as a percentage of total investments)

(Unaudited)

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS | | | | | | 98.3 | % | | | |

| | | | | | | | | | | | | | |

| | | Internet-Commerce | | | 19.9 | % | | | | | | | |

| | 15,250 | | Bottomline Technologies, Inc.* | | | | | | | | | | $ | 544,273 | |

| | 155,856 | | Coastal Contacts Inc.*^ | | | | | | | | | | | 1,756,497 | |

| | 16,000 | | Ctrip.com International Ltd.—ADR*^ | | | | | | | | | | | 864,160 | |

| | 20,000 | | eBay Inc.* | | | | | | | | | | | 1,175,400 | |

| | 104,000 | | E-House (China) Holdings Ltd.—ADR^ | | | | | | | | | | | 1,302,080 | |

| | 14,600 | | Expedia, Inc. | | | | | | | | | | | 1,146,538 | |

| | 29,826 | | Shutterfly, Inc.* | | | | | | | | | | | 1,627,307 | |

| | 218,341 | | ZipRealty, Inc.* | | | | | | | | | | | 1,034,936 | |

| | | | | | | | | | | | | | | 9,451,191 | |

| | | | | | | | | | | | | | | | |

| | | | Internet-Infrastructure | | | 46.8 | % | | | | | | | | |

| | 5,000 | | Apple Computer, Inc. | | | | | | | | | | | 2,631,200 | |

| | 27,000 | | Applied Optoelectronics, Inc.* | | | | | | | | | | | 638,820 | |

| | 3,200 | | athenahealth Inc.* | | | | | | | | | | | 620,384 | |

| | 38,000 | | Broadcom Corp.—Class A | | | | | | | | | | | 1,129,360 | |

| | 65,900 | | CEVA, Inc.* | | | | | | | | | | | 1,191,472 | |

| | 60,000 | | Cisco Systems, Inc. | | | | | | | | | | | 1,308,000 | |

| | 55,000 | | Ellie Mae, Inc.* | | | | | | | | | | | 1,705,000 | |

| | 121,700 | | Immersion Corp.* | | | | | | | | | | | 1,454,315 | |

| | 32,000 | | InvenSense, Inc.* | | | | | | | | | | | 644,800 | |

| | 675,451 | | iPass Inc.* | | | | | | | | | | | 1,046,949 | |

| | 63,806 | | LogMeIn, Inc.* | | | | | | | | | | | 2,670,281 | |

| | 206,000 | | Mitek Systems, Inc.* | | | | | | | | | | | 1,093,860 | |

| | 62,000 | | Numerex Corp.* | | | | | | | | | | | 920,080 | |

| | 60,800 | | Rally Software Development Corp.* | | | | | | | | | | | 1,209,312 | |

| | 20,000 | | Red Hat, Inc.* | | | | | | | | | | | 1,179,800 | |

| | 14,600 | | Salesforce.com, Inc.* | | | | | | | | | | | 910,602 | |

| | 12,496 | | SanDisk Corp. | | | | | | | | | | | 928,453 | |

| | 156,500 | | Silicon Image, Inc.* | | | | | | | | | | | 946,825 | |

| | | | | | | | | | | | | | | 22,229,513 | |

| | | | | | | | | | | | | | | | |

| | | | Internet-Media | | | 31.6 | % | | | | | | | | |

| | 18,000 | | Facebook, Inc.* | | | | | | | | | | | 1,232,280 | |

| | 1,900 | | Google Inc.* | | | | | | | | | | | 2,309,735 | |

| | 176,084 | | Jiayuan.com International Ltd.—ADR^ | | | | | | | | | | | 1,295,978 | |

| | 7,200 | | LinkedIn Corp.* | | | | | | | | | | | 1,469,088 | |

| | 30,000 | | SINA Corp.*^ | | | | | | | | | | | 2,049,900 | |

| | 30,000 | | Tencent Holdings Ltd. (HK) | | | | | | | | | | | 2,408,881 | |

| | 11,900 | | TripAdvisor Inc.* | | | | | | | | | | | 1,192,856 | |

The accompanying notes are an integral part of these financial statements.

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS (Continued)

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS—(CONTINUED) | | | | | | 98.3 | % | | | |

| | | | | | | | | | | | | | |

| | | Internet-Media—(Continued) | | | 31.6 | % | | | | | | | |

| | 54,874 | | Yahoo! Inc.* | | | | | | | | | | $ | 2,121,978 | |

| | 9,900 | | Yelp! Inc.* | | | | | | | | | | | 934,758 | |

| | | | | | | | | | | | | | | 15,015,454 | |

| | | | TOTAL COMMON STOCKS (Cost $25,277,832) | | | | | | | | | | | 46,696,158 | |

| | | | | | | | | | | | | | | | |

| | | | SHORT TERM INVESTMENT | | | | | | | 1.9 | % | | | | |

| | | | | | | | | | | | | | | | |

| | | | Money Market Fund | | | 1.9 | % | | | | | | | | |

| | 871,450 | | Fidelity Government Portfolio-Class I, 0.01%(a) | | | | | | | | | | | 871,450 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $871,450) | | | | | | | | | | | 871,450 | |

| | | | TOTAL INVESTMENTS (Cost $26,149,282) | | | | | | | 100.2 | % | | | 47,567,608 | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS | | | | | | | (0.2 | )% | | | (78,669 | ) |

| | | | TOTAL NET ASSETS | | | | | | | 100.0 | % | | $ | 47,488,939 | |

| | | | | | | | | | | | | | | | |

| ^ | U.S. Dollar-denominated foreign security. |

ADRAmerican Depositary Receipt.

HKSecurity denominated in Hong Kong dollars. Value translated into U.S. dollars.

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS | | | | | | 93.0 | % | | | |

| | | | | | | | | | | | | | |

| | | Arts, Entertainment, and Recreation | | | 4.6 | % | | | | | | | |

| | 86,900 | | DHX Media Ltd.^ | | | | | | | | | | $ | 374,346 | |

| | 14,900 | | Multimedia Games Holding Co., Inc.* | | | | | | | | | | | 492,072 | |

| | | | | | | | | | | | | | | 866,418 | |

| | | | | | | | | | | | | | | | |

| | | | Biotech & Pharmaceuticals | | | 10.1 | % | | | | | | | | |

| | 33,000 | | Array BioPharma Inc.* | | | | | | | | | | | 159,060 | |

| | 8,000 | | Celldex Therapeutics, Inc.* | | | | | | | | | | | 233,760 | |

| | 28,651 | | Cempra, Inc.* | | | | | | | | | | | 326,335 | |

| | 108,125 | | Curis, Inc.* | | | | | | | | | | | 329,781 | |

| | 38,000 | | Merrimack Pharmaceuticals, Inc.* | | | | | | | | | | | 189,240 | |

| | 21,800 | | Omeros Corp.* | | | | | | | | | | | 291,248 | |

| | 28,000 | | Tetraphase Pharmaceuticals, Inc.* | | | | | | | | | | | 380,800 | |

| | | | | | | | | | | | | | | 1,910,224 | |

| | | | | | | | | | | | | | | | |

| | | | Energy-Exploration & Production | | | 14.1 | % | | | | | | | | |

| | 12,500 | | Carrizo Oil & Gas, Inc.* | | | | | | | | | | | 621,750 | |

| | 26,600 | | Matador Resources Co.* | | | | | | | | | | | 645,316 | |

| | 52,000 | | Penn Virginia Corp.* | | | | | | | | | | | 787,800 | |

| | 66,750 | | Triangle Petroleum Corp.* | | | | | | | | | | | 598,080 | |

| | | | | | | | | | | | | | | 2,652,946 | |

| | | | | | | | | | | | | | | | |

| | | | Energy-Infrastructure & Services | | | 2.1 | % | | | | | | | | |

| | 4,800 | | Chart Industries, Inc.* | | | | | | | | | | | 401,088 | |

| | | | | | | | | | | | | | | | |

| | | | Financial | | | 2.7 | % | | | | | | | | |

| | 32,050 | | HomeTrust Bancshares, Inc.* | | | | | | | | | | | 502,224 | |

| | | | | | | | | | | | | | | | |

| | | | Health Care Providers & Services | | | 1.4 | % | | | | | | | | |

| | 10,700 | | Capital Senior Living Corp.* | | | | | | | | | | | 271,994 | |

| | | | | | | | | | | | | | | | |

| | | | Industrial | | | 8.2 | % | | | | | | | | |

| | 7,022 | | Advanced Emissions Solutions, Inc.* | | | | | | | | | | | 378,486 | |

| | 12,700 | | MasTec, Inc.* | | | | | | | | | | | 519,938 | |

| | 10,600 | | Mistras Group, Inc.* | | | | | | | | | | | 233,624 | |

| | 13,300 | | XPO Logistics, Inc.* | | | | | | | | | | | 418,152 | |

| | | | | | | | | | | | | | | 1,550,200 | |

| | | | | | | | | | | | | | | | |

| | | | Medical Devices | | | 10.3 | % | | | | | | | | |

| | 22,456 | | Derma Sciences, Inc.* | | | | | | | | | | | 329,879 | |

| | 8,000 | | DexCom, Inc.* | | | | | | | | | | | 360,800 | |

| | 14,500 | | Endologix, Inc.* | | | | | | | | | | | 195,750 | |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued)

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS—(CONTINUED) | | | | | | 93.0 | % | | | |

| | | Medical Devices—(Continued) | | | 10.3 | % | | | | | | | |

| | 9,800 | | Foundation Medicine, Inc.* | | | | | | | | | | $ | 349,174 | |

| | 14,835 | | STAAR Surgical Co.* | | | | | | | | | | | 210,063 | |

| | 62,200 | | TearLab Corp.* | | | | | | | | | | | 500,710 | |

| | | | | | | | | | | | | | | 1,946,376 | |

| | | | | | | | | | | | | | | | |

| | | | Retail & Restaurants | | | 7.7 | % | | | | | | | | |

| | 15,800 | | Kate Spade & Co.* | | | | | | | | | | | 540,676 | |

| | 18,200 | | Steven Madden, Ltd.* | | | | | | | | | | | 663,390 | |

| | 21,100 | | Tilly’s Inc.—Class A* | | | | | | | | | | | 252,356 | |

| | | | | | | | | | | | | | | 1,456,422 | |

| | | | | | | | | | | | | | | | |

| | | | Technology-Hardware | | | 7.5 | % | | | | | | | | |

| | 11,000 | | Applied Optoelectronics, Inc.* | | | | | | | | | | | 260,260 | |

| | 8,300 | | Cardtronics, Inc.* | | | | | | | | | | | 336,316 | |

| | 26,303 | | CEVA, Inc.* | | | | | | | | | | | 475,558 | |

| | 16,900 | | InvenSense, Inc.* | | | | | | | | | | | 340,535 | |

| | | | | | | | | | | | | | | 1,412,669 | |

| | | | | | | | | | | | | | | | |

| | | | Technology-Software & Services | | | 24.3 | % | | | | | | | | |

| | 6,600 | | Bottomline Technologies, Inc.* | | | | | | | | | | | 235,554 | |

| | 52,000 | | E-House (China) Holdings Ltd.—ADR^ | | | | | | | | | | | 651,040 | |

| | 21,800 | | Ellie Mae, Inc.* | | | | | | | | | | | 675,800 | |

| | 38,000 | | Immersion Corp.* | | | | | | | | | | | 454,100 | |

| | 25,000 | | LogMeIn, Inc.* | | | | | | | | | | | 1,046,250 | |

| | 25,000 | | Numerex Corp.* | | | | | | | | | | | 371,000 | |

| | 24,400 | | Rally Software Development Corp.* | | | | | | | | | | | 485,316 | |

| | 12,183 | | Shutterfly, Inc.* | | | | | | | | | | | 664,705 | |

| | | | | | | | | | | | | | | 4,583,765 | |

| | | | TOTAL COMMON STOCKS (Cost $12,577,599) | | | | | | | | | | | 17,554,326 | |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND SCHEDULE OF INVESTMENTS (Continued)

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | SHORT TERM INVESTMENT | | | | | | 2.2 | % | | | |

| | | Money Market Fund | | | 2.2 | % | | | | | | | |

| | 405,090 | | Fidelity Government Portfolio-Class I, 0.01%(a) | | | | | | | | | | $ | 405,090 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $405,090) | | | | | | | | | | | 405,090 | |

| | | | TOTAL INVESTMENTS (Cost $12,982,689) | | | | | | | 95.2 | % | | | 17,959,416 | |

| | | | OTHER ASSETS IN EXCESS OF LIABILITIES | | | | | | | 4.8 | % | | | 908,494 | |

| | | | TOTAL NET ASSETS | | | | | | | 100.0 | % | | $ | 18,867,910 | |

| | | | | | | | | | | | | | | | |

| ^ | U.S. Dollar-denominated foreign security. |

ADRAmerican Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS | | | | | | 94.9 | % | | | |

| | | | | | | | | | | | | | |

| | | Arts, Entertainment, and Recreation | | | 3.8 | % | | | | | | | |

| | 58,600 | | DHX Media Ltd.^ | | | | | | | | | | $ | 252,436 | |

| | 10,100 | | Multimedia Games Holding Co., Inc.* | | | | | | | | | | | 333,552 | |

| | | | | | | | | | | | | | | 585,988 | |

| | | | | | | | | | | | | | | | |

| | | | Biotech & Pharmaceuticals | | | 13.6 | % | | | | | | | | |

| | 43,000 | | Array BioPharma Inc.* | | | | | | | | | | | 207,260 | |

| | 11,954 | | Cancer Genetics, Inc.* | | | | | | | | | | | 225,453 | |

| | 23,921 | | Cempra, Inc.* | | | | | | | | | | | 272,460 | |

| | 104,739 | | Curis, Inc.* | | | | | | | | | | | 319,454 | |

| | 44,000 | | Merrimack Pharmaceuticals, Inc.* | | | | | | | | | | | 219,120 | |

| | 166,100 | | NovaBay Pharmaceuticals, Inc.* | | | | | | | | | | | 209,286 | |

| | 25,000 | | Omeros Corp.* | | | | | | | | | | | 334,000 | |

| | 21,900 | | Tetraphase Pharmaceuticals, Inc.* | | | | | | | | | | | 297,840 | |

| | | | | | | | | | | | | | | 2,084,873 | |

| | | | | | | | | | | | | | | | |

| | | | Energy-Exploration & Production | | | 8.2 | % | | | | | | | | |

| | 44,000 | | Penn Virginia Corp.* | | | | | | | | | | | 666,600 | |

| | 65,388 | | Triangle Petroleum Corp.* | | | | | | | | | | | 585,876 | |

| | | | | | | | | | | | | | | 1,252,476 | |

| | | | | | | | | | | | | | | | |

| | | | Financial | | | 2.1 | % | | | | | | | | |

| | 20,000 | | HomeTrust Bancshares, Inc.* | | | | | | | | | | | 313,400 | |

| | | | | | | | | | | | | | | | |

| | | | Food & Beverages | | | 2.6 | % | | | | | | | | |

| | 52,413 | | Reed’s, Inc.* | | | | | | | | | | | 403,580 | |

| | | | | | | | | | | | | | | | |

| | | | Health Care Providers & Services | | | 1.5 | % | | | | | | | | |

| | 9,000 | | Capital Senior Living Corp.* | | | | | | | | | | | 228,780 | |

| | | | | | | | | | | | | | | | |

| | | | Industrial | | | 8.4 | % | | | | | | | | |

| | 5,860 | | Advanced Emissions Solutions, Inc.* | | | | | | | | | | | 15,854 | |

| | 24,478 | | CECO Environmental Corp. | | | | | | | | | | | 395,320 | |

| | 55,000 | | Energy Recovery, Inc.* | | | | | | | | | | | 246,400 | |

| | 14,900 | | Mistras Group, Inc.* | | | | | | | | | | | 328,396 | |

| | | | | | | | | | | | | | | 1,285,970 | |

| | | | | | | | | | | | | | | | |

| | | | Medical Devices | | | 11.3 | % | | | | | | | | |

| | 25,671 | | Derma Sciences, Inc.* | | | | | | | | | | | 377,107 | |

| | 5,600 | | Foundation Medicine, Inc.* | | | | | | | | | | | 199,528 | |

| | 48,000 | | iCAD, Inc.* | | | | | | | | | | | 559,200 | |

| | 12,350 | | STAAR Surgical Co.* | | | | | | | | | | | 174,876 | |

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued)

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS—(CONTINUED) | | | | | | 94.9 | % | | | |

| | | | | | | | | | | | | | |

| | | Medical Devices—(Continued) | | | 11.3 | % | | | | | | | |

| | 52,400 | | TearLab Corp.* | | | | | | | | | | $ | 421,820 | |

| | | | | | | | | | | | | | | 1,732,531 | |

| | | | | | | | | | | | | | | | |

| | | | Retail & Restaurants | | | 6.5 | % | | | | | | | | |

| | 60,144 | | Coastal Contacts Inc.*^ | | | | | | | | | | | 677,823 | |

| | 26,400 | | Tilly’s Inc.—Class A* | | | | | | | | | | | 315,744 | |

| | | | | | | | | | | | | | | 993,567 | |

| | | | | | | | | | | | | | | | |

| | | | Technology-Hardware | | | 9.0 | % | | | | | | | | |

| | 9,000 | | Applied Optoelectronics, Inc.* | | | | | | | | | | | 212,940 | |

| | 22,840 | | CEVA, Inc.* | | | | | | | | | | | 412,947 | |

| | 67,800 | | Lantronix, Inc.* | | | | | | | | | | | 172,890 | |

| | 130,000 | | Netlist, Inc.* | | | | | | | | | | | 248,950 | |

| | 54,119 | | Silicon Image, Inc.* | | | | | | | | | | | 327,420 | |

| | | | | | | | | | | | | | | 1,375,147 | |

| | | | | | | | | | | | | | | | |

| | | | Technology-Software & Services | | | 27.9 | % | | | | | | | | |

| | 15,900 | | Ellie Mae, Inc.* | | | | | | | | | | | 492,900 | |

| | 32,160 | | Immersion Corp.* | | | | | | | | | | | 384,312 | |

| | 231,681 | | iPass Inc.* | | | | | | | | | | | 359,106 | |

| | 85,232 | | Jiayuan.com International Ltd.—ADR^ | | | | | | | | | | | 627,308 | |

| | 19,164 | | LogMeIn, Inc.* | | | | | | | | | | | 802,013 | |

| | 66,000 | | Mitek Systems, Inc.* | | | | | | | | | | | 350,460 | |

| | 21,000 | | Numerex Corp.* | | | | | | | | | | | 311,640 | |

| | 13,700 | | Rally Software Development Corp.* | | | | | | | | | | | 272,493 | |

| | 50,000 | | Vringo, Inc.* | | | | | | | | | | | 202,500 | |

| | 96,545 | | ZipRealty, Inc.* | | | | | | | | | | | 457,623 | |

| | | | | | | | | | | | | | | 4,260,355 | |

| | | | TOTAL COMMON STOCKS (Cost $11,304,575) | | | | | | | | | | | 14,516,667 | |

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued)

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | SHORT TERM INVESTMENT | | | | | | 4.9 | % | | | |

| | | | | | | | | | | | | | |

| | | Money Market Fund | | | 4.9 | % | | | | | | | |

| | 749,639 | | Fidelity Government Portfolio-Class I, 0.01%(a) | | | | | | | | | | $ | 749,639 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $749,639) | | | | | | | | | | | 749,639 | |

| | | | TOTAL INVESTMENTS (Cost $12,054,214) | | | | | | | 99.8 | % | | | 15,266,306 | |

| | | | OTHER ASSETS IN EXCESS OF LIABILITIES | | | | | | | 0.2 | % | | | 23,957 | |

| | | | TOTAL NET ASSETS | | | | | | | 100.0 | % | | $ | 15,290,263 | |

| ^ | U.S. Dollar-denominated foreign security. |

ADRAmerican Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

JACOB WISDOM FUND

SCHEDULE OF INVESTMENTS

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS | | | | | | 98.9 | % | | | |

| | | | | | | | | | | | | | |

| | | Air Freight & Logistics | | | 3.9 | % | | | | | | | |

| | 1,200 | | Union Pacific Corp. | | | | | | | | | | $ | 216,456 | |

| | 2,400 | | United Parcel Service, Inc. (UPS)—Class B | | | | | | | | | | | 229,848 | |

| | | | | | | | | | | | | | | 446,304 | |

| | | | | | | | | | | | | | | | |

| | | | Beverages | | | 6.7 | % | | | | | | | | |

| | 2,400 | | Anheuser-Busch InBev NV—ADR^ | | | | | | | | | | | 251,064 | |

| | 7,500 | | The Coca-Cola Co. | | | | | | | | | | | 286,500 | |

| | 1,800 | | Diageo plc—ADR^ | | | | | | | | | | | 226,278 | |

| | | | | | | | | | | | | | | 763,842 | |

| | | | | | | | | | | | | | | | |

| | | | Cable/Satellite TV | | | 4.8 | % | | | | | | | | |

| | 4,000 | | DIRECTV* | | | | | | | | | | | 310,400 | |

| | 2,700 | | Viacom Inc. | | | | | | | | | | | 236,871 | |

| | | | | | | | | | | | | | | 547,271 | |

| | | | | | | | | | | | | | | | |

| | | | Commercial Banks | | | 2.7 | % | | | | | | | | |

| | 12,000 | | Banco Latinoamericano de Comercio Exterior SA^ | | | | | | | | | | | 305,880 | |

| | | | | | | | | | | | | | | | |

| | | | Commercial Services & Supplies | | | 7.2 | % | | | | | | | | |

| | 600 | | AutoZone, Inc.* | | | | | | | | | | | 323,064 | |

| | 1,200 | | The Sherwin-Williams Co. | | | | | | | | | | | 240,576 | |

| | 4,000 | | Verisk Analytics, Inc.—Class A* | | | | | | | | | | | 254,860 | |

| | | | | | | | | | | | | | | 818,500 | |

| | | | | | | | | | | | | | | | |

| | | | Consumer Finance | | | 9.2 | % | | | | | | | | |

| | 3,600 | | American Express Co. | | | | | | | | | | | 328,608 | |

| | 5,000 | | MasterCard, Inc.—Class A | | | | | | | | | | | 388,600 | |

| | 1,500 | | Visa Inc.—Class A | | | | | | | | | | | 338,910 | |

| | | | | | | | | | | | | | | 1,056,118 | |

| | | | | | | | | | | | | | | | |

| | | | Consumer Non-Cyclical | | | 4.4 | % | | | | | | | | |

| | 5,400 | | Lorillard, Inc. | | | | | | | | | | | 264,924 | |

| | 3,000 | | Philip Morris International Inc. | | | | | | | | | | | 242,730 | |

| | | | | | | | | | | | | | | 507,654 | |

| | | | | | | | | | | | | | | | |

| | | | Diversified Manufacturing | | | 2.5 | % | | | | | | | | |

| | 3,000 | | Dover Corp. | | | | | | | | | | | 282,900 | |

| | | | | | | | | | | | | | | | |

| | | | Food & Staples Retailing | | | 4.1 | % | | | | | | | | |

| | 1,500 | | Costco Wholesale Corp. | | | | | | | | | | | 175,200 | |

| | 4,000 | | Wal-Mart Stores, Inc. | | | | | | | | | | | 298,800 | |

| | | | | | | | | | | | | | | 474,000 | |

The accompanying notes are an integral part of these financial statements.

JACOB WISDOM FUND

SCHEDULE OF INVESTMENTS (Continued)

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS—(CONTINUED) | | | | | | 98.9 | % | | | |

| | | | | | | | | | | | | | |

| | | Food Products | | | 5.7 | % | | | | | | | |

| | 5,000 | | Campbell Soup Co. | | | | | | | | | | $ | 216,550 | |

| | 3,000 | | Mead Johnson Nutrition Co. | | | | | | | | | | | 244,650 | |

| | 4,800 | | Unilever NV—NY Shares—ADR^ | | | | | | | | | | | 189,888 | |

| | | | | | | | | | | | | | | 651,088 | |

| | | | | | | | | | | | | | | | |

| | | | Health Care Equipment & Supplies | | | 5.6 | % | | | | | | | | |

| | 2,700 | | C.R. Bard, Inc. | | | | | | | | | | | 389,232 | |

| | 3,600 | | DaVita HealthCare Partners Inc.* | | | | | | | | | | | 247,428 | |

| | | | | | | | | | | | | | | 636,660 | |

| | | | | | | | | | | | | | | | |

| | | | Hotels, Restaurants & Leisure | | | 4.7 | % | | | | | | | | |

| | 3,000 | | McDonald’s Corp. | | | | | | | | | | | 285,450 | |

| | 1,400 | | Panera Bread Co.* | | | | | | | | | | | 253,848 | |

| | | | | | | | | | | | | | | 539,298 | |

| | | | | | | | | | | | | | | | |

| | | | Insurance | | | 4.6 | % | | | | | | | | |

| | 2 | | Berkshire Hathaway Inc.—Class A* | | | | | | | | | | | 347,416 | |

| | 2,000 | | The Chubb Corp. | | | | | | | | | | | 174,960 | |

| | | | | | | | | | | | | | | 522,376 | |

| | | | | | | | | | | | | | | | |

| | | | Machinery | | | 8.0 | % | | | | | | | | |

| | 2,000 | | Cummins Inc. | | | | | | | | | | | 291,840 | |

| | 4,800 | | The Toro Co. | | | | | | | | | | | 317,904 | |

| | 3,000 | | WABCO Holdings Inc.* | | | | | | | | | | | 307,350 | |

| | | | | | | | | | | | | | | 917,094 | |

| | | | | | | | | | | | | | | | |

| | | | Oil, Gas & Consumable Fuels | | | 5.7 | % | | | | | | | | |

| | 3,000 | | Exxon Mobil Corp. | | | | | | | | | | | 288,810 | |

| | 5,000 | | Southwestern Energy Co.* | | | | | | | | | | | 206,700 | |

| | 9,000 | | WPX Energy Inc.* | | | | | | | | | | | 158,580 | |

| | | | | | | | | | | | | | | 654,090 | |

| | | | | | | | | | | | | | | | |

| | | | Pharmaceuticals | | | 2.1 | % | | | | | | | | |

| | 4,000 | | Eli Lilly & Co. | | | | | | | | | | | 238,440 | |

| | | | | | | | | | | | | | | | |

| | | | Technology-Hardware & Software | | | 9.2 | % | | | | | | | | |

| | 1,300 | | Apple Computer, Inc. | | | | | | | | | | | 684,112 | |

| | 2,000 | | International Business Machines Corp. (IBM) | | | | | | | | | | | 370,340 | |

| | | | | | | | | | | | | | | 1,054,452 | |

The accompanying notes are an integral part of these financial statements.

JACOB WISDOM FUND

SCHEDULE OF INVESTMENTS (Continued)

February 28, 2014 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS—(CONTINUED) | | | | | | 98.9 | % | | | |

| | | | | | | | | | | | | | |

| | | Textiles, Apparel & Luxury Goods | | | 7.8 | % | | | | | | | |

| | 5,000 | | Coach, Inc. | | | | | | | | | | $ | 244,050 | |

| | 6,000 | | Kohl’s Corp. | | | | | | | | | | | 337,140 | |

| | 4,000 | | Nike, Inc.—Class B | | | | | | | | | | | 313,200 | |

| | | | | | | | | | | | | | | 894,390 | |

| | | | TOTAL COMMON STOCKS (Cost $7,758,965) | | | | | | | | | | | 11,310,357 | |

| | | | | | | | | | | | | | | | |

| | | | SHORT TERM INVESTMENT | | | | | | | 1.3 | % | | | | |

| | | | | | | | | | | | | | | | |

| | | | Money Market Fund | | | 1.3 | % | | | | | | | | |

| | 151,768 | | Fidelity Government Portfolio-Class I, 0.01%(a) | | | | | | | | | | | 151,768 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $151,768) | | | | | | | | | | | 151,768 | |

| | | | TOTAL INVESTMENTS (Cost $7,910,733) | | | | | | | 100.2 | % | | | 11,462,125 | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS | | | | | | | (0.2 | )% | | | (17,822 | ) |

| | | | TOTAL NET ASSETS | | | | | | | 100.0 | % | | $ | 11,444,303 | |

| ^ | U.S. Dollar-denominated foreign security. |

ADRAmerican Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

(This Page Intentionally Left Blank.)

JACOB FUNDS INC.

STATEMENTS OF ASSETS AND LIABILITIES

February 28, 2014 (Unaudited)

| | | | | | Jacob | |

| | | Jacob | | | Small Cap | |

| | | Internet Fund | | | Growth Fund | |

| Assets: | | | | | | |

| Investments, at value (cost $26,149,282 and $12,982,689, respectively) | | $ | 47,567,608 | | | $ | 17,959,416 | |

| Cash | | | — | | | | 2,000 | |

| Receivable for capital shares sold | | | 49,513 | | | | 14,650 | |

| Receivable for investments sold | | | 344,044 | | | | 945,739 | |

| Dividend receivable | | | 4,566 | | | | 807 | |

| Other assets | | | 14,951 | | | | 20,000 | |

| Total Assets | | | 47,980,682 | | | | 18,942,612 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable for securities purchased | | | 155,064 | | | | — | |

| Payable to adviser | | | 43,292 | | | | 4,856 | |

| Payable for distribution expenses (see Note 8) | | | 91,722 | | | | 665 | |

| Payable for capital shares repurchased | | | 119,340 | | | | 21,123 | |

| Accrued printing and mailing fees | | | 5,428 | | | | 2,738 | |

| Accrued transfer agent fees | | | 22,707 | | | | 10,652 | |

| Accrued expenses and other liabilities | | | 54,190 | | | | 34,668 | |

| Total Liabilities | | | 491,743 | | | | 74,702 | |

| Net Assets | | $ | 47,488,939 | | | $ | 18,867,910 | |

| | | | | | | | | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Capital Stock | | $ | 29,443,344 | | | $ | 22,144,731 | |

| Accumulated net investment loss | | | (962,187 | ) | | | (750,630 | ) |

| Accumulated net realized loss on investment transactions | | | (2,410,544 | ) | | | (7,502,918 | ) |

| Net unrealized appreciation on investments | | | 21,418,326 | | | | 4,976,727 | |

| Total Net Assets | | $ | 47,488,939 | | | $ | 18,867,910 | |

| | | | | | | | | |

Institutional Class(2) | | | | | | | | |

| Net Assets | | $ | — | | | $ | 11,162,736 | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | — | | | | 549,429 | |

| Net asset value, redemption price and offering price per share | | $ | — | | | $ | 20.32 | |

| | | | | | | | | |

| Investor Class | | | | | | | | |

| Net Assets | | $ | 47,488,939 | | | $ | 7,705,174 | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | 10,399,563 | | | | 380,745 | |

Net asset value, redemption price and offering price per share(1) | | $ | 4.57 | | | $ | 20.24 | |

_______________

| (1) | Redemption of shares held less than 30 days (Internet Fund and Small Cap Growth Fund, Investor Class only) may be charged a 2% redemption fee. See Note 3. |

| (2) | The Internet Fund currently offers Investor Class shares only. See Note 1. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF ASSETS AND LIABILITIES

February 28, 2014 (Unaudited)

| | | Jacob | | | | |

| | | Micro Cap | | | Jacob | |

| | | Growth Fund | | | Wisdom Fund | |

| Assets: | | | | | | |

| Investments, at value (cost $12,054,214 and $7,910,733, respectively) | | $ | 15,266,306 | | | $ | 11,462,125 | |

| Receivable for capital shares sold | | | 71 | | | | 100 | |

| Receivable for investments sold | | | 177,828 | | | | — | |

| Dividend receivable | | | 543 | | | | 21,871 | |

| Other assets | | | 27,599 | | | | 11,885 | |

| Total Assets | | | 15,472,347 | | | | 11,495,981 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable for securities purchased | | | 91,190 | | | | — | |

| Payable to adviser | | | 12,241 | | | | 426 | |

| Payable for distribution expenses (see Note 8) | | | — | | | | 9,640 | |

| Payable for capital shares repurchased | | | 22,655 | | | | 3,370 | |

| Accrued printing and mailing fees | | | 3,467 | | | | 1,433 | |

| Accrued transfer agent fees | | | 12,998 | | | | 6,455 | |

| Accrued expenses and other liabilities | | | 39,533 | | | | 30,354 | |

| Total Liabilities | | | 182,084 | | | | 51,678 | |

| Net Assets | | $ | 15,290,263 | | | $ | 11,444,303 | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Capital Stock | | $ | 12,130,605 | | | $ | 8,348,334 | |

| Undistributed net investment loss | | | (157,191 | ) | | | (7,103 | ) |

| Accumulated net realized gain (loss) on investment transactions | | | 104,757 | | | | (448,320 | ) |

| Net unrealized appreciation on investments | | | 3,212,092 | | | | 3,551,392 | |

| Total Net Assets | | $ | 15,290,263 | | | $ | 11,444,303 | |

| | | | | | | | | |

Institutional Class(2) | | | | | | | | |

| Net Assets | | $ | 11,571,960 | | | $ | — | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | 496,418 | | | | — | |

| Net asset value, redemption price and offering price per share | | $ | 23.31 | | | $ | — | |

| | | | | | | | | |

| Investor Class | | | | | | | | |

| Net Assets | | $ | 3,718,303 | | | $ | 11,444,303 | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | 166,694 | | | | 991,073 | |

Net asset value, redemption price and offering price per share(1) | | $ | 22.31 | | | $ | 11.55 | |

_______________

| (1) | Redemption of shares held less than 30 days (Micro Cap Growth Fund, Investor Class only and Wisdom Fund) may be charged a 2% redemption fee. See Note 3. |

| (2) | The Wisdom Fund currently offers Investor Class shares only. See Note 1. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF OPERATIONS

For the Six Months Ended February 28, 2014 (Unaudited)

| | | | | | Jacob | |

| | | Jacob | | | Small Cap | |

| | | Internet Fund | | | Growth Fund | |

| Investment Income: | | | | | | |

| Dividend income | | $ | 53,509 | | | $ | 2,583 | (1) |

| Interest income | | | 86 | | | | 60 | |

| Securities lending income (See Note 7) | | | 5,197 | | | | — | |

| Total Investment Income | | | 58,792 | | | | 2,643 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Investment advisory fees | | | 268,625 | | | | 79,182 | |

| Distribution expenses—Investor Class (See Note 8) | | | 75,215 | | | | 12,708 | |

| Administration fees | | | 24,085 | | | | 20,557 | |

| Fund accounting fees | | | 13,958 | | | | 16,434 | |

| Transfer agent fees | | | 59,305 | | | | 29,717 | |

| Custody fees | | | 3,545 | | | | 2,895 | |

| Federal and state registration | | | 10,221 | | | | 20,034 | |

| Insurance expense | | | 4,915 | | | | 2,382 | |

| Audit fees | | | 7,296 | | | | 6,920 | |

| Legal fees | | | 23,160 | | | | 7,120 | |

| Reports to shareholders | | | 10,673 | | | | 4,362 | |

| Directors’ fees and expenses | | | 21,096 | | | | 8,369 | |

| Other | | | 121 | | | | 45 | |

| Total Expenses | | | 522,215 | | | | 210,725 | |

| Expense Waiver (See Note 6) | | | — | | | | (28,272 | ) |

| Net expenses | | | 522,215 | | | | 182,453 | |

| Net Investment Loss | | | (463,423 | ) | | | (179,810 | ) |

| | | | | | | | | |

| Realized and Unrealized Gain on Investments: | | | | | | | | |

| Net realized gain on investment transactions | | | 2,907,480 | | | | 1,752,190 | |

| Change in net unrealized appreciation/depreciation on investments | | | 5,469,368 | | | | 921,777 | |

| Net realized and unrealized gain on investments | | | 8,376,848 | | | | 2,673,967 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 7,913,425 | | | $ | 2,494,157 | |

_______________

| (1) | Net of foreign tax withheld of $456 for the Small Cap Growth Fund. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF OPERATIONS

For the Six Months Ended February 28, 2014 (Unaudited)

| | | Jacob | | | | |

| | | Micro Cap | | | Jacob | |

| | | Growth Fund | | | Wisdom Fund | |

| Investment Income: | | | | | | |

| Dividend income | | $ | 4,939 | (1) | | $ | 94,224 | (1) |

| Interest income | | | 34 | | | | 25 | |

| Total Investment Income | | | 4,973 | | | | 94,249 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Investment advisory fees | | | 87,530 | | | | 27,917 | |

| Distribution expenses—Investor Class (See Note 8) | | | 6,230 | | | | 19,542 | |

| Administration fees | | | 20,265 | | | | 21,333 | |

| Fund accounting fees | | | 16,495 | | | | 13,747 | |

| Transfer agent fees | | | 28,897 | | | | 15,981 | |

| Custody fees | | | 2,914 | | | | 2,479 | |

| Federal and state registration | | | 18,757 | | | | 9,939 | |

| Insurance expense | | | 2,384 | | | | 1,673 | |

| Audit fees | | | 7,146 | | | | 7,296 | |

| Legal fees | | | 7,200 | | | | 6,615 | |

| Reports to shareholders | | | 3,815 | | | | 2,729 | |

| Directors’ fees and expenses | | | 7,040 | | | | 5,397 | |

| Other | | | 66 | | | | 30 | |

| Total Expenses | | | 208,739 | | | | 134,678 | |

| Expense Waiver (See Note 6) | | | (46,575 | ) | | | (25,760 | ) |

| Net expenses | | | 162,164 | | | | 108,918 | |

| Net Investment Loss | | | (157,191 | ) | | | (14,669 | ) |

| | | | | | | | | |

| Realized and Unrealized Gain on Investments: | | | | | | | | |

| Net realized gain on investment transactions | | | 1,843,200 | | | | 374,936 | |

| Change in net unrealized appreciation/depreciation on investments | | | 103,987 | | | | 754,988 | |

| Net realized and unrealized gain on investments | | | 1,947,187 | | | | 1,129,924 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 1,789,996 | | | $ | 1,115,255 | |

_______________

(1)Net of foreign tax withheld of $440 for the Micro Cap Growth Fund and $1,013 for the Wisdom Fund.

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB INTERNET FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | February 28, 2014 | | | August 31, 2013 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (463,423 | ) | | $ | (766,055 | ) |

| Net realized gain on investment transactions | | | 2,907,480 | | | | 3,707,701 | |

| Change in net unrealized appreciation/depreciation on investments | | | 5,469,368 | | | | 5,339,874 | |

| Net increase in net assets resulting from operations | | | 7,913,425 | | | | 8,281,520 | |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 2,689,314 | | | | 1,586,863 | |

| Cost of shares redeemed | | | (3,151,276 | ) | | | (9,820,679 | ) |

| Redemption fees | | | 4,625 | | | | 1,711 | |

| Net decrease in net assets resulting from capital share transactions | | | (457,337 | ) | | | (8,232,105 | ) |

| | | | | | | | | |

| Net Increase in Net Assets | | | 7,456,088 | | | | 49,415 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 40,032,851 | | | | 39,983,436 | |

| End of period* | | $ | 47,488,939 | | | $ | 40,032,851 | |

| *Includes accumulated net investment loss of: | | $ | (962,187 | ) | | $ | (498,764 | ) |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | February 28, 2014 | | | August 31, 2013 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (179,810 | ) | | $ | (286,016 | ) |

| Net realized gain on investment transactions | | | 1,752,190 | | | | 1,658,627 | |

| Change in net unrealized appreciation/depreciation on investments | | | | | | | | |

| and foreign currency translations | | | 921,777 | | | | 3,225,508 | |

| Net increase in net assets resulting from operations | | | 2,494,157 | | | | 4,598,119 | |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 491,689 | | | | 343,645 | |

Proceeds from reorganization(1) | | | — | | | | 10,729,289 | |

| Cost of shares redeemed | | | (1,485,014 | ) | | | (3,687,836 | ) |

| Redemption fees | | | — | | | | 50 | |

| Net increase (decrease) in net assets resulting from capital share transactions | | | (993,325 | ) | | | 7,385,148 | |

| | | | | | | | | |

| Net Increase in Net Assets | | | 1,500,832 | | | | 11,983,267 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 17,367,078 | | | | 5,383,811 | |

| End of period* | | $ | 18,867,910 | | | $ | 17,367,078 | |

| *Includes accumulated net investment loss of: | | $ | (750,630 | ) | | $ | (570,820 | ) |

_______________

(1)Represents the amount acquired as a result of the reorganization of the Jacob Small Cap Growth Fund II Series of Jacob Funds II into the Fund on November 12, 2012.

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Period Ended | | | Year Ended | |

| �� | | February 28, 2014 | | | August 31, 2013** | | | November 30, 2012 | |

| | | (Unaudited) | | | | | | | |

| Operations: | | | | | | | | | |

| Net investment loss | | $ | (157,191 | ) | | $ | (245,413 | ) | | $ | (915,324 | ) |

| Net realized gain on investment transactions | | | 1,843,200 | | | | 4,155,641 | | | | 4,877,091 | |

| Change in net unrealized | | | | | | | | | | | | |

| appreciation/depreciation on investments | | | 103,987 | | | | 385,044 | | | | (594,088 | ) |

| Net increase in net assets resulting from operations | | | 1,789,996 | | | | 4,295,272 | | | | 3,367,679 | |

| | | | | | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | | | | | |

| From net realized gain | | | (2,768,226 | ) | | | — | | | | — | |

| | | | | | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | | | | | |

| Proceeds from shares sold | | | 213,113 | | | | 181,622 | | | | 10,321,021 | |

| Proceeds from reinvestment of distribution | | | 2,574,766 | | | | — | | | | — | |

| Cost of shares redeemed | | | (892,013 | ) | | | (35,126,662 | ) | | | (28,069,923 | ) |

| Redemption fees | | | — | | | | 8 | | | | — | |

| Net increase (decrease) in net assets resulting from | | | | | | | | | | | | |

| capital share transactions | | | 1,895,866 | | | | (34,945,032 | ) | | | (17,748,902 | ) |

| | | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets | | | 917,636 | | | | (30,649,760 | ) | | | (14,381,223 | ) |

| Net Assets: | | | | | | | | | | | | |

| Beginning of period | | | 14,372,627 | | | | 45,022,387 | | | | 59,403,610 | |

| End of period* | | $ | 15,290,263 | | | $ | 14,372,627 | | | $ | 45,022,387 | |

| *Includes accumulated net investment loss of: | | $ | (157,191 | ) | | $ | — | | | $ | — | |

| ** | The Micro Cap Growth Fund’s predecessor fund had a fiscal year end of November 30, so the current activity began on December 1, 2012 and the numbers shown above were for the nine month period ended August 31, 2013. The fiscal year end was changed to August 31 to align with the other Jacob Funds. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB WISDOM FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | February 28, 2014 | | | August 31, 2013 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | (14,669 | ) | | $ | 198,123 | |

| Net realized gain on investment transactions | | | 374,936 | | | | 440,853 | |

| Change in net unrealized appreciation/depreciation on investments | | | 754,988 | | | | 229,380 | |

| Net increase in net assets resulting from operations | | | 1,115,255 | | | | 868,356 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From net investment income | | | (185,925 | ) | | | (169,237 | ) |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 27,338 | | | | 153,427 | |

| Proceeds from reinvestment of distribution | | | 155,981 | | | | 138,611 | |

| Cost of shares redeemed | | | (360,533 | ) | | | (941,399 | ) |

| Net decrease in net assets resulting from capital share transactions | | | (177,214 | ) | | | (649,361 | ) |

| | | | | | | | | |

| Net Increase in Net Assets | | | 752,116 | | | | 49,758 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 10,692,187 | | | | 10,642,429 | |

| End of period* | | $ | 11,444,303 | | | $ | 10,692,187 | |

| *Includes undistributed net investment income (loss) of: | | $ | (7,103 | ) | | $ | 193,491 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB INTERNET FUND

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | February 28, | | | Year Ended August 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Investor Class | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 3.81 | | | $ | 3.03 | | | $ | 2.95 | | | $ | 2.28 | | | $ | 1.99 | | | $ | 2.07 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.04 | ) | | | (0.07 | ) | | | (0.06 | ) | | | (0.08 | ) | | | (0.06 | ) | | | (0.06 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 0.80 | | | | 0.85 | | | | 0.14 | | | | 0.75 | | | | 0.35 | | | | (0.02 | ) |

| Total from investment operations | | | 0.76 | | | | 0.78 | | | | 0.08 | | | | 0.67 | | | | 0.29 | | | | (0.08 | ) |

| Net asset value, end of period | | $ | 4.57 | | | $ | 3.81 | | | $ | 3.03 | | | $ | 2.95 | | | $ | 2.28 | | | $ | 1.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 19.95 | %(3) | | | 25.74 | % | | | 2.71 | % | | | 29.39 | % | | | 14.57 | % | | | (3.86 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 47,489 | | | $ | 40,033 | | | $ | 39,983 | | | $ | 41,266 | | | $ | 35,058 | | | $ | 36,913 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or recoupments) to average net assets | | | 2.43 | %(4) | | | 2.66 | % | | | 2.87 | % | | | 2.69 | % | | | 3.06 | % | | | 3.71 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or recoupments) to average net assets | | | 2.43 | %(2)(4) | | | 2.66 | %(2) | | | 2.87 | %(2) | | | 2.82 | %(2) | | | 2.96 | %(2) | | | 3.64 | %(2) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or recoupments) to average net assets | | | (2.16 | )%(4) | | | (2.05 | )% | | | (1.99 | )% | | | (2.53 | )% | | | (2.49 | )% | | | (3.54 | )% |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or recoupments) to average net assets | | | (2.16 | )%(2)(4) | | | (2.05 | )%(2) | | | (1.99 | )%(2) | | | (2.66 | )%(2) | | | (2.39 | )%(2) | | | (3.47 | )%(2) |

| Portfolio turnover rate | | | 27.67 | %(3) | | | 44.10 | % | | | 55.61 | % | | | 52.39 | % | | | 52.09 | % | | | 106.98 | % |

| (1) | Net investment loss per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (2) | For the period January 1, 2009 through January 2, 2015, the Adviser has contractually agreed to waive its advisory fees in an amount up to an annual rate of 0.10% of the Fund’s average daily net assets, to the extent that the Fund’s expense ratio exceeds 2.95%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. All eligible previously waived expenses under this agreement were recouped by the Adviser during the year ended August 31, 2011. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | | | | November 12, 2012(1) | |

| | | Six Months Ended | | | through | |

| | | February 28, 2014 | | | August 31, 2013 | |

| | | (Unaudited) | | | | |

| Institutional Class | | | | | | |

| | | | | | | |

| Per Share Data: | | | | | | |

| Net asset value, beginning of period | | $ | 17.67 | | | $ | 12.94 | |

| | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | |

Net investment loss(3) | | | (0.18 | ) | | | (0.22 | ) |

| Net realized and unrealized gain on investment transactions | | | 2.83 | | | | 4.95 | |

| Total from investment operations | | | 2.65 | | | | 4.73 | |

| Net asset value, end of period | | $ | 20.32 | | | $ | 17.67 | |

| | | | | | | | | |

| Total return | | | 15.00 | %(4) | | | 36.55 | %(4) |

| | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 11,163 | | | $ | 10,131 | |

| Ratio of gross operating expenses | | | | | | | | |

| (prior to waiver or reimbursements) to average net assets | | | 2.25 | %(5) | | | 2.32 | %(5) |

| Ratio of net operating expenses | | | | | | | | |

(after waiver or reimbursements) to average net assets(2) | | | 1.95 | %(5) | | | 1.95 | %(5) |

| Ratio of net investment loss | | | | | | | | |

| (prior to waiver or reimbursements) to average net assets | | | (2.22 | )%(5) | | | (2.20 | )%(5) |

| Ratio of net investment loss | | | | | | | | |

(after waiver or reimbursements) to average net assets(2) | | | (1.92 | )%(5) | | | (1.83 | )%(5) |

| Portfolio turnover rate | | | 51.29 | %(4) | | | 80.91 | %(4) |

_______________

| (1) | Commencement of operations of the Small Cap Growth Fund Institutional Class. The Class I shares of the Jacob Small Cap Growth Fund II, (formerly, PineBridge US Small Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) was reorganized into Institutional Class shares of the Small Cap Growth Fund on November 12, 2012. On July 9, 2012, before the reorganization, the adviser of the Jacob Small Cap Growth Fund II changed from PineBridge Investments, LLC to Jacob Asset Management of New York LLC (the “Adviser”). |

| (2) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2015, to waive up to 100% of its advisory fee of 0.90% to the extent that the Fund’s operating expense ratio exceeds 1.95%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

| (3) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | | | | | | | | | | | | | | | | | | | | |

| | | Months | | | | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | Through | | | Year Ended | |

| | | February 28, | | | Year Ended August 31, | | | August 31, | | | September 30, | |

| | | 2014 | | | 2013(7) | | | 2012 | | | 2011 | | | 2010(1) | | | 2009 | | | 2008 | |

| Investor Class | | (Unaudited) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 17.63 | | | $ | 13.87 | | | $ | 15.12 | | | $ | 10.90 | | | $ | 11.16 | | | $ | 13.82 | | | $ | 21.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.20 | )(2) | | | (0.35 | )(2) | | | (0.47 | )(2) | | | (0.55 | )(2) | | | (0.48 | )(2) | | | (0.17 | )(2) | | | (0.29 | )(3) |

| Net realized and unrealized gain (loss) on | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| investment transactions | | | 2.81 | | | | 4.11 | | | | (0.15 | ) | | | 4.75 | | | | 0.22 | | | | (2.49 | ) | | | (7.83 | ) |

| Total from investment operations | | | 2.61 | | | | 3.76 | | | | (0.62 | ) | | | 4.20 | | | | (0.26 | ) | | | (2.66 | ) | | | (8.12 | ) |

| Less distributions from net | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| investment income | | | — | | | | — | | | | (0.63 | ) | | | — | | | | — | | | | — | | | | — | |

| Paid in capital from redemption fees | | | — | | | | 0.00 | (11) | | | 0.00 | (11) | | | 0.02 | | | | 0.00 | (11) | | | 0.00 | (11) | | | 0.00 | (11) |

| Net asset value, end of period | | $ | 20.24 | | | $ | 17.63 | | | $ | 13.87 | | | $ | 15.12 | | | $ | 10.90 | | | $ | 11.16 | | | $ | 13.82 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 14.80 | %(9) | | | 27.11 | % | | | (3.75 | )% | | | 38.72 | % | | | (2.33 | )%(9) | | | (19.25 | )% | | | (37.01 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 7,705 | | | $ | 7,236 | | | $ | 5,384 | | | $ | 7,013 | | | $ | 4,073 | | | $ | 8,321 | | | $ | 31,907 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 2.60 | %(10) | | | 2.97 | % | | | 4.28 | % | | | 4.45 | % | | | 5.43 | %(4)(10) | | | 2.64 | %(4) | | | 1.86 | %(4) |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 2.25 | %(8)(10) | | | 2.47 | %(6)(8) | | | 3.38 | %(6) | | | 3.55 | %(6) | | | 4.82 | %(4)(5)(6)(10) | | | 2.64 | %(4)(5) | | | 1.86 | %(4) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (2.57 | )%(10) | | | (2.86 | )% | | | (4.27 | )% | | | (4.44 | )% | | | (5.21 | )%(10) | | | (1.87 | )% | | | (1.56 | )% |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (2.22 | )%(8)(10) | | | (2.36 | )%(6)(8) | | | (3.37 | )%(6) | | | (3.54 | )%(6) | | | (4.60 | )%(5)(6)(10) | | | (1.87 | )%(5) | | | (1.56 | )% |

| Portfolio turnover rate | | | 51.29 | %(9) | | | 80.91 | % | | | 77.65 | % | | | 102.80 | % | | | 228.16 | %(9) | | | 307.06 | % | | | 246.41 | % |

_______________

| (1) | The financial highlights set forth herein include the historical financial highlights of the Rockland Small Cap Growth Fund. The assets of the Rockland Small Cap Growth Fund were acquired by the Fund on February 1, 2010. At the time of the reorganization, the adviser changed from Gould Investment Partners, LLC to Jacob Asset Management of New York LLC. The Fund’s fiscal year was changed to August 31 to align with the other Jacob Funds. |

| (2) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

| (3) | Net investment loss per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (4) | The expense ratio includes interest expense paid to the custodian on overdrafts to cover shareholder redemptions. The expense ratio for interest expense paid to the custodian for the period ended August 31, 2010 and the years ended September 30, 2009 and 2008 was 0.02%, 0.01% and 0.01%, respectively. |

| (5) | Effective September 1, 2009, Gould Investment Partners, LLC agreed to voluntarily waive 0.25% of its advisory fee indefinitely. The impact on the net operating expense ratio was (0.01)% for the fiscal year ended September 30, 2009 and (0.25)% for the period October 1, 2009 through January 31, 2010. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND (Continued)

| (6) | The Adviser contractually agreed, through November 11, 2012, to waive its advisory fees in an amount up to an annual rate of 0.90% of the Fund’s average daily net assets, to the extent that the Fund’s operating expense ratio exceeds 2.45%. |

| (7) | On November 12, 2012, Class R shares of the Jacob Small Cap Growth Fund II (formerly, PineBridge US Small Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) were reorganized into Investor Class shares of the Small Cap Growth Fund. Activity after November 12, 2012 reflects the Funds’ combined operations. |

| (8) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2015, to waive its advisory fees in an amount up to an annual rate of 0.90% of the Fund’s average daily net assets, to the extent that the Fund’s operating expense ratio exceeds 2.25% excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

| (11) | Amount is less than $0.01. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | Nine Months | | | | | | | | | | | | | | | |

| | | Ended | | Ended | | | | | | | | | | | | | | | |

| | | February 28, | | August 31, | | Year Ended November 30, | |

| | | 2014 | | | 2013* | | | 2012(1) | | | 2011(1) | | | 2010(1) | | | 2009(1) | | | 2008(1) |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 25.31 | | | $ | 19.11 | | | $ | 18.19 | | | $ | 17.82 | | | $ | 13.18 | | | $ | 10.42 | | | $ | 24.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(4) | | | (0.25 | ) | | | (0.27 | ) | | | (0.31 | ) | | | (0.30 | ) | | | (0.20 | ) | | | (0.15 | ) | | | (0.10 | ) |

| Net realized and | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 3.21 | | | | 6.47 | | | | 1.23 | | | | 0.67 | | | | 4.84 | | | | 2.91 | | | | (10.40 | ) |

| Total from investment operations | | | 2.96 | | | | 6.20 | | | | 0.92 | | | | 0.37 | | | | 4.64 | | | | 2.76 | | | | (10.50 | ) |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| From net realized gain | | | (4.96 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (3.96 | ) |

| Net asset value, end of period | | $ | 23.31 | | | $ | 25.31 | | | $ | 19.11 | | | $ | 18.19 | | | $ | 17.82 | | | $ | 13.18 | | | $ | 10.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 12.69 | %(6) | | | 32.44 | %(6) | | | 5.06 | % | | | 2.08 | % | | | 35.20 | % | | | 26.49 | % | | | (50.02 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | $ | 11,572 | | | $ | 10,800 | | | $ | 40,666 | | | $ | 50,065 | | | $ | 51,300 | | | $ | 40,122 | | | $ | 41,582 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 2.78 | %(7) | | | 3.01 | %(7) | | | 2.12 | % | | | 1.79 | % | | | 1.89 | % | | | 2.00 | % | | | 1.73 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 2.15 | %(2)(7) | | | 2.28 | %(2)(7) | | | 1.72 | %(2)(3) | | | 1.60 | %(3) | | | 1.60 | %(3) | | | 1.60 | %(3) | | | 1.60 | %(3) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (2.71 | )%(7) | | | (2.46 | )%(7) | | | (1.95 | )% | | | (1.72 | )%(5) | | | (1.64 | )%(5) | | | (1.76 | )%(5) | | | (0.71 | )%(5) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (2.08 | )%(2)(7) | | | (1.73 | )%(2)(7) | | | (1.55 | )%(2)(3) | | | (1.53 | )%(3) | | | (1.35 | )%(3) | | | (1.36 | )%(3) | | | (0.58 | )%(3) |

| Portfolio turnover rate | | | 39.93 | %(6) | | | 40.19 | %(6) | | | 115 | % | | | 165 | % | | | 216 | % | | | 209 | % | | | 250 | % |

_______________

| (1) | The financial highlights set forth herein include the historical financial highlights of the Jacob Micro Cap Growth Fund (formerly, PineBridge US Micro Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) (the “Predecessor Fund”). The Predecessor Fund was reorganized into the Micro Cap Growth Fund on November 12, 2012. On July 9, 2012, before the reorganization, the adviser changed from PineBridge Investments, LLC to Jacob Asset Management of New York LLC (the “Adviser”). Information prior to November 12, 2012 reflects the performance of the Predecessor Fund’s Class I shares. |

| (2) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2015, to waive up to 100% of its advisory fee of 1.20% to the extent that the Fund’s operating expense ratio exceeds 2.15%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

| (3) | Prior to November 12, 2012, the previous adviser and the Adviser agreed to waive operating expenses over 1.60% of the Fund’s average daily net assets. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND (Continued)

FINANCIAL HIGHLIGHTS

| (4) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

| * | The Micro Cap Growth Fund’s predecessor fund had a fiscal year end of November 30, so the current activity begins on December 1, 2012 and the numbers shown are for the nine month period. The fiscal year was changed to August 31 to align with the other Jacob Funds. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | Nine Months | | | | | | | | | | | | | | | |

| | | Ended | | Ended | | | | | | | | | | | | | | | |

| | | February 28, | | August 31, | | Year Ended November 30, | |

| | | 2014 | | | 2013* | | | 2012(1) | | | 2011(1) | | | 2010(1) | | | 2009(1) | | | 2008(1) |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| beginning of period | | $ | 24.47 | | | $ | 18.51 | | | $ | 17.68 | | | $ | 17.36 | | | $ | 12.88 | | | $ | 10.21 | | | $ | 24.51 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(4) | | | (0.28 | ) | | | (0.37 | ) | | | (0.37 | ) | | | (0.35 | ) | | | (0.25 | ) | | | (0.18 | ) | | | (0.14 | ) |

| Net realized and unrealized gain | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (loss) on investment transactions | | | 3.08 | | | | 6.33 | | | | 1.20 | | | | 0.67 | | | | 4.73 | | | | 2.85 | | | | (10.20 | ) |

| Total from investment operations | | | 2.80 | | | | 5.96 | | | | 0.83 | | | | 0.32 | | | | 4.48 | | | | 2.67 | | | | (10.34 | ) |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| From net realized gain | | | (4.96 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (3.96 | ) |

| Net asset value, end of period | | $ | 22.31 | | | $ | 24.47 | | | $ | 18.51 | | | $ | 17.68 | | | $ | 17.36 | | | $ | 12.88 | | | $ | 10.21 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 12.61 | %(6) | | | 32.20 | %(6) | | | 4.69 | % | | | 1.84 | % | | | 34.78 | % | | | 26.15 | % | | | (50.14 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |