UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09447

Jacob Funds Inc.

(Exact name of Registrant as specified in charter)

C/O Jacob Asset Management of New York LLC

653 Manhattan Beach Blvd. # J

Manhattan Beach, CA 90266

(Address of principal executive offices) (Zip code)

Ryan Jacob

C/O Jacob Asset Management of New York LLC

653 Manhattan Beach Blvd. # J

Manhattan Beach, CA 90266

(Name and address of agent for service)

(424)-237-2164

Registrant's telephone number, including area code

Date of fiscal year end: August 31

Date of reporting period: February 29, 2016

Item 1. Reports to Stockholders.

Jacob Internet Fund

Jacob Small Cap Growth Fund

Jacob Micro Cap Growth Fund

Jacob Wisdom Fund

Semi-Annual Report

February 29, 2016

The Jacob Internet Fund, Jacob Small Cap Growth Fund and

Jacob Micro Cap Growth Fund are mutual funds with the

primary investment objective of long-term growth of capital.

The Jacob Wisdom Fund is a mutual fund with the primary investment

objective to maximize total investment return consisting of a

combination of income and capital appreciation.

The Jacob Internet Fund has current income as a secondary objective.

Investment Adviser

Jacob Asset Management of New York LLC

TABLE OF CONTENTS

| Letter From the Manager | 1 | | Statements of Changes in Net Assets | 22 |

| Industry Breakdowns | 5 | | Financial Highlights | 26 |

| Schedules of Investments | 9 | | Notes to the Financial Statements | 32 |

| Statements of Assets and Liabilities | 18 | | Additional Information on Fund Expenses | 45 |

| Statements of Operations | 20 | | Additional Information | 48 |

Dear Fellow Investors,

Although we ended last calendar year with U.S. economy still inching forward, the beginning of 2016 started off inauspiciously with a severe correction in stock prices. Many of the same investor worries that permeated 2015 were cited as the cause, including weaker manufacturing at home, slowing growth in China, and increasing uncertainty about other emerging markets. The fact the Fed had finally embarked on its plan to slowly raise interest rates – for the first time in almost a decade – was just another brick in the market’s wall of worry. Our belief, however, is that not only have stock prices overplayed these concerns, but we have now gotten to valuation levels where the risk/reward in equites provides maybe the best opportunity we have seen since the 2008 financial panic. We would argue that an overall improvement in business activity – spurred by a more benign U.S. dollar – coupled with lower energy prices, should have a magnified ripple effect across our economy and help us finally break out of the subpar growth we have become accustomed to in recent years. For this reason, we have been more aggressive in increasing position sizes, adding new holdings, and even buying back some previous names that have fallen to very attractive levels. We believe that this latest downturn, like many over the past several years, will prove to be transitory and potentially lead to outsized gains as the year progresses.

Jacob Internet Fund

The Jacob Internet Fund was down -4.13% for the six month period ended February 29, 2016, while the NASDAQ Composite Index returned -3.95%. Most large capitalization technology companies performed admirably in the period, with our larger holdings in Internet leaders helping us stay close to our sector benchmarks. Generally speaking, weakness in small-capitalization names continues to be a drag on the portfolio, but we expect that this two-year plus trend is likely to end soon. The Fund continues to believe that its strategy of owning more small- and mid-capitalization holdings than our peers and the major indexes should be a key component in our ability to outperform over the long-term.

One of the best-performing stocks recently was also one of our largest holdings: Mitek. A provider of document imaging services, its lead product enabling mobile check deposit for leading financial institutions has now become a standard in the industry. Its stock was up over 56% in this fiscal period, a notable increase given recent market conditions. Ellie Mae, a provider of online mortgage software, and a name we have frequently cited in the past, was also a positive contributor, up over 16% for the six months ended February 29, 2016. Many other Internet leaders, including Facebook, Alphabet (the parent company of Google) and Amazon produced positive returns for the Fund. Luckily, most of our worst performers during the period were relatively small positions, but the fact that many of them were down more than 30% still negatively affected our results. Two in particular, Linked In and Twitter, struggled in their latest quarterly results, but we believe that both are now trading at levels that unfairly discount their dominant positions on the Internet today.

We added a number of new positions over the period ended February 29, 2016. These included Hortonworks, an open-source software and service provider for big data applications and Bazaarvoice, which provides third-party review services for e-commerce companies. Also, we took advantage of the market’s most recent decline to re-initiate a position in Zillow, the online real estate portal whose stock we owned years ago.

Jacob Small Cap Growth Fund

The Jacob Small Cap Growth Fund faced some unusually difficult headwinds. For the six month period ended February 29, 2016 the Fund’s Investor Class was down -29.46% while the Russell 2000 Growth Index was down -13.47%. The Fund’s heavy technology and healthcare exposure, typically a positive contributor to outperformance during more bullish markets, was just too much to overcome in that steep of a downturn.

Some of the poorest performers were in healthcare, and included names like Tearlab, Esperion Therapeutics, Array Biopharma and Cempra, all down in excess of 50% in the period ended February 29, 2016. While some company-specific issues contributed to each of these declines, the underperformance was mainly a result of the difficult market environment and investors’ lack of appetite for riskier, unprofitable names.

Despite one of the worst markets for small-capitalization companies in our recent memory, a handful of our positions posted strong gains. Leading the way were long-time favorites Ellie Mae, Shutterfly and Sina, all of which have been in the Fund for many years and performed well in a tough environment.

Aside from the three names that were also added to the Internet Fund, the Small Cap Fund added three additional new positions. Intercept Pharmaceuticals, a name we have been researching for well over a year, is developing a drug to treat various liver diseases that has shown remarkable success in reversing liver fibrosis in early trials. Its drop this year finally gave us what we believe to be a good entry point for a position. The other names we added in the period were Codexis, which has successfully developed protein enzymes that help drug and food companies reduce manufacturing costs; and First Northwest Bancorp, a small regional bank serving the upper- northwest corner of Washington state and trading at a substantial discount to its peers.

Jacob Micro Cap Growth Fund

The Jacob Micro Cap Growth Fund endured a particularly tough market environment given its focus on micro-capitalization companies and the Investor Class posted a return of -22.23% for the six month period ended February 29, 2016, while the Russell Microcap Growth Index was down -18.56%. Some of the worst performers mirrored some of the above-mentioned companies, but the fund also had a larger number of its names down more than 50% in the period. Again, like the Small Cap Fund, our overweighted positions in technology and healthcare bore the brunt of this most recent downturn.

The Micro Cap Fund did have some standouts, including Energy Recovery and Netlist, which were both up more than 150% in the period. A leader in energy-efficient pumps and pressure exchangers for the water desalination industry, Energy Recovery received a large contract from oilfield equipment behemoth Schlumberger, which could result in a doubling or tripling of revenues over the next several years as the company targets an entirely new end market. Netlist, a company whose innovations in high-performance storage and memory technologies are being increasingly adopted (and arguably co-opted) by other players in the computer industry, signed a major deal with Samsung that validates its intellectual property and gives them the resources to continue fighting its battles in the markets and the courts.

Two other holdings, Mitek and USA Technology, continue to execute well and have now risen to become two of our top holdings based on performance.

Besides some of the names mentioned earlier (Bazaarvoice, HortonWorks, First Northwest Bancorp), a few other names were added exclusively to Micro Cap. Imprimis Pharmaceuticals, a fast-growing compound pharmacy, has created an exciting new drug applied during cataract surgery that often alleviates the need for post-op eye-drop therapy. The other new name, Sajan, provides translation services and software products for large corporations, helping solve an increasingly big challenge for these companies as they start selling into more and more international markets.

Jacob Wisdom Fund

Both the Wisdom Fund and the S&P 500 Index also posted negative returns over the six month period ended February, 29, 2016 with the Fund down -3.98% and the S&P down -0.92%.

Perhaps unsurprisingly, given the continued steep drop in oil prices, all of our energy and energy-related names hurt our results the most over the period. Names like Southwestern Energy, CF Industries, Methanex and Union Pacific all underperformed, with most down more than 20% and some down as much as 50%. Due to heightened risks with these smaller names, we subsequently exited these positions, and now only hold larger, integrated energy companies in the portfolio. Finally, two of our largest positions in the portfolio, Apple and Gilead, also dragged down the portfolio as they were down over 10% in the period.

We did have a few bright spots in the period. Campbell Soup and McDonalds were two of our larger weightings, and both were up more than 20%. McDonalds benefitted greatly from its well-publicized all-day breakfast which had a significant ripple effect across the fast food industry. Meanwhile, Campbell Soup also posted solid operating results over the last few quarters and its stock was also boosted by continued takeover speculation and industry consolidation.

There were two new additions in the period and both contributed positively in the period. Ross Stores had some outstanding results recently, which is especially impressive given the lackluster retailing environment, and it was up over 15% from our purchase price. Our other new name, Michael Kors, finally turned around its operations and is now actually showing accelerating same-store sales, which has caused the stock to rise from its overly distressed valuation. While we bought our position after the first signs of progress, we still made close to 10% in just a few short months.

Besides the smaller energy-related names, we sold several other positions from the portfolio in the period. Long-time holdings Wal-Mart and Costco were replaced with some of our more recently added discount retailing names. American Express has been having some operational difficulties that made us more uncomfortable with the name. Meanwhile, we sold Eli Lilly – a name that we have done very well with – mostly on valuation concerns. Finally the insurance company Chubb was acquired for a significant premium and we chose not to hold on to the newly combined entity.

Although we have now dealt with trying market conditions for an extended period of time, we believe staying true to our investment philosophies is still key to obtaining the best possible investment performance for our shareholders. Thank you again for your continued confidence and trust.

Ryan Jacob

Chairman and Chief Investment Officer

Portfolio Manager

Frank Alexander

Portfolio Manager

Darren Chervitz

Portfolio Manager

Past performance is not a guarantee of future results.

Performance data reflects fee waivers and in the absence of these waivers performance would be reduced.

Must be accompanied or preceded by a prospectus.

The opinions expressed above are those of the portfolio manager and are subject to change at any time. Forecasts cannot be guaranteed and should not be considered investment advice.

Mutual fund investing involves risk; loss of principal is possible. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. There are more specific risks inherent in investing in the Internet area, particularly with respect to smaller capitalized companies and the high volatility of Internet stocks. The Funds can invest in small-and mid-cap securities which involve additional risks such as limited liquidity and greater volatility. Investments in micro capitalization companies may involve greater risks, as these companies tend to have limited product lines, markets and financial or managerial resources. Micro cap stocks often also have a more limited trading market, such that the Adviser may not be able to sell stocks at an optimal time or price. In addition, less frequently-traded securities may be subject to more abrupt price movements than securities of larger capitalized companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investments in real estate related instruments may be affected by economic, legal, cultural, environmental or technological factors that affect property values, rents or occupancies of real estate related to the Fund’s holdings. The performance of REITs depends on how well the REIT manages the properties it owns.

Fund holdings are subject to change and should not be construed as a recommendation to buy or sell any security.

Current and future portfolio holdings are subject to risk.

Please refer to the schedule of investments for complete Fund holdings information.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The NASDAQ Composite Index is a market capitalization weighted index that is designed to represent performance of the National Market System which includes over 5,000 stocks traded only over-the-counter and not on an exchange. The Russell 2000 Growth Index measures the performance of the small cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell Microcap Growth Index measures the performance of the microcap growth segment of the U.S. equity market. It includes those Russell Microcap Index companies with higher price-to-book ratios and higher forecasted growth values. It is not possible to invest directly in an index.

The Funds are distributed by Quasar Distributors, LLC.

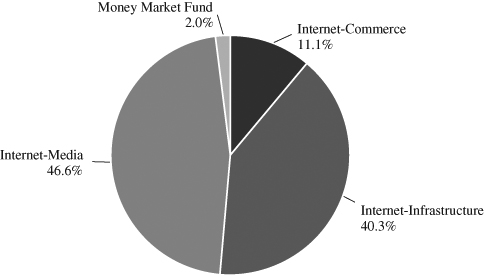

JACOB INTERNET FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 29, 2016

(as a percentage of total investments)

(Unaudited)

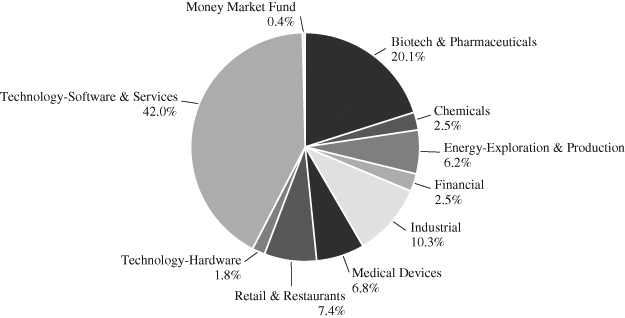

JACOB SMALL CAP GROWTH FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 29, 2016

(as a percentage of total investments)

(Unaudited)

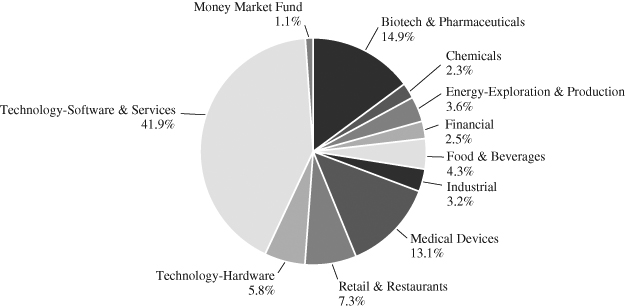

JACOB MICRO CAP GROWTH FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 29, 2016

(as a percentage of total investments)

(Unaudited)

JACOB WISDOM FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 29, 2016

(as a percentage of total investments)

(Unaudited)

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS

February 29, 2016 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS | | | | | | 98.5 | % | | | |

| | | Internet-Commerce | | | 11.1 | % | | | | | | | |

| | 2,600 | | Amazon.com, Inc.* | | | | | | | | | | $ | 1,436,552 | |

| | 25,426 | | Shutterfly, Inc.* | | | | | | | | | | | 1,129,932 | |

| | 58,500 | | Zillow Group, Inc.* | | | | | | | | | | | 1,263,600 | |

| | | | | | | | | | | | | | | 3,830,084 | |

| | | | Internet-Infrastructure | | | 40.6 | % | | | | | | | | |

| | 16,200 | | Apple Computer, Inc. | | | | | | | | | | | 1,566,378 | |

| | 182,000 | | Bazaarvoice Inc.* | | | | | | | | | | | 571,480 | |

| | 135,000 | | Castlight Health, Inc.—Class B* | | | | | | | | | | | 448,200 | |

| | 31,500 | | CEVA, Inc.* | | | | | | | | | | | 617,715 | |

| | 25,000 | | Cvent, Inc.* | | | | | | | | | | | 488,250 | |

| | 421,000 | | Digital Turbine Inc.* | | | | | | | | | | | 475,730 | |

| | 12,600 | | Ellie Mae, Inc.* | | | | | | | | | | | 1,060,038 | |

| | 55,000 | | Hortonworks Inc.* | | | | | | | | | | | 635,250 | |

| | 138,446 | | Immersion Corp.* | | | | | | | | | | | 1,247,398 | |

| | 32,281 | | LogMeIn, Inc.* | | | | | | | | | | | 1,643,103 | |

| | 386,009 | | Mitek Systems, Inc.* | | | | | | | | | | | 1,995,667 | |

| | 189,163 | | Numerex Corp.* | | | | | | | | | | | 1,110,387 | |

| | 15,000 | | Red Hat, Inc.* | | | | | | | | | | | 980,250 | |

| | 16,200 | | Salesforce.com, Inc.* | | | | | | | | | | | 1,097,550 | |

| | | | | | | | | | | | | | | 13,937,396 | |

| | | | Internet-Media | | | 46.8 | % | | | | | | | | |

| | 2,660 | | Alphabet, Inc.* | | | | | | | | | | | 1,856,068 | |

| | 17,000 | | Facebook, Inc.* | | | | | | | | | | | 1,817,640 | |

| | 13,700 | | LinkedIn Corp.* | | | | | | | | | | | 1,605,503 | |

| | 126,600 | | Pandora Media, Inc.* | | | | | | | | | | | 1,293,852 | |

| | 26,460 | | SINA Corp.*^ | | | | | | | | | | | 1,130,371 | |

| | 85,000 | | Tencent Holdings Ltd. (HK)(a) | | | | | | | | | | | 1,555,290 | |

| | 21,600 | | TripAdvisor, Inc.* | | | | | | | | | | | 1,352,160 | |

| | 98,000 | | Twitter, Inc.* | | | | | | | | | | | 1,775,760 | |

| | 57,274 | | Yahoo! Inc.* | | | | | | | | | | | 1,820,740 | |

| | 92,650 | | Yelp Inc.* | | | | | | | | | | | 1,875,236 | |

| | | | | | | | | | | | | | | 16,082,620 | |

| | | | TOTAL COMMON STOCKS (Cost $27,681,981) | | | | | | | | | | | 33,850,100 | |

The accompanying notes are an integral part of these financial statements.

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS (Continued)

February 29, 2016 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | SHORT TERM INVESTMENT | | | | | | 2.0 | % | | | |

| | | Money Market Fund | | | 2.0 | % | | | | | | | |

| | 694,011 | | Fidelity Government Portfolio-Class I, 0.21%(b) | | | | | | | | | | $ | 694,011 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $694,011) | | | | | | | | | | | 694,011 | |

| | | | TOTAL INVESTMENTS (Cost $28,375,992) | | | | | | | 100.5 | % | | | 34,544,111 | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS | | | | | | | (0.5 | )% | | | (168,045 | ) |

| | | | TOTAL NET ASSETS | | | | | | | 100.0 | % | | $ | 34,376,066 | |

| * | Non Income Producing. |

| ^ | U.S. Dollar-denominated foreign security. |

(a) | Level 2 Security. See Note 2. |

(b) | 7-day yield. |

| HK | Security denominated in Hong Kong dollars. Value translated into U.S. dollars. |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

February 29, 2016 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS | | | | | | 98.9 | % | | | |

| | | Biotech & Pharmaceuticals | | | 19.9 | % | | | | | | | |

| | 81,000 | | Array BioPharma Inc.* | | | | | | | | | | $ | 203,310 | |

| | 15,700 | | Celldex Therapeutics, Inc.* | | | | | | | | | | | 106,760 | |

| | 14,851 | | Cempra, Inc.* | | | | | | | | | | | 249,942 | |

| | 72,000 | | Codexis, Inc.* | | | | | | | | | | | 292,320 | |

| | 18,000 | | Esperion Therapeutics, Inc.* | | | | | | | | | | | 268,020 | |

| | 3,600 | | Intercept Pharmaceuticals, Inc.* | | | | | | | | | | | 400,968 | |

| | 22,800 | | Omeros Corp.* | | | | | | | | | | | 231,192 | |

| | 3,000 | | Pacira Pharmaceuticals, Inc.* | | | | | | | | | | | 156,030 | |

| | 15,200 | | Theravance Biopharma, Inc.*^ | | | | | | | | | | | 238,944 | |

| | | | | | | | | | | | | | | 2,147,486 | |

| | | | Chemicals | | | 2.4 | % | | | | | | | | |

| | 74,806 | | BioAmber Inc.* | | | | | | | | | | | 261,821 | |

| | | | | | | | | | | | | | | | |

| | | | Energy-Exploration & Production | | | 6.2 | % | | | | | | | | |

| | 11,800 | | Carrizo Oil & Gas, Inc.* | | | | | | | | | | | 253,700 | |

| | 45,324 | | Energy Recovery Inc.* | | | | | | | | | | | 329,052 | |

| | 259,250 | | Triangle Petroleum Corp.* | | | | | | | | | | | 82,960 | |

| | | | | | | | | | | | | | | 665,712 | |

| | | | Financial | | | 2.5 | % | | | | | | | | |

| | 21,594 | | First Northwest Bancorp* | | | | | | | | | | | 271,653 | |

| | | | | | | | | | | | | | | | |

| | | | Industrial | | | 10.2 | % | | | | | | | | |

| | 55,230 | | CECO Environmental Corp. | | | | | | | | | | | 342,978 | |

| | 25,000 | | MasTec, Inc.* | | | | | | | | | | | 424,500 | |

| | 13,400 | | XPO Logistics, Inc.* | | | | | | | | | | | 331,784 | |

| | | | | | | | | | | | | | | 1,099,262 | |

| | | | Medical Devices | | | 6.8 | % | | | | | | | | |

| | 26,000 | | Intersect ENT, Inc.* | | | | | | | | | | | 470,080 | |

| | 310,600 | | TearLab Corp.* | | | | | | | | | | | 260,904 | |

| | | | | | | | | | | | | | | 730,984 | |

| | | | Retail & Restaurants | | | 7.4 | % | | | | | | | | |

| | 98,590 | | Pacific Sunwear of California, Inc.* | | | | | | | | | | | 19,028 | |

| | 54,200 | | Rave Restaurant Group, Inc.* | | | | | | | | | | | 281,840 | |

| | 69,000 | | Tilly’s Inc.—Class A* | | | | | | | | | | | 496,110 | |

| | | | | | | | | | | | | | | 796,978 | |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued)

February 29, 2016 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS—(Continued) | | | | | | 98.9 | % | | | |

| | | Technology-Hardware | | | 1.8 | % | | | | | | | |

| | 10,000 | | CEVA, Inc.* | | | | | | | | | | $ | 196,100 | |

| | | | | | | | | | | | | | | | |

| | | | Technology-Software & Services | | | 41.7 | % | | | | | | | | |

| | 60,000 | | Bazaarvoice Inc.* | | | | | | | | | | | 188,400 | |

| | 51,500 | | Castlight Health, Inc.—Class B* | | | | | | | | | | | 170,980 | |

| | 8,000 | | Cvent, Inc.* | | | | | | | | | | | 156,240 | |

| | 4,000 | | Ellie Mae, Inc.* | | | | | | | | | | | 336,520 | |

| | 18,000 | | Hortonworks Inc.* | | | | | | | | | | | 207,900 | |

| | 44,329 | | Immersion Corp.* | | | | | | | | | | | 399,404 | |

| | 10,075 | | LogMeIn, Inc.* | | | | | | | | | | | 512,818 | |

| | 62,161 | | Numerex Corp.* | | | | | | | | | | | 364,885 | |

| | 40,700 | | Pandora Media, Inc.* | | | | | | | | | | | 415,954 | |

| | 8,033 | | Shutterfly, Inc.* | | | | | | | | | | | 356,987 | |

| | 8,460 | | SINA Corp.*^ | | | | | | | | | | | 361,411 | |

| | 29,850 | | Yelp Inc.* | | | | | | | | | | | 604,164 | |

| | 19,500 | | Zillow Group, Inc.* | | | | | | | | | | | 421,200 | |

| | | | | | | | | | | | | | | 4,496,863 | |

| | | | TOTAL COMMON STOCKS (Cost $14,470,151) | | | | | | | | | | | 10,666,859 | |

| | | | | | | | | | | | | | | | |

| | | | SHORT TERM INVESTMENT | | | | | | | 0.4 | % | | | | |

| | | | Money Market Fund | | | 0.4 | % | | | | | | | | |

| | 42,057 | | Fidelity Government Portfolio-Class I, 0.21%(a) | | | | | | | | | | | 42,057 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $42,057) | | | | | | | | | | | 42,057 | |

| | | | TOTAL INVESTMENTS (Cost $14,512,208) | | | | | | | 99.3 | % | | | 10,708,916 | |

| | | | OTHER ASSETS IN EXCESS OF LIABILITIES | | | | | | | 0.7 | % | | | 76,917 | |

| | | | TOTAL NET ASSETS | | | | | | | 100.0 | % | | $ | 10,785,833 | |

| * | Non Income Producing. |

| ^ | U.S. Dollar-denominated foreign security. |

(a) | 7-day yield. |

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

February 29, 2016 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS | | | | | | 99.4 | % | | | |

| | | Biotech & Pharmaceuticals | | | 15.0 | % | | | | | | | |

| | 54,000 | | Array BioPharma Inc.* | | | | | | | | | | $ | 135,540 | |

| | 14,954 | | Cancer Genetics, Inc.* | | | | | | | | | | | 32,899 | |

| | 5,121 | | Cempra, Inc.* | | | | | | | | | | | 86,187 | |

| | 45,006 | | Codexis, Inc.* | | | | | | | | | | | 182,724 | |

| | 9,000 | | Esperion Therapeutics, Inc.* | | | | | | | | | | | 134,010 | |

| | 30,000 | | Imprimis Pharmaceuticals, Inc.* | | | | | | | | | | | 122,400 | |

| | 15,000 | | Omeros Corp.* | | | | | | | | | | | 152,100 | |

| | 80,000 | | pSivida Corp.* | | | | | | | | | | | 216,800 | |

| | 10,400 | | Theravance Biopharma, Inc.*^ | | | | | | | | | | | 163,488 | |

| | | | | | | | | | | | | | | 1,226,148 | |

| | | | Chemicals | | | 2.3 | % | | | | | | | | |

| | 53,110 | | BioAmber Inc.* | | | | | | | | | | | 185,885 | |

| | | | | | | | | | | | | | | | |

| | | | Energy-Exploration & Production | | | 3.6 | % | | | | | | | | |

| | 35,000 | | Energy Recovery Inc.* | | | | | | | | | | | 254,100 | |

| | 125,888 | | Triangle Petroleum Corp.* | | | | | | | | | | | 40,284 | |

| | | | | | | | | | | | | | | 294,384 | |

| | | | Financial | | | 2.5 | % | | | | | | | | |

| | 16,112 | | First Northwest Bancorp* | | | | | | | | | | | 202,689 | |

| | | | | | | | | | | | | | | | |

| | | | Food & Beverages | | | 4.3 | % | | | | | | | | |

| | 43,013 | | Reed’s, Inc.* | | | | | | | | | | | 217,216 | |

| | 40,000 | | Senomyx, Inc.* | | | | | | | | | | | 132,800 | |

| | | | | | | | | | | | | | | 350,016 | |

| | | | Industrial | | | 3.2 | % | | | | | | | | |

| | 41,848 | | CECO Environmental Corp. | | | | | | | | | | | 259,876 | |

| | | | | | | | | | | | | | | | |

| | | | Medical Devices | | | 13.1 | % | | | | | | | | |

| | 55,671 | | Derma Sciences, Inc.* | | | | | | | | | | | 183,714 | |

| | 68,660 | | iCAD, Inc.* | | | | | | | | | | | 306,910 | |

| | 9,000 | | Intersect ENT, Inc.* | | | | | | | | | | | 162,720 | |

| | 100,000 | | Nanosphere, Inc.* | | | | | | | | | | | 71,000 | |

| | 27,350 | | STAAR Surgical Co.* | | | | | | | | | | | 170,391 | |

| | 214,000 | | TearLab Corp.* | | | | | | | | | | | 179,760 | |

| | | | | | | | | | | | | | | 1,074,495 | |

| | | | Retail & Restaurants | | | 7.4 | % | | | | | | | | |

| | 13,000 | | Jamba, Inc.* | | | | | | | | | | | 172,510 | |

| | 61,644 | | Pacific Sunwear of California, Inc.* | | | | | | | | | | | 11,897 | |

| | 32,300 | | Rave Restaurant Group, Inc.* | | | | | | | | | | | 167,960 | |

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued)

February 29, 2016 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS—(Continued) | | | | | | 99.4 | % | | | |

| | | Retail & Restaurants—(Continued) | | | 7.4 | % | | | | | | | |

| | 35,000 | | Tilly’s Inc.—Class A* | | | | | | | | | | $ | 251,650 | |

| | | | | | | | | | | | | | | 604,017 | |

| | | | Technology-Hardware | | | 5.9 | % | | | | | | | | |

| | 7,540 | | CEVA, Inc.* | | | | | | | | | | | 147,859 | |

| | 168,200 | | Lantronix, Inc.* | | | | | | | | | | | 139,606 | |

| | 149,700 | | Netlist, Inc.* | | | | | | | | | | | 193,113 | |

| | | | | | | | | | | | | | | 480,578 | |

| | | | Technology-Software & Services | | | 42.1 | % | | | | | | | | |

| | 46,000 | | Bazaarvoice Inc.* | | | | | | | | | | | 144,440 | |

| | 31,000 | | Castlight Health, Inc.—Class B* | | | | | | | | | | | 102,920 | |

| | 150,000 | | Digital Turbine Inc.* | | | | | | | | | | | 169,500 | |

| | 47,800 | | E-House (China) Holdings Ltd.—ADR^ | | | | | | | | | | | 277,718 | |

| | 14,000 | | Hortonworks Inc.* | | | | | | | | | | | 161,700 | |

| | 55,599 | | I.D. Systems, Inc.* | | | | | | | | | | | 241,300 | |

| | 33,393 | | Immersion Corp.* | | | | | | | | | | | 300,871 | |

| | 56,909 | | Jiayuan.com International Ltd.—ADR*^ | | | | | | | | | | | 413,159 | |

| | 90,826 | | Mitek Systems, Inc.* | | | | | | | | | | | 469,571 | |

| | 48,776 | | Numerex Corp.* | | | | | | | | | | | 286,315 | |

| | 41,029 | | Sajan Inc.* | | | | | | | | | | | 124,728 | |

| | 150,000 | | Sysorex Global* | | | | | | | | | | | 81,060 | |

| | 112,021 | | Top Image Systems Ltd.*^ | | | | | | | | | | | 271,091 | |

| | 100,000 | | USA Technologies, Inc.* | | | | | | | | | | | 397,000 | |

| | | | | | | | | | | | | | | 3,441,373 | |

| | | | TOTAL COMMON STOCKS (Cost $11,815,743) | | | | | | | | | | | 8,119,461 | |

| | | | | | | | | | | | | | | | |

| | | | SHORT TERM INVESTMENT | | | | | | | 1.1 | % | | | | |

| | | | Money Market Fund | | | 1.1 | % | | | | | | | | |

| | 91,134 | | Fidelity Government Portfolio-Class I, 0.21%(a) | | | | | | | | | | | 91,134 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $91,134) | | | | | | | | | | | 91,134 | |

| | | | TOTAL INVESTMENTS (Cost $11,906,877) | | | | | | | 100.5 | % | | | 8,210,595 | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS | | | | | | | (0.5 | )% | | | (39,269 | ) |

| | | | TOTAL NET ASSETS | | | | | | | 100.0 | % | | $ | 8,171,326 | |

| * | Non Income Producing. |

| ^ | U.S. Dollar-denominated foreign security. |

(a) | 7-day yield. |

| ADR | American Depositary Receipt. |

The accompanying notes are an integral part of these financial statements.

JACOB WISDOM FUND

SCHEDULE OF INVESTMENTS

February 29, 2016 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS | | | | | | 84.6 | % | | | |

| | | Beverages | | | 8.1 | % | | | | | | | |

| | 1,800 | | Anheuser-Busch InBev NV—ADR^ | | | | | | | | | | $ | 200,700 | |

| | 4,800 | | The Coca-Cola Co. | | | | | | | | | | | 207,024 | |

| | 1,800 | | Diageo plc—ADR^ | | | | | | | | | | | 184,680 | |

| | | | | | | | | | | | | | | 592,404 | |

| | | | Cable/Satellite TV | | | 2.4 | % | | | | | | | | |

| | 4,800 | | Liberty Global plc*^ | | | | | | | | | | | 172,608 | |

| | | | | | | | | | | | | | | | |

| | | | Commercial Banks | | | 1.3 | % | | | | | | | | |

| | 4,500 | | Banco Latinoamericano de Comercio Exterior SA^ | | | | | | | | | | | 96,165 | |

| | | | | | | | | | | | | | | | |

| | | | Commercial Services & Supplies | | | 9.6 | % | | | | | | | | |

| | 300 | | AutoZone, Inc.* | | | | | | | | | | | 232,371 | |

| | 900 | | The Sherwin-Williams Co. | | | | | | | | | | | 243,450 | |

| | 3,000 | | Verisk Analytics, Inc.—Class A* | | | | | | | | | | | 218,520 | |

| | | | | | | | | | | | | | | 694,341 | |

| | | | Consumer Finance | | | 5.9 | % | | | | | | | | |

| | 2,400 | | MasterCard, Inc.—Class A | | | | | | | | | | | 208,608 | |

| | 3,000 | | Visa Inc.—Class A | | | | | | | | | | | 217,170 | |

| | | | | | | | | | | | | | | 425,778 | |

| | | | Consumer Non-Cyclical | | | 3.0 | % | | | | | | | | |

| | 2,400 | | Philip Morris International Inc. | | | | | | | | | | | 218,472 | |

| | | | | | | | | | | | | | | | |

| | | | Food Products | | | 9.4 | % | | | | | | | | |

| | 4,500 | | Campbell Soup Co. | | | | | | | | | | | 277,875 | |

| | 3,000 | | Kraft Heinz Co. | | | | | | | | | | | 231,060 | |

| | 2,400 | | Mead Johnson Nutrition Co. | | | | | | | | | | | 177,024 | |

| | | | | | | | | | | | | | | 685,959 | |

| | | | Health Care Equipment & Supplies | | | 6.7 | % | | | | | | | | |

| | 1,700 | | C.R. Bard, Inc. | | | | | | | | | | | 327,046 | |

| | 2,400 | | DaVita HealthCare Partners Inc.* | | | | | | | | | | | 158,328 | |

| | | | | | | | | | | | | | | 485,374 | |

| | | | Hotels, Restaurants & Leisure | | | 3.9 | % | | | | | | | | |

| | 2,400 | | McDonald’s Corp. | | | | | | | | | | | 281,256 | |

| | | | | | | | | | | | | | | | |

| | | | Insurance | | | 1.1 | % | | | | | | | | |

| | 600 | | Berkshire Hathaway Inc.—Class B* | | | | | | | | | | | 80,502 | |

The accompanying notes are an integral part of these financial statements.

JACOB WISDOM FUND

SCHEDULE OF INVESTMENTS (Continued)

February 29, 2016 (Unaudited)

| Shares | | | | | | | | | | Value | |

| | | COMMON STOCKS—(Continued) | | | | | | 84.6 | % | | | |

| | | Machinery | | | 4.7 | % | | | | | | | |

| | 900 | | Cummins Inc. | | | | | | | | | | $ | 87,813 | |

| | 1,800 | | The Toro Co. | | | | | | | | | | | 143,460 | |

| | 1,200 | | WABCO Holdings Inc.* | | | | | | | | | | | 113,160 | |

| | | | | | | | | | | | | | | 344,433 | |

| | | | Oil, Gas & Consumable Fuels | | | 3.7 | % | | | | | | | | |

| | 1,500 | | Chevron Corp. | | | | | | | | | | | 125,160 | |

| | 1,800 | | Exxon Mobil Corp. | | | | | | | | | | | 144,270 | |

| | | | | | | | | | | | | | | 269,430 | |

| | | | Pharmaceuticals | | | 5.4 | % | | | | | | | | |

| | 4,500 | | Gilead Sciences, Inc. | | | | | | | | | | | 392,625 | |

| | | | | | | | | | | | | | | | |

| | | | Technology-Hardware & Software | | | 6.4 | % | | | | | | | | |

| | 4,800 | | Apple Computer, Inc. | | | | | | | | | | | 464,112 | |

| | | | | | | | | | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods | | | 13.0 | % | | | | | | | | |

| | 4,800 | | Kohl’s Corp. | | | | | | | | | | | 224,016 | |

| | 4,200 | | Michael Kors Holdings Limited*^ | | | | | | | | | | | 237,930 | |

| | 3,000 | | Nike, Inc.—Class B | | | | | | | | | | | 184,770 | |

| | 5,400 | | Ross Stores, Inc. | | | | | | | | | | | 296,892 | |

| | | | | | | | | | | | | | | 943,608 | |

| | | | TOTAL COMMON STOCKS (Cost $4,018,000) | | | | | | | | | | | 6,147,067 | |

| | | | | | | | | | | | | | | | |

| | | | SHORT TERM INVESTMENT | | | | | | | 16.8 | % | | | | |

| | | | Money Market Fund | | | 16.8 | % | | | | | | | | |

| | 1,226,425 | | Fidelity Government Portfolio-Class I, 0.21%(a) | | | | | | | | | | | 1,226,425 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $1,226,425) | | | | | | | | | | | 1,226,425 | |

| | | | TOTAL INVESTMENTS (Cost $5,244,425) | | | | | | | 101.4 | % | | | 7,373,492 | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS | | | | | | | (1.4 | )% | | | (105,326 | ) |

| | | | TOTAL NET ASSETS | | | | | | | 100.0 | % | | $ | 7,268,166 | |

| * | Non Income Producing. |

| ^ | U.S. Dollar-denominated foreign security. |

(a) | 7-day yield. |

| ADR | American Depositary Receipt. |

The accompanying notes are an integral part of these financial statements.

(This Page Intentionally Left Blank.)

JACOB FUNDS INC.

STATEMENTS OF ASSETS AND LIABILITIES

February 29, 2016 (Unaudited)

| | | | | | Jacob | |

| | | Jacob | | | Small Cap | |

| | | Internet Fund | | | Growth Fund | |

| Assets: | | | | | | |

| Investments, at value (cost $28,375,992 and $14,512,208, respectively) | | $ | 34,544,111 | | | $ | 10,708,916 | |

| Receivable for capital shares sold | | | 5,540 | | | | — | |

| Receivable for investments sold | | | — | | | | 80,865 | |

| Dividend and interest receivable | | | 54 | | | | 5 | |

| Receivable from Adviser | | | — | | | | 7,645 | |

| Other assets | | | 16,791 | | | | 21,343 | |

| Total Assets | | | 34,566,496 | | | | 10,818,774 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable to Adviser | | | 32,598 | | | | — | |

| Payable for distribution and shareholder servicing expenses—Investor Class (see Note 7) | | | 103,395 | | | | — | |

| Payable for capital shares repurchased | | | 3,288 | | | | 3 | |

| Accrued printing and mailing fees | | | 6,948 | | | | 1,596 | |

| Accrued transfer agent fees | | | 15,151 | | | | 10,280 | |

| Accrued expenses and other liabilities | | | 29,050 | | | | 21,062 | |

| Total Liabilities | | | 190,430 | | | | 32,941 | |

| Net Assets | | $ | 34,376,066 | | | $ | 10,785,833 | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Capital Stock | | $ | 27,890,295 | | | $ | 19,993,289 | |

| Accumulated net investment loss | | | (1,028,375 | ) | | | (508,822 | ) |

| Accumulated net realized gain (loss) on investment transactions | | | 1,346,027 | | | | (4,895,342 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 6,168,119 | | | | (3,803,292 | ) |

| Total Net Assets | | $ | 34,376,066 | | | $ | 10,785,833 | |

| | | | | | | | | |

Institutional Class(1) | | | | | | | | |

| Net Assets | | $ | — | | | $ | 6,310,832 | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | — | | | | 474,704 | |

Net asset value, redemption price and offering price per share(2) | | $ | — | | | $ | 13.29 | |

| Investor Class | | | | | | | | |

| Net Assets | | $ | 34,376,066 | | | $ | 4,475,001 | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | 10,268,708 | | | | 339,367 | |

Net asset value, redemption price and offering price per share(2) | | $ | 3.35 | | | $ | 13.19 | |

_______________

(1) | The Internet Fund currently offers Investor Class shares only. See Note 1. |

(2) | Redemption of shares held less than 30 days may be charged a 2% redemption fee. See Note 3. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF ASSETS AND LIABILITIES

February 29, 2016 (Unaudited)

| | | Jacob | | | | |

| | | Micro Cap | | | Jacob | |

| | | Growth Fund | | | Wisdom Fund | |

| Assets: | | | | | | |

| Investments, at value (cost $11,906,877 and $5,244,425, respectively) | | $ | 8,210,595 | | | $ | 7,373,492 | |

| Cash | | | — | | | | 1 | |

| Receivable for capital shares sold | | | 75 | | | | 100 | |

| Receivable for investments sold | | | 9,754 | | | | — | |

| Dividend and interest receivable | | | 17 | | | | 10,111 | |

| Other assets | | | 21,171 | | | | 11,150 | |

| Total Assets | | | 8,241,612 | | | | 7,394,854 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable for securities purchased | | | 35,374 | | | | 77,831 | |

| Payable for distribution and shareholder servicing expenses—Investor Class (see Note 7) | | | — | | | | 19,776 | |

| Payable for capital shares repurchased | | | — | | | | 50 | |

| Accrued printing and mailing fees | | | 3,002 | | | | 1,671 | |

| Accrued transfer agent fees | | | 3,954 | | | | 4,183 | |

| Accrued expenses and other liabilities | | | 27,956 | | | | 23,177 | |

| Total Liabilities | | | 70,286 | | | | 126,688 | |

| Net Assets | | $ | 8,171,326 | | | $ | 7,268,166 | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Capital Stock | | $ | 13,497,209 | | | $ | 5,228,370 | |

| Accumulated net investment loss | | | (120,739 | ) | | | (53,319 | ) |

| Accumulated net realized loss on investment transactions | | | (1,508,862 | ) | | | (35,952 | ) |

| Net unrealized appreciation (depreciation) on investments | | | (3,696,282 | ) | | | 2,129,067 | |

| Total Net Assets | | $ | 8,171,326 | | | $ | 7,268,166 | |

| | | | | | | | | |

Institutional Class(1) | | | | | | | | |

| Net Assets | | $ | 6,273,677 | | | $ | — | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | 613,445 | | | | — | |

Net asset value, redemption price and offering price per share(2) | | $ | 10.23 | | | $ | — | |

| Investor Class | | | | | | | | |

| Net Assets | | $ | 1,897,649 | | | $ | 7,268,166 | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | 201,109 | | | | 761,778 | |

Net asset value, redemption price and offering price per share(2) | | $ | 9.44 | | | $ | 9.54 | |

_______________

(1) | The Wisdom Fund currently offers Investor Class shares only. See Note 1. |

(2) | Redemption of shares held less than 30 days may be charged a 2% redemption fee. See Note 3. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF OPERATIONS

For the Six Months Ended February 29, 2016 (Unaudited)

| | | | | | Jacob | |

| | | Jacob | | | Small Cap | |

| | | Internet Fund | | | Growth Fund | |

| Investment Income: | | | | | | |

| Dividend Income | | $ | 8,463 | | | $ | 7,211 | |

| Interest income | | | 346 | | | | 12 | |

| Total Investment Income | | | 8,809 | | | | 7,223 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Investment advisor fees | | | 240,002 | | | | 62,988 | |

| Distribution and shareholder servicing expenses—Investor Class (See Note 7) | | | 67,201 | | | | 11,166 | |

| Administration fees | | | 23,390 | | | | 20,901 | |

| Fund accounting fees | | | 13,727 | | | | 16,940 | |

| Transfer agent fees | | | 61,285 | | | | 34,534 | |

| Custody fees | | | 3,542 | | | | 4,614 | |

| Federal and state registration | | | 10,641 | | | | 15,374 | |

| Insurance expense | | | 5,279 | | | | 2,357 | |

| Audit fees | | | 7,628 | | | | 7,703 | |

| Legal fees | | | 27,930 | | | | 12,025 | |

| Printing and mailing of reports to shareholders | | | 11,382 | | | | 4,268 | |

| Directors’ fees and expenses | | | 22,929 | | | | 8,866 | |

| Other | | | 122 | | | | 45 | |

| Total Expenses | | | 495,058 | | | | 201,781 | |

| Expense Waiver (See Note 6) | | | — | | | | (47,997 | ) |

| Net expenses | | | 495,058 | | | | 153,784 | |

| Net Investment Loss | | | (486,249 | ) | | | (146,561 | ) |

| | | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

| Net realized gain (loss) on investments | | | 1,667,544 | | | | (1,970,314 | ) |

| Change in net unrealized appreciation (depreciation) on investments | | | (2,751,249 | ) | | | (2,830,257 | ) |

| Net realized and unrealized loss on investments | | | (1,083,705 | ) | | | (4,800,571 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (1,569,954 | ) | | $ | (4,947,132 | ) |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF OPERATIONS

For the Six Months Ended February 29, 2016 (Unaudited)

| | | Jacob | | | | |

| | | Micro Cap | | | Jacob | |

| | | Growth Fund | | | Wisdom Fund | |

| Investment Income: | | | | | | |

| Dividend Income | | $ | 4,298 | | | $ | 66,175 | (1) |

| Interest income | | | 115 | | | | 360 | |

| Total Investment Income | | | 4,413 | | | | 66,535 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Investment advisor fees | | | 57,121 | | | | 19,652 | |

| Distribution and shareholder servicing expenses—Investor Class (See Note 7) | | | 3,839 | | | | 11,337 | |

| Administration fees | | | 20,841 | | | | 20,330 | |

| Fund accounting fees | | | 17,290 | | | | 13,869 | |

| Transfer agent fees | | | 33,026 | | | | 17,567 | |

| Custody fees | | | 3,372 | | | | 2,871 | |

| Federal and state registration | | | 15,033 | | | | 9,674 | |

| Insurance expense | | | 1,608 | | | | 1,441 | |

| Audit fees | | | 7,628 | | | | 7,653 | |

| Legal fees | | | 8,937 | | | | 7,798 | |

| Printing and mailing of reports to shareholders | | | 3,272 | | | | 2,802 | |

| Directors’ fees and expenses | | | 5,878 | | | | 4,778 | |

| Other | | | 14 | | | | 70 | |

| Total Expenses | | | 177,859 | | | | 119,842 | |

| Expense Waiver (See Note 6) | | | (57,121 | ) | | | (19,652 | ) |

| Net expenses | | | 120,738 | | | | 100,190 | |

| Net Investment Loss | | | (116,325 | ) | | | (33,655 | ) |

| | | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

| Net realized gain (loss) on investments | | | (525,374 | ) | | | 64,032 | |

| Change in net unrealized appreciation (depreciation) on investments | | | (1,779,860 | ) | | | (361,368 | ) |

| Net realized and unrealized loss on investments | | | (2,305,234 | ) | | | (297,336 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (2,421,559 | ) | | $ | (330,991 | ) |

_______________

(1) | Net of foreign tax withheld of $684 for the Wisdom Fund. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB INTERNET FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | February 29, 2016 | | | August 31, 2015 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (486,249 | ) | | $ | (813,729 | ) |

| Net realized gain on investment transactions | | | 1,667,544 | | | | 6,387,262 | |

| Change in net unrealized depreciation on investments | | | (2,751,249 | ) | | | (6,674,010 | ) |

| Net decrease in net assets resulting from operations | | | (1,569,954 | ) | | | (1,100,477 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From net realized gain | | | (4,682,043 | ) | | | (4,292,552 | ) |

| | | | | | | | | |

| Capital Share Transactions (See Note 3): | | | | | | | | |

| Proceeds from shares sold | | | 1,297,518 | | | | 2,483,271 | |

| Proceeds from reinvestment of distribution | | | 4,560,019 | | | | 4,102,934 | |

| Cost of shares redeemed | | | (4,089,372 | ) | | | (7,882,988 | ) |

| Redemption fees | | | 304 | | | | 3,453 | |

| Net increase (decrease) in net assets resulting from capital share transactions | | | 1,768,469 | | | | (1,293,330 | ) |

| | | | | | | | | |

| Net Decrease in Net Assets | | | (4,483,528 | ) | | | (6,686,359 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 38,859,594 | | | | 45,545,953 | |

| End of period* | | $ | 34,376,066 | | | $ | 38,859,594 | |

| * Includes accumulated net investment loss of: | | $ | (1,028,375 | ) | | $ | (542,126 | ) |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | February 29, 2016 | | | August 31, 2015 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (146,561 | ) | | $ | (372,196 | ) |

| Net realized gain (loss) on investment transactions | | | (1,970,314 | ) | | | 2,565,776 | |

| Change in net unrealized depreciation on investments | | | (2,830,257 | ) | | | (2,845,946 | ) |

| Net decrease in net assets resulting from operations | | | (4,947,132 | ) | | | (652,366 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From net investment income | | | (86,651 | ) | | | — | |

| | | | | | | | | |

| Capital Share Transactions (See Note 3): | | | | | | | | |

| Proceeds from shares sold | | | 138,265 | | | | 8,304,124 | |

| Proceeds from reinvestment of distribution | | | 79,101 | | | | — | |

| Cost of shares redeemed | | | (3,010,901 | ) | | | (5,693,760 | ) |

| Redemption fees | | | 6 | | | | 11,182 | |

| Net increase (decrease) in net assets resulting from capital share transactions | | | (2,793,529 | ) | | | 2,621,546 | |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets | | | (7,827,312 | ) | | | 1,969,180 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 18,613,145 | | | | 16,643,965 | |

| End of period* | | $ | 10,785,833 | | | $ | 18,613,145 | |

| * Includes accumulated net investment loss of: | | $ | (508,822 | ) | | $ | (275,610 | ) |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | February 29, 2016 | | | August 31, 2015 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (116,325 | ) | | $ | (219,035 | ) |

| Net realized gain (loss) on investment transactions | | | (525,374 | ) | | | 2,814,448 | |

| Change in net unrealized depreciation on investments | | | (1,779,860 | ) | | | (2,274,756 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (2,421,559 | ) | | | 320,657 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From net realized gain | | | (2,158,976 | ) | | | (2,473,500 | ) |

| | | | | | | | | |

| Capital Share Transactions (See Note 3): | | | | | | | | |

| Proceeds from shares sold | | | 84,839 | | | | 822,626 | |

| Proceeds from reinvestment of distribution | | | 1,996,946 | | | | 2,259,190 | |

| Cost of shares redeemed | | | (584,804 | ) | | | (2,611,413 | ) |

| Redemption fees | | | 2 | | | | 498 | |

| Net increase in net assets resulting from capital share transactions | | | 1,496,983 | | | | 470,901 | |

| | | | | | | | | |

| Net Decrease in Net Assets | | | (3,083,552 | ) | | | (1,681,942 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 11,254,878 | | | | 12,936,820 | |

| End of period* | | $ | 8,171,326 | | | $ | 11,254,878 | |

| * Includes accumulated net investment loss of: | | $ | (120,739 | ) | | $ | (4,414 | ) |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB WISDOM FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | February 29, 2016 | | | August 31, 2015 | |

| | | (Unaudited) | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (33,655 | ) | | $ | (28,854 | ) |

| Net realized gain on investment transactions | | | 64,032 | | | | 1,488,311 | |

| Change in net unrealized appreciation on investments | | | (361,368 | ) | | | (1,480,779 | ) |

| Net decrease in net assets resulting from operations | | | (330,991 | ) | | | (21,322 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From net realized gain | | | (1,441,098 | ) | | | — | |

| | | | | | | | | |

| Capital Share Transactions (See Note 3): | | | | | | | | |

| Proceeds from shares sold | | | 206,540 | | | | 162,144 | |

| Proceeds from reinvestment of distribution | | | 1,215,172 | | | | — | |

| Cost of shares redeemed | | | (2,850,619 | ) | | | (949,943 | ) |

| Redemption fees | | | 4 | | | | 21 | |

| Net decrease in net assets resulting from capital share transactions | | | (1,428,903 | ) | | | (787,778 | ) |

| | | | | | | | | |

| Net Decrease in Net Assets | | | (3,200,992 | ) | | | (809,100 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 10,469,158 | | | | 11,278,258 | |

| End of period* | | $ | 7,268,166 | | | $ | 10,469,158 | |

| * Includes accumulated net investment loss of: | | $ | (53,319 | ) | | $ | (19,664 | ) |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB INTERNET FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | February 29, | | | Year Ended August 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 3.96 | | | $ | 4.51 | | | $ | 3.81 | | | $ | 3.03 | | | $ | 2.95 | | | $ | 2.28 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.05 | ) | | | (0.08 | ) | | | (0.09 | ) | | | (0.07 | ) | | | (0.06 | ) | | | (0.08 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | (0.07 | ) | | | (0.03 | ) | | | 0.79 | | | | 0.85 | | | | 0.14 | | | | 0.75 | |

| Total from investment operations | | | (0.12 | ) | | | (0.11 | ) | | | 0.70 | | | | 0.78 | | | | 0.08 | | | | 0.67 | |

| Less distributions from net realized gain | | | (0.49 | ) | | | (0.44 | ) | | | — | | | | — | | | | — | | | | — | |

Paid in capital from redemption fees(2) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Net asset value, end of period | | $ | 3.35 | | | $ | 3.96 | | | $ | 4.51 | | | $ | 3.81 | | | $ | 3.03 | | | $ | 2.95 | |

| Total return | | | (4.13 | )%(3) | | | (2.14 | )% | | | 18.37 | % | | | 25.74 | % | | | 2.71 | % | | | 29.39 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 34,376 | | | $ | 38,860 | | | $ | 45,546 | | | $ | 40,033 | | | $ | 39,983 | | | $ | 41,266 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) to average net assets | 2.58 | %(4) | | | 2.46 | % | | | 2.42 | % | | | 2.66 | % | | | 2.87 | % | | | 2.69 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver or recoupments) to average net assets(5) | 2.58 | %(4) | | | 2.46 | % | | | 2.42 | % | | | 2.66 | % | | | 2.87 | % | | | 2.82 | % |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) to average net assets | (2.53 | )%(4) | | | (1.93 | )% | | | (2.00 | )% | | | (2.05 | )% | | | (1.99 | )% | | | (2.53 | )% |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver or recoupments) to average net assets(5) | (2.53 | )%(4) | | | (1.93 | )% | | | (2.00 | )% | | | (2.05 | )% | | | (1.99 | )% | | | (2.66 | )% |

| Portfolio turnover rate | | | 28 | %(3) | | | 50 | % | | | 56 | % | | | 44 | % | | | 56 | % | | | 52 | % |

_______________

(1) | Net investment loss per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

(2) | Less than $0.01 per share. |

(3) | Not annualized. |

(4) | Annualized. |

(5) | For the period January 1, 2010 through January 2, 2017, the Adviser has contractually agreed to waive its advisory fee in an amount up to an annual rate of 0.10% of the Fund’s average daily net assets, to the extent that the Fund’s gross operating expense ratio exceeds 2.95%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. All eligible previously waived expenses under this agreement were recouped by the Adviser during the year ended August 31, 2011. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | | | | | | | | | | November 12, | |

| | | Six Months | | | | | | | | | 2012(1) | |

| | | Ended | | | | | | | | | through | |

| | | February 29, | | | Year Ended August 31, | | | August 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | (Unaudited) | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 18.95 | | | $ | 19.01 | | | $ | 17.67 | | | $ | 12.94 | |

| | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.15 | ) | | | (0.36 | ) | | | (0.35 | ) | | | (0.22 | ) |

| Net realized and unrealized gain (loss) on investment transactions | | | (5.40 | ) | | | 0.30 | | | | 1.69 | | | | 4.95 | |

| Total from investment operations | | | (5.55 | ) | | | (0.06 | ) | | | 1.34 | | | | 4.73 | |

| Less distributions from net investment income | | | (0.11 | ) | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 13.29 | | | $ | 18.95 | | | $ | 19.01 | | | $ | 17.67 | |

| Total return | | | (29.34 | )%(3) | | | (0.32 | )% | | | 7.58 | % | | | 36.55 | %(3) |

| | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 6,311 | | | $ | 9,367 | | | $ | 10,164 | | | $ | 10,131 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) to average net assets | | | 2.75 | %(4) | | | 2.17 | % | | | 2.25 | % | | | 2.32 | %(4) |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | |

(after waiver or reimbursements) to average net assets(5) | | | 2.07 | %(4) | | | 1.95 | % | | | 1.95 | % | | | 1.95 | %(4) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) to average net assets | | | (2.64 | )%(4) | | | (2.00 | )% | | | (2.16 | )% | | | (2.20 | )%(4) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | |

(after waiver or reimbursements) to average net assets(5) | | | (1.96 | )%(4) | | | (1.78 | )% | | | (1.86 | )% | | | (1.83 | )%(4) |

| Portfolio turnover rate | | | 34 | %(3) | | | 84 | % | | | 86 | % | | | 81 | %(3) |

_______________

(1) | Commencement of operations of the Small Cap Growth Fund Institutional Class. The Class I shares of the Jacob Small Cap Growth Fund II, (formerly, PineBridge US Small Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) was reorganized into Institutional Class shares of the Small Cap Growth Fund on November 12, 2012. On July 9, 2012, before the reorganization, the adviser of the Jacob Small Cap Growth Fund II changed from PineBridge Investments, LLC to Jacob Asset Management of New York LLC (the “Adviser”). |

(2) | Net investment loss per share represents net investment loss divided by average shares outstanding throughout the period. |

(3) | Not annualized. |

(4) | Annualized. |

(5) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2017, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 1.95%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | February 29, | | | Year Ended August 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013(1) | | | 2012 | | | 2011 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 18.81 | | | $ | 18.91 | | | $ | 17.63 | | | $ | 13.87 | | | $ | 15.12 | | | $ | 10.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.18 | ) | | | (0.43 | ) | | | (0.40 | ) | | | (0.35 | ) | | | (0.47 | ) | | | (0.55 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | (5.34 | ) | | | 0.30 | | | | 1.68 | | | | 4.11 | | | | (0.15 | ) | | | 4.75 | |

| Total from investment operations | | | (5.52 | ) | | | (0.13 | ) | | | 1.28 | | | | 3.76 | | | | (0.62 | ) | | | 4.20 | |

Less distributions from net investment income | | | (0.10 | ) | | | — | | | | — | | | | — | | | | (0.63 | ) | | | — | |

| Paid in capital from redemption fees | | | 0.00 | (3) | | | 0.03 | | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.02 | |

| Net asset value, end of period | | $ | 13.19 | | | $ | 18.81 | | | $ | 18.91 | | | $ | 17.63 | | | $ | 13.87 | | | $ | 15.12 | |

| Total return | | | (29.46 | )%(4) | | | (0.53 | )% | | | 7.26 | % | | | 27.11 | % | | | (3.75 | )% | | | 38.72 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 4,475 | | | $ | 9,246 | | | $ | 6,480 | | | $ | 7,236 | | | $ | 5,384 | | | $ | 7,013 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver or reimbursements) to average net assets | | | 3.04 | %(5) | | | 2.48 | % | | | 2.59 | % | | | 2.97 | % | | | 4.28 | % | | | 4.45 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver or reimbursements) to average net assets | | | 2.35 | %(5)(6) | | | 2.25 | %(6) | | | 2.25 | %(6) | | | 2.47 | %(6)(7) | | | 3.38 | %(7) | | | 3.55 | %(7) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(prior to waiver or reimbursements) to average net assets | | | (2.94 | )%(5) | | | (2.31 | )% | | | (2.51 | )% | | | (2.86 | )% | | | (4.27 | )% | | | (4.44 | )% |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver or reimbursements) to average net assets(6) | | | (2.25% | )(5) | | | (2.08 | )%(6) | | | (2.17 | )%(6) | | | (2.36 | )%(6)(7) | | | (3.37 | )%(7) | | | (3.54 | )%(7) |

| Portfolio turnover rate | | | 34 | %(4) | | | 84 | % | | | 86 | % | | | 81 | % | | | 78 | % | | | 103 | % |

_______________

(1) | On November 12, 2012, Class R shares of the Jacob Small Cap Growth Fund II (formerly, PineBridge US Small Cap Growth Fund) series of Jacob Funds II (formerly, PineBridgeMutual Funds) were reorganized into Investor Class shares of the Small Cap Growth Fund. Activity after November 12, 2012 reflects the Funds’ combined operations. |

(2) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

(3) | Amount is less than $0.01. |

(4) | Not annualized. |

(5) | Annualized. |

(6) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2017, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.25%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(7) | The Adviser contractually agreed, through November 11, 2012, to waive its advisory fees in an amount up to an annual rate of 0.90% of the Fund’s average daily net assets, to the extent that the Fund’s operating expense ratio exceeds 2.45%. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | | | | | | | | Nine Months | | | | | | | | | | |

| | | Ended | | | Year Ended | | | Ended | | | | | | | | | | |

| | | February 29, | | | August 31, | | | August 31, | | | Year Ended November 30, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013* | | | 2012(1) | | | 2011(1) | | | 2010(1) | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 16.86 | | | $ | 20.65 | | | $ | 25.31 | | | $ | 19.11 | | | $ | 18.19 | | | $ | 17.82 | | | $ | 13.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.16 | ) | | | (0.32 | ) | | | (0.45 | ) | | | (0.27 | ) | | | (0.31 | ) | | | (0.30 | ) | | | (0.20 | ) |

Net realized and unrealized gain (loss) on | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| investment transactions | | (3.18 | ) | | | 0.67 | | | | 0.75 | | | | 6.47 | | | | 1.23 | | | | 0.67 | | | | 4.84 | |

Total from investment operations | | | (3.34 | ) | | | 0.35 | | | | 0.30 | | | | 6.20 | | | | 0.92 | | | | 0.37 | | | | 4.64 | |

Less distributions from net realized gain | | | (3.29 | ) | | | (4.14 | ) | | | (4.96 | ) | | | — | | | | — | | | | — | | | | — | |

Net asset value, end of period | | $ | 10.23 | | | $ | 16.86 | | | $ | 20.65 | | | $ | 25.31 | | | $ | 19.11 | | | $ | 18.19 | | | $ | 17.82 | |

| Total return | | | (22.11 | )%(3) | | | 2.23 | % | | | 0.11 | % | | | 32.44 | %(3) | | | 5.06 | % | | | 2.08 | % | | | 35.20 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | $ | 6,274 | | | $ | 8,651 | | | $ | 9,979 | | | $ | 10,800 | | | $ | 40,666 | | | $ | 50,065 | | | $ | 51,300 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 3.66 | %(4) | | | 2.97 | % | | | 2.79 | % | | | 3.01 | %(4) | | | 2.12 | % | | | 1.79 | % | | | 1.89 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 2.46 | %(4)(5) | | | 2.15 | %(5) | | | 2.15 | %(5) | | | 2.28 | %(4)(5) | | | 1.72 | %(5)(6) | | | 1.60 | %(6) | | | 1.60 | %(6) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (3.56 | )%(4) | | | (2.51 | )% | | | (2.61 | )% | | | (2.46 | )%(4) | | | (1.95 | )% | | | (1.72 | )%(7) | | | (1.64 | )%(7) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (2.36 | )%(4)(5) | | | (1.69 | )%(5) | | | (1.97 | )%(5) | | | (1.73 | )%(4)(5) | | | (1.55 | )%(5)(6) | | | (1.53 | )%(6) | | | (1.35 | )%(6) |

| Portfolio turnover rate | | | 21 | %(3) | | | 84 | % | | | 66 | % | | | 40 | %(3) | | | 115 | % | | | 165 | % | | | 216 | % |

_______________

| * | The Micro Cap Growth Fund’s predecessor fund had a fiscal year end of November 30, so the activity begins on December 1, 2012 and the numbers shown are for the nine month period. The fiscal year was changed to August 31 to align with the other Jacob Funds. |

(1) | The financial highlights set forth herein include the historical financial highlights of the Jacob Micro Cap Growth Fund (formerly, PineBridge US Micro Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) (the “Predecessor Fund”). The Predecessor Fund was reorganized into the Micro Cap Growth Fund on November 12, 2012. On July 9, 2012, before the reorganization, the adviser changed from PineBridge Investments, LLC to Jacob Asset Management of New York LLC (the “Adviser”). Information prior to November 12, 2012 reflects the performance of the Predecessor Fund’s Class I shares. |

(2) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

(3) | Not annualized. |

(4) | Annualized. |

(5) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2017, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.15%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(6) | Prior to November 12, 2012, the previous adviser and the Adviser agreed to waive operating expenses over 1.60% of the Fund’s average daily net assets. |

(7) | Unaudited. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | | | | | | | | Nine Months | | | | | | | | | | |

| | | Ended | | | Year Ended | | | Ended | | | | | | | | | | |

| | | February 29, | | | August 31, | | | August 31, | | | Year Ended November 30, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013* | | | 2012(1) | | | 2011(1) | | | 2010(1) | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 15.87 | | | $ | 19.73 | | | $ | 24.47 | | | $ | 18.51 | | | $ | 17.68 | | | $ | 17.36 | | | $ | 12.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.17 | ) | | | (0.35 | ) | | | (0.49 | ) | | | (0.37 | ) | | | (0.37 | ) | | | (0.35 | ) | | | (0.25 | ) |

Net realized and unrealized gain (loss) on | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| investment transactions | | (2.97 | ) | | | 0.63 | | | | 0.71 | | | | 6.33 | | | | 1.20 | | | | 0.67 | | | | 4.73 | |

Total from investment operations | | | (3.14 | ) | | | 0.28 | | | | 0.22 | | | | 5.96 | | | | 0.83 | | | | 0.32 | | | | 4.48 | |

Less distributions from net realized gain | | | (3.29 | ) | | | (4.14 | ) | | | (4.96 | ) | | | — | | | | — | | | | — | | | | — | |

Paid in capital from redemption fees(3) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Net asset value, end of period | | $ | 9.44 | | | $ | 15.87 | �� | | $ | 19.73 | | | $ | 24.47 | | | $ | 18.51 | | | $ | 17.68 | | | $ | 17.36 | |

| Total return | | | (22.23 | )%(4) | | | 1.93 | % | | | (0.25 | )% | | | 32.20 | %(4) | | | 4.69 | % | | | 1.84 | % | | | 34.78 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 1,898 | | | $ | 2,603 | | | $ | 2,958 | | | $ | 3,573 | | | $ | 4,356 | | | $ | 9,339 | | | $ | 9,282 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 4.01 | %(5) | | | 3.32 | % | | | 3.14 | % | | | 3.65 | %(5) | | | 2.47 | % | | | 2.12 | % | | | 2.24 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 2.81 | %(5)(6) | | | 2.45 | %(6) | | | 2.45 | %(6) | | | 2.63 | %(5)(6) | | | 2.07 | %(6)(7) | | | 1.88 | %(7) | | | 1.90 | %(7) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (3.91 | )%(5) | | | (2.86 | )% | | | (2.96 | )% | | | (3.34 | )%(5) | | | (2.30 | )% | | | (2.05 | )%(8) | | | (2.01 | )%(8) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver or reimbursements) | | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (2.71 | )%(5)(6) | | | (1.99 | )%(6) | | | (2.27 | )%(6) | | | (2.32 | )%(5)(6) | | | (1.90 | )%(6)(7) | | | (1.81 | )%(7) | | | (1.67 | )%(7) |

| Portfolio turnover rate | | | 21 | %(4) | | | 84 | % | | | 66 | % | | | 40 | %(4) | | | 115 | % | | | 165 | % | | | 216 | % |

_______________

| * | The Micro Cap Growth Fund’s predecessor fund had a fiscal year end of November 30, so the activity begins on December 1, 2012 and the numbers shown are for the nine month period. The fiscal year was changed to August 31 to align with the other Jacob Funds. |

(1) | The financial highlights set forth herein include the historical financial highlights of the Jacob Micro Cap Growth Fund (formerly, PineBridge US Micro Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) (the “Predecessor Fund”). The Predecessor Fund was reorganized into the Micro Cap Growth Fund on November 12, 2012. On July 9, 2012, before the reorganization, the adviser changed from PineBridge Investments, LLC to Jacob Asset Management of New York LLC (the “Adviser”). Information prior to November 12, 2012 reflects the performance of the Predecessor Fund’s Class R shares. |

(2) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

(3) | Less than $0.01 per share. |

(4) | Not annualized. |

(5) | Annualized. |

(6) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2017, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.45%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(7) | Prior to November 12, 2012, the previous adviser and the Adviser agreed to waive operating expenses over 1.90% of the Fund’s average daily net assets. |

(8) | Unaudited. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB WISDOM FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | February 29, | | | Year Ended August 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 12.24 | | | $ | 12.29 | | | $ | 10.62 | | | $ | 9.96 | | | $ | 8.81 | | | $ | 7.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.05 | )(2) | | | (0.03 | )(1) | | | (0.02 | )(2) | | | 0.20 | (2) | | | 0.16 | (2) | | | 0.08 | (2) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | (0.39 | ) | | | (0.02 | ) | | | 1.88 | | | | 0.62 | | | | 1.08 | | | | 1.10 | |

| Total from investment operations | | | (0.44 | ) | | | (0.05 | ) | | | 1.86 | | | | 0.82 | | | | 1.24 | | | | 1.18 | |

| Less distributions from net investment income | | | — | | | | — | | | | (0.19 | ) | | | (0.16 | ) | | | (0.09 | ) | | | — | |

| Less distributions from net realized gain | | | (2.26 | ) | | | — | | | | — | | | | — | | | | — | | | | (0.02 | ) |

| Total distributions | | | (2.26 | ) | | | — | | | | (0.19 | ) | | | (0.16 | ) | | | (0.09 | ) | | | (0.02 | ) |

| Net asset value, end of period | | $ | 9.54 | | | $ | 12.24 | | | $ | 12.29 | | | $ | 10.62 | | | $ | 9.96 | | | $ | 8.81 | |

| Total return | | | (3.98 | )%(3) | | | (0.41 | )% | | | 17.60 | % | | | 8.40 | % | | | 14.08 | % | | | 15.40 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |