UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09447

Jacob Funds Inc.

(Exact name of Registrant as specified in charter)

C/O Jacob Asset Management of New York LLC

727 2nd Street #106

Hermosa Beach, CA 90254

(Address of principal executive offices) (Zip code)

Ryan Jacob

C/O Jacob Asset Management of New York LLC

727 2nd Street #106

Hermosa Beach, CA 90254

(Name and address of agent for service)

(424) 237-2164

Registrant's telephone number, including area code

Date of fiscal year end: August 31

Date of reporting period: February 28, 2018

Item 1. Reports to Stockholders.

Jacob Internet Fund

Jacob Small Cap Growth Fund

Jacob Micro Cap Growth Fund

Semi-Annual Report

February 28, 2018

The Jacob Internet Fund, Jacob Small Cap Growth Fund and

Jacob Micro Cap Growth Fund are mutual funds with the

primary investment objective of long-term growth of capital.

The Jacob Internet Fund has current income as a secondary objective.

Investment Adviser

Jacob Asset Management of New York LLC

TABLE OF CONTENTS

| Letter From the Manager | 1 |

| Industry Breakdowns | 4 |

| Schedules of Investments | 7 |

| Statements of Assets and Liabilities | 17 |

| Statements of Operations | 18 |

| Statements of Changes in Net Assets | 19 |

| Financial Highlights | 22 |

| Notes to the Financial Statements | 27 |

| Additional Information on Fund Expenses | 40 |

| Additional Information | 42 |

Dear Fellow Investors,

For most of the fiscal period (six month period ended February 28, 2018), the equity markets had a quite impressive run, with most indices rising between 10-15% through January. Starting in February, however, we experienced a notable pick up in volatility around higher short- and long-term interest rates and which subsequently was exacerbated by privacy issues among large tech companies and concerns regarding a possible trade war. Considering the market strength for much of 2017, and the corresponding rise in valuations, it is not surprising that the markets would be in a more vulnerable position. While we believe that this market turbulence will be short lived given the underlying strength of the US and global economies, one byproduct of this shift in market character has been the underperformance of larger cap names. This is something we have been anticipating for quite some time and we believe will likely continue if interest rates move higher. Accordingly, we continue to increase small company exposure for all of the Jacob Funds to seek to better take advantage of these trends.

Jacob Internet Fund

The Jacob Internet Fund was up 11.51% for the fiscal period ended February 28, 2018, while the NASDAQ returned 13.72%. While the Fund performed well on an absolute basis, it was another difficult period to be compared to other indices, such as the NASDAQ and the S&P 500. Additionally, we did reduce some of our larger positions during the period, including Apple, Facebook and Google to reflect growing concerns regarding their ability to continue expanding their valuations. We maintained a significant portion of the Fund’s portfolio in small and mid-sized companies that, while contributing to our positive returns, could not match the recent gains of the larger index components. A key part of the Fund’s strategy has always been to seek out early-stage businesses that have the potential for a more meaningful impact on the Fund’s performance. We believe this more diverse mix of market caps will provide us the opportunity to significantly outperform over the long term.

As for individual stocks, one of our best-performing names over the period was a controversial name that we had been adding to through some difficult times: Twitter. Though not regarded as a top-tier technology player, Twitter has regained stability after recent operating difficulties and concerns about user experience. Now generating substantial profits and showing improving user growth trends, Twitter has been reembraced by investors, and was up over 88% in this fiscal period. Smaller positions that are also owned in the Jacob Micro Cap Growth Fund, Digital Turbine and USA Technologies, were up 94% and 50%, respectively in the period. We also had two of our newer cloud-based software names Instructure (education market) and Tabula Rasa (drug delivery) both contribute over 40% during the period.

Thankfully, most of the worst performers in the period were also some of our smallest size positions. Pandora’s performance continued to be weak following the acquisition of a large portion of the company’s equity by satellite radio service provider SiriusXM, contributing to a 48% loss in the period. We have subsequently reduced the position size further and will consider exiting completely following the upcoming Spotify initial public offering (IPO). Expedia, down 29% for the period, has recently guided to more spending in 2018 which was negatively interpreted by investors. As we believe this investment period will be temporary, we are comfortable keeping Expedia as a modest holding and would consider adding to the position on further weakness. Additional small company positions, such as Mitek Systems, Radisys and Netlist, down 25%, 45% and 58%, respectively also had a negative impact on performance and will be discussed in more detail in the Jacob Micro Cap Growth Fund section.

Jacob Small Cap Growth Fund

The Jacob Small Cap Growth Fund was up 13.79% for the fiscal period ended February 28, 2018 while the Russell 2000 Growth Index was up 11.32%. The Fund’s performance was fairly broad based, with the top 10 performers all up over 40% for the period. Healthcare and Consumer names stood out, with small cap tech names having a more difficult time keeping up. The top performing stock was Ignyta, up over 134%, as it received a takeover proposal from Roche. Two of the Fund’s larger healthcare holdings, Codexis and Esperion, were up 72% and 63%, respectively during the

period. Another long time holding, XPO Logistics, was up over 60% over the period and was recently sold by the Fund as it exceeded our market capitalization guidelines. Two of the Fund’s restaurant holdings, BJ’s and Chuy’s rebounded strongly in the period up over 40%.

Besides names like Pandora and Mitek that we mentioned above, a couple of pharmaceutical names were some of the worst performers. Omeros, which lost reimbursement for its major product, was down over 50% for the period. In the last month, that reimbursement has been restated, and given the excitement we have about the company’s pipeline, we have recently added back to the position. Intercept Pharmaceuticals, down over 48%, has suffered from a lack of near-term catalysts and concerns regarding increased competition. In both cases, these were some of the Fund’s smallest positions and had limited impact on performance in the period.

Jacob Micro Cap Growth Fund

The Jacob Micro Cap Growth Fund rebounded even more strongly, posting a 18.56% return for the fiscal period ended February 28, 2018, while the Russell Micro Cap Growth Index was up 8.21%.

It is nearly impossible to discern industry- or theme-specific trends by looking at the performance of individual sectors or market cap categories, and we believe going forward that bottoms-up stock picking will be even more crucial in delivering relative outperformance. All of our top 10 performing positions were up 60% or more in the period, and several of those were top holdings of the Fund. The Fund’s biggest position, Codexis, was up 69% and we remain bullish on the prospects for the developer of proprietary protein enzymes. The company has done a remarkable job signing up partnerships with most of the big pharmaceutical names and has recently had success expanding their business in new areas, such as food, biotech and even spearheading their own drug development programs. Another top performer was Senomyx, a company that has had its share of issues in the past but saw some excitement over the continued development of its natural monk fruit-based sweetener called siratose. While an expected partnership to help fund siratose failed to materialize, we still believe in the value of the company’s assets in a world where sugar is increasingly being villainized. Senomyx has currently engaged investment bankers to explore ways to realize value, including a possible sale of the company, and we expect that they will have a number of interested bidders.

Among the worst performers were two names that had to deal with severe stress due to balance sheet concerns: BioAmber and Real Industry, both down more than 95% during the period. Fortunately, both positions were rather small given our increased focus over the past two years on limiting exposure to overleveraged companies. We completely sold out of our position in BioAmber given that we do not believe there is a realistic path for the company to be able to sell enough of their bio-based succinic acid to pay back their still high debt load. Meanwhile, we have actually added to our position in Real Industry, which filed for bankruptcy last year. The company’s issues were almost entirely due to their high debt levels as the aluminum scrap market has been getting healthier for quite some time, and it appears that the most likely settlement arising from the bankruptcy process will give enough of a stake in the new company to leave room for a fair amount of upside.

As always, we believe that staying true to our investment philosophy and process is still key to obtaining the best possible long-term investment performance for our shareholders. Thank you again for your continued confidence and trust.

Ryan Jacob

Chairman and Chief Investment Officer

Portfolio Manager

Frank Alexander

Portfolio Manager

Darren Chervitz

Portfolio Manager

Past performance is not a guarantee of future results.

Performance data reflects fee waivers and in the absence of these waivers performance would be reduced.

Diversification does not assure a profit or protect against a loss in a declining market.

Must be accompanied or preceded by a prospectus.

The opinions expressed above are those of the portfolio manager and are subject to change at any time. Forecasts cannot be guaranteed and should not be considered investment advice.

Mutual fund investing involves risk; loss of principal is possible. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. There are more specific risks inherent in investing in the Internet area, particularly with respect to smaller capitalized companies and the high volatility of Internet stocks. The Funds can invest in small-and mid-cap securities which involve additional risks such as limited liquidity and greater volatility. Investments in micro capitalization companies may involve greater risks, as these companies tend to have limited product lines, markets and financial or managerial resources. Micro cap stocks often also have a more limited trading market, such that the Adviser may not be able to sell stocks at an optimal time or price. In addition, less frequently-traded securities may be subject to more abrupt price movements than securities of larger capitalized companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities.

Fund holdings are subject to change and should not be construed as a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

Please refer to the schedule of investments for complete Fund holdings information.

The NASDAQ Composite Index is a market capitalization weighted index that is designed to represent performance of the National Market System which includes over 5,000 stocks traded only over-the-counter and not on an exchange. The Russell 2000 Growth Index measures the performance of the small cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell Microcap Growth Index measures the performance of the microcap growth segment of the U.S. equity market. It includes those Russell Microcap Index companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. It is not possible to invest directly in an index.

The Funds are distributed by Quasar Distributors, LLC.

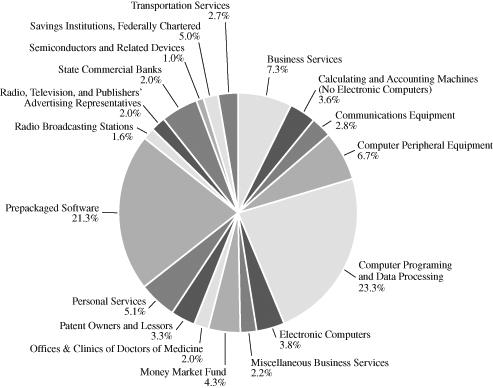

JACOB INTERNET FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 28, 2018

(as a percentage of total investments)

(Unaudited)

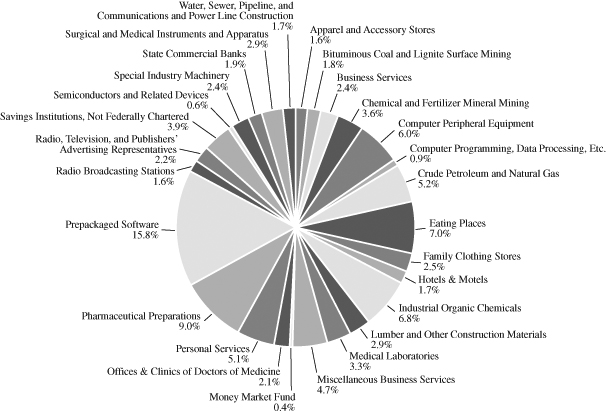

JACOB SMALL CAP GROWTH FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 28, 2018

(as a percentage of total investments)

(Unaudited)

JACOB MICRO CAP GROWTH FUND

INDUSTRY BREAKDOWN AS OF FEBRUARY 28, 2018

(as a percentage of total investments)

(Unaudited)

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS(+)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | COMMON STOCKS | | | 97.7 | % | | | |

| | | Business Services | | | 7.4% | | | |

| | 10,000 | | PayPal Holdings, Inc.* | | | | | | $ | 794,100 | |

| | 56,049 | | Reis, Inc. | | | | | | | 1,078,943 | |

| | 31,975 | | Zillow Group, Inc.—Class C* | | | | | | | 1,524,248 | |

| | | | | | | | | | | 3,397,291 | |

| | | | Calculating and Accounting | | | | | | | | |

| | | | Machines (No Electronic Computers) | | | 3.7% | | | | |

| | 206,000 | | USA Technologies, Inc.* | | | | | | | 1,678,900 | |

| | | | Communications Equipment | | | 2.8% | | | | |

| | 176,740 | | I.D. Systems, Inc.* | | | | | | | 1,291,969 | |

| | | | Computer Peripheral Equipment | | | 6.9% | | | | |

| | 107,411 | | Immersion Corp.* | | | | | | | 1,244,893 | |

| | 203,409 | | Mitek Systems, Inc.* | | | | | | | 1,556,079 | |

| | 400,000 | | Radisys Corp.* | | | | | | | 344,000 | |

| | | | | | | | | | | 3,144,972 | |

| | | | Computer Programing and Data Processing | | | 23.8% | | | | |

| | 2,200 | | Alphabet, Inc.—Class C* | | | | | | | 2,430,406 | |

| | 11,600 | | Facebook, Inc.—Class A* | | | | | | | 2,068,512 | |

| | 7,000 | | Red Hat, Inc.* | | | | | | | 1,031,800 | |

| | 30,000 | | Tencent Holdings Ltd. (HK)(a) | | | | | | | 1,641,256 | |

| | 10,800 | | TripAdvisor, Inc.* | | | | | | | 432,864 | |

| | 103,200 | | Twitter, Inc.* | | | | | | | 3,287,952 | |

| | | | | | | | | | | 10,892,790 | |

| | | | Electronic Computers | | | 3.9% | | | | |

| | 10,000 | | Apple, Inc. | | | | | | | 1,781,200 | |

| | | | Miscellaneous Business Services | | | 2.3% | | | | |

| | 220,000 | | Helios & Matheson Analytics, Inc.* | | | | | | | 1,047,200 | |

| | | | Offices & Clinics of Doctors of Medicine | | | 2.0% | | | | |

| | 23,400 | | Teladoc, Inc.* | | | | | | | 938,340 | |

| | | | Patent Owners and Lessors | | | 3.4% | | | | |

| | 694,596 | | Digital Turbine, Inc.* | | | | | | | 1,562,841 | |

| | | | Personal Services | | | 5.2% | | | | |

| | 55,000 | | Yelp, Inc.—Class A* | | | | | | | 2,395,800 | |

The accompanying notes are an integral part of these financial statements.

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | COMMON STOCKS—(Continued) | | | 97.7 | % | | | |

| | | Prepackaged Software | | | 21.8% | | | |

| | 128,100 | | Hortonworks, Inc.* | | | | | | $ | 2,303,238 | |

| | 20,600 | | Instructure, Inc.* | | | | | | | 894,040 | |

| | 8,556 | | LogMeIn, Inc. | | | | | | | 988,646 | |

| | 18,000 | | Paylocity Holding Corp.* | | | | | | | 841,860 | |

| | 8,300 | | salesforce.com, Inc.* | | | | | | | 964,875 | |

| | 11,260 | | SINA Corp.*^ | | | | | | | 1,316,632 | |

| | 25,400 | | Tabula Rasa HealthCare, Inc.* | | | | | | | 820,674 | |

| | 54,000 | | Twilio Inc.—Class A* | | | | | | | 1,844,640 | |

| | | | | | | | | | | 9,974,605 | |

| | | | Radio Broadcasting Stations | | | 1.6% | | | | |

| | 165,400 | | Pandora Media, Inc.* | | | | | | | 729,414 | |

| | | | Radio, Television, and Publishers’ | | | | | | | | |

| | | | Advertising Representatives | | | 2.1% | | | | |

| | 76,000 | | Yext, Inc.* | | | | | | | 965,200 | |

| | | | Savings Institutions, Federally Chartered | | | 5.1% | | | | |

| | 45,000 | | E*TRADE Financial Corp.* | | | | | | | 2,350,350 | |

| | | | Semiconductors and Related Devices | | | 1.0% | | | | |

| | 7,600 | | CEVA, Inc.* | | | | | | | 279,300 | |

| | 594,000 | | Netlist, Inc.* | | | | | | | 175,527 | |

| | | | | | | | | | | 454,827 | |

| | | | State Commercial Banks | | | 2.0% | | | | |

| | 24,356 | | First Internet Bancorp | | | | | | | 921,875 | |

| | | | Transportation Services | | | 2.7% | | | | |

| | 11,900 | | Expedia, Inc. | | | | | | | 1,251,523 | |

| | | | TOTAL COMMON STOCKS (Cost $26,146,954) | | | | | | | 44,779,097 | |

The accompanying notes are an integral part of these financial statements.

JACOB INTERNET FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | SHORT TERM INVESTMENT | | | 4.4 | % | | | |

| | | Money Market Fund | | | 4.4% | | | |

| | 1,993,255 | | Fidelity Government Portfolio-Class I, 1.26%(b) | | | | | | $ | 1,993,255 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $1,993,255) | | | | | | | 1,993,255 | |

| | | | TOTAL INVESTMENTS (Cost $28,140,209) | | | 102.1 | % | | | 46,772,352 | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS | | | (2.1 | )% | | | (943,465 | ) |

| | | | TOTAL NET ASSETS | | | 100.0 | % | | $ | 45,828,887 | |

| * | Non Income Producing. |

| ^ | U.S. Dollar-denominated foreign security. |

| HK | Security denominated in Hong Kong dollars. Value translated into U.S. dollars. |

| (a) | Level 2 Security. See Note 2. |

| (b) | 7-day yield. |

| (+) | Schedule of Investments is classified using the U.S. Securities and Exchange Commission’s Standard Industrial Classification (SIC) Code List. |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | COMMON STOCKS | | | 100.6 | % | | | |

| | | Apparel and Accessory Stores | | | 1.6% | | | |

| | 18,000 | | Tilly’s, Inc.—Class A | | | | | | $ | 234,900 | |

| | | | Bituminous Coal and Lignite Surface Mining | | | 1.8% | | | | |

| | 2,800 | | Arch Coal, Inc.—Class A | | | | | | | 267,988 | |

| | | | Business Services | | | 2.4% | | | | |

| | 18,721 | | Reis, Inc. | | | | | | | 360,379 | |

| | | | Chemical and Fertilizer Mineral Mining | | | 3.6% | | | | |

| | 11,000 | | Lithium Americas Corp.*^ | | | | | | | 68,970 | |

| | 16,000 | | Nexa Resources SA*^ | | | | | | | 328,000 | |

| | 30,000 | | Orocobre Ltd.*^ | | | | | | | 145,260 | |

| | | | | | | | | | | 542,230 | |

| | | | Computer Peripheral Equipment | | | 6.1% | | | | |

| | 36,483 | | Immersion Corp.* | | | | | | | 422,838 | |

| | 64,000 | | Mitek Systems, Inc.* | | | | | | | 489,600 | |

| | | | | | | | | | | 912,438 | |

| | | | Computer Programming, Data Processing, Etc. | | | 0.9% | | | | |

| | 3,500 | | TripAdvisor, Inc.* | | | | | | | 140,280 | |

| | | | Crude Petroleum and Natural Gas | | | 5.3% | | | | |

| | 26,600 | | Carrizo Oil & Gas, Inc.* | | | | | | | 373,730 | |

| | 30,000 | | Oasis Petroleum, Inc.* | | | | | | | 236,400 | |

| | 12,400 | | Ring Energy, Inc.* | | | | | | | 168,268 | |

| | 2,100 | | Rosehill Resources, Inc.—Class A* | | | | | | | 12,978 | |

| | | | | | | | | | | 791,376 | |

| | | | Eating Places | | | 7.0% | | | | |

| | 8,000 | | BJ’s Restaurants, Inc. | | | | | | | 348,000 | |

| | 14,800 | | Chuy’s Holdings, Inc.* | | | | | �� | | 399,600 | |

| | 31,900 | | El Pollo Loco Holdings, Inc.* | | | | | | | 311,025 | |

| | | | | | | | | | | 1,058,625 | |

| | | | Family Clothing Stores | | | 2.5% | | | | |

| | 20,000 | | American Eagle Outfitters, Inc. | | | | | | | 385,400 | |

| | | | Hotels & Motels | | | 1.7% | | | | |

| | 27,000 | | Red Lion Hotels Corp.* | | | | | | | 261,900 | |

| | | | Industrial Organic Chemicals | | | 6.9% | | | | |

| | 108,046 | | Codexis, Inc.* | | | | | | | 1,031,839 | |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | COMMON STOCKS—(Continued) | | | 100.6 | % | | | |

| | | Lumber and Other Construction Materials | | | 2.9% | | | |

| | 94,000 | | Aspen Aerogels, Inc.* | | | | | | $ | 432,400 | |

| | | | Medical Laboratories | | | 3.3% | | | | |

| | 84,867 | | CareDx, Inc.* | | | | | | | 493,926 | |

| | | | Miscellaneous Business Services | | | 4.8% | | | | |

| | 73,000 | | Helios & Matheson Analytics, Inc.* | | | | | | | 347,480 | |

| | 8,600 | | NV5 Global, Inc.* | | | | | | | 371,950 | |

| | | | | | | | | | | 719,430 | |

| | | | Offices & Clinics of Doctors of Medicine | | | 2.1% | | | | |

| | 8,000 | | Teladoc, Inc.* | | | | | | | 320,800 | |

| | | | Personal Services | | | 5.2% | | | | |

| | 17,850 | | Yelp, Inc.—Class A* | | | | | | | 777,546 | |

| | | | Pharmaceutical Preparations | | | 9.1% | | | | |

| | 20,800 | | ChemoCentryx, Inc.* | | | | | | | 202,176 | |

| | 8,800 | | Esperion Therapeutics, Inc.* | | | | | | | 707,608 | |

| | 2,600 | | Intercept Pharmaceuticals, Inc.* | | | | | | | 155,298 | |

| | 16,000 | | Mersana Therapeutics, Inc.* | | | | | | | 276,960 | |

| | 2,975 | | Omeros Corp.* | | | | | | | 30,047 | |

| | | | | | | | | | | 1,372,089 | |

| | | | Prepackaged Software | | | 15.9% | | | | |

| | 42,100 | | Hortonworks, Inc.* | | | | | | | 756,958 | |

| | 7,100 | | Instructure, Inc.* | | | | | | | 308,140 | |

| | 1,200 | | LogMeIn, Inc. | | | | | | | 138,660 | |

| | 6,150 | | Paylocity Holding Corp.* | | | | | | | 287,636 | |

| | 8,800 | | Tabula Rasa HealthCare, Inc.* | | | | | | | 284,328 | |

| | 18,000 | | Twilio, Inc.—Class A* | | | | | | | 614,880 | |

| | | | | | | | | | | 2,390,602 | |

| | | | Radio Broadcasting Stations | | | 1.6% | | | | |

| | 55,700 | | Pandora Media, Inc.* | | | | | | | 245,637 | |

| | | | Radio, Television, and Publishers’ Advertising Representatives | | | 2.2% | | | | |

| | 26,000 | | Yext, Inc.* | | | | | | | 330,200 | |

| | | | Savings Institutions, Not Federally Chartered | | | 4.0% | | | | |

| | 9,500 | | Entegra Financial Corp.* | | | | | | | 266,950 | |

| | 20,686 | | First Northwest Bancorp* | | | | | | | 330,976 | |

| | | | | | | | | | | 597,926 | |

The accompanying notes are an integral part of these financial statements.

JACOB SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | COMMON STOCKS—(Continued) | | | 100.6 | % | | | |

| | | Semiconductors and Related Devices | | | 0.6% | | | |

| | 2,600 | | CEVA, Inc.* | | | | | | $ | 95,550 | |

| | | | Special Industry Machinery | | | 2.4% | | | | |

| | 53,124 | | Energy Recovery, Inc.* | | | | | | | 364,431 | |

| | | | State Commercial Banks | | | 2.0% | | | | |

| | 7,775 | | First Internet Bancorp | | | | | | | 294,284 | |

| | | | Surgical and Medical Instruments and Apparatus | | | 3.0% | | | | |

| | 94,000 | | Alphatec Holdings, Inc.* | | | | | | | 299,860 | |

| | 4,000 | | Intersect ENT, Inc.* | | | | | | | 147,400 | |

| | | | | | | | | | | 447,260 | |

| | | | Water, Sewer, Pipeline, and Communications | | | | | | | | |

| | | | and Power Line Construction | | | 1.7% | | | | |

| | 5,000 | | MasTec, Inc.* | | | | | | | 254,750 | |

| | | | TOTAL COMMON STOCKS (Cost $12,372,434) | | | | | | | 15,124,186 | |

| | | | | | | | | | | | |

| | | | WARRANTS | | | 0.0% | | | | |

| | 12,750 | | TearLab Corp.*(a) | | | | | | | — | |

| | | | TOTAL WARRANTS (Cost $0) | | | | | | | — | |

| | | | | | | | | | | | |

| | | | SHORT TERM INVESTMENT | | | 0.4 | % | | | | |

| | | | Money Market Fund | | | 0.4% | | | | |

| | 66,004 | | Fidelity Government Portfolio-Class I, 1.26%(b) | | | | | | | 66,004 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $66,004) | | | | | | | 66,004 | |

| | | | TOTAL INVESTMENTS (Cost $12,438,438) | | | 101.0 | % | | | 15,190,190 | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS | | | (1.0 | )% | | | (153,356 | ) |

| | | | TOTAL NET ASSETS | | | 100.0 | % | | $ | 15,036,834 | |

| * | Non Income Producing. |

| ^ | U.S. Dollar-denominated foreign security. |

| (a) | Level 3 Security. See Note 2. |

| (b) | 7-day yield. |

| (+) | Schedule of Investments is classified using the U.S. Securities and Exchange Commission’s Standard Industrial Classification (SIC) Code List. |

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | COMMON STOCKS | | | 96.9 | % | | | |

| | | Advertising | | | 1.2% | | | |

| | 28,428 | | IZEA, Inc.* | | | | | | $ | 101,772 | |

| | | | Apparel and Accessory Stores | | | 2.2% | | | | |

| | 14,000 | | Tilly’s, Inc.—Class A | | | | | | | 182,700 | |

| | | | Bituminous Coal & Lignite Mining | | | 1.1% | | | | |

| | 13,000 | | Ramaco Resources, Inc.* | | | | | | | 89,050 | |

| | | | Business Services | | | 2.4% | | | | |

| | 10,249 | | Reis, Inc. | | | | | | | 197,293 | |

| | | | Calculating and Accounting Machines | | | | | | | | |

| | | | (No Electronic Computers) | | | 6.6% | | | | |

| | 67,000 | | USA Technologies, Inc.* | | | | | | | 546,050 | |

| | | | Chemical and Fertilizer Mineral Mining | | | 0.9% | | | | |

| | 42,000 | | Advantage Lithium Corp.*^ | | | | | | | 36,511 | |

| | 6,000 | | Lithium Americas Corp.*^ | | | | | | | 37,620 | |

| | | | | | | | | | | 74,131 | |

| | | | Commercial Physical and Biological Research | | | 2.2% | | | | |

| | 155,000 | | Senomyx, Inc.* | | | | | | 184,450 | |

| | | | Communications Equipment | | | 4.1% | | | | |

| | 46,599 | | I.D. Systems, Inc.* | | | | | | | 340,639 | |

| | | | Computer Communications Equipment | | | 3.1% | | | | |

| | 110,200 | | Lantronix, Inc.* | | | | | | | 257,868 | |

| | | | Computer Peripheral Equipment | | | 8.9% | | | | |

| | 17,274 | | Immersion Corp.* | | | | | | | 200,206 | |

| | 30,425 | | Mitek Systems, Inc.* | | | | | | | 232,751 | |

| | 142,000 | | Radisys Corp.* | | | | | | | 122,120 | |

| | 168,021 | | Top Image Systems Ltd.*^ | | | | | | | 176,422 | |

| | | | | | | | | | | 731,499 | |

| | | | Eating and Drinking Places | | | 1.5% | | | | |

| | 14,000 | | Jamba, Inc.* | | | | | | | 120,680 | |

| | | | Eating Places | | | 7.1% | | | | |

| | 4,600 | | BJ’s Restaurants, Inc. | | | | | | | 200,100 | |

| | 7,900 | | Chuy’s Holdings, Inc.* | | | | | | | 213,300 | |

| | 17,500 | | El Pollo Loco Holdings, Inc.* | | | | | | | 170,625 | |

| | | | | | | | | | | 584,025 | |

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | COMMON STOCKS—(Continued) | | | 96.9 | % | | | |

| | | Electrical Apparatus and Equipment Wiring Supplies | | | 0.3% | | | |

| | 120,000 | | Real Industry, Inc.* | | | | | | $ | 28,200 | |

| | | | Gold and Silver Ores | | | 1.0% | | | | |

| | 150,000 | | Solitario Zinc Corp.* | | | | | | | 79,500 | |

| | | | Help Supply Services | | | 0.9% | | | | |

| | 22,000 | | Staffing 360 Solutions, Inc.* | | | | | | | 69,740 | |

| | | | Hotels & Motels | | | 1.8% | | | | |

| | 15,000 | | Red Lion Hotels Corp.* | | | | | | | 145,500 | |

| | | | Industrial Organic Chemicals | | | 6.7% | | | | |

| | 57,506 | | Codexis, Inc.* | | | | | | | 549,182 | |

| | | | Laboratory Analytical Instruments | | | 1.0% | | | | |

| | 80,000 | | pSivida Corp.* | | | | | | | 84,000 | |

| | | | Lumber and Other Construction Materials | | | 2.8% | | | | |

| | 51,000 | | Aspen Aerogels, Inc.* | | | | | | | 234,600 | |

| | | | Medical Laboratories | | | 3.3% | | | | |

| | 46,333 | | CareDx, Inc.* | | | | | | | 269,658 | |

| | | | Medicinal Chemicals and Botanical Products | | | 1.7% | | | | |

| | 25,000 | | ChromaDex Corp.* | | | | | | | 136,250 | |

| | | | Metal Mining | | | 0.4% | | | | |

| | 38,000 | | Wealth Minerals Ltd.*^ | | | | | | | 37,103 | |

| | | | Miscellaneous Business Services | | | 2.0% | | | | |

| | 16,750 | | Helios & Matheson Analytics, Inc.* | | | | | | | 79,730 | |

| | 1,900 | | NV5 Global, Inc.* | | | | | | | 82,175 | |

| | | | | | | | | | | 161,905 | |

| | | | Ophthalmic Goods | | | 1.2% | | | | |

| | 6,350 | | STAAR Surgical Co.* | | | | | | | 99,695 | |

| | | | Patent Owners and Lessors | | | 4.7% | | | | |

| | 172,300 | | Digital Turbine, Inc.* | | | | | | | 387,675 | |

| | | | Pharmaceutical Preparations | | | 5.0% | | | | |

| | 11,000 | | ChemoCentryx, Inc.* | | | | | | | 106,920 | |

| | 71,389 | | Imprimis Pharmaceuticals, Inc.* | | | | | | | 129,928 | |

| | 9,000 | | Mersana Therapeutics, Inc.* | | | | | | | 155,790 | |

| | 1,625 | | Omeros Corp.* | | | | | | | 16,412 | |

| | | | | | | | | | | 409,050 | |

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | COMMON STOCKS—(Continued) | | | 96.9 | % | | | |

| | | Prepackaged Software | | | 6.4% | | | |

| | 13,000 | | Hortonworks, Inc.* | | | | | | $ | 233,740 | |

| | 3,600 | | Instructure, Inc.* | | | | | | | 156,240 | |

| | 4,400 | | Tabula Rasa HealthCare, Inc.* | | | | | | | 142,164 | |

| | | | | | | | | | | 532,144 | |

| | | | Radio, Television, and Publishers’ | | | | | | | | |

| | | | Advertising Representatives | | | 2.1% | | | | |

| | 14,000 | | Yext, Inc.* | | | | | | | 177,800 | |

| | | | Savings Institutions, Not Federally Chartered | | | 3.6% | | | | |

| | 4,500 | | Entegra Financial Corp.* | | | | | | | 126,450 | |

| | 10,522 | | First Northwest Bancorp* | | | | | | | 168,352 | |

| | | | | | | | | | | 294,802 | |

| | | | Semiconductors and Related Devices | | | 1.0% | | | | |

| | 1,340 | | CEVA, Inc.* | | | | | | | 49,245 | |

| | 120,700 | | Netlist, Inc.* | | | | | | | 35,667 | |

| | | | | | | | | | | 84,912 | |

| | | | Special Industry Machinery | | | 2.3% | | | | |

| | 28,000 | | Energy Recovery, Inc.* | | | | | | | 192,080 | |

| | | | State Commercial Banks | | | 1.9% | | | | |

| | 4,215 | | First Internet Bancorp | | | | | | | 159,538 | |

| | | | Surgical and Medical Instruments and Apparatus | | | 5.5% | | | | |

| | 50,000 | | Alphatec Holdings, Inc.* | | | | | | | 159,500 | |

| | 61,160 | | iCAD, Inc.* | | | | | | | 209,779 | |

| | 2,300 | | Intersect ENT, Inc.* | | | | | | | 84,755 | |

| | | | | | | | | | | 454,034 | |

| | | | TOTAL COMMON STOCKS (Cost $7,288,793) | | | | | | | 7,997,525 | |

| | | | | | | | | | | | |

| | | | WARRANTS | | | 0.0% | | | | |

| | 9,750 | | TearLab Corp.*(a) | | | | | | | — | |

| | | | TOTAL WARRANTS (Cost $0) | | | | | | | — | |

The accompanying notes are an integral part of these financial statements.

JACOB MICRO CAP GROWTH FUND

SCHEDULE OF INVESTMENTS(+) (Continued)

February 28, 2018 (Unaudited)

| Shares | | | | | | | Value | |

| | | SHORT TERM INVESTMENT | | | 3.4 | % | | | |

| | | Money Market Fund | | | 3.4% | | | |

| | 276,957 | | Fidelity Government Portfolio-Class I, 1.26%(b) | | | | | | $ | 276,957 | |

| | | | TOTAL SHORT TERM INVESTMENT (Cost $276,957) | | | | | | | 276,957 | |

| | | | TOTAL INVESTMENTS (Cost $7,565,750) | | | 100.3 | % | | | 8,274,482 | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS | | | (0.3 | )% | | | (23,059 | ) |

| | | | TOTAL NET ASSETS | | | 100.0 | % | | $ | 8,251,423 | |

| * | Non Income Producing. |

| ^ | U.S. Dollar-denominated foreign security. |

| (a) | Level 3 Security. See Note 2. |

| (b) | 7-day yield. |

| (+) | Schedule of Investments is classified using the U.S. Securities and Exchange Commission’s Standard Industrial Classification (SIC) Code List. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF ASSETS AND LIABILITIES

February 28, 2018 (Unaudited)

| | | | | | Jacob | | | Jacob | |

| | | Jacob | | | Small Cap | | | Micro Cap | |

| | | Internet Fund | | | Growth Fund | | | Growth Fund | |

| Assets: | | | | | | | | | |

| Investments, at value (cost $28,140,209, | | | | | | | | | |

| $12,438,438 and $7,565,750, respectively) | | $ | 46,772,352 | | | $ | 15,190,190 | | | $ | 8,274,482 | |

| Receivable for capital shares sold | | | 7,130 | | | | — | | | | — | |

| Receivable for investments sold | | | — | | | | 207,134 | | | | 114,603 | |

| Dividend and interest receivable | | | 1,678 | | | | 1,164 | | | | 502 | |

| Prepaid expenses and other assets | | | 17,811 | | | | 22,533 | | | | 24,026 | |

| Total Assets | | | 46,798,971 | | | | 15,421,021 | | | | 8,413,613 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payable for securities purchased | | | 749,242 | | | | 239,209 | | | | 129,694 | |

| Payable to adviser | | | 43,774 | | | | 2,237 | | | | — | |

| Payable for distribution and shareholder | | | | | | | | | | | | |

| servicing expenses—Investor Class (see Note 7) | | | 84,442 | | | | — | | | | — | |

| Payable for capital shares repurchased | | | — | | | | 105,267 | | | | 24 | |

| Accrued audit fees | | | 7,687 | | | | 7,687 | | | | 7,687 | |

| Accrued directors fees | | | 13,922 | | | | 4,991 | | | | 2,759 | |

| Accrued expenses and other liabilities | | | 71,017 | | | | 24,796 | | | | 22,026 | |

| Total Liabilities | | | 970,084 | | | | 384,187 | | | | 162,190 | |

| Net Assets | | $ | 45,828,887 | | | $ | 15,036,834 | | | $ | 8,251,423 | |

| | | | | | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | | | | | |

| Capital Stock | | $ | 26,413,766 | | | $ | 15,588,341 | | | $ | 10,232,197 | |

| Accumulated net investment loss | | | (1,348,669 | ) | | | (426,466 | ) | | | (84,128 | ) |

| Accumulated net realized gain (loss) on investment transactions | | | 2,131,647 | | | | (2,876,793 | ) | | | (2,605,378 | ) |

| Net unrealized appreciation on investments | | | 18,632,143 | | | | 2,751,752 | | | | 708,732 | |

| Total Net Assets | | $ | 45,828,887 | | | $ | 15,036,834 | | | $ | 8,251,423 | |

| | | | | | | | | | | | | |

Institutional Class(1) | | | | | | | | | | | | |

| Net Assets | | $ | — | | | $ | 10,552,424 | | | $ | 6,637,970 | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | — | | | | 500,211 | | | | 493,897 | |

Net asset value, redemption price and offering price per share(2) | | $ | — | | | $ | 21.10 | | | $ | 13.44 | |

| | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | |

| Net Assets | | $ | 45,828,887 | | | $ | 4,484,410 | | | $ | 1,613,453 | |

| Shares outstanding (20 billion shares of $0.001 par value authorized) | | | 9,758,933 | | | | 215,639 | | | | 130,827 | |

Net asset value, redemption price and offering price per share(2) | | $ | 4.70 | | | $ | 20.80 | | | $ | 12.33 | |

_______________

(1) | The Internet Fund currently offers Investor Class shares only. See Note 1. |

(2) | Redemption of shares held less than 30 days may be charged a 2% redemption fee. See Note 3. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

STATEMENTS OF OPERATIONS

For the Six Months Ended February 28, 2018 (Unaudited)

| | | | | | Jacob | | | Jacob | |

| | | Jacob | | | Small Cap | | | Micro Cap | |

| | | Internet Fund | | | Growth Fund | | | Growth Fund | |

| Investment Income: | | | | | | | | | |

| Dividend income | | $ | 40,484 | | | $ | 36,112 | | | $ | 18,079 | |

| Interest income | | | 10,076 | | | | 823 | | | | 3,142 | |

| Total Investment Income | | | 50,560 | | | | 36,935 | | | | 21,221 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment advisor fees | | | 278,773 | | | | 60,607 | | | | 45,347 | |

| Distribution and shareholder servicing expenses—Investor Class (See Note 7) | | | 55,755 | | | | 5,698 | | | | 2,094 | |

| Administration fees | | | 30,785 | | | | 19,819 | | | | 18,774 | |

| Fund accounting fees | | | 14,341 | | | | 17,239 | | | | 17,239 | |

| Transfer agent fees | | | 57,751 | | | | 33,312 | | | | 27,563 | |

| Custody fees | | | 3,781 | | | | 3,562 | | | | 3,310 | |

| Federal and state registration | | | 10,702 | | | | 18,745 | | | | 15,938 | |

| Insurance expense | | | 6,401 | | | | 2,368 | | | | 1,180 | |

| Audit fees | | | 7,687 | | | | 7,687 | | | | 7,687 | |

| Legal fees | | | 59,900 | | | | 14,830 | | | | 3,251 | |

| Printing and mailing of reports to shareholders | | | 7,909 | | | | 3,807 | | | | 1,480 | |

| Directors’ fees and expenses | | | 28,008 | | | | 9,027 | | | | 5,204 | |

| Miscellaneous expenses | | | 5,703 | | | | 2,496 | | | | 1,629 | |

| Total Expenses | | | 567,496 | | | | 199,197 | | | | 150,696 | |

| Expense Waiver (See Note 6) | | | — | | | | (44,530 | ) | | | (45,347 | ) |

| Net Expenses | | | 567,496 | | | | 154,667 | | | | 105,349 | |

| Net Investment Loss | | | (516,936 | ) | | | (117,732 | ) | | | (84,128 | ) |

| | | | | | | | | | | | | |

| Realized and Unrealized Gain on Investments: | | | | | | | | | | | | |

| Net realized gain on investments | | | 4,553,775 | | | | 1,116,721 | | | | 71,203 | |

| Change in net unrealized appreciation on investments | | | 851,528 | | | | 950,117 | | | | 1,359,366 | |

| Net realized and unrealized gain on investments | | | 5,405,303 | | | | 2,066,838 | | | | 1,430,569 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 4,888,367 | | | $ | 1,949,106 | | | $ | 1,346,441 | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB INTERNET FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | February 28, 2018 | | | Year Ended | |

| | | (Unaudited) | | | August 31, 2017 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (516,936 | ) | | $ | (912,041 | ) |

| Net realized gain on investment transactions | | | 4,553,775 | | | | 4,727,164 | |

| Change in net unrealized appreciation on investments | | | 851,528 | | | | 1,429,836 | |

| Net increase in net assets resulting from operations | | | 4,888,367 | | | | 5,244,959 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From net realized gain: | | | (5,003,092 | ) | | | (1,931,879 | ) |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 450,122 | | | | 2,727,085 | |

| Proceeds from reinvestment of distribution | | | 4,841,339 | | | | 1,892,600 | |

| Cost of shares redeemed | | | (2,953,982 | ) | | | (7,858,648 | ) |

| Redemption fees | | | 87 | | | | 13,627 | |

| Net increase (decrease) in net assets resulting from capital share transactions | | | 2,337,566 | | | | (3,225,336 | ) |

| | | | | | | | | |

| Net Increase in Net Assets | | | 2,222,841 | | | | 87,744 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 43,606,046 | | | | 43,518,302 | |

| End of period* | | $ | 45,828,887 | | | $ | 43,606,046 | |

| * Includes accumulated net investment loss of: | | $ | (1,348,669 | ) | | $ | (831,733 | ) |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | February 28, 2018 | | | Year Ended | |

| | | (Unaudited) | | | August 31, 2017 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (117,732 | ) | | $ | (258,741 | ) |

| Net realized gain on investment transactions | | | 1,116,721 | | | | 510,017 | |

| Change in net unrealized appreciation on investments | | | 950,117 | | | | 1,241,947 | |

| Net increase in net assets resulting from operations | | | 1,949,106 | | | | 1,493,223 | |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 213,868 | | | | 199,143 | |

| Cost of shares redeemed | | | (1,932,493 | ) | | | (3,891,298 | ) |

| Redemption fees | | | 97 | | | | 231 | |

Other transactions(1) | | | — | | | | 4,846 | |

| Net decrease in net assets resulting from capital share transactions | | | (1,718,528 | ) | | | (3,687,078 | ) |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets | | | 230,578 | | | | (2,193,855 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 14,806,256 | | | | 17,000,111 | |

| End of period* | | $ | 15,036,834 | | | $ | 14,806,256 | |

| * Includes accumulated net investment loss of: | | $ | (426,466 | ) | | $ | (308,734 | ) |

_______________

(1) | Reimbursement from U.S. Bancorp Fund Services, LLC due to NAV Error. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | February 28, 2018 | | | Year Ended | |

| | | (Unaudited) | | | August 31, 2017 | |

Operations: | | | | | | |

| Net investment loss | | $ | (84,128 | ) | | $ | (194,849 | ) |

| Net realized gain (loss) on investment transactions | | | 71,203 | | | | (1,259,469 | ) |

| Change in net unrealized appreciation on investments | | | 1,359,366 | | | | 851,584 | |

| Net increase (decrease) in net assets resulting from operations | | | 1,346,441 | | | | (602,734 | ) |

| | | | | | | | | |

| Capital Share Transactions: (Note 3) | | | | | | | | |

| Proceeds from shares sold | | | 550,511 | | | | 149,937 | |

| Cost of shares redeemed | | | (1,029,338 | ) | | | (982,732 | ) |

| Net decrease in net assets resulting from capital share transactions | | | (478,827 | ) | | | (832,795 | ) |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets | | | 867,614 | | | | (1,435,529 | ) |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 7,383,809 | | | | 8,819,338 | |

| End of period* | | $ | 8,251,423 | | | $ | 7,383,809 | |

| * Includes accumulated net investment loss of: | | $ | (84,128 | ) | | $ | — | |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB INTERNET FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | February 28, | | | Year Ended August 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 4.76 | | | $ | 4.39 | | | $ | 3.96 | | | $ | 4.51 | | | $ | 3.81 | | | $ | 3.03 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.05 | )(4) | | | (0.10 | )(4) | | | (0.10 | )(1) | | | (0.08 | )(1) | | | (0.09 | )(1) | | | (0.07 | )(1) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 0.55 | | | | 0.67 | | | | 1.02 | | | | (0.03 | ) | | | 0.79 | | | | 0.85 | |

| Total from investment operations | | | 0.50 | | | | 0.57 | | | | 0.92 | | | | (0.11 | ) | | | 0.70 | | | | 0.78 | |

| Less distributions from net realized gains | | | (0.56 | ) | | | (0.20 | ) | | | (0.49 | ) | | | (0.44 | ) | | | — | | | | — | |

Paid in capital from redemption fees(2) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Net asset value, end of period | | $ | 4.70 | | | $ | 4.76 | | | $ | 4.39 | | | $ | 3.96 | | | $ | 4.51 | | | $ | 3.81 | |

| Total return | | | 11.51 | %(5) | | | 13.65 | % | | | 25.31 | % | | | (2.14 | )% | | | 18.37 | % | | | 25.74 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 45,829 | | | $ | 43,606 | | | $ | 43,518 | | | $ | 38,860 | | | $ | 45,546 | | | $ | 40,033 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver) to average net assets | | | 2.54 | %(6) | | | 2.38 | % | | | 2.60 | % | | | 2.46 | % | | | 2.42 | % | | | 2.66 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(3) | | | 2.54 | %(6) | | | 2.38 | % | | | 2.60 | % | | | 2.46 | % | | | 2.42 | % | | | 2.66 | % |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver) to average net assets | | | (2.32 | )%(6) | | | (2.15 | )% | | | (2.47 | )% | | | (1.93 | )% | | | (2.00 | )% | | | (2.05 | )% |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(3) | | | (2.32 | )%(6) | | | (2.15 | )% | | | (2.47 | )% | | | (1.93 | )% | | | (2.00 | )% | | | (2.05 | )% |

| Portfolio turnover rate | | | 30 | %(5) | | | 46 | % | | | 43 | % | | | 50 | % | | | 56 | % | | | 44 | % |

_______________

(1) | Net investment loss per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

(2) | Less than $0.01 per share. |

(3) | For the period September 1, 2011 through January 2, 2019, the Adviser has contractually agreed to waive its advisory fee in an amount up to an annual rate of 0.10% of the Fund’s average daily net assets, to the extent that the Fund’s gross operating expense ratio exceeds 2.95%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(4) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

(5) | Not annualized |

(6) | Annualized. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | | | | | | | | | | | | | | | | November 12, | |

| | | Six Months | | | | | | | | | | | | | | | 2012(2) | |

| | | Ended | | | | | | | | | | | | | | | through | |

| | | February 28, | | | Year Ended August 31, | | | August 31, | |

| | | 2018 | | | 2017 | | | 2016(1) | | | 2015 | | | 2014 | | | 2013 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 18.52 | | | $ | 16.82 | | | $ | 18.95 | | | $ | 19.01 | | | $ | 17.67 | | | $ | 12.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(3) | | | (0.15 | ) | | | (0.27 | ) | | | (0.29 | ) | | | (0.36 | ) | | | (0.35 | ) | | | (0.22 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 2.73 | | | | 1.97 | | | | (1.73 | ) | | | (0.30 | )(4) | | | 1.69 | | | | 4.95 | |

| Total from investment operations | | | 2.58 | | | | 1.70 | | | | (2.02 | ) | | | (0.06 | ) | | | 1.34 | | | | 4.73 | |

| Less distributions from return on capital | | | — | | | | — | | | | (0.11 | ) | | | — | | | | — | | | | — | |

| Paid in capital from redemption fees | | | 0.00 | (10) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 21.10 | | | $ | 18.52 | | | $ | 16.82 | | | $ | 18.95 | | | $ | 19.01 | | | $ | 17.67 | |

| Total return | | | 13.91 | %(5)(6) | | | 10.11 | %(5) | | | (10.64 | )%(5) | | | (0.32 | )% | | | 7.58 | % | | | 36.55 | %(6) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 10,552 | (7) | | $ | 10,480 | | | $ | 12,012 | | | $ | 9,367 | | | $ | 10,164 | | | $ | 10,131 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver) to average net assets | | | 2.55 | %(7) | | | 2.59 | % | | | 2.94 | % | | | 2.17 | % | | | 2.25 | % | | | 2.32 | %(7) |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(8) | | | 1.95 | %(7) | | | 1.95 | % | | | 2.04 | % | | | 1.95 | % | | | 1.95 | % | | | 1.95 | %(7) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver) to average net assets | | | (2.06 | )%(7) | | | (2.19 | )% | | | (2.80 | )% | | | (2.00 | )% | | | (2.16 | )% | | | (2.20 | )%(7) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(8) | | | (1.46 | )%(7) | | | (1.55 | )% | | | (1.90 | )% | | | (1.78 | )% | | | (1.86 | )% | | | (1.83 | )%(7) |

Portfolio turnover rate(9) | | | 43 | %(6) | | | 60 | % | | | 58 | % | | | 84 | % | | | 86 | % | | | 81 | %(6) |

_______________

(1) | On August 29, 2016, Investor Class shares of the Jacob Wisdom Fund series of Jacob Funds Inc. were reorganized into Institutional Class Shares of the Small Cap Growth Fund. See Note 8. |

(2) | Commencement of operations of the Small Cap Growth Fund Institutional Class. The Class I shares of the Jacob Small Cap Growth Fund II, (formerly, PineBridge US Small Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) was reorganized into Institutional Class shares of the Small Cap Growth Fund on November 12, 2012. On July 9, 2012, before the reorganization, the adviser of the Jacob Small Cap Growth Fund II changed from PineBridge Investments, LLC to Jacob Asset Management of New York LLC (the “Adviser”). |

(3) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

(4) | Due to timing of capital share transactions, the per share amount of net realized and unrealized gain on investment transactions varies from the amount shown in the statement of changes in net assets. |

(5) | Includes adjustments in accordance with GAAP and, consequently, the net asset values used for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for the shareholder transactions. |

(6) | Not annualized. |

(7) | Annualized. |

(8) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2019, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 1.95%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(9) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between classes of shares issued. |

(10) | Less than $0.01 per share. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB SMALL CAP GROWTH FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | February 28, | | | Year Ended August 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013(1) | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 18.28 | | | $ | 16.66 | | | $ | 18.81 | | | $ | 18.91 | | | $ | 17.63 | | | $ | 13.87 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.17 | ) | | | (0.32 | ) | | | (0.34 | ) | | | (0.43 | ) | | | (0.40 | ) | | | (0.35 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investment transactions | | | 2.69 | | | | 1.94 | | | | (1.71 | ) | | | 0.30 | (8) | | | 1.68 | | | | 4.11 | |

| Total from investment operations | | | 2.52 | | | | 1.62 | | | | (2.05 | ) | | | (0.13 | ) | | | 1.28 | | | | 3.76 | |

Less distributions from net investment income | | | — | | | | — | | | | (0.10 | ) | | | — | | | | — | | | | — | |

| Paid in capital from redemption fees | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.03 | | | | 0.00 | (3) | | | 0.00 | (3) |

| Net asset value, end of period | | $ | 20.80 | | | $ | 18.28 | | | $ | 16.66 | | | $ | 18.81 | | | $ | 18.91 | | | $ | 17.63 | |

| Total return | | | 13.76 | %(9)(4) | | | 9.72 | %(4) | | | (10.90 | )%(4) | | | (0.53 | )% | | | 7.26 | % | | | 27.11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 4,484 | (10) | | $ | 4,326 | | | $ | 4,988 | | | $ | 9,246 | | | $ | 6,480 | | | $ | 7,236 | |

| Ratio of gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver) to average net assets | | | 2.80 | %(10) | | | 2.84 | % | | | 3.23 | % | | | 2.48 | % | | | 2.59 | % | | | 2.97 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(5) | | | 2.25 | %(10) | | | 2.25 | % | | | 2.33 | % | | | 2.25 | % | | | 2.25 | % | | | 2.47 | %(6) |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| (prior to waiver) to average net assets | | | (2.31 | )%(10) | | | (2.44 | )% | | | (3.10 | )% | | | (2.31 | )% | | | (2.51 | )% | | | (2.86 | )% |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

(after waiver) to average net assets(5) | | | (1.76 | )%(10) | | | (1.85 | )% | | | (2.20 | )% | | | (2.08 | )% | | | (2.17 | )% | | | (2.36 | )%(6) |

Portfolio turnover rate(8) | | | 43 | %(9) | | | 60 | % | | | 58 | % | | | 84 | % | | | 86 | % | | | 81 | % |

_______________

(1) | On November 12, 2012, Class R shares of the Jacob Small Cap Growth Fund II (formerly, PineBridge US Small Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) were reorganized into Investor Class shares of the Small Cap Growth Fund. Activity after November 12, 2012 reflects the Funds’ combined operations. |

(2) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

(3) | Amount is less than $0.01. |

(4) | Includes adjustments in accordance with GAAP and, consequently, the net asset values used for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for the shareholder transactions. |

(5) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through January 2, 2019, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.25%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(6) | The Adviser contractually agreed, through November 11, 2012, to waive its advisory fees in an amount up to an annual rate of 0.90% of the Fund’s average daily net assets, to the extent that the Fund’s operating expense ratio exceeds 2.45%. |

(7) | Due to timing of capital share transactions, the per share amount of net realized and unrealized gain on investment transactions varies from the amount shown in the statement of changes in net assets. |

(8) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between classes of shares issued. |

(9) | Not annualized. |

(10) | Annualized. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | | | | | | | | | | | | | | | | Nine | | | | |

| | | Six Months | | | | | | | | | | | | | | | Months | | | | |

| | | Ended | | | | | | | | | | | | | | | Ended | | | Year Ended | |

| | | February 28, | | | Year Ended August 31, | | | August 31, | | | November 30, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013* | | | 2012(1) | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.32 | | | $ | 12.11 | | | $ | 16.86 | | | $ | 20.65 | | | $ | 25.31 | | | $ | 19.11 | | | $ | 18.19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.13 | ) | | | (0.28 | ) | | | (0.31 | ) | | | (0.32 | ) | | | (0.45 | ) | | | (0.27 | ) | | | (0.31 | ) |

Net realized and unrealized gain (loss) on investment transactions | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2.25 | | | | (0.51 | ) | | | (1.15 | ) | | | 0.67 | | | | 0.75 | | | | 6.47 | | | | 1.23 | |

| Total from investment operations | | | 2.12 | | | | (0.79 | ) | | | (1.46 | ) | | | 0.35 | | | | 0.30 | | | | 6.20 | | | | 0.92 | |

Less distributions from net realized gains | | | — | | | | — | | | | (3.29 | ) | | | (4.14 | ) | | | (4.96 | ) | | | — | | | | — | |

| Net asset value, end of period | | $ | 13.44 | | | $ | 11.32 | | | $ | 12.11 | | | $ | 16.86 | | | $ | 20.65 | | | $ | 25.31 | | | $ | 19.11 | |

| Total return | | | 18.73 | %(3) | | | (6.52 | )% | | | (7.79 | )% | | | 2.23 | % | | | 0.11 | % | | | 32.44 | %(3) | | | 5.06 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 6,638 | | | $ | 5,870 | | | $ | 6,782 | | | $ | 8,651 | | | $ | 9,979 | | | $ | 10,800 | | | $ | 40,666 | |

Ratio of gross operating expenses (prior to waiver) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3.60 | %(4)(5) | | | 3.86 | % | | | 3.81 | % | | | 2.97 | % | | | 2.79 | % | | | 3.01 | %(4) | | | 2.12 | % |

| Ratio of net operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver) to average net assets | 2.50 | %(4)(5) | | | 2.66 | %(5)(6) | | | 2.61 | %(6) | | | 2.15 | %(6) | | | 2.15 | %(6) | | | 2.28 | %(4)(6) | | | 1.72 | %(6)(7) |

Ratio of net investment loss (prior to waiver) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (3.08 | )%(4) | | | (3.65 | )% | | | (3.74 | )% | | | (2.51 | )% | | | (2.61 | )% | | | (2.46 | )%(4) | | | (1.95 | )% |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (after waiver) to average net assets | (1.98 | )%(4)(5) | | | (2.45 | )%(5)(6) | | | (2.54 | )%(6) | | | (1.69 | )%(6) | | | (1.97 | )%(6) | | | (1.73 | )%(4)(6) | | | (1.55 | )%(6)(7) |

Portfolio turnover rate(8) | | | 34 | %(3) | | | 48 | % | | | 43 | % | | | 84 | % | | | 66 | % | | | 40 | %(3) | | | 115 | % |

_______________

| * | The Micro Cap Growth Fund’s Predecessor Fund had a fiscal year end of November 30, so the activity begins on December 1, 2012 and the numbers shown are for the nine month period. The fiscal year was changed to August 31 to align with the other Jacob Funds. |

(1) | The financial highlights set forth herein include the historical financial highlights of the Jacob Micro Cap Growth Fund (formerly, PineBridge US Micro Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) (the “Predecessor Fund”). The Predecessor Fund was reorganized into the Micro Cap Growth Fund on November 12, 2012. On July 9, 2012 before the reorganization, the adviser changed from PineBridge Investments, LLC to Jacob Asset Management of New York LLC (the “Adviser”). Information prior to November 12, 2012 reflects the performance of the Predecessor Fund’s Class I shares. |

(2) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

(3) | Not annualized. |

(4) | Annualized. |

(5) | The Adviser has contractually agreed, effective December 29, 2016 through at least January 2, 2019, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.00%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(6) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through December 28, 2016, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.15%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(7) | Prior to November 12, 2012, the previous adviser and the Adviser agreed to waive operating expenses over 1.60% of the Fund’s average daily net assets. |

(8) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between classes of shares issued. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

JACOB MICRO CAP GROWTH FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of the Fund outstanding throughout each period presented.

| | | | | | | | | | | | | | | | | | Nine | | | | |

| | | Six Months | | | | | | | | | | | | | | | Months | | | | |

| | | Ended | | | | | | | | | | | | | | | Ended | | | Year Ended | |

| | | February 28, | | | Year Ended August 31, | | | August 31, | | | November 30, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013* | | | 2012(1) | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.40 | | | $ | 11.16 | | | $ | 15.87 | | | $ | 19.73 | | | $ | 24.47 | | | $ | 18.51 | | | $ | 17.68 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.13 | ) | | | (0.28 | ) | | | (0.32 | ) | | | (0.35 | ) | | | (0.49 | ) | | | (0.37 | ) | | | (0.37 | ) |

Net realized and unrealized gain (loss) on investment transactions | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2.06 | | | | (0.48 | ) | | | (1.10 | ) | | | 0.63 | | | | 0.71 | | | | 6.33 | | | | 1.20 | |

| Total from investment operations | | | 1.93 | | | | (0.76 | ) | | | (1.42 | ) | | | 0.28 | | | | 0.22 | | | | 5.96 | | | | 0.83 | |

Less distributions from net realized gains | | | — | | | | — | | | | (3.29 | ) | | | (4.14 | ) | | | (4.96 | ) | | | — | | | | — | |

| Paid in capital from redemption fees | | — | | | | — | | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) |

| Net asset value, end of period | | $ | 12.33 | | | $ | 10.40 | | | $ | 11.16 | | | $ | 15.87 | | | $ | 19.73 | | | $ | 24.47 | | | $ | 18.51 | |

| Total return | | | 18.56 | %(4) | | | (6.81 | )% | | | (8.06 | )% | | | 1.93 | % | | | (0.25 | )% | | | 32.20 | %(4) | | | 4.69 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 1,613 | | | $ | 1,514 | | | $ | 2,037 | | | $ | 2,603 | | | $ | 2,958 | | | $ | 3,573 | | | $ | 4,356 | |

Ratio of gross operating expenses (prior to waiver or reimbursements) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3.86 | %(5) | | | 4.11 | % | | | 4.16 | % | | | 3.32 | % | | | 3.14 | % | | | 3.65 | %(5) | | | 2.47 | % |

Ratio of net operating expenses (after waiver or reimbursements) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2.76 | %(5)(6) | | | 2.91 | %(6)(7) | | | 2.96 | %(7) | | | 2.45 | %(7) | | | 2.45 | %(7) | | | 2.63 | %(5)(7) | | | 2.07 | %(7)(8) |

Ratio of net investment loss (prior to waiver or reimbursements) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (3.36 | )%(5) | | | (3.90 | )% | | | (4.09 | )% | | | (2.86 | )% | | | (2.96 | )% | | | (3.34 | )%(5) | | | (2.30 | )% |

Ratio of net investment loss (after waiver or reimbursements) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (2.26 | )%(5)(6) | | | (2.70 | )%(6)(7) | | | (2.89 | )%(7) | | | (1.99 | )%(7) | | | (2.27 | )%(7) | | | (2.32 | )%(5)(7) | | | (1.90 | )%(7)(8) |

Portfolio turnover rate(9) | | | 34 | %(4) | | | 48 | % | | | 43 | % | | | 84 | % | | | 66 | % | | | 40 | %(4) | | | 115 | % |

_______________

| * | The Micro Cap Growth Fund’s Predecessor Fund had a fiscal year end of November 30, so the activity begins on December 1, 2012 and the numbers shown are for the nine month period. The fiscal year was changed to August 31 to align with the other Jacob Funds. |

(1) | The financial highlights set forth herein include the historical financial highlights of the Jacob Micro Cap Growth Fund (formerly, PineBridge US Micro Cap Growth Fund) series of Jacob Funds II (formerly, PineBridge Mutual Funds) (the “Predecessor Fund”). The Predecessor Fund was reorganized into the Micro Cap Growth Fund on November 12, 2012. On July 9, 2012 before the reorganization, the adviser changed from PineBridge Investments, LLC to Jacob Asset Management of New York LLC (the “Adviser”). Information prior to November 12, 2012 reflects the performance of the Predecessor Fund’s Class R shares. |

(2) | Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period. |

(3) | Less than $0.01 per share. |

(4) | Not annualized. |

(5) | Annualized. |

(6) | The Adviser has contractually agreed, effective December 29, 2016 through at least January 2, 2019, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.30%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(7) | The Adviser has contractually agreed, effective November 12, 2012 (date of reorganization) through December 28, 2016, to waive up to 100% of its advisory fee to the extent that the Fund’s gross operating expense ratio exceeds 2.45%, excluding any taxes, interest, brokerage fees, acquired fund fees and expenses, and extraordinary expenses. |

(8) | Prior to November 12, 2012, the previous adviser and the Adviser agreed to waive operating expenses over 1.90% of the Fund’s average daily net assets. |

(9) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between classes of shares issued. |

The accompanying notes are an integral part of these financial statements.

JACOB FUNDS INC.

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2018 (Unaudited)

NOTE 1—DESCRIPTION OF ORGANIZATION

Jacob Funds Inc. (the “Corporation”) was organized as a Maryland corporation on July 13, 1999 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company issuing its shares in series. The Corporation currently consists of three “diversified” series, the Jacob Internet Fund (the “Internet Fund”), the Jacob Small Cap Growth Fund (the “Small Cap Growth Fund”) and the Jacob Micro Cap Growth Fund (the “Micro Cap Growth Fund”), each a “Fund”, collectively the “Funds”, and the authorized capital stock of the Corporation consists of twenty billion shares of stock having a par value of one-tenth of one cent ($0.001) per share. The primary investment objective of the Internet Fund is long-term growth of capital with current income as a secondary objective. The primary investment objective of the Small Cap Growth Fund and Micro Cap Growth Fund is long-term growth of capital.

The Internet Fund commenced operations on December 14, 1999. The Small Cap Growth Fund commenced operations on February 1, 2010 when it acquired the assets and liabilities of the Rockland Small Cap Growth Fund series of Rockland Funds Trust in a reorganization transaction (the Small Cap Growth Fund is the successor fund to the Rockland Small Cap Growth Fund). The Small Cap Growth Fund acquired the Class I and Class R shares of the Jacob Small Cap Growth Fund II (formerly, PineBridge US Small Cap Growth Fund) series of Jacob Funds II (formerly, the PineBridge Mutual Funds) (the “Predecessor Small Cap Growth Fund”) on November 12, 2012. The Small Cap Growth Fund acquired the Investor Class shares of the Jacob Wisdom Fund series of the Corporation on August 26, 2016. The Micro Cap Growth Fund commenced operations on November 12, 2012 when it acquired the assets and liabilities of the Jacob Micro Cap Growth Fund (formerly, PineBridge US Micro Cap Growth Fund) series of Jacob Funds II (the “Predecessor Micro Cap Growth Fund”) in a reorganization transaction (the Micro Cap Growth Fund is the successor fund to the Predecessor Micro Cap Growth Fund).

The Internet Fund currently offers Investor Class shares. The Small Cap Growth Fund and Micro Cap Growth Fund currently offer Investor Class and Institutional Class shares. Each share of each class of a Fund represents an equal pro rata interest in such Fund and provides the shareholder the same voting, dividend, and other rights, except that shareholders of each class of a Fund have exclusive voting rights regarding any matter relating solely to that particular class. Shareholders may be charged a redemption fee of 2% if the shares are redeemed within 30 days of initial investment.

NOTE 2—SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Funds are investment companies and follow accounting and reporting guidance under the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies”.

| | (a) Investment Valuation—Investment securities traded on a national securities exchange are valued at their market value determined by their last sales price in the principal market in which these securities are normally traded (except those traded on the NASDAQ National Market and Capital Market exchanges which are valued at the NASDAQ Official Closing Price (“NOCP”)), unless there are no transactions on the valuation date, in which case they are valued at the mean between the closing bid and ask prices. Securities traded over-the-counter are valued at the last reported sales price unless there is no reported sales price, in which case the mean between the closing bid and ask prices is used. Foreign securities, currencies and other assets denominated in foreign currencies are translated into U.S. dollars at the exchange rate of such currencies. Foreign equity securities are valued at the last |

JACOB FUNDS INC.

NOTES TO THE FINANCIAL STATEMENTS (Continued)

February 28, 2018 (Unaudited)

| | sale price at the close of the exchange on which the security is principally traded. Debt securities with maturities of 60 days or less are valued at amortized cost, which approximates market value. Short-term securities with 60 days or less remaining to maturity are, unless conditions indicate otherwise, amortized to maturity based on their cost to a Fund if acquired within 60 days of maturity or, if already held by a Fund on the 60th day, based on the value determined on the 61st day. If amortized cost does not approximate fair value, short-term securities are reported at fair value. Where market quotations are not readily available, are unreliable or when values have been materially affected by events occurring before the close of U.S. markets but after the close of the securities’ primary markets, securities are valued at fair value using procedures approved by the Board of Directors that are designed to determine a security’s fair value. |

| | |

| | The Funds adhere to fair valuation accounting standards which provide an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. |

| | |

| | Summary of Fair Value Exposure |

| | |

| | Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the three broad levels listed below: |

| | Level 1—Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| | | |

| | Level 2—Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | | |

| | Level 3—Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and based on the best information available. |

| | The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. |

JACOB FUNDS INC.

NOTES TO THE FINANCIAL STATEMENTS (Continued)

February 28, 2018 (Unaudited)