UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09477

Voya Variable Insurance Trust

(Exact name of registrant as specified in charter)

| 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ | | 85258 |

| (Address of principal executive offices) | | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2022

| Voya Investors Trust | | Voya Variable Insurance Trust |

| ■ | VY® | BlackRock Inflation Protected Bond Portfolio

Classes ADV, I and S | | ■ | VY® | BrandywineGLOBAL — Bond Portfolio |

As permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of each portfolio’s annual and semi-annual shareholder reports, like this annual report, are not sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you need not take any action. You may elect to receive shareholder reports and other communications from your insurance carrier electronically by contacting them directly. You may elect to receive all future reports in paper free of charge. If you received this document in the mail, please follow the instructions provided to elect to continue receiving paper copies of your shareholder reports. You can inform us that you wish to continue receiving paper copies by calling 1-866-345-5954. Your election to receive reports in paper will apply to all the funds in which you invest. |

This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. |

INVESTMENT MANAGEMENT

voyainvestments.com |  |

TABLE OF CONTENTS

| | 2 | |

| | 7 | |

| | 8 | |

| | 9 | |

| | 11 | |

| | 12 | |

| | 13 | |

| | 14 | |

| | 28 | |

| | 50 | |

| | 51 | |

| | 54 | |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Portfolios’ website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Portfolios’ website at www.voyainvestments.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form NPORT-P. The Portfolios’ Forms NPORT-P are available on the SEC’s website at www.sec.gov. Each Portfolio’s complete schedule of portfolio holdings is available at: www.voyainvestments.com and without charge upon request from the Portfolio by calling Shareholder Services toll-free at (800) 992-0180.

(THIS PAGE INTENTIONALLY LEFT BLANK)

BENCHMARK DESCRIPTIONS

| Index | | Description |

|---|

Bloomberg U.S. Aggregate Bond Index

(“Bloomberg U.S. Aggregate Bond”) | | An index of publicly issued investment grade U.S. government, mortgage-backed, asset-backed and corporate debt securities. |

| Bloomberg U.S. Treasury Inflation Protected Securities Index (“TIPS Index”) | | A market index comprised of all U.S. Treasury Inflation Linked Securities. |

1

VY® BLACKROCK INFLATION PROTECTED

BOND PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

| | Investment Type Allocation

as of December 31, 2022

(as a percentage of net assets) | |

| | U.S. Treasury Obligations | | 52.7 | % | |

| | Corporate Bonds/Notes | | 24.8 | % | |

| | U.S. Government Agency Obligations | | 10.8 | % | |

| | Commercial Mortgage-Backed Securities | | 5.6 | % | |

| | Collateralized Mortgage Obligations | | 1.8 | % | |

| | Asset-Backed Securities | | 1.6 | % | |

| | Sovereign Bonds | | 0.7 | % | |

| | Purchased Options | | 0.4 | % | |

| | Municipal Bonds | | 0.1 | % | |

| | Assets in Excess of Other Liabilities* | | 1.5 | % | |

| | Net Assets | | 100.0 | % | |

| | | | | | |

| | * | Includes short-term investments. | | | | |

| | | | | | |

| | Portfolio holdings are subject to change daily. | |

| | | |

VY® BlackRock Inflation Protected Bond Portfolio (the “Portfolio”) seeks to maximize real return, consistent with preservation of real capital and prudent investment management. The Portfolio is managed by Chris Allen, Managing Director and Akiva Dickstein, Managing Director, and David Rogal, Portfolio Managers of BlackRock Financial Management, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2022, the Portfolio’s Class I shares provided a total return of -12.74% compared to the Bloomberg U.S. Treasury Inflation Protected Securities Index (“TIPS Index” or “TIPS”) which returned -11.85% for the same period.

Portfolio Specifics: Our structural underweight in US nominal rates was the most notable contributor to performance over the year. We were underweight headline nominal duration in the US, as the rates market recalibrated its pricing after the continued hawkish pivot from the Fed since late 2021. The portfolio’s long in US breakevens at both the 1-year and 5-year points on the curve also positively contributed to performance due to the tailwind of high inflation prints over the year. Finally, the portfolio’s relative value positions between US vs. EU breakevens contributed to performance as breakevens in the US slightly outperformed the EU.

Offsetting some of the positive performance was the portfolio’s outright short in UK breakevens, especially earlier in the year. An acute surge in energy prices in the UK pushed the country’s inflation expectations materially higher over period. 10-year UK breakevens increased ~41 bps just in Q1 2022 and settled materially higher than realized inflation. The portfolio’s tactical positions in EU supra sovereign spread assets negatively contributed to performance as spread levels widened. Also, detracting from performance was the portfolio’s relative value positions between New Zealand vs. US real rates as New Zealand real rates increased more than the US. The Team’s tactical interest rate volatility positions also hurt performance as rates volatility picked up over the year. The small allocation to emerging market debt and European peripheral spreads also negatively contributed to performance.

| | Top Ten Holdings

as of December 31, 2022*

(as a percentage of net assets) |

| | United States Treasury Inflation Indexed Bonds, 0.125%, 01/15/32 | | 4.0 | % | |

| | United States Treasury Inflation Indexed Bonds, 0.625%, 07/15/32 | | 3.5 | % | |

| | United States Treasury Inflation Indexed Bonds, 0.125%, 07/15/30 | | 3.1 | % | |

| | United States Treasury Inflation Indexed Bonds, 0.125%, 01/15/31 | | 3.1 | % | |

| | United States Treasury Inflation Indexed Bonds, 0.625%, 01/15/24 | | 3.0 | % | |

| | United States Treasury Inflation Indexed Bonds, 0.750%, 07/15/28 | | 2.7 | % | |

| | United States Treasury Inflation Indexed Bonds, 0.875%, 01/15/29 | | 2.2 | % | |

| | United States Treasury Inflation Indexed Bonds, 3.875%, 04/15/29 | | 1.9 | % | |

| | United States Treasury Inflation Indexed Bonds, 0.125%, 07/15/31 | | 1.9 | % | |

| | United States Treasury Inflation Indexed Bonds, 2.375%, 01/15/27 | | 1.7 | % | |

| | | | | | | |

| | * | Excludes short-term investments. | | | | |

| | | | | | | |

| Portfolio holdings are subject to change daily. |

Market Overview: In our opinion, the past year was one defined by central banks moving interest rates higher as inflation ran at its highest level in decades. As the Fed and other central banks raised rates, interest rates across the curve moved materially higher, curves inverted, and risks assets performed poorly. The market did, however, price inflation expectations higher over the period given the elevated levels of realized inflation. Following the extensive rate hikes of the Fed, inflationary pressures are thought to have peaked and therefore, likely to ease into 2023. This is also due to healing supply chains. However, we believe the full effects of Fed policy have not been totally apparent due to the lagging effect of economic indicators, which has resulted in increased expectations for a recession. Macroeconomic volatility and uncertainty during the year was only reinforced by major global events contributing to the turbulence in the markets in 2022. Energy prices underwent shocks across the globe and, particularly in Europe, driven by the war in Ukraine leading to soaring prices. To dampen the burden of these high energy costs, the EU energy ministers settled on a gas price cap of €180 per megawatt hour but will likely continue to combat recessionary symptoms in the new year. In addition to the numerous rate hikes from the ECB, it is anticipated that their hawkish rhetoric will continue in order to subdue the omnipresent inflation throughout the euro area. For the UK, the Bank of England followed the ECB and raised rates onset by the UK Gilt crisis seen earlier this fall. Meanwhile, the Bank of Japan shocked markets during their announcement to increase the range of the Japanese 10-year note which may drive global long-term bond yields into the new year as loosening in their yield curve control led to a selloff.

Current Strategy and Outlook: US: The Team views the Federal Reserve (Fed) will only pause its rate hikes in Q2 or H2 of 2023. It will remain focused on crushing inflation and hold rates at a restrictive area to temper the stubbornly strong labor market. However, in our opinion, this makes a recession almost inevitable. The central bank has been toeing the line between a soft landing and a hard landing,

2

PORTFOLIO MANAGERS’ REPORT | VY® BLACKROCK INFLATION PROTECTED

BOND PORTFOLIO |

where the former means we can get through this tightening period without a significant economic contraction. We believe volatility in the rates market is likely to come down as inflation pressures ease further with the healing of the supply chain and normalizing consumer demand. We believe this puts the terminal policy rate in sight, with the market pricing in a potential rate cut in the latter half of 2023. We believe the interest rate carry is attractive in the front end, but rates further out the curve have room to increase as investors demand higher term premiums. Depending on the inflation trajectory, we forecast the Fed to raise rates by either 25 or 50 bps at its February meeting, followed by a 25 bps hike in March. This will bring the Fed Funds Target to ~4.85% by the end of Q1.

On the inflation front, CPI data showed compelling signs of slowing over Q4, with declines across the spectrum. The Team believes inflation has likely peaked and will continue to slow in the coming months. Our current forecasts have MoM core CPI hovering ~0.2 — 0.3% MoM and headline CPI ~0.1 — 0.2% MoM over the next several months. However, we believe shelter inflation, in particular, will remain sticky into 2023.

Within Europe: We view the near-term policy path for the European Central Bank (ECB) is materially impacted by the ongoing energy crisis and persistent inflation. The war-induced energy crisis has put EU countries’ economies in a precarious situation, with a recession that is likely to run deep without significant recovery until 2024. The warmer-than-expected winter has helped ease the energy crunch, but the problem will likely persist in 2023 as major supply pipelines, such as the Nord Stream 1, likely stay permanently shut; stockpiling energy will remain a crucial focus for the Euro area in 2023.

The energy supply crunch has translated to double-digit inflation and has significantly raised stagflation risk. Given geopolitical uncertainties, we think current price momentum is unlikely to fade quickly. Given the recent hawkish ECB rhetoric, we believe the central bank will continue to hike rates to control the high, persistent, and broad-based inflation in the euro area. We expect the ECB Governing Council to increase policy rates by a total of ~100 bps over Q1, lifting the deposit rate to 3% and the Main Refinancing Operations (MRO) rate to 3.5% by March 2023. We forecast headline (core) inflation to average ~5.6% (3.7%) in 2023 before converging to the ECB 2% target by the end of 2024.

Against a similar backdrop, the Bank of England (BoE) has a perilous task of weighing the need for further rate hikes without triggering a material economic downturn. The capping of energy prices has returned some freedom to BoE in terms of growth/inflation policy trade-off. However, the government has pledged not to extend the energy cap beyond April 2023. In light of this, we expect inflation to remain above 8% for most of 2023 before falling towards 2% in mid-2024 as base effects from higher energy costs wane. We believe we will see the BoE hike two more times before potentially pausing, 50 bps at the February meeting and 25 bps at the March meeting, taking the terminal Bank Rate to 4.25%.

Within Japan: The Bank of Japan (BoJ) surprised the market in December when it tweaked its long-standing Yield Curve Control (YCC) policy by adjusting its 10-year yield range up from +/-0.25% to +/-0.50%. This sent a shockwave across the market as the upward adjustment signaled a potential beginning of policy normalization. The change helped the Japanese Yen (JPY) to regain some lost ground after experiencing significant depreciation in 2022. It’s important to note that the BoJ does not face the same surging inflationary macro backdrop as some of its developed market peers. Despite inflation running well above the BoJ’s 2% target at ~3.7% YoY in November, its sustainability is questionable as most of the increase is led by FX and commodity induced price increases. We believe wage growth is the key to the longer-term sustainability of inflation. One focal point in 2023 will be whether the annual spring wage negotiations produce notable wage increases. We estimate that core CPI inflation reached 3.6% YoY in Q4 due to a concentration of markups to food prices with the rise in the cost of raw material imports. We expect core CPI ex. perishables eases to around 1.6% YoY by the end of 2023.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

3

VY® BLACKROCK INFLATION PROTECTED

BOND PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

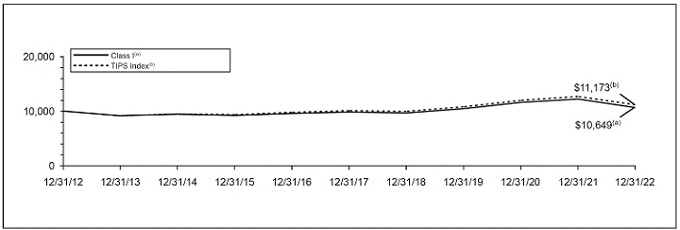

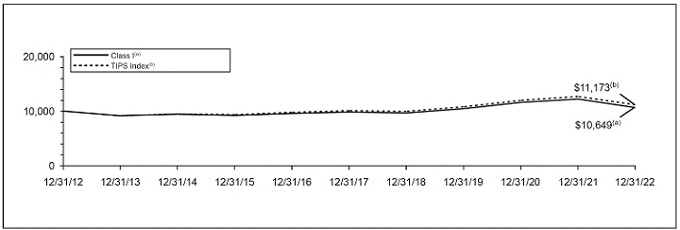

| Average Annual Total Returns for the Periods Ended December 31, 2022 |

|---|

| | 1 Year | | | 5 Year | | | 10 Year | |

|---|

| Class ADV | | – | 13.34 | % | | | 1.02 | % | | | 0.02 | % |

| Class I | | – | 12.74 | % | | | 1.65 | % | | | 0.63 | % |

| Class S | | – | 13.03 | % | | | 1.39 | % | | | 0.37 | % |

| TIPS Index | | – | 11.85 | % | | | 2.11 | % | | | 1.12 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® BlackRock Inflation Protected Bond Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other

service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 366-0066 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

4

PORTFOLIO MANAGERS’ REPORT | VY® BRANDYWINEGLOBAL —

BOND PORTFOLIO |

| | Investment Type Allocation

as of December 31, 2022

(as a percentage of net assets) |

| | U.S. Treasury Obligations | | 44.8 | % | |

| | U.S. Government Agency Obligations | | 29.8 | % | |

| | Corporate Bonds/Notes | | 20.7 | % | |

| | Commercial Mortgage-Backed Securities | | 1.5 | % | |

| | Collateralized Mortgage Obligations | | 0.1 | % | |

| | Assets in Excess of Other Liabilities* | | 3.1 | % | |

| | Net Assets | | 100.0 | % | |

| | * Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

VY® BrandywineGLOBAL — Bond Portfolio (the “Portfolio”) seeks total return consisting of capital appreciation and income. The Portfolio is managed by David F. Hoffman, CFA, John P. McIntyre, CFA, and Anujeet Sareen, CFA, Portfolio Managers of Brandywine Global Investment Management, LLC (“Brandywine”). — the Sub-Adviser.

Performance: For the year-ended December 31, 2022, the Portfolio’s shares provided a total return of -11.89% compared to the Bloomberg U.S. Aggregate Bond Index (“Bloomberg U.S. Aggregate Bond”), which returned -13.01% for the same period.

Portfolio Specifics — The Portfolio started the year with an underweight duration position versus the benchmark but ended the year with a substantially overweight duration position. As the Federal Reserve began aggressively raising interest rates in the first half of 2022, we felt it was prudent to begin increasing duration to take advantage of value opportunities in anticipation of slowing growth and inflation. The underweight duration position in the first half of the year along with selection and timing within corporates and mortgages were the primary drivers of our relative outperformance.

We increased duration during the year, mostly notably in the second half of 2022. The team elected to increase duration for a couple of key reasons. First, we believe that rate hikes tend to impact the economy on a lagged basis, and we felt the aggressive hikes had the potential to materially slow growth and inflation to a point that the Fed may have to reverse course in 2023. Secondly, virtually all major economic indicators began to turn lower (some sharply) by late summer.

We reduced our investment grade corporate positions in late 2021 and early 2022 due to valuations and tight spreads but elected to add back exposure in the second half of the year due to wider spreads and attractive yields. We increased our exposure to agency MBS in the second half of the year due to attractive spreads and a decrease in prepayment risk.

| | Top Ten Holdings

as of December 31, 2022*

(as a percentage of net assets) |

| | United States Treasury Bond, 2.875%, 05/15/52 | | 18.2 | % | |

| | United States Treasury Bond, 2.250%, 02/15/52 | | 10.8 | % | |

| | Uniform Mortgage-Backed Securities, 4.000%, 06/01/52 | | 9.4 | % | |

| | United States Treasury Note, 4.125%, 11/15/32 | | 6.2 | % | |

| | United States Treasury Bond, 3.000%, 08/15/52 | | 5.9 | % | |

| | Uniform Mortgage-Backed Securities, 5.000%, 11/01/52 | | 5.4 | % | |

| | Uniform Mortgage-Backed Securities, 5.500%, 11/01/52 | | 4.6 | % | |

| | Freddie Mac, 0.375%, 05/05/23 | | 3.6 | % | |

| | Uniform Mortgage-Backed Securities, 4.500%, 09/01/52 | | 2.3 | % | |

| | Macquarie Group Ltd., 6.207%, 11/22/24 | | 2.2 | % | |

| * Excludes short-term investments. |

| Portfolio holdings are subject to change daily. |

Current Strategy and Outlook: We believe the outlook for the U.S. economy is complicated; the inverted yield curve suggests inflation is set to moderate, while the Fed appears committed to further action. In our opinion, this hawkishness, accompanied by more supply-side normalization, should lead to significantly slower inflation and a softer labor market. We believe the conditions for a credit crunch, commonly seen ahead of previous U.S. recessions, do not exist currently. That said, recession odds increase significantly if Fed Chair Powell remains dogmatic about creating labor market slack through monetary policy. A pause in rate hikes seems probable in our opinion, especially if economic data shows a steep decline in inflation.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

5

VY® BRANDYWINEGLOBAL —

BOND PORTFOLIO | PORTFOLIO MANAGERS’ REPORT |

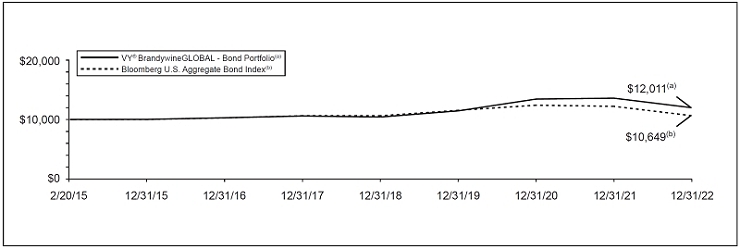

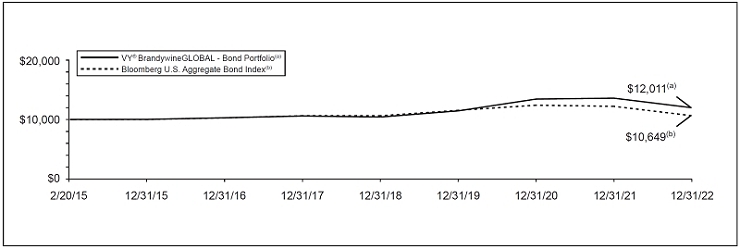

| Average Annual Total Returns for the Periods Ended December 31, 2022 |

|---|

| | 1 Year | | | 5 Year | | | Since Inception

February 20, 2015 |

|---|

VY® BrandywineGLOBAL - Bond Portfolio | | – | 11.89 | % | | | 2.54 | % | | | 2.36 | % |

| Bloomberg U.S. Aggregate Bond | | – | 13.01 | % | | | 0.02 | % | | | 0.80 | % |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® BrandywineGLOBAL - Bond Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract and/or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract and/or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

Prior to August 9, 2019, the Portfolio was managed by a different sub-adviser.

The Portfolio’s performance information for these periods reflects returns achieved by different sub-advisers.

6

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2022 to December 31, 2022. The Portfolios’ expenses are shown without the imposition of any charges which are, or may be, imposed under your variable annuity contract, variable life insurance policy, qualified pension, or retirement plan. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Portfolio Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Actual Portfolio Return | | Hypothetical (5% return before expenses) |

|---|

| | Beginning

Account

Value

July 1,

2022 | | Ending

Account

Value

December 31,

2022 | | Annualized

Expense

Ratio | | Expenses Paid

During the

Period Ended

December 31,

2022* | | Beginning

Account

Value

July 1,

2022 | | Ending

Account

Value

December 31,

2022 | | Annualized

Expense

Ratio | | Expenses Paid

During the

Period Ended

December 31,

2022* |

|---|

VY® BlackRock Inflation Protected Bond Portfolio | | | | | | | | | | | | | | | |

| Class ADV | | $ | 1,000.00 | | | $ | 970.40 | | | | 1.18 | % | | $ | 5.86 | | | $ | 1,000.00 | | | $ | 1,019.26 | | | | 1.18 | % | | $ | 6.01 | |

| Class I | | | 1,000.00 | | | | 973.80 | | | | 0.58 | | | | 2.89 | | | | 1,000.00 | | | | 1,022.28 | | | | 0.58 | | | | 2.96 | |

| Class S | | | 1,000.00 | | | | 971.70 | | | | 0.83 | | | | 4.12 | | | | 1,000.00 | | | | 1,021.02 | | | | 0.83 | | | | 4.23 | |

VY® BrandywineGLOBAL — Bond Portfolio | | | | | | | | | | | | | | | | |

| | | $ | 1,000.00 | | | $ | 943.30 | | | | 0.56 | % | | $ | 2.74 | | | $ | 1,000.00 | | | $ | 1,022.38 | | | | 0.56 | % | | $ | 2.85 | |

| * | Expenses are equal to each Portfolio’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half-year. |

7

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of VY® BlackRock Inflation Protected Bond Portfolio and VY® BrandywineGLOBAL — Bond Portfolio and the Boards of Trustees of Voya Investors Trust and Voya Variable Insurance Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of VY® BlackRock Inflation Protected Bond Portfolio and VY® BrandywineGLOBAL — Bond Portfolio (collectively referred to as the “Portfolios”) (each a portfolio of Voya Investors Trust and Voya Variable Insurance Trust, respectively (collectively referred to as the “Trusts”)), including the portfolios of investments, as of December 31, 2022, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the three years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Portfolios at December 31, 2022, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and their financial highlights for each of the two years in the period then ended, in conformity with U.S. generally accepted accounting principles.

The financial highlights for each of the years in the two-year period ended December 31, 2019, were audited by another independent registered public accounting firm whose report, dated February 21, 2020, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Trusts’ management. Our responsibility is to express an opinion on the Portfolios’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trusts in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trusts are not required to have, nor were we engaged to perform, an audit of the Trusts’ internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trusts’ internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022, by correspondence with the custodian, brokers and others; when replies were not received from brokers and others, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Voya investment companies since 2019.

Boston, Massachusetts

February 28, 2023

8

STATEMENTS OF ASSETS AND LIABILITIES AS OF DECEMBER 31, 2022

| | VY®

BlackRock

Inflation

Protected

Bond

Portfolio | | VY®

BrandywineGLOBAL —

Bond

Portfolio |

|---|

ASSETS: | | | | | | | | |

| Investments in securities at fair value* | | $ | 250,382,288 | | | $ | 258,218,168 | |

| Short-term investments at fair value† | | | 5,637,951 | | | | 6,092,762 | |

| Cash pledged for centrally cleared swaps (Note 2) | | | 3,341,000 | | | | — | |

| Due from broker | | | 162,081 | | | | — | |

| Foreign currencies at value‡ | | | 370,267 | | | | — | |

| Receivables: | | | | | | | | |

| Investment securities sold | | | 2,893,575 | | | | 297,818 | |

| Investment securities sold on a delayed-delivery or when-issued basis | | | 10,214,794 | | | | — | |

| Fund shares sold | | | 104,827 | | | | 100,743 | |

| Dividends | | | 8,172 | | | | 20,490 | |

| Interest | | | 1,244,833 | | | | 1,864,216 | |

| Variation margin on centrally cleared swaps | | | 41,742 | | | | — | |

| Unrealized appreciation on forward foreign currency contracts | | | 3,788 | | | | — | |

| Unrealized appreciation on OTC swap agreements | | | 330,515 | | | | — | |

| Prepaid expenses | | | 1,388 | | | | 1,457 | |

| Other assets | | | 16,141 | | | | 5,584 | |

| Total assets | | | 274,753,362 | | | | 266,601,238 | |

LIABILITIES: | | | | | | | | |

| Payable for investment securities purchased | | | 2,787,432 | | | | — | |

| Payable for investment securities purchased on a delayed-delivery or when-issued basis | | | 12,131,328 | | | | — | |

| Payable for fund shares redeemed | | | 64,246 | | | | 99,213 | |

| Sales commitments^^^ | | | 2,502,114 | | | | — | |

| Unrealized depreciation on forward foreign currency contracts | | | 14,395 | | | | — | |

| Variation margin payable on futures contracts | | | 14,713 | | | | — | |

| Cash received as collateral for OTC derivatives (Note 2) | | | 680,000 | | | | — | |

| Payable for investment management fees | | | 107,404 | | | | 117,275 | |

| Payable for distribution and shareholder service fees | | | 51,202 | | | | — | |

| Payable to trustees under the deferred compensation plan (Note 6) | | | 16,141 | | | | 5,584 | |

| Payable for trustee fees | | | 715 | | | | 744 | |

| Other accrued expenses and liabilities | | | 79,661 | | | | 63,947 | |

| Written options, at fair value^ | | | 2,087,860 | | | | — | |

| Total liabilities | | | 20,537,211 | | | | 286,763 | |

NET ASSETS | | $ | 254,216,151 | | | $ | 266,314,475 | |

| |

NET ASSETS WERE COMPRISED OF: | | | | | | | | |

| Paid-in capital | | $ | 343,138,934 | | | $ | 299,484,487 | |

| Total distributable loss | | | (88,922,783 | ) | | | (33,170,012 | ) |

NET ASSETS | | $ | 254,216,151 | | | $ | 266,314,475 | |

| | | | | | | | | | |

| * Cost of investments in securities | | $ | 280,424,130 | | | $ | 279,729,671 | |

| † Cost of short-term investments | | $ | 5,637,951 | | | $ | 6,092,762 | |

| ‡ Cost of foreign currencies | | $ | 365,429 | | | $ | — | |

| ^ Premiums received on written options | | $ | 2,137,532 | | | $ | — | |

| ^^^ Proceeds receivable from sales commitments | | $ | 2,530,082 | | | $ | — | |

See Accompanying Notes to Financial Statements

9

STATEMENTS OF ASSETS AND LIABILITIES AS OF DECEMBER 31, 2022 (CONTINUED)

| | VY®

BlackRock

Inflation

Protected

Bond

Portfolio | | VY®

BrandywineGLOBAL —

Bond

Portfolio |

|---|

Class ADV | | | | | | | | |

| Net assets | | $ | 43,211,677 | | | | n/a | |

| Shares authorized | | | unlimited | | | | n/a | |

| Par value | | $ | 0.001 | | | | n/a | |

| Shares outstanding | | | 4,930,797 | | | | n/a | |

| Net asset value and redemption price per share | | $ | 8.76 | | | | n/a | |

Class I | | | | | | | | |

| Net assets | | $ | 77,275,476 | | | | n/a | |

| Shares authorized | | | unlimited | | | | n/a | |

| Par value | | $ | 0.001 | | | | n/a | |

| Shares outstanding | | | 8,468,137 | | | | n/a | |

| Net asset value and redemption price per share | | $ | 9.13 | | | | n/a | |

Class S | | | | | | | | |

| Net assets | | $ | 133,728,998 | | | | n/a | |

| Shares authorized | | | unlimited | | | | n/a | |

| Par value | | $ | 0.001 | | | | n/a | |

| Shares outstanding | | | 14,772,246 | | | | n/a | |

| Net asset value and redemption price per share | | $ | 9.05 | | | | n/a | |

Portfolio(1) | | | | | | | | |

| Net assets | | | n/a | | | $ | 266,314,475 | |

| Shares authorized | | | n/a | | | | unlimited | |

| Par value | | | n/a | | | $ | 0.001 | |

| Shares outstanding | | | n/a | | | | 28,656,402 | |

| Net asset value and redemption price per share | | | n/a | | | $ | 9.29 | |

(1) | Portfolio does not have a share class designation. |

See Accompanying Notes to Financial Statements

10

STATEMENTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2022

| | VY®

BlackRock

Inflation

Protected

Bond

Portfolio | | VY®

BrandywineGLOBAL —

Bond

Portfolio |

|---|

| | | | | | | | |

|---|

INVESTMENT INCOME: | | | | | | | | |

| Dividends | | $ | 62,677 | | | $ | 100,873 | |

| Interest | | | 13,876,720 | (1) | | | 6,343,556 | |

| Total investment income | | | 13,939,397 | | | | 6,444,429 | |

EXPENSES: | | | | | | | | |

| Investment management fees | | | 1,529,840 | | | | 1,487,948 | |

| Distribution and shareholder service fees: | | | | | | | | |

| Class ADV | | | 293,347 | | | | — | |

| Class S | | | 385,997 | | | | — | |

| Transfer agent fees: | | | | | | | 1,628 | |

| Class ADV | | | 12,880 | | | | — | |

| Class I | | | 21,782 | | | | — | |

| Class S | | | 40,678 | | | | — | |

| Shareholder reporting expense | | | 13,623 | | | | 3,285 | |

| Registration fees | | | — | | | | 4,449 | |

| Professional fees | | | 48,527 | | | | 37,450 | |

| Custody and accounting expense | | | 100,825 | | | | 73,000 | |

| Trustee fees | | | 7,149 | | | | 7,440 | |

| Miscellaneous expense | | | 15,789 | | | | 16,021 | |

| Interest expense | | | 1,009 | | | | — | |

| Total expenses | | | 2,471,446 | | | | 1,631,221 | |

| Recouped/(Waived and reimbursed fees) | | | (142,988 | ) | | | 46,992 | |

| Net expenses | | | 2,328,458 | | | | 1,678,213 | |

| Net investment income | | | 11,610,939 | | | | 4,766,216 | |

REALIZED AND UNREALIZED GAIN (LOSS): | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | (15,219,603 | ) | | | (11,132,254 | ) |

| Forward foreign currency contracts | | | 471,006 | | | | — | |

| Foreign currency related transactions | | | (205,337 | ) | | | — | |

| Futures | | | 7,143,904 | | | | (5,348,388 | ) |

| Swaps | | | 8,942,675 | | | | — | |

| Written options | | | (1,017,889 | ) | | | — | |

| Net realized gain (loss) | | | 114,756 | | | | (16,480,642 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | (47,501,046 | ) | | | (26,471,962 | ) |

| Forward foreign currency contracts | | | (82,137 | ) | | | — | |

| Foreign currency related transactions | | | (5,289 | ) | | | — | |

| Futures | | | 649,987 | | | | 75,297 | |

| Swaps | | | (5,726,062 | ) | | | — | |

| Written options | | | 5,203 | | | | — | |

| Sales commitments | | | 27,968 | | | | — | |

| Net change in unrealized appreciation (depreciation) | | | (52,631,376 | ) | | | (26,396,665 | ) |

| Net realized and unrealized loss | | | (52,516,620 | ) | | | (42,877,307 | ) |

Decrease in net assets resulting from operations | | $ | (40,905,681 | ) | | $ | (38,111,091 | ) |

| (1) | Includes net inflationary and deflationary adjustments. See Note 2 of the Notes to Financial Statements. |

See Accompanying Notes to Financial Statements

11

STATEMENTS OF CHANGES IN NET ASSETS

| | VY® BlackRock Inflation

Protected Bond Portfolio | | VY® BrandywineGLOBAL —

Bond Portfolio |

|---|

| | Year Ended

December 31,

2022 | | Year Ended

December 31,

2021 | | Year Ended

December 31,

2022 | | Year Ended

December 31,

2021 |

|---|

FROM OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 11,610,939 | | | $ | 7,734,657 | | | $ | 4,766,216 | | | $ | 2,832,682 | |

| Net realized gain (loss) | | | 114,756 | | | | 9,554,588 | | | | (16,480,642 | ) | | | 14,721,215 | |

| Net change in unrealized appreciation (depreciation) | | | (52,631,376 | ) | | | (2,516,642 | ) | | | (26,396,665 | ) | | | (13,802,164 | ) |

| Increase (decrease) in net assets resulting from operations | | | (40,905,681 | ) | | | 14,772,603 | | | | (38,111,091 | ) | | | 3,751,733 | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

| Total distributions (excluding return of capital): | | | | | | | | | | | (17,111,781 | ) | | | (27,082,394 | ) |

| Class ADV | | | (1,666,644 | ) | | | (1,140,854 | ) | | | — | | | | — | |

| Class I | | | (3,241,222 | ) | | | (2,600,461 | ) | | | — | | | | — | |

| Class S | | | (5,726,059 | ) | | | (4,058,689 | ) | | | — | | | | — | |

| Return of capital: | | | | | | | | | | | | | | | | |

| Class ADV | | | (251,719 | ) | | | — | | | | — | | | | — | |

| Class I | | | (413,119 | ) | | | — | | | | — | | | | — | |

| Class S | | | (766,743 | ) | | | — | | | | — | | | | — | |

| Total distributions | | | (12,065,506 | ) | | | (7,800,004 | ) | | | (17,111,781 | ) | | | (27,082,394 | ) |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Net proceeds from sale of shares | | | 37,100,330 | | | | 83,578,121 | | | | 84,693,352 | | | | 86,294,017 | |

| Reinvestment of distributions | | | 12,065,506 | | | | 7,796,663 | | | | 17,111,781 | | | | 27,082,394 | |

| | | | 49,165,836 | | | | 91,374,784 | | | | 101,805,133 | | | | 113,376,411 | |

| Cost of shares redeemed | | | (66,619,636 | ) | | | (73,208,287 | ) | | | (123,596,753 | ) | | | (65,382,155 | ) |

| Net increase (decrease) in net assets resulting from capital share transactions | | | (17,453,800 | ) | | | 18,166,497 | | | | (21,791,620 | ) | | | 47,994,256 | |

| Net increase (decrease) in net assets | | | (70,424,987 | ) | | | 25,139,096 | | | | (77,014,492 | ) | | | 24,663,595 | |

NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of year or period | | | 324,641,138 | | | | 299,502,042 | | | | 343,328,967 | | | | 318,665,372 | |

| End of year or period | | $ | 254,216,151 | | | $ | 324,641,138 | | | $ | 266,314,475 | | | $ | 343,328,967 | |

See Accompanying Notes to Financial Statements

12

Selected data for a share of beneficial interest outstanding throughout each year or period.

| | | | Income (loss)

from

investment

operations | | | | Less distributions | | | | | | | | | | Ratios to average

net assets | | Supplemental

data |

|---|

| | | | | | | | | | | | | | | | | | | | | |

|---|

| | | Net

asset

value,

beginning

of year

or period | | Net

investment

income

(loss) | | Net

realized

and

unrealized

gain (loss) | | Total

from

investment

operations | | From

net

investment

income | | From

net

realized

gains | | From

return of

capital | | Total

distributions | | Payment

by

affiliate | | Net

asset

value,

end of

year or

period | | Total Return(1) | | Expenses

before

reductions/

additions(2)(3)(4) | | Expenses

net of

fee waivers

and/or

recoupments

if any(2)(3)(4) | | Expense

net

of all

reductions/

additions(2)(3)(4) | | Net

investment

income

(loss)(2)(3) | | Net

assets,

end of

year or

period | | Portfolio

turnover

rate |

|---|

| Year or period ended | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | (%) | | (%) | | (%) | | (%) | | (%) | | ($000’s) | | (%) |

VY® BlackRock Inflation Protected Bond Portfolio |

Class ADV | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 10.51 | | | | 0.35 | • | | | (1.73 | ) | | | (1.38 | ) | | | 0.32 | | | | — | | | | 0.05 | | | | 0.37 | | | | — | | | | 8.76 | | | | (13.34 | ) | | | 1.23 | | | | 1.18 | | | | 1.18 | | | | 3.70 | | | | 43,212 | | | | 231 | |

| 12-31-21 | | | 10.28 | | | | 0.22 | • | | | 0.24 | | | | 0.46 | | | | 0.23 | | | | — | | | | — | | | | 0.23 | | | | — | | | | 10.51 | | | | 4.54 | | | | 1.22 | | | | 1.18 | | | | 1.18 | | | | 2.14 | | | | 56,857 | | | | 156 | |

| 12-31-20 | | | 9.42 | | | | 0.05 | | | | 0.95 | | | | 1.00 | | | | 0.08 | | | | — | | | | 0.06 | | | | 0.14 | | | | — | | | | 10.28 | | | | 10.65 | | | | 1.26 | | | | 1.22 | | | | 1.22 | | | | 0.52 | | | | 47,352 | | | | 87 | |

| 12-31-19 | | | 8.93 | | | | 0.11 | | | | 0.56 | | | | 0.67 | | | | 0.18 | | | | — | | | | — | | | | 0.18 | | | | — | | | | 9.42 | | | | 7.53 | | | | 1.20 | | | | 1.16 | | | | 1.16 | | | | 1.23 | | | | 44,885 | | | | 72 | |

| 12-31-18 | | | 9.30 | | | | 0.14 | | | | (0.36 | ) | | | (0.22 | ) | | | 0.15 | | | | — | | | | — | | | | 0.15 | | | | — | | | | 8.93 | | | | (2.39 | ) | | | 1.18 | | | | 1.14 | | | | 1.14 | | | | 1.47 | | | | 44,035 | | | | 63 | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 10.94 | | | | 0.42 | • | | | (1.79 | ) | | | (1.37 | ) | | | 0.39 | | | | — | | | | 0.05 | | | | 0.44 | | | | — | | | | 9.13 | | | | (12.74 | ) | | | 0.63 | | | | 0.58 | | | | 0.58 | | | | 4.27 | | | | 77,275 | | | | 231 | |

| 12-31-21 | | | 10.68 | | | | 0.30 | • | | | 0.25 | | | | 0.55 | | | | 0.29 | | | | — | | | | — | | | | 0.29 | | | | — | | | | 10.94 | | | | 5.25 | | | | 0.62 | | | | 0.58 | | | | 0.58 | | | | 2.75 | | | | 94,962 | | | | 156 | |

| 12-31-20 | | | 9.78 | | | | 0.12 | | | | 0.97 | | | | 1.09 | | | | 0.13 | | | | — | | | | 0.06 | | | | 0.19 | | | | — | | | | 10.68 | | | | 11.15 | | | | 0.66 | | | | 0.62 | | | | 0.62 | | | | 1.11 | | | | 92,767 | | | | 87 | |

| 12-31-19 | | | 9.26 | | | | 0.18 | | | | 0.57 | | | | 0.75 | | | | 0.23 | | | | — | | | | — | | | | 0.23 | | | | — | | | | 9.78 | | | | 8.21 | | | | 0.60 | | | | 0.56 | | | | 0.56 | | | | 1.98 | | | | 88,759 | | | | 72 | |

| 12-31-18 | | | 9.66 | | | | 0.20 | • | | | (0.37 | ) | | | (0.17 | ) | | | 0.23 | | | | — | | | | — | | | | 0.23 | | | | — | | | | 9.26 | | | | (1.75 | ) | | | 0.58 | | | | 0.54 | | | | 0.54 | | | | 2.14 | | | | 40,731 | | | | 63 | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12-31-22 | | | 10.85 | | | | 0.40 | • | | | (1.79 | ) | | | (1.39 | ) | | | 0.36 | | | | — | | | | 0.05 | | | | 0.41 | | | | — | | | | 9.05 | | | | (13.03 | ) | | | 0.88 | | | | 0.83 | | | | 0.83 | | | | 4.06 | | | | 133,729 | | | | 231 | |

| 12-31-21 | | | 10.60 | | | | 0.26 | • | | | 0.26 | | | | 0.52 | | | | 0.27 | | | | — | | | | — | | | | 0.27 | | | | — | | | | 10.85 | | | | 4.94 | | | | 0.87 | | | | 0.83 | | | | 0.83 | | | | 2.48 | | | | 172,822 | | | | 156 | |

| 12-31-20 | | | 9.70 | | | | 0.09 | | | | 0.97 | | | | 1.06 | | | | 0.10 | | | | — | | | | 0.06 | | | | 0.16 | | | | — | | | | 10.60 | | | | 10.95 | | | | 0.91 | | | | 0.87 | | | | 0.87 | | | | 0.86 | | | | 159,383 | | | | 87 | |

| 12-31-19 | | | 9.18 | | | | 0.15 | | | | 0.58 | | | | 0.73 | | | | 0.21 | | | | — | | | | — | | | | 0.21 | | | | — | | | | 9.70 | | | | 8.01 | | | | 0.85 | | | | 0.81 | | | | 0.81 | | | | 1.57 | | | | 144,313 | | | | 72 | |

| 12-31-18 | | | 9.57 | | | | 0.17 | | | | (0.36 | ) | | | (0.19 | ) | | | 0.20 | | | | — | | | | — | | | | 0.20 | | | | — | | | | 9.18 | | | | (2.04 | ) | | | 0.83 | | | | 0.79 | | | | 0.79 | | | | 1.83 | | | | 153,793 | | | | 63 | |

VY® BrandywineGLOBAL- Bond Portfolio |

| 12-31-22 | | | 11.22 | | | | 0.16 | • | | | (1.45 | ) | | | (1.29 | ) | | | 0.11 | | | | 0.53 | | | | — | | | | 0.64 | | | | — | | | | 9.29 | | | | (11.89 | ) | | | 0.55 | | | | 0.56 | | | | 0.56 | | | | 1.60 | | | | 266,314 | | | | 184 | |

| 12-31-21 | | | 12.03 | | | | 0.10 | • | | | 0.04 | | | | 0.14 | | | | 0.19 | | | | 0.76 | | | | — | | | | 0.95 | | | | — | | | | 11.22 | | | | 1.15 | | | | 0.54 | | | | 0.58 | | | | 0.58 | | | | 0.84 | | | | 343,329 | | | | 57 | |

| 12-31-20 | | | 10.51 | | | | 0.22 | • | | | 1.59 | | | | 1.81 | | | | 0.21 | | | | 0.08 | | | | — | | | | 0.29 | | | | — | | | | 12.03 | | | | 17.47 | | | | 0.56 | | | | 0.58 | | | | 0.58 | | | | 1.92 | | | | 318,665 | | | | 134 | |

| 12-31-19 | | | 9.73 | | | | 0.25 | • | | | 0.73 | | | | 0.98 | | | | 0.20 | | | | — | | | | — | | | | 0.20 | | | | — | | | | 10.51 | | | | 10.12 | | | | 0.61 | | | | 0.58 | | | | 0.58 | | | | 2.48 | | | | 182,892 | | | | 449 | |

| 12-31-18 | | | 10.12 | | | | 0.26 | • | | | (0.43 | ) | | | (0.17 | ) | | | 0.22 | | | | — | | | | — | | | | 0.22 | | | | — | | | | 9.73 | | | | (1.65 | ) | | | 0.71 | | | | 0.58 | | | | 0.58 | | | | 2.61 | | | | 194,159 | | | | 457 | |

(1) | | Total return is calculated assuming reinvestment of all dividends, capital gain distributions and return of capital distributions, if any, at net asset value and does not reflect the effect of insurance contract charges. Total return for periods less than one year is not annualized. |

(2) | | Annualized for periods less than one year. |

(3) | | Ratios reflect operating expenses of a Portfolio. Expenses before reductions/additions do not reflect amounts reimbursed or recouped by the Investment Adviser and/or Distributor or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by a Portfolio during periods when reimbursements or reductions occur. |

| | | Expenses net of fee waivers reflect expenses after reimbursement by the Investment Adviser and/or Distributor or recoupment of previously reimbursed fees by the Investment Adviser, but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions/additions represent the net expenses paid by a Portfolio. Net investment income (loss) is net of all such additions or reductions. |

(4) | | Ratios do not include fees and expenses charged under the variable annuity contract or variable life insurance policy. |

• | | Calculated using average number of shares outstanding throughout the year or period. |

See Accompanying Notes to Financial Statements

13

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 NOTE 1 — ORGANIZATION

Voya Investors Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and was organized as a Massachusetts business trust on August 3, 1988. Voya Investors Trust currently consists of twenty-one active separate investment series. The one series included in this report is: VY® BlackRock Inflation Protected Bond Portfolio (“BlackRock Inflation Protected Bond”), a diversified series of Voya Investors Trust.

Voya Variable Insurance Trust is registered under the 1940 Act as an open-end management investment company and was organized as a Delaware statutory trust on July 15, 1999. Voya Variable Insurance Trust consists of one active investment series which is included in this report: VY® BrandywineGLOBAL — Bond Portfolio (“Bond Portfolio”), a diversified series of Voya Variable Insurance Trust.

Voya Investors Trust and Voya Variable Insurance Trust are collectively referred to as the “Trusts.” BlackRock Inflation Protected Bond and Bond Portfolio are each, a “Portfolio” and together, the “Portfolios.” The investment objective of the Portfolios is described in each Portfolio’s Prospectus.

The classes of shares included in this report for BlackRock Inflation Protected Bond are: Adviser (“Class ADV”), Institutional (“Class I”), and Service (“Class S”). With the exception of class specific matters, each class has equal voting rights as to voting privileges. For class specific proposals, only the applicable class would have voting privileges. The classes differ principally in the applicable distribution and shareholder service fees, as well as differences in the amount of waiver of fees and reimbursement of expenses, if any. Generally, shareholders of each class also bear certain expenses that pertain to that particular class. All shareholders are allocated the common expenses of a portfolio and earn income and realized gains/losses from a portfolio pro rata based on the daily ending net assets of each class, without distinction between share classes. Expenses that are specific to a portfolio or a class are charged directly to that portfolio or class. Other operating expenses shared by several portfolios are generally allocated among those portfolios based on average net assets. Distributions are determined separately for each class based on income and expenses allocated to each class. Realized gain distributions are allocated to each class pro rata based on the shares outstanding of each class on the date of distribution. Differences in per share dividend rates generally result from differences in separate class expenses, including distribution and shareholder service fees, if any, as well as differences in the amount of waiver of fees and reimbursement of expenses between the

separate classes, if any. Bond Portfolio does not have a share class designation.

Voya Investments, LLC (“Voya Investments” or the “Investment Adviser”), an Arizona limited liability company, serves as the Investment Adviser to the Portfolios. Voya Investments Distributor, LLC (“VID” or the “Distributor”), a Delaware limited liability company, serves as the principal underwriter to the Portfolios.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies are consistently followed by the Portfolios in the preparation of their financial statements. Each Portfolio is considered an investment company under U.S. generally accepted accounting principles (“GAAP”) and follows the accounting and reporting guidance applicable to investment companies.

A. Security Valuation. Each Portfolio is open for business every day the New York Stock Exchange (“NYSE”) opens for regular trading (each such day, a “Business Day”). The net asset value (“NAV”) per share for each class of each Portfolio is determined each Business Day as of the close of the regular trading session (“Market Close”), as determined by the Consolidated Tape Association (“CTA”), the central distributor of transaction prices for exchange-traded securities (normally 4:00 p.m. Eastern time unless otherwise designated by the CTA). The NAV per share of each class of each Portfolio is calculated by taking the value of the Portfolio’s assets attributable to that class, subtracting the Portfolio’s liabilities attributable to that class, and dividing by the number of shares of that class that are outstanding. On days when a Portfolio is closed for business, Portfolio shares will not be priced and a Portfolio does not transact purchase and redemption orders. To the extent a Portfolio’s assets are traded in other markets on days when a Portfolio does not price its shares, the value of a Portfolio’s assets will likely change and you will not be able to purchase or redeem shares of a Portfolio.

Portfolio securities for which market quotations are readily available are valued at market value. Investments in open-end registered investment companies that do not trade on an exchange are valued at the end of day NAV per share. The prospectuses of the open-end registered investment companies in which each Portfolio may invest explain the circumstances under which they will use fair value pricing and the effects of using fair value pricing. Foreign securities’ prices are converted into U.S. dollar amounts using the applicable exchange rates as of Market Close.

When a market quotation for a portfolio security is not readily available or is deemed unreliable (for example when trading has been halted or there are unexpected

14

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

market closures or other material events that would suggest that the market quotation is unreliable) and for purposes of determining the value of other Portfolio assets, the asset is priced at its fair value. The Board has designated the Investment Adviser, as the valuation designee, to make fair value determinations in good faith. In determining the fair value of each Portfolio’s assets, the Investment Adviser, pursuant to its fair valuation policy, may consider inputs from pricing service providers, broker-dealers, or each Portfolio’s sub-adviser(s). Issuer specific events, transaction price, position size, nature and duration of restrictions on disposition of the security, market trends, bid/ask quotes of brokers and other market data may be reviewed in the course of making a good faith determination of an asset’s fair value. Because trading hours for certain foreign securities end before Market Close, closing market quotations may become unreliable. The prices of foreign securities will generally be adjusted based on inputs from an independent pricing service that are intended to reflect valuation changes through the NYSE close. Because of the inherent uncertainties of fair valuation, the values used to determine each Portfolio’s NAV may materially differ from the value received upon actual sale of those investments. Thus, fair valuation may have an unintended dilutive or accretive effect on the value of shareholders’ investments in each Portfolio.

The Portfolios’ financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 — quoted prices (unadjusted) in active markets for identical financial instruments that the portfolio can access at the reporting date.

Level 2 — inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads).

Level 3 — unobservable inputs (including the portfolio’s own assumptions in determining fair value).

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market

participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

A table summarizing each Portfolio’s investments under these levels of classification is included within each Portfolio of Investments.

Each investment asset or liability of the Portfolios is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Quoted prices in active markets for identical securities are classified as “Level 1,” inputs other than quoted prices for an asset or liability that are observable are classified as “Level 2” and significant unobservable inputs, including the sub-advisers’ or Pricing Committee’s judgment about the assumptions that a market participant would use in pricing an asset or liability are classified as “Level 3.” The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Short-term securities of sufficient credit quality are generally considered to be Level 2 securities under applicable accounting rules. A table summarizing each Portfolio’s investments under these levels of classification is included within the Portfolio of Investments.

GAAP requires a reconciliation of the beginning to ending balances for reported fair values that presents changes attributable to total realized and unrealized gains or losses, purchases and sales, and transfers in or out of the Level 3 category during the period. A reconciliation of Level 3 investments within the Portfolio of Investments is presented only when a Portfolio has a significant amount of Level 3 investments.

B. Securities Transactions and Revenue Recognition. Securities transactions are accounted for on the trade date. Realized gains and losses are reported on the basis of identified cost of securities sold. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date, or for certain foreign securities, when the information becomes available to the Portfolios. Premium amortization and discount accretion are determined by the effective yield method.

15

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

C. Foreign Currency Translation. The books and records of the Portfolios are maintained in U.S. dollars. Any foreign currency amounts are translated into U.S. dollars on the following basis:

| (1) | | Market value of investment securities, other assets and liabilities — at the exchange rates prevailing at Market Close. |

| | | |

| (2) | | Purchases and sales of investment securities, income and expenses — at the rates of exchange prevailing on the respective dates of such transactions. |

Although the net assets and the market values are presented at the foreign exchange rates at Market Close, the Portfolios do not isolate the portion of their results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses from investments. For securities, which are subject to foreign withholding tax upon disposition, liabilities are recorded on the Statement of Assets and Liabilities for the estimated tax withholding based on the securities’ current market value. Upon disposition, realized gains or losses on such securities are recorded net of foreign withholding tax.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding tax reclaims recorded on the Portfolios’ books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in the exchange rate. Foreign security and currency transactions may involve certain considerations and risks not typically associated with investing in U.S. companies and U.S. government securities. These risks include, but are not limited to, revaluation of currencies and future adverse political and economic developments which could cause securities and their markets to be less liquid and prices more volatile than those of comparable U.S. companies and U.S. government securities. The foregoing risks are even greater with respect to securities of issuers in emerging markets.

D. Distributions to Shareholders. Net investment income dividends and net capital gain distributions, if any, for Bond Portfolio are declared and paid annually. For BlackRock Inflation Protected Bond, dividends from net

investment income, if any, are declared and paid monthly and distributions of net capital gains, if any, are declared and paid annually. The Portfolios may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code. The characteristics of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from GAAP for investment companies.

E. Federal Income Taxes. It is the policy of each Portfolio to comply with the requirements of subchapter M of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized capital gains to its shareholders. Therefore, a federal income tax or excise tax provision is not required. Management has considered the sustainability of the Portfolios’ tax positions taken on federal income tax returns for all open tax years in making this determination. No capital gain distributions shall be made until the capital loss carryforwards have been fully utilized.

The Portfolios may utilize equalization accounting for tax purposes, whereby a portion of redemption payments are treated as distributions of income or gain.

F. Use of Estimates. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

G. Risk Exposures and the Use of Derivative Instruments. The Portfolios’ investment strategies permit the Portfolios to enter into various types of derivatives contracts, including, but not limited to, futures contracts, forward foreign currency exchange contracts, credit default swaps, interest rate swaps, total return swaps, and purchased and written options. In doing so, a Portfolio will employ strategies in differing combinations to permit it to increase or decrease the level of risk, or change the level or types of exposure to risk factors. This may allow a Portfolio to pursue its objectives more quickly, and efficiently than if it were to make direct purchases or sales of securities capable of affecting a similar response to market or credit factors.

In pursuit of its investment objectives, a Portfolio may seek to increase or decrease its exposure to the following market or credit risk factors:

Credit Risk. The price of a bond or other debt instrument is likely to fall if the issuer’s actual or perceived financial

16

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

health deteriorates, whether because of broad economic or issuer-specific reasons. In certain cases, the issuer could be late in paying interest or principal, or could fail to pay its financial obligations altogether.

Equity Risk. Stock prices may be volatile or have reduced liquidity in response to real or perceived impacts of factors including, but not limited to, economic conditions, changes in market interest rates, and political events. Stock markets tend to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely impact the investment techniques available to a manager, add to costs and impair the ability of a Portfolio to achieve its investment objectives.

Foreign Exchange Rate Risk. To the extent that a Portfolio invests directly in foreign (non-U.S.) currencies or in securities denominated in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those foreign (non-U.S.) currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged by a Portfolio through foreign currency exchange transactions.

Currency rates may fluctuate significantly over short periods of time. Currency rates may be affected by changes in market interest rates, intervention (or the failure to intervene) by U.S. or foreign governments, central banks or supranational entities such as the International Monetary Fund, by the imposition of currency controls, or other political or economic developments in the United States or abroad.

Interest Rate Risk. With bonds and other fixed rate debt instruments, a rise in market interest rates generally causes values to fall; conversely, values generally rise as market interest rates fall. The higher the credit quality of the instrument, and the longer its maturity or duration, the more sensitive it is likely to be to interest rate risk As of the date of this report, the United States experiences a rising market interest rate environment, which may increase a Portfolio’s exposure to risks associated with rising market interest rates. Rising market interest rates have unpredictable effects on the markets and may expose fixed-income and related markets to heightened volatility. For a fund that invests in fixed-income securities, an increase in market interest rates may lead to increased redemptions and increased portfolio turnover, which could reduce liquidity

for certain investments, adversely affect values, and increase costs. If dealer capacity in fixed-income markets is insufficient for market conditions, it may further inhibit liquidity and increase volatility in the fixed-income markets. Further, recent and potential changes in government policy may affect interest rates.

Risks of Investing in Derivatives. A Portfolio’s use of derivatives can result in losses due to unanticipated changes in the market or credit risk factors and the overall market. In instances where a Portfolio is using derivatives to decrease, or hedge, exposures to market or credit risk factors for securities held by a Portfolio, there are also risks that those derivatives may not perform as expected resulting in losses for the combined or hedged positions.

Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in market interest rates and liquidity and volatility risk. The amounts required to purchase certain derivatives may be small relative to the magnitude of exposure assumed by a Portfolio. Therefore, the purchase of certain derivatives may have an economic leveraging effect on a Portfolio and exaggerate any increase or decrease in the NAV. Derivatives may not perform as expected, so a Portfolio may not realize the intended benefits. When used for hedging purposes, the change in value of a derivative may not correlate as expected with the currency, security or other risk being hedged. When used as an alternative or substitute for direct cash investments, the return provided by the derivative may not provide the same return as direct cash investment. In addition, given their complexity, derivatives expose a Portfolio to the risk of improper valuation.

Generally, derivatives are sophisticated financial instruments whose performance is derived, at least in part, from the performance of an underlying asset or assets. Derivatives include, among other things, swap agreements, options, forwards and futures. Investments in derivatives are generally negotiated over-the-counter (“OTC”) with a single counterparty and as a result are subject to credit risks related to the counterparty’s ability or willingness to perform its obligations; any deterioration in the counterparty’s creditworthiness could adversely affect the value of the derivative. In addition, derivatives and their underlying securities may experience periods of illiquidity which could cause a Portfolio to hold a security it might otherwise sell, or to sell a security it otherwise might hold at inopportune times or at an unanticipated price. A manager might imperfectly judge the direction of the market. For instance, if a derivative is used as a hedge to offset investment risk in another security, the hedge might not correlate to the market’s movements and may have

17

NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022 (CONTINUED)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

unexpected or undesired results such as a loss or a reduction in gains.

Counterparty Credit Risk and Credit Related Contingent Features. Certain derivative positions are subject to counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to a Portfolio. Each Portfolio’s derivative counterparties are financial institutions who are subject to market conditions that may weaken their financial position. A Portfolio intends to enter into financial transactions with counterparties that it believes to be creditworthy at the time of the transaction. To reduce this risk, a Portfolio has entered into master netting arrangements, established within each Portfolio’s International Swap and Derivatives Association, Inc. (“ISDA”) Master Agreements (“Master Agreements”). These Master Agreements are with select counterparties and they govern transactions, including certain OTC derivative and forward foreign currency contracts, entered into by a Portfolio and the counterparty. The Master Agreements maintain provisions for general obligations, representations, agreements, collateral, and events of default or termination. The occurrence of a specified event of termination may give a counterparty the right to terminate all of its contracts and affect settlement of all outstanding transactions under the applicable Master Agreement.