October 18, 2021 Third Quarter 2021 Financial Review

2 Forward-Looking Statements; Use of Non-GAAP Financial Measures Forward Looking Information This presentation includes “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and assumptions regarding future events or determinations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, industry results or regulatory outcomes to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements include, among others: ▪ statements with respect to the Bank’s beliefs, plans, objectives, goals, targets, commitments, designs, guidelines, expectations, anticipations, and future financial condition, results of operations and performance; and ▪ statements preceded by, followed by, or that include the words “may,” “might,” “can,” “continue,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “forecasts,” “expect,” “intend,” “target,” “commit,” “design,” “plan,” “projects,” “will,” and the negative thereof and similar words. Forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Actual results and outcomes may differ materially from those presented. Important risk factors that may cause such material differences include changes in general economic, regulatory, and industry conditions; changes and uncertainties in fiscal, monetary, regulatory, trade and tax policies and legislative and regulatory changes; changes in interest rates and uncertainty regarding the transition away from the London Interbank Offered Rate ("LIBOR") toward other alternative reference rates; the quality and composition of our loan and securities portfolios; competitive pressures and other factors that may affect aspects of our business, such as pricing and demand for our products and services; our ability to execute our strategic plans, manage our risks, and achieve our business objectives; our ability to develop and maintain information security systems, technologies and controls designed to guard against fraud, cyber and privacy risks; and the effects of the COVID-19 pandemic or other national or international crises or conflicts that may occur in the future and governmental responses to such matters. These factors, among others, are discussed in the Bank’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (SEC) and available at the SEC’s Internet site (https://www.sec.gov/). In addition, you may obtain documents filed with the SEC by the Bank free of charge by contacting: Investor Relations, Zions Bancorporation, N.A., One South Main Street, 16th Floor, Salt Lake City, Utah 84133, (801) 844-7637. We caution you against undue reliance on forward-looking statements, which reflect our views only as of the date they are made. Except as may be required by law, Zions Bancorporation, N.A. specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments. Use of Non-GAAP Financial Measures: This document contains several references to non-GAAP measures, including pre-provision net revenue and the “efficiency ratio,” which are common industry terms used by investors and financial services analysts. Certain of these non-GAAP measures are key inputs into Zions’ management compensation and are used in Zions’ strategic goals that have been and may continue to be articulated to investors. Therefore, the use of such non-GAAP measures are believed by management to be of substantial interest to the consumers of these financial disclosures and are used prominently throughout the disclosures. A full reconciliation of the difference between such measures and GAAP financials is provided within the document, and users of this document are encouraged to carefully review this reconciliation.

▪ Reporting continued strength in deposit growth ▪ We are investing significantly in loans and modest duration securities to generate earnings today ▪ Simultaneously, we are maintaining a strong liquidity profile ▪ Outperforming most peers in credit quality through an ongoing pandemic ▪ Emerging from a challenging operating environment for loan growth ▪ We are countering what has been a challenging loan growth environment with promotional-rate products as a more attractive alternative to money market investments for surplus liquidity resources ▪ We have employed strategies designed to bring new customers to the bank ▪ Promotional products aimed at core small business and affluent clients ▪ >20,000 PPP loans to new to the bank customers ▪ Managing for rising interest rates ▪ We have positioned the bank for future interest rates by carefully managing balance sheet liquidity ▪ An “up 100” interest rate change (+100 basis point parallel interest rate shock) would result in approximately 12% more net interest income (pre-tax ~$250 million annually) ▪ Investing significantly in technology to position the company for improved long-term resiliency, revenue growth and above-average operating leverage 3 Select Themes Key near-term objectives designed to position the bank for superior revenue growth and operating leverage

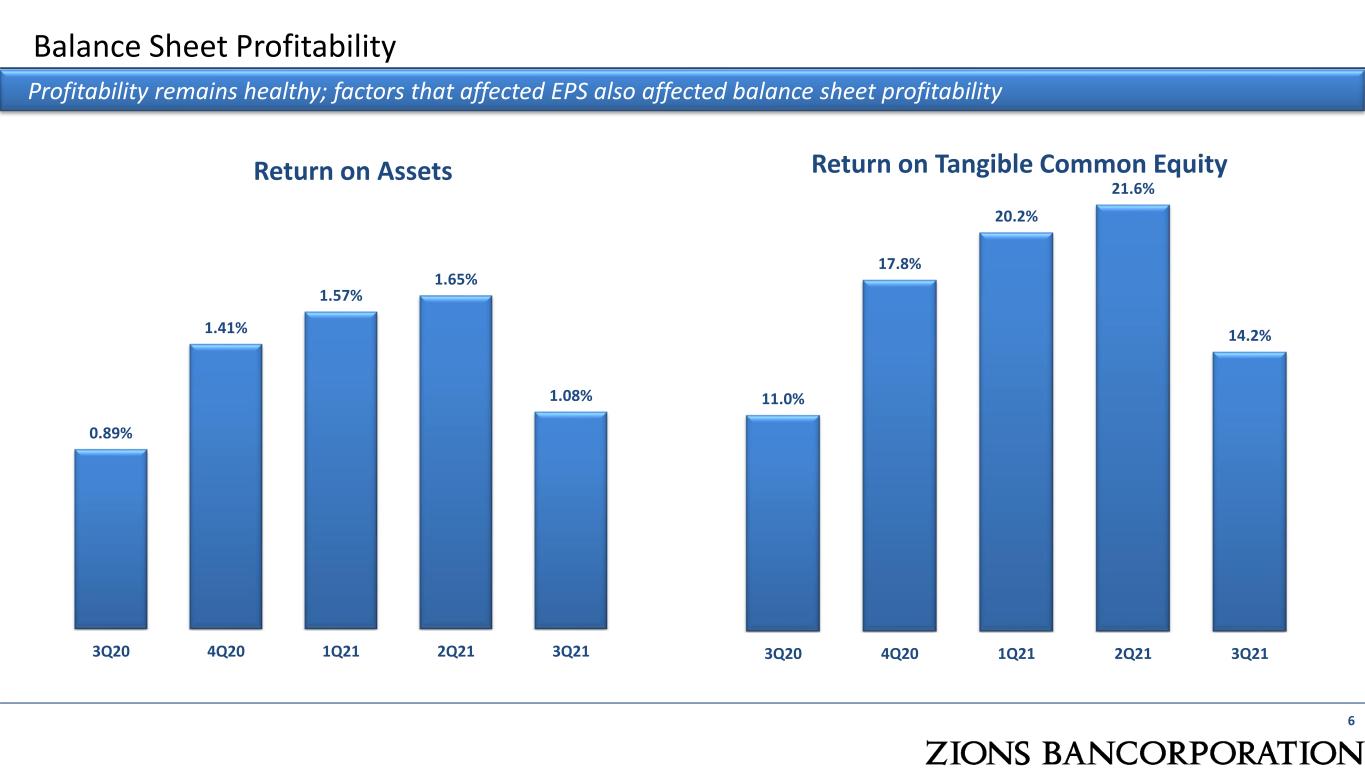

✓ Earnings and Profitability: ▪ $1.45 diluted earnings/share compared to $2.08 ▪ $272 million Pre-Provision Net Revenue ▪ $290 million Adjusted PPNR(1) ▪ $(46) million provision for credit loss compared to $(123) million ▪ $234 million Net Income Applicable to Common, down from $345 million due to provision for credit loss and securities gains/(losses) ▪ 1.1% Return on Assets (annualized) ▪ 14.2% Return on Average Tangible Common Equity (annualized) ✓ Credit quality (excluding PPP Loans): ▪ 0.69% Nonperforming Assets + loans 90+ days past due / non-PPP loans and leases and other real estate owned ▪ 0.01% net loan recoveries, percent of loans, annualized. Both 2Q and 3Q 2021 experienced net recoveries ▪ Decrease in the allowance for credit loss (“ACL”), to $529 million or 1.11% of non-PPP loans from 1.22% 4 Third Quarter 2021 Financial Highlights Vs. 2Q21, adjusted PPNR was stable, with continue strong increases in deposits and a healthy increase in non-PPP loans Note: For the purposes of comparison in this presentation, we generally use linked-quarter ("LQ"), due to that being the preferred comparison for professional investors and analysts. (1) Adjusted for items such as severance costs, restructuring costs, other real estate expense, pension termination-related expense, securities gains and losses, and accruals for investment and advisory expenses related to the unrealized gain on an SBIC investment. See Appendix for GAAP to non-GAAP reconciliation tables. ✓ Loans and Deposits: Vs. 2Q21, growth rates not annualized ▪ 1.4% decline in period-end loan balances ▪ 1.4% increase in period-end loan balances (excluding PPP loans) ▪ 2.3% increase in period-end deposits ▪ 2.7% increase in period-end total noninterest-bearing deposits ▪ 65% period-end loan-to-deposit ratio ▪ 0.03% cost of total deposits ✓ Capital Strength: ▪ 10.9% Common Equity Tier 1 Ratio (CET1), down from 11.3% ▪ 11.8% (CET1+Allowance for Credit Losses) / Risk-Weighted Assets ▪ $325 million of common stock repurchased during 3Q21

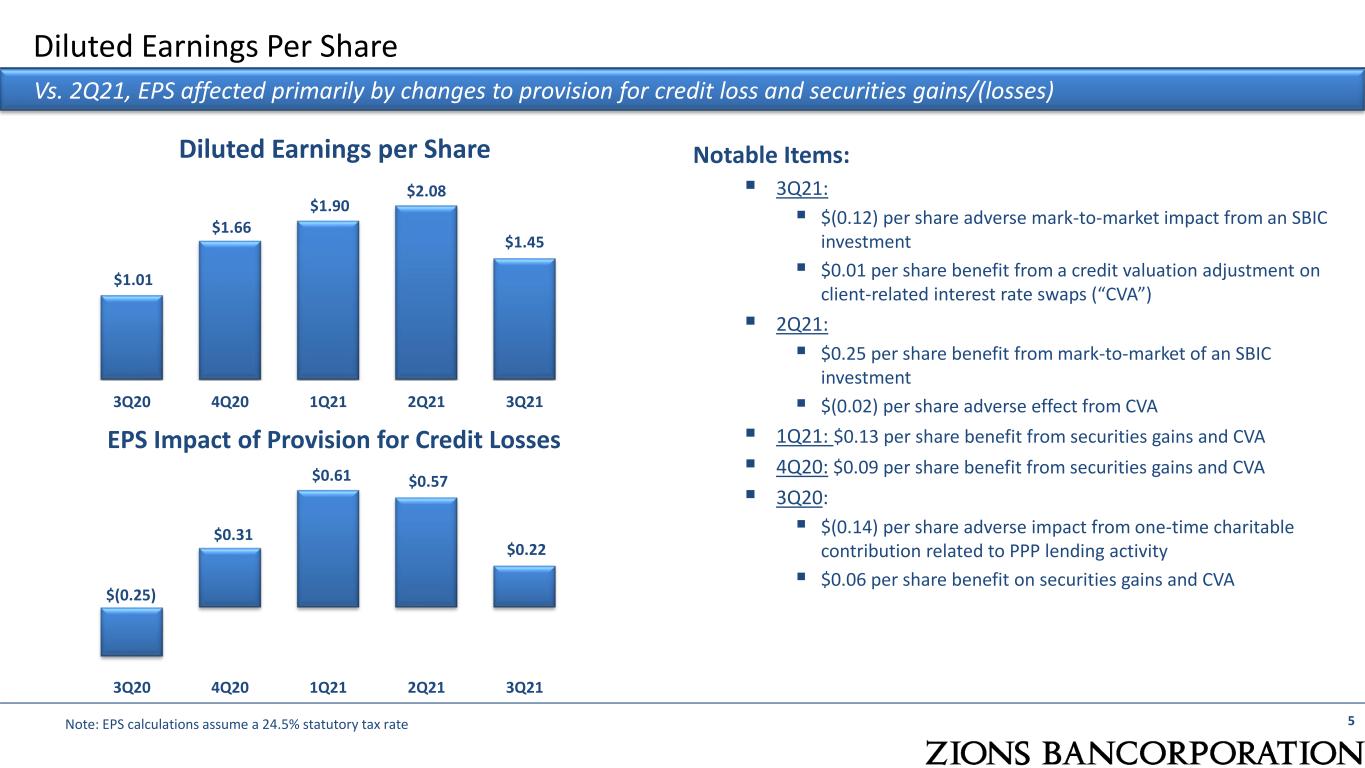

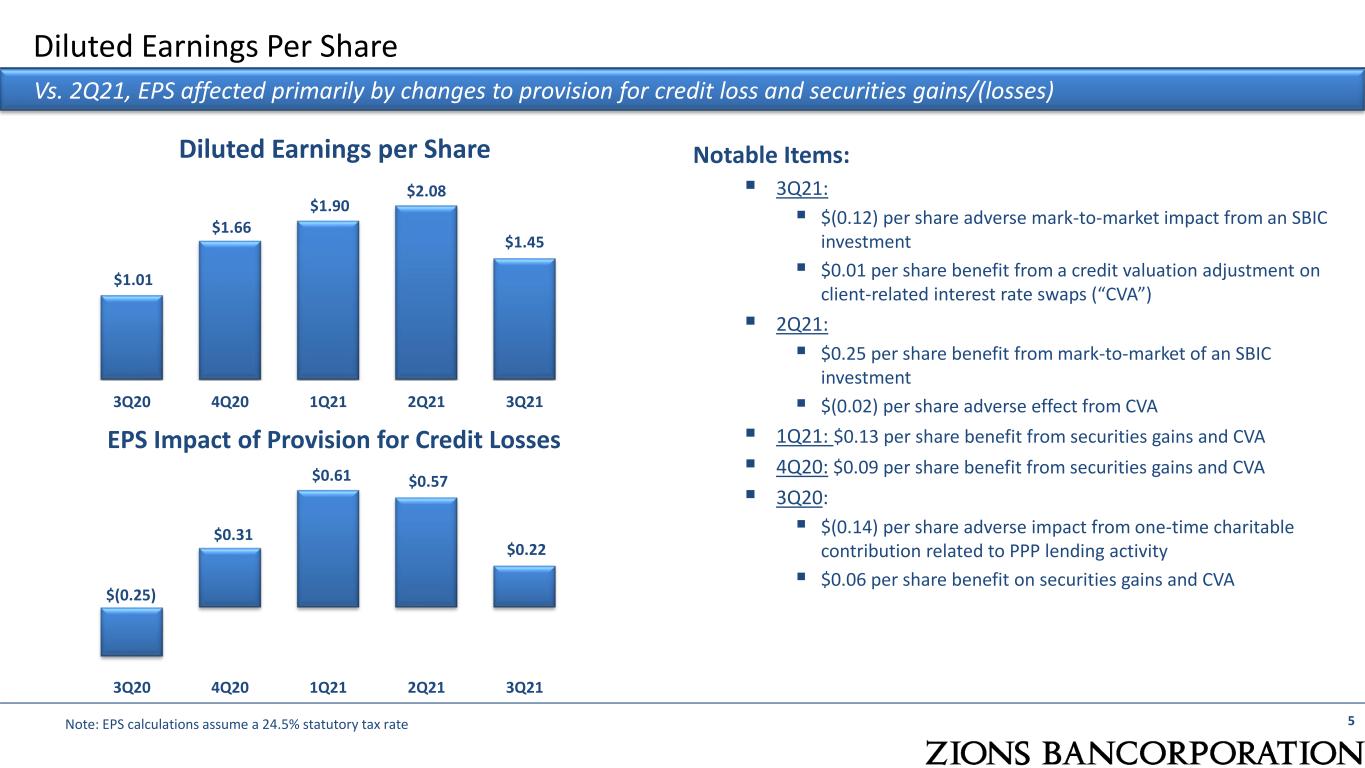

$1.01 $1.66 $1.90 $2.08 $1.45 3Q20 4Q20 1Q21 2Q21 3Q21 Diluted Earnings Per Share Notable Items: ▪ 3Q21: ▪ $(0.12) per share adverse mark-to-market impact from an SBIC investment ▪ $0.01 per share benefit from a credit valuation adjustment on client-related interest rate swaps (“CVA”) ▪ 2Q21: ▪ $0.25 per share benefit from mark-to-market of an SBIC investment ▪ $(0.02) per share adverse effect from CVA ▪ 1Q21: $0.13 per share benefit from securities gains and CVA ▪ 4Q20: $0.09 per share benefit from securities gains and CVA ▪ 3Q20: ▪ $(0.14) per share adverse impact from one-time charitable contribution related to PPP lending activity ▪ $0.06 per share benefit on securities gains and CVA 5 Vs. 2Q21, EPS affected primarily by changes to provision for credit loss and securities gains/(losses) Diluted Earnings per Share Note: EPS calculations assume a 24.5% statutory tax rate $(0.25) $0.31 $0.61 $0.57 $0.22 3Q20 4Q20 1Q21 2Q21 3Q21 EPS Impact of Provision for Credit Losses

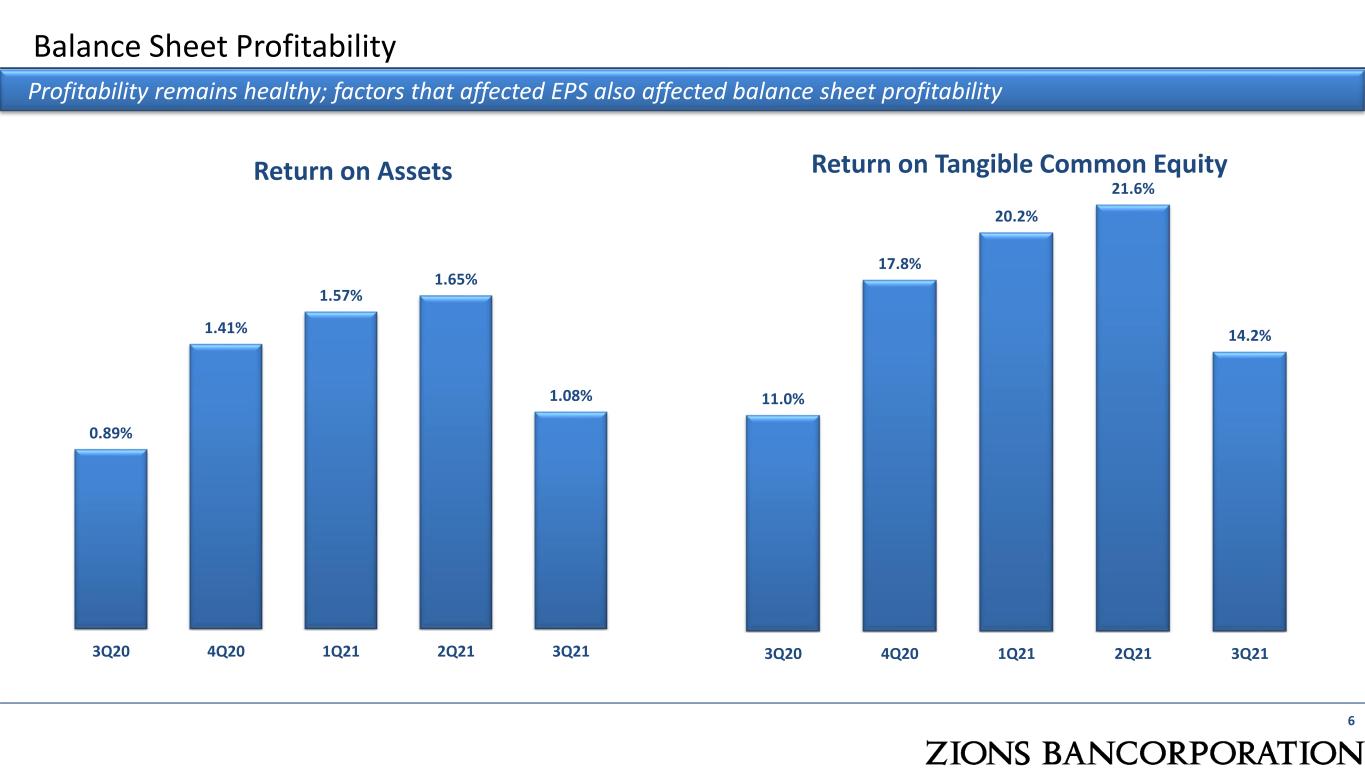

0.89% 1.41% 1.57% 1.65% 1.08% 3Q20 4Q20 1Q21 2Q21 3Q21 11.0% 17.8% 20.2% 21.6% 14.2% 3Q20 4Q20 1Q21 2Q21 3Q21 Balance Sheet Profitability 6 Profitability remains healthy; factors that affected EPS also affected balance sheet profitability Return on Assets Return on Tangible Common Equity

7 Credit Quality Ratios Credit quality continues to show improvement, with last 12 months net charge-offs at just 0.04% of average loans Key credit metrics: ▪ Classified loans/loans: 2.9% ▪ NPAs+90(1)/loans + OREO: 0.69% ▪ Annualized net loan losses (recoveries): ▪ (1) basis point in 3Q21 ▪ 0.04% net charge-offs / average loans over the last 12 months Allowance for credit losses: ▪ 1.11% of total loans and leases (1) Nonperforming assets plus accruing loans that were ≥ 90 days past due Note: Net charge-offs / average loans and provision / average loans ratios are annualized for all periods shown Credit Quality 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 3Q20 4Q20 1Q21 2Q21 3Q21 Classified / Loans NPAs +90/ Loans + OREO ACL / Loans All Ratios Exclude PPP Loans 0.43% 0.13% 0.07% (0.02)% (0.01)% 0.46% (0.56)% (1.11)% (1.05)% (0.39)% NCOs / Loans (ann.) Provision/Avg Loans (ann.)

Capital Strength 8 Our superior risk profile and a healthy, strengthening economy positions us for continued active capital management Common Equity Tier 1 Capital Return of Shareholder Equity Dividends (Common and Preferred(1)) and Share Repurchases 10.4% 10.8% 11.2% 11.3% 10.9% 3Q20 4Q20 1Q21 2Q21 3Q21 $64 $65 $64 $65 $68 $50 $100 $325 3Q20 4Q20 1Q21 2Q21 3Q21 Dividends Buybacks ($ millions) (1) Preferred dividends are expected to be $5.7 million for the first and third quarters of 2022 and $7.8 million for the fourth quarter of 2021 and the second and fourth quarters of 2022.

Adjusted Pre-Provision Net Revenue 9 Adjusted PPNR aided by PPP related revenues (22% of adjusted PPNR in 3Q21) (1) Adjusted for items such as severance costs, restructuring costs, other real estate expense, pension termination-related expense, securities gains and losses, and accruals for investment and advisory expenses related to the unrealized gain on an SBIC investment. This investment will continue to be marked-to-market until the SBIC fund manager divests of the shares, which are subject to a minimum 180-day lock-up period from the initial offering in April 2021. See Appendix for GAAP to non-GAAP reconciliation table. Notable items: ▪ Interest Income from PPP Loans net the professional services expense associated with PPP forgiveness: ▪ 3Q21: $63 million ($63 million income) ▪ 2Q21: $67 million ($68 million less $1 million professional service expense) ▪ 1Q21: $52 million ($60 million less $8 million) ▪ 4Q20: $52 million ($55 million less $3 million) ▪ 3Q20: $52 million ▪ 3Q20: $30 million adverse impact from a one-time charitable contribution related to PPP lending activity $267 $280 $253 $290 $290 $52 $52 $52 $67 $63 3Q20 4Q20 1Q21 2Q21 3Q21 Interest Income from PPP Loans net professional services expense associated with PPP forgiveness Adjusted PPNR (non-GAAP) Adjusted PPNR(1) ($ millions)

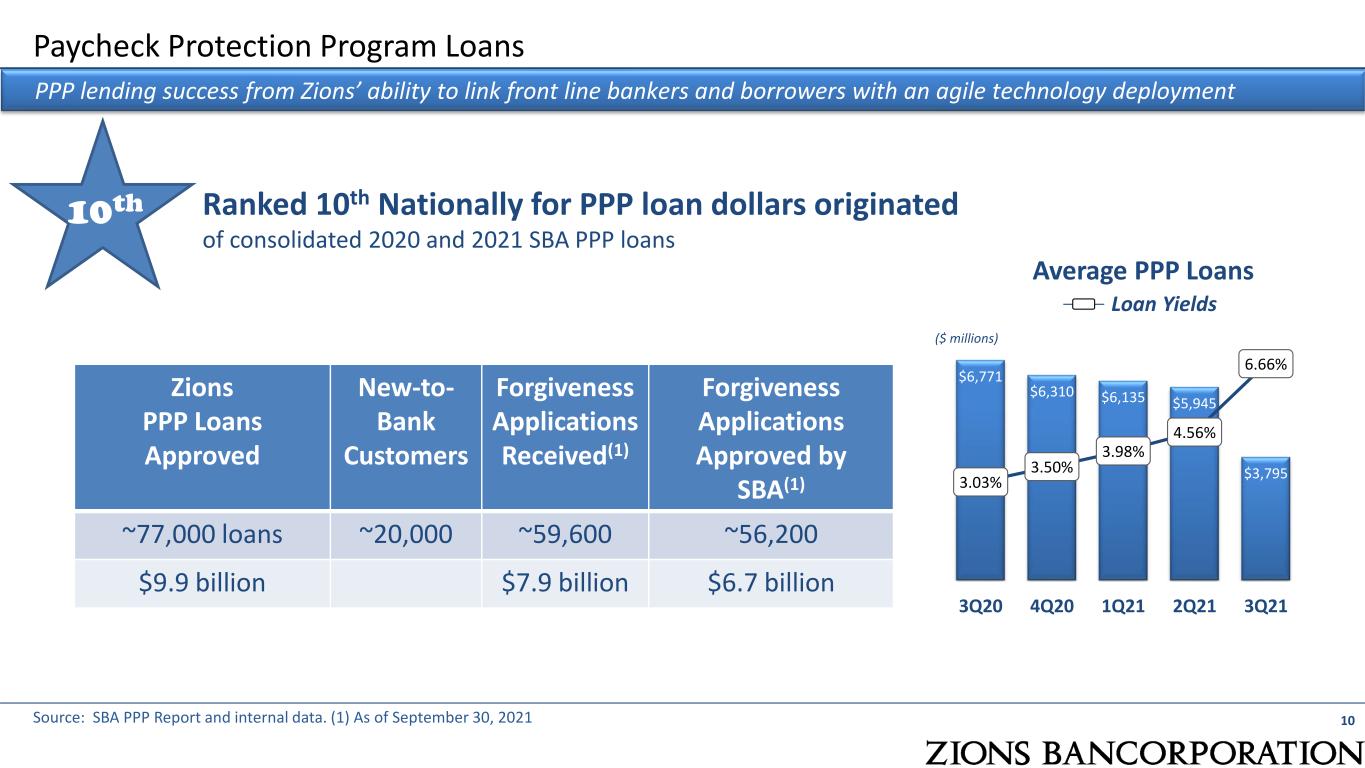

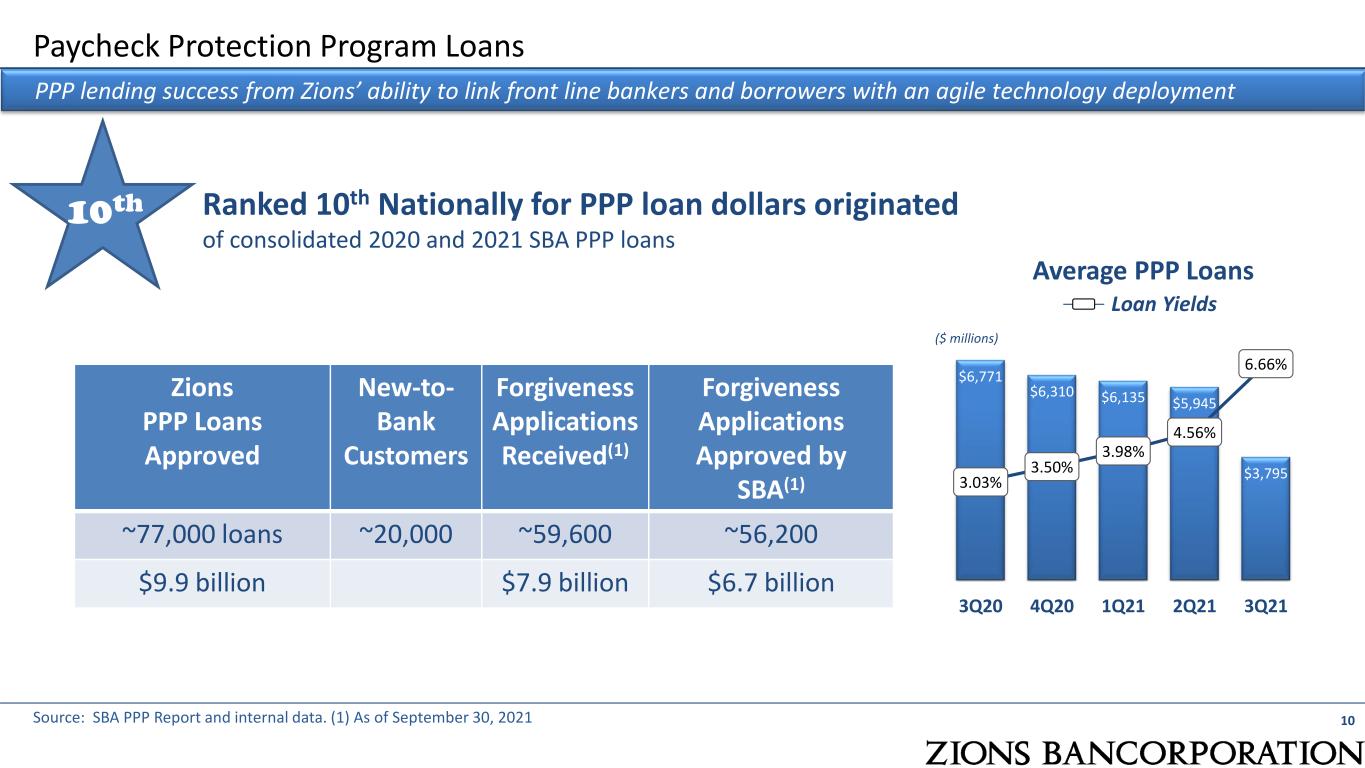

Paycheck Protection Program Loans 10 PPP lending success from Zions’ ability to link front line bankers and borrowers with an agile technology deployment Zions PPP Loans Approved New-to- Bank Customers Forgiveness Applications Received(1) Forgiveness Applications Approved by SBA(1) ~77,000 loans ~20,000 ~59,600 ~56,200 $9.9 billion $7.9 billion $6.7 billion Source: SBA PPP Report and internal data. (1) As of September 30, 2021 $6,771 $6,310 $6,135 $5,945 $3,795 3.03% 3.50% 3.98% 4.56% 6.66% 3Q20 4Q20 1Q21 2Q21 3Q21 Average PPP Loans Loan Yields 10th Ranked 10th Nationally for PPP loan dollars originated of consolidated 2020 and 2021 SBA PPP loans ($ millions)

0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 3Q20 4Q20 1Q21 2Q21 3Q21 Existing New Paycheck Protection Program Customers – Enhanced Relationships 11 Growth rate of new services provided to both existing and new-to-bank customers remains steady New Accounts and Services Utilized by PPP Customers New revenue generating services include: ▪ New accounts (checking or loan) ▪ Account analysis / Treasury Internet Banking ▪ ACH and wire transfers / Remote Deposit Capture ▪ Wealth Management / Credit Cards 57,000 20,000 New-to-Bank Customers Existing Customers PPP Loans (Prior to Forgiveness) New accounts and services do not include the PPP loan, or the deposit account required to receive the PPP funds, and includes only products and services that generate revenue Related benefits from PPP customers ▪ Deposit growth exceeding $6 billion ▪ New loans exceeding $550 million ▪ ~50% of PPP (2020 vintage) new-to-bank customers are considered active users of their deposit accounts, rising consistently since origination ▪ Retention rate for new-to-bank customers has been solid

12 Replacing the entire core legacy environment to improve operational resiliency and efficiency • Parameter driven • Real time • One data model • Natively API enabled • Cloud deployable • Modern cyber paradigm • Continuously upgraded & tested • Facilitates automation Modern Architecture Built for Resiliency and Speed • Faster time to market for new products • Unified account opening platform (branch/online/ mobile) • Decreased outage risk • Improves consistency of customer attribute data across numerous apps • 7-day processing (when U.S. adopts) • Real time: Fraud alerts and data entry correction Improved Customer Experience • Intuitive user-friendly front end • Real time data vs. calling the back office • Reduces duplicate data entry • Training simplified Empowered Bankers • General ledger simplification • Credit approval workflow • Loan ops consolidation • Data governance disciplines • Deposit product rationalization • Charter consolidation Driving Modernization FutureCore: A Strategic Technology Advantage for Years to Come Fu tu re C o re as a C at al ys t B e n ef it s o f Fu tu re C o re

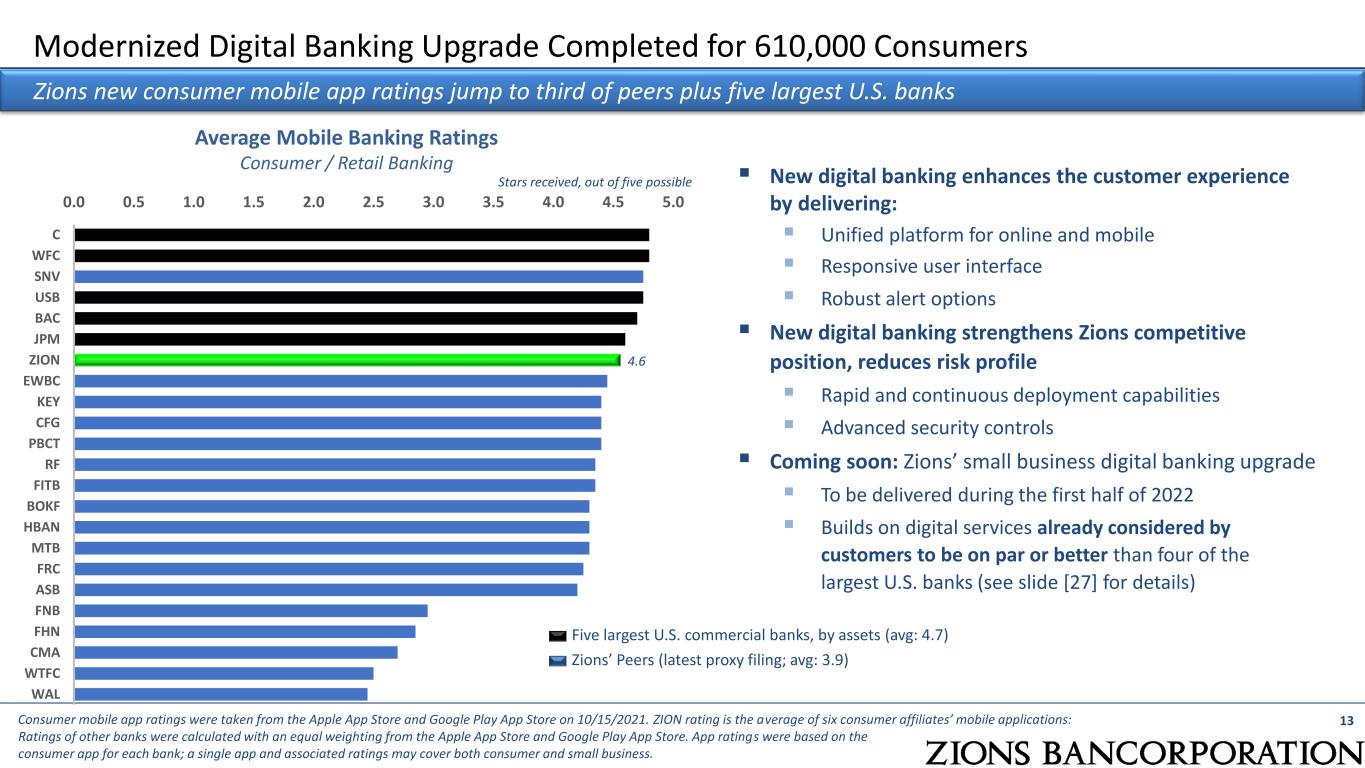

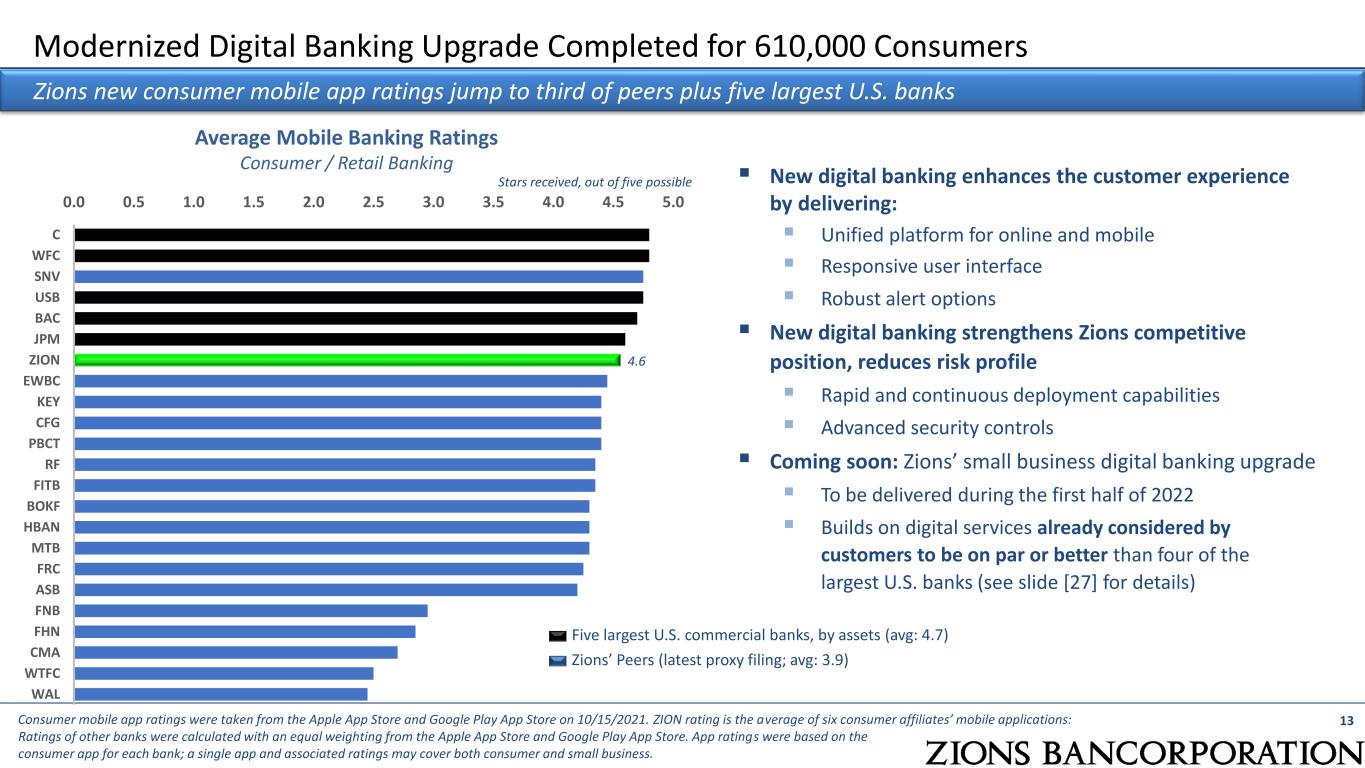

Modernized Digital Banking Upgrade Completed for 610,000 Consumers 13 Zions new consumer mobile app ratings jump to third of peers plus five largest U.S. banks Consumer mobile app ratings were taken from the Apple App Store and Google Play App Store on 10/15/2021. ZION rating is the average of six consumer affiliates’ mobile applications: ▪ New digital banking enhances the customer experience by delivering: ▪ Unified platform for online and mobile ▪ Responsive user interface ▪ Robust alert options ▪ New digital banking strengthens Zions competitive position, reduces risk profile ▪ Rapid and continuous deployment capabilities ▪ Advanced security controls ▪ Coming soon: Zions’ small business digital banking upgrade ▪ To be delivered during the first half of 2022 ▪ Builds on digital services already considered by customers to be on par or better than four of the largest U.S. banks (see slide [27] for details) 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 WAL WTFC CMA FHN FNB ASB FRC MTB HBAN BOKF FITB RF PBCT CFG KEY EWBC ZION JPM BAC USB SNV WFC C Average Mobile Banking Ratings Consumer / Retail Banking Stars received, out of five possible Five largest U.S. commercial banks, by assets (avg: 4.7) Zions’ Peers (latest proxy filing; avg: 3.9) Ratings of other banks were calculated with an equal weighting from the Apple App Store and Google Play App Store. App ratings were based on the consumer app for each bank; a single app and associated ratings may cover both consumer and small business. 4.6

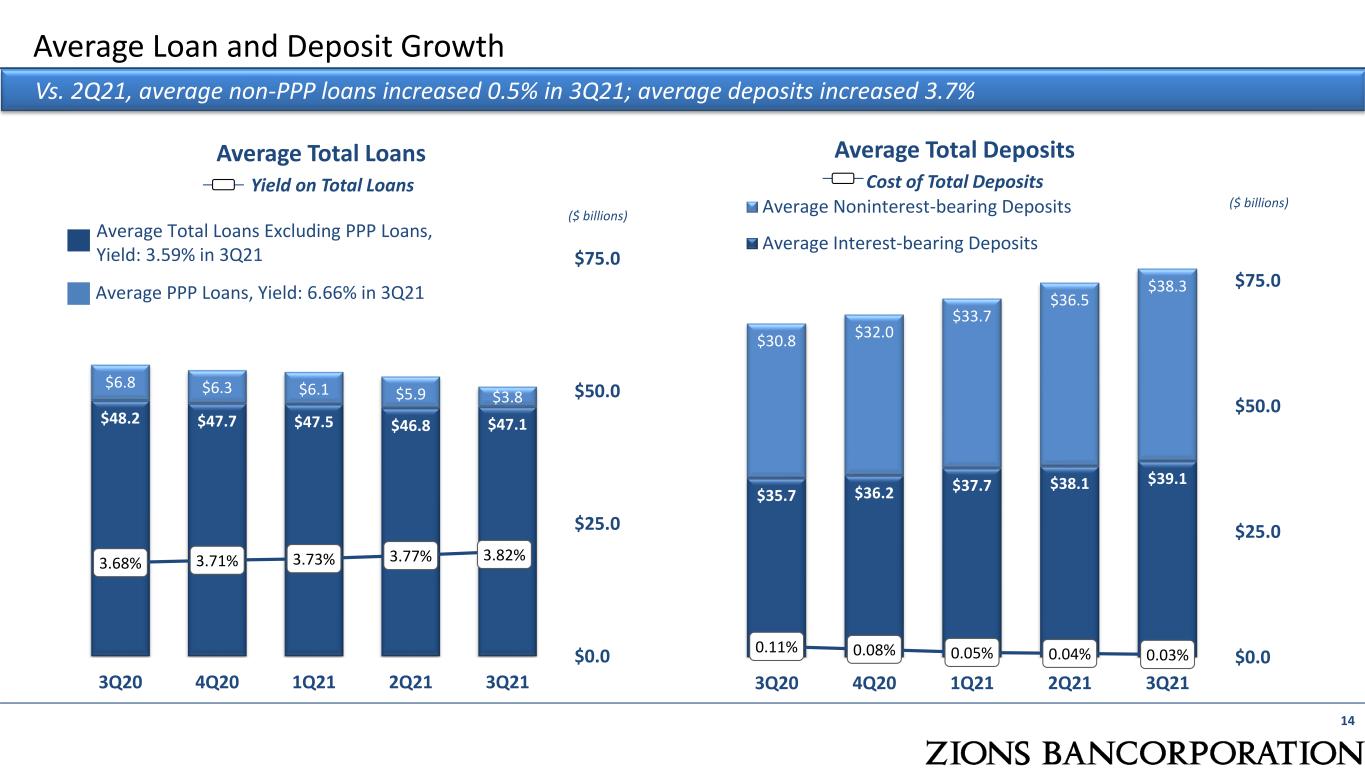

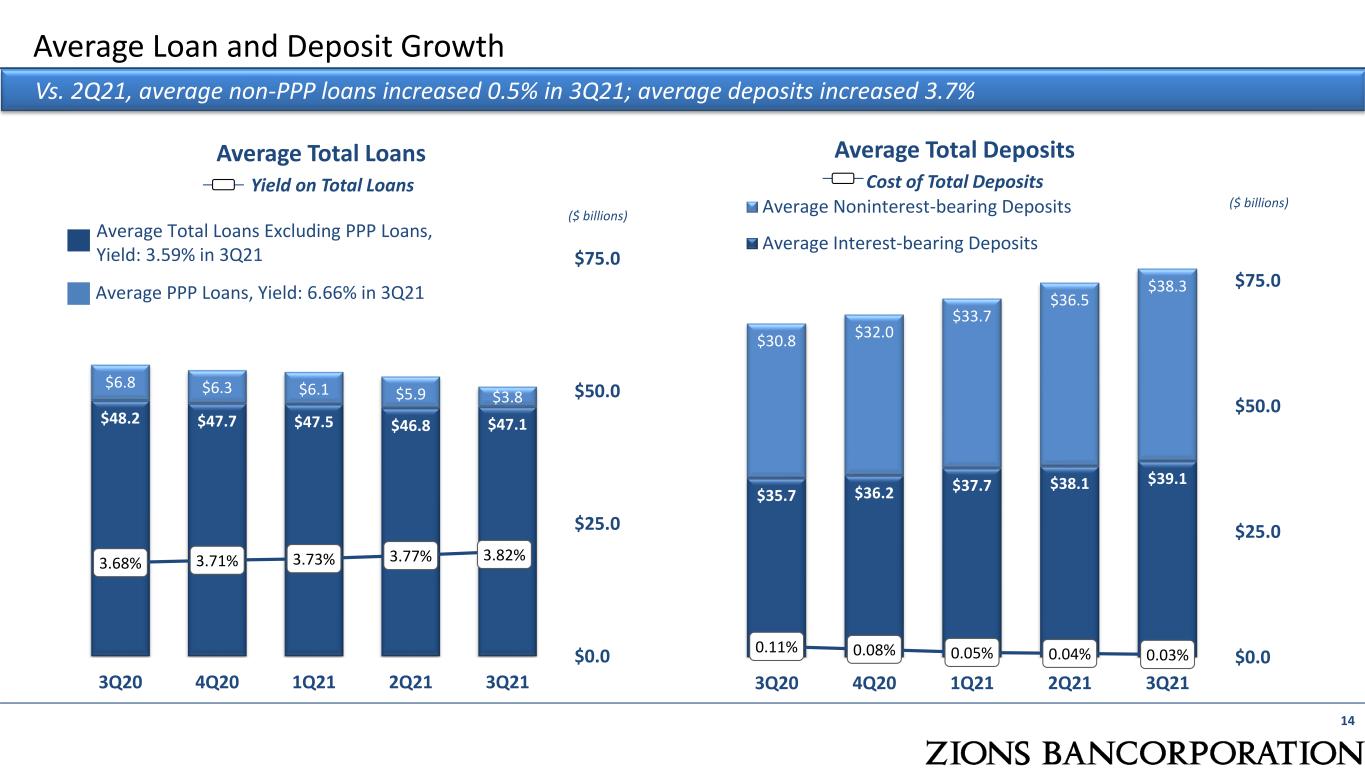

$48.2 $47.7 $47.5 $46.8 $47.1 $6.8 $6.3 $6.1 $5.9 $3.8 3.68% 3.71% 3.73% 3.77% 3.82% $0.0 $25.0 $50.0 $75.0 3Q20 4Q20 1Q21 2Q21 3Q21 Average Total Loans Excluding PPP Loans, Yield: 3.59% in 3Q21 Average PPP Loans, Yield: 6.66% in 3Q21 Average Loan and Deposit Growth Average Total Loans Yield on Total Loans Average Total Deposits Cost of Total Deposits 14 Vs. 2Q21, average non-PPP loans increased 0.5% in 3Q21; average deposits increased 3.7% $35.7 $36.2 $37.7 $38.1 $39.1 $30.8 $32.0 $33.7 $36.5 $38.3 0.11% 0.08% 0.05% 0.04% 0.03% $0.0 $25.0 $50.0 $75.0 3Q20 4Q20 1Q21 2Q21 3Q21 Average Noninterest-bearing Deposits Average Interest-bearing Deposits ($ billions) ($ billions)

▪ Interest rate sensitivity reduced through interest rate hedges(1): ▪ $3.6B in securities purchases in 3Q21 with an avg yield of 1.53% ▪ $1.5B in forward-starting interest-rate swaps added in 3Q21 with a weighted average rate of 0.94% 0.00% 2.06% 1.31% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Through the End of 2021 2022 2023–2027 Net Swaps Maturing Average Receive-Fixed Rate (R-Axis) $0 million $(27) million $(41) million Securities, Money Market Investments and Interest Rate Swaps 15 Total Securities Portfolio and Money Market Investments (end of period balances) $15.5 $16.6 $17.4 $19.0 $21.2 $3.7 $6.8 $9.7 $11.8 $11.3 3Q20 4Q20 1Q21 2Q21 3Q21 Total Securities Money Market Investments ($ billions) The securities portfolio increased $2.3 B in 3Q21, absorbing deposit growth ▪ Strong deposit growth has significantly increased the bank’s overall liquidity profile ▪ 3Q21 period-end securities growth was $2.3 billion and accounted for 25% of period-end interest-earning assets ▪ 3Q21 period-end money market investments declined $0.5 billion and accounted for 14% of period-end interest-earning assets ($ millions) Δ in Interest Income assuming no further swap activity (1) Text boxes indicate the annual net interest income reductions from the most recent quarter’s annualized net interest income if no additional swaps were added and if 1M Libor were to remain constant. 26% 30% 34% 37% 39% Percent of earning assets

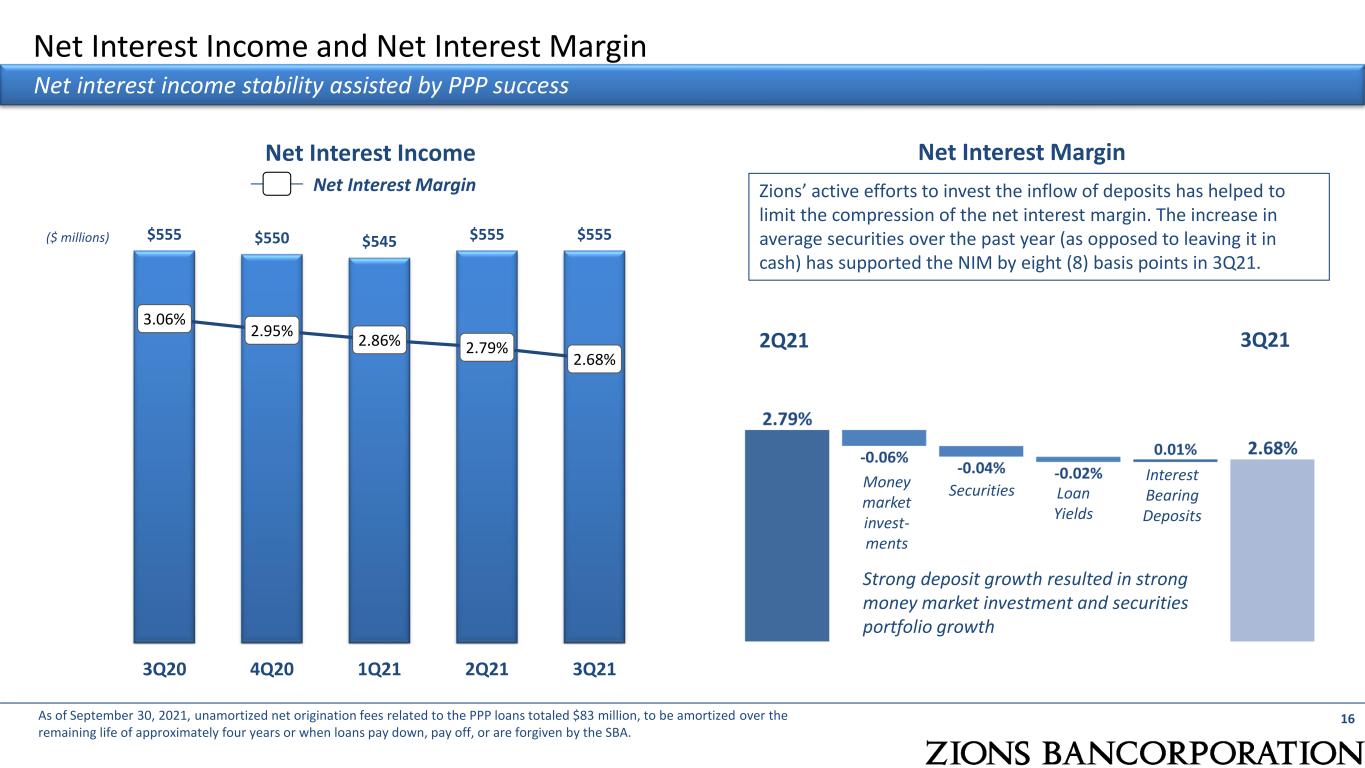

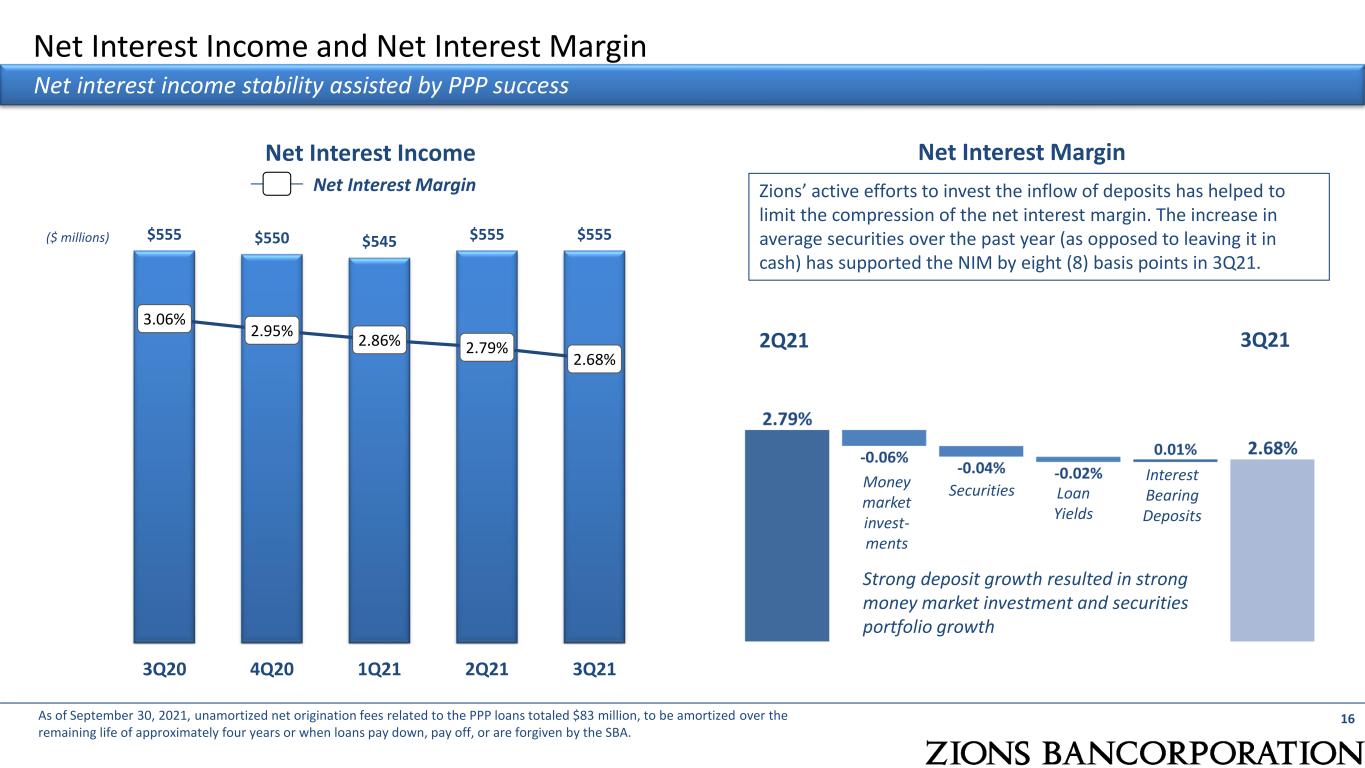

$555 $550 $545 $555 $555 3.06% 2.95% 2.86% 2.79% 2.68% 3Q20 4Q20 1Q21 2Q21 3Q21 Net Interest Income and Net Interest Margin Net Interest Income Net Interest Margin 16 Net interest income stability assisted by PPP success ($ millions) Net Interest Margin 2Q21 3Q21 Securities Loan Yields Interest Bearing Deposits As of September 30, 2021, unamortized net origination fees related to the PPP loans totaled $83 million, to be amortized over the remaining life of approximately four years or when loans pay down, pay off, or are forgiven by the SBA. Zions’ active efforts to invest the inflow of deposits has helped to limit the compression of the net interest margin. The increase in average securities over the past year (as opposed to leaving it in cash) has supported the NIM by eight (8) basis points in 3Q21. Money market invest- ments Strong deposit growth resulted in strong money market investment and securities portfolio growth

4 9 % 1 4 % 1 0 % 8 % 1 0 % 9 % 3 0 % 1 4 % 1 0 % 9 % 2 6 % 1 1 % ≤ 3m 4-12m 1-2 yrs 2-3 yrs 3-5 yrs > 5 yrs Pe rc en t o f Lo an s Loans: Rate Reset and Cash Flow Profile Loans After Hedging Interest Rate Sensitivity 17 The low interest rate environment and surge in deposits has resulted in increased asset sensitivity Source: Company filings and S&P Global; “Prior Fed Cycle” refers to 3Q15-2Q19, reflecting the lag effect of deposit pricing relative to Fed Funds rates. The “Current Fed Cycle” begins in 3Q19 to present. (1) 12-month simulated impact of an instantaneous and parallel change in interest rates. Loans are assumed to experience prepayments, amortization and maturity events, in addition to interest rate resets in chart on the right. The loan and securities portfolios have durations of 1.8 and 3.0 years, respectively. -6% 12% 25% −100 bps +100 bps +200 bps Net Interest Income Sensitivity (1) A ss u m ed H is to ri ca l In the down 100 scenario, models assume rates do not fall below zero 18% 21% 15% 14% 1% Prior Fed Cycle (+225 bps) Current Fed Cycle (-225 bps) +200 bps +100 bps −100 bps Total Deposit Betas

$139 $139 $133 $139 $151 3Q20 4Q20 1Q21 2Q21 3Q21 Customer-related fee income increased from the prior quarter due to: ▪ $6 million increase in loan-related fees and income, primarily from mortgage banking activities ▪ Incremental increase in retail banking fees, card fees, wealth management and other fees Over the longer term, customer-related fees are benefitting from improved capital markets, wealth management, and mortgage banking activities Noninterest Income 18 Customer-Related Fee Income (1) Total customer-related fee income increased 9% from 2Q21 primarily due to an increase in loan-related fee income (1) Reflects total customer-related noninterest income, which excludes items such as fair value and non-hedge derivative income, securities gains (losses), and other items, as detailed in the Noninterest Income table located in the earnings release. ($ millions)

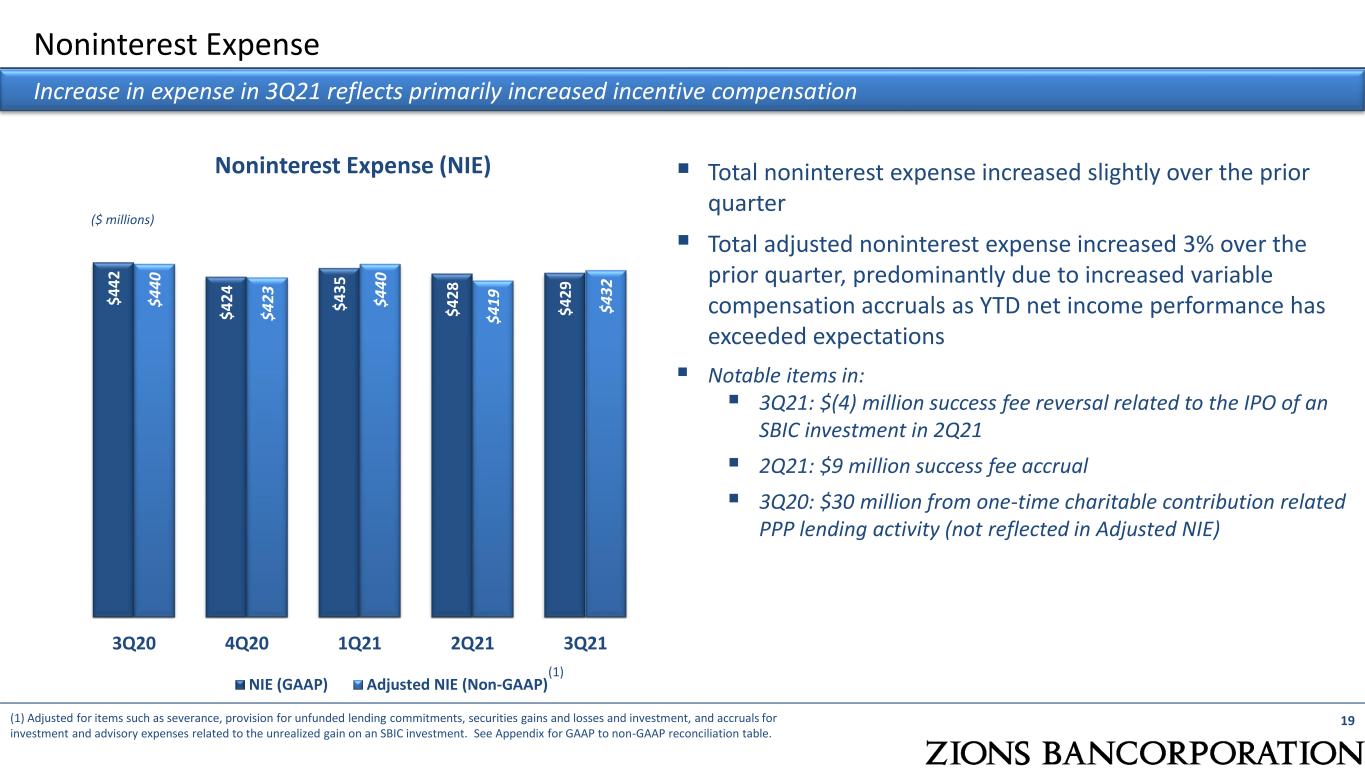

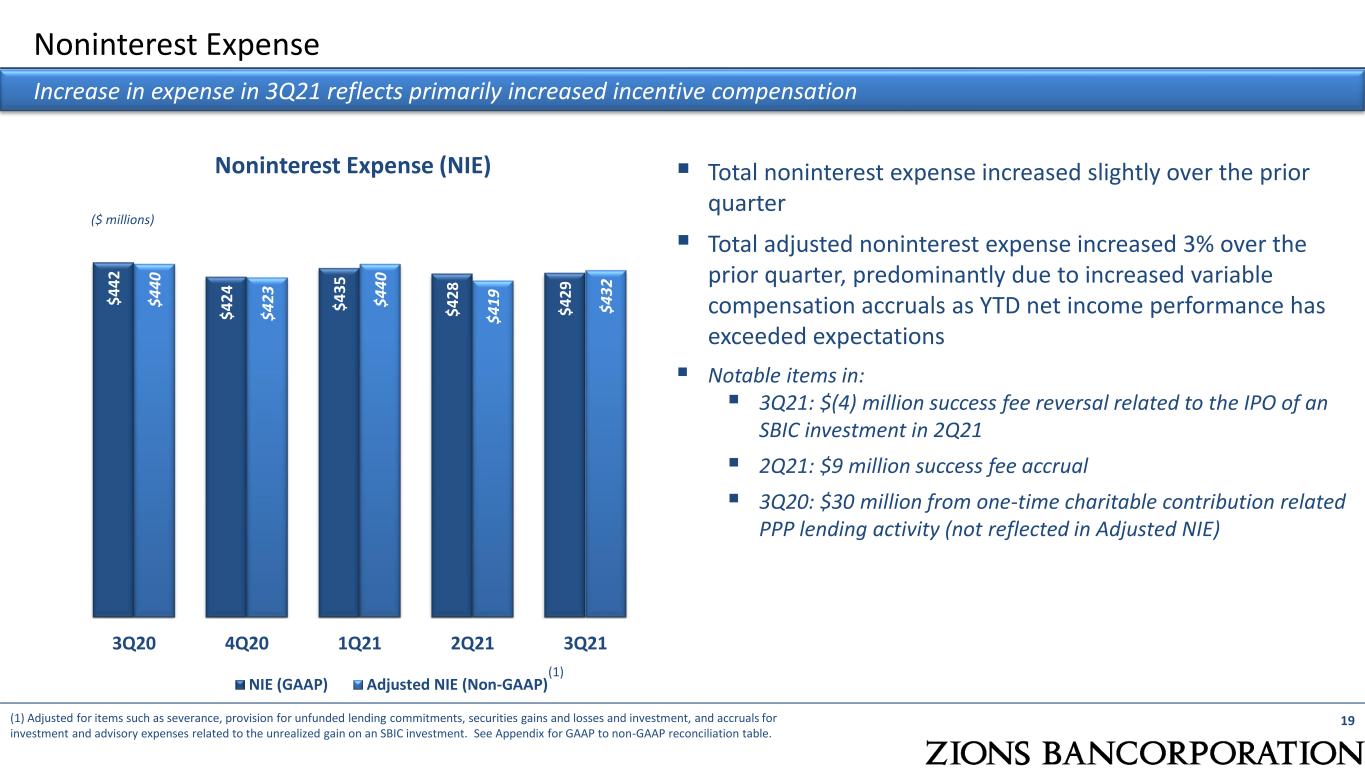

$ 4 4 2 $ 4 2 4 $ 4 3 5 $ 4 2 8 $ 4 2 9 $ 4 4 0 $ 4 2 3 $ 4 4 0 $ 4 1 9 $ 4 3 2 3Q20 4Q20 1Q21 2Q21 3Q21 NIE (GAAP) Adjusted NIE (Non-GAAP) ($ millions) Noninterest Expense 19 Increase in expense in 3Q21 reflects primarily increased incentive compensation ▪ Total noninterest expense increased slightly over the prior quarter ▪ Total adjusted noninterest expense increased 3% over the prior quarter, predominantly due to increased variable compensation accruals as YTD net income performance has exceeded expectations ▪ Notable items in: ▪ 3Q21: $(4) million success fee reversal related to the IPO of an SBIC investment in 2Q21 ▪ 2Q21: $9 million success fee accrual ▪ 3Q20: $30 million from one-time charitable contribution related PPP lending activity (not reflected in Adjusted NIE) (1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and investment, and accruals for investment and advisory expenses related to the unrealized gain on an SBIC investment. See Appendix for GAAP to non-GAAP reconciliation table. Noninterest Expense (NIE) (1)

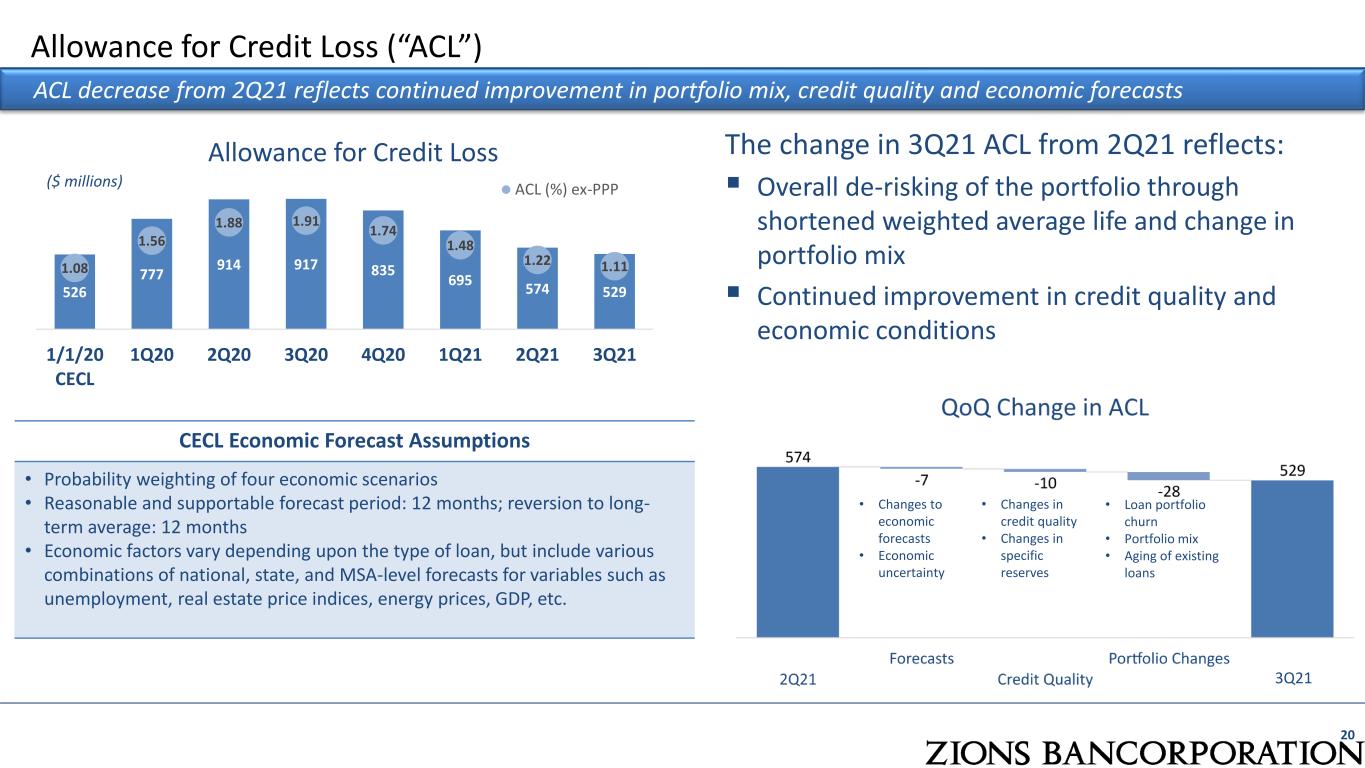

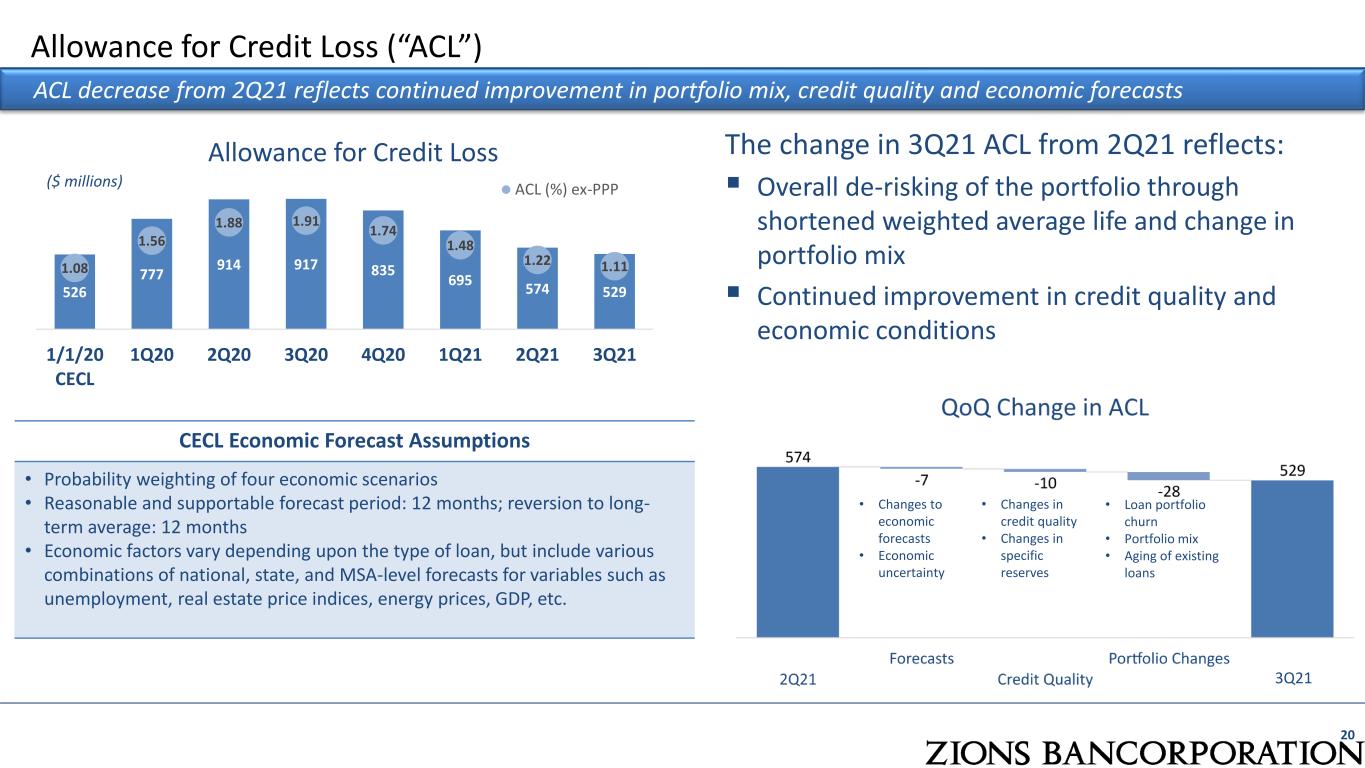

20 Allowance for Credit Loss (“ACL”) ACL decrease from 2Q21 reflects continued improvement in portfolio mix, credit quality and economic forecasts 526 777 914 917 835 695 574 529 1.08 1.56 1.88 1.91 1.74 1.48 1.22 1.11 1/1/20 CECL 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 Allowance for Credit Loss ACL (%) ex-PPP The change in 3Q21 ACL from 2Q21 reflects: ▪ Overall de-risking of the portfolio through shortened weighted average life and change in portfolio mix ▪ Continued improvement in credit quality and economic conditions • Changes to economic forecasts • Economic uncertainty • Loan portfolio churn • Portfolio mix • Aging of existing loans • Changes in credit quality • Changes in specific reserves CECL Economic Forecast Assumptions • Probability weighting of four economic scenarios • Reasonable and supportable forecast period: 12 months; reversion to long- term average: 12 months • Economic factors vary depending upon the type of loan, but include various combinations of national, state, and MSA-level forecasts for variables such as unemployment, real estate price indices, energy prices, GDP, etc. ($ millions) 3Q21

Financial Outlook (3Q 2022E vs 3Q 2021A) 21 Outlook Comments Moderately Increasing ▪ Moderate growth in the next twelve months, excluding PPP loans Increasing ▪ Assumes no change in interest rates ▪ Excludes PPP loan income Stable to Slightly Increasing ▪ Customer-related fees excludes securities gains and dividends Moderately Increasing ▪ 3Q22 expected to be moderately higher than 3Q21’s $432 million adjusted NIE ▪ Improved confidence in the economic outlook combined with strong capital ratios expected to allow continued active capital management Customer-Related Fees Loan Balances Net Interest Income Capital Management Adjusted Noninterest Expense

▪ Financial results summary ▪ Loan growth by geography and type ▪ Loan loss severity (NCOs as a percentage of nonperforming assets) ▪ Mortgage banking results ▪ GAAP to Non-GAAP reconciliation 22 Appendix

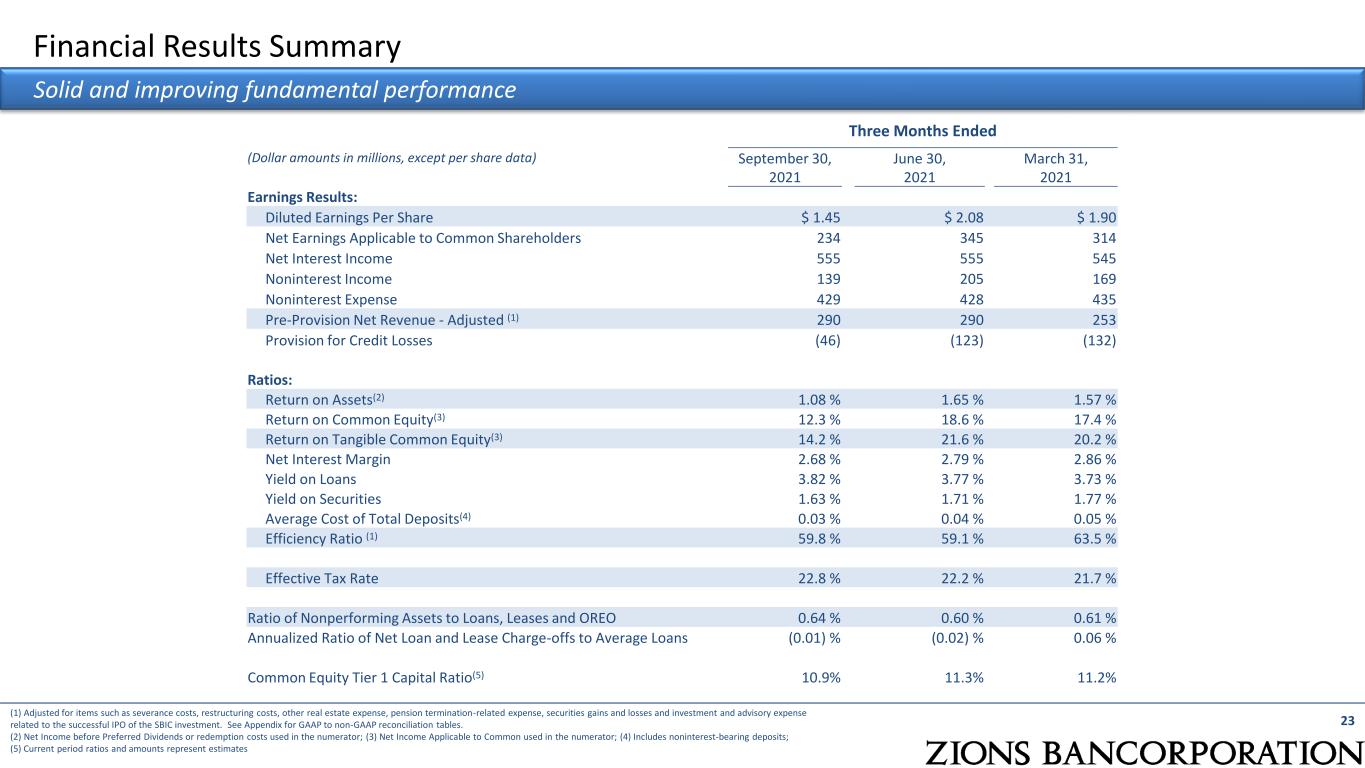

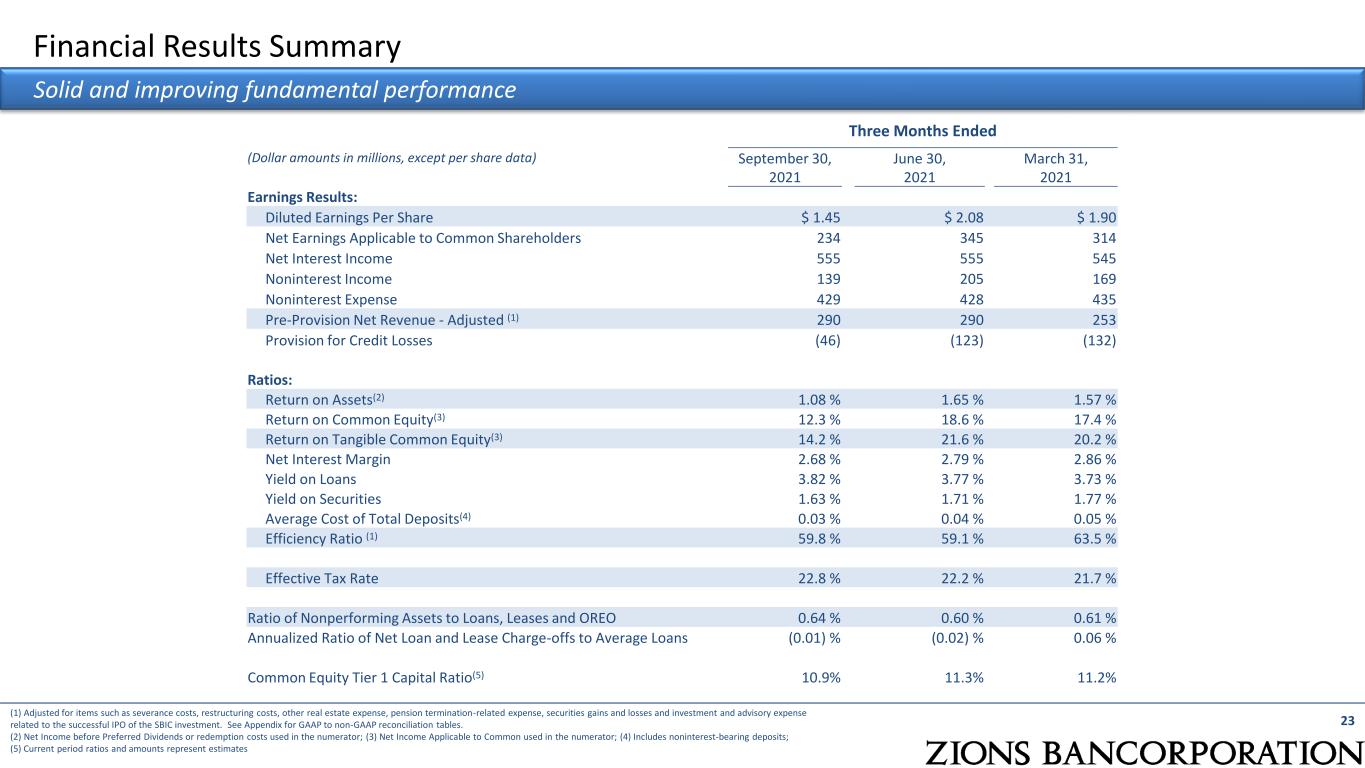

Financial Results Summary 23 Solid and improving fundamental performance Three Months Ended (Dollar amounts in millions, except per share data) September 30, 2021 June 30, 2021 March 31, 2021 Earnings Results: Diluted Earnings Per Share $ 1.45 $ 2.08 $ 1.90 Net Earnings Applicable to Common Shareholders 234 345 314 Net Interest Income 555 555 545 Noninterest Income 139 205 169 Noninterest Expense 429 428 435 Pre-Provision Net Revenue - Adjusted (1) 290 290 253 Provision for Credit Losses (46) (123) (132) Ratios: Return on Assets(2) 1.08 % 1.65 % 1.57 % Return on Common Equity(3) 12.3 % 18.6 % 17.4 % Return on Tangible Common Equity(3) 14.2 % 21.6 % 20.2 % Net Interest Margin 2.68 % 2.79 % 2.86 % Yield on Loans 3.82 % 3.77 % 3.73 % Yield on Securities 1.63 % 1.71 % 1.77 % Average Cost of Total Deposits(4) 0.03 % 0.04 % 0.05 % Efficiency Ratio (1) 59.8 % 59.1 % 63.5 % Effective Tax Rate 22.8 % 22.2 % 21.7 % Ratio of Nonperforming Assets to Loans, Leases and OREO 0.64 % 0.60 % 0.61 % Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans (0.01) % (0.02) % 0.06 % Common Equity Tier 1 Capital Ratio(5) 10.9% 11.3% 11.2% (1) Adjusted for items such as severance costs, restructuring costs, other real estate expense, pension termination-related expense, securities gains and losses and investment and advisory expense related to the successful IPO of the SBIC investment. See Appendix for GAAP to non-GAAP reconciliation tables. (2) Net Income before Preferred Dividends or redemption costs used in the numerator; (3) Net Income Applicable to Common used in the numerator; (4) Includes noninterest-bearing deposits; (5) Current period ratios and amounts represent estimates

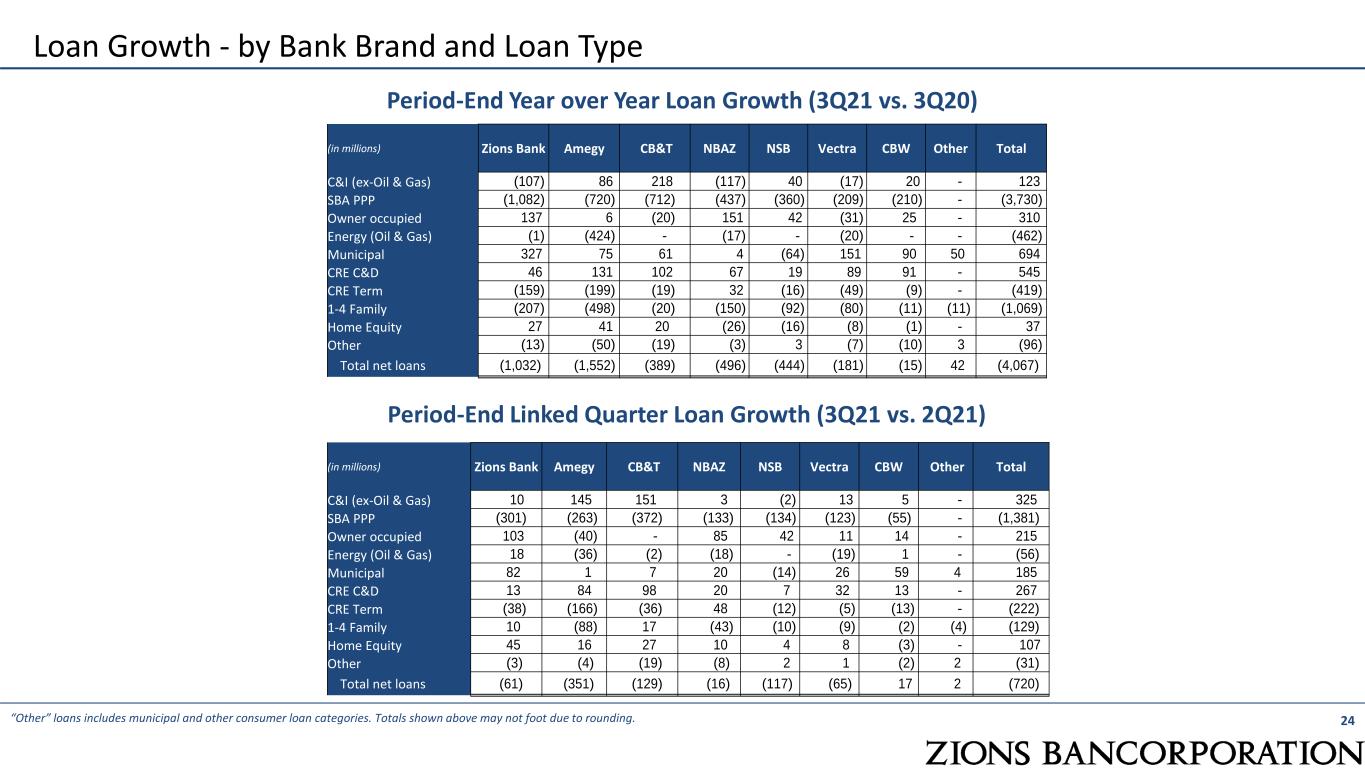

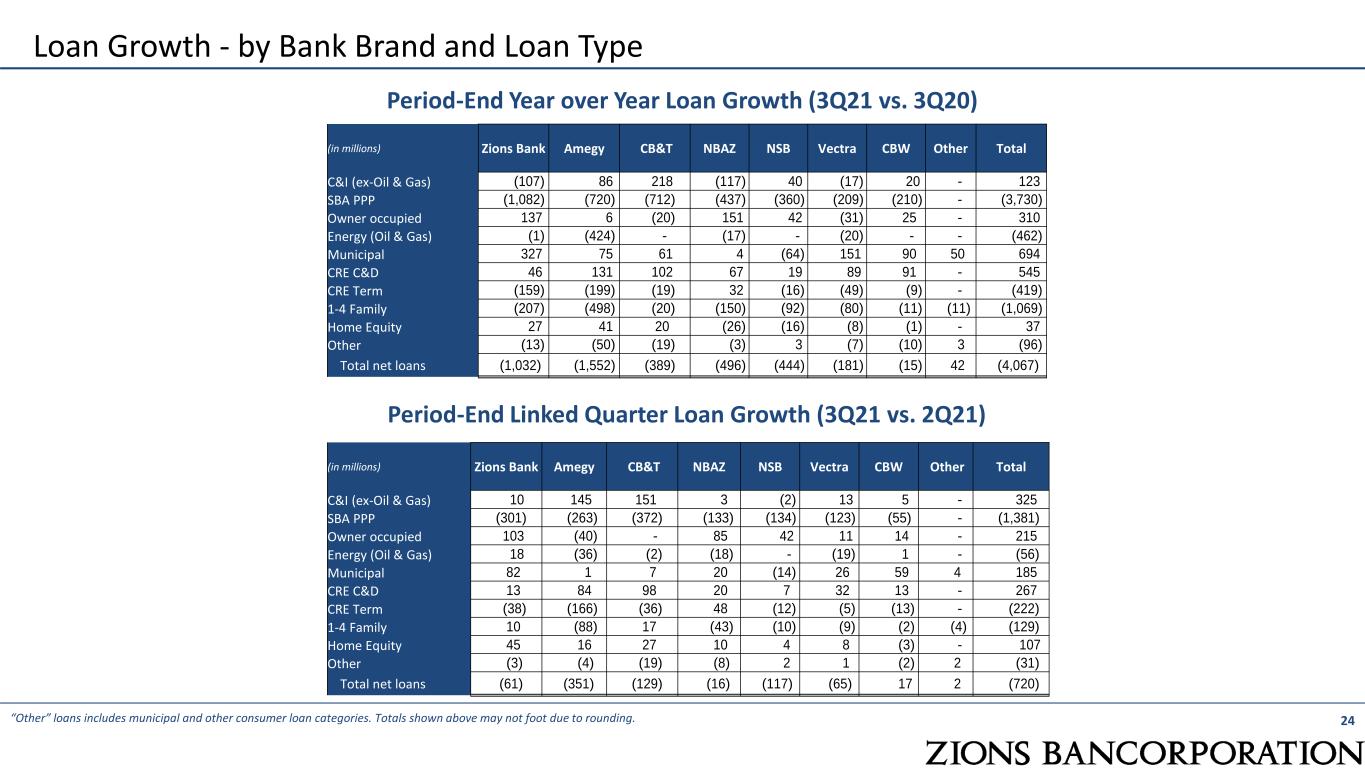

24 Loan Growth - by Bank Brand and Loan Type “Other” loans includes municipal and other consumer loan categories. Totals shown above may not foot due to rounding. Period-End Year over Year Loan Growth (3Q21 vs. 3Q20) Period-End Linked Quarter Loan Growth (3Q21 vs. 2Q21) (in millions) Zions Bank Amegy CB&T NBAZ NSB Vectra CBW Other Total C&I (ex-Oil & Gas) 10 145 151 3 (2) 13 5 - 325 SBA PPP (301) (263) (372) (133) (134) (123) (55) - (1,381) Owner occupied 103 (40) - 85 42 11 14 - 215 Energy (Oil & Gas) 18 (36) (2) (18) - (19) 1 - (56) Municipal 82 1 7 20 (14) 26 59 4 185 CRE C&D 13 84 98 20 7 32 13 - 267 CRE Term (38) (166) (36) 48 (12) (5) (13) - (222) 1-4 Family 10 (88) 17 (43) (10) (9) (2) (4) (129) Home Equity 45 16 27 10 4 8 (3) - 107 Other (3) (4) (19) (8) 2 1 (2) 2 (31) Total net loans (61) (351) (129) (16) (117) (65) 17 2 (720) (in millions) Zions Bank Amegy CB&T NBAZ NSB Vectra CBW Other Total C&I (ex-Oil & Gas) (107) 86 218 (117) 40 (17) 20 - 123 SBA PPP (1,082) (720) (712) (437) (360) (209) (210) - (3,730) Owner occupied 137 6 (20) 151 42 (31) 25 - 310 Energy (Oil & Gas) (1) (424) - (17) - (20) - - (462) Municipal 327 75 61 4 (64) 151 90 50 694 CRE C&D 46 131 102 67 19 89 91 - 545 CRE Term (159) (199) (19) 32 (16) (49) (9) - (419) 1-4 Family (207) (498) (20) (150) (92) (80) (11) (11) (1,069) Home Equity 27 41 20 (26) (16) (8) (1) - 37 Other (13) (50) (19) (3) 3 (7) (10) 3 (96) Total net loans (1,032) (1,552) (389) (496) (444) (181) (15) 42 (4,067)

6 % 1 6 % 2 3 % 3 1 % 3 1 % 3 8 % 4 0 % 4 0 % 4 2 % 4 4 % 4 6 % 5 6 % 5 7 % 5 7 % 5 7 % 6 6 % 7 9 % FR C P B C T B O K F A SB ZI O N C M A C FG FH N W A L W TF C FN B EW B C R F SN V K EY H B A N FI TB 3 % 1 2 % 1 2 % 1 5 % 1 6 % 2 1 % 2 8 % 3 0 % 3 2 % 3 7 % 4 6 % 4 7 % 5 1 % 5 3 % 5 3 % 5 3 % 6 4 % FR C W A L P B C T ZI O N FH N B O K F W TF C A SB EW B C C M A C FG K EY FN B SN V H B A N R F FI TB Loan Loss Severity Annualized NCOs / Nonaccrual Loans Five Year Average (2016 – 2020) Annualized NCOs / Nonaccrual Loans Fifteen Year Average (2006 – 2020) 25Source: S&P Global. Calculated using the average of annualized quarterly results. Note: Survivorship bias: some banks that may have been included in Zions’ peer group have been excluded due to their failed or merged status. When problems arise, Zions generally experiences less severe loan losses due to strong collateral

26 Mortgage Banking Successes amid COVID-19 pandemic: very strong mortgage revenue $485 $433 $435 $627 $651 $433 $409 $411 $383 $345 3Q20 4Q20 1Q21 2Q21 3Q21 Strong Mortgage Funding HFI HFS $918 million $996 million ($ millions) $18.2 $10.4 $10.6 $7.8 $11.3 3Q20 4Q20 1Q21 2Q21 3Q21 Loan Sales Revenue 2019 ▪ Roll-out 2020 ▪ Enhanced Digital Fulfillment Process ▪ 87% of all applications taken digitally ▪ 25% reduction in turn-time allowing for record unit production 3Q21 ▪ Funded approximately $1 Billion in mortgage loans for Q3, raising the total YTD to $2.85 Billion ▪ Pipeline of $1.9 Billions will allow for continued strong funding volume through the end of the year. ▪ Mortgage Operations continues to improve turn times as newly released technology and updated processes create efficiencies ▪ Underwriting metrics remain strong: ▪ FICO: average 759 ▪ LTV: average 62% ▪ DTI: average 30%

Middle Market and Small Business Research Feedback Source: 2020 Greenwich Associates Market Tracking Program Nationwide *Major Competitors: JPMorgan, Bank of America Merrill Lynch, US Bank, Wells Fargo ** Excellent Citations are a "5" on a 5 point scale from "5" excellent to "1" poor Zions compares favorably to major competitors (JPMorgan, Bank of America, US Bank, Wells Fargo) 27 Major Competitors* (Average Score %) Closest Competitor's Score % Our Rank (2020) Middle Market (Revenues of $10-$500 million) Overall Satisfaction Overall Satisfaction - Customers 61 45 55 1st Bank You Can Trust 75 61 69 1st Values Long-Term Relationships 70 61 69 1st Ease of Doing Business 65 55 61 1st Digital Product Capabilities 59 55 65 2nd Satisfaction with our Bankers Overall Customer Satisfaction with Relationship Managers 67 64 71 2nd Overall Customer Satisfaction with Cash Management Specialist 69 63 68 1st Credit Process Willingness to Extend Credit 73 70 92 2nd Speed in Responding to a Loan Request 70 66 78 3rd Flexible Terms and Conditions 67 63 80 3rd Net Promoter Score 56 33 48 1st Small Business (Revenues of $1-$10 million) Overall Satisfaction Overall Satisfaction - Customers 70 42 49 1st Bank You Can Trust 78 57 66 1st Values Long Term Relationships 76 53 68 1st Ease of Doing Business 75 55 63 1st Digital Product Capabilities 64 51 60 1st Satisfaction with our Bankers Overall Customer Satisfaction with Relationship Managers 78 60 74 1st Overall Customer Satisfaction with Cash Management Specialist 85 72 94 2nd Credit Process Willingness to Extend Credit 67 55 68 2nd Speed in Responding to a Loan Request 76 53 66 1st Flexible Terms and Conditions 63 48 57 1st Net Promoter Score 55 15 36 1st % of "Excellent" Customer Citations** Greenwich Associates Customer Satisfaction Categories Zions Bancorporation Client Score % % of "Excellent" Customer Citations**

28 GAAP to Non-GAAP Reconciliation In millions, except per share amounts 3Q21 2Q21 1Q21 4Q20 3Q20 Pre-Provision Net Revenue (PPNR) (a) Total noninterest expense $429 $428 $435 $424 $442 LESS adjustments: Severance costs 1 1 1 Other real estate expense 1 - Provision for unfunded lending commitments - - Pension Termination related expense - - Restructuring costs (5) (1) 1 SBIC Investment Success Fee Accrual (4) 9 (b) Total adjustments (3) 9 (5) 1 2 (a-b)=(c) Adjusted noninterest expense 432 419 440 423 440 (d) Net interest income 555 555 545 550 555 (e) Fully taxable-equivalent adjustments 7 7 8 7 7 (d+e)=(f) Taxable-equivalent net interest income (TE NII) 562 562 553 557 562 (g) Noninterest Income 139 205 169 166 157 (f+g)=(h) Combined Income $701 $767 $722 $723 $719 LESS adjustments: Fair value and nonhedge derivative income (loss) 2 (5) 18 8 8 Securities gains (losses), net (23) 63 11 12 4 (i) Total adjustments (21) 58 29 20 12 (h-i)=(j) Adjusted revenue $722 $709 $693 $703 $707 (j-c) Adjusted pre- provision net revenue (PPNR) $290 $290 $253 $280 $267 (c)/(j) Efficiency Ratio 59.8% 59.1% 63.5% 60.2% 62.2%

29 GAAP to Non-GAAP Reconciliation (Continued) In millions, except per share amounts 3Q21 2Q21 1Q21 4Q20 3Q20 Net Earnings Applicable to Common Shareholders (NEAC) (k) Net earnings applicable to common $234 $345 $314 $275 $167 (l) Diluted Shares (average) 160 163 164 164 164 GAAP Diluted EPS 1.45 2.08 1.90 1.66 1.01 PLUS Adjustments: Adjustments to noninterest expense (3) 9 (5) 1 2 Adjustments to revenue 21 (58) (29) (20) (12) Tax effect for adjustments (4) 12 8 5 3 Preferred stock redemption - - - (m) Total adjustments 14 (37) (26) (14) (7) (k+m)=(n) Adjusted net earnings applicable to common (NEAC) 248 308 288 261 160 (n)/(l) Adjusted EPS 1.53 1.85 1.74 1.58 0.97 (o) Average assets 88,556 85,957 83,080 80,060 77,983 (p) Average tangible common equity 6,554 6,421 6,317 6,150 6,063 Balance Sheet Profitability (n)/(o) Adjusted Return on Assets 1.12% 1.44% 1.38% 1.30% 0.82% (n)/(p) Adjusted Return on Tangible Common Equity 15.2% 19.2% 18.2% 16.9% 10.6%