FORM 6K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of: September, 2003

Commission File Number: 0-30456

| CHARTWELL TECHNOLOGY INC. |

| (Translation of registrant’s name into English) |

Suite 700, 407 2nd Street SW

Calgary, Alberta

Canada T2P 2Y3 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| September 22, 2003 | signed "Don Gleason"

Don Gleason, CFO |

C h a r t w e l l T e c h n o l o g y I n c .

PRESS RELEASE

CHARTWELL ANNOUNCES THIRD SUCCESSIVE QUARTER OF

PROFITABILITY

| Chartwell Technology Inc. | TSX-VEN: CWH |

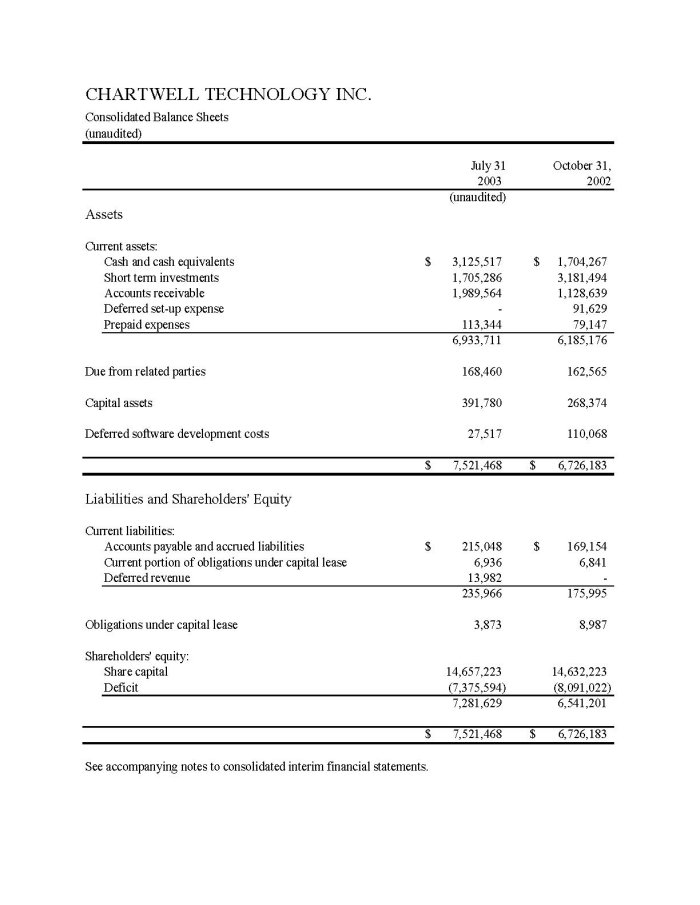

Calgary, Canada, September 15, 2003, Chartwell Technology Inc. (TSX-VEN: CWH) a leading provider of gaming software systems and entertainment content to the online and remote gaming industry, announces financial results for the third quarter ended July 31, 2003.

Highlights of the quarter included:

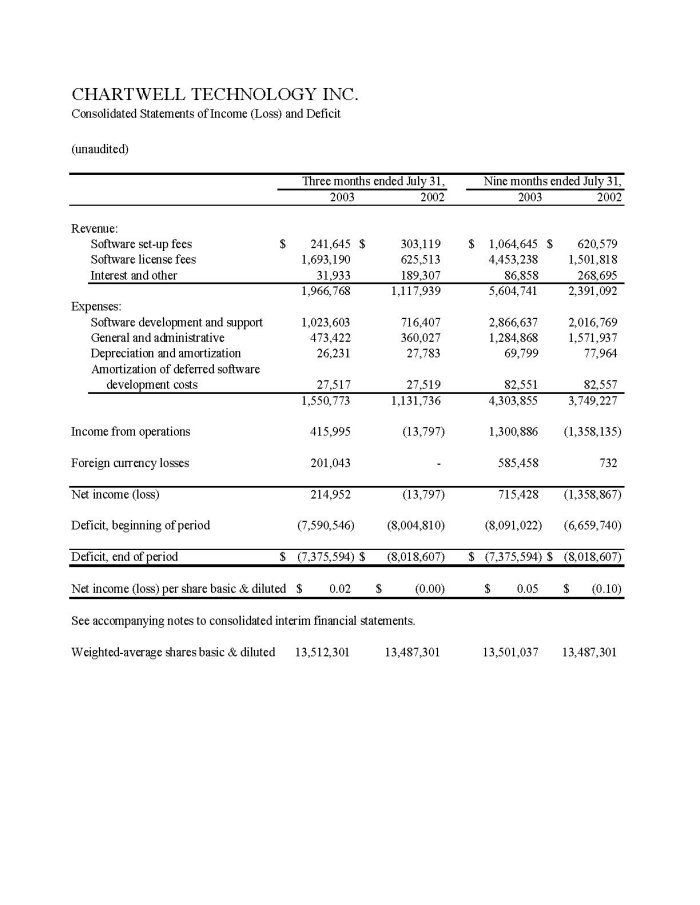

| • | | Revenue of $1.9M compared with $1.1M during the same period in fiscal 2002; |

| • | | Operating income of $416K or $0.03 per share and net income of $215K or $0.02 per share compared with a net loss of ($14K) or ($0.00) per share during the same period in fiscal 2002; |

| • | | Software license fees of $1.7M compared to $625K during the same period in fiscal 2002; |

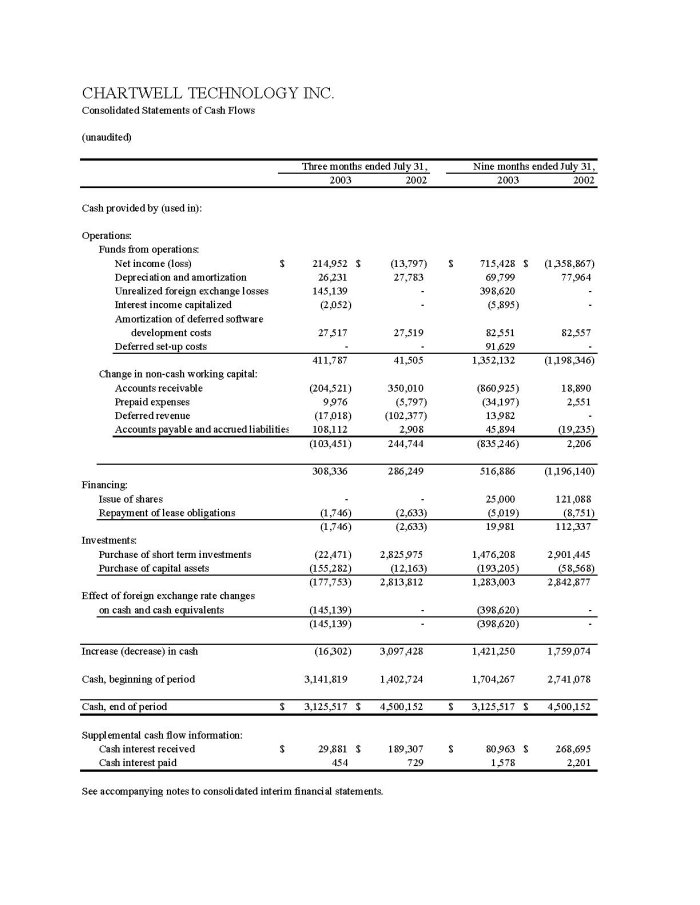

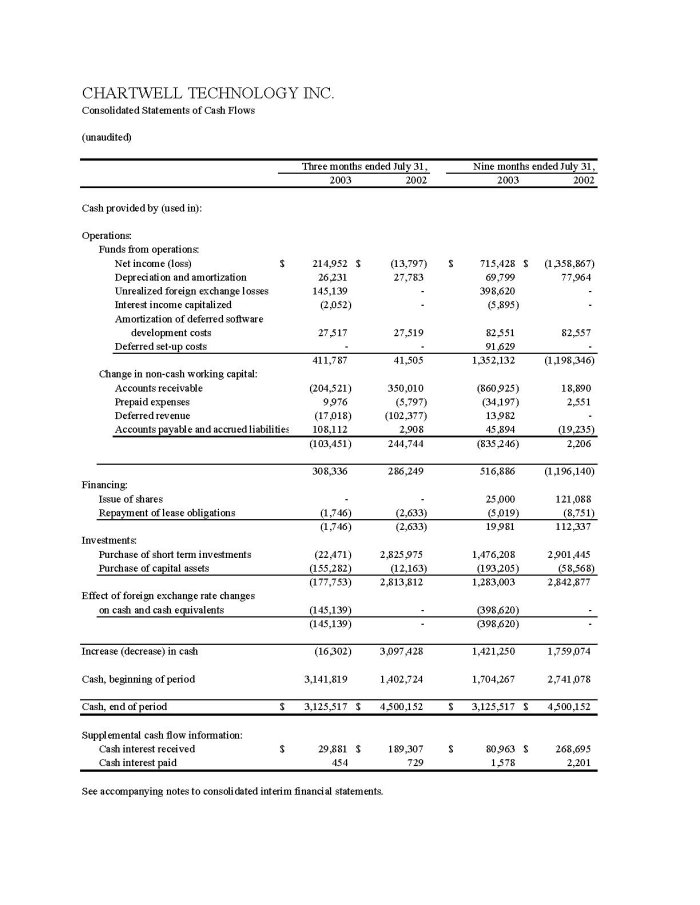

| • | | Cash flow from operations of $308K compared to $286K during the same period in fiscal year 2002; |

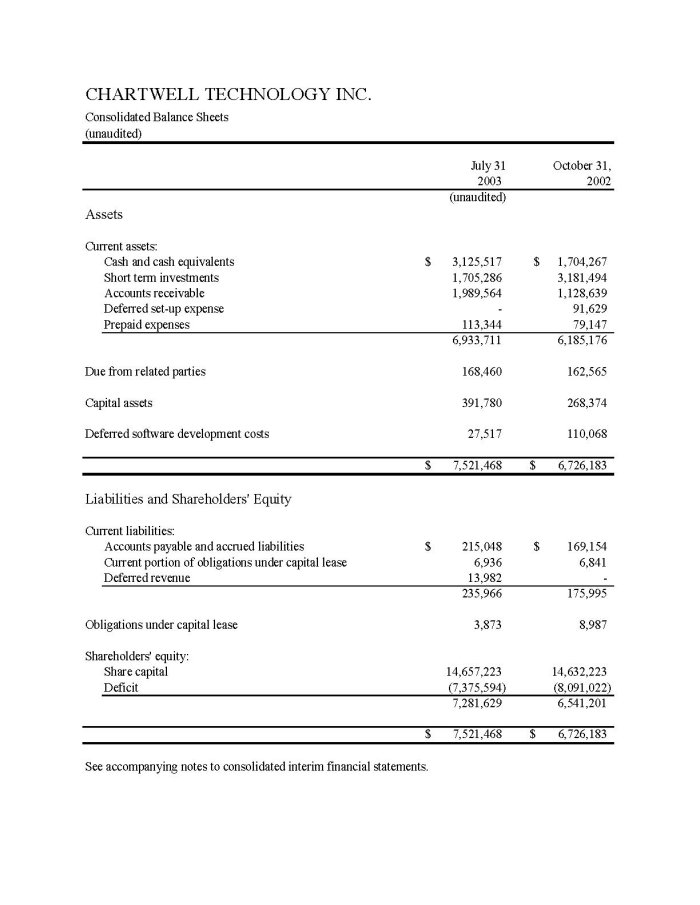

| • | | Working capital of $6.7M. |

Revenue growth andcontinuedprofitability remain key characteristics of Chartwell’s financial performance.

“We are pleased with the financial results that we have achieved in our third quarter” states Don Gleason, CFO. “We continue to meet our financial objectives of revenue growth and increased earnings while achieving our product and business development goals. Q3 is our third successive quarter of profitability and with our strong financial position, growing customer base and expanding product offering we are well positioned to deliver on our annual revenue and profitability targets.”

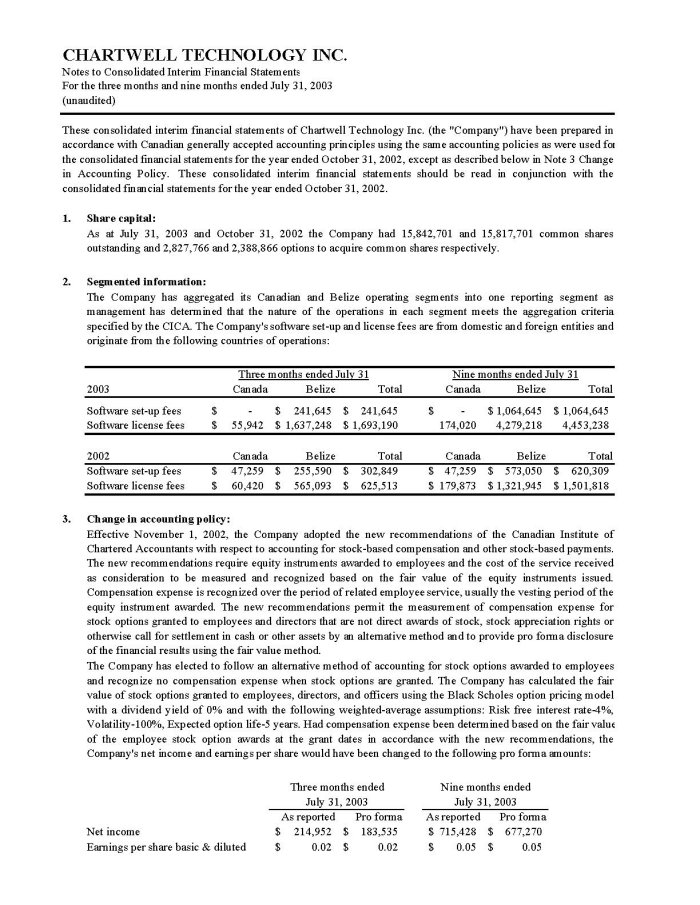

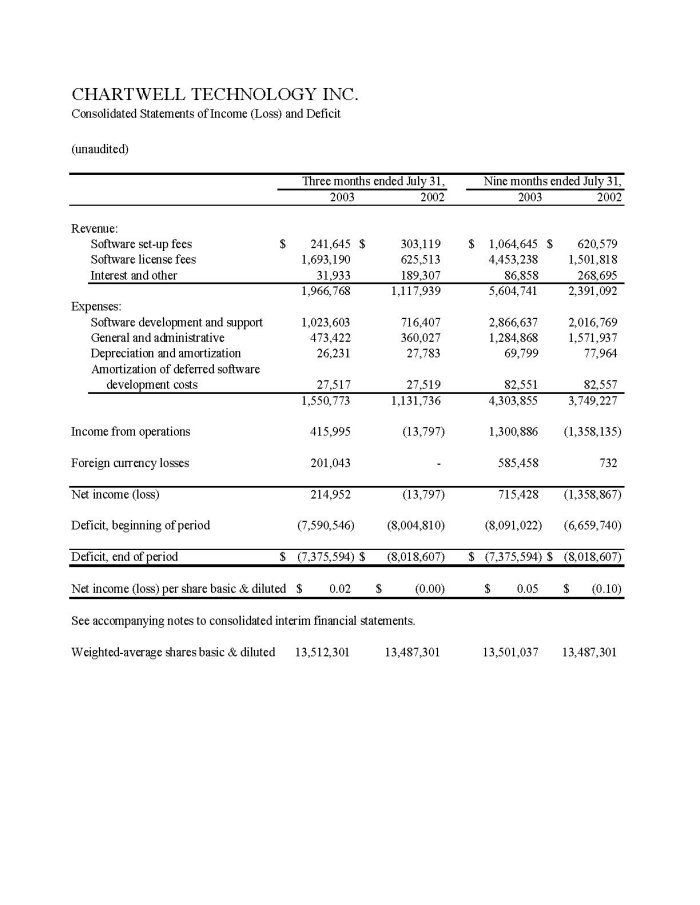

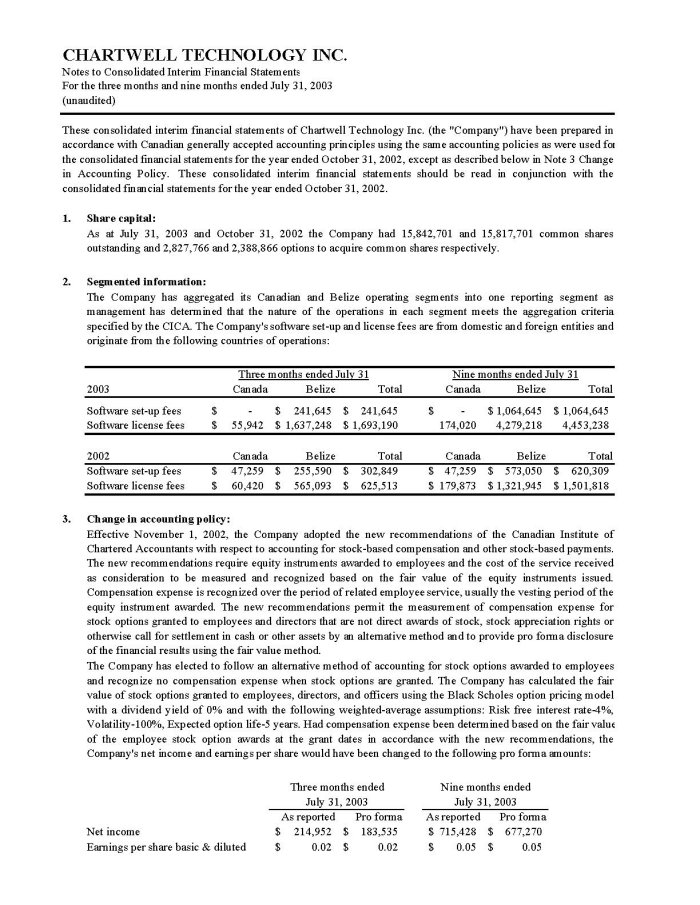

Revenue for the three months ended July 31, 2003 was $1,966,768, an increase of 76% compared to $1,117,939 in the same period of 2002. For the nine months ended July 31, 2003 revenue was $5,604,741, an increase of 134% compared to $2,391,092 for the corresponding period of the previous year. The increase in revenues is directly attributable to the increase in license fee revenue resulting from the expanding installed base of clients. License fee revenue for the third quarter of 2003 was $1,693,190 compared to $625,513 for the same period of the previous year, representing an increase of 171%. For the nine months ending July 31, 2003 license fee revenue totaled $4,453,238 compared to $1,501,818, an increase of 197% compared to the previous year.

Total operating expenses for the three month period totaled $1,550,773 compared to $1,131,736 for the same period of 2002. For the nine months ended July 31, 2003 total operating expenses were $4,303,855 compared to $3,749,227. Software development and support costs were the sole contributor to the increase in operating expenses as personnel were added in accordance with new product development initiatives. For the three months and nine months ended July 31, 2003, general and administrative expenses increased 31% and decreased 18% respectively compared to the same period of 2002.

Due to a continued decline in the US dollar compared to its Canadian counterpart and the corresponding revaluation of US monetary assets the Company realized foreign currency losses for the three months and nine months ending July 31, 2003 of $201,043 and $585,458 respectively. There were no comparative losses for the same period of 2002. Since the majority of expenses are incurred in

Canadian dollars and as a means of reducing exposure to the downward performance of the US currency the Company converted a significant portion of US monetary assets into Canadian dollars.

Net income for the third quarter, after the currency translation expense, was $214,952 or $0.02 per share compared with a loss ($13,797) for the corresponding period of the previous year. Net income for the nine months ending July 31, 2003 was $715,428 or $0.05 per share compared to a loss of ($1,358,135) or ($0.10) per share for the same period in the previous year. Chartwell continues to maintain a solid financial base from which to execute its growth strategy. At the end of July 31, 2003 Chartwell had $4,830,803 in cash, cash equivalents and short term investments, working capital of $6,711,727 and remains debt free.

For the balance of the fiscal year, Chartwell will continue to grow its bottom line through a combination of increased license fees, new client set-up fees and prudent and effective cost management.

About Chartwell

Chartwell Technology Inc. specializes in the development of leading edge gaming applications and entertainment content for the Internet and wireless platforms and other remote access devices. Chartwell’s Java and Flash based software products and games are designed for deployment in gaming, entertainment, advertising and promotional applications. Chartwell does not participate in the online gaming business of its clients. Chartwell’s team of highly trained professionals is committed to delivering the highest quality software and maintaining its leading edge through continuous development and unparalleled customer support.

Chartwell invites you to preview and play our games at:www.chartwelltechnology.com

For further information, please contact: Chartwell Technology Inc.

| | Darold H Parken, President

(877) 261-6619 or (403) 261-6619

dhp@chartwelltechnology.com | David Bajwa, Investor Relations

(877) 669-4180 or (604) 669-4180

info@chartwelltechnology.com |

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: The statements contained herein which are not historical fact are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements, including, but not limited to, certain delays in testing and evaluation of products, regulation of the online gaming industry, and other risks detailed from time to time in Chartwell’s filings with the Securities & Exchange Commission. We assume no responsibility for the accuracy and completeness of these statements and are under no duty to update any of the forward-looking statements contained herein to conform these statements to actual results. This is not an offer to sell or a solicitation of an offer to purchase any securities.