UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09645 |

|

Columbia Funds Series Trust |

(Exact name of registrant as specified in charter) |

|

50606 Ameriprise Financial Center Minneapolis, MN | | 55474 |

(Address of principal executive offices) | | (Zip code) |

|

Christopher O. Petersen, Esq. c/o Columbia Management Investment Advisers, LLC 225 Franklin Street Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 345-6611 | |

|

Date of fiscal year end: | February 28 | |

|

Date of reporting period: | February 28, 2014 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

February 28, 2014

Columbia Large Cap Index Fund

Not FDIC insured • No bank guarantee • May lose value

Dear Shareholders,

Dear Shareholders,

Equities recovered

In the final months of 2013, the U.S. economy embraced a robust recovery. After five years of only modest progress, the pace of economic growth picked up, job gains continued, manufacturing activity accelerated and a rebound in the housing market showed staying power. Growth, as measured by gross domestic product, was 4.1% in the third quarter, with expectations for a solid fourth quarter. Job growth averaged close to 200,000 monthly. Industrial production rose at a rate of 3.3%, considerably higher than the 12-month average of 2.5%. Factories were busier than at any point since the 2008/2009 recession, with capacity utilization at 79%. Orders for durable goods were strong, bolstered by rising auto sales. Holiday spending was solid, especially online sales, which rose 10% year over year, despite a shorter season.

Against this backdrop, the Federal Reserve's (the Fed's) announcement that it would slowly retreat from its monthly bond buying program and a bipartisan budget deal in Washington were welcome news for investors. Stocks climbed to new highs in the fourth quarter, while bonds retreated as yields moved higher. Small-cap stocks outperformed large- and mid-cap stocks, led by significant gains from the industrials, technology and consumer discretionary sectors. All 10 sectors of the S&P 500 Index delivered positive returns, although telecommunications and utilities posted only modest gains.

Fixed-income retreated

Improved economic data drove interest rates higher over the fourth quarter, credit spreads narrowed and the dollar weakened against most developed market currencies. Against this backdrop, most non-Treasury, fixed-income sectors delivered positive returns. Outgoing Fed chairman Ben Bernanke expressed concern about the persistently low level of core inflation, but gains in the labor market and reduced unemployment led to the Fed's decision to taper its bond-buying program gradually beginning in January 2014.

As the stock market soared, the riskiest sectors of the fixed-income markets fared the best. U.S. and foreign high-yield bonds were the strongest performers, followed by emerging-market and U.S. investment-grade corporate bonds. U.S. mortgage-backed securities (MBS) and securitized bonds produced negative total returns, as did U.S. Treasuries and developed world government bonds. Treasury inflation-protected bonds were the period's biggest losers. Investment-grade municipals delivered fractional gains, as better economic conditions helped steady state finances.

Stay on track with Columbia Management

Backed by more than 100 years of experience, Columbia Management is one of the nation's largest asset managers. At the heart of our success and, most importantly, that of our investors, are highly talented industry professionals, brought together by a unique way of working. At Columbia Management, reaching our performance goals matters, and how we reach them matters just as much.

Visit columbiamanagement.com for:

> The Columbia Management Perspectives blog, offering insights on current market events and investment opportunities

> Detailed up-to-date fund performance and portfolio information

> Quarterly fund commentaries

> Columbia Management Investor, our award-winning quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

Investing involves risk including the risk of loss of principal.

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance. The Dow Jones Industrial Average is a price weighted average of 30 actively traded shares of blue chip US industrial corporations listed on the New York Stock Exchange. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and, if available, a summary prospectus, which contains this and other important information about a fund, visit columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2014 Columbia Management Investment Advisers, LLC. All rights reserved.

Columbia Large Cap Index Fund

Performance Overview | | | 2 | | |

Manager Discussion of Fund Performance | | | 4 | | |

Understanding Your Fund's Expenses | | | 6 | | |

Portfolio of Investments | | | 7 | | |

Statement of Assets and Liabilities | | | 19 | | |

Statement of Operations | | | 21 | | |

Statement of Changes in Net Assets | | | 22 | | |

Financial Highlights | | | 24 | | |

Notes to Financial Statements | | | 29 | | |

Report of Independent Registered

Public Accounting Firm | | | 36 | | |

Federal Income Tax Information | | | 37 | | |

Trustees and Officers | | | 38 | | |

Important Information About This Report | | | 45 | | |

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiamanagement.com or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

Columbia Large Cap Index Fund

Performance Summary

> Columbia Large Cap Index Fund (the Fund) Class A shares returned 24.80% for the 12-month period that ended February 28, 2014.

> The Fund's benchmark, the S&P 500 Index, returned 25.37% for the same time period.

> Mutual funds, unlike unmanaged indices, incur operating expenses, which accounted for the Fund's underperformance relative to the benchmark.

Average Annual Total Returns (%) (for period ended February 28, 2014)

| | Inception | | 1 Year | | 5 Years | | 10 Years | |

Class A | | 10/10/95 | | | 24.80 | | | | 22.50 | | | | 6.75 | | |

Class B* | | 09/23/05 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 23.88 | | | | 21.59 | | | | 5.96 | | |

Including sales charges | | | | | | | 18.88 | | | | 21.40 | | | | 5.96 | | |

Class I* | | 11/16/11 | | | 25.12 | | | | 22.78 | | | | 6.98 | | |

Class R5* | | 11/08/12 | | | 25.14 | | | | 22.82 | | | | 7.02 | | |

Class Z | | 12/15/93 | | | 25.09 | | | | 22.81 | | | | 7.02 | | |

S&P 500 Index | | | | | | | 25.37 | | | | 23.00 | | | | 7.16 | | |

Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiamanagement.com or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiamanagement.com/mutual-funds/appended-performance for more information.

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2014

2

Columbia Large Cap Index Fund

Performance Overview (continued)

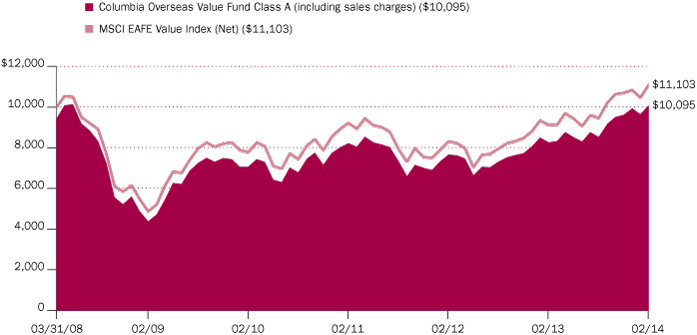

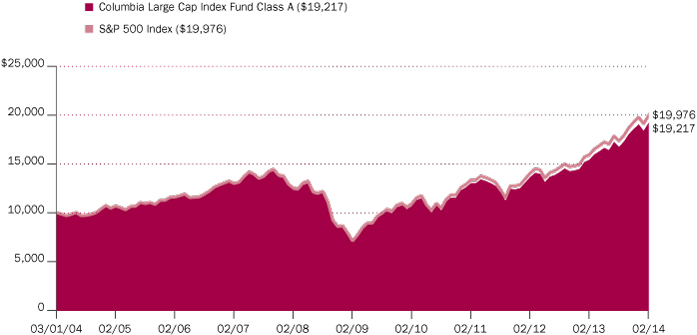

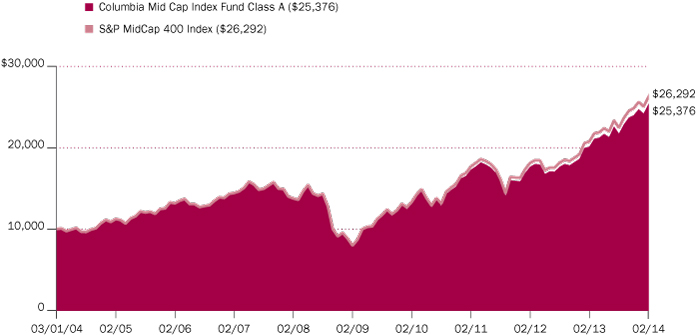

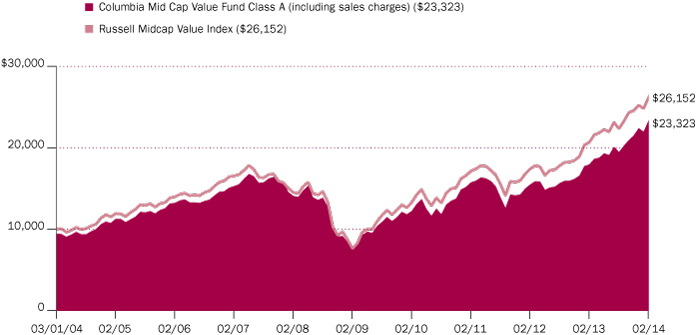

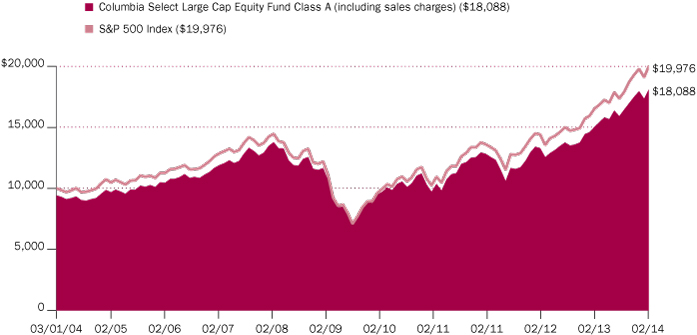

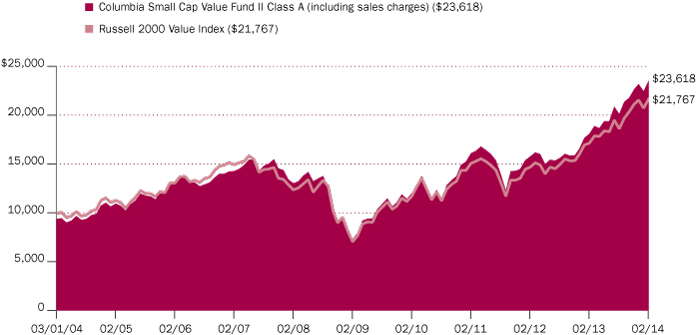

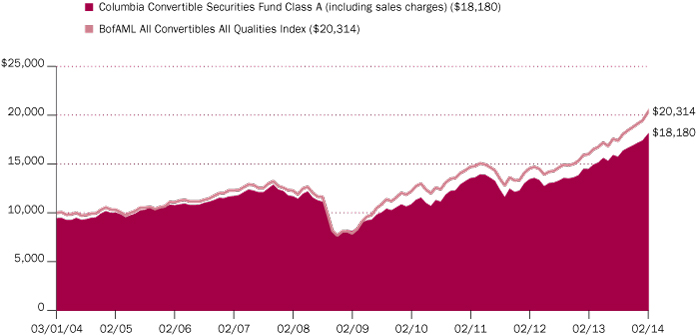

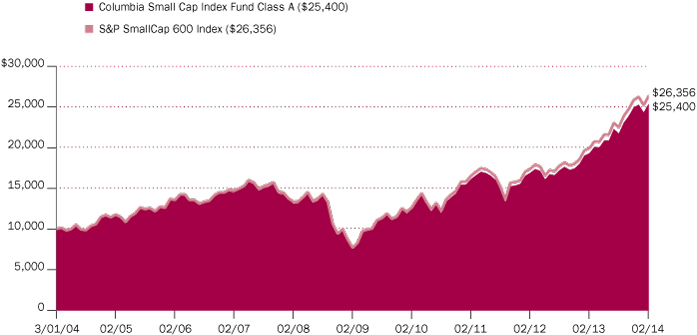

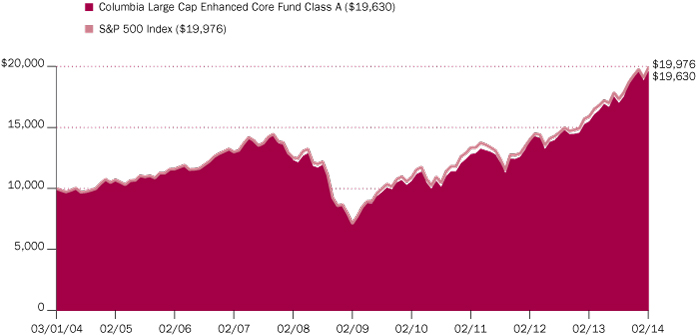

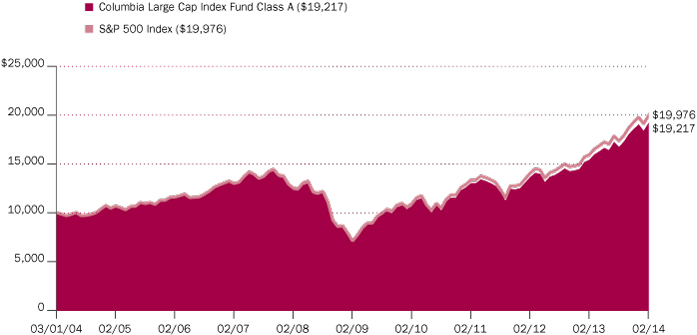

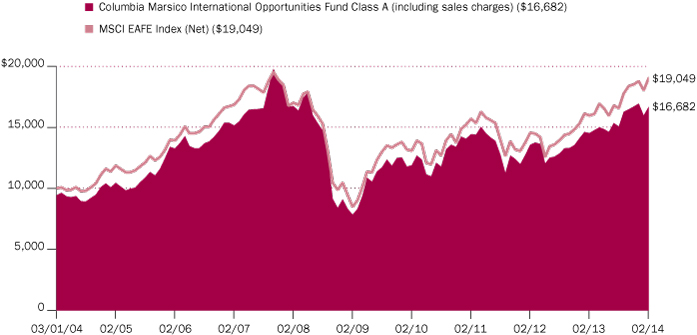

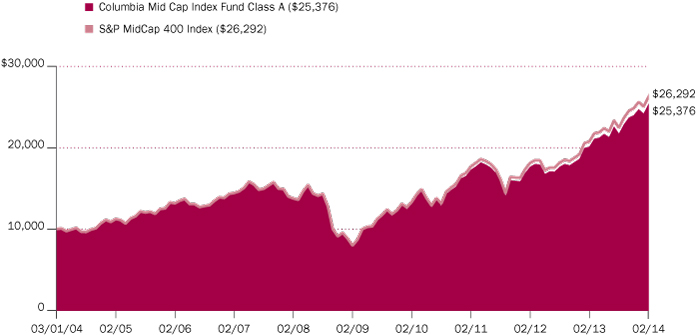

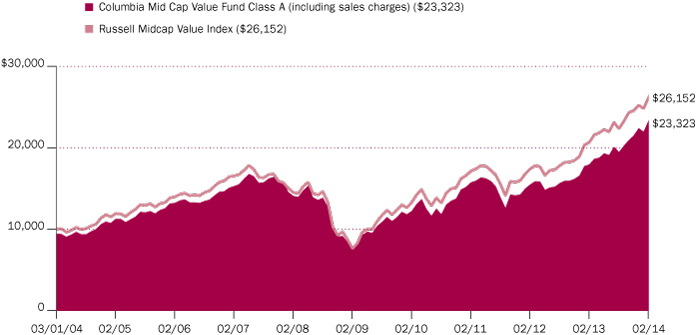

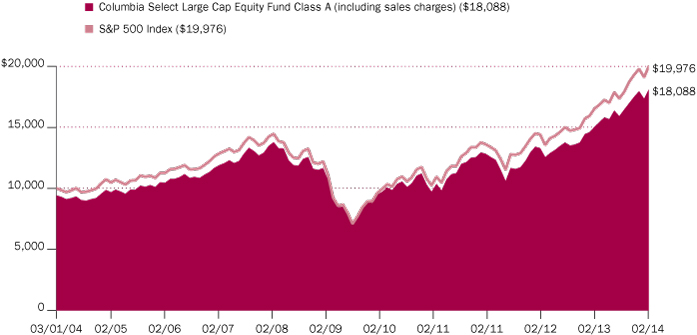

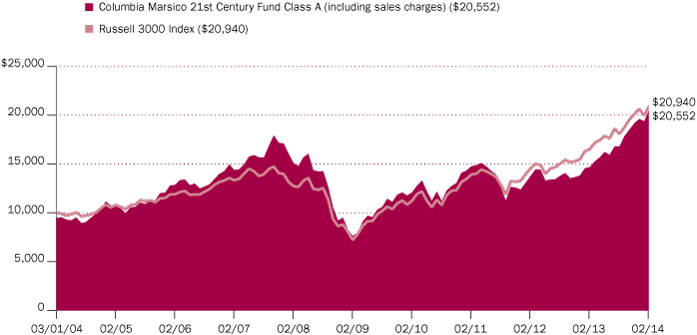

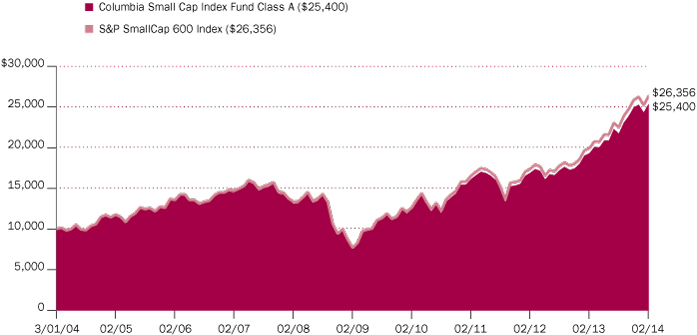

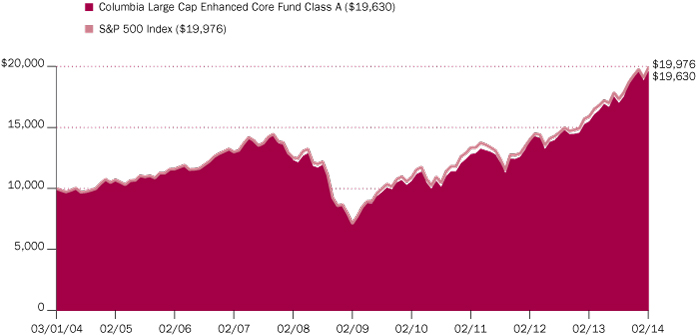

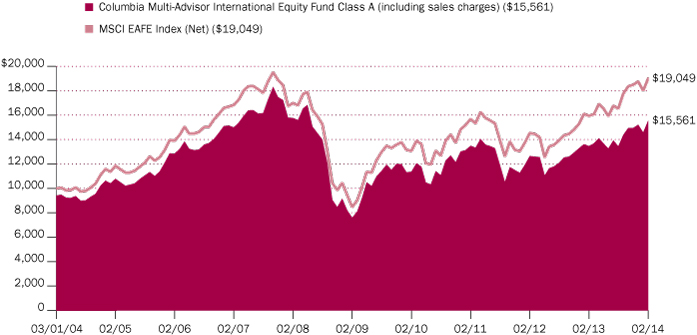

Performance of a Hypothetical $10,000 Investment (March 1, 2004 – February 28, 2014)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Large Cap Index Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Annual Report 2014

3

Columbia Large Cap Index Fund

Manager Discussion of Fund Performance

For the 12-month period that ended February 28, 2014, the Fund's Class A shares returned 24.80%. The Fund's benchmark, the S&P 500 Index, returned 25.37% for the same period. Mutual funds, unlike unmanaged indices, incur operating expenses, which helped to account for the Fund's underperformance relative to the benchmark.

U.S. Equity Market Posted Strong Gains

Following a strong first quarter of 2013 when investors turned attention to the modest but continued strengthening of the U.S. economy, volatility heightened in the second calendar quarter, as uncertainty about the global economy, monetary policy and the impact of the sequester's spending cuts weighed on investors. While consumers weathered the domestic drag well, businesses remained cautious, keeping inventories, capital expenditures and staffs lean. U.S. equities delivered positive returns during the third quarter of 2013 despite threats of military action in Syria, rumblings from Iran and an impending showdown over the U.S. debt ceiling. Still, robust economic growth continued to elude the U.S. economy, which merely plodded along. The Federal Reserve (the Fed) unsettled investors with a hint that it was ready to taper its purchase of U.S. Treasury and mortgage securities. However, the Fed's decision to not take any action at its September 2013 meeting rallied stocks to new highs. In the final months of 2013, the U.S. economy embraced a healthy recovery, with job gains continuing, manufacturing activity accelerating and a rebound in housing showing staying power. Against this backdrop, the Fed's announcement in mid-December that it would slowly retreat from its monthly bond purchases and a bipartisan budget deal in Washington D.C. were welcome news for investors, and U.S. equities climbed to new highs.

The benchmark posted a new all-time high on January 15, 2014 but reacted poorly to reports of lower Chinese manufacturing and fell for the month overall. However, the bear market only lasted 11 days — ending on February 3. U.S. equities subsequently regained losses and set another all-time high. Global concerns heightened amidst conflict in the Ukraine, but investors generally remained positive on U.S. equities given strong corporate earnings reports and guidance.

Benchmark Enjoyed Broad-Based Gains

All ten sectors of the benchmark posted positive returns during the 12 months ended February 28, 2014. In terms of total return, health care, consumer discretionary and industrials were the best relative performers. On the basis of impact, which takes weightings and total returns into account, information technology, health care and financials were the biggest contributors to the benchmark's return. The top performing industries for the annual period were airlines, biotechnology, auto components, internet and catalog retail and aerospace and defense.

Conversely, telecommunication services and utilities, traditionally considered defensive sectors, were the weakest sectors from both a total return perspective and on the basis of impact. Each, though, still generated positive, albeit more modest, returns. The worst performing industries for the annual period were personal products, diversified telecommunication services, metals and mining, tobacco, and trading companies and distributors.

Top individual contributors within the benchmark included information technology giants Google, Microsoft and Apple, financials company Wells

Portfolio Management

Alfred Alley III, CFA

Vadim Shteyn

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on a fund's portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2014 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Top Ten Holdings (%)

(at February 28, 2014) | |

Apple, Inc. | | | 2.8 | | |

Exxon Mobil Corp. | | | 2.5 | | |

Google, Inc., Class A | | | 2.0 | | |

Microsoft Corp. | | | 1.7 | | |

Johnson & Johnson | | | 1.6 | | |

General Electric Co. | | | 1.5 | | |

Wells Fargo & Co. | | | 1.3 | | |

Chevron Corp. | | | 1.3 | | |

Procter & Gamble Co. (The) | | | 1.3 | | |

JPMorgan Chase & Co. | | | 1.3 | | |

Percentages indicated are based upon total investments (excluding Money Market Funds).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Annual Report 2014

4

Columbia Large Cap Index Fund

Manager Discussion of Fund Performance (continued)

Fargo and biopharmaceutical company Gilead Sciences. Top detractors were information technology company International Business Machines, tobacco company Philip Morris International, gold mining company Newmont Mining, telecommunication services giant AT&T and medical device company Intuitive Surgical.

As always, each sector and stock in the benchmark was represented in the Fund with approximately the same weighting as in the benchmark and therefore had a similar effect.

Index Additions and Deletions Drove Portfolio Changes

During the annual period, there were 18 additions and 18 deletions to the benchmark and the Fund's portfolio. Among those stocks added to the benchmark and Fund were social networking website Facebook; consumer discretionary companies Mohawk Industries, Michael Kors Holdings and Tractor Supply; real estate investment trusts General Growth Properties and Macerich; airline Delta Air Lines; pharmaceuticals companies Vertex Pharmaceuticals, Zoetis and Regeneron Pharmaceuticals; auto manufacturer General Motors; rail company Kansas City Southern; media conglomerate News Corporation; and energy services company Transocean.

Deletions included semiconductor companies Teradyne and Advanced Micro Devices; consumer staples companies H.J. Heinz and Dean Foods; retailers Abercrombie & Fitch and J.C. Penney; information technology-related companies JDS Uniphase, Dell and BMC Software; financials-related companies NYSE Euronext and First Horizon National; telecommunications companies Sprint Nextel and MetroPCS Communications; and health care-related companies Coventry Health Care and Life Technologies.

The Fund used equity index futures on an opportunistic basis to equitize cash balances held in the portfolio for trading and redemption purposes. The percentage of Fund assets held in these instruments changed daily due to changes in the Fund's cash position but was generally minimal in size and impact.

Looking Ahead

We do not anticipate any changes in the portfolio beyond the customary quarterly rebalancings and stock substitutions we make to align the Fund with the benchmark.

From a broad perspective, following developed equity markets performing strongly relative to other asset classes in 2013, we currently believe U.S. equities have the potential to perform well in 2014, albeit perhaps not as well as last year. While valuations for most U.S. stocks did not appear as cheap at the end of February 2014 as they were 12 months prior, we believe they were still fairly valued, especially relative to fixed income. Indeed, we believe corporate earnings have been strong and guidance has been encouraging for the most part. Balance sheets remain healthy at this time with high cash levels and low debt. We currently believe the U.S. economy may continue to benefit from an improving labor market, a strengthening housing market, reduced fiscal drag, normalization of monetary policy, an improving eurozone recovery and aggressive Japanese economic stimulus. There will almost certainly be challenges along the way, such as geopolitical risk and the unknown impact of ongoing Fed tapering, but we believe developed equity markets, especially U.S. equity markets, may still provide reasonably attractive returns in the coming months.

Portfolio Breakdown (%)

(at February 28, 2014) | |

Common Stocks | | | 98.7 | | |

Consumer Discretionary | | | 12.3 | | |

Consumer Staples | | | 9.3 | | |

Energy | | | 9.9 | | |

Financials | | | 15.7 | | |

Health Care | | | 13.5 | | |

Industrials | | | 10.6 | | |

Information Technology | | | 18.5 | | |

Materials | | | 3.5 | | |

Telecommunication Services | | | 2.5 | | |

Utilities | | | 2.9 | | |

Money Market Funds | | | 1.3 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change.

Investment Risks

Risks include stock market fluctuations and changes in the values of specific fund holdings due to economic and business developments. See the Fund's prospectus for information on these and other risks.

Annual Report 2014

5

Columbia Large Cap Index Fund

Understanding Your Fund's Expenses

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the "Actual" column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

September 1, 2013 – February 28, 2014

| | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,148.00 | | | | 1,022.69 | | | | 2.41 | | | | 2.27 | | | | 0.45 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,144.00 | | | | 1,018.95 | | | | 6.41 | | | | 6.04 | | | | 1.20 | | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,149.50 | | | | 1,023.93 | | | | 1.07 | | | | 1.01 | | | | 0.20 | | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 1,149.60 | | | | 1,023.93 | | | | 1.07 | | | | 1.01 | | | | 0.20 | | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,149.50 | | | | 1,023.93 | | | | 1.07 | | | | 1.01 | | | | 0.20 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange-traded funds).

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Annual Report 2014

6

Columbia Large Cap Index Fund

Portfolio of Investments

February 28, 2014

(Percentages represent value of investments compared to net assets)

Common Stocks 97.3%

Issuer | | Shares | | Value ($) | |

Consumer Discretionary 12.1% | |

Auto Components 0.4% | |

BorgWarner, Inc. | | | 42,594 | | | | 2,617,402 | | |

Delphi Automotive PLC | | | 52,397 | | | | 3,488,068 | | |

Goodyear Tire & Rubber Co. (The) | | | 46,190 | | | | 1,241,125 | | |

Johnson Controls, Inc. | | | 128,213 | | | | 6,333,722 | | |

Total | | | | | 13,680,317 | | |

Automobiles 0.7% | |

Ford Motor Co. | | | 738,236 | | | | 11,361,452 | | |

General Motors Co.(a) | | | 243,909 | | | | 8,829,506 | | |

Harley-Davidson, Inc. | | | 41,404 | | | | 2,735,148 | | |

Total | | | | | 22,926,106 | | |

Distributors 0.1% | |

Genuine Parts Co. | | | 28,883 | | | | 2,544,303 | | |

Diversified Consumer Services 0.1% | |

Graham Holdings Co., Class B | | | 806 | | | | 579,272 | | |

H&R Block, Inc. | | | 51,140 | | | | 1,618,070 | | |

Total | | | | | 2,197,342 | | |

Hotels, Restaurants & Leisure 1.7% | |

Carnival Corp. | | | 81,957 | | | | 3,250,415 | | |

Chipotle Mexican Grill, Inc.(a) | | | 5,809 | | | | 3,283,305 | | |

Darden Restaurants, Inc. | | | 24,439 | | | | 1,247,855 | | |

International Game Technology | | | 46,578 | | | | 702,862 | | |

Marriott International, Inc., Class A | | | 42,047 | | | | 2,280,209 | | |

McDonald's Corp. | | | 186,206 | | | | 17,717,501 | | |

Starbucks Corp. | | | 141,047 | | | | 10,008,695 | | |

Starwood Hotels & Resorts

Worldwide, Inc. | | | 35,847 | | | | 2,955,944 | | |

Wyndham Worldwide Corp. | | | 24,383 | | | | 1,777,033 | | |

Wynn Resorts Ltd. | | | 15,103 | | | | 3,662,326 | | |

Yum! Brands, Inc. | | | 83,365 | | | | 6,175,679 | | |

Total | | | | | 53,061,824 | | |

Household Durables 0.4% | |

D.R. Horton, Inc. | | | 53,190 | | | | 1,306,346 | | |

Garmin Ltd. | | | 23,002 | | | | 1,234,287 | | |

Harman International Industries, Inc. | | | 12,640 | | | | 1,323,787 | | |

Leggett & Platt, Inc. | | | 26,412 | | | | 846,505 | | |

Lennar Corp., Class A | | | 31,300 | | | | 1,373,444 | | |

Mohawk Industries, Inc.(a) | | | 11,400 | | | | 1,613,442 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Newell Rubbermaid, Inc. | | | 53,756 | | | | 1,726,105 | | |

PulteGroup, Inc. | | | 64,534 | | | | 1,354,569 | | |

Whirlpool Corp. | | | 14,704 | | | | 2,126,640 | | |

Total | | | | | 12,905,125 | | |

Internet & Catalog Retail 1.4% | |

Amazon.com, Inc.(a) | | | 69,386 | | | | 25,124,671 | | |

Expedia, Inc. | | | 19,269 | | | | 1,513,194 | | |

Netflix, Inc.(a) | | | 11,092 | | | | 4,942,928 | | |

priceline.com, Inc.(a) | | | 9,619 | | | | 12,974,492 | | |

TripAdvisor, Inc.(a) | | | 20,726 | | | | 2,077,574 | | |

Total | | | | | 46,632,859 | | |

Leisure Equipment & Products 0.1% | |

Hasbro, Inc. | | | 21,602 | | | | 1,191,567 | | |

Mattel, Inc. | | | 63,320 | | | | 2,362,469 | | |

Total | | | | | 3,554,036 | | |

Media 3.6% | |

Cablevision Systems Corp., Class A | | | 40,058 | | | | 705,021 | | |

CBS Corp., Class B Non Voting | | | 104,463 | | | | 7,007,378 | | |

Comcast Corp., Class A | | | 487,761 | | | | 25,212,366 | | |

DIRECTV(a) | | | 91,461 | | | | 7,097,374 | | |

Discovery Communications, Inc.,

Class A(a) | | | 42,242 | | | | 3,519,603 | | |

Gannett Co., Inc. | | | 42,670 | | | | 1,269,432 | | |

Interpublic Group of Companies, Inc. (The) | | | 77,915 | | | | 1,380,654 | | |

News Corp., Class A(a) | | | 93,181 | | | | 1,708,008 | | |

Omnicom Group, Inc. | | | 48,163 | | | | 3,644,976 | | |

Scripps Networks Interactive, Inc.,

Class A | | | 20,527 | | | | 1,667,613 | | |

Time Warner Cable, Inc. | | | 52,743 | | | | 7,402,480 | | |

Time Warner, Inc. | | | 169,327 | | | | 11,366,921 | | |

Twenty-First Century Fox, Inc., Class A | | | 367,289 | | | | 12,318,873 | | |

Viacom, Inc., Class B | | | 75,961 | | | | 6,664,059 | | |

Walt Disney Co. (The) | | | 305,884 | | | | 24,718,486 | | |

Total | | | | | 115,683,244 | | |

Multiline Retail 0.7% | |

Dollar General Corp.(a) | | | 55,151 | | | | 3,303,545 | | |

Dollar Tree, Inc.(a) | | | 38,943 | | | | 2,132,908 | | |

Family Dollar Stores, Inc. | | | 18,112 | | | | 1,186,336 | | |

Kohl's Corp. | | | 37,650 | | | | 2,115,554 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

7

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Macy's, Inc. | | | 68,971 | | | | 3,990,662 | | |

Nordstrom, Inc. | | | 26,767 | | | | 1,645,635 | | |

Target Corp. | | | 118,313 | | | | 7,399,295 | | |

Total | | | | | 21,773,935 | | |

Specialty Retail 2.1% | |

AutoNation, Inc.(a) | | | 12,094 | | | | 636,628 | | |

AutoZone, Inc.(a) | | | 6,367 | | | | 3,428,247 | | |

Bed Bath & Beyond, Inc.(a) | | | 40,171 | | | | 2,724,397 | | |

Best Buy Co., Inc. | | | 51,144 | | | | 1,361,965 | | |

CarMax, Inc.(a) | | | 41,790 | | | | 2,023,890 | | |

GameStop Corp., Class A | | | 21,862 | | | | 815,671 | | |

Gap, Inc. (The) | | | 49,555 | | | | 2,168,031 | | |

Home Depot, Inc. (The) | | | 263,542 | | | | 21,618,350 | | |

L Brands, Inc. | | | 45,636 | | | | 2,570,676 | | |

Lowe's Companies, Inc. | | | 195,753 | | | | 9,793,523 | | |

O'Reilly Automotive, Inc.(a) | | | 20,079 | | | | 3,028,917 | | |

PetSmart, Inc. | | | 19,411 | | | | 1,301,702 | | |

Ross Stores, Inc. | | | 40,572 | | | | 2,953,642 | | |

Staples, Inc. | | | 123,643 | | | | 1,680,308 | | |

Tiffany & Co. | | | 20,594 | | | | 1,920,390 | | |

TJX Companies, Inc. (The) | | | 133,113 | | | | 8,181,125 | | |

Tractor Supply Co. | | | 26,130 | | | | 1,843,733 | | |

Urban Outfitters, Inc.(a) | | | 20,420 | | | | 764,525 | | |

Total | | | | | 68,815,720 | | |

Textiles, Apparel & Luxury Goods 0.8% | |

Coach, Inc. | | | 52,484 | | | | 2,561,744 | | |

Fossil Group, Inc.(a) | | | 9,191 | | | | 1,056,138 | | |

Michael Kors Holdings Ltd.(a) | | | 33,570 | | | | 3,290,867 | | |

Nike, Inc., Class B | | | 139,849 | | | | 10,950,177 | | |

PVH Corp. | | | 15,280 | | | | 1,931,850 | | |

Ralph Lauren Corp. | | | 11,150 | | | | 1,796,042 | | |

VF Corp. | | | 65,852 | | | | 3,858,269 | | |

Total | | | | | 25,445,087 | | |

Total Consumer Discretionary | | | | | 389,219,898 | | |

Consumer Staples 9.2% | |

Beverages 2.0% | |

Beam, Inc. | | | 30,537 | | | | 2,533,350 | | |

Brown-Forman Corp., Class B | | | 30,349 | | | | 2,543,246 | | |

Coca-Cola Co. (The) | | | 710,774 | | | | 27,151,567 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Coca-Cola Enterprises, Inc. | | | 45,180 | | | | 2,127,074 | | |

Constellation Brands, Inc., Class A(a) | | | 31,167 | | | | 2,525,462 | | |

Dr. Pepper Snapple Group, Inc. | | | 37,549 | | | | 1,956,678 | | |

Molson Coors Brewing Co., Class B | | | 29,569 | | | | 1,680,406 | | |

Monster Beverage Corp.(a) | | | 25,428 | | | | 1,881,672 | | |

PepsiCo, Inc. | | | 287,037 | | | | 22,983,053 | | |

Total | | | | | 65,382,508 | | |

Food & Staples Retailing 2.3% | |

Costco Wholesale Corp. | | | 81,798 | | | | 9,554,006 | | |

CVS Caremark Corp. | | | 222,758 | | | | 16,292,520 | | |

Kroger Co. (The) | | | 97,382 | | | | 4,084,201 | | |

Safeway, Inc. | | | 46,176 | | | | 1,729,291 | | |

SYSCO Corp. | | | 108,849 | | | | 3,920,741 | | |

Wal-Mart Stores, Inc. | | | 302,801 | | | | 22,619,235 | | |

Walgreen Co. | | | 162,972 | | | | 11,073,948 | | |

Whole Foods Market, Inc. | | | 69,635 | | | | 3,763,772 | | |

Total | | | | | 73,037,714 | | |

Food Products 1.5% | |

Archer-Daniels-Midland Co. | | | 123,147 | | | | 4,999,768 | | |

Campbell Soup Co. | | | 33,606 | | | | 1,455,476 | | |

ConAgra Foods, Inc. | | | 78,952 | | | | 2,242,237 | | |

General Mills, Inc. | | | 118,729 | | | | 5,940,012 | | |

Hershey Co. (The) | | | 28,053 | | | | 2,968,569 | | |

Hormel Foods Corp. | | | 25,187 | | | | 1,195,123 | | |

JM Smucker Co. (The) | | | 19,691 | | | | 1,969,297 | | |

Kellogg Co. | | | 48,139 | | | | 2,921,556 | | |

Kraft Foods Group, Inc. | | | 111,533 | | | | 6,164,429 | | |

McCormick & Co., Inc. | | | 24,703 | | | | 1,640,279 | | |

Mead Johnson Nutrition Co. | | | 37,828 | | | | 3,084,873 | | |

Mondelez International, Inc., Class A | | | 328,237 | | | | 11,169,905 | | |

Tyson Foods, Inc., Class A | | | 50,857 | | | | 2,006,309 | | |

Total | | | | | 47,757,833 | | |

Household Products 1.9% | |

Clorox Co. (The) | | | 24,174 | | | | 2,109,907 | | |

Colgate-Palmolive Co. | | | 164,525 | | | | 10,337,106 | | |

Kimberly-Clark Corp. | | | 71,429 | | | | 7,882,190 | | |

Procter & Gamble Co. (The) | | | 508,755 | | | | 40,018,668 | | |

Total | | | | | 60,347,871 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

8

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Personal Products 0.1% | |

Avon Products, Inc. | | | 81,189 | | | | 1,255,994 | | |

Estee Lauder Companies, Inc. (The),

Class A | | | 47,928 | | | | 3,299,363 | | |

Total | | | | | 4,555,357 | | |

Tobacco 1.4% | |

Altria Group, Inc. | | | 374,313 | | | | 13,572,589 | | |

Lorillard, Inc. | | | 68,941 | | | | 3,382,245 | | |

Philip Morris International, Inc. | | | 299,857 | | | | 24,261,430 | | |

Reynolds American, Inc. | | | 58,690 | | | | 2,983,213 | | |

Total | | | | | 44,199,477 | | |

Total Consumer Staples | | | | | 295,280,760 | | |

Energy 9.8% | |

Energy Equipment & Services 1.9% | |

Baker Hughes, Inc. | | | 82,977 | | | | 5,250,785 | | |

Cameron International Corp.(a) | | | 44,511 | | | | 2,851,375 | | |

Diamond Offshore Drilling, Inc. | | | 13,008 | | | | 615,278 | | |

Ensco PLC, Class A | | | 43,695 | | | | 2,300,979 | | |

FMC Technologies, Inc.(a) | | | 44,261 | | | | 2,223,673 | | |

Halliburton Co. | | | 158,772 | | | | 9,050,004 | | |

Helmerich & Payne, Inc. | | | 20,038 | | | | 1,978,752 | | |

Nabors Industries Ltd. | | | 48,612 | | | | 1,119,048 | | |

National Oilwell Varco, Inc. | | | 80,107 | | | | 6,171,443 | | |

Noble Corp. PLC | | | 47,450 | | | | 1,473,323 | | |

Rowan Companies PLC, Class A(a) | | | 23,270 | | | | 776,287 | | |

Schlumberger Ltd. | | | 246,485 | | | | 22,923,105 | | |

Transocean Ltd. | | | 63,460 | | | | 2,690,704 | | |

Total | | | | | 59,424,756 | | |

Oil, Gas & Consumable Fuels 7.9% | |

Anadarko Petroleum Corp. | | | 94,209 | | | | 7,928,629 | | |

Apache Corp. | | | 74,725 | | | | 5,924,945 | | |

Cabot Oil & Gas Corp. | | | 78,803 | | | | 2,758,105 | | |

Chesapeake Energy Corp. | | | 94,585 | | | | 2,450,697 | | |

Chevron Corp. | | | 359,930 | | | | 41,510,727 | | �� |

ConocoPhillips | | | 229,314 | | | | 15,249,381 | | |

CONSOL Energy, Inc. | | | 42,873 | | | | 1,719,207 | | |

Denbury Resources, Inc. | | | 68,608 | | | | 1,122,427 | | |

Devon Energy Corp. | | | 71,419 | | | | 4,600,812 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

EOG Resources, Inc. | | | 51,072 | | | | 9,674,058 | | |

EQT Corp. | | | 28,200 | | | | 2,884,578 | | |

Exxon Mobil Corp.(b) | | | 817,614 | | | | 78,711,796 | | |

Hess Corp. | | | 53,247 | | | | 4,261,357 | | |

Kinder Morgan Management LLC(c) | | | 1 | | | | 42 | | |

Kinder Morgan, Inc. | | | 126,012 | | | | 4,013,482 | | |

Marathon Oil Corp. | | | 130,380 | | | | 4,367,730 | | |

Marathon Petroleum Corp. | | | 56,340 | | | | 4,732,560 | | |

Murphy Oil Corp. | | | 32,888 | | | | 1,952,561 | | |

Newfield Exploration Co.(a) | | | 25,490 | | | | 718,563 | | |

Noble Energy, Inc. | | | 67,265 | | | | 4,625,141 | | |

Occidental Petroleum Corp. | | | 150,859 | | | | 14,560,911 | | |

ONEOK, Inc. | | | 38,632 | | | | 2,284,697 | | |

Peabody Energy Corp. | | | 50,497 | | | | 886,727 | | |

Phillips 66 | | | 112,190 | | | | 8,398,543 | | |

Pioneer Natural Resources Co. | | | 26,671 | | | | 5,365,672 | | |

QEP Resources, Inc. | | | 33,556 | | | | 970,775 | | |

Range Resources Corp. | | | 30,569 | | | | 2,630,463 | | |

Southwestern Energy Co.(a) | | | 65,650 | | | | 2,713,971 | | |

Spectra Energy Corp. | | | 125,421 | | | | 4,675,695 | | |

Tesoro Corp. | | | 24,883 | | | | 1,269,282 | | |

Valero Energy Corp. | | | 101,008 | | | | 4,846,364 | | |

Williams Companies, Inc. (The) | | | 127,935 | | | | 5,283,716 | | |

WPX Energy, Inc.(a) | | | 37,595 | | | | 662,424 | | |

Total | | | | | 253,756,038 | | |

Total Energy | | | | | 313,180,794 | | |

Financials 15.5% | |

Capital Markets 2.1% | |

Ameriprise Financial, Inc.(d) | | | 36,391 | | | | 3,966,255 | | |

Bank of New York Mellon Corp. (The) | | | 214,947 | | | | 6,878,304 | | |

BlackRock, Inc. | | | 23,787 | | | | 7,251,229 | | |

Charles Schwab Corp. (The) | | | 217,145 | | | | 5,756,514 | | |

E*TRADE Financial Corp.(a) | | | 53,739 | | | | 1,207,515 | | |

Franklin Resources, Inc. | | | 75,575 | | | | 4,024,369 | | |

Goldman Sachs Group, Inc. (The) | | | 78,891 | | | | 13,131,407 | | |

Invesco Ltd. | | | 82,988 | | | | 2,846,488 | | |

Legg Mason, Inc. | | | 19,879 | | | | 913,639 | | |

Morgan Stanley | | | 259,300 | | | | 7,986,440 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

9

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Northern Trust Corp. | | | 42,047 | | | | 2,600,607 | | |

State Street Corp. | | | 82,171 | | | | 5,396,170 | | |

T. Rowe Price Group, Inc. | | | 48,850 | | | | 3,965,154 | | |

Total | | | | | 65,924,091 | | |

Commercial Banks 2.7% | |

BB&T Corp. | | | 131,957 | | | | 4,987,975 | | |

Comerica, Inc. | | | 34,255 | | | | 1,650,406 | | |

Fifth Third Bancorp | | | 165,223 | | | | 3,584,513 | | |

Huntington Bancshares, Inc. | | | 155,422 | | | | 1,481,172 | | |

KeyCorp | | | 167,830 | | | | 2,210,321 | | |

M&T Bank Corp. | | | 24,397 | | | | 2,844,446 | | |

PNC Financial Services Group, Inc. (The) | | | 99,585 | | | | 8,144,061 | | |

Regions Financial Corp. | | | 257,828 | | | | 2,743,290 | | |

SunTrust Banks, Inc. | | | 100,170 | | | | 3,774,406 | | |

U.S. Bancorp | | | 341,820 | | | | 14,062,475 | | |

Wells Fargo & Co. | | | 897,179 | | | | 41,647,049 | | |

Zions Bancorporation | | | 34,571 | | | | 1,078,615 | | |

Total | | | | | 88,208,729 | | |

Consumer Finance 1.0% | |

American Express Co. | | | 172,421 | | | | 15,738,589 | | |

Capital One Financial Corp. | | | 107,897 | | | | 7,922,877 | | |

Discover Financial Services | | | 89,659 | | | | 5,144,633 | | |

SLM Corp. | | | 81,664 | | | | 1,955,036 | | |

Total | | | | | 30,761,135 | | |

Diversified Financial Services 4.9% | |

Bank of America Corp. | | | 1,996,297 | | | | 32,998,789 | | |

Berkshire Hathaway, Inc., Class B(a) | | | 336,895 | | | | 39,005,703 | | |

Citigroup, Inc. | | | 567,651 | | | | 27,604,868 | | |

CME Group, Inc. | | | 59,011 | | | | 4,356,192 | | |

IntercontinentalExchange Group, Inc. | | | 21,521 | | | | 4,494,446 | | |

JPMorgan Chase & Co. | | | 703,582 | | | | 39,977,529 | | |

Leucadia National Corp. | | | 58,659 | | | | 1,638,932 | | |

McGraw Hill Financial, Inc. | | | 50,689 | | | | 4,037,886 | | |

Moody's Corp. | | | 35,416 | | | | 2,797,864 | | |

NASDAQ OMX Group, Inc. (The) | | | 21,653 | | | | 831,259 | | |

Total | | | | | 157,743,468 | | |

Insurance 2.8% | |

ACE Ltd. | | | 63,647 | | | | 6,229,132 | | |

Aflac, Inc. | | | 87,209 | | | | 5,588,353 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Allstate Corp. (The) | | | 85,147 | | | | 4,620,076 | | |

American International Group, Inc. | | | 275,563 | | | | 13,714,770 | | |

Aon PLC | | | 56,354 | | | | 4,823,902 | | |

Assurant, Inc. | | | 13,609 | | | | 893,159 | | |

Chubb Corp. (The) | | | 47,105 | | | | 4,120,745 | | |

Cincinnati Financial Corp. | | | 27,585 | | | | 1,293,185 | | |

Genworth Financial, Inc., Class A(a) | | | 92,498 | | | | 1,437,419 | | |

Hartford Financial Services

Group, Inc. (The) | | | 83,693 | | | | 2,945,157 | | |

Lincoln National Corp. | | | 49,111 | | | | 2,461,934 | | |

Loews Corp. | | | 57,234 | | | | 2,488,534 | | |

Marsh & McLennan Companies, Inc. | | | 102,685 | | | | 4,945,310 | | |

MetLife, Inc. | | | 209,833 | | | | 10,632,238 | | |

Principal Financial Group, Inc. | | | 51,225 | | | | 2,323,054 | | |

Progressive Corp. (The) | | | 103,327 | | | | 2,530,478 | | |

Prudential Financial, Inc. | | | 86,643 | | | | 7,328,265 | | |

Torchmark Corp. | | | 16,931 | | | | 1,312,322 | | |

Travelers Companies, Inc. (The) | | | 68,164 | | | | 5,714,870 | | |

Unum Group | | | 48,897 | | | | 1,700,638 | | |

XL Group PLC | | | 52,925 | | | | 1,608,920 | | |

Total | | | | | 88,712,461 | | |

Real Estate Investment Trusts (REITs) 1.9% | |

American Tower Corp. | | | 73,843 | | | | 6,015,989 | | |

Apartment Investment & Management

Co., Class A | | | 27,334 | | | | 817,013 | | |

AvalonBay Communities, Inc. | | | 22,792 | | | | 2,939,484 | | |

Boston Properties, Inc. | | | 28,633 | | | | 3,219,208 | | |

Equity Residential | | | 62,715 | | | | 3,666,946 | | |

General Growth Properties, Inc. | | | 100,600 | | | | 2,215,212 | | |

HCP, Inc. | | | 85,408 | | | | 3,311,268 | | |

Health Care REIT, Inc. | | | 54,028 | | | | 3,173,605 | | |

Host Hotels & Resorts, Inc. | | | 141,550 | | | | 2,784,289 | | |

Kimco Realty Corp. | | | 76,701 | | | | 1,707,364 | | |

Macerich Co. (The) | | | 26,288 | | | | 1,580,698 | | |

Plum Creek Timber Co., Inc. | | | 33,091 | | | | 1,432,509 | | |

ProLogis, Inc. | | | 93,349 | | | | 3,845,045 | | |

Public Storage | | | 27,068 | | | | 4,574,492 | | |

Simon Property Group, Inc. | | | 58,090 | | | | 9,369,336 | | |

Ventas, Inc. | | | 55,023 | | | | 3,435,086 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

10

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Vornado Realty Trust | | | 32,560 | | | | 3,135,203 | | |

Weyerhaeuser Co. | | | 109,051 | | | | 3,218,095 | | |

Total | | | | | 60,440,842 | | |

Real Estate Management & Development —% | |

CBRE Group, Inc., Class A(a) | | | 52,125 | | | | 1,456,894 | | |

Thrifts & Mortgage Finance 0.1% | |

Hudson City Bancorp, Inc. | | | 89,009 | | | | 845,585 | | |

People's United Financial, Inc. | | | 59,480 | | | | 842,832 | | |

Total | | | | | 1,688,417 | | |

Total Financials | | | | | 494,936,037 | | |

Health Care 13.3% | |

Biotechnology 2.6% | |

Alexion Pharmaceuticals, Inc.(a) | | | 36,713 | | | | 6,490,858 | | |

Amgen, Inc. | | | 141,163 | | | | 17,507,035 | | |

Biogen Idec, Inc.(a) | | | 44,205 | | | | 15,059,760 | | |

Celgene Corp.(a) | | | 77,104 | | | | 12,394,468 | | |

Gilead Sciences, Inc.(a) | | | 287,001 | | | | 23,760,813 | | |

Regeneron Pharmaceuticals, Inc.(a) | | | 14,724 | | | | 4,895,730 | | |

Vertex Pharmaceuticals, Inc.(a) | | | 43,750 | | | | 3,537,625 | | |

Total | | | | | 83,646,289 | | |

Health Care Equipment & Supplies 2.1% | |

Abbott Laboratories | | | 289,391 | | | | 11,511,974 | | |

Baxter International, Inc. | | | 101,574 | | | | 7,059,393 | | |

Becton Dickinson and Co. | | | 36,316 | | | | 4,184,330 | | |

Boston Scientific Corp.(a) | | | 249,924 | | | | 3,274,004 | | |

CareFusion Corp.(a) | | | 39,548 | | | | 1,602,880 | | |

Covidien PLC | | | 86,110 | | | | 6,195,615 | | |

CR Bard, Inc. | | | 14,591 | | | | 2,103,439 | | |

DENTSPLY International, Inc. | | | 26,708 | | | | 1,212,009 | | |

Edwards Lifesciences Corp.(a) | | | 20,466 | | | | 1,427,708 | | |

Intuitive Surgical, Inc.(a) | | | 7,142 | | | | 3,176,976 | | |

Medtronic, Inc. | | | 186,854 | | | | 11,072,968 | | |

St. Jude Medical, Inc. | | | 54,609 | | | | 3,676,278 | | |

Stryker Corp. | | | 55,238 | | | | 4,432,297 | | |

Varian Medical Systems, Inc.(a) | | | 19,803 | | | | 1,660,085 | | |

Zimmer Holdings, Inc. | | | 31,999 | | | | 3,002,786 | | |

Total | | | | | 65,592,742 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Health Care Providers & Services 2.0% | |

Aetna, Inc. | | | 68,805 | | | | 5,002,812 | | |

AmerisourceBergen Corp. | | | 43,072 | | | | 2,922,435 | | |

Cardinal Health, Inc. | | | 63,926 | | | | 4,572,627 | | |

CIGNA Corp. | | | 51,755 | | | | 4,119,180 | | |

DaVita HealthCare Partners, Inc.(a) | | | 33,034 | | | | 2,270,427 | | |

Express Scripts Holding Co.(a) | | | 150,817 | | | | 11,358,028 | | |

Five Star Quality Care, Inc.(c)(e) | | | — | | | | 1 | | |

Humana, Inc. | | | 29,188 | | | | 3,282,483 | | |

Laboratory Corp. of America Holdings(a) | | | 16,358 | | | | 1,530,127 | | |

McKesson Corp. | | | 42,982 | | | | 7,609,963 | | |

Patterson Companies, Inc. | | | 15,582 | | | | 641,355 | | |

Quest Diagnostics, Inc. | | | 27,238 | | | | 1,443,614 | | |

Tenet Healthcare Corp.(a) | | | 18,585 | | | | 819,970 | | |

UnitedHealth Group, Inc. | | | 188,408 | | | | 14,558,286 | | |

WellPoint, Inc. | | | 55,284 | | | | 5,008,178 | | |

Total | | | | | 65,139,486 | | |

Health Care Technology 0.1% | |

Cerner Corp.(a) | | | 55,266 | | | | 3,391,675 | | |

Life Sciences Tools & Services 0.5% | |

Agilent Technologies, Inc. | | | 61,923 | | | | 3,525,276 | | |

PerkinElmer, Inc. | | | 21,020 | | | | 952,627 | | |

Thermo Fisher Scientific, Inc. | | | 74,150 | | | | 9,234,641 | | |

Waters Corp.(a) | | | 15,908 | | | | 1,772,151 | | |

Total | | | | | 15,484,695 | | |

Pharmaceuticals 6.0% | |

AbbVie, Inc. | | | 297,737 | | | | 15,157,791 | | |

Actavis PLC(a) | | | 32,554 | | | | 7,188,574 | | |

Allergan, Inc. | | | 55,640 | | | | 7,066,280 | | |

Bristol-Myers Squibb Co. | | | 308,190 | | | | 16,571,376 | | |

Eli Lilly & Co. | | | 185,543 | | | | 11,060,218 | | |

Forest Laboratories, Inc.(a) | | | 44,379 | | | | 4,330,059 | | |

Hospira, Inc.(a) | | | 31,033 | | | | 1,343,108 | | |

Johnson & Johnson | | | 528,074 | | | | 48,646,177 | | |

Merck & Co., Inc. | | | 546,858 | | | | 31,165,438 | | |

Mylan, Inc.(a) | | | 71,651 | | | | 3,981,646 | | |

Perrigo Co. PLC | | | 24,894 | | | | 4,093,569 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

11

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Pfizer, Inc. | | | 1,212,997 | | | | 38,949,334 | | |

Zoetis, Inc. | | | 93,557 | | | | 2,902,138 | | |

Total | | | | | 192,455,708 | | |

Total Health Care | | | | | 425,710,595 | | |

Industrials 10.4% | |

Aerospace & Defense 2.7% | |

Boeing Co. (The) | | | 129,407 | | | | 16,683,150 | | |

General Dynamics Corp. | | | 62,618 | | | | 6,859,176 | | |

Honeywell International, Inc. | | | 146,882 | | | | 13,871,536 | | |

L-3 Communications Holdings, Inc. | | | 16,569 | | | | 1,912,063 | | |

Lockheed Martin Corp. | | | 50,357 | | | | 8,172,941 | | |

Northrop Grumman Corp. | | | 41,560 | | | | 5,030,007 | | |

Precision Castparts Corp. | | | 27,211 | | | | 7,017,173 | | |

Raytheon Co. | | | 59,789 | | | | 5,853,941 | | |

Rockwell Collins, Inc. | | | 25,312 | | | | 2,089,252 | | |

Textron, Inc. | | | 52,625 | | | | 2,089,212 | | |

United Technologies Corp. | | | 157,992 | | | | 18,488,224 | | |

Total | | | | | 88,066,675 | | |

Air Freight & Logistics 0.7% | |

CH Robinson Worldwide, Inc. | | | 28,377 | | | | 1,471,631 | | |

Expeditors International of Washington, Inc. | | | 38,473 | | | | 1,520,068 | | |

FedEx Corp. | | | 55,704 | | | | 7,427,014 | | |

United Parcel Service, Inc., Class B | | | 133,802 | | | | 12,814,218 | | |

Total | | | | | 23,232,931 | | |

Airlines 0.2% | |

Delta Air Lines, Inc. | | | 160,100 | | | | 5,316,921 | | |

Southwest Airlines Co. | | | 130,391 | | | | 2,925,974 | | |

Total | | | | | 8,242,895 | | |

Building Products 0.1% | |

Allegion PLC(a) | | | 16,732 | | | | 909,384 | | |

Masco Corp. | | | 66,811 | | | | 1,560,037 | | |

Total | | | | | 2,469,421 | | |

Commercial Services & Supplies 0.5% | |

ADT Corp. (The) | | | 37,437 | | | | 1,149,690 | | |

Cintas Corp. | | | 18,851 | | | | 1,143,502 | | |

Iron Mountain, Inc. | | | 31,849 | | | | 866,293 | | |

Pitney Bowes, Inc. | | | 37,821 | | | | 962,544 | | |

Republic Services, Inc. | | | 50,556 | | | | 1,724,465 | | |

Stericycle, Inc.(a) | | | 16,035 | | | | 1,827,990 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Tyco International Ltd. | | | 87,085 | | | | 3,673,245 | | |

Waste Management, Inc. | | | 81,669 | | | | 3,389,264 | | |

Total | | | | | 14,736,993 | | |

Construction & Engineering 0.2% | |

Fluor Corp. | | | 30,597 | | | | 2,377,081 | | |

Jacobs Engineering Group, Inc.(a) | | | 24,662 | | | | 1,495,750 | | |

Quanta Services, Inc.(a) | | | 40,377 | | | | 1,421,674 | | |

Total | | | | | 5,294,505 | | |

Electrical Equipment 0.7% | |

AMETEK, Inc. | | | 45,815 | | | | 2,439,191 | | |

Eaton Corp. PLC | | | 88,786 | | | | 6,633,202 | | |

Emerson Electric Co. | | | 131,733 | | | | 8,596,895 | | |

Rockwell Automation, Inc. | | | 25,940 | | | | 3,186,470 | | |

Roper Industries, Inc. | | | 18,596 | | | | 2,521,989 | | |

Total | | | | | 23,377,747 | | |

Industrial Conglomerates 2.3% | |

3M Co. | | | 119,718 | | | | 16,129,606 | | |

Danaher Corp. | | | 112,222 | | | | 8,583,861 | | |

General Electric Co. | | | 1,893,561 | | | | 48,228,999 | | |

Total | | | | | 72,942,466 | | |

Machinery 1.7% | |

Caterpillar, Inc. | | | 119,101 | | | | 11,549,224 | | |

Cummins, Inc. | | | 32,602 | | | | 4,757,284 | | |

Deere & Co. | | | 71,648 | | | | 6,156,713 | | |

Dover Corp. | | | 31,910 | | | | 3,009,113 | | |

Flowserve Corp. | | | 26,104 | | | | 2,119,906 | | |

Illinois Tool Works, Inc. | | | 76,445 | | | | 6,306,712 | | |

Ingersoll-Rand PLC | | | 50,146 | | | | 3,065,926 | | |

Joy Global, Inc. | | | 19,906 | | | | 1,094,830 | | |

PACCAR, Inc. | | | 66,260 | | | | 4,362,558 | | |

Pall Corp. | | | 20,729 | | | | 1,782,694 | | |

Parker Hannifin Corp. | | | 27,936 | | | | 3,367,685 | | |

Pentair Ltd. | | | 37,325 | | | | 3,016,233 | | |

Snap-On, Inc. | | | 10,903 | | | | 1,222,990 | | |

Stanley Black & Decker, Inc. | | | 29,049 | | | | 2,412,229 | | |

Xylem, Inc. | | | 34,510 | | | | 1,357,969 | | |

Total | | | | | 55,582,066 | | |

Professional Services 0.2% | |

Dun & Bradstreet Corp. (The) | | | 7,128 | | | | 707,169 | | |

Equifax, Inc. | | | 22,774 | | | | 1,595,546 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

12

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Nielsen Holdings NV | | | 47,355 | | | | 2,241,786 | | |

Robert Half International, Inc. | | | 25,929 | | | | 1,061,533 | | |

Total | | | | | 5,606,034 | | |

Road & Rail 0.9% | |

CSX Corp. | | | 189,703 | | | | 5,256,670 | | |

Kansas City Southern | | | 20,637 | | | | 1,938,227 | | |

Norfolk Southern Corp. | | | 57,836 | | | | 5,315,707 | | |

Ryder System, Inc. | | | 9,831 | | | | 740,471 | | |

Union Pacific Corp. | | | 86,224 | | | | 15,553,085 | | |

Total | | | | | 28,804,160 | | |

Trading Companies & Distributors 0.2% | |

Fastenal Co. | | | 51,103 | | | | 2,411,551 | | |

WW Grainger, Inc. | | | 11,542 | | | | 2,943,441 | | |

Total | | | | | 5,354,992 | | |

Total Industrials | | | | | 333,710,885 | | |

Information Technology 18.3% | |

Communications Equipment 1.7% | |

Cisco Systems, Inc. | | | 1,000,674 | | | | 21,814,693 | | |

F5 Networks, Inc.(a) | | | 14,533 | | | | 1,632,637 | | |

Harris Corp. | | | 20,023 | | | | 1,478,098 | | |

Juniper Networks, Inc.(a) | | | 94,526 | | | | 2,527,625 | | |

Motorola Solutions, Inc. | | | 43,101 | | | | 2,853,286 | | |

QUALCOMM, Inc. | | | 316,219 | | | | 23,808,129 | | |

Total | | | | | 54,114,468 | | |

Computers & Peripherals 3.8% | |

Apple, Inc. | | | 168,397 | | | | 88,617,237 | | |

EMC Corp. | | | 385,143 | | | | 10,156,221 | | |

Hewlett-Packard Co. | | | 359,693 | | | | 10,747,627 | | |

NetApp, Inc. | | | 63,794 | | | | 2,577,916 | | |

SanDisk Corp. | | | 42,275 | | | | 3,141,032 | | |

Seagate Technology PLC | | | 61,041 | | | | 3,185,730 | | |

Western Digital Corp. | | | 39,406 | | | | 3,427,928 | | |

Total | | | | | 121,853,691 | | |

Electronic Equipment, Instruments & Components 0.4% | |

Amphenol Corp., Class A | | | 29,634 | | | | 2,608,385 | | |

Corning, Inc. | | | 270,865 | | | | 5,219,569 | | |

FLIR Systems, Inc. | | | 26,519 | | | | 905,359 | | |

Jabil Circuit, Inc. | | | 34,599 | | | | 640,427 | | |

TE Connectivity Ltd. | | | 76,821 | | | | 4,500,174 | | |

Total | | | | | 13,873,914 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Internet Software & Services 3.4% | |

Akamai Technologies, Inc.(a) | | | 33,497 | | | | 2,047,672 | | |

eBay, Inc.(a) | | | 218,048 | | | | 12,814,681 | | |

Facebook, Inc., Class A(a) | | | 307,850 | | | | 21,075,411 | | |

Google, Inc., Class A(a) | | | 52,534 | | | | 63,862,957 | | |

VeriSign, Inc.(a) | | | 24,107 | | | | 1,328,537 | | |

Yahoo!, Inc.(a) | | | 176,569 | | | | 6,827,923 | | |

Total | | | | | 107,957,181 | | |

IT Services 3.6% | |

Accenture PLC, Class A | | | 118,997 | | | | 9,918,400 | | |

Alliance Data Systems Corp.(a) | | | 9,100 | | | | 2,594,501 | | |

Automatic Data Processing, Inc. | | | 90,090 | | | | 7,007,200 | | |

Cognizant Technology Solutions Corp.,

Class A(a) | | | 56,626 | | | | 5,892,502 | | |

Computer Sciences Corp. | | | 27,563 | | | | 1,741,982 | | |

Fidelity National Information Services, Inc. | | | 54,513 | | | | 3,031,468 | | |

Fiserv, Inc.(a) | | | 48,264 | | | | 2,801,725 | | |

International Business Machines Corp. | | | 191,012 | | | | 35,369,692 | | |

MasterCard, Inc., Class A | | | 193,850 | | | | 15,066,022 | | |

Paychex, Inc. | | | 60,814 | | | | 2,539,593 | | |

Teradata Corp.(a) | | | 30,558 | | | | 1,403,223 | | |

Total System Services, Inc. | | | 31,272 | | | | 952,545 | | |

Visa, Inc., Class A | | | 95,306 | | | | 21,533,438 | | |

Western Union Co. (The) | | | 103,369 | | | | 1,729,363 | | |

Xerox Corp. | | | 216,595 | | | | 2,380,379 | | |

Total | | | | | 113,962,033 | | |

Semiconductors & Semiconductor Equipment 2.0% | |

Altera Corp. | | | 60,082 | | | | 2,181,578 | | |

Analog Devices, Inc. | | | 58,204 | | | | 2,957,927 | | |

Applied Materials, Inc. | | | 225,382 | | | | 4,273,243 | | |

Broadcom Corp., Class A | | | 101,016 | | | | 3,002,196 | | |

First Solar, Inc.(a) | | | 13,225 | | | | 754,751 | | |

Intel Corp. | | | 930,390 | | | | 23,036,456 | | |

KLA-Tencor Corp. | | | 31,194 | | | | 2,032,289 | | |

Lam Research Corp.(a) | | | 30,369 | | | | 1,570,988 | | |

Linear Technology Corp. | | | 43,823 | | | | 2,052,669 | | |

LSI Corp. | | | 102,014 | | | | 1,131,335 | | |

Microchip Technology, Inc. | | | 37,135 | | | | 1,691,499 | | |

Micron Technology, Inc.(a) | | | 196,886 | | | | 4,762,672 | | |

NVIDIA Corp. | | | 108,294 | | | | 1,990,444 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

13

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Texas Instruments, Inc. | | | 204,879 | | | | 9,211,360 | | |

Xilinx, Inc. | | | 50,241 | | | | 2,622,580 | | |

Total | | | | | 63,271,987 | | |

Software 3.4% | |

Adobe Systems, Inc.(a) | | | 87,033 | | | | 5,971,334 | | |

Autodesk, Inc.(a) | | | 42,233 | | | | 2,215,543 | | |

CA, Inc. | | | 60,814 | | | | 2,037,269 | | |

Citrix Systems, Inc.(a) | | | 34,902 | | | | 2,095,865 | | |

Electronic Arts, Inc.(a) | | | 57,851 | | | | 1,653,960 | | |

Intuit, Inc. | | | 53,308 | | | | 4,166,020 | | |

Microsoft Corp. | | | 1,421,817 | | | | 54,469,809 | | |

Oracle Corp. | | | 656,785 | | | | 25,686,861 | | |

Red Hat, Inc.(a) | | | 35,461 | | | | 2,091,845 | | |

Salesforce.com, Inc.(a) | | | 103,842 | | | | 6,476,626 | | |

Symantec Corp. | | | 130,290 | | | | 2,798,629 | | |

Total | | | | | 109,663,761 | | |

Total Information Technology | | | | | 584,697,035 | | |

Materials 3.4% | |

Chemicals 2.5% | |

Air Products & Chemicals, Inc. | | | 39,520 | | | | 4,794,566 | | |

Airgas, Inc. | | | 12,433 | | | | 1,340,277 | | |

CF Industries Holdings, Inc. | | | 10,747 | | | | 2,696,422 | | |

Dow Chemical Co. (The) | | | 226,992 | | | | 11,056,780 | | |

Eastman Chemical Co. | | | 28,827 | | | | 2,520,345 | | |

Ecolab, Inc. | | | 50,758 | | | | 5,469,175 | | |

EI du Pont de Nemours & Co. | | | 173,312 | | | | 11,546,045 | | |

FMC Corp. | | | 24,965 | | | | 1,926,799 | | |

International Flavors & Fragrances, Inc. | | | 15,261 | | | | 1,431,329 | | |

LyondellBasell Industries NV, Class A | | | 81,748 | | | | 7,200,364 | | |

Monsanto Co. | | | 98,437 | | | | 10,830,039 | | |

Mosaic Co. (The) | | | 63,793 | | | | 3,116,926 | | |

PPG Industries, Inc. | | | 26,577 | | | | 5,257,462 | | |

Praxair, Inc. | | | 55,077 | | | | 7,180,389 | | |

Sherwin-Williams Co. (The) | | | 16,141 | | | | 3,235,948 | | |

Sigma-Aldrich Corp. | | | 22,389 | | | | 2,113,745 | | |

Total | | | | | 81,716,611 | | |

Construction Materials 0.1% | |

Vulcan Materials Co. | | | 24,329 | | | | 1,652,669 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Containers & Packaging 0.2% | |

Avery Dennison Corp. | | | 18,089 | | | | 901,194 | | |

Ball Corp. | | | 27,077 | | | | 1,504,398 | | |

Bemis Co., Inc. | | | 19,284 | | | | 757,476 | | |

MeadWestvaco Corp. | | | 33,277 | | | | 1,245,558 | | |

Owens-Illinois, Inc.(a) | | | 30,892 | | | | 1,047,857 | | |

Sealed Air Corp. | | | 36,729 | | | | 1,250,255 | | |

Total | | | | | 6,706,738 | | |

Metals & Mining 0.5% | |

Alcoa, Inc. | | | 200,180 | | | | 2,350,113 | | |

Allegheny Technologies, Inc. | | | 20,213 | | | | 642,369 | | |

Cliffs Natural Resources, Inc. | | | 28,668 | | | | 574,220 | | |

Freeport-McMoRan Copper & Gold, Inc. | | | 194,281 | | | | 6,337,446 | | |

Newmont Mining Corp. | | | 93,181 | | | | 2,167,390 | | |

Nucor Corp. | | | 59,540 | | | | 2,991,290 | | |

United States Steel Corp. | | | 27,100 | | | | 656,362 | | |

Total | | | | | 15,719,190 | | |

Paper & Forest Products 0.1% | |

International Paper Co. | | | 83,020 | | | | 4,058,848 | | |

Total Materials | | | | | 109,854,056 | | |

Telecommunication Services 2.4% | |

Diversified Telecommunication Services 2.3% | |

AT&T, Inc. | | | 985,975 | | | | 31,482,182 | | |

CenturyLink, Inc. | | | 110,627 | | | | 3,458,200 | | |

Frontier Communications Corp. | | | 187,071 | | | | 912,906 | | |

Verizon Communications, Inc. | | | 771,476 | | | | 36,706,828 | | |

Windstream Holdings, Inc. | | | 111,578 | | | | 894,856 | | |

Total | | | | | 73,454,972 | | |

Wireless Telecommunication Services 0.1% | |

Crown Castle International Corp.(a) | | | 62,518 | | | | 4,745,116 | | |

Total Telecommunication Services | | | | | 78,200,088 | | |

Utilities 2.9% | |

Electric Utilities 1.6% | |

American Electric Power Co., Inc. | | | 91,215 | | | | 4,578,993 | | |

Duke Energy Corp. | | | 132,137 | | | | 9,365,871 | | |

Edison International | | | 60,996 | | | | 3,194,361 | | |

Entergy Corp. | | | 33,365 | | | | 2,129,354 | | |

Exelon Corp. | | | 160,403 | | | | 4,877,855 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

14

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

FirstEnergy Corp. | | | 78,287 | | | | 2,409,674 | | |

NextEra Energy, Inc. | | | 80,583 | | | | 7,364,480 | | |

Northeast Utilities | | | 58,956 | | | | 2,620,594 | | |

Pepco Holdings, Inc. | | | 46,769 | | | | 953,620 | | |

Pinnacle West Capital Corp. | | | 20,589 | | | | 1,145,778 | | |

PPL Corp. | | | 117,966 | | | | 3,809,122 | | |

Southern Co. (The) | | | 165,052 | | | | 6,989,952 | | |

Xcel Energy, Inc. | | | 93,161 | | | | 2,821,847 | | |

Total | | | | | 52,261,501 | | |

Gas Utilities 0.1% | |

AGL Resources, Inc. | | | 22,233 | | | | 1,045,840 | | |

Independent Power Producers & Energy Traders 0.1% | |

AES Corp. (The) | | | 122,873 | | | | 1,677,217 | | |

NRG Energy, Inc. | | | 60,518 | | | | 1,759,258 | | |

Total | | | | | 3,436,475 | | |

Multi-Utilities 1.1% | |

Ameren Corp. | | | 45,419 | | | | 1,835,382 | | |

CenterPoint Energy, Inc. | | | 80,209 | | | | 1,896,943 | | |

CMS Energy Corp. | | | 49,766 | | | | 1,414,847 | | |

Consolidated Edison, Inc. | | | 54,809 | | | | 3,072,044 | | |

Dominion Resources, Inc. | | | 108,625 | | | | 7,538,575 | | |

DTE Energy Co. | | | 33,107 | | | | 2,375,758 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Integrys Energy Group, Inc. | | | 14,917 | | | | 854,297 | | |

NiSource, Inc. | | | 58,652 | | | | 2,042,263 | | |

PG&E Corp. | | | 84,099 | | | | 3,705,402 | | |

Public Service Enterprise Group, Inc. | | | 94,690 | | | | 3,471,335 | | |

SCANA Corp. | | | 26,286 | | | | 1,301,157 | | |

Sempra Energy | | | 42,553 | | | | 4,019,982 | | |

TECO Energy, Inc. | | | 38,220 | | | | 641,332 | | |

Wisconsin Energy Corp. | | | 42,405 | | | | 1,864,124 | | |

Total | | | | | 36,033,441 | | |

Total Utilities | | | | | 92,777,257 | | |

Total Common Stocks

(Cost: $2,115,099,448) | | | | | 3,117,567,405 | | |

Money Market Funds 1.3%

| | | Shares | | Value ($) | |

Columbia Short-Term Cash Fund,

0.098%(d)(f) | | | 42,522,199 | | | | 42,522,199 | | |

Total Money Market Funds

(Cost: $42,522,199) | | | | | 42,522,199 | | |

Total Investments

(Cost: $2,157,621,647) | | | | | 3,160,089,604 | | |

Other Assets & Liabilities, Net | | | | | 43,426,435 | | |

Net Assets | | | | | 3,203,516,039 | | |

Investments in Derivatives

Futures Contracts Outstanding at February 28, 2014

At February 28, 2014, securities totaling $5,006,040 were pledged as collateral to cover initial margin requirements on open futures contracts.

Contract Description | | Number of

Contracts

Long (Short) | | Trading

Currency | | Notional

Market

Value ($) | | Expiration

Date | | Unrealized

Appreciation ($) | | Unrealized

Depreciation ($) | |

S&P 500 | | | 175 | | | USD | | | | | 81,270,000 | | | 03/2014 | | | 636,044 | | | | — | | |

Notes to Portfolio of Investments

(a) Non-income producing.

(b) This security, or a portion of this security, has been pledged as collateral in connection with open futures contracts. These values are denoted within the Investments in Derivatives section of the Portfolio of Investments.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

15

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Notes to Portfolio of Investments (continued)

(c) Identifies issues considered by the Investment Manager to be illiquid as to their marketability. The aggregate value of such securities at February 28, 2014 was $43, representing less than 0.01% of net assets. Information concerning such security holdings at February 28, 2014 is as follows:

Security Description | | Acquisition Dates | | Cost ($) | |

Five Star Quality Care, Inc. | | 01/02/2002 | | | 2 | | |

Kinder Morgan Management LLC | | 09/26/2002 - 05/20/2008 | | | 14 | | |

(d) As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of its outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended February 28, 2014, are as follows:

Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Proceeds

From Sales ($) | | Realized

Gain (Loss) ($) | | Ending

Cost ($) | | Dividends —

Affiliated

Issuers ($) | | Value ($) | |

Ameriprise Financial, Inc. | | | 1,159,328 | | | | 64,717 | | | | (123,278 | ) | | | 78,648 | | | | 1,179,415 | | | | 76,117 | | | | 3,966,255 | | |

Columbia Short-Term

Cash Fund | | | 57,654,389 | | | | 336,740,994 | | | | (351,873,184 | ) | | | — | | | | 42,522,199 | | | | 60,542 | | | | 42,522,199 | | |

Total | | | 58,813,717 | | | | 336,805,711 | | | | (351,996,462 | ) | | | 78,648 | | | | 43,701,614 | | | | 136,659 | | | | 46,488,454 | | |

(e) Represents fractional shares.

(f) The rate shown is the seven-day current annualized yield at February 28, 2014.

Currency Legend

USD US Dollar

Fair Value Measurements

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

16

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Fair Value Measurements (continued)

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund's Board of Trustees (the Board), the Investment Manager's Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager's organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2014

17

Columbia Large Cap Index Fund

Portfolio of Investments (continued)

February 28, 2014

Fair Value Measurements (continued)

The following table is a summary of the inputs used to value the Fund's investments at February 28, 2014:

Description | | Level 1

Quoted Prices in Active

Markets for Identical

Assets ($) | | Level 2

Other Significant

Observable Inputs ($) | | Level 3

Significant

Unobservable Inputs ($) | | Total ($) | |

Equity Securities | |

Common Stocks | |

Consumer Discretionary | | | 389,219,898 | | | | — | | | | — | | | | 389,219,898 | | |

Consumer Staples | | | 295,280,760 | | | | — | | | | — | | | | 295,280,760 | | |

Energy | | | 313,180,752 | | | | 42 | | | | — | | | | 313,180,794 | | |

Financials | | | 494,936,037 | | | | — | | | | — | | | | 494,936,037 | | |