UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-09645

Columbia Funds Series Trust

(Exact name of registrant as specified in charter)

225 Franklin Street

Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Christopher O. Petersen, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, Massachusetts 02110

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800)345-6611

Date of fiscal year end: February 28

Date of reporting period: February 28, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

February 28, 2019

Columbia Convertible Securities Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (columbiathreadneedleus.com/investor/), and each time a report is posted you will be notified by mail and provided with a website address to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, for Fund shares held directly with the Fund, by calling 800.345.6611 or by enrolling in “eDelivery” by logging into your account at columbiathreadneedleus.com/investor/.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can call 800.345.6611 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive paper reports will apply to all Columbia Funds held in your account if you invest through a financial intermediary or all Columbia Funds held with the fund complex if you invest directly with the Fund.

Not FDIC Insured • No bank guarantee • May lose value

Dear Shareholders,

Volatility exists in financial markets and this is not a comfortable fact of life. How investors deal with this reality, including how they react to short term spikes in volatility as well as to longer periods of increased or decreased volatility, may have a significant impact on their overall investing success.

Too often, investors change their investment strategy based on something that’s happening at a moment in time rather than thinking about how that change in strategy might affect their ability to achieve their longer term financial goals. Emotion replaces logic and reasoning. Investors may sell in reaction to a market drop (fear or panic), locking in low returns which means they won’t be invested when the market returns, or they invest more at a market peak (greed or conviction), essentially when it is expensive to do so. In both cases, selling and buying at the exact wrong time.

We believe the best outcomes come from a consistent approach to investing. Here are five areas where advisors can help us overcome the tendency to react emotionally as we struggle to make the right choices with our investments:

Long-term focus

The further away long-term goals, aspirations and objectives are, the easier it is to stray away from the goals and priorities that we set out. Advisors help us stay focused on what we want to accomplish.

Discipline through up-and-down markets

Advisors help set rules to prevent us from making rash decisions that we may regret later. Knowing ahead of time what you should do in case of certain situations will help you get through volatile markets and not make emotional decisions.

Tax-awareness

Taxes are one of the biggest drags on investment returns and are critical attributes of investing. Yet few of us take the necessary steps to ease the corrosive effect of taxes. Advisors have tools and knowledge that may help us to manage portfolios more tax-efficiently and keep more of what we earn.

Emotional objectivity

Our emotions are very hard to manage and making investment decisions in an emotional state can lead to exceedingly bad outcomes. An objective advisor can help prevent some of the reactionary mistakes emotions often lead us to.

Education and guidance

The role of the advisor is to teach and guide us toward achieving our financial goals. In terms of working through emotions, guidance is by far the most important component.

By understanding our own behaviors and biases, we can prepare for future challenges. Your success is our priority. Talk to your advisor about how working with Columbia Threadneedle Investments may help you stay the course and position your portfolio for consistent, sustainable outcomes, regardless of market conditions.

Sincerely,

Christopher O. Petersen

President, Columbia Funds

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2019 Columbia Management Investment Advisers, LLC. All rights reserved.

Columbia Convertible Securities Fund | Annual Report 2019

Columbia Convertible Securities Fund | Annual Report 2019

Investment objective

Columbia Convertible Securities Fund (the Fund) seeks total return, consisting of capital appreciation and current income.

Portfolio management

David King, CFA

Lead Portfolio Manager

Managed Fund since 2010

Yan Jin

Portfolio Manager

Managed Fund since 2006

| Average annual total returns (%) (for the period ended February 28, 2019) |

| | | Inception | 1 Year | 5 Years | 10 Years |

| Class A | Excluding sales charges | 09/25/87 | 7.70 | 6.70 | 11.98 |

| | Including sales charges | | 1.48 | 5.45 | 11.31 |

| Advisor Class* | 11/08/12 | 7.99 | 6.98 | 12.17 |

| Class C | Excluding sales charges | 10/21/96 | 6.92 | 5.90 | 11.14 |

| | Including sales charges | | 5.92 | 5.90 | 11.14 |

| Institutional Class | 05/21/99 | 8.00 | 6.97 | 12.26 |

| Institutional 2 Class* | 11/08/12 | 8.07 | 7.07 | 12.23 |

| Institutional 3 Class* | 10/01/14 | 8.11 | 7.06 | 12.17 |

| Class R* | 11/16/11 | 7.44 | 6.43 | 11.65 |

| ICE BofAML All Convertibles All Qualities Index | | 8.33 | 6.79 | 13.60 |

Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the 1.00% contingent deferred sales charge for the first year only. The Fund’s other share classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each share class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.345.6611.

| * | The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information. |

The ICE BofAML All Convertibles All Qualities Index measures the performance of U.S. dollar-denominated convertible securities not currently in bankruptcy with a total market value greater than $50 million at issuance.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

| 2 | Columbia Convertible Securities Fund | Annual Report 2019 |

Fund at a Glance (continued)

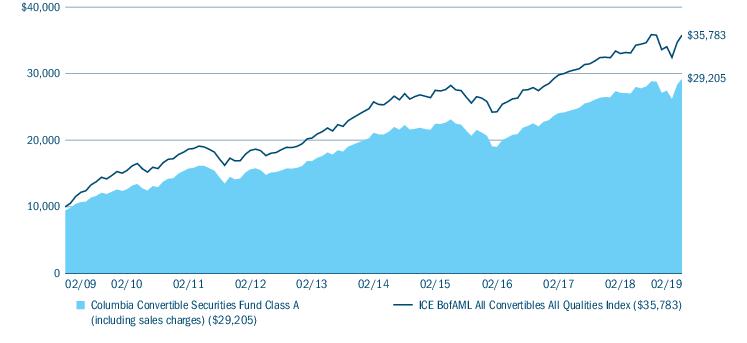

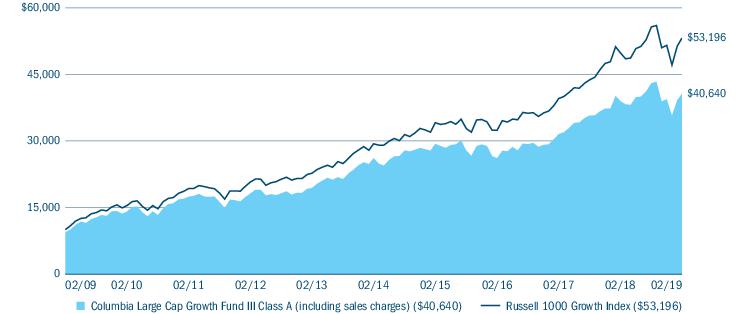

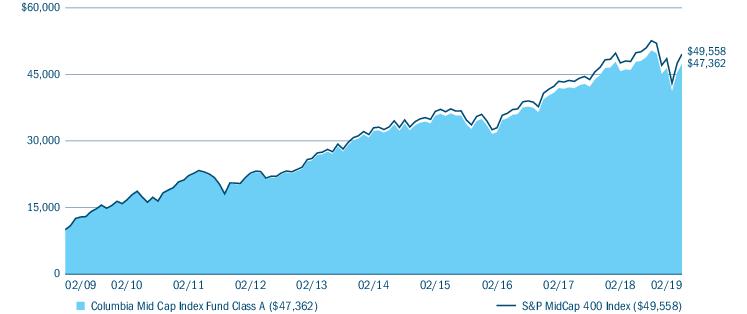

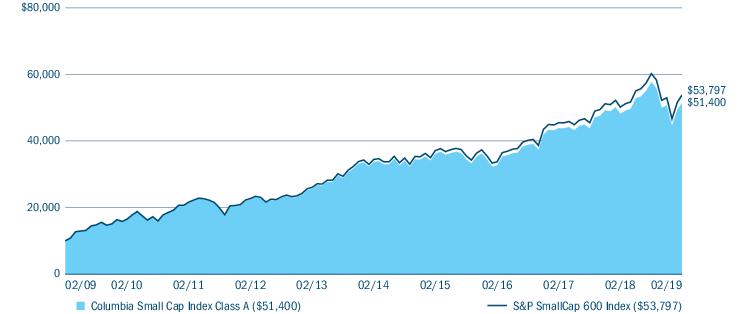

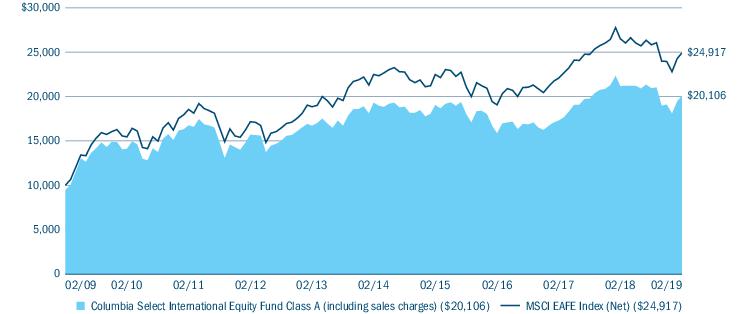

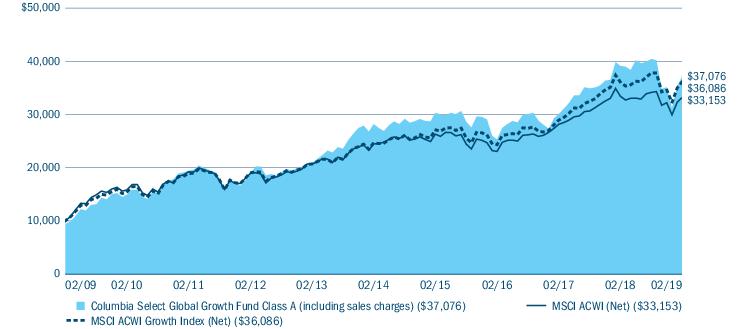

Performance of a hypothetical $10,000 investment (February 28, 2009 — February 28, 2019)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Convertible Securities Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

| Top 10 holdings (%) (at February 28, 2019) |

Bank of America Corp.

12/31/2049 7.250% | 2.8 |

DISH Network Corp.

03/15/2024 2.375% | 2.6 |

Palo Alto Networks, Inc.

07/01/2023 0.750% | 2.3 |

Square, Inc.

05/15/2023 0.500% | 2.1 |

Becton Dickinson and Co.

05/01/2020 6.125% | 1.9 |

Microchip Technology, Inc.

02/15/2027 1.625% | 1.8 |

Microchip Technology, Inc.

02/15/2037 2.250% | 1.8 |

Danaher Corp.

04/15/2022 4.750% | 1.6 |

Crown Castle International Corp.

08/01/2020 6.875% | 1.6 |

Fortive Corp.

07/01/2021 5.000% | 1.6 |

Percentages indicated are based upon total investments excluding Money Market Funds and investments in derivatives, if any.

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.”

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Portfolio breakdown (%) (at February 28, 2019) |

| Common Stocks | 3.5 |

| Convertible Bonds | 72.7 |

| Convertible Preferred Stocks | 18.4 |

| Equity-Linked Notes | 0.8 |

| Money Market Funds | 4.6 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

Columbia Convertible Securities Fund | Annual Report 2019

| 3 |

Manager Discussion of Fund Performance

For the 12-month period ended February 28, 2019, the Fund’s Class A shares returned 7.70% excluding sales charges. The Fund modestly lagged its benchmark, the ICE BofAML All Convertibles All Qualities Index, which returned 8.33% for the same time period. Convertible securities outperformed broad measures of the stock and bond markets.

Financial markets advanced despite year-end equity sell-off

Investors kicked off the 12-month period ended February 28, 2019 with soaring optimism. Positive global economic conditions, broad corporate tax cuts and moves to reduce regulation in a number of industries buoyed confidence. The pace of economic growth averaged more than 3.0%, as the labor markets added an average of 209,000 jobs per month, wages increased on the order of 3.0% and manufacturing activity remained solid. Unemployment rose modestly in December and January, but even that was a net positive, as it reflected an increase in the number of Americans seeking employment. Weak job creation in February drove unemployment back down to 3.8%.

As 2018 progressed, the rosy global picture dimmed. European economies transitioned to a slower pace, struggling with rising interest rates, trade tensions and uncertainty surrounding Brexit (the U.K.’s departure from the European Union). At the same time, China’s economic conditions weakened and emerging markets came under pressure, driven by trade concerns and a rising U.S dollar. In December, the Federal Reserve (the Fed) rattled investors when it raised the target range of its key short-term interest rate, the federal funds rate, to 2.25%-2.50%, the fourth such increase for the year. However, the Fed maintained this rate in its January 2019 meeting and announced that it would be patient moving forward.

As uncertainties rose late in 2018, investors backed away from riskier assets. Technology stocks, which had been global market leaders, stumbled in the third quarter of 2018 and triggered a broader market sell-off of stocks and high-yield bonds in the fourth quarter. However, stocks rebounded early in 2019 as a patient Fed and hopes for progress on the trade front inspired confidence. The S&P 500 Index, a broad measure of U.S. stock returns, gained 4.68% for the 12-month period, with dividends reinvested. Investment-grade bonds, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, returned 3.17%.

Contributors and detractors

In a year that was more volatile month to month than overall market returns suggest, the Fund’s top performers came from a broad range of sectors, including technology, health care and communication services. In technology, the Fund was positioned to benefit from trending themes, such as alternative communications and messaging and all forms of security — data, personal and computing. The convertible securities of cybersecurity company Palo Alto Networks and Okta, a cloud-based provider of enterprise identity and security solutions, both posted solid gains for the period. Twilio, a cloud-based communications platform-as-a-service company, and innovative payment processor Square were also strong performers. A position in Western Digital Corp. stock partially offset some of these gains within technology, as its shares fell with the sector in the fourth quarter and did not rebound.

In health care, Exact Sciences Corp., Tesaro and Teledoc Health, Inc. were solid performers. Exact Sciences targets people who are candidates for routine colonoscopies but do not get them because of cost or inconvenience. Exact Sciences rose materially as the company benefited from a sales and marketing partnership with pharmaceutical giant Pfizer. Biotechnology company Tesaro gained ground after the announcement that GlaxoSmithKline would pay a hefty premium to acquire the company. Teledoc, which uses telephone and videoconferencing technology to provide on-demand remote medical care, rebounded after a weak fourth quarter. By contrast, Novavax convertibles came down dramatically late in the period after the developmental-stage vaccine company reported that its respiratory virus vaccine failed yet again in a pivotal trial.

In the communication services sector, World Wrestling Entertainment convertible securities had a strong run as the company signed longer term contracts at higher prices and increased its online presence. We trimmed the Fund’s position, but it remained overweight at period’s end. A position in Caesars Entertainment Corp. convertibles was the biggest detractor for the period. Weakness in the gaming industry weighed on the company, one of the largest owners of casinos in the United States.

In the energy sector, Bristow Group and Nabors Industries, whose businesses are closely tied to the price of oil, were major detractors from returns. Both companies suffered as crude prices fell sharply during the year. And both companies were doubly exposed, as they have elevated balance-sheet leverage, which put off investors.

| 4 | Columbia Convertible Securities Fund | Annual Report 2019 |

Manager Discussion of Fund Performance (continued)

At period’s end

We do not believe the period’s volatility had a lasting impact on the Fund’s long-term prospects. At the end of the period, we believed conditions in the convertibles market were orderly in terms of transactions and attractive in terms of new issuance. We continue to use bottom-up security selection to target convertibles and other income-generating securities that have the potential for both price appreciation and high current income. We believe the Fund continues to offer long-term investors a solid building block for diversification.

Marketrisk may affect a single issuer, sector of the economy, industry or the market as a whole.Convertible securities are subject toissuer default risk. A rise ininterest rates may result in a price decline of fixed-income instruments held by the Fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund’s income and yield. These risks may be heightened for longer maturity and duration securities. The Fund may also be forced to convert a convertible security at an inopportune time, which may decrease the Fund’s return.Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities.Foreigninvestments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers.Short positions (where the underlying asset is not owned) can create unlimited risk. Market or other (e.g., interest rate) environments may adversely affect theliquidityof Fund investments, negatively impacting their price. Generally, the less liquid the market at the time the Fund sells a holding, the greater the risk of loss or decline of value to the Fund.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Columbia Convertible Securities Fund | Annual Report 2019

| 5 |

Understanding Your Fund’s Expenses

(Unaudited)

As an investor, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing fund costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| September 1, 2018 — February 28, 2019 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 1,012.40 | 1,019.19 | 5.64 | 5.66 | 1.13 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,014.00 | 1,020.43 | 4.39 | 4.41 | 0.88 |

| Class C | 1,000.00 | 1,000.00 | 1,009.00 | 1,015.47 | 9.36 | 9.39 | 1.88 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,013.70 | 1,020.43 | 4.39 | 4.41 | 0.88 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 1,014.40 | 1,020.78 | 4.05 | 4.06 | 0.81 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,014.10 | 1,021.03 | 3.80 | 3.81 | 0.76 |

| Class R | 1,000.00 | 1,000.00 | 1,011.10 | 1,017.95 | 6.88 | 6.90 | 1.38 |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

| 6 | Columbia Convertible Securities Fund | Annual Report 2019 |

Portfolio of Investments

February 28, 2019

(Percentages represent value of investments compared to net assets)

Investments in securities

| Common Stocks 3.6% |

| Issuer | Shares | Value ($) |

| Consumer Discretionary 0.4% |

| Internet & Direct Marketing Retail 0.4% |

| Expedia Group, Inc. | 35,000 | 4,315,850 |

| Total Consumer Discretionary | 4,315,850 |

| Energy 0.2% |

| Oil, Gas & Consumable Fuels 0.2% |

| Ascent Resources, Class B(a),(b),(c) | 10,248,729 | 2,295,715 |

| Total Energy | 2,295,715 |

| Health Care 1.5% |

| Health Care Equipment & Supplies 0.5% |

| Danaher Corp. | 45,000 | 5,715,900 |

| Health Care Providers & Services 1.0% |

| Anthem, Inc. | 35,000 | 10,525,550 |

| Total Health Care | 16,241,450 |

| Information Technology 1.5% |

| Semiconductors & Semiconductor Equipment 1.3% |

| Lam Research Corp. | 53,000 | 9,332,770 |

| NXP Semiconductors NV | 57,000 | 5,205,240 |

| Total | | 14,538,010 |

| Technology Hardware, Storage & Peripherals 0.2% |

| Western Digital Corp. | 45,000 | 2,263,500 |

| Total Information Technology | 16,801,510 |

Total Common Stocks

(Cost $29,503,712) | 39,654,525 |

| Convertible Bonds(d) 73.4% |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Aerospace & Defense 0.5% |

| Aerojet Rocketdyne Holdings, Inc. |

| 12/15/2023 | 2.250% | | 3,500,000 | 5,390,032 |

| Airlines 0.7% |

| Air Transport Services Group, Inc. |

| 10/15/2024 | 1.125% | | 7,500,000 | 7,518,007 |

| Cable and Satellite 2.5% |

| DISH Network Corp. |

| 03/15/2024 | 2.375% | | 34,000,000 | 28,176,174 |

| Convertible Bonds(d) (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Consumer Cyclical Services 0.7% |

| Booking Holdings, Inc. |

| 06/15/2020 | 0.350% | | 6,000,000 | 7,953,468 |

| Electric 0.7% |

| NRG Energy, Inc.(e) |

| 06/01/2048 | 2.750% | | 7,000,000 | 7,813,155 |

| Finance Companies 1.0% |

| Encore Capital Europe Finance Ltd. |

| 09/01/2023 | 4.500% | | 6,000,000 | 5,932,458 |

| iStar, Inc. |

| 09/15/2022 | 3.125% | | 6,000,000 | 5,459,556 |

| Total | 11,392,014 |

| Gaming 1.2% |

| Caesars Entertainment Corp. |

| 10/01/2024 | 5.000% | | 9,000,000 | 12,811,581 |

| Health Care 3.4% |

| DexCom, Inc.(e) |

| 12/01/2023 | 0.750% | | 10,000,000 | 10,993,280 |

| Insulet Corp.(e) |

| 11/15/2024 | 1.375% | | 7,000,000 | 8,414,056 |

| Invacare Corp. |

| 02/15/2021 | 5.000% | | 5,000,000 | 4,768,750 |

| Novavax, Inc. |

| 02/01/2023 | 3.750% | | 9,700,000 | 3,042,172 |

| Teladoc Health, Inc.(e) |

| 05/15/2025 | 1.375% | | 7,500,000 | 10,680,450 |

| Total | 37,898,708 |

| Home Construction 0.6% |

| SunPower Corp. |

| 01/15/2023 | 4.000% | | 8,030,000 | 6,430,625 |

| Independent Energy 1.5% |

| Chesapeake Energy Corp. |

| 09/15/2026 | 5.500% | | 12,500,000 | 11,449,075 |

| PDC Energy, Inc. |

| 09/15/2021 | 1.125% | | 6,000,000 | 5,618,136 |

| Total | 17,067,211 |

| Leisure 0.5% |

| World Wrestling Entertainment, Inc.(e) |

| 12/15/2023 | 3.375% | | 1,600,000 | 5,441,901 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2019

| 7 |

Portfolio of Investments (continued)

February 28, 2019

| Convertible Bonds(d) (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Life Insurance 0.6% |

| AXA SA(e) |

| 05/15/2021 | 7.250% | | 7,200,000 | 6,915,305 |

| Lodging 0.6% |

| Marriott Vacations Worldwide Corp. |

| 09/15/2022 | 1.500% | | 7,000,000 | 6,650,574 |

| Media and Entertainment 1.7% |

| Liberty Media Corp.(e) |

| 03/31/2048 | 2.125% | | 11,000,000 | 10,786,875 |

| 12/01/2048 | 2.250% | | 7,500,000 | 7,921,530 |

| Total | 18,708,405 |

| Metals and Mining 0.5% |

| Endeavour Mining Corp.(e) |

| 02/15/2023 | 3.000% | | 5,700,000 | 5,308,410 |

| Midstream 0.4% |

| Scorpio Tankers, Inc.(e) |

| 07/01/2019 | 2.375% | | 4,790,000 | 4,706,103 |

| Other Financial Institutions 1.5% |

| Euronet Worldwide, Inc. |

| 10/01/2044 | 1.500% | | 5,500,000 | 10,223,125 |

| LendingTree, Inc. |

| 06/01/2022 | 0.625% | | 3,600,000 | 5,846,450 |

| Total | 16,069,575 |

| Other Industry 0.7% |

| Green Plains, Inc. |

| 09/01/2022 | 4.125% | | 7,700,000 | 7,165,813 |

| Other REIT 2.7% |

| Apollo Commercial Real Estate Finance, Inc. |

| 08/23/2022 | 4.750% | | 7,000,000 | 6,794,375 |

| Blackstone Mortgage Trust, Inc. |

| 05/05/2022 | 4.375% | | 7,800,000 | 7,813,377 |

| IH Merger Sub LLC |

| 01/15/2022 | 3.500% | | 10,000,000 | 11,144,370 |

| New York Mortgage Trust, Inc. |

| 01/15/2022 | 6.250% | | 4,700,000 | 4,626,562 |

| Total | 30,378,684 |

| Pharmaceuticals 13.1% |

| Acorda Therapeutics, Inc. |

| 06/15/2021 | 1.750% | | 6,500,000 | 5,732,194 |

| Aegerion Pharmaceuticals, Inc. |

| 08/15/2019 | 2.000% | | 4,460,000 | 3,336,638 |

| Convertible Bonds(d) (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Alder Biopharmaceuticals, Inc. |

| 02/01/2025 | 2.500% | | 8,700,000 | 8,042,063 |

| Array BioPharma, Inc.(e) |

| 12/01/2024 | 2.625% | | 4,000,000 | 6,740,000 |

| BioMarin Pharmaceutical, Inc. |

| 08/01/2024 | 0.599% | | 11,500,000 | 11,995,937 |

| Canopy Growth Corp.(e) |

| 07/15/2023 | 4.250% | CAD | 3,000,000 | 3,291,348 |

| Clovis Oncology, Inc. |

| 05/01/2025 | 1.250% | | 14,500,000 | 11,607,714 |

| Dermira, Inc. |

| 05/15/2022 | 3.000% | | 9,300,000 | 7,259,813 |

| Illumina, Inc. |

| 06/15/2021 | 0.500% | | 9,500,000 | 12,950,257 |

| ImmunoGen, Inc. |

| 07/01/2021 | 4.500% | | 1,000,000 | 1,315,481 |

| Innoviva, Inc. |

| Subordinated |

| 01/15/2023 | 2.125% | | 5,000,000 | 5,257,340 |

| Insmed, Inc. |

| 01/15/2025 | 1.750% | | 13,000,000 | 13,065,000 |

| Intercept Pharmaceuticals, Inc. |

| 07/01/2023 | 3.250% | | 10,200,000 | 9,537,622 |

| Medicines Co. (The)(e) |

| 01/15/2024 | 3.500% | | 7,000,000 | 8,165,381 |

| PTC Therapeutics, Inc. |

| 08/15/2022 | 3.000% | | 7,000,000 | 7,091,938 |

| Radius Health, Inc. |

| 09/01/2024 | 3.000% | | 10,400,000 | 8,481,824 |

| Sarepta Therapeutics, Inc. |

| 11/15/2024 | 1.500% | | 4,000,000 | 8,395,000 |

| Supernus Pharmaceuticals, Inc.(e) |

| 04/01/2023 | 0.625% | | 8,000,000 | 8,067,152 |

| Tilray, Inc.(e) |

| 10/01/2023 | 5.000% | | 6,250,000 | 5,378,906 |

| Total | 145,711,608 |

| Property & Casualty 1.2% |

| Heritage Insurance Holdings, Inc. |

| 08/01/2037 | 5.875% | | 4,200,000 | 5,036,212 |

| MGIC Investment Corp.(e),(f) |

| Junior Subordinated |

| 04/01/2063 | 9.000% | | 6,070,000 | 7,779,785 |

| Total | 12,815,997 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Columbia Convertible Securities Fund | Annual Report 2019 |

Portfolio of Investments (continued)

February 28, 2019

| Convertible Bonds(d) (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Retailers 1.2% |

| GNC Holdings, Inc. |

| 08/15/2020 | 1.500% | | 6,000,000 | 4,591,482 |

| Restoration Hardware, Inc.(e),(g) |

| 06/15/2023 | 0.000% | | 8,500,000 | 8,612,336 |

| Total | 13,203,818 |

| Technology 33.1% |

| Akamai Technologies, Inc.(e) |

| 05/01/2025 | 0.125% | | 10,500,000 | 10,368,551 |

| Atlassian, Inc.(e) |

| 05/01/2023 | 0.625% | | 6,500,000 | 9,343,750 |

| Boingo Wireless, Inc.(e) |

| 10/01/2023 | 1.000% | | 9,000,000 | 7,888,086 |

| Coupa Software, Inc.(e) |

| 01/15/2023 | 0.375% | | 3,500,000 | 7,546,074 |

| CSG Systems International, Inc. |

| 03/15/2036 | 4.250% | | 5,500,000 | 5,741,703 |

| DocuSign, Inc.(e) |

| 09/15/2023 | 0.500% | | 9,000,000 | 9,585,000 |

| Electronics for Imaging, Inc.(e) |

| 11/15/2023 | 2.250% | | 6,000,000 | 6,124,680 |

| Exact Sciences Corp. |

| 01/15/2025 | 1.000% | | 8,000,000 | 11,140,480 |

| Guidewire Software, Inc. |

| 03/15/2025 | 1.250% | | 8,000,000 | 8,466,888 |

| IAC FinanceCo, Inc.(e) |

| 10/01/2022 | 0.875% | | 5,300,000 | 7,861,055 |

| Intel Corp. |

| Junior Subordinated |

| 08/01/2039 | 3.250% | | 5,300,000 | 13,703,680 |

| MercadoLibre, Inc.(e) |

| 08/15/2028 | 2.000% | | 8,000,000 | 9,762,816 |

| Microchip Technology, Inc. |

| 02/15/2027 | 1.625% | | 17,000,000 | 19,536,043 |

| Junior Subordinated |

| 02/15/2037 | 2.250% | | 16,500,000 | 19,179,699 |

| Micron Technology, Inc. |

| 11/15/2043 | 3.000% | | 8,500,000 | 11,910,939 |

| MongoDB, Inc.(e) |

| 06/15/2024 | 0.750% | | 3,500,000 | 5,599,314 |

| New Relic, Inc.(e) |

| 05/01/2023 | 0.500% | | 8,000,000 | 9,279,368 |

| Okta, Inc. |

| 02/15/2023 | 0.250% | | 4,500,000 | 8,339,081 |

| Convertible Bonds(d) (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| ON Semiconductor Corp. |

| 10/15/2023 | 1.625% | | 8,300,000 | 10,472,118 |

| Palo Alto Networks, Inc.(e) |

| 07/01/2023 | 0.750% | | 22,000,000 | 24,467,696 |

| Pure Storage, Inc.(e) |

| 04/15/2023 | 0.125% | | 7,500,000 | 7,772,250 |

| Rapid7, Inc.(e) |

| 08/01/2023 | 1.250% | | 5,000,000 | 6,370,525 |

| Red Hat, Inc. |

| 10/01/2019 | 0.250% | | 4,000,000 | 9,894,696 |

| ServiceNow, Inc.(g) |

| 06/01/2022 | 0.000% | | 8,000,000 | 14,417,528 |

| Silicon Laboratories, Inc. |

| 03/01/2022 | 1.375% | | 7,500,000 | 8,106,960 |

| Splunk, Inc.(e) |

| 09/15/2025 | 1.125% | | 14,500,000 | 16,413,985 |

| Square, Inc.(e) |

| 05/15/2023 | 0.500% | | 18,000,000 | 22,818,600 |

| Tabula Rasa HealthCare, Inc.(e) |

| 02/15/2026 | 1.750% | | 5,500,000 | 5,750,910 |

| Teradyne, Inc. |

| 12/15/2023 | 1.250% | | 6,200,000 | 8,800,125 |

| Twilio, Inc.(e) |

| 06/01/2023 | 0.250% | | 6,000,000 | 10,731,000 |

| Veeco Instruments, Inc. |

| 01/15/2023 | 2.700% | | 6,500,000 | 5,506,644 |

| Verastem, Inc. |

| 11/01/2048 | 5.000% | | 6,500,000 | 5,136,203 |

| Vishay Intertechnology, Inc.(e) |

| 06/15/2025 | 2.250% | | 10,000,000 | 9,843,320 |

| Workday, Inc. |

| 10/01/2022 | 0.250% | | 7,500,000 | 10,793,520 |

| Zendesk, Inc.(e) |

| 03/15/2023 | 0.250% | | 6,000,000 | 8,277,432 |

| Total | 366,950,719 |

| Tobacco 0.4% |

| Vector Group Ltd.(f) |

| 04/15/2020 | 1.750% | | 4,720,000 | 4,802,600 |

| Wireless 0.5% |

| Gogo, Inc.(e) |

| 05/15/2022 | 6.000% | | 5,500,000 | 5,259,711 |

| Wirelines 1.9% |

| GCI Liberty, Inc.(e) |

| 09/30/2046 | 1.750% | | 12,500,000 | 13,655,875 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2019

| 9 |

Portfolio of Investments (continued)

February 28, 2019

| Convertible Bonds(d) (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| RingCentral, Inc.(e),(g) |

| 03/15/2023 | 0.000% | | 5,000,000 | 6,994,445 |

| Total | 20,650,320 |

Total Convertible Bonds

(Cost $742,787,891) | 813,190,518 |

| Convertible Preferred Stocks 18.5% |

| Issuer | | Shares | Value ($) |

| Consumer Staples 1.5% |

| Food Products 1.0% |

| Bunge Ltd. | 4.875% | 115,000 | 11,106,021 |

| Household Products 0.5% |

| Energizer Holdings, Inc. | 7.500% | 55,000 | 5,531,290 |

| Total Consumer Staples | 16,637,311 |

| Energy 0.4% |

| Energy Equipment & Services 0.4% |

| Nabors Industries Ltd. | 6.000% | 180,000 | 4,603,896 |

| Total Energy | 4,603,896 |

| Financials 3.7% |

| Banks 2.7% |

| Bank of America Corp. | 7.250% | 23,000 | 29,849,860 |

| Capital Markets 0.5% |

| Cowen, Inc. | 5.625% | 6,200 | 5,288,538 |

| Insurance 0.5% |

| Assurant, Inc. | 6.500% | 52,500 | 5,715,439 |

| Total Financials | 40,853,837 |

| Health Care 3.3% |

| Health Care Equipment & Supplies 3.3% |

| Becton Dickinson and Co. | 6.125% | 320,000 | 19,744,000 |

| Danaher Corp. | 4.750% | 17,000 | 17,373,320 |

| Total | | | 37,117,320 |

| Total Health Care | 37,117,320 |

| Convertible Preferred Stocks (continued) |

| Issuer | | Shares | Value ($) |

| Industrials 2.5% |

| Machinery 2.5% |

| Colfax Corp. | 5.750% | 45,000 | 5,474,326 |

| Fortive Corp. | 5.000% | 16,000 | 16,634,997 |

| Rexnord Corp. | 5.750% | 90,000 | 5,058,495 |

| Total | | | 27,167,818 |

| Total Industrials | 27,167,818 |

| Information Technology 0.6% |

| Electronic Equipment, Instruments & Components 0.6% |

| Belden, Inc. | 6.750% | 85,000 | 7,074,550 |

| Total Information Technology | 7,074,550 |

| Materials 0.7% |

| Chemicals 0.7% |

| International Flavors & Fragrances, Inc. | 6.000% | 160,000 | 7,926,400 |

| Total Materials | 7,926,400 |

| Real Estate 2.3% |

| Equity Real Estate Investment Trusts (REITS) 2.3% |

| Crown Castle International Corp. | 6.875% | 15,500 | 17,198,489 |

| QTS Realty Trust, Inc. | | 80,000 | 8,345,840 |

| Total | | | 25,544,329 |

| Total Real Estate | 25,544,329 |

| Utilities 3.5% |

| Electric Utilities 1.1% |

| NextEra Energy, Inc. | 6.123% | 200,000 | 12,183,940 |

| Multi-Utilities 2.4% |

| CenterPoint Energy, Inc. | 7.000% | 250,000 | 13,074,325 |

| DTE Energy Co. | 6.500% | 235,000 | 13,024,946 |

| Total | | | 26,099,271 |

| Total Utilities | 38,283,211 |

Total Convertible Preferred Stocks

(Cost $199,656,725) | 205,208,672 |

|

| Equity-Linked Notes 0.8% |

| Issuer | Coupon

Rate | Shares | Value ($) |

| Credit Suisse AG(e) |

| (linked to common stock of Stanley Black & Decker, Inc.) |

| 05/15/2020 | 6.000% | 69,050 | 9,042,699 |

Total Equity-Linked Notes

(Cost $10,002,583) | 9,042,699 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Columbia Convertible Securities Fund | Annual Report 2019 |

Portfolio of Investments (continued)

February 28, 2019

| Money Market Funds 4.6% |

| | Shares | Value ($) |

| Columbia Short-Term Cash Fund, 2.523%(h),(i) | 51,277,519 | 51,272,392 |

Total Money Market Funds

(Cost $51,272,392) | 51,272,392 |

Total Investments in Securities

(Cost: $1,033,223,303) | 1,118,368,806 |

| Other Assets & Liabilities, Net | | (9,786,293) |

| Net Assets | 1,108,582,513 |

Notes to Portfolio of Investments

| (a) | Represents fair value as determined in good faith under procedures approved by the Board of Trustees. At February 28, 2019, the total value of these securities amounted to $2,295,715, which represents 0.21% of total net assets. |

| (b) | Non-income producing investment. |

| (c) | Valuation based on significant unobservable inputs. |

| (d) | Principal amounts are denominated in United States Dollars unless otherwise noted. |

| (e) | Represents privately placed and other securities and instruments exempt from SEC registration (collectively, private placements), such as Section 4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified institutional buyers. The Fund may invest in private placements determined to be liquid as well as those determined to be illiquid. Private placements may be determined to be liquid under guidelines established by the Fund’s Board of Trustees. At February 28, 2019, the total value of these securities amounted to $357,773,115, which represents 32.27% of total net assets. |

| (f) | Represents a variable rate security with a step coupon where the rate adjusts according to a schedule for a series of periods, typically lower for an initial period and then increasing to a higher coupon rate thereafter. The interest rate shown was the current rate as of February 28, 2019. |

| (g) | Zero coupon bond. |

| (h) | The rate shown is the seven-day current annualized yield at February 28, 2019. |

| (i) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended February 28, 2019 are as follows: |

| Issuer | Beginning

shares | Shares

purchased | Shares

sold | Ending

shares | Realized gain

(loss) —

affiliated

issuers ($) | Net change in

unrealized

appreciation

(depreciation) —

affiliated

issuers ($) | Dividends —

affiliated

issuers ($) | Value —

affiliated

issuers

at end of

period ($) |

| Columbia Short-Term Cash Fund, 2.523% |

| | 41,182,650 | 475,189,101 | (465,094,232) | 51,277,519 | (1,011) | 957 | 789,678 | 51,272,392 |

Currency Legend

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| ■ | Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments. |

| ■ | Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| ■ | Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2019

| 11 |

Portfolio of Investments (continued)

February 28, 2019

Fair value measurements (continued)

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Certain investments that have been measured at fair value using the net asset value (NAV) per share (or its equivalent) are not categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to reconcile the fair value hierarchy to the amounts presented in the Portfolio of Investments. The Columbia Short-Term Cash Fund seeks to provide shareholders with maximum current income consistent with liquidity and stability of principal. Columbia Short-Term Cash Fund prices its shares with a floating NAV and no longer seeks to maintain a stable NAV.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund’s Board of Trustees (the Board), the Investment Manager’s Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The following table is a summary of the inputs used to value the Fund’s investments at February 28, 2019:

| | Level 1

quoted prices

in active

markets for

identical

assets ($) | Level 2

other

significant

observable

inputs ($) | Level 3

significant

unobservable

inputs ($) | Investments

measured at

net asset

value ($) | Total ($) |

| Investments in Securities | | | | | |

| Common Stocks | | | | | |

| Consumer Discretionary | 4,315,850 | — | — | — | 4,315,850 |

| Energy | — | — | 2,295,715 | — | 2,295,715 |

| Health Care | 16,241,450 | — | — | — | 16,241,450 |

| Information Technology | 16,801,510 | — | — | — | 16,801,510 |

| Total Common Stocks | 37,358,810 | — | 2,295,715 | — | 39,654,525 |

| Convertible Bonds | — | 813,190,518 | — | — | 813,190,518 |

| Convertible Preferred Stocks | | | | | |

| Consumer Staples | — | 16,637,311 | — | — | 16,637,311 |

| Energy | — | 4,603,896 | — | — | 4,603,896 |

| Financials | 29,849,860 | 11,003,977 | — | — | 40,853,837 |

| Health Care | — | 37,117,320 | — | — | 37,117,320 |

| Industrials | — | 27,167,818 | — | — | 27,167,818 |

| Information Technology | — | 7,074,550 | — | — | 7,074,550 |

| Materials | — | 7,926,400 | — | — | 7,926,400 |

| Real Estate | — | 25,544,329 | — | — | 25,544,329 |

| Utilities | — | 38,283,211 | — | — | 38,283,211 |

| Total Convertible Preferred Stocks | 29,849,860 | 175,358,812 | — | — | 205,208,672 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Columbia Convertible Securities Fund | Annual Report 2019 |

Portfolio of Investments (continued)

February 28, 2019

Fair value measurements (continued)

| | Level 1

quoted prices

in active

markets for

identical

assets ($) | Level 2

other

significant

observable

inputs ($) | Level 3

significant

unobservable

inputs ($) | Investments

measured at

net asset

value ($) | Total ($) |

| Equity-Linked Notes | — | 9,042,699 | — | — | 9,042,699 |

| Money Market Funds | — | — | — | 51,272,392 | 51,272,392 |

| Total Investments in Securities | 67,208,670 | 997,592,029 | 2,295,715 | 51,272,392 | 1,118,368,806 |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund’s assets assigned to the Level 2 input category are generally valued using the market approach, in which a security’s value is determined through reference to prices and information from market transactions for similar or identical assets.

There were no transfers of financial assets between Levels 2 and 3 during the period.

Financial assets were transferred from Level 1 to Level 2 as the market for these assets was deemed not to be active and fair values were consequently obtained using observable market inputs rather than quoted prices for identical assets as of period end.

Transfers between levels are determined based on the fair value at the beginning of the period for security positions held throughout the period.

The following table(s) show(s) transfers between levels of the fair value hierarchy:

| Transfers In | Transfers Out |

| Level 1 ($) | Level 2 ($) | Level 1 ($) | Level 2 ($) |

| — | 58,872,715 | 58,872,715 | — |

The Fund does not hold any significant investments (greater than one percent of net assets) categorized as Level 3.

The Fund’s assets assigned to the Level 3 category are valued utilizing the valuation technique deemed the most appropriate in the circumstances. Certain common stocks classified as Level 3 are valued using a market approach. To determine fair value for these securities, management considered various factors which may have included, but were not limited to, the Fund’s pro-rata interest in the company’s capital balance, estimated earnings of the respective company, and the position of the security within the respective company’s capital structure. Significant increases (decreases) to any of these inputs would result in a significantly higher (lower) fair value measurement. Generally, a change in the fund’s pro-rata interest would result in a change to the company’s capital balance.

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2019

| 13 |

Statement of Assets and Liabilities

February 28, 2019

| Assets | |

| Investments in securities, at value | |

| Unaffiliated issuers (cost $981,950,911) | $1,067,096,414 |

| Affiliated issuers (cost $51,272,392) | 51,272,392 |

| Receivable for: | |

| Investments sold | 1,377,262 |

| Capital shares sold | 1,952,744 |

| Dividends | 695,291 |

| Interest | 4,203,784 |

| Expense reimbursement due from Investment Manager | 2,240 |

| Prepaid expenses | 2,226 |

| Total assets | 1,126,602,353 |

| Liabilities | |

| Payable for: | |

| Investments purchased | 17,000,000 |

| Capital shares purchased | 705,351 |

| Management services fees | 23,995 |

| Distribution and/or service fees | 3,209 |

| Transfer agent fees | 94,381 |

| Compensation of board members | 124,661 |

| Compensation of chief compliance officer | 14 |

| Other expenses | 68,229 |

| Total liabilities | 18,019,840 |

| Net assets applicable to outstanding capital stock | $1,108,582,513 |

| Represented by | |

| Paid in capital | 1,015,258,320 |

| Total distributable earnings (loss) (Note 2) | 93,324,193 |

| Total - representing net assets applicable to outstanding capital stock | $1,108,582,513 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Columbia Convertible Securities Fund | Annual Report 2019 |

Statement of Assets and Liabilities (continued)

February 28, 2019

| Class A | |

| Net assets | $286,075,238 |

| Shares outstanding | 13,675,526 |

| Net asset value per share | $20.92 |

| Maximum sales charge | 5.75% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | $22.20 |

| Advisor Class | |

| Net assets | $51,486,594 |

| Shares outstanding | 2,435,864 |

| Net asset value per share | $21.14 |

| Class C | |

| Net assets | $44,034,953 |

| Shares outstanding | 2,113,237 |

| Net asset value per share | $20.84 |

| Institutional Class | |

| Net assets | $544,139,714 |

| Shares outstanding | 25,963,959 |

| Net asset value per share | $20.96 |

| Institutional 2 Class | |

| Net assets | $80,366,609 |

| Shares outstanding | 3,805,974 |

| Net asset value per share | $21.12 |

| Institutional 3 Class | |

| Net assets | $100,142,167 |

| Shares outstanding | 4,705,437 |

| Net asset value per share | $21.28 |

| Class R | |

| Net assets | $2,337,238 |

| Shares outstanding | 111,849 |

| Net asset value per share | $20.90 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2019

| 15 |

Statement of Operations

Year Ended February 28, 2019

| Net investment income | |

| Income: | |

| Dividends — unaffiliated issuers | $10,972,186 |

| Dividends — affiliated issuers | 789,678 |

| Interest | 17,071,712 |

| Interfund lending | 2,062 |

| Total income | 28,835,638 |

| Expenses: | |

| Management services fees | 7,620,759 |

| Distribution and/or service fees | |

| Class A | 652,663 |

| Class C | 404,600 |

| Class R | 13,751 |

| Class T | 76 |

| Transfer agent fees | |

| Class A | 312,806 |

| Advisor Class | 35,861 |

| Class C | 48,516 |

| Institutional Class | 560,988 |

| Institutional 2 Class | 37,009 |

| Institutional 3 Class | 7,113 |

| Class R | 3,293 |

| Class T | 36 |

| Compensation of board members | 19,366 |

| Custodian fees | 10,135 |

| Printing and postage fees | 70,060 |

| Registration fees | 153,689 |

| Audit fees | 37,975 |

| Legal fees | 14,986 |

| Interest on interfund lending | 66 |

| Compensation of chief compliance officer | 198 |

| Other | 30,185 |

| Total expenses | 10,034,131 |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | (711,529) |

| Fees waived by transfer agent | |

| Institutional 2 Class | (3,262) |

| Institutional 3 Class | (4,833) |

| Expense reduction | (700) |

| Total net expenses | 9,313,807 |

| Net investment income | 19,521,831 |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments — unaffiliated issuers | 49,822,983 |

| Investments — affiliated issuers | (1,011) |

| Foreign currency translations | (4,996) |

| Net realized gain | 49,816,976 |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — unaffiliated issuers | (146,683) |

| Investments — affiliated issuers | 957 |

| Foreign currency translations | 59 |

| Net change in unrealized appreciation (depreciation) | (145,667) |

| Net realized and unrealized gain | 49,671,309 |

| Net increase in net assets resulting from operations | $69,193,140 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Columbia Convertible Securities Fund | Annual Report 2019 |

Statement of Changes in Net Assets

| | Year Ended

February 28, 2019 | Year Ended

February 28, 2018 |

| Operations | | |

| Net investment income | $19,521,831 | $18,476,329 |

| Net realized gain | 49,816,976 | 39,351,154 |

| Net change in unrealized appreciation (depreciation) | (145,667) | 36,635,827 |

| Net increase in net assets resulting from operations | 69,193,140 | 94,463,310 |

| Distributions to shareholders | | |

| Net investment income and net realized gains | | |

| Class A | (12,738,952) | |

| Advisor Class | (1,481,568) | |

| Class C | (1,662,746) | |

| Institutional Class | (24,982,005) | |

| Institutional 2 Class | (3,368,780) | |

| Institutional 3 Class | (4,841,333) | |

| Class R | (118,214) | |

| Class T | (1,687) | |

| Net investment income | | |

| Class A | | (6,739,140) |

| Advisor Class | | (465,367) |

| Class B | | (1,037) |

| Class C | | (817,792) |

| Class I | | (667,656) |

| Institutional Class | | (9,821,119) |

| Institutional 2 Class | | (2,196,731) |

| Institutional 3 Class | | (2,150,013) |

| Class R | | (83,251) |

| Class T | | (1,375) |

| Total distributions to shareholders (Note 2) | (49,195,285) | (22,943,481) |

| Increase in net assets from capital stock activity | 245,000,419 | 44,429,491 |

| Total increase in net assets | 264,998,274 | 115,949,320 |

| Net assets at beginning of year | 843,584,239 | 727,634,919 |

| Net assets at end of year | $1,108,582,513 | $843,584,239 |

| Undistributed (excess of distributions over) net investment income | $303,321 | $(2,525,569) |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2019

| 17 |

Statement of Changes in Net Assets (continued)

| | Year Ended | Year Ended |

| | February 28, 2019 | February 28, 2018 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Capital stock activity |

| Class A | | | | |

| Subscriptions | 4,172,480 | 85,945,217 | 2,884,158 | 55,952,259 |

| Distributions reinvested | 431,159 | 8,523,504 | 217,367 | 4,175,959 |

| Redemptions | (3,082,744) | (62,933,185) | (6,461,623) | (122,715,632) |

| Net increase (decrease) | 1,520,895 | 31,535,536 | (3,360,098) | (62,587,414) |

| Advisor Class | | | | |

| Subscriptions | 2,549,520 | 52,499,070 | 563,583 | 11,111,339 |

| Distributions reinvested | 73,988 | 1,481,424 | 23,907 | 465,285 |

| Redemptions | (1,081,929) | (22,255,559) | (319,576) | (6,361,222) |

| Net increase | 1,541,579 | 31,724,935 | 267,914 | 5,215,402 |

| Class B | | | | |

| Subscriptions | — | — | 14 | 240 |

| Distributions reinvested | — | — | 43 | 772 |

| Redemptions | — | — | (8,944) | (166,122) |

| Net decrease | — | — | (8,887) | (165,110) |

| Class C | | | | |

| Subscriptions | 683,086 | 14,015,683 | 401,508 | 7,796,904 |

| Distributions reinvested | 72,090 | 1,413,721 | 35,785 | 685,998 |

| Redemptions | (629,862) | (13,016,084) | (719,242) | (13,767,086) |

| Net increase (decrease) | 125,314 | 2,413,320 | (281,949) | (5,284,184) |

| Class I | | | | |

| Distributions reinvested | — | — | 36,463 | 667,718 |

| Redemptions | — | — | (4,598,386) | (84,470,170) |

| Net decrease | — | — | (4,561,923) | (83,802,452) |

| Institutional Class | | | | |

| Subscriptions | 15,114,824 | 312,133,611 | 11,573,656 | 223,546,403 |

| Distributions reinvested | 916,774 | 18,154,010 | 333,051 | 6,413,438 |

| Redemptions | (9,303,311) | (186,562,038) | (4,941,695) | (96,252,519) |

| Net increase | 6,728,287 | 143,725,583 | 6,965,012 | 133,707,322 |

| Institutional 2 Class | | | | |

| Subscriptions | 2,622,930 | 54,101,373 | 1,032,319 | 20,162,601 |

| Distributions reinvested | 168,798 | 3,368,633 | 113,394 | 2,196,647 |

| Redemptions | (1,400,041) | (27,998,257) | (2,203,774) | (44,150,364) |

| Net increase (decrease) | 1,391,687 | 29,471,749 | (1,058,061) | (21,791,116) |

| Institutional 3 Class | | | | |

| Subscriptions | 833,390 | 17,415,288 | 4,856,182 | 90,806,162 |

| Distributions reinvested | 240,177 | 4,840,196 | 108,478 | 2,148,481 |

| Redemptions | (738,309) | (15,321,230) | (661,453) | (13,271,495) |

| Net increase | 335,258 | 6,934,254 | 4,303,207 | 79,683,148 |

| Class R | | | | |

| Subscriptions | 24,847 | 507,976 | 41,970 | 821,414 |

| Distributions reinvested | 1,340 | 26,465 | 1,006 | 19,252 |

| Redemptions | (63,010) | (1,295,811) | (68,275) | (1,345,147) |

| Net decrease | (36,823) | (761,370) | (25,299) | (504,481) |

| Class T | | | | |

| Distributions reinvested | 78 | 1,548 | 68 | 1,299 |

| Redemptions | (2,311) | (45,136) | (2,298) | (42,923) |

| Net decrease | (2,233) | (43,588) | (2,230) | (41,624) |

| Total net increase | 11,603,964 | 245,000,419 | 2,237,686 | 44,429,491 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 18 | Columbia Convertible Securities Fund | Annual Report 2019 |

[THIS PAGE INTENTIONALLY LEFT BLANK]

Columbia Convertible Securities Fund | Annual Report 2019

| 19 |

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| | Net asset value,

beginning of

period | Net

investment

income | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

| Class A |

| Year Ended 2/28/2019 | $20.41 | 0.39 | 1.11 | 1.50 | (0.40) | (0.59) | (0.99) |

| Year Ended 2/28/2018 | $18.64 | 0.43 | 1.89 | 2.32 | (0.55) | — | (0.55) |

| Year Ended 2/28/2017 | $15.07 | 0.47 | 3.52 | 3.99 | (0.42) | — | (0.42) |

| Year Ended 2/29/2016 | $19.53 | 0.38 | (3.25) | (2.87) | (0.75) | (0.87) | (1.62) |

| Year Ended 2/28/2015 | $19.22 | 0.28 | 0.92 | 1.20 | (0.43) | (0.46) | (0.89) |

| Advisor Class |

| Year Ended 2/28/2019 | $20.61 | 0.44 | 1.13 | 1.57 | (0.45) | (0.59) | (1.04) |

| Year Ended 2/28/2018 | $18.82 | 0.48 | 1.90 | 2.38 | (0.59) | — | (0.59) |

| Year Ended 2/28/2017 | $15.21 | 0.50 | 3.57 | 4.07 | (0.46) | — | (0.46) |

| Year Ended 2/29/2016 | $19.69 | 0.45 | (3.29) | (2.84) | (0.80) | (0.87) | (1.67) |

| Year Ended 2/28/2015 | $19.37 | 0.33 | 0.93 | 1.26 | (0.48) | (0.46) | (0.94) |

| Class C |

| Year Ended 2/28/2019 | $20.33 | 0.23 | 1.12 | 1.35 | (0.25) | (0.59) | (0.84) |

| Year Ended 2/28/2018 | $18.57 | 0.29 | 1.87 | 2.16 | (0.40) | — | (0.40) |

| Year Ended 2/28/2017 | $15.02 | 0.34 | 3.50 | 3.84 | (0.29) | — | (0.29) |

| Year Ended 2/29/2016 | $19.46 | 0.25 | (3.24) | (2.99) | (0.61) | (0.87) | (1.48) |

| Year Ended 2/28/2015 | $19.16 | 0.14 | 0.91 | 1.05 | (0.29) | (0.46) | (0.75) |

| Institutional Class |

| Year Ended 2/28/2019 | $20.44 | 0.44 | 1.12 | 1.56 | (0.45) | (0.59) | (1.04) |

| Year Ended 2/28/2018 | $18.67 | 0.48 | 1.88 | 2.36 | (0.59) | — | (0.59) |

| Year Ended 2/28/2017 | $15.10 | 0.51 | 3.52 | 4.03 | (0.46) | — | (0.46) |

| Year Ended 2/29/2016 | $19.56 | 0.42 | (3.24) | (2.82) | (0.80) | (0.87) | (1.67) |

| Year Ended 2/28/2015 | $19.25 | 0.33 | 0.92 | 1.25 | (0.48) | (0.46) | (0.94) |

| Institutional 2 Class |

| Year Ended 2/28/2019 | $20.59 | 0.45 | 1.14 | 1.59 | (0.47) | (0.59) | (1.06) |

| Year Ended 2/28/2018 | $18.80 | 0.50 | 1.90 | 2.40 | (0.61) | — | (0.61) |

| Year Ended 2/28/2017 | $15.20 | 0.52 | 3.55 | 4.07 | (0.47) | — | (0.47) |

| Year Ended 2/29/2016 | $19.68 | 0.45 | (3.27) | (2.82) | (0.82) | (0.87) | (1.69) |

| Year Ended 2/28/2015 | $19.37 | 0.35 | 0.92 | 1.27 | (0.50) | (0.46) | (0.96) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 20 | Columbia Convertible Securities Fund | Annual Report 2019 |

Financial Highlights (continued)

| | Proceeds from

regulatory

settlements | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Class A |

| Year Ended 2/28/2019 | — | $20.92 | 7.70% | 1.20%(c) | 1.13%(c),(d) | 1.88% | 60% | $286,075 |

| Year Ended 2/28/2018 | — | $20.41 | 12.65% | 1.22% | 1.12%(d) | 2.21% | 67% | $248,052 |

| Year Ended 2/28/2017 | — | $18.64 | 26.68% | 1.25% | 1.13%(d) | 2.73% | 72% | $289,232 |

| Year Ended 2/29/2016 | 0.03 | $15.07 | (15.46%)(e) | 1.23%(f) | 1.11%(d),(f) | 2.11% | 71% | $287,364 |

| Year Ended 2/28/2015 | — | $19.53 | 6.44% | 1.30%(f) | 1.10%(d),(f) | 1.49% | 78% | $386,856 |

| Advisor Class |

| Year Ended 2/28/2019 | — | $21.14 | 7.99% | 0.95%(c) | 0.88%(c),(d) | 2.15% | 60% | $51,487 |

| Year Ended 2/28/2018 | — | $20.61 | 12.91% | 0.97% | 0.87%(d) | 2.43% | 67% | $18,432 |

| Year Ended 2/28/2017 | — | $18.82 | 27.00% | 1.00% | 0.88%(d) | 2.95% | 72% | $11,789 |

| Year Ended 2/29/2016 | 0.03 | $15.21 | (15.21%)(e) | 1.00%(f) | 0.87%(d),(f) | 2.59% | 71% | $14,556 |

| Year Ended 2/28/2015 | — | $19.69 | 6.71% | 1.05%(f) | 0.85%(d),(f) | 1.74% | 78% | $3,027 |

| Class C |

| Year Ended 2/28/2019 | — | $20.84 | 6.92% | 1.95%(c) | 1.88%(c),(d) | 1.14% | 60% | $44,035 |

| Year Ended 2/28/2018 | — | $20.33 | 11.80% | 1.97% | 1.87%(d) | 1.47% | 67% | $40,419 |

| Year Ended 2/28/2017 | — | $18.57 | 25.70% | 2.00% | 1.88%(d) | 1.98% | 72% | $42,161 |

| Year Ended 2/29/2016 | 0.03 | $15.02 | (16.06%)(e) | 1.99%(f) | 1.87%(d),(f) | 1.38% | 71% | $47,322 |

| Year Ended 2/28/2015 | — | $19.46 | 5.62% | 2.05%(f) | 1.85%(d),(f) | 0.74% | 78% | $54,655 |

| Institutional Class |

| Year Ended 2/28/2019 | — | $20.96 | 8.00% | 0.95%(c) | 0.88%(c),(d) | 2.13% | 60% | $544,140 |

| Year Ended 2/28/2018 | — | $20.44 | 12.91% | 0.97% | 0.87%(d) | 2.49% | 67% | $393,240 |

| Year Ended 2/28/2017 | — | $18.67 | 26.94% | 1.00% | 0.88%(d) | 2.97% | 72% | $229,113 |

| Year Ended 2/29/2016 | 0.03 | $15.10 | (15.21%)(e) | 0.98%(f) | 0.86%(d),(f) | 2.27% | 71% | $203,574 |

| Year Ended 2/28/2015 | — | $19.56 | 6.70% | 1.05%(f) | 0.85%(d),(f) | 1.74% | 78% | $816,941 |

| Institutional 2 Class |

| Year Ended 2/28/2019 | — | $21.12 | 8.07% | 0.89%(c) | 0.81%(c) | 2.19% | 60% | $80,367 |

| Year Ended 2/28/2018 | — | $20.59 | 13.02% | 0.90% | 0.80% | 2.54% | 67% | $49,709 |

| Year Ended 2/28/2017 | — | $18.80 | 27.08% | 0.90% | 0.79% | 3.02% | 72% | $65,291 |

| Year Ended 2/29/2016 | 0.03 | $15.20 | (15.13%)(e) | 0.87%(f) | 0.76%(f) | 2.48% | 71% | $38,717 |

| Year Ended 2/28/2015 | — | $19.68 | 6.80% | 0.86%(f) | 0.73%(f) | 1.86% | 78% | $35,859 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2019

| 21 |

Financial Highlights (continued)

| | Net asset value,

beginning of

period | Net

investment

income | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

| Institutional 3 Class |

| Year Ended 2/28/2019 | $20.74 | 0.47 | 1.14 | 1.61 | (0.48) | (0.59) | (1.07) |

| Year Ended 2/28/2018 | $18.94 | 0.51 | 1.91 | 2.42 | (0.62) | — | (0.62) |

| Year Ended 2/28/2017 | $15.31 | 0.53 | 3.58 | 4.11 | (0.48) | — | (0.48) |

| Year Ended 2/29/2016 | $19.81 | 0.51 | (3.34) | (2.83) | (0.83) | (0.87) | (1.70) |

| Year Ended 2/28/2015(g) | $19.21 | 0.13 | 0.90 | 1.03 | (0.13) | (0.30) | (0.43) |

| Class R |

| Year Ended 2/28/2019 | $20.39 | 0.33 | 1.12 | 1.45 | (0.35) | (0.59) | (0.94) |

| Year Ended 2/28/2018 | $18.62 | 0.38 | 1.89 | 2.27 | (0.50) | — | (0.50) |

| Year Ended 2/28/2017 | $15.06 | 0.42 | 3.51 | 3.93 | (0.37) | — | (0.37) |

| Year Ended 2/29/2016 | $19.51 | 0.34 | (3.24) | (2.90) | (0.71) | (0.87) | (1.58) |

| Year Ended 2/28/2015 | $19.21 | 0.24 | 0.90 | 1.14 | (0.38) | (0.46) | (0.84) |

| Notes to Financial Highlights |

| (a) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (b) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

| (c) | Ratios include interfund lending expense which is less than 0.01%. |

| (d) | The benefits derived from expense reductions had an impact of less than 0.01%. |

| (e) | The Fund received proceeds from regulatory settlements. Had the Fund not received these proceeds, the total return would have been lower by 0.14%. |

| (f) | Ratios include line of credit interest expense which is less than 0.01%. |

| (g) | Institutional 3 Class shares commenced operations on October 1, 2014. Per share data and total return reflect activity from that date. |

| (h) | Annualized. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 22 | Columbia Convertible Securities Fund | Annual Report 2019 |

Financial Highlights (continued)

| | Proceeds from

regulatory

settlements | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Institutional 3 Class |

| Year Ended 2/28/2019 | — | $21.28 | 8.11% | 0.84%(c) | 0.76%(c) | 2.25% | 60% | $100,142 |

| Year Ended 2/28/2018 | — | $20.74 | 13.03% | 0.85% | 0.75% | 2.58% | 67% | $90,655 |

| Year Ended 2/28/2017 | — | $18.94 | 27.14% | 0.85% | 0.74% | 3.06% | 72% | $1,269 |

| Year Ended 2/29/2016 | 0.03 | $15.31 | (15.09%)(e) | 0.84%(f) | 0.72%(f) | 3.01% | 71% | $812 |

| Year Ended 2/28/2015(g) | — | $19.81 | 5.48% | 0.81%(f),(h) | 0.69%(f),(h) | 1.88%(h) | 78% | $61 |

| Class R |

| Year Ended 2/28/2019 | — | $20.90 | 7.44% | 1.45%(c) | 1.38%(c),(d) | 1.63% | 60% | $2,337 |

| Year Ended 2/28/2018 | — | $20.39 | 12.38% | 1.47% | 1.37%(d) | 1.97% | 67% | $3,031 |

| Year Ended 2/28/2017 | — | $18.62 | 26.32% | 1.50% | 1.38%(d) | 2.44% | 72% | $3,240 |

| Year Ended 2/29/2016 | 0.03 | $15.06 | (15.63%)(e) | 1.49%(f) | 1.37%(d),(f) | 1.91% | 71% | $2,429 |

| Year Ended 2/28/2015 | — | $19.51 | 6.13% | 1.55%(f) | 1.35%(d),(f) | 1.24% | 78% | $2,412 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2019

| 23 |

Notes to Financial Statements

February 28, 2019

Note 1. Organization

Columbia Convertible Securities Fund (the Fund), a series of Columbia Funds Series Trust (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

Fund shares

The Trust may issue an unlimited number of shares (without par value). Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust’s organizational documents or by law. Different share classes pay different distribution amounts to the extent the expenses of such share classes differ, and distributions in liquidation will be proportional to the net asset value of each share class. Each share class has its own expense and sales charge structure. The Fund offers each of the share classes identified below.

Class A shares are subject to a maximum front-end sales charge of 5.75% based on the initial investment amount. Class A shares purchased without an initial sales charge in accounts aggregating $1 million to $50 million at the time of purchase are subject to a contingent deferred sales charge (CDSC) if the shares are sold within 18 months after purchase, charged as follows: 1.00% CDSC if redeemed within 12 months after purchase, and 0.50% CDSC if redeemed more than 12, but less than 18, months after purchase.

Advisor Class shares are not subject to sales charges and are generally available only to omnibus retirement plans and certain investors as described in the Fund’s prospectus.

Class C shares are subject to a 1.00% CDSC on shares redeemed within 12 months after purchase. Effective July 1, 2018, Class C shares automatically convert to Class A shares of the same Fund in the month of or the month following the 10-year anniversary of the Class C shares purchase date.

Institutional Class shares are not subject to sales charges and are generally available only to eligible investors, which are subject to different investment minimums as described in the Fund’s prospectus.