UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedMarch 31, 2007

Commission File Number1-7375

COMMERCE GROUP CORP.

(Exact name of registrant as specified in its charter)

WISCONSIN

39-6050862

(State or other jurisdiction of incorporation or organization)

(I.R.S. Employer Identification No.)

6001 North 91st Street

Milwaukee, Wisconsin 53225-1795

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code:(414) 462-5310

Securities registered pursuant to Section 12(b) of the Act:

Name of each exchange

Title of each class

on which registered

Common Shares $0.10 par value

Pink Sheets

Common Shares $0.10 par value

Over the Counter Bulletin Board (OTCBB)

Common Shares $0.10 par value

Berlin-Bremen Stock Exchange (C9G)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [x]

Indicate by check mark whether the Registrant is an accelerated file (as defined in Rule 12b-2 of the Exchange Act). Yes __ No x

The aggregate market value of the 18,074,069 registrant’s common shares held by nonaffiliates of the registrant based on the closing sale price of the OTC BB on September 30, 2006 was approximately $1,084,444.

At March 31, 2007, there were 27,778,596 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of Form 10-K/A is incorporated herein by reference to the registrant’s definitive Proxy Statement relating to its 2007 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes __ No x

1

COMMERCE GROUP CORP.

2007 FORM 10-K/A ANNUAL REPORT

For the Fiscal Year Ended March 31, 2007

TABLE OF CONTENTS

Page

PART I

Item 1.

Business

3

Item 2.

Properties

16

Item 3.

Legal Proceedings

29

Item 4.

Submission of Matters to a Vote of Security Holders

30

Item 4(a).

Executive Officers and Managers of the Company

30

PART II

Item 5.

Market for the Company’s Common Stock and Related Stockholders’ Matters

31

Item 6.

Selected Financial Data

34

Item 7.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

35

Item 7(a).

Quantitative and Qualitative Disclosures About Market Risk

48

Item 8.

Financial Statements and Supplementary Data

50

Item 9.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

82

Item 9(a).

Controls and Procedures

82

Item 9(b)

Other Information

82

PART III

Item 10.

Directors and Executive Officers of the Registrant

83

Item 11.

Executive Compensation

83

Item 12.

Security Ownership of Certain Beneficial Owners and Management

83

Item 13.

Certain Relationships and Related Transactions

83

Item 14.

Principal Accounting Fees and Services

83

PART IV

Item 15.

Exhibits, Financial Statement Schedules and Reports on Form 8-K

84

Subsidiaries

Consent of Chisholm, Bierwolf & Nilson, LLC

Certification Pursuant to Section 302

Certification Pursuant to Section 302

Certification Pursuant to Section 906

Certification Pursuant to Section 906

2

PART I

Item 1. Business

Glossary of Selected Mining Terms

Cut-off Grade | The minimum grade of ore used to establish reserves. |

Doré | Unrefined gold and silver bullion consisting of approximately 90% precious metals that will be further refined to almost pure metal. |

Development Stage | A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. |

Exploration Stage | An “exploration stage” prospect is one which is not in either the development or production stage. |

Fault | A surface or zone of rock fracture along which there has been displacement. |

Feasibility Study | An engineering study designed to define the technical, economic, and legal viability of a mining project with a high degree of reliability. |

Formation | A distinct layer of sedimentary rock of similar composition. |

Grade | The metal content of ore, usually expressed in troy ounces per ton (2,000 pounds) or in grams per ton or metric tons which contain 2,204.6 pounds or 1,000 kilograms. This report refers to ounces per ton. |

Heap Leaching | A method of recovering gold or other precious metals from a heap of ore placed on an impervious pad, whereby a dilute leaching solution is allowed to percolate through the heap, dissolving the precious metal, which is subsequently captured and recovered. |

Mineralized Material | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

Mining | Mining is the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized. |

3

Net Smelter Return Royalty | A defined percentage of the gross revenue from a resource extraction operation, less a proportionate share or transportation, insurance, and processing costs. |

Outcrop | That part of a geologic formation or structure that appears at the surface of the earth. |

Probable Reserves | Reserves for which quantity and grade and/or quality are computed from information similar to that used for Proven Reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Reserves, is high enough to assume continuity between points of observation. |

Production Stage | A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. |

Proven Reserves | Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling, and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well-defined that size, shape, depth and mineral content of reserves are well established. |

Reclamation | The process of returning land to another use after mining is completed. |

Recoverable | That portion of metal contained in ore that can be extracted by processing. |

Reserves | That part of a mineral deposit which could be economically and legally extracted or produced at the time of reserve determination. |

Run-of-Mine | Mined ore of a size that can be processed without further crushing. |

Strip Ratio | The ratio between tonnage of waste and ore in an open pit mine. |

Waste | Barren rock or mineralized material that is too low in grade to be economically processed. |

4

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995.

The matters discussed in this annual report on Form 10-K/A, when not historical matters, are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from projections or estimates contained herein. Such forward-looking statements include, among others, scoping and feasibility studies for the San Sebastian Gold Mine, mineralized material estimates, potential residual production levels, future expenditures, cash requirement predictions and the ability to finance continuing operations. Factors that could cause actual results to differ materially from these forward-looking statements include, among others, the factors described in this annual report on Form 10-K/A. Many of these factors are beyond our ability to control or predict. We disclaim any intent or obligation to update our forward-looking statements, whether as a result of re ceiving new information, the occurrence of future events, or otherwise.

General

Commerce Group Corp. (“Commerce,” the “Company,” and/or the “Registrant” and reference to these identifications such as “we,” “our,” and “us” may be used herein to refer to Commerce or to any or all of wholly-owned subsidiaries of Commerce) is one of the only precious metals company that has produced gold and silver in the past twenty or more years in the Republic of El Salvador, Central America. Starting in 1968, for periods during the 1970's and 1980's Commerce was operative in the exploration, exploitation, development, and production of precious metals in El Salvador. It continues to be operative in the exploration of precious metals in El Salvador while it seeks funding for exploitation, development, and production. Commerce’s objectives are to obtain the permission of the Government of El Salvador to continue the exploitation of minerali zed material at SSGM and to obtain a sufficient amount of funds to operate and expand its San Cristobal Mill and Plant and to commence an open-pit, heap-leach operation at its SSGM to produce gold at a profit. It further plans to broaden its exploration targets as the opportunity to discover more gold and silver is evident. Commerce simultaneously continues to seek a compatible acquisition, merger, other business arrangement, or an endeavor in which synergism will prevail. This combination should continue to enhance the value of Commerce’s common shares.

Commerce has been a Wisconsin-chartered corporation since its merger from a State of Delaware corporation on April 1, 1999, and its corporate headquarters since its inception have been based in Milwaukee, Wisconsin. Commerce was organized in 1962 and its common shares have been publicly traded since 1968. The Company’s shares have been trading on the Over the Counter Bulletin Board (OTCBB) under the trade symbol CGCO.OB, on the Pink Sheets under the trade symbol of CGCO.PK, and on the Berlin-Bremen Stock Exchange under the trade symbol of C9G since October 2006. The organizational chart on the following page reflects the mining organization and the mining activities in El Salvador as of March 31, 2007.

Company’s Website

Commerce has a website located at http://www.commercegroupcorp.com. This website can be used to access recent new releases, U.S. Securities and Exchange Commission filings, the Company’s Annual Report, Proxy Statement, Board Committee Charter, and other items of interest. The contents of the Company’s website are not incorporated into this document. The U.S. Securities and Exchange Commission filings, including supplemental schedules and exhibits can also be accessed free of charge through the U.S. Securities and Exchange Commission’s website at: http://www.sec.gov.

Precious Metal Mining

Commerce continues to be involved in the exploration of gold and silver mines in the Republic of El Salvador, Central America, through its Commerce/Sanseb Joint Venture (“Joint Venture”). Commerce holds a nearly 100% interest in the Joint Venture which is the operator of the San Sebastian Gold Mine (“SSGM”).

Commerce’s objective is to enhance the value of its shares by realizing profits from the production and sale of gold and silver, cash flow, and by locating, developing and exploiting gold/silver ore reserves. This may be achieved by its being a low-cost gold producer.

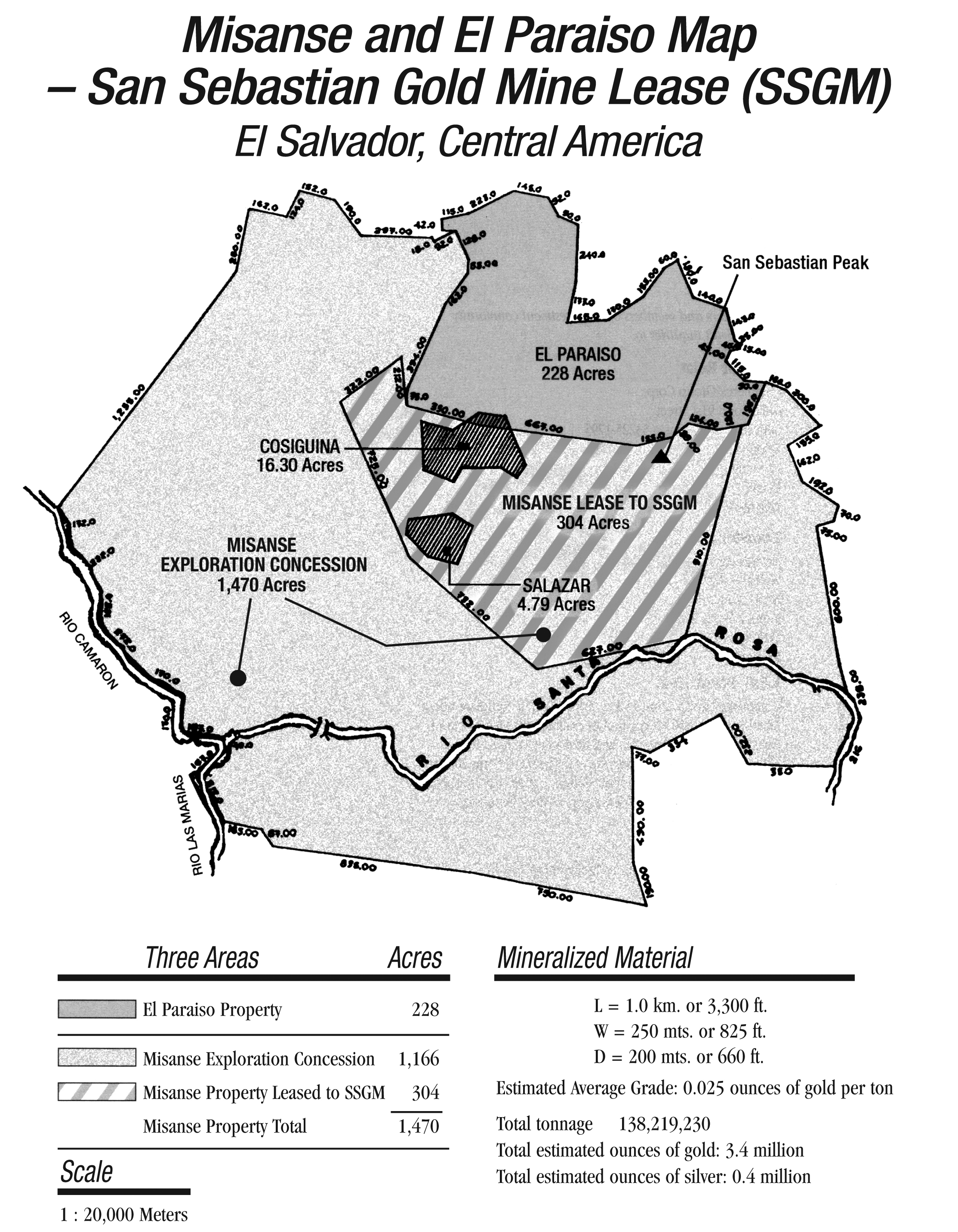

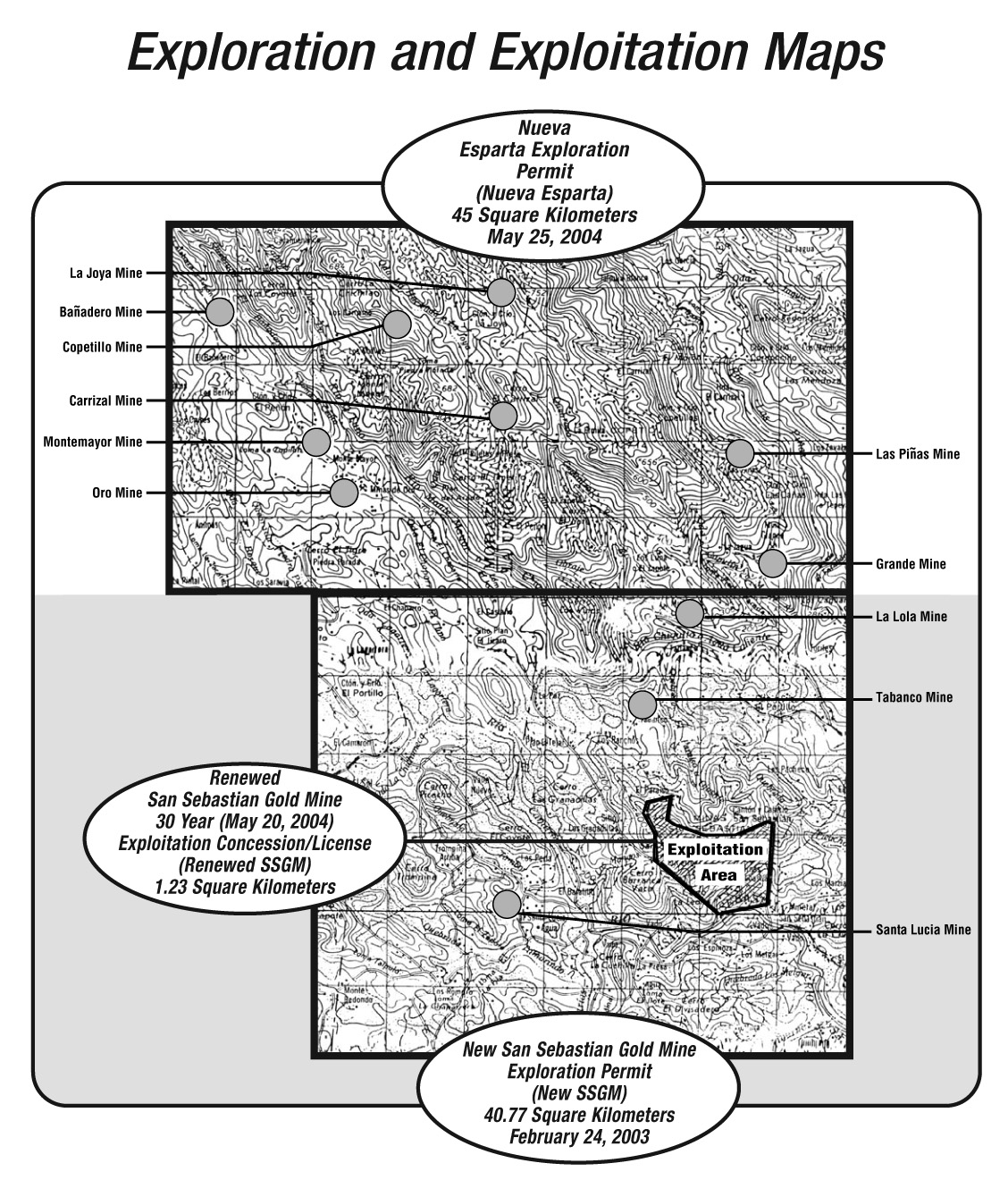

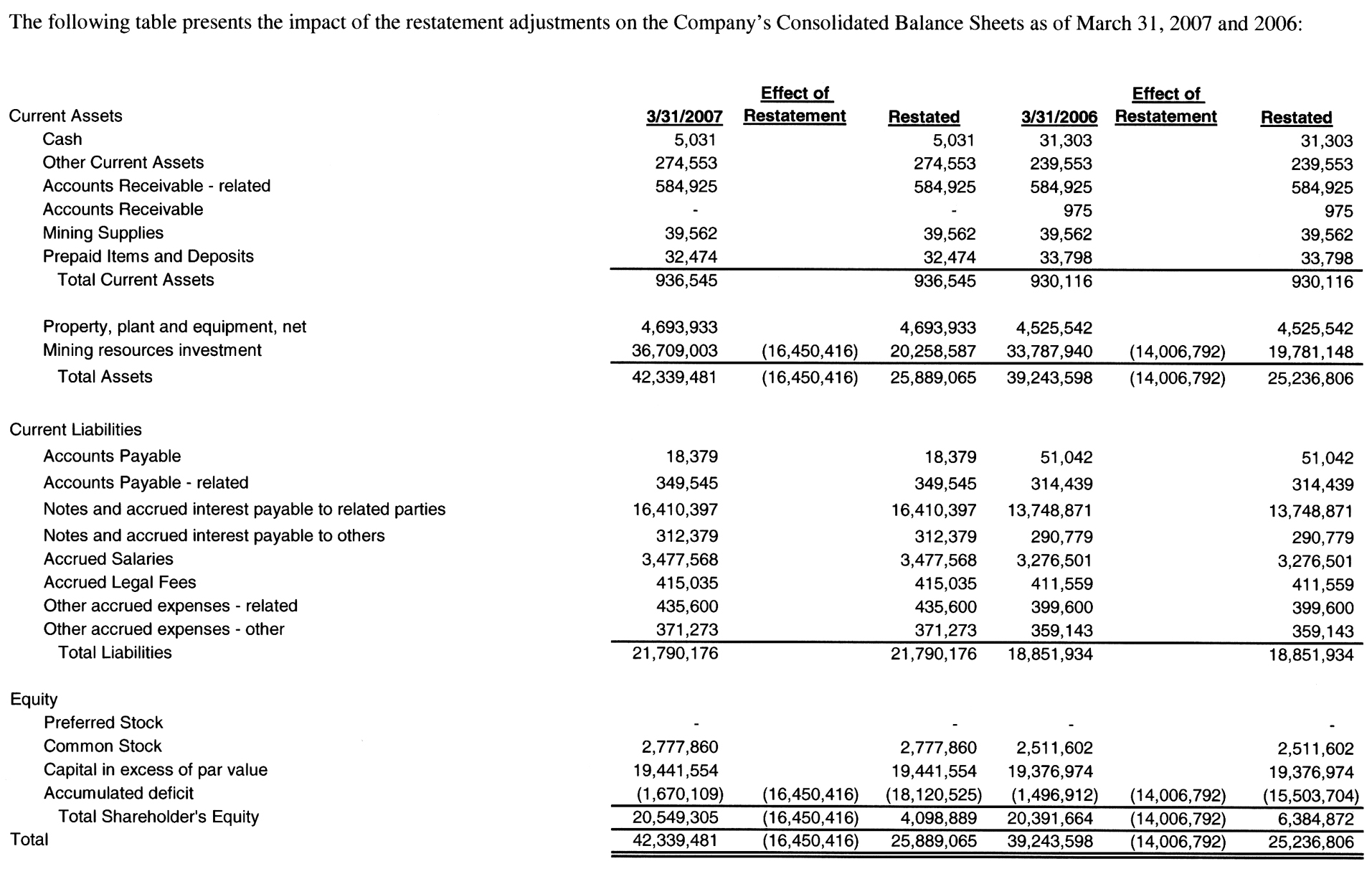

In 1987 Commerce, through Misanse, was granted the 304-acre SSGM exploitation concession by the El Salvadoran Department of Hydrocarbons and Mines. This concession was renewed on May 20, 2004. On March 3, 2003, Commerce received the New San Sebastian Exploration License. It commenced exploring targeted areas in this 41-square kilometer area (10,374 acres), which includes three formerly-operated mines and encompasses the SSGM. On or about September 13, 2006, the El Salvador Ministry of the Environment delivered to Commerce’s El Salvadoran legal counsel its revocation of the environmental permits issued for the SSGM exploitation concession and the SCMP. This Company’s legal counsel on December 6, 2006, filed with the El Salvadoran Court of Administrative Litigation of the Supreme Court of Justice two complaints relating to this matter. (See the Company’s discussion in the sect ion entitled “Environmental Matters.”) These legal proceedings are pending.

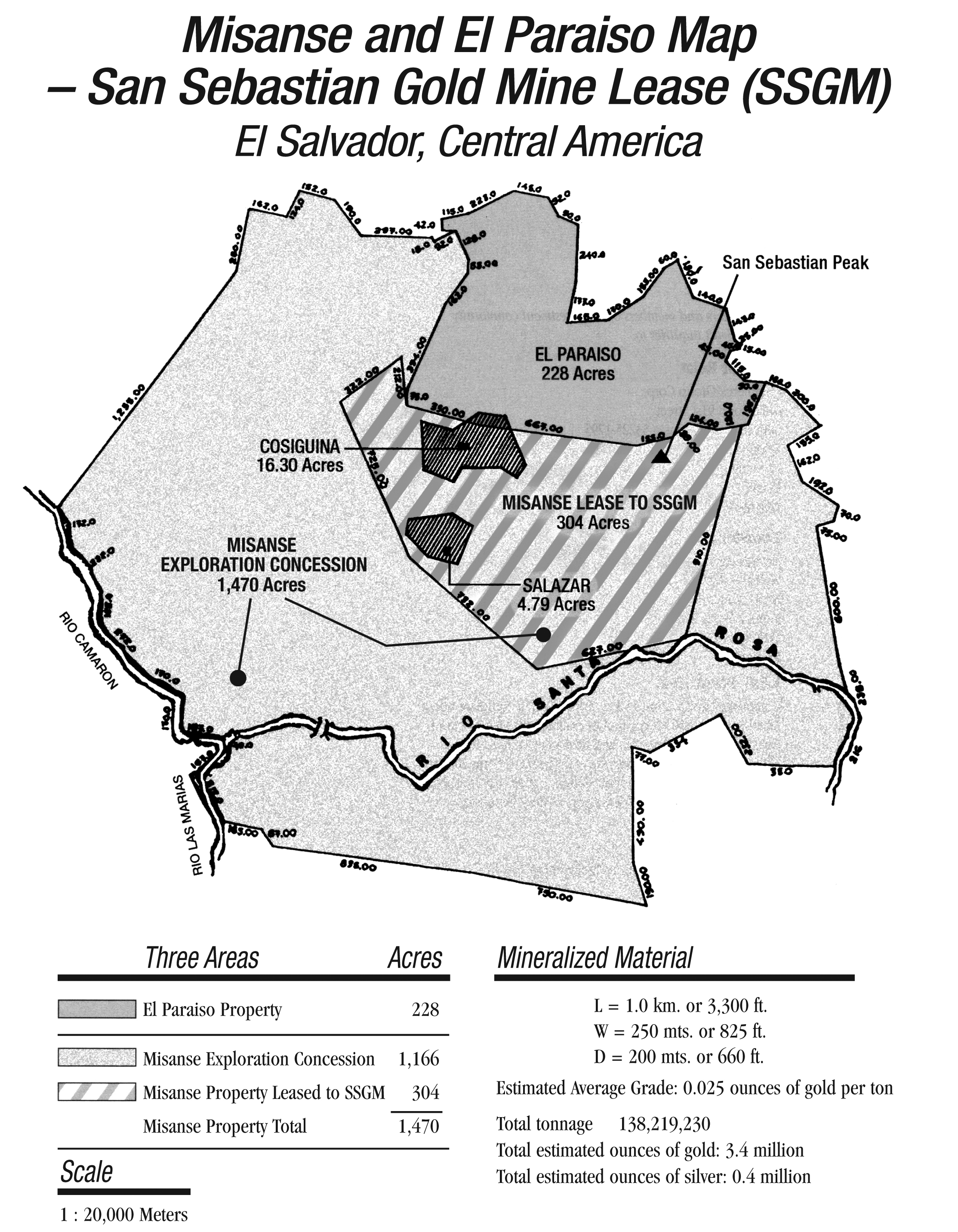

The Government of El Salvador on May 25, 2004 granted the Nueva Esparta Exploration License which consists of 45 square kilometers of area (11,115 acres) and includes eight formerly-operated gold and silver mines. This exploration area which abuts the New San Sebastian Exploration License area further enhances the potential to locate and evaluate gold and silver ore reserves through the exploration of the eleven formerly-operated gold and silver mines located in both exploration areas. The concession and exploration map is included in this report.

Commerce’s current goal is to secure sufficient capital to in time produce 100,000 ounces of gold per year and to simultaneously develop gold/silver ore reserves. The Company expects to engage in production by developing an open-pit, heap-leach operation on the SSGM site and by acquiring additional mill and related equipment which will increase the capacity of the processing of its higher grade virgin mineralized material at the San Cristobal Mill and Plant (“SCMP”). The SSGM heap-leach operation should have the capability of producing (through processing a higher volume of gold mineralized material beginning with 2,000 tons and in time increasing to 6,000 tons per day) significantly more gold than what can be produced at the SCMP, which has a present capacity of processing 200 tons of gold mineralized material per day. Commerce will also continue to explore areas contiguous to the SSGM site and in its vast exploration license areas.

5

Operations

On December 31, 1999, there was significant concern about the price of gold declining to $250 an ounce with a strong indication that the price per ounce would continue to decrease. With this in mind, the Joint Venture decided to temporarily suspend its processing of gold at its SCMP. In order to preserve the integrity of the SCMP equipment, it was necessary for the Company to have adequate funds to retrofit, restore, rehabilitate, and expand its mill and plant. The initial resumption of producing gold was accomplished with the SCMP used equipment that the Joint Venture purchased on February 23, 1993. Even though the Joint Venture has maintained this mill and plant on a continuous basis, certain basic structural components are worn out and need to be replaced, retrofitted or overhauled. Concurrent with the decision to suspend processing gold mineralized material was the awareness to increase efficiency by expanding the SCMP facilities from the existing 200-ton-per-day capacity to a 500-ton-per-day operation. From March 31, 1995 through December 31, 1999 when production was suspended, 22,710 ounces of bullion containing 13,305 ounces of gold and 4,667 ounces of silver were mined at the SSGM and then sold at the respective current world market price.

Although the financial statements presented herein reflect that the SSGM is the only one of the Company’s mining properties which has generated revenues, there are strong indications of commercial gold/silver mineralized material present at some of the other gold mine sites.

In the past, the Company’s geologists have estimated that the SSGM has the following mineralized material:

SSGM Mineralized Material

GOLD Mineralized Material (03/31/07) |

Tons | Estimated GoldGrade (OPT) | Estimated Gold Ounces(1) |

Virgin material (includes 960,000 tons of dump material) | 14,404,096 | 0.081 | 1,166,732 |

Stope fill (estimated) | 1,000,000 | 0.340 | 340,000 |

Estimated other mineralized material and open pit | 122,815,134 | 0.016 | 1,948,748 |

Total estimated mineralized material | 138,219,230 | 0.025 | 3,455,480 |

(1)

The estimated recoverable ounces of gold by processing are: SCMP, 85% to 95%; heap leach, 65% to 70%. Because the Company does not have a final feasibility study completed within the past five years, a determination that the property contains valid reserve estimates is not possible at this time.

SSGM Joint Venture Arrangements

Commerce acquired 82 1/2% of the authorized and issued common shares of San Sebastian Gold Mines, Inc. (“Sanseb”), a Nevada corporation formed on September 4, 1968. Approximately 200 unrelated shareholders hold the balance of Sanseb’s shares. From 1969 forward, Commerce has provided substantially all of the capital required to develop a mining operation at the SSGM, to fund exploration, and to acquire, refurbish and operate the SCMP.

6

On September 22, 1987, Commerce and Sanseb entered into a joint venture agreement (named the “Commerce/Sanseb Joint Venture” and sometimes referred to herein as the “Joint Venture”) to formalize the relationship between Commerce and Sanseb with respect to the mining venture and to divide profits. The terms of this agreement authorize Commerce to supervise and control all of the business affairs of the Joint Venture. Under this agreement 90% of the net pre-tax profits of the Joint Venture will be distributed to Commerce and ten percent to Sanseb, and because Commerce owns 82 1/2% of the authorized and issued shares of Sanseb, Commerce in effect has an over 98% interest in the activities of the Joint Venture. In order to maintain current accounting between Commerce and Sanseb, the interest charges to Sanseb on advances made by Commerce are kept separately. T herefore, when profits are earned, the recorded interest due to Commerce will be paid from the cash distributions due and payable to Sanseb.

The Joint Venture leases the SSGM from the Company’s 52%-owned subsidiary, Mineral San Sebastian, S.A. de C.V. (“Misanse”), an El Salvadoran corporation. On January 14, 2003, the Company entered into an amended and renewed 30-year lease agreement with Mineral San Sebastian Sociedad Anomina de Capital Variable (Misanse) pursuant to the approval of the Misanse shareholders and Misanse directors at a meeting held on January 12, 2003. The renewed lease is for a period of time commencing and coinciding with the date that the Company received its Renewed San Sebastian Gold Mine Exploitation Concession, hereinafter identified as the “Renewed SSGM,” from the Ministry of Economy’s Director of El Salvador Department of Hydrocarbons and Mines (DHM). The lease is automatically extendible for one or more equal periods. The Company will pay to Misanse for the rental of this real estate the sum of five percent of the sales of the gold and silver produced from this real estate, however, the payment will not be less than $343.00 per month. The Company has the right to assign this lease without prior notice or permission from Misanse. This lease is pledged as collateral for loans made to related parties (Item 8. Financial Statements and Supplementary Data, Note 7). The Misanse shareholders and directors have acknowledged, approved and confirmed at this shareholders’ meeting the total amount owed to Commerce for funds provided to obtain and maintain this lease agreement and concession.

The Joint Venture is registered as an operating entity to do business in the State of Wisconsin, U.S.A. and in the Republic of El Salvador, Central America. The Joint Venture Agreement authorizes Commerce to execute agreements on behalf of the Joint Venture.

Organizational Structure and Mining Projects

The consolidated financial statements include the accounts of the Company, its majority-owned subsidiaries, and its Commerce/Sanseb Joint Venture, but it excludes its 52% ownership of Mineral San Sebastian S.A. de C.V. Upon consolidation, all intercompany balances and transactions are eliminated.

| | | Charter/Joint Venture |

Included in the Consolidated Statements | % Ownership | Place | Date |

Homespan Realty Co., Inc. (“Homespan”) | 100.0 | Wisconsin | 02/12/1959 |

Ecomm Group Inc. (“Ecomm”) | 100.0 | Wisconsin | 06/24/1974 |

San Luis Estates, Inc. (“SLE”) | 100.0 | Colorado | 11/09/1970 |

San Sebastian Gold Mines, Inc. (“Sanseb”) | 82.5 | Nevada | 09/04/1968 |

Universal Developers, Inc. (“UDI”) | 100.0 | Wisconsin | 09/28/1964 |

Commerce/Sanseb Joint Venture (“Joint Venture”) | 90.0 | Wisconsin & El Salvador | 09/22/1987 |

Not included in the Consolidated Statements | | | |

Mineral San Sebastian, S.A. de C.V. (“Misanse”) | 52.0 | El Salvador | 05/08/1960 |

7

Commerce was originally formed as a Wisconsin corporation (September 14, 1962). It then merged into a Delaware corporation on July 26, 1971 and on April 1, 1999 it merged back into a Wisconsin corporation. It owns 52% of Misanse, an El Salvadoran corporation that was formed on May 8, 1960, reinstated on January 25, 1975 and reincorporated on October 22, 1993. Misanse previously had a mining concession with the government of El Salvador and is the owner of the SSGM real estate. At that time, Misanse had assigned the mining concession to Commerce Group Corp. and San Sebastian Gold Mines, Inc., the mining operator formed on September 22, 1987 and known as the Commerce/Sanseb Joint Venture (Joint Venture). The Joint Venture has the right to operate the SCMP (the gold processing plant acquired on February 23, 1993). It conducted exploration and operations at the SSGM s tarting in October 1968; it mined and sold gold from 1972 through March 1978 and from April 1, 1995 through December 1999. Commerce also owns 82 1/2% of the San Sebastian Gold Mines, Inc. (SSGM) which was chartered as a Nevada corporation on September 4, 1968.

Starting in 2003 the Joint Venture has performed exploration at the La Lola Mine, the Santa Lucia Mine, the Tabanco Mine, and the Montemayor Mine, and from 2005 the La Joya Mine, which are included in the New San Sebastian Exploration and the Nueva Esparta Exploration License areas.

The Company’s current exploration program is being conducted under the guidance of Luis Alfonso Limay, with direction from the Chairman and the Board of Directors. Mr. Limay has been with the Company since 1986. He is a geologist and mining engineer. He was appointed to the position of Project and Mine Manager in October 1986, and became the Manager of El Salvador operations in March 1995. As such, Mr. Limay is responsible for managing the daily operations of the Joint Venture. As of March 2007 he supervised a staff of approximately forty persons in El Salvador.

From 2003 to the present the Joint Venture has been performing limited exploration at the La Lola Mine, the Santa Lucia Mine, the Tabanco Mine, and the Montemayor Mine, and since 2005 also at the La Joya Mine. Exploration has been minimized because, as previously disclosed, the Company’s environmental permits have been revoked and the Company is not able to do drilling. The Company is doing some trenching and initial exploration at the five listed sites, and is doing limited exploration of its other properties. The Company anticipates that in the near future the Country of El Salvador will complete its revision of its environmental laws and permit more extensive exploration.

The Government of El Salvador has issued the Modesto mining concession to others. Commerce’s attorneys have challenged the legality of the issuance of this concession. Commerce, through its Chairman, owns certain properties believed to be crucial to the Modesto Mine. It plans to apply for concessions on the Modesto property that it owns. Although the sub surface rights belong to the Government of El Salvador, access to the surface rights must be obtained from the landowner.

All of the mines mentioned, including the eleven mines in the two exploration license areas, were formerly mined and did produce gold and/or silver. In addition to the channel trenching, test pit holes, and underground adit openings, the Joint Venture had its own diamond drilling rig and had contracted with others to explore the above-described SSGM potential targets in depth. All of the mining properties appear to have promising geologic prospects, alterations, and historical records that bear evidence that all have been mined and at one time in the past produced gold/silver.

8

World Gold Market Price, Customers and Competition

Since the Joint Venture was in operation and mined gold on a curbed start-up basis, its revenues, profitability and cash flow were greatly influenced by the world market price of gold. The gold world market price is generally influenced by basic supply and demand fundamentals. The price of gold/silver is unpredictable, volatile, can fluctuate widely and is affected by numerous factors beyond the Company’s control, including, but not limited to, expectations for inflation, the relative strength of the United States’ dollar in relation to other major worldwide currencies, political and economic conditions, central bank sales or purchases, inflation, production costs in major gold-producing regions, and other factors. The supply and demand for gold can also greatly affect the price of gold. The Company has not and does not expect in the foreseeable future to engage in hedging or other similar t ransactions to minimize the risk of fluctuations in gold prices or currencies. The Company’s past practice has been to sell its gold and silver at the world market spot prices. Gold and silver can be sold on numerous markets throughout the world, and the market price is readily ascertainable for such precious metals. There are many worldwide refiners and smelters available to refine these precious metals. Refined gold and silver can also be sold to a large number of precious metal dealers on a competitive basis. When it was producing doré, the Joint Venture’s SCMP sold the doré to a refinery located in the United States. During the past five years the average annual spot market price of gold has fluctuated between $276 and $725 an ounce.

At this time the Joint Venture believes that, due to its current financial capacity, it may not be a major gold producer based on the size of larger existing gold mining companies. At this time the Company believes no single gold-producing company could have a large impact to offset either the price or supply of gold in the world market. There are many mining entities in the world producing gold. Many of these companies have substantially greater technical and financial resources and larger gold ore reserves than the Company. The Company believes that the expertise of the Joint Venture’s experienced key personnel, its ability to train its employees, its low overhead, its gold mineralized material, its accessibility to the mine, its infrastructure, and its projected low cost of production may allow it to compete effectively and to produce reasonable profits.

The profitability and viability of the Joint Venture is dependent upon, not only the price of gold in the world market (which can be unstable), but also upon the political stability of El Salvador, the cooperation of the Government of El Salvador in issuing needed environmental and other permits, and the availability of adequate funding for either the SCMP operation or the SSGM open-pit, heap-leaching operation and for the exploration projects.

As of this date, inflation, currency, interest rate fluctuations, and political instability have not had a material impact on the Company or its results of operations.

Seasonality

Seasonality does not have a material impact on the Company’s operations, but the rainy season in El Salvador (May through November) can subdue production.

9

Environmental Matters

The Company’s operations are subject to environmental laws and regulations adopted by various governmental authorities in the jurisdictions in which the Company operates. Accordingly, the Company has adopted policies, practices and procedures in the areas of pollution control, product safety, occupational health and the production, handling, storage, use and disposal of hazardous materials to prevent material environmental or other damage, and to limit the financial liability which could result from such events. However, some risk of environmental or other damage is inherent in the business of the Company, as it is with other companies engaged in similar businesses.

Since the Company has been granted the Renewed SSGM exploitation concession from the DHM, it is required to maintain environmental permits. The issuance of these permits is under the jurisdiction of the El Salvador Ministry of Environment and Natural Resources Office (MARN). On October 15, 2002, MARN issued an environmental permit under Resolution 474-2002 for the SCMP. On October 20, 2002, MARN issued an environmental permit under Resolution 493-2002 for the Renewed SSGM Exploitation concession. Financial security bond(s) have been submitted as required.

Since the Government of El Salvador (GOES) has established a new Mining Law effective February 1996, its exploration, exploitation, development, and production programs are subject to environmental protection. The GOES has established the Office of the El Salvador Ministry of Environment and Natural Resources (MARN). In order to comply with mining law, the Company was required to obtain environmental permits. On October 15, 2002, an environmental permit under MARN Resolution 474-2002 was issued for the SCMP. On October 21, 2002, an environmental permit under MARN Resolution 493-2002 was issued pertaining to the SSGM exploitation concession. This permit was renewed for a three-year period with the issuance of Resolution No. 3026-003-2006 dated January 4, 2006.

On or about September 13, 2006, without any prior notice, the El Salvador Ministry of Environment’s office delivered to Commerce’s El Salvadoran legal counsel, its revocation of the MARN Resolution dated July 6, 2006 which included its San Sebastian Gold Mine Exploitation and San Cristobal Mill and Plant environmental permits. These were the only permits of their kind issued in the Republic of El Salvador. The Company’s El Salvadoran legal counsel, after reviewing the two letters (one for the SSGM exploitation concession and the other for the SCMP), concluded that the revocation of these permits was arbitrary, illegal and unconstitutional and he so stated in his September 20, 2006 letter to the Ministry of Environment’s office; a second letter was submitted by our legal counsel as the Ministry of Environment’s office requested a response to the first letter.

On or about December 6, 2006, the Company’s legal counsel filed with the El Salvadoran Court of Administrative Litigation of the Supreme Court of Justice two complaints against the revocation of the environmental permits: one for the San Sebastian Gold Mine and the other for the San Cristobal Mill and Plant. In these complaints the attorney filed the Company’s following defense:

1.

Violation of the Right to a Hearing and Due Process – pursuant to Articles 88 and 93 of the Environmental Law. On January 4, 2006 under MARN Resolution No. 3026-003-2006, the environmental permit was extended.

2.

Lack of legal foundation for the sanction – the Company was not in production, therefore, it could not be in violation. This fact was verified by a written MARN report after a site inspection on June 23, 2006.

3.

Excess of Authority – besides revoking the environmental permit, MARN ordered the closing of operations which said determination and authority are under the jurisdiction of the El Salvador Ministry of Economy’s office.

Environmental regulations add to the cost and time needed to bring new mines into production and add to operating and closure costs for mines already in operation. As the Company places more mines into production, the costs associated with regulatory compliance can be expected to increase. Such costs are a normal cost of doing business in the mining industry, and may require significant capital and operating expenditures in the future. The Company’s policy is to adhere to the El Salvador environmental standards. The Company cannot accurately predict or estimate the impact of any future laws or regulations developed in El Salvador that would affect the Company’s operations.

All operations by the Company involving the exploration or the production of minerals are subject to existing laws and regulations relating to exploration procedures, safety precautions, employee health and safety, air quality standards, pollution of water sources, waste materials, odor, noise, dust and other environmental protection requirements adopted by the El Salvador governmental authorities. The Company was required to prepare and present to such authorities data pertaining to the effect or impact that any proposed exploration or production of minerals may have upon the environment. The requirements imposed by any such authorities may be costly, time consuming and may delay operations. Future legislation and regulations designed to protect the environment, as well as future interpretations of existing laws and regulations, may require substantial increases in equipment and operating costs to the Comp any and delays, interruptions, or a termination of operations. The Company cannot accurately predict or estimate the impact of any such future laws or regulations, or future interpretations of existing laws and regulations, on its operations.

Republic of El Salvador, Central America Information Sources

The most current information about El Salvador can be obtained from the following sources:

1.

General information can be obtained through the Internet from the following websites: http://www.usinfo.org.sv/eng/irc/svlinks.html and http://www.dirla.com/elsalvador2.html.

2.

The U.S. Embassy in El Salvador can also be contacted at Final Boulevard Santa Elena Sur, Urbanización Santa Elena, Antiguo Cuscatlán, La Libertad, El Salvador, telephone (011) 503-278-4444 and fax (011) 503-278-6011 or at its website: http://www.elsalvador.org/home.nsf/consularinfo.

Operations, Other Than Mining

Commerce independently and through its partially and wholly-owned subsidiaries conducted other business activities, which at present are suspended. Previous operations consisted of the following: (1) land acquisition and real estate development through its wholly-owned subsidiaries, San Luis Estates, Inc. (“SLE”) and Universal Developers, Inc. (“UDI”); (2) real estate sales, through its wholly-owned subsidiary, Homespan Realty Co., Inc. (“Homespan”); and (3) advertising and various businesses, including Internet-related businesses, through its subsidiary, Ecomm Group Inc. (“Ecomm”).

10

Land Acquisition, Development, Ownership and Real Estate Sales

During the past years, the Company has substantially diminished its activities in the business of real estate development conducted principally through its subsidiaries San Luis Estates, Inc. (“SLE”), a Colorado corporation, and Universal Developers, Inc. (“UDI”), a Wisconsin corporation. At present, all activities are suspended.

Misanse, the Company’s majority-owned subsidiary (52%) owns the SSGM real estate consisting of approximately 1,470 acres. This real estate is located approximately two and one-half miles northwest of the city of Santa Rosa de Lima, off of the Pan American Highway (a four-lane, first-class highway), about 108 miles southeast of the capital city of San Salvador, El Salvador, and is about 11 miles west from the border of the Country of Honduras. It is also about 26 miles from the city of La Union which has railroad and port facilities. The Company, on January 14, 2003, renewed its lease into a long-term lease arrangement with Misanse.

The Company also leases approximately 166 acres of real estate on which it has its SCMP and plans to process mineralized material on this site. These facilities are located on the Pan American Highway, near the City of El Divisadero.

The Company, through its Chairman, owns approximately 63 acres of land on the Modesto Mine site which is located due north of the city of Paisnal and approximately 19 miles north of San Salvador, the capital city of El Salvador. This real estate is pledged as collateral for funds advanced to the Company. The Company also has permission from a number of property owners to explore, exploit and develop the Montemayor Mine in the Department of Morazan.

Reference is made to “Item 2. Properties,” for additional information.

Homespan, the local real estate marketing subsidiary of the Company, is presently inactive. It has no significant activity and is not material to the Company’s operation.

Employees

As of March 31, 2007, the Company and its wholly-owned subsidiaries employed approximately 40 full-time persons in El Salvador, which number may adjust seasonally. The Company also employs up to four persons, including part-time help, in the United States. None of the Company’s employees are covered by collective bargaining agreements.

Patents, Trademarks, Licenses, Franchises, Concessions & Government Contracts

Other than concessions, licenses and interests in mining properties granted by the Government of El Salvador and permission from private landowners, the Company does not own any material patents, trademarks, licenses, franchises or non-mining concessions.

Significant Customers

The Company presently has no individual significant customers in which the loss of one or more would have an adverse effect on any segment of its operations or from whom the Company has received more than ten percent of its consolidated revenues, except for the sale of gold when the Joint Venture was mining gold. The gold in doré form was refined and then sold at the world market spot price to a refinery located in the United States. Given the marketability and liquidity of the precious metals sold and because of the large source of qualified buyers of gold and silver, the Company believes that a loss of its customers could be quickly replaced without any adverse affect.

Miscellaneous

Backlog orders at this time are not significant to either the Company’s or its majority-owned subsidiaries’ areas of operations, nor at this time is any portion of their operations subject to renegotiation of profits or termination of contracts at the election of the United States’ Government.

At this time, neither the Company nor its majority-owned subsidiaries conduct any material research and development activities, except as indicated in this report with respect to the Joint Venture and its mining exploration programs in the Republic of El Salvador, Central America.

The Company believes that the United States federal, state and local provisions regulating the discharge of materials into the environment should not have a substantial effect on the capital expenditures, earnings or competitive position of the Company or any of its majority-owned subsidiaries as the Company does not have any mining activity in the United States.

Item 2. Properties: Mining Properties

The significant mining properties in which Commerce Group Corp. or the Joint Venture has an interest are summarized below. All of the properties are located in the Republic of El Salvador, Central America.

1.

San Sebastian Gold Mine

Property Description | San Sebastian Gold Mine located two and one-half miles northwest of the city of Santa Rosa de Lima and the Pan American Highway |

Nature of Interest | Mineral concession consisting of 100% ownership of the precious metals extracted from this mine. Environmental permit has been revoked but legal challenge is pending. |

Date Interest was Acquired | 1968 |

Cost of Interest | 5% of the gross precious metal proceeds or $343 a month whichever is higher. |

Amount of Funds to Make Property Operational | This is dependent on the scale of production that management decides to perform. The amount of investment could be from $5 million to $100 million. |

Date Mine will be Operational | It was in operation on a curbed production basis from March 31, 1995 until December 31, 1999 when operations were suspended due to the need to overhaul, repair, restore and expand the SCMP facilities and due to the low price of gold. |

11

2.

Modesto Mine

Property Description | Modesto Mine located near the city of Paisnal and about 19 miles north of San Salvador, the capital city. |

Nature of Interest | Land ownership only through the Company’s Chairman. |

Date Interest was Acquired | September 1993 |

Cost of Interest | No cost for interest. |

Amount of Funds to Make Property Operational | Not applicable. |

Date Mine will be Operational | Not applicable. |

3.

San Cristobal Mill and Plant

Property Description | San Cristobal Mill and Plant located on the Pan American Highway west of the city of El Divisadero. |

Nature of Interest | Mill and Plant owned by Joint Venture. The real estate is owned by an agency of the Government of El Salvador. Environmental permit has been revoked but legal challenge is pending. |

Date Interest was Acquired | Equipment was acquired on February 23, 1993; lease was acquired on November 12, 1993. |

Cost of Interest | Equipment purchased and extensive retrofitting was and continues to be performed. The cost of the investment through March 31, 2006, including the crushing system located at the San Sebastian Gold Mine, is $6,946,070. |

Amount of Funds to Make Property Operational | To expand the plant, including a crushing system to a capacity of 500 tons per day; an estimated sum of up to $4 million may be required, all dependent on whether new or used equipment will be purchased. |

Date Mine will be Operational | Curbed production commenced March 1995; operations suspended on December 31, 1999 until the existing equipment is overhauled, repaired, restored and expansion of the SCMP facilities are completed, and dependent on the price of gold and restoration of the environmental permit. |

12

4.

New San Sebastian Exploration License

Property Description | New San Sebastian Exploration License consisting of 41 square kilometers. |

Nature of Interest | Exploration license issued by the Government of El Salvador for the precious metals. |

Date Interest was Acquired | February 2003 |

Cost of Interest | Undetermined until negotiated with the surface rights’ owners. |

Amount of Funds to Make Property Operational | Undetermined until preliminary exploration at an estimated cost of $2 million is completed. |

Date Mine will be Operational | Undetermined until exploration is completed. |

5.

Nueva Esparta Exploration License

Property Description | Nueva Esparta Exploration License consisting of 45 square kilometers. |

Nature of Interest | Exploration license issued by the Government of El Salvador for the precious metals. |

Date Interest was Acquired | May 2004 |

Cost of Interest | Undetermined until negotiated with the surface rights’ owners. |

Amount of Funds to Make Property Operational | Undetermined until preliminary exploration at an estimated cost of $2 million is completed.

|

Date Mine will be Operational | Undetermined until exploration is completed. |

13

14

The San Sebastian Gold Mine

General Location and Accessibility

The SSGM is situated on a mountainous tract of land owned by Misanse consisting of approximately 1,470 acres of explored and unexplored mining prospects. The SSGM is located approximately three miles off of the Pan American Highway, northwest of the city of Santa Rosa de Lima in the Department of La Union, El Salvador. The tract is typical of the numerous volcanic mountains of the coastal range of southeastern El Salvador. The topography is mountainous with elevations ranging from 300 to 1,500 feet above sea level. The mountain slopes are steep, the gulches are well defined, and the drainage is excellent.

There is good roadway access to the SSGM site. The reconstruction of the Pan American Highway from two lanes to four lanes (from the city of San Salvador to the Honduran border) has been completed. The city of Santa Rosa de Lima (approximately three miles from the SSGM) is one of the larger cities in the Eastern Zone. The SSGM is approximately 30 miles from the city of San Miguel, which is El Salvador’s third largest city, and approximately 108 miles southeast of El Salvador’s capital city, San Salvador. SSGM is also approximately 26 miles from the city of La Union which has port and railroad facilities. Major United States’ commercial airlines provide daily scheduled flights to the Comalapa Airport which is located on the outskirts of the city of San Salvador.

SSGM Mineralized Material

GOLD Mineralized Material (03/31/07) |

Tons | Estimated GoldGrade (OPT) | Estimated Gold Ounces(1) |

Virgin material (includes 960,000 tons of dump material) | 14,404,096 | 0.081 | 1,166,732 |

Stope fill (estimated) | 1,000,000 | 0.340 | 340,000 |

Estimated other mineralized material and open pit | 122,815,134 | 0.016 | 1,948,748 |

Total estimated mineralized material | 138,219,230 | 0.025 | 3,455,480 |

(1)

The estimated recoverable ounces of gold by processing are: SCMP, 85% to 95%; heap leach, 65% to 70%. Because the Company does not have a final feasibility study completed within the past five years, a determination that the property contains valid reserve estimates is not possible at this time.

The dump material and stope fill at the SSGM are the by-products of past mining operations. The dump material was mined in the past in the search for higher grades of gold ore and piled to the side of past excavations as it was considered at that time to be too low of a grade of ore to process economically; however, it was reserved for future processing when the price of gold is at a level to process it profitably. The stope fill that was available was in the past (1900 era) considered to be too low of a grade of mineralized material to process economically, therefore it was primarily used to fill the voids in the underground workings to accommodate the extraction of the higher grade of gold mineralized material in the past SSGM mining activities. Virgin material, as the term is used in this report, is mineralized material which is on the surface and readily available for processing; it also includes the un developed underground mineralized material.

At the turn of the twentieth century, the SSGM was rated as one of the richest gold mines in the world. The United Nations’ 1969 Mineral Survey Report states that “unquestionably the San Sebastian deposit was the jewel of the El Salvador mining industry and one of the most prolific gold mines in Central America.”

The Company estimates that at the SSGM it has 14.4 million tons of virgin mineralized material, including the dump waste material. The Company plans to use an open-pit mining method and will truck the lower grade mineralized material to one or more heap-leaching pads developed at the SSGM site. The use of open-pit mining and heap-leaching techniques will enable the Company to process a higher volume of low grade mineralized material than can be processed at the SCMP. The Company plans to continue to operate the SCMP after developing a leach-pad operation at the SSGM, using the facility to process the higher grade mineralized material it encounters in the course of mining at the SSGM. The milling operation at the SCMP is expected to return a higher rate of gold recovery than can be expected from heap-leaching techniques.

Approximately 960,000 tons of dump material present at the SSGM site, with grades estimated from 0.082 to 0.178 ounces of gold per ton, have been combined with the virgin ore mineralized material. The Company’s consulting geologist who has confirmed that about seven percent of the stope fill had been removed and processed during the 1973-1978 period made an analysis of the underground stope fill material. It is estimated that the grade of the stope fill averages 0.34 ounces of gold per ton. It is estimated that there are about one million tons available for SCMP treatment from the underground operations. It is necessary to remove the material which has caved in the adits to reach the stope fill areas, or it eventually will be encountered in the open-pit operations.

The Company’s geologists estimated the gold content of the mineralized material by calculating the gold content in an area consisting of 3,300 lineal feet in length, 825 lineal feet in width, and 660 feet in depth, to determine the volume. To support these additional reserves, this Company, since July 1987, has completed the following in the SSGM site: 116,121 lineal feet of 22 miles of surface trenching; 2,162 lineal feet of test pit hole excavation; 42,372 lineal feet of underground adit workings; and more than 19,775 feet of diamond core and reverse circulation drilling. A total of 78,441 fire assays were completed at the Company’s laboratory through 2004. Also, there were more than 30 miles of former adit excavations. These samples, extending the diamond core and reverse circulation drilling, reflected a grade of 0.025. Samples from the 30 miles of former underground workings were assayed through 2004.

All residue from the contemplated operations will be stockpiled for potential future processing dependent upon the price of gold, improvements in technology, and the depletion of higher grade material.

Misanse Mining Lease

The Company (previously through the Joint Venture) leases the SSGM from Mineral San Sebastian, S.A. de C.V. (“Misanse”), an El Salvadoran corporation. The Company owns 52% of the total of Misanse’s issued and outstanding shares. About 100 El Salvador, Central American and United States’ citizens own the balance of the shares. (Reference is made to Item 8. Financial Statements and Supplementary Data, Note 7, for related party interests.)

SSGM Mining Lease

On January 14, 2003, the Company entered into an amended and renewed lease agreement with Mineral San Sebastian Sociedad Anomina de Capital Variable (Misanse) pursuant to the approval of the Misanse shareholders and directors at a shareholders’ meeting and thereafter at a directors’ meeting both held on January 12, 2003. The renewed lease is for a period to coincide with the term of its Renewed SSGM concession, which it received on August 29, 2003 from the DHM. It was automatically amended on May 20, 2004 to coincide with the extension of the term of the Renewed SSGM Exploitation Concession from 20 to 30 years. The lease is automatically extendible for one or more equal periods. The Company will pay to Misanse for the rental of this real estate the sum of five percent of the sales of the gold and silver produced from this real estate, however, the payment will not be less than $343.00 per mo nth. The Company has the right to assign this lease without prior notice or permission from Misanse. This lease is pledged as collateral for loans made to related parties (Item 8. Financial Statements and Supplementary Data, Note 7).

Misanse Mineral Concession-Government of El Salvador

In El Salvador, the rights to minerals below the sub-surface are vested with the government. The government through concessions grants mineral rights. Reference is made to the San Sebastian Gold Mine map and the exploration and exploitation maps included in this report.

On January 27, 1987, the Government of El Salvador granted a right to the SSGM mining concession (“concession”) to Misanse which was subject to the performance of the El Salvador Mining Law requirements. These rights were simultaneously assigned to the Joint Venture.

On July 23, 1987, the Government of El Salvador delivered and granted to Misanse, possession of the mining concession. At that time this provided the right to extract minerals and export gold and silver for a term of 25 years (plus a 25-year renewal option) beginning on the first day of production from the real estate which encompasses the SSGM owned by Misanse. Misanse assigned this concession to the Joint Venture.

Effective February 1996, the Government of El Salvador passed a law which required mining companies to pay to it three percent of its gross gold sale receipts and an additional one percent is to be paid to the El Salvador municipality which has jurisdiction of the mine site. As of July 2001, a series of revisions to the El Salvador Mining Law were made. A principal change is that the fee payable to the GOES has been reduced to two percent of the gross gold and silver receipts.

Renewed San Sebastian Gold Mine Exploitation Concession under El Salvador Agreement Number 591 dated May 20, 2004 and delivered on June 4, 2004 (Renewed SSGM) - approximately 1.2306 square kilometers (304 acres) located in the Department of La Union, El Salvador, Central America

On September 6, 2002, at a meeting held with the El Salvadoran Minister of Economy and the Department of Hydrocarbons and Mines (DHM), it was agreed to submit an application for the Renewed SSGM concession for a 30-year term and to simultaneously cancel the concession obtained on July 23, 1987. On September 26, 2002, the Company filed this application. On February 28, 2003 (received March 3, 2003) the DHM admitted to the receipt of the application and the Company proceeded to file public notices as required by Article 40 of the El Salvadoran Mining Law and its Reform (MLIR). On April 16, 2003, the Company’s El Salvadoran legal counsel filed with the DHM notice that it believed that it complied with the requirements of Article 40, and that there were no objections; and requested that the DHM make its inspection as required by MLIR Article 42. An inspection by the DHM was made. The Company then pro vided a bond which was required by the DHM to protect third parties against any damage caused from the mining operations, and it simultaneously paid the annual surface tax. On August 29, 2003 the Office of the Ministry of Economy formally presented the Company with a twenty-year Renewed SSGM concession which was dated August 18, 2003. On May 20, 2004 (delivered June 4, 2004) the Government of El Salvador under this Agreement Number 591 extended the exploitation concession for a period of thirty (30) years. This Renewed SSGM concession replaces the collateral that the same parties held with the previous concession.

On or about September 13, 2006, the El Salvador Ministry of the Environment delivered to Commerce’s El Salvadoran legal counsel its revocation of the environmental permits issued for the SSGM and SCMP. This Company’s legal counsel on December 6, 2006, filed with the El Salvadoran Court of Administrative Litigation of the Supreme Court of Justice two complaints relating to this matter. (See the Company’s discussion in the section entitled “Environmental Matters.”) These legal proceedings are pending.

New San Sebastian Exploration License under El Salvador Resolution Number 27 - approximately 40.7694 square kilometers (10,070 acres) located in the Departments of La Union and Morazan, El Salvador, Central America

On October 20, 2002, the Company applied to the Government of El Salvador through the DHM for the New San Sebastian Exploration License, which covers an area of 41 square kilometers and includes approximately 1.2306 square kilometers of the Renewed SSGM concession. The New San Sebastian Exploration License area is in the jurisdiction of the City of Santa Rosa de Lima in the Department of La Union, Republic of El Salvador, Central America. On February 24, 2003, the DHM issued the New San Sebastian Exploration License for a period of four years starting from the date of December 27, 2003, following the notification of this resolution which was received on March 3, 2003. The New San Sebastian Exploration License may be extended for two two-year periods, or for a total of eightyears. This license is in the process of being renewed for a period of four years. Besides the San Sebastian Gold Mine, th e following three other formerly operative gold and silver mines are included in the New San Sebastian Exploration License area: the La Lola Mine, the Tabanco Mine, and the Santa Lucia Mine. Historical data reflects the following:

A French company operated the La Lola Mine in 1920; they developed two quartz veins, which were named La Lola and Buena Vista. From 1950 through 1953, Mr. Amadeo Tinetti produced 1,850 ounces of gold and 66,000 ounces of silver.

The Tabanco Mine is south of the La Lola Mine. Records evidence and local citizens confirm that several levels of mining occurred. Isolated rich ore shoots reported to contain sulfides and silver chloride were encountered. The oxidized sulfide ore was mined from a width of three to six feet with a grade of 0.50 ounces per ton of gold and five ounces of silver. Records reflect that the Herrera family produced gold and silver beginning in the year 1780.

In the Tepeyac vein very high-grade ore in one to two foot widths was encountered. A United Nation’s team performed sampling and reported that in a sulfide bearing zone they found 0.31 ounces of gold and 4.52 ounces of silver in a 4.9 foot wide vein. The footwall host rock assayed at 0.22 ounces of gold and 41.29 ounces of silver. This footwall rock area location was not specifically identified, but the result lends strength to the recommendation that in any further sampling or mapping of veins in the epithermal environment, close attention will be directed to the wall rock.

The third mine in this exploration area is the Santa Lucia Mine in which Mr. Humberto Perla developed a 100 meter wide underground vein. This vein is the west continuation of the Granadilla and the Año Nuevo veins located about two miles west of the SSGM property.

Nueva Esparta Exploration License (Nueva Esparta) Resolution Number 271 - 45 square kilometers (11,115 acres) located in the Departments of La Union and Morazan, El Salvador, Central America

On or about October 20, 2002, the Company filed an application with the Government of El Salvador through the DHM for the Nueva Esparta, which consists of 45 square kilometers north and adjacent to the New San Sebastian Exploration License area. This rectangular area is in the Departments of La Union (east) and Morazan (west) and in the jurisdiction of the City of Santa Rosa de Lima, El Salvador, Central America. On May 25, 2004 (received June 4, 2004) the Government of El Salvador under Resolution Number 271 issued the exploration license for a period of four years with a right to request an additional four year extension. An important observation is that these mines form a belt of mineralization following a fault line from the SSGM to the Montemayor Mine for a distance of approximately five miles. Included in the Nueva Esparta are eight other formerly-operated gold and silver mines known as: t he Grande Mine, the Las Piñas Mine, the Oro Mine, the Montemayor Mine, the Bañadero Mine, the Carrizal Mine, the La Joya Mine and the Copetillo Mine. Historical data reflects the following:

The Montemayor Mine has records that show that an English company commenced production of precious metals sometime about 1860. A report prepared by Mr. Fleury in 1878 stated that the area assayed approximately 48 ounces of silver and 0.85 ounces of gold per ton. Six underground workings were developed, but no records are available. A United Nation’s report reflects a possible grade of twelve ounces of silver and 0.29 ounces of gold from a section of the Montemayor vein stope. The Montañita, Tempique, Guarumo, Santa Gertrudis and El Indio vein findings support expanded exploration. The Company performed preliminary exploration in the Montemayor Mine area from 1995 through 1997. Its findings from the ore samples were very positive and encouraged additional exploration. Exploration will consist of locating workable ore within the known structures through mapping and sampling o f vein outcrops and reopening, mapping and sampling of underground work.

The El Bañadero Mine is located near the Montemayor Mine. When in production, most of the mineralized material processed at the Montemayor mill came from this area and the quality of the precious metals appeared to have the highest values. The veins identified in the area are the Saravia, Borbollon, Caraguito 1 to 3, Eulalio and the Miserocordia.

At the La Joya Mine the Company, during previous exploration, discovered three parallel wide quartz veins averaging in width from six feet to twenty-seven feet running northwest by southeast dipping at 42 degrees southwest. More exploration will be concentrated in this tract.

El Jimenito and Santa Teresa are two wide veins that the Company found at the Carrizal Mine. They are 1,920 to 2,560 feet apart. The local residents recollect that free gold was found in the Santa Teresa Vein Adit. This mine is located between the La Joya and Copetillo Mines.

One vein was discovered at the Copetillo Mine in an underground adit. It was developed into two sublevels connected to the south with one 100-foot shaft. Residents recall seeing free gold in the Canton Copetillo.

The Las Piñas Mine is located in the Canton Las Cañas and was in operation in 1935. It was developed for a five-year, 100-ton-per-day mill and plant. Records show that the average grade of silver was 5.10 ounces per ton and that the grade of gold averaged 0.06 ounces per ton.

The La Joya Mine is located in the Canton La Joya. Records relating to activities were not preserved. While exploring the region, Commerce found three parallel wide quartz veins ranging from six to 25 feet running northwest to southeast for a distance of over one mile. The grass roots exploration suggests that this is an area with great ore potential.

At this time there is no available information about the Oro Mine. It is a short distance south of the Montemayor Mine. This should be a good exploration target.

15

16

SSGM Current Status

The Company, through its Joint Venture is in the exploration stage. Presently, the Company is seeking funding to purchase equipment, to purchase inventory, and to use for working capital for its on-site proposed open-pit, heap-leaching operation. As an alternate, the Company is considering a joint venture, merger, acquisition, or any other mutually agreed upon business arrangement.

The Company’s main objective and plan, through the Joint Venture, is to operate a moderate tonnage, low-grade, open-pit, heap-leaching operation to mine gold on its SSGM site. Dependent on the funding, the grade of mineralized material, and the tonnage processed, it anticipates producing more than 56,000 ounces of gold from its open-pit, heap-leaching operation during the first twelve full operating months and then gradually increasing the average annual production of gold to 113,000 ounces.

The Company’s plans include placing its SCMP into production. Although it will be a low tonnage operation, the Company believes that it would be profitable since the present price of gold is over $600 an ounce.

Proposed SSGM Open-Pit, Heap-Leaching Operation

The Joint Venture has placed the SCMP into a maintenance position until it receives the funds that it requires or enters into a business arrangement, and receives permission from MARN to resume operations. It now intends to obtain a sum of $19 million or more to commence an open-pit, heap-leaching operation at the SSGM site. These funds are required to install the crushing system and plant, to purchase mining equipment, and for working capital. The Joint Venture may be able to lease this equipment. When these funds are available, the Joint Venture intends to start processing gold mineralized material from its open pit at a production level of 2,000 tons per day (expected 50,000 ounces annually). During the second year, the production level plans are to expand production to 3,000 tons per day (the funds for this expansion could be generated from profits, with an expectation of 56,000 ounces annually). An increase to process 4,000 tons of gold mineralized material per day would take place during the third year with an expectation of producing 75,000 ounces annually and another expansion to process 6,000 tons per day would take place at the beginning of the fifth year (with an expectation of producing 113,000 ounces annually); all funds for this expansion should be available through a combination of earned profits, borrowings, equity sales, or other creative sources. With the anticipated production volume, there is more than a nine-year supply of gold mineralized material and it is believed that a substantial amount of gold ore can be proven during the production period to continue operating at the same levels for a much longer period.

The Company’s geologists have defined a body of mineralized material estimated to consist of 138 million tons of gold mineralized material at an estimated grade of 0.025 ounces of gold per ton. This reflects a potential of 3.4 million ounces of gold and about 400,000 ounces of silver from this planned open-pit, heap-leaching operation. It would take about 64 years to process this body of gold mineralized material at a production capacity of 6,000 tons per day.

SSGM Ownership of the Property

Misanse, a Salvadoran corporation, owns the San Sebastian Gold Mine real estate consisting of approximately 1,470 acres. The Company owns 52% of Misanse common shares that are issued and outstanding.

17

Modesto Mine

Modesto Mine Location

The Modesto Mine is located due north of the town of El Paisnal, approximately 19 miles north of the capital city, San Salvador, in the Republic of El Salvador, Central America.

Modesto Mine Present Status

The Joint Venture suspended exploration activities at this site in July 1997 as the Government of El Salvador awarded the concession of the property to another mining company. The Company believes that, through its Chairman, it owns the title to key property; therefore permission from the Company will be required before entry can be made by others.

Montemayor Mine (“Montemayor”)

The Joint Venture has obtained permission from a number of property owners to enter their property for the purpose of exploring, exploiting and developing the property and then, if feasible, to mine and extract minerals from this property. The Company believes that this real estate contains the “heart” of the mine. Montemayor is located about 14 miles northeast of the SCMP, six miles northwest of the SSGM and about two and one-half miles east of the city of San Francisco Gotera in the Department of Morazan, Republic of El Salvador. Historical records evidence that the potential for the Montemayor to become an exploration and development silver-gold producing prospect is excellent.

San Cristobal Mill and Plant (“SCMP”) Recovery and Processing System

SCMP Location

SCMP is located near the city of El Divisadero (bordering the Pan American Highway), and is approximately 13 miles east of the city of San Miguel, the third largest city in the Republic of El Salvador, Central America.

SCMP Lease Agreement

Although the Joint Venture owns the mill, plant and related equipment, it does not own the land and certain buildings.

On November 12, 1993, the Joint Venture entered into an agreement with Corporacion Salvadorena de Inversiones (“Corsain”), an El Salvadoran governmental agency, to lease for a period of ten years (expiring November 12, 2003), approximately 166 acres of land and buildings on which its gold processing mill, plant and related equipment (the SCMP) are located, and which is approximately 15 miles west of the SSGM site. The basic annual lease payment was U.S. $11,500, payable annually in advance, unless otherwise amended, and subject to an annual increase based on the annual United States’ inflation rate. As agreed, a security deposit of U.S. $11,500 was paid on the same date and this deposit was subject to increases based on any United States’ inflationary rate adjustments.

On April 26, 2004, a three-year lease, which includes an automatic additional three-year extension subject to Corsain’s review, was executed by and between Corsain and the Company. This lease is retroactive to November 12, 2003 and the monthly lease payments are $1,418.51 plus the El Salvadoran added value tax. The lease is subject to an annual increase based on the U.S. annual inflationary rate adjustments. The SCMP is strategically located to process mineralized material from other mining projects.

SCMP Mill and Plant Process Description

Current Status

The SCMP (a precious metal cyanidation carbon-in-leach system) has a capacity of processing up to 200 tons of virgin mineralized material per day. The following units of operation are required: crushing, grinding, thickening, agitated leaching and recovery of precious metals via a carbon-in-leach (CIL) system.

The SCMP has been designed to process up to 500 tons of virgin mineralized material per day. The SCMP operations were suspended as of December 31, 1999, as the plant, equipment, and facilities have been placed on a care and maintenance status until such time as the Company has sufficient funds to complete a major overhaul in order to place it into operating condition to increase the SCMP’s processing capacity from 200 to 500 tons per day and at a time the price of gold is stabilized to assure a profit.

On or about September 13, 2006, the El Salvador Ministry of the Environment delivered to Commerce’s El Salvadoran legal counsel its revocation of the environmental permits issued for the SSGM and SCMP. This Company’s legal counsel on December 6, 2006, filed with the El Salvadoran Court of Administrative Litigation of the Supreme Court of Justice two complaints relating to this matter. (See the Company’s discussion in the section entitled “Environmental Matters.”) These legal proceedings are pending.

SCMP Project Operating Plan

Current and Anticipated Schedule

Development, consisting primarily of expansive road and site improvements to the mine and mill sites, mill equipment modifications and the development and hauling of virgin mineralized material has taken place in the past. Initial processing from April 1, 1995 was from the SSGM tailings. After the SSGM tailings’ resource was exhausted, virgin gold mineralized material was excavated from the SSGM surface (Coseguina area) and hauled to the SCMP site for processing.

The other sources of gold mineralized material from the SSGM to be used at the SCMP operation will be obtained from the stope fill or higher grade gold mineralized material after obtaining access via the underground workings or from the surface. This gold mineralized material will have to be crushed and pulverized, which increases the cost, but is expected to yield a 90% or higher recovery. The income, dependent on the market price of gold, from the higher grade and recovery of gold, is expected to be substantially more than the cost involved, providing that the world gold market price does not decline to a level of unprofitability.

In the past, the gold mineralized material from the SSGM open-pit was loaded onto 20-25 ton dump trucks for transport to the SCMP. Trucks then hauled the gold mineralized material on the Pan American Highway approximately 15 miles from the SSGM. Mine employees were responsible for the mining activities including the determination of areas to be excavated, trucking and loading operations, head sampling and sample analysis.

The gold mineralized material was received at the SCMP where it was weighed, logged, and sampled. Weighing was performed utilizing a conveyor belt scale and/or a truck scale located on the SCMP site. The excess gold mineralized material was then unloaded at the SCMP site and stockpiled in an area which was developed to allow storage of more than 50,000 tons.

Environmental Matters

Reference is made to San Sebastian Gold Mine “Environmental Matters.” The same information applies. On March 15, 2006, the Office of the El Salvadoran Ministry of Environment and Natural Resources (MARN) issued an environmental permit (Resolution 3026-003-2006) relative to the Renewed SSGM Exploitation Concession and the San Cristobal Mill and Plant. On or about September 13, 2006, MARN revoked both permits. For more details, reference is made to page 12, “Environmental Matters” and to Item 3. Litigation.

The Joint Venture Laboratories (Lab)

The Joint Venture has two laboratories: one located at the SCMP facilities and the other on real estate owned by the Company near the SSGM site. A total of 78,441 samples of exploration fire assays were logged through 2004. This total does not include the assays that were performed for production purposes. Assay work has not been performed at the laboratories since 2004.

Corporate Headquarters

The Company leases approximately 4,032 square feet of office space for its corporate headquarters on the second floor of the building known as the General Building located at 6001 North 91st Street, Milwaukee, Wisconsin, at a monthly rental charge of $2,789 on a month-to-month basis. The lessor is General Lumber & Supply Co., Inc. (“General Lumber”), a Wisconsin corporation. The Company’s President, Edward L. Machulak, owns 55% of the common stock of General Lumber. Edward L. Machulak disclaims any interest in the balance of General Lumber common stock which is owned by relatives, his wife, and a trust formed for the benefit of his children. In addition, the Company shares proportionately any increase in real property taxes and any increase in general fire and extended coverage insurance on the property. In lieu of cash payment, the Lessor has agreed to apply the monthly rental paym ents owed to the secured open-ended, on-demand promissory note(s) due to it.

Item 3. Legal Proceedings

There is no pending litigation in the United States. However, in the Republic of El Salvador, Central America, the Company’s El Salvadoran legal counsel on December 6, 2006, filed a complaint with the El Salvadoran Supreme Court Administrative Division claiming that the El Salvadoran Office of the Ministry of Environment and Natural Resources, (MARN) has revoked its El Salvadoran environmental permits for mining exploitation, without any prior notice, without a right to a hearing and without the right of due process, based on misguided assertions, and contrary to El Salvadoran law. In addition, the Company’s legal counsel stated that there is a lack of legal foundation for the sanctions and excess authority exercised by MARN. For more details, reference is made to page 12, “Environmental Matters.”

18

Item 4. Submission of Matters to a Vote of Security Holders

No matters were brought to a vote of security holders in the fourth quarter ended March 31, 2007.

Item 4(a). Executive Officers and Managers of the Company

Listed below are the names, ages and positions of the executive officers and managers of the Company and their business experience during the past five or more years. All officers are elected at the annual meeting of the directors, which is usually held after the annual shareholders’ meeting.

Name | Age as of March 31, 2007 | Executive Offices Held With Company (1) | Period Served In Office (2) |

Edward L. Machulak | 80 | President, Chief Executive, Operating and Financial Officer Treasurer |

9/14/62 to present 06/78 to present |

Edward A. Machulak (Son of the President) | 55 | Executive Vice President Secretary Assistant Secretary | 10/16/92 to present 1/12/87 to present 4/15/86 to 1/12/87 |

Luis A. Limay | 65 | Project and Mine Manager Manager of El Salvador Operations | 10/86 to 1995

03/95 to present |

(1)

There have never been any undisclosed arrangements or understandings between any Executive Officer and any other person pursuant to which any Executive Officer was elected as an Executive Officer.

(2)

Executive Officers are elected by the Directors for a term expiring at the Directors’ Annual Meeting and/or hold such positions until their successors have been elected and have qualified.

Family Relationships

Edward A. Machulak, presently a Director, Member of the Directors’ Executive Committee, Director-Emeritus, Executive Vice President, and Secretary, is the son of Edward L. Machulak, the Company’s Chairman of the Board of Directors who is also a Member of the Directors’ Executive Committee, and is the President and Treasurer of the Company. Attorney John E. Machulak (son of Edward L. Machulak) of the law firm of Machulak, Robertson & Sodos, S.C. is the legal counsel for the Company.

Officers’ and Key Management’s Experience

The business experience of each of the Directors, Officers, and Key Management is as follows: