Exhibit 99(c)(3)

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Project Oak Tree

Special Committee Update

[LOGO]

Champions of Growth

February 10, 2006

[LOGO]

Process Overview

Process Summary |

TWP and Oak Tree signed an engagement letter on June 28th, 2005

TWP conducted on site diligence at Oak Tree’s offices in Santa Barbara in late June

• Reviewed due diligence list for data room

• Discussed Tier I strategic and financial buyers

• Discussed financial performance and pipeline

Oak Tree and TWP finalized an initial list of potential buyers after several iterative discussions

• Detailed discussion around rationale, approach, strategy and call script “tailored” for each buyer

Prior to contacting any potential buyers, TWP drafted three documents

• “Teaser” – High level overview of the Company on a no names basis

• Mutual sell side NDA to be signed by a potential buyer prior to TWP’s releasing any non-public, confidential information

• Customized calling script for each buyer

Oak Tree pre-announced Q2-05 results on July 5th, 2005

• Stock fell 12%

• Given the weakness in the stock price and the impending summer slowdown, TWP and Oak Tree decided that it was not an appropriate time to initiate contact with potential buyers

[LOGO] | | Confidential – For Internal Purposes Only |

2

Between August and October 2005, Oak Tree share price continued to drop

• Announced Q2 results on August 9th

• Announced termination of Sprint contract on September 30th

In October 2005, Austin Ventures indicated that it may potentially be interested in submitting a proposal

• The BOD formed a Special Committee to continue the M&A process

TWP began contacting buyers in early November

• Initial list included 12 strategic and 8 financial buyers

• List was expanded to include additional 5 strategic and 4 financial buyers

• Four strategic buyers were contacted on a “no names” basis

3

Situation Analysis

LTM Price Performance |

• Oak Tree’s stock has exhibited continuous weakness over the past twelve months

Trading Summary

Average | | Current | | 1 Month | | 3 Months | | 6 Months | | 1 Year | |

Price | | $ | 4.11 | | $ | 3.98 | | $ | 4.12 | | $ | 4.03 | | $ | 6.76 | |

Volume (000s) | | 8 | | 20 | | 40 | | 30 | | 22 | |

| | | | | | | | | | | | | | | | |

[CHART]

Source: Factset Research Systems as of 2/8/06.

4

Process Overview

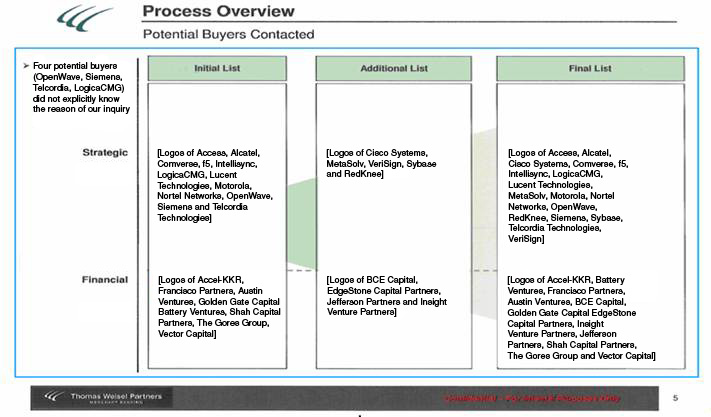

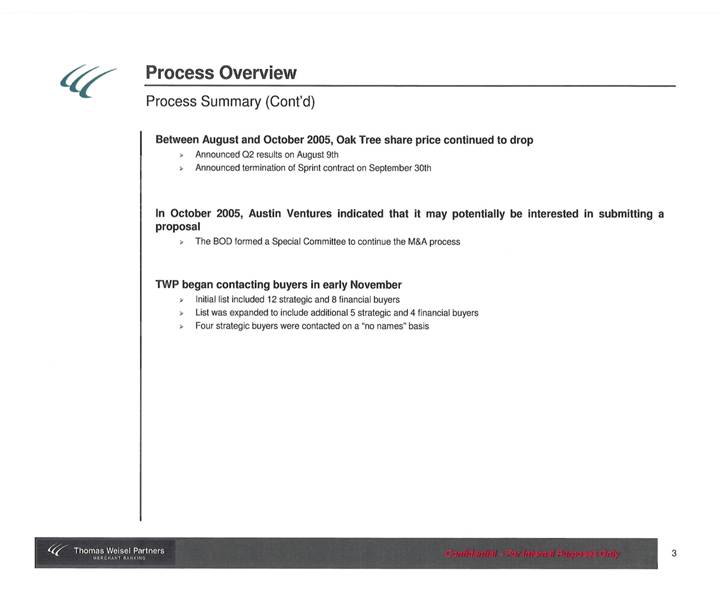

Potential Buyers Contacted

Four potential buyers (OpenWave, Siemens, Telcordia, LogicaCMG) did not explicitly know the reason of our inquiry

| | Initial List | | Additional List | | Final List | |

Strategic | | [Logos of Access, Alcatel, Comverse, f5, Intellisync, LogicaCMG, Lucent Technologies, Motorola, Nortel Networks, OpenWave, Siemens and Telcordia Technologies] | | [Logos of Cisco Systems, MetaSolv, VeriSign, Sybase and RedKnee] | | [Logos of Access, Alcatel, Cisco Systems, Comverse, f5, Intellisync, LogicaCMG, Lucent Technologies, MetaSolv, Motorola, Nortel Networks, OpenWave, RedKnee, Siemens, Sybase, Telcordia Technologies, VeriSign] | |

| | | | | | | |

Financial | | [Logos of Accel-KKR, Francisco Partners, Austin Ventures, Golden Gate Capital Battery Ventures, Shah Capital Partners, The Gores Group, Vector Capital] | | [Logos of BCE Capital, EdgeStone Capital Partners, Jefferson Partners and Insight Venture Partners] | | [Logos of Accel-KKR, Battery Ventures, Francisco Partners, Austin Ventures, BCE Capital, Golden Gate Capital EdgeStone Capital Partners, Insight Venture Partners, Jefferson Partners, Shah Capital Partners, The Gores Group and Vector Capital] | |

5

Potential Buyers Contract Summary

Strategic Buyers Contact Summary – Tier I

Names to Contact | | Made

Contact | | Sent

Teaser / NDA | | Decline | | NDA

Executed | | Mgmt.

Presentation | | Comments | |

Siemens | | | | | | | | | | | | Hold off for now. | |

Telcordia Technologies | | | | | | | | | | | | Potential meeting with Oak Tree next week. | |

| | | | | | | | | | | | | |

Total | 2 | | 0 | | 0 | | 0 | | 0 | | 0 | | | |

| | | | | | | | | | | | | | |

Declined

Names to Contact | | Made

Contact | | Sent

Teaser / NDA | | Decline | | NDA

Executed | | Mgmt.

Presentation | | Comments | |

ACCESS | | x | | | | x | | | | | | Implicit decline. | |

Alcatel | | x | | x | | x | | | | | | Implicit decline. | |

Comverse | | x | | x | | x | | | | | | Familiar with Oak Tree; focused on integrating Kenan acquisition; “Not the right time”. | |

F5 Networks | | x | | | | x | | | | | | Implicit decline. | |

Intellisync | | x | | x | | x | | | | | | Getting acquired by Nokia. | |

LogicaCMG | | x | | | | x | | | | | | Likely implicit decline - being reviewed by senior board members. | |

Lucent | | x | | x | | x | | | | | | Sector is generally of interest but prefer organic and other “viable” opportunities. | |

Motorola | | x | | x | | x | | | | | | Not interested; sector is of interest but “not the right time”. | |

Openwave | | x | | | | x | | | | | | Declined; Pursuing organic initiatives. | |

Nortel | | x | | x | | x | | | | | | Declined. | |

| | | | | | | | | | | | | |

Total | 9 | | 9 | | 6 | | 9 | | 0 | | 0 | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

6

Names to Contact | | Made

Contact | | Sent

Teaser / NDA | | Decline | | NDA

Executed | | Mgmt.

Presentation | | Comments | |

Austin Ventures | | x | | x | | | | x | | x | | Conference call held on 2/6/06. Will follow-up next week. | |

| | | | | | | | | | | | | |

Total | 1 | | 1 | | 1 | | 0 | | 1 | 0 | 1 | | | |

| | | | | | | | | | | | | | |

Declined

Names to Contact | | Made

Contact | | Sent

Teaser / NDA | | Decline | | NDA

Executed | | Mgmt.

Presentation | | Comments | |

Accel/KKR | | x | | x | | x | | | | | | Lack of scale; negative cash flow; might need additional investment. | |

Battery Ventures | | x | | x | | x | | | | | | Declined; Lack of scale | |

BCE Capital | | x | | | | x | | | | | | Focused on early stage. | |

Edgestone Capital Partners | | x | | x | | x | | | | | | Declined. | |

Francisco Partners | | x | | | | x | | | | | | Declined; lack of scale. | |

Garnett & Helfrich Capital | | x | | x | | x | | | | | | Declined; Busy integrating Ingres. | |

Golden Gate Capital | | x | | x | | x | | | | | | Declined. | |

Insight Venture Partners | | x | | x | | x | | | | | | Declined; Cited lack of QoQ growth as the primary reason. | |

Jefferson Partners | | x | | x | | x | | | | | | Focused on early stage opportunities in the near term. | |

Shah Capital | | x | | x | | x | | | | | | Subscale / negative cash flows / uncomfortable with using Oak Tree as a platform, given assumption that they’d likely need to complement with additional acquisitions. | |

The Gores Group | | x | | x | | x | | x | | x | | Declined; Lack of scale. | |

Vector Capital | | x | | x | | x | | | | | | Declined due to lack of scale. Take private economics are appealing only above a $40M run rate. | |

| | | | | | | | | | | | | |

Total | 12 | | 12 | | 10 | | 12 | | 1 | | 1 | | | |

| | | | | | | | | | | | | | |

7

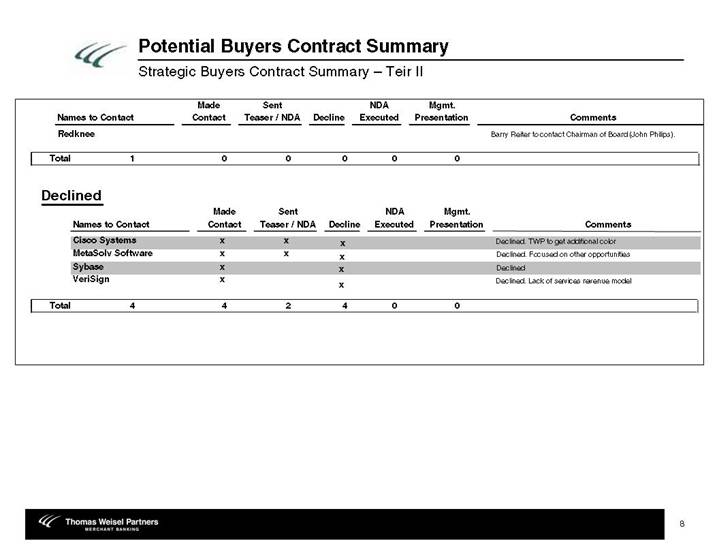

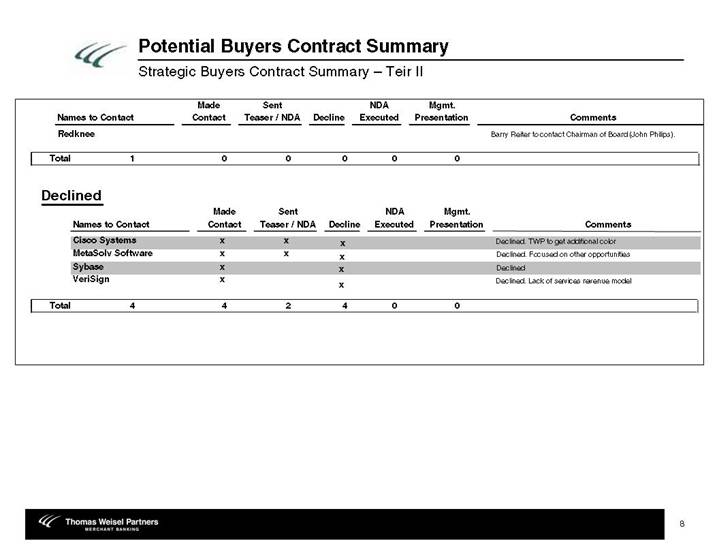

Potential Buyers Contract Summary

Strategic Buyers Contact Summary – Tier II

Names to Contact | | Made

Contact | | Sent

Teaser / NDA | | Decline | | NDA

Executed | | Mgmt.

Presentation | | Comments | |

Redknee | | | | | | | | | | | | Barry Reiter to contact Chairman of Board

(John Philips). | |

| | | | | | | | | | | | | |

Total | 1 | | 0 | | 0 | | 0 | | 0 | | 0 | | | |

| | | | | | | | | | | | | | |

Declined

Names to Contact | | Made

Contact | | Sent

Teaser / NDA | | Decline | | NDA

Executed | | Mgmt.

Presentation | | Comments | |

Cisco Systems | | x | | x | | x | | | | | | Declined. TWP to get additional color. | |

MetaSolv Software | | x | | x | | x | | | | | | Declined. Focused on other opportunities. | |

Sybase | | x | | | | x | | | | | | Declined. | |

VeriSign | | x | | | | x | | | | | | Declined. Lack of services revenue model. | |

| | | | | | | | | | | | | |

Total | 4 | | 4 | | 2 | | 4 | | 0 | | 0 | | | |

| | | | | | | | | | | | | | |

8

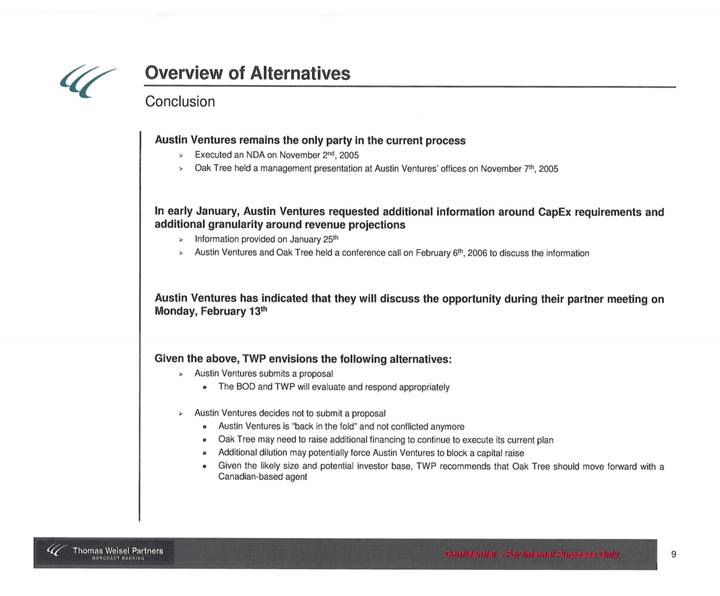

Overview of Alternatives

Conclusion |

Austin Ventures remains the only party in the current process

• Executed an NDA on November 2nd, 2005

• Oak Tree held a management presentation at Austin Ventures’ offices on November 7th, 2005

In early January, Austin Ventures requested additional information around CapEx requirements and additional granularity around revenue projections

• Information provided on January 25th

• Austin Ventures and Oak Tree held a conference call on February 6th, 2006 to discuss the information

Austin Ventures has indicated that they will discuss the opportunity during their partner meeting on Monday, February 13th

Given the above, TWP envisions the following alternatives:

• Austin Ventures submits a proposal

• The BOD and TWP will evaluate and respond appropriately

• Austin Ventures decides not to submit a proposal

• Austin Ventures is “back in the fold” and not conflicted anymore

• Oak Tree may need to raise additional financing to continue to execute its current plan

• Additional dilution may potentially force Austin Ventures to block a capital raise

• Given the likely size and potential investor base, TWP recommends that Oak Tree should move forward with a Canadian-based agent

9