UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09721

Allianz Global Investors Managed Accounts Trust

(Exact name of registrant as specified in charter)

| | |

| 1633 Broadway, New York, New York | | 10019 |

| (Address of principal executive offices) | | (Zip code) |

Lawrence G. Altadonna — 1633 Broadway, New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: October 31, 2012

Date of reporting period: October 31, 2012

ITEM1. REPORT TO SHAREHOLDERS

Annual Report

October 31, 2012

Allianz Global Investors Managed Accounts Trust

Fixed Income SHares: Series C, M, R, TE

Contents

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 1 | |

Hans W. Kertess

Chairman

Brian S. Shlissel

President & CEO

Dear Shareholder:

The U.S. economy expanded during the twelve-month fiscal reporting period ended October 31, 2012, however, growth slowed amid ongoing geopolitical and economic concerns in both the United States and abroad.

Twelve Months in Review

For the twelve-month fiscal reporting period ended October 31, 2012:

| • | | Fixed Income SHares: Series C returned 13.79% prior to the deduction of fees. |

| • | | Fixed Income SHares: Series M returned 12.23% prior to the deduction of fees. |

| • | | Fixed Income SHares: Series R returned 13.26% prior to the deduction of fees. |

| • | | Fixed Income SHares: Series TE returned 0.43% since its inception on June 26, 2012, prior to the deduction of fees. |

The fiscal reporting period began on a robust note, with gross domestic product (“GDP”), the value of goods and services produced in the country, the broadest measure of economic activity and the principal indicator of economic performance, expanding at an annual rate of 4.1%. This growth rate, the strongest since 2009, eased to a 2.0% annual pace in the first quarter of 2012, and to a 1.3% annual pace during the second quarter, before rebounding to a growth rate of 2.0% (preliminary estimate) during the third quarter.

Austerity in both the public and private sectors was the principal reason for the U.S. slowdown. The federal government and the majority of state and local governments cut back. Corporations grew cautious with concerns over slowing exports, profits leveling off, and uncertainty over future levels of federal taxes and spending.

Despite the slowdown, the economy showed signs of improvement. The U.S. unemployment rate dropped from 8.9% to 7.9% during the reporting period, consumer confidence reached its highest level since 2007 and the housing market showed signs of recovery.

The Federal Reserve (the “Fed”) revealed that it would launch a third round of “quantitative easing.” The Fed agreed to purchase $40 billion of mortgage securities

| | | | |

| 2 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

each month for the foreseeable future, the objective of which is to lower already record low mortgage rates in an effort to boost the housing market. The Fed also announced that it expected to keep the Fed Funds rate in the 0.0% to 0.25% range well into 2015, longer than previously forecasted.

Outlook

The U.S. election is over, however, the division of power that produced so much political gridlock in recent years remains. Republicans hold control of the House of Representatives, Democrats hold a majority in the Senate and President Obama was re-elected. The government must act prior to the end of the year in order to avoid the U.S. from falling off “the fiscal cliff,” a

series of expiring tax cuts and spending reductions scheduled to begin in January 2013. Higher taxes, reduced spending, or both, are likely to have a detrimental impact on the economy in 2013. The resolution remains uncertain; consequently, there are many reasons for caution going forward.

This caution also extends overseas, where the sovereign debt crisis in the European Union (“E.U.”) continues. Economic growth for the E.U. has ground to a halt and unemployment reached 11.6% in October 2012. Growth in China also slowed during the twelve-month fiscal period, however there are signs that a rebound may be underway.

Together with Allianz Global Investors Fund Management LLC, the Portfolios’ investment manager, and Pacific Investment Management Company LLC, the Portfolios’ sub-adviser, we thank you for investing with us.

We remain dedicated to serving your investment needs.

Sincerely,

| | |

| |  |

Hans W. Kertess Chairman | | Brian S. Shlissel President & CEO |

Receive this report electronically and eliminate paper mailings. To enroll, go to www.allianzinvestors.com/ edelivery.

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 3 | |

Allianz Global Investors Managed Accounts Trust

Fixed Income SHares: Series C, M, R, TE

Important Information

October 31, 2012 (unaudited)

In an economic environment where interest rates may trend upward, rising rates will negatively impact the performance of most bond funds and fixed income securities held by a fund and are likely to cause these instruments to decrease in value. Bond funds and individual bonds with a longer duration (a measure of the expected life of a security) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities with shorter durations.

Fixed Income SHares: Series C, M, R and TE (the “Portfolios”) may be subject to various risks as described in their prospectuses. Some of these risks may include, but are not limited to, the following: derivatives risk, foreign (non-U.S.) investment risk, high-yield security risk, counterparty risk and issuer non-diversification risk. The Portfolios may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks, such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a Portfolio could not close out a position when it would be most advantageous to do so. Portfolios investing in derivatives could lose more than the principal amount invested in these instruments. Investing in non-U.S. securities may entail risk due to non-U.S. economic, political and other developments. This risk may be enhanced when a Portfolio invests in emerging markets. High-yield bonds typically have a lower credit rating than other bonds. Lower rated bonds generally involve a greater risk to principal than higher rated bonds. Concentrating investments in individual sectors may add additional risk and volatility compared to a diversified Portfolio. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall Portfolio.

Allianz Global Investors Fund Management LLC (the “Investment Manager”) serves as the Portfolios’ Investment Manager and Pacific Investment Management Company LLC (“PIMCO” or the “Sub-Adviser”) serves as the sub-adviser. The Portfolios’ Investment Manager and Sub-Adviser have adopted written proxy voting policies and procedures (the “Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Portfolios as the policies and procedures that the Sub-Adviser will use when voting proxies on behalf of the Portfolios. Copies of the written Proxy Policy and the factors that the Sub-Adviser may consider in determining how to vote proxies for each Portfolio, and information about how each Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Portfolios’ shareholder servicing agent at (800) 628-1237, on the Allianz Global Investors Distributors’ website at www.allianzinvestors.com and on the Securities and Exchange Commission’s (the “SEC”) website at http://www.sec.gov.

Past performance is no guarantee of future results. Total return is calculated by subtracting the value of an investment in each Portfolio at the beginning of each specified period from its value at the end of the period and dividing the remainder by the value of the investment at the beginning of the period and expressing the result as a percentage. The calculation assumes that all income dividends and capital gain distributions, if any, have been reinvested. Total return does not reflect broker commissions or “wrap fee” charges. Total return for a period of more than one year represents the average annual total return during the period.

An investment in the Portfolios involves risk, including the loss of principal. Total return, distribution yield, net asset value and duration will fluctuate with changes in market conditions. The following data is provided for informational purposes only and is not intended for trading purposes. Net asset value is equal to total assets less total liabilities divided by the number of shares outstanding.

This report, including the financial information herein, is transmitted to the shareholders of Allianz Global Investors Managed Accounts Trust for their information. It is not a prospectus, circular or representation intended for use in the purchase of shares of the Portfolios or any other securities mentioned in this report.

| | | | |

| 4 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Allianz Global Investors Managed Accounts Trust

Fixed Income SHares: Series C Portfolio Insights

October 31, 2012 (unaudited)

| | | | |

| Symbol: | | Primary Investments: | | Inception Date: |

| FXICX | | Intermediate maturity fixed income securities | | 3/17/00 |

| | |

| | | | Net Assets: |

| | | | $4.0 billion |

| | |

| | | | Portfolio Manager: |

| | | | Curtis Mewbourne |

Performance, Statistics & Drivers

For the 12-months ended October 31, 2012, Series C returned 13.79%, prior to the deduction of fees, outperforming the unmanaged Barclays U.S. Credit Intermediate Index (the “benchmark index”), which returned 7.78% during the reporting period.

An overweighting to U.S. duration contributed positively to Series C’s performance. The 10-year U.S. Treasury yield fell 45 basis points during the 12-month reporting period amid concerns of a U.S. economic downturn and signs of a recession in Europe. Non-U.S. interest rate exposure, particularly to Australia and the U.K., also enhanced performance, as yields declined in these countries during the reporting period. An emphasis on the bonds of financial firms within the corporate debt market added to returns. Financial companies outpaced the broader investment grade corporate market, as the impact from ratings downgrades of U.S. banks was largely benign. An allocation to Build America Bonds enhanced returns as these securities outperformed Treasuries of similar duration. Modest exposure to non-agency mortgage-backed securities (“MBS”), which are not guaranteed by the government, contributed to performance as this sector was positively impacted by generally strong risk appetite during the 12-month reporting period. An allocation to emerging market debt, particularly Brazil and Mexico, was additive to returns as the markets reflected a more favorable short-term economic outlook and risk assets rallied amid supportive policy measures in the U.S. and Europe. Exposure to select currencies, including the Mexican peso and Canadian dollar, aided returns as these currencies rallied versus the U.S. dollar.

An overall underweighting to corporate bonds adversely impacted performance, as investors continued to seek higher yielding sectors as a result of continued low rates. Exposure to agency MBS detracted from returns as these securities underperformed the benchmark index.

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 5 | |

Allianz Global Investors Managed Accounts Trust

Fixed Income SHares: Series M Portfolio Insights

October 31, 2012 (unaudited)

| | | | |

| Symbol: | | Primary Investments: | | Inception Date: |

| FXIMX | | Intermediate maturity mortgage-backed

securities | | 3/17/00 |

| | |

| | | | Net Assets: |

| | | | $4.0 billion |

| | |

| | | | Portfolio Manager: |

| | | | Curtis Mewbourne |

Performance, Statistics & Drivers

For the 12-months ended October 31, 2012, Series M returned 12.23%, prior to the deduction of fees, outperforming the unmanaged Barclays U.S. MBS Fixed-Rate Index (the “benchmark index”), which returned 3.56% during the reporting period.

An overweighting to U.S. duration contributed positively to Series M’s performance. The 10-year U.S. Treasury yield fell 45 basis points during the 12-month reporting period amid concerns of a U.S. economic downturn and signs of a recession in Europe. Non-U.S. interest rate exposure, particularly to the U.K., also enhanced performance, as yields fell in most developed countries during the reporting period. Exposure to non-agency mortgage-backed securities (“MBS”), which are not guaranteed by the government, contributed to performance as this sector was positively impacted by generally strong risk appetite during the 12-month reporting period. An allocation to Build America Bonds enhanced returns as these securities outperformed the benchmark index during the period. Positions in investment-grade corporate bonds, particularly Financials, positively impacted performance as investors continued to seek higher yielding sectors in the continuing low interest rate environment. Exposure to emerging market corporate debt, especially to countries such as South Korea and Mexico, was beneficial to returns.

Exposure to U.S. interest rates through Treasuries detracted from returns as this sector underperformed the benchmark index during the 12-month reporting period.

| | | | |

| 6 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Allianz Global Investors Managed Accounts Trust

Fixed Income SHares: Series R Portfolio Insights

October 31, 2012 (unaudited)

| | | | |

| Symbol: | | Primary Investments: | | Inception Date: |

| FXIRX | | Inflation-indexed fixed income securities | | 4/15/04 |

| | |

| | | | Net Assets: |

| | | | $602.7 million |

| | |

| | | | Portfolio Manager: |

| | | | Mihir Worah |

Performance, Statistics & Drivers

For the 12-months ended October 31, 2012, Series R returned 13.26%, prior to the deduction of fees, outperforming the unmanaged Barclays U.S. TIPS Index (the “benchmark index”), which returned 8.03% during the reporting period.

An overall overweighting to investment-grade corporate bonds positively impacted performance as investors continued to seek higher yielding sectors in the continuing low interest rate environment. An allocation to Brazilian nominal rates added to performance as these securities posted strong returns as real rates continued to fall in the country. A modest exposure to non-agency mortgage-backed securities (“MBS”), which are not guaranteed by the government, contributed to performance as this sector was positively impacted by generally strong risk appetite during the 12-month reporting period. Exposure to emerging market credits, particularly Brazilian corporate securities, was positive for performance. Exposure to real rates in Australia and Italy was positive for performance as real yields rallied in these countries.

An underweight to U.S. real duration detracted from performance as breakeven inflation levels widened.

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 7 | |

Allianz Global Investors Managed Accounts Trust

Fixed Income SHares: Series TE Portfolio Insights

October 31, 2012 (unaudited)

| | | | |

| Symbol: | | Primary Investments: | | Inception Date: |

| FXIEX | | High yield municipal securities | | 6/26/12 |

| | |

| | | | Net Assets: |

| | | | $9.5 million |

| | |

| | | | Portfolio Manager: |

| | | | Curtis Mewbourne |

Performance, Statistics & Drivers

From its inception on June 26, 2012 through October 31, 2012, Series TE returned 0.43%, prior to the deduction of fees, outperforming the unmanaged Barclays Municipal Bond 1-Year Index (the “benchmark index”), which returned 0.25% during the same period.

An overweighting to U.S. duration contributed to Series TE’s performance as municipal yields fell across the curve. An emphasis on revenue bonds versus general obligation bonds was positive for performance as revenue bonds outperformed general obligation securities during the reporting period. An overweighting to special-tax and corporate-backed sectors contributed to returns as these sectors outperformed the broader municipal market.

An underweighting to pre-refunded municipal securities detracted from performance as they outperformed the benchmark index during the reporting period. An allocation to the Health Care sector was also a drag on performance during the reporting period.

| | | | |

| 8 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Allianz Global Investors Managed Accounts Trust

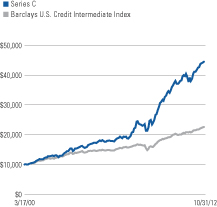

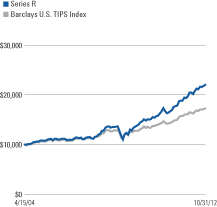

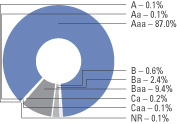

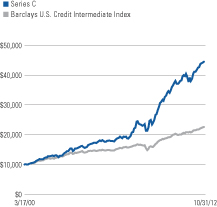

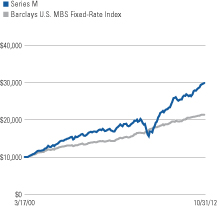

Fixed Income SHares: Series C Performance & Statistics

October 31, 2012 (unaudited)

| | | | | | | | | | | | | | | | |

| Total Returns (Period ended 10/31/12) | | 1 Year | | | 5 Years | | | 10 Years | | | Since Inception

(3/17/00) | |

Series C | | | 13.79% | | | | 16.44% | | | | 13.14% | | | | 12.55% | |

Barclays U.S. Credit Intermediate Index | | | 7.78% | | | | 6.92% | | | | 5.93% | | | | 6.65% | |

Change in Value of $10,000 Investments in

Series C and the Barclays U.S. Credit

Intermediate Index

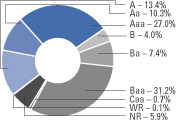

Moody’s Ratings

(as a % of total investments,

before options written and securities sold short)

Past performance is no guarantee of future results. Returns presented do not reflect the deduction of taxes that a shareholder would pay on fund distribution or the redemption of fund shares.

| | | | |

| Shareholder Expense Example | | Actual | | Hypothetical |

| | | | | (5 % return before expenses) |

Beginning Account Value (5/1/12) | | $1,000.00 | | $1,000.00 |

Ending Account Value (10/31/12) | | $1,064.00 | | $1,025.13 |

Expenses Paid During Period | | $0.01 | | $0.01 |

Expenses are equal to the annualized expense ratio of 0.002%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 9 | |

Allianz Global Investors Managed Accounts Trust

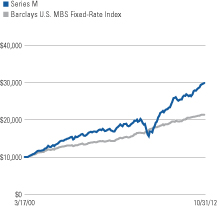

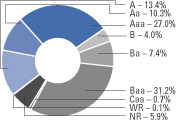

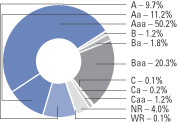

Fixed Income SHares: Series M Performance & Statistics

October 31, 2012 (unaudited)

| | | | | | | | | | | | | | | | |

| Total Returns (Period ended 10/31/12) | | 1 Year | | | 5 Years | | | 10 Years | | | Since Inception

(3/17/00) | |

Series M | | | 12.23% | | | | 9.11% | | | | 7.55% | | | | 9.06% | |

Barclays U.S. MBS Fixed-Rate Index | | | 3.56% | | | | 6.17% | | | | 5.22% | | | | 6.17% | |

Change in Value of $10,000 Investments in Series M and the Barclays U.S. MBS Fixed-Rate Index

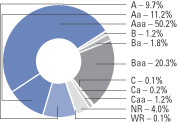

Moody’s Ratings

(as a % of total investments,

before options written)

Past performance is no guarantee of future results. Returns presented do not reflect the deduction of taxes that a shareholder would pay on fund distribution or the redemption of fund shares.

| | | | |

| Shareholder Expense Example | | Actual | | Hypothetical |

| | | | | (5 % return before expenses) |

Beginning Account Value (5/1/12) | | $1,000.00 | | $1,000.00 |

Ending Account Value (10/31/12) | | $1,057.00 | | $1,025.13 |

Expenses Paid During Period | | $0.00 | | $0.00 |

Expenses are equal to the annualized expense ratio of 0.0008%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| | | | |

| 10 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Allianz Global Investors Managed Accounts Trust

Fixed Income SHares: Series R Performance & Statistics

October 31, 2012 (unaudited)

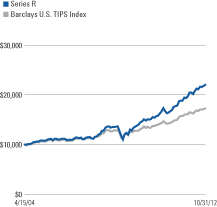

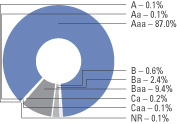

| | | | | | | | | | | | |

| Total Returns (Period ended 10/31/12) | | 1 Year | | | 5 Years | | | Since Inception

(4/15/04) | |

Series R | | | 13.26% | | | | 12.58% | | | | 9.68% | |

Barclays U.S. TIPS Index | | | 8.03% | | | | 7.88% | | | | 6.64% | |

Change in Value of $10,000 Investments in Series R and the Barclays U.S. TIPS Index

Moody’s Ratings

(as a % of total investments,

before options written )

Past performance is no guarantee of future results. Returns presented do not reflect the deduction of taxes that a shareholder would pay on fund distribution or the redemption of fund shares.

| | | | |

| Shareholder Expense Example | | Actual | | Hypothetical |

| | | | | (5 % return before expenses) |

Beginning Account Value (5/1/12) | | $1,000.00 | | $1,000.00 |

Ending Account Value (10/31/12) | | $1,059.30 | | $1,024.94 |

Expenses Paid During Period | | $0.21 | | $0.20 |

Expenses are equal to the annualized expense ratio of 0.04%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 11 | |

Allianz Global Investors Managed Accounts Trust

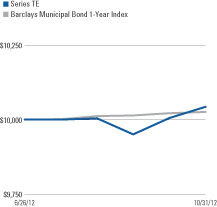

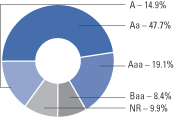

Fixed Income SHares: Series TE Performance & Statistics

October 31, 2012 (unaudited)

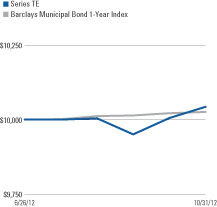

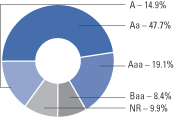

| | | | |

| Total Returns (Period ended 10/31/12) | | Since Inception

(6/26/12) | |

Series TE | | | 0.43% | |

Barclays Municipal Bond 1-Year Index | | | 0.25% | |

Change in Value of $10,000 Investments in

Series TE and the Barclays Municipal Bond 1-Year Index

Moody’s Ratings

(as a % of total investments)

Past performance is no guarantee of future results. Returns presented do not reflect the deduction of taxes that a shareholder would pay on fund distribution or the redemption of fund shares.

| | | | |

| Shareholder Expense Example | | Actual | | Hypothetical |

| | | | | (5 % return before expenses) |

Beginning Account Value (6/26/12)* | | $1,000.00 | | $1,000.00 |

Ending Account Value (10/31/12) | | $1,004.30 | | $1,025.14 |

Expenses Paid During Period | | $0.00 | | $0.00 |

| * | | Series TE commenced operations on June 26, 2012. The Actual expense example is based on the period since inception; the Hypothetical expense example is based on the period beginning May 1, 2012. |

Expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 127/366 for the Actual expense example and 184/366 for the Hypothetical expense example.

| | | | |

| 12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Allianz Global Investors Managed Accounts Trust

Benchmark Descriptions

October 31, 2012 (unaudited)

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Index/Description

| • | | Barclays Municipal Bond 1-Year Index |

The Barclays Municipal Bond 1-Year Index is an unmanaged index comprised of national municipal bond issues having a maturity of at least one year and less than two years.

| • | | Barclays U.S. Credit Intermediate Index |

The Barclays U.S. Credit Intermediate Index is an unmanaged index of publicly issued U.S. corporate and specified foreign debentures and secured notes with intermediate maturities ranging from 1 to 10 years. Securities must also meet specific liquidity and quality requirements.

| • | | Barclays U.S. MBS Fixed-Rate Index |

The Barclays U.S. MBS Fixed-Rate Index is an unmanaged index comprised of fixed rate mortgage pass through securities issued by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC), with a Weighted Average Maturity (WAM) of at least one year and at least $250 million par outstanding.

| • | | Barclays U.S. TIPS Index |

The Barclays U.S. TIPS Index is an unmanaged market index comprised of all U.S. Treasury Inflation Protected Securities rated investment grade (Baa3 or better), having at least one year to final maturity, and at least $250 million par amount outstanding. Performance data for this index prior to October 1997 represents returns of the Barclays Inflation Notes Index.

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 13 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| CORPORATE BONDS & NOTES–50.2% | | | | |

| | | | | | | | | | |

| | | | Airlines–1.0% | | | | | | |

| $ | 86 | | | American Airlines Pass Through Trust, 10.375%, 1/2/21 | | | | $ | 90,931 | |

| | | | Northwest Airlines, Inc., | | | | | | |

| | 1,365 | | | 7.041%, 10/1/23 | | | | | 1,523,407 | |

| | 37,571 | | | 7.15%, 4/1/21, (MBIA) | | | | | 40,107,252 | |

| | 50 | | | United Air Lines Pass Through Trust, 10.125%, 3/22/15 (b)(f) | | | | | 31,378 | |

| | | | | | | | | | |

| | | | | | | | | 41,752,968 | |

| | | | | | | | | | |

| | | |

| | | | Automotive–0.3% | | | | | | |

| | 9,100 | | | Volkswagen International Finance NV, 4.00%, 8/12/20 (a)(d) | | | | | 10,128,245 | |

| | | | | | | | | | |

| | | |

| | | | Banking–6.7% | | | | | | |

| | 16,200 | | | Abbey National Treasury Services PLC, 1.893%, 4/25/14 (j) | | | | | 16,174,987 | |

| | 5,000 | | | American Express Bank FSB, 5.50%, 4/16/13 | | | | | 5,116,435 | |

| | 5,200 | | | Banco do Brasil S.A., 4.50%, 1/22/15 (a)(d) | | | | | 5,486,000 | |

| | | | Banco Santander Brasil S.A., | | | | | | |

| | 1,000 | | | 4.50%, 4/6/15 | | | | | 1,037,500 | |

| | 3,500 | | | 4.50%, 4/6/15 (a)(d) | | | | | 3,631,250 | |

| | 30,200 | | | Banco Santander Brasil S.A., 2.485%, 3/18/14 (a)(d)(j) | | | | | 29,747,242 | |

| | | | Barclays Bank PLC, | | | | | | |

| | 24,000 | | | 6.05%, 12/4/17 (a)(b)(d)(o) (acquisition cost–$20,582,878; purchased 12/7/07-4/24/09) | | | | | 26,317,440 | |

| £ | 3,300 | | | 14.00%, 6/15/19 (i) | | | | | 6,890,393 | |

| $ | 23,900 | | | BPCE S.A., 2.189%, 2/7/14 (a)(b)(d)(j)(o)

(acquisition cost–$23,863,194; purchased 1/31/11) | | | | | 24,181,207 | |

| AUD | 2,600 | | | Commonwealth Bank of Australia, 4.50%, 2/20/14 | | | | | 2,749,340 | |

| $ | 20,000 | | | Cooperatieve Centrale Raiffeisen-Boerenleenbank BA,

11.00%, 6/30/19 (a)(b)(d)(i)(o)

(acquisition cost–$21,080,262; purchased 5/29/09-7/16/09) | | | | | 26,907,580 | |

| | 5,000 | | | HBOS Capital Funding L.P., 6.071%, 6/30/14 (a)(b)(d)(i)(o)

(acquisition cost–$5,332,000; purchased 7/20/05) | | | | | 4,137,500 | |

| | 30,600 | | | HBOS PLC, 6.75%, 5/21/18 (a)(b)(d)(o)

(acquisition cost–$30,472,704; purchased 5/15/08) | | | | | 32,589,000 | |

| | | | HSBC Capital Funding L.P. (a)(d)(i), | | | | | | |

| | 13,900 | | | 4.61%, 6/27/13 | | | | | 13,896,497 | |

| | 1,350 | | | 10.176%, 6/30/30 (b)(o) (acquisition cost–$1,545,528; purchased 5/30/02-10/10/08) | | | | | 1,863,000 | |

| | | | ICICI Bank Ltd., | | | | | | |

| | 5,900 | | | 4.75%, 11/25/16 (a)(d) | | | | | 6,200,516 | |

| | 2,500 | | | 5.00%, 1/15/16 | | | | | 2,634,505 | |

| | 700 | | | 5.50%, 3/25/15 | | | | | 739,283 | |

| | 900 | | | Korea Exchange Bank, 4.875%, 1/14/16 | | | | | 978,381 | |

| | 29,300 | | | Lloyds TSB Bank PLC, 12.00%, 12/16/24 (a)(d)(i) | | | | | 32,749,841 | |

| | | | |

| 14 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Banking (continued) | | | | | | |

| $ | 2,400 | | | RBS Capital Trust I, 4.709%, 7/1/13 (i) | | | | $ | 1,671,000 | |

| | | | State Bank of India, | | | | | | |

| | 1,300 | | | 4.50%, 10/23/14 | | | | | 1,352,295 | |

| | 1,000 | | | 4.50%, 7/27/15 (a)(d) | | | | | 1,050,694 | |

| AUD | 20,000 | | | Westpac Banking Corp., 4.75%, 3/5/14 | | | | | 21,232,746 | |

| | | | | | | | | | |

| | | | | | | | | 269,334,632 | |

| | | | | | | | | | |

| | | |

| | | | Biotechnology–0.1% | | | | | | |

| $ | 1,700 | | | Amgen, Inc., 5.70%, 2/1/19 | | | | | 2,048,000 | |

| | | | | | | | | | |

| | | |

| | | | Computers–0.1% | | | | | | |

| | 5,000 | | | Lexmark International, Inc., 5.90%, 6/1/13 | | | | | 5,109,440 | |

| | | | | | | | | | |

| | | |

| | | | Diversified Manufacturing–0.4% | | | | | | |

| | 15,000 | | | Tyco Electronics Group S.A., 6.55%, 10/1/17 | | | | | 17,980,245 | |

| | | | | | | | | | |

| | | |

| | | | Drugs & Medical Products–0.3% | | | | | | |

| | 1,800 | | | Abbott Laboratories, 5.125%, 4/1/19 | | | | | 2,173,484 | |

| | 100 | | | Biomet, Inc., 10.00%, 10/15/17 | | | | | 105,625 | |

| | 3,400 | | | GlaxoSmithKline Capital, Inc., 5.65%, 5/15/18 | | | | | 4,182,520 | |

| | 1,700 | | | Hospira, Inc., 6.05%, 3/30/17 | | | | | 1,996,670 | |

| | 1,300 | | | Pfizer, Inc., 6.20%, 3/15/19 | | | | | 1,665,441 | |

| | | | | | | | | | |

| | | | | | | | | 10,123,740 | |

| | | | | | | | | | |

| | | |

| | | | Financial Services–20.3% | | | | | | |

| | | | Ally Financial, Inc., | | | | | | |

| | 13,894 | | | 2.618%, 12/1/14 (j) | | | | | 13,689,619 | |

| | 21,075 | | | 3.779%, 6/20/14 (j) | | | | | 21,649,715 | |

| | 16,700 | | | 4.625%, 6/26/15 | | | | | 17,358,681 | |

| | 1,000 | | | 6.75%, 12/1/14 | | | | | 1,075,692 | |

| | 10,500 | | | 7.50%, 12/31/13 | | | | | 11,169,375 | |

| | 17,300 | | | 8.00%, 3/15/20 | | | | | 20,718,480 | |

| | 19,100 | | | 8.30%, 2/12/15 | | | | | 21,444,525 | |

| | 11,000 | | | American Express Co., 7.25%, 5/20/14 | | | | | 12,088,461 | |

| | | | Bank of America Corp., | | | | | | |

| | 3,800 | | | 5.65%, 5/1/18 | | | | | 4,427,536 | |

| | 4,300 | | | 5.75%, 12/1/17 | | | | | 4,984,212 | |

| | 2,715 | | | 6.00%, 9/1/17 | | | | | 3,172,423 | |

| | | | Bear Stearns Cos. LLC, | | | | | | |

| | 1,500 | | | 5.30%, 10/30/15 | | | | | 1,677,609 | |

| | 17,265 | | | 7.25%, 2/1/18 | | | | | 21,499,069 | |

| | 39,800 | | | BNP Paribas S.A., 5.00%, 1/15/21 | | | | | 44,189,860 | |

| | 2,300 | | | BRFkredit A/S, 2.05%, 4/15/13 (a)(d) | | | | | 2,318,706 | |

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 15 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Financial Services (continued) | | | | | | |

| $ | 5,700 | | | Caterpillar Financial Services Corp., 7.15%, 2/15/19 | | | | $ | 7,572,912 | |

| | | | Citigroup, Inc., | | | | | | |

| | 12,350 | | | 4.75%, 5/19/15 | | | | | 13,391,895 | |

| | 700 | | | 5.50%, 4/11/13 | | | | | 714,828 | |

| | 700 | | | 5.50%, 10/15/14 | | | | | 756,545 | |

| | 11,718 | | | 6.00%, 8/15/17 | | | | | 13,802,843 | |

| | 13,500 | | | 6.125%, 11/21/17 | | | | | 16,024,500 | |

| | | | Ford Motor Credit Co. LLC, | | | | | | |

| | 49,300 | | | 5.625%, 9/15/15 | | | | | 54,042,364 | |

| | 16,900 | | | 7.00%, 10/1/13 | | | | | 17,830,768 | |

| | 20,750 | | | 8.00%, 6/1/14 | | | | | 22,654,663 | |

| | 7,900 | | | 8.00%, 12/15/16 | | | | | 9,583,790 | |

| | 2,700 | | | 8.125%, 1/15/20 | | | | | 3,439,344 | |

| | 3,400 | | | 8.70%, 10/1/14 | | | | | 3,834,054 | |

| | | | General Electric Capital Corp., | | | | | | |

| € | 10,000 | | | 4.625%, 9/15/66, (converts to FRN on 9/15/16) (a)(d) | | | | | 12,378,227 | |

| € | 19,100 | | | 5.50%, 9/15/67, (converts to FRN on 9/15/17) | | | | | 24,620,293 | |

| $ | 5,000 | | | 6.15%, 8/7/37 | | | | | 6,403,095 | |

| £ | 1,400 | | | 6.50%, 9/15/67, (converts to FRN on 9/15/17) | | | | | 2,303,869 | |

| | | | Goldman Sachs Group, Inc., | | | | | | |

| € | 10,000 | | | 0.668%, 5/23/16 (j) | | | | | 12,316,776 | |

| $ | 15,200 | | | 6.15%, 4/1/18 | | | | | 17,813,138 | |

| | 2,000 | | | HSBC Finance Corp., 0.848%, 6/1/16 (j) | | | | | 1,926,020 | |

| | | | HSBC Holdings PLC, | | | | | | |

| | 700 | | | 6.50%, 5/2/36 | | | | | 857,842 | |

| | 400 | | | 7.625%, 5/17/32 | | | | | 520,610 | |

| | | | International Lease Finance Corp. (a)(d), | | | | | | |

| | 4,000 | | | 6.75%, 9/1/16 | | | | | 4,540,000 | |

| | 3,000 | | | 7.125%, 9/1/18 | | | | | 3,540,000 | |

| | 14,800 | | | JPMorgan Chase & Co., 6.00%, 1/15/18 | | | | | 17,626,726 | |

| | | | LBG Capital No.1 PLC, | | | | | | |

| € | 2,825 | | | 7.375%, 3/12/20 | | | | | 3,505,271 | |

| £ | 9,402 | | | 7.588%, 5/12/20 | | | | | 15,137,573 | |

| £ | 1,000 | | | 7.869%, 8/25/20 | | | | | 1,619,397 | |

| $ | 3,400 | | | 7.875%, 11/1/20 (a)(b)(d)(o) | | | | | | |

| | | | (acquisition cost–$2,788,000; purchased 12/7/09) | | | | | 3,527,500 | |

| | 22,200 | | | 8.50%, 12/17/21 (a)(b)(d)(i)(o) | | | | | | |

| | | | (acquisition cost–$22,200,000; purchased 9/22/05-5/10/07) | | | | | 20,646,000 | |

| | | | LBG Capital No.2 PLC, | | | | | | |

| £ | 2,331 | | | 9.00%, 12/15/19 | | | | | 3,808,444 | |

| | | | |

| 16 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Financial Services (continued) | | | | | | |

| £ | 4,500 | | | 9.334%, 2/7/20 | | | | $ | 7,566,870 | |

| € | 2,180 | | | 15.00%, 12/21/19 | | | | | 3,750,992 | |

| | | | Merrill Lynch & Co., Inc., | | | | | | |

| $ | 500 | | | 5.00%, 1/15/15 | | | | | 537,425 | |

| | 200 | | | 6.15%, 4/25/13 | | | | | 204,988 | |

| | 22,700 | | | 6.40%, 8/28/17 | | | | | 26,785,092 | |

| | 40,100 | | | 6.875%, 4/25/18 | | | | | 48,452,269 | |

| | | | Morgan Stanley, | | | | | | |

| € | 10,000 | | | 0.63%, 1/16/17 (j) | | | | | 12,005,545 | |

| $ | 15,700 | | | 1.293%, 4/29/13 (j) | | | | | 15,730,788 | |

| | 2,800 | | | 5.375%, 10/15/15 | | | | | 3,053,924 | |

| € | 5,000 | | | 5.375%, 8/10/20 | | | | | 7,125,018 | |

| $ | 900 | | | 5.95%, 12/28/17 | | | | | 1,022,088 | |

| | 3,700 | | | 6.625%, 4/1/18 | | | | | 4,306,571 | |

| £ | 550 | | | MUFG Capital Finance 5 Ltd., 6.299%, 1/25/17 (i) | | | | | 972,324 | |

| $ | 1,000 | | | Novatek Finance Ltd., 5.326%, 2/3/16 (a)(d) | | | | | 1,078,920 | |

| | 528 | | | Preferred Term Securities XIII Ltd., 0.939%, 3/24/34 (a)(b)(d)(j)(o) | | | | | | |

| | | | (acquisition cost–$528,393; purchased 3/9/04) | | | | | 359,307 | |

| | 1,500 | | | Qatari Diar Finance QSC, 5.00%, 7/21/20 | | | | | 1,755,000 | |

| | 500 | | | QNB Finance Ltd., 3.125%, 11/16/15 | | | | | 523,500 | |

| | | | Royal Bank of Scotland Group PLC, | | | | | | |

| | 273 | | | 5.00%, 11/12/13 | | | | | 279,825 | |

| | 22,200 | | | 6.99%, 10/5/17 (a)(b)(d)(i)(o) | | | | | | |

| | | | (acquisition cost–$22,553,947; purchased 10/25/07-10/26/07) | | | | | 20,368,500 | |

| | 5,000 | | | 7.648%, 9/30/31 (i) | | | | | 4,975,000 | |

| € | 1,000 | | | Royal Bank of Scotland PLC, | | | | | | |

| | | | 4.625%, 9/22/21, (converts to FRN on 9/22/16) | | | | | 1,199,943 | |

| | | | RSHB Capital S.A. for OJSC Russian Agricultural Bank, | | | | | | |

| $ | 500 | | | 7.125%, 1/14/14 | | | | | 530,650 | |

| | 1,500 | | | 9.00%, 6/11/14 (a)(d) | | | | | 1,659,855 | |

| | | | SLM Corp., | | | | | | |

| € | 2,950 | | | 0.582%, 6/17/13 (j) | | | | | 3,785,660 | |

| £ | 500 | | | 4.875%, 12/17/12 | | | | | 810,941 | |

| $ | 750 | | | 5.00%, 10/1/13 | | | | | 778,125 | |

| | 11,200 | | | 5.375%, 1/15/13 | | | | | 11,274,816 | |

| | 400 | | | 5.375%, 5/15/14 | | | | | 420,514 | |

| | 36,000 | | | 6.25%, 1/25/16 | | | | | 39,061,800 | |

| | 9,555 | | | 8.45%, 6/15/18 | | | | | 11,403,224 | |

| | | | Teco Finance, Inc., | | | | | | |

| | 983 | | | 6.572%, 11/1/17 | | | | | 1,192,828 | |

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 17 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Financial Services (continued) | | | | | | |

| $ | 2,000 | | | 6.75%, 5/1/15 | | | | $ | 2,268,310 | |

| | 7,700 | | | TNK-BP Finance S.A., 7.50%, 3/13/13 | | | | | 7,888,188 | |

| | 6,800 | | | TransCapitalInvest Ltd. for OJSC AK Transneft, 5.67%, 3/5/14 | | | | | 7,196,644 | |

| | | | UBS AG, | | | | | | |

| | 500 | | | 4.875%, 8/4/20 | | | | | 574,678 | |

| | 1,000 | | | 5.875%, 12/20/17 | | | | | 1,184,142 | |

| | 6,700 | | | USB Capital IX, 3.50%, 11/30/12 (i) | | | | | 6,022,496 | |

| | 2,050 | | | Wachovia Corp., 5.75%, 2/1/18 | | | | | 2,475,955 | |

| | 19,217 | | | Wells Fargo & Co., 7.98%, 3/15/18 (i) | | | | | 22,796,166 | |

| | 4,200 | | | White Nights Finance BV for Gazprom, 10.50%, 3/25/14 | | | | | 4,670,106 | |

| | 7,400 | | | Xstrata Finance Canada Ltd., 5.80%, 11/15/16 (a)(d) | | | | | 8,391,149 | |

| | | | | | | | | | |

| | | | | | | | | 814,643,386 | |

| | | | | | | | | | |

| | | |

| | | | Food & Beverage–0.2% | | | | | | |

| | 6,700 | | | Mondelez International, Inc., 6.50%, 8/11/17 | | | | | 8,280,932 | |

| | 1,100 | | | Tate & Lyle International Finance PLC, 6.625%, 6/15/16 (a)(b)(d)(o) | | | | | | |

| | | | (acquisition cost–$957,637; purchased 3/12/09) | | | | | 1,261,901 | |

| | | | | | | | | | |

| | | | | | | | | 9,542,833 | |

| | | | | | | | | | |

| | | |

| | | | Healthcare & Hospitals–0.2% | | | | | | |

| | | | HCA, Inc., | | | | | | |

| | 3,200 | | | 7.25%, 9/15/20 | | | | | 3,556,000 | |

| | 4,000 | | | 7.875%, 2/15/20 | | | | | 4,490,000 | |

| | | | | | | | | | |

| | | | | | | | | 8,046,000 | |

| | | | | | | | | | |

| | | |

| | | | Holding Companies–0.2% | | | | | | |

| | | | Hutchison Whampoa International Ltd., | | | | | | |

| | 100 | | | 5.75%, 9/11/19 | | | | | 120,159 | |

| | 1,000 | | | 7.625%, 4/9/19 | | | | | 1,290,536 | |

| | 6,300 | | | Sinochem Overseas Capital Co., Ltd., 4.50%, 11/12/20 (a)(d) | | | | | 6,815,233 | |

| | | | | | | | | | |

| | | | | | | | | 8,225,928 | |

| | | | | | | | | | |

| | | |

| | | | Insurance–4.3% | | | | | | |

| | | | American International Group, Inc., | | | | | | |

| | 1,900 | | | 3.65%, 1/15/14 | | | | | 1,957,460 | |

| | 7,600 | | | 5.05%, 10/1/15 | | | | | 8,387,079 | |

| | 2,000 | | | 5.45%, 5/18/17 | | | | | 2,293,660 | |

| | 900 | | | 5.60%, 10/18/16 | | | | | 1,032,149 | |

| | 30,600 | | | 5.85%, 1/16/18 | | | | | 35,819,564 | |

| | 17,200 | | | 6.25%, 5/1/36 | | | | | 22,273,759 | |

| £ | 1,456 | | | 6.765%, 11/15/17 | | | | | 2,757,841 | |

| € | 5,557 | | | 6.797%, 11/15/17 | | | | | 8,659,521 | |

| | | | |

| 18 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Insurance (continued) | | | | | | |

| $ | 70,000 | | | 8.25%, 8/15/18 | | | | $ | 91,112,420 | |

| | | | | | | | | | |

| | | | | | | | | 174,293,453 | |

| | | | | | | | | | |

| | | |

| | | | Metals & Mining–0.9% | | | | | | |

| | 2,900 | | | CSN Islands XI Corp., 6.875%, 9/21/19 (a)(d) | | | | | 3,356,750 | |

| | | | Gerdau Holdings, Inc., | | | | | | |

| | 3,950 | | | 7.00%, 1/20/20 | | | | | 4,664,950 | |

| | 11,800 | | | 7.00%, 1/20/20 (a)(d) | | | | | 13,935,800 | |

| | 1,000 | | | Gerdau Trade, Inc., 5.75%, 1/30/21 (a)(d) | | | | | 1,120,500 | |

| | 5,000 | | | Gold Fields Orogen Holding BVI Ltd., 4.875%, 10/7/20 (a)(d) | | | | | 4,951,925 | |

| | 1,600 | | | Newmont Mining Corp., 5.125%, 10/1/19 | | | | | 1,856,790 | |

| | 800 | | | Teck Resources Ltd., 4.50%, 1/15/21 | | | | | 862,264 | |

| | | | Vale Overseas Ltd., | | | | | | |

| | 2,790 | | | 6.875%, 11/10/39 | | | | | 3,477,105 | |

| | 2,000 | | | 8.25%, 1/17/34 | | | | | 2,724,204 | |

| | | | | | | | | | |

| | | | | | | | | 36,950,288 | |

| | | | | | | | | | |

| | | |

| | | | Multi-Media–1.9% | | | | | | |

| | 1,000 | | | Comcast Cable Communications LLC, 7.125%, 6/15/13 | | | | | 1,040,113 | |

| | | | Comcast Corp., | | | | | | |

| | 10,600 | | | 5.875%, 2/15/18 | | | | | 12,945,070 | |

| | 1,700 | | | 5.90%, 3/15/16 | | | | | 1,977,144 | |

| | 700 | | | 6.30%, 11/15/17 | | | | | 869,846 | |

| | | | CSC Holdings LLC, | | | | | | |

| | 7,850 | | | 7.625%, 7/15/18 | | | | | 9,125,625 | |

| | 810 | | | 7.875%, 2/15/18 | | | | | 943,650 | |

| | 7,500 | | | 8.625%, 2/15/19 | | | | | 8,925,000 | |

| | | | DISH DBS Corp., | | | | | | |

| | 3,700 | | | 7.00%, 10/1/13 | | | | | 3,880,375 | |

| | 4,200 | | | 7.125%, 2/1/16 | | | | | 4,714,500 | |

| | 19,200 | | | 7.75%, 5/31/15 | | | | | 21,696,000 | |

| | | | Time Warner Cable, Inc., | | | | | | |

| | 6,940 | | | 5.85%, 5/1/17 | | | | | 8,309,533 | |

| | 1,500 | | | 8.25%, 4/1/19 | | | | | 2,029,452 | |

| | | | | | | | | | |

| | | | | | | | | 76,456,308 | |

| | | | | | | | | | |

| | | |

| | | | Oil & Gas–5.8% | | | | | | |

| | 300 | | | Anadarko Petroleum Corp., 5.95%, 9/15/16 | | | | | 348,679 | |

| | 1,100 | | | BP Capital Markets PLC, 3.625%, 5/8/14 | | | | | 1,151,930 | |

| | 2,400 | | | Canadian Natural Resources Ltd., 6.00%, 8/15/16 | | | | | 2,822,338 | |

| | 10,400 | | | Canadian Oil Sands Ltd., 7.75%, 5/15/19 (a)(d) | | | | | 13,207,667 | |

| | 2,900 | | | DCP Midstream LLC, 5.375%, 10/15/15 (a)(d) | | | | | 3,104,676 | |

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 19 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Oil & Gas (continued) | | | | | | |

| $ | 846 | | | Devon Energy Corp., 7.95%, 4/15/32 | | | | $ | 1,290,523 | |

| | 1,300 | | | Devon Financing Corp. ULC, 7.875%, 9/30/31 | | | | | 1,939,536 | |

| | 1,330 | | | Ecopetrol S.A., 7.625%, 7/23/19 | | | | | 1,729,000 | |

| | | | El Paso LLC, | | | | | | |

| | 1,789 | | | 7.00%, 6/15/17 | | | | | 2,052,207 | |

| | 19,700 | | | 7.25%, 6/1/18 | | | | | 22,835,590 | |

| | 4,800 | | | Enbridge Energy Partners L.P., 5.875%, 12/15/16 | | | | | 5,642,736 | |

| | | | EnCana Corp., | | | | | | |

| | 2,000 | | | 5.90%, 12/1/17 | | | | | 2,387,308 | |

| | 4,700 | | | 6.50%, 8/15/34 | | | | | 5,862,169 | |

| | | | Energy Transfer Partners L.P., | | | | | | |

| | 2,100 | | | 6.125%, 2/15/17 | | | | | 2,460,068 | |

| | 2,600 | | | 6.625%, 10/15/36 | | | | | 3,220,802 | |

| | | | Gaz Capital S.A. for Gazprom, | | | | | | |

| | 6,500 | | | 6.212%, 11/22/16 | | | | | 7,258,680 | |

| | 1,300 | | | 6.51%, 3/7/22 | | | | | 1,537,250 | |

| | 14,000 | | | 8.146%, 4/11/18 (a)(d) | | | | | 17,221,820 | |

| | 1,280 | | | Gazprom International S.A. for Gazprom, 7.201%, 2/1/20 | | | | | 1,442,666 | |

| | 1,800 | | | Halliburton Co., 6.15%, 9/15/19 | | | | | 2,293,465 | |

| | 867 | | | Kern River Funding Corp., 4.893%, 4/30/18 (a)(b)(d)(o)

(acquisition cost–$866,908; purchased 4/28/03) | | | | | 946,238 | |

| | | | Kinder Morgan Energy Partners L.P., | | | | | | |

| | 700 | | | 5.00%, 12/15/13 | | | | | 732,371 | |

| | 5,800 | | | 6.00%, 2/1/17 | | | | | 6,868,140 | |

| | 3,800 | | | 6.95%, 1/15/38 | | | | | 5,104,851 | |

| | 5,500 | | | 7.30%, 8/15/33 | | | | | 7,439,492 | |

| | 11,900 | | | Midcontinent Express Pipeline LLC, 5.45%, 9/15/14 (a)(b)(d)(o)

(acquisition cost–$11,879,413; purchased 9/9/09) | | | | | 12,388,293 | |

| | 3,400 | | | NGPL PipeCo LLC, 7.119%, 12/15/17 (a)(d) | | | | | 3,663,500 | |

| | 1,700 | | | Northwest Pipeline GP, 7.00%, 6/15/16 | | | | | 2,024,185 | |

| | 291 | | | Odebrecht Drilling Norbe VIII/IX Ltd., 6.35%, 6/30/21 (a)(d) | | | | | 336,832 | |

| | 500 | | | Pemex Project Funding Master Trust, 5.75%, 12/15/15 | | | | | 560,000 | |

| | 15,250 | | | Petrobras International Finance Co., 7.875%, 3/15/19 | | | | | 19,371,160 | |

| | | | Petroleos Mexicanos, | | | | | | |

| | 18,700 | | | 5.50%, 1/21/21 | | | | | 21,925,750 | |

| | 14,550 | | | 6.50%, 6/2/41 | | | | | 18,132,937 | |

| | 7,500 | | | 8.00%, 5/3/19 | | | | | 9,862,500 | |

| | 2,600 | | | Plains All American Pipeline L.P., 6.65%, 1/15/37 | | | | | 3,509,730 | |

| | 2,791 | | | Ras Laffan Liquefied Natural Gas Co., Ltd. II, 5.298%, 9/30/20 | | | | | 3,161,091 | |

| | | | Ras Laffan Liquefied Natural Gas Co., Ltd. III, | | | | | | |

| | 1,400 | | | 5.50%, 9/30/14 | | | | | 1,522,150 | |

| | | | |

| 20 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Oil & Gas (continued) | | | | | | |

| $ | 1,616 | | | 5.832%, 9/30/16 (b) | | | | $ | 1,787,296 | |

| | 3,000 | | | 6.75%, 9/30/19 | | | | | 3,775,500 | |

| | 1,800 | | | Reliance Holdings USA, Inc., 4.50%, 10/19/20 (b) | | | | | 1,903,133 | |

| | 100 | | | Rockies Express Pipeline LLC, 5.625%, 4/15/20 (a)(d) | | | | | 95,750 | |

| | 4,400 | | | Southern Natural Gas Co. LLC, 5.90%, 4/1/17 (a)(d) | | | | | 5,177,801 | |

| | 1,950 | | | Tennessee Gas Pipeline Co. LLC, 7.50%, 4/1/17 | | | | | 2,435,562 | |

| | 1,100 | | | TransCanada PipeLines Ltd., 3.80%, 10/1/20 | | | | | 1,242,129 | |

| | | | | | | | | | |

| | | | | | | | | 233,775,501 | |

| | | | | | | | | | |

| | | |

| | | | Paper & Forest Products–0.2% | | | | | | |

| | 5,000 | | | Weyerhaeuser Co., 7.375%, 10/1/19 | | | | | 6,240,770 | |

| | | | | | | | | | |

| | | |

| | | | Paper/Paper Products–0.2% | | | | | | |

| | 6,300 | | | Georgia-Pacific LLC, 5.40%, 11/1/20 (a)(d) | | | | | 7,483,619 | |

| | | | | | | | | | |

| | | |

| | | | Retail–1.0% | | | | | | |

| | | | CVS Pass Through Trust, | | | | | | |

| | 7,936 | | | 6.943%, 1/10/30 | | | | | 10,061,590 | |

| | 22,605 | | | 7.507%, 1/10/32 (a)(d) | | | | | 30,266,740 | |

| | | | | | | | | | |

| | | | | | | | | 40,328,330 | |

| | | | | | | | | | |

| | | |

| | | | Road & Rail–0.1% | | | | | | |

| | 1,800 | | | Canadian National Railway Co., 5.55%, 3/1/19 | | | | | 2,192,157 | |

| | | | | | | | | | |

| | | |

| | | | Technology–0.1% | | | | | | |

| | 1,800 | | | International Business Machines Corp., 8.375%, 11/1/19 | | | | | 2,588,150 | |

| | 1,800 | | | Oracle Corp., 5.00%, 7/8/19 | | | | | 2,189,383 | |

| | | | | | | | | | |

| | | | | | | | | 4,777,533 | |

| | | | | | | | | | |

| | | |

| | | | Telecommunications–2.9% | | | | | | |

| | | | America Movil S.A.B. De C.V., | | | | | | |

| | 42,800 | | | 5.00%, 3/30/20 | | | | | 50,525,785 | |

| | 21,400 | | | 6.125%, 3/30/40 | | | | | 28,399,448 | |

| | 51 | | | AT&T Corp., 8.00%, 11/15/31 | | | | | 79,299 | |

| | | | AT&T, Inc., | | | | | | |

| | 1,718 | | | 5.35%, 9/1/40 | | | | | 2,109,391 | |

| | 5,000 | | | 5.50%, 2/1/18 | | | | | 6,080,195 | |

| | 1,100 | | | 5.80%, 2/15/19 | | | | | 1,382,124 | |

| | 1,000 | | | Axiata SPV1 Labuan Ltd., 5.375%, 4/28/20 | | | | | 1,134,326 | |

| | 4,500 | | | Deutsche Telekom International Finance BV, 6.75%, 8/20/18 | | | | | 5,641,178 | |

| | | | Qtel International Finance Ltd. (a)(d), | | | | | | |

| | 3,000 | | | 3.375%, 10/14/16 | | | | | 3,180,000 | |

| | 7,300 | | | 5.00%, 10/19/25 | | | | | 8,322,000 | |

| | | | Qwest Corp., | | | | | | |

| | 2,000 | | | 3.639%, 6/15/13 (j) | | | | | 2,009,684 | |

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 21 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Telecommunications (continued) | | | | | | |

| $ | 1,250 | | | 6.50%, 6/1/17 | | | | $ | 1,467,746 | |

| | 4,800 | | | Sprint Capital Corp., 8.75%, 3/15/32 | | | | | 5,688,000 | |

| | 1,100 | | | Verizon Communications, Inc., 8.75%, 11/1/18 | | | | | 1,536,066 | |

| | | | | | | | | | |

| | | | | | | | | 117,555,242 | |

| | | | | | | | | | |

| | | |

| | | | Tobacco–0.7% | | | | | | |

| | 10,000 | | | Altria Group, Inc., 10.20%, 2/6/39 | | | | | 17,583,260 | |

| | 1,400 | | | Philip Morris International, Inc., 5.65%, 5/16/18 | | | | | 1,719,852 | |

| | 8,130 | | | Reynolds American, Inc., 7.75%, 6/1/18 | | | | | 10,255,434 | |

| | | | | | | | | | |

| | | | | | | | | 29,558,546 | |

| | | | | | | | | | |

| | | |

| | | | Utilities–2.3% | | | | | | |

| | 2,498 | | | Bruce Mansfield Unit, 6.85%, 6/1/34 | | | | | 2,661,829 | |

| | 2,000 | | | Consumers Energy Co., 5.15%, 2/15/17 | | | | | 2,319,438 | |

| | 5,000 | | | DTE Energy Co., 6.35%, 6/1/16 | | | | | 5,888,300 | |

| | 14,200 | | | EDF S.A., 6.50%, 1/26/19 (a)(d) | | | | | 17,572,202 | |

| | 27,500 | | | Entergy Corp., 3.625%, 9/15/15 | | | | | 29,044,565 | |

| | 174 | | | GG1C Funding Corp., 5.129%, 1/15/14 (a)(b)(d)(o)

(acquisition cost–$173,799; purchased 4/16/04) | | | | | 176,352 | |

| | | | Korea Hydro & Nuclear Power Co., Ltd., | | | | | | |

| | 300 | | | 3.125%, 9/16/15 (a)(d) | | | | | 314,578 | |

| | 4,550 | | | 6.25%, 6/17/14 | | | | | 4,913,964 | |

| | 1,000 | | | Majapahit Holding BV, 7.25%, 6/28/17 | | | | | 1,195,000 | |

| | | | Nevada Power Co., | | | | | | |

| | 100 | | | 5.875%, 1/15/15 | | | | | 110,859 | |

| | 1,600 | | | 5.95%, 3/15/16 | | | | | 1,843,934 | |

| | 3,000 | | | 6.50%, 5/15/18 | | | | | 3,783,948 | |

| | 900 | | | Nisource Finance Corp., 6.40%, 3/15/18 | | | | | 1,096,296 | |

| | 6,100 | | | NRG Energy, Inc., 7.625%, 1/15/18 | | | | | 6,694,750 | |

| | 1,700 | | | Ohio Edison Co., 5.45%, 5/1/15 | | | | | 1,858,721 | |

| | 2,900 | | | Public Service Co. of Oklahoma, 6.15%, 8/1/16 | | | | | 3,400,120 | |

| | 1,900 | | | Sierra Pacific Power Co., 6.00%, 5/15/16 | | | | | 2,222,063 | |

| | 4,500 | | | Toledo Edison Co., 6.15%, 5/15/37 | | | | | 5,854,392 | |

| | 54 | | | W3A Funding Corp., 8.09%, 1/2/17 | | | | | 55,544 | |

| | | | | | | | | | |

| | | | | | | | | 91,006,855 | |

| | | | | | | | | | |

| | | | Total Corporate Bonds & Notes (cost–$1,761,917,763) | | | | | 2,017,554,019 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SOVEREIGN DEBT OBLIGATIONS–14.1% | | | | |

| | | | Australia–7.3% | | | | | | |

| | | | Australia Government Bond (k), | | | | | | |

| AUD | 110,800 | | | 3.00%, 9/20/25, Ser. 25-CI | | | | | 161,540,993 | |

| AUD | 61,700 | | | 4.00%, 8/20/20, Ser. 20-CI | | | | | 125,096,367 | |

| | | | |

| 22 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Australia (continued) | | | | | | |

| AUD | 5,400 | | | Queensland Treasury Corp., 6.00%, 9/14/17, Ser. 17 | | | | $ | 6,293,685 | |

| | | | | | | | | | |

| | | | | | | | | 292,931,045 | |

| | | | | | | | | | |

| | | |

| | | | Brazil–5.2% | | | | | | |

| | | | Brazil Notas do Tesouro Nacional, Ser. F, | | | | | | |

| BRL | 8,390 | | | 10.00%, 1/1/13 | | | | | 4,154,781 | |

| BRL | 40,777 | | | 10.00%, 1/1/14 | | | | | 20,657,341 | |

| BRL | 164,206 | | | 10.00%, 1/1/17 | | | | | 85,203,887 | |

| BRL | 147,171 | | | 10.00%, 1/1/21 | | | | | 76,498,024 | |

| $ | 3,300 | | | Brazilian Development Bank, 6.369%, 6/16/18 | | | | | 4,001,250 | |

| | | | Brazilian Government International Bond, | | | | | | |

| | 1,600 | | | 4.875%, 1/22/21 | | | | | 1,924,000 | |

| | 12,176 | | | 8.875%, 10/14/19 | | | | | 17,594,320 | |

| | | | | | | | | | |

| | | | | | | | | 210,033,603 | |

| | | | | | | | | | |

| | | |

| | | | Canada–0.3% | | | | | | |

| CAD | 2,400 | | | Province of Ontario Canada, 6.50%, 3/8/29 | | | | | 3,387,339 | |

| $ | 7,800 | | | Province of Quebec Canada, 3.50%, 7/29/20 | | | | | 8,693,022 | |

| | | | | | | | | | |

| | | | | | | | | 12,080,361 | |

| | | | | | | | | | |

| | | |

| | | | Colombia–0.1% | | | | | | |

| | 2,000 | | | Colombia Government International Bond, 7.375%, 1/27/17 | | | | | 2,495,000 | |

| | | | | | | | | | |

| | | |

| | | | Indonesia–0.1% | | | | | | |

| | 3,100 | | | Indonesia Government International Bond, 6.875%, 1/17/18 | | | | | 3,785,875 | |

| | | | | | | | | | |

| | | |

| | | | Korea (Republic of)–0.4% | | | | | | |

| | | | Export-Import Bank of Korea, | | | | | | |

| | 10,900 | | | 4.00%, 1/29/21 | | | | | 11,995,657 | |

| | 250 | | | 5.125%, 6/29/20 | | | | | 293,870 | |

| | | | Korea Development Bank, | | | | | | |

| | 3,950 | | | 4.00%, 9/9/16 | | | | | 4,302,984 | |

| | 300 | | | 8.00%, 1/23/14 | | | | | 325,174 | |

| | | | | | | | | | |

| | | | | | | | | 16,917,685 | |

| | | | | | | | | | |

| | | |

| | | | Mexico–0.3% | | | | | | |

| | 10,000 | | | Mexico Government International Bond, 6.05%, 1/11/40 | | | | | 13,325,000 | |

| | | | | | | | | | |

| | | |

| | | | Qatar–0.3% | | | | | | |

| | | | Qatar Government International Bond (a)(b)(d)(o), | | | | | | |

| | 3,500 | | | 4.00%, 1/20/15 | | | | | | |

| | | | (acquisition cost–$3,507,960; purchased 11/17/09-9/17/12) | | | | | 3,722,250 | |

| | 6,400 | | | 5.25%, 1/20/20 | | | | | | |

| | | | (acquisition cost–$6,436,800; purchased 11/17/09-9/17/12) | | | | | 7,654,400 | |

| | | | | | | | | | |

| | | | | | | | | 11,376,650 | |

| | | | | | | | | | |

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 23 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Russian Federation–0.1% | | | | | | |

| $ | 1,550 | | | Russian Federation Bond, 7.50%, 3/31/30 | | | | $ | 1,965,865 | |

| | | | | | | | | | |

| | | |

| | | | South Africa–0.0% | | | | | | |

| | 300 | | | South Africa Government International Bond, 6.875%, 5/27/19 | | | | | 375,120 | |

| | | | | | | | | | |

| | | | Total Sovereign Debt Obligations (cost–$542,114,946) | | | | | 565,286,204 | |

| | | | | | | | | | |

| | | | | | | | | | |

| MUNICIPAL BONDS–12.0% | | | | |

| | | | Arizona–0.1% | | | | | | |

| | 2,000 | | | Univ. of Arizona Rev., 6.423%, 8/1/35, Ser. A | | | | | 2,345,820 | |

| | | | | | | | | | |

| | | |

| | | | California–5.3% | | | | | | |

| | 2,400 | | | Golden State Tobacco Securitization Corp. Rev., 5.75%, 6/1/47, Ser. A-1 | | | | | 2,153,280 | |

| | 15,000 | | | Infrastructure & Economic Dev. Bank Rev., 6.486%, 5/15/49 | | | | | 18,461,400 | |

| | | | Los Angeles Cnty. Public Works Financing Auth. Rev., | | | | | | |

| | 7,400 | | | 7.488%, 8/1/33 | | | | | 9,448,764 | |

| | 12,300 | | | 7.618%, 8/1/40 | | | | | 16,363,797 | |

| | 25,000 | | | Los Angeles Community College Dist., GO, 6.75%, 8/1/49 | | | | | 34,284,000 | |

| | | | Los Angeles Department of Water & Power Rev., | | | | | | |

| | 3,000 | | | 5.516%, 7/1/27, Ser. C | | | | | 3,500,490 | |

| | 5,000 | | | 6.574%, 7/1/45 | | | | | 7,009,950 | |

| | 1,300 | | | Los Angeles Unified School Dist., GO, 6.758%, 7/1/34 | | | | | 1,728,337 | |

| | 300 | | | Palomar Community College Dist., GO, 7.194%, 8/1/45, Ser. B-1 | | | | | 355,743 | |

| | 1,000 | | | San Diego Cnty. Water Auth. Rev., 6.138%, 5/1/49 | | | | | 1,335,010 | |

| | | | State, GO, | | | | | | |

| | 800 | | | 4.85%, 10/1/14 | | | | | 855,784 | |

| | 400 | | | 6.20%, 10/1/19 | | | | | 476,264 | |

| | 1,500 | | | 6.65%, 3/1/22 | | | | | 1,837,995 | |

| | 8,550 | | | 7.55%, 4/1/39 | | | | | 11,933,919 | |

| | 36,400 | | | 7.60%, 11/1/40 | | | | | 51,425,556 | |

| | 12,000 | | | 7.70%, 11/1/30 | | | | | 14,706,600 | |

| | 23,500 | | | 7.95%, 3/1/36 | | | | | 28,167,100 | |

| | 7,500 | | | Univ. of California Rev., 0.887%, 7/1/13, Ser. AA-2 | | | | | 7,529,325 | |

| | | | | | | | | | |

| | | | | | | | | 211,573,314 | |

| | | | | | | | | | |

| | | |

| | | | Illinois–0.4% | | | | | | |

| | 10,500 | | | Chicago Transit Auth. Rev., 6.20%, 12/1/40, Ser. B | | | | | 11,903,640 | |

| | 1,600 | | | Finance Auth. Rev., Univ. of Chicago, 5.50%, 7/1/37, Ser. B | | | | | 1,923,616 | |

| | 2,500 | | | Greater Chicago Metropolitan Water Reclamation Dist., GO, 5.72%, 12/1/38 | | | | | 3,172,025 | |

| | | | | | | | | | |

| | | | | | | | | 16,999,281 | |

| | | | | | | | | | |

| | | |

| | | | Iowa–0.0% | | | | | | |

| | 680 | | | Tobacco Settlement Auth. Rev., 6.50%, 6/1/23, Ser. A | | | | | 673,316 | |

| | | | | | | | | | |

| | | | |

| 24 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Massachusetts–0.5% | | | | | | |

| $ | 17,000 | | | School Building Auth. Rev., 5.468%, 6/15/27 | | | | $ | 20,561,330 | |

| | | | | | | | | | |

| | | |

| | | | New Jersey–0.3% | | | | | | |

| | | | State Turnpike Auth. Rev., | | | | | | |

| | 5,000 | | | 7.102%, 1/1/41, Ser. A | | | | | 7,209,250 | |

| | 3,900 | | | 7.414%, 1/1/40, Ser. F | | | | | 5,811,468 | |

| | 250 | | | Tobacco Settlement Financing Corp. Rev., 5.00%, 6/1/41, Ser. 1-A | | | | | 218,472 | |

| | | | | | | | | | |

| | | | | | | | | 13,239,190 | |

| | | | | | | | | | |

| | | |

| | | | New York–2.2% | | | | | | |

| | 5,500 | | | Metropolitan Transportation Auth. Rev., 5.871%, 11/15/39 | | | | | 6,530,865 | |

| | 3,000 | | | New York City, GO, 4.769%, 10/1/23, Ser. A-2 | | | | | 3,463,260 | |

| | | | New York City Municipal Water Finance Auth. Rev., | | | | | | |

| | 3,640 | | | 5.79%, 6/15/41 | | | | | 4,135,295 | |

| | 1,445 | | | 6.011%, 6/15/42 | | | | | 1,972,974 | |

| | | | New York City Transitional Finance Auth. Rev., | | | | | | |

| | 400 | | | 4.325%, 11/1/21 | | | | | 456,024 | |

| | 800 | | | 4.525%, 11/1/22 | | | | | 922,536 | |

| | 10,000 | | | 5.00%, 11/1/38, Ser. D | | | | | 11,489,100 | |

| | 3,000 | | | 5.267%, 5/1/27, Ser. G-3 | | | | | 3,628,920 | |

| | 700 | | | 5.572%, 11/1/38 | | | | | 872,788 | |

| | 800 | | | 5.932%, 11/1/36 | | | | | 915,976 | |

| | | | State Dormitory Auth. Rev., | | | | | | |

| | 10,000 | | | 5.00%, 3/15/27, Ser. A | | | | | 12,000,700 | |

| | 20,345 | | | 5.00%, 2/15/30, Ser. D | | | | | 24,290,913 | |

| | 1,600 | | | 5.289%, 3/15/33, Ser. H | | | | | 1,898,752 | |

| | 2,700 | | | 5.389%, 3/15/40, Ser. H | | | | | 3,325,779 | |

| | 3,180 | | | State Thruway Auth. Rev., 5.00%, 3/15/25, Ser. A | | | | | 3,878,900 | |

| | | | State Urban Dev. Corp. Rev., | | | | | | |

| | 1,500 | | | 5.00%, 3/15/23, Ser. A | | | | | 1,842,270 | |

| | 4,000 | | | 5.77%, 3/15/39 | | | | | 4,906,040 | |

| | | | | | | | | | |

| | | | | | | | | 86,531,092 | |

| | | | | | | | | | |

| | | |

| | | | Ohio–0.4% | | | | | | |

| | | | American Municipal Power, Inc. Rev.,

| | | | | | |

| | 3,600 | | | 5.939%, 2/15/47 | | | | | 4,178,700 | |

| | 1,400 | | | Comb Hydroelectric Projects, 7.834%, 2/15/41, Ser. B | | | | | 1,933,610 | |

| | | | Buckeye Tobacco Settlement Financing Auth. Rev., Ser. A-2, | | | | | | |

| | 11,700 | | | 5.75%, 6/1/34 | | | | | 9,957,051 | |

| | 900 | | | 5.875%, 6/1/47 | | | | | 773,856 | |

| | | | | | | | | | |

| | | | | | | | | 16,843,217 | |

| | | | | | | | | | |

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 25 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Texas–2.8% | | | | | | |

| | | | Conroe Independent School Dist., GO, Ser. A (PSF-GTD) (e), | | | | | | |

| $ | 1,000 | | | 5.00%, 2/15/24 | | | | $ | 1,226,930 | |

| | 2,610 | | | 5.00%, 2/15/25 | | | | | 3,188,924 | |

| | 2,905 | | | 5.00%, 2/15/26 | | | | | 3,524,753 | |

| | 3,115 | | | 5.00%, 2/15/27 | | | | | 3,766,440 | |

| | 5,000 | | | 5.00%, 2/15/28 | | | | | 6,020,450 | |

| | 4,520 | | | 5.00%, 2/15/29 | | | | | 5,419,887 | |

| | 21,200 | | | Dallas, GO, 5.00%, 2/15/23 | | | | | 26,601,336 | |

| | 43,800 | | | Dallas Area Rapid Transit Rev., 5.022%, 12/1/48 | | | | | 53,372,052 | |

| | 4,400 | | | Dallas Cnty. Hospital Dist., GO, 5.621%, 8/15/44, Ser. C | | | | | 5,667,200 | |

| | 4,100 | | | North Texas Tollway Auth. Rev., 6.718%, 1/1/49, Ser. B | | | | | 5,613,392 | |

| | | | | | | | | | |

| | | | | | | | | 114,401,364 | |

| | | | | | | | | | |

| | | | Total Municipal Bonds (cost–$411,242,518) | | | | | 483,167,924 | |

| | | | | | | | | | |

| | | | | | | | | | |

| U.S. GOVERNMENT AGENCY SECURITIES–7.6% | | | | |

| | | | Fannie Mae–6.5% | | | | | | |

| | 2 | | | 2.319%, 8/25/18, CMO (j) | | | | | 2,441 | |

| | 1,204 | | | 2.48%, 5/1/35, MBS (j) | | | | | 1,271,492 | |

| | 3,359 | | | 2.649%, 11/1/35, MBS (j) | | | | | 3,605,683 | |

| | 4 | | | 3.085%, 2/1/18, MBS (j) | | | | | 4,433 | |

| | 1,940 | | | 4.00%, 11/1/40, MBS | | | | | 2,080,944 | |

| | 3 | | | 4.095%, 4/1/17, MBS (j) | | | | | 3,015 | |

| | 234,438 | | | 4.50%, 3/1/29-11/1/41, MBS | | | | | 253,981,466 | |

| | 925 | | | 5.29%, 11/25/33, CMO | | | | | 951,301 | |

| | | | | | | | | | |

| | | | | | | | | 261,900,775 | |

| | | | | | | | | | |

| | | |

| | | | Freddie Mac–0.0% | | | | | | |

| | 1 | | | 1.95%, 6/1/30, MBS (j) | | | | | 1,369 | |

| | 7 | | | 2.375%, 12/1/18, MBS (j) | | | | | 7,578 | |

| | 374 | | | 6.50%, 1/1/38-10/1/38, MBS | | | | | 425,286 | |

| | | | | | | | | | |

| | | | | | | | | 434,233 | |

| | | | | | | | | | |

| | | |

| | | | Ginnie Mae–0.0% | | | | | | |

| | 12 | | | 1.625%, 1/20/22, MBS (j) | | | | | 12,511 | |

| | | | | | | | | | |

| | | |

| | | | Small Business Administration Participation Certificates–1.1% | | | | | | |

| | 183 | | | 4.504%, 2/10/14 | | | | | 188,412 | |

| | 3,132 | | | 4.77%, 4/1/24, ABS | | | | | 3,505,506 | |

| | 20,678 | | | 5.32%, 1/1/27, ABS | | | | | 23,748,155 | |

| | 14,616 | | | 5.70%, 8/1/26, ABS | | | | | 16,870,841 | |

| | | | | | | | | | |

| | | | | | | | | 44,312,914 | |

| | | | | | | | | | |

| | | | Total U.S. Government Agency Securities (cost–$289,666,933) | | | | | 306,660,433 | |

| | | | | | | | | | |

| | | | |

| 26 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| MORTGAGE-BACKED SECURITIES–5.2% | | | | |

| | | | | | | | | | |

| $ | 179 | | | Banc of America Funding Corp., 5.669%, 1/20/47, CMO (j) | | | | $ | 127,534 | |

| | 89 | | | Banc of America Large Loan, Inc., 0.724%, 8/15/29, CMO (b)(j) | | | | | 87,398 | |

| | 4,400 | | | Banc of America Merrill Lynch Commercial Mortgage, Inc.,

5.889%, 7/10/44, CMO (j) | | | | | 5,059,457 | |

| | | | Bear Stearns Adjustable Rate Mortgage Trust, CMO (j), | | | | | | |

| | 1,387 | | | 2.32%, 8/25/35 | | | | | 1,358,016 | |

| | 1,508 | | | 2.57%, 3/25/35 | | | | | 1,526,383 | |

| | 114 | | | 2.884%, 10/25/33 | | | | | 115,754 | |

| | 312 | | | 3.078%, 3/25/35 | | | | | 314,751 | |

| | 75 | | | 3.195%, 5/25/34 | | | | | 73,196 | |

| | | | Bear Stearns Alt-A Trust, CMO (j), | | | | | | |

| | 1,273 | | | 2.852%, 2/25/36 | | | | | 694,254 | |

| | 4,241 | | | 2.94%, 11/25/36 | | | | | 2,843,765 | |

| | 5,452 | | | 3.071%, 11/25/36 | | | | | 3,470,319 | |

| | | | Bear Stearns Commercial Mortgage Securities, CMO, | | | | | | |

| | 1,600 | | | 5.54%, 9/11/41 | | | | | 1,850,060 | |

| | 7,500 | | | 5.694%, 6/11/50 (j) | | | | | 8,893,174 | |

| | | | Citigroup Mortgage Loan Trust, Inc., CMO (j), | | | | | | |

| | 585 | | | 2.23%, 9/25/35 | | | | | 581,364 | |

| | 534 | | | 2.34%, 9/25/35 | | | | | 518,750 | |

| | | | Citigroup/Deutsche Bank Commercial Mortgage Trust, CMO, | | | | | | |

| | 8,000 | | | 5.302%, 1/15/46 (j) | | | | | 9,014,412 | |

| | 4,400 | | | 5.322%, 12/11/49 | | | | | 5,079,818 | |

| | 27,960 | | | Commercial Mortgage Pass Through Certificates, 5.762%, 9/15/39, CMO (j) | | | | | 32,288,348 | |

| € | 240 | | | Cordusio RMBS SRL, 0.362%, 6/30/35, CMO (j) | | | | | 293,480 | |

| | | | Countrywide Alternative Loan Trust, CMO, | | | | | | |

| $ | 2,036 | | | 0.401%, 11/25/46 (j) | | | | | 1,342,142 | |

| | 595 | | | 0.411%, 5/25/36 (j) | | | | | 374,989 | |

| | 9,806 | | | 6.25%, 8/25/37 | | | | | 7,139,470 | |

| | | | Countrywide Home Loan Mortgage Pass Through Trust, CMO (j), | | | | | | |

| | 290 | | | 0.531%, 3/25/35 | | | | | 184,601 | |

| | 62 | | | 3.026%, 8/25/34 | | | | | 53,299 | |

| | 18 | | | Credit Suisse First Boston Mortgage Securities Corp.,

2.601%, 7/25/33, CMO (j) | | | | | 18,230 | |

| | | | Credit Suisse Mortgage Capital Certificates, CMO, | | | | | | |

| | 2,600 | | | 5.311%, 12/15/39 | | | | | 2,975,833 | |

| | 7,300 | | | 5.676%, 6/15/39 (j) | | | | | 8,334,673 | |

| | | | Downey Savings & Loan Assoc. Mortgage Loan Trust, CMO (j), | | | | | | |

| | 2,149 | | | 0.472%, 8/19/45 | | | | | 1,718,608 | |

| | 1,271 | | | 2.457%, 7/19/44 | | | | | 1,182,151 | |

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 27 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| $ | 109 | | | First Horizon Mortgage Pass Through Trust, 2.612%, 12/25/33, CMO (j) | | | | $ | 109,387 | |

| | 3,465 | | | Greenpoint Mortgage Funding Trust, 0.441%, 6/25/45, CMO (j) | | | | | 2,388,127 | |

| | 14 | | | Greenpoint Mortgage Pass Through Certificates, 3.177%, 10/25/33, CMO (j) | | | | | 13,395 | |

| | | | GSR Mortgage Loan Trust, CMO (j), | | | | | | |

| | 103 | | | 1.87%, 3/25/33 | | | | | 104,181 | |

| | 1,920 | | | 2.654%, 9/25/35 | | | | | 1,941,044 | |

| | 826 | | | 2.659%, 9/25/35 | | | | | 834,209 | |

| | | | Harborview Mortgage Loan Trust, CMO (j), | | | | | | |

| | 302 | | | 0.402%, 1/19/38 | | | | | 220,142 | |

| | 520 | | | 0.551%, 6/20/35 | | | | | 462,285 | |

| | 213 | | | 2.759%, 5/19/33 | | | | | 214,981 | |

| | | | Homebanc Mortgage Trust, CMO (j), | | | | | | |

| | 2,880 | | | 0.471%, 1/25/36 | | | | | 2,140,754 | |

| | 355 | | | 5.588%, 4/25/37 | | | | | 293,319 | |

| | | | JPMorgan Chase Commercial Mortgage Securities Corp., CMO, | | | | | | |

| | 12,500 | | | 3.341%, 7/15/46 (a)(d) | | | | | 13,446,200 | |

| | 20,600 | | | 4.106%, 7/15/46 (a)(d) | | | | | 23,208,928 | |

| | 1,000 | | | 5.336%, 5/15/47 | | | | | 1,153,825 | |

| | 6,600 | | | 5.42%, 1/15/49 | | | | | 7,672,698 | |

| | 2,200 | | | 5.44%, 6/12/47 | | | | | 2,556,906 | |

| | | | JPMorgan Mortgage Trust, CMO (j), | | | | | | |

| | 106 | | | 2.365%, 11/25/33 | | | | | 105,734 | |

| | 1,502 | | | 2.983%, 7/25/35 | | | | | 1,549,269 | |

| | 131 | | | 4.985%, 2/25/35 | | | | | 133,716 | |

| | 5,043 | | | 5.154%, 2/25/36 | | | | | 4,260,911 | |

| | 1,541 | | | 5.28%, 7/25/35 | | | | | 1,555,168 | |

| | | | Merrill Lynch/Countrywide Commercial Mortgage Trust, CMO (j), | | | | | | |

| | 1,200 | | | 5.172%, 12/12/49 | | | | | 1,371,416 | |

| | 1,600 | | | 5.949%, 8/12/49 | | | | | 1,866,825 | |

| | 121 | | | Morgan Stanley Dean Witter Capital I, 4.74%, 11/13/36, CMO | | | | | 121,080 | |

| | 1,500 | | | Morgan Stanley Reremic Trust, 5.789%, 8/15/45, CMO (a)(d)(j) | | | | | 1,776,112 | |

| | 260 | | | Ocwen Residential MBS Corp., 7.00%, 10/25/40, CMO (a)(d)(g)(j) | | | | | 22,003 | |

| | | | RBSSP Resecuritization Trust, CMO (a)(d)(j), | | | | | | |

| | 1,258 | | | 0.497%, 5/26/37 | | | | | 1,202,311 | |

| | 13,211 | | | 0.537%, 3/26/37 | | | | | 12,255,593 | |

| | 6,524 | | | 0.711%, 9/26/34 | | | | | 6,176,003 | |

| | 8,424 | | | 0.711%, 3/26/36 | | | | | 8,157,934 | |

| | 5,764 | | | 0.711%, 4/26/37 | | | | | 5,387,537 | |

| | 1,475 | | | Residential Accredit Loans, Inc., 0.421%, 4/25/46, CMO (j) | | | | | 732,646 | |

| | 146 | | | Structured Adjustable Rate Mortgage Loan Trust, 2.778%, 2/25/34, CMO (j) | | | | | 148,225 | |

| | 3,853 | | | Structured Asset Mortgage Investments, Inc., 0.431%, 5/25/36, CMO (j) | | | | | 2,467,318 | |

| | | | |

| 28 | | Allianz Global Investors Managed Accounts Trust Annual Report | | 10.31.12 |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | | | | | | | |

| | | | Wachovia Bank Commercial Mortgage Trust, CMO, | | | | | | |

| $ | 304 | | | 0.294%, 6/15/20 (a)(d)(j) | | | | $ | 292,129 | |

| | 700 | | | 5.416%, 1/15/45 (j) | | | | | 796,310 | |

| | 1,300 | | | 5.678%, 5/15/46 | | | | | 1,533,756 | |

| | | | WaMu Mortgage Pass Through Certificates, CMO (j), | | | | | | |

| | 211 | | | 0.521%, 1/25/45 | | | | | 203,106 | |

| | 2,302 | | | 0.62%, 11/25/34 | | | | | 2,219,917 | |

| | 1,177 | | | 1.148%, 2/25/46 | | | | | 1,051,897 | |

| | 705 | | | Wells Fargo Mortgage-Backed Securities Trust, 2.647%, 3/25/36, CMO (j) | | | | | 611,258 | |

| | | | | | | | | | |

| | | | Total Mortgage-Backed Securities (cost–$185,749,775) | | | | | 210,272,784 | |

| | | | | | | | | | |

| | | | | | | | | | |

| U.S. TREASURY OBLIGATIONS–3.3% | | | | |

| | 11,393 | | | U.S. Treasury Inflation Indexed Bonds, 3.625%, 4/15/28 (k)(l) | | | | | 18,296,387 | |

| | | | U.S. Treasury Notes, | | | | | | |

| | 9,100 | | | 0.125%, 8/31/13 | | | | | 9,095,732 | |

| | 10,000 | | | 0.25%, 10/31/13 | | | | | 10,005,080 | |

| | 60,000 | | | 1.125%, 5/31/19 (l) | | | | | 60,253,140 | |

| | 30,600 | | | 3.625%, 2/15/21 | | | | | 35,988,477 | |

| | | | | | | | | | |

| | | | Total U.S. Treasury Obligations (cost–$130,369,824) | | | | | 133,638,816 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SENIOR LOANS (a)(c)–0.6% | | | | |

| | | | Financial Services–0.6% | | | | | | |

| | 23,000 | | | Springleaf Finance Corp., 5.50%, 5/10/17 | | | | | 22,712,500 | |

| | | | | | | | | | |

| | | |

| | | | Healthcare & Hospitals–0.0% | | | | | | |

| | 886 | | | HCA, Inc., 3.612%, 3/31/17, Term B2 | | | | | 888,758 | |

| | | | | | | | | | |

| | | | Total Senior Loans (cost–$23,798,165) | | | | | 23,601,258 | |

| | | | | | | | | | |

| | | | | | | | | | |

| ASSET-BACKED SECURITIES–0.2% | | | | |

| | | | Bear Stearns Asset-Backed Securities Trust (j), | | | | | | |

| | 2,000 | | | 0.411%, 12/25/36 | | | | | 1,440,029 | |

| | 563 | | | 1.211%, 10/25/37 | | | | | 434,812 | |

| | 306 | | | BNC Mortgage Loan Trust, 0.311%, 5/25/37 (j) | | | | | 299,077 | |

| | | | Conseco Financial Corp., | | | | | | |

| | 262 | | | 6.22%, 3/1/30 | | | | | 287,946 | |

| | 4,007 | | | 6.53%, 2/1/31 (j) | | | | | 3,862,435 | |

| | 89 | | | JPMorgan Mortgage Acquisition Corp., 0.291%, 3/25/37 (j) | | | | | 88,617 | |

| | 3 | | | Keystone Owner Trust, 9.00%, 1/25/29 (a)(d) | | | | | 1,346 | |

| | 321 | | | MASTR Asset-Backed Securities Trust, 0.291%, 5/25/37 (j) | | | | | 315,579 | |

| | 246 | | | Merrill Lynch Mortgage Investors, Inc., 0.331%, 2/25/37 (j) | | | | | 88,016 | |

| | 197 | | | Morgan Stanley Mortgage Loan Trust, 0.571%, 4/25/37 (j) | | | | | 88,573 | |

| | 262 | | | Popular ABS Mortgage Pass Through Trust, 0.301%, 6/25/47 (j) | | | | | 222,347 | |

| | | | | | | | | | |

| | | | Total Asset-Backed Securities (cost–$6,722,203) | | | | | 7,128,777 | |

| | | | | | | | | | |

| | | | | | |

| 10.31.12 | | Allianz Global Investors Managed Accounts Trust Annual Report | | | 29 | |

Fixed Income SHares: Series C Schedule of Investments

October 31, 2012 (continued)

| | | | | | | | | | |

| Shares | | | | | | | Value | |

| COMMON STOCK–0.0% | | | | |

| | | | | | | | | | |

| | | | Insurance–0.0% | | | | | | |

| | 451 | | | American International Group, Inc. (m) (cost–$13,115) | | | | $ | 15,753 | |

| | | | | | | | | | |

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | |

| SHORT-TERM INVESTMENTS–6.7% | | | | |

| | | | U.S. Treasury Obligations (l)(h)–3.3% | | | | | | |

| $ | 134,161 | | | U.S. Treasury Bills, 0.134%-0.197%, 3/7/13-10/17/13 (cost–$134,016,283) | | | | | 134,024,050 | |

| | | | | | | | | | |

| | | |

| | | | U.S. Government Agency Securities (h)–1.1% | | | | | | |

| | 16,200 | | | Federal Home Loan Bank Discount Notes,

0.100%-0.162%, 11/28/12-2/20/13 | | | | | 16,194,814 | |

| | 28,600 | | | Freddie Mac Discount Notes,

0.112%-0.194%, 1/3/13-8/1/13 | | | | | 28,589,917 | |

| | | | | | | | | | |

| | | | Total U.S. Government Agency Securities (cost–$44,777,751) | | | | | 44,784,731 | |

| | | | | | | | | | |

| | | |

| | | | Repurchase Agreements–2.3% | | | | | | |

| | 12,800 | | | Barclays Capital, Inc.,

dated 10/26/12, 0.21%-0.23%, due 11/2/12, proceeds $12,800,548; collateralized by Ginnie Mae, 4.50%, due 3/20/41, valued at $6,591,548 and U.S. Treasury Bonds, 4.375%, due 2/15/38, valued at $6,614,807 including accrued interest | | | | | 12,800,000 | |

| | 2,200 | | | Barclays Capital, Inc.,

dated 10/31/12, 0.35%, due 11/1/12, proceeds $2,200,021; collateralized by Ginnie Mae, 3.50%, due 6/20/42, valued at $2,274,071 including accrued interest | | | | | 2,200,000 | |