UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-09999 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 2 |

(This Form N-CSR relates solely to the Registrant’s: Prudential Commodity Strategies Fund, Prudential Core Conservative Bond Fund, Prudential Jennison Small-Cap Core Equity Fund, Prudential QMA Mid-Cap Core Equity Fund, Prudential QMA US Broad Market Index Fund and Prudential TIPS Fund.)

| | |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs 655 Broad Street, 17th Floor Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal period end: | | 7/31/2017 |

| |

| Date of reporting period: | | 7/31/2017 |

Item 1 – Reports to Stockholders

Prudential Jennison Small-Cap Core Equity Fund

Prudential Core Conservative Bond Fund

Prudential TIPS Fund

Prudential Commodity Strategies Fund

Prudential QMA US Broad Market Index Fund

Prudential QMA Mid-Cap Core Equity Fund

ANNUAL REPORT

JULY 31, 2017

To enroll in e-delivery, go to pgiminvestments.com/edelivery

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Funds’ portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. QMA is the primary business name of Quantitative Management Associates LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), a Prudential Financial company. © 2017 Prudential Financial, Inc. and its related entities. The Prudential logo and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

Prudential Day One Underlying Funds

TABLE OF CONTENTS

| | | | |

| Prudential Day One Underlying Funds | | | 3 | |

This Page Intentionally Left Blank

Prudential Jennison Small-Cap Core Equity Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | |

| | | Total Returns as of 7/31/17 |

| | | Since Inception* (%) |

| Class Q | | 12.89 (11/15/16) |

| Russell 2000 Index | | 8.73 |

*Not annualized

Source: PGIM Investments LLC and Lipper Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The Since Inception returns for the index are measured from the closest month-end to the Fund’s inception date.

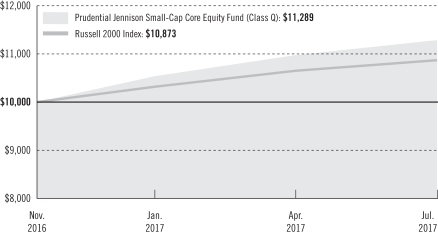

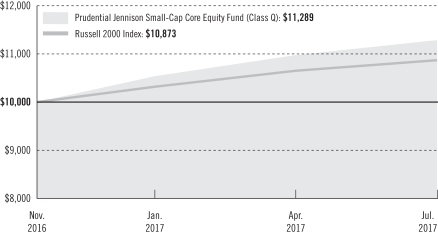

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class Q shares with a similar investment in the Russell 2000 Index by portraying the initial account values at the commencement of operations of Class Q shares (November 15, 2016) and the account values at the end of the current fiscal year (July 31, 2017), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends

| | | | |

| Prudential Day One Underlying Funds | | | 5 | |

Prudential Jennison Small-Cap Core Equity Fund

Your Fund’s Performance (continued)

and distributions were reinvested. The line graph provides information for Class Q shares only. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definition

Russell 2000 Index—The Russell 2000 Index is an unmanaged index of the 2,000 smallest US companies included in the Russell 3000 Index. It gives an indication of how stock prices of smaller companies have performed.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

Presentation of Fund Holdings

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 7/31/17 (%) | |

| East West Bancorp, Inc., Banks | | | 2.1 | |

| Summit Materials, Inc., Construction Materials | | | 1.8 | |

| Paycom Software, Inc., Software | | | 1.8 | |

| MACOM Technology Solutions Holdings, Inc., Semiconductors & Semiconductor Equipment | | | 1.7 | |

| Univar, Inc., Trading Companies & Distributors | | | 1.7 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Five Largest Industries expressed as a

percentage of net assets as of 7/31/17 (%) | |

| Banks | | | 13.2 | |

| Software | | | 8.1 | |

| Equity Real Estate Investment Trusts (REITs) | | | 7.2 | |

| Hotels, Restaurants & Leisure | | | 6.2 | |

| Machinery | | | 4.5 | |

Industry weightings reflect only long-term investments and are subject to change.

| | |

| 6 | | Visit our website at pgiminvestments.com |

Prudential Core Conservative Bond Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | |

| | | Total Returns as of 7/31/17 |

| | | Since Inception* (%) |

| Class Q | | 1.72 (11/15/16) |

| Bloomberg Barclays US Aggregate Bond Index | | 2.86 |

*Not annualized

Source: PGIM Investments LLC and Lipper Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The Since Inception returns for the index are measured from the closest month-end to the Fund’s inception date.

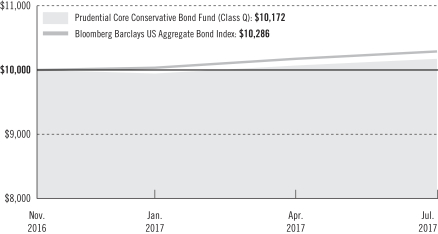

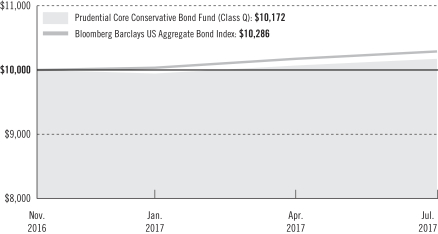

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class Q shares with a similar investment in the Bloomberg Barclays US Aggregate Bond Index by portraying the initial account values at the commencement of operations of Class Q shares (November 15, 2016) and the account values at the end of the current fiscal year (July 31, 2017), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were

| | | | |

| Prudential Day One Underlying Funds | | | 7 | |

Prudential Core Conservative Bond Fund

Your Fund’s Performance (continued)

deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Q shares only. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definition

Bloomberg Barclays US Aggregate Bond Index—The Bloomberg Barclays US Aggregate Bond Index is unmanaged and represents securities that are SEC-registered, taxable, and dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

Presentation of Fund Holdings

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 7/31/17 (%) | |

| US Treasury Notes, 1.500%, 01/31/2019 | | | 3.8 | |

| US Treasury Notes, 1.250%, 11/30/2018 | | | 2.6 | |

| US Treasury Bonds, 3.000%, 05/15/2045 | | | 2.6 | |

| US Treasury Notes, 1.625%, 06/30/2020 | | | 2.5 | |

| US Treasury Notes, 1.250%, 12/31/2018 | | | 2.5 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Fund Composition expressed as a

percentage of net assets as of 7/31/17 (%) | |

| US Treasury Obligations | | | 37.9 | |

Corporate Bonds | | | 29.0 | |

| US Government Agency Obligations | | | 27.9 | |

| Commercial Mortgage-Backed Securities | | | 2.6 | |

Municipal Bonds | | | 1.2 | |

Fund Composition reflects only long-term investments and are subject to change.

| | |

| 8 | | Visit our website at pgiminvestments.com |

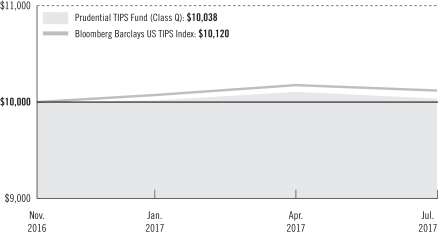

Prudential TIPS Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | |

| | | Total Returns as of 7/31/17 |

| | | Since Inception* (%) |

| Class Q | | 0.38 (11/15/16) |

| Bloomberg Barclays US TIPS Index | | 1.20 |

*Not annualized

Source: PGIM Investments LLC and Lipper Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The Since Inception returns for the index are measured from the closest month-end to the Fund’s inception date.

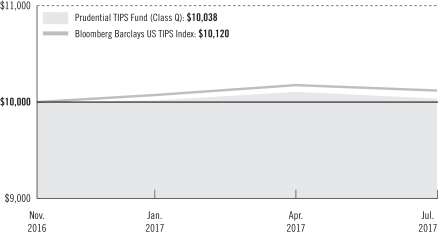

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class Q shares with a similar investment in the Bloomberg Barclays US TIPS Index by portraying the initial account values at the commencement of operations of Class Q shares (November 15, 2016) and the account values at the end of the current fiscal year (July 31, 2017), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all

| | | | |

| Prudential Day One Underlying Funds | | | 9 | |

Prudential TIPS Fund

Your Fund’s Performance (continued)

dividends and distributions were reinvested. The line graph provides information for Class Q shares only. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definition

Bloomberg Barclays US TIPS Index—The Bloomberg Barclays US Treasury Inflation-Protected Securities Index (TIPS Index) is an unmanaged index that consists of inflation-protected securities issued by the US Treasury.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

Presentation of Fund Holdings

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 7/31/17 (%) | |

| US Treasury Inflation Indexed Bonds, TIPS, 0.125%, 01/15/2022 | | | 14.1 | |

| US Treasury Inflation Indexed Bonds, TIPS, 2.375%, 01/15/2025 | | | 13.9 | |

| US Treasury Inflation Indexed Bonds, TIPS, 0.125%, 04/15/2020 | | | 5.5 | |

| US Treasury Inflation Indexed Bonds, TIPS, 0.125%, 01/15/2023 | | | 5.4 | |

| US Treasury Inflation Indexed Bonds, TIPS, 0.625%, 01/15/2024 | | | 5.4 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Fund Composition expressed as a

percentage of net assets as of 7/31/17 (%) | |

| US Treasury Obligations | | | 99.5 | |

Fund Composition reflects only long-term investments and is subject to change.

| | |

| 10 | | Visit our website at pgiminvestments.com |

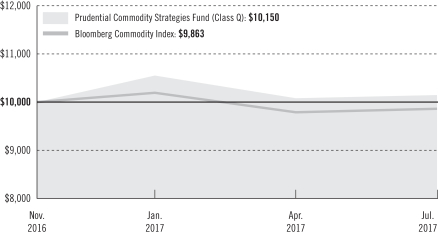

Prudential Commodity Strategies Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | |

| | | Total Returns as of 7/31/17 |

| | | Since Inception* (%) |

| Class Q | | 1.50 (11/15/16) |

| Bloomberg Commodity Index | | –1.37 |

*Not annualized

Source: PGIM Investments LLC and Lipper Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The Since Inception returns for the index are measured from the closest month-end to the Fund’s inception date.

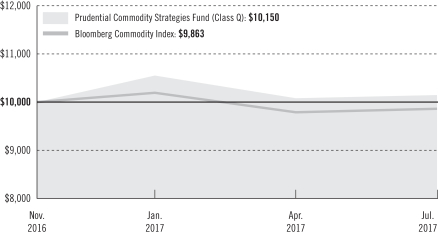

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class Q shares with a similar investment in the Bloomberg Commodity Index by portraying the initial account values at the commencement of operations of Class Q shares (November 15, 2016) and the account values at the end of the current fiscal year (July 31, 2017), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends

| | | | |

| Prudential Day One Underlying Funds | | | 11 | |

Prudential Commodity Strategies Fund

Your Fund’s Performance (continued)

and distributions were reinvested. The line graph provides information for Class Q shares only. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definition

Bloomberg Commodity Index—The Bloomberg Commodity Index is a diversified benchmark for the commodity futures market. It is composed of futures contracts on 19 physical commodities traded on US exchanges, with the exception of aluminum, nickel, and zinc, which trade on the London Metal Exchange (LME).

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

Presentation of Fund Holdings

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 7/31/17 (%) | |

| US Treasury Bills, 0.957%, 08/31/2017 | | | 49.2 | |

| Dreyfus Treasury Securities Cash Management | | | 19.6 | |

| US Treasury Bills, 0.977%, 09/07/2017 | | | 8.0 | |

| US Treasury Bills, 1.023%, 10/12/2017 | | | 7.2 | |

| US Treasury Bills, 1.138%, 10/26/2017 | | | 6.5 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Top Five Commodities Futures Exposure as a

percentage of net assets as of 7/31/17 (%) | |

| Brent Crude | | | 9.6 | |

| Copper | | | 8.4 | |

| Corn | | | 8.2 | |

| Natural Gas | | | 7.4 | |

| Gold 100oz | | | 7.4 | |

Commodity Futures contracts reflect net exposure and are subject to change.

| | |

| 12 | | Visit our website at pgiminvestments.com |

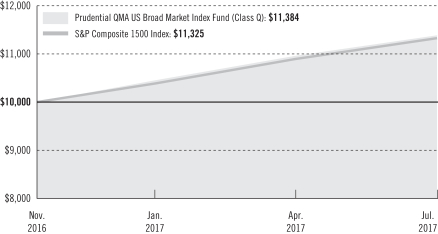

Prudential QMA US Broad Market Index Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | |

| | | Total Returns as of 7/31/17 |

| | | Since Inception* (%) |

| Class Q | | 13.84 (11/17/16) |

| S&P Composite 1500 Index | | 13.25 |

*Not annualized

Source: PGIM Investments LLC and Lipper Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The Since Inception returns for the index are measured from the closest month-end to the Fund’s inception date.

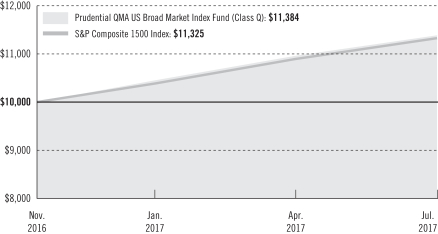

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class Q shares with a similar investment in the S&P Composite 1500 Index by portraying the initial account values at the commencement of operations of Class Q shares (November 17, 2016) and the account values at the end of the current fiscal year (July 31, 2017), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends

| | | | |

| Prudential Day One Underlying Funds | | | 13 | |

Prudential QMA US Broad Market Index Fund

Your Fund’s Performance (continued)

and distributions were reinvested. The line graph provides information for Class Q shares only. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definition

S&P Composite 1500 Index—The S&P Composite 1500® Index combines three leading indices, the S&P 500®, the S&P MidCap 400®, and the S&P SmallCap 600® to cover approximately 90% of the US market capitalization.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

Presentation of Fund Holdings

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 7/31/17 (%) | |

| Apple, Inc., Technology Hardware, Storage & Peripherals | | | 3.0 | |

| SPDR S&P 500 ETF Trust, Exchange-Traded Funds | | | 2.9 | |

| Microsoft Corp., Software | | | 2.2 | |

| Facebook, Inc., Internet Software & Services | | | 1.6 | |

| Amazon.com, Inc., Internet & Direct Marketing Retail | | | 1.5 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Five Largest Industries expressed as a

percentage of net assets as of 7/31/17 (%) | |

| Banks | | | 6.0 | |

| Software | | | 4.4 | |

| Oil, Gas & Consumable Fuels | | | 4.4 | |

| Pharmaceuticals | | | 4.2 | |

| Internet Software & Services | | | 4.0 | |

Industry weightings reflect only long-term investments and are subject to change.

| | |

| 14 | | Visit our website at pgiminvestments.com |

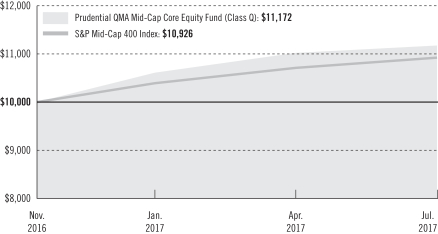

Prudential QMA Mid-Cap Core Equity Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | |

| | | Total Returns as of 7/31/17 |

| | | Since Inception* (%) |

| Class Q | | 11.72 (11/17/16) |

| S&P Mid-Cap 400 Index | | 9.26 |

*Not annualized

Source: PGIM Investments LLC and Lipper Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The Since Inception returns for the index are measured from the closest month-end to the Fund’s inception date.

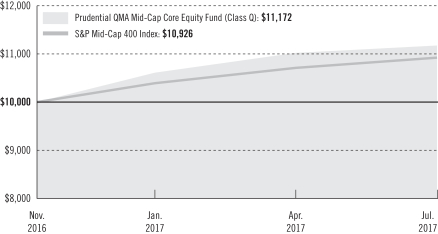

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class Q shares with a similar investment in the S&P Mid-Cap 400 Index by portraying the initial account values at the commencement of operations of Class Q shares (November 17, 2016) and the account values at the end of the current fiscal year (July 31, 2017), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends

| | | | |

| Prudential Day One Underlying Funds | | | 15 | |

Prudential QMA Mid-Cap Core Equity Fund

Your Fund’s Performance (continued)

and distributions were reinvested. The line graph provides information for Class Q shares only. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definition

S&P Mid-Cap 400 Index—The S&P 400 Index is designed to measure the performance of 400 mid-sized companies in the US.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

Presentation of Fund Holdings

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 7/31/17 (%) | |

| Chemours Co. (The), Chemicals | | | 1.2 | |

| iShares Core S&P Mid-Cap ETF, Exchange-Traded Funds | | | 1.2 | |

| Cadence Design Systems, Inc., Software | | | 1.1 | |

| MSCI, Inc., Capital Markets | | | 1.1 | |

| Atmos Energy Corp., Gas Utilities | | | 1.0 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Five Largest Industries expressed as a

percentage of net assets as of 7/31/17 (%) | |

| Equity Real Estate Investment Trusts (REITs) | | | 8.5 | |

| Banks | | | 7.2 | |

| Electronic Equipment, Instruments & Components | | | 5.8 | |

| Machinery | | | 5.7 | |

| Software | | | 4.6 | |

Industry weightings reflect only long-term investments and are subject to change.

| | |

| 16 | | Visit our website at pgiminvestments.com |

Prudential Jennison Small-Cap Core Equity Fund

Strategy and Performance Overview

How did the Fund perform?

The Prudential Jennison Small-Cap Core Equity Fund’s Class Q shares rose 12.89% since inception on November 15, 2016 through July 31, 2017. In the same period, the Russell 2000® Index (the Index) advanced 8.73%.

What was the market environment?

| • | | Equity markets posted strong gains in the period. Growth stocks meaningfully outperformed value stocks and large caps topped mid and small caps. |

| • | | Despite the Trump administration’s unorthodox approach and the Republican-controlled legislature’s lack of accomplishment, equity market gains so far this year have been supported by earnings growth and margin expansion across many industries. |

| • | | In the Index, utilities and information technology gained the most ground, while energy declined sharply. |

| • | | Solid economic fundamentals in the US included moderate GDP expansion, robust employment, and accelerating corporate profit growth. Inflation remained benign. The Federal Reserve raised the federal funds target rate to 1.00%-1.25%. |

What worked?

| • | | Information Technology contributed strongly to performance: |

| | • | | Paycom Software’s earnings and operating margins were impressive. Jennison continues to believe the company is executing extremely well, and its mix of growth and profitability is one of the best among its peers. It also has a defensible competitive position as well as the ability to gain clients from legacy vendors. |

| | • | | Results for semiconductor company MACOM Technology Solutions were driven by strength, most notably in its Datacenter Optical segment. Jennison believes the company is a unique mix of near and long term growth drivers and expanding margins. |

| • | | The consumer discretionary, materials, and industrials sectors also added value in aggregate; however, other key contributors were not concentrated in any one sector: |

| | • | | Vail Resorts enjoyed a good quarter despite a slow start to the ski season. This demonstrates to Jennison how nicely the business model has developed, with significant revenue locked in via season passes and increasing geographic diversity moderating some of the weather risk. Jennison continues to see numerous growth opportunities for the company, while eyeing its steadily increasing market cap for suitability in its portfolios. |

| | • | | Intersect ENT’s long-term upside remains compelling in Jennison’s view. Jennison expects accelerating sales growth to continue into 2019 and Jennison is encouraged by sales force productivity and early success of the PROPEL Contour launch. |

| | | | |

| Prudential Day One Underlying Funds | | | 17 | |

Prudential Jennison Small-Cap Core Equity Fund

Strategy and Performance Overview (continued)

| | • | | NN, Inc. is a global diversified industrial manufacturer of high-precision metal and plastic components and assemblies. The company posted organic growth in its three business segments—Precision Bearing Components, Autocam Precision Components, and Precision Engineered Products. Jennison believes there is the potential for additional upside as positive industrial data points turn into revenues in what should be a more robust macro environment. |

What didn’t work?

| • | | Overweight positions in energy and health care hurt relative results. Individual detractors were diversified across sectors. |

| | • | | Shares of Forum Energy Technologies likely fell as a result of slower cost absorption and less-robust pricing than investors anticipated. In our view, the company continues to be well situated for what Jennison still expects to be a broader recovery, particularly after the company absorbs costs at its facilities and pricing picks up at the same time. |

| | • | | Zoe’s Kitchen’s quarterly results were disappointing, and management signaled expectations for margin pressures to persist in the coming quarters, as core initiatives were not expected to drive sales until the latter half of this year. In addition, the fast casual industry remains difficult overall due to macro headwinds. Jennison likes the steps that management is taking to build future growth, including expanding its menu and delivery options, increasing infrastructure and technology investments, while building a national footprint. |

| | • | | Aggressive price actions by United drove weaker than expected guidance which sent shares of Spirit Airlines and broader airline equities down sharply. While fare wars will drive earnings down, Jennison is hopeful that this could be short lived. Jennison continues to like Spirit’s business model and position as a low cost provider in key leisure markets. |

| | • | | Radius Health suffered from complications surrounding the approval and commercialization of its program to treat severe osteoporosis. Jennison’s original investment decision was predicated on the strategic value of its treatments and oncology program However, Jennison eliminated the position as the launch and payer environment would take time before the drug was truly successful. |

| | • | | Shares of CyberArk Software declined on decelerating license revenue growth and sales execution issues. Jennison believes that the end markets are healthy and that CyberArk Software can fix its execution missteps. |

| | |

| 18 | | Visit our website at pgiminvestments.com |

The percentage points shown in the tables identify each security’s positive or negative contribution to the Fund’s return, which is the sum of all contributions by individual holdings.

| | | | | | |

| Top Contributors (%) | | Top Detractors (%) |

| Paycom Software Inc. | | 0.93 | | Forum Energy Technologies, Inc. | | –0.41 |

| Vail Resorts, Inc. | | 0.80 | | Zoe’s Kitchen, Inc. | | –0.37 |

| MACOM Technology Solutions Holdings, Inc. | | 0.68 | | Spirit Airlines, Inc. | | –0.27 |

| Intersect ENT, Inc. | | 0.59 | | Radius Health, Inc. | | –0.26 |

| NN, Inc. | | 0.56 | | CyberArk Software Ltd. | | –0.19 |

Current outlook

| • | | There are a number of outcomes from President Trump’s policy changes being discussed that could be positive for the overall US economy and equity markets. |

| • | | These include reduced regulations and a more business-friendly environment; a likelihood of lower corporate and personal tax rates; rising confidence of consumers and small business owners; and increased capital spending and/or stimulative fiscal policy. |

| • | | On the other hand, Jennison sees certain economic headwinds that indicate it might not be smooth sailing. |

| • | | These include historically low labor productivity, rising commodity prices and rising interest rates; calls for protectionism and increased tariffs or border taxes; and a rising US dollar. |

| • | | Jennison is more positive on the financial sector, which could benefit from the combination of rising rates, reduced regulation and possibly lower taxes. Jennison is also constructive on Technology and selected parts of Industrials which have been depressed and could benefit from increased spending in infrastructure and/or defense and improvement in Energy markets. |

| • | | In contrast, Jennison has concerns about the uncertainty impacting health care. At the same time, Jennison is cautious on cyclical stocks which have rebounded strongly but where the magnitude and duration of the recovery is very uncertain. Jennison favors more services-oriented businesses in the consumer discretionary sector over retail. |

| • | | As always, Jennison remains biased towards long term secular growth stories with attractive valuations, good balance sheets, and strong free cash flow. With inflation rising for the first time in many years, Jennison’s particular focus is on companies that can demonstrate pricing power and the ability to hold margins against cost pressures. |

| | | | |

| Prudential Day One Underlying Funds | | | 19 | |

Prudential Core Conservative Bond Fund

Strategy and Performance Overview

How did the Fund perform?

The Prudential Core Conservative Bond Fund’s Class Q shares returned 1.72% for the period since its inception on November 15, 2016 through July 31, 2017, underperforming the 2.86% gain of the Bloomberg Barclays US Aggregate Bond Index (the Index).

What were market conditions?

| • | | During the reporting period, the market experienced several significant events, including the surprise victory of Donald Trump in the US Presidential election, the impact of ongoing bond-buying programs by the European Central Bank and the Bank of England, two Federal Reserve (Fed) rate hikes, and the wait for details about the Fed’s long-expected balance sheet runoff. As the period ended, speculation increased about who would head the Fed after Janet Yellen’s term expires in early 2018. Would it be a dove intent on boosting the Trump growth agenda? Or, would it be a more rules-based chairperson intent on reaching the Fed’s “dots”? (“Dots” refer to projections made by the members of the Fed’s Open Market Committee about where they think interest rates should be at a particular point in the future.) |

| • | | US economic growth, which had weakened earlier in the period, rebounded to a 2.6% pace during the second quarter of 2017 against a backdrop of continued above-trend growth in the rest of the G3. (The G3, or Group of Three, refers to the US, Japan and the European Union.) US inflation, however, was generally weaker than expected, continuing to undershoot G3 central bank targets. |

| • | | Overall, the underlying momentum in the US economy has remained solid since early 2016. Real final private sector demand has been notably robust, growing at an annualized rate of between 2.6% and 3.3% in each of the last five calendar quarters and averaging 2.8% in first half of 2017. (Real final demand is the total demand for final goods and services, adjusted for inflation, in an economy.) Consumer spending has been particularly strong, but investment spending, too, has picked up as headwinds from the collapse in energy prices and the strengthening US dollar have faded. |

| • | | US companies continued to hire at a strong pace, with monthly job gains averaging 184,000 in the year to date through July 31, 2017, which is little changed from 2016’s average of 187,000 jobs and well above the estimated 75,000 to 100,000 jobs needed to keep the unemployment rate unchanged. Indeed, the unemployment rate gradually ticked lower during the reporting period, inching down to 4.3% in July. Importantly, job gains were widespread across industries. Even the retail sector, which shed jobs every month from February through May, saw stable employment in the last two months of the period. |

| • | | Lean business inventories, solid core durable goods orders, and ongoing strong job gains suggest real US GDP growth is on track to maintain its second-quarter momentum into the third quarter. |

| | |

| 20 | | Visit our website at pgiminvestments.com |

| • | | The US fixed income markets, as represented by the Index, performed well during the reporting period, posting a return of 2.86%. |

| • | | US corporate bonds also performed well. Within the Index, metals & mining, energy, and paper & packaging were amongst the strongest-performing sectors, while airlines, tobacco, and retailers & restaurants were amongst the largest underperforming sectors. |

| • | | Agency mortgage-backed securities outperformed US Treasuries during the fourth quarter of 2016 as interest rates rose sharply after the US Presidential election. The underperformance continued in the first quarter of 2017 due to increased concern about a more aggressive pace of Fed rate hikes and statements about potential adjustments to the Fed’s balance sheet. Toward the end of the period, mortgage-backed securities spreads (yield differentials versus comparable-maturity Treasuries) tightened, net supply increased, and outright buyers seemed willing to wait for better entry points to add mortgage-backed securities exposure. The 30-year mortgage rate ended the period at approximately 4%. |

| • | | Structured products performed very well but closed the period with notable spread tightening in asset-backed securities (ABS), non-agency mortgage-backed securities, and commercial mortgage-backed securities (CMBS). |

What worked?

| • | | The Fund’s overweight positions in investment-grade corporate bonds and municipal securities added to relative performance. |

| • | | Security selection among US Treasuries and emerging markets debt also contributed positively. |

| • | | Within corporate bonds, positioning in the foreign non-corporate, automotive, and consumer non-cyclical sectors was positive. |

| • | | In individual security selection, the Fund benefited from overweights in Morgan Stanley (banking), General Motors (automotive), and Anheuser-Busch InBev (consumer non-cyclical). |

| • | | The Fund’s duration positioning added to performance for the reporting period. Duration measures the sensitivity of the price (the value of principal) of a bond to a change in interest rates. |

What didn’t work?

| • | | The Fund underperformed due to expenses related to its start-up costs. |

| • | | The Fund’s underweights in emerging markets debt and mortgage-backed securities detracted from relative returns. |

| | | | |

| Prudential Day One Underlying Funds | | | 21 | |

Prudential Core Conservative Bond Fund

Strategy and Performance Overview (continued)

| • | | Security selection in investment-grade corporate bonds limited results. |

| • | | The Fund’s positioning in the telecommunication services, midstream energy, and banking sectors detracted from performance. |

| • | | In individual security selection, the Fund’s overweight positions in Verizon Communications (telecommunication services), Goldman Sachs (banking) and Oracle (technology) hurt relative returns. |

Current outlook

| • | | PGIM Fixed Income, a PGIM business, maintains a positive view of fundamentals in the credit sectors of the fixed income market and the Fund is overweight in spread sectors, including investment-grade corporate bonds, and also in municipal securities and CMBS. |

| • | | Within investment-grade corporate bonds, the Fund continues to have a longer duration emphasis, with a modest overweight in financials. Within industrials, PGIM Fixed Income is focusing on names where an “event” has passed, as companies that issue higher-quality corporate bonds continue to add debt and consolidation remains a concern. Furthermore, PGIM Fixed Income is focusing on US-centric issuers rather than multinationals or exporters that are vulnerable to potential protectionist trade policies. The main near-term risks in the corporate bond market are the policies of the US Administration, the impact of the tightening Fed, and political instability outside the US. |

| • | | With regards to municipal securities, PGIM Fixed Income believes market technicals (supply and demand conditions) should remain favorable through much of the third quarter of 2017 but expects the environment to become less supportive by the end of the quarter. Tax-reform discussions in Washington, D.C. will be closely monitored, though they are not expected to negatively impact the market during 2017. Volatility is likely to continue in Puerto Rico, as the judge overseeing the commonwealth’s bankruptcy case has encouraged all parties to resolve disputes through negotiation. Looking ahead, PGIM Fixed Income expects taxable municipal bonds to perform in line with corporate bonds, with the potential for outperformance should corporate mergers and acquisitions activity pick up. |

| • | | Among US Treasuries, the Fund is positioned for higher two-year yields given the potential for additional Fed policy tightening amid the recent firmness in economic data and the possibility of further increases in asset prices. Overall, PGIM Fixed Income remains positive on the intermediate portion of the Treasury yield curve, which appears cheap based on potential Fed policy scenarios. |

| • | | Structured products are noteworthy for favorable supply technicals and a benign fundamental backdrop, but PGIM Fixed Income believes they remain vulnerable to spread volatility in other riskier asset classes. Nevertheless, PGIM Fixed Income remains very positive on assets at the top of the capital structure. |

| | |

| 22 | | Visit our website at pgiminvestments.com |

| • | | In CMBS, PGIM Fixed Income continues to find value in high-quality securities of new issue conduit deals. (Conduit deals are collateralized by a pool of approximately 50 to 100 fixed-rate commercial mortgage loans that are fairly well diversified by loan size, geographic location, and property type.) |

| • | | The Fund maintains an underweight in non-US government-related sectors, as well as in US agency securities and US agency mortgage-backed securities, as PGIM Fixed Income finds more compelling value in the sectors previously mentioned. |

| | | | |

| Prudential Day One Underlying Funds | | | 23 | |

Prudential TIPS Fund

Strategy and Performance Overview

How did the Fund Perform?

The Prudential TIPS Fund’s Class Q shares returned 0.38% from its inception on November 15, 2016 through July 31, 2017. During the same period, the Bloomberg Barclays US TIPS Index (the Index) returned 1.20%.

What were market conditions?

| • | | Developed market rates encountered a steady headwind in late 2016 amid expectations for expanded fiscal policies in the US, signs of policy restraint or tightening from major central banks, and firming inflation prospects as oil prices rose. |

| • | | TIPS performed well in the fourth quarter of 2016, due to Donald Trump’s election win and expectations of more stimulus and pro-growth initiatives, which typically result in higher inflation. The increase in oil prices throughout the quarter also contributed to strong TIPS performance. |

| • | | While the market reaction to the global reflation trade, which reflects a pick-up in economic activity and corporate earnings, garnered many headlines in the first quarter of 2017, the US 10-year Treasury yield retraced its increase since the start of the year and ended the first quarter about six basis points lower at 2.39%. The earlier increase in rates occurred globally amid signs of accelerating growth and inflation. Indeed, the increase in inflation in both Europe and the US appeared to approach targets set by the respective central banks. TIPS breakevens widened to start the year as they outperformed nominal Treasuries on the global reflation trade. (A TIPS breakeven rate is when the expected inflation rate equals comparable US Treasury yield minus TIPS real yield.) Then later in the quarter, TIPS underperformed nominal Treasuries as confidence waned that the new President would be able to easily push through his pro-growth agenda. TIP breakevens finished the first quarter little changed. |

| • | | The US Treasuries market continued to offer a robust set of long and short opportunities across the curve. The front of the curve rose in the second quarter as the Federal Reserve (Fed) implemented another rate hike in June and set the stage to start tapering its balance sheet by the end of the year. While PGIM Fixed Income’s base case is that the Fed raises rates one more time in 2017, the market-implied probability for another hike this year only stood at about 50% as the quarter ended, which PGIM Fixed Income believes is underpriced and supports the Fund’s short positioning at the front of the Treasuries curve. TIPS breakevens tightened in the second quarter as inflation decelerated and commodity prices decreased. |

What worked?

| • | | Security selection added to performance for the reporting period. |

| | |

| 24 | | Visit our website at pgiminvestments.com |

| • | | The duration of the Fund was closely matched to the Index for the reporting period. Duration positioning added to performance during the period. The Fund ended the period with a neutral duration position to the Index. |

What didn’t work?

| • | | The Fund’s underperformance was driven mainly by transaction costs related to the launch of the Fund in November 2016. |

| • | | The Fund maintained a yield curve flattening position which hurt performance over the reporting period. |

Current outlook

The weak inflation environment poses a quandary for the Fed as it contemplates the next steps in its tightening cycle. At the Fed’s next meeting on September 20, PGIM Fixed Income anticipates the Fed will likely formally announce plans to begin reducing its balance sheet gradually by tapering its reinvestments of maturing securities, with actual tapering likely to begin in October. PGIM Fixed Income still anticipates an additional rate hike in December, followed by two additional rate hikes next year, as a base case. Policy developments out of Congress remain a risk for the timing of Fed tightening, however. The lack of progress on healthcare reform has likely delayed tax reform, and the legislative calendar in September is packed, including the need for Congress to address the debt ceiling and extend government spending authorization beyond the current September 30 deadline.

| | | | |

| Prudential Day One Underlying Funds | | | 25 | |

Prudential Commodity Strategies Fund

Strategy and Performance Overview

How did the Fund perform?

The Prudential Commodity Strategies Fund Class Q shares returned 1.50% for the period since the Fund’s inception on November 15, 2016 through July 31, 2017. The Fund outperformed the Bloomberg Commodity Index (the Index), which fell –1.37%.

What were market conditions?

For the period, the industrial metals, precious metals and livestock sectors rallied, while the energy and agriculture (grains and soft commodities) sectors fell.

What worked?

| | • | | The Fund’s positions in natural gas and sugar contributed to the relative outperformance for the period. |

| | • | | Underweights in sugar and soybean oil in addition to an overweight in wheat contributed to portfolio performance. |

What didn’t work?

| • | | The performance of natural gas and grains markets were hindered by negative roll yield associated with contango—a situation where the future spot price (the current market price) is below the current price. The precious metals and softs sectors moved lower. |

Did the Fund use derivatives and how did they affect performance?

| • | | The Fund primarily trades in listed exchange-traded commodity futures contracts. These futures are a form of derivatives, based on the underlying price of a specific commodity. |

Current outlook

At the moment, the portfolio is positioned with an overweight to the energy sector (both the petroleum complex as well as natural gas), underweight positions held in the precious metals and livestock sectors (sectors which have historically demonstrated lower betas (risk measures) to the performance of the asset class) and an intra-sector relative value position in grains in which corn and the two wheat contracts (Chicago and Kansas City) are overweighted while the soybean complex (soybeans, soybean meal and soybean oil) are underweighted. Additionally, deferred calendar months futures contracts are held to varying extents across the portfolio.

| | |

| 26 | | Visit our website at pgiminvestments.com |

Prudential QMA US Broad Market Index Fund

Strategy and Performance Overview

How did the Fund perform?

The Prudential QMA Broad Index Fund’s Class Q shares returned 13.84% for the period since the Fund’s inception on November 17, 2016, through July 31, 2017. During the same period, the S&P 1500 Composite Index (the Index) gained 13.25%.

What were market conditions?

| • | | Stocks turned in strong performance during the reporting period. As a result of some turbulence in November just after the US presidential election, stocks initially plummeted but quickly reversed course and maintained gains through the reporting period on strong earnings and positive investor sentiment. |

| • | | Headline macro-events included fiercely contested disputes in the US Congress over the Trump administration’s policy initiatives, especially on health care and tax reform. Investors shrugged off the political impasse, as stocks sailed smoothly to new highs on strong earnings and positive investor sentiment. However, the extended low-volatility environment had some investors worried over concerns that a sense of complacency may have taken hold. |

| • | | Solid economic fundamentals in the US included moderate GDP expansion, robust employment, and accelerating corporate profit growth. Inflation remained benign. The Federal Reserve raised the federal funds target rate to 1.00%–1.25%. |

What worked?

| • | | The Fund closely tracked the performance of the Index over the period ending July 31, 2017. |

| • | | The Fund held all stocks included in the Index in approximately the same proportions. |

Did the Fund use derivatives and how did they affect performance?

| • | | The Fund held S&P 500 E-Mini stock index futures, a form of derivatives, to maintain exposure to equities and provide portfolio liquidity. Futures had minimal impact on performance over the year to date. |

| | | | |

| Prudential Day One Underlying Funds | | | 27 | |

Prudential QMA Mid-Cap Core Equity Fund

Strategy and Performance Overview

How did the Fund perform?

The Prudential QMA Mid-Cap Core Fund’s Class Q Shares returned 11.72% for the period since its inception on November 17, 2016 through July 31, 2017. The Fund outperformed the 9.26% return of the S&P Mid-Cap 400 Index (the Index).

What were market conditions?

| • | | Stocks turned in strong performance during the reporting period. As a result of some turbulence in November just after the US presidential election, stocks initially plummeted but quickly reversed course and maintained gains through the reporting period on strong earnings and positive investor sentiment. |

| • | | Headline macro-events included fiercely contested disputes in the US Congress over the Trump administration’s policy initiatives, especially on health care and tax reform. Investors shrugged off the political impasse, as stocks sailed smoothly to new highs on strong earnings and positive investor sentiment. However, the extended low-volatility environment had some investors worried over concerns that a sense of complacency may have taken hold. |

| • | | Solid economic fundamentals in the US included moderate GDP expansion, robust employment, and accelerating corporate profit growth. Inflation remained benign. The Federal Reserve raised the federal funds target rate to 1.00%–1.25%. |

What worked?

| • | | The Fund’s positions are based on a quantitative stock selection model that favors companies that are a good value, are high quality and have good earnings prospects relative to peers. QMA’s quality factors in stock selection were particularly powerful over the period, and accounted for much of the excess return. |

| • | | Growth factors, including measures of analyst revision and adjustments to target prices, were a positive contributor as well, but to a lesser degree. |

| • | | QMA maintains diversified portfolios built from the bottom up, with limited deviations from the benchmark with respect to sector and industry. These risk controls ensured unintended bets did not unwind the strength of the signals from QMA’s stock selection model. |

What did not work?

| • | | Relative value factors in QMA’s model detracted from performance. In general, stocks that were more expensive relative to peers when using earnings, book and sales-based |

| | multiples meaningfully outperformed attractively priced stocks. This was concentrated in the second quarter of 2017. |

| • | | Stock selection among technology stocks struggled as investors reached for growth with little regard for the relative value or quality of the companies. |

| | |

| 28 | | Visit our website at pgiminvestments.com |

Current outlook:

| • | | While valuation signals were less effective in the second quarter, QMA continues to see potential among attractively priced stocks. Through the second quarter QMA observed that the difference in valuations between the most and least expensive stocks (the valuation spread) had widened to extreme levels when compared to historical levels. QMA’s research shows that during this type of environment, there tends to be a stronger payoff to valuation factors. The valuation spread remains above average and points to ongoing opportunities among undervalued stocks. |

| | | | |

| Prudential Day One Underlying Funds | | | 29 | |

Fees and Expenses

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended July 31, 2017. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential Jennison

Small-Cap Core

Equity Fund | | Beginning Account

Value

February 1, 2017 | | | Ending Account

Value

July 31, 2017 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class Q | | Actual | | $ | 1,000.00 | | | $ | 1,071.30 | | | | 0.95 | % | | $ | 4.88 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.08 | | | | 0.95 | % | | $ | 4.76 | |

| | |

| 30 | | Visit our website at pgiminvestments.com |

| | | | | | | | | | | | | | | | | | |

Prudential Core

Conservative Bond Fund | | Beginning Account

Value

February 1, 2017 | | | Ending Account

Value

July 31, 2017 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class Q | | Actual | | $ | 1,000.00 | | | $ | 1,022.80 | | | | 0.50 | % | | $ | 2.51 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.32 | | | | 0.50 | % | | $ | 2.51 | |

| | | | | | | | | | | | | | | | | | |

Prudential

TIPS Fund | | Beginning Account

Value

February 1, 2017 | | | Ending Account

Value

July 31, 2017 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class Q | | Actual | | $ | 1,000.00 | | | $ | 1,001.90 | | | | 0.40 | % | | $ | 1.99 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.81 | | | | 0.40 | % | | $ | 2.01 | |

| | | | | | | | | | | | | | | | | | |

Prudential Commodity

Strategies Fund | | Beginning Account

Value

February 1, 2017 | | | Ending Account

Value

July 31, 2017 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class Q | | Actual | | $ | 1,000.00 | | | $ | 962.10 | | | | 1.01 | % | | $ | 4.91 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.84 | | | | 1.01 | % | | $ | 5.06 | |

| | | | | | | | | | | | | | | | | | |

Prudential QMA

US Broad Market

Index Fund | | Beginning Account

Value

February 1, 2017 | | | Ending Account

Value

July 31, 2017 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class Q | | Actual | | $ | 1,000.00 | | | $ | 1,089.20 | | | | 0.20 | % | | $ | 1.04 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,023.80 | | | | 0.20 | % | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | |

Prudential QMA

Mid-Cap Core Equity Fund | | Beginning Account

Value

February 1, 2017 | | | Ending Account

Value

July 31, 2017 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class Q | | Actual | | $ | 1,000.00 | | | $ | 1,052.80 | | | | 0.85 | % | | $ | 4.33 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.58 | | | | 0.85 | % | | $ | 4.26 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the tables), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended July 31, 2017, and divided by the 365 days in the Fund’s fiscal year ended July 31, 2017 (to reflect the six-month period). Expenses presented in the tables include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

| Prudential Day One Underlying Funds | | | 31 | |

Prudential Jennison Small-Cap Core Equity Fund

Schedule of Investments

as of July 31, 2017

| | | | | | | | |

| Description | | Shares | | | Value | |

LONG-TERM INVESTMENTS 95.3% | |

| | |

COMMON STOCKS | | | | | | | | |

| | |

Aerospace & Defense 0.7% | | | | | | | | |

KLX, Inc.* | | | 1,739 | | | $ | 90,289 | |

| | |

Airlines 0.8% | | | | | | | | |

Spirit Airlines, Inc.* | | | 2,506 | | | | 97,358 | |

| | |

Auto Components 0.1% | | | | | | | | |

Dorman Products, Inc.* | | | 203 | | | | 15,850 | |

| | |

Banks 13.2% | | | | | | | | |

Bank of the Ozarks, Inc. | | | 3,493 | | | | 150,723 | |

BankUnited, Inc. | | | 4,726 | | | | 162,669 | |

Brookline Bancorp, Inc. | | | 4,165 | | | | 61,850 | |

Byline Bancorp, Inc.* | | | 1,253 | | | | 25,260 | |

Columbia Banking System, Inc. | | | 3,183 | | | | 126,811 | |

Eagle Bancorp, Inc.* | | | 2,743 | | | | 171,300 | |

East West Bancorp, Inc. | | | 4,641 | | | | 264,444 | |

Pinnacle Financial Partners, Inc. | | | 3,325 | | | | 212,468 | |

Renasant Corp. | | | 2,314 | | | | 98,090 | |

Seacoast Banking Corp. of Florida* | | | 3,559 | | | | 83,174 | |

Signature Bank* | | | 739 | | | | 102,411 | |

Wintrust Financial Corp. | | | 2,670 | | | | 201,078 | |

| | | | | | | | |

| | | | | | | 1,660,278 | |

| | |

Beverages 0.3% | | | | | | | | |

MGP Ingredients, Inc. | | | 640 | | | | 37,734 | |

| | |

Biotechnology 2.9% | | | | | | | | |

Amicus Therapeutics, Inc.* | | | 9,609 | | | | 124,436 | |

DBV Technologies SA (France), ADR* | | | 1,139 | | | | 50,731 | |

Juno Therapeutics, Inc.* | | | 1,725 | | | | 49,042 | |

La Jolla Pharmaceutical Co.* | | | 1,946 | | | | 57,660 | |

Otonomy, Inc.* | | | 4,100 | | | | 77,080 | |

| | | | | | | | |

| | | | | | | 358,949 | |

| | |

Building Products 0.7% | | | | | | | | |

JELD-WEN Holding, Inc.* | | | 572 | | | | 18,676 | |

PGT Innovations, Inc.* | | | 5,794 | | | | 75,322 | |

| | | | | | | | |

| | | | | | | 93,998 | |

See Notes to Financial Statements.

| | | | |

| Prudential Day One Underlying Funds | | | 33 | |

Prudential Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2017

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Capital Markets 0.9% | | | | | | | | |

Moelis & Co. (Class A Stock) | | | 1,639 | | | $ | 67,035 | |

OM Asset Management PLC | | | 3,316 | | | | 49,972 | |

| | | | | | | | |

| | | | | | | 117,007 | |

| | |

Chemicals 2.2% | | | | | | | | |

Ferro Corp.* | | | 8,468 | | | | 162,925 | |

PolyOne Corp. | | | 3,185 | | | | 116,507 | |

| | | | | | | | |

| | | | | | | 279,432 | |

| | |

Commercial Services & Supplies 2.1% | | | | | | | | |

Advanced Disposal Services, Inc.* | | | 4,651 | | | | 112,461 | |

Mobile Mini, Inc. | | | 3,735 | | | | 115,038 | |

West Corp. | | | 1,467 | | | | 34,284 | |

| | | | | | | | |

| | | | | | | 261,783 | |

| | |

Construction & Engineering 0.2% | | | | | | | | |

Great Lakes Dredge & Dock Corp.* | | | 5,320 | | | | 21,014 | |

| | |

Construction Materials 1.8% | | | | | | | | |

Summit Materials, Inc. (Class A Stock)* | | | 7,851 | | | | 223,282 | |

| | |

Distributors 0.6% | | | | | | | | |

Core-Mark Holding Co., Inc. | | | 2,001 | | | | 73,377 | |

| | |

Diversified Telecommunication Services 1.2% | | | | | | | | |

Cogent Communications Holdings, Inc. | | | 3,756 | | | | 156,813 | |

| | |

Electric Utilities 1.7% | | | | | | | | |

El Paso Electric Co. | | | 2,186 | | | | 113,454 | |

Portland General Electric Co. | | | 2,357 | | | | 105,334 | |

| | | | | | | | |

| | | | | | | 218,788 | |

| | |

Electronic Equipment, Instruments & Components 1.4% | | | | | | | | |

Anixter International, Inc.* | | | 1,203 | | | | 94,736 | |

Littelfuse, Inc. | | | 450 | | | | 81,081 | |

| | | | | | | | |

| | | | | | | 175,817 | |

| | |

Energy Equipment & Services 0.7% | | | | | | | | |

Basic Energy Services, Inc.* | | | 680 | | | | 15,232 | |

Forum Energy Technologies, Inc.* | | | 5,687 | | | | 75,353 | |

| | | | | | | | |

| | | | | | | 90,585 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Equity Real Estate Investment Trusts (REITs) 7.2% | | | | | | | | |

Chatham Lodging Trust | | | 4,557 | | | $ | 94,239 | |

Colony NorthStar, Inc. (Class A Stock) | | | 9,085 | | | | 133,004 | |

Cousins Properties, Inc. | | | 8,852 | | | | 81,350 | |

Gaming & Leisure Properties, Inc. | | | 2,370 | | | | 89,918 | |

Hersha Hospitality Trust | | | 6,495 | | | | 121,846 | |

National Storage Affiliates Trust | | | 3,520 | | | | 80,819 | |

Pebblebrook Hotel Trust | | | 2,859 | | | | 96,262 | |

QTS Realty Trust, Inc. (Class A Stock) | | | 1,634 | | | | 87,370 | |

Retail Opportunity Investments Corp. | | | 5,828 | | | | 118,192 | |

| | | | | | | | |

| | | | | | | 903,000 | |

| | |

Food & Staples Retailing 1.9% | | | | | | | | |

Performance Food Group Co.* | | | 5,538 | | | | 159,494 | |

Sprouts Farmers Market, Inc.* | | | 3,321 | | | | 79,937 | |

| | | | | | | | |

| | | | | | | 239,431 | |

| | |

Food Products 2.0% | | | | | | | | |

Adecoagro SA (Argentina)* | | | 11,660 | | | | 118,582 | |

Darling Ingredients, Inc.* | | | 5,271 | | | | 85,759 | |

Hain Celestial Group, Inc. (The)* | | | 937 | | | | 41,894 | |

| | | | | | | | |

| | | | | | | 246,235 | |

| | |

Health Care Equipment & Supplies 3.1% | | | | | | | | |

GenMark Diagnostics, Inc.* | | | 9,511 | | | | 112,515 | |

Integra LifeSciences Holdings Corp.* | | | 2,016 | | | | 100,115 | |

Nevro Corp.* | | | 1,440 | | | | 123,926 | |

NuVasive, Inc.* | | | 857 | | | | 56,382 | |

| | | | | | | | |

| | | | | | | 392,938 | |

| | |

Health Care Providers & Services 2.8% | | | | | | | | |

Acadia Healthcare Co., Inc.*(a) | | | 1,907 | | | | 100,938 | |

Premier, Inc. (Class A Stock)* | | | 1,400 | | | | 48,860 | |

Teladoc, Inc.* | | | 2,544 | | | | 83,443 | |

Tivity Health, Inc.* | | | 2,920 | | | | 115,778 | |

| | | | | | | | |

| | | | | | | 349,019 | |

| | |

Hotels, Restaurants & Leisure 6.2% | | | | | | | | |

ClubCorp Holdings, Inc. | | | 4,175 | | | | 70,766 | |

Pinnacle Entertainment, Inc.* | | | 8,087 | | | | 153,653 | |

Planet Fitness, Inc. (Class A Stock) | | | 6,609 | | | | 149,760 | |

Texas Roadhouse, Inc. | | | 1,322 | | | | 62,531 | |

Vail Resorts, Inc. | | | 902 | | | | 190,105 | |

Wingstop, Inc.* | | | 3,655 | | | | 109,687 | |

Zoe’s Kitchen, Inc.*(a) | | | 3,697 | | | | 41,813 | |

| | | | | | | | |

| | | | | | | 778,315 | |

See Notes to Financial Statements.

| | | | |

| Prudential Day One Underlying Funds | | | 35 | |

Prudential Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2017

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Insurance 2.1% | | | | | | | | |

Validus Holdings Ltd. | | | 2,637 | | | $ | 141,844 | |

White Mountains Insurance Group Ltd. | | | 142 | | | | 122,773 | |

| | | | | | | | |

| | | | | | | 264,617 | |

| | |

Internet & Direct Marketing Retail 0.4% | | | | | | | | |

Wayfair, Inc. (Class A Stock)*(a) | | | 635 | | | | 48,482 | |

| | | | | | | | |

| | |

Internet Software & Services 3.2% | | | | | | | | |

Criteo SA (France), ADR* | | | 1,644 | | | | 83,186 | |

MINDBODY, Inc. (Class A Stock)* | | | 2,618 | | | | 67,937 | |

MuleSoft, Inc. (Class A Stock)*(a) | | | 2,256 | | | | 49,045 | |

New Relic, Inc.* | | | 1,452 | | | | 68,186 | |

Q2 Holdings, Inc.* | | | 2,655 | | | | 103,280 | |

Shutterstock, Inc.* | | | 870 | | | | 36,662 | |

| | | | | | | | |

| | | | | | | 408,296 | |

| | |

IT Services 2.1% | | | | | | | | |

Global Payments, Inc. | | | 796 | | | | 75,119 | |

InterXion Holding NV (Netherlands)* | | | 2,654 | | | | 127,047 | |

Presidio, Inc.* | | | 4,826 | | | | 65,778 | |

| | | | | | | | |

| | | | | | | 267,944 | |

| | |

Life Sciences Tools & Services 1.1% | | | | | | | | |

INC Research Holdings, Inc. (Class A Stock)* | | | 1,411 | | | | 77,605 | |

NanoString Technologies, Inc.* | | | 2,175 | | | | 33,082 | |

VWR Corp.* | | | 1,040 | | | | 34,320 | |

| | | | | | | | |

| | | | | | | 145,007 | |

| | |

Machinery 4.5% | | | | | | | | |

Actuant Corp. (Class A Stock) | | | 2,727 | | | | 65,993 | |

Gardner Denver Holdings, Inc.* | | | 4,411 | | | | 101,277 | |

Mueller Water Products, Inc. (Class A Stock) | | | 5,177 | | | | 60,053 | |

NN, Inc. | | | 3,343 | | | | 92,601 | |

Rexnord Corp.* | | | 6,987 | | | | 161,819 | |

Terex Corp. | | | 2,252 | | | | 88,661 | |

| | | | | | | | |

| | | | | | | 570,404 | |

| | |

Media 1.2% | | | | | | | | |

Cinemark Holdings, Inc. | | | 3,928 | | | | 152,799 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| |

Mortgage Real Estate Investment Trusts (REITs) 1.1% | | | | | |

MFA Financial, Inc. | | | 15,638 | | | $ | 132,767 | |

| | |

Oil, Gas & Consumable Fuels 3.0% | | | | | | | | |

Arch Coal, Inc. (Class A Stock) | | | 660 | | | | 50,206 | |

PDC Energy, Inc.* | | | 729 | | | | 34,380 | |

SemGroup Corp. (Class A Stock) | | | 3,260 | | | | 88,183 | |

Tallgrass Energy GP LP | | | 2,854 | | | | 74,061 | |

WPX Energy, Inc.* | | | 11,575 | | | | 124,779 | |

| | | | | | | | |

| | | | | | | 371,609 | |

|

Personal Products 0.7% | |

elf Beauty, Inc.* | | | 3,256 | | | | 82,605 | |

|

Pharmaceuticals 2.7% | |

Dermira, Inc.* | | | 3,174 | | | | 87,380 | |

GW Pharmaceuticals PLC (United Kingdom), ADR*(a) | | | 464 | | | | 51,866 | |

Intersect ENT, Inc.* | | | 3,545 | | | | 97,133 | |

Prestige Brands Holdings, Inc.* | | | 1,851 | | | | 99,269 | |

| | | | | | | | |

| | | | 335,648 | |

|

Professional Services 1.0% | |

Korn/Ferry International | | | 3,642 | | | | 121,825 | |

|

Real Estate Management & Development 0.2% | |

Marcus & Millichap, Inc.* | | | 1,218 | | | | 31,181 | |

|

Road & Rail 0.3% | |

Saia, Inc.* | | | 723 | | | | 39,295 | |

|

Semiconductors & Semiconductor Equipment 4.2% | |

Cavium, Inc.* | | | 2,571 | | | | 159,248 | |

MACOM Technology Solutions Holdings, Inc.* | | | 3,572 | | | | 216,285 | |

MaxLinear, Inc. (Class A Stock)* | | | 3,380 | | | | 88,556 | |

Monolithic Power Systems, Inc. | | | 679 | | | | 69,475 | |

| | | | | | | | |

| | | | 533,564 | |

|

Software 8.1% | |

Callidus Software, Inc.* | | | 4,442 | | | | 107,940 | |

CommVault Systems, Inc.* | | | 938 | | | | 55,858 | |

CyberArk Software Ltd. (Israel)* | | | 2,053 | | | | 85,569 | |

Fortinet, Inc.* | | | 2,268 | | | | 83,712 | |

HubSpot, Inc.* | | | 1,831 | | | | 132,473 | |

Paycom Software, Inc.* | | | 3,142 | | | | 220,223 | |

See Notes to Financial Statements.

| | | | |

| Prudential Day One Underlying Funds | | | 37 | |

Prudential Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2017

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

|

Software (cont’d.) | |

Proofpoint, Inc.* | | | 1,453 | | | $ | 123,853 | |

Varonis Systems, Inc.* | | | 3,379 | | | | 125,868 | |

Zendesk, Inc.* | | | 2,843 | | | | 83,357 | |

| | | | | | | | |

| | | | 1,018,853 | |

|

Specialty Retail 2.3% | |

Five Below, Inc.* | | | 4,010 | | | | 193,723 | |

Party City Holdco, Inc.*(a) | | | 6,481 | | | | 90,410 | |

| | | | | | | | |

| | | | 284,133 | |

|

Thrifts & Mortgage Finance 0.2% | |

WSFS Financial Corp. | | | 511 | | | | 23,072 | |

|

Trading Companies & Distributors 2.2% | |

Beacon Roofing Supply, Inc.* | | | 1,444 | | | | 66,323 | |

Univar, Inc.* | | | 6,929 | | | | 215,076 | |

| | | | | | | | |

| | | | 281,399 | |

| | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $10,937,984) | | | | 11,994,792 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENTS 7.8% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUNDS | | | | | | | | |

Prudential Investment Portfolios 2 - Prudential Core Ultra Short Bond Fund(w) | | | 653,270 | | | | 653,270 | |

Prudential Investment Portfolios 2 - Prudential Institutional Money Market Fund

(cost $329,204; includes $328,829 of cash collateral for securities on loan)(b)(w) | | | 329,171 | | | | 329,204 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $982,474) | | | | 982,474 | |

| | | | | | | | |

TOTAL INVESTMENTS 103.1%

(cost $11,920,458) | | | | 12,977,266 | |

Liabilities in excess of other assets (3.1)% | | | | (393,627 | ) |

| | | | | | | | |

NET ASSETS 100.0% | | | $ | 12,583,639 | |

| | | | | | | | |

See the Glossary for abbreviations used in the annual report.

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement is $317,420; cash collateral of $328,829 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. |

| (b) | Represents security purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (w) | PGIM Investments LLC, the manager of the Fund, also serves as manager of the Prudential Investment Portfolios 2—Prudential Core Ultra Short Bond Fund and Prudential Institutional Money Market Fund. |

See Notes to Financial Statements.

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of July 31, 2017 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Aerospace & Defense | | $ | 90,289 | | | $ | — | | | $ | — | |

Airlines | | | 97,358 | | | | — | | | | — | |

Auto Components | | | 15,850 | | | | — | | | | — | |

Banks | | | 1,660,278 | | | | — | | | | — | |

Beverages | | | 37,734 | | | | — | | | | — | |

Biotechnology | | | 358,949 | | | | — | | | | — | |

Building Products | | | 93,998 | | | | — | | | | — | |

Capital Markets | | | 117,007 | | | | — | | | | — | |

Chemicals | | | 279,432 | | | | — | | | | — | |

Commercial Services & Supplies | | | 261,783 | | | | — | | | | — | |

Construction & Engineering | | | 21,014 | | | | — | | | | — | |

Construction Materials | | | 223,282 | | | | — | | | | — | |

Distributors | | | 73,377 | | | | — | | | | — | |

Diversified Telecommunication Services | | | 156,813 | | | | — | | | | — | |

Electric Utilities | | | 218,788 | | | | — | | | | — | |

Electronic Equipment, Instruments & Components | | | 175,817 | | | | — | | | | — | |

Energy Equipment & Services | | | 90,585 | | | | — | | | | — | |

Equity Real Estate Investment Trusts (REITs) | | | 903,000 | | | | — | | | | — | |

Food & Staples Retailing | | | 239,431 | | | | — | | | | — | |

Food Products | | | 246,235 | | | | — | | | | — | |

Health Care Equipment & Supplies | | | 392,938 | | | | — | | | | — | |

Health Care Providers & Services | | | 349,019 | | | | — | | | | — | |

Hotels, Restaurants & Leisure | | | 778,315 | | | | — | | | | — | |

Insurance | | | 264,617 | | | | — | | | | — | |

Internet & Direct Marketing Retail | | | 48,482 | | | | — | | | | — | |

Internet Software & Services | | | 408,296 | | | | — | | | | — | |

See Notes to Financial Statements.

| | | | |

| Prudential Day One Underlying Funds | | | 39 | |

Prudential Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2017

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities (continued) | | | | | | | | | | | | |

Common Stocks (continued) | | | | | | | | | | | | |

IT Services | | $ | 267,944 | | | $ | — | | | $ | — | |

Life Sciences Tools & Services | | | 145,007 | | | | — | | | | — | |

Machinery | | | 570,404 | | | | — | | | | — | |

Media | | | 152,799 | | | | — | | | | — | |