UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-09999 | |

| Exact name of registrant as specified in charter: | Prudential Investment Portfolios 2 | |

| (This Form N-CSR relates solely to the Registrant’s: PGIM Jennison Small-Cap Core Equity Fund, PGIM Core Conservative Bond Fund, PGIM TIPS Fund, PGIM Quant Solutions Commodity Strategies Fund, PGIM Quant Solutions Mid-Cap Core Fund and PGIM Quant Solutions US Broad Market Index Fund.) | ||

| Address of principal executive offices: | 655 Broad Street, 6th Floor | |

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Andrew R. French | |

| 655 Broad Street, 6th Floor | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 7/31/2022 | |

| Date of reporting period: | 7/31/2022 | |

Item 1 – Reports to Stockholders

PGIM Jennison Small-Cap Core Equity Fund

PGIM Core Conservative Bond Fund

PGIM TIPS Fund

PGIM Quant Solutions Commodity Strategies Fund

PGIM Quant Solutions Mid-Cap Core Fund

PGIM Quant Solutions US Broad Market Index Fund

ANNUAL REPORT

JULY 31, 2022

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 9 | ||||

| 11 | ||||

| 14 | ||||

| 17 | ||||

| 20 | ||||

| 33 | ||||

| 36 | ||||

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Funds’ portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC a Prudential Financial company and member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. Jennison Associates LLC is a registered investment adviser. PGIM Quantitative Solutions is the primary business name of PGIM Quantitative Solutions LLC (formerly known as QMA LLC), a wholly owned subsidiary of PGIM, Inc. (PGIM), a Prudential Financial company. © 2022 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

| Dear Shareholder:

| |

We hope you find the annual report for the PGIM Day One Underlying Funds informative and useful. The report covers performance for the 12-month period that ended July 31, 2022.

| ||

| The attention of the global economy and markets turned during the period from the impact of the COVID-19 pandemic to the challenge of rapidly rising inflation. Prices for a wide range of goods and services rose in response to economic reopenings, supply-chain disruptions, pandemic-related governmental stimulus and Russia’s invasion of Ukraine. As inflation surged at its fastest rate in more than 40 years, central banks, led by the US Federal Reserve, sought to restrain the trend by aggressively hiking interest rates, prompting concerns of a potential recession. |

After rising to record levels during the closing months of 2021, US stocks retreated in 2022 in the face of rising prices, slowing economic growth and uncertainties related to the war in Ukraine. Growth-oriented stocks suffered the sharpest losses as investors turned for protection to traditionally defensive, value-oriented stocks. Large-cap equities ended the period in negative territory but outperformed their small-cap counterparts by a significant margin. International developed markets trailed the US market, while emerging markets lagged further behind.

Rising rates and economic uncertainty drove fixed-income prices broadly lower as well. US and global investment-grade bonds, along with US high yield corporate bonds and emerging market debt, all posted negative returns for the period.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 11th-largest investment manager with more than $1.5 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Day One Underlying Funds

September 15, 2022

PGIM Day One Underlying Funds 3

PGIM Jennison Small-Cap Core Equity Fund

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 7/31/22 | ||||||

| One Year (%) | Five Years (%) | Since Inception (%) | ||||

Class R6 | -19.13 | 9.51 | 10.61 (11/15/2016) | |||

Russell 2000 Index |

-14.29 | 7.12 | 7.84 | |||

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

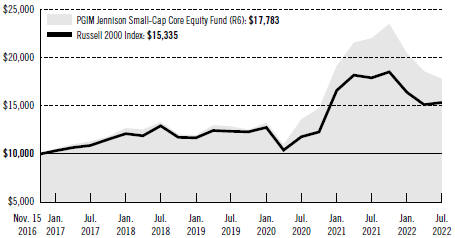

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the Russell 2000 Index (the Index) by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the current fiscal year (July 31, 2022), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 15, 2016, while the Index assumes that the initial investment occurred on November 30, 2016. For purposes of

4 Visit our website at pgim.com/investments

the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

Russell 2000 Index—The Russell 2000® Index is an unmanaged index of the 2,000 smallest US companies included in the Russell 3000® Index. It gives an indication of how the stock prices of smaller companies have performed.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

PGIM Day One Underlying Funds 5

PGIM Jennison Small-Cap Core Equity Fund

Your Fund’s Performance (continued)

Presentation of Fund Holdings as of 7/31/2022

| Ten Largest Holdings | Line of Business | % of Net Assets | ||

Performance Food Group Co. | Food & Staples Retailing | 2.2% | ||

PDC Energy, Inc. | Oil, Gas & Consumable Fuels | 2.1% | ||

Trinity Industries, Inc. | Machinery | 1.9% | ||

elf Beauty, Inc. | Personal Products | 1.8% | ||

Axis Capital Holdings Ltd. | Insurance | 1.8% | ||

Acadia Healthcare Co., Inc. | Health Care Providers & Services | 1.8% | ||

National Storage Affiliates Trust | Equity Real Estate Investment Trusts (REITs) | 1.7% | ||

Tower Semiconductor Ltd. (Israel) | Semiconductors & Semiconductor Equipment | 1.7% | ||

NextEra Energy Partners LP | Independent Power & Renewable Electricity Producers | 1.7% | ||

Independence Realty Trust, Inc. | Equity Real Estate Investment Trusts (REITs) | 1.6% | ||

Holdings reflect only long-term investments and are subject to change.

6 Visit our website at pgim.com/investments

PGIM Core Conservative Bond Fund

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 7/31/22 | ||||||

| One Year (%) | Five Years (%) | Since Inception (%) | ||||

Class R6 | -9.79 | 0.77 | 0.98 (11/15/2016) | |||

Bloomberg US Aggregate Bond Index |

-9.12 | 1.28 | 1.63 | |||

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

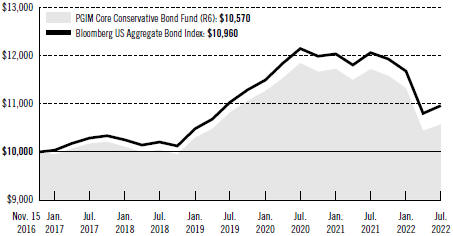

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the Bloomberg US Aggregate Bond Index (the Index) by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the current fiscal year (July 31, 2022), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 15, 2016, while the Index assumes that the initial investment occurred on November 30,

PGIM Day One Underlying Funds 7

PGIM Core Conservative Bond Fund

Your Fund’s Performance (continued)

2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

Bloomberg US Aggregate Bond Index—The Bloomberg US Aggregate Bond Index is unmanaged and represents securities that are taxable and dollar denominated. It covers the US investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| Credit Quality expressed as a percentage of total investments as of 7/31/22 (%) | ||||

AAA | 72.3 | |||

AA | 5.2 | |||

A | 8.4 | |||

BBB | 13.2 | |||

Cash/Cash Equivalents | 0.9 | |||

| Total | 100 | |||

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

8 Visit our website at pgim.com/investments

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 7/31/22 | ||||||

| One Year (%) | Five Years (%) | Since Inception (%) | ||||

Class R6 | -3.91 | 3.62 | 3.23 (11/15/2016) | |||

Bloomberg US Treasury Inflation-Protected Securities (TIPS) Index | ||||||

| -3.58 | 4.00 | 3.74 | ||||

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

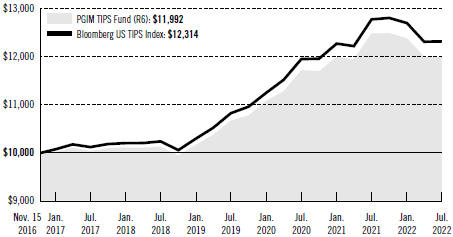

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the Bloomberg US Treasury Inflation-Protected (TIPS) Index (the Index) by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the current fiscal year (July 31, 2022), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 15, 2016, while the Index assumes that the initial investment occurred on

PGIM Day One Underlying Funds 9

PGIM TIPS Fund

Your Fund’s Performance (continued)

November 30, 2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

Bloomberg US Treasury Inflation-Protected (TIPS) Index—The Bloomberg US Treasury Inflation-Protected (TIPS) Index is an unmanaged index that consists of inflation-protected securities issued by the US Treasury.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| Credit Quality expressed as a percentage of total investments as of 7/31/22 (%) | ||||

AAA | 99.9 | |||

Cash/Cash Equivalents | 0.1 | |||

| Total | 100 | |||

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

10 Visit our website at pgim.com/investments

PGIM Quant Solutions Commodity Strategies Fund

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 7/31/22 | ||||||

| One Year (%) | Five Years (%) | Since Inception (%) | ||||

Class Z | N/A | N/A | 32.62*(12/14/2021) | |||

Class R6 | 30.61 | 10.29 | 9.24 (11/15/2016) | |||

Bloomberg Commodity Index |

27.23 | 8.82 | 7.48 | |||

| Average Annual Total Returns as of 7/31/22 Since Inception (%) | ||||

Class Z 12/14/2021 | Class R6 11/15/2016 | |||

Bloomberg Commodity Index | 27.84* | 7.48 | ||

*Not annualized

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

PGIM Day One Underlying Funds 11

PGIM Quant Solutions Commodity Strategies Fund

Your Fund’s Performance (continued)

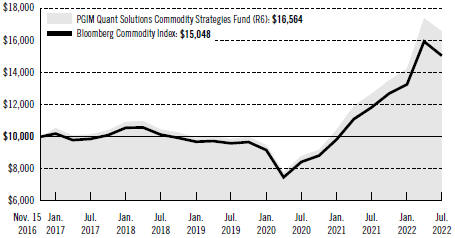

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the Bloomberg Commodity Index (the Index) by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the current fiscal year (July 31, 2022), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 15, 2016, while the Index assumes that the initial investment occurred on November 30, 2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class R6 shares only. As indicated in the tables provided earlier and in the following paragraphs, performance for other share classes will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

12 Visit our website at pgim.com/investments

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| Class Z | Class R6 | |||

Maximum initial sales charge |

None |

None | ||

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | None | None | ||

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets)

| None | None | ||

Benchmark Definitions

Bloomberg Commodity Index—The Bloomberg Commodity Index is a diversified benchmark for the commodity futures market. It is composed of futures contracts on 23 physical commodities traded on US exchanges, with the exception of aluminum, nickel, and zinc, which trade on the London Metal Exchange (LME).

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

Presentation of Fund Holdings as of 7/31/2022

| Ten Largest Commodities Future Exposure Holdings | % of Net Assets | |

Natural Gas | 15.8% | |

Gold 100 OZ | 12.7% | |

WTI Crude | 9.6% | |

Brent Crude | 7.4% | |

Soybean | 6.5% | |

Corn | 5.2% | |

LME PRI Aluminum | 4.5% | |

Soybean Oil | 3.8% | |

Copper | 3.7% | |

Silver | 3.7% | |

PGIM Day One Underlying Funds 13

PGIM Quant Solutions Mid-Cap Core Fund

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 7/31/22 | ||||||

| One Year (%) | Five Years (%) | Since Inception (%) | ||||

Class R6 | -3.86 | 6.58 | 7.82 (11/17/2016) | |||

S&P MidCap 400 Index |

-5.70 | 9.06 | 9.65 | |||

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

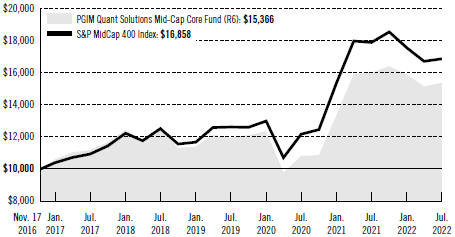

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the S&P MidCap 400 Index (the Index) by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the current fiscal year (July 31, 2022), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 17, 2016, while the Index assumes that the initial investment occurred on November 30, 2016. For

14 Visit our website at pgim.com/investments

purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

S&P MidCap 400 Index*—The S&P MidCap 400 Index is an unmanaged index of 400 domestic stocks chosen for market capitalization, liquidity and industry representation. It gives a broad look at how US mid-cap stock prices have performed.

*The S&P MidCap 400 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices, please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

PGIM Day One Underlying Funds 15

PGIM Quant Solutions Mid-Cap Core Fund

Your Fund’s Performance (continued)

Presentation of Fund Holdings as of 7/31/2022

| Ten Largest Holdings | Line of Business | % of Net Assets | ||

iShares Core S&P Mid-Cap ETF | Exchange-Traded Funds | 2.0% | ||

Targa Resources Corp. | Oil, Gas & Consumable Fuels | 1.5% | ||

Carlisle Cos., Inc. | Building Products | 1.5% | ||

Steel Dynamics, Inc. | Metals & Mining | 1.4% | ||

United Therapeutics Corp. | Biotechnology | 1.2% | ||

Essential Utilities, Inc. | Water Utilities | 1.2% | ||

UGI Corp. | Gas Utilities | 1.2% | ||

American Financial Group, Inc. | Insurance | 1.2% | ||

Lamar Advertising Co. (Class A Stock) | Equity Real Estate Investment Trusts (REITs) | 1.1% | ||

Genpact Ltd. | IT Services | 1.1% | ||

Holdings reflect only long-term investments and are subject to change.

16 Visit our website at pgim.com/investments

PGIM Quant Solutions US Broad Market Index Fund

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 7/31/22 | ||||||

| One Year (%) | Five Years (%) | Since Inception (%) | ||||

Class R6 | -4.80 | 12.33 | 13.27 (11/17/2016) | |||

S&P Composite 1500 Index |

-4.74 | 12.49 | 13.40 | |||

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

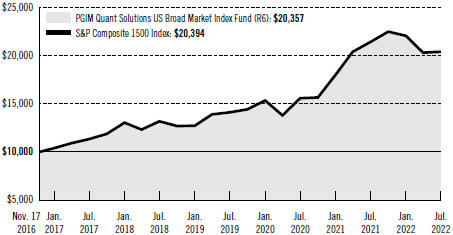

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the S&P Composite 1500 Index (the Index) by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the current fiscal year (July 31, 2022), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 17, 2016, while the Index assumes that the initial investment occurred on November 30, 2016. For

PGIM Day One Underlying Funds 17

PGIM Quant Solutions US Broad Market Index Fund

Your Fund’s Performance (continued)

purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

S&P Composite 1500 Index*—The S&P Composite 1500® Index is an unmanaged index of the stocks of 1,500 US companies, with market capitalizations ranging from small to large. The S&P Composite 1500 Index is a combination of three leading US stock indices: The S&P 500 Index (which measures the performance of US large cap stocks), the S&P MidCap 400 Index (which measures the performance of mid cap stocks) and the S&P 600 Index (which measures the performance of US small cap stocks) and gives an indication of how the broad US stock market has performed.

*The S&P Composite 1500 Index (the Index) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright© 2022 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

18 Visit our website at pgim.com/investments

Presentation of Fund Holdings as of 7/31/2022

| Ten Largest Holdings | Line of Business | % of Net Assets | ||

Apple, Inc. | Technology Hardware, Storage & Peripherals | 6.4% | ||

Microsoft Corp. | Software | 5.3% | ||

Amazon.com, Inc. | Internet & Direct Marketing Retail | 3.0% | ||

Tesla, Inc. | Automobiles | 1.9% | ||

Alphabet, Inc. (Class A Stock) | Interactive Media & Services | 1.8% | ||

Alphabet, Inc. (Class C Stock) | Interactive Media & Services | 1.6% | ||

Berkshire Hathaway, Inc. (Class B Stock) | Diversified Financial Services | 1.4% | ||

iShares Core S&P 500 ETF | Exchange-Traded Funds | 1.3% | ||

UnitedHealth Group, Inc. | Health Care Providers & Services | 1.3% | ||

Johnson & Johnson | Pharmaceuticals | 1.2% | ||

Holdings reflect only long-term investments and are subject to change.

PGIM Day One Underlying Funds 19

PGIM Jennison Small-Cap Core Equity Fund

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Jennison Small Cap Core Equity Fund’s Class R6 shares returned –19.13% in the 12-month reporting period ended July 31, 2022, underperforming the –14.29% return of the Russell 2000 Index (the Index).

What were the market conditions?

| ● | Over the period, the investment backdrop changed from one of stimulus and spending to one of inflation and tightening financial conditions, with the need to control inflation moving aggressively to the fore. |

| ● | The final months of 2021 were marked by the emergence of the Omicron variant of the COVID-19 virus, as well as heightened concerns over inflation, which led the Federal Reserve (the Fed) to announce an accelerated plan of reduced asset purchases. Against this backdrop, equity markets rose to all-time highs to close out the year. |

| ● | The investment environment at the start of 2022 was clouded by continued uncertainties related to the pandemic, inflation, and the prospect of slowing growth on the back of the Fed’s plans for policy tightening. The brutal military conflict in Ukraine added a dangerous new dimension of uncertainty in late February. Commodity prices rose sharply, led by crude oil, as the sanctions imposed on Russia by the US and European Union made it difficult for the world’s largest oil exporter to complete transactions. |

| ● | As the year continued, stock prices continued to suffer from the impacts of the war in Ukraine, unexpectedly high inflation, tightening monetary policy, and ongoing COVID-19 lockdowns in China. As a result, the second quarter of 2022 saw one of the largest equity selloffs since the global financial crisis nearly fifteen years ago. |

| ● | The accumulation of these events started to weigh on GDP growth around the globe. Commodity prices continued to exhibit strength due to the imbalance between Russia/Ukraine-related supply constraints and still-resilient demand. Concerns over the effects of high prices on demand and downward revisions in global growth expectations drove a reversal across many commodities during June. |

| ● | The Fed’s task of bringing inflation back to its 2% target without undermining the robust employment backdrop and precipitating a recession underscored prevailing uncertainty regarding the macro outlook. |

| ● | Small-cap core stocks underperformed their large- and mid-cap counterparts over the period. In the Russell 2000 Index, only the energy and utilities sectors posted gains. Communication services, healthcare, and consumer discretionary experienced the most significant declines. |

What worked?

| ● | From a sector perspective, healthcare holdings added the most value. Stock selection in real estate also proved comparatively strong. Individual positions that performed |

20 Visit our website at pgim.com/investments

| well were diversified across sectors. Top performers included PDC Energy, Inc. (energy), Acadia Healthcare Company, Inc. (healthcare), Tower Semiconductor Ltd. (information technology), and e.l.f. Beauty, Inc. (consumer discretionary). |

| ● | PDC Energy is an independent oil and gas company focused on maintaining a strong balance sheet and solid debt metrics while delivering value-added organic growth from a liquids-rich portfolio through horizontal drilling. The company’s operations are primarily located in the Wattenberg Field in Colorado and the Delaware Basin in Texas. After a difficult 2020, the oil and gas industry rebounded in 2021 and 2022 along with the price of oil. |

| ● | Acadia Healthcare is an American provider of behavioral healthcare services. It operates a network of over 225 facilities across the US and Puerto Rico. It continued to benefit during the period from secular tailwinds, while navigating labor headwinds better than most of its peers. The company anticipates favorable rate increases well above its 2%-4% long-term target. Acadia’s secular trends and diversified business mix should drive solid same-store growth, and margin expansion should drive low-double-digit earnings growth. |

| ● | Tower Semiconductor engages in the manufacture of integrated circuits. Its products include semiconductors and integrated circuits used in consumer electronics, personal computers, communications, automotive, industrial, and medical device products. During the period, Intel announced a definitive agreement to acquire Tower at a significant premium. |

| ● | e.l.f. Beauty is a manufacturer and marketer of mass cosmetics, skin care, and beauty tools. Its first-to-mass innovation focus has driven a pickup to top-line growth, attracting new consumers to the brand. Market-share inflection has been driven by enhanced and efficient marketing spending, productivity improvements, and investments in innovation. Share gains should result in added shelf space at primary customers, set to coincide with the economy reopening and a rebound in the broader cosmetics category. e.l.f. continued to execute well during the period despite a difficult cost backdrop and provided initial fiscal year 2023 guidance above consensus expectations. |

What didn’t work?

| ● | Holdings in industrials, information technology, and consumer discretionary detracted the most from relative performance. Underweight exposure, relative to the Index, to the energy sector also undermined returns. Stock selection in communication services hurt performance, but an underweight position in the sector helped mitigate some of the negative effect. Notably underperforming individual holdings included Varonis Systems, Inc. (information technology), Harsco Corp. (industrials), Cardlytics, Inc. (communication services), and Bandwidth Inc. (communication services). Bandwidth is |

PGIM Day One Underlying Funds 21

PGIM Jennison Small-Cap Core Equity Fund

Strategy and Performance Overview* (continued)

| a communications platform as a service (CPaas) company. Its shares fell amid a broader pullback for the growth-dependent cloud services space, and the position was eliminated from the Fund during the period. |

| ● | Software company Varonis Systems provides its core Data Protect suite, a unique solution that has established itself as an industry standard for protecting structured and unstructured human-generated data. Varonis is positioned well in the current environment of increased regulation and more frequent security breaches. Despite prevailing currency exchange headwinds during the reporting period, Varonis’s business remained healthy, and profitability trends remained intact. |

| ● | Harsco provides environmental solutions and services. Continued labor shortage, container-cost inflation, and little-to-no soil and drainage revenues, which are high-margin areas for the company, weighed on results. Jennison expects steadier organic growth as well as high margins and more stable free-cash-flow generation. |

| ● | Cardlytics operates an advertising platform within financial institutions’ digital channels, which include online, mobile, email, and various real-time notifications. Specifically, the company operates digital rewards programs (similar to rewards points earned on debit and credit card purchases) for banks in the US and UK to offer their banking customers. Broader macro economic issues, especially wage inflation, as well as some timing-related payments weighed on results. Jennison expects an increase in advertisers and monthly active users, which should generate greater operating leverage. |

| ● | Bandwidth is a communications platform as a service (CPaas) company that sells software application programming interfaces for voice and messaging using its own IP voice network. Shares fell amid a broader pullback in the growth-dependent cloud services space. In Jennison’s view, the company’s vertical integration and software-first approach to voice communication within an application are likely to provide a competitive edge and lead to sustainable growth. |

Current outlook

Experience with many uncertain economic backdrops over 20+ years of investing history has solidified Jennison’s view that constructing prudently diversified portfolios while focusing on quality business models with balance sheet flexibility, strong earnings, and cash-flow-growth prospects, led by capable management teams, is the best approach. Jennison remains optimistic that Fund holdings—which include companies with strong fundamentals positioned to outgrow market averages—are well positioned to navigate this complex landscape.

* This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s assigned index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances

22 Visit our website at pgim.com/investments

will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

PGIM Day One Underlying Funds 23

PGIM Core Conservative Bond Fund

Strategy and Performance Overview*

How did the Fund perform?

The PGIM Core Conservative Bond Fund’s Class R6 shares returned –9.79% in the 12-month reporting period that ended July 31, 2022, underperforming the –9.12% return of the Bloomberg US Aggregate Bond Index (the Index).

What were the market conditions?

| ● | From a starting point of low yields, tight spreads, and high equity multiples, the shift in fundamentals—most notably, high inflation—drove a wholesale repricing of markets during the reporting period. Concerns about central bank tightening, hard economic landings, and the war in Ukraine led global credit spreads notably wider, while rate volatility increased as markets first began pricing in more aggressive Federal Open Market Committee (FOMC) policy tightening, and later began to price in a hard economic landing. |

| ● | Against the backdrop of historic lows in unemployment and generational highs in inflation, central banks signaled an increased willingness to accept more economic and market pain than they had over the last decade of low inflation. A succession of rate hikes during the first half of 2022—including two outsized hikes of 75 basis points (bps) each by the Federal Reserve (the Fed) in June and July—confirmed to markets that the Fed was fully focused on tackling inflation. (One basis point equals 0.01%.) Following the July 2022 FOMC meeting, the market expected the target rate to be lifted to around 3.25%, not far from Fed officials’ most recent median projection, but the market then began pricing in rate cuts beginning in 2023. |

| ● | As a result, enormous volatility continued to be priced into US Treasuries, with sharply higher front-end rates and lower long-dated yields forming a substantially flatter US Treasury yield curve. The curve finally inverted in the last month of the period. From 1.05% on July 31, 2021, the 10-year/2-year Treasury spread declined to -0.23% by the end of the period. |

| ● | After rising to nearly 3.5% in June 2022, US 10-year Treasury yields ended the period on July 31, 2022 at 2.65%. Meanwhile, the yield on the two-year Treasury note ended the period on July 31, 2022 at 2.88%, a rise of 270 bps over the period. |

| ● | US investment grade corporate spreads widened significantly as corporates were challenged by elevated inflationary pressures, a slower growth outlook, and higher event and geopolitical risk. Securitized credit spreads widened, with commercial mortgage-backed securities (CMBS) spreads trading well above their recent tights by the end of the period. Meanwhile, agency mortgage-backed securities (MBS) underperformed Treasuries on concerns that the Fed would begin selling MBS if officials needed to step up their inflation fight. However, agency MBS strengthened over the final weeks of the period amid a decline in rate volatility. |

24 Visit our website at pgim.com/investments

What worked?

| ● | While overall security selection detracted from performance during the period, selection within emerging markets added to returns. |

| ● | While overall sector allocation also detracted, underweight allocations to MBS, agencies, and emerging markets, each relative to the Index, contributed positively. |

| ● | Within credit, selection in finance companies, gaming/lodging/leisure, and foreign non-corporates was positive. In individual security selection relative to the Index, the Fund benefited from an underweight position in Oracle Corporation (technology), along with overweight positions in ConocoPhillips (upstream energy) and Anheuser Busch InBev SA/NV (consumer non-cyclical). |

| ● | The Fund’s curve and duration positioning both contributed positively to performance as US Treasury rates sold off, and the yield curve flattened. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

What didn’t work?

| ● | Overall security selection was negative, with selection in investment grade corporates, Treasuries, and CMBS limiting results. |

| ● | Overall sector allocation detracted from performance, with overweight allocations to CMBS and municipal bonds, each relative to the Index, detracting. |

| ● | Within credit, the Fund’s positioning in healthcare & pharmaceuticals, banking, and metals & mining detracted from performance. |

| ● | In individual security selection, the Fund’s overweight positioning, relative to the Index, in Viatris Inc. (healthcare & pharmaceuticals), Charter Communications, Inc. (cable & satellite), and General Motors Company (automotive) detracted from performance. |

Current outlook

| ● | Tighter financial conditions are expected to continue working their way through the economy with lagged effects in coming quarters. For now, the Fed is focused on currently high monthly inflation readings, vowing to keep up the pressure until those readings show convincing signs they are softening toward the Fed’s target. At some point, though, PGIM Fixed Income expects the Fed will likely pivot back toward a focus on the projected lagged effects of its tightening and, should material signs of softening accumulate, will adopt a more measured pace of policy normalization. |

| ● | Even though fundamentals and issuer liquidity are arguably well braced for recession, and spread widening has already generated value in a number of sectors, PGIM Fixed Income believes spreads may remain soft until most of the current bad news—e.g., a cutoff of Russian gas supplies, cooling of the housing market, etc.—has largely played out. |

PGIM Day One Underlying Funds 25

PGIM Core Conservative Bond Fund

Strategy and Performance Overview* (continued)

| ● | However, over the intermediate and longer term, the selloff in rates and spreads could turn out to be a positive as the overarching trends of aging demographics, high debt burdens, and other factors that conspired for decades to push equilibrium interest rates down are more likely hibernating than reversing. Once the reopening enthusiasm and supply-chain problems have passed, inflation will likely return to, or below, targets, and bonds will likely be well on their way to an extended period of solid returns. In the meantime, PGIM Fixed Income believes the best course will be to focus on the micro-alpha opportunities within and across sectors. |

| ● | PGIM Fixed Income maintains its positive view of the spread sectors over the medium to long term, positioning the Fund with overweight allocations to structured products (CMBS) relative to the Index. The Fund holds underweight exposure to MBS, relative to the Index, in favor of more attractive opportunities across spread sectors. |

| ● | In terms of calling the cycle top in long-term rates, given the strength of the economy and level of inflation, PGIM Fixed Income believes it is too early to preclude the possibility of higher highs. Yet, from a long-term perspective, exposure to developed market duration is becoming more compelling after the broad repricing of markets and with the looming moderation in global growth. While acknowledging the immediate trajectory of inflation is going to dictate market volatility and the path of the US Treasury 10-year yield, PGIM Fixed Income’s base case holds that implied volatility will ultimately decline, and the 10-year yield will stay below the terminal rate of this hiking cycle when it is eventually reached. |

* This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s assigned index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

26 Visit our website at pgim.com/investments

PGIM TIPS Fund

Strategy and Performance Overview*

How did the Fund perform?

The PGIM TIPS Fund’s Class R6 shares returned –3.91% in the 12-month reporting period that ended July 31, 2022, underperforming the –3.58% return of the Bloomberg US Treasury Inflation-Protected (TIPS) Index (the Index).

What were the market conditions?

| ● | From a starting point of low yields, the shift in fundamentals—most notably, high inflation—drove a wholesale repricing of markets during the reporting period. Concerns about central bank tightening, hard economic landings, and the war in Ukraine drove increased rate volatility as markets first began pricing in more aggressive Federal Open Market Committee (FOMC) policy tightening, and later began to price in a hard economic landing. |

| ● | The US saw a marked acceleration in inflation throughout the period, with personal consumption expenditures (PCE) inflation for June 2022 rising 6.8% and core PCE inflation rising 4.8% from the year before. Reflecting the increase in inflation expectations, the five-year breakeven inflation rate rose from 2.56% as of July 31, 2021, to a high of 3.59% in March 2022 before ending the period on July 31, 2022 at 2.73%. |

| ● | Against the backdrop of historic lows in unemployment and generational highs in inflation, central banks signaled an increased willingness to accept more economic and market pain than they had over the last decade of low inflation. A succession of rate hikes over the first half of 2022—including two outsized hikes of 75 basis points (bps) each by the Federal Reserve (the Fed) in June and July—confirmed to markets that the Fed was fully focused on tackling inflation. (One basis point equals 0.01%.) Following the July 2022 FOMC meeting, the market expected the target rate to be lifted to around 3.25%, not far from Fed officials’ median projection, but the market began pricing in rate cuts beginning in 2023. |

| ● | As a result, enormous volatility continued to be priced into US Treasuries, with sharply higher front-end rates and lower long-dated yields forming a substantially flatter US Treasury yield curve before finally inverting in the last month of the period. From 1.05% on July 31, 2021, the 10-year/2-year Treasury spread declined to -0.23% by the end of the period on July 31, 2022. |

| ● | Just as longer-term Treasuries saw substantial volatility throughout the period, yields on short-term securities also rose substantially. The three-month Treasury bill rose from 0.05% to 2.37% during the period, while the three-month London Interbank Offered Rate (LIBOR) rose from 0.12% to 2.79%. Meanwhile, the three-month Secured Overnight Financing Rate (SOFR) rose from 0.05% to 2.27%. |

What worked?

Yield-curve-flattener positioning was the largest contributor to the Fund’s performance during the reporting period.

PGIM Day One Underlying Funds 27

PGIM TIPS Fund

Strategy and Performance Overview* (continued)

What didn’t work?

| ● | The duration of the Fund was tactically managed versus the Index during the period. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) Overall, duration positioning detracted from performance. The Fund ended the period with a neutral duration position versus the Index. |

| ● | Security selection detracted from the Fund’s performance during the period. |

Current outlook

| ● | Against the backdrop of historic lows in unemployment and generational highs in inflation, the Fed is signaling an increased willingness to accept more economic and market pain than it had over the last decade of low inflation. If the Fed can avoid a recession, it will, but more than anything else, Fed officials want to get inflation under control. |

| ● | Tighter financial conditions are expected to continue working their way through the economy with lagged effects in coming quarters. For now, the Fed is focused on currently high monthly inflation readings, vowing to keep up the pressure until they show convincing signs they are softening toward the Fed’s target. At some point, though, PGIM Fixed Income expects the Fed to pivot back toward a focus on the projected lagged effects of its tightening and, should material signs of softening accumulate, will adopt a more measured pace of policy normalization. |

* This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s assigned index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

28 Visit our website at pgim.com/investments

PGIM Quant Solutions Commodity Strategies Fund

Strategy and Performance Overview*

How did the Fund perform?

The PGIM Quant Solutions Commodity Strategies Fund’s Class R6 shares returned 30.61% in the 12-month reporting period that ended July 31, 2022, outperforming the 27.23% return of the Bloomberg Commodity Index (the Index).

What were the market conditions?

For the reporting period, commodities in general appreciated strongly, as inflation picked up after the initial shock of the COVID-19 pandemic, especially in the energy sector. Agricultural commodities also generally rose. Industrial metals produced mixed results, and precious metals declined slightly.

What worked?

The Fund’s strong gains relative to the Index during the period were driven by overweight positions in energy commodities and nickel.

What didn’t work?

Underweight positions in wheat and corn detracted most from the Fund’s performance relative to the Index for the period.

Did the Fund hold derivatives?

The Fund primarily invests in listed, exchange-traded commodities futures contracts. These futures are a form of derivatives based on the underlying price of a specific commodity. Since the Fund is invested primarily in these derivatives, its performance during the reporting period is explained by the derivatives.

Current outlook

As of the end of the period, the Fund held overweight positions relative to the Index in the industrial metal, energy, and grain sectors, and underweight positions in the livestock and soft commodities sectors. Within precious metals, the Fund held overweight exposure to gold and underweight exposure to silver.

* This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s assigned index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

PGIM Day One Underlying Funds 29

PGIM Quant Solutions Mid-Cap Core Fund

Strategy and Performance Overview*

How did the Fund perform?

The PGIM Quant Solutions Mid-Cap Core Fund’s Class R6 shares returned –3.86% in the 12-month reporting period that ended July 31, 2022, outperforming the –5.70% return of the S&P MidCap 400 Index (the Index).

What were the market conditions?

| ● | US equity markets finished 2021 at record highs before reversing course in 2022. |

| ● | A series of risks weighed on stock performances during the first seven months of 2022. These risks included rising inflation, interest-rate hikes, supply-chain bottlenecks, and the Russia-Ukraine war. |

What worked?

| ● | The Fund is comprised of a diversified portfolio of stocks that PGIM Quant Solutions identifies as attractive using a proprietary quantitative model. The model evaluates stocks based on quality, earnings expectations, and relative-value metrics. The emphasis on these factors varies based on the growth rate of the company under evaluation. |

| ● | Relative to the Index, overweighting companies that were inexpensive, while underweighting those that were expensive, contributed positively to the Fund’s performance over the reporting period. |

| ● | The Fund delivered its best relative performance in the healthcare sector. |

What didn’t work?

The Fund underperformed the Index in the information technology sector. Within this sector, companies with positive growth outlooks, which PGIM Quant Solutions favors, underperformed those with negative growth outlooks.

Did the Fund hold derivatives?

The Fund did not hold derivatives during the reporting period. The Fund did, however, hold exchange-traded funds that track the Index. PGIM Quant Solutions uses these instruments primarily to manage daily cash flows and provide liquidity, but not as a means of adding to performance. Subsequently, the effect on performance was minimal.

Current outlook

PGIM Quant Solutions does not envision the prevailing macroeconomic risks fading in the near future. This is likely to result in continued investor emphasis on valuation, fundamentals, and profitability. These dynamics lead PGIM Quant Solutions to believe that there is plenty of runway left for the Fund’s strategies to continue to outperform the Index.

* This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based

30 Visit our website at pgim.com/investments

on how the Fund performed relative to the Fund’s assigned index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

PGIM Day One Underlying Funds 31

PGIM Quant Solutions US Broad Market Index Fund

Strategy and Performance Overview*

How did the Fund perform?

The PGIM Quant Solutions US Broad Market Index Fund’s Class R6 shares returned -4.80% in the 12-month reporting period that ended July 31, 2022, underperforming the –4.74% return of the S&P 1500 Composite Index (the Index).

What were the market conditions?

During the early part of the reporting period, COVID-19 continued to make headlines as new variants emerged, particularly Omicron. However, markets seemed to shrug off most concerns as this highly contagious strain led to less severe impacts and hospitalizations, especially among vaccinated individuals. Companies continued to post strong results, although many also cautioned investors on future 2022 earnings due to continued supply-chain disruptions. In early 2022, market risk increased due to mounting inflationary pressures, rising interest rates, supply-chain disruptions, and the Russia-Ukraine war. US inflation reached its highest year-over-year level in over 40 years, leading the Federal Reserve (the Fed) to hike interest rates several times to fight inflation. Rising costs and supply-chain disruptions continued to weigh on companies’ growth for the remainder of the period, and were expected to continue.

What worked?

| ● | The Fund’s performance closely tracked the Index’s performance over the period. |

| ● | The Fund held all stocks included in the Index in approximately the same proportions. |

Did the Fund hold derivatives?

The Fund held S&P 500, S&P 400, and Russell 2000 E-Mini stock index futures, a form of derivatives, to maintain exposure to equities and provide portfolio liquidity. Futures had minimal impact on performance over the period.

* This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s assigned index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

32 Visit our website at pgim.com/investments

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended July 31, 2022. The example is for illustrative purposes only; you should consult the Funds’ Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line in the tables below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the tables below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line in each table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

PGIM Jennison Small-Cap Core Equity Fund | Beginning Account Value February 1, 2022 | Ending Account Value July 31, 2022 | Annualized Expense | Expenses Paid During the Six-Month Period* | ||||||

Class R6 | Actual | $1,000.00 | $ 870.30 | 0.95% | $4.41 | |||||

| Hypothetical | $1,000.00 | $1,020.08 | 0.95% | $4.76 | ||||||

PGIM Day One Underlying Funds 33

Fees and Expenses (continued)

PGIM Core Conservative Bond Fund | Beginning Account Value February 1, 2022 | Ending Account Value July 31, 2022 | Annualized Expense | Expenses Paid During the Six-Month Period* | ||||||

Class R6 | Actual | $1,000.00 | $ 933.80 | 0.50% | $2.40 | |||||

| Hypothetical | $1,000.00 | $1,022.32 | 0.50% | $2.51 | ||||||

| PGIM TIPS Fund | Beginning Account Value February 1, 2022 | Ending Account Value July 31, 2022 | Annualized Expense | Expenses Paid During the Six-Month Period* | ||||||

Class R6 | Actual | $1,000.00 | $ 969.00 | 0.39% | $1.90 | |||||

| Hypothetical | $1,000.00 | $1,022.86 | 0.39% | $1.96 | ||||||

| ||||||||||

PGIM Quant Solutions Commodity Strategies Fund | Beginning Account Value February 1, 2022 | Ending Account Value July 31, 2022 | Annualized Expense | Expenses Paid During the Six-Month Period* | ||||||

Class Z | Actual | $1,000.00 | $1,163.50 | 0.71% | $3.81 | |||||

| Hypothetical | $1,000.00 | $1,021.27 | 0.71% | $3.56 | ||||||

Class R6 | Actual | $1,000.00 | $1,163.50 | 0.65% | $3.49 | |||||

| Hypothetical | $1,000.00 | $1,021.57 | 0.65% | $3.26 | ||||||

PGIM Quant Solutions Mid-Cap Core Fund | Beginning Account Value February 1, 2022 | Ending Account Value July 31, 2022 | Annualized Expense | Expenses Paid During the Six-Month Period* | ||||||

Class R6 | Actual | $1,000.00 | $ 968.50 | 0.81% | $3.95 | |||||

| Hypothetical | $1,000.00 | $1,020.78 | 0.81% | $4.06 | ||||||

PGIM Quant Solutions US Broad Market Index Fund | Beginning Account Value February 1, 2022 | Ending Account Value July 31, 2022 | Annualized Expense | Expenses Paid During the Six-Month Period* | ||||||

Class R6 | Actual | $1,000.00 | $ 924.30 | 0.20% | $0.95 | |||||

Hypothetical | $1,000.00 | $1,023.80 | 0.20% | $1.00 | ||||||

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended July 31, 2022, and divided by the 365 days in the Fund’s fiscal year ended July 31, 2022 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

34 Visit our website at pgim.com/investments

Glossary

The following abbreviations are used in the Funds’ descriptions:

USD—US Dollar

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

ADR—American Depositary Receipt

BABs—Build America Bonds

CLO—Collateralized Loan Obligation

ETF—Exchange-Traded Fund

GMTN—Global Medium Term Note

LIBOR—London Interbank Offered Rate

LME—London Metal Exchange

LP—Limited Partnership

MTN—Medium Term Note

OTC—Over-the-counter

PRI—Primary Rate Interface

RBOB—Reformulated Gasoline Blendstock for Oxygen Blending

REITs—Real Estate Investment Trust

S&P—Standard & Poor’s

STRIPs—Separate Trading of Registered Interest and Principal of Securities

TIPS—Treasury Inflation-Protected Securities

ULSD—Ultra-Low Sulfur Diesel

WTI—West Texas Intermediate

35

PGIM Jennison Small-Cap Core Equity Fund

Schedule of Investments

as of July 31, 2022

| Description | Shares | Value | ||||||

LONG-TERM INVESTMENTS 96.9% | ||||||||

COMMON STOCKS | ||||||||

Aerospace & Defense 0.7% | ||||||||

Spirit AeroSystems Holdings, Inc. (Class A Stock) | 5,979 | $ | 196,231 | |||||

Airlines 0.8% | ||||||||

Sun Country Airlines Holdings, Inc.* | 11,135 | 224,593 | ||||||

Banks 8.0% | ||||||||

Atlantic Union Bankshares Corp. | 4,186 | 144,794 | ||||||

BankUnited, Inc. | 7,867 | 305,633 | ||||||

Brookline Bancorp, Inc. | 18,925 | 261,733 | ||||||

Eastern Bankshares, Inc. | 14,998 | 305,959 | ||||||

Enterprise Financial Services Corp. | 7,977 | 375,158 | ||||||

First Bancorp | 6,926 | 262,357 | ||||||

First Foundation, Inc. | 10,983 | 228,666 | ||||||

PacWest Bancorp | 2,136 | 59,872 | ||||||

Pinnacle Financial Partners, Inc. | 3,684 | 291,404 | ||||||

Wintrust Financial Corp. | 1,671 | 143,773 | ||||||

|

| |||||||

| 2,379,349 | ||||||||

Biotechnology 2.5% | ||||||||

Apellis Pharmaceuticals, Inc.* | 7,284 | 409,944 | ||||||

Avid Bioservices, Inc.* | 16,842 | 330,945 | ||||||

|

| |||||||

| 740,889 | ||||||||

Building Products 1.8% | ||||||||

Armstrong World Industries, Inc. | 3,121 | 278,861 | ||||||

Zurn Elkay Water Solutions Corp. | 8,862 | 256,555 | ||||||

|

| |||||||

| 535,416 | ||||||||

Capital Markets 4.9% | ||||||||

AssetMark Financial Holdings, Inc.* | 3,802 | 72,200 | ||||||

Bridge Investment Group Holdings, Inc. (Class A Stock) | 13,487 | 229,684 | ||||||

Brightsphere Investment Group, Inc. | 5,917 | 111,890 | ||||||

Focus Financial Partners, Inc. (Class A Stock)* | 2,359 | 95,374 | ||||||

Hamilton Lane, Inc. (Class A Stock) | 3,347 | 252,933 | ||||||

Houlihan Lokey, Inc. | 4,357 | 368,428 | ||||||

Lazard Ltd. (Class A Stock) | 3,380 | 127,325 | ||||||

See Notes to Financial Statements.

36

PGIM Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2022

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Capital Markets (cont’d.) | ||||||||

Moelis & Co. (Class A Stock) | 2,564 | $ | 119,431 | |||||

Open Lending Corp. (Class A Stock)* | 6,337 | 65,651 | ||||||

|

| |||||||

| 1,442,916 | ||||||||

Chemicals 1.5% | ||||||||

Avient Corp. | 10,411 | 449,235 | ||||||

Commercial Services & Supplies 1.3% | ||||||||

ACV Auctions, Inc. (Class A Stock)* | 15,879 | 117,346 | ||||||

Casella Waste Systems, Inc. (Class A Stock)* | 2,773 | 224,474 | ||||||

Harsco Corp.* | 12,068 | 58,047 | ||||||

|

| |||||||

| 399,867 | ||||||||

Construction & Engineering 2.9% | ||||||||

Concrete Pumping Holdings, Inc.* | 20,120 | 131,384 | ||||||

Great Lakes Dredge & Dock Corp.* | 30,798 | 398,218 | ||||||

WillScot Mobile Mini Holdings Corp.* | 8,172 | 315,521 | ||||||

|

| |||||||

| 845,123 | ||||||||

Construction Materials 1.5% | ||||||||

Summit Materials, Inc. (Class A Stock)* | 16,659 | 458,289 | ||||||

Electric Utilities 0.8% | ||||||||

PNM Resources, Inc. | 4,624 | 223,200 | ||||||

Electronic Equipment, Instruments & Components 1.4% | ||||||||

Littelfuse, Inc. | 1,537 | 428,623 | ||||||

Energy Equipment & Services 2.7% | ||||||||

Cactus, Inc. (Class A Stock) | 9,218 | 383,377 | ||||||

Patterson-UTI Energy, Inc. | 24,618 | 407,428 | ||||||

|

| |||||||

| 790,805 | ||||||||

Equity Real Estate Investment Trusts (REITs) 8.6% | ||||||||

American Assets Trust, Inc. | 6,935 | 209,645 | ||||||

Cousins Properties, Inc. | 8,324 | 256,796 | ||||||

Independence Realty Trust, Inc. | 21,576 | 478,987 | ||||||

National Storage Affiliates Trust | 9,448 | 518,128 | ||||||

See Notes to Financial Statements.

PGIM Day One Underlying Funds 37

PGIM Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2022

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Equity Real Estate Investment Trusts (REITs) (cont’d.) |

| |||||||

Plymouth Industrial REIT, Inc. | 6,451 | $ | 124,246 | |||||

Retail Opportunity Investments Corp. | 18,916 | 330,273 | ||||||

Summit Hotel Properties, Inc.* | 36,189 | 284,084 | ||||||

UMH Properties, Inc. | 16,477 | 351,125 | ||||||

|

| |||||||

| 2,553,284 | ||||||||

Food & Staples Retailing 2.2% | ||||||||

Performance Food Group Co.* | 13,404 | 666,313 | ||||||

Food Products 1.9% | ||||||||

Adecoagro SA (Brazil) | 23,533 | 192,971 | ||||||

Freshpet, Inc.* | 1,867 | 99,772 | ||||||

Utz Brands, Inc. | 15,261 | 256,690 | ||||||

|

| |||||||

| 549,433 | ||||||||

Health Care Equipment & Supplies 4.9% | ||||||||

BioLife Solutions, Inc.* | 4,614 | 88,912 | ||||||

CONMED Corp. | 2,194 | 214,200 | ||||||

Inari Medical, Inc.* | 3,113 | 241,507 | ||||||

Inspire Medical Systems, Inc.* | 1,568 | 327,696 | ||||||

Integra LifeSciences Holdings Corp.* | 3,083 | 169,688 | ||||||

Nevro Corp.* | 2,278 | 98,751 | ||||||

Outset Medical, Inc.* | 6,550 | 101,198 | ||||||

Silk Road Medical, Inc.* | 4,341 | 197,559 | ||||||

|

| |||||||

| 1,439,511 | ||||||||

Health Care Providers & Services 3.4% | ||||||||

Acadia Healthcare Co., Inc.* | 6,285 | 521,089 | ||||||

Agiliti, Inc.* | 2,701 | 59,125 | ||||||

Covetrus, Inc.* | 10,630 | 220,785 | ||||||

Progyny, Inc.* | 6,472 | 197,590 | ||||||

|

| |||||||

| 998,589 | ||||||||

Health Care Technology 0.4% | ||||||||

Phreesia, Inc.* | 3,873 | 90,977 | ||||||

Sophia Genetics SA (Switzerland)* | 9,555 | 32,965 | ||||||

|

| |||||||

| 123,942 | ||||||||

See Notes to Financial Statements.

38

PGIM Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2022

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Hotels, Restaurants & Leisure 2.6% | ||||||||

Bally’s Corp.* | 2,769 | $ | 60,835 | |||||

Bloomin’ Brands, Inc. | 15,663 | 319,369 | ||||||

Rush Street Interactive, Inc.* | 10,105 | 55,982 | ||||||

Sweetgreen, Inc. (Class A Stock)*(a) | 5,795 | 91,039 | ||||||

Wingstop, Inc. | 2,039 | 257,281 | ||||||

|

| |||||||

| 784,506 | ||||||||

Household Durables 1.1% | ||||||||

Century Communities, Inc. | 6,428 | 328,921 | ||||||

Independent Power & Renewable Electricity Producers 1.7% | ||||||||

NextEra Energy Partners LP | 6,047 | 500,329 | ||||||

Insurance 2.6% | ||||||||

Axis Capital Holdings Ltd. | 10,468 | 528,529 | ||||||

Goosehead Insurance, Inc. (Class A Stock) | 1,811 | 101,796 | ||||||

James River Group Holdings Ltd. | 5,943 | 141,206 | ||||||

|

| |||||||

| 771,531 | ||||||||

IT Services 3.6% | ||||||||

Evo Payments, Inc. (Class A Stock)* | 13,852 | 378,714 | ||||||

Grid Dynamics Holdings, Inc.* | 23,008 | 434,161 | ||||||

Shift4 Payments, Inc. (Class A Stock)* | 6,755 | 246,084 | ||||||

|

| |||||||

| 1,058,959 | ||||||||

Leisure Products 1.5% | ||||||||

Brunswick Corp. | 5,423 | 434,491 | ||||||

Life Sciences Tools & Services 0.7% | ||||||||

Azenta, Inc. | 2,452 | 167,374 | ||||||

Olink Holding AB (Sweden), ADR*(a) | 3,992 | 53,692 | ||||||

|

| |||||||

| 221,066 | ||||||||

Machinery 3.4% | ||||||||

Energy Recovery, Inc.* | 6,361 | 141,405 | ||||||

Enerpac Tool Group Corp. | 8,079 | 164,004 | ||||||

Gates Industrial Corp. PLC* | 7,627 | 93,812 | ||||||

See Notes to Financial Statements.

PGIM Day One Underlying Funds 39

PGIM Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2022

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Machinery (cont’d.) | ||||||||

Mayville Engineering Co., Inc.* | 7,995 | $ | 57,084 | |||||

Trinity Industries, Inc. | 21,469 | 557,121 | ||||||

|

| |||||||

| 1,013,426 | ||||||||

Marine 0.9% | ||||||||

Kirby Corp.* | 4,053 | 257,122 | ||||||

Media 0.1% | ||||||||

Cardlytics, Inc.* | 2,936 | 40,517 | ||||||

Metals & Mining 0.2% | ||||||||

ERO Copper Corp. (Brazil)* | 7,158 | 70,864 | ||||||

Mortgage Real Estate Investment Trusts (REITs) 0.8% | ||||||||

Ladder Capital Corp. | 18,844 | 223,867 | ||||||

Oil, Gas & Consumable Fuels 3.7% | ||||||||

Chord Energy Corp. | 3,671 | 470,769 | ||||||

PDC Energy, Inc. | 9,636 | 632,989 | ||||||

|

| |||||||

| 1,103,758 | ||||||||

Personal Products 1.8% | ||||||||

elf Beauty, Inc.* | 15,966 | 535,340 | ||||||

Pharmaceuticals 2.5% | ||||||||

Pacira BioSciences, Inc.* | 3,442 | 194,679 | ||||||

Pliant Therapeutics, Inc.* | 6,060 | 105,262 | ||||||

Prestige Consumer Healthcare, Inc.* | 5,107 | 308,003 | ||||||

Revance Therapeutics, Inc.* | 9,105 | 141,310 | ||||||

|

| |||||||

| 749,254 | ||||||||

Professional Services 2.7% | ||||||||

ASGN, Inc.* | 3,317 | 344,172 | ||||||

HireRight Holdings Corp.* | 7,959 | 118,271 | ||||||

Huron Consulting Group, Inc.* | 5,004 | 335,768 | ||||||

|

| |||||||

| 798,211 | ||||||||

See Notes to Financial Statements.

40

PGIM Jennison Small-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2022

| Description | Shares | Value | ||||||

COMMON STOCKS (Continued) | ||||||||

Road & Rail 0.9% | ||||||||

Saia, Inc.* | 1,095 | $ | 260,446 | |||||

Semiconductors & Semiconductor Equipment 3.5% | ||||||||

MACOM Technology Solutions Holdings, Inc.* | 4,875 | 282,457 | ||||||

MaxLinear, Inc.* | 5,676 | 229,367 | ||||||

Tower Semiconductor Ltd. (Israel)* | 10,732 | 513,634 | ||||||

|

| |||||||

| 1,025,458 | ||||||||

Software 6.1% | ||||||||

Clear Secure, Inc. (Class A Stock)* | 7,665 | 194,078 | ||||||

CS Disco, Inc.* | 783 | 19,215 | ||||||

Descartes Systems Group, Inc. (The) (Canada)* | 1,904 | 131,452 | ||||||

Intapp, Inc.* | 3,932 | 59,648 | ||||||

KnowBe4, Inc. (Class A Stock)* | 15,184 | 216,979 | ||||||

PagerDuty, Inc.* | 8,408 | 218,020 | ||||||

Paycor HCM, Inc.* | 6,183 | 165,024 | ||||||