UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-09999 |

| |

Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 2 |

|

| (This Form N-CSR relates solely to the Registrant’s PGIM QMA Emerging Markets Equity Fund and PGIM QMA International Developed Markets Index Fund (each a “Fund” and collectively the “Funds”)) |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2021 |

| |

| Date of reporting period: | | 10/31/2021 |

Item 1 – Reports to Stockholders

PGIM QMA EMERGING MARKETS EQUITY FUND

[Effective 12/29/21, fund name changes to PGIM Quant Solutions Emerging Markets Equity Fund]

ANNUAL REPORT

OCTOBER 31, 2021

|

|

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery |

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company. PGIM Quantitative Solutions is the primary business name of PGIM Quantitative Solutions LLC (formerly known as QMA LLC), a wholly owned subsidiary of PGIM, Inc. (PGIM), a registered investment adviser and Prudential Financial company. © 2021 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgim.com/investments |

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM QMA Emerging Markets Equity Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2021. The global economy and markets continued to recover throughout the period from the ongoing impact of the COVID-19 pandemic. The Federal Reserve slashed interest rates and kept them near zero to encourage borrowing. |

| | |

Congress passed stimulus bills worth several trillion dollars to help consumers and businesses. And several effective COVID-19 vaccines received regulatory approval. Those measures were enough to offset the fear of rising inflation and supply chain challenges that threatened to disrupt growth. |

At the start of the period, stocks had recovered most of the steep losses they had suffered at the onset of the pandemic. Equities rallied as states reopened their economies but became more volatile as investors worried that a surge in COVID-19 infections would stall the recovery. However, rising corporate profits and economic growth, the resolution of the US presidential election, and the global rollout of approved vaccines lifted equity markets to record levels, helping stocks around the globe post gains for the full period.

Throughout this volatile period, investors sought safety in fixed income.

Investment-grade bonds in the US and the overall global bond market declined slightly during the period as the economy recovered, but emerging market debt rose. While the 10-year US Treasury yield hovered near record lows early in the period after a significant rally in interest rates, rates moved higher later on as investors began to focus on stronger economic growth and the prospects of higher inflation. The Fed also took several aggressive actions to keep the bond markets running smoothly, implementing many of the relief programs that proved to be successful in helping end the global financial crisis in 2008-09.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1.5 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM QMA Emerging Markets Equity Fund

December 15, 2021

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 3 | |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | |

| |

| | | Average Annual Total Returns as of 10/31/21 |

| | | One Year (%) | | Since Inception (%) |

| | |

| Fund | | 12.08 | | 8.10 (11/29/2016) |

| MSCI Emerging Markets Index | | | | |

| | | 16.96 | | 10.62 |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.Since Inception returns are provided for less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the Fund’s inception date.

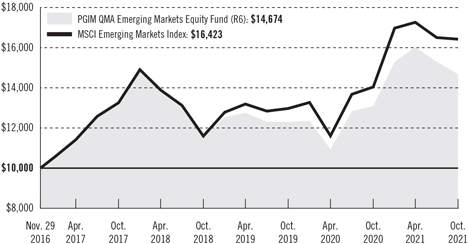

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund with a similar investment in the MSCI Emerging Markets Index by portraying the initial account values at the commencement of operations of the Fund (November 29, 2016) and the account values at the end of the current fiscal year (October 31, 2021), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and

| | |

| 4 | | Visit our website at pgim.com/investments |

(b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

MSCI Emerging Markets Index—The MSCI Emerging Markets Index is an unmanaged free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of emerging markets. It consists of the following 27 emerging market country indexes: Argentina, Brazil, Chile, China, Colombia, the Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait Malaysia, Mexico, Pakistan, Peru, the Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 5 | |

Your Fund’s Performance (continued)

Presentation of Fund Holdings as of 10/31/21

| | | | | | |

| | | |

| Ten Largest Holdings | | Line of Business | | Country | | % of Net Assets |

Taiwan Semiconductor Manufacturing Co. Ltd. | | Semiconductors & Semiconductor Equipment | | Taiwan | | 6.4% |

Samsung Electronics Co. Ltd. | | Technology Hardware, Storage & Peripherals | | South Korea | | 4.1% |

Tencent Holdings Ltd. | | Interactive Media & Services | | China | | 3.6% |

Alibaba Group Holding Ltd. | | Internet & Direct Marketing Retail | | China | | 3.0% |

China Construction Bank Corp. (Class H Stock) | | Banks | | China | | 1.5% |

Sberbank of Russia PJSC, ADR | | Banks | | Russia | | 1.4% |

MediaTek, Inc. | | Semiconductors & Semiconductor Equipment | | Taiwan | | 1.3% |

Al Rajhi Bank | | Banks | | Saudi Arabia | | 1.3% |

Vale SA | | Metals & Mining | | Brazil | | 1.1% |

Industrial & Commercial Bank of China Ltd. (Class H Stock) | | Banks | | China | | 1.1% |

Holdings reflect only long-term investments and are subject to change.

| | |

| 6 | | Visit our website at pgim.com/investments |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM QMA Emerging Markets Equity Fund’s Class Z shares returned 12.08% in the 12-month reporting period that ended October 31, 2021, underperforming the 16.96% return of the MSCI Emerging Markets Index (the Index).

What were the market conditions?

| • | | After a challenging 2020, equity markets bounced back sharply in the beginning of 2021. With the rollout and expansion of global vaccination programs signaling an imminent return to relative normality, the severe market volatility subsequent to the COVID-19 pandemic began to ease in favor of the broader markets as investors refocused their attention on company fundamentals. While value investments performed well in this environment, subsequent performance was more volatile with the global economic recovery still in doubt. Investor confidence surrounding global growth expectations ebbed and flowed with concerns about a new Delta variant, geopolitical stresses, rising interest rates, and inflationary pressures that were partly due to disruptions in the global supply chain. |

| • | | In absolute terms, emerging markets underperformed developed markets during the reporting period, particularly among large-cap companies. China, the world’s second-largest economy, was one of the worst-performing international equity markets. With steep losses in July 2021, large-cap Chinese stocks plunged into negative territory as investors reacted harshly to increased regulatory pressures. |

What worked?

| • | | The bounce-back in value stocks during the reporting period, particularly in the beginning of 2021, was reinforced by the continued solid performance of growth stocks from the previous period. |

| • | | Favoring reasonably priced, high-growth companies across China (industrials and marine transportation sectors), Korea (materials sector) and Taiwan (information technology sector) also contributed to the Fund’s returns relative to the Index during the period. |

What didn’t work?

| • | | Higher-quality stocks detracted from Fund returns relative to the Index during the reporting period, as investor appetite for faster growth in lower-quality stocks superseded their appetite for companies with stronger balance sheets. |

| • | | Favoring high-quality consumer discretionary companies was especially detrimental to Fund performance relative to the Index during the period. |

Did the Fund use derivatives?

The Fund held fully collateralized index futures during the period that were used for cash management purposes. They had a negligible impact on performance.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 7 | |

Strategy and Performance Overview (continued)

Current outlook

| • | | The global recovery from the pandemic-induced downturn was robust during the reporting period despite signs that economic activity may have hit a speed bump in the third quarter of 2021 as the Delta variant spread worldwide. Renewed lockdowns in certain countries and cautious behavior among consumers pushed down third-quarter growth expectations. |

| • | | In China, economic growth was expected to slow during the second half of 2021 from the strong pace during the first half of the year following government regulatory crackdowns on certain sectors. However, China’s fiscal and monetary policies may become more supportive to protect growth, in PGIM Quantitative Solutions’ view. |

| • | | Inflationary pressures weighed on investors and remained elevated during the period. Whether “transitory” or not, inflation may likely remain a concern in the near term. In addition, PGIM Quantitative Solutions believes pressures related to the pandemic may continue, and any monetary unwinding policies may be gradual in a market environment of strong consumer demand, lean inventories, and the normalization of service sector prices. |

| • | | On the whole, the central banks of advanced economies maintained accommodative monetary policies, although there was a modest tilt toward a more hawkish position toward the end of the period. In emerging markets, central banks were divided between those hiking rates to address rising inflation—Russia, Brazil, Mexico, Peru, Pakistan, and Chile—and others supporting their economies from virus-related downside risks—India, China, and some southeast Asian countries. |

| | |

| 8 | | Visit our website at pgim.com/investments |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2021. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 9 | |

Fees and Expenses (continued)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | |

PGIM QMA

Emerging Markets

Equity Fund | | Beginning

Account Value

May 1, 2021 | | Ending

Account Value

October 31, 2021 | | Annualized

Expense

Ratio Based on

the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| Class | | R6 Actual | | $1,000.00 | | $915.80 | | 1.20% | | $5.79 |

| | | Hypothetical | | $1,000.00 | | $1,019.16 | | 1.20% | | $6.11 |

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2021, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2021 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 10 | | Visit our website at pgim.com/investments |

Schedule of Investments

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| LONG-TERM INVESTMENTS 96.2% | | | | | | |

| | |

| COMMON STOCKS 93.4% | | | | | | |

| | |

| Brazil 2.5% | | | | | | |

Ambev SA | | | 80,400 | | | $ | 242,605 | |

Banco Bradesco SA | | | 8,001 | | | | 24,185 | |

Banco Santander Brasil SA, UTS | | | 12,900 | | | | 79,085 | |

Centrais Eletricas Brasileiras SA | | | 1,800 | | | | 10,812 | |

Cia Siderurgica Nacional SA | | | 10,000 | | | | 40,593 | |

Equatorial Energia SA | | | 4,900 | | | | 19,830 | |

Petroleo Brasileiro SA | | | 19,500 | | | | 95,914 | |

Vale SA | | | 36,832 | | | | 468,574 | |

WEG SA | | | 9,600 | | | | 62,783 | |

XP, Inc., BDR* | | | 143 | | | | 4,667 | |

| | | | | | | | |

| | |

| | | | | | | 1,049,048 | |

| | |

Chile 1.1% | | | | | | | | |

Banco Santander Chile | | | 6,225,994 | | | | 272,459 | |

Cencosud SA | | | 8,670 | | | | 12,682 | |

Falabella SA | | | 67,757 | | | | 187,371 | |

| | | | | | | | |

| | |

| | | | | | | 472,512 | |

| | |

China 33.2% | | | | | | | | |

Agricultural Bank of China Ltd. (Class H Stock) | | | 136,000 | | | | 46,285 | |

Alibaba Group Holding Ltd.* | | | 61,800 | | | | 1,267,313 | |

A-Living Smart City Services Co. Ltd., 144A | | | 3,250 | | | | 10,863 | |

Aluminum Corp. of China Ltd. (Class H Stock)* | | | 20,000 | | | | 11,901 | |

Bank of Beijing Co. Ltd. (Class A Stock) | | | 34,100 | | | | 23,585 | |

Bank of Chengdu Co. Ltd. (Class A Stock) | | | 33,600 | | | | 66,981 | |

Bank of China Ltd. (Class H Stock) | | | 1,196,000 | | | | 423,102 | |

Bank of Communications Co. Ltd. (Class H Stock) | | | 51,000 | | | | 30,371 | |

Baoshan Iron & Steel Co. Ltd. (Class A Stock) | | | 54,000 | | | | 59,945 | |

Beijing Enterprises Holdings Ltd. | | | 2,500 | | | | 9,644 | |

Beijing New Building Materials PLC (Class A Stock) | | | 12,900 | | | | 56,876 | |

Beijing United Information Technology Co. Ltd. (Class A Stock) | | | 3,600 | | | | 63,106 | |

BYD Co. Ltd. (Class H Stock) | | | 11,500 | | | | 437,900 | |

China CITIC Bank Corp. Ltd. (Class H Stock) | | | 318,000 | | | | 139,813 | |

China Construction Bank Corp. (Class H Stock) | | | 902,000 | | | | 614,183 | |

China Galaxy Securities Co. Ltd. (Class H Stock) | | | 18,000 | | | | 10,044 | |

China Hongqiao Group Ltd. | | | 179,000 | | | | 199,223 | |

China Life Insurance Co. Ltd. (Class H Stock) | | | 39,000 | | | | 67,841 | |

China Medical System Holdings Ltd. | | | 137,000 | | | | 232,856 | |

China Meidong Auto Holdings Ltd. | | | 2,000 | | | | 10,371 | |

China Merchants Bank Co. Ltd. (Class H Stock) | | | 23,500 | | | | 198,084 | |

China Merchants Port Holdings Co. Ltd. | | | 8,000 | | | | 13,352 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 11 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| China (cont’d.) | | | | | | |

China National Building Material Co. Ltd. (Class H Stock) | | | 20,000 | | | $ | 25,118 | |

China Overseas Property Holdings Ltd. | | | 240,000 | | | | 216,755 | |

China Petroleum & Chemical Corp. (Class H Stock) | | | 668,000 | | | | 328,515 | |

China Resources Cement Holdings Ltd. | | | 16,000 | | | | 13,475 | |

China Resources Land Ltd. | | | 18,000 | | | | 69,785 | |

China Resources Mixc Lifestyle Services Ltd., 144A | | | 1,800 | | | | 9,488 | |

China Resources Sanjiu Medical & Pharmaceutical Co. Ltd. (Class A Stock) | | | 14,000 | | | | 52,718 | |

China Shenhua Energy Co. Ltd. (Class H Stock) | | | 153,000 | | | | 329,867 | |

China South Publishing & Media Group Co. Ltd. (Class A Stock) | | | 44,500 | | | | 56,978 | |

China Tourism Group Duty Free Corp. Ltd. (Class A Stock) | | | 689 | | | | 28,762 | |

China Yuhua Education Corp. Ltd., 144A | | | 190,000 | | | | 86,786 | |

Chongqing Zhifei Biological Products Co. Ltd. (Class A Stock) | | | 3,000 | | | | 70,421 | |

CITIC Ltd. | | | 284,000 | | | | 285,080 | |

Contemporary Amperex Technology Co. Ltd. (Class A Stock) | | | 800 | | | | 79,867 | |

COSCO SHIPPING Holdings Co. Ltd. (Class H Stock)*(a) | | | 201,350 | | | | 313,009 | |

COSCO SHIPPING Ports Ltd. | | | 10,000 | | | | 8,342 | |

Country Garden Services Holdings Co. Ltd. | | | 9,000 | | | | 69,820 | |

CSPC Pharmaceutical Group Ltd. | | | 163,200 | | | | 171,317 | |

Daqo New Energy Corp., ADR* | | | 200 | | | | 15,558 | |

East Money Information Co. Ltd. (Class A Stock) | | | 3,200 | | | | 16,417 | |

Ecovacs Robotics Co. Ltd. (Class A Stock) | | | 2,700 | | | | 72,403 | |

Fangda Carbon New Material Co. Ltd. (Class A Stock) | | | 4,200 | | | | 7,043 | |

Focus Media Information Technology Co. Ltd. (Class A Stock) | | | 61,800 | | | | 70,819 | |

Fuyao Glass Industry Group Co. Ltd. (Class H Stock), 144A | | | 3,200 | | | | 18,385 | |

G-bits Network Technology Xiamen Co. Ltd. (Class A Stock) | | | 1,006 | | | | 53,543 | |

GF Securities Co. Ltd. (Class H Stock) | | | 5,800 | | | | 9,870 | |

Greenland Holdings Corp. Ltd. (Class A Stock) | | | 94,800 | | | | 60,676 | |

Haitian International Holdings Ltd. | | | 4,000 | | | | 11,670 | |

Hengan International Group Co. Ltd. | | | 4,000 | | | | 20,931 | |

Huatai Securities Co. Ltd. (Class H Stock), 144A | | | 8,000 | | | | 11,910 | |

Huaxia Bank Co. Ltd. (Class A Stock) | | | 72,000 | | | | 63,275 | |

Huaxin Cement Co. Ltd. (Class A Stock) | | | 3,400 | | | | 8,863 | |

Hunan Valin Steel Co. Ltd. (Class A Stock) | | | 12,900 | | | | 10,776 | |

Industrial & Commercial Bank of China Ltd. (Class H Stock) | | | 832,000 | | | | 455,381 | |

Industrial Bank Co. Ltd. (Class A Stock) | | | 29,400 | | | | 85,670 | |

Inner Mongolia Yili Industrial Group Co. Ltd. (Class A Stock) | | | 1,900 | | | | 12,720 | |

Intco Medical Technology Co. Ltd. (Class A Stock) | | | 7,050 | | | | 56,361 | |

JD Health International, Inc., 144A* | | | 17,650 | | | | 155,909 | |

JD.com, Inc., ADR* | | | 4,600 | | | | 360,088 | |

Jiangxi Copper Co. Ltd. (Class H Stock) | | | 6,000 | | | | 10,497 | |

Jiumaojiu International Holdings Ltd., 144A | | | 5,000 | | | | 12,507 | |

Kweichow Moutai Co. Ltd. (Class A Stock) | | | 100 | | | | 28,465 | |

Lenovo Group Ltd. | | | 38,000 | | | | 41,180 | |

See Notes to Financial Statements.

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| China (cont’d.) | | | | | | |

Li Ning Co. Ltd. | | | 33,000 | | | $ | 366,558 | |

Longfor Group Holdings Ltd., 144A | | | 59,500 | | | | 290,025 | |

Maccura Biotechnology Co. Ltd. (Class A Stock) | | | 10,800 | | | | 46,962 | |

Meituan (Class B Stock), 144A* | | | 11,800 | | | | 409,321 | |

Metallurgical Corp. of China Ltd. (Class A Stock) | | | 104,900 | | | | 66,270 | |

Midea Group Co. Ltd. (Class A Stock) | | | 1,100 | | | | 11,801 | |

NARI Technology Co. Ltd. (Class A Stock) | | | 13,200 | | | | 80,370 | |

New China Life Insurance Co. Ltd. (Class H Stock) | | | 86,100 | | | | 249,282 | |

People’s Insurance Co. Group of China Ltd. (The) (Class H Stock) | | | 420,000 | | | | 131,279 | |

PetroChina Co. Ltd. (Class H Stock) | | | 354,000 | | | | 170,750 | |

PICC Property & Casualty Co. Ltd. (Class H Stock) | | | 36,000 | | | | 33,587 | |

Pinduoduo, Inc., ADR* | | | 2,100 | | | | 186,732 | |

Ping An Insurance Group Co. of China Ltd. (Class H Stock) | | | 22,000 | | | | 157,692 | |

RiseSun Real Estate Development Co. Ltd. (Class A Stock) | | | 86,900 | | | | 58,156 | |

Shaanxi Coal Industry Co. Ltd. (Class A Stock) | | | 44,500 | | | | 87,064 | |

Shanghai International Port Group Co. Ltd. (Class A Stock) | | | 98,361 | | | | 86,816 | |

Shanghai Pharmaceuticals Holding Co. Ltd. (Class H Stock) | | | 4,400 | | | | 8,078 | |

Shanghai Pudong Development Bank Co. Ltd. (Class A Stock) | | | 28,400 | | | | 39,660 | |

Shanxi Lu’an Environmental Energy Development Co. Ltd. (Class A Stock) | | | 16,800 | | | | 34,039 | |

Shenzhen Inovance Technology Co. Ltd. (Class A Stock) | | | 6,000 | | | | 60,872 | |

Silergy Corp. | | | 1,000 | | | | 165,901 | |

Sinopharm Group Co. Ltd. (Class H Stock) | | | 7,600 | | | | 18,150 | |

Sinotruk Hong Kong Ltd. | | | 9,500 | | | | 13,131 | |

Sunac China Holdings Ltd. | | | 155,000 | | | | 332,958 | |

Sungrow Power Supply Co. Ltd. (Class A Stock) | | | 400 | | | | 10,287 | |

Tencent Holdings Ltd. | | | 25,100 | | | | 1,526,038 | |

Wanhua Chemical Group Co. Ltd. (Class A Stock) | | | 1,000 | | | | 16,516 | |

Want Want China Holdings Ltd. | | | 25,000 | | | | 19,387 | |

Weibo Corp., ADR* | | | 6,000 | | | | 269,880 | |

XCMG Construction Machinery Co. Ltd. (Class A Stock) | | | 64,000 | | | | 60,969 | |

Xiamen C & D, Inc. (Class A Stock) | | | 49,800 | | | | 62,244 | |

Xiaomi Corp. (Class B Stock), 144A* | | | 81,600 | | | | 223,116 | |

Yanzhou Coal Mining Co. Ltd. (Class H Stock)(a) | | | 144,000 | | | | 214,458 | |

Yum China Holdings, Inc. | | | 1,700 | | | | 97,036 | |

Zhangzhou Pientzehuang Pharmaceutical Co. Ltd. (Class A Stock) | | | 200 | | | | 12,826 | |

Zhongsheng Group Holdings Ltd. | | | 36,500 | | | | 329,151 | |

Zhuzhou Kibing Group Co. Ltd. (Class A Stock) | | | 28,200 | | | | 70,043 | |

Zoomlion Heavy Industry Science & Technology Co. Ltd. (Class A Stock) | | | 9,473 | | | | 10,748 | |

| | | | | | | | |

| | |

| | | | | | | 13,908,812 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 13 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Colombia 0.1% | | | | | | |

Bancolombia SA | | | 1,330 | | | $ | 11,895 | |

Ecopetrol SA | | | 25,146 | | | | 19,011 | |

| | | | | | | | |

| | |

| | | | | | | 30,906 | |

| | |

Greece 0.2% | | | | | | | | |

Hellenic Telecommunications Organization SA | | | 1,375 | | | | 24,368 | |

OPAP SA | | | 2,867 | | | | 44,621 | |

| | | | | | | | |

| | |

| | | | | | | 68,989 | |

| | |

Hong Kong 0.1% | | | | | | | | |

| | |

Sino Biopharmaceutical Ltd. | | | 53,000 | | | | 39,091 | |

| | |

| Hungary 0.1% | | | | | | |

MOL Hungarian Oil & Gas PLC | | | 1,862 | | �� | | 15,956 | |

OTP Bank Nyrt* | | | 449 | | | | 26,985 | |

Richter Gedeon Nyrt | | | 840 | | | | 23,548 | |

| | | | | | | | |

| | |

| | | | | | | 66,489 | |

| | |

India 9.6% | | | | | | | | |

Ambuja Cements Ltd. | | | 3,600 | | | | 19,550 | |

Aurobindo Pharma Ltd. | | | 21,666 | | | | 200,231 | |

Balkrishna Industries Ltd. | | | 532 | | | | 17,541 | |

Bharat Electronics Ltd. | | | 6,052 | | | | 16,792 | |

Cipla Ltd. | | | 2,627 | | | | 31,854 | |

Colgate-Palmolive India Ltd. | | | 5,690 | | | | 117,525 | |

Dabur India Ltd. | | | 3,224 | | | | 25,300 | |

Divi’s Laboratories Ltd. | | | 1,812 | | | | 124,982 | |

GAIL India Ltd. | | | 9,078 | | | | 18,159 | |

Godrej Consumer Products Ltd.* | | | 1,860 | | | | 23,848 | |

Hindalco Industries Ltd. | | | 19,472 | | | | 119,848 | |

Hindustan Petroleum Corp. Ltd. | | | 3,824 | | | | 15,937 | |

Housing Development Finance Corp. Ltd. | | | 925 | | | | 35,299 | |

ICICI Bank Ltd. | | | 2,520 | | | | 27,029 | |

Indian Oil Corp. Ltd. | | | 10,829 | | | | 18,591 | |

Infosys Ltd., ADR | | | 17,300 | | | | 385,444 | |

Ipca Laboratories Ltd. | | | 350 | | | | 10,042 | |

ITC Ltd. | | | 90,869 | | | | 271,956 | |

JSW Steel Ltd. | | | 4,900 | | | | 44,001 | |

Jubilant Foodworks Ltd. | | | 405 | | | | 20,044 | |

Larsen & Toubro Infotech Ltd., 144A | | | 326 | | | | 29,259 | |

Lupin Ltd. | | | 1,239 | | | | 15,332 | |

Marico Ltd. | | | 2,751 | | | | 20,958 | |

See Notes to Financial Statements.

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| India (cont’d.) | | | | | | |

NTPC Ltd. | | | 182,814 | | | $ | 325,378 | |

Piramal Enterprises Ltd. | | | 2,711 | | | | 94,634 | |

Power Grid Corp. of India Ltd. | | | 63,844 | | | | 158,200 | |

Reliance Industries Ltd. | | | 5,789 | | | | 196,825 | |

State Bank of India | | | 13,198 | | | | 89,003 | |

Sun Pharmaceutical Industries Ltd. | | | 30,044 | | | | 319,748 | |

Tata Consultancy Services Ltd. | | | 4,742 | | | | 215,776 | |

Tata Steel Ltd. | | | 17,475 | | | | 308,751 | |

Tech Mahindra Ltd. | | | 14,154 | | | | 280,698 | |

UltraTech Cement Ltd. | | | 520 | | | | 53,229 | |

Wipro Ltd. | | | 41,057 | | | | 355,345 | |

| | | | | | | | |

| | |

| | | | | | | 4,007,109 | |

| | |

Indonesia 1.9% | | | | | | | | |

Astra International Tbk PT | | | 657,200 | | | | 280,985 | |

Charoen Pokphand Indonesia Tbk PT | | | 42,000 | | | | 18,444 | |

Indofood Sukses Makmur Tbk PT | | | 610,000 | | | | 274,223 | |

Kalbe Farma Tbk PT | | | 122,200 | | | | 13,841 | |

Telkom Indonesia Persero Tbk PT | | | 731,300 | | | | 196,491 | |

| | | | | | | | |

| | |

| | | | | | | 783,984 | |

| | |

Malaysia 0.8% | | | | | | | | |

Hartalega Holdings Bhd | | | 9,900 | | | | 14,029 | |

IOI Corp. Bhd | | | 12,800 | | | | 12,158 | |

Kossan Rubber Industries | | | 39,800 | | | | 22,708 | |

Kuala Lumpur Kepong Bhd | | | 2,200 | | | | 11,505 | |

Sime Darby Plantation Bhd | | | 9,900 | | | | 9,598 | |

Supermax Corp. Bhd | | | 14,733 | | | | 6,847 | |

Telekom Malaysia Bhd | | | 124,300 | | | | 174,005 | |

Top Glove Corp. Bhd | | | 110,400 | | | | 72,604 | |

Westports Holdings Bhd | | | 8,000 | | | | 8,643 | |

| | | | | | | | |

| | |

| | | | | | | 332,097 | |

| | |

Mexico 2.3% | | | | | | | | |

America Movil SAB de CV (Class L Stock) | | | 450,000 | | | | 400,646 | |

Arca Continental SAB de CV | | | 2,600 | | | | 15,825 | |

Cemex SAB de CV, UTS* | | | 29,000 | | | | 18,706 | |

Grupo Aeroportuario del Pacifico SAB de CV (Class B Stock)* | | | 1,900 | | | | 23,995 | |

Grupo Aeroportuario del Sureste SAB de CV (Class B Stock) | | | 1,120 | | | | 22,625 | |

Grupo Bimbo SAB de CV (Class A Stock) | | | 9,600 | | | | 28,537 | |

Grupo Mexico SAB de CV (Class B Stock) | | | 79,100 | | | | 346,629 | |

Megacable Holdings SAB de CV, UTS | | | 21,000 | | | | 61,976 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 15 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Mexico (cont’d.) | | | | | | |

Orbia Advance Corp. SAB de CV | | | 5,400 | | | $ | 14,111 | |

Wal-Mart de Mexico SAB de CV | | | 12,600 | | | | 43,899 | |

| | | | | | | | |

| | |

| | | | | | | 976,949 | |

| | |

Peru 0.1% | | | | | | | | |

Southern Copper Corp. | | | 700 | | | | 41,993 | |

| | |

Philippines 0.7% | | | | | | | | |

International Container Terminal Services, Inc. | | | 72,880 | | | | 260,521 | |

Jollibee Foods Corp. | | | 2,520 | | | | 11,766 | |

PLDT, Inc. | | | 420 | | | | 13,691 | |

| | | | | | | | |

| | |

| | | | | | | 285,978 | |

| | |

Poland 0.1% | | | | | | | | |

Cyfrowy Polsat SA | | | 1,590 | | | | 14,236 | |

Polskie Gornictwo Naftowe i Gazownictwo SA | | | 9,274 | | | | 13,997 | |

Powszechny Zaklad Ubezpieczen SA | | | 3,000 | | | | 30,053 | |

| | | | | | | | |

| | |

| | | | | | | 58,286 | |

| | |

Qatar 0.5% | | | | | | | | |

Commercial Bank PSQC (The) | | | 10,220 | | | | 17,045 | |

Industries Qatar QSC | | | 10,255 | | | | 44,653 | |

Masraf Al Rayan QSC | | | 91,377 | | | | 119,811 | |

Qatar National Bank QPSC | | | 3,385 | | | | 19,066 | |

| | | | | | | | |

| | |

| | | | | | | 200,575 | |

| | |

Russia 2.8% | | | | | | | | |

Inter RAO UES PJSC | | | 202,400 | | | | 13,747 | |

LUKOIL PJSC | | | 3,407 | | | | 348,103 | |

Magnit PJSC, GDR | | | 8,583 | | | | 159,472 | |

Rosneft Oil Co. PJSC | | | 5,931 | | | | 53,375 | |

Sberbank of Russia PJSC, ADR | | | 28,691 | | | | 575,070 | |

Severstal PAO | | | 1,064 | | | | 24,241 | |

| | | | | | | | |

| | |

| | | | | | | 1,174,008 | |

| | |

Saudi Arabia 2.7% | | | | | | | | |

Al Rajhi Bank | | | 14,456 | | | | 534,650 | |

Alinma Bank | | | 4,680 | | | | 31,412 | |

Banque Saudi Fransi | | | 3,034 | | | | 34,173 | |

Riyad Bank | | | 7,137 | | | | 56,292 | |

See Notes to Financial Statements.

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Saudi Arabia (cont’d.) | | | | | | |

SABIC Agri-Nutrients Co. | | | 1,071 | | | $ | 46,870 | |

Sahara International Petrochemical Co. | | | 1,794 | | | | 21,006 | |

Saudi Arabian Mining Co.* | | | 2,205 | | | | 47,970 | |

Saudi Basic Industries Corp. | | | 6,810 | | | | 234,534 | |

Saudi Industrial Investment Group | | | 1,105 | | | | 11,160 | |

Saudi Kayan Petrochemical Co.* | | | 3,703 | | | | 20,142 | |

Saudi Telecom Co. | | | 3,057 | | | | 95,552 | |

| | | | | | | | |

| | |

| | | | | | | 1,133,761 | |

| | |

South Africa 2.6% | | | | | | | | |

Absa Group Ltd. | | | 3,696 | | | | 33,897 | |

African Rainbow Minerals Ltd. | | | 680 | | | | 9,113 | |

Clicks Group Ltd. | | | 1,294 | | | | 23,680 | |

Exxaro Resources Ltd. | | | 1,265 | | | | 13,909 | |

FirstRand Ltd. | | | 25,536 | | | | 97,075 | |

Impala Platinum Holdings Ltd. | | | 17,329 | | | | 225,731 | |

Kumba Iron Ore Ltd. | | | 6,253 | | | | 190,519 | |

MultiChoice Group | | | 10,806 | | | | 85,986 | |

Nedbank Group Ltd. | | | 1,932 | | | | 22,032 | |

Old Mutual Ltd. | | | 27,166 | | | | 27,744 | |

Sasol Ltd.* | | | 8,610 | | | | 144,705 | |

Shoprite Holdings Ltd. | | | 4,609 | | | | 54,702 | |

Sibanye Stillwater Ltd. | | | 16,296 | | | | 56,935 | |

Woolworths Holdings Ltd. | | | 35,844 | | | | 126,750 | |

| | | | | | | | |

| | |

| | | | | | | 1,112,778 | |

| | |

South Korea 13.2% | | | | | | | | |

BNK Financial Group, Inc. | | | 40,014 | | | | 301,806 | |

Cheil Worldwide, Inc. | | | 10,869 | | | | 222,738 | |

Coway Co. Ltd. | | | 254 | | | | 17,275 | |

DB Insurance Co. Ltd. | | | 278 | | | | 14,085 | |

E-MART, Inc. | | | 101 | | | | 14,593 | |

GS Holdings Corp. | | | 231 | | | | 8,375 | |

Hana Financial Group, Inc. | | | 9,384 | | | | 361,243 | |

Hankook Tire & Technology Co. Ltd. | | | 6,919 | | | | 245,378 | |

HMM Co. Ltd.* | | | 1,377 | | | | 31,615 | |

Hyundai Glovis Co. Ltd. | | | 445 | | | | 64,143 | |

Hyundai Steel Co. | | | 437 | | | | 16,718 | |

Industrial Bank of Korea | | | 1,330 | | | | 12,596 | |

Kakao Corp. | | | 1,614 | | | | 174,842 | |

KB Financial Group, Inc. | | | 3,318 | | | | 160,596 | |

Kia Corp. | | | 5,624 | | | | 412,068 | |

Korea Investment Holdings Co. Ltd. | | | 3,609 | | | | 270,396 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 17 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| South Korea (cont’d.) | | | | | | |

KT&G Corp. | | | 365 | | | $ | 25,364 | |

Kumho Petrochemical Co. Ltd. | | | 1,704 | | | | 252,688 | |

LG Corp. | | | 465 | | | | 36,418 | |

LG Electronics, Inc. | | | 1,517 | | | | 157,794 | |

LG Innotek Co. Ltd. | | | 168 | | | | 30,442 | |

Meritz Securities Co. Ltd. | | | 17,313 | | | | 69,255 | |

Mirae Asset Securities Co. Ltd. | | | 1,712 | | | | 12,793 | |

NAVER Corp. | | | 631 | | | | 221,764 | |

NH Investment & Securities Co. Ltd. | | | 988 | | | | 11,171 | |

Pan Ocean Co. Ltd. | | | 1,298 | | | | 6,764 | |

POSCO | | | 404 | | | | 102,572 | |

Samsung C&T Corp. | | | 252 | | | | 24,728 | |

Samsung Electro-Mechanics Co. Ltd. | | | 305 | | | | 41,918 | |

Samsung Electronics Co. Ltd. | | | 28,822 | | | | 1,729,505 | |

Samsung Engineering Co. Ltd.* | | | 836 | | | | 17,875 | |

Samsung Fire & Marine Insurance Co. Ltd. | | | 168 | | | | 33,184 | |

Samsung SDI Co. Ltd. | | | 282 | | | | 178,612 | |

Samsung Securities Co. Ltd. | | | 2,055 | | | | 83,689 | |

Seegene, Inc. | | | 285 | | | | 13,014 | |

Shinhan Financial Group Co. Ltd. | | | 2,075 | | | | 67,849 | |

SK Telecom Co. Ltd. | | | 224 | | | | 59,418 | |

Woori Financial Group, Inc. | | | 2,580 | | | | 29,284 | |

| | | | | | | | |

| | |

| | | | | | | 5,534,568 | |

| | |

Taiwan 15.2% | | | | | | | | |

Acer, Inc. | | | 16,000 | | | | 15,032 | |

ASE Technology Holding Co. Ltd. | | | 12,000 | | | | 43,448 | |

Asustek Computer, Inc. | | | 28,000 | | | | 357,304 | |

Cathay Financial Holding Co. Ltd. | | | 46,000 | | | | 96,062 | |

Chunghwa Telecom Co. Ltd. | | | 39,000 | | | | 154,981 | |

Compal Electronics, Inc. | | | 11,000 | | | | 9,698 | |

Evergreen Marine Corp. Taiwan Ltd. | | | 60,000 | | | | 217,892 | |

Formosa Chemicals & Fibre Corp. | | | 18,000 | | | | 52,213 | |

Fubon Financial Holding Co. Ltd. | | | 151,060 | | | | 399,915 | |

Giant Manufacturing Co. Ltd. | | | 26,000 | | | | 302,598 | |

Hon Hai Precision Industry Co. Ltd. | | | 64,000 | | | | 247,516 | |

Innolux Corp. | | | 421,000 | | | | 255,505 | |

Lite-On Technology Corp. | | | 11,000 | | | | 24,259 | |

MediaTek, Inc. | | | 17,000 | | | | 560,029 | |

Micro-Star International Co. Ltd. | | | 4,000 | | | | 20,207 | |

momo.com, Inc. | | | 1,000 | | | | 64,757 | |

Nan Ya Plastics Corp. | | | 27,000 | | | | 82,801 | |

Nan Ya Printed Circuit Board Corp. | | | 1,000 | | | | 17,829 | |

Nien Made Enterprise Co. Ltd. | | | 1,000 | | | | 13,773 | |

See Notes to Financial Statements.

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Taiwan (cont’d.) | | | | | | |

Novatek Microelectronics Corp. | | | 4,000 | | | $ | 60,379 | |

Pou Chen Corp. | | | 13,000 | | | | 15,972 | |

Realtek Semiconductor Corp. | | | 3,000 | | | | 54,211 | |

Shin Kong Financial Holding Co. Ltd. | | | 62,000 | | | | 21,901 | |

SinoPac Financial Holdings Co. Ltd. | | | 44,000 | | | | 22,423 | |

Synnex Technology International Corp. | | | 8,000 | | | | 15,513 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 127,000 | | | | 2,698,889 | |

Unimicron Technology Corp. | | | 7,000 | | | | 48,350 | |

United Microelectronics Corp. | | | 163,000 | | | | 342,729 | |

Vanguard International Semiconductor Corp. | | | 5,000 | | | | 26,193 | |

Wan Hai Lines Ltd. | | | 4,400 | | | | 25,678 | |

WPG Holdings Ltd. | | | 8,000 | | | | 14,985 | |

Yageo Corp. | | | 2,000 | | | | 31,499 | |

Yuanta Financial Holding Co. Ltd. | | | 51,000 | | | | 45,428 | |

| | | | | | | | |

| | |

| | | | | | | 6,359,969 | |

| | |

Thailand 2.3% | | | | | | | | |

Charoen Pokphand Foods PCL | | | 343,000 | | | | 261,176 | |

Land & Houses PCL | | | 42,900 | | | | 10,918 | |

PTT Exploration & Production PCL | | | 7,500 | | | | 26,531 | |

PTT Global Chemical PCL | | | 73,600 | | | | 139,333 | |

Siam Cement PCL (The) | | | 4,200 | | | | 50,164 | |

Sri Trang Gloves Thailand PCL(a) | | | 215,600 | | | | 198,870 | |

Thai Union Group PCL | | | 476,000 | | | | 300,740 | |

| | | | | | | | |

| | |

| | | | | | | 987,732 | |

| | |

Turkey 0.3% | | | | | | | | |

BIM Birlesik Magazalar A/S | | | 2,542 | | | | 16,436 | |

Ford Otomotiv Sanayi A/S | | | 447 | | | | 8,674 | |

Haci Omer Sabanci Holding A/S | | | 61,104 | | | | 70,893 | |

KOC Holding A/S | | | 4,214 | | | | 10,350 | |

Turkiye Garanti Bankasi A/S | | | 12,007 | | | | 12,333 | |

| | | | | | | | |

| | |

| | | | | | | 118,686 | |

| | |

United Arab Emirates 0.7% | | | | | | | | |

Abu Dhabi Commercial Bank PJSC | | | 14,355 | | | | 32,476 | |

Abu Dhabi Islamic Bank PJSC | | | 124,042 | | | | 197,183 | |

Abu Dhabi National Oil Co. for Distribution PJSC | | | 13,205 | | | | 15,397 | |

Aldar Properties PJSC | | | 20,874 | | | | 22,989 | |

Emaar Properties PJSC | | | 18,075 | | | | 19,769 | |

| | | | | | | | |

| | |

| | | | | | | 287,814 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 19 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| United States 0.3% | | | | | | |

JBS SA | | | 16,000 | | | $ | 111,046 | |

| | | | | | | | |

| | |

| TOTAL COMMON STOCKS | | | | | | |

(cost $32,984,608) | | | | | | | 39,143,180 | |

| | | | | | | | |

| | |

| PREFERRED STOCKS 2.8% | | | | | | |

| | |

| Brazil 2.1% | | | | | | |

Braskem SA (PRFC A)* | | | 1,000 | | | | 9,641 | |

Cia Energetica de Minas Gerais (PRFC) | | | 82,845 | | | | 187,890 | |

Cia Paranaense de Energia (PRFC B) | | | 211,200 | | | | 222,284 | |

Gerdau SA (PRFC) | | | 7,100 | | | | 34,029 | |

Itau Unibanco Holding SA (PRFC) | | | 3,700 | | | | 15,321 | |

Itausa SA (PRFC) | | | 22,800 | | | | 41,530 | |

Petroleo Brasileiro SA (PRFC) | | | 72,400 | | | | 349,570 | |

| | | | | | | | |

| | |

| | | | | | | 860,265 | |

| | |

| Russia 0.0% | | | | | | |

Surgutneftegas PJSC (PRFC) | | | 38,200 | | | | 20,844 | |

| | |

| South Korea 0.7% | | | | | | |

Hyundai Motor Co. (2nd PRFC) | | | 200 | | | | 16,856 | |

Hyundai Motor Co. (PRFC) | | | 128 | | | | 10,739 | |

LG Chem Ltd. (PRFC) | | | 42 | | | | 13,869 | |

Samsung Electronics Co. Ltd. (PRFC) | | | 4,238 | | | | 232,881 | |

| | | | | | | | |

| | |

| | | | | | | 274,345 | |

| | | | | | | | |

| | |

| TOTAL PREFERRED STOCKS | | | | | | |

(cost $1,112,377) | | | | | | | 1,155,454 | |

| | | | | | | | |

| | |

| TOTAL LONG-TERM INVESTMENTS | | | | | | |

(cost $34,096,985) | | | | | | | 40,298,634 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS 5.2% | | | | | | | | |

| | |

| AFFILIATED MUTUAL FUNDS 4.6% | | | | | | | | |

PGIM Core Ultra Short Bond Fund(wa) | | | 1,210,487 | | | | 1,210,487 | |

PGIM Institutional Money Market Fund | | | | | | | | |

(cost $718,364; includes $718,339 of cash collateral for securities on loan)(b)(wa) | | | 718,796 | | | | 718,364 | |

| | | | | | | | |

| | |

| TOTAL AFFILIATED MUTUAL FUNDS | | | | | | |

(cost $1,928,851) | | | | | | | 1,928,851 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Description | | | | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | |

U.S. TREASURY OBLIGATION(k)(n) 0.6% | | | | | | | | | | | | | | | | | |

U.S. Treasury Bills

(cost $249,991) | | | | | | | 0.034 | % | | | 12/09/21 | | | | 250 | | | $ | 249,983 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | | | | |

(cost $2,178,842) | | | | | | | | | | | | | | | | | | | 2,178,834 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| TOTAL INVESTMENTS 101.4% | | | | | | | | | | | | | | | |

(cost $36,275,827) | | | | | | | | | | | | | | | | | | | 42,477,468 | |

Liabilities in excess of other assets(z) (1.4)% | | | | | | | | | | | | | | | | | | | (584,800 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

NET ASSETS 100.0% | | | | | | | | | | | | | | | | | | $ | 41,892,668 | |

| | | | | | | | | | | | | | | | | | | | |

Below is a list of the abbreviation(s) used in the annual report:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

ADR—American Depositary Receipt

BDR—Brazilian Depositary Receipt

GDR—Global Depositary Receipt

LIBOR—London Interbank Offered Rate

MSCI—Morgan Stanley Capital International

PJSC—Public Joint-Stock Company

PRFC—Preference Shares

UTS—Unit Trust Security

| * | Non-income producing security. |

| # | Principal amount is shown in U.S. dollars unless otherwise stated. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $618,709; cash collateral of $718,339 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the Fund may reflect a collateral value that is less than the market value of the loaned securities and such shortfall is remedied the following business day. |

| (b) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (k) | Represents security, or a portion thereof, segregated as collateral for centrally cleared/exchange-traded derivatives. |

| (n) | Rate shown reflects yield to maturity at purchased date. |

| (wa) | PGIM Investments LLC, the manager of the Fund, also serves as manager of the PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund, if applicable. |

| (z) | Includes net unrealized appreciation/(depreciation) and/or market value of the below holdings which are excluded from the Schedule of Investments: |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 21 | |

Schedule of Investments (continued)

as of October 31, 2021

Futures contracts outstanding at October 31, 2021:

| | | | | | | | | | | | | | | | | | | |

Number

of

Contracts | | | | Type | | Expiration

Date | | Current

Notional

Amount | | Value /

Unrealized

Appreciation

(Depreciation) |

| Long Position: | | | | | | | | | | | | | | | |

| 22 | | | | Mini MSCI Emerging Markets Index | | | | Dec. 2021 | | | | $ | 1,388,200 | | | | $ | (40,852 | ) |

| | | | | | | | | | | | | | | | | | | |

Summary of Collateral for Centrally Cleared/Exchange-traded Derivatives:

Cash and securities segregated as collateral, including pending settlement for closed positions, to cover requirements for centrally cleared/exchange-traded derivatives are listed by broker as follows:

| | | | | | | | | | |

Broker | | Cash and/or Foreign Currency | | Securities Market Value |

Morgan Stanley & Co. LLC | | | $ | — | | | | $ | 249,983 | |

| | | | | | | | | | |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2021 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

| Investments in Securities | | | | | | | | | |

| Assets | | | | | | | | | |

| Long-Term Investments | | | | | | | | | |

| Common Stocks | | | | | | | | | |

Brazil | | $ | 1,049,048 | | | $ | — | | | | $— | |

Chile | | | 472,512 | | | | — | | | | — | |

China | | | 929,294 | | | | 12,979,518 | | | | — | |

Colombia | | | 30,906 | | | | — | | | | — | |

Greece | | | — | | | | 68,989 | | | | — | |

Hong Kong | | | — | | | | 39,091 | | | | — | |

Hungary | | | — | | | | 66,489 | | | | — | |

India | | | 385,444 | | | | 3,621,665 | | | | — | |

Indonesia | | | — | | | | 783,984 | | | | — | |

Malaysia | | | — | | | | 332,097 | | | | — | |

Mexico | | | 976,949 | | | | — | | | | — | |

Peru | | | 41,993 | | | | — | | | | — | |

Philippines | | | — | | | | 285,978 | | | | — | |

Poland | | | — | | | | 58,286 | | | | — | |

See Notes to Financial Statements.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

| Investments in Securities (continued) | | | | | | | | | |

| Assets (continued) | | | | | | | | | |

| Long-Term Investments (continued) | | | | | | | | | |

| Common Stocks (continued) | | | | | | | | | |

Qatar | | $ | — | | | $ | 200,575 | | | $ | — | |

Russia | | | — | | | | 1,174,008 | | | | — | |

Saudi Arabia | | | — | | | | 1,133,761 | | | | — | |

South Africa | | | — | | | | 1,112,778 | | | | — | |

South Korea | | | — | | | | 5,534,568 | | | | — | |

Taiwan | | | — | | | | 6,359,969 | | | | — | |

Thailand | | | — | | | | 987,732 | | | | — | |

Turkey | | | — | | | | 118,686 | | | | — | |

United Arab Emirates | | | — | | | | 287,814 | | | | — | |

United States | | | 111,046 | | | | — | | | | — | |

| Preferred Stocks | | | | | | | | | |

Brazil | | | 860,265 | | | | — | | | | — | |

Russia | | | — | | | | 20,844 | | | | — | |

South Korea | | | — | | | | 274,345 | | | | — | |

| Short-Term Investments | | | | | | | | | |

| Affiliated Mutual Funds | | | 1,928,851 | | | | — | | | | — | |

| U.S. Treasury Obligation | | | — | | | | 249,983 | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 6,786,308 | | | $ | 35,691,160 | | | $ | — | |

| | | | | | | | | | | | |

| Other Financial Instruments* | | | | | | | | | |

| Liabilities | | | | | | | | | |

Futures Contracts | | $ | (40,852) | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

| * | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and centrally cleared swap contracts, which are recorded at the unrealized appreciation (depreciation) on the instrument, and OTC swap contracts which are recorded at fair value. |

Industry Classification:

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2021 were as follows (unaudited):

| | | | |

Banks | | | 12.9 | % |

Semiconductors & Semiconductor Equipment | | | 9.5 | |

Technology Hardware, Storage & Peripherals | | | 6.3 | |

Internet & Direct Marketing Retail | | | 5.8 | |

Metals & Mining | | | 5.7 | |

Oil, Gas & Consumable Fuels | | | 5.7 | |

Interactive Media & Services | | | 5.2 | |

Affiliated Mutual Funds (1.7% represents investments purchased with collateral from securities on loan) | | | 4.6 | |

| | | | |

IT Services | | | 3.0 | % |

Insurance | | | 3.0 | |

Real Estate Management & Development | | | 2.8 | |

Automobiles | | | 2.8 | |

Pharmaceuticals | | | 2.7 | |

Chemicals | | | 2.6 | |

Food Products | | | 2.5 | |

Electronic Equipment, Instruments & Components | | | 2.1 | |

Diversified Telecommunication Services | | | 1.5 | |

Electric Utilities | | | 1.5 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 23 | |

Schedule of Investments (continued)

as of October 31, 2021

Industry Classification (continued):

| | | | |

Marine | | | 1.4 | % |

Media | | | 1.2 | |

Capital Markets | | | 1.2 | |

Wireless Telecommunication Services | | | 1.1 | |

Transportation Infrastructure | | | 1.0 | |

Industrial Conglomerates | | | 1.0 | |

Specialty Retail | | | 0.9 | |

Textiles, Apparel & Luxury Goods | | | 0.9 | |

Health Care Equipment & Supplies | | | 0.9 | |

Food & Staples Retailing | | | 0.8 | |

Independent Power & Renewable Electricity Producers | | | 0.8 | |

Multiline Retail | | | 0.7 | |

Diversified Financial Services | | | 0.7 | |

Leisure Products | | | 0.7 | |

Tobacco | | | 0.7 | |

Beverages | | | 0.7 | |

Auto Components | | | 0.7 | |

Household Durables | | | 0.7 | |

U.S. Treasury Obligation | | | 0.6 | |

Electrical Equipment | | | 0.6 | |

| | | | |

Personal Products | | | 0.5 | % |

Construction Materials | | | 0.4 | |

Hotels, Restaurants & Leisure | | | 0.4 | |

Life Sciences Tools & Services | | | 0.4 | |

Machinery | | | 0.4 | |

Building Products | | | 0.3 | |

Trading Companies & Distributors | | | 0.3 | |

Diversified Consumer Services | | | 0.2 | |

Construction & Engineering | | | 0.2 | |

Biotechnology | | | 0.2 | |

Air Freight & Logistics | | | 0.2 | |

Entertainment | | | 0.1 | |

Thrifts & Mortgage Finance | | | 0.1 | |

Gas Utilities | | | 0.1 | |

Health Care Providers & Services | | | 0.1 | |

Aerospace & Defense | | | 0.0 | * |

| | | | |

| | | 101.4 | |

Liabilities in excess of other assets | | | (1.4 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

Effects of Derivative Instruments on the Financial Statements and Primary Underlying Risk Exposure:

The Fund invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity contracts risk. See the Notes to Financial Statements for additional detail regarding these derivative instruments and their risks. The effect of such derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

Fair values of derivative instruments as of October 31, 2021 as presented in the Statement of Assets and Liabilities:

| | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

Derivatives not accounted for as hedging

instruments, carried at fair value | | Statement of

Assets and

Liabilities Location | | Fair

Value | | | Statement of

Assets and

Liabilities Location | | Fair

Value | |

|

| | | | | | | | Due from/to

broker-variation margin | | | |

Equity contracts | | — | | | $— | | | futures | | | $40,852 | * |

| | | | | | | | | | | | |

| * | Includes cumulative appreciation (depreciation) as reported in the schedule of open futures and centrally cleared swap contracts. Only unsettled variation margin receivable (payable) is reported within the Statement of Assets and Liabilities. |

See Notes to Financial Statements.

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2021 are as follows:

| | | | |

Amount of Realized Gain (Loss) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Futures | |

Equity contracts | | $ | 10,361 | |

| | | | |

| | | | |

Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Futures | |

Equity contracts | | $ | (40,852 | ) |

| | | | |

For the year ended October 31, 2021, the Fund’s average volume of derivative activities is as follows:

|

Futures

Contracts—

Long

Positions(1) |

$1,018,467 |

| (1) | Notional Amount in USD. |

Average volume is based on average quarter end balances as noted for the year ended October 31, 2021.

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Fund entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions where the legal right to set-off exists is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

| | | | | | |

Description | | Gross Market

Value of

Recognized

Assets/(Liabilities) | | Collateral

Pledged/(Received)(1) | | Net

Amount |

Securities on Loan | | $618,709 | | $(618,709) | | $— |

| | | | | | |

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 25 | |

Statement of Assets & Liabilities

as of October 31, 2021

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $618,709: | | | | |

Unaffiliated investments (cost $34,346,976) | | $ | 40,548,617 | |

Affiliated investments (cost $1,928,851) | | | 1,928,851 | |

Foreign currency, at value (cost $53,439) | | | 53,018 | |

Receivable for Fund shares sold | | | 256,774 | |

Dividends receivable | | | 42,095 | |

Due from Manager | | | 29,507 | |

Tax reclaim receivable | | | 386 | |

Receivable for investments sold | | | 24 | |

Prepaid expenses and other assets | | | 3,038 | |

| | | | |

Total Assets | | | 42,862,310 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan | | | 718,339 | |

Accrued expenses and other liabilities | | | 133,255 | |

Foreign capital gains tax liability accrued | | | 97,279 | |

Due to broker—variation margin futures | | | 19,910 | |

Trustees’ fees payable | | | 804 | |

Affiliated transfer agent fee payable | | | 55 | |

| | | | |

Total Liabilities | | | 969,642 | |

| | | | |

| |

Net Assets | | $ | 41,892,668 | |

| | | | |

| |

| | | | | |

Net assets were comprised of: | | | | |

Shares of beneficial interest, at par | | $ | 3,264 | |

Paid-in capital in excess of par | | | 34,674,186 | |

Total distributable earnings (loss) | | | 7,215,218 | |

| | | | |

Net assets, October 31, 2021 | | $ | 41,892,668 | |

| | | | |

| |

Class R6 | | | | |

Net asset value, offering price and redemption price per share,

($41,892,668 ÷ 3,264,080 shares of beneficial interest issued and outstanding) | | $ | 12.83 | |

| | | | |

See Notes to Financial Statements.

Statement of Operations

Year Ended October 31, 2021

| | | | |

Net Investment Income (Loss) | | | | |

Income | | | | |

Unaffiliated dividend income (net of $197,966 foreign withholding tax) | | $ | 1,493,829 | |

Income from securities lending, net (including affiliated income of $216) | | | 11,808 | |

Affiliated dividend income | | | 1,008 | |

| | | | |

Total income | | | 1,506,645 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 337,551 | |

Custodian and accounting fees | | | 141,934 | |

Fund data services | | | 68,535 | |

Audit fee | | | 34,404 | |

Legal fees and expenses | | | 20,162 | |

Trustees’ fees | | | 10,000 | |

Shareholders’ reports | | | 7,605 | |

SEC registration fees | | | 780 | |

Transfer agent’s fees and expenses (including affiliated expense of $324) | | | 416 | |

Registration fees | | | 250 | |

Miscellaneous | | | 17,247 | |

| | | | |

Total expenses | | | 638,884 | |

Less: Fee waiver and/or expense reimbursement | | | (98,726 | ) |

| | | | |

Net expenses | | | 540,158 | |

| | | | |

Net investment income (loss) | | | 966,487 | |

| | | | |

|

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | |

Net realized gain (loss) on: | | | | |

Investment transactions (including affiliated of $(96)) (net of foreign capital gains taxes $(43,211)) | | | 4,045,939 | |

Futures transactions | | | 10,361 | |

Foreign currency transactions | | | (29,468 | ) |

| | | | |

| | | 4,026,832 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments (net of change in foreign capital gains taxes $(97,279)) | | | (467,013 | ) |

Futures | | | (40,852 | ) |

Foreign currencies | | | (1,151 | ) |

| | | | |

| | | (509,016 | ) |

| | | | |

Net gain (loss) on investment and foreign currency transactions | | | 3,517,816 | |

| | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 4,484,303 | |

| | | | |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 27 | |

Statements of Changes in Net Assets

| | | | | | | | |

| |

| | | Year Ended

October 31, | |

| | |

| | | 2021 | | | 2020 | |

| | |

Increase (Decrease) in Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 966,487 | | | $ | 530,694 | |

Net realized gain (loss) on investment and foreign currency transactions | | | 4,026,832 | | | | (1,996,159 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | (509,016 | ) | | | 3,667,270 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 4,484,303 | | | | 2,201,805 | |

| | | | | | | | |

| | |

Dividends and Distributions | | | | | | | | |

Distributions from distributable earnings | | | | | | | | |

Class R6 | | | (567,424 | ) | | | (649,151 | ) |

| | | | | | | | |

| | |

Fund share transactions | | | | | | | | |

Net proceeds from shares sold | | | 11,048,336 | | | | 7,601,460 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 567,424 | | | | 649,151 | |

Cost of shares purchased | | | (9,693,559 | ) | | | (3,553,887 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from Fund share transactions | | | 1,922,201 | | | | 4,696,724 | |

| | | | | | | | |

Total increase (decrease) | | | 5,839,080 | | | | 6,249,378 | |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 36,053,588 | | | | 29,804,210 | |

| | | | | | | | |

End of year | | $ | 41,892,668 | | | $ | 36,053,588 | |

| | | | | | | | |

See Notes to Financial Statements.

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class R6 Shares | | | | | | | | | | | | | | | | | | |

| | | Year Ended October 31, | | | | | | November 29, 2016(a)

through October 31, 2017 | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | | |

| Per Share Operating Performance(b): | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | $11.61 | | | | $11.14 | | | | $10.84 | | | | $13.21 | | | | | | | | $10.00 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.29 | | | | 0.18 | | | | 0.19 | | | | 0.20 | | | | | | | | 0.16 | |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 1.11 | | | | 0.53 | | | | 0.43 | | | | (1.71 | ) | | | | | | | 3.09 | |

| Total from investment operations | | | 1.40 | | | | 0.71 | | | | 0.62 | | | | (1.51 | ) | | | | | | | 3.25 | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.18 | ) | | | (0.24 | ) | | | (0.21 | ) | | | (0.17 | ) | | | | | | | (0.04 | ) |

| Distributions from net realized gains | | | - | | | | - | | | | (0.11 | ) | | | (0.69 | ) | | | | | | | - | |

| Total dividends and distributions | | | (0.18 | ) | | | (0.24 | ) | | | (0.32 | ) | | | (0.86 | ) | | | | | | | (0.04 | ) |

| Net asset value, end of period | | | $12.83 | | | | $11.61 | | | | $11.14 | | | | $10.84 | | | | | | | | $13.21 | |

| Total Return(c): | | | 12.08 | % | | | 6.42 | % | | | 5.82 | % | | | (12.31 | )% | | | | | | | 32.58 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | | $41,893 | | | | $36,054 | | | | $29,804 | | | | $27,145 | | | | | | | | $28,470 | |

| Average net assets (000) | | | $45,007 | | | | $32,007 | | | | $28,694 | | | | $29,759 | | | | | | | | $24,017 | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | | | | | 1.20 | %(e) |

| Expenses before waivers and/or expense reimbursement | | | 1.42 | % | | | 1.53 | % | | | 1.70 | % | | | 1.54 | % | | | | | | | 1.74 | %(e) |

| Net investment income (loss) | | | 2.15 | % | | | 1.66 | % | | | 1.71 | % | | | 1.56 | % | | | | | | | 1.49 | %(e) |

| Portfolio turnover rate(f) | | | 108 | % | | | 106 | % | | | 117 | % | | | 118 | % | | | | | | | 102 | % |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 29 | |

Notes to Financial Statements

1. Organization

Prudential Investment Portfolios 2 (the “Registered Investment Company” or “RIC”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. The RIC is organized as a Delaware Statutory Trust and currently consists of eleven separate funds: PGIM Core Conservative Bond Fund, PGIM Core Short-Term Bond Fund, PGIM Core Ultra Short Bond Fund, PGIM Institutional Money Market Fund, PGIM Jennison Small-Cap Core Equity Fund, PGIM QMA Commodity Strategies Fund, PGIM QMA Emerging Markets Equity Fund, PGIM QMA International Developed Markets Index Fund, PGIM QMA Mid-Cap Core Equity Fund, PGIM QMA US Broad Market Index Fund and PGIM TIPS Fund. These financial statements relate only to the PGIM QMA Emerging Markets Equity Fund (the “Fund”). The Fund is classified as a diversified fund for purposes of the 1940 Act.

The investment objective of the Fund is to seek to provide returns in excess of the Morgan Stanley Capital International Emerging Markets Index over full market cycles.

2. Accounting Policies

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services — Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to U.S. generally accepted accounting principles (“GAAP”). The Fund consistently follows such policies in the preparation of their financial statements.

Securities Valuation: The Fund holds securities and other assets and liabilities that are fair valued as of the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. As described in further detail below, the Fund’s investments are valued daily based on a number of factors, including the type of investment and whether market quotations are readily available. The RIC’s Board of Trustees (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or the “Manager”). Pursuant to the Board’s delegation, the Manager has established a Valuation Committee responsible for supervising the fair valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. A

record of the Valuation Committee’s actions is subject to the Board’s review at its first quarterly meeting following the quarter in which such actions take place.

For the fiscal reporting year-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities trade in markets that are open on weekends and U.S. holidays, the values of some of the Fund’s foreign investments may change on days when investors cannot purchase or redeem Fund shares.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820 - Fair Value Measurements and Disclosures.

Common or preferred stocks, exchange-traded funds and derivative instruments, if applicable, that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy. In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Foreign equities traded on foreign securities exchanges are generally valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements up to the time the Fund is valued. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stock valuation policies discussed above.

Investments in open-end funds (other than exchange-traded funds) are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Fixed income securities traded in the OTC market are generally classified as Level 2 in the fair value hierarchy. Such fixed income securities are typically valued using the market approach which generally involves obtaining data from an approved independent third-party vendor source. The Fund utilizes the market approach as the primary method to value

| | | | |

PGIM QMA Emerging Markets Equity Fund | | | 31 | |

Notes to Financial Statements (continued)