UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| Investment Company Act file number: | 811-09999 | |

| Exact name of registrant as specified in charter: | Prudential Investment Portfolios 2 | |

| (This Form N-CSR relates solely to the Registrant’s PGIM QMA Emerging Markets Equity Fund and PGIM QMA International Developed Markets Index Fund (each a “Fund” and collectively the “Funds”)) | ||

| Address of principal executive offices: | 655 Broad Street, 17th Floor | |

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Andrew R. French | |

| 655 Broad Street, 17th Floor | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 10/31/2020 | |

| Date of reporting period: | 10/31/2020 | |

Item 1 – Reports to Stockholders

PGIM QMA EMERGING MARKETS EQUITY FUND

ANNUAL REPORT

OCTOBER 31, 2020

COMING SOON: PAPERLESS SHAREHOLDER REPORTS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (pgim.com/investments), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an email request to PGIM Investments at shareholderreports@pgim.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 7 | ||||

| 9 | ||||

| 11 | ||||

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company, member SIPC. QMA is the primary business name of QMA LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), a Prudential Financial company. © 2020 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| 2 | Visit our website at pgim.com/investments |

Dear Shareholder:

We hope you find the annual report for the PGIM QMA Emerging Markets Equity Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2020.

During the first four months of the period, the global economy remained healthy—particularly in the US—fueled by rising corporate profits and strong job growth. The outlook changed dramatically in March as the coronavirus outbreak quickly and substantially shut down economic activity worldwide, leading to significant job losses and a steep decline in global growth and earnings. Responding to this disruption, the Federal Reserve (the Fed) cut the federal funds rate target to near zero and flooded capital markets with liquidity; and Congress passed stimulus bills worth approximately $3 trillion that offered an economic lifeline to consumers and businesses.

While stocks climbed throughout the first four months of the period, they fell significantly in March amid a spike in volatility, ending the 11-year-long equity bull market. With stores and factories closing and consumers staying at home to limit the spread of the virus, investors sold stocks on fears that corporate earnings would take a serious hit. Equities rallied around the globe throughout the spring and summer as states reopened their economies, but became more volatile during the last two months of the period as investors worried that a surge in coronavirus infections would stall the economic recovery. For the period overall, large-cap US and emerging market stocks rose, small-cap US stocks were virtually unchanged, and stocks in developed foreign markets declined.

The bond market overall—including US and global bonds as well as emerging market debt—rose during the period as investors sought safety in fixed income. A significant rally in interest rates pushed the 10-year US Treasury yield down to a record low. In March, the Fed took several aggressive actions to keep the bond markets running smoothly, restarting many of the relief programs that proved to be successful in helping end the global financial crisis in 2008-09.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM QMA Emerging Markets Equity Fund

December 15, 2020

PGIM QMA Emerging Markets Equity Fund | 3 |

Your Fund’s Performance (unaudited)

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852

Average Annual Total Returns as of 10/31/20 | ||||

| One Year (%) | Since Inception (%) | |||

| Fund (Class R6) | 6.42 | 7.11 (11/29/16) | ||

| MSCI Emerging Markets Index | ||||

| 8.25 | 9.05 | |||

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns for the Index are measured from the closest month-end to the Fund’s inception date.

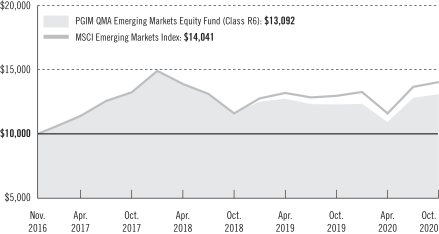

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund with a similar investment in the MSCI Emerging Markets Index by portraying the initial account values at the commencement of operations of the Fund (November 29, 2016) and the account values at the end of the current fiscal year (October 31, 2020), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and

| 4 | Visit our website at pgim.com/investments |

distributions were reinvested. Without waiver of fees and/or expense reimbursments, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

MSCI Emerging Markets Index—The MSCI Emerging Markets Index is an unmanaged free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of emerging markets. It consists of the following 24 emerging market country indexes: Brazil, Chile, China, Colombia, the Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

PGIM QMA Emerging Markets Equity Fund | 5 |

Your Fund’s Performance (continued)

Presentation of Fund Holdings as of 10/31/20

| Ten Largest Holdings | Line of Business | Country | % of Net Assets | |||

| Alibaba Group Holding Ltd., ADR | Internet & Direct Marketing Retail | China | 9.6% | |||

| Tencent Holdings Ltd. | Interactive Media & Services | China | 7.5% | |||

| Taiwan Semiconductor Manufacturing Co. Ltd. | Semiconductors & Semiconductor Equipment | Taiwan | 6.0% | |||

| Samsung Electronics Co. Ltd. | Technology Hardware, Storage & Peripherals | South Korea | 3.6% | |||

| Meituan (Class B Stock) | Internet & Direct Marketing Retail | China | 2.0% | |||

| JD.com, Inc., ADR | Internet & Direct Marketing Retail | China | 1.9% | |||

| Vale SA | Metals & Mining | Brazil | 1.2% | |||

| iShares MSCI Emerging Markets ETF | Exchange-Traded Funds | United States | 1.2% | |||

| China Mobile Ltd. | Wireless Telecommunication Services | China | 1.1% | |||

| China Construction Bank Corp. (Class H Stock) | Banks | China | 1.1% | |||

Holdings reflect only long-term investments and are subject to change.

| 6 | Visit our website at pgim.com/investments |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM QMA Emerging Markets Equity Fund’s Class R6 shares returned 6.42% in the 12-month reporting period that ended October 31, 2020, underperforming the 8.25% return of the MSCI Emerging Markets Index (the Index).

What were the market conditions?

| • | The reporting period was dominated by the proliferation of COVID-19 infections that began in early 2020. While economists continue to debate the shape of the economic recovery, it clearly has been V-shaped in global equity markets, with many markets fully erasing losses from the severe decline in March 2020 by period-end. (A V-shaped recovery refers to a sharp rise back to previous measures of economic performance after a downturn.) |

| • | However, performance among equity market segments was divergent during the period. For example, China’s economy bounced back sooner than the rest of the world, as the country’s draconian lockdown was highly effective at curbing the spread of the virus in February. As a result, China’s economy suffered less damage and is likely to post positive growth for 2020. |

| • | In international developed markets, information technology was the best-performing sector during the period, gaining about 30%, while energy stocks fared the worst, declining almost 30%. |

| • | Growth significantly outperformed value over the period. Geographically, US stocks outpaced non-US developed markets and emerging markets. Nonetheless, by period-end there were already signs that growth was slowing, as uncertainty remained over when the global economy would resume pre-COVID-19 levels of economic activity. |

What worked?

| • | Growth measures contributed to the Fund’s performance, particularly high-growth Taiwanese information technology and Korean materials holdings, along with positions in Chinese industrials and healthcare. |

| • | The Fund also benefited from bets on high-quality communication services names in China and avoiding positions in low-quality names across South Africa and Brazil. |

What didn’t work?

| • | The Fund’s investments in relatively inexpensive stocks offset the gains, and the shortfall was particularly significant given that expensive stocks by far outperformed cheaper stocks over the period. |

| • | Avoiding expensive information technology, consumer discretionary, and consumer services names in China was particularly detrimental given the significant run-up in the |

PGIM QMA Emerging Markets Equity Fund | 7 |

Strategy and Performance Overview (continued)

| price of those stocks during the period. Favoring inexpensive financials and communication services companies in China detracted further. |

Did the Fund use derivatives?

The Fund did not hold futures during the period. However, the Fund may invest in futures, including for the ease of cash management.

Current outlook

| • | QMA believes the current market is crowded and not sustainable, and that diversification and the Fund’s investment strategy should prevail as markets normalize and move past fear and uncertainty. Specifically, QMA sees a correction in the extremely high valuations of the momentum-driven stocks responsible for much of the market’s returns during the period, coupled with the recovery of fundamentals and valuations among cheaper stocks with very high relative and nominal earnings and book-value yields. |

| • | While the pathway and timing of events leading to this reversion is hard to predict, QMA views the eventual neutralization of the COVID-19 pandemic as a key catalyst in bringing more balance to the equity markets, an environment where QMA’s strategies have historically performed well. |

| • | In QMA’s view, the biggest risk appears to be political, as the results of the US presidential election, particularly if contested or prolonged, and new policies from the subsequent administration could prove disruptive to the US and global economy. |

| 8 | Visit our website at pgim.com/investments |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs as applicable, and (2) ongoing costs, including management fees and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2020. The example is for illustrative purposes only; you should consult the Fund’s Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

PGIM QMA Emerging Markets Equity Fund | 9 |

Fees and Expenses (continued)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| PGIM QMA Emerging Markets Equity Fund | Beginning Account Value May 1, 2020 | Ending Account Value October 31, 2020 | Annualized Expense Ratio Based on the Six-Month Period | Expenses Paid During the Six-Month Period* | ||||||||||||

| Actual | $1,000.00 | $ | 1,196.90 | 1.22 | % | $ | 6.74 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,019.00 | 1.22 | % | $ | 6.19 | ||||||||

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2020, and divided by the 366 days in the Fund’s fiscal year ended October 31, 2020 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| 10 | Visit our website at pgim.com/investments |

Schedule of Investments

as of October 31, 2020

| Description | Shares | Value | ||||||

| LONG-TERM INVESTMENTS 100.6% | ||||||||

| COMMON STOCKS 97.9% | ||||||||

| Brazil 4.0% | ||||||||

B3 SA - Brasil Bolsa Balcao | 27,700 | $ | 245,286 | |||||

Banco Bradesco SA | 7,274 | 22,983 | ||||||

Banco do Brasil SA | 4,800 | 24,887 | ||||||

Banco Santander Brasil SA, UTS | 45,200 | 251,288 | ||||||

Centrais Eletricas Brasileiras SA | 1,200 | 6,458 | ||||||

Cosan SA | 7,200 | 81,136 | ||||||

Petroleo Brasileiro SA | 19,800 | 65,598 | ||||||

Vale SA | 41,032 | 431,562 | ||||||

WEG SA | 23,500 | 310,852 | ||||||

|

| |||||||

| 1,440,050 | ||||||||

| China 44.1% | ||||||||

Alibaba Group Holding Ltd., ADR* | 11,300 | 3,442,997 | ||||||

Anhui Conch Cement Co. Ltd. (Class H Stock) | 35,000 | 219,229 | ||||||

Autohome, Inc., ADR | 400 | 38,220 | ||||||

Bank of Chengdu Co. Ltd. (Class A Stock) | 39,500 | 61,143 | ||||||

Bank of China Ltd. (Class H Stock) | 436,000 | 138,143 | ||||||

Bank of Jiangsu Co. Ltd. (Class A Stock) | 53,200 | 47,799 | ||||||

Beijing Enterprises Holdings Ltd. | 2,500 | 7,550 | ||||||

China CITIC Bank Corp. Ltd. (Class H Stock) | 285,000 | 116,172 | ||||||

China Construction Bank Corp. (Class H Stock) | 574,000 | 397,705 | ||||||

China Galaxy Securities Co. Ltd. (Class H Stock) | 154,000 | 84,714 | ||||||

China Lesso Group Holdings Ltd. | 20,000 | 32,476 | ||||||

China Life Insurance Co. Ltd. (Class H Stock) | 133,000 | 289,957 | ||||||

China Medical System Holdings Ltd. | 191,000 | 201,195 | ||||||

China Merchants Energy Shipping Co. Ltd. (Class A Stock) | 61,600 | 53,244 | ||||||

China Minsheng Banking Corp. Ltd. (Class H Stock) | 373,500 | 204,779 | ||||||

China Mobile Ltd. | 67,000 | 409,296 | ||||||

China National Building Material Co. Ltd. (Class H Stock) | 191,000 | 219,768 | ||||||

China Overseas Land & Investment Ltd. | 99,500 | 250,348 | ||||||

China Pacific Insurance Group Co. Ltd. (Class H Stock) | 15,000 | 46,987 | ||||||

China Reinsurance Group Corp. (Class H Stock) | 390,000 | 37,374 | ||||||

China Resources Cement Holdings Ltd. | 58,000 | 76,150 | ||||||

China Resources Power Holdings Co. Ltd. | 12,000 | 12,502 | ||||||

China South Publishing & Media Group Co. Ltd. (Class A Stock) | 31,600 | 49,529 | ||||||

China Tourism Group Duty Free Corp. Ltd. (Class A Stock) | 2,689 | 80,161 | ||||||

China Unicom Hong Kong Ltd. | 312,000 | 192,533 | ||||||

China Yuhua Education Corp. Ltd., 144A | 256,000 | 203,316 | ||||||

CNOOC Ltd. | 96,000 | 87,811 | ||||||

COSCO SHIPPING Energy Transportation Co. Ltd. (Class H Stock) | 434,000 | 171,009 | ||||||

Country Garden Holdings Co. Ltd. | 41,000 | 50,702 | ||||||

Country Garden Services Holdings Co. Ltd. | 31,000 | 195,321 | ||||||

See Notes to Financial Statements.

PGIM QMA Emerging Markets Equity Fund | 11 |

Schedule of Investments (continued)

as of October 31, 2020

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) | ||||||||

| China (cont’d.) | ||||||||

CSC Financial Co. Ltd. (Class A Stock) | 8,400 | $ | 53,574 | |||||

CSPC Pharmaceutical Group Ltd. | 35,200 | 37,417 | ||||||

Daqin Railway Co. Ltd. (Class A Stock) | 18,900 | 18,110 | ||||||

Far East Horizon Ltd. | 185,000 | 182,396 | ||||||

Fujian Sunner Development Co. Ltd. (Class A Stock) | 9,000 | 29,667 | ||||||

G-bits Network Technology Xiamen Co. Ltd. (Class A Stock) | 700 | 49,283 | ||||||

Great Wall Motor Co. Ltd. (Class H Stock) | 44,500 | 72,441 | ||||||

Greenland Holdings Corp. Ltd. (Class A Stock) | 44,300 | 40,971 | ||||||

Haidilao International Holding Ltd., 144A | 7,000 | 46,294 | ||||||

Hengan International Group Co. Ltd. | 29,000 | 202,011 | ||||||

Huaxin Cement Co. Ltd. (Class A Stock) | 13,900 | 50,294 | ||||||

Hunan Valin Steel Co. Ltd. (Class A Stock) | 85,800 | 65,151 | ||||||

Industrial & Commercial Bank of China Ltd. (Class H Stock) | 615,000 | 346,951 | ||||||

JD.com, Inc., ADR* | 8,200 | 668,464 | ||||||

Jiangsu Hengli Hydraulic Co. Ltd. (Class A Stock) | 6,956 | 78,836 | ||||||

Jiangsu Yuyue Medical Equipment & Supply Co. Ltd. (Class A Stock) | 11,100 | 51,292 | ||||||

Jinke Properties Group Co. Ltd. (Class A Stock) | 39,100 | 45,287 | ||||||

Kweichow Moutai Co. Ltd. (Class A Stock) | 200 | 49,859 | ||||||

KWG Group Holdings Ltd. | 89,500 | 119,162 | ||||||

KWG Living Group Holdings Ltd.* | 44,750 | 35,096 | ||||||

Li Ning Co. Ltd. | 11,500 | 59,862 | ||||||

Livzon Pharmaceutical Group, Inc. (Class A Stock) | 7,600 | 55,115 | ||||||

Logan Group Co. Ltd. | 55,000 | 86,752 | ||||||

Longfor Group Holdings Ltd., 144A | 32,000 | 175,738 | ||||||

LONGi Green Energy Technology Co. Ltd. (Class A Stock) | 2,300 | 26,192 | ||||||

Luxshare Precision Industry Co. Ltd. (Class A Stock) | 9,229 | 75,510 | ||||||

Meituan (Class B Stock)* | 19,300 | 717,009 | ||||||

Metallurgical Corp. of China Ltd. (Class A Stock) | 136,000 | 52,660 | ||||||

Muyuan Foods Co. Ltd. (Class A Stock) | 5,200 | 55,103 | ||||||

NetEase, Inc., ADR | 4,200 | 364,518 | ||||||

New China Life Insurance Co. Ltd. (Class H Stock) | 63,100 | 252,902 | ||||||

NIO, Inc., ADR* | 1,800 | 55,044 | ||||||

Offcn Education Technology Co. Ltd. (Class A Stock) | 11,700 | 69,235 | ||||||

People’s Insurance Co. Group of China Ltd. (The) (Class H Stock) | 46,000 | 13,724 | ||||||

PICC Property & Casualty Co. Ltd. (Class H Stock) | 98,000 | 66,585 | ||||||

Ping An Insurance Group Co. of China Ltd. (Class H Stock) | 16,500 | 170,262 | ||||||

Poly Developments & Holdings Group Co. Ltd. (Class A Stock) | 23,173 | 53,128 | ||||||

Sany Heavy Industry Co. Ltd. (Class A Stock) | 20,900 | 81,268 | ||||||

SF Holding Co. Ltd. (Class A Stock) | 5,700 | 70,583 | ||||||

Shaanxi Coal Industry Co. Ltd. (Class A Stock) | 44,500 | 58,180 | ||||||

Shandong Buchang Pharmaceuticals Co. Ltd. (Class A Stock) | 5,200 | 18,819 | ||||||

Shanghai Pudong Development Bank Co. Ltd. (Class A Stock) | 10,400 | 14,389 | ||||||

See Notes to Financial Statements.

| 12 |

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) | ||||||||

| China (cont’d.) | ||||||||

Shenzhen Mindray Bio-Medical Electronics Co. Ltd. (Class A Stock) | 1,400 | $ | 81,082 | |||||

Shenzhou International Group Holdings Ltd. | 9,700 | 169,134 | ||||||

Shimao Group Holdings Ltd. | 25,000 | 88,678 | ||||||

Sinotruk Hong Kong Ltd. | 3,500 | 8,976 | ||||||

Tencent Holdings Ltd. | 35,300 | 2,689,618 | ||||||

Tingyi Cayman Islands Holding Corp. | 10,000 | 18,240 | ||||||

Uni-President China Holdings Ltd. | 8,000 | 6,942 | ||||||

Weichai Power Co. Ltd. (Class H Stock) | 82,000 | 156,017 | ||||||

Wens Foodstuffs Group Co. Ltd. (Class A Stock) | 17,560 | 49,771 | ||||||

Wuhu Sanqi Interactive Entertainment Network Technology Group Co. Ltd. (Class A Stock) | 12,300 | 54,312 | ||||||

Yum China Holdings, Inc. | 4,300 | 228,889 | ||||||

Zhejiang Expressway Co. Ltd. (Class H Stock) | 22,000 | 15,003 | ||||||

Zhongsheng Group Holdings Ltd. | 3,000 | 21,518 | ||||||

Zoomlion Heavy Industry Science & Technology Co. Ltd. (Class A Stock) | 54,400 | 60,281 | ||||||

|

| |||||||

| 15,901,725 | ||||||||

| Colombia 0.0% | ||||||||

Bancolombia SA | 1,330 | 8,433 | ||||||

| Greece 0.3% | ||||||||

Hellenic Telecommunications Organization SA | 9,508 | 126,673 | ||||||

| Hungary 0.2% | ||||||||

Richter Gedeon Nyrt | 3,254 | 66,320 | ||||||

| India 7.6% | ||||||||

Aurobindo Pharma Ltd. | 19,950 | 208,712 | ||||||

Bajaj Auto Ltd. | 452 | 17,601 | ||||||

Cipla Ltd. | 8,801 | 89,659 | ||||||

Dr. Reddy’s Laboratories Ltd. | 4,206 | 277,498 | ||||||

GAIL India Ltd. | 171,846 | 196,660 | ||||||

HCL Technologies Ltd. | 30,080 | 341,975 | ||||||

Hero MotoCorp Ltd. | 4,168 | 157,402 | ||||||

Hindalco Industries Ltd. | 75,926 | 174,969 | ||||||

Housing Development Finance Corp. Ltd. | 925 | 24,028 | ||||||

Infosys Ltd., ADR | 23,400 | 333,918 | ||||||

ITC Ltd. | 41,267 | 92,146 | ||||||

LIC Housing Finance Ltd. | 2,645 | 10,120 | ||||||

NTPC Ltd. | 81,828 | 96,660 | ||||||

Petronet LNG Ltd. | 3,153 | 9,841 | ||||||

See Notes to Financial Statements.

PGIM QMA Emerging Markets Equity Fund | 13 |

Schedule of Investments (continued)

as of October 31, 2020

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) | ||||||||

| India (cont’d.) | ||||||||

Power Grid Corp. of India Ltd. | 84,027 | $ | 193,609 | |||||

Reliance Industries Ltd. | 4,326 | 120,315 | ||||||

Reliance Industries Ltd., 144A, GDR | 2,913 | 159,943 | ||||||

Wipro Ltd. | 49,763 | 228,345 | ||||||

|

| |||||||

| 2,733,401 | ||||||||

| Indonesia 1.4% | ||||||||

Bank Mandiri Persero Tbk PT | 95,200 | 37,198 | ||||||

Bank Rakyat Indonesia Persero Tbk PT | 316,400 | 72,119 | ||||||

Gudang Garam Tbk PT* | 2,800 | 7,840 | ||||||

Indofood CBP Sukses Makmur Tbk PT | 31,600 | 20,820 | ||||||

Indofood Sukses Makmur Tbk PT | 343,400 | 163,775 | ||||||

United Tractors Tbk PT | 153,600 | 220,367 | ||||||

|

| |||||||

| 522,119 | ||||||||

| Malaysia 1.3% | ||||||||

Dialog Group Bhd | 19,100 | 17,005 | ||||||

Hartalega Holdings Bhd | 9,900 | 43,063 | ||||||

Kossan Rubber Industries | 8,400 | 15,227 | ||||||

MISC Bhd | 5,000 | 7,922 | ||||||

Sime Darby Bhd | 144,000 | 83,888 | ||||||

Top Glove Corp. Bhd | 126,600 | 261,699 | ||||||

Westports Holdings Bhd | 51,900 | 48,586 | ||||||

|

| |||||||

| 477,390 | ||||||||

| Mexico 1.0% | ||||||||

Gruma SAB de CV (Class B Stock) | 3,120 | 33,300 | ||||||

Grupo Financiero Inbursa SAB de CV (Class O Stock)* | 206,000 | 152,668 | ||||||

Grupo Mexico SAB de CV (Class B Stock) | 16,800 | 47,902 | ||||||

Kimberly-Clark de Mexico SAB de CV (Class A Stock) | 82,600 | 123,365 | ||||||

|

| |||||||

| 357,235 | ||||||||

| Pakistan 0.1% | ||||||||

MCB Bank Ltd. | 36,501 | 37,883 | ||||||

| Philippines 0.8% | ||||||||

Globe Telecom, Inc. | 540 | 22,664 | ||||||

International Container Terminal Services, Inc. | 5,760 | 13,701 | ||||||

PLDT, Inc. | 8,890 | 244,031 | ||||||

|

| |||||||

| 280,396 | ||||||||

See Notes to Financial Statements.

| 14 |

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) | ||||||||

| Poland 0.1% | ||||||||

KGHM Polska Miedz SA* | 710 | $ | 21,216 | |||||

Polskie Gornictwo Naftowe i Gazownictwo SA | 9,557 | 10,093 | ||||||

|

| |||||||

| 31,309 | ||||||||

| Qatar 1.1% | ||||||||

Masraf Al Rayan QSC | 168,555 | 198,666 | ||||||

Qatar Islamic Bank SAQ | 40,911 | 181,915 | ||||||

|

| |||||||

| 380,581 | ||||||||

| Russia 2.9% | ||||||||

Gazprom PJSC | 14,290 | 27,874 | ||||||

Inter RAO UES PJSC | 1,410,000 | 90,115 | ||||||

LUKOIL PJSC | 4,138 | 211,120 | ||||||

Magnit PJSC, GDR | 9,663 | 133,146 | ||||||

Mobile TeleSystems PJSC, ADR | 9,700 | 75,854 | ||||||

Polyus PJSC | 705 | 138,199 | ||||||

Rosneft Oil Co. PJSC | 1,790 | 7,921 | ||||||

Sberbank of Russia PJSC, ADR | 24,702 | 249,557 | ||||||

Surgutneftegas PJSC | 256,600 | 106,421 | ||||||

|

| |||||||

| 1,040,207 | ||||||||

| Saudi Arabia 1.8% | ||||||||

Abdullah Al Othaim Markets Co. | 1,056 | 36,895 | ||||||

Al Rajhi Bank | 11,000 | 193,089 | ||||||

Jarir Marketing Co. | 4,764 | 220,179 | ||||||

National Commercial Bank | 3,337 | 34,775 | ||||||

Riyad Bank | 35,386 | 170,090 | ||||||

|

| |||||||

| 655,028 | ||||||||

| South Africa 3.4% | ||||||||

Anglo American Platinum Ltd. | 3,362 | 220,505 | ||||||

Exxaro Resources Ltd. | 30,598 | 205,553 | ||||||

Impala Platinum Holdings Ltd. | 21,526 | 190,249 | ||||||

Kumba Iron Ore Ltd. | 7,408 | 219,868 | ||||||

Naspers Ltd. (Class N Stock) | 1,125 | 218,779 | ||||||

Old Mutual Ltd. | 27,166 | 15,704 | ||||||

Shoprite Holdings Ltd. | 16,048 | 127,454 | ||||||

Sibanye Stillwater Ltd. | 11,424 | 33,164 | ||||||

|

| |||||||

| 1,231,276 | ||||||||

See Notes to Financial Statements.

PGIM QMA Emerging Markets Equity Fund | 15 |

Schedule of Investments (continued)

as of October 31, 2020

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) | ||||||||

| South Korea 12.3% | ||||||||

BNK Financial Group, Inc. | 51,721 | $ | 251,976 | |||||

Coway Co. Ltd.* | 940 | 57,328 | ||||||

Daelim Industrial Co. Ltd. | 1,873 | 129,360 | ||||||

DB Insurance Co. Ltd. | 646 | 25,232 | ||||||

E-MART, Inc. | 410 | 51,825 | ||||||

Hana Financial Group, Inc. | 10,779 | 290,155 | ||||||

Hankook Tire & Technology Co. Ltd. | 392 | 10,935 | ||||||

Hyundai Glovis Co. Ltd. | 1,376 | 203,977 | ||||||

Hyundai Mobis Co. Ltd. | 407 | 81,105 | ||||||

Kakao Corp. | 984 | 286,042 | ||||||

KB Financial Group, Inc. | 9,200 | 326,749 | ||||||

Kia Motors Corp. | 7,777 | 348,716 | ||||||

Korea Investment Holdings Co. Ltd. | 247 | 15,052 | ||||||

Korea Zinc Co. Ltd. | 45 | 15,220 | ||||||

KT&G Corp. | 3,141 | 224,419 | ||||||

Kumho Petrochemical Co. Ltd. | 2,428 | 285,763 | ||||||

LG Corp. | 335 | 19,950 | ||||||

LG Electronics, Inc. | 558 | 41,450 | ||||||

LG Innotek Co. Ltd. | 664 | 89,470 | ||||||

Meritz Securities Co. Ltd. | 24,183 | 70,527 | ||||||

NH Investment & Securities Co. Ltd. | 988 | 8,367 | ||||||

Samsung Card Co. Ltd. | 294 | 7,636 | ||||||

Samsung Electronics Co. Ltd. | 25,726 | 1,293,475 | ||||||

Seegene, Inc. | 58 | 13,505 | ||||||

Shinhan Financial Group Co. Ltd. | 10,343 | 277,404 | ||||||

|

| |||||||

| 4,425,638 | ||||||||

| Taiwan 12.9% | ||||||||

Asustek Computer, Inc. | 13,000 | 110,394 | ||||||

Chailease Holding Co. Ltd. | 27,000 | 131,130 | ||||||

Chicony Electronics Co. Ltd. | 63,000 | 189,194 | ||||||

China Development Financial Holding Corp. | 176,000 | 51,410 | ||||||

Delta Electronics, Inc. | 11,000 | 73,191 | ||||||

Fubon Financial Holding Co. Ltd. | 37,000 | 52,472 | ||||||

Giant Manufacturing Co. Ltd. | 2,000 | 19,593 | ||||||

Globalwafers Co. Ltd. | 2,000 | 29,046 | ||||||

Hon Hai Precision Industry Co. Ltd. | 130,000 | 351,241 | ||||||

Lite-On Technology Corp. | 144,000 | 234,384 | ||||||

MediaTek, Inc. | 16,000 | 379,543 | ||||||

Micro-Star International Co. Ltd. | 4,000 | 16,126 | ||||||

Nien Made Enterprise Co. Ltd. | 20,000 | 224,442 | ||||||

Novatek Microelectronics Corp. | 4,000 | 37,232 | ||||||

Pegatron Corp. | 56,000 | 120,325 | ||||||

Quanta Computer, Inc. | 16,000 | 40,348 | ||||||

See Notes to Financial Statements.

| 16 |

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) | ||||||||

| Taiwan (cont'd.) | ||||||||

Realtek Semiconductor Corp. | 6,000 | $ | 74,447 | |||||

Synnex Technology International Corp. | 8,000 | 11,883 | ||||||

Taiwan Semiconductor Manufacturing Co. Ltd. | 144,000 | 2,162,219 | ||||||

United Microelectronics Corp. | 290,000 | 313,567 | ||||||

Wistron Corp. | 29,000 | 28,871 | ||||||

|

| |||||||

| 4,651,058 | ||||||||

| Thailand 1.0% | ||||||||

Charoen Pokphand Foods PCL | 218,200 | 176,708 | ||||||

Krung Thai Bank PCL | 391,900 | 109,337 | ||||||

PTT Exploration & Production PCL | 7,500 | 18,983 | ||||||

Siam Commercial Bank PCL (The) | 4,800 | 10,027 | ||||||

Thai Union Group PCL (Class F Stock) | 79,500 | 39,020 | ||||||

|

| |||||||

| 354,075 | ||||||||

| Turkey 1.3% | ||||||||

Anadolu Efes Biracilik Ve Malt Sanayii A/S | 74,854 | 174,102 | ||||||

BIM Birlesik Magazalar A/S* | 2,542 | 20,319 | ||||||

Coca-Cola Icecek A/S | 7,971 | 42,866 | ||||||

Ford Otomotiv Sanayi A/S | 17,235 | 222,612 | ||||||

|

| |||||||

| 459,899 | ||||||||

| United Arab Emirates 0.3% | ||||||||

Dubai Islamic Bank PJSC | 9,870 | 11,162 | ||||||

Emirates Telecommunications Group Co. PJSC | 20,698 | 95,145 | ||||||

|

| |||||||

| 106,307 | ||||||||

|

| |||||||

| TOTAL COMMON STOCKS | ||||||||

(cost $28,658,393) | 35,287,003 | |||||||

|

| |||||||

| EXCHANGE-TRADED FUND 1.2% | ||||||||

| United States | ||||||||

iShares MSCI Emerging Markets ETF | 9,649 | 431,407 | ||||||

|

| |||||||

See Notes to Financial Statements.

PGIM QMA Emerging Markets Equity Fund | 17 |

Schedule of Investments (continued)

as of October 31, 2020

| Description | Shares | Value | ||||||

| PREFERRED STOCKS 1.5% | ||||||||

| Brazil 0.5% | ||||||||

Centrais Eletricas Brasileiras SA (PRFC B) | 21,500 | $ | 115,969 | |||||

Cia Paranaense de Energia (PRFC B) | 6,100 | 65,380 | ||||||

|

| |||||||

| 181,349 | ||||||||

| Chile 0.3% | ||||||||

Embotelladora Andina SA (PRFC B) | 54,556 | 113,585 | ||||||

| Russia 0.1% | ||||||||

Surgutneftegas PJSC (PRFC) | 77,200 | 35,278 | ||||||

| South Korea 0.6% | ||||||||

Samsung Electronics Co. Ltd. (PRFC) | 4,676 | 207,521 | ||||||

|

| |||||||

| TOTAL PREFERRED STOCKS | ||||||||

(cost $613,190) | 537,733 | |||||||

|

| |||||||

| TOTAL LONG-TERM INVESTMENTS | ||||||||

(cost $29,684,768) | 36,256,143 | |||||||

|

| |||||||

| TOTAL INVESTMENTS 100.6% | ||||||||

(cost $29,684,768) | 36,256,143 | |||||||

| Liabilities in excess of other assets (0.6)% | (202,555 | ) | ||||||

|

| |||||||

| NET ASSETS 100.0% | $ | 36,053,588 | ||||||

|

| |||||||

Below is a list of the abbreviation(s) used in the annual report:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

ADR—American Depositary Receipt

ETF—Exchange-Traded Fund

GDR—Global Depositary Receipt

LIBOR—London Interbank Offered Rate

MSCI—Morgan Stanley Capital International

PJSC—Public Joint-Stock Company

PRFC—Preference Shares

UTS—Unit Trust Security

| * | Non-income producing security. |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

See Notes to Financial Statements.

| 18 |

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2020 in valuing such portfolio securities:

| Level 1 | Level 2 | Level 3 | |||||||||||||

| Investments in Securities | |||||||||||||||

| Assets | |||||||||||||||

| Common Stocks | |||||||||||||||

Brazil | $ | 1,440,050 | $ | — | $— | ||||||||||

China | 4,833,228 | 11,068,497 | — | ||||||||||||

Colombia | 8,433 | — | — | ||||||||||||

Greece | — | 126,673 | — | ||||||||||||

Hungary | — | 66,320 | — | ||||||||||||

India | 333,918 | 2,399,483 | — | ||||||||||||

Indonesia | — | 522,119 | — | ||||||||||||

Malaysia | — | 477,390 | — | ||||||||||||

Mexico | 357,235 | — | — | ||||||||||||

Pakistan | — | 37,883 | — | ||||||||||||

Philippines | — | 280,396 | — | ||||||||||||

Poland | — | 31,309 | — | ||||||||||||

Qatar | — | 380,581 | — | ||||||||||||

Russia | 75,854 | 964,353 | — | ||||||||||||

Saudi Arabia | — | 655,028 | — | ||||||||||||

South Africa | — | 1,231,276 | — | ||||||||||||

South Korea | — | 4,425,638 | — | ||||||||||||

Taiwan | — | 4,651,058 | — | ||||||||||||

Thailand | — | 354,075 | — | ||||||||||||

Turkey | — | 459,899 | — | ||||||||||||

United Arab Emirates | — | 106,307 | — | ||||||||||||

| Exchange-Traded Fund | |||||||||||||||

United States | 431,407 | — | — | ||||||||||||

| Preferred Stocks | |||||||||||||||

Brazil | 181,349 | — | — | ||||||||||||

Chile | 113,585 | — | — | ||||||||||||

Russia | — | 35,278 | — | ||||||||||||

South Korea | — | 207,521 | — | ||||||||||||

|

|

|

|

|

| ||||||||||

Total | $ | 7,775,059 | $ | 28,481,084 | $— | ||||||||||

|

|

|

|

|

| ||||||||||

Industry Classification:

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2020 were as follows (unaudited):

Internet & Direct Marketing Retail | 14.1 | % | ||

Banks | 11.8 | |||

Semiconductors & Semiconductor Equipment | 8.5 |

Interactive Media & Services | 8.4 | % | ||

Technology Hardware, Storage & Peripherals | 6.2 | |||

Oil, Gas & Consumable Fuels | 4.6 |

See Notes to Financial Statements.

PGIM QMA Emerging Markets Equity Fund | 19 |

Schedule of Investments (continued)

as of October 31, 2020

Industry Classification (continued):

Metals & Mining | 4.3 | % | ||

Pharmaceuticals | 2.9 | |||

Insurance | 2.7 | |||

Real Estate Management & Development | 2.5 | |||

IT Services | 2.5 | |||

Automobiles | 2.5 | |||

Wireless Telecommunication Services | 2.1 | |||

Electronic Equipment, Instruments & Components | 1.7 | |||

Food Products | 1.7 | |||

Construction Materials | 1.5 | |||

Capital Markets | 1.3 | |||

Entertainment | 1.3 | |||

Electric Utilities | 1.2 | |||

Health Care Equipment & Supplies | 1.2 | |||

Exchange-Traded Fund | 1.2 | |||

Diversified Telecommunication Services | 1.1 | |||

Food & Staples Retailing | 1.1 | |||

Machinery | 1.0 | |||

Beverages | 1.0 | |||

Tobacco | 0.9 | |||

Household Durables | 0.9 | |||

Specialty Retail | 0.9 | |||

Diversified Financial Services | 0.9 | |||

Electrical Equipment | 0.8 | |||

Chemicals | 0.8 | |||

Air Freight & Logistics | 0.8 | |||

Diversified Consumer Services | 0.8 | |||

Hotels, Restaurants & Leisure | 0.7 | |||

Textiles, Apparel & Luxury Goods | 0.7 | |||

Personal Products | 0.6 | |||

Gas Utilities | 0.5 | |||

Commercial Services & Supplies | 0.5 | |||

Construction & Engineering | 0.5 | |||

Household Products | 0.4 | |||

Independent Power & Renewable Electricity Producers | 0.3 | |||

Industrial Conglomerates | 0.3 | |||

Auto Components | 0.2 | |||

Transportation Infrastructure | 0.1 | |||

Media | 0.1 | |||

Thrifts & Mortgage Finance | 0.1 | |||

Building Products | 0.1 | |||

Leisure Products | 0.1 | |||

Road & Rail | 0.1 | |||

Energy Equipment & Services | 0.1 | |||

Biotechnology | 0.0 | * |

Marine | 0.0 | *% | ||

Consumer Finance | 0.0 | * | ||

|

| |||

| 100.6 | ||||

Liabilities in excess of other assets | (0.6 | ) | ||

|

| |||

| 100.0 | % | |||

|

|

| * | Less than +/- 0.05% |

See Notes to Financial Statements.

| 20 |

Effects of Derivative Instruments on the Financial Statements and Primary Underlying Risk Exposure:

The Fund invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity contracts risk. See the Notes to Financial Statements for additional detail regarding these derivative instruments and their risks. The effect of such derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

The Fund did not hold any derivative instruments as of October 31, 2020, accordingly, no derivative positions were presented in the Statement of Assets and Liabilities.

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2020 are as follows:

Amount of Realized Gain (Loss) on Derivatives Recognized in Income | ||||||||||

Derivatives not accounted for as hedging | Rights(1) | Warrants(1) | ||||||||

Equity contracts | $4,736 | $622 | ||||||||

|

|

|

| |||||||

| (1) | Included in net realized gain (loss) on investment transactions in the Statement of Operations. |

For the year ended October 31, 2020, the Fund did not have any change in unrealized appreciation (depreciation) on derivatives in the Statement of Operations.

See Notes to Financial Statements.

PGIM QMA Emerging Markets Equity Fund | 21 |

Statement of Assets & Liabilities

as of October 31, 2020

Assets | |||||

Unaffiliated investments (cost $29,684,768) | $ | 36,256,143 | |||

Foreign currency, at value (cost $6,835) | 6,828 | ||||

Receivable for investments sold | 66,713 | ||||

Dividends receivable | 49,013 | ||||

Receivable for Fund shares sold | 40,293 | ||||

Tax reclaim receivable | 377 | ||||

Prepaid expenses and other assets | 4,793 | ||||

|

| ||||

Total Assets | 36,424,160 | ||||

|

| ||||

Liabilities | |||||

Payable for Fund shares reacquired | 200,222 | ||||

Payable to custodian | 64,382 | ||||

Accrued expenses and other liabilities | 34,552 | ||||

Custodian and accounting fees payable | 33,463 | ||||

Audit fee payable | 32,300 | ||||

Management fee payable | 4,707 | ||||

Trustees’ fees payable | 904 | ||||

Affiliated transfer agent fee payable | 42 | ||||

|

| ||||

Total Liabilities | 370,572 | ||||

|

| ||||

Net Assets | $ | 36,053,588 | |||

|

| ||||

Net assets were comprised of: | |||||

Shares of beneficial interest, at par | $ | 3,106 | |||

Paid-in capital in excess of par | 32,752,143 | ||||

Total distributable earnings (loss) | 3,298,339 | ||||

|

| ||||

Net assets, October 31, 2020 | $ | 36,053,588 | |||

|

| ||||

Class R6 | |||||

Net asset value, offering price and redemption price per share, | $ | 11.61 | |||

|

| ||||

See Notes to Financial Statements.

| 22 |

Statement of Operations

Year Ended October 31, 2020

Net Investment Income (Loss) | |||||

Income | |||||

Unaffiliated dividend income (net of $127,633 foreign withholding tax) | $ | 911,258 | |||

Income from securities lending, net (including affiliated income of $2,266) | 2,525 | ||||

Affiliated dividend income | 1,006 | ||||

|

| ||||

Total income | 914,789 | ||||

|

| ||||

Expenses | |||||

Management fee | 240,049 | ||||

Custodian and accounting fees | 120,452 | ||||

Audit fee | 32,748 | ||||

Fund data services | 32,388 | ||||

Legal fees and expenses | 19,509 | ||||

Shareholders’ reports | 11,502 | ||||

Trustees’ fees | 10,980 | ||||

Pricing fees | 8,331 | ||||

Transfer agent’s fees and expenses (including affiliated expense of $290) | 378 | ||||

Registration fees | 250 | ||||

Miscellaneous | 13,913 | ||||

|

| ||||

Total expenses | 490,500 | ||||

Less: Fee waiver and/or expense reimbursement | (106,405 | ) | |||

|

| ||||

Net expenses | 384,095 | ||||

|

| ||||

Net investment income (loss) | 530,694 | ||||

|

| ||||

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions |

| ||||

Net realized gain (loss) on: | |||||

Investment transactions (including affiliated of $(587)) | (1,975,595 | ) | |||

Foreign currency transactions | (20,564 | ) | |||

|

| ||||

| (1,996,159 | ) | ||||

|

| ||||

Net change in unrealized appreciation (depreciation) on: | |||||

Investments (including affiliated of $(97)) | 3,667,001 | ||||

Foreign currencies | 269 | ||||

|

| ||||

| 3,667,270 | |||||

|

| ||||

Net gain (loss) on investment and foreign currency transactions | 1,671,111 | ||||

|

| ||||

Net Increase (Decrease) In Net Assets Resulting From Operations | $ | 2,201,805 | |||

|

| ||||

See Notes to Financial Statements.

PGIM QMA Emerging Markets Equity Fund | 23 |

Statements of Changes in Net Assets

| Year Ended October 31, | ||||||||||

| 2020 | 2019 | |||||||||

Increase (Decrease) in Net Assets | ||||||||||

Operations | ||||||||||

Net investment income (loss) | $ | 530,694 | $ | 491,320 | ||||||

Net realized gain (loss) on investment and foreign currency transactions | (1,996,159 | ) | (1,488,263 | ) | ||||||

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | 3,667,270 | 2,574,931 | ||||||||

|

|

|

| |||||||

Net increase (decrease) in net assets resulting from operations | 2,201,805 | 1,577,988 | ||||||||

|

|

|

| |||||||

Dividends and Distributions | ||||||||||

Distributions from distributable earnings | ||||||||||

Class R6 | (649,151 | ) | (787,341 | ) | ||||||

|

|

|

| |||||||

Fund share transactions | ||||||||||

Net proceeds from shares sold | 7,601,460 | 2,606,831 | ||||||||

Net asset value of shares issued in reinvestment of dividends and distributions | 649,151 | 787,341 | ||||||||

Cost of shares reacquired | (3,553,887 | ) | (1,525,185 | ) | ||||||

|

|

|

| |||||||

Net increase (decrease) in net assets from Fund share transactions | 4,696,724 | 1,868,987 | ||||||||

|

|

|

| |||||||

Total increase (decrease) | 6,249,378 | 2,659,634 | ||||||||

Net Assets: | ||||||||||

Beginning of year | 29,804,210 | 27,144,576 | ||||||||

|

|

|

| |||||||

End of year | $ | 36,053,588 | $ | 29,804,210 | ||||||

|

|

|

| |||||||

See Notes to Financial Statements.

| 24 |

Notes to Financial Statements

1. Organization

Prudential Investment Portfolios 2 (“PIP2”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. PIP2 consists of eleven separate series: PGIM Core Conservative Bond Fund, PGIM Core Short-Term Bond Fund, PGIM Core Ultra Short Bond Fund, PGIM Institutional Money Market Fund, PGIM Jennison Small-Cap Core Equity Fund, PGIM QMA Emerging Markets Equity Fund, PGIM QMA International Developed Markets Index Fund, PGIM QMA Mid-Cap Core Equity Fund, PGIM QMA US Broad Market Index Fund and PGIM TIPS Fund, each of which are diversified funds for purposes of the 1940 Act, and PGIM QMA Commodity Strategies Fund, which is a non-diversified fund for purposes of the 1940 Act, and therefore, may invest a greater percentage of their assets in the securities of a single company or other issuer than a diversified fund. Investing in a non-diversified fund involves greater risk than investing in a diversified fund because a loss resulting from the decline in value of any one security may represent a greater portion of the total assets of a non-diversified fund. These financial statements relate only to the PGIM QMA Emerging Markets Equity Fund (the “Fund”).

The investment objective of the Fund is to seek to provide returns in excess of the Morgan Stanley Capital International Emerging Markets Index over full market cycles.

2. Accounting Policies

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services — Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles. The Fund consistently follows such policies in the preparation of their financial statements.

Securities Valuation: The Fund holds securities and other assets and liabilities that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. PIP2’s Board of Trustees (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or the “Manager”). Pursuant to the Board’s delegation, the Manager has established a Valuation Committee responsible for supervising the fair valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the

PGIM QMA Emerging Markets Equity Fund | 25 |

Notes to Financial Statements (continued)

Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly scheduled quarterly meeting.

For the fiscal reporting year-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities trade in markets that are open on weekends and U.S. holidays, the values of some of the Fund’s foreign investments may change on days when investors cannot purchase or redeem Fund shares.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820 - Fair Value Measurements and Disclosures.

Common or preferred stocks, exchange-traded funds and derivative instruments, if applicable, that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy. In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Foreign equities traded on foreign securities exchanges are generally valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements up to the time the Fund is valued. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stock valuation policies discussed above.

Investments in open-end funds (other than exchange-traded funds) are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

| 26 |

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the Manager regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other unaffiliated mutual funds to calculate their net asset values.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities — at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses — at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not generally isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, holding period realized foreign currency gains (losses) are included in the reported net realized gains (losses) on investment transactions.

Net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from the disposition of holdings of foreign currencies, currency gains (losses) realized between the trade and settlement dates on investment transactions, and the difference between the amounts of interest, dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains (losses) arise from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates.

Master Netting Arrangements: The Fund is subject to various Master Agreements, or netting arrangements, with select counterparties. These are agreements which a subadviser may

PGIM QMA Emerging Markets Equity Fund | 27 |

Notes to Financial Statements (continued)

have negotiated and entered into on behalf of all or a portion of the Fund. A master netting arrangement between the Fund and the counterparty permits the Fund to offset amounts payable by the Fund to the same counterparty against amounts to be received; and by the receipt of collateral from the counterparty by the Fund to cover the Fund’s exposure to the counterparty. However, there is no assurance that such mitigating factors are easily enforceable. In addition to master netting arrangements, the right to set-off exists when all the conditions are met such that each of the parties owes the other determinable amounts, the reporting party has the right to set-off the amount owed with the amount owed by the other party, the reporting party intends to set-off and the right of set-off is enforceable by law. During the reporting period, there was no intention to settle on a net basis and all amounts are presented on a gross basis on the Statement of Assets and Liabilities.

Warrants and Rights: The Fund held warrants and rights acquired either through a direct purchase or pursuant to corporate actions. Warrants and rights entitle the holder to buy a proportionate amount of common stock, or such other security that the issuer may specify, at a specific price and time through the expiration dates. Such warrants and rights are held as long positions by the Fund until exercised, sold or expired. Warrants and rights are valued at fair value in accordance with the Board approved fair valuation procedures.

Securities Lending: The Fund lends its portfolio securities to banks and broker-dealers. The loans are secured by collateral at least equal to the market value of the securities loaned. Collateral pledged by each borrower is invested in an affiliated money market fund and is marked to market daily, based on the previous day’s market value, such that the value of the collateral exceeds the value of the loaned securities. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the financial statements may reflect a collateral value that is less than the market value of the loaned securities. Such shortfall is remedied as described above. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will return to the Fund securities identical to the loaned securities. Should the borrower of the securities fail financially, the Fund has the right to repurchase the securities in the open market using the collateral.

The Fund recognizes income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The borrower receives all interest and dividends from the securities loaned and such payments are passed back to the lender in amounts equivalent thereto, which are reflected in interest income or unaffiliated dividend income based upon the nature of the payment on the Statement of Operations. The Fund also continues to recognize any unrealized gain (loss) in the market price of the securities loaned and on the change in the value of the collateral invested that may occur during the term of the loan. In addition, realized gain (loss) is recognized on changes in the value of the collateral invested upon

| 28 |

liquidation of the collateral. Net earnings from securities lending are disclosed in the Statement of Operations.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains (losses) from investment and currency transactions are calculated on the specific identification method. Dividend income is recorded on the ex-date, or for certain foreign securities, when the Fund becomes aware of such dividends. Expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual.

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required. Withholding taxes on foreign dividends, interest and capital gains, if any, are recorded, net of reclaimable amounts, at the time the related income is earned.

Dividends and Distributions: The Fund expects to pay dividends from net investment income and distributions from net realized capital gains, if any, annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified between total distributable earnings (loss) and paid-in capital in excess of par, as appropriate.

Estimates: The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

3. Agreements

The Fund has a management agreement with the Manager. Pursuant to this agreement, the Manager has responsibility for all investment advisory services and supervises the subadviser’s performance of such services. In addition, under the management agreement, the Manager provides all of the administrative functions necessary for the organization, operation and management of the Fund. The Manager administers the corporate affairs of the Fund and, in connection therewith, furnishes the Fund with office facilities, together with those ordinary clerical and bookkeeping services which are not being furnished by the Fund’s custodian and the Fund’s transfer agent. The Manager is also responsible for the staffing and management of dedicated groups of legal, marketing, compliance and related personnel necessary for the operation of the Fund. The legal, marketing, compliance and related personnel are also responsible for the management and oversight of the various service providers to the Fund, including, but not limited to, the custodian, transfer agent, and accounting agent.

PGIM QMA Emerging Markets Equity Fund | 29 |

Notes to Financial Statements (continued)

The Manager has entered into a subadvisory agreement with QMA LLC (“QMA”). The subadvisory agreement provides that QMA will furnish investment advisory services in connection with the management of the Fund. In connection therewith, QMA is obligated to keep certain books and records of the Fund. The Manager pays for the services of QMA, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to the Manager is accrued daily and payable monthly at an annual rate of 0.75% of the Fund’s average daily net assets.

The Manager has contractually agreed, through February 28, 2022, to limit total annual operating expenses after fee waivers and/or expense reimbursements to 1.20% of average daily net assets for Class R6 shares. This contractual waiver excludes interest, brokerage, taxes (such as income and foreign withholding taxes, stamp duty and deferred tax expenses), acquired fund fees and expenses, extraordinary expenses, and certain other Fund expenses such as dividend and interest expense and broker charges on short sales. Fees and/or expenses waived and/or reimbursed by the Manager may be recouped by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year.

PIP2, on behalf of the Fund, has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class R6 shares of the Fund. No distribution or service fees are paid to PIMS as distributor for Class R6 shares of the Fund.

PGIM Investments, PIMS and QMA are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

4. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PGIM Investments and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Fund may invest its overnight sweep cash in the PGIM Core Ultra Short Bond Fund (the “Core Fund”), and its securities lending cash collateral in the PGIM Institutional Money Market Fund (the “Money Market Fund”), each a series of PIP2, registered under the 1940 Act and managed by PGIM Investments. The Fund may also invest in the PGIM Core Short-Term Bond Fund, pursuant to an exemptive order received from the Securities

| 30 |

Exchange Commission (“SEC”), a series of Prudential Investment Portfolios 2 (together with PGIM Core Ultra Short Bond Fund, the “Core Funds”) registered under the 1940 Act and managed by PGIM Investments. Through the Fund’s investments in the mentioned underlying funds, PGIM Investments and/or its affiliates are paid fees or reimbursed for providing their services. In addition to the realized and unrealized gains on investments in the Core Fund and Money Market Fund, earnings from such investments are disclosed on the Statement of Operations as “Affiliated dividend income” and “Income from securities lending, net”, respectively.

The Fund may enter into certain securities purchase or sale transactions under Board approved Rule 17a-7 procedures. Rule 17a-7 is an exemptive rule under the 1940 Act, that subject to certain conditions, permits purchase and sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common directors, and/or common officers. Pursuant to the Rule 17a-7 procedures and consistent with guidance issued by the Securities and Exchange Commission (“SEC”), the Trust’s Chief Compliance Officer (“CCO”) prepares a quarterly summary of all such transactions for submission to the Board, together with the CCO’s written representation that all such 17a-7 transactions were effected in accordance with the Fund’s Rule 17a-7 procedures. For the year ended October 31, 2020, no 17a-7 transactions were entered into by the Fund.

5. Portfolio Securities

The aggregate cost of purchases and proceeds from sales of portfolio securities (excluding short-term investments and U.S. Government securities) for the year ended October 31, 2020, were $38,251,720 and $33,572,282, respectively.

A summary of the cost of purchases and proceeds from sales of shares of affiliated investments for the year ended October 31, 2020, is presented as follows:

| Value, Beginning of Year | Cost of Purchases | Proceeds from Sales | Change in Unrealized Gain (Loss) | Realized Gain (Loss) | Value, End of Year | Shares, End of Year | Income | |||||||||||||||||||||||||||||||

PGIM Core Ultra Short Bond Fund* | ||||||||||||||||||||||||||||||||||||||

| $ | — | $ | 10,217,878 | $ | 10,217,878 | $ | — | $ | — | $ | — | — | $ | 1,006 | ||||||||||||||||||||||||

PGIM Institutional Money Market Fund* | ||||||||||||||||||||||||||||||||||||||

| 640,956 | 9,517,147 | 10,157,419 | (97 | ) | (587 | ) | — | — | 2,266 | ** | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| $ | 640,956 | $ | 19,735,025 | $ | 20,375,297 | $ | (97 | ) | $ | (587 | ) | $ | — | $ | 3,272 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| * | The Fund did not have any capital gain distributions during the reporting period. |

| ** | The amount, or a portion thereof, represents the affiliated securities lending income shown on the Statement of Operations. |

PGIM QMA Emerging Markets Equity Fund | 31 |

Notes to Financial Statements (continued)

6. Distributions and Tax Information

Distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-date.

For the year ended October 31, 2020, the tax character of dividends paid by the Fund was $649,151 of ordinary income. For the year ended October 31, 2019, the tax character of dividends paid by the Fund were $527,776 of ordinary income and $259,565 of long-term capital gains.

As of October 31, 2020, the accumulated undistributed earnings on a tax basis was $489,273 of ordinary income.

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of October 31, 2020 were as follows:

| Tax Basis | Gross Unrealized Appreciation | Gross Unrealized Depreciation | Net Unrealized Appreciation | |||

| $29,926,709 | $8,696,251 | $(2,366,817) | $6,329,434 |

The differences between book basis and tax basis were primarily attributable to deferred losses on wash sales, investments in passive foreign investment companies, corporate spin-off adjustment and other cost basis differences between financial and tax accounting.

For federal income tax purposes, the Fund had a capital loss carryforward as of October 31, 2020 of approximately $3,520,000 which can be carried forward for an unlimited period. No capital gains distributions are expected to be paid to shareholders until net gains have been realized in excess of such losses.

The Manager has analyzed the Fund’s tax positions taken on federal, state and local income tax returns for all open tax years and has concluded that no provision for income tax is required in the Fund’s financial statements for the current reporting period. Since tax authorities can examine previously filed tax returns, the Fund’s U.S. federal and state tax returns for each of the four fiscal years up to the most recent fiscal year ended October 31, 2020 are subject to such review.

7. Capital and Ownership

The Fund offers Class R6 shares. Class R6 shares are not subject to any sales or redemption charge and are available exclusively for sale to a limited group of investors.

| 32 |

PIP2 has authorized the Fund to issue an unlimited number of shares of beneficial interest of the Fund at $0.001 par value per share.

As of October 31, 2020, Prudential, through its affiliated entities, including affiliated funds (if applicable), owned shares of the Fund as follows:

| Number of Shares | Percentage of Outstanding Shares | |||||||||

Class R6 | 3,106,043 | 100.0% | ||||||||

At the reporting period end, the number of shareholders holding greater than 5% of the Fund are as follows:

| Affiliated | Unaffiliated | |||||

| Number of | Percentage of | Number of | Percentage of | |||

| Shareholders | Outstanding Shares | Shareholders | Outstanding Shares | |||

3 | 84.4% | — | —% | |||

Transactions in shares of beneficial interest were as follows:

Class R6 | Shares | Amount | ||||||

Year ended October 31, 2020: | ||||||||

Shares sold | 706,936 | $7,601,460 | ||||||

Shares issued in reinvestment of dividends and distributions | 56,744 | 649,151 | ||||||

Shares reacquired | (333,994 | ) | (3,553,887 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | 429,686 | $4,696,724 | ||||||

|

|

|

| |||||

Year ended October 31, 2019: | ||||||||

Shares sold | 237,477 | $2,606,831 | ||||||

Shares issued in reinvestment of dividends and distributions | 74,138 | 787,341 | ||||||

Shares reacquired | (139,441 | ) | (1,525,185 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in shares outstanding | 172,174 | $1,868,987 | ||||||

|

|

|

| |||||

8. Borrowings

PIP2, on behalf of the Fund, along with other affiliated registered investment companies (the “Participating Funds”), is a party to a Syndicated Credit Agreement (“SCA”) with a group of banks. The purpose of the SCA is to provide an alternative source of temporary funding for capital share redemptions. The table below provides details of the current SCA in effect at the reporting period-end as well as the prior SCA.

| Current SCA | Prior SCA | |||

Term of Commitment | 10/2/2020 – 9/30/2021 | 10/3/2019 – 10/1/2020 | ||

Total Commitment | $ 1,200,000,000 | $ 1,222,500,000* | ||

Annualized Commitment Fee on the Unused Portion of the SCA | 0.15% | 0.15% | ||

Annualized Interest Rate on Borrowings | 1.30% plus the higher of (1) the effective federal funds rate, (2) the one-month LIBOR rate or (3) zero percent | 1.20% plus the higher of (1) the effective federal funds rate, (2) the one-month LIBOR rate or (3) zero percent | ||

* EffectiveMarch 31, 2020, the SCA’s total commitment was increased from $900,000,000 to $1,162,500,000 and subsequently, effective April 7, 2020 was increased to $1,222,500,000. | ||||

PGIM QMA Emerging Markets Equity Fund | 33 |

Notes to Financial Statements (continued)

Certain affiliated registered investment companies that are parties to the SCA include portfolios that are subject to a predetermined mathematical formula used to manage certain benefit guarantees offered under variable annuity contracts. The formula may result in large scale asset flows into and out of these portfolios. Consequently, these portfolios may be more likely to utilize the SCA for purposes of funding redemptions. It may be possible for those portfolios to fully exhaust the committed amount of the SCA, thereby requiring the Manager to allocate available funding per a Board-approved methodology designed to treat the Participating Funds in the SCA equitably.

The Fund utilized the SCA during the year ended October 31, 2020. The average daily balance for the 3 days that the Fund had loans outstanding during the period was approximately $143,667, borrowed at a weighted average interest rate of 1.39%. The maximum loan outstanding amount during the period was $209,000. At October 31, 2020, the Fund did not have an outstanding loan amount.

9. Risks of Investing in the Fund

The Fund’s risks include, but are not limited to, some or all of the risks discussed below. For further information on the Fund’s risks, please refer to the Fund’s Prospectus and Statement of Additional Information.