UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-09999 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 2 |

|

| (This Form N-CSR relates solely to the Registrant’s: PGIM Core Short-Term Bond Fund, PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund) |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 1/31/2024 |

| |

| Date of reporting period: | | 1/31/2024 |

Item 1 – Reports to Stockholders

PGIM CORE SHORT-TERM BOND FUND

PGIM CORE ULTRA SHORT BOND FUND

PGIM INSTITUTIONAL MONEY MARKET FUND

ANNUAL REPORT

JANUARY 31, 2024

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Funds’ portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC a Prudential Financial company and member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PGIM is a Prudential Financial company. © 2024 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

PGIM Core Short-Term Bond Fund

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | | | |

| |

| | | Average Annual Total Returns as of 1/31/24 |

| | | |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) |

| | | |

Fund | | 6.04 | | 2.64 | | 2.20 |

| | | |

ICE BofA US 3-Month Treasury Bill Index | | | | | | |

| | | |

| | 5.13 | | 1.93 | | 1.29 |

| | |

Bloomberg US Short Treasury Index | | | | |

| | | |

| | | 5.16 | | 1.93 | | 1.33 |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

Prudential Investment Portfolios 2 3

PGIM Core Short-Term Bond Fund

Your Fund’s Performance (continued)

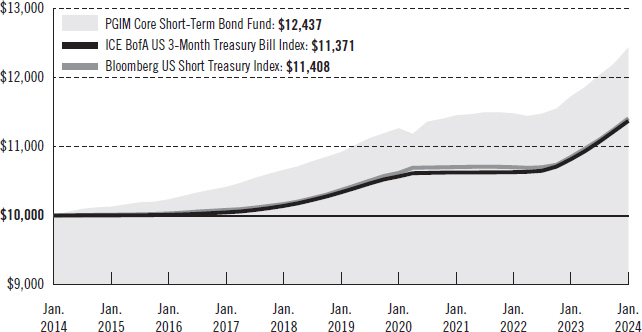

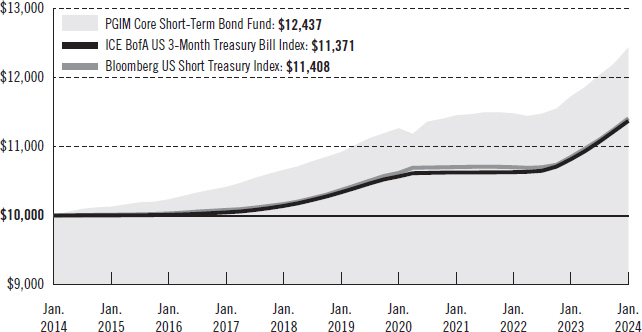

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund with a similar investment in the ICE BofA US 3-Month Treasury Bill Index and the Bloomberg US Short Treasury Index, by portraying the initial account values at the beginning of the 10-year period (January 31, 2014) and the account values at the end of the current fiscal year (January 31, 2024) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns in the table and the graph do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

ICE BofA US 3-Month Treasury Bill Index— The ICE BofA US 3-Month Treasury Bill Index is an unmanaged index that is comprised of a single US Treasury issue with approximately three months to final maturity, purchased at the beginning of each month and held for one full month.

4 Visit our website at pgim.com/investments

Bloomberg US Short Treasury Index—The Bloomberg US Short Treasury Index includes aged U.S. Treasury bills, notes and bonds with a remaining maturity from 1 up to (but not including) 12 months. It excludes zero coupon strips.

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | | | | | |

|

| Distributions and Yields as of 1/31/24 |

| | | |

| | | Total Distributions

Paid for 12

Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| | | |

PGIM Core Short-Term Bond Fund | | 0.54 | | 4.90 | | 4.90 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

Prudential Investment Portfolios 2 5

PGIM Core Short-Term Bond Fund

Your Fund’s Performance (continued)

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 1/31/24 (%) | |

| |

AAA | | | 12.9 | |

| |

AA | | | 30.0 | |

| |

A | | | 31.9 | |

| |

BBB | | | 19.2 | |

| |

B | | | 0.1 | |

| |

CCC | | | 0.2 | |

| |

Not Rated | | | 5.7 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

6 Visit our website at pgim.com/investments

PGIM Core Ultra Short Bond Fund

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | | | |

| |

| | | Average Annual Total Returns as of 1/31/24 |

| | | |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) |

| | | |

Fund | | 5.50 | | 2.16 | | 1.51 |

| | | |

ICE US 1-Month Treasury Bill Index | | | | | | |

| | | |

| | 5.09 | | 1.83 | | 1.22 |

| | |

Bloomberg 1-3 Month US Treasury Bill | | | | |

| | | |

| | 5.24 | | 1.92 | | 1.27 |

| | | |

iMoneyNet Prime Institutional Funds Average | | | | | | |

| | | |

| | | 5.05 | | 1.87 | | 1.25 |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

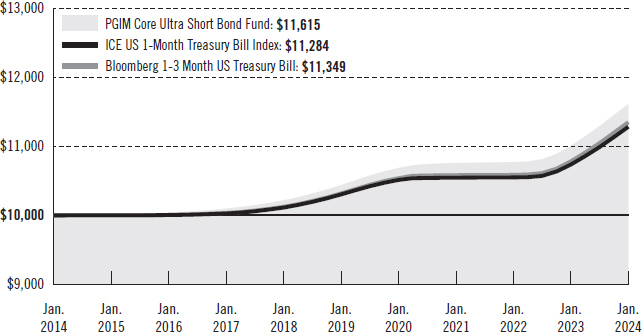

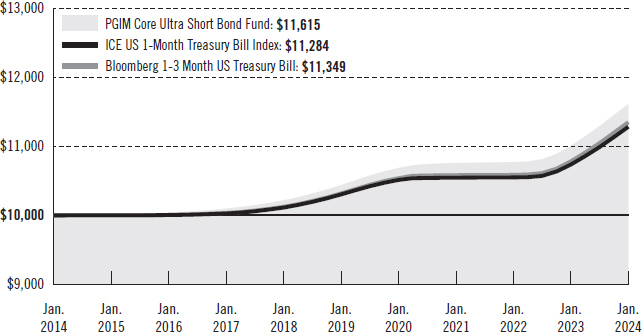

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund with a similar investment in the ICE US 1-Month Treasury Bill Index and the Bloomberg 1-3 Month US Treasury Bill

Prudential Investment Portfolios 2 7

PGIM Core Ultra Short Bond Fund

Your Fund’s Performance (continued)

Index as its current Index by portraying the initial account values at the beginning of the

10-year period (January 31, 2014) and the account values at the end of the current fiscal year (January 31, 2024) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns in the table and the graph do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definitions

ICE US 1-Month Treasury Bill Index— The ICE US 1-Month Treasury Bill Index is an unmanaged index that is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not less than, one month from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

Bloomberg 1–3 Month US Treasury Bill Index—The Bloomberg 1–3 Month US Treasury Bill Index includes all publicly issued zero-coupon US Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value.

iMoneyNet Prime Institutional Funds Average—The iMoneyNet Prime Institutional Funds Average is based on the average return of all funds in the iMoneyNet Prime Institutional Funds universe for the periods noted. Funds in the iMoneyNet Prime Institutional Funds Average primarily invest in a variety of taxable short-term corporate and bank debt securities.

| | | | | | |

|

| Distributions and Yields as of 1/31/24 |

| | | |

| | | Total

Distributions

Paid for

12 Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| | | |

PGIM Core Ultra Short Bond Fund | | 0.05 | | 5.50 | | 5.50 |

8 Visit our website at pgim.com/investments

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 1/31/24 (%) | |

| |

A-1+/P-1 | | | 73.7 | |

| |

A-1/P-1 | | | 26.3 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

Prudential Investment Portfolios 2 9

PGIM Institutional Money Market Fund

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | | | |

| |

| | | Average Annual Total Returns as of 1/31/24 |

| | | One Year (%) | | Five Years (%) | | Since Inception (%) |

| | | |

Fund | | 5.44 | | 2.10 | | 1.87 (07/19/2016) |

| | | |

ICE US 1-Month Treasury Bill Index | | | | | | |

| | | |

| | 5.09 | | 1.83 | | 1.60 |

| |

iMoneyNet Prime Institutional Funds Average | | |

| | | |

| | | 5.05 | | 1.87 | | 1.64 |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

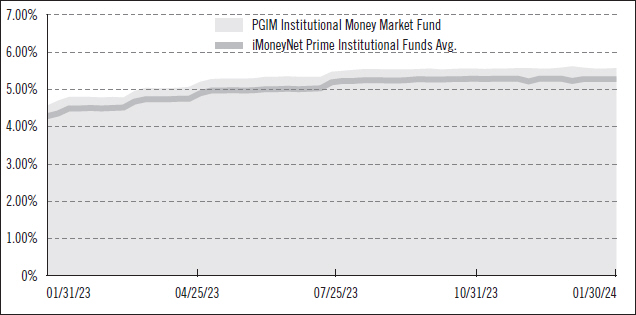

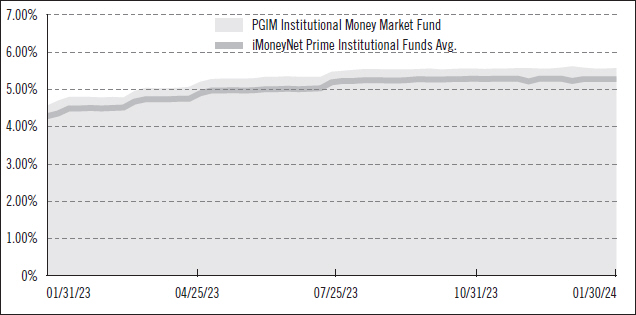

Institutional Money Market Fund Yield Comparison

10 Visit our website at pgim.com/investments

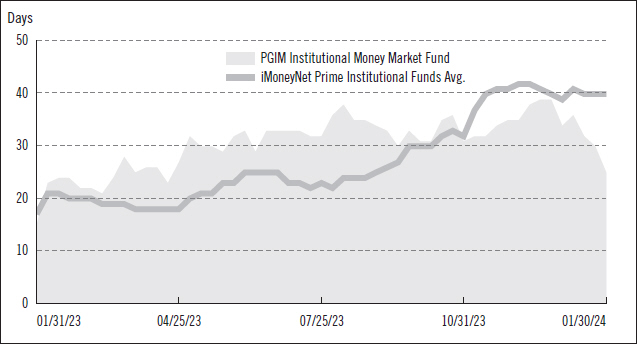

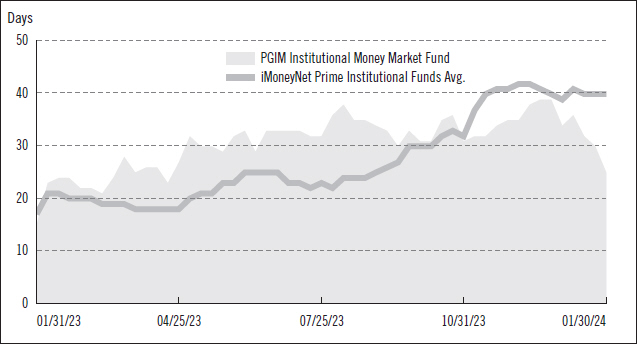

Weighted Average Maturity* (WAM) Comparison

The graphs portray weekly 7-day current yields and weekly WAMs for the Fund and the iMoneyNet Prime Institutional Funds Average every Tuesday from January 31, 2023 to January 30, 2024, the closest dates prior to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the end of the reporting period in the graphs may not match the data portrayed in the Fund’s performance table as of January 31, 2024.

* Weighted Average Maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding, or redemption provision.

Benchmark Definitions

ICE US 1-Month Treasury Bill Index— The ICE US 1-Month Treasury Bill Index is an unmanaged index that is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not less than, one month from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

iMoneyNet Prime Institutional Funds Average—The iMoneyNet Prime Institutional Funds Average is based on the average return of all funds in the iMoneyNet Prime Institutional Funds universe for the

Prudential Investment Portfolios 2 11

PGIM Institutional Money Market Fund

Your Fund’s Performance (continued)

periods noted. Funds in the iMoneyNet Prime Institutional Funds Average primarily invest in a variety of taxable short-term corporate and bank debt securities.

12 Visit our website at pgim.com/investments

PGIM Core Short-Term Bond Fund

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Core Short-Term Bond Fund returned 6.04% in the 12-month reporting period that ended January 31, 2024, outperforming the 5.13% return of the ICE BofA US 3-Month Treasury Bill Index (the Index).

What were the market conditions?

| · | | Shifting fundamentals—most notably, inflation—helped drive the repricing of markets during the reporting period. Rate volatility increased as markets began pricing in aggressive Federal Open Market Committee (FOMC) policy tightening and the possibility of a hard economic landing. (When central banks raise interest rates enough to cause a significant economic slowdown or a recession, it is known as a hard landing. When they raise rates just enough to slow the economy and lower inflation without causing a recession, it is known as a soft landing.) |

| · | | However, the US economy proved resilient amid moderating consumer spending. Consumption was supported by household savings, which fell below pre-pandemic levels, and by credit card usage, which rose 4.6% (or $1.13 trillion) in the fourth quarter of 2023. Meanwhile, the labor market showed persistent strength, with job growth accelerating in the last month of the reporting period and the unemployment rate remaining below 4% for the second consecutive year, which raised hopes of a soft landing. |

| · | | Over the reporting period, the US Federal Reserve (the Fed) tightened monetary policy by an additional 100 basis points (bps). (One basis point equals 0.01%.) Although remaining above the Fed’s 2% target, inflation continued to show signs of cooling. In January, the FOMC kept interest rates on hold for a fourth consecutive meeting but held off on signaling a rate cut at its March meeting, with Fed Chairman Jerome Powell saying he wanted to see “more good data” before lowering the federal funds rate. |

| · | | The 10-year/2-year US Treasury spread declined from –0.70% on January 31, 2023, to –0.29% at the end of the reporting period, while the yield on the 2-year Treasury note ended the reporting period at 4.21%, unchanged from the beginning of the reporting period. In the elevated volatility environment of the reporting period, US investment-grade corporate spreads tightened as expectations for an economic hard landing dissipated and fundamentals remained solid. Securitized credit spreads also tightened, with high-quality collateralized loan obligation spreads tightening over the reporting period and high-quality commercial mortgage-backed securities (CMBS) spreads outperforming corporates over the final two months of the reporting period. |

What strategies or holdings affected the Fund’s performance?

During the reporting period, the Fund emphasized spread assets, including short-term investment-grade corporates and structured products, such as CMBS. This positioning helped the Fund outperform the Index during the reporting period.

Prudential Investment Portfolios 2 13

PGIM Core Short-Term Bond Fund

Strategy and Performance Overview* (continued)

Did the Fund use derivatives?

During the reporting period, the Fund used swap agreements for hedging interest rate risk and to add value versus cash securities. The use of these derivatives had a positive impact on performance for the reporting period.

Current outlook

PGIM Fixed Income continues to find value within investment-grade corporates and structured products, which represent attractive value in relation to Treasuries and agency mortgage-backed securities. In PGIM Fixed Income’s view, spreads should benefit from currently high all-in yields and increased expectations for a soft economic landing. The Fund continues to emphasize well-researched, short-term credit sectors, as PGIM Fixed Income expects these assets to offer the most value from a total return perspective.

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

14 Visit our website at pgim.com/investments

PGIM Core Ultra Short Bond Fund

Strategy and Performance Overview*

How did the Fund perform?

The PGIM Core Ultra Short Bond Fund returned 5.50% in the 12-month reporting period that ended January 31, 2024, outperforming the 5.09% return of the ICE US 1-Month Treasury Bill Index (the Index).

What were the market conditions?

| · | | Shifting fundamentals—most notably, inflation—helped drive the repricing of markets during the reporting period. Rate volatility increased as markets began pricing in aggressive Federal Open Market Committee (FOMC) policy tightening and the possibility of a hard economic landing. (When central banks raise interest rates enough to cause a significant economic slowdown or a recession, it is known as a hard landing. When they raise rates just enough to slow the economy and lower inflation without causing a recession, it is known as a soft landing.) |

| · | | However, the US economy proved resilient amid moderating consumer spending. Consumption was supported by household savings, which fell below pre-pandemic levels, and by credit card usage, which rose 4.6% (or $1.13 trillion) in the fourth quarter of 2023. Meanwhile, the labor market showed persistent strength, with job growth accelerating in the last month of the reporting period and the unemployment rate remaining below 4% for the second consecutive year, which raised hopes of a soft landing. |

| · | | Over the reporting period, the US Federal Reserve (the Fed) tightened monetary policy by an additional 100 basis points (bps). (One basis point equals 0.01%.) Although remaining above the Fed’s 2% target, inflation continued to show signs of cooling. In January, the FOMC kept interest rates on hold for a fourth consecutive meeting but held off on signaling a rate cut at its March meeting, with Fed Chairman Jerome Powell saying he wanted to see “more good data” before lowering the federal funds rate. |

| · | | The 10-year/2-year US Treasury spread declined from –0.70% on January 31, 2023, to –0.29% at the end of the reporting period, while the yield on the 2-year Treasury note ended the reporting period at 4.21%, unchanged from the beginning of the reporting period. At the same time, the yield on the 3-month Treasury bill rose from 4.65% to 5.38%, while the Secured Overnight Financing Rate (SOFR) rose 101 bps to end the reporting period at 5.31%. In the short-term credit markets, investment-grade credit spreads tightened during the reporting period. The Bloomberg 1–3 Year Credit Index, a proxy for the short-term spread market, outperformed short-duration Treasuries by 0.73% during the reporting period. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

What strategies or holdings affected the Fund’s performance?

| · | | The Fund’s weighted average maturity remained longer than its peers during the majority of the reporting period but shortened in November 2023 and remained |

Prudential Investment Portfolios 2 15

PGIM Core Ultra Short Bond Fund

Strategy and Performance Overview* (continued)

| | shorter than its peers for the remainder of the period, as expectations that the Fed was nearing the end of its rate-hiking cycle increased. The Fund’s weighted average life remained longer than its peers throughout the reporting period. |

| · | | During the reporting period, the Fund increased its holdings in repurchase agreements, Treasuries, foreign corporates, and supranationals as their relative value improved. Holdings of government agencies, domestic banks, foreign banks, and domestic corporates were reduced as an offset to that trade. Adjustable-rate holdings decreased during the reporting period, led by a decrease in SOFR floaters. (Floaters are bonds or other types of debt whose coupon rate changes with short-term interest rates.) Holdings of securities maturing beyond 90 days also decreased over the reporting period. |

Current outlook

The Fund continues to emphasize well-researched, short-term credit sectors, as PGIM Fixed Income expects these assets to offer the most value from a total return perspective. As relative value between floating-rate and fixed-rate assets fluctuates, PGIM Fixed Income will seek to rotate into more attractively priced holdings.

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

16 Visit our website at pgim.com/investments

PGIM Institutional Money Market Fund

Strategy and Performance Overview*

How did the Fund perform?

The PGIM Institutional Money Market Fund returned 5.44% in the 12-month reporting period that ended January 31, 2024.

What were the market conditions?

| · | | Shifting fundamentals—most notably, inflation—helped drive the repricing of markets during the reporting period. Rate volatility increased as markets began pricing in aggressive Federal Open Market Committee (FOMC) policy tightening and the possibility of a hard economic landing. (When central banks raise interest rates enough to cause a significant economic slowdown or a recession, it is known as a hard landing. When they raise rates just enough to slow the economy and lower inflation without causing a recession, it is known as a soft landing.) |

| · | | However, the US economy proved resilient amid moderating consumer spending. Consumption was supported by household savings, which fell below pre-pandemic levels, and by credit card usage, which rose 4.6% (or $1.13 trillion) in the fourth quarter of 2023. Meanwhile, the labor market showed persistent strength, with job growth accelerating in the last month of the reporting period and the unemployment rate remaining below 4% for the second consecutive year, which raised hopes of a soft landing. |

| · | | Over the reporting period, the US Federal Reserve (the Fed) tightened monetary policy by an additional 100 basis points (bps). (One basis point equals 0.01%.) Although remaining above the Fed’s 2% target, inflation continued to show signs of cooling. In January, the FOMC kept interest rates on hold for a fourth consecutive meeting but held off on signaling a rate cut at its March meeting, with Fed Chairman Jerome Powell saying he wanted to see “more good data” before lowering the federal funds rate. |

| · | | The 10-year/2-year US Treasury spread declined from –0.70% on January 31, 2023, to –0.29% at the end of the reporting period, while the yield on the 2-year Treasury note ended the reporting period at 4.21%, unchanged from the beginning of the reporting period. At the same time, the yield on the 3-month Treasury bill rose from 4.65% to 5.38%, while the Secured Overnight Financing Rate (SOFR) rose 101 bps to end the reporting period at 5.31%. In the short-term credit markets, investment-grade credit spreads tightened during the reporting period. The Bloomberg 1–3 Year Credit Index, a proxy for the short-term spread market, outperformed short-duration Treasuries by 0.73% during the reporting period. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

What strategies or holdings affected the Fund’s performance?

| · | | The Fund’s weighted average maturity remained longer than its peers during the majority of the reporting period but shortened in November 2023 and remained |

Prudential Investment Portfolios 2 17

PGIM Institutional Money Market Fund

Strategy and Performance Overview* (continued)

| | shorter than its peers for the remainder of the reporting period, as expectations that the Fed was nearing the end of its rate-hiking cycle increased. The Fund’s weighted average life remained longer than its peers throughout the reporting period. |

| · | | During the reporting period, the Fund increased its holdings in Treasuries, foreign corporates, domestic corporates, and supranationals as their relative value improved. Holdings of repurchase agreements, government agencies, domestic banks, and foreign banks were reduced as an offset to that trade. Adjustable-rate holdings decreased during the reporting period, led by a decrease in Fed funds floaters. (Floaters are bonds or other types of debt whose coupon rate changes with short-term interest rates.) Holdings of securities maturing beyond 90 days increased over the reporting period. |

Current outlook

The Fund continues to emphasize well-researched, short-term credit sectors, as PGIM Fixed Income expects these assets to offer the most value from a total return perspective. As relative value between floating-rate and fixed-rate assets fluctuates, PGIM Fixed Income will seek to rotate into more attractively priced holdings.

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

18 Visit our website at pgim.com/investments

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended January 31, 2024. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

PGIM Core Short-Term Bond Fund | | Beginning

Account Value

August 1, 2023 | | Ending Account Value

January 31, 2024 | | Annualized Expense

Ratio Based on the Six-Month Period | | Expenses Paid During the

Six-Month Period* |

| | | | | |

Actual | | $1,000.00 | | $1,033.40 | | 0.06% | | $0.31 |

| | | | | |

Hypothetical | | $1,000.00 | | $1,024.90 | | 0.06% | | $0.31 |

Prudential Investment Portfolios 2 19

Fees and Expenses (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

PGIM Core Ultra Short Bond Fund | | Beginning Account Value

August 1, 2023 | | Ending

Account Value

January 31, 2024 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | | |

Actual | | $1,000.00 | | $1,028.50 | | 0.01% | | $0.05 |

| | | | | |

Hypothetical | | $1,000.00 | | $1,025.16 | | 0.01% | | $0.05 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

PGIM Institutional Money Market Fund | | Beginning Account

Value

August 1, 2023 | | Ending

Account Value

January 31, 2024 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid During the

Six-Month Period* |

| | | | | |

Actual | | $1,000.00 | | $1,028.60 | | 0.07% | | $0.36 |

| | | | | |

Hypothetical | | $1,000.00 | | $1,024.85 | | 0.07% | | $0.36 |

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended January 31, 2024, and divided by the 365 days in the Fund’s fiscal year ended January 31, 2024 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which each Fund may invest.

20 Visit our website at pgim.com/investments

Glossary

The following abbreviations are used in the Funds’ descriptions:

USD—US Dollar

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

A—Annual payment frequency for swaps

ABS—Asset-Backed Security

BBVA—Banco Bilbao Vizcaya Argentaria

BNS—Bank of Nova Scotia

BOS—Bank of America Securities, Inc.

BSA—Banco Santander SA

CA—Credit Agricole Securities Inc.

CF—CF Secured, LLC

CGM—Citigroup Global Markets, Inc.

CNRP—Cantor Fitzgerald

DB—Deutsche Bank AG

FFCSB—Federal Farm Credit System Bank

FHLB—Federal Home Loan Bank

FHLMC—Federal Home Loan Mortgage Corporation

FNMA—Federal National Mortgage Association

GNMA—Government National Mortgage Association

GS—Goldman Sachs & Co. LLC

ING—ING Financial Markets LLC

MASTR—Morgan Stanley Structured Asset Security

MTN—Medium Term Note

NAT—Natixis

NORP—Nomura International PLC

NTC—Northern Trust Co.

NWS—NatWest Markets Securities, Inc.

RBD—RBC Dominion Securities, Inc.

REITs—Real Estate Investment Trust

SAN—Santander Bank, N.A.

SOFR—Secured Overnight Financing Rate

SSB—State Street Bank & Trust Company

TDM—TD Securities (USA) LLC

USOIS—United States Overnight Index Swap

WFS—Wells Fargo Securities LLC

21

PGIM Core Short-Term Bond Fund

Schedule of Investments

as of January 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal Amount (000)# | | | Value | |

|

LONG-TERM INVESTMENTS 72.5% | |

|

ASSET-BACKED SECURITIES 1.3% | |

|

Automobiles 0.0% | |

| | | | |

CarMax Auto Owner Trust,

Series 2020-04, Class A3 | | 0.500% | | 08/15/25 | | | 330 | | | $ | 327,017 | |

|

Home Equity Loans 0.9% | |

| | | | |

Accredited Mortgage Loan Trust,

Series 2004-04, Class A2D, 1 Month SOFR + 0.814% (Cap N/A, Floor 0.700%) | | 4.880(c) | | 01/25/35 | | | 679 | | | | 666,475 | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates,

Series 2003-11, Class AV2, 1 Month SOFR + 0.854% (Cap N/A, Floor 0.740%) | | 5.001(c) | | 12/25/33 | | | 143 | | | | 139,308 | |

Argent Securities, Inc., Asset-Backed Pass-Through Certificates,

Series 2003-W03, Class M2, 1 Month SOFR + 2.814% (Cap N/A, Floor 2.700%) | | 4.121(c) | | 09/25/33 | | | 3,195 | | | | 3,049,809 | |

Asset-Backed Funding Certificate Trust, | | | | | | | | | | | | |

Series 2003-AHL01, Class A1 | | 4.184 | | 03/25/33 | | | 111 | | | | 109,440 | |

Series 2003-OPT01, Class A3, 1 Month SOFR + 0.794% (Cap N/A, Floor 0.680%) | | 6.130(c) | | 04/25/33 | | | 531 | | | | 515,366 | |

Series 2004-HE01, Class M1, 1 Month SOFR + 1.014% (Cap N/A, Floor 0.900%) | | 6.350(c) | | 03/25/34 | | | 233 | | | | 228,693 | |

Asset-Backed Securities Corp. Home Equity Loan Trust,

Series 2003-HE06, Class A2, 1 Month SOFR + 0.794% (Cap N/A, Floor 0.680%) | | 6.130(c) | | 11/25/33 | | | 65 | | | | 65,776 | |

Bear Stearns Asset-Backed Securities Trust,

Series 2003-03, Class M1, 1 Month SOFR + 1.344% (Cap 11.000%, Floor 1.230%) | | 6.680(c) | | 06/25/43 | | | 128 | | | | 129,128 | |

CDC Mortgage Capital Trust,

Series 2003-HE03, Class M1, 1 Month SOFR + 1.164% (Cap N/A, Floor 1.050%) | | 6.500(c) | | 11/25/33 | | | 330 | | | | 326,981 | |

Equifirst Mortgage Loan Trust,

Series 2003-01, Class M2, 1 Month SOFR + 2.964% (Cap N/A, Floor 2.850%) | | 8.300(c) | | 12/25/32 | | | —(r | ) | | | 377 | |

Home Equity Asset Trust, | | | | | | | | | | | | |

Series 2002-03, Class M1, 1 Month SOFR + 1.464% (Cap N/A, Floor 1.350%) | | 6.800(c) | | 02/25/33 | | | 214 | | | | 205,727 | |

Series 2003-02, Class M1, 1 Month SOFR + 1.434% (Cap N/A, Floor 1.320%) | | 6.770(c) | | 08/25/33 | | | 479 | | | | 458,289 | |

See Notes to Financial Statements.

22

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal Amount (000)# | | | Value | |

|

ASSET-BACKED SECURITIES (Continued) | |

|

Home Equity Loans (cont’d.) | |

| | | | |

Home Equity Asset Trust, (cont’d.) | | | | | | | | | | | | |

Series 2003-03, Class M1, 1 Month SOFR + 1.404% (Cap N/A, Floor 1.290%) | | 6.740%(c) | | 08/25/33 | | | 318 | | | $ | 309,484 | |

Series 2003-08, Class M1, 1 Month SOFR + 1.194% (Cap N/A, Floor 1.080%) | | 6.530(c) | | 04/25/34 | | | 114 | | | | 112,417 | |

MASTR Asset-Backed Securities Trust,

Series 2004-OPT02, Class A2, 1 Month SOFR + 0.814% (Cap N/A, Floor 0.700%) | | 6.150(c) | | 09/25/34 | | | 91 | | | | 82,670 | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | |

Series 2004-HE02, Class A1A, 1 Month SOFR + 0.914% (Cap N/A, Floor 0.800%) | | 6.250(c) | | 08/25/35 | | | 43 | | | | 40,854 | |

Series 2004-HE02, Class M1, 1 Month SOFR + 1.314% (Cap N/A, Floor 1.200%) | | 6.650(c) | | 08/25/35 | | | 83 | | | | 80,560 | |

Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | |

Series 2003-NC05, Class M1, 1 Month SOFR + 1.389% (Cap N/A, Floor 1.275%) | | 6.725(c) | | 04/25/33 | | | 38 | | | | 38,622 | |

Series 2003-NC05, Class M3, 1 Month SOFR + 3.564% (Cap N/A, Floor 3.450%) | | 8.900(c) | | 04/25/33 | | | 71 | | | | 73,174 | |

Series 2003-NC08, Class M1, 1 Month SOFR + 1.164% (Cap N/A, Floor 1.050%) | | 6.500(c) | | 09/25/33 | | | 442 | | | | 438,422 | |

Series 2003-NC10, Class M1, 1 Month SOFR + 1.134% (Cap N/A, Floor 1.020%) | | 6.470(c) | | 10/25/33 | | | 57 | | | | 56,466 | |

Series 2004-HE07, Class M1, 1 Month SOFR + 1.014% (Cap N/A, Floor 0.900%) | | 6.350(c) | | 08/25/34 | | | 1,801 | | | | 1,760,329 | |

New Century Home Equity Loan Trust,

Series 2004-01, Class M1, 1 Month SOFR + 0.999% (Cap 11.500%, Floor 0.885%) | | 6.335(c) | | 05/25/34 | | | 1,763 | | | | 1,727,077 | |

Renaissance Home Equity Loan Trust,

Series 2003-01, Class A, 1 Month SOFR + 0.974% (Cap N/A, Floor 0.860%) | | 6.310(c) | | 06/25/33 | | | 203 | | | | 179,392 | |

Residential Asset Securities Trust,

Series 2004-KS05, Class AI5 | | 4.298 | | 06/25/34 | | | 2,266 | | | | 2,185,120 | |

Saxon Asset Securities Trust,

Series 2003-03, Class M2, 1 Month SOFR + 2.514% (Cap N/A, Floor 2.400%) | | 4.047(c) | | 12/25/33 | | | 14 | | | | 12,814 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 12,992,770 | |

See Notes to Financial Statements.

Prudential Investment Portfolios 2 23

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal Amount (000)# | | | Value | |

|

ASSET-BACKED SECURITIES (Continued) | |

|

Residential Mortgage-Backed Securities 0.4% | |

| | | | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates,

Series 2004-R05, Class M1, 1 Month SOFR + 0.984% (Cap N/A, Floor 0.870%) | | 6.320%(c) | | 07/25/34 | | | 101 | | | $ | 99,533 | |

Amortizing Residential Collateral Trust,

Series 2002-BC05, Class M2, 1 Month SOFR + 1.914% (Cap N/A, Floor 1.800%) | | 7.250(c) | | 07/25/32 | | | 57 | | | | 57,280 | |

Chase Funding Trust, | | | | | | | | | | | | |

Series 2002-02, Class 2A1, 1 Month SOFR + 0.614% (Cap N/A, Floor 0.500%) | | 5.950(c) | | 05/25/32 | | | 132 | | | | 130,779 | |

Series 2003-01, Class 2A2, 1 Month SOFR + 0.774% (Cap N/A, Floor 0.660%) | | 6.110(c) | | 11/25/32 | | | 88 | | | | 87,018 | |

Countrywide Asset-Backed Certificates, | | | | | | | | | | | | |

Series 2003-BC04, Class M1, 1 Month SOFR + 1.164% (Cap N/A, Floor 1.050%) | | 6.500(c) | | 07/25/33 | | | 57 | | | | 56,366 | |

Series 2004-01, Class M1, 1 Month SOFR + 0.864% (Cap N/A, Floor 0.750%) | | 6.200(c) | | 03/25/34 | | | 62 | | | | 61,851 | |

Equity One Mortgage Pass-Through Trust,

Series 2003-01, Class M1 | | 4.860(cc) | | 08/25/33 | | | 14 | | | | 14,085 | |

First Franklin Mortgage Loan Trust,

Series 2004-FF05, Class A1, 1 Month SOFR + 0.834% (Cap N/A, Floor 0.720%) | | 6.170(c) | | 08/25/34 | | | 104 | | | | 95,198 | |

Long Beach Mortgage Loan Trust, | | | | | | | | | | | | |

Series 2003-03, Class M1, 1 Month SOFR + 1.239% (Cap N/A, Floor 1.125%) | | 6.575(c) | | 07/25/33 | | | 362 | | | | 355,848 | |

Series 2003-04, Class M1, 1 Month SOFR + 1.134% (Cap N/A, Floor 1.020%) | | 6.470(c) | | 08/25/33 | | | 48 | | | | 48,010 | |

Series 2004-02, Class M1, 1 Month SOFR + 0.909% (Cap N/A, Floor 0.795%) | | 6.245(c) | | 06/25/34 | | | 1,215 | | | | 1,192,057 | |

Series 2004-03, Class M1, 1 Month SOFR + 0.969% (Cap N/A, Floor 0.855%) | | 6.305(c) | | 07/25/34 | | | 1,866 | | | | 1,827,462 | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | |

Series 2003-WMC02, Class M2, 1 Month SOFR + 2.964% (Cap N/A, Floor 2.850%) | | 8.300(c) | | 02/25/34 | | | 100 | | | | 97,023 | |

Series 2004-WMC01, Class M2, 1 Month SOFR + 1.764% (Cap N/A, Floor 1.650%) | | 7.100(c) | | 10/25/34 | | | 341 | | | | 322,997 | |

See Notes to Financial Statements.

24

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

ASSET-BACKED SECURITIES (Continued) | |

|

Residential Mortgage-Backed Securities (cont’d.) | |

| | | | |

Morgan Stanley ABS Capital I, Inc. Trust,

Series 2004-NC05, Class M1, 1 Month SOFR + 1.014% (Cap N/A, Floor 0.900%) | | | 6.350%(c) | | | | 05/25/34 | | | | 296 | | | $ | 278,906 | |

Structured Asset Investment Loan Trust,

Series 2003-BC01, Class A2, 1 Month SOFR + 0.794% (Cap N/A, Floor 0.680%) | | | 6.130(c) | | | | 01/25/33 | | | | 52 | | | | 51,035 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 4,775,448 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $17,057,220) | | | | | | | | | | | | | | | 18,095,235 | |

| | | | | | | | | | | | | | | | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 11.1% | | | | | | | | | | | | | | | | |

Banc of America Commercial Mortgage Trust,

Series 2015-UBS07, Class A3 | | | 3.441 | | | | 09/15/48 | | | | 9,503 | | | | 9,216,685 | |

Barclays Commercial Mortgage Securities Trust,

Series 2018-TALL, Class A, 144A, 1 Month SOFR + 0.919% (Cap N/A, Floor 0.872%) | | | 6.253(c) | | | | 03/15/37 | | | | 7,479 | | | | 7,125,388 | |

Benchmark Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2018-B03, Class A2 | | | 3.848 | | | | 04/10/51 | | | | 363 | | | | 355,993 | |

Series 2018-B05, Class A2 | | | 4.077 | | | | 07/15/51 | | | | 1,324 | | | | 1,295,178 | |

CAMB Commercial Mortgage Trust,

Series 2019-LIFE, Class A, 144A, 1 Month SOFR + 1.367% (Cap N/A, Floor 1.070%) | | | 6.701(c) | | | | 12/15/37 | | | | 9,500 | | | | 9,499,991 | |

CD Mortgage Trust,

Series 2016-CD2, Class A3 | | | 3.248 | | | | 11/10/49 | | | | 3,399 | | | | 3,255,268 | |

Citigroup Commercial Mortgage Trust,

Series 2016-P04, Class A2 | | | 2.450 | | | | 07/10/49 | | | | 7,270 | | | | 7,094,475 | |

Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2014-UBS03, Class A3 | | | 3.546 | | | | 06/10/47 | | | | 5,178 | | | | 5,149,484 | |

Series 2014-UBS04, Class A4 | | | 3.420 | | | | 08/10/47 | | | | 5,567 | | | | 5,509,293 | |

Series 2015-CR26, Class A3 | | | 3.359 | | | | 10/10/48 | | | | 8,356 | | | | 8,092,773 | |

Credit Suisse Mortgage Capital Certificates,

Series 2019-ICE04, Class A, 144A, 1 Month SOFR + 1.027% (Cap N/A, Floor 0.980%) | | | 6.361(c) | | | | 05/15/36 | | | | 9,975 | | | | 9,968,948 | |

CSAIL Commercial Mortgage Trust,

Series 2015-C03, Class A3 | | | 3.447 | | | | 08/15/48 | | | | 6,812 | | | | 6,669,126 | |

GS Mortgage Securities Corp. Trust,

Series 2018-HART, Class A, 144A, 1 Month SOFR + 1.143% (Cap N/A, Floor 1.090%) | | | 6.483(c) | | | | 10/15/31 | | | | 1,533 | | | | 1,416,598 | |

See Notes to Financial Statements.

Prudential Investment Portfolios 2 25

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | |

| | | | |

GS Mortgage Securities Trust,

Series 2014-GC22, Class A4 | | | 3.587% | | | | 06/10/47 | | | | 4,400 | | | $ | 4,373,073 | |

JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2014-C24, Class A3 | | | 3.098 | | | | 11/15/47 | | | | 3,504 | | | | 3,460,232 | |

Series 2020-COR07, Class A2 | | | 2.215 | | | | 05/13/53 | | | | 20,000 | | | | 18,159,596 | |

JPMorgan Chase Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2018-WPT, Class AFL, 144A, 1 Month SOFR + 1.439% (Cap N/A, Floor 1.200%) | | | 6.784(c) | | | | 07/05/33 | | | | 10,751 | | | | 10,168,473 | |

Series 2019-BKWD, Class A, 144A, 1 Month SOFR + 1.614% (Cap N/A, Floor 1.000%) | | | 6.948(c) | | | | 09/15/29 | | | | 3,126 | | | | 2,938,436 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | | | |

Series 2015-C24, Class A3 | | | 3.479 | | | | 05/15/48 | | | | 6,570 | | | | 6,400,496 | |

Series 2015-C25, Class A4 | | | 3.372 | | | | 10/15/48 | | | | 1,500 | | | | 1,461,181 | |

Series 2015-C26, Class A4 | | | 3.252 | | | | 10/15/48 | | | | 3,000 | | | | 2,928,815 | |

Morgan Stanley Capital I Trust,

Series 2015-UBS08, Class A3 | | | 3.540 | | | | 12/15/48 | | | | 5,341 | | | | 5,209,428 | |

One New York Plaza Trust,

Series 2020-01NYP, Class A, 144A, 1 Month SOFR + 1.064% (Cap N/A, Floor 0.950%) | | | 6.398(c) | | | | 01/15/36 | | | | 10,840 | | | | 10,656,848 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-C33, Class A3 | | | 3.162 | | | | 03/15/59 | | | | 5,205 | | | | 5,001,434 | |

Series 2016-LC24, Class A3 | | | 2.684 | | | | 10/15/49 | | | | 11,624 | | | | 11,009,813 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $159,384,524) | | | | | | | | | | | | | | | 156,417,025 | |

| | | | | | | | | | | | | | | | |

| | | | |

CORPORATE BONDS 60.1% | | | | | | | | | | | | | | | | |

| | | | |

Aerospace & Defense 0.4% | | | | | | | | | | | | | | | | |

RTX Corp.,

Sr. Unsec’d. Notes | | | 5.000 | | | | 02/27/26 | | | | 5,000 | | | | 5,024,471 | |

| | | | |

Agriculture 0.7% | | | | | | | | | | | | | | | | |

| | | | |

Cargill, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 3.500 | | | | 04/22/25 | | | | 6,750 | | | | 6,638,853 | |

Sr. Unsec’d. Notes, 144A | | | 4.875 | | | | 10/10/25 | | | | 3,250 | | | | 3,262,463 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 9,901,316 | |

| | | | |

Auto Manufacturers 5.7% | | | | | | | | | | | | | | | | |

American Honda Finance Corp.,

Sr. Unsec’d. Notes | | | 4.750 | | | | 01/12/26 | | | | 4,000 | | | | 4,008,553 | |

See Notes to Financial Statements.

26

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

CORPORATE BONDS (Continued) | |

|

Auto Manufacturers (cont’d.) | |

| | | | |

American Honda Finance Corp., (cont’d.) | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | | 0.750% | | | | 08/09/24 | | | | 7,500 | | | $ | 7,320,081 | |

BMW US Capital LLC (Germany), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 3.250 | | | | 04/01/25 | | | | 2,750 | | | | 2,702,217 | |

Gtd. Notes, 144A, SOFR Index + 0.530% | | | 5.881(c) | | | | 04/01/24 | | | | 8,500 | | | | 8,504,420 | |

Gtd. Notes, 144A, SOFR Index + 0.840% | | | 6.191(c) | | | | 04/01/25 | | | | 6,450 | | | | 6,479,233 | |

Daimler Truck Finance North America LLC (Germany),

Gtd. Notes, 144A | | | 5.150 | | | | 01/16/26 | | | | 10,000 | | | | 10,031,241 | |

Mercedes-Benz Finance North America LLC (Germany), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 0.750 | | | | 03/01/24 | | | | 21,500 | | | | 21,413,912 | |

Gtd. Notes, 144A, SOFR + 0.670% | | | 6.015(c) | | | | 01/09/26 | | | | 4,333 | | | | 4,334,926 | |

PACCAR Financial Corp.,

Sr. Unsec’d. Notes, MTN | | | 3.550 | | | | 08/11/25 | | | | 6,000 | | | | 5,910,428 | |

Toyota Motor Credit Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | | 3.650 | | | | 08/18/25 | | | | 5,000 | | | | 4,924,409 | |

Sr. Unsec’d. Notes, MTN | | | 3.950 | | | | 06/30/25 | | | | 4,750 | | | | 4,698,921 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 80,328,341 | |

| | | | |

Banks 11.6% | | | | | | | | | | | | | | | | |

| | | | |

Australia & New Zealand Banking Group Ltd. (Australia),

Sr. Unsec’d. Notes, 144A, SOFR + 0.810% | | | 6.156(c) | | | | 01/18/27 | | | | 3,500 | | | | 3,513,659 | |

Bank of Montreal (Canada),

Sr. Unsec’d. Notes, MTN, SOFR Index + 0.710% | | | 6.065(c) | | | | 03/08/24 | | | | 20,000 | | | | 20,002,442 | |

Bank of Nova Scotia (The) (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.440 | | | | 03/11/24 | | | | 11,100 | | | | 11,060,465 | |

Sr. Unsec’d. Notes, MTN, SOFR Index + 0.900% | | | 6.246(c) | | | | 04/11/25 | | | | 4,750 | | | | 4,764,977 | |

Banque Federative du Credit Mutuel SA (France), | | | | | | | | | | | | | | | | |

Sr. Preferred Notes, 144A | | | 0.650 | | | | 02/27/24 | | | | 12,750 | | | | 12,707,475 | |

Sr. Unsec’d. Notes, 144A, SOFR + 1.130% | | | 6.475(c) | | | | 01/23/27 | | | | 2,570 | | | | 2,586,876 | |

Citibank NA,

Sr. Unsec’d. Notes, SOFR + 0.805% | | | 6.157(c) | | | | 09/29/25 | | | | 10,000 | | | | 10,026,076 | |

Cooperatieve Rabobank UA (Netherlands),

Sr. Preferred Notes, SOFR Index + 0.710% | | | 6.056(c) | | | | 01/09/26 | | | | 5,000 | | | | 5,017,700 | |

Credit Suisse AG (Switzerland), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 0.495 | | | | 02/02/24 | | | | 5,000 | | | | 5,000,000 | |

Sr. Unsec’d. Notes, SOFR Index + 0.390% | | | 5.752(c) | | | | 02/02/24 | | | | 5,000 | | | | 4,999,972 | |

DNB Bank ASA (Norway),

Sr. Non-Preferred Notes, 144A | | | 5.896(ff) | | | | 10/09/26 | | | | 10,000 | | | | 10,105,431 | |

See Notes to Financial Statements.

Prudential Investment Portfolios 2 27

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

CORPORATE BONDS (Continued) | |

|

Banks (cont’d.) | |

| | | | |

Federation des Caisses Desjardins du Quebec (Canada),

Sr. Unsec’d. Notes, 144A | | | 4.400% | | | | 08/23/25 | | | | 10,000 | | | $ | 9,890,387 | |

| | | | |

National Australia Bank Ltd. (Australia),

Sr. Unsec’d. Notes | | | 3.500 | | | | 06/09/25 | | | | 7,250 | | | | 7,125,452 | |

| | | | |

NatWest Markets PLC (United Kingdom),

Sr. Unsec’d. Notes, 144A, SOFR + 1.450% | | | 6.804(c) | | | | 03/22/25 | | | | 15,000 | | | | 15,097,255 | |

| | | | |

Nordea Bank Abp (Finland),

Sr. Preferred Notes, 144A | | | 4.750 | | | | 09/22/25 | | | | 10,000 | | | | 9,957,302 | |

| | | | |

Toronto-Dominion Bank (The) (Canada),

Sr. Unsec’d. Notes, MTN, SOFR + 0.350% | | | 5.705(c) | | | | 09/10/24 | | | | 20,000 | | | | 19,982,804 | |

| | | | |

UBS AG (Switzerland),

Sr. Unsec’d. Notes, 144A, MTN, SOFR + 0.360% | | | 5.721(c) | | | | 02/09/24 | | | | 7,500 | | | | 7,499,878 | |

| | | | |

Wells Fargo Bank NA,

Sr. Unsec’d. Notes, SOFR + 0.710% | | | 6.052(c) | | | | 01/15/26 | | | | 4,000 | | | | 4,002,552 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 163,340,703 | |

| | | | |

Beverages 2.3% | | | | | | | | | | | | | | | | |

| | | | |

Coca-Cola Europacific Partners PLC (United Kingdom),

Sr. Unsec’d. Notes, 144A | | | 0.800 | | | | 05/03/24 | | | | 3,000 | | | | 2,956,219 | |

| | | | |

Diageo Capital PLC (United Kingdom),

Gtd. Notes | | | 5.200 | | | | 10/24/25 | | | | 10,000 | | | | 10,078,979 | |

| | | | |

Keurig Dr. Pepper, Inc.,

Gtd. Notes | | | 0.750 | | | | 03/15/24 | | | | 20,000 | | | | 19,885,975 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 32,921,173 | |

| | | | |

Biotechnology 0.7% | | | | | | | | | | | | | | | | |

| | | | |

Amgen, Inc.,

Sr. Unsec’d. Notes | | | 5.250 | | | | 03/02/25 | | | | 10,500 | | | | 10,525,430 | |

| | | | |

Chemicals 1.8% | | | | | | | | | | | | | | | | |

| | | | |

Linde, Inc.,

Gtd. Notes | | | 4.700 | | | | 12/05/25 | | | | 9,500 | | | | 9,525,977 | |

| | | | |

Nutrien Ltd. (Canada),

Sr. Unsec’d. Notes | | | 5.950 | | | | 11/07/25 | | | | 7,000 | | | | 7,118,709 | |

See Notes to Financial Statements.

28

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

CORPORATE BONDS (Continued) | |

|

Chemicals (cont’d.) | |

| | | | |

Sherwin-Williams Co. (The),

Sr. Unsec’d. Notes | | | 4.250% | | | | 08/08/25 | | | | 5,500 | | | $ | 5,443,549 | |

| | | | |

Westlake Corp.,

Sr. Unsec’d. Notes | | | 0.875 | | | | 08/15/24 | | | | 4,000 | | | | 3,899,622 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 25,987,857 | |

| | | | |

Commercial Services 0.5% | | | | | | | | | | | | | | | | |

| | | | |

Verisk Analytics, Inc.,

Sr. Unsec’d. Notes | | | 4.000 | | | | 06/15/25 | | | | 7,326 | | | | 7,224,421 | |

| | | | |

Computers 1.5% | | | | | | | | | | | | | | | | |

| | | | |

Apple, Inc.,

Sr. Unsec’d. Notes | | | 3.250 | | | | 02/23/26 | | | | 11,000 | | | | 10,745,196 | |

| | | | |

International Business Machines Corp.,

Sr. Unsec’d. Notes | | | 4.500 | | | | 02/06/26 | | | | 10,000 | | | | 9,977,521 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 20,722,717 | |

| | | | |

Cosmetics/Personal Care 0.9% | | | | | | | | | | | | | | | | |

| | | | |

Colgate-Palmolive Co.,

Sr. Unsec’d. Notes | | | 3.100 | | | | 08/15/25 | | | | 7,000 | | | | 6,861,775 | |

| | | | |

Kenvue, Inc.,

Gtd. Notes | | | 5.350 | | | | 03/22/26 | | | | 6,250 | | | | 6,345,470 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 13,207,245 | |

| | | | |

Diversified Financial Services 0.7% | | | | | | | | | | | | | | | | |

| | | | |

American Express Co.,

Sr. Unsec’d. Notes | | | 3.950 | | | | 08/01/25 | | | | 10,000 | | | | 9,854,085 | |

| | | | |

Electric 5.4% | | | | | | | | | | | | | | | | |

| | | | |

CenterPoint Energy, Inc.,

Sr. Unsec’d. Notes, SOFR Index + 0.650% | | | 6.010(c) | | | | 05/13/24 | | | | 6,750 | | | | 6,749,511 | |

| | | | |

DTE Energy Co.,

Sr. Unsec’d. Notes | | | 4.220 | | | | 11/01/24 | | | | 8,250 | | | | 8,167,061 | |

| | | | |

Duke Energy Corp.,

Sr. Unsec’d. Notes | | | 5.000 | | | | 12/08/25 | | | | 10,500 | | | | 10,524,126 | |

| | | | |

NextEra Energy Capital Holdings, Inc.,

Gtd. Notes | | | 2.940 | | | | 03/21/24 | | | | 15,000 | | | | 14,951,098 | |

See Notes to Financial Statements.

Prudential Investment Portfolios 2 29

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

CORPORATE BONDS (Continued) | |

|

Electric (cont’d.) | |

NextEra Energy Capital Holdings, Inc., (cont’d.) | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.051% | | | | 03/01/25 | | | | 2,750 | | | $ | 2,772,969 | |

Southern California Edison Co.,

First Mortgage, Series C | | | 4.200 | | | | 06/01/25 | | | | 14,250 | | | | 14,086,157 | |

WEC Energy Group, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 0.800 | | | | 03/15/24 | | | | 11,000 | | | | 10,933,797 | |

Sr. Unsec’d. Notes | | | 4.750 | | | | 01/09/26 | | | | 5,000 | | | | 4,988,629 | |

Sr. Unsec’d. Notes | | | 5.000 | | | | 09/27/25 | | | | 3,500 | | | | 3,501,874 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 76,675,222 | |

| | | | |

Electronics 1.1% | | | | | | | | | | | | | | | | |

Tyco Electronics Group SA,

Gtd. Notes | | | 4.500 | | | | 02/13/26 | | | | 15,000 | | | | 14,938,991 | |

| | | | |

Foods 1.8% | | | | | | | | | | | | | | | | |

Mondelez International Holdings Netherlands BV,

Gtd. Notes, 144A | | | 4.250 | | | | 09/15/25 | | | | 14,000 | | | | 13,848,819 | |

Nestle Holdings, Inc.,

Gtd. Notes, 144A | | | 4.000 | | | | 09/12/25 | | | | 11,725 | | | | 11,621,104 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 25,469,923 | |

| | | | |

Healthcare-Services 1.1% | | | | | | | | | | | | | | | | |

UnitedHealth Group, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 0.550 | | | | 05/15/24 | | | | 12,000 | | | | 11,835,920 | |

Sr. Unsec’d. Notes | | | 5.150 | | | | 10/15/25 | | | | 4,000 | | | | 4,038,077 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 15,873,997 | |

| | | | |

Insurance 3.4% | | | | | | | | | | | | | | | | |

Corebridge Global Funding,

Sr. Sec’d. Notes, 144A | | | 0.650 | | | | 06/17/24 | | | | 21,000 | | | | 20,594,064 | |

Equitable Financial Life Global Funding,

Sec’d. Notes, 144A | | | 0.800 | | | | 08/12/24 | | | | 3,000 | | | | 2,923,073 | |

Metropolitan Life Global Funding I,

Sec’d. Notes, 144A, MTN | | | 4.050 | | | | 08/25/25 | | | | 11,000 | | | | 10,867,178 | |

New York Life Global Funding,

Sec’d. Notes, 144A, MTN | | | 3.600 | | | | 08/05/25 | | | | 10,500 | | | | 10,334,739 | |

See Notes to Financial Statements.

30

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

CORPORATE BONDS (Continued) | |

|

Insurance (cont’d.) | |

| | | | |

Principal Life Global Funding II, | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A | | | 5.000% | | | | 01/16/27 | | | | 857 | | | $ | 864,216 | |

Sec’d. Notes, 144A, SOFR + 0.450% | | | 5.796(c) | | | | 04/12/24 | | | | 2,750 | | | | 2,749,218 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 48,332,488 | |

| | | | |

Internet 0.7% | | | | | | | | | | | | | | | | |

Amazon.com, Inc.,

Sr. Unsec’d. Notes | | | 4.600 | | | | 12/01/25 | | | | 10,000 | | | | 10,022,993 | |

| | | | |

Iron/Steel 0.6% | | | | | | | | | | | | | | | | |

Nucor Corp.,

Sr. Unsec’d. Notes | | | 3.950 | | | | 05/23/25 | | | | 8,000 | | | | 7,888,957 | |

| | | | |

Machinery-Diversified 1.5% | | | | | | | | | | | | | | | | |

CNH Industrial Capital LLC,

Gtd. Notes | | | 3.950 | | | | 05/23/25 | | | | 11,000 | | | | 10,831,004 | |

John Deere Capital Corp.,

Sr. Unsec’d. Notes, MTN | | | 4.800 | | | | 01/09/26 | | | | 10,250 | | | | 10,311,010 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 21,142,014 | |

| | | | |

Media 0.5% | | | | | | | | | | | | | | | | |

Comcast Corp.,

Gtd. Notes | | | 5.250 | | | | 11/07/25 | | | | 7,000 | | | | 7,078,051 | |

| | | | |

Mining 1.3% | | | | | | | | | | | | | | | | |

BHP Billiton Finance USA Ltd. (Australia),

Gtd. Notes | | | 4.875 | | | | 02/27/26 | | | | 18,750 | | | | 18,850,433 | |

| | | | |

Oil & Gas 1.1% | | | | | | | | | | | | | | | | |

Phillips 66,

Gtd. Notes | | | 0.900 | | | | 02/15/24 | | | | 16,000 | | | | 15,972,293 | |

| | | | |

Pipelines 2.2% | | | | | | | | | | | | | | | | |

Enterprise Products Operating LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 3.900 | | | | 02/15/24 | | | | 4,376 | | | | 4,372,412 | |

Gtd. Notes | | | 5.050 | | | | 01/10/26 | | | | 9,500 | | | | 9,569,640 | |

See Notes to Financial Statements.

Prudential Investment Portfolios 2 31

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

CORPORATE BONDS (Continued) | |

|

Pipelines (cont’d.) | |

TransCanada PipeLines Ltd. (Canada),

Sr. Unsec’d. Notes | | | 1.000% | | | | 10/12/24 | | | | 8,000 | | | $ | 7,755,194 | |

Williams Cos., Inc. (The),

Sr. Unsec’d. Notes | | | 5.400 | | | | 03/02/26 | | | | 9,000 | | | | 9,092,940 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 30,790,186 | |

| | | | |

Real Estate Investment Trusts (REITs) 2.1% | | | | | | | | | | | | | | | | |

Public Storage Operating Co.,

Gtd. Notes, SOFR + 0.470% | | | 5.815(c) | | | | 04/23/24 | | | | 20,000 | | | | 20,000,367 | |

Weyerhaeuser Co.,

Sr. Unsec’d. Notes | | | 4.750 | | | | 05/15/26 | | | | 10,000 | | | | 9,951,253 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 29,951,620 | |

| | | | |

Retail 3.4% | | | | | | | | | | | | | | | | |

7-Eleven, Inc.,

Sr. Unsec’d. Notes, 144A | | | 0.800 | | | | 02/10/24 | | | | 7,000 | | | | 6,989,931 | |

Dollar General Corp.,

Sr. Unsec’d. Notes | | | 4.250 | | | | 09/20/24 | | | | 6,750 | | | | 6,686,369 | |

Home Depot, Inc. (The),

Sr. Unsec’d. Notes | | | 4.000 | | | | 09/15/25 | | | | 10,000 | | | | 9,914,086 | |

Lowe’s Cos., Inc.,

Sr. Unsec’d. Notes | | | 4.400 | | | | 09/08/25 | | | | 10,000 | | | | 9,933,965 | |

Walmart, Inc.,

Sr. Unsec’d. Notes | | | 3.900 | | | | 09/09/25 | | | | 14,000 | | | | 13,868,814 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 47,393,165 | |

| | | | |

Semiconductors 1.9% | | | | | | | | | | | | | | | | |

Intel Corp.,

Sr. Unsec’d. Notes | | | 2.600 | | | | 05/19/26 | | | | 9,000 | | | | 8,623,605 | |

Microchip Technology, Inc.,

Sr. Unsec’d. Notes | | | 0.972 | | | | 02/15/24 | | | | 18,500 | | | | 18,466,042 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 27,089,647 | |

| | | | |

Software 1.0% | | | | | | | | | | | | | | | | |

Fidelity National Information Services, Inc.,

Sr. Unsec’d. Notes | | | 0.600 | | | | 03/01/24 | | | | 14,250 | | | | 14,190,143 | |

See Notes to Financial Statements.

32

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

CORPORATE BONDS (Continued) | |

|

Telecommunications 2.9% | |

| | | | |

Cisco Systems, Inc.,

Sr. Unsec’d. Notes | | | 2.950% | | | | 02/28/26 | | | | 12,000 | | | $ | 11,646,203 | |

NTT Finance Corp. (Japan), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 0.583 | | | | 03/01/24 | | | | 15,250 | | | | 15,184,413 | |

Sr. Unsec’d. Notes, 144A | | | 4.142 | | | | 07/26/24 | | | | 2,000 | | | | 1,987,199 | |

Verizon Communications, Inc.,

Sr. Unsec’d. Notes | | | 0.750 | | | | 03/22/24 | | | | 12,000 | | | | 11,919,294 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 40,737,109 | |

| | | | |

Transportation 0.9% | | | | | | | | | | | | | | | | |

| | | | |

Union Pacific Corp.,

Sr. Unsec’d. Notes | | | 4.750 | | | | 02/21/26 | | | | 12,500 | | | | 12,552,604 | |

| | | | |

Trucking & Leasing 0.4% | | | | | | | | | | | | | | | | |

| | | | |

Penske Truck Leasing Co. LP/PTL Finance Corp.,

Sr. Unsec’d. Notes, 144A | | | 5.750 | | | | 05/24/26 | | | | 5,250 | | | | 5,299,311 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL CORPORATE BONDS

(cost $851,939,907) | | | | | | | | | | | | | | | 849,286,906 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $1,028,381,651) | | | | | | | | | | | | | | | 1,023,799,166 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | Shares | | | | |

| | | | |

SHORT-TERM INVESTMENTS 26.6% | | | | | | | | | | | | | | | | |

| | | | |

AFFILIATED MUTUAL FUND 5.7% | | | | | | | | | | | | | | | | |

PGIM Core Government Money Market Fund (7-day effective yield 5.560%) | | | | | | | | | | | | | |

(cost $79,447,177)(wb) | | | | | | | | | | | 79,447,177 | | | | 79,447,177 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | | |

| | | | |

CERTIFICATES OF DEPOSIT 9.0% | | | | | | | | | | | | | | | | |

Bank of America NA | | | 5.930% | | | | 04/08/24 | | | | 15,000 | | | | 15,008,863 | |

Bank of Montreal | | | 5.840 | | | | 05/20/24 | | | | 2,000 | | | | 2,001,871 | |

BNP Paribas SA, SOFR + 0.530% | | | 5.840(c) | | | | 04/08/24 | | | | 15,000 | | | | 15,012,016 | |

See Notes to Financial Statements.

Prudential Investment Portfolios 2 33

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

|

CERTIFICATES OF DEPOSIT (Continued) | |

Canadian Imperial Bank of Commerce | | | 6.000% | | | | 10/18/24 | | | | 10,000 | | | $ | 10,054,116 | |

Credit Agricole Corporate & Investment Bank | | | 5.700 | | | | 02/08/24 | | | | 20,000 | | | | 20,001,365 | |

Mizuho Bank Ltd., SOFR + 0.560% | | | 5.870(c) | | | | 03/14/24 | | | | 20,000 | | | | 20,011,219 | |

State Street Bank & Trust Co., SOFR + 0.470% | | | 5.780(c) | | | | 05/21/24 | | | | 10,000 | | | | 10,010,692 | |

Sumitomo Mitsui Trust Bank Ltd., SOFR + 0.400% | | | 5.710(c) | | | | 02/20/24 | | | | 10,000 | | | | 10,001,720 | |

Svenska Handelsbanken, SOFR + 0.510% (Cap N/A, Floor 0.000%) | | | 5.820(c) | | | | 03/25/24 | | | | 15,000 | | | | 15,009,219 | |

Swedbank AB, SOFR + 0.680% | | | 5.990(c) | | | | 03/20/24 | | | | 10,000 | | | | 10,008,192 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL CERTIFICATES OF DEPOSIT

(cost $127,006,067) | | | | | | | | | | | | | | | 127,119,273 | |

| | | | | | | | | | | | | | | | |

| | | | |

COMMERCIAL PAPER 11.9% | | | | | | | | | | | | | | | | |

Alexandria Real Estate Equities, Inc.,

144A | | | 5.562(n) | | | | 02/09/24 | | | | 10,000 | | | | 9,986,291 | |

Alimentation Couche-Tard, Inc.,

144A | | | 5.621(n) | | | | 02/28/24 | | | | 11,000 | | | | 10,951,851 | |

Bayer Corp.,

144A | | | 6.271(n) | | | | 08/13/24 | | | | 7,000 | | | | 6,791,591 | |

BPCE SA,

144A, SOFR + 0.590% | | | 5.900(c) | | | | 08/05/24 | | | | 10,000 | | | | 10,020,267 | |

CDP Financial, Inc.,

144A | | | 5.814(n) | | | | 04/01/24 | | | | 15,000 | | | | 14,861,318 | |

Glencore Funding LLC,

144A | | | 5.817(n) | | | | 03/22/24 | | | | 3,000 | | | | 2,975,903 | |

144A | | | 5.821(n) | | | | 03/21/24 | | | | 5,000 | | | | 4,960,625 | |

144A | | | 5.831(n) | | | | 03/20/24 | | | | 5,000 | | | | 4,961,412 | |

HCP, Inc.,

144A | | | 5.577(n) | | | | 02/14/24 | | | | 9,000 | | | | 8,980,731 | |

144A | | | 5.578(n) | | | | 02/08/24 | | | | 4,000 | | | | 3,995,141 | |

ING (U.S.) Funding LLC,

144A, SOFR + 0.550% | | | 5.860(c) | | | | 05/07/24 | | | | 15,000 | | | | 15,016,952 | |

JPMorgan Securities LLC,

144A, SOFR + 0.650% | | | 5.960(c) | | | | 08/01/24 | | | | 10,000 | | | | 10,009,781 | |

LVMH Moet Hennessy Louis Vuitton SE,

144A | | | 5.841(n) | | | | 04/08/24 | | | | 15,000 | | | | 14,849,059 | |

McKesson Corp.,

144A | | | 5.611(n) | | | | 02/27/24 | | | | 5,000 | | | | 4,979,149 | |

Nutrien Ltd.,

144A | | | 5.732(n) | | | | 02/01/24 | | | | 10,000 | | | | 9,998,483 | |

O’Reilly Automotive, Inc.,

144A | | | 5.511(n) | | | | 02/07/24 | | | | 5,000 | | | | 4,994,721 | |

See Notes to Financial Statements.

34

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

| | | | |

COMMERCIAL PAPER (Continued) | | | | | | | | | | | | | | | | |

Ontario Teachers’ Finance Trust,

144A | | | 5.837%(n) | | | | 04/03/24 | | | | 15,000 | | | $ | 14,858,250 | |

Skandinaviska Enskilda Banken AB,

144A, SOFR + 0.530% | | | 5.840(c) | | | | 04/08/24 | | | | 15,000 | | | | 15,012,336 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL COMMERCIAL PAPER

(cost $168,130,657) | | | | | | | | | | | | | | | 168,203,861 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $374,583,901) | | | | | | | | | | | | | | | 374,770,311 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL INVESTMENTS 99.1%

(cost $1,402,965,552) | | | | | | | | | | | | | | | 1,398,569,477 | |

Other assets in excess of liabilities(z) 0.9% | | | | | | | | | | | | 13,056,485 | |

| | | | | | | | | | | | | | | | |

| | | | |

NET ASSETS 100.0% | | | | | | | | | | | | | | $ | 1,411,625,962 | |

| | | | | | | | | | | | | | | | |

See the Glossary for a list of the abbreviation(s) used in the annual report.

| # | Principal or notional amount is shown in U.S. dollars unless otherwise stated. |

| (c) | Variable rate instrument. The interest rate shown reflects the rate in effect at January 31, 2024. |

| (cc) | Variable rate instrument. The rate shown is based on the latest available information as of January 31, 2024. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. |

| (ff) | Variable rate security. Security may be issued at a fixed coupon rate, which converts to a variable rate at a specified date. Rate shown is the rate in effect as of period end. |

| (n) | Rate shown reflects yield to maturity at purchased date. |

| (r) | Principal or notional amount is less than $500 par. |

| (wb) | Represents an investment in a Fund affiliated with the Manager. |

| (z) | Includes net unrealized appreciation/(depreciation) and/or market value of the below holdings which are excluded from the Schedule of Investments: |

Interest rate swap agreements outstanding at January 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | |

Notional Amount (000)# | | | Termination

Date | | | Fixed

Rate | | | Floating Rate | | Value at

Trade Date | | | Value at

January 31,

2024 | | | Unrealized

Appreciation

(Depreciation) |

| | | | | | | | | | | | | | | | | | |

| | | |

| | Centrally Cleared Interest Rate Swap Agreements: | | | | | | | | | | | | |

| | 19,250 | | | | 02/04/24 | | | | 0.133%(A) | | | 1 Day USOIS(1)(A)/ 5.330% | | $ | 24,122 | | | $ | 978,427 | | | $ | 954,305 | |

| | 47,000 | | | | 03/01/24 | | | | 0.230%(A) | | | 1 Day USOIS(1)(A)/ 5.330% | | | 58,857 | | | | 2,366,904 | | | | 2,308,047 | |

See Notes to Financial Statements.

Prudential Investment Portfolios 2 35

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2024

Interest rate swap agreements outstanding at January 31, 2024 (continued):

| | | | | | | | | | | | | | | | | | | | | | | | |

Notional

Amount

(000)# | | | Termination

Date | | | Fixed

Rate | | | Floating Rate | | Value at

Trade Date | | | Value at

January 31,

2024 | | | Unrealized

Appreciation

(Depreciation) | |

| | | |

| | Centrally Cleared Interest Rate Swap Agreements (cont’d.): | | | | | | | | | | | | |

| | 28,500 | | | | 03/01/24 | | | | 2.478%(A) | | | 1 Day SOFR(1)(A)/ 5.320% | | $ | — | | | $ | 780,052 | | | $ | 780,052 | |

| | 12,000 | | | | 03/15/24 | | | | 0.276%(A) | | | 1 Day USOIS(1)(A)/ 5.330% | | | — | | | | 601,976 | | | | 601,976 | |

| | 17,000 | | | | 03/18/24 | | | | 0.278%(A) | | | 1 Day USOIS(1)(A)/ 5.330% | | | — | | | | 853,403 | | | | 853,403 | |

| | 13,000 | | | | 03/31/24 | | | | 2.305%(A) | | | 1 Day SOFR(1)(A)/ 5.320% | | | 78,331 | | | | 384,496 | | | | 306,165 | |

| | 90,000 | | | | 05/11/24 | | | | 2.603%(A) | | | 1 Day SOFR(1)(A)/ 5.320% | | | (14,235 | ) | | | 2,457,016 | | | | 2,471,251 | |

| | 2,750 | | | | 05/20/24 | | | | 0.296%(A) | | | 1 Day USOIS(1)(A)/ 5.330% | | | — | | | | 140,587 | | | | 140,587 | |