UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-09999 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 2 |

| |

| (This Form N-CSR relates solely to the Registrant’s PGIM Quant Solutions Emerging Markets Equity Fund and PGIM Quant Solutions International Developed Markets Index Fund (each a “Fund” and collectively the “Funds”)) |

| |

| Address of principal executive offices: | | 655 Broad Street, 6 th Floor |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | | 655 Broad Street, 6 th Floor |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | |

| |

| Date of fiscal year end: | | 10/31/20 24 |

| |

| Date of reporting period: | | 10/31/2024 |

Item 1 – Reports to Stockholders

| | (a) | Report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

PGIM Quant Solutions Emerging Markets

Equity Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class R6 shares of PGIM Quant Solutions Emerging Markets Equity

Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Quant Solutions Emerging Markets Equity | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Over the reporting period, market performance was strong, with MSCI Emerging Markets ND Index gains primarily driven by strong

performance in Taiwan, India, and China, particularly within the information technology, financials, and consumer discretionary sectors.

■

The Fund benefited from strong performance across all factor groups. Top contributors included overweight exposure to stocks with cheap

valuations, strong quality measures, and improving sentiment measures, as well as underweight exposure to stocks with expensive valuations,

weak quality measures, and decreasing sentiment measures.

■

By country, Korea (overweight/stock selection in industrials and financials), Taiwan (overweight in information technology), and India (stock

selection in financials, overweight in materials) led outperformers.

■

The best-performing sectors, in relative terms, were industrials (underweight/stock selection in Korea), financials (stock selection in India and

China), and energy (stock selection in India and China).

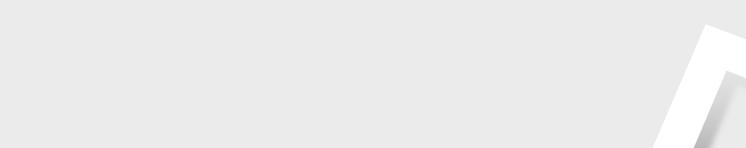

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R6 shares and assumes that all

recurring

fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: November 29, 2016 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: MSCI Emerging Markets

ND Index | | | |

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the

closest month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

| |

| |

Semiconductors & Semiconductor Equipment | |

Affiliated Mutual Fund - Short-Term Investment (0.7% represents investments purchased with collateral from securities on loan) | |

| |

Interactive Media & Services | |

Technology Hardware, Storage & Peripherals | |

| |

Oil, Gas & Consumable Fuels | |

| |

| |

| |

Hotels, Restaurants & Leisure | |

| |

Real Estate Management & Development | |

| |

Electronic Equipment, Instruments & Components | |

| |

| |

Diversified Telecommunication Services | |

| |

| |

| |

| |

Wireless Telecommunication Services | |

| |

Textiles, Apparel & Luxury Goods | |

| |

Consumer Staples Distribution & Retail | |

| |

Health Care Providers & Services | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Liabilities in excess of other assets | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since November 1, 2023:

■

The Fund's principal risk disclosure was revised to include Sector Exposure Risk as a principal risk of the Fund due to changes in the Fund's

portfolio which may result in greater exposure to certain economic sectors.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by February 28, 2025 at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Quant Solutions Emerging Markets Equity Fund

PGIM Quant Solutions International Developed

Markets Index Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class R6 shares of PGIM Quant Solutions International Developed

Markets Index Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Quant Solutions International Developed Markets Index Fund—Class R6 | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

International equities advanced at the end of 2023, based on the hope that a continued decline in inflation data would lead to interest rate cuts

by central banks. The markets continued upward in the first quarter of 2024, based on expectations of future interest rate cuts. Despite volatility

during the remainder of the reporting period, as investors digested the outcomes of various international elections and the hoped-for easing of

monetary policy in Europe, these markets ended the period little changed from their March 2024 levels.

■

The Fund closely tracked the MSCI EAFE ND Index’s performance over the reporting period, holding almost all stocks included in the Index in

approximately the same proportions, in keeping with its “passively managed”—or index—investment approach.

■

The Fund used TOPIX Futures, EURO STOXX 50 Futures, FTSE 100 Futures, and MSCI EAFE Mini Futures to equitize cash and enhance

portfolio liquidity. These positions had a negligible effect on performance.

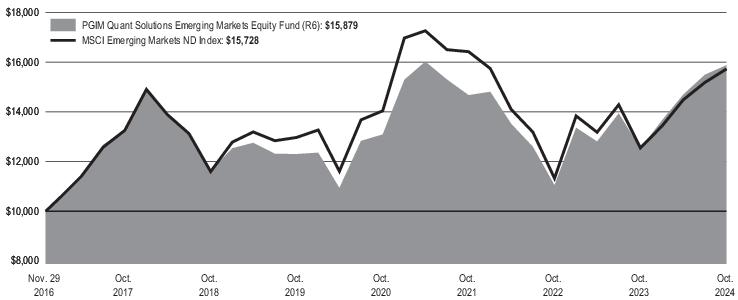

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R6 shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or

expense

reimbursements, if any, the returns would

have been lower.

Cumulative Performance: November 17, 2016 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: MSCI EAFE ND Index | | | |

FTSE Developed Markets Ex-North America Net Index | | | |

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the

closest month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

| |

| |

| |

| |

Oil, Gas & Consumable Fuels | |

Semiconductors & Semiconductor Equipment | |

| |

| |

| |

| |

| |

Unaffiliated Exchange-Traded Funds | |

Textiles, Apparel & Luxury Goods | |

| |

| |

| |

| |

Health Care Equipment & Supplies | |

Trading Companies & Distributors | |

| |

| |

| |

| |

Diversified Telecommunication Services | |

| |

Hotels, Restaurants & Leisure | |

Electronic Equipment, Instruments & Components | |

Consumer Staples Distribution & Retail | |

| |

Real Estate Management & Development | |

| |

| |

Wireless Telecommunication Services | |

| |

| |

| |

| |

| |

| |

| |

Affiliated Mutual Fund - Short-Term Investment (0.0% represents investments purchased with collateral from securities on loan) | |

| |

Construction & Engineering | |

| |

| |

| |

Technology Hardware, Storage & Peripherals | |

| |

| |

Other assets in excess of liabilities | |

| |

* Consists of Industries that each make up less than 0.5% of the Fund's net assets

WERE THERE ANY CHANGES TO THE FUND THIS YEAR?

The following is a summary of certain changes to the Fund since November 1, 2023:

■

Effective December 11, 2023, the Fund's contractual expense limitation was lowered from 0.25% to 0.19% of the average daily net assets for

Class R6 shares.

For more complete information, you should review the Fund’s next prospectus, which we expect to be available by February 28, 2025 at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by request at (800) 225-1852.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Quant Solutions International Developed Markets Index Fund

| | (b) | Copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule – Not applicable. |

Item 2 – Code of Ethics – See Exhibit (a)

As of the end of the period covered by this report, the registrant has adopted a code of ethics (the “Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers”) that applies to the registrant’s Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer.

The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant 800-225-1852, and ask for a copy of the Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers.

Item 3 – Audit Committee Financial Expert –

The registrant’s Board has determined that Ms. Grace C. Torres, member of the Board’s Audit Committee is an “audit committee financial expert,” and that she is “independent,” for purposes of this item.

Item 4 – Principal Accountant Fees and Services –

For the fiscal years ended October 31, 2024 and October 31, 2023, PricewaterhouseCoopers LLP (“PwC”), the Registrant’s principal accountant, billed the Registrant $62,328 and $59,360, respectively, for professional services rendered for the audit of the Registrant’s annual financial statements or services that are normally provided in connection with statutory and regulatory filings.

For the fiscal years ended October 31, 2024 and October 31, 2023: none.

For the fiscal years ended October 31, 2024 and October 31, 2023: none.

For the fiscal years ended October 31, 2024 and October 31, 2023: none.

| | (e) | (1) Audit Committee Pre-Approval Policies and Procedures |

THE PGIM MUTUAL FUNDS

AUDIT COMMITTEE POLICY

on

Pre-Approval of Services Provided by the Independent Accountants

The Audit Committee of each PGIM Mutual Fund is charged with the responsibility to monitor the independence of the Fund’s independent accountants. As part of this responsibility, the Audit Committee must pre-approve the independent accounting firm’s engagement to render audit and/or permissible non-audit services, as required by law. In evaluating a proposed engagement of the independent accountants, the Audit Committee will assess the effect that the engagement might reasonably be expected to have on the accountant’s independence. The Committee’s evaluation will be based on:

| | • | | a review of the nature of the professional services expected to be provided, |

| | • | | a review of the safeguards put into place by the accounting firm to safeguard independence, and |

| | • | | periodic meetings with the accounting firm. |

Policy for Audit and Non-Audit Services Provided to the Funds

On an annual basis, the scope of audits for each Fund, audit fees and expenses, and audit-related and non-audit services (and fees proposed in respect thereof) proposed to be performed by the Fund’s independent accountants will be presented by the Treasurer and the independent accountants to the Audit Committee for review and, as appropriate, approval prior to the initiation of such services.

Such presentation shall be accompanied by confirmation by both the Treasurer and the independent accountants that the proposed non-audit services will not adversely affect the independence of the independent accountants. Such proposed non-audit services shall be described in sufficient detail to enable the Audit Committee to assess the appropriateness of such services and fees, and the compatibility of the provision of such services with the auditor’s independence. The Committee shall receive periodic reports on the progress of the audit and other services which are approved by the Committee or by the Committee Chair pursuant to authority delegated in this Policy.

The categories of services enumerated under “Audit Services”, “Audit-related Services”, and “Tax Services” are intended to provide guidance to the Treasurer and the independent accountants as to those categories of services which the Committee believes are generally consistent with the independence of the independent accountants and which the Committee (or the Committee Chair) would expect upon the presentation of specific proposals to pre-approve. The enumerated categories are not intended as an exclusive list of audit, audit-related or tax services, which the Committee (or the Committee Chair) would consider for pre-approval.

Audit Services

The following categories of audit services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Annual Fund financial statement audits |

| | • | | Seed audits (related to new product filings, as required) |

| | • | | SEC and regulatory filings and consents |

Audit-related Services

The following categories of audit-related services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Accounting consultations |

| | • | | Fund merger support services |

| | • | | Agreed Upon Procedure Reports |

| | • | | Other Internal Control Reports |

Individual audit-related services that fall within one of these categories (except for fund merger support services) and are not presented to the Audit Committee as part of the annual pre-approval process are subject to an authorized pre-approval by the Audit Committee so long as the estimated fee for those services does not exceed $30,000. Any services provided under such pre-approval will be reported to the Audit Committee at its next regular meeting. Should the amount of such services exceed $30,000 any additional fees will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated). Fees related to fund merger support services are subject to a separate authorized pre-approval by the Audit Committee with fees determined on a per occurrence and merger complexity basis.

Tax Services

The following categories of tax services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Tax compliance services related to the filing or amendment of the following: |

| | • | | Federal, state and local income tax compliance; and, |

| | • | | Sales and use tax compliance |

| | • | | Timely RIC qualification reviews |

| | • | | Tax distribution analysis and planning |

| | • | | Tax authority examination services |

| | • | | Tax appeals support services |

| | • | | Accounting methods studies |

| | • | | Fund merger support services |

| | • | | Tax consulting services and related projects |

Individual tax services that fall within one of these categories and are not presented to the Audit Committee as part of the annual pre-approval process are subject to an authorized pre-approval by the Audit Committee so long as the estimated fee for those services does not exceed $30,000. Any services provided under such pre-approval will be reported to the Audit Committee at its next regular meeting. Should the amount of such services exceed $30,000 any additional fees will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated).

Other Non-Audit Services

Certain non-audit services that the independent accountants are legally permitted to render will be subject to pre-approval by the Committee or by one or more Committee members to whom the Committee has delegated this authority and who will report to the full Committee any pre-approval decisions made pursuant to this Policy. Non-audit services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Proscribed Services

The Fund’s independent accountants will not render services in the following categories of non-audit services:

| | • | | Bookkeeping or other services related to the accounting records or financial statements of the Fund |

| | • | | Financial information systems design and implementation |

| | • | | Appraisal or valuation services, fairness opinions, or contribution-in-kind reports |

| | • | | Internal audit outsourcing services |

| | • | | Management functions or human resources |

| | • | | Broker or dealer, investment adviser, or investment banking services |

| | • | | Legal services and expert services unrelated to the audit |

| | • | | Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible. |

Pre-approval of Non-Audit Services Provided to Other Entities Within the PGIM Fund Complex

Certain non-audit services provided to PGIM Investments LLC or any of its affiliates that also provide ongoing services to the PGIM Mutual Funds will be subject to pre-approval by the Audit Committee. The only non-audit services provided to these entities that will require pre-approval are those related directly to the operations and financial reporting of the Funds. Individual projects that are not presented to the Audit Committee as part of the annual pre-approval process will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $30,000. Services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Although the Audit Committee will not pre-approve all services provided to PGIM Investments LLC and its affiliates, the Committee will receive an annual report from the Fund’s independent accounting firm showing the aggregate fees for all services provided to PGIM Investments and its affiliates.

| (e) | (2) Percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X – |

| | | | | | |

| | | Fiscal Year Ended October 31, 2024 | | Fiscal Year Ended October 31, 2023 | | |

| 4(b) | | Not applicable. | | Not applicable. | | |

| 4(c) | | Not applicable. | | Not applicable. | | |

| 4(d) | | Not applicable. | | Not applicable. | | |

| (f) | Percentage of hours expended attributable to work performed by other than full time employees of principal accountant if greater than 50%. |

The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was 0%.

The aggregate non-audit fees billed by the Registrant’s principal accountant for services rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant for the fiscal years ended October 31, 2024 and October 31, 2023 was $0 and $0, respectively.

| (h) | Principal Accountant’s Independence |

Not applicable as the Registrant’s principal accountant has not provided non-audit services to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X.

Item 5 – Audit Committee of Listed Registrants – Not applicable.

| Item 6 | – Investments – The registrant’s Schedule of Investments is included in the financial statements filed under Item 7 of this Form. |

| Items | 7 – 11 (Refer to Report below) |

PRUDENTIAL INVESTMENT PORTFOLIOS 2

PGIM Quant Solutions Emerging Markets Equity Fund

PGIM Quant Solutions International Developed Markets Index Fund

FINANCIAL STATEMENTS AND OTHER INFORMATION

OCTOBER 31, 2024

| | | | |

Table of Contents | | Financial Statements and Other Information | | October 31, 2024 |

Form N-CSR Item 7 - Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Other Information - Form N-CSR Items 8-11

Glossary

The following abbreviations are used in the Funds’ descriptions:

USD—US Dollar

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

ADR—American Depositary Receipt

CDI—Chess Depository Interest

CVA—Certificate Van Aandelen (Bearer)

EAFE—Europe, Australasia, Far East

ETF—Exchange-Traded Fund

FTSE—Financial Times Stock Exchange

GDR—Global Depositary Receipt

MSC—Morgan Stanley & Co. LLC

MSCI—Morgan Stanley Capital International

OTC—Over-the-counter

PJSC—Public Joint-Stock Company

PRFC—Preference Shares

REITs—Real Estate Investment Trust

SOFR—Secured Overnight Financing Rate

STOXX—Stock Index of the Eurozone

TOPIX—Tokyo Stock Price Index

UTS—Unit Trust Security

XLON—London Stock Exchange

XSTU—Stuttgart Stock Exchange

1

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

LONG-TERM INVESTMENTS 92.9% | | | | | | | | |

| | |

COMMON STOCKS 89.6% | | | | | | | | |

| | |

Brazil 3.1% | | | | | | | | |

| | |

Ambev SA | | | 49,500 | | | $ | 107,890 | |

B3 SA - Brasil Bolsa Balcao | | | 27,600 | | | | 50,751 | |

Banco Bradesco SA | | | 8,801 | | | | 19,350 | |

Banco BTG Pactual SA, UTS | | | 3,600 | | | | 20,245 | |

Banco do Brasil SA | | | 56,800 | | | | 258,016 | |

Centrais Eletricas Brasileiras SA | | | 5,900 | | | | 38,660 | |

CPFL Energia SA | | | 21,400 | | | | 121,495 | |

Embraer SA* | | | 3,200 | | | | 26,864 | |

Engie Brasil Energia SA | | | 1,100 | | | | 7,897 | |

Klabin SA, UTS | | | 3,520 | | | | 12,781 | |

Pagseguro Digital Ltd. (Class A Stock)* | | | 1,800 | | | | 14,472 | |

Petroleo Brasileiro SA | | | 18,900 | | | | 127,343 | |

Vale SA | | | 29,932 | | | | 320,761 | |

WEG SA | | | 15,800 | | | | 148,628 | |

XP, Inc. (Class A Stock) | | | 2,600 | | | | 45,396 | |

| | | | | | | | |

| | |

| | | | | | | 1,320,549 | |

| | |

Chile 0.7% | | | | | | | | |

| | |

Banco de Chile | | | 720,850 | | | | 83,733 | |

Enel Americas SA | | | 304,339 | | | | 28,483 | |

Enel Chile SA | | | 2,735,263 | | | | 145,153 | |

Falabella SA* | | | 14,619 | | | | 52,361 | |

| | | | | | | | |

| | |

| | | | | | | 309,730 | |

| | |

China 24.6% | | | | | | | | |

| | |

Agricultural Bank of China Ltd. (Class H Stock) | | | 416,000 | | | | 204,400 | |

Alibaba Group Holding Ltd. | | | 72,700 | | | | 889,289 | |

Aluminum Corp. of China Ltd. (Class H Stock) | | | 112,000 | | | | 71,361 | |

Anhui Conch Cement Co. Ltd. (Class H Stock) | | | 6,500 | | | | 18,881 | |

ANTA Sports Products Ltd. | | | 14,600 | | | | 155,829 | |

Bank of China Ltd. (Class H Stock) | | | 330,000 | | | | 156,628 | |

Bank of Hangzhou Co. Ltd. (Class A Stock) | | | 35,600 | | | | 69,322 | |

Bank of Nanjing Co. Ltd. (Class A Stock) | | | 46,000 | | | | 66,274 | |

Bank of Shanghai Co. Ltd. (Class A Stock) | | | 59,100 | | | | 64,377 | |

Bosideng International Holdings Ltd. | | | 402,000 | | | | 225,420 | |

BYD Co. Ltd. (Class H Stock) | | | 3,000 | | | | 108,356 | |

Chifeng Jilong Gold Mining Co. Ltd. (Class A Stock) | | | 19,800 | | | | 52,362 | |

China Construction Bank Corp. (Class H Stock) | | | 413,000 | | | | 320,586 | |

China Feihe Ltd., 144A | | | 68,000 | | | | 51,323 | |

China Hongqiao Group Ltd. | | | 71,500 | | | | 114,879 | |

See Notes to Financial Statements.

2

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

China (cont’d.) | | | | | | | | |

| | |

China Life Insurance Co. Ltd. (Class H Stock) | | | 29,000 | | | $ | 61,473 | |

China Pacific Insurance Group Co. Ltd. (Class H Stock) | | | 91,000 | | | | 316,030 | |

China Resources Mixc Lifestyle Services Ltd., 144A | | | 13,200 | | | | 54,455 | |

China Resources Power Holdings Co. Ltd. | | | 20,000 | | | | 48,110 | |

China Taiping Insurance Holdings Co. Ltd. | | | 44,200 | | | | 76,132 | |

Chongqing Rural Commercial Bank Co. Ltd. (Class A Stock) | | | 82,000 | | | | 64,253 | |

CMOC Group Ltd. (Class H Stock) | | | 57,000 | | | | 47,183 | |

Contemporary Amperex Technology Co. Ltd. (Class A Stock) | | | 3,100 | | | | 107,503 | |

COSCO SHIPPING Holdings Co. Ltd. (Class H Stock) | | | 74,500 | | | | 110,330 | |

Dong-E-E-Jiao Co. Ltd. (Class A Stock) | | | 900 | | | | 7,448 | |

ENN Energy Holdings Ltd. | | | 2,400 | | | | 16,909 | |

Fuyao Glass Industry Group Co. Ltd. (Class H Stock), 144A | | | 3,200 | | | | 22,635 | |

Geely Automobile Holdings Ltd. | | | 31,000 | | | | 54,495 | |

Goneo Group Co. Ltd. (Class A Stock) | | | 1,330 | | | | 13,616 | |

Gree Electric Appliances, Inc. of Zhuhai (Class A Stock) | | | 9,200 | | | | 56,241 | |

Haier Smart Home Co. Ltd. (Class H Stock) | | | 12,600 | | | | 45,728 | |

Haitian International Holdings Ltd. | | | 3,000 | | | | 8,298 | |

Hangzhou Great Star Industrial Co. Ltd. (Class A Stock) | | | 7,300 | | | | 29,376 | |

Henan Shenhuo Coal Industry & Electricity Power Co. Ltd. (Class A Stock) | | | 4,500 | | | | 11,290 | |

Hisense Home Appliances Group Co. Ltd. (Class H Stock) | | | 6,000 | | | | 19,010 | |

Huaxia Bank Co. Ltd. (Class A Stock) | | | 59,800 | | | | 59,383 | |

Hubei Jumpcan Pharmaceutical Co. Ltd. (Class A Stock) | | | 5,627 | | | | 23,864 | |

Industrial Bank Co. Ltd. (Class A Stock) | | | 30,500 | | | | 78,337 | |

Inner Mongolia Yuan Xing Energy Co. Ltd. (Class A Stock) | | | 8,800 | | | | 8,346 | |

JD.com, Inc., ADR | | | 11,600 | | | | 471,192 | |

Jiangxi Copper Co. Ltd. (Class H Stock) | | | 15,000 | | | | 25,232 | |

Jinduicheng Molybdenum Co. Ltd. (Class A Stock) | | | 41,100 | | | | 61,916 | |

KE Holdings, Inc., ADR | | | 2,300 | | | | 50,439 | |

Kingsoft Corp. Ltd. | | | 5,000 | | | | 17,231 | |

Kuaishou Technology, 144A* | | | 28,900 | | | | 170,308 | |

Kweichow Moutai Co. Ltd. (Class A Stock) | | | 100 | | | | 21,460 | |

Meihua Holdings Group Co. Ltd. (Class A Stock) | | | 41,000 | | | | 54,520 | |

Meituan (Class B Stock), 144A* | | | 32,760 | | | | 774,131 | |

Midea Group Co. Ltd. (Class A Stock) | | | 6,400 | | | | 64,103 | |

NetEase, Inc. | | | 600 | | | | 9,653 | |

NetEase, Inc., ADR(a) | | | 2,300 | | | | 185,173 | |

New China Life Insurance Co. Ltd. (Class H Stock) | | | 3,000 | | | | 10,124 | |

Ningbo Deye Technology Co. Ltd. (Class A Stock) | | | 700 | | | | 9,311 | |

Ningbo Sanxing Medical Electric Co. Ltd. (Class A Stock) | | | 4,100 | | | | 17,809 | |

PDD Holdings, Inc., ADR* | | | 2,700 | | | | 325,593 | |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 3

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

China (cont’d.) | | | | | | | | |

| | |

People’s Insurance Co. Group of China Ltd. (The) (Class H Stock) | | | 332,000 | | | $ | 167,579 | |

Ping An Bank Co. Ltd. (Class A Stock) | | | 39,300 | | | | 62,885 | |

Ping An Insurance Group Co. of China Ltd. (Class H Stock) | | | 53,500 | | | | 331,474 | |

Pop Mart International Group Ltd., 144A | | | 29,600 | | | | 267,610 | |

Qifu Technology, Inc., ADR | | | 1,500 | | | | 49,215 | |

Satellite Chemical Co. Ltd. (Class A Stock) | | | 5,400 | | | | 14,340 | |

Shandong Himile Mechanical Science & Technology Co. Ltd. (Class A Stock) | | | 10,200 | | | | 65,150 | |

Shandong Nanshan Aluminum Co. Ltd. (Class A Stock) | | | 45,500 | | | | 26,041 | |

Shanghai Pudong Development Bank Co. Ltd. (Class A Stock) | | | 55,000 | | | | 76,141 | |

Shanjin International Gold Co. Ltd. (Class A Stock) | | | 16,200 | | | | 40,790 | |

Shenzhou International Group Holdings Ltd. | | | 3,500 | | | | 27,027 | |

Sinopharm Group Co. Ltd. (Class H Stock) | | | 3,600 | | | | 8,969 | |

Sinotruk Hong Kong Ltd. | | | 14,500 | | | | 39,137 | |

Sungrow Power Supply Co. Ltd. (Class A Stock) | | | 4,120 | | | | 52,468 | |

Suzhou TFC Optical Communication Co. Ltd. (Class A Stock) | | | 2,200 | | | | 39,208 | |

Tencent Holdings Ltd. | | | 38,000 | | | | 1,981,401 | |

Tencent Music Entertainment Group, ADR | | | 4,100 | | | | 45,633 | |

Tianshan Aluminum Group Co. Ltd. (Class A Stock) | | | 35,400 | | | | 41,108 | |

Trip.com Group Ltd.* | | | 4,150 | | | | 267,071 | |

Want Want China Holdings Ltd. | | | 61,000 | | | | 37,958 | |

Weichai Power Co. Ltd. (Class H Stock) | | | 74,000 | | | | 111,819 | |

Western Mining Co. Ltd. (Class A Stock) | | | 23,800 | | | | 58,777 | |

Xiaomi Corp. (Class B Stock), 144A* | | | 77,000 | | | | 264,102 | |

Yunnan Aluminium Co. Ltd. (Class A Stock) | | | 18,300 | | | | 36,467 | |

Yunnan Yuntianhua Co. Ltd. (Class A Stock) | | | 19,400 | | | | 62,732 | |

Yutong Bus Co. Ltd. (Class A Stock) | | | 17,200 | | | | 58,531 | |

Zhejiang Century Huatong Group Co. Ltd. (Class A Stock)* | | | 64,800 | | | | 42,983 | |

Zhejiang China Commodities City Group Co. Ltd. (Class A Stock) | | | 7,500 | | | | 11,245 | |

Zhuzhou CRRC Times Electric Co. Ltd. (Class H Stock) | | | 2,500 | | | | 9,594 | |

Zijin Mining Group Co. Ltd. (Class H Stock) | | | 22,000 | | | | 46,862 | |

| | | | | | | | |

| | |

| | | | | | | 10,522,244 | |

| | |

Colombia 0.0% | | | | | | | | |

| | |

Bancolombia SA | | | 1,330 | | | | 11,451 | |

| | |

Greece 0.2% | | | | | | | | |

| | |

Eurobank Ergasias Services & Holdings SA | | | 8,675 | | | | 17,950 | |

See Notes to Financial Statements.

4

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Greece (cont’d.) | | | | | | | | |

| | |

National Bank of Greece SA | | | 3,770 | | | $ | 29,537 | |

Piraeus Financial Holdings SA | | | 5,518 | | | | 20,791 | |

| | | | | | | | |

| | |

| | | | | | | 68,278 | |

| | |

India 15.5% | | | | | | | | |

| | |

ABB India Ltd. | | | 2,573 | | | | 226,629 | |

Aditya Birla Sun Life Asset Management Co. Ltd. | | | 3,485 | | | | 32,812 | |

Aurobindo Pharma Ltd. | | | 11,425 | | | | 189,382 | |

Bajaj Auto Ltd. | | | 878 | | | | 102,545 | |

Bharat Electronics Ltd. | | | 29,583 | | | | 99,860 | |

Bharat Petroleum Corp. Ltd. | | | 20,474 | | | | 75,525 | |

Canara Bank | | | 16,650 | | | | 20,231 | |

Cipla Ltd. | | | 15,062 | | | | 277,092 | |

Coal India Ltd. | | | 45,554 | | | | 244,350 | |

Colgate-Palmolive India Ltd. | | | 3,104 | | | | 112,894 | |

Cummins India Ltd. | | | 3,820 | | | | 158,454 | |

DLF Ltd. | | | 3,876 | | | | 37,677 | |

Dr. Reddy’s Laboratories Ltd. | | | 15,005 | | | | 226,962 | |

GAIL India Ltd. | | | 9,144 | | | | 21,666 | |

HCL Technologies Ltd. | | | 15,705 | | | | 328,621 | |

HDFC Asset Management Co. Ltd., 144A | | | 5,180 | | | | 264,343 | |

HDFC Bank Ltd. | | | 7,486 | | | | 153,873 | |

Hindalco Industries Ltd. | | | 24,459 | | | | 198,470 | |

Hindustan Aeronautics Ltd. | | | 4,625 | | | | 232,739 | |

ICICI Bank Ltd. | | | 10,606 | | | | 162,691 | |

Indraprastha Gas Ltd. | | | 1,764 | | | | 8,796 | |

Indus Towers Ltd.* | | | 5,798 | | | | 23,395 | |

Infosys Ltd. | | | 8,890 | | | | 185,487 | |

Infosys Ltd., ADR | | | 18,900 | | | | 395,199 | |

InterGlobe Aviation Ltd., 144A* | | | 1,271 | | | | 61,058 | |

LTIMindtree Ltd., 144A | | | 1,270 | | | | 85,939 | |

Lupin Ltd. | | | 3,901 | | | | 101,218 | |

Mahindra & Mahindra Ltd. | | | 1,075 | | | | 34,714 | |

Mankind Pharma Ltd.* | | | 2,524 | | | | 79,872 | |

Maruti Suzuki India Ltd. | | | 1,925 | | | | 252,661 | |

Muthoot Finance Ltd. | | | 8,463 | | | | 193,766 | |

NMDC Ltd. | | | 18,256 | | | | 47,944 | |

Oil & Natural Gas Corp. Ltd. | | | 22,692 | | | | 71,564 | |

Persistent Systems Ltd. | | | 1,107 | | | | 70,484 | |

Power Finance Corp. Ltd. | | | 8,572 | | | | 46,051 | |

Reliance Industries Ltd. | | | 14,466 | | | | 228,736 | |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 5

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

India (cont’d.) | | | | | | | | |

| | |

Samvardhana Motherson International Ltd. | | | 18,976 | | | $ | 40,658 | |

Sun Pharmaceutical Industries Ltd. | | | 14,050 | | | | 308,331 | |

Suzlon Energy Ltd.* | | | 10,274 | | | | 8,147 | |

Tata Consultancy Services Ltd. | | | 984 | | | | 46,285 | |

Tata Motors Ltd. | | | 13,756 | | | | 136,061 | |

Tech Mahindra Ltd. | | | 3,072 | | | | 58,473 | |

Torrent Pharmaceuticals Ltd. | | | 1,474 | | | | 56,028 | |

Trent Ltd. | | | 4,039 | | | | 341,307 | |

UTI Asset Management Co. Ltd. | | | 2,254 | | | | 35,650 | |

Vedanta Ltd. | | | 43,582 | | | | 239,905 | |

Wipro Ltd. | | | 32,122 | | | | 209,095 | |

Zydus Lifesciences Ltd. | | | 6,277 | | | | 74,558 | |

| | | | | | | | |

| | |

| | | | | | | 6,608,198 | |

| | |

Indonesia 1.9% | | | | | | | | |

| | |

Adaro Energy Indonesia Tbk PT | | | 1,197,500 | | | | 275,621 | |

Astra International Tbk PT | | | 238,800 | | | | 77,526 | |

Bank Central Asia Tbk PT | | | 151,800 | | | | 99,137 | |

Bank Mandiri Persero Tbk PT | | | 230,500 | | | | 97,851 | |

Indofood Sukses Makmur Tbk PT | | | 420,900 | | | | 203,644 | |

United Tractors Tbk PT | | | 21,200 | | | | 37,005 | |

| | | | | | | | |

| | |

| | | | | | | 790,784 | |

| | |

Kuwait 0.0% | | | | | | | | |

| | |

Mobile Telecommunications Co. KSCP | | | 13,175 | | | | 19,600 | |

| | |

Luxembourg 0.3% | | | | | | | | |

| | |

Reinet Investments SCA | | | 4,408 | | | | 122,963 | |

| | |

Malaysia 1.2% | | | | | | | | |

| | |

AMMB Holdings Bhd | | | 84,000 | | | | 97,519 | |

CIMB Group Holdings Bhd | | | 57,800 | | | | 104,810 | |

Hong Leong Bank Bhd | | | 8,100 | | | | 37,789 | |

IHH Healthcare Bhd | | | 5,600 | | | | 9,268 | |

Malayan Banking Bhd | | | 47,400 | | | | 113,514 | |

Telekom Malaysia Bhd | | | 33,100 | | | | 49,004 | |

YTL Corp. Bhd | | | 13,000 | | | | 5,811 | |

YTL Power International Bhd | | | 141,600 | | | | 98,632 | |

| | | | | | | | |

| | |

| | | | | | | 516,347 | |

See Notes to Financial Statements.

6

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Mexico 1.3% | | | | | | | | |

| | |

America Movil SAB de CV (Class B Stock) | | | 9,900 | | | $ | 7,832 | |

Banco del Bajio SA, 144A | | | 86,000 | | | | 190,700 | |

Grupo Financiero Banorte SAB de CV (Class O Stock) | | | 9,700 | | | | 67,698 | |

Grupo Financiero Inbursa SAB de CV (Class O Stock)* | | | 8,100 | | | | 18,006 | |

Grupo Mexico SAB de CV (Class B Stock) | | | 19,900 | | | | 104,416 | |

Prologis Property Mexico SA de CV, REIT | | | 39,600 | | | | 132,597 | |

Promotora y Operadora de Infraestructura SAB de CV | | | 3,920 | | | | 34,154 | |

| | | | | | | | |

| | |

| | | | | | | 555,403 | |

| | |

Philippines 0.4% | | | | | | | | |

| | |

Converge Information & Communications Technology Solutions, Inc. | | | 65,000 | | | | 17,949 | |

International Container Terminal Services, Inc. | | | 9,930 | | | | 67,482 | |

Manila Electric Co. | | | 3,340 | | | | 28,164 | |

PLDT, Inc. | | | 2,220 | | | | 54,558 | |

| | | | | | | | |

| | |

| | | | | | | 168,153 | |

| | |

Poland 1.2% | | | | | | | | |

| | |

Alior Bank SA | | | 348 | | | | 7,605 | |

Bank Polska Kasa Opieki SA | | | 5,038 | | | | 176,261 | |

Budimex SA | | | 64 | | | | 8,004 | |

Powszechna Kasa Oszczednosci Bank Polski SA | | | 5,368 | | | | 74,584 | |

Powszechny Zaklad Ubezpieczen SA | | | 6,365 | | | | 63,123 | |

Santander Bank Polska SA | | | 1,433 | | | | 160,694 | |

| | | | | | | | |

| | |

| | | | | | | 490,271 | |

| | |

Qatar 0.9% | | | | | | | | |

| | |

Ooredoo QPSC | | | 94,126 | | | | 295,411 | |

Qatar National Bank QPSC | | | 10,956 | | | | 52,146 | |

Vodafone Qatar QSC | | | 36,648 | | | | 18,722 | |

| | | | | | | | |

| | |

| | | | | | | 366,279 | |

| | |

Russia 0.0% | | | | | | | | |

| | |

Inter RAO UES PJSC^ | | | 202,400 | | | | — | |

LUKOIL PJSC^ | | | 2,762 | | | | — | |

Magnit PJSC^ | | | 1,716 | | | | — | |

PhosAgro PJSC^ | | | 232 | | | | — | |

PhosAgro PJSC, GDR (XSTU)*^ | | | 4 | | | | — | |

PhosAgro PJSC, GDR (XLON)*^ | | | 2 | | | | — | |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 7

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Russia (cont’d.) | | | | | | | | |

| | |

Rosneft Oil Co. PJSC^ | | | 5,856 | | | $ | — | |

Sberbank of Russia PJSC^ | | | 55,364 | | | | — | |

Surgutneftegas PJSC^ | | | 38,400 | | | | — | |

| | | | | | | | |

| | |

| | | | | | | — | |

| | |

Saudi Arabia 2.2% | | | | | | | | |

| | |

Al Rajhi Bank | | | 7,456 | | | | 174,214 | |

Almarai Co. JSC | | | 1,324 | | | | 19,387 | |

Dr. Sulaiman Al Habib Medical Services Group Co. | | | 451 | | | | 34,355 | |

Etihad Etisalat Co. | | | 17,581 | | | | 242,065 | |

Jamjoom Pharmaceuticals Factory Co. | | | 196 | | | | 8,824 | |

Jarir Marketing Co. | | | 10,032 | | | | 35,273 | |

Nahdi Medical Co. | | | 3,970 | | | | 130,294 | |

Riyad Bank | | | 5,148 | | | | 35,188 | |

SAL Saudi Logistics Services | | | 810 | | | | 59,340 | |

Saudi Awwal Bank | | | 6,734 | | | | 60,615 | |

Saudi Telecom Co. | | | 14,196 | | | | 159,325 | |

| | | | | | | | |

| | |

| | | | | | | 958,880 | |

| | |

South Africa 2.1% | | | | | | | | |

| | |

Absa Group Ltd. | | | 883 | | | | 8,462 | |

FirstRand Ltd. | | | 3,285 | | | | 14,433 | |

Harmony Gold Mining Co. Ltd. | | | 27,972 | | | | 303,479 | |

Kumba Iron Ore Ltd. | | | 3,546 | | | | 67,153 | |

Naspers Ltd. (Class N Stock) | | | 96 | | | | 22,689 | |

Nedbank Group Ltd. | | | 16,725 | | | | 283,480 | |

Old Mutual Ltd. | | | 27,166 | | | | 18,753 | |

Standard Bank Group Ltd. | | | 11,533 | | | | 158,781 | |

| | | | | | | | |

| | |

| | | | | | | 877,230 | |

| | |

South Korea 10.4% | | | | | | | | |

| | |

BNK Financial Group, Inc. | | | 1,751 | | | | 11,940 | |

CJ CheilJedang Corp. | | | 254 | | | | 50,256 | |

Coway Co. Ltd. | | | 272 | | | | 12,427 | |

DB Insurance Co. Ltd. | | | 869 | | | | 68,494 | |

Hana Financial Group, Inc. | | | 4,079 | | | | 175,986 | |

Hankook Tire & Technology Co. Ltd. | | | 7,920 | | | | 201,711 | |

Hanmi Semiconductor Co. Ltd. | | | 272 | | | | 17,696 | |

HD Hyundai Electric Co. Ltd. | | | 276 | | | | 64,599 | |

See Notes to Financial Statements.

8

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

South Korea (cont’d.) | | | | | | | | |

| | |

HD Hyundai Heavy Industries Co. Ltd.* | | | 96 | | | $ | 12,641 | |

HD Korea Shipbuilding & Offshore Engineering Co. Ltd.* | | | 470 | | | | 62,186 | |

Hyundai Glovis Co. Ltd. | | | 2,486 | | | | 218,724 | |

Hyundai Mobis Co. Ltd. | | | 358 | | | | 64,344 | |

JB Financial Group Co. Ltd. | | | 1,675 | | | | 21,730 | |

KB Financial Group, Inc. | | | 5,804 | | | | 377,659 | |

Kia Corp. | | | 4,304 | | | | 284,619 | |

Korea Electric Power Corp.* | | | 7,296 | | | | 121,979 | |

Korea Investment Holdings Co. Ltd. | | | 548 | | | | 30,413 | |

Krafton, Inc.* | | | 150 | | | | 35,861 | |

KT Corp. | | | 3,221 | | | | 102,702 | |

KT&G Corp. | | | 3,757 | | | | 298,434 | |

NH Investment & Securities Co. Ltd. | | | 832 | | | | 8,012 | |

Orion Corp. | | | 369 | | | | 26,594 | |

Samsung Electronics Co. Ltd. | | | 18,448 | | | | 783,320 | |

Samsung Life Insurance Co. Ltd. | | | 2,842 | | | | 207,962 | |

Samsung Securities Co. Ltd. | | | 5,450 | | | | 179,846 | |

Shinhan Financial Group Co. Ltd. | | | 7,888 | | | | 293,830 | |

SK Hynix, Inc. | | | 3,878 | | | | 507,684 | |

SK Telecom Co. Ltd. | | | 2,725 | | | | 111,832 | |

Woori Financial Group, Inc. | | | 6,955 | | | | 77,430 | |

| | | | | | | | |

| | |

| | | | | | | 4,430,911 | |

| | |

Taiwan 16.9% | | | | | | | | |

| | |

Accton Technology Corp. | | | 2,000 | | | | 33,607 | |

Asia Vital Components Co. Ltd. | | | 4,000 | | | | 76,627 | |

Asustek Computer, Inc. | | | 13,000 | | | | 229,553 | |

Catcher Technology Co. Ltd. | | | 4,000 | | | | 29,113 | |

Cathay Financial Holding Co. Ltd. | | | 26,000 | | | | 54,911 | |

China Airlines Ltd. | | | 15,000 | | | | 10,461 | |

Compal Electronics, Inc. | | | 21,000 | | | | 23,053 | |

Delta Electronics, Inc. | | | 17,000 | | | | 209,965 | |

Eva Airways Corp. | | | 240,000 | | | | 277,176 | |

Evergreen Marine Corp. Taiwan Ltd. | | | 24,000 | | | | 152,067 | |

Far Eastern New Century Corp. | | | 15,000 | | | | 17,309 | |

Hon Hai Precision Industry Co. Ltd. | | | 89,000 | | | | 570,465 | |

MediaTek, Inc. | | | 11,000 | | | | 428,210 | |

Nien Made Enterprise Co. Ltd. | | | 3,000 | | | | 44,704 | |

Pegatron Corp. | | | 18,000 | | | | 54,579 | |

President Chain Store Corp. | | | 11,000 | | | | 101,000 | |

Quanta Computer, Inc. | | | 42,000 | | | | 381,416 | |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 9

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Taiwan (cont’d.) | | | | | | | | |

| | |

Realtek Semiconductor Corp. | | | 13,000 | | | $ | 190,742 | |

Synnex Technology International Corp. | | | 4,000 | | | | 8,786 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 130,000 | | | | 4,076,733 | |

United Microelectronics Corp. | | | 82,000 | | | | 118,305 | |

Yang Ming Marine Transport Corp. | | | 20,000 | | | | 41,060 | |

Yuanta Financial Holding Co. Ltd. | | | 107,460 | | | | 107,779 | |

| | | | | | | | |

| | |

| | | | | | | 7,237,621 | |

| | |

Thailand 2.3% | | | | | | | | |

| | |

Bangkok Dusit Medical Services PCL | | | 58,400 | | | | 47,604 | |

Bumrungrad Hospital PCL | | | 30,500 | | | | 246,154 | |

Central Pattana PCL | | | 103,800 | | | | 193,120 | |

CP ALL PCL | | | 31,200 | | | | 58,481 | |

Intouch Holdings PCL | | | 12,600 | | | | 39,949 | |

Kasikornbank PCL | | | 59,500 | | | | 257,885 | |

Krung Thai Bank PCL | | | 18,000 | | | | 10,933 | |

PTT PCL | | | 32,000 | | | | 31,791 | |

TMBThanachart Bank PCL | | | 1,957,200 | | | | 103,268 | |

| | | | | | | | |

| | |

| | | | | | | 989,185 | |

| | |

Turkey 1.1% | | | | | | | | |

| | |

Anadolu Efes Biracilik Ve Malt Sanayii A/S | | | 14,858 | | | | 83,026 | |

BIM Birlesik Magazalar A/S | | | 6,114 | | | | 83,424 | |

Coca-Cola Icecek A/S | | | 116,591 | | | | 173,194 | |

Turk Hava Yollari AO* | | | 13,028 | | | | 103,618 | |

Turkcell Iletisim Hizmetleri A/S | | | 9,570 | | | | 23,663 | |

Turkiye Is Bankasi A/S (Class C Stock) | | | 1 | | | | — | |

Turkiye Petrol Rafinerileri A/S | | | 5,264 | | | | 22,243 | |

| | | | | | | | |

| | |

| | | | | | | 489,168 | |

| | |

United Arab Emirates 2.9% | | | | | | | | |

| | |

Abu Dhabi Islamic Bank PJSC | | | 82,848 | | | | 283,976 | |

Abu Dhabi National Oil Co. for Distribution PJSC | | | 30,927 | | | | 30,352 | |

Aldar Properties PJSC | | | 78,263 | | | | 162,224 | |

Dubai Islamic Bank PJSC | | | 10,397 | | | | 17,667 | |

Emaar Properties PJSC | | | 140,884 | | | | 333,098 | |

Emirates NBD Bank PJSC | | | 60,638 | | | | 313,424 | |

First Abu Dhabi Bank PJSC | | | 22,601 | | | | 80,769 | |

| | | | | | | | |

| | |

| | | | | | | 1,221,510 | |

See Notes to Financial Statements.

10

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

United Kingdom 0.1% | | | | | | | | |

| | |

Anglogold Ashanti PLC | | | 2,025 | | | $ | 56,496 | |

| | |

United States 0.3% | | | | | | | | |

| | |

JBS SA | | | 21,400 | | | | 133,933 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS | | | | | | | | |

(cost $30,203,445) | | | | | | | 38,265,184 | |

| | | | | | | | |

| | |

PREFERRED STOCKS 3.0% | | | | | | | | |

| | |

Brazil 2.6% | | | | | | | | |

| | |

Banco ABC Brasil SA (PRFC) | | | 3,700 | | | | 13,447 | |

Cia Energetica de Minas Gerais (PRFC) | | | 85,537 | | | | 167,940 | |

Gerdau SA (PRFC) | | | 65,694 | | | | 207,506 | |

Itau Unibanco Holding SA (PRFC) | | | 59,300 | | | | 360,566 | |

Metalurgica Gerdau SA (PRFC) | | | 6,400 | | | | 11,370 | |

Petroleo Brasileiro SA (PRFC) | | | 57,300 | | | | 355,245 | |

| | | | | | | | |

| | |

| | | | | | | 1,116,074 | |

| | |

Russia 0.0% | | | | | | | | |

| | |

Surgutneftegas PJSC (PRFC)^ | | | 38,200 | | | | — | |

| | |

South Korea 0.4% | | | | | | | | |

| | |

Hyundai Motor Co. (2nd PRFC) | | | 200 | | | | 23,107 | |

Hyundai Motor Co. (PRFC) | | | 128 | | | | 14,455 | |

Samsung Electronics Co. Ltd. (PRFC) | | | 4,194 | | | | 144,275 | |

| | | | | | | | |

| | |

| | | | | | | 181,837 | |

| | | | | | | | |

| | |

TOTAL PREFERRED STOCKS | | | | | | | | |

(cost $1,178,883) | | | | | | | 1,297,911 | |

| | | | | | | | |

| | |

UNAFFILIATED EXCHANGE-TRADED FUND 0.3% | | | | | | | | |

| | |

United States | | | | | | | | |

| | |

iShares MSCI Emerging Markets ETF(a)

(cost $127,748) | | | 3,000 | | | | 133,350 | |

| | | | | | | | |

| | |

TOTAL LONG-TERM INVESTMENTS | | | | | | | | |

(cost $31,510,076) | | | | | | | 39,696,445 | |

| | | | | | | | |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 11

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

SHORT-TERM INVESTMENTS 7.7% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUNDS 7.5% | | | | | | | | |

PGIM Core Government Money Market Fund (7-day effective yield 5.011%)(wb) | | | 2,900,286 | | | $ | 2,900,286 | |

PGIM Institutional Money Market Fund (7-day effective yield 5.096%) (cost $302,980; includes $301,281 of cash collateral for securities on loan)(b)(wb) | | | 303,132 | | | | 302,980 | |

| | | | | | | | |

| | |

TOTAL AFFILIATED MUTUAL FUNDS | | | | | | | | |

(cost $3,203,266) | | | | | | | 3,203,266 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000)# | | | | |

| | | | |

U.S. TREASURY OBLIGATION(k)(n) 0.2% | | | | | | | | | | | | | | | | |

U.S. Treasury Bills | | | | | | | | | | | | | | | | |

(cost $69,558) | | | 4.799% | | | | 12/19/24 | | | | 70 | | | | 69,576 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | | | | | |

(cost $3,272,824) | | | | | | | | | | | | | | | 3,272,842 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL INVESTMENTS 100.6% | | | | | | | | | | | | | | | | |

(cost $34,782,900) | | | | | | | | | | | | | | | 42,969,287 | |

Liabilities in excess of other assets(z) (0.6)% | | | | | | | | | | | | | | | (237,088 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

NET ASSETS 100.0% | | | | | | | | | | | | | | $ | 42,732,199 | |

| | | | | | | | | | | | | | | | |

See the Glossary for a list of the abbreviation(s) used in the annual report.

| * | Non-income producing security. |

| # | Principal amount is shown in U.S. dollars unless otherwise stated. |

| ^ | Indicates a Level 3 instrument. The aggregate value of Level 3 instruments is $0 and 0.0% of net assets. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $293,531; cash collateral of $301,281 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the Fund may reflect a collateral value that is less than the market value of the loaned securities and such shortfall is remedied the following business day. |

| (b) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (k) | Represents security, or a portion thereof, segregated as collateral for centrally cleared/exchange-traded derivatives. |

| (n) | Rate shown reflects yield to maturity at purchased date. |

| (wb) | Represents an investment in a Fund affiliated with the Manager. |

| (z) | Includes net unrealized appreciation/(depreciation) and/or market value of the below holdings which are excluded from the Schedule of Investments: |

See Notes to Financial Statements.

12

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

Futures contracts outstanding at October 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | |

Number

of

Contracts | | Type | | Expiration

Date | | | Current

Notional

Amount | | | Value /

Unrealized

Appreciation

(Depreciation) | |

Long Position: | | | | | | | | | | | | | | | | | | | | |

53 | | Mini MSCI Emerging Markets Index | | | Dec. 2024 | | | $ | 2,985,225 | | | | | | | $ | 20,289 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Summary of Collateral for Centrally Cleared/Exchange-traded Derivatives:

Cash and securities segregated as collateral, including pending settlement for closed positions, to cover requirements for centrally cleared/exchange-traded derivatives are listed by broker as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Broker | | Cash and/or Foreign Currency | | | Securities Market Value | |

MSC | | | | | | $ | — | | | | | | | | | | | $ | 69,576 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2024 in valuing such portfolio securities:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | | |

Long-Term Investments | | | | | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | | | | | |

Brazil | | $ | 1,320,549 | | | $ | — | | | | | | | $ | — | | | | | |

Chile | | | 145,153 | | | | 164,577 | | | | | | | | — | | | | | |

China | | | 1,127,245 | | | | 9,394,999 | | | | | | | | — | | | | | |

Colombia | | | 11,451 | | | | — | | | | | | | | — | | | | | |

Greece | | | — | | | | 68,278 | | | | | | | | — | | | | | |

India | | | 395,199 | | | | 6,212,999 | | | | | | | | — | | | | | |

Indonesia | | | 99,137 | | | | 691,647 | | | | | | | | — | | | | | |

Kuwait | | | — | | | | 19,600 | | | | | | | | — | | | | | |

Luxembourg | | | — | | | | 122,963 | | | | | | | | — | | | | | |

Malaysia | | | — | | | | 516,347 | | | | | | | | — | | | | | |

Mexico | | | 555,403 | | | | — | | | | | | | | — | | | | | |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 13

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities (continued) | | | | | | | | | | | | | | | | | | | | |

Assets (continued) | | | | | | | | | | | | | | | | | | | | |

Long-Term Investments (continued) | | | | | | | | | | | | | | | | | | | | |

Common Stocks (continued) | | | | | | | | | | | | | | | | | | | | |

Philippines | | $ | 28,164 | | | $ | 139,989 | | | | | | | $ | — | | | | | |

Poland | | | — | | | | 490,271 | | | | | | | | — | | | | | |

Qatar | | | 18,722 | | | | 347,557 | | | | | | | | — | | | | | |

Russia | | | — | | | | — | | | | | | | | — | ** | | | | |

Saudi Arabia | | | — | | | | 958,880 | | | | | | | | — | | | | | |

South Africa | | | — | | | | 877,230 | | | | | | | | — | | | | | |

South Korea | | | — | | | | 4,430,911 | | | | | | | | — | | | | | |

Taiwan | | | — | | | | 7,237,621 | | | | | | | | — | | | | | |

Thailand | | | — | | | | 989,185 | | | | | | | | — | | | | | |

Turkey | | | 173,194 | | | | 315,974 | | | | | | | | — | | | | | |

United Arab Emirates | | | — | | | | 1,221,510 | | | | | | | | — | | | | | |

United Kingdom | | | — | | | | 56,496 | | | | | | | | — | | | | | |

United States | | | 133,933 | | | | — | | | | | | | | — | | | | | |

Preferred Stocks | | | | | | | | | | | | | | | | | | | | |

Brazil | | | 1,116,074 | | | | — | | | | | | | | — | | | | | |

Russia | | | — | | | | — | | | | | | | | — | ** | | | | |

South Korea | | | — | | | | 181,837 | | | | | | | | — | | | | | |

Unaffiliated Exchange-Traded Fund | | | | | | | | | | | | | | | | | | | | |

United States | | | 133,350 | | | | — | | | | | | | | — | | | | | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | |

Affiliated Mutual Funds | | | 3,203,266 | | | | — | | | | | | | | — | | | | | |

U.S. Treasury Obligation | | | — | | | | 69,576 | | | | | | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total | | $ | 8,460,840 | | | $ | 34,508,447 | | | | | | | $ | — | ** | | | | |

| | | | | | | | | | | | |

| | | | | |

Other Financial Instruments* | | | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | 20,289 | | | $ | — | | | | | | | $ | — | | | | | |

| | | | | | | | | | | | |

| * | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and centrally cleared swap contracts, which are recorded at unrealized appreciation (depreciation) on the instrument, and OTC swap contracts which are recorded at fair value. |

| ** | Includes Level 3 investments with an aggregate value of $0. |

Industry Classification:

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2024 were as follows:

| | | | |

Banks | | | 15.1 | % |

Semiconductors & Semiconductor Equipment | | | 12.5 | |

See Notes to Financial Statements.

14

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

Industry Classification (continued):

| | | | |

Affiliated Mutual Funds (0.7% represents investments purchased with collateral from securities on loan) | | | 7.5 | % |

Metals & Mining | | | 5.1 | |

Interactive Media & Services | | | 5.0 | |

Technology Hardware, Storage & Peripherals | | | 4.6 | |

Broadline Retail | | | 4.2 | |

Oil, Gas & Consumable Fuels | | | 3.4 | |

IT Services | | | 3.2 | |

Insurance | | | 3.2 | |

Pharmaceuticals | | | 3.2 | |

Hotels, Restaurants & Leisure | | | 2.4 | |

Automobiles | | | 2.4 | |

Real Estate Management & Development | | | 2.0 | |

Capital Markets | | | 1.9 | |

Electronic Equipment, Instruments & Components | | | 1.9 | |

Specialty Retail | | | 1.6 | |

Electric Utilities | | | 1.5 | |

Diversified Telecommunication Services | | | 1.5 | |

Electrical Equipment | | | 1.5 | |

Machinery | | | 1.3 | |

Food Products | | | 1.2 | |

Wireless Telecommunication Services | | | 1.2 | |

Passenger Airlines | | | 1.1 | |

Textiles, Apparel & Luxury Goods | | | 1.0 | |

Beverages | | | 0.9 | |

Consumer Staples Distribution & Retail | | | 0.9 | |

Aerospace & Defense | | | 0.8 | |

Health Care Providers & Services | | | 0.8 | |

Entertainment | | | 0.8 | |

Automobile Components | | | 0.8 | |

Marine Transportation | | | 0.7 | |

Tobacco | | | 0.7 | |

Air Freight & Logistics | | | 0.7 | |

Household Durables | | | 0.6 | |

Consumer Finance | | | 0.6 | |

Financial Services | | | 0.4 | |

Chemicals | | | 0.3 | |

Unaffiliated Exchange-Traded Fund | | | 0.3 | |

Industrial REITs | | | 0.3 | |

Personal Care Products | | | 0.3 | |

Multi-Utilities | | | 0.2 | |

Transportation Infrastructure | | | 0.2 | |

| | | | |

Industrial Conglomerates | | | 0.2 | % |

Communications Equipment | | | 0.2 | |

U.S. Treasury Obligation | | | 0.2 | |

Independent Power & Renewable Electricity Producers | | | 0.1 | |

Gas Utilities | | | 0.1 | |

Construction Materials | | | 0.0 | * |

Containers & Packaging | | | 0.0 | * |

Construction & Engineering | | | 0.0 | * |

| | | | |

| |

| | | 100.6 | |

Liabilities in excess of other assets | | | (0.6 | ) |

| | | | |

| |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 15

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

Effects of Derivative Instruments on the Financial Statements and Primary Underlying Risk Exposure:

The Fund invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity risk. See the Notes to Financial Statements for additional detail regarding these derivative instruments and their risks. The effect of such derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

Fair values of derivative instruments as of October 31, 2024 as presented in the Statement of Assets and Liabilities:

| | | | | | | | | | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Statement of Assets and Liabilities Location | | Fair

Value | | | Statement of Assets and Liabilities Location | | Fair

Value | |

Equity contracts | | Due from/to broker-variation margin futures | | $ | 20,289 | * | | — | | | | | | $ | — | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| * | Includes cumulative appreciation (depreciation) as reported in the schedule of open futures and centrally cleared swap contracts. Only unsettled variation margin receivable (payable) is reported within the Statement of Assets and Liabilities. |

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2024 are as follows:

| | | | |

Amount of Realized Gain (Loss) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Futures | |

Equity contracts | | $ | 102,205 | |

| | | | |

| | | | |

Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Futures | |

Equity contracts | | $ | 83,233 | |

| | | | |

For the year ended October 31, 2024, the Fund’s average volume of derivative activities is as follows:

| | |

| Derivative Contract Type | | Average Volume of Derivative Activities* |

Futures Contracts - Long Positions (1) | | $1,474,700 |

| * | Average volume is based on average quarter end balances for the year ended October 31, 2024. |

| (1) | Notional Amount in USD. |

See Notes to Financial Statements.

16

PGIM Quant Solutions Emerging Markets Equity Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | |

| Description | | Gross Market

Value of

Recognized

Assets/(Liabilities) | | Collateral

Pledged/(Received)(1) | | Net

Amount |

Securities on Loan | | $293,531 | | $(293,531) | | $— |

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 17

PGIM Quant Solutions Emerging Markets Equity Fund

Statement of Assets & Liabilities

as of October 31, 2024

| | | | | | |

Assets | | | | | | |

| | |

Investments at value, including securities on loan of $293,531: | | | | | | |

Unaffiliated investments (cost $31,579,634) | | $ | 39,766,021 | | | |

Affiliated investments (cost $3,203,266) | | | 3,203,266 | | | |

Foreign currency, at value (cost $47,767) | | | 47,415 | | | |

Receivable for Fund shares sold | | | 223,303 | | | |

Dividends and interest receivable | | | 71,548 | | | |

Tax reclaim receivable | | | 5,445 | | | |

Prepaid expenses and other assets | | | 3,931 | | | |

| | | | | | |

| | |

Total Assets | | | 43,320,929 | | | |

| | | | | | |

Liabilities | | | | | | |

| | |

Payable to broker for collateral for securities on loan | | | 301,281 | | | |

Foreign capital gains tax liability accrued | | | 178,396 | | | |

Custodian and accounting fees payable | | | 32,519 | | | |

Audit fee payable | | | 31,166 | | | |

Accrued expenses and other liabilities | | | 20,065 | | | |

Payable for Fund shares purchased | | | 9,332 | | | |

Due to broker—variation margin futures | | | 8,387 | | | |

Management fee payable | | | 6,693 | | | |

Trustees’ fees payable | | | 826 | | | |

Affiliated transfer agent fee payable | | | 65 | | | |

| | | | | | |

| | |

Total Liabilities | | | 588,730 | | | |

| | | | | | |

| | |

Net Assets | | $ | 42,732,199 | | | |

| | | | | | |

| | | | | | |

| | |

Net assets were comprised of: | | | | | | |

Paid-in capital | | $ | 36,550,866 | | | |

Total distributable earnings (loss) | | | 6,181,333 | | | |

| | | | | | |

| | |

Net assets, October 31, 2024 | | $ | 42,732,199 | | | |

| | | | | | |

| | |

Class R6 | | | | | | |

| | |

Net asset value, offering price and redemption price per share, | | | | | | |

($42,732,199 ÷ 3,430,950 shares of beneficial interest issued and outstanding) | | $ | 12.45 | | | |

| | | | | | |

See Notes to Financial Statements.

18

PGIM Quant Solutions Emerging Markets Equity Fund

Statement of Operations

Year Ended October 31, 2024

| | | | |

Net Investment Income (Loss) | | | | |

| |

Income | | | | |

Unaffiliated dividend income (net of $188,152 foreign withholding tax) | | $ | 1,292,322 | |

Affiliated dividend income | | | 54,446 | |

Interest income | | | 3,982 | |

Income from securities lending, net (including affiliated income of $161) | | | 605 | |

| | | | |

| |

Total income | | | 1,351,355 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 291,149 | |

Custodian and accounting fees | | | 131,272 | |

Professional fees | | | 85,605 | |

Audit fee | | | 31,164 | |

Shareholders’ reports | | | 13,698 | |

Trustees’ fees | | | 10,097 | |

Transfer agent’s fees and expenses (including affiliated expense of $387) | | | 427 | |

Registration fees | | | 249 | |

Miscellaneous | | | 16,461 | |

| | | | |

| |

Total expenses | | | 580,122 | |

Less: Fee waiver and/or expense reimbursement | | | (112,911 | ) |

| | | | |

| |

Net expenses | | | 467,211 | |

| | | | |

| |

Net investment income (loss) | | | 884,144 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | | | | |

| |

Net realized gain (loss) on: | | | | |

Investment transactions (including affiliated of $(69)) (net of foreign capital gains taxes $(274,086)) | | | 2,229,054 | |

Futures transactions | | | 102,205 | |

Foreign currency transactions | | | (28,623 | ) |

| | | | |

| |

| | | 2,302,636 | |

| | | | |

| |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments (net of change in foreign capital gains taxes $(108,318)) | | | 5,716,244 | |

Futures | | | 83,233 | |

Foreign currencies | | | (3,745 | ) |

| | | | |

| |

| | | 5,795,732 | |

| | | | |

| |

Net gain (loss) on investment and foreign currency transactions | | | 8,098,368 | |

| | | | |

| |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 8,982,512 | |

| | | | |

See Notes to Financial Statements.

PGIM Quant Solutions Emerging Markets Equity Fund 19

PGIM Quant Solutions Emerging Markets Equity Fund

Statements of Changes in Net Assets

| | | | | | | | |

| |

| | | Year Ended

October 31, | |

| | |

| | | 2024 | | | 2023 | |

| | |

Increase (Decrease) in Net Assets | | | | | | | | |

| | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 884,144 | | | $ | 947,391 | |

Net realized gain (loss) on investment and foreign currency transactions | | | 2,302,636 | | | | (1,162,979 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | 5,795,732 | | | | 4,576,407 | |

| | | | | | | | |

| | |

Net increase (decrease) in net assets resulting from operations | | | 8,982,512 | | | | 4,360,819 | |

| | | | | | | | |

| | |

Dividends and Distributions | | | | | | | | |

Distributions from distributable earnings | | | | | | | | |

Class R6 | | | (1,306,279 | ) | | | (1,391,984 | ) |

| | | | | | | | |

| | |

Fund share transactions | | | | | | | | |

Net proceeds from shares sold (463,928 and 337,480 shares, respectively) | | | 5,528,953 | | | | 3,482,394 | |

Net asset value of shares issued in reinvestment of dividends and distributions (125,123 and 136,737 shares, respectively) | | | 1,306,279 | | | | 1,391,984 | |

Cost of shares purchased (640,346 and 437,103 shares, respectively) | | | (7,214,867 | ) | | | (4,588,650 | ) |

| | | | | | | | |

| | |

Net increase (decrease) in net assets from Fund share transactions | | | (379,635 | ) | | | 285,728 | |

| | | | | | | | |

Total increase (decrease) | | | 7,296,598 | | | | 3,254,563 | |

| | |

Net Assets: | | | | | | | | |

| | |

Beginning of year | | | 35,435,601 | | | | 32,181,038 | |

| | | | | | | | |

| | |

End of year | | $ | 42,732,199 | | | $ | 35,435,601 | |

| | | | | | | | |

See Notes to Financial Statements.

20

PGIM Quant Solutions Emerging Markets Equity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Class R6 Shares | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended October 31, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| | | | | | |

| Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | | $10.18 | | | | $9.34 | | | | $12.83 | | | | $11.61 | | | | $11.14 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.26 | | | | 0.27 | | | | 0.38 | | | | 0.29 | | | | 0.18 | |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 2.38 | | | | 0.98 | | | | (3.45 | ) | | | 1.11 | | | | 0.53 | |

| Total from investment operations | | | 2.64 | | | | 1.25 | | | | (3.07 | ) | | | 1.40 | | | | 0.71 | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.37 | ) | | | (0.41 | ) | | | (0.35 | ) | | | (0.18 | ) | | | (0.24 | ) |