Exhibit (c)(1)

| Presentation to the Special Committee 26 March 2007 Project Stellar |

| Disclaimer 1 The following materials are being provided to the Special Committee (the "Special Committee") of the Board of Directors of STATS ChipPAC Ltd ("Company") by Morgan Stanley Dean Witter Asia (Singapore) Pte ("Morgan Stanley") in connection with a presentation made by Morgan Stanley at a meeting held to evaluate the acquisition proposal made by Singapore Technologies Semiconductors Pte Ltd. and should be reviewed and considered as a part of such presentation. These materials have been prepared solely for the use by the Special Committee in connection with its evaluation of the foregoing acquisition proposal and may not be relied upon by any other persons for any purpose. These materials are proprietary to Morgan Stanley and may not be disclosed or referred to by the Special Committee to any third party or distributed, reproduced or used for any other purpose without the prior written consent of Morgan Stanley. These materials do not constitute a fairness opinion for a potential or contemplated transaction and should not be represented as such. The analyses set out herein are not and do not purport to be an appraisal or valuation of any of the securities, assets or businesses of the Company. The information used in preparing these materials was obtained from or through the Special Committee or its representatives or from public sources. Morgan Stanley assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance (including estimates of potential cost savings and synergies) prepared by or reviewed or discussed with the management of the Company or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such management (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). Morgan Stanley's views expressed in these materials are necessarily based on financial economic, market and other conditions, as in effect on, and the information made available to Morgan Stanley as of the date hereof. These materials were designed for use by specific persons familiar with the business and the affairs of the Company and Morgan Stanley assumes no obligation to update or otherwise revise these materials. Nothing contained herein should be construed as tax, accounting or legal advice. The Special Committee may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to the Special Committee relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction. Morgan Stanley has adopted policies and guidelines designed to preserve the independence of its research analysts. Morgan Stanley's policies prohibit employees from directly or indirectly offering a favorable research rating or specific price target, or offering to change a research rating or price target, as consideration for or an inducement to obtain business or other compensation. Morgan Stanley's policies prohibit research analysts from being compensated for their involvement in investment banking transactions. Project Stellar |

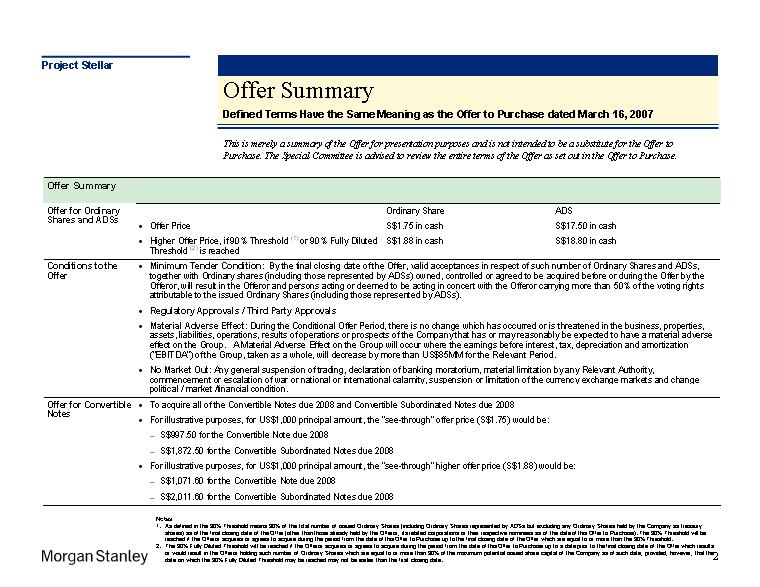

| Offer Summary Defined Terms Have the Same Meaning as the Offer to Purchase dated March 16, 2007 2 Project Stellar Notes As defined in the 90% Threshold means 90% of the total number of issued Ordinary Shares (including Ordinary Shares represented by ADSs but excluding any Ordinary Shares held by the Company as treasury shares) as of the final closing date of the Offer (other than those already held by the Offeror, its related corporations or their respective nominees as of the date of this Offer to Purchase). The 90% Threshold will be reached if the Offeror acquires or agrees to acquire during the period from the date of this Offer to Purchase up to the final closing date of the Offer which are equal to or more than the 90% Threshold. The 90% Fully Diluted Threshold will be reached if the Offeror acquires or agrees to acquire during the period from the date of this Offer to Purchase up to a date prior to the final closing date of the Offer which results or would result in the Offeror holding such number of Ordinary Shares which are equal to or more than 90% of the maximum potential issued share capital of the Company as of such date; provided, however, that the date on which the 90% Fully Diluted Threshold may be reached may not be earlier than the first closing date. This is merely a summary of the Offer for presentation purposes and is not intended to be a substitute for the Offer to Purchase. The Special Committee is advised to review the entire terms of the Offer as set out in the Offer to Purchase. |

| Offer Summary (cont'd) Defined Terms Have the Same Meaning as the Offer to Purchase dated March 16, 2007 3 Project Stellar This is merely a summary of the Offer for presentation purposes and is not intended to be a substitute for the Offer to Purchase. The Special Committee is advised to review the entire terms of the Offer as set out in the Offer to Purchase. |

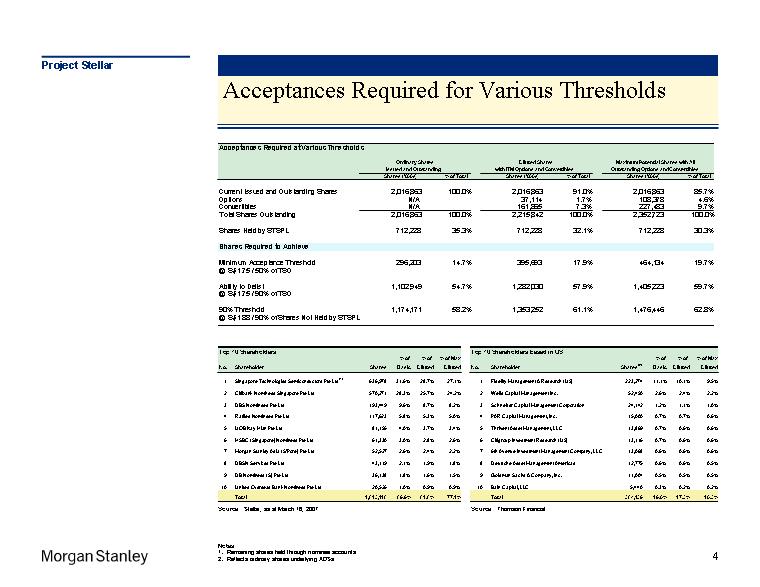

| Project Stellar Acceptances Required for Various Thresholds Notes Remaining shares held through nominee accounts Reflects ordinary shares underlying ADSs 4 Acceptances Required at Various Thresholds Ordinary Shares Diluted Shares Maximum Potential Shares with All Issued and Outstanding with ITM Options and Convertibles Outstanding Options and Convertibles Shares ('000s) % of Total Shares ('000s) % of Total Shares ('000s) % of Total Current Issued and Outstanding Shares 2,016,863 100.0% 2,016,863 91.0% 2,016,863 85.7% Options N/A 37,114 1.7% 108,378 4.6% Convertibles N/A 161,865 7.3% 227,483 9.7% Total Shares Outstanding 2,016,863 100.0% 2,215,842 100.0% 2,352,723 100.0% Shares Held by STSPL 712,228 35.3% 712,228 32.1% 712,228 30.3% Shares Required to Achieve Minimum Acceptance Threshold 296,203 14.7% 395,693 17.9% 464,134 19.7% @ S$1.75 / 50% of TSO Ability to Delist 1,102,949 54.7% 1,282,030 57.9% 1,405,223 59.7% @ S$1.75 / 90% of TSO 90% Threshold 1,174,171 58.2% 1,353,252 61.1% 1,476,446 62.8% @ S$1.88 / 90% of Shares Not Held by STSPL Top 10 Shareholders Top 10 Shareholders based in US % of % of % of Max % of % of % of Max No. Shareholder Shares Basic Diluted Diluted No. Shareholder Shares (2) Basic Diluted Diluted 1 Singapore Technologies Semiconductors Pte Ltd (1) 636,978 31.6% 28.7% 27.1% 1 Fidelity Management & Research (US) 223,274 11.1% 10.1% 9.5% 2 Citibank Nominees Singapore Pte Ltd 570,271 28.3% 25.7% 24.2% 2 Wells Capital Management Inc. 52,450 2.6% 2.4% 2.2% 3 DBS Nominees Pte Ltd 193,449 9.6% 8.7% 8.2% 3 Schneider Capital Management Corporation 24,142 1.2% 1.1% 1.0% 4 Raffles Nominees Pte Ltd 117,623 5.8% 5.3% 5.0% 4 PAR Capital Management, Inc. 15,000 0.7% 0.7% 0.6% 5 UOB Kay Hian Pte Ltd 81,156 4.0% 3.7% 3.4% 5 Thrivent Asset Management, LLC 13,869 0.7% 0.6% 0.6% 6 HSBC (Singapore) Nominees Pte Ltd 61,330 3.0% 2.8% 2.6% 6 Citigroup Investment Research (US) 13,116 0.7% 0.6% 0.6% 7 Morgan Stanley Asia (S'Pore) Pte Ltd 52,527 2.6% 2.4% 2.2% 7 6th Avenue Investment Management Company, LLC 13,068 0.6% 0.6% 0.6% 8 DBSN Services Pte Ltd 43,119 2.1% 1.9% 1.8% 8 Deutsche Asset Management Americas 12,775 0.6% 0.6% 0.5% 9 DB Nominees (S) Pte Ltd 36,138 1.8% 1.6% 1.5% 9 Goldman Sachs & Company, Inc. 11,004 0.5% 0.5% 0.5% 10 United Overseas Bank Nominees Pte Ltd 20,526 1.0% 0.9% 0.9% 10 Bain Capital, LLC 5,440 0.3% 0.2% 0.2% Total 1,813,118 89.9% 81.8% 77.1% Total 384,139 19.0% 17.3% 16.3% Source Stellar, as at March 16, 2007 Source Thomson Financial |

| Stellar Historical Price Performance Since January 1, 2006 Project Stellar 5 Share Price Performance Since January 1, 2006 S$ Volume (MM) Source Factset as at March 19, 2007 28-Jun-06 Announced inclusion in the New NASDAQ Global Select Market 25-Jan-06 4Q05 earnings release Revenue: US$358MM EBITDA: US$102MM Net Income: US$17M 26-Apr-06 1Q06 earnings release Revenue: US$386MM EBITDA: US$99MM Net Income: US$12M 25-Oct-06 3Q06 earnings announced Revenue: US$397MM EBITDA: US$101MM Net Income: US$18M 13-Mar-07 Special Committee announced appointment of advisers 24-Jan-07 4Q06 and FY06 earnings release Revenue: US$416MM EBITDA: US$111MM Net Income: US$28M 16-Mar-07 Dispatch of Offer to Purchase 22-Jun-06 Stellar entered strategic joint venture with China Resources Logic 26-Jul-06 2Q06 earnings release Revenue: US$418MM EBITDA: US$111MM Net Income: US$18M Notes Up to and including March 19, 2007 24-Nov-06 ASE received buyout offer from Carlyle Group 1-Mar-07 Announcement of voluntary conditional cash offer |

| Project Stellar Comparative Price Performance Since January 1, 2006 6 Notes Average daily traded volume as a percentage of the total number of shares traded and not owned by affiliates or management Includes ordinary shares only Indexed Share Price Performance Since January 1, 2006 Source Factset as at March 19, 2007 Announcement of Carlyle-ASE transaction |

| Project Stellar Comparative Price Performance Since January 1, 2007 7 Indexed Share Price Performance Since January 1, 2007 Source Factset as at March 19, 2007 18-Jan-07 "Ardentec and SPIL are both said to have landed new NAND flash orders and should see stronger sales growth in 2007. Industry sources said ...SPIL is said to have strengthened its partnership with Samsung Electronics." 24-Jan-07 Stellar announced results for the fourth quarter and full year 2006 12-Feb-07 Amkor 4Q and 2006 Profit Up, forecasts decline in Q1 sales 13-Feb-07 The board of SPIL announced plans to divest its exisiting shares of ChipMOS Technologies Taiwan and acquire shares of its parent company 1-Mar-07 Stellar shareholders received a voluntary conditional cash offer from Temasek 26-Feb-07 "Analog Devices (a key customer) has reported above-consensus F1Q07 results and confirmed that a broad-based recovery in customer bookings...and gives us confidence that Stellar Q1 sales are tracking in line with guidance" - UBS 2-Feb-07 "As SPIL's '07 ROE will likely surpass the peak level seen since the Internet bubble, we expect valuation rerating to be triggered." We are upgrading SPIL to 1- OW..." - Lehman |

| Valuation Summary Project Stellar 8 Valuation Summary S$ Per Share S$1.75 S$1.88 Notes Based on 9.5-11.5% WACC and 5.0-6.0x LTM EBITDA Terminal Multiple Based on consensus IBES estimates as well as both current multiples and those before announcement of ASE transaction Tangible book adjusted for US$555MM intangibles, US$26MM in-the-money stock options, and US$150MM in-the-money convertible subordinated notes Based on potential returns achievable for Temasek Statistics US$488MM US$133MM US$547MM Market Values Current (March 19, 2007) Prior to bid 1 Week 1 Month 3 Months 52 Weeks Analyst Targets (Pre-Bid) Discounted Cash Flow Analysis Management Case (1) Wall Street Case (1) Comparable Companies Analysis (2) 5.0-5.5x 2007E EBITDA With 15-30% Control Premium With 15-30% Control Premium 9.0-13.0x 2007E Earnings 4.5-5.0x 2008E EBITDA With 15-30% Control Premium 7.5-12.0x 2008E Earnings With 15-30% Control Premium 2.0-2.5x 2006A Tangible Book (3) With 15-30% Control Premium Recapitalization Analysis Value to Shareholders Leveraged Returns Analysis (4) US$173MM US$867MM To achieve 20-30% IRR Premium Analysis With 15-30% Control Premium 1 Day Prior to Announcement 1 Month Average Prior to Announcement S$1.48 S$1.34 Median of 3 Month Average Prior to Announcement S$1.25 |

| Transaction Matrix Project Stellar 9 Notes 2,216MM diluted shares = 2,017MM basic shares + 37MM shares from gross in-the-money options + 162MM shares converted from in-the-money convertible notes US$428MM net debt = US$65MM ST debt + US$698MM LT debt + US$58MM minority interest - US$217MM cash - US$150MM convertible notes - US$26MM proceeds from in-the-money options Tangible book adjusted for intangibles, in-the-money options and in-the-money convertibles Implied premia paid one trading day before announcement of the transaction (Feb 28, 2007) Based on Factset downloads Median excludes Stellar 1 day prior to Carlyle-ASE announcement Based on company financials and Factset (4) (6) (3) (6) |

| Research Analyst Price Targets Post 4Q06 Results and Prior to Bid Project Stellar 10 Recommendation at Date of Report Prior to Bid Source Thomson Research Source Thomson Research |

| Discounted Cash Flow Analysis Management Case Project Stellar Note Multiples based on management projections 11 |

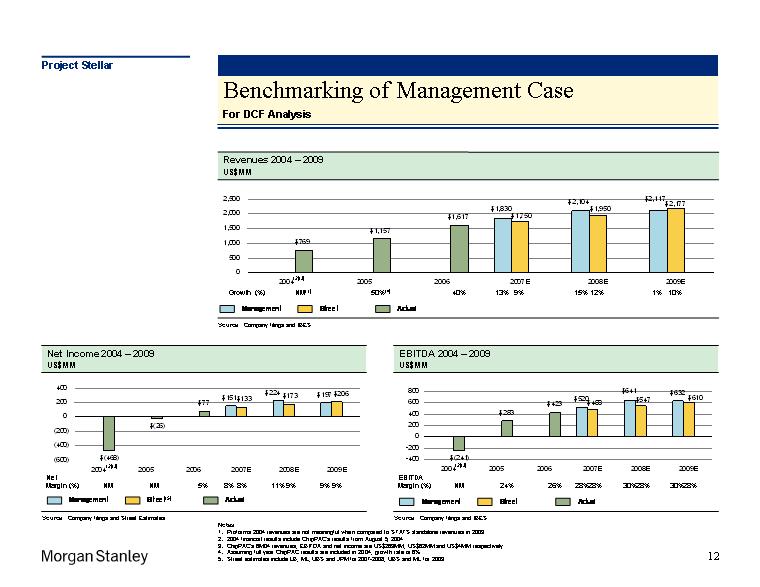

| Benchmarking of Management Case For DCF Analysis Project Stellar 12 Notes Proforma 2004 revenues are not meaningful when compared to STATS standalone revenues in 2003 2004 financial results include ChipPAC's results from August 5, 2004 ChipPAC's 6M04 revenues, EBITDA and net income are US$269MM, US$62MM and US$4MM respectively Assuming full year ChipPAC results are included in 2004, growth rate is 6% Street estimates include LB, ML, UBS and JPM for 2007-2008, UBS and ML for 2009 Source Company filings and Street Estimates Net Income 2004 - 2009 US$MM Source Company filings and IBES EBITDA 2004 - 2009 US$MM Source Company filings and IBES Revenues 2004 - 2009 US$MM Growth (%) NM(1) 50%(4) 40% 13% 9% 15% 12% 1% 10% Net Margin (%) NM NM 5% 8% 8% 11% 9% 9% 9% EBITDA Margin (%) NM 24% 26% 28% 28% 30% 28% 30% 28% (2)(3) (2)(3) (2)(3) (5) |

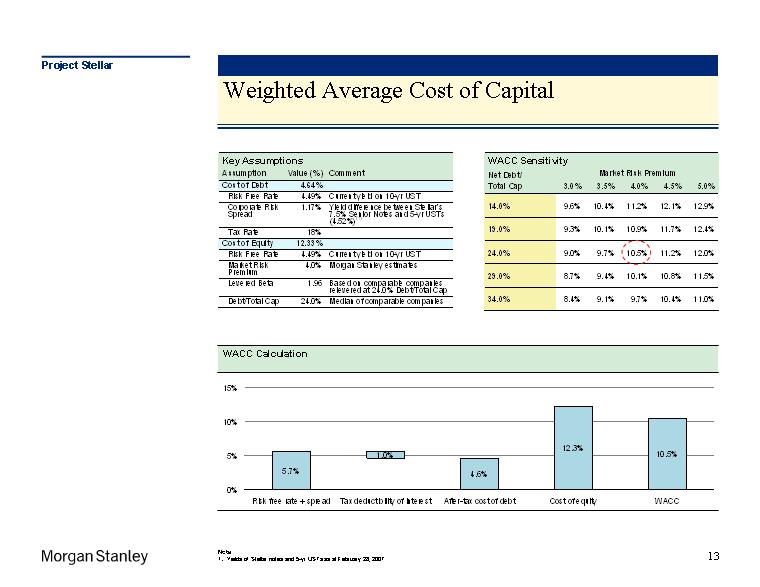

| Weighted Average Cost of Capital Project Stellar 13 WACC Calculation Note Yields of Stellar notes and 5-yr USTs as at February 28, 2007 |

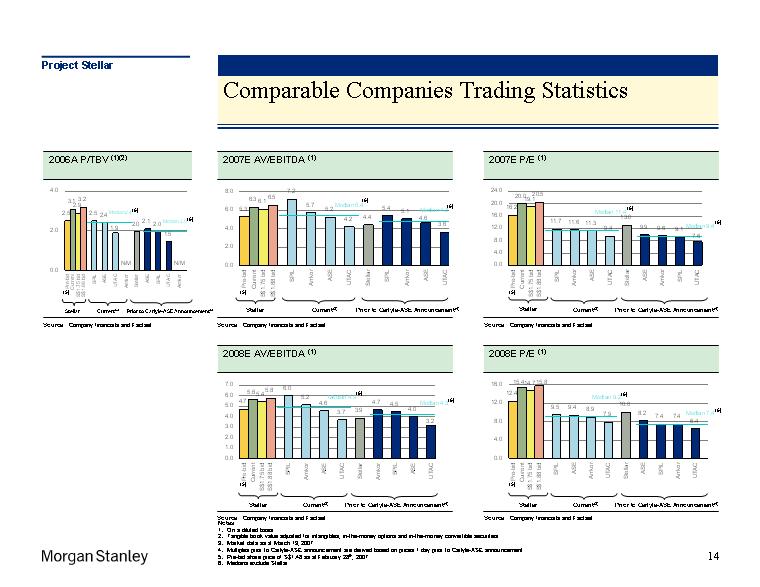

| Comparable Companies Trading Statistics Project Stellar Notes On a diluted basis Tangible book value adjusted for intangibles, in-the-money options and in-the-money convertible securities Market data as at March 19, 2007 Multiples prior to Carlyle-ASE announcement are derived based on prices 1 day prior to Carlyle-ASE announcement Pre-bid share price of S$1.48 as at February 28th, 2007 Medians exclude Stellar 14 2007E AV/EBITDA (1) Stellar 2007E P/E (1) 2008E P/E (1) 2008E AV/EBITDA (1) Prior to Carlyle-ASE Announcement(4) Current(3) 2006A P/TBV (1)(2) Stellar Prior to Carlyle-ASE Announcement(4) Current(3) Stellar Prior to Carlyle-ASE Announcement(4) Current(3) Stellar Prior to Carlyle-ASE Announcement(4) Current(3) Stellar Prior to Carlyle-ASE Announcement(4) Current(3) Source Company financials and Factset Source Company financials and Factset Source Company financials and Factset Source Company financials and Factset Source Company financials and Factset (6) (6) (6) (6) (6) (6) (6) (6) (6) (6) (5) (5) (5) (5) (5) |

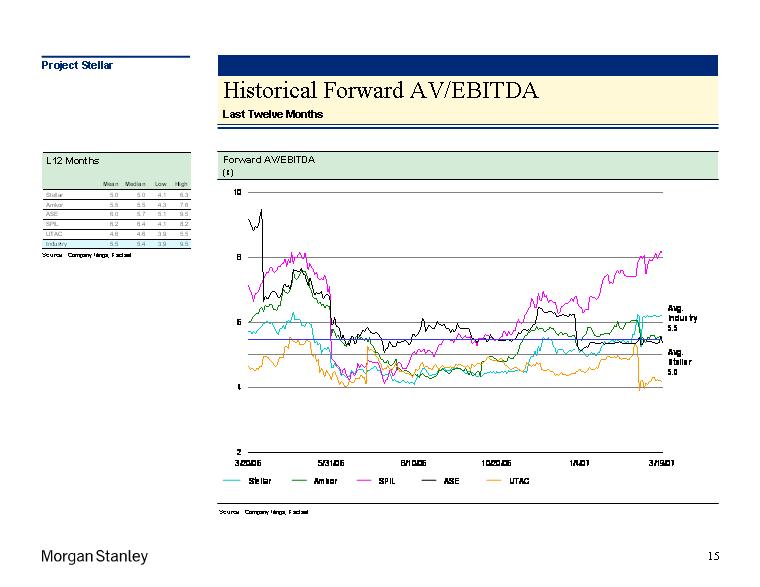

| Historical Forward AV/EBITDA Last Twelve Months Project Stellar 15 Forward AV/EBITDA (x) Source Company filings, Factset Source Company filings, Factset |

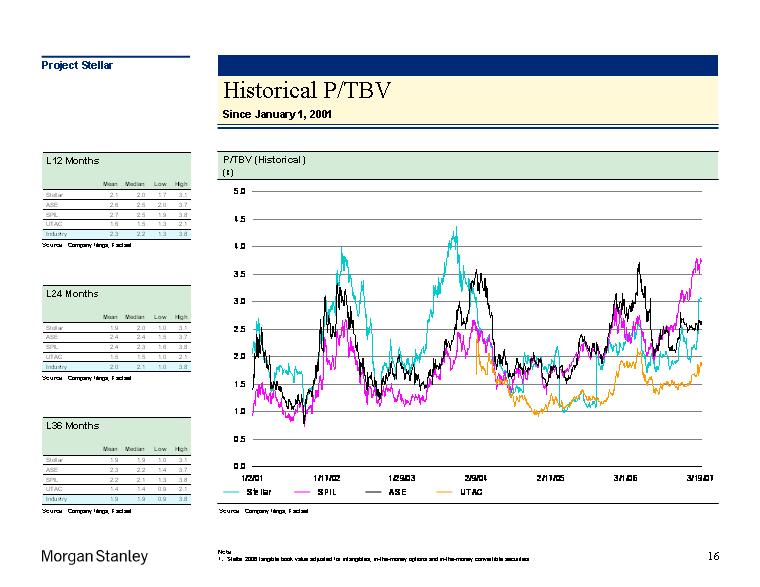

| Project Stellar Historical P/TBV Since January 1, 2001 16 P/TBV (Historical) (x) Source Company filings, Factset Note Stellar 2006 tangible book value adjusted for intangibles, in-the-money options and in-the-money convertible securities Source Company filings, Factset Source Company filings, Factset Source Company filings, Factset |

| Historical Forward P/E Last Twelve Months Project Stellar 17 Forward P/E (x) Source Company filings, Factset Source Company filings, Factset Source Company filings, Factset |

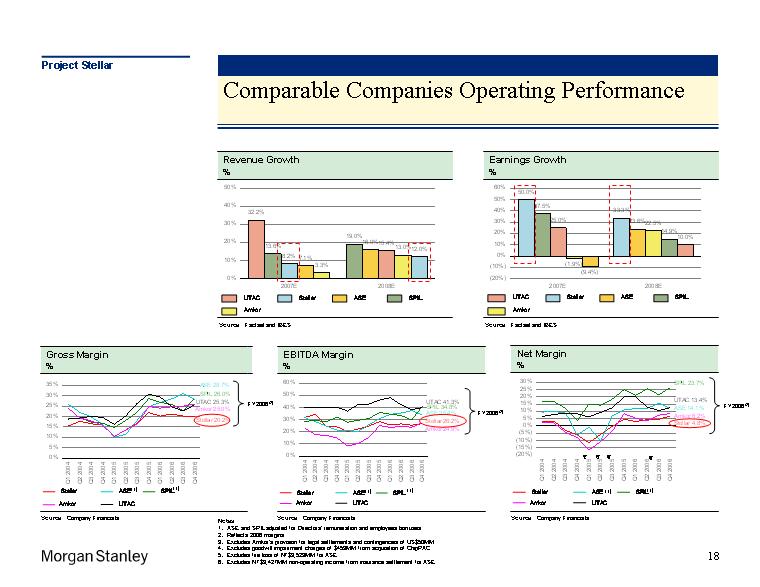

| Comparable Companies Operating Performance Project Stellar 18 Notes ASE and SPIL adjusted for Directors' remuneration and employees bonuses Reflects 2006 margins Excludes Amkor's provision for legal settlements and contingencies of US$50MM Excludes goodwill impairment charges of $453MM from acquisition of ChipPAC Excludes fire loss of NT$9,529MM for ASE Excludes NT$3,427MM non-operating income from insurance settlement for ASE Source Company Financials EBITDA Margin % Net Margin % Source Company Financials FY2006 (2) Source Company Financials Gross Margin (1) % Gross Margin % FY2006 (2) (4) (3) (5) Source Factset and IBES FY2006 (2) Revenue Growth % Earnings Growth % Source Factset and IBES (1) (1) (1) (1) (1) (1) (6) |

| Public Valuation Benchmarking Project Stellar Notes Tangible ROE = (Earnings + Amortization * (1 - Tax Rate)) / Average of (Book Value - Intangible Assets - Goodwill) Tangible book value adjusted for intangibles, in-the-money options and in-the-money convertible securities Amkor's P/TBV not meaningful due to its negative tangible book value Implied Stellar's valuation at S$1.75 bid and S$1.88 bid (in blue dots) are shown in chart for illustration purposes; these data points are not included in the regression analysis 19 Source Factset as at March 19, 2007, Company financials 2006A P/TBV vs. Tangible ROE (1)(2)(3) Tangible ROE 2006A P/TBV (x) Stellar ROE 17% Implied P/TBV 1.7x (4) (4) |

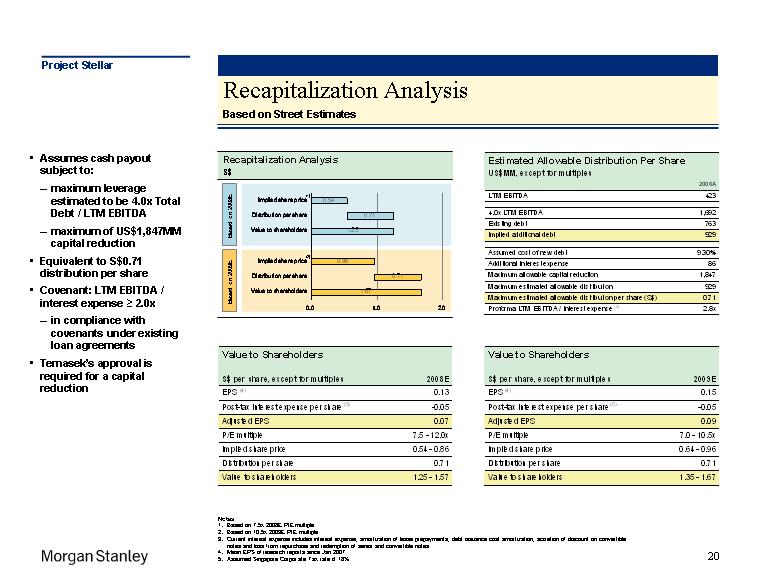

| Recapitalization Analysis Based on Street Estimates Project Stellar Notes Based on 7.5x 2008E P/E multiple Based on 10.5x 2009E P/E multiple Current interest expense includes interest expense, amortization of lease prepayments, debt issuance cost amortization, accretion of discount on convertible notes and loss from repurchase and redemption of senior and convertible notes Mean EPS of research reports since Jan 2007 Assumed Singapore Corporate Tax rate of 18% 20 Assumes cash payout subject to: maximum leverage estimated to be 4.0x Total Debt / LTM EBITDA maximum of US$1,847MM capital reduction Equivalent to S$0.71 distribution per share Covenant: LTM EBITDA / interest expense ^ 2.0x in compliance with covenants under existing loan agreements Temasek's approval is required for a capital reduction Recapitalization Analysis S$ Based on 2009E Based on 2008E (1) (2) |

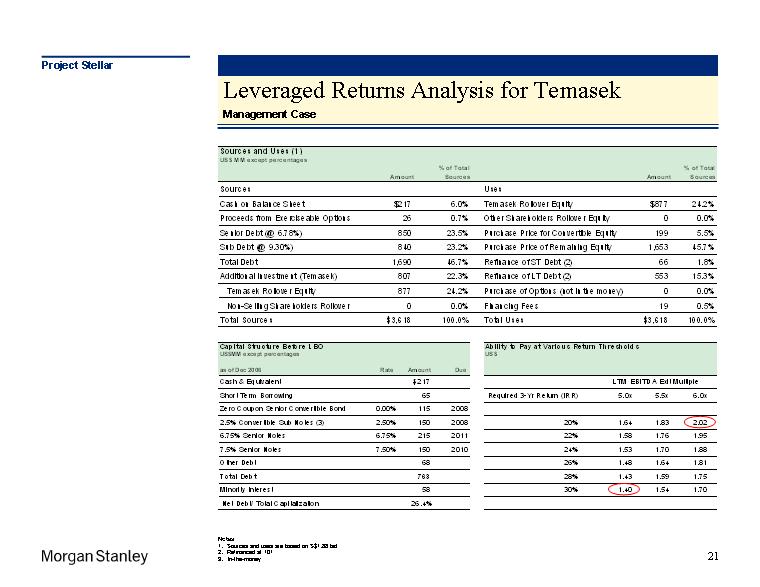

| Leveraged Returns Analysis for Temasek Management Case Project Stellar 21 (3) Notes Sources and uses are based on S$1.88 bid Refinanced at 101 In-the-money |

| Selected Precedent Singapore Transactions Premia Analysis Change of Control Transactions Project Stellar 22 Deal size greater than US$50MM Public transactions completed on the SGX and which were announced after January 1, 2001 Change of control transactions defined as: Offeror's initial stake less than 50% Offeror's final stake greater than 50% Judgment formed to exclude transactions where technical GOs were made in order to comply with the Singapore Code On Takeovers and Mergers Source Factiva newsruns, company financials, offering circulars and Factset Transactions where the acquiror had a significant minority stake prior to offer |

| Selected Precedent Semiconductor Transactions Project Stellar 23 Deal size greater than US$1Bn Public transactions announced after January 1, 2001 Source Company financials and Factset |