Exhibit (c)(3)

| Discussion Materials March 12, 2006 Project Stellar |

| Disclaimer 1 This document has been prepared by Morgan Stanley Dean Witter Asia (Singapore) Pte ("Morgan Stanley") for the Special Committee of STATS ChipPAC on March 12, 2007 solely for information purposes and should not be relied upon, or form the basis for any decision or action, by STATS ChipPAC. This document must be held by you and your directors, officers and employees in strict confidence and may not be communicated, reproduced or distributed to any other person in whole or in part at any time except with the prior written consent of Morgan Stanley. This document and the analyses and valuations contained in it were prepared based solely on information obtained from public sources on or prior to the date hereof. We have assumed and relied upon, without independent verification, the accuracy and completeness of the information reviewed by us for the purposes of this presentation. No representation or warranty, express or implied, is or will be made by Morgan Stanley or its affiliates or by any of their respective officers, employees or agents in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection therewith, or the data it generates and no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) is or will be accepted by any of them in relation to such information. We have not conducted any independent valuation or appraisal of the assets or liabilities of STATS ChipPAC nor have we been provided with any such valuation or appraisal. Morgan Stanley and its affiliates and their respective officers, employees and agents expressly disclaim any and all liability which may be based on this document and any errors therein or omissions therefrom. In particular, no representation or warranty, express or implied, is given as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any. Morgan Stanley is not a legal, accounting or tax expert, and makes no representation or warranty as to the sufficiency or adequacy of this analysis with respect to such issues. Any views contained herein are based on financial, economic, market and other conditions prevailing as of the date of this presentation. This document does not constitute and should not be considered as any form of financial opinion or recommendation on the part of Morgan Stanley or any of its subsidiaries or associated companies. Project Stellar |

| Discussion Agenda Project Stellar 2 Topics for Discussion Timeline and key Morgan Stanley work streams Manner of Temasek approach Overview of potential market check candidates Market environment update since January 19, 2007 valuation |

| Timetable for ST's Voluntary Conditional Tender Offer Integrated Singapore and US Timetable Notes Singapore regulations require that a tender offer stay open for a minimum of 28 calendar days. If ST chooses to close the tender offer by April 19, it may modify the terms of its offer no later than April 5th (modified offers are required to stay open for 14 calendar days). US rules require that tender offers remain open for a minimum of 20 business days and material changes cannot be made to the offer unless the offer remains open for at least 5-10 business days (depending on the nature of the change) after target shareholders are notified of the change Under Singapore regulations target shareholders may only withdraw acceptances from the first closing date to the date that the offer goes unconditional as to acceptances (>50% acceptances). However, STATS ChipPAC shareholders may withdraw acceptances at any time until closing Under Singapore regulations, the offeror has 21 days from the date the offer goes unconditional in all respects to accept shares and pay shareholders. However, STATS ChipPAC shareholders will be paid at the offer close per US regulations ST's voluntary conditional tender offer will primarily follow Singapore's standard tender offer timetable Some exceptions will be made to conform with U.S. regulations STATS ChipPAC shareholders may withdraw tendered shares until the tender offer closes STATS ChipPAC shareholders will be paid upon tender offer close The Independent Committee has approximately 3 weeks from today to issue its Offeree Circular / file Schedule 14d-9 with SEC 3 Week March 1, Announcement Within 14-21 days: (1) Finalize tender offer documents, (2) appoint printers, information agent, depository and dealer-manager March 15-22, Commencement Date (T): (1) Publish summary advertisement, (2) issue press release announcing commencement of tender offer, (3) provide telephonic notice to SGX and NASDAQ and mail copies of Offer Document/Schedule TO, (4) file schedule TO/schedule 13e3 with SEC and SGX and deliver to STATS ChipPAC, (5) print and mail Offer to Purchase to shareholders By April 5, Deadline for Independent Committee to issue Offeree Circular (within T + 10 business days) By April 19, Earliest possible close date (T+28) (1) By May 21, Latest date for offer to achieve >50% acceptances By May 7, Last day to revise offer (T+46) By June 11, Latest date for offeror to satisfy all other conditions, e.g., regulatory approval June 25, Offer closes, accept and pay for all target shares tendered (T+81) (T+60) (2) (T+95) (3) 1 10 2 3 7 8 5 9 14 4 6 13 12 11 15 The Independent Committee will likely have between 4 to 5 weeks to issue its Offeree Circular Project Stellar |

| Near Term Work Plan (For Discussion) Project Stellar We plan to run two streams of work Analysis of fundamental value and standalone alternatives to develop view on Temasek offer Market check to assess the possibility of a superior offer 4 Near Term Work Plan March 12 19 26 2 April 1. Accelerated Due Diligence Receive Management Plan Meetings with Management Follow up / Clarification Meetings 2. Update Stats ChipPAC model 3. Perform Financial Analysis to Develop Opinion Develop Initial Views Finalize Analysis 4. Discussions with Temasek 5. Conduct Market Check Discussion with Strategic and Financial Buyers Facilitate Limited Due Diligence for Interested Buyers to Submit Firm Bid 6. Prepare Presentation and Draft Opinion Week of Discuss Initial View on Value with Committee Initial Meeting with Temasek Discuss Draft of Opinion with Committee Singapore Holiday H.K. Holiday U.S. Holiday |

| Overview of Major Work Streams Project Stellar 5 |

| Temasek Approach Project Stellar 6 We would recommend scheduling a meeting with Temasek for Friday of this week to discuss their offer Upon receipt of authorization from the Independent Committee, Morgan Stanley will approach Temasek to discuss the following topics: Objectives with respect to its current offer for the company Interest in disposing of its stake to a superior offer, if Temasek is unwilling to match it Flexibility with respect to deal terms, including price Potential buyers will be interested in Temasek's responses in light of its 36% ownership stake in the company Soon thereafter, Morgan Stanley will approach a select number of alternative financial and strategic buyers |

| Potential Financial Sponsors Project Stellar We will approach 5-6 potential financial sponsors with experience in investing in the semiconductor sector 7 Notes Total capital committed to buyouts globally Includes $5Bn publicly-listed investment vehicle Includes $15Bn global fund and $1.5Bn Asia-focused Fund |

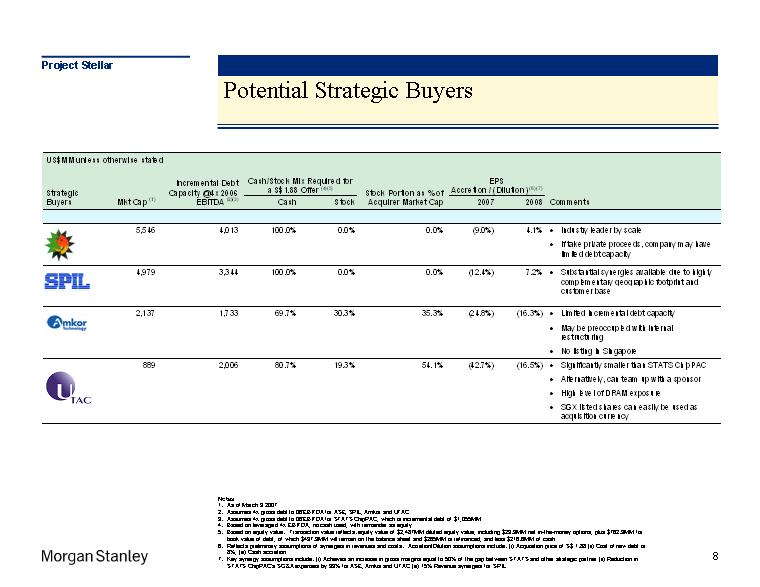

| Potential Strategic Buyers Project Stellar Notes As of March 9 2007 Assumes 4x gross debt to 06'EBITDA for ASE, SPIL, Amkor and UTAC Assumes 4x gross debt to 06'EBITDA for STATS ChipPAC, which is incremental debt of $1,055MM Based on leveraged 4x EBITDA, no cash used, with remainder as equity Based on equity value. Transaction value reflects: equity value of $2,487MM diluted equity value, including $23.9MM net in-the-money options; plus $762.9MM for book value of debt, of which $497.9MM will remain on the balance sheet and $265MM is refinanced; and less $216.6MM of cash Reflects preliminary assumptions of synergies in revenues and costs. Accretion/Dilution assumptions include: (i) Acquisition price of S$ 1.88 (ii) Cost of new debt is 8%, (iii) Cash accretion Key synergy assumptions include: (i) Achieves an increase in gross margins equal to 50% of the gap between STATS and other strategic partner (ii) Reduction in STATS ChipPAC's SG&A expenses by 33% for ASE, Amkor and UTAC (iii) 15% Revenue synergies for SPIL 8 |

| Sector-wide Share Price Performance Since January 1 2007 Project Stellar 9 Indexed Price Graph S$ Source Factset as of March 9, 2007 STATS ChipPAC: +49.2% UTAC: +22.3% SPIL: +16.3% Amkor: +21.0% Bid Announced on Mar 1, 2007 on Jan 19, 2007 ASE: +8.7% NASDAQ: (1.5%) Stock prices across the test and assembly sector have outperformed the NASDAQ since January 1, 2007 Note 1 day prior to bid announcement |

| Recent Wall Street Commentary Project Stellar 10 JP Morgan (Jan 25, 2007) Solid 4Q06 results round off a good year for STATS ChipPAC "Stats ChipPAC believes its 2007 growth will outpace the overall semiconductor industry growth estimate of 7%, with incremental growth from: 1) penetration of PLD segment; 2) new customer win for NAND Flash; and 3) increasing demand for 3D packages for advanced 3G handset applications." " ...we upgrade STATS ChipPAC to Neutral. Key risks to push STATS ChipPAC share price past our PT include dramatic margin improvements and significant wins on the advanced flip chip business." Lehman Brothers (Jan 26, 2007) "We are upgrading STTS to 1-OW and raising our 12-month TP to US$ 11.4 per ADS (1.8x our 12-month forward P/B)." "Potential capacity tightness in 2H: we estimate that industry-wide capex will decline 4% in 2007, based on our recent industry survey." "Expected improvements in profitability and ROE: we expect STTS's GM and ROE to improve in 2007 owing to (1) the company's focus on profitability rather than growth and (2) improved utilization resulting from its cautious capex." ".....the possibility that STTS could be the beneficiary of fund flows should ASE decide to delist in 2Q07." UBS (Feb 25, 2007) "We think now is a good time to BUY.....The strengthening revenue outlook supports our forecast for a 350bps improvement in EBIT margins in 07. We expect this recovery to be driven by i) the on-going transfer of low- margin lead frame production to the China JV; ii) A recovery in capacity utilisation rates from c75% to 80% by the year-end, on maintenance capex and 11% sales growth. New customer wins are an upside risk." "We expect STATS sales to recover strongly in Q2, driven by the bounce-back in demand following the end of the handset component inventory correction." Even prior to Temasek's bid for STATS ChipPAC on March 1, 2007, research commentary had been demonstrably more upbeat More optimistic views driven by: Solid 4Q earnings announcement Stronger demand / revenue outlook for 2007 Improved near-term utilization rates |

| Change in Valuation Multiples Project Stellar 11 AV/EBITDA (2007E) x P/TBV (Current) x P/E (2007E) x Note Current Price as of March 9 Since our last Board presentation, public market values have increased over a range of metrics AV/Revenue (2007E) x |