QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /X/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /X/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12

|

EARTHLINK, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /X/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

EARTHLINK, INC.

1375 Peachtree St.

Atlanta, Georgia 30309

(404) 815-0770

April 18, 2002

Dear Stockholders:

You are cordially invited to attend the 2002 Annual Meeting of Stockholders of EarthLink, Inc. (the "Company"), which will be held at 10:00 a.m. (local time) on Thursday, May 23, 2002, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street NW, Atlanta, Georgia (the "Annual Meeting").

The principal business of the Annual Meeting will be (i) the election of our Class III directors, (ii) the approval and ratification of the adoption of the EarthLink, Inc. Employee Stock Purchase Plan and the reservation of shares of the Company's Common Stock for issuance thereunder, and (iii) the ratification of the appointment by the Company's Board of Directors of Ernst & Young LLP as independent auditors for the year ending December 31, 2002. We will also review our results for the past fiscal year and report on significant aspects of our operations during the first quarter of 2002.

Our Board of Directors is divided into three classes, with only one class (Class III) to be elected at this year's Annual Meeting. Please refer to the section entitled "Proposal 1—Election of Directors" in the Proxy Statement for further details.

If you do not attend the Annual Meeting, you may vote your shares in any of three ways—by mail, by telephone or by Internet. The enclosed proxy card materials provide you details on how to vote by these three methods. Whether or not you plan to attend the Annual Meeting, we encourage you to vote in the method that suits you best so that your shares will be voted at the Annual Meeting. If you decide to attend the Annual Meeting, you may revoke your proxy and personally cast your votes.

Thank you, and we look forward to seeing you at the Annual Meeting or receiving your proxy vote.

EARTHLINK, INC.

1375 Peachtree St.

Atlanta, Georgia 30309

(404) 815-0770

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2002 Annual Meeting of the Stockholders of EarthLink, Inc. (the "Company") will be held at 10:00 a.m. (local time), on Thursday, May 23, 2002, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street NW, Atlanta, Georgia. The meeting is called for the following purposes:

- 1.

- To elect Class III directors for a three-year term;

- 2.

- To approve and ratify the adoption of the EarthLink, Inc. Employee Stock Purchase Plan and to reserve shares of the Company's Common Stock for issuance thereunder;

- 3.

- To ratify the appointment by the Company's Board of Directors of Ernst & Young LLP as the Company's independent auditors for the year ending December 31, 2002; and

- 4.

- To transact such other business as may properly come before the meeting.

The Board of Directors has fixed the close of business on March 25, 2002 as the record date for the purpose of determining the stockholders who are entitled to notice of and to vote at the meeting and any adjournment or postponement thereof.

Atlanta, Georgia

April 18, 2002

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. IF YOU ARE UNABLE TO BE PRESENT AT THE MEETING, PLEASE VOTE YOUR SHARES BY MAIL WITH THE ENCLOSED PROXY CARD, BY TELEPHONE OR BY INTERNET SO THAT YOUR SHARES WILL BE REPRESENTED. IF YOU WISH, YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE TIME IT IS VOTED.

EARTHLINK, INC.

1375 Peachtree St.

Atlanta, Georgia 30309

PROXY STATEMENT

For the Annual Meeting of Stockholders

to be held May 23, 2002

This Proxy Statement is furnished by and on behalf of the Board of Directors (the "Board of Directors") of EarthLink, Inc. (the "Company" or "EarthLink") in connection with the solicitation of proxies for use at the 2002 Annual Meeting of Stockholders of the Company to be held at 10:00 a.m. (local time) on Thursday, May 23, 2002, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street NW, Atlanta Georgia, and at any adjournments or postponements thereof (the "Annual Meeting"). This Proxy Statement and the enclosed proxy card will be mailed on or about April 18, 2002 to the Company's stockholders of record (the "Stockholders") on the Record Date, as defined below.

THE BOARD OF DIRECTORS URGES YOU TO VOTE YOUR SHARES BY ANY OF THE THREE AVAILABLE METHODS—BY MAIL, BY TELEPHONE OR BY INTERNET. IF YOU VOTE BY MAIL, PLEASE COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE.

SOLICITATION, VOTING AND REVOCABILITY OF PROXIES

General

Proxies will be voted as specified by the Stockholder or Stockholders granting the proxy. Unless contrary instructions are specified, if the enclosed proxy card is executed and returned (and not revoked) prior to the Annual Meeting, the shares of Common Stock, $.01 par value per share, of the Company (the "Common Stock") represented thereby will be voted FOR the proposals set forth in this Proxy Statement. The submission of a signed proxy will not affect a Stockholder's right to attend and to vote in person at the Annual Meeting. A Stockholder who executes a proxy may revoke it at any time before it is voted by filing with the Secretary of the Company either a written revocation or an executed proxy bearing a later date or by attending and voting in person at the Annual Meeting.

Only holders of record of Common Stock as of the close of business on March 25, 2002 (the "Record Date") will be entitled to vote at the Annual Meeting. Holders of shares of Common Stock (the "Shares") authorized to vote are entitled to cast one vote per Share on all matters voted upon at the Annual Meeting. As of the close of business on the Record Date, there were 150,165,193 Shares outstanding.

Quorum Required

According to the Company's Bylaws, the holders of a majority of the Shares entitled to be voted must be present or represented by proxy to constitute a quorum. Shares as to which authority to vote is withheld and abstentions are counted in determining whether a quorum exists.

Vote Required

Under Delaware law, directors are elected by a plurality of the votes of the Shares entitled to vote and present in person or represented by proxy at a meeting at which a quorum is present. Only votes actually cast will be counted for the purpose of determining whether a particular nominee received more votes than the persons, if any, nominated for the same seat on the Board of Directors. A stockholder may withhold votes from any or all nominees by notation on the proxy card. Except to the extent that a stockholder withholds votes from any or all nominees, the persons named in the proxy card, in their sole discretion, will vote such proxy for the election of the nominees listed below as directors of the Company.

Abstentions will be counted in determining the minimum number of votes required for approval of proposals and will therefore, have the effect of votes against such proposals. Broker non-votes, those Shares held by a broker or nominee as to which such a broker or nominee does not have discretionary voting power, will not be counted as votes for or against approval of such matters.

With respect to any other matters that may come before the Annual Meeting, if proxies are executed and returned, such proxies will be voted in a manner deemed by the proxy representatives named therein to be in the best interests of the Company and its stockholders.

PROPOSAL 1—ELECTION OF DIRECTORS

Nominees

EarthLink's Amended and Restated Certificate of Incorporation provides that the Company shall have at least two and not more than 17 directors, with the exact number to be fixed by resolution of the Board of Directors from time to time or by a majority vote of the stockholders entitled to vote on directors. The current size of the Board of Directors is fixed at 13, and the Company currently has eight directors. The existing vacancies may be filled by the Board of Directors in the future. The Board of Directors held seven meetings in 2001, and held one meeting from January 1, 2002 through the date of this Proxy Statement.

As established in its Amended and Restated Certificate of Incorporation, EarthLink's Board of Directors is divided into three classes, designated as Class I, Class II and Class III, which classes are to have as nearly equal number of directors as possible. The current eight-member Board of Directors consists of three Class I members, three Class II members and two Class III members. The remaining five director positions (which are currently vacant) consist of two Class I directorships, one Class II directorship and two Class III directorships. The term for each class is three years, which expires at the third succeeding annual stockholder meeting after their election. The term for our Board of Director's Class III directors expires at this year's Annual Meeting.

Directors Standing for Election

The Board of Directors has nominated Charles G. Betty and Sky D. Dayton for election as Class III directors to the Board of Directors at the Annual Meeting, each to serve until the 2005 Annual Meeting of Stockholders or until their successors are duly elected and qualified.

Set forth below is certain biographical information furnished to the Company by the directors standing for election:

Charles G. Betty—Class III Director

Age: 45

Mr. Betty is our Chief Executive Officer and a member of our Board of Directors, and has served in those positions since February 2000 when EarthLink Network, Inc. ("EarthLink Network") merged with MindSpring Enterprises, Inc. ("MindSpring"). Mr. Betty served as President and as a director of EarthLink Network from January 1996 until May 1996 when he was named President and Chief Executive Officer of EarthLink Network, serving in each capacity until its merger with MindSpring. From February 1994 to January 1996, Mr. Betty was a strategic planning consultant, advising Reply Corp., Perot Systems Corporation and Microdyne, Inc. From September 1989 to February 1994, Mr. Betty served as President, Chief Executive Officer and a director of Digital Communications Associates, Inc., a publicly traded network connectivity provider. Mr. Betty serves on the Board of Directors of ChoicePoint Inc.

2

Sky D. Dayton—Class III Director

Age: 30

Mr. Dayton is the Chairman of the Board of Directors of EarthLink and the founder of EarthLink Network. After founding EarthLink Network in May 1994, Mr. Dayton served as Chief Executive Officer until May 1996 and Chairman of the Board until February 2000. He has served on the Board of Directors of EarthLink since February 2000 and was named Chairman of the Board in August 2000. Mr. Dayton is Founder, Chairman of the Board and Chief Executive Officer of Boingo Wireless, Inc. He is also a member of the Board of Directors of eCompanies, LLC and Business.com, Inc., is a founding partner of eCompanies Venture Group, LP, and a partner in Evercore Ventures.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE ELECTION AS DIRECTORS OF THE NOMINEES NAMED ABOVE.

DIRECTORS CONTINUING IN OFFICE

Below is certain biographical information furnished to the Company by each of the directors continuing in office and not subject to a vote at the Annual Meeting:

Austin M. Beutner—Class I Director

Age: 42

Mr. Beutner has served on our Board of Directors since April 2001. He is the Registered Representative of Evercore Group Inc., which he co-founded in 1996, Co-Chairman of Evercore Capital Partners L.P. and Chairman of the Board and Chief Executive Officer of Evercore Ventures. From 1994 to 1996, Mr. Beutner was President and Chief Executive Officer of The U.S. Russia Investment Fund, a private investment company capitalized with $440 million by the U.S. Government. Mr. Beutner serves on the Board of Directors of American Media, Inc., Business.com, Inc., Continental Energy Services, Inc., eCompanies, LLC, Encoda Systems, Inc., Energy Partners, Ltd., Telenet Holding N.V. and Vertis, Inc. and as an observer on the Board of Directors of Callahan Associates International L.L.C. He also serves as Trustee of the California Institute of the Arts and is a member of the Council on Foreign Relations.

Marce Fuller—Class I Director

Age: 41

Ms. Fuller has served on our Board of Directors since October 2001. Since July 1999, she has been President, Chief Executive Officer and a member of the Board of Directors of Mirant Corp., a U.S. marketer of power and natural gas. Under Ms. Fuller's guidance, Mirant spun off from its parent, Southern Company, in April 2001. From September 1997 to July 1999, Ms. Fuller served as President and Chief Executive Officer of the Mirant Americas Energy Marketing division of Mirant. From May 1996 to September 1997, Ms. Fuller was Senior Vice President of Mirant's North American operations and business development, and from February 1994 to May 1996, she was Mirant's Vice President for domestic business development. Ms. Fuller serves on the Board of Directors of numerous corporations, educational institutions and governmental agencies including the Curtiss-Wright Corporation, the U.S. Department of Energy's Electricity Advisory Board, the President's International Board of Advisors of the Philippines, the Leadership Board of the College of Engineering, University of Alabama and the Board of Trustees of the Atlanta International School.

Robert M. Kavner—Class I Director

Age: 58

Mr. Kavner has served on our Board of Directors since February 2001. He was a member of the Board of Directors of EarthLink Network until the merger with MindSpring in February 2000. Since 1995, Mr. Kavner has been a venture capital investor in Internet companies and in December 1998, he became Vice Chairman of Idealab, Inc., an incubator of Internet companies. In April 2001, he retired and continues as a member of the Board of Directors of Idealab, Inc. From September 1996 through

3

December 1998, he served as President and Chief Executive Officer of On Command Corporation, a provider of on-demand video for the hospitality industry. From 1984 to 1994, Mr. Kavner held several senior management positions at AT&T, including Senior Vice President and Chief Financial Officer, Chief Executive Officer of the Multimedia Products and Services Group, and Chairman of AT&T Venture Capital Group. Mr. Kavner also served as a member of AT&T's Executive Committee. Mr. Kavner serves as a member of the Board of Directors of Fleet Boston Financial, Inc., Jupiter Media Metrix, Inc., and Overture Services, Inc., where he is also Chairman of the Board.

Linwood A. Lacy, Jr.—Class II Director

Age: 56

Mr. Lacy has served on our Board of Directors since February 2000 when EarthLink Network merged with MindSpring, and was a member of the Board of Directors of EarthLink Network from June 1996 until its merger with MindSpring. From October 1996 to October 1997, he served as President and Chief Executive Officer of Micro Warehouse Incorporated. From 1985 to May 1996, he served as the Co-Chairman and Chief Executive Officer of Ingram Micro, Inc., a microcomputer products distributor and a then wholly-owned subsidiary of Ingram Industries Inc. From December 1993 to June 1995, Mr. Lacy was also President of Ingram Industries Inc. From June 1995 until April 1996, he was President and Chief Executive Officer of Ingram Industries Inc., and from April 1996 to May 1996, he served as its Vice Chairman. Mr. Lacy was the Chairman of 4Sure.com, Inc. from June 1998 to July 2001. Mr. Lacy serves as a member of the Board of Directors of Ingram Industries Inc. and Modus Media International.

Michael S. McQuary—Class II Director

Age: 42

Mr. McQuary is our President and a member of our Board of Directors, on which he has served since February 2000 when EarthLink Network merged with MindSpring. He served as the President of MindSpring from March 1996, Chief Operating Officer of MindSpring from September 1995 and as a member of the Board of Directors of MindSpring from December 1995 until its merger with EarthLink Network. He also served as MindSpring's Executive Vice President from October 1995 to March 1996 and MindSpring's Executive Vice President of Sales and Marketing from July 1995 to September 1995. Prior to joining MindSpring, Mr. McQuary served in a variety of management positions with Mobil Chemical Co., a petrochemical company, from August 1984 to June 1995, including Regional Sales Manager from April 1991 to February 1994 and Manager of Operations (Reengineering) from February 1994 to June 1995.

Robert M. Metcalfe—Class II Director

Age: 56

Dr. Robert M. Metcalfe has served on our Board of Directors since October 2001. Dr. Metcalfe is a general partner of Polaris Venture Partners, which he joined in January 2001 and where he specializes in information technology start-ups. Dr. Metcalfe represents Polaris on the Board of Directors of Ember, Narad Networks, Inc., InvisibleHand Networks, and Nanosys, Inc. He also serves on the Board of Directors of Avistar Communications, Camden Technology Conference, IDC, IDG, Kelmscott Rare Breeds Foundation, The Massachusetts Institute of Technology and MediaLabEurope. While an engineer-scientist (1965-1979), Dr. Metcalfe helped develop the early Internet. In 1973, at the Xerox Palo Alto Research Center, he invented Ethernet, the international local-area networking standard on which he shares four patents. From 1976 through 1983, he was consulting associate professor of electrical engineering at Stanford University. While an entrepreneur-executive (1979-1990), Dr. Metcalfe founded 3Com Corporation, where at various times he was Chairman of the Board, Chief Executive Officer, division general manager and vice president of engineering, marketing and sales. From 1990 to 2000, Dr. Metcalfe was a publisher and industry commentator, including serving as Chief Executive Officer of IDG's InfoWorld Publishing Company (1992-1995), and writing for various other publications, including

4

The Wall Street Journal,Forbes andThe New York Times. He is a member of the National Academy of Engineering.

In 2001, William T. Esrey, Campbell B. Lanier, III, Len J. Lauer, Philip W. Schiller, William H. Scott, III and Reed E. Slatkin each served on but resigned from the Board of Directors. Mr. Beutner, Ms. Fuller, Mr. Kavner and Dr. Metcalfe each were appointed to the Board of Directors in 2001.

Certain Legal Proceedings

Marce Fuller, a member of our Board of Directors, was an executive officer of Mobile Energy Services Company, L.L.C. ("Mobile Energy") and its parent Mobile Energy Services Holdings, Inc., each affiliates of the Southern Company, at the time such entities filed for bankruptcy in January 1999. Ms. Fuller left such officer positions in 2001 and 1999, respectively, and is not currently an executive officer of either entity. Mobile Energy owns a power generating facility which provides power and steam to a tissue mill in Mobile, Alabama. A proposed plan of reorganization of both entities is pending before the bankruptcy court.

Committees of the Board of Directors

The Company has the following standing committees of its Board of Directors: Compensation Committee, Audit Committee, Investment Committee and Nominating Committee.

The Compensation Committee presently consists of: Mr. Lacy (Chairman), Mr. Dayton and Ms. Fuller. The Compensation Committee met four times during the year ended December 31, 2001. The Compensation Committee establishes cash and long-term incentive compensation for executive officers and other key employees of the Company. The Compensation Committee also administers the Company's Stock Incentive Plan for employees and Stock Option Plan for Non-Employee Directors. In 2001, Mr. Lanier, Mr. Kavner and Mr. Schiller each served on but resigned from the Compensation Committee.

The Audit Committee presently consists of: Mr. Kavner (Chairman), Mr. Beutner and Dr. Metcalfe. The Audit Committee met five times during the year ended December 31, 2001. The Audit Committee is responsible for making recommendations to the Board of Directors regarding the selection of independent auditors, reviews the results and scope of audits and other services provided by the Company's independent auditors and reviews and evaluates the Company's internal control functions. The members of our Audit Committee are independent, as defined in Rule 4200(a)(15) of the NASD Listing Standards for Nasdaq-listed companies. In 2001, Mr. Lacy, Mr. Lauer, Mr. Scott and Mr. Slatkin each served on but resigned from the Audit Committee.

The Investment Committee presently consists of: Mr. Betty, Mr. Dayton and Mr. Lacy. The Investment Committee did not meet separately during the year ended December 31, 2001. The Investment Committee is responsible for reviewing, analyzing and making determinations regarding material investments by EarthLink in other companies. In 2001, the responsibilities of the Investment Committee were met by the entire Board of Directors. In 2001, Mr. Scott and Mr. Slatkin each served on but resigned from the Investment Committee.

The Nominating Committee of the Board of Directors presently consists of Mr. Dayton and Mr. Betty. The Nominating Committee did not meet during the year ended December 31, 2001. The Nominating Committee is responsible for identifying, nominating, proposing and qualifying nominees for open seats on the Board of Directors. In 2001, the responsibilities of the Nominating Committee were met by the entire Board of Directors. The Nominating Committee does not consider or accept nominees recommended by the Company's security holders.

Director Compensation

Directors do not receive cash compensation for serving in that capacity, but are reimbursed for the expenses they incur in attending meetings of the Board of Directors or committees thereof. Non-employee

5

directors are eligible to receive options to purchase Common Stock awarded under the Company's Stock Option Plan for Non-Employee Directors. Members of EarthLink's Board of Directors are granted stock options to purchase EarthLink Common Stock as follows: options to purchase 35,000 shares are granted upon joining the Board of Directors, and options to purchase 10,000 shares are granted yearly, each with an exercise price equal to the fair market value on the date of grant.

EXECUTIVE OFFICERS

The executive officers of the Company serve at the discretion of the Board of Directors, and serve until they resign, are removed or are otherwise disqualified to serve, or until their successors are elected and qualified. EarthLink's executive officers presently include: Charles G. Betty, Lee Adrean, Linda W. Beck, Samuel R. DeSimone, Jr., Karen L. Gough, William S. Heys, Jon M. Irwin, Michael C. Lunsford, Michael S. McQuary, Veronica J. Murdock, Gregory J. Stromberg, Lance Weatherby and Brinton O. C. Young. The following sets forth biographical information for our executive officers who are not directors, for whom the biographical summaries are provided in "Proposal 1—Election of Directors" and "Directors Continuing in Office" above.

Lee Adrean—Executive Vice President and Chief Financial Officer

Age: 50

Mr. Adrean has served as our Executive Vice President and Chief Financial Officer since March 2000. From May 1995 to February 2000, Mr. Adrean served as Executive Vice President and Chief Financial Officer of First Data Corporation in Atlanta. From August 1993 to April 1995, Mr. Adrean served as President of Providian Corporation Agency Group (a division of Providian Corporation). Prior to that, Mr. Adrean was Chief Financial Officer of Providian Corporation and held various positions with Bain & Company and Peat, Marwick, Mitchell & Company.

Linda W. Beck—Executive Vice President, Operations

Age: 38

Ms. Beck has served as our Executive Vice President of Operations since September 2000. Ms. Beck is responsible for the management of EarthLink's operations groups, including development, system administration, MIS and network operations. Following the EarthLink Network/MindSpring merger in February 2000, Ms. Beck served as Vice President of Engineering responsible for the development of EarthLink's products and services, as well as the development of EarthLink's service delivery infrastructure. She held similar positions at both MindSpring from February 1999 to February 2000 and Netcom from September 1996 to February 1999. Before joining Netcom in 1996, Ms. Beck served in a variety of positions at Sybase, GTE, Amdahl and the National Security Agency.

Samuel R. DeSimone, Jr.—Executive Vice President, General Counsel and Secretary

Age: 42

Mr. DeSimone has served as our Executive Vice President, General Counsel and Secretary since February 2000. Prior to that, Mr. DeSimone served in such capacities at MindSpring since November 1998. From September 1995 to August 1998, Mr. DeSimone served as Vice President of Corporate Development with Merix Corporation of Forest Grove, Oregon, a printed circuit board manufacturer. From June 1990 to August 1995, he was an associate attorney and partner with Lane Powell Spears Lubersky of Portland, Oregon.

Karen L. Gough—Executive Vice President, Marketing

Age: 45

Ms. Gough has served as our Executive Vice President, Marketing since June 2001. She is responsible for leading our consumer marketing efforts, including branding campaigns, advertising, media, promotions and our extensive direct marketing efforts. Prior to joining EarthLink, from October 1998 until June 2001, she served as the Vice President of Marketing Solutions for The Coca-Cola Company, where she was

6

responsible for Coca-Cola's media planning and buying, brand building promotional marketing programs, and sports and entertainment marketing initiatives. From August 1990 to October 1998, Ms. Gough held a variety of senior sales and marketing positions with Reckitt & Colman, Inc., a manufacturer of household cleaning products and specialty food items. She has also held sales and marketing positions with Pepsi-Cola Company, The National Football League Properties and International Playtex.

William S. Heys—Executive Vice President, Sales

Age: 52

Mr. Heys has served as our Executive Vice President, Sales since September 2000 and was Executive Vice President, Business Development and Business Services from February 2000 to September 2000. Prior to that, Mr. Heys served as Senior Vice President, Sales of EarthLink Network since August 1999, and was Vice President of EarthLink Network's relationship with Sprint from January 1999 to August 1999. Prior to joining EarthLink Network in October 1994, Mr. Heys founded BHC & Associates, a high-tech industry consulting firm. Before starting BHC, Mr. Heys served in a variety of executive sales and marketing management positions at IBM, Wang, Hayes Microcomputer Products and Digital Communications Associates, Inc.

Jon M. Irwin—Executive Vice President, Member Experience

Age: 41

Mr. Irwin has served as our Executive Vice President, Member Experience since September 2000 and was Executive Vice President of Operations from February 2000 to September 2000. Mr. Irwin served EarthLink Network in a variety of executive positions from November 1995 until its merger with MindSpring in February 2000, including Executive Vice President of Operations, Senior Vice President of Broadband Services and Vice President of Customer Support. From November 1994 to November 1995, Mr. Irwin was Vice President for Operations at WorldCom, a telecommunications company. From November 1992 to November 1994, Mr. Irwin served as Vice President of Corporate Development for Impact Telecommunications, an integrated communications company. He has been involved in several start-up telecommunications companies in various management roles.

Michael C. Lunsford—Executive Vice President, Strategic Brand Marketing

Age: 34

Mr. Lunsford has served as our Executive Vice President, Strategic Brand Marketing since August 2001. Prior to that, Mr. Lunsford served as Executive Vice President, Broadband Services from February 2000 to August 2001, and in that same role for EarthLink Network from November 1999 until its merger with MindSpring in February 2000. Prior to that, Mr. Lunsford was EarthLink Network's Vice President of Special Projects, a position he held from the beginning of his employment with EarthLink Network in March of 1999. Before joining EarthLink Network, Mr. Lunsford was a Director with Scott, Madden & Associates, a management consulting firm in Raleigh, North Carolina, from 1995 to 1999. Prior to that, Mr. Lunsford worked for Andersen Consulting in Chicago, Illinois.

Veronica J. Murdock—Executive Vice President, Acquisitions and Integration

Age: 38

Ms. Murdock has served as our Executive Vice President, Acquisitions and Integration since September 2000. Ms. Murdock has served EarthLink in a variety of executive positions including, Executive Vice President of Member Support and Services and Vice President, Member Support and Services. Prior to joining EarthLink Network, from 1994 to 1998, Ms. Murdock served as Senior Vice President of Worldwide Operations for 7th Level, a multimedia company. Prior to that, Ms. Murdock served as Vice President of Operations for Digital Magic, a visual effects and teleportation company, as well as several executive positions managing teleproduction studios and content technology for the film and television mediums.

7

Gregory J. Stromberg—Executive Vice President, Employee Services

Age: 49

Mr. Stromberg has served as our Executive Vice President, Employee Services since February 2000. Prior to that, Mr. Stromberg served as MindSpring's Executive Vice President of Business Services since January 1999, Executive Vice President of Technology from August 1998 until January 1999, Executive Vice President of Call Centers from March 1998 until August 1998, Vice President of Call Centers from June 1996 to March 1998, and Vice President of Technical Support from October 1995 until June 1996. From June 1993 to September 1994, Mr. Stromberg worked as a Regional Manager for Digital Financial Services, a subsidiary of GE Capital. Mr. Stromberg worked in various sales, product management, operations and management positions with Digital Equipment Corporation from June 1983 to June 1993.

Lance Weatherby—Executive Vice President, EarthLink Everywhere

Age: 41

Mr. Weatherby has served as Executive Vice President, EarthLink Everywhere since September 2000. From February 2000 to September 2000, he served as EarthLink's Executive Vice President of Dialup Services. From September 1995 until the EarthLink Network/MindSpring merger in February 2000, Mr. Weatherby served in a variety of executive positions at MindSpring including Executive Vice President of Sales and Marketing and Vice President of Business Development. Prior to joining MindSpring, Mr. Weatherby held a variety of sales, sales management and marketing positions with Mobil from October 1990 through September 1995, including District Sales Manager from December 1992 through September 1995.

Brinton O. C. Young—Executive Vice President, Strategic Planning

Age: 50

Mr. Young has served as our Executive Vice President, Strategic Planning since June 2001. From February 2000 to June 2001, he was our Executive Vice President, Marketing and Corporate Strategy. Prior to that, he was Senior Vice President, Marketing of EarthLink Network from August 1998 through February 2000, and was Vice President, Strategic Planning of EarthLink Network from March 1996 throughout 1998. From 1990 to 1996, Mr. Young was President of Young & Associates, a consulting firm specializing in strategic planning for high growth companies.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires the Company's directors, executive officers and persons who own beneficially more than 10% of the Company's Common Stock to file reports of ownership and changes in ownership of such stock with the Securities and Exchange Commission (the "SEC") and the National Association of Securities Dealers, Inc. These persons are also required by SEC regulations to furnish the Company with copies of all such forms they file. To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, all of the Company's reporting persons complied during fiscal 2001 with all applicable Section 16(a) filing requirements, except for the following: Mr. Heys has filed a report on Form 5 to correct his unintentional failure to report one transaction in November 2001; Ms. Fuller has filed a report on Form 5 to correct the unintentional omission to report existing holdings of the Company's Common Stock at the time she filed her Form 3 report in November 2001; and Mr. Irwin has filed a report on Form 5 to correct his unintentional failure to report one transaction in November 2001.

8

Beneficial Ownership of Common Stock

The following table sets forth information concerning the beneficial ownership of our outstanding Common Stock by: (i) those persons known by management of the Company to own beneficially more than 5% of the Company's outstanding Common Stock, (ii) the directors of the Company, (iii) the executive officers identified as "Named Executive Officers" in the Summary Compensation Table included elsewhere in this Proxy Statement, and (iv) all directors and officers of the Company as a group. Except as otherwise indicated in the footnotes below, such information is provided as of February 28, 2002. According to rules adopted by the SEC, a person is the "beneficial owner" of securities if he or she has or shares the power to vote them or to direct their investment or has the right to acquire beneficial ownership of such securities within 60 days through the exercise of an option, warrant or right, the conversion of a security or otherwise. Except as otherwise noted, the indicated owners have sole voting and investment power with respect to shares beneficially owned.

Name and Address of Beneficial Owners(1)

| | Amount and Nature of

Beneficial Ownership(2)

| | Percent of

Class

|

|---|

| Lee Adrean | | 206,250 | (3) | * |

| Charles G. Betty | | 1,081,595 | (4) | * |

| Austin M. Beutner | | 11,667 | (5) | * |

| Sky D. Dayton | | 3,577,753 | (6) | 2.4 |

| Marce Fuller | | 4,845 | (7) | * |

| William S. Heys | | 246,949 | (8) | * |

| Jon M. Irwin | | 256,676 | (9) | * |

| Robert M. Kavner | | 67,373 | (10) | * |

| Linwood A. Lacy, Jr. | | 360,050 | (11) | * |

| Michael S. McQuary | | 993,925 | (12) | * |

| Dr. Robert M. Metcalfe | | — | (13) | * |

| Sprint Corporation | | 29,950,407 | (14) | 16.8 |

| All directors and executive officers as a group (19 persons) | | 8,276,328 | (15) | 5.6 |

- *

- Represents beneficial ownership of less than 1% of our Common Stock.

- (1)

- Except as otherwise indicated by footnote (i) the named person has sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned, and (ii) the address of the named person is that of EarthLink.

- (2)

- Beneficial ownership is determined in accordance with the rules of the SEC, based on factors including voting and investment power with respect to shares, subject to applicable community property laws. Shares of Common Stock subject to options or warrants currently exercisable and exercisable within 60 days after February 28, 2002 are deemed outstanding for the purpose of computing the percentage ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage ownership of any other person.

- (3)

- Includes options to purchase 201,250 shares of Common Stock.

- (4)

- Includes options to purchase 632,441 shares of Common Stock.

- (5)

- Represents options to purchase 11,667 shares of Common Stock.

- (6)

- Includes options to purchase 10,000 shares of Common Stock.

9

- (7)

- Represents shares beneficially owned by Ms. Fuller.

- (8)

- Includes options and warrants to purchase 240,423 shares of Common Stock.

- (9)

- Includes options to purchase 202,239 shares of Common Stock.

- (10)

- Includes options to purchase 11,667 shares of Common Stock.

- (11)

- Includes options to purchase 10,000 shares of Common Stock.

- (12)

- Includes options to purchase 687,405 shares of Common Stock.

- (13)

- Dr. Metcalfe does not have beneficial ownership of any shares.

- (14)

- Represents shares of Common Stock and shares of Series A Convertible Preferred Stock and Series B Convertible Preferred Stock convertible into Common Stock. Sprint's address is: 2330 Shawnee Mission Parkway, Westwood, Kansas, 66205.

- (15)

- Includes options and warrants to purchase an aggregate of 3,215,093 shares of Common Stock.

10

EXECUTIVE COMPENSATION

Pursuant to SEC rules for proxy statement disclosure of executive officer compensation, the Compensation Committee of the Board of Directors of the Company has prepared the following Report on Executive Officer Compensation. The Committee intends that this report clearly describe the current executive officer compensation program of the Company, including the underlying philosophy of the program and the specific performance criteria on which executive officer compensation is based. This report also discusses in detail the compensation paid to the Company's Chief Executive Officer.

Compensation Committee Report on Executive Officer Compensation

This report by the Compensation Committee of the Board of Directors (the "Committee") discusses the Committee's compensation objectives and policies applicable to the Company's executive officers. The report reviews the Committee's policy generally with respect to the compensation of all executive officers as a group for fiscal 2001 as reported in the Summary Compensation Table. The Committee is comprised entirely of non-employee directors. The Committee also administers the Company's stock option plans.

Compensation Philosophy

The Committee consists of three non-employee directors, Mr. Lacy—Chairman, Mr. Dayton and Ms. Fuller. The Committee is responsible for setting cash and long-term incentive compensation for executive officers and other key employees of the Company. The Company's compensation policies are intended to create a direct relationship between the level of compensation paid to executives and the Company's current and long-term level of performance. The Committee believes that this relationship is best implemented by providing a compensation package of separate components, all of which are designed to enhance the Company's overall performance. The components are base salary, short-term compensation in the form of annual bonuses and long-term incentive compensation in the form of stock options.

Base Salaries

The base salaries for the Company's executive officers for 2001 were established by comparing base salaries offered for similar positions in competing or similar companies. The salaries of the executive officers were established based on the market environment and the Company's need to attract and retain key personnel for whom the Company must compete against larger, more established companies.

Short-Term Annual Bonuses

Annual bonuses established for the executive officers are intended to provide an incentive for improved performance in the short term. The Committee establishes target bonus levels for the executive officers at the beginning of the year based on predetermined goals such as total paying customers, customer retention, revenue and profitability.

Long-Term Incentive Compensation

The Company's long-term incentive compensation plan for its executive officers is based on the Company's stock option plans. These plans promote ownership of the Company's Common Stock, which, in turn, provides a common interest between the stockholders of the Company and the executive officers of the Company. In establishing a long-term compensation plan, the Board of Directors concluded that any compensation received under such plans should be directly linked to the performance of the Company, as reflected by increases in the price of its Common Stock, and the contribution of the individual thereto. Options have an exercise price equal to the fair market value of the shares on the date of grant and, to encourage a long-term perspective, have an exercise period of ten years and generally vest over four to five years. The number of options granted to executive officers is determined by the Committee, which is charged with administering the stock option plans.

11

The base salaries, targeted bonus amounts and number of stock options established for or granted to the Company's executive officers are based in part on the Committee's understanding of compensation amounts and forms paid to persons in comparable roles performing at comparable levels at other companies in the same or related industries. Such amounts, however, mainly reflect the subjective discretion of the members of the Committee based on the evaluation of the Company's current and anticipated future financial performance, the contribution of the individual executive officers to such financial performance, the contribution of the individual executive officers to the Company in areas not necessarily reflected by the Company's financial performance and the most appropriate incentive to link the performance and compensation of the executive officers to the stockholder's return on the Company's Common Stock.

The Compensation Committee Report on Executive Compensation shall not be deemed to be incorporated by reference as a result of any general incorporation by reference of this Proxy Statement or any part hereof in the Company's 2002 Annual Report to Stockholders or its Annual Report on Form 10-K for the year ended December 31, 2001.

Change-In-Control Accelerated Vesting and Severance Plan

General. EarthLink's Change-In-Control Accelerated Vesting and Severance Plan (the "CIC Plan") provides security to certain employees of EarthLink and its affiliates in the event of a Change of Control (as defined) of the Company. For purposes of the CIC Plan, "Change of Control" generally means a transaction pursuant to which any person acquires more than 50% of the voting power of the Company or any merger, reorganization or similar event where the owners of the voting stock of the Company before the event do not own voting stock representing at least 50% of the voting power of the Company or its successor after the event. The CIC Plan generally is a severance pay plan that provides continued compensation and other benefits to certain employees of the Company and its affiliates if their employment terminates for reasons described in the CIC Plan within a certain time of a Change of Control of the Company. The CIC Plan as a "welfare plan" is subject to the Employee Retirement Income Security Act of 1974, as amended. The CIC Plan is administered by the Company, which has responsibility for construing and interpreting the CIC Plan and establishing and amending such rules and regulations as it deems necessary or desirable for the proper administration of the CIC Plan.

Eligibility for Participation. The CIC Plan creates three benefit categories based on the employee's position with the Company or an affiliate. For purposes of the CIC Plan, the "Gold" benefit category includes the Chief Executive Officer and President of the Company. The "Silver" benefit category includes the Chief Financial Officer of the Company, the Chief Executive Officer, President, and Chief Financial Officer of an affiliate, and the Executive Vice Presidents of the Company or an affiliate. Finally, the "Bronze" benefit category includes Vice Presidents of the Company or an affiliate, Blue Zone Classified Jobs of the Company or an affiliate (as defined in the normal payroll practices and procedures of the Company or an affiliate), or one or more classes of employees whom the Board of Directors of the Company may select for participation under the CIC Plan.

Compensation Benefits. If at any time within eighteen (18) months after a Change of Control occurs, the employment of a participating employee is terminated by the Company or an affiliate for any reason other than Cause (as defined in the CIC Plan), disability or death or the participating employee voluntarily terminates his employment for Good Reason (as defined in the CIC Plan), such participating employee is entitled to receive the following benefits. To an employee in the Gold or Silver benefit category, the

12

Company will make a lump sum payment equal to (a) one and a half (11/2) times the employee's salary plus bonus target and (b) all amounts payable with respect to such employee's elected COBRA coverage (including for spouse and dependents) for one and a half (11/2) years from termination. To an employee in the Bronze benefit category, the Company will make a lump sum payment equal to (a) 100% of the employee's salary plus bonus target and (b) all amounts payable with respect to such employee's elected COBRA coverage (including for spouse and dependents) for one year from termination. The payment of the compensation benefits will be consistent with normal payroll practices and subject to applicable withholdings and employment taxes.

Acceleration of Options. As with the compensation benefits, a participating employee's benefit category determines the accelerated vesting benefits to which he or she is entitled. For an employee in the Gold or Silver benefit category, if his or her stock options are assumed or continued after a Change of Control, all outstanding stock options granted on or before the Change of Control will vest and be exercisable in full, if not already fully vested, on termination of employee's employment for any reason after the Change of Control occurs; however, if his or her stock options are not assumed or continued after the Change of Control, all outstanding stock options will vest and be exercisable in full contemporaneously with the Change of Control, if not already fully vested. For an employee in the Bronze benefit category, if his or her stock options are assumed or continued after a Change of Control, all outstanding stock options granted on or before the Change of Control will vest and be exercisable at least as much as if the employee had remained employed for twenty four (24) months after the Change of Control occurs, if not already vested to such extent; however, if his or her stock options are not assumed or continued after the Change of Control, all outstanding stock options are vested and exercisable at least as much as if the employee had remained employed for twenty four (24) months after the Change of Control occurs, if not already vested to such extent.

Unfunded Status. The CIC Plan is unfunded, and the Company and its affiliates are not required to segregate any assets to fund the benefits, if any, that will become payable under it. Any liability of the Company or any affiliate to any employee with respect to the CIC Plan is based solely on any contractual obligations that may be created pursuant to the CIC Plan.

Amendment and Termination. The Company will have the right to amend the CIC Plan from time to time and may terminate it at any time;provided, however, that after a Change of Control of the Company occurs (i) no amendment may be made that diminishes any employee's rights following such Change of Control and (ii) the CIC Plan may not be terminated.

13

Compensation of our Chief Executive Officer

Charles G. Betty is employed as our Chief Executive Officer pursuant to an employment agreement at a salary of not less than $600,000 per year, plus a $24,000 a year travel allowance for Mr. Betty and his family, and such other benefits generally made available to our other senior executives. Mr. Betty is entitled, if specified performance goals are met, to an annual bonus in the amount equal to 50% of his base salary. In addition, Mr. Betty will receive a severance payment equal to 100% of his then current base salary, will receive the full bonus to which he would have otherwise been entitled during the year in which the termination occurs, and will continue to receive health, medical, life and liability insurance coverage for one year (i) if he is terminated by the Company other than for "cause" as defined in the employment agreement, (ii) if the Company elects not to extend the employment agreement at the end of the first three-year term or any yearly extension or (iii) if Mr. Betty terminates his employment because of a breach of the employment agreement by the Company. Mr. Betty's benefits under his employment agreement are cumulative of his benefits under other Company sponsored plans such as the CIC Plan.

Limitations on Deductibility of Compensation

Under the 1993 Omnibus Budget Reconciliation Act, a portion of annual compensation payable after 1993 to any of the Company's five highest paid executive officers would not be deductible by the Company for federal income tax purposes to the extent such officer's overall compensation exceeds $1,000,000. Qualifying performance-based incentive compensation, however, would be both deductible and excluded for purposes of calculating the $1,000,000 base. Although the Committee does not presently intend to award compensation in excess of the $1,000,000 cap, it will continue to address this issue when formulating compensation arrangements for the Company's executive officers.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Company's Board of Directors currently consists of Mr. Lacy, Mr. Dayton and Ms. Fuller. No member of the Compensation Committee was, during the last fiscal year, an officer or employee of the Company nor was formerly an officer of the Company, except for Mr. Dayton who served as EarthLink Network's Chief Executive Officer and President prior to Mr. Betty's appointment to those positions in January 1996. Mr. Campbell B. Lanier, III, who prior to February 2001 served on the Board of Directors and on the Compensation Committee, resigned from these positions in February 2001. Mr. Lanier is a member of the Board of Directors of ITC Holding Company, which was a substantial investor in EarthLink, before selling all its shares of EarthLink Common Stock during February 2001. The Company is a party to certain business relationships with subsidiaries and affiliates of ITC Holding Company. Except as noted below, none of these transactions were material for the periods presented.

The Company purchases long-distance telephone services and wide area network transport service from ITC DeltaCom, Inc. ("ITC DeltaCom"), a related party through relationships with ITC Holding Company. Long-distance charges from ITC DeltaCom totaled approximately $9.4 million for 2001.

The Company paid consulting fees and expenses in 2001 to eCompanies, LLC ("eCompanies"). Mr. Dayton is a founder and member of the Board of Directors of eCompanies, and Austin M. Beutner is a member of the Board of Directors of eCompanies. Mr. Dayton is a founding partner of eCompanies Venture Group, LP ("EVG"), with which eCompanies is affiliated. Mr. Dayton is the Chairman of EarthLink's Board of Directors and a member of the Compensation Committee of the Board of Directors, and Mr. Beutner is a member of EarthLink's Board of Directors. The consulting fees and expenses paid to eCompanies during the three years ended December 31, 2001 were zero, $226,000 and $454,000, respectively. All amounts due under the consulting contract were paid as of March 2001. In 2001, the Company maintained its $10 million equity capital investment as a limited partner of EVG, which was originally invested in 2000.

14

The Company had commercial arrangements with Computers4Sure.com, Inc. and Shopping4Sure.com, Inc. in 2001, each of which is an affiliate of 4Sure.com, Inc. (together, "4Sure") Mr. Lacy, a member of our Board of Directors and Chairman of our Compensation Committee, was the Chairman of 4Sure.com, Inc. from June 1998 through July 2001. 4Sure was a tenant in the Company's former online shopping mall and also had other arrangements with the Company relating to online sales of computer hardware. In 2001, 4Sure paid the Company approximately $320,212 in connection with those arrangements.

No other members of the Compensation Committee had disclosable relationships with the Company in 2001. However, the following disclosure regarding non-Compensation Committee Board members is required.

Certain Relationships and Related Transactions

In February 2001, we restructured our commercial and governance arrangements with Sprint, a significant stockholder of EarthLink, to reflect the evolution of both our relationship and the telecommunications-Internet market. While we continue to have a close relationship with Sprint, the following highlights the changes we made.

Commercial Relationship. EarthLink continues to support a variety of Sprint-branded retail Internet services, such as Sprint's broadband services, and some of its web hosting services. We do this through a wholesale arrangement with Sprint. Sprint continues to sell EarthLink-branded dial-up Internet access service, though Sprint may now, at its election, create a Sprint-branded dial-up service, using EarthLink components on a wholesale basis. Both companies have removed all exclusivity provisions from the relationship. Sprint is free to pursue relationships with other Internet Service Providers, and we are free to enter into commercial relationships with other telecommunications service providers.

Governance Relationship. Among other changes in the governance relationship, Sprint no longer has the contractual right to acquire EarthLink. Sprint will continue to have the right to maintain its percentage of our fully diluted equity ownership by purchasing shares on the market or from third parties in the event that we dilute Sprint's interest by issuing voting securities in a financing, in an acquisition, or by the exercise of options or warrants or the conversion of convertible securities into voting stock. However, Sprint will, in most cases, have no other rights to acquire EarthLink securities directly from EarthLink. Sprint will retain the ability to make a counteroffer to buy all, but not less than all, of our equity in the event a third-party seeks to acquire a controlling interest in EarthLink. In that case, our Board of Directors is not contractually obligated to accept Sprint's counter-offer, but will analyze Sprint's counter-offer in exercising its fiduciary duties to our stockholders. Sprint has also relinquished its right to appoint two members to our Board of Directors and its representatives have resigned from their positions on our Board of Directors. This new governance arrangement terminates in the event that EarthLink consummates a change in control transaction with a third party, or if Sprint acquires all of the equity of EarthLink pursuant to a counter-offer that our Board of Directors accepts, or if Sprint's ownership of our common and preferred equity falls below 5% of our total voting equity.

Changes in Sprint's ownership of EarthLink. In August 2001, the Company registered 32.1 million shares of its Common Stock with the Securities and Exchange Commission on Form S-3. Of the 32.1 million shares, (i) approximately 12.5 million represented previously unregistered shares of Common Stock held by Sprint, (ii) approximately 12.5 million represented Common Stock underlying approximately 13.2 million shares of convertible preferred stock held by Sprint, and (iii) 7.1 million represented common shares underlying 7.1 million shares of Series C convertible preferred stock held by Apple Computer, Inc. This registration represented Apple's entire stock ownership in EarthLink. Sprint subsequently sold 18.4 million shares of Common Stock. Of that amount, 12.5 million shares were previously unregistered shares of EarthLink Common Stock held by Sprint and 5.9 million shares were obtained by Sprint upon conversion of 6.2 million shares of Series B convertible preferred stock. In November 2001, Sprint

15

obtained approximately 3.0 million shares of the Company's Common Stock upon conversion of approximately 3.1 million shares of the Company's Series A convertible preferred stock.

During 2000, the Company loaned money to certain executive officers to allow them to meet margin calls on shares of EarthLink Common Stock that they hold. As of December 31, 2001, the following loans to executive officers were outstanding: Mr. Betty—$621,061 ($617,493 of principal and $3,568 of interest); Mr. McQuary—$277,399 ($273,595 of principal and $3,804 of interest); Mr. Irwin—$190,206 ($190,000 of principal and $206 of interest); and Mr. Young—$1,026,738 ($1,000,000 of principal and $26,738 of interest). These loans were made at what the Company believes to be market interest rates, and may be prepaid at any time, without penalty, prior to their due dates.

The Company had commercial arrangements with Overture Services, Inc. (formerly known as GoTo.com) ("Overture") in 2001. Mr. Kavner, a member of our Board of Directors, is the Chairman of the Board of Overture. Overture was (but no longer is) EarthLink's default search engine provider, and in 2001 Overture paid the Company approximately $6,786,481 in connection with those arrangements.

Please also see "Compensation Committee Interlocks and Insider Participation" above for a description of other arrangements between the Company and certain members of the Compensation Committee of the Board of Directors.

The Company believes that the foregoing transactions were on terms no less favorable to the Company than could be obtained from unaffiliated parties. It is the Company's current policy that all transactions by the Company with officers, directors, more than five percent stockholders and their affiliates will be entered into only if such transactions are approved by a majority of disinterested independent directors and are on terms such directors believe are no less favorable to the Company than could be obtained from unaffiliated parties.

Executive Officer Compensation

Table I—Summary Compensation Table

The following table presents certain information required by the SEC relating to various forms of compensation awarded to, earned by or paid to the Company's Chief Executive Officer and the four most highly compensated executive officers other than the Chief Executive Officer who earned more than $100,000 during fiscal 2001 and were serving at the end of fiscal 2001. This compensation information

16

relates to compensation received by the named executives while employed by EarthLink. Such executive officers are referred to as the "Named Executive Officers."

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Options

| | All Other

Compensation

| |

|---|

Charles G. Betty

Chief Executive Officer | | 2001

2000

1999 | | $

| 496,667

353,076

300,438 | | $

| 186,498

133,652

163,643 | | 300,000

300,000

— | | $

| 2,625

4,059

19,385 | (1)

(2)

(3) |

Michael S. McQuary

President | | 2001

2000

1999 | | | 328,335

260,016

160,417 | | | 123,290

94,711

71,355 | | —

321,370

52,102 | | | 2,625

2,625

— | (1)

(1)

|

Lee Adrean

Executive Vice President,

Chief Financial Officer | | 2001

2000 | | | 301,667

200,807 | | | 90,621

58,515 | | —

440,000 | | | 2,625

94,000 | (1)

(4) |

William S. Heys

Executive Vice President, Sales | | 2001

2000

1999 | | | 243,750

234,768

174,685 | | | 73,222

68,311

78,444 | | —

191,000

— | | | 2,625

—

— | (1)

|

Jon M. Irwin

Executive Vice President,

Member Experience | | 2001

2000

1999 | | | 259,167

255,182

179,114 | | | 77,854

74,251

68,902 | | —

195,000

64,600 | | | 2,625

2,732

2,529 | (1)

(1)

(1) |

- (1)

- Consists of matching contributions made under our 401(k) Plan.

- (2)

- Consists of reimbursement in 2000 of $2,378 in travel expenses pursuant to Mr. Betty's employment agreement and $1,681 in matching contributions made to Mr. Betty's account under our 401(k) Plan.

- (3)

- Consists of reimbursement in 1999 of $16,785 in travel expenses pursuant to Mr. Betty's employment agreement and $2,600 in matching contributions made to Mr. Betty's account under our 401(k) Plan.

- (4)

- Represents a signing bonus and reimbursement for benefits lost when Mr. Adrean left First Data Corporation to join EarthLink in March 2000.

Table II—Option Grants in Fiscal 2001

This table presents information regarding options granted to the Company's Named Executive Officers during fiscal year 2001 to purchase shares of the Company's Common Stock. In accordance with SEC rules, the table shows the hypothetical "gains" or "option spreads" that would exist for the respective options based on assumed rates of annual compound stock price appreciation of 5% and 10% from the date the options were granted over the full option term.

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value

at Assumed Annual

Rates of Stock

Price Appreciation for

the Option Term(3)

|

|---|

| |

| | Percentage

of Total

Options

Granted to

Employees in

Fiscal

Year

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options

Granted(1)

| |

| |

|

|---|

Name

| | Exercise Price

Per Share(2)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Charles G. Betty | | 300,000 | (4) | 7.2 | % | 16.820 | | 07/26/11 | | 3,173,402 | | 8,042,024 |

- (1)

- The total number of options granted to employees in fiscal year 2001 were 4,151,000.

- (2)

- The exercise price per share of options granted represented the fair market value of the underlying shares of Common Stock on the dates the options were granted.

17

- (3)

- As required under the SEC's rules, amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. These assumptions are not intended to forecast future appreciation of our stock price. The potential realizable value computation does not take into account federal or state income tax consequences of option exercises or sales of appreciated stock. If our stock price does not actually increase to a level above the applicable exercise price at the time of exercise, the realized value to the Named Executive Officers from these options will be zero.

- (4)

- These options become exercisable as follows: (i) 25% of the options become exercisable one year after the date of grant, and (ii) an additional 6.25% of the options become exercisable each fiscal quarter thereafter until fully vested.

Set forth below is the number of incentive stock options that had been granted to certain employees of the Company under the stock option plans of EarthLink that remained outstanding as of December 31, 2001. On December 31, 2001, the closing price for EarthLink's Common Stock was $12.17 per share as reported by Nasdaq.

Name

| | Incentive

Options

| |

|---|

| Charles G. Betty | | 920,941 | (1) |

| Lee Adrean | | 440,000 | |

| Michael S. McQuary | | 865,458 | |

| William S. Heys | | 339,704 | |

| Jon M. Irwin | | 336,464 | |

| All Executive Officers as a Group (5 Persons) | | 2,902,567 | (2) |

| Non-Executive Officer Employees as a Group | | 16,351,259 | (3) |

- (1)

- Includes 300,000 options granted in 2001.

- (2)

- Represents a total of 3,971,458 options granted less the exercise of 1,068,891 shares as of December 31, 2001.

- (3)

- Represents options granted to 5,111 employees under the stock option plans of EarthLink. This figure was adjusted to reflect both the recapture of 10,557,499 options pursuant to employee terminations and the exercise of 6,089,300 options by employees as of December 31, 2001.

Table III—Option Exercises In Fiscal 2001 and Fiscal 2001 Year-End Option Values

The following table shows the number of shares of Common Stock subject to exercisable and unexercisable stock options held by each of the Named Executive Officers as of December 31, 2001. The table also reflects the values of such options based on the positive spread between the exercise price of

18

such options and the closing sales prices of EarthLink Common Stock as reported on Nasdaq on December 31, 2001.

| |

| |

| | Number of

Securities Underlying

Unexercised Options

| | Value of Unexercised

In-the-Money Options(1)

|

|---|

Name

| | Shares

Acquired on Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Charles G. Betty | | — | | | | | 557,441 | | 525,000 | | $ | 2,930,298 | | $ | 474,188 |

| Michael S. McQuary | | — | | | — | | 616,813 | | 248,645 | | | 5,607,522 | | | 340,631 |

| Lee Adrean | | — | | | — | | 166,250 | | 273,750 | | | 119,864 | | | 280,561 |

| William S. Heys | | 27,376 | | $ | 105,666 | | 220,986 | | 127,438 | | | 664,636 | | | 208,116 |

| Jon M. Irwin | | — | | | | | 206,776 | | 129,688 | | | 335,602 | | | 208,116 |

- (1)

- The value of "in-the-money" options represents the difference between the exercise price of stock options and $12.17, the per share closing sales price on December 31, 2001 for EarthLink's Common Stock as reported by Nasdaq.

STOCK PERFORMANCE GRAPH

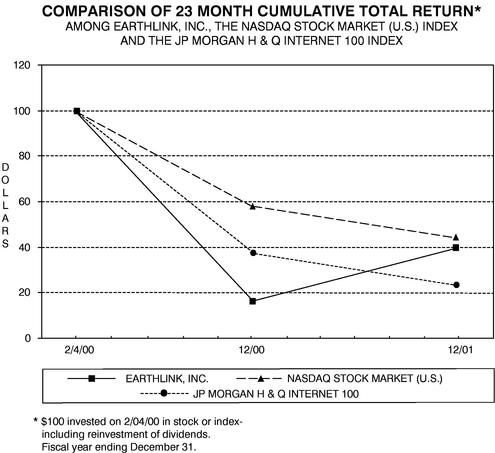

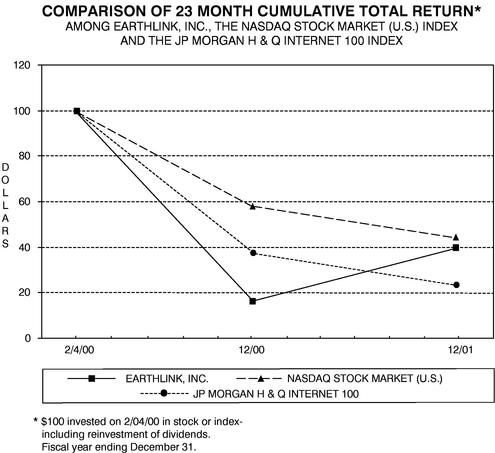

The following indexed line graph indicates EarthLink's total return to stockholders from February 7, 2000, the date on which the Company's Common Stock began trading on the Nasdaq National Market, to December 31, 2001, as compared to the total return for the Nasdaq Stock Market—US Index and the JP Morgan H&Q Internet index for the same period. The calculations in the graph assume that $100 was invested on February 7, 2000, in the Company's Common Stock and each index and also assume dividend reinvestment.

19

AUDIT COMMITTEE

Pursuant to SEC rules for proxy statements, the Audit Committee of the Board of Directors of the Company has prepared the following Audit Committee Report. The Audit Committee intends that this report clearly describe the current Audit program of the Company, including the underlying philosophy and activities of the Audit Committee.

Audit Committee Report

The primary function of the Audit Committee of the Board of Directors (the "Audit Committee") is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing: (a) the financial reports and other financial information provided by the Company to any governmental body or the public, (b) the Company's systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board of Directors have established, and (c) the Company's auditing, accounting and financial reporting processes generally. The Audit Committee operates under a written charter. Consistent with this function, the Audit Committee encourages continuous improvement of, and fosters adherence to, the Company's policies, procedures and practices at all levels. The Audit Committee is accountable and responsible to the full Board of Directors. The Audit Committee's primary duties and responsibilities are to:

- •

- Serve as an independent and objective party to monitor the Company's financial reporting process and internal control systems;

- •

- Review and appraise the audit efforts of the Company's independent auditors; and

- •

- Provide open channels of communication among the Company's independent auditors, financial and senior management and the Board of Directors.

Composition and Qualifications of Audit Committee

The Audit Committee presently consists of three non-employee directors: Mr. Kavner—Chairman, Mr. Beutner and Dr. Metcalfe. Each member of the Audit Committee is independent, financially literate and is free from any relationship that, in the judgment of the Board of Directors, would interfere with the exercise of his independent judgment as a member of the Audit Committee. At least one member of the Audit Committee has accounting or related financial expertise. Accordingly, the members of the Audit Committee meet the independence and experience requirements of Nasdaq as set forth in the NASD Listing Standards for Nasdaq-listed companies.

Election and Meetings

The members of the Audit Committee are appointed by the Board of Directors annually. The Audit Committee meets at least four times annually, or more frequently as circumstances require. The Audit Committee meets at least annually with representatives from the Company's executive management and its independent auditors in separate sessions to discuss any matters that the Audit Committee or any of these groups believe should be discussed. In addition, the Audit Committee or its Chairman meets with the independent auditors and a representative(s) of the Company's management at least quarterly to review the Company's quarterly financial statements consistent with the provisions of Statement of Auditing Standards No. 61.

20

Responsibilities and Duties

To fulfill its responsibilities and duties, the Audit Committee performed the following during the year ended December 31, 2001:

- 1.

- Reviewed regular internal reports to management prepared by the Company's internal accounting department.

- 2.

- Reviewed with the Company's financial management and its independent auditors, prior to filing with the Securities and Exchange Commission, all 10-Q Quarterly Reports, 10-K Annual Reports and other published reports that contain financial information. The Audit Committee or just the Chairman of the Audit Committee may perform these reviews.

- 3.

- Recommended to the Board of Directors the selection of Ernst & Young LLP as independent auditors. The Audit Committee evaluates the performance of the independent accounting firm. The Audit Committee has discussed with the firm the matters required to be discussed by Statement of Auditing Standards No. 61 (Codification of Statements on Auditing Standards, AU Sect. 380). These discussions include the scope of the auditor's responsibilities, significant accounting adjustments, any disagreements with management and a discussion of the quality, not just the acceptability of accounting principles, reasonableness of significant judgments, and the clarity of disclosures in the financial statements. In addition, the Audit Committee has also received the written disclosures and the letter from Ernst & Young LLP relating to the independence of that firm as required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees), and has discussed with Ernst & Young LLP that firm's independence from the Company.

- 4.

- In consultation with the independent auditing firm and the Company's internal financial and accounting personnel, the Audit Committee reviewed the integrity of the Company's financial reporting process, both internal and external.

- 5.

- Reviewed, with the Company's General Counsel, legal compliance matters, including corporate securities trading policies.

Based on the Audit Committee's discussions with management and Ernst & Young LLP and the Audit Committee's review of the representation of management and report of Ernst & Young LLP to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2001 filed with the Securities and Exchange Commission.

The Audit Committee Report shall not be deemed to be incorporated by reference as a result of any general incorporation by reference of this Proxy Statement or any part hereof in the Company's 2002 Annual Report to Stockholders or its Annual Report on Form 10-K for the year ended December 31, 2001.

21

PROPOSAL 2

APPROVAL OF THE COMPANY'S

EMPLOYEE STOCK PURCHASE PLAN

The Board of Directors of EarthLink has approved an Employee Stock Purchase Plan, pursuant to which eligible employees of EarthLink may purchase EarthLink Common Stock at a 15% discount through payroll deductions.

Summary of the Employee Stock Purchase Plan

The following summary of the EarthLink, Inc. Employee Stock Purchase Plan (the "Purchase Plan") is qualified in its entirety by the specific language of the Purchase Plan, a copy of which is attached as Annex A to this Proxy Statement and is available to any stockholder upon request.

General. The Purchase Plan is intended to qualify as an "employee stock purchase plan" under Section 423 of the Internal Revenue Code of 1986, as amended. Under the Purchase Plan, each calendar quarter, beginning on April 1, 2002, will be a "Participation Period." Each eligible employee can enroll for a Participation Period and elect to have between one percent (1%) and fifteen percent (15%) of his or her compensation (as defined in the Purchase Plan) for the Participation Period withheld from his or her paycheck to buy shares of Common Stock, subject to certain limits on the number of shares that may be bought under the Purchase Plan as described below. The price at which an eligible employee may buy Common Stock will be discounted.

Shares Subject to Plan. The Purchase Plan reserves in the aggregate 500,000 shares of Common Stock, plus an annual increase, to be added on January 1 of each calendar year beginning with calendar year 2003 and ending with (and including) calendar year 2007, equal to the lesser of (i) one-half of one percent (0.5%) of the shares of Common Stock outstanding on such January 1 (rounded to the nearest whole share and calculated on a fully-diluted basis), (ii) 100,000 shares of Common Stock, or (iii) such number of shares of Common Stock as the Board of Directors determines (which must be less than the numbers described in (i) and (ii)). The aggregate number of shares of Common Stock available for purchase under the Purchase Plan is subject to further adjustment as described below. If any purchase right to buy Common Stock granted under the Purchase Plan expires unexercised, the number of shares of Common Stock subject to such purchase right will again be available for purchase and will not reduce the aggregate number of shares of Common Stock available for purchase.

Eligibility. An employee of the Company or of any subsidiary the Board of Directors designates, will be eligible to participate in the Purchase Plan so long as such employee has been employed continuously for the preceding one-year period and such employment is for at least twenty (20) hours per week (an "Eligible Employee"). An officer of the Company or of a designated subsidiary will be an Eligible Employee if such officer is otherwise eligible under the terms of the Purchase Plan.