QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

EarthLink, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

EARTHLINK, INC.

1375 Peachtree St.

Atlanta, Georgia 30309

(404) 815-0770

April 22, 2003

Dear Stockholders:

You are cordially invited to attend the 2003 Annual Meeting of Stockholders of EarthLink, Inc. (the "Company"), which will be held at 10:00 a.m. (local time) on Tuesday, May 27, 2003, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street NW, Atlanta, Georgia (the "Annual Meeting").

The principal business of the Annual Meeting will be (i) the election of our Class I directors, (ii) the approval and ratification of amendments to the EarthLink, Inc. Stock Option Plan for Non-Employee Directors, (iii) the approval and ratification of amendments to the EarthLink, Inc. Stock Incentive Plan, and (iv) the ratification of the appointment by the Company's Audit Committee of the Board of Directors of Ernst & Young LLP as independent auditors for the year ending December 31, 2003. We will also review our results for the past fiscal year and report on significant aspects of our operations during the first quarter of 2003.

If you do not attend the Annual Meeting, you may vote your shares in any of three ways—by mail, by telephone or by Internet. The enclosed proxy card materials provide you details on how to vote by these three methods. Whether or not you plan to attend the Annual Meeting, we encourage you to vote in the method that suits you best so that your shares will be voted at the Annual Meeting. If you decide to attend the Annual Meeting, you may revoke your proxy and personally cast your votes.

Thank you, and we look forward to seeing you at the Annual Meeting or receiving your proxy vote.

| | Sincerely yours, |

|

|

| | Sky D. Dayton

Chairman of the Board |

EARTHLINK, INC.

1375 Peachtree St.

Atlanta, Georgia 30309

(404) 815-0770

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2003 Annual Meeting of Stockholders of EarthLink, Inc. (the "Company") will be held at 10:00 a.m. (local time), on Tuesday, May 27, 2003, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street NW, Atlanta, Georgia. The meeting is called for the following purposes:

- 1.

- To elect Class I directors for a three-year term;

- 2.

- To approve and ratify the amendment of the EarthLink, Inc. Stock Option Plan for Non-Employee Directors as described in the Proxy Statement, including in order to reserve an additional 600,000 shares of the Company's Common Stock for issuance thereunder and to permit the use of up to 300,000 of these shares for grants of Restricted Stock and Restricted Stock Units thereunder and the issuance of shares of Common Stock for deferred stock benefits;

- 3.

- To approve and ratify the amendment of the EarthLink, Inc. Stock Incentive Plan as described in the Proxy Statement, including in order to permit the use of up to 1,000,000 of the shares currently reserved for issuance under this Plan for the grant of Restricted Stock, Restricted Stock Units, Stock Appreciation Rights and Performance Awards thereunder and the issuance of shares of Common Stock for deferred stock benefits;

- 4.

- To ratify the appointment by the Company's Audit Committee of the Board of Directors of Ernst & Young LLP as the Company's independent auditors for the year ending December 31, 2003; and

- 5.

- To transact such other business as may properly come before the meeting.

The Board of Directors has fixed the close of business on March 31, 2003 as the record date for the purpose of determining the stockholders who are entitled to notice of and to vote at the meeting and any adjournment or postponement thereof.

| | By order of the Board of Directors, |

|

|

| | Sky D. Dayton

Chairman of the Board |

Atlanta, Georgia

April 22, 2003

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. IF YOU ARE UNABLE TO BE PRESENT AT THE MEETING, PLEASE VOTE YOUR SHARES BY MAIL WITH THE ENCLOSED PROXY CARD, BY TELEPHONE OR BY INTERNET SO THAT YOUR SHARES WILL BE REPRESENTED. IF YOU WISH, YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE TIME IT IS VOTED.

EARTHLINK, INC.

1375 Peachtree St.

Atlanta, Georgia 30309

PROXY STATEMENT

For the Annual Meeting of Stockholders

to be held May 27, 2003

This Proxy Statement is furnished by and on behalf of the Board of Directors (the "Board of Directors") of EarthLink, Inc. (the "Company" or "EarthLink") in connection with the solicitation of proxies for use at the 2003 Annual Meeting of Stockholders of the Company to be held at 10:00 a.m. (local time) on Tuesday, May 27, 2003, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street NW, Atlanta, Georgia, and at any adjournments or postponements thereof (the "Annual Meeting"). This Proxy Statement and the enclosed proxy card will be mailed on or about April 22, 2003 to the Company's stockholders of record (the "Stockholders") on the Record Date, as defined below.

THE BOARD OF DIRECTORS URGES YOU TO VOTE YOUR SHARES BY ANY OF THE THREE AVAILABLE METHODS—BY MAIL, BY TELEPHONE OR BY INTERNET. IF YOU VOTE BY MAIL, PLEASE COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE.

YOUR VOTE IS IMPORTANT!

SOLICITATION, VOTING AND REVOCABILITY OF PROXIES

General

Proxies will be voted as specified by the Stockholder or Stockholders granting the proxy. Unless contrary instructions are specified, if the enclosed proxy card is executed and returned (and not revoked) prior to the Annual Meeting, the shares of Common Stock, $.01 par value per share, of the Company (the "Common Stock") represented thereby will be voted FOR the proposals set forth in this Proxy Statement. The submission of a signed proxy will not affect a Stockholder's right to attend and to vote in person at the Annual Meeting. A Stockholder who executes a proxy may revoke it at any time before it is voted by filing with the Secretary of the Company either a written revocation or an executed proxy bearing a later date or by attending and voting in person at the Annual Meeting.

Only holders of record of Common Stock as of the close of business on March 31, 2003 (the "Record Date") will be entitled to vote at the Annual Meeting. Holders of shares of Common Stock (the "Shares") authorized to vote are entitled to cast one vote per Share on all matters voted upon at the Annual Meeting. As of the close of business on the Record Date, there were 151,651,175 Shares issued and outstanding.

Quorum Required

According to the Company's Bylaws, the holders of a majority of the Shares entitled to be voted must be present or represented by proxy to constitute a quorum. Each outstanding Share is entitled to one vote on all matters. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, the Stockholders who are present at the Annual Meeting in person or by proxy and who abstain, including brokers holding customers' shares of record who cause abstentions to be recorded at the meeting, are considered Stockholders who are present and entitled to vote and they count toward the quorum.

Vote Required

Under Delaware law, directors are elected by a plurality of the votes of the Shares entitled to vote and present in person or represented by proxy at a meeting at which a quorum is present. Only votes

actually cast will be counted for the purpose of determining whether a particular nominee received more votes than the persons, if any, nominated for the same seat on the Board of Directors. A Stockholder may withhold votes from any or all nominees by notation on the proxy card. Except to the extent that a Stockholder withholds votes from any or all nominees, the persons named in the proxy card, in their sole discretion, will vote such proxy for the election of the nominees listed below as directors of the Company.

Under rules of self-regulatory organizations governing brokers, brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. As used herein, "broker non-votes" means the votes that could have been cast on the matter in question by brokers if the brokers had received their customers' instructions.

Each of the proposals to be voted upon at the Annual Meeting, except as discussed above with respect to election of directors, requires the affirmative vote of a majority of the Shares present or represented and entitled to vote at the Annual Meeting to be approved. Abstentions have the effect of negative votes on these matters and broker non-votes would have no effect on these matters.

With respect to any other matters that may come before the Annual Meeting, if proxies are executed and returned, such proxies will be voted in a manner deemed by the proxy representatives named therein to be in the best interests of the Company and its stockholders.

PROPOSAL 1—ELECTION OF DIRECTORS

Nominees

EarthLink's Amended and Restated Certificate of Incorporation provides that the Company shall have at least two and not more than 17 directors, with the exact number to be fixed by resolution of the Board of Directors from time to time or by a majority vote of the stockholders entitled to vote on directors. The current size of the Board of Directors is fixed at seven, and the Company currently has seven directors. The Board of Directors held seven meetings in 2002. Each of the members of the Company's Board of Directors, except for Austin M. Beutner, attended at least 75% of the aggregate number of (i) meetings of the Board of Directors and (ii) meetings held by all committees of the Board of Directors on which the director served.

As established in its Amended and Restated Certificate of Incorporation, EarthLink's Board of Directors is divided into three classes, designated as Class I, Class II and Class III, which classes are to have as nearly equal number of directors as possible. The current seven-member Board of Directors consists of three Class I members, two Class II members and two Class III members. The term for each class is three years, which expires at the third succeeding Annual Meeting of Stockholders after their election. The term for our Board of Directors' Class I directors expires at this year's Annual Meeting.

Directors Standing for Election

The Board of Directors has nominated Marce Fuller and Robert M. Kavner for election as Class I directors to the Board of Directors at the Annual Meeting, each to serve until the 2006 Annual Meeting of Stockholders or until their successors are duly elected and qualified. Austin M. Beutner, currently a Class I director, has determined not to stand for re-election in order to devote more attention to other commitments.

In the event that each nominee listed below is elected as director, there will be one vacancy on the Board of Directors. This vacancy is the result of Mr. Beutner's decision not to stand for re-election. We are maintaining a vacant director's seat at this time in order to provide the Board of Directors flexibility to add an additional director if it so determines. The Company's Stockholders may not vote,

2

or cause their proxies to be voted, for a greater number of nominees for director than the two named below.

Set forth below is certain biographical information furnished to the Company by the directors standing for election:

Marce Fuller—Class I Director

Age: 42

Ms. Fuller has served on our Board of Directors since October 2001. Since July 1999, she has been President, Chief Executive Officer and a member of the Board of Directors of Mirant Corporation, a U.S. marketer of power and natural gas. Under Ms. Fuller's guidance, Mirant spun off from its parent, Southern Company, in April 2001. From September 1997 to July 1999, Ms. Fuller served as President and Chief Executive Officer of the Mirant Americas Energy Marketing division of Mirant. From May 1996 to September 1997, Ms. Fuller was Senior Vice President of Mirant's North American operations and business development, and from February 1994 to May 1996, she was Mirant's Vice President for domestic business development. Ms. Fuller serves on the Board of Directors of numerous corporations, educational institutions and governmental agencies including the Curtiss-Wright Corporation, the U.S. Department of Energy's Electricity Advisory Board, the President's International Board of Advisors of the Philippines and the Leadership Board of the College of Engineering, University of Alabama.

Robert M. Kavner—Class I Director

Age: 59

Mr. Kavner has served on our Board of Directors since February 2001. He was a member of the Board of Directors of EarthLink Network, Inc. ("EarthLink Network") until its merger with MindSpring Enterprises, Inc. ("MindSpring") in February 2000. Since 1995, Mr. Kavner has been a venture capital investor in Internet companies and in December 1998, he became Vice Chairman of Idealab, Inc., an incubator of Internet companies. In April 2001, he retired and continues as a member of the Board of Directors of Idealab, Inc. From September 1996 through December 1998, he served as President and Chief Executive Officer of On Command Corporation, a provider of on-demand video for the hospitality industry. From 1984 to 1994, Mr. Kavner held several senior management positions at AT&T, including Senior Vice President and Chief Financial Officer, Chief Executive Officer of the Multimedia Products and Services Group, and Chairman of AT&T Venture Capital Group. Mr. Kavner also served as a member of AT&T's Executive Committee. Mr. Kavner serves as a member of the Board of Directors of Fleet Boston Financial, Inc. and Overture Services, Inc., where he is also Chairman of the Board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE ELECTION AS DIRECTORS OF THE NOMINEES NAMED ABOVE.

Directors Not Standing for Election

Below is certain biographical information furnished to the Company by each of the directors that is not subject to a vote at the Annual Meeting:

Austin M. Beutner—Class I Director

Age: 43

Mr. Beutner has served on our Board of Directors since April 2001. He is the President of Evercore, which he co-founded in 1996, Co-Chairman of Evercore Capital Partners L.P. and Chairman

3

and Chief Executive Officer of Evercore Ventures. From 1994 to 1996, Mr. Beutner was President and Chief Executive Officer of The U.S. Russia Investment Fund, a private investment company capitalized with $440 million by the U.S. Government. Mr. Beutner serves on the Board of Directors of American Media, Inc.; Business.com, Inc.; Causeway Capital Management LLC; Continental Energy Services, Inc.; Encoda Systems, Inc.; Energy Partners, Ltd.; Telenet Holding N.V.; and Vertis, Inc. He also serves as Trustee of the California Institute of the Arts and is a member of the Council on Foreign Relations.

Linwood A. Lacy, Jr.—Class II Director

Age: 57

Mr. Lacy has served on our Board of Directors since February 2000 when EarthLink Network merged with MindSpring, and was a member of the Board of Directors of EarthLink Network from June 1996 until its merger with MindSpring. From October 1996 to October 1997, he served as President and Chief Executive Officer of Micro Warehouse Incorporated. From 1985 to May 1996, he served as the Co-Chairman and Chief Executive Officer of Ingram Micro, Inc., a microcomputer products distributor and a then wholly-owned subsidiary of Ingram Industries Inc. From December 1993 to June 1995, Mr. Lacy was also President of Ingram Industries Inc. From June 1995 until April 1996, he was President and Chief Executive Officer of Ingram Industries Inc., and from April 1996 to May 1996, he served as its Vice Chairman. Mr. Lacy was the Chairman of 4Sure.com, Inc. from June 1998 to July 2001. Mr. Lacy serves as a member of the Board of Directors of Ingram Industries Inc., Modus Media International and Netgear, Inc.

Robert M. Metcalfe—Class II Director

Age: 57

Dr. Metcalfe has served on our Board of Directors since October 2001. Dr. Metcalfe is a general partner of Polaris Venture Partners, which he joined in January 2001 and where he specializes in information technology start-ups. Dr. Metcalfe represents Polaris on the Board of Directors of Ember Corp.; Narad Networks, Inc.; Nanosys, Inc. and Windspeed. He also serves on the Board of Directors of Avistar Communications Corp., Camden Technology Conference, IDC, International Data Group, Kelmscott Rare Breeds Foundation, The Massachusetts Institute of Technology and MediaLab Europe. While an engineer-scientist (1965-1979), Dr. Metcalfe helped develop the early Internet. In 1973, at the Xerox Palo Alto Research Center, he invented Ethernet, the international local-area networking standard on which he shares four patents. From 1976 through 1983, he was consulting associate professor of electrical engineering at Stanford University. While an entrepreneur-executive (1979-1990), Dr. Metcalfe founded 3Com Corporation, where at various times he was Chairman of the Board, Chief Executive Officer, division general manager and vice president of engineering, marketing and sales. From 1990 to 2000, Dr. Metcalfe was a publisher and columnist, including serving as Chief Executive Officer of International Data Group's InfoWorld Publishing Company (1992-1995). Dr. Metcalfe is a member of the National Academy of Engineering.

Charles G. Betty—Class III Director

Age: 46

Mr. Betty is our President and Chief Executive Officer and a member of our Board of Directors, and has served in those positions since February 2000 when EarthLink Network merged with MindSpring. Mr. Betty served as President, Chief Operating Officer and as a director of EarthLink Network from January 1996 until May 1996 when he was named President and Chief Executive Officer of EarthLink Network, serving in each capacity until its merger with MindSpring. From February 1994 to January 1996, Mr. Betty was a strategic planning consultant. From September 1989 to February 1994,

4

Mr. Betty served as President, Chief Executive Officer and a director of Digital Communications Associates, Inc., a network connectivity provider. Mr. Betty serves on the Board of Directors of Global Payments Inc.

Sky D. Dayton—Class III Director

Age: 31

Mr. Dayton is the Chairman of the Board of Directors of EarthLink and the founder of EarthLink Network. After founding EarthLink Network in May 1994, Mr. Dayton served as Chief Executive Officer until May 1996 and Chairman of the Board until February 2000. He has served on the Board of Directors of EarthLink since February 2000 and was named Chairman of the Board in August 2000. Mr. Dayton is Founder, Chairman of the Board and Chief Executive Officer of Boingo Wireless, Inc. He is also a member of the Board of Directors of eCompanies, LLC and Business.com, Inc.; is a founding partner of eCompanies Venture Group, LP; and is a partner in Evercore Ventures.

Stockholder Nominees for Director

Any stockholder recommendation for a nominee for director to be voted upon at the 2004 annual meeting should be submitted in writing to our Corporate Secretary not later than 90 days in advance of our 2004 annual meeting, which tentatively is scheduled for May 27, 2004. As required by our Amended and Restated Certificate of Incorporation, the Stockholder's notice must include (i) the name and address of the Stockholder who intends to make the nomination and of the person or persons to be nominated; (ii) a representation that the Stockholder is a holder of record of shares of the Company entitled to vote at the applicable meeting and intends to appear in person or by proxy at the applicable meeting to nominate the person or persons specified in the notice; (iii) a description of all arrangements or understandings between the Stockholder and each nominee and any other person or persons (naming them) pursuant to which the nomination or nominations are to be made by the Stockholder; (iv) all other information regarding each nominee proposed by the Stockholder as would be required to be included in a proxy statement filed pursuant to the then-current proxy rules of the Securities and Exchange Commission ("SEC") if the nominees were to be nominated by the Board of Directors; and (v) the consent of each nominee to serve as a director of the Company if elected.

Certain Legal Proceedings

Marce Fuller, a member of our Board of Directors, was an executive officer of Mobile Energy Services Company, L.L.C. ("Mobile Energy") and its parent, Mobile Energy Services Holdings, Inc., each affiliates of the Southern Company, at the time such entities filed for bankruptcy in January 1999. Ms. Fuller left such officer positions in 2001 and 1999, respectively, and is not currently an executive officer of either entity. Mobile Energy owns a power generating facility which provides power and steam to a tissue mill in Mobile, Alabama. A proposed plan of reorganization of both entities is pending before the bankruptcy court.

Committees of the Board of Directors

The Company has the following standing committees of its Board of Directors: Compensation Committee, Audit Committee, Investment Committee, and Corporate Governance and Nominating Committee.

The Compensation Committee presently consists of Mr. Lacy (Chairman) and Ms. Fuller. The Compensation Committee met five times during the year ended December 31, 2002. The Compensation Committee establishes and approves cash and long-term incentive compensation for executive officers and other key employees of the Company. The Compensation Committee also administers the Company's equity-based compensation plans.

5

The Audit Committee presently consists of Mr. Kavner (Chairman), Mr. Beutner and Dr. Metcalfe. The Company expects that Mr. Lacy will be appointed by the Board of Directors to serve on the Audit Committee upon the expiration of Mr. Beutner's term as director. The Audit Committee met six times during the year ended December 31, 2002. The Audit Committee is responsible for selecting the Company's independent auditors, reviewing the results and scope of audits and other services provided by the independent auditors, and reviewing and evaluating the Company's internal control functions. In light of recent legal developments, the Company's Board of Directors has amended the written charter for the Audit Committee, and a copy of this amended charter is attached hereto asAnnex A. The members of our Audit Committee are independent, as defined in Rule 4200(a)(15) of the National Association of Securities Dealers, Inc. ("NASD") Listing Standards for Nasdaq-listed companies.

The Investment Committee presently consists of Mr. Betty, Mr. Dayton and Mr. Lacy. The Investment Committee did not meet separately during the year ended December 31, 2002. The Investment Committee is responsible for reviewing, analyzing and making determinations regarding material investments by EarthLink in other companies. In 2002, the responsibilities of the Investment Committee were met by the entire Board of Directors.

The Corporate Governance and Nominating Committee presently consists of Dr. Metcalfe (Chairman), Ms. Fuller, Mr. Kavner and Mr. Lacy. The Corporate Governance and Nominating Committee did not meet separately during the year ended December 31, 2002. The Corporate Governance and Nominating Committee is responsible for (i) overseeing the Company's corporate governance principles, guidelines and practices, and (ii) identifying, nominating, proposing and qualifying nominees for open seats on the Board of Directors. In 2002, the responsibilities of the Corporate Governance and Nominating Committee were met by the entire Board of Directors. In January 2003, the Corporate Governance and Nominating Committee met for the first time as currently composed and is expected to continue to meet on a periodic basis.

Director Compensation

The Company pays each non-employee director a semi-annual retainer of $10,000 for serving on the Board of Directors. The Company pays each Board and Committee Chairperson $1,500 for attending in person (or telephonically) the Board or Committee meeting he or she chairs and each non-employee, non-Chairperson director $1,000 for each full Board meeting and Committee meeting he or she attends in person ($500 if he or she attends telephonically). The Company also reimburses non-employee directors for the expenses they incur in attending meetings of the Board of Directors or Committees thereof.

Non-employee directors are eligible to receive options to purchase Common Stock awarded under the Company's Stock Option Plan for Non-Employee Directors. Members of EarthLink's Board of Directors currently are granted stock options to purchase EarthLink Common Stock as follows: options to purchase 15,000 shares are granted upon joining the Board of Directors, and options to purchase 10,000 shares are granted yearly, each with an exercise price equal to the fair market value of EarthLink Common Stock on the date of grant. Options granted generally have a ten year term and vest in 25% increments on each of the next four anniversaries of the grant date.

EXECUTIVE OFFICERS

The executive officers of the Company serve at the discretion of the Board of Directors, and serve until they resign, are removed or are otherwise disqualified to serve, or until their successors are elected and qualified. EarthLink's executive officers presently include: Charles G. Betty, Lee Adrean, Linda W. Beck, Donald B. Berryman, Samuel R. DeSimone, Jr., Karen L. Gough, William S. Heys, Michael C. Lunsford and Brinton O. C. Young. The following sets forth biographical information for

6

our executive officers who are not directors. The biographical summary for the executive officer who is a director is provided in "Proposal 1—Election of Directors" and "Directors Not Standing for Election" above.

Lee Adrean—Executive Vice President and Chief Financial Officer

Age: 51

Mr. Adrean has served as our Executive Vice President and Chief Financial Officer since March 2000 and Chief Administrative Officer since May 2002. From May 1995 to February 2000, Mr. Adrean served as Executive Vice President and Chief Financial Officer of First Data Corporation in Atlanta, Georgia. From August 1993 to April 1995, Mr. Adrean served as President of Providian Corporation Agency Group (a division of Providian Corporation). Prior to that, Mr. Adrean was Chief Financial Officer of Providian Corporation and held various positions with Bain & Company and Peat, Marwick, Mitchell & Company.

Linda W. Beck—Executive Vice President, Operations

Age: 39

Ms. Beck has served as our Executive Vice President, Operations since September 2000. Following the merger of EarthLink Network and MindSpring in February 2000 and until September 2000, Ms. Beck served as Vice President, Engineering. She held similar positions at both MindSpring from February 1999 to February 2000 and Netcom from September 1996 to February 1999. Before joining Netcom in 1996, Ms. Beck served in a variety of positions at Sybase, GTE, Amdahl and the National Security Agency.

Donald B. Berryman—Executive Vice President, Customer Support

Age: 44

Mr. Berryman has served as our Executive Vice President, Customer Support since November 2002. Prior to that, from May 2000 to November 2002, Mr. Berryman served as the President and Chief Executive Officer of IdentityNow, Inc., a privately held company in Kansas City, Missouri which is the parent company of American Identity, Inc. Mr. Berryman served as the Senior Vice President of APAC Customer Services, Inc. from January 1997 to May 2001. From March 1993 to January 1997, Mr. Berryman served as Vice President and General Manager of APAC's Service Solutions Group. Mr. Berryman also has served in executive positions at Ryder Truck Rental and USA TODAY.

Samuel R. DeSimone, Jr.—Executive Vice President, General Counsel and Secretary

Age: 43

Mr. DeSimone has served as our Executive Vice President, General Counsel and Secretary since February 2000. Prior to that, Mr. DeSimone served in such capacities at MindSpring since November 1998. From September 1995 to August 1998, Mr. DeSimone served as Vice President of Corporate Development with Merix Corporation of Forest Grove, Oregon, a printed circuit board manufacturer. From June 1990 to August 1995, he was an associate attorney and a partner with Lane Powell Spears Lubersky of Portland, Oregon.

7

Karen L. Gough—Executive Vice President, Marketing

Age: 46

Ms. Gough has served as our Executive Vice President, Marketing since June 2001. Prior to that, from October 1998 until June 2001, she served as the Vice President of Marketing Solutions for The Coca-Cola Company. From August 1990 to October 1998, Ms. Gough held a variety of senior sales and marketing positions with Reckitt & Colman, Inc., a manufacturer of household cleaning products and specialty food items. She has also held sales and marketing positions with Pepsi-Cola Company, The National Football League Properties and International Playtex.

William S. Heys—Executive Vice President, Sales

Age: 53

Mr. Heys has served as our Executive Vice President, Sales since September 2000 and was Executive Vice President, Business Development and Business Services from February 2000 to September 2000. Prior to that, Mr. Heys served as Senior Vice President, Sales of EarthLink Network since August 1999, and was Vice President of EarthLink Network's relationship with Sprint Corporation from January 1999 to August 1999. Prior to joining EarthLink Network in October 1994, Mr. Heys founded BHC & Associates, a high-tech industry consulting firm. Before starting BHC, Mr. Heys served in a variety of executive sales and marketing management positions at IBM, Wang, Hayes Microcomputer Products and Digital Communications Associates, Inc.

Michael C. Lunsford—Executive Vice President, Customer Experience

Age: 35

Mr. Lunsford has served as our Executive Vice President, Customer Experience since April 2002. Prior to that, Mr. Lunsford served as our Executive Vice President, Strategic Brand Marketing from August 2001 to April 2002. Mr. Lunsford served as Executive Vice President, Broadband Services from February 2000 to August 2001, and in that same role for EarthLink Network from November 1999 until its merger with MindSpring in February 2000. Prior to that, Mr. Lunsford was EarthLink Network's Vice President of Special Projects, a position he held from the beginning of his employment with EarthLink Network in March of 1999. Before joining EarthLink Network, Mr. Lunsford was a Director with Scott, Madden & Associates, a management consulting firm in Raleigh, North Carolina, from 1995 to 1999. Prior to that, Mr. Lunsford worked for Andersen Consulting in Chicago, Illinois.

Brinton O. C. Young—Executive Vice President, Strategic Planning

Age: 51

Mr. Young has served as our Executive Vice President, Strategic Planning since June 2001. From February 2000 to June 2001, he was our Executive Vice President, Marketing and Corporate Strategy. Prior to that, he was Senior Vice President, Marketing of EarthLink Network from August 1998 through February 2000, and was Vice President, Strategic Planning of EarthLink Network from March 1996 through December 1998. From 1990 to 1996, Mr. Young was President of Young & Associates, a consulting firm specializing in strategic planning for high growth companies.

8

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires the Company's directors, executive officers and persons who own beneficially more than 10% of the Company's Common Stock to file reports of ownership and changes in ownership of such stock with the SEC and the NASD. These persons are also required by SEC regulations to furnish the Company with copies of all such forms they file. To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, all persons subject to the reporting requirements of Section 16(a) filed the required reports on a timely basis for the year ended December 31, 2002, except that (i) as a result of an internal miscommunication at the Company, each of the Company's above-named executive officers, with the exception of Mr. Berryman who was not so required, filed a Form 4 on November 20, 2002, to correct the failure to timely file a Form 4 with respect to a stock option grant made October 17, 2002 and (ii) a Form 4 was late as filed on November 20, 2002 for Mr. Dayton to reflect his gift of shares of EarthLink Common Stock to a trust on November 7, 2002.

Beneficial Ownership of Common Stock

The following table sets forth information concerning the beneficial ownership of our issued and outstanding Common Stock by: (i) those persons known by management of the Company to own beneficially more than 5% of the Company's issued and outstanding Common Stock, (ii) the directors of the Company, (iii) the executive officers identified as "Named Executive Officers" in the Summary Compensation Table included elsewhere in this Proxy Statement, and (iv) all directors and officers of the Company as a group. Except as otherwise indicated in the footnotes below, such information is provided as of February 28, 2003. According to rules adopted by the SEC, a person is the "beneficial owner" of securities if he or she has or shares the power to vote them or to direct their investment or has the right to acquire beneficial ownership of such securities within 60 days through the exercise of an option, warrant or right, the conversion of a security or otherwise.

Name and Address of Beneficial Owners(1)

| | Amount and

Nature of

Beneficial

Ownership(2)

| |

| | Percent

of Class

| |

|---|

| Lee Adrean | | 347,500 | | (3) | | * | |

| Charles G. Betty | | 1,304,613 | | (4) | | * | |

| Austin M. Beutner | | 50,668 | | (5) | | * | |

| Sky D. Dayton | | 3,550,017 | | (6) | | 2.3 | % |

| Marce Fuller | | 19,846 | | (7) | | * | |

| William S. Heys | | 313,450 | | (8) | | * | |

| Jon M. Irwin | | 346,650 | | (9) | | * | |

| Robert M. Kavner | | 82,374 | | (10) | | * | |

| Linwood A. Lacy, Jr. | | 373,384 | | (11) | | * | |

| Michael C. Lunsford | | 247,676 | | (12) | | * | |

| Michael S. McQuary | | 1,116,635 | | (13) | | * | |

| Dr. Robert M. Metcalfe | | 15,001 | | (14) | | * | |

| Brinton O. C. Young | | 538,590 | | (15) | | * | |

| Capital Research and Management Company | | 9,191,700 | | (16) | | 6.0 | % |

| Merrill Lynch & Co., Inc. | | 8,325,411 | | (17) | | 5.5 | % |

| Shapiro Capital Management Company, Inc. | | 7,744,650 | | (18) | | 5.1 | % |

| Sprint Corporation | | 29,675,457 | | (19) | | 17.4 | % |

| All directors and executive officers as a group (15 persons) | | 7,392,742 | | (20) | | 4.8 | % |

- *

- Represents beneficial ownership of less than 1.0% of our Common Stock.

- (1)

- Except as otherwise indicated by footnote (i) the named person has sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned, and (ii) the address of the named person is that of EarthLink.

- (2)

- Beneficial ownership is determined in accordance with the rules of the SEC, based on factors including voting and investment power with respect to shares, subject to applicable community property laws. Shares of

9

Common Stock into which Series A and Series B Convertible Preferred Stock is convertible and shares of Common Stock underlying options or warrants currently exercisable and exercisable within 60 days after February 28, 2003 are deemed outstanding for the purpose of computing the percentage ownership of the person holding such Series A and Series B Convertible Preferred Stock, options or warrants, but are not deemed outstanding for computing the percentage ownership of any other person.

- (3)

- Includes options to purchase 342,500 shares of Common Stock.

- (4)

- Includes options to purchase 832,446 shares of Common Stock.

- (5)

- Includes options to purchase 26,668 shares of Common Stock.

- (6)

- Includes options to purchase 23,334 shares of Common Stock.

- (7)

- Includes options to purchase 15,001 shares of Common Stock.

- (8)

- Includes options and warrants to purchase 306,924 shares of Common Stock.

- (9)

- Includes options to purchase 285,213 shares of Common Stock. Resigned from position as an executive officer of EarthLink in 2002.

- (10)

- Includes options to purchase 26,668 shares of Common Stock.

- (11)

- Includes options to purchase 23,334 shares of Common Stock.

- (12)

- Represents options to purchase 247,676 shares of Common Stock.

- (13)

- Includes options to purchase 810,115 shares of Common Stock. Resigned from position as an executive officer of EarthLink in 2002.

- (14)

- Represents options to purchase 15,001 shares of Common Stock.

- (15)

- Includes options to purchase 300,388 shares of Common Stock.

- (16)

- Represents ownership as of December 31, 2002, according to the Schedule 13G filed by Capital Research and Management Company on February 13, 2003. The address for Capital Research and Management Company is 333 South Hope Street, Los Angeles, California 90071.

- (17)

- Represents ownership as of December 31, 2002, according to the Schedule 13G filed by Merrill Lynch & Co., Inc. on January 8, 2003. The address for Merrill Lynch & Co., Inc. is 4 World Financial Center, New York, New York 10080.

- (18)

- Represents beneficial ownership as of December 31, 2002, according to the Schedule 13G filed by Samuel R. Shapiro and Shapiro Capital Management Company, Inc. on February 4, 2003. The address for Samuel R. Shapiro and Shapiro Capital Management Company, Inc. is 3060 Peachtree Rd. NW, Suite 1555, Atlanta, Georgia 30305.

- (19)

- Represents 11,750,000 shares of Common Stock and 1,142,755 shares of Series A Convertible Preferred Stock and 16,836,640 shares of Series B Convertible Preferred Stock convertible into 1,139,327 and 16,786,130 shares of Common Stock, respectively, as of February 28, 2003 and within 60 days thereafter. Sprint Corporation currently maintains title to and the right to vote the 11,750,000 shares of Common Stock; provided however, Sprint Corporation has entered into variable prepaid forward transactions which obligate Sprint Corporation to deliver and relinquish title to some or all of such shares of Common Stock in settlement of the transactions at varying dates over the next two to three years. The address for Sprint Corporation is 2330 Shawnee Mission Parkway, Westwood, Kansas 66205.

On April 4, 2003, we repurchased from Sprint Corporation 9,000,000 shares of EarthLink Common Stock obtained by Sprint upon conversion of 9,046,136 shares of Series B Convertible Preferred Stock.

- (20)

- Includes options and warrants to purchase an aggregate of 2,709,563 shares of Common Stock. Does not include shares of Common Stock, including options and warrants, beneficially owned by Mr. Irwin and Mr. McQuary, both of whom resigned as executive officers of EarthLink in 2002.

10

EXECUTIVE COMPENSATION

Pursuant to SEC rules for proxy statement disclosure of executive officer compensation, the Compensation Committee of the Board of Directors of the Company has prepared the following Report on Executive Officer Compensation. The Committee intends that this report clearly describe the current executive officer compensation program of the Company, including the underlying philosophy of the program and the specific performance criteria on which executive officer compensation is based. This report also discusses in detail the compensation paid to the Company's Chief Executive Officer.

Compensation Committee Report on Executive Officer Compensation

This report by the Compensation Committee of the Board of Directors (the "Committee") discusses the Committee's compensation objectives and policies applicable to the Company's executive officers. The report reviews the Committee's policy generally with respect to the compensation of all executive officers as a group for the year ended December 31, 2002, as reported in the Summary Compensation Table. The Committee is comprised entirely of non-employee directors. The Committee also administers the Company's equity-based compensation plans.

Compensation Philosophy

The Committee consists of two non-employee directors, Mr. Lacy—Chairman and Ms. Fuller. The Committee is responsible for setting cash and long-term incentive compensation for executive officers and other key employees of the Company. The Company's compensation policies are intended to create a direct relationship between the level of compensation paid to executives and the Company's current and long-term level of performance. The Committee believes that this relationship is best implemented by providing a compensation package of separate components, all of which are designed to enhance the Company's overall performance. The components are base salary, short-term compensation in the form of annual bonuses and long-term incentive compensation in the form of stock options.

Base Salaries

The base salaries for the Company's executive officers for the year ended December 31, 2002 were established by comparing base salaries offered for similar positions in competing or similar companies. The salaries of the executive officers were established based on the market environment and the Company's need to attract and retain key personnel for whom the Company must compete against similar companies and larger, more established companies.

Short-Term Annual Bonuses

Annual bonuses established for the executive officers are intended to provide an incentive for advancing company performance in the short term. The Committee establishes target bonus levels for the executive officers at the beginning of the year based on predetermined goals such as total paying customers, customer retention, revenue and profitability.

Long-Term Incentive Compensation

The Company's long-term incentive compensation plan for its executive officers is based on the Company's stock option plans. These plans promote ownership of the Company's Common Stock, which, in turn, provides a common interest between the stockholders of the Company and the executive officers of the Company. In establishing a long-term compensation plan, the Committee concluded that any compensation received under such plans should be directly linked to the performance of the Company, as reflected by increases in the price of its Common Stock, and the contribution of the individual thereto. Options have an exercise price equal to the fair market value of the shares on the

11

date of grant and, to encourage a long-term perspective, have an exercise period of 10 years and generally vest over four to six years. The number of options granted to executive officers is determined by the Committee, which is charged with administering the stock option plans.

The base salaries, targeted bonus amounts and number of stock options established for or granted to the Company's executive officers are based in part on the Committee's understanding of compensation amounts and forms paid to persons in comparable roles performing at comparable levels at other companies in the same or related industries. Such amounts, however, mainly reflect the subjective discretion of the members of the Committee based on the evaluation of the Company's current and anticipated future financial performance, the contribution of the individual executive officers to such financial performance, the contribution of the individual executive officers to the Company in areas not necessarily reflected by the Company's financial performance and the most appropriate incentive to link the performance and compensation of the executive officers to the stockholders' return on the Company's Common Stock.

| | Submitted by: The Compensation Committee |

|

Linwood A. Lacy, Jr.

Marce Fuller |

The Compensation Committee Report on Executive Compensation does not constitute solicitation material and should not be deemed filed or incorporated by reference into any of the Company's other filings under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that EarthLink specifically incorporates this report by reference therein.

Change-In-Control Accelerated Vesting and Severance Plan

General. EarthLink's Change-In-Control Accelerated Vesting and Severance Plan (the "CIC Plan") provides security to certain employees of EarthLink and its designated subsidiaries in the event of a Change in Control (as defined) of the Company. For purposes of the CIC Plan, "Change in Control" generally means a transaction pursuant to which any person acquires more than 50% of the voting power of the Company or any merger, reorganization or similar event where the owners of the voting stock of the Company before the event do not own voting stock representing at least 50% of the voting power of the Company or its successor after the event. The CIC Plan generally is a severance pay plan that provides continued compensation and other benefits to certain employees of the Company and its designated subsidiaries if their employment terminates for reasons described in the CIC Plan within a certain time of a Change in Control of the Company. The CIC Plan as a "welfare plan" is subject to the Employee Retirement Income Security Act of 1974. The CIC Plan is administered by the Company, which has responsibility for construing and interpreting the CIC Plan and establishing and amending such rules and regulations as it deems necessary or desirable for the proper administration of the CIC Plan.

Eligibility for Participation. The CIC Plan creates three benefit categories based on the employee's position with the Company or a designated subsidiary. For purposes of the CIC Plan, the "Gold" benefit category includes the Chief Executive Officer and President of the Company. The "Silver" benefit category includes the Chief Financial Officer of the Company, the Chief Executive Officer, President, and Chief Financial Officer of a designated subsidiary, and the Executive Vice Presidents of the Company or a designated subsidiary. Finally, the "Bronze" benefit category includes Vice Presidents of the Company or a designated subsidiary, Blue Zone Classified Jobs of the Company or a designated subsidiary (as defined in the normal human resources practices and procedures of the Company or a designated subsidiary), or one or more classes of employees whom the Board of Directors of the Company may select for participation under the CIC Plan.

12

Compensation Benefits. If at any time within 18 months after a Change in Control occurs, the employment of a participating employee is terminated by the Company or a designated subsidiary for any reason other than Cause (as defined in the CIC Plan), disability or death, or the participating employee voluntarily terminates his employment for Good Reason (as defined in the CIC Plan), such participating employee is entitled to receive the following benefits. To an employee in the Gold or Silver benefit category, the Company will make a lump sum payment equal to (a) 150% of the employee's salary plus bonus target and (b) all amounts payable with respect to such employee's elected COBRA coverage (including for spouse and dependents) for one and one-half (11/2) years from termination. To an employee in the Bronze benefit category, the Company will make a lump sum payment equal to (a) 100% of the employee's salary plus bonus target and (b) all amounts payable with respect to such employee's elected COBRA coverage (including for spouse and dependents) for one year from termination. The payment of the compensation benefits will be consistent with normal payroll practices and subject to applicable withholdings and employment taxes.

Acceleration of Options. As with the compensation benefits, a participating employee's benefit category determines the accelerated vesting benefits to which he or she is entitled. For an employee in the Gold or Silver benefit category, if his or her stock options are assumed or continued after a Change in Control, all outstanding stock options granted on or before the Change in Control will vest and be exercisable in full, if not already fully vested, on termination of the employee's employment for any reason after the Change in Control occurs; however, if his or her stock options are not assumed or continued after the Change in Control, all outstanding stock options will vest and be exercisable in full contemporaneously with the Change in Control, if not already fully vested. For an employee in the Bronze benefit category, if his or her stock options are assumed or continued after a Change in Control, all outstanding stock options granted on or before the Change in Control will vest and be exercisable at least as much as if the employee had remained employed for 24 months after the Change in Control occurs, if not already vested to such extent; however, if his or her stock options are not assumed or continued after the Change in Control, all outstanding stock options are vested and exercisable at least as much as if the employee had remained employed for 24 months after the Change in Control occurs, if not already vested to such extent.

Unfunded Status. The CIC Plan is unfunded, and the Company and its subsidiaries are not required to segregate any assets to fund the benefits, if any, that will become payable under it. Any liability of the Company or any subsidiary to any employee with respect to the CIC Plan is based solely on any contractual obligations that may be created pursuant to the CIC Plan.

Amendment and Termination. The Company will have the right to amend the CIC Plan from time to time and may terminate it at any time; provided, however, that after a Change in Control in the Company occurs (i) no amendment may be made that diminishes any employee's rights following such Change in Control and (ii) the CIC Plan may not be terminated.

Compensation of our Chief Executive Officer

Charles G. Betty is employed as our Chief Executive Officer pursuant to an employment agreement for a term of three years, as such may automatically be extended from year-to-year thereafter, at a salary of not less than $600,000 per year, plus such other benefits generally made available to our other senior executives. Mr. Betty is entitled, if the bonus criteria for the applicable annual period are met, to an annual bonus in the amount equal to 50% of his base salary in 2003, and an amount equal to 60% of his base salary in each year thereafter. The Company provides Mr. Betty and his family with health, medical, disability and term life insurance in accordance with any group plan it maintains. The Company reimburses Mr. Betty for any term life insurance policy payments made under a policy (or policies) with aggregate death benefits of $3,000,000 until such time as the Company provides a policy (or policies) with coverage and benefits the same as or substantially similar

13

to the term life insurance policy held by Mr. Betty. In addition, if Mr. Betty is terminated by the Company for any reason other than for "cause," as defined in the employment agreement, the Company elects not to extend the term of the employment agreement or any yearly extension of the term, or Mr. Betty terminates the employment agreement for reasons of a breach by the Company, Mr. Betty will receive (i) his base salary for the longer of 18 months or the remainder of the initial term of the employment agreement (the "Severance Period"), (ii) the earned but unpaid bonus payment for that portion of the year Mr. Betty was employed, and (iii) health, medical, life and disability insurance coverage for himself and his family for the term of the Severance Period. If the employment agreement is terminated as a result of Mr. Betty's death, the Company will (i) pay to Mr. Betty's estate (A) Mr. Betty's base salary for a period of 18 months plus (B) the earned but unpaid bonus payment for that portion of the year prior to Mr. Betty's death, and (ii) provide Mr. Betty's family with health, medical, life and disability insurance coverage for a period of 18 months. If the Company terminates Mr. Betty's employment for "cause," the Company shall not have an obligation to pay Mr. Betty his base salary or make any bonus payment or provide any benefits beyond the termination date, except as required by law. In the event (i) a "change in control event" occurs, as defined in the employment agreement, (ii) the Company terminates Mr. Betty's employment for other than "cause," or (iii) Mr. Betty terminates his employment for reasons of a breach by the Company, all unvested stock options shall immediately vest and be fully exercisable by Mr. Betty. Mr. Betty's benefits under his employment agreement are cumulative of his benefits under all other Company sponsored plans, except that, with respect to the CIC Plan, Mr. Betty must elect whether to take benefits under the terms of the CIC Plan or his employment agreement. The employment agreement restricts Mr. Betty from competing, directly or indirectly, with the Company or soliciting certain employees and officers of the Company or its affiliates during the term of the employment agreement and for a period of 18 months following its termination.

Limitations on Deductibility of Compensation

Under the 1993 Omnibus Budget Reconciliation Act, a portion of annual compensation payable after 1993 to any of the Company's five highest paid executive officers would not be deductible by the Company for federal income tax purposes to the extent such officer's overall compensation exceeds $1,000,000. Qualifying performance-based incentive compensation, however, would be both deductible and excluded for purposes of calculating the $1,000,000 base. Although the Committee does not presently intend to award compensation in excess of the $1,000,000 cap, it will continue to address this issue when formulating compensation arrangements for the Company's executive officers.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Company's Board of Directors currently consists of Mr. Lacy and Ms. Fuller. No member of the Compensation Committee was, during the last fiscal year, an officer or employee of the Company nor was formerly an officer of the Company, except for Mr. Dayton, who served on the Compensation Committee until October 2002 and who had served as EarthLink Network's Chief Executive Officer and President prior to Mr. Betty's appointment to those positions in January 1996.

Mr. Dayton is a founder and member of the Board of Directors of eCompanies, LLC ("eCompanies"), and Austin M. Beutner was a member of the Board of Directors of eCompanies for a portion of the year ended December 31, 2002. Mr. Dayton is a founding partner of eCompanies Venture Group, LP ("EVG"), with which eCompanies is affiliated. Mr. Dayton is the Chairman of EarthLink's Board of Directors, and through October 2002, Mr. Dayton was a member of the Compensation Committee of the Board of Directors. Mr. Beutner is a member of EarthLink's Board of Directors. During the year ended December 31, 2002, the Company maintained its $10.0 million equity capital investment as a limited partner of EVG, which was originally invested in 2000. The Company

14

paid consulting fees and expenses to eCompanies in years prior to, but not during, the year ended December 31, 2002.

No other members of the Compensation Committee had disclosable relationships with the Company during the year ended December 31, 2002.

Certain Relationships and Related Transactions

During the year ended December 31, 2000 and during the quarter ended June 30, 2001, the Company loaned money to certain executive officers to allow them to meet margin calls on shares of EarthLink Common Stock that they held at that time. These loans were made at what the Company believes to be market interest rates and may be prepaid at any time, without penalty, prior to their due dates. As of February 28, 2003, the following loans to executive officers were outstanding:

Name of Executive Officer

| | Largest Aggregate Amount of Indebtedness During the Year Ended

December 31, 2002

| | Aggregate Amount of Indebtedness Outstanding as of

February 28, 2003

| | Interest Rate

%

| |

|---|

| Jon M. Irwin(1) | | $ | 202,834 | | $ | 121,408 | | 6.5 | % |

| Brinton O.C. Young | | $ | 1,066,248 | | $ | 1,038,910 | | 6.5 | % |

- (1)

- Mr. Irwin was an executive officer of EarthLink through May 31, 2002.

Overture Services, Inc. (formerly known as GoTo.com) ("Overture") served as EarthLink's default search engine provider during 2001 and until February 2002. Mr. Kavner, a member of our Board of Directors, is the Chairman of the Board of Overture. In 2002, Overture paid the Company approximately $292,000 in connection with those arrangements.

Please also see "Compensation Committee Interlocks and Insider Participation" above for a description of other arrangements between the Company and certain members of the Compensation Committee of the Board of Directors.

The Company believes that the foregoing transactions were on terms no less favorable to the Company than could be obtained from unaffiliated parties. It is the Company's current policy that all transactions by the Company with officers, directors, more than five percent stockholders and their affiliates will be entered into only if such transactions are approved by the Audit Committee of the Board of Directors and are on terms the Audit Committee believes are no less favorable to the Company than could be obtained from unaffiliated parties.

15

Executive Officer Compensation

Table I—Summary Compensation Table

The following table presents certain information required by the SEC relating to various forms of compensation awarded to, earned by or paid to the Company's (i) Chief Executive Officer, (ii) the four most highly compensated executive officers other than the Chief Executive Officer who earned more than $100,000 during the year ended December 31, 2002 and (iii) two individuals who served in an executive capacity for a portion of the year ended December 31, 2002 who would be listed among the four most highly compensated executives except that such individuals were not serving in an executive capacity at December 31, 2002. This compensation information relates to compensation received by the named executives while employed by EarthLink. Such executive officers collectively are referred to as the "Named Executive Officers."

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Options

| | All Other

Compensation

| |

|

|---|

Charles G. Betty

President, Chief Executive Officer | | 2002

2001

2000 | | $

| 600,000

496,667

353,076 | | $

| 196,590

186,498

133,652 | | 200,000

300,000

300,000 | | $

| 6,421

2,625

4,059 | | (1)

(2)

(3) |

Lee Adrean

Executive Vice President, Chief Financial Officer |

|

2002

2001

2000 |

|

|

350,000

301,667

200,807 |

|

|

114,677

90,621

58,515 |

|

140,000

—

440,000 |

|

|

3,630

2,625

94,000 |

|

(2)

(2)

(4) |

William S. Heys

Executive Vice President, Sales |

|

2002

2001

2000 |

|

|

249,583

243,750

234,768 |

|

|

81,776

73,222

68,311 |

|

100,000

—

191,000 |

|

|

—

2,625

— |

|

(2) |

Michael C. Lunsford

Executive Vice President, Customer Experience |

|

2002

2001

2000 |

|

|

250,833

227,500

203,846 |

|

|

82,186

68,341

59,401 |

|

90,000

—

197,000 |

|

|

3,630

2,625

2,641 |

|

(2)

(2)

(2) |

Brinton O. C. Young

Executive Vice President, Strategic Planning |

|

2002

2001

2000 |

|

|

249,583

243,750

234,423 |

|

|

81,776

73,222

68,311 |

|

90,000

—

191,000 |

|

|

—

—

— |

|

|

Michael S. McQuary(5)

Former President |

|

2002

2001

2000 |

|

|

500,000

328,335

260,016 |

|

|

250,000

123,290

94,711 |

|

100,000

—

321,370 |

|

|

3,630

2,625

2,625 |

|

(2)

(2)

(2) |

Jon M. Irwin(5)

Former Executive Vice President, Member Experience |

|

2002

2001

2000 |

|

|

269,167

259,167

255,182 |

|

|

88,192

77,854

74,251 |

|

40,000

—

195,000 |

|

|

3,630

2,625

2,732 |

|

(2)

(2)

(2) |

- (1)

- Consists of reimbursement in 2002 of $2,791 in travel expenses pursuant to Mr. Betty's employment agreement and $3,630 in matching contributions made to Mr. Betty's account under our 401(k) Plan.

- (2)

- Consists of matching contributions made under our 401(k) Plan.

- (3)

- Consists of reimbursement in 2000 of $2,378 in travel expenses pursuant to Mr. Betty's employment agreement and $1,681 in matching contributions made to Mr. Betty's account under our 401(k) Plan.

- (4)

- Represents a signing bonus and reimbursement for benefits lost when Mr. Adrean left First Data Corporation to join EarthLink in March 2000.

- (5)

- Resigned from position as an executive officer of EarthLink in 2002.

16

Table II—Option Grants in 2002

This table presents information regarding options granted to the Company's Named Executive Officers during the year ended December 31, 2002 to purchase shares of the Company's Common Stock. In accordance with SEC rules, the table shows the hypothetical "gains" or "option spreads" that would exist for the respective options based on assumed rates of annual compound stock price appreciation of 5% and 10% from the date the options were granted over the full option term.

| | Individual Grants

| |

| |

|

|---|

| |

| | Percentage

of Total

Options

Granted to

Employees in

Fiscal

Year

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for the Option Term(3)

|

|---|

| | Number of

Securities

Underlying

Option

Grants(1)

| |

| |

|

|---|

| | Exercise

Price

Per

Share(2)

| |

|

|---|

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Charles G. Betty | | 200,000 | (4) | 1.8 | % | $ | 5.10 | | 10/17/2012 | | $ | 641,473 | | $ | 1,625,617 |

Lee Adrean |

|

100,000

40,000 |

(5)

(4) |

0.9

0.4 |

%

% |

|

9.64

5.10 |

|

1/24/2012

10/17/2012 |

|

|

606,254

128,295 |

|

|

1,536,368

325,123 |

William S. Heys |

|

60,000

40,000 |

(5)

(4) |

0.5

0.4 |

%

% |

|

9.64

5.10 |

|

1/24/2012

10/17/2012 |

|

|

363,753

128,295 |

|

|

921,821

325,123 |

Michael C. Lunsford |

|

50,000

40,000 |

(5)

(4) |

0.5

0.4 |

%

% |

|

9.64

5.10 |

|

1/24/2012

10/17/2012 |

|

|

303,127

128,295 |

|

|

768,184

325,123 |

Brinton O. C. Young |

|

50,000

40,000 |

(5)

(4) |

0.5

0.4 |

%

% |

|

9.64

5.10 |

|

1/24/2012

10/17/2012 |

|

|

303,127

128,295 |

|

|

768,184

325,123 |

Michael S. McQuary |

|

100,000 |

(5) |

0.9 |

% |

|

9.64 |

|

1/24/2012 |

|

|

606,254 |

|

|

1,536,368 |

Jon M. Irwin |

|

40,000 |

(5) |

0.4 |

% |

|

9.64 |

|

1/24/2012 |

|

|

242,502 |

|

|

614,547 |

- (1)

- The total number of options granted to employees during the year ended December 31, 2002 was 10,924,502.

- (2)

- The exercise price per share of options granted represented the fair market value of the underlying shares of Common Stock on the dates the options were granted.

- (3)

- As required under the SEC's rules, amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. These assumptions are not intended to forecast future appreciation of our stock price. The potential realizable value computation does not take into account federal or state income tax consequences of option exercises or sales of appreciated stock. If our stock price does not actually increase to a level above the applicable exercise price at the time of exercise, the realized value to the Named Executive Officers from these options will be zero.

- (4)

- These options vest and become exercisable on October 17, 2008 but are subject to four acceleration clauses. If EarthLink meets certain operating and financial performance targets in 2003 and 2004, all or portions of these options vest and become exercisable upon the achievement of such targets.

- (5)

- These options become exercisable as follows: (i) 25% of the options become exercisable one year after the date of the grant, and (ii) an additional 6.25% of the options become exercisable each fiscal quarter thereafter until fully vested.

17

Table III—Option Exercises In Fiscal 2002 and Fiscal 2002 Year-End Option Values

The following table shows the number of shares of Common Stock subject to exercisable and unexercisable stock options held by each of the Named Executive Officers as of December 31, 2002. The table also reflects the values of such options based on the positive spread between the exercise price of such options and the closing sales prices of EarthLink Common Stock as reported on Nasdaq on December 31, 2002.

| |

| |

| | Number of

Securities Underlying

Unexercised Options

| | Value of Unexercised

In-the-Money Options(1)

|

|---|

Name

| | Shares

Acquired

on Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Charles G. Betty | | 6,244 | | $ | 26,047 | | 558,447 | | 556,250 | | $ | 477,724 | | $ | 70,000 |

| Lee Adrean | | — | | | — | | 276,250 | | 303,750 | | | — | | | 14,000 |

| William S. Heys | | — | | | — | | 260,015 | | 179,688 | | | — | | | 14,000 |

| Michael C. Lunsford | | — | | | — | | 206,547 | | 185,428 | | | — | | | 14,000 |

| Brinton O. C. Young | | — | | | — | | 268,451 | | 169,688 | | | 107,061 | | | 14,000 |

| Michael S. McQuary | | — | | | — | | 723,523 | | 241,935 | | | 2,220,783 | | | — |

| Jon M. Irwin | | — | | | — | | 255,526 | | 120,939 | | | 33,592 | | | — |

- (1)

- The value of "in-the-money" options represents the difference between the exercise price of stock options and $5.45, the per share closing sales price on December 31, 2002 for EarthLink's Common Stock as reported by Nasdaq.

18

Table IV—Amended Equity Compensation Plan Information

The following table sets forth information as of December 31, 2002 concerning the shares of the Company's Common Stock which are authorized for issuance under our equity compensation plans.

Plan Category

| | Number of Securities to Be Issued on Exercise of Outstanding Options, Warrants and Rights

| | Weighted-average Exercise Price of Outstanding Options, Warrants and Rights

| | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a))

|

|---|

| | (a)

| | (b)

| | (c)

|

|---|

| Equity Compensation Plans Approved by Stockholders | | 27,857,446 | | $ | 12.70 | | 5,796,082 |

Equity Compensation Plans Not Approved by Stockholders |

|

499,033 |

|

|

8.16 |

|

0 |

|

|

|

|

|

|

|

|

Total |

|

28,356,479 |

|

$ |

12.62 |

|

5,796,082 |

|

|

|

|

|

|

|

|

- (1)

- The Company does not currently have equity compensation plans that have not been approved by stockholders. However, included in the securities outstanding for equity compensation plans not approved by stockholders are 334,645 options and warrants granted prior to the merger of EarthLink Network and MindSpring during the years ended December 31, 1995, 1996 and 1997 to certain officers, consultants and investors. The options and warrants have terms of 10 years and exercise prices ranging from $1.50 to $5.50 per share. All 334,645 options and warrants were exercisable as of December 31, 2002.

- (2)

- In connection with the Company's acquisition of OneMain.com, Inc. in September 2000, the Company granted warrants to purchase a total of 164,388 shares of Common Stock to two investors at a per share purchase price of $18.25. The warrants expire in September 2005. All 164,388 warrants were exercisable as of December 31, 2002.

- (3)

- Column (c) includes 399,190 shares available for issuance pursuant to the EarthLink, Inc. Employee Stock Purchase Plan which entitles employees to allocate a portion of their compensation to purchase the Company's Common Stock at a per share purchase price of 85% of the lesser of (i) the closing price on the first trading day of the just completed quarter or (ii) the closing price on the last trading day of the just completed quarter.

19

STOCK PERFORMANCE GRAPH

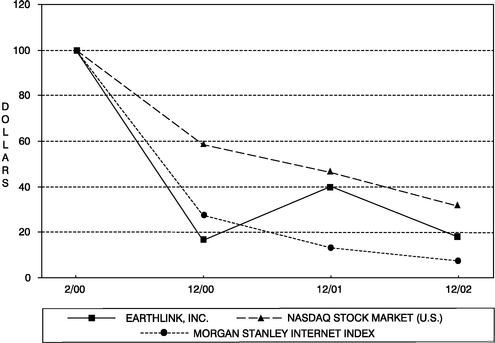

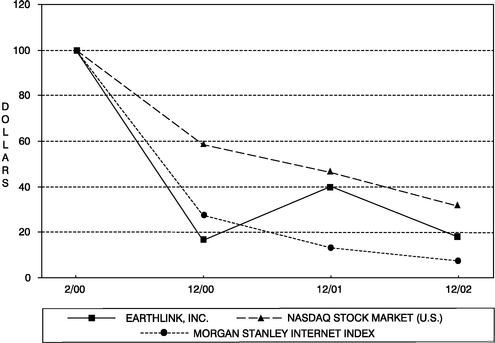

The following indexed line graph indicates EarthLink's total return to stockholders from February 7, 2000, the date on which the Company's Common Stock began trading on the Nasdaq National Market, to December 31, 2002, as compared to the total return for the Nasdaq Stock Market—US Index and the Morgan Stanley Internet Index for the same period. The calculations in the graph assume that $100 was invested on February 7, 2000 in the Company's Common Stock and each index and also assume dividend reinvestment.

| | Feb-00

| | Dec-00

| | Dec-01

| | Dec-02

|

|---|

| EarthLink, Inc. | | 100.0 | | 16.5 | | 39.9 | | 17.9 |

| NASDAQ Stock Market (U.S.) | | 100.0 | | 58.2 | | 46.0 | | 31.5 |

| Morgan Stanley Internet Index | | 100.0 | | 27.4 | | 13.2 | | 7.5 |

In the Company's Proxy Statement for its 2002 annual meeting of Stockholders, the Company compared its stock performance to the JP Morgan H&Q Internet Index. Since the JP Morgan H&Q Internet Index no longer exists, the Company decided to compare in this Proxy Statement its performance to the Morgan Stanley Internet Index.

20

AUDIT COMMITTEE

Pursuant to SEC rules for proxy statements, the Audit Committee of the Board of Directors of the Company has prepared the following Audit Committee Report. The Audit Committee intends that this report clearly describe the current audit program of the Company, including the underlying philosophy and activities of the Audit Committee.

Audit Committee Report

The primary function of the Audit Committee of the Board of Directors (the "Audit Committee") is to assist the Board of Directors in fulfilling its oversight responsibilities by overseeing: (a) the integrity of the Company's financial reports provided by the Company to any governmental body or the public, (b) the Company's systems of internal auditing and controls, and (c) the Company's finance, auditing, accounting, legal, financial reporting and regulatory compliance as established by the Company. The Audit Committee operates under a written charter. Consistent with this function, the Audit Committee encourages continuous improvement of, and fosters adherence to, the Company's policies, procedures and practices at all levels. The Audit Committee is accountable and responsible to the full Board of Directors. The Audit Committee's primary duties and responsibilities are to:

- •

- Serve as an independent and objective party to monitor the Company's financial reporting process and internal control systems;

- •

- Review and appraise the audit efforts of the Company's independent auditors and internal auditing department; and

- •

- Provide open channels of communication among the Company's independent auditors, financial and senior management, the internal auditing department and the Board of Directors.

Composition and Qualifications of Audit Committee

The Audit Committee presently consists of three non-employee directors: Mr. Kavner—Chairman, Mr. Beutner and Dr. Metcalfe. Each member of the Audit Committee is independent, financially literate and is free from any relationship that, in the judgment of the Board of Directors, would interfere with the exercise of his independent judgment as a member of the Audit Committee. At least one member of the Audit Committee is an audit committee financial expert, as defined by regulations promulgated by the SEC. The members of the Audit Committee meet the independence and experience requirements of Nasdaq as set forth in the NASD Listing Standards for Nasdaq-listed companies.

Election and Meetings

The Board of Directors annually elects the members of the Audit Committee to serve for a term of one year or other length of term, in the discretion of the Board of Directors, and shall otherwise serve until their successors are duly elected and qualified. Each member of the Audit Committee shall serve at the pleasure and discretion of the Board of Directors and may be replaced or removed by the Board of Directors at any time and from time to time in its discretion. At the time of each annual election of the Audit Committee members, or at other times in the discretion of the Audit Committee or the Board of Directors, the Audit Committee shall designate one member of the Audit Committee to be its Chairman; in the absence of such designation, the Board of Directors shall designate the Chairman.

The Audit Committee meets at least four times annually, or more frequently as circumstances require. The Audit Committee meets at least annually with representatives from the Company's executive management and its independent auditors in separate sessions to discuss any matters that the Audit Committee or either of these groups believe should be discussed. In addition, the Audit

21

Committee or its Chairman meets with the independent auditors and a representative(s) of the Company's management at least quarterly to review the Company's quarterly financial statements consistent with the provisions of Statement of Auditing Standards No. 61.

Responsibilities and Duties

To fulfill its responsibilities and duties, the Audit Committee performed the following during the year ended December 31, 2002: