QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

EarthLink, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

EARTHLINK, INC.

1375 Peachtree St., NW

Atlanta, Georgia 30309

(404) 815-0770

April 19, 2004

Dear Stockholders:

You are cordially invited to attend the 2004 Annual Meeting of Stockholders of EarthLink, Inc. ("EarthLink"), which will be held at 10:00 a.m. (local time) on Tuesday, May 25, 2004, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street, NW, Atlanta, Georgia (the "Annual Meeting").

The principal business of the Annual Meeting will be (i) the election of our Class II directors and our recently appointed Class I and Class III directors and (ii) the ratification of the appointment by EarthLink's Audit Committee of the Board of Directors of Ernst & Young LLP as independent auditors for the year ending December 31, 2004. We will also review our results for the past fiscal year and report on significant aspects of our operations during the first quarter of 2004.

If you do not attend the Annual Meeting, you may vote your shares in any of three ways—by mail, by telephone or by Internet. The enclosed proxy card materials provide you details on how to vote by these three methods. Whether or not you plan to attend the Annual Meeting, we encourage you to vote in the method that suits you best so that your shares will be voted at the Annual Meeting. If you decide to attend the Annual Meeting, you may revoke your proxy and personally cast your vote.

We are pleased to announce that EarthLink is now offering you the opportunity to receive future proxy statements and annual reports over the Internet. We encourage you to enroll in this program by following the instructions set forth in a separate letter enclosed with this proxy statement. You may continue to receive these materials through the mail, but by consenting to Internet delivery you will assist EarthLink with its ongoing efforts to streamline operations and reduce costs.

Thank you, and we look forward to seeing you at the Annual Meeting or receiving your proxy vote.

EARTHLINK, INC.

1375 Peachtree St., NW

Atlanta, Georgia 30309

(404) 815-0770

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2004 Annual Meeting of Stockholders of EarthLink, Inc. ("EarthLink") will be held at 10:00 a.m. (local time), on Tuesday, May 25, 2004, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street, NW, Atlanta, Georgia. The meeting is called for the following purposes:

- 1.

- To elect Class II directors for a three-year term and to elect recently appointed Class I and Class III directors to fulfill the remaining terms of their respective classes;

- 2.

- To ratify the appointment by EarthLink's Audit Committee of the Board of Directors of Ernst & Young LLP as EarthLink's independent auditors for the year ending December 31, 2004; and

- 3.

- To transact such other business as may properly come before the meeting.

The Board of Directors has fixed the close of business on March 31, 2004 as the record date for the purpose of determining the stockholders who are entitled to notice of and to vote at the meeting and any adjournment or postponement thereof.

Atlanta, Georgia

April 19, 2004

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. IF YOU ARE UNABLE TO BE PRESENT AT THE MEETING, PLEASE VOTE YOUR SHARES BY MAIL WITH THE ENCLOSED PROXY CARD, BY TELEPHONE OR BY INTERNET SO THAT YOUR SHARES WILL BE REPRESENTED. IF YOU WISH, YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE TIME IT IS VOTED.

EARTHLINK, INC.

1375 Peachtree St., NW

Atlanta, Georgia 30309

PROXY STATEMENT

For the Annual Meeting of Stockholders

to be held May 25, 2004

This Proxy Statement is furnished by and on behalf of the Board of Directors (the "Board of Directors") of EarthLink, Inc. ("EarthLink") in connection with the solicitation of proxies for use at the 2004 Annual Meeting of Stockholders of EarthLink to be held at 10:00 a.m. (local time) on Tuesday, May 25, 2004, at the Georgia Center for Advanced Telecommunications Technology (GCATT), located at 250 14th Street, NW, Atlanta, Georgia, and at any adjournments or postponements thereof (the "Annual Meeting"). This Proxy Statement and the enclosed proxy card will be mailed on or about April 19, 2004 to EarthLink's stockholders of record (the "Stockholders") on the Record Date, as defined below.

THE BOARD OF DIRECTORS URGES YOU TO VOTE YOUR SHARES BY ANY OF THE THREE AVAILABLE METHODS—BY MAIL, BY TELEPHONE OR BY INTERNET. IF YOU VOTE BY MAIL, PLEASE COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE.

YOUR VOTE IS IMPORTANT!

SOLICITATION, VOTING AND REVOCABILITY OF PROXIES

General

Proxies will be voted as specified by the Stockholder or Stockholders granting the proxy. Unless contrary instructions are specified, if the enclosed proxy card is executed and returned (and not revoked) prior to the Annual Meeting, the shares of Common Stock, $.01 par value per share, of EarthLink (the "Common Stock") represented thereby will be voted FOR the proposals set forth in this Proxy Statement. The submission of a signed proxy will not affect a Stockholder's right to attend and to vote in person at the Annual Meeting. A Stockholder who executes a proxy may revoke it at any time before it is voted by filing with the Secretary of EarthLink either a written revocation or an executed proxy bearing a later date or by attending and voting in person at the Annual Meeting. If you hold your shares of Common Stock ("Shares") in a brokerage account or through another nominee, you are the beneficial owner of those Shares but not the record holder and you will need to obtain a "legal proxy" from the record holder to attend and vote at the Annual Meeting.

Only holders of record of Common Stock as of the close of business on March 31, 2004 (the "Record Date") will be entitled to vote at the Annual Meeting. Holders of Shares authorized to vote are entitled to cast one vote per Share on all matters voted upon at the Annual Meeting. As of the close of business on the Record Date, there were 157,195,094 Shares issued and outstanding.

Quorum Required

According to EarthLink's Amended and Restated Bylaws, the holders of a majority of the Shares entitled to be voted must be present or represented by proxy to constitute a quorum. Each outstanding Share is entitled to one vote on all matters. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, the Stockholders who are present at the Annual Meeting in person or by proxy and who abstain are considered Stockholders who are present and entitled to vote and they count toward the quorum. Abstentions and shares of record held by a broker or its nominee that are voted on any matter are included in determining whether a quorum is present. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present.

Vote Required

Under Delaware law, directors are elected by a plurality of the votes of the Shares entitled to vote and present in person or represented by proxy at a meeting at which a quorum is present. Only votes actually cast will be counted for the purpose of determining whether a particular nominee received more votes than the persons, if any, nominated for the same seat on the Board of Directors. A Stockholder may withhold votes from any or all nominees by notation on the proxy card. Except to the extent that a Stockholder withholds votes from any or all nominees, the persons named in the proxy card, in their sole discretion, will vote such proxy for the election of the nominees listed below as directors of EarthLink. Abstentions will have no effect on the outcome of the election of directors.

Under rules of self-regulatory organizations governing brokers, brokers holding shares of record for customers generally are entitled to vote on routine matters without voting instructions from their customers. The election of directors and the ratification of the appointment of Ernst & Young LLP are considered routine matters. On non-routine matters, brokers must obtain voting instructions from customers. If a broker does not receive voting instructions from a customer on non-routine matters and accordingly does not vote on these matters, this is called a broker non-vote.

The proposal to be voted upon at the Annual Meeting with respect to ratifying the appointment of Ernst & Young LLP requires the affirmative vote of a majority of the Shares present or represented and entitled to vote at the Annual Meeting to be approved. Abstentions will have the same effect as a vote against this proposal.

With respect to any other matters that may come before the Annual Meeting, if proxies are executed and returned, such proxies will be voted in a manner deemed by the proxy representatives named therein to be in the best interests of EarthLink and its stockholders.

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors

EarthLink's Second Restated Certificate of Incorporation provides that EarthLink shall have at least two and not more than 17 directors, with the exact number to be fixed by resolution of the Board of Directors from time to time or by a majority vote of the stockholders entitled to vote on directors. The current size of the Board of Directors is fixed at eight, and EarthLink currently has eight directors. The Board of Directors held six meetings in 2003. During 2003, each of the members of EarthLink's Board of Directors attended at least 75% of the aggregate number of (i) meetings of the Board of Directors and (ii) meetings held by all committees of the Board of Directors on which the director served held during the period such member was a director, except for Thomas E. Wheeler who attended one of the two Board of Directors meetings and three of the four Audit Committee meetings held during the period he was a director.

As established in its Second Restated Certificate of Incorporation, EarthLink's Board of Directors is divided into three classes, designated as Class I, Class II and Class III, which classes are to have as nearly equal number of directors as possible. The current eight member Board of Directors consists of three Class I members, two Class II members and three Class III members. The term for each class is three years, which expires at the third succeeding Annual Meeting of Stockholders after the respective class election. The term for our Board of Directors' Class II directors expires at this year's Annual Meeting.

Nominees Standing for Election

The Board of Directors has nominated Linwood A. Lacy, Jr. and Terrell B. Jones for election as Class II directors to the Board of Directors at the Annual Meeting, each to serve until the 2007 Annual Meeting of Stockholders or until their successors are duly elected and qualified.

2

Furthermore, the Board of Directors has nominated Thomas E. Wheeler for election as a Class I director and William H. Harris, Jr. for election as a Class III director, each to serve until the 2006 and 2005 Annual Meeting of Stockholders, respectively, or until their successors are duly elected and qualified.

Set forth below is certain biographical information furnished to EarthLink by the directors standing for election:

Linwood A. Lacy, Jr.—Class II Director

Age: 58

Mr. Lacy has served on our Board of Directors since February 2000 when EarthLink Network, Inc. ("EarthLink Network") merged with MindSpring Enterprises, Inc. ("MindSpring") and was a member of the Board of Directors of EarthLink Network from June 1996 until its merger with MindSpring. Mr. Lacy currently is a private investor. Mr. Lacy was the Chairman of 4Sure.com, Inc. from June 1998 to July 2001. From October 1996 to October 1997, he served as President and Chief Executive Officer of Micro Warehouse Incorporated. From 1985 to May 1996, he served as the Co-Chairman and Chief Executive Officer of Ingram Micro, Inc., a microcomputer products distributor and a then wholly-owned subsidiary of Ingram Industries Inc. From December 1993 to June 1995, Mr. Lacy was also President of Ingram Industries Inc. From June 1995 until April 1996, he was President and Chief Executive Officer of Ingram Industries Inc., and from April 1996 to May 1996, he served as its Vice Chairman. Mr. Lacy serves as a member of the Board of Directors of Ingram Industries Inc., Modus Media International and Netgear, Inc.

Terrell B. Jones—Class II Director

Age: 55

Mr. Jones has served on our Board of Directors since October 2003. Mr. Jones currently is a self-employed consultant. Mr. Jones served as President and Chief Executive Officer of Travelocity.com Inc., a provider of online travel reservation capabilities, from January 1998 through May 2002. Mr. Jones served as a director of Travelocity.com Inc. from March 2000 through May 2002. Under Mr. Jones' guidance, Travelocity.com Inc., then a division of Sabre Holdings Corporation, merged with Preview Travel, Inc. in March 2000 and became an independent publicly traded company. Prior to that time, Mr. Jones served in a number of executive officer positions with Sabre Inc. and Sabre Holdings Corporation, including Chief Information Officer, over a period of 24 years. Mr. Jones is managing partner of Essential Ideas, a consulting firm, and also serves as a special venture partner of General Catalyst Partners, a venture capital firm. Mr. Jones serves as a member of the Board of Directors of Entrust, Inc.

William H. Harris, Jr.—Class III Director

Age: 48

Mr. Harris has served on our Board of Directors since October 2003. Mr. Harris currently is a private investor. From October 1999 through March 2000, Mr. Harris served as Chief Executive Officer of PayPal, Inc. From December 1993 through September 1999, Mr. Harris served as the Executive Vice President and then subsequently as Chief Executive Officer of Intuit Inc. Mr. Harris serves as a member of the Board of Directors of Macromedia, Inc. and several privately-held corporations, including Yodlee, Inc., Xtec, Inc., MyVest Corporation, and LowerMyBills, Inc.

3

Thomas E. Wheeler—Class I Director

Age: 57

Mr. Wheeler has served on our Board of Directors since July 2003. Since July 2003, Mr. Wheeler has been President and Chief Executive Officer of Shiloh Group, LLC, a strategy development and private investment company specializing in telecommunications services. From 1992 through October 2003, Mr. Wheeler served as the President and Chief Executive Officer of the Cellular Telecommunications & Internet Association. Mr. Wheeler serves on the Board of Trustees of the John F. Kennedy Center for Performing Arts having been appointed to such position by Presidents Clinton and Bush. Mr. Wheeler is also President of the Foundation for the National Archives. Mr. Wheeler serves on the Board of Directors of Telephia, Inc., InPhonic, Inc. and the Public Broadcasting Service.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE ELECTION AS DIRECTORS OF THE NOMINEES NAMED ABOVE.

Directors Not Standing for Election

Below is certain biographical information furnished to EarthLink by each of the directors that is not subject to a vote at the Annual Meeting:

Marce Fuller—Class I Director

Age: 43

Ms. Fuller has served on our Board of Directors since October 2001. Since July 1999, she has been President, Chief Executive Officer and a member of the Board of Directors of Mirant Corporation ("Mirant"), a U.S. marketer of power and natural gas. From September 1997 to July 1999, Ms. Fuller served as President and Chief Executive Officer of the Mirant Americas Energy Marketing division of Mirant. From May 1996 to September 1997, Ms. Fuller was Senior Vice President of Mirant's North American operations and business development, and from February 1994 to May 1996, she was Mirant's Vice President for domestic business development. Ms. Fuller serves on the Board of Directors of Curtiss-Wright Corporation, the U.S. Department of Energy's Electricity Advisory Board, the President's International Board of Advisors of the Philippines and the Leadership Board of the College of Engineering, University of Alabama.

Mirant filed for bankruptcy protection on July 14, 2003 and continues to operate as an ongoing business. In addition, Mobile Energy Services Company, LLC ("Mobile Energy") and its parent, Mobile Energy Services Holdings, Inc., each affiliates of the Southern Company, filed for bankruptcy in January 1999 while Ms. Fuller was an executive officer of those companies. Ms. Fuller left such officer positions in 2001 and 1999, respectively, and is not currently an executive officer of either company. Mobile Energy owns a power generating facility which provides power and steam to a tissue mill in Mobile, Alabama. A plan of reorganization of both Mobile Energy and Mobile Energy Services Holdings, Inc. was approved by the bankruptcy court and became effective December 16, 2003.

Robert M. Kavner—Class I Director

Age: 60

Mr. Kavner has served on our Board of Directors since February 2001. He was a member of the Board of Directors of EarthLink Network until its merger with MindSpring in February 2000. Since 1995, Mr. Kavner has been a venture capital investor in technology companies, and in January 1999, he became Vice Chairman of Idealab, Inc., an incubator of technology companies. In April 2001, he retired and continues as a member of the Board of Directors of Idealab, Inc. From January 1996 through December 1998, he served as President and Chief Executive Officer of On Command

4

Corporation, a provider of on-demand video for the hospitality industry. From 1984 to 1994, Mr. Kavner held several senior management positions at AT&T including Senior Vice President and Chief Financial Officer, Chief Executive Officer of the Multimedia Products and Services Group, and Chairman of AT&T Venture Capital Group. Mr. Kavner also served as a member of AT&T's Executive Committee.

Charles G. Betty—Class III Director

Age: 47

Mr. Betty is our President and Chief Executive Officer and a member of our Board of Directors, and has served in those positions since February 2000 when EarthLink Network merged with MindSpring. Mr. Betty served as President, Chief Operating Officer and as a director of EarthLink Network from January 1996 until May 1996 when he was named President and Chief Executive Officer of EarthLink Network, serving in each capacity until its merger with MindSpring. From February 1994 to January 1996, Mr. Betty was a strategic planning consultant. From September 1989 to February 1994, Mr. Betty served as President, Chief Executive Officer and a director of Digital Communications Associates, Inc., a network connectivity provider. Mr. Betty serves on the Board of Directors of Global Payments Inc.

Sky D. Dayton—Class III Director

Age: 32

Mr. Dayton is the Chairman of the Board of Directors of EarthLink and the founder of EarthLink Network. After founding EarthLink Network in May 1994, Mr. Dayton served as Chief Executive Officer until May 1996 and Chairman of the Board of Directors until February 2000. He has served on the Board of Directors of EarthLink since February 2000 and was named Chairman of the Board of Directors in August 2000. Mr. Dayton is Founder, Chairman of the Board of Directors and Chief Executive Officer of Boingo Wireless, Inc. He is also a member of the Board of Directors of eCompanies, LLC, Business.com, Inc. and Neopets, Inc.; is a founding partner of eCompanies Venture Group, LP and is a partner in Evercore Ventures. Mr. Dayton serves on the advisory boards of NTT DoCoMo and the Center for Public Leadership at the John F. Kennedy School of Government at Harvard University.

Committees of the Board of Directors

EarthLink has the following standing committees of its Board of Directors: Compensation Committee, Audit Committee, Investment Committee and Corporate Governance and Nominating Committee. Each committee has a charter which is available for review at the following website, www.earthlink.net. The charters may be found by clicking "About EarthLink", then "Investor Relations" and then "Corporate Governance."

The Compensation Committee presently consists of Mr. Lacy (Chairperson), Ms. Fuller and Mr. Harris. The Compensation Committee met four times during the year ended December 31, 2003. The Compensation Committee establishes and approves cash and long-term incentive compensation for executive officers and other key employees of EarthLink. The Compensation Committee also administers EarthLink's equity-based compensation plans and deferred compensation plan. EarthLink's Board of Directors has determined that the members of our Compensation Committee are independent as defined in Rule 4200(a)(15) of the National Association of Securities Dealers, Inc. ("NASD") Listing Standards for Nasdaq-listed companies.

5

The Audit Committee presently consists of Mr. Kavner (Chairperson), Mr. Jones and Mr. Wheeler. The Audit Committee met 11 times during the year ended December 31, 2003. The Audit Committee is responsible for selecting EarthLink's independent auditors, reviewing the results and scope of audits and other services provided by EarthLink's independent auditors, and reviewing and evaluating EarthLink's financial reporting and disclosure processes and internal control functions. The Board of Directors has determined that the members of our Audit Committee are independent as defined in Rule 4200(a)(15) and 4350(d) of the NASD Listing Standards for Nasdaq-listed companies.

The Corporate Governance and Nominating Committee presently consists of Ms. Fuller (Chairperson), Mr. Kavner and Mr. Lacy. The Corporate Governance and Nominating Committee met four times during the year ended December 31, 2003. The Corporate Governance and Nominating Committee is responsible for overseeing EarthLink's corporate governance principles, guidelines and practices, and identifying, nominating, proposing and qualifying nominees for open seats on the Board of Directors. EarthLink's Board of Directors has determined that the members of our Corporate Governance and Nominating Committee are independent as defined in Rule 4200(a)(15) of the NASD Listing Standards for Nasdaq-listed companies.

The Investment Committee presently consists of Mr. Betty, Mr. Dayton and Mr. Lacy. The Investment Committee is responsible for reviewing, analyzing and making determinations regarding material investments by EarthLink in other companies. The Investment Committee met two times during the year ended December 31, 2003.

Corporate Governance Matters

The Corporate Governance and Nominating Committee identifies nominees for director on its own as well as by considering recommendations from other members of the Board of Directors, officers and employees of EarthLink, and other sources that the committee deems appropriate. The Corporate Governance and Nominating Committee also will consider stockholder recommendations for nominees for director subject to such recommendations being made in accordance with EarthLink's Second Restated Certificate of Incorporation. In addition to the Corporate Governance and Nominating Committee's charter, EarthLink has adopted Corporate Governance Guidelines that contain, among other matters, important information concerning the Corporate Governance and Nominating Committee's responsibilities when identifying and evaluating nominees for director. You will find these guidelines at www.earthlink.net by clicking "About EarthLink", then "Investor Relations" and then "Corporate Governance".

As required by EarthLink's Second Restated Certificate of Incorporation, any stockholder recommendation for a nominee for director to be voted upon at the 2005 annual meeting should be submitted in writing to our Corporate Secretary not later than 90 days in advance of our 2005 annual meeting, which tentatively is scheduled for May 24, 2005. In addition, the stockholder's notice must include (i) the name and address of the stockholder who intends to make the nomination and of the person or persons to be nominated; (ii) a representation that the stockholder is a holder of record of shares of EarthLink entitled to vote at the applicable meeting and intends to appear in person or by proxy at the applicable meeting to nominate the person or persons specified in the notice; (iii) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming them) pursuant to which the nomination or nominations are to be

6

made by the Stockholder; (iv) all other information regarding each nominee proposed by the Stockholder as would be required to be included in a proxy statement filed pursuant to the then-current proxy rules of the Securities and Exchange Commission ("SEC") if the nominees were to be nominated by the Board of Directors; and (v) the consent of each nominee to serve as a director of EarthLink if elected. These requirements are separate from the requirements that stockholders must meet to include proposals in the proxy materials for the 2005 annual meeting, discussed later in this Proxy Statement.

When evaluating prospective nominees, the Corporate Governance and Nominating Committee considers the current composition of the Board of Directors and the characteristics of each individual under consideration, including that individual's competencies, experience, reputation, integrity, independence, potential for conflicts of interest and other qualities the committee deems appropriate. When considering a director standing for re-election as a nominee, in addition to the attributes described above, the Corporate Governance and Nominating Committee also considers that individual's past contribution and future commitment to EarthLink. The Corporate Governance and Nominating Committee evaluates the totality of the merits of each prospective nominee that it considers and does not restrict itself by establishing minimum qualifications or attributes. Additionally, the Corporate Governance and Nominating Committee will continue to seek to populate the Board of Directors with a sufficient number of independent directors to satisfy Nasdaq listing standards and SEC requirements. The Corporate Governance and Nominating Committee will also seek to assure that the Board of Directors, and consequently the Audit Committee, will have at least three independent members that satisfy Nasdaq financial and accounting experience requirements and at least one member who qualifies as an audit committee financial expert.

There is no difference in the manner by which the Corporate Governance and Nominating Committee evaluates prospective nominees for director based on the source from which the individual was first identified.

Each of our recently appointed directors, Messrs. Jones, Wheeler and Harris, were recommended as nominees to the Board of Directors by non-management directors of our Board of Directors.

In determining to recommend these individuals for their initial election to EarthLink's Board of Directors, the Corporate Governance and Nominating Committee and EarthLink's independent directors took into account their extensive experience in the communications and Internet industries, including with respect to Mr. Wheeler his public policy experience and with respect to Messrs. Harris and Jones their product innovation and marketing experience.

We encourage stockholders to communicate with our Board of Directors by sending written correspondence to EarthLink, Inc., Attention: Chairperson of the Corporate Governance and Nominating Committee, 1375 Peachtree Street, NW, Mail Stop 1A7-14, Atlanta, Georgia, 30309. EarthLink does not screen correspondence for content but may screen regular incoming mail for security reasons. The Chairperson of the Corporate Governance and Nominating Committee and his or her duly authorized agents are responsible for collecting and organizing stockholder communications. Absent a conflict of interest, the Chairperson of the Corporate Governance and Nominating Committee is responsible for evaluating the materiality of each stockholder communication and determining which stockholder communications are to be presented to the full Board of Directors or other appropriate body.

EarthLink's Board of Directors has determined that Ms. Fuller and Messrs. Kavner, Lacy, Wheeler, Harris and Jones are independent as defined in Rule 4200(a)(15) of the NASD Listing

7

Standards for Nasdaq-listed companies. The independent directors of the Board of Directors meet in executive session at least quarterly.

Historically, EarthLink's annual meetings have not been well attended by stockholders. EarthLink has not had a policy with respect to director attendance at these meetings, and last year Mr. Betty was the only director who attended the annual meeting. This year, however, EarthLink has instituted a policy encouraging directors to attend the Annual Meeting.

EarthLink has adopted a Code of Ethics for its Chief Executive Officer / Senior Financial Officers. EarthLink has also adopted a Code of Business Conduct and Ethics for directors, officers and employees. Copies of each of these codes may be found at the following website, www.earthlink.net. You will find the codes by clicking "About EarthLink", then "Investor Relations" and then "Corporate Governance". EarthLink intends to satisfy the disclosure requirement under Item 10 of Form 8-K by posting such information on its website.

Director Compensation

EarthLink pays each non-employee director an annual retainer of $25,000 for serving on the Board of Directors, payable semi-annually. EarthLink also pays each non-employee chairperson of the Board of Directors, Compensation Committee and Corporate Governance and Nominating Committee an additional annual retainer of $10,000 for serving in such capacity, payable semi-annually. Furthermore, EarthLink pays the chairperson of the Audit Committee an additional annual retainer of $20,000 for serving in such capacity, payable semi-annually.

EarthLink pays each non-employee member of the Board of Directors and each committee $1,000 for each full Board of Directors and committee meeting he or she attends in person ($500 if he or she attends telephonically). EarthLink also reimburses directors for the expenses they incur in attending meetings of the Board of Directors or committees thereof.

Non-employee directors receive an initial grant of 15,000 options to purchase Common Stock when they join the Board of Directors. In addition, non-employee directors receive 10,000 options to purchase Common Stock on the first business day of each year. These options are granted with an exercise price equal to the fair market value of the Common Stock on the date of grant, generally have a ten year term and vest in 25% increments over a four year period.

Each non-employee director also receives a grant of restricted stock units each year valued at $30,000 at the time of the grant. The first grant of restricted stock units was made in October 2003, and subsequent grants are intended to be made in July of each year. The restricted stock units vest over a four year period or upon an earlier change in control, and upon vesting the director may receive shares of Common Stock or may defer receipt of those shares in accordance with EarthLink's Deferred Compensation Plan for Directors and Certain Key Employees (described elsewhere in this Proxy Statement).

8

EXECUTIVE OFFICERS

The executive officers of EarthLink serve at the discretion of the Board of Directors, and serve until they resign, are removed or are otherwise disqualified to serve, or until their successors are elected and qualified. EarthLink's executive officers presently include: Charles G. Betty, Lee Adrean, Linda W. Beck, Donald B. Berryman, Samuel R. DeSimone, Jr., William S. Heys, Michael C. Lunsford and Brinton O. C. Young. The following sets forth biographical information for our executive officers who are not directors. The biographical summary for Charles G. Betty, who is also a director, is provided in "Proposal 1—Election of Directors—Directors Not Standing for Election" above.

Lee Adrean—Executive Vice President and Chief Financial Officer

Age: 52

Mr. Adrean has served as our Executive Vice President and Chief Financial Officer since March 2000 and Chief Administrative Officer since May 2002. From May 1995 to February 2000, Mr. Adrean served as Executive Vice President and Chief Financial Officer of First Data Corporation in Atlanta, Georgia. From August 1993 to April 1995, Mr. Adrean served as President of Providian Corporation Agency Group (a division of Providian Corporation). Prior to that, Mr. Adrean was Chief Financial Officer of Providian Corporation and held various positions with Bain & Company and Peat, Marwick, Mitchell & Company.

Linda W. Beck—Executive Vice President, Operations

Age: 40

Ms. Beck has served as our Executive Vice President, Operations since September 2000. Following the merger of EarthLink Network and MindSpring in February 2000 and until September 2000, Ms. Beck served as Vice President, Engineering. She held similar positions at both MindSpring from February 1999 to February 2000 and Netcom from September 1996 to February 1999. Before joining Netcom in 1996, Ms. Beck served in a variety of positions at Sybase, GTE, Amdahl and the National Security Agency.

Donald B. Berryman—Executive Vice President, Customer Support

Age: 45

Mr. Berryman has served as our Executive Vice President, Customer Support since November 2002. Prior to that, from May 2000 to November 2002, Mr. Berryman served as the President and Chief Executive Officer of IdentityNow, Inc., a privately-held company in Kansas City, Missouri which is the parent company of American Identity, Inc. Mr. Berryman served as the Senior Vice President of APAC Customer Services, Inc. from January 1997 to May 2001. From March 1993 to January 1997, Mr. Berryman served as Vice President and General Manager of APAC's Service Solutions Group. Mr. Berryman also has served in executive positions at Ryder Truck Rental and USA TODAY.

Samuel R. DeSimone, Jr.—Executive Vice President, General Counsel and Secretary

Age: 44

Mr. DeSimone has served as our Executive Vice President, General Counsel and Secretary since February 2000. Prior to that, Mr. DeSimone served in such capacities at MindSpring since November 1998. From September 1995 to August 1998, Mr. DeSimone served as Vice President of Corporate Development with Merix Corporation of Forest Grove, Oregon, a printed circuit board

9

manufacturer. From June 1990 to August 1995, he was an associate attorney and a partner with Lane Powell Spears Lubersky of Portland, Oregon.

William S. Heys—Executive Vice President, Sales

Age: 54

Mr. Heys has served as our Executive Vice President, Sales since September 2000 and was Executive Vice President, Business Development and Business Services from February 2000 to September 2000. Prior to that, Mr. Heys served as Senior Vice President, Sales of EarthLink Network since August 1999 and was Vice President of EarthLink Network's relationship with Sprint Corporation from January 1998 to August 1999. Prior to joining EarthLink Network, Mr. Heys founded and managed BHC & Associates, a technology industry consulting firm, from 1994 to January 1998. Prior to that, Mr. Heys served in a variety of executive sales and marketing management positions at IBM, Wang, Hayes Microcomputer Products and Digital Communications Associates, Inc.

Michael C. Lunsford—Executive Vice President, Marketing and Products

Age: 36

Mr. Lunsford currently serves as our Executive Vice President, Marketing and Products. Prior to that, Mr. Lunsford served as our Executive Vice President, Products from April 2002 to March 2004 and as our Executive Vice President, Strategic Brand Marketing from August 2001 to April 2002. Mr. Lunsford served as Executive Vice President, Broadband Services from February 2000 to August 2001, and in that same role for EarthLink Network from November 1999 until its merger with MindSpring in February 2000. Prior to that, Mr. Lunsford was EarthLink Network's Vice President of Special Projects, a position he held from the beginning of his employment with EarthLink Network in March of 1999. Before joining EarthLink Network, Mr. Lunsford was a Director with Scott, Madden & Associates, a management consulting firm in Raleigh, North Carolina, from 1995 to 1999. Prior to that, Mr. Lunsford worked for Andersen Consulting in Chicago, Illinois.

Brinton O. C. Young—Executive Vice President, Strategic Planning

Age: 52

Mr. Young has served as our Executive Vice President, Strategic Planning since June 2001. From February 2000 to June 2001, he was our Executive Vice President, Marketing and Corporate Strategy. Prior to that, he was Senior Vice President, Marketing of EarthLink Network from August 1998 through February 2000, and was Vice President, Strategic Planning of EarthLink Network from March 1996 through December 1998. From 1990 to 1996, Mr. Young was President of Young & Associates, a consulting firm specializing in strategic planning for high-growth companies.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires EarthLink's directors, executive officers and persons who own beneficially more than 10% of EarthLink's Common Stock to file reports of ownership and changes in ownership of such stock with the SEC and the NASD. These persons are also required by SEC regulations to furnish EarthLink with copies of all such forms they file. To EarthLink's knowledge, based solely on a review of the copies of such reports furnished to EarthLink and written representations that no other reports were required, all persons subject to the reporting requirements of Section 16(a) filed the required reports on a timely basis for the year ended December 31, 2003, except that, as a result of an internal miscommunication at EarthLink, D. Cary Smith, EarthLink's former chief accounting officer, failed to timely file a Form 4

10

with respect to each of a purchase and a sale of EarthLink stock in the EarthLink, Inc. 401(k) Plan in February and May 2003.

Beneficial Ownership of Common Stock

The following table sets forth information concerning the beneficial ownership of our issued and outstanding Common Stock by: (i) those persons known by management of EarthLink to own beneficially more than 5% of EarthLink's issued and outstanding Common Stock, (ii) the directors of EarthLink, (iii) the executive officers identified as "Named Executive Officers" in the Summary Compensation Table included elsewhere in this Proxy Statement, and (iv) all directors and officers of EarthLink as a group. Except as otherwise indicated in the footnotes below, such information is provided as of February 29, 2004. According to rules adopted by the SEC, a person is the "beneficial owner" of securities if he or she has or shares the power to vote them or to direct their investment or has the right to acquire beneficial ownership of such securities within 60 days through the exercise of an option, warrant or right, the conversion of a security or otherwise.

Name and Address of Beneficial Owners(1)

| | Amount and

Nature of

Beneficial

Ownership(2)

| | Percent

of Class

| |

|---|

| Lee Adrean | | 512,740 | (3) | * | |

| Linda W. Beck | | 290,250 | (4) | * | |

| Donald B. Berryman | | 46,874 | (5) | * | |

| Charles G. Betty | | 1,354,613 | (6) | * | |

| Sky D. Dayton | | 3,332,350 | (7) | 2.1 | % |

| Marce Fuller | | 37,346 | (8) | * | |

| William H. Harris, Jr. | | — | | * | |

| Terrell B. Jones | | — | | * | |

| Robert M. Kavner | | 99,873 | (9) | * | |

| Linwood A. Lacy, Jr. | | 391,046 | (10) | * | |

| Michael C. Lunsford | | 332,599 | (11) | * | |

| Thomas E. Wheeler | | — | | * | |

| Brinton O. C. Young | | 543,216 | (12) | * | |

| FMR Corp. | | 15,989,675 | (13) | 9.2 | % |

| Sprint Corporation | | 18,886,927 | (14) | 12.0 | % |

| UBS AG | | 10,448,954 | (15) | 6.6 | % |

| All directors and executive officers as a group (15 persons) | | 7,622,355 | (16) | 4.7 | % |

- *

- Represents beneficial ownership of less than 1.0% of our Common Stock.

- (1)

- Except as otherwise indicated by footnote below or in any applicable Schedule 13G, (i) the named person has sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned, and (ii) the address of the named person is that of EarthLink.

- (2)

- Beneficial ownership is determined in accordance with the rules of the SEC based on factors such as voting and investment power with respect to shares of Common Stock.

- (3)

- Includes options to purchase 498,750 shares of Common Stock and includes a deemed investment in 8,990 shares of Common Stock pursuant to EarthLink's Deferred Compensation Plan for Directors and Certain Key Employees (described elsewhere in this Proxy Statement).

- (4)

- Represents options to purchase 290,250 shares of Common Stock.

- (5)

- Represents options to purchase 46,874 shares of Common Stock.

11

- (6)

- Includes options to purchase 907,446 shares of Common Stock.

- (7)

- Includes options to purchase 39,167 shares of Common Stock.

- (8)

- Includes options to purchase 32,501 shares of Common Stock.

- (9)

- Includes options to purchase 44,167 shares of Common Stock.

- (10)

- Includes options to purchase 39,167 shares of Common Stock and includes a deemed investment in 1,829 shares of Common Stock pursuant to EarthLink's Deferred Compensation Plan for Directors and Certain Key Employees (described elsewhere in this Proxy Statement).

- (11)

- Represents options to purchase 332,599 shares of Common Stock.

- (12)

- Includes options to purchase 372,514 shares of Common Stock.

- (13)

- Represents ownership as of January 31, 2004, according to the Schedule 13G/A filed by FMR Corp. on February 10, 2004. The address for FMR Corp. is 82 Devonshire Street, Boston, Massachusetts 02109.

- (14)

- Represents ownership as of February 29, 2004 of 18,886,927 shares of Common Stock by Sprint Corporation. Sprint Corporation currently maintains title to and the right to vote the 18,886,927 shares of Common Stock; however, Sprint Corporation has entered into variable prepaid forward transactions which obligate Sprint Corporation to deliver and relinquish title to some or all of such shares of Common Stock in settlement of the transactions at varying dates over the next two years. The address for Sprint Corporation is 6200 Sprint Parkway, Overland Park, Kansas 66251.

- (15)

- Represents beneficial ownership as of December 31, 2003 according to the Schedule 13G filed by UBS AG on February 18, 2004. The address for UBS AG is Bahnhofstrasse 45, PO Box CH-8021, Zurich, Switzerland.

- (16)

- Includes options and warrants to purchase an aggregate of 3,278,357 shares of Common Stock and includes deemed investments in 10,819 shares of Common Stock pursuant to EarthLink's Deferred Compensation Plan for Directors and Certain Key Employees (discussed elsewhere in this Proxy Statement).

12

EXECUTIVE COMPENSATION

Pursuant to SEC rules for proxy statement disclosure of executive officer compensation, the Compensation Committee of the Board of Directors of EarthLink has prepared the following Report on Executive Officer Compensation. The Committee intends that this report clearly describe the current executive officer compensation program of EarthLink, including the underlying philosophy of the program and the specific performance criteria on which executive officer compensation is based. This report also discusses in detail the compensation paid to EarthLink's Chief Executive Officer.

Compensation Committee Report on Executive Officer Compensation

This report by the Compensation Committee of the Board of Directors (the "Committee") discusses the Committee's compensation objectives and policies applicable to EarthLink's executive officers. The report reviews the Committee's policy generally with respect to the compensation of all executive officers as a group for the year ended December 31, 2003, as reported in the Summary Compensation Table. The Committee is comprised entirely of independent directors. The Committee also administers EarthLink's equity-based compensation plans and deferred compensation plan.

Compensation Philosophy

The Committee consists of three non-employee directors, Mr. Lacy—Chairperson, Ms. Fuller and Mr. Harris. The Committee is responsible for setting cash and long-term incentive compensation for executive officers and other key employees of EarthLink. EarthLink's compensation policies are intended to create a direct relationship between the level of compensation paid to executives and EarthLink's current and long-term level of performance. The Committee believes that this relationship is best implemented by providing a compensation package of separate components, all of which are designed to enhance EarthLink's overall performance. The components are base salary, short-term compensation in the form of annual bonuses and long-term incentive compensation in the form of stock options and restricted stock units.

Base Salaries

The base salaries for EarthLink's executive officers for the year ended December 31, 2003 were established by considering the performance and contribution of each officer and by comparing base salaries offered for similar positions in competing or similar companies. The salaries of the executive officers also took into account the market environment and EarthLink's need to attract and retain key personnel for whom EarthLink must compete against similar companies and larger, more established companies.

Short-Term Annual Bonuses

Annual bonuses established for the executive officers are intended to provide an incentive for advancing EarthLink performance in the short term. The Committee establishes target bonus levels for the executive officers at the beginning of the year based on predetermined goals such as total paying customers, customer retention, revenue and profitability.

Long-Term Incentive Compensation

EarthLink's long-term incentive compensation plan for its executive officers is based on EarthLink's equity incentive plans. These plans promote ownership of EarthLink's Common Stock, which, in turn, provides a common interest between the stockholders of EarthLink and the executive officers of EarthLink. In establishing a long-term compensation plan, the Committee concluded that any compensation received under such plans should be directly linked to the performance of EarthLink, as reflected by increases in the price of its Common Stock, and the contribution of the individual

13

thereto. Stock options have an exercise price equal to the fair market value of the shares on the date of grant and, to encourage a long-term perspective, have an exercise period of 10 years and generally vest over four to six years. In addition, EarthLink may grant restricted stock units under the plans. The restricted stock units are granted based upon the fair market value of the shares on the date of the grant and, to support retention, generally have a vesting period. The number of options and restricted stock units granted to executive officers is determined by the Committee, which is charged with administering the equity incentive plans.

In 2003, EarthLink implemented a deferred compensation plan, described elsewhere in this Proxy Statement, to allow executive officers and other key employees to defer the receipt of designated cash compensation and Common Stock payable pursuant to restricted stock units. Only certain key employees are eligible to participate in the deferred compensation plan.

The base salaries, targeted bonus amounts, number of stock options, number of restricted stock units and other equity awards established for or granted to EarthLink's executive officers are based in part on the Committee's understanding of compensation amounts and forms paid to persons in comparable roles performing at comparable levels at other companies in the same or related industries. Such amounts, however, mainly reflect the subjective discretion of the members of the Committee based on the evaluation of EarthLink's current and anticipated future financial performance, the contribution of the individual executive officers to such financial performance, the contribution of the individual executive officers to EarthLink in areas not necessarily reflected by EarthLink's financial performance and the most appropriate incentive to link the performance and compensation of the executive officers to the stockholders' return on EarthLink's Common Stock.

Compensation of our Chief Executive Officer

The compensation of our Chief Executive Officer is governed primarily by an employment agreement, the material terms of which are described below in this Proxy Statement. This agreement was amended in 2003, including to provide for a base salary of $650,000. Also, the Committee acted on January 2, 2004 to grant Mr. Betty a long-term incentive award in the form of 150,000 restricted stock units. In its deliberations on those items, the Committee took into account not only compensation information for chief executive officers of competing or similar companies but also EarthLink's improving results of operations. The Committee noted, for example, EarthLink's return to profitability in the third quarter of 2003, the growth in broadband and value dial-up subscribers in 2003 and the significant number of new products and features introduced in 2003. The Committee then structured Mr. Betty's long-term incentive award to provide for vesting of the restricted stock units in increments on the earlier of achievement of performance objectives tied to continuing improvements in total EarthLink net income and in the financial performance and subscriber growth in EarthLink's broadband and value dial-up product lines, or the sixth anniversary of the date of grant. The Committee did not grant stock options to Mr. Betty in 2003.

Submitted by: The Compensation Committee

Linwood A. Lacy, Jr.

Marce Fuller

William H. Harris, Jr.

The Compensation Committee Report on Executive Compensation does not constitute solicitation material and should not be deemed filed or incorporated by reference into any of EarthLink's other filings under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that EarthLink specifically incorporates this report by reference therein.

14

Change-In-Control Accelerated Vesting and Severance Plan

General. EarthLink's Change-In-Control Accelerated Vesting and Severance Plan (the "CIC Plan") provides security to certain employees of EarthLink and its designated subsidiaries in the event of a Change in Control (as defined) of EarthLink. For purposes of the CIC Plan, "Change in Control" generally means a transaction pursuant to which any person acquires more than 50% of the voting power of EarthLink or any merger, reorganization or similar event where the owners of the voting stock of EarthLink before the event do not own voting stock representing at least 50% of the voting power of EarthLink or its successor after the event. The CIC Plan generally is a severance pay plan that provides continued compensation and other benefits to certain employees of EarthLink and its designated subsidiaries if their employment terminates for reasons described in the CIC Plan within a certain time of a Change in Control of EarthLink. The CIC Plan as a "welfare plan" is subject to the Employee Retirement Income Security Act of 1974. The CIC Plan is administered by EarthLink, which has responsibility for construing and interpreting the CIC Plan and establishing and amending such rules and regulations as it deems necessary or desirable for the proper administration of the CIC Plan.

Eligibility for Participation. The CIC Plan creates three benefit categories based on the employee's position with EarthLink or a designated subsidiary. For purposes of the CIC Plan, the "Gold" benefit category includes the Chief Executive Officer and President of EarthLink. The "Silver" benefit category includes the Chief Financial Officer of EarthLink, the Chief Executive Officer, President, and Chief Financial Officer of a designated subsidiary, and the Executive Vice Presidents of EarthLink or a designated subsidiary. Finally, the "Bronze" benefit category includes Vice Presidents of EarthLink or a designated subsidiary and other classes of employees whom the Board of Directors of EarthLink may select for participation under the CIC Plan.

Compensation Benefits. If at any time within eighteen (18) months after a Change in Control occurs, the employment of a participating employee is terminated by EarthLink or a designated subsidiary for any reason other than Cause (as defined in the CIC Plan), disability or death or the participating employee voluntarily terminates his employment for Good Reason (as defined in the CIC Plan), such participating employee is entitled to receive the following benefits. To an employee in the Gold or Silver benefit category, EarthLink will make a lump sum payment equal to (a) 150% of the employee's salary plus bonus target and (b) all amounts payable with respect to such employee's elected COBRA coverage (including for spouse and dependents) for one and one-half (11/2) years from termination. To an employee in the Bronze benefit category, EarthLink will make a lump sum payment equal to (a) 100% of the employee's salary plus bonus target and (b) all amounts payable with respect to such employee's elected COBRA coverage (including for spouse and dependents) for one year from termination. The payment of the compensation benefits will be consistent with normal payroll practices and subject to applicable withholdings and employment taxes.

Acceleration of Options. As with the compensation benefits, a participating employee's benefit category determines the accelerated vesting benefits to which he or she is entitled. For an employee in the Gold or Silver benefit category, if his or her stock options are assumed or continued after a Change in Control, all outstanding stock options granted on or before the Change in Control will vest and be exercisable in full, if not already fully vested, on termination of the employee's employment for any reason after the Change in Control occurs; however, if his or her stock options are not assumed or continued after the Change in Control, all outstanding stock options will vest and be exercisable in full contemporaneously with the Change in Control, if not already fully vested. For an employee in the Bronze benefit category, if his or her stock options are assumed or continued after a Change in Control, all outstanding stock options granted on or before the Change in Control will vest and be exercisable at least as much as if the employee had remained employed for 24 months after the Change in Control occurs, if not already vested to such extent; however, if his or her stock options are not assumed or continued after the Change in Control, all outstanding stock options will be vested and

15

exercisable at least as much as if the employee had remained employed for 24 months after the Change in Control occurs, if not already vested to such extent.

Unfunded Status. The CIC Plan is unfunded, and EarthLink and its subsidiaries are not required to segregate any assets to fund the benefits, if any, that will become payable under it. Any liability of EarthLink or any subsidiary to any employee with respect to the CIC Plan is based solely on any contractual obligations that may be created pursuant to the CIC Plan.

Amendment and Termination. EarthLink will have the right to amend the CIC Plan from time to time and may terminate it at any time; provided, however, that after a Change in Control in EarthLink occurs (i) no amendment may be made that diminishes any employee's rights following such Change in Control and (ii) the CIC Plan may not be terminated.

Deferred Compensation Plan

EarthLink has established a deferred compensation plan to permit any director or key employee who is selected to participate in the plan to elect to defer the receipt of designated cash compensation and Common Stock payable pursuant to restricted stock units. If a director or eligible key employee elects to defer any such amounts, the deferred amounts are credited to a bookkeeping account that EarthLink maintains and are deemed invested in Common Stock. Payment of deferred amounts will be made in shares of Common Stock (i) for directors, on or beginning upon the director's termination of service or, if earlier and the director so elects, the director's attainment of a specified age or (ii) for eligible key employees, on or beginning after the eligible key employee's termination of employment. Earlier payment is available, if the participant so elects, in the event of a change in control, bankruptcy or insolvency of EarthLink or, if the participant requests, in the event of an unforeseeable emergency to the extent necessary to satisfy such emergency, or, if the participant is willing to incur a 10% penalty, for any other reason.

Employment Agreement with our Chief Executive Officer

Charles G. Betty is employed as our Chief Executive Officer pursuant to an employment agreement for a term of three years, as such may automatically be extended from year-to-year thereafter, at a salary of not less than $600,000 per year, plus such other benefits generally made available to our other senior executives. Mr. Betty's current salary is $650,000 per year. Mr. Betty is entitled, if the bonus criteria for the applicable annual period are met, to an annual bonus in an amount equal to at least 60% of his base salary. EarthLink provides Mr. Betty and his family with health, medical, disability and term life insurance in accordance with any group plan it maintains. EarthLink reimburses Mr. Betty for any term life insurance policy payments made under a policy (or policies) with aggregate death benefits of $3,000,000 until such time as EarthLink provides a policy (or policies) with coverage and benefits the same as or substantially similar to the term life insurance policy held by Mr. Betty. In addition, if Mr. Betty is terminated by EarthLink for any reason other than for "cause", as defined in the employment agreement, EarthLink elects not to extend the term of the employment agreement or any yearly extension of the term, or Mr. Betty terminates the employment agreement for reasons of a breach by EarthLink, Mr. Betty will receive (i) his base salary for the longer of 18 months or the remainder of the initial term of the employment agreement (the "Severance Period"), (ii) the earned but unpaid bonus payment for that portion of the year Mr. Betty was employed, and (iii) health, medical, life and disability insurance coverage for himself and his family for the term of the Severance Period. If the employment agreement is terminated as a result of Mr. Betty's death, EarthLink will (i) pay to Mr. Betty's estate (A) Mr. Betty's base salary for a period of 18 months, plus (B) the earned but unpaid bonus payment for that portion of the year prior to Mr. Betty's death, and (ii) provide Mr. Betty's family with health, medical, life and disability insurance coverage for a period of 18 months. If EarthLink terminates Mr. Betty's employment for "cause," EarthLink shall not have an obligation to pay Mr. Betty his base salary or make any bonus payment or

16

provide any benefits beyond the termination date, except as required by law. In the event (i) a "change in control event" occurs, as defined in the employment agreement, (ii) EarthLink terminates Mr. Betty's employment for other than "cause," or (iii) Mr. Betty terminates his employment for reasons of a breach by EarthLink, all unvested stock options shall immediately vest and be fully exercisable by Mr. Betty. Mr. Betty's benefits under his employment agreement are cumulative of his benefits under all other EarthLink sponsored plans, except that, with respect to the CIC Plan, Mr. Betty must elect whether to take benefits under the terms of the CIC Plan or his employment agreement. The employment agreement restricts Mr. Betty from competing, directly or indirectly, with EarthLink or soliciting certain employees and officers of EarthLink or its affiliates during the term of the employment agreement and for a period of 18 months following its termination.

Limitations on Deductibility of Compensation

Under the 1993 Omnibus Budget Reconciliation Act, a portion of annual compensation payable to any of EarthLink's five highest paid executive officers would not be deductible by EarthLink for federal income tax purposes to the extent such officer's overall compensation exceeds $1,000,000. Qualifying performance-based incentive compensation, however, would be both deductible and excluded for purposes of calculating the $1,000,000 base. Although the Committee to date has not approved compensation arrangements that could exceed the $1,000,000 cap for any of these executive officers by any material amount, it will continue to address this issue when formulating compensation arrangements for EarthLink's executive officers.

Compensation Committee Interlocks

The Compensation Committee of EarthLink's Board of Directors currently consists of Mr. Lacy, Ms. Fuller and Mr. Harris. No member of the Compensation Committee was, during the last fiscal year, an officer or employee of EarthLink nor was formerly an officer of EarthLink. There are no Compensation Committee interlocks between EarthLink and other entities involving EarthLink's executive officers and members of the Board of Directors who serve as executive officer or board member of such other entities.

Certain Relationships and Related Transactions

During the year ended December 31, 2000 and during the quarter ended June 30, 2001, EarthLink loaned money to certain executive officers to allow them to meet margin calls on shares of EarthLink Common Stock that they held at that time. These loans were made at what EarthLink believes to be market interest rates, and may be prepaid at any time, without penalty, prior to their due dates. As of March 16, 2004, a loan of $266,620 to Mr. Young was outstanding with an interest rate of 61/2% and the largest amount of indebtedness outstanding under this loan during the year ended December 31, 2003 was $1,048,341.

Mr. Dayton is Founder, Chairman of the Board of Directors and Chief Executive Officer of Boingo Wireless, Inc. ("Boingo"). During the year ended December 31, 2003, EarthLink paid Boingo approximately $60,000 pursuant to a revenue sharing arrangement. The revenue sharing arrangement provides that EarthLink will pay Boingo a portion of certain wireless service revenue that EarthLink collects.

17

Executive Officer Compensation

Table I—Summary Compensation Table

The following table presents certain information required by the SEC relating to various forms of compensation awarded to, earned by or paid to EarthLink's (i) Chief Executive Officer and (ii) the four most highly compensated executive officers other than the Chief Executive Officer who earned more than $100,000 during the year ended December 31, 2003. Such executive officers collectively are referred to as the "Named Executive Officers."

| |

| | Annual

Compensation

| | Long-Term

Compensation

| |

| |

|---|

Name and Principal Position

| |

| | All Other

Compensation

| |

|---|

| | Year

| | Salary

| | Bonus

| | Options

| |

|---|

Charles G. Betty

President,

Chief Executive Officer | | 2003

2002

2001 | | $

| 621,154

600,000

496,667 | | $

| 346,790

196,590

186,498 | | —

200,000

300,000 | | $

| 5,725

6,421

2,625 | (1)

(2)

(3) |

Lee Adrean

Executive Vice President and

Chief Financial Officer |

|

2003

2002

2001 |

|

|

365,962

350,000

301,667 |

|

|

170,264

114,677

90,621 |

(4)

|

100,000

140,000

— |

|

|

4,659

3,630

2,625 |

(3)

(3)

(3) |

Michael C. Lunsford

Executive Vice President,

Marketing and Products |

|

2003

2002

2001 |

|

|

276,538

250,833

227,500 |

|

|

128,660

82,186

68,341 |

|

80,000

90,000

— |

|

|

4,659

3,630

2,625 |

(3)

(3)

(3) |

Donald B. Berryman

Executive Vice President,

Customer Support |

|

2003

2002 |

|

|

273,237

44,952 |

|

|

127,124

110,000 |

(5) |

—

190,000 |

|

|

4,346

— |

(3)

|

Linda W. Beck

Executive Vice President,

Operations |

|

2003

2002

2001 |

|

|

257,500

248,750

234,167 |

|

|

119,802

81,503

70,344 |

|

80,000

110,000

— |

|

|

4,509

3,159

2,260 |

(3)

(3)

(3) |

Brinton O. C. Young

Executive Vice President,

Strategic Planning |

|

2003

2002

2001 |

|

|

257,500

249,583

243,750 |

|

|

119,802

81,776

73,222 |

|

60,000

90,000

— |

|

|

—

—

— |

|

- (1)

- Consists of reimbursement in 2003 of $2,019 in travel expenses and $3,706 in matching contributions made to Mr. Betty's account under our 401(k) Plan.

- (2)

- Consists of reimbursement in 2002 of $2,791 in travel expenses and $3,630 in matching contributions made to Mr. Betty's account under our 401(k) Plan.

- (3)

- Consists of matching contributions made under our 401(k) Plan.

- (4)

- Mr. Adrean deferred receipt of 50% of this bonus in accordance with EarthLink's Deferred Compensation Plan for Directors and Certain Key Employees described elsewhere in this Proxy Statement.

- (5)

- Represents a signing bonus and reimbursement for benefits lost when Mr. Berryman left his previous employer to join EarthLink in November 2002.

18

Table II—Option Grants in 2003

This table presents information regarding options granted to EarthLink's Named Executive Officers during the year ended December 31, 2003 to purchase shares of EarthLink's Common Stock. In accordance with SEC rules, the table shows the hypothetical "gains" or "option spreads" that would exist for the respective options based on assumed rates of annual compound stock price appreciation of 5% and 10% from the date the options were granted over the full option term.

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value

at Assumed Annual

Rates of Stock Price

Appreciation for the

Option Term(3)

|

|---|

| |

| | Percentage

of Total

Options

Granted to

Employees in

Fiscal

Year

| |

| |

|

|---|

| | Number of

Securities

Underlying

Grants(1)

| |

| |

|

|---|

| | Exercise

Price Per

Share(2)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Charles G. Betty | | — | | — | | | — | | — | | | — | | | — |

| Lee Adrean | | 100,000 | (4) | 4.3 | % | $ | 5.98 | | 1/23/2013 | | $ | 376,079 | | $ | 953,058 |

| Michael C. Lunsford | | 80,000 | (4) | 3.4 | % | | 5.98 | | 1/23/2013 | | | 300,863 | | | 762,446 |

| Donald B. Berryman | | — | | — | | | — | | — | | | — | | | — |

| Linda W. Beck | | 80,000 | (4) | 3.4 | % | | 5.98 | | 1/23/2013 | | | 300,863 | | | 762,446 |

| Brinton O. C. Young | | 60,000 | (4) | 2.5 | % | | 5.98 | | 1/23/2013 | | | 225,647 | | | 571,855 |

- (1)

- The total number of options granted to employees during the year ended December 31, 2003 was 2,327,693.

- (2)

- The exercise price per share of options granted represented the fair market value of the underlying shares of Common Stock on the date the options were granted.

- (3)

- As required under the SEC's rules, amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. These assumptions are not intended to forecast future appreciation of our stock price. The potential realizable value computation does not take into account federal or state income tax consequences of option exercises or sales of appreciated stock. If our stock price does not actually increase to a level above the applicable exercise price at the time of exercise, the realized value to the Named Executive Officers from these options will be zero.

- (4)

- These options become exercisable as follows: (i) 25% of the options become exercisable one year after the date of the grant, and (ii) an additional 6.25% of the options become exercisable each quarterly anniversary date of the date of the grant thereafter until fully vested.

19

Table III—Option Exercises In 2003 and 2003 Year-End Option Values

The following table shows the number of shares of Common Stock subject to exercisable and unexercisable stock options held by each of the Named Executive Officers as of December 31, 2003. The table also reflects the values of such options based on the positive spread between the exercise price of such options and the closing sales price of EarthLink Common Stock as reported on Nasdaq on December 31, 2003.

| |

| |

| | Number of Securities Underlying

Unexercised Options

| | Value of Unexercised

In-the-Money Options(1)

|

|---|

Name

| | Shares

Acquired

on Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Charles G. Betty | | — | | $ | — | | 869,947 | | 406,250 | | $ | 2,092,801 | | $ | 980,000 |

| Lee Adrean | | — | | | — | | 430,000 | | 250,000 | | | 15,750 | | | 618,250 |

| Michael C. Lunsford | | — | | | — | | 291,537 | | 180,438 | | | 7,875 | | | 527,725 |

| Donald B. Berryman | | — | | | — | | 37,500 | | 152,500 | | | 145,125 | | | 590,175 |

| Linda W. Beck | | — | | | — | | 242,999 | | 191,001 | | | 11,025 | | | 521,334 |

| Brinton O. C. Young | | — | | | — | | 338,076 | | 160,063 | | | 321,669 | | | 447,325 |

- (1)

- The value of "in-the-money" options represents the difference between the exercise price of stock options and $10.00, the per share closing sales price on December 31, 2003 for EarthLink's Common Stock as reported by Nasdaq.

Table IV—Long-Term Incentive Plan—Awards For Last Fiscal Year

The following table presents information concerning a restricted stock unit grant made to EarthLink's Chief Executive Officer.

| |

| |

| | Estimated Future Payouts Under

Non-Stock Price-Based Plan

|

|---|

| | Number of

Shares, Units

or Other

Rights(#)

| | Performance or

Other Period

Until Maturation

or Payout

|

|---|

Name

| | Threshold

($ or #)

| | Target

($ or #)

| | Maximum

($ or #)

|

|---|

| Charles G. Betty | | 150,000 | (1) | January 2, 2010(1) | | (1) | | (1) | | 150,000 |

- (1)

- On January 2, 2004, Mr. Betty received a grant of 150,000 restricted stock units for the issuance of up to 150,000 shares of EarthLink Common Stock. The restricted stock units vest in increments on the earlier of the achievement of specified future performance objectives or the sixth anniversary of the date of the grant. They also vest upon a change in control. The restricted stock units are subject to forfeiture until vested. During the performance period for the restricted stock units, Mr. Betty will be entitled to receive that number of shares of EarthLink's Common Stock ranging from 0% to 100% of the number of shares of EarthLink's Common Stock underlying such restricted stock units based upon EarthLink's net income and upon the financial performance and subscriber growth in EarthLink's broadband and value dial-up product lines during the performance period. No restricted stock units would have accelerated in vesting based on EarthLink's performance in 2003 if the restricted stock units' performance objectives had been in effect at that time.

20

Table V—Amended Equity Compensation Plan Information

The following table sets forth information as of December 31, 2003 concerning the shares of EarthLink's Common Stock which are authorized for issuance under our equity compensation plans.

Plan Category

| | Number of Securities to

Be Issued on Exercise of

Outstanding Options,

Warrants and Rights

| | Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (a))

|

|---|

| | (a)

| | (b)

| | (c)

|

|---|

| Equity Compensation Plans Approved by Stockholders | | 22,244,003 | | $ | 12.02 | | 10,854,854 |

| Equity Compensation Plans Not Approved by Stockholders | | 497,990 | | | 8.16 | | 0 |

| | |

| | | | |

|

| Total | | 22,741,993 | | | 11.93 | | 10,854,854 |

| | |

| | | | |

|

- (1)

- EarthLink does not currently have equity compensation plans that have not been approved by stockholders. However, included in the securities outstanding for equity compensation plans not approved by stockholders are 333,602 options and warrants granted prior to the merger of EarthLink Network and MindSpring during the years ended December 31, 1995, 1996 and 1997 to certain officers, consultants, and investors. The options and warrants have terms of 10 years and have exercise prices ranging from $1.50 to $5.50 per share. All 333,602 options and warrants were exercisable as of December 31, 2003.

- (2)

- In connection with EarthLink's acquisition of OneMain.com, Inc. in September 2000, EarthLink granted warrants to purchase a total of 164,388 shares of Common Stock to two investors at a per share purchase price of $18.25. The warrants expire in September 2005. All 164,388 warrants were exercisable as of December 31, 2003.

- (3)

- Column (c) includes 277,089 shares available for issuance pursuant to the EarthLink, Inc. Employee Stock Purchase Plan which entitles employees to allocate a portion of their compensation to purchase EarthLink's Common Stock at a per share purchase price of 85% of the lesser of (i) the closing price on the first trading day of the just completed quarter or (ii) the closing price on the last trading day of the just completed quarter.

21

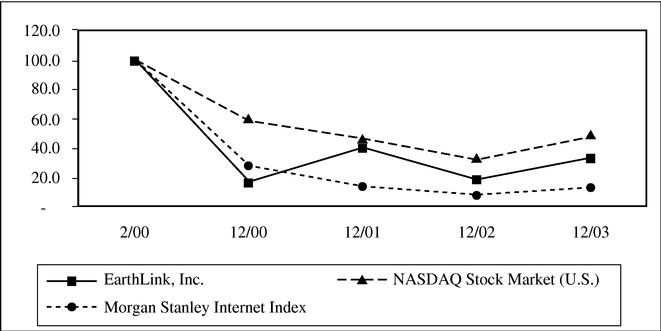

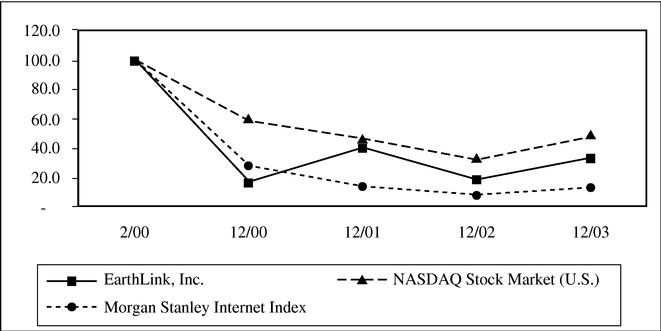

STOCK PERFORMANCE GRAPH