SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) | |

| þ | OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | For the Fiscal Year Ended: December 31, 2007 | |

| | OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) | |

| o | OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | For the transition period from . . . . to . . . . | |

Commission File Number: 1-7627

FRONTIER OIL CORPORATION

(Exact name of registrant as specified in its charter)

| Wyoming | | 74-1895085 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

| 10000 Memorial Drive, Suite 600 | | 77024-3411 |

| Houston, Texas | | (Zip Code) |

| (Address of principal executive offices) | | |

Registrant’s telephone number, including area code: (713) 688-9600

Securities registered pursuant to Section 12(b) of the Act:

| | Name of Each Exchange |

| Title of Each Class | | on Which Registered |

| Common Stock | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to rule 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ü

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one)

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of June 29, 2007 was $4.5 billion.

The number of shares of common stock outstanding as of February 22, 2008 was 103,521,366.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Annual Proxy Statement for the registrant’s 2008 annual meeting of shareholders are incorporated by reference into Items 10 through 14 of Part III.

Forward-Looking Statements

This Form 10-K contains “forward-looking statements” as defined by the Securities and Exchange Commission (“SEC”). Such statements are those concerning contemplated transactions and strategic plans, expectations and objectives for future operations. These include, without limitation:

| · | statements, other than statements of historical fact, that address activities, events or developments that we expect, believe or anticipate will or may occur in the future; |

| · | statements relating to future financial performance, future capital sources and other matters; and |

| · | any other statements preceded by, followed by or that include the words “anticipates,” “believes,” “expects,” “plans,” “intends,” “estimates,” “projects,” “could,” “should,” “may,” or similar expressions. |

Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this Form 10-K are reasonable, we can give no assurance that such plans, intentions or expectations will be achieved. These statements are based on assumptions made by us based on our experience and perception of historical trends, current conditions, expected future developments and other factors that we believe are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond our control. You are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements.

All forward-looking statements contained in this Form 10-K only speak as of the date of this document. We undertake no obligation to update or revise publicly any revisions to any such forward-looking statements that may be made to reflect events or circumstances after the date of this Form 10-K, or to reflect the occurrence of unanticipated events.

The terms “Frontier,” “we,” “us” and “our” as used in this Form 10-K refer to Frontier Oil Corporation and its subsidiaries, except where it is clear that those terms mean only the parent company. When we use the term “Rocky Mountain region,” we refer to the states of Colorado, Wyoming, Montana and Utah, and when we use the term “Plains States,” we refer to the states of Kansas, Oklahoma, eastern Nebraska, Iowa, Missouri, North Dakota and South Dakota.

Overview

We are an independent energy company, organized in the State of Wyoming in 1977, engaged in crude oil refining and the wholesale marketing of refined petroleum products. We operate refineries (the “Refineries”) in Cheyenne, Wyoming and El Dorado, Kansas with a total annual average crude oil capacity of approximately 162,000 barrels per day (“bpd”). Both of our Refineries are complex refineries, which means that they can process heavier, less expensive types of crude oil and still produce a high percentage of gasoline, diesel fuel and other high value refined products. We focus our marketing efforts in the Rocky Mountain region and the Plains States, which we believe are among the most attractive refined products markets in the United States. The operations of refining and marketing of petroleum products are considered part of one reporting segment.

Cheyenne Refinery. Our Cheyenne Refinery has a permitted crude oil capacity of 52,000 bpd on a twelve-month average. We market its refined products primarily in the eastern slope of the Rocky Mountain region, which encompasses eastern Colorado (including the Denver metropolitan area), eastern Wyoming and western Nebraska (the “Eastern Slope”). The Cheyenne Refinery has a coking unit, which allows the refinery to process extensive amounts of heavy crude oil for use as a feedstock. The ability to process heavy crude oil lowers our raw material costs because heavy crude oil is generally less expensive than lighter types of crude oil. For the year ended December 31, 2007, heavy crude oil constituted approximately 72% of the Cheyenne Refinery’s total crude oil charge. For the year ended December 31, 2007, the Cheyenne Refinery’s product yield included gasoline (42%), diesel fuel (30%) and asphalt and other refined petroleum products (28%).

El Dorado Refinery. The El Dorado Refinery is one of the largest refineries in the Plains States and the Rocky Mountain region with an average crude oil capacity of 110,000 bpd. The El Dorado Refinery can select from many different types of crude oil because of its direct access to Cushing, Oklahoma, which is connected by pipelines to the Gulf Coast and to Canada. This access, combined with the El Dorado Refinery’s complexity (including a coking unit), gives it the flexibility to refine a wide variety of crude oils. In connection with our acquisition of the El Dorado Refinery in 1999, we entered into a 15-year refined product offtake agreement for gasoline and diesel production at this refinery with Shell Oil Products US (“Shell”). Shell has also agreed to purchase all jet fuel production until the end of the product offtake agreement. As our deliveries to Shell have declined, per the terms of the refined product offtake agreement, we have marketed an increasing portion of the El Dorado Refinery’s gasoline and diesel in the same markets where Shell currently sells the El Dorado Refinery’s products, primarily in Denver and throughout the Plains States. For the year ended December 31, 2007, the El Dorado Refinery’s product yield included gasoline (50%), diesel and jet fuel (36%) and chemicals and other refined petroleum products (14%).

Other Assets. In February 2007, the Company acquired Ethanol Management Company (“EMC”) for approximately $3.1 million cash. EMC’s primary assets are a 25,000 bpd products terminal and blending facility located near Denver, Colorado. The Company owned, until their sale in September 2007, a 34.72% interest in a crude oil pipeline in Wyoming and a 50% interest in two crude oil tanks in Guernsey, Wyoming, both of which were accounted for as undivided interests. Each of these assets and the associated liabilities, revenues and expenses were reported on a proportionate gross basis until their sale in September 2007.

Varieties of Crude Oil and Products. Traditionally, crude oil has been classified within the following types:

· sweet (low sulfur content),

· sour (high sulfur content),

· light (high gravity),

· heavy (low gravity) and

· intermediate (if gravity or sulfur content is in between).

For the most part, heavy crude oil tends to be sour and light crude oil tends to be sweet. When refined, light crude oil produces a higher proportion of high value refined products such as gasoline, diesel and jet fuel and, as a result, is more expensive than heavy crude oil. In contrast, heavy crude oil produces more low value by-products and heavy residual oils. The discount at which heavy crude oil sells compared to light crude oil is known in the industry as the light/heavy spread or differential, while the discount at which sour crude oil sells compared to light crude oil is known as the sweet/sour, or WTI/WTS, spread or differential. Coking units, such as the ones at our Refineries, can process certain by-products and heavy residual oils to produce additional volumes of gasoline and diesel, thus increasing the aggregate yields of higher value refined products from the same initial barrel of crude oil.

Refineries are frequently classified according to their complexity, which refers to the number, type and capacity of processing units at the refinery. Each of our Refineries possesses a coking unit, which provides substantial upgrading capacity and generally increases a refinery’s complexity rating. Upgrading capacity refers to the ability of a refinery to produce high yields of high value refined products such as gasoline and diesel from heavy and intermediate crude oil. In contrast, refiners with low upgrading capacity must process primarily light, sweet crude oil to produce a similar yield of gasoline and diesel. Some low complexity refineries may be capable of processing heavy and intermediate crude oil, but they will produce large volumes of by-products, including heavy residual oils and asphalt. Because gasoline, diesel and jet fuel sales generally achieve higher margins than are available on other refined products, we expect that these products will continue to make up the majority of our production.

Refinery Maintenance. Each of the processing units at our Refineries requires scheduled significant maintenance and repair shutdowns (referred to as “turnarounds”) during which the unit is not in operation. Turnaround cycles vary for different units but are generally required every one to five years. In general, turnarounds at our Refineries are managed so that some units continue to operate while others are down for scheduled maintenance. We also coordinate operations by staggering turnarounds between our two Refineries. Turnarounds are implemented using our regular personnel as well as additional contract labor. Once started, turnaround work typically proceeds 24 hours per day to minimize unit downtime. We defer the costs of turnarounds, reflected as “Deferred turnaround costs” on the Consolidated Balance Sheets, and subsequently amortize them on a straight-line basis over the period of time estimated to lapse until the next turnaround occurs. We normally schedule our turnaround work during the spring or fall of each year. When we perform a turnaround, we may increase product inventories prior to the turnaround to minimize the impact of the turnaround on our sales of refined products.

During 2007, the only major turnaround work at the El Dorado Refinery involved the alkylation unit. For 2008, major turnaround work planned at the El Dorado Refinery is on the crude unit, the coker, and the reformer. The timing of the El Dorado turnaround is expected to coincide with the completion of the crude unit and vacuum expansion project in the spring of 2008.

Fiscal 2007 was a major turnaround year for the Cheyenne Refinery with work completed on the fluid catalytic cracking unit (“FCCU”), the crude unit, the coker, and other operating units. At the Cheyenne refinery, 2008 turnaround work is expected to be modest in scope and will involve a naphtha hydrotreater and its associated reformer, diesel hydrotreater, and sulfur recovery unit.

Cheyenne Refinery. The primary market for the Cheyenne Refinery’s refined products is the Eastern Slope. For the year ended December 31, 2007, we sold approximately 88% of the Cheyenne Refinery’s gasoline volumes in Colorado and 11% in Wyoming. For the year ended December 31, 2007, we sold approximately 67% of the Cheyenne Refinery’s diesel in Wyoming and 30% in Colorado. Because of the location of the Cheyenne Refinery, we are able to sell a significant portion of its diesel product from the truck rack at the Refinery, thereby eliminating transportation costs. The gasoline and remaining diesel produced by this Refinery are primarily shipped via pipeline to terminals for distribution by truck or rail. Pipeline shipments from the Cheyenne Refinery are handled mainly by the Plains All American Pipeline (formerly Rocky Mountain Pipeline), serving Denver and Colorado Springs, Colorado, and the ConocoPhillips Pipeline, serving Sidney, Nebraska.

We sell refined products from our Cheyenne Refinery to a broad base of independent retailers, jobbers and major oil companies. Refined product prices are determined by local market conditions at distribution centers known as “terminal racks,” and prices at the terminal racks are posted daily by sellers. The customer at a terminal rack typically supplies its own truck transportation. In the year ended December 31, 2007, approximately 91% of the Cheyenne Refinery’s sales were made to its 25 largest customers compared to the year ended December 31, 2006, when approximately 88% of the Cheyenne Refinery’s sales were made to its 25 largest customers. Occasionally, volumes sold exceed the Refinery’s production, in which case we purchase product in the spot market as needed.

El Dorado Refinery. The primary markets for the El Dorado Refinery’s refined products are Colorado and the Plains States, which include the Kansas City metropolitan area. The gasoline, diesel and jet fuel produced by the El Dorado Refinery are primarily shipped via pipeline to terminals for distribution by truck or rail. The Valero Pipeline, serving the northern Plains States, the Magellan Pipeline Company, L.P. (“Magellan”) mountain pipeline serving Denver, Colorado, and the Magellan mid-continent pipeline serving the Plains States handle shipments from our El Dorado Refinery.

For the year ended December 31, 2007, Shell was the El Dorado Refinery’s largest customer, representing approximately 61% of the El Dorado Refinery’s total sales and 42% of our total consolidated sales. Under the offtake agreement, Shell purchases gasoline, diesel and jet fuel produced by the El Dorado Refinery at market-based prices. Initially in 1999, Shell purchased all of the El Dorado Refinery’s production of these products. Beginning in 2000, we retained and marketed 5,000 bpd of the Refinery’s gasoline and diesel production. The retained portion increases by 5,000 bpd each year through 2009. In 2007, we retained 40,000 bpd of the Refinery’s gasoline and diesel production. As our sales to Shell under this agreement decrease, we intend to sell the gasoline and diesel produced by the El Dorado Refinery in the same general markets currently served by Shell, as previously described.

Cheyenne Refinery. The most competitive market for the Cheyenne Refinery’s products is the Denver metropolitan area. Other than the Cheyenne Refinery, three principal refineries serve the Denver market: an approximate 70,000 bpd refinery near Rawlins, Wyoming and an approximate 25,000 bpd refinery in Casper, Wyoming, both owned by Sinclair Oil Company (“Sinclair”); and a 90,000 bpd refinery located in Denver and owned by Suncor Energy (U.S.A.) Inc. (“Suncor”). Five product pipelines also supply Denver, including three from outside the region that enable refined products from other regions to be sold in the Denver market. Refined products shipped from other regions typically bear the burden of higher transportation costs.

The Suncor refinery located in Denver has lower product transportation costs to serve the Denver market than we do. However, the Cheyenne Refinery has lower crude oil transportation costs because of its proximity to the Guernsey, Wyoming hub, the major crude oil pipeline hub in the Rocky Mountain region. Moreover, unlike Sinclair and Suncor, we only sell our products to the wholesale market. We believe that our commitment to the wholesale market gives us certain marketing advantages over our principal competitors in the Eastern Slope area, all of which also have retail outlets, because we do not compete directly with independent retailers of gasoline and diesel.

El Dorado Refinery. The El Dorado Refinery faces competition from other Plains States and mid-continent refiners, but the principal competitors for the El Dorado Refinery are Gulf Coast refiners. Although our Gulf Coast competitors typically have lower production costs because of their size (economies of scale) than the El Dorado Refinery, we believe that our competitors’ higher refined product transportation costs allow our El Dorado Refinery to compete effectively in the Plains States and Rocky Mountain region with the Gulf Coast refineries. The Plains States and mid-continent regions are supplied by three product pipelines (Magellan Midstream Partners, L.P., Explorer Pipeline and Nustar Energy L.P.) that originate from the Gulf Coast.

Cheyenne Refinery. In the year ended December 31, 2007, we obtained approximately 61% of the Cheyenne Refinery’s crude oil charge from Canada, 19% from Wyoming, 18% from Colorado and 2% from other domestic sources. During the same period, heavy crude oil constituted approximately 72% of the Cheyenne Refinery’s total crude oil charge, compared to 73% in 2006. Cheyenne is 88 miles south of Guernsey, Wyoming, the main hub and crude oil trading center for the Rocky Mountain region. We have crude oil pipeline capacity from Guernsey to the Cheyenne Refinery via the Plains All American Pipeline, which first transported crude oil in October 2007, and a common carrier pipeline. Ample quantities of heavy crude oil are available at Guernsey, including both locally produced Wyoming general sour and imported Canadian heavy crude oil, which is supplied by the Express pipeline system and the Poplar and Butte pipelines. This type of crude oil typically sells at a discount from lighter crude oil prices. The Cheyenne Refinery’s ability to process a higher percentage of heavy crude oil, gives us an advantage over the three other Eastern Slope refineries, none of which has the necessary upgrading capacity to process such high volumes of heavy crude oil.

We purchase crude oil for the Cheyenne Refinery from several suppliers, including major oil companies, marketing companies and large and small independent producers, under arrangements which contain market-responsive pricing provisions. Many of these arrangements are subject to cancellation by either party or have terms that are not in excess of one year and are subject to periodic renegotiation. We had an agreement with Baytex Marketing Ltd., a Canadian crude oil producer, to supply heavy Canadian crude oil that expired on December 31, 2007. We will continue to purchase crude oil from various suppliers under short-term commitments. In the event we become unable to purchase crude oil from any one of these sources, we believe that adequate alternative supplies of crude oil would be available.

El Dorado Refinery. In the year ended December 31, 2007, we obtained approximately 67% of the El Dorado Refinery’s crude oil charge from Texas, 20% from Canada, 6% from Kansas, 4% from the Gulf of Mexico, and the remaining 3% from other foreign and domestic locations. El Dorado is 125 miles north of Cushing, Oklahoma, a major crude oil hub. The Cushing hub is supplied by the Seaway Pipeline, which runs from the Gulf Coast; the Basin Pipeline, which runs through Wichita Falls, Texas from West Texas; the Sun Pipeline, which originates at the Gulf Coast and connects to the Basin Pipeline at Wichita Falls and the Spearhead Pipeline which connects at Griffith, Indiana with the Enbridge Pipeline to bring crude from Canada. The Osage Pipeline runs from Cushing to El Dorado and transported approximately 94% of our crude oil charge during the year ended December 31, 2007. The remainder of our crude oil charge was transported to the El Dorado Refinery through Kansas gathering system pipelines. We have a Transportation Services Agreement to transport up to 38,000 bpd of crude oil on the Spearhead Pipeline from Griffith, Indiana to Cushing, Oklahoma, enabling us to transport heavy Canadian crude oil to our El Dorado Refinery. The initial term of this agreement is for a period of ten years from the actual commencement date of March 2006. We have the right to extend the agreement for an additional ten years and increase the volume transported under a preferential tariff to 50,000 bpd.

Environmental Matters.

See “Environmental” in Note 9 in the “Notes to Consolidated Financial Statements.”

Centennial Pipeline Regulation. We owned a 34.72% undivided interest in the Centennial Pipeline, which runs approximately 88 miles from Guernsey to Cheyenne, Wyoming. Suncor Pipe Line Company is the sole operator of the Centennial Pipeline and held the remaining ownership interest and purchased our interest in September 2007. During our ownership, the Cheyenne Refinery received up to 25,000 bpd of crude oil feedstock through the Centennial Pipeline. Under the terms of the operating agreement for the Centennial Pipeline, the costs and expenses incurred to operate and maintain the Centennial Pipeline were allocated to us on a combined basis, based on our throughput and ownership interest. The Centennial Pipeline is subject to numerous federal, state and local laws and regulations relating to the protection of health, safety and the environment. We believe that the Centennial Pipeline was operated in accordance with all applicable laws and regulations. We are not aware of any material pending legal proceedings which relate to the Centennial Pipeline during our ownership.

We are subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) and comparable state occupational safety statutes.

The Cheyenne Refinery’s OSHA recordable incident rate in 2007 of 2.72 is higher than the latest reported U.S. industry average of 0.89 as compiled by the National Petrochemical and Refiner’s Association (“NPRA”) but comparable to the regional NPRA rate of 2.01. While the frequency of injuries at the Cheyenne Refinery has risen above NPRA averages, we continue to emphasize safety at all levels of the Cheyenne organization. In 2007, we reduced our contractor injury rate by 64% and achieved a 2007 contractor incidence rate of 2.19, a significant improvement over prior years. By improving the training and selection of the contractor workforce, we were able to improve the safety of the outside labor we hire. We intend to focus on safety by improving procedures and training for all refinery workers in the coming year. These efforts include programs in both areas of occupational and process safety initiatives and are comprehensive across all areas of the Refinery.

The El Dorado Refinery’s OSHA recordable incident rate of 0.95 in 2007 is a marked improvement against the rate of 1.47 for 2006, and compares favorably to the U.S. refining industry average of 0.89. Management and employees at the El Dorado Refinery remain committed to programs, processes and behaviors that drive safety excellence. Improvement in contractor safety continued to be a key initiative for the El Dorado Refinery during 2007. Behavior-based safety programs were introduced in 2004 for our own employees. During 2006, we included the majority of our contractor base in these programs as well. These efforts resulted in a significant increase in contractor safety awareness and much improved contractor safety results. During 2008, the El Dorado Refinery also plans to undertake extended work and embark upon new efforts to make the plant stronger both in occupational- and process safety-related areas.

Our employees and management continue to dedicate their efforts to a balanced safety program that combines individual behavioral elements in a safety-coaching environment with structured, management-driven programs to improve the safety of our facilities and operating procedures. Our objective is to provide a safe working environment for employees and contractors who know how to work safely. Encouraging all employees and contractors to contribute toward improving safety performance through personal involvement in safety-related activities is an industry-proven method of reducing injuries.

At December 31, 2007, we employed approximately 800 full-time employees: 90 in the Houston and Denver offices, 315 at the Cheyenne Refinery, and 395 at the El Dorado Refinery. The Cheyenne Refinery employees included approximately 110 administrative and technical personnel and approximately 205 union members. The El Dorado Refinery employees included 145 administrative and technical personnel and approximately 250 union members. The union members at our El Dorado Refinery are represented by the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union (“USW”). The union members at our Cheyenne Refinery are represented by seven bargaining units, the largest being the USW and the others with various craft unions.

For our Cheyenne Refinery, the current contract between the Company, the USW, and its Local 8-0574 expires in July 2009. The current contract between the Company, the craft unions, and its various local chapters expires in June 2009.

At our El Dorado Refinery, the current contract between the Company, the USW, and its Local 5-241 expires in January 2009.

| Risk Factors Relating to Our Business |

Crude oil prices and refining margins significantly impact our cash flow and have fluctuated substantially in the past.

Our cash flow from operations is primarily dependent upon producing and selling refined products at margins that are high enough to cover our fixed and variable expenses. In recent years, crude oil costs and crack spreads (the difference between refined product sales prices and crude oil prices) have fluctuated substantially. Factors that may affect crude oil costs and refined product prices include:

· overall demand for crude oil and refined products;

· general economic conditions;

· the level of foreign and domestic production of crude oil and refined products;

· the availability of imports of crude oil and refined products;

· the marketing of alternative and competing fuels;

· the extent of government regulation;

· global market dynamics;

· product pipeline capacity;

· local market conditions; and

· the level of operations of competing refineries.

Crude oil supply contracts are generally short-term contracts with price terms that change as market prices change. Our crude oil requirements are supplied from sources that include:

· major oil companies;

· crude oil marketing companies;

· large independent producers; and

· smaller local producers.

The price at which we can sell gasoline and other refined products is strongly influenced by the price of crude oil. Generally, an increase or decrease in the price of crude oil results in a corresponding increase or decrease in the price of gasoline and other refined products. However, if crude oil prices increase significantly, our operating margins would fall unless we could pass along these price increases to our customers.

Our Refineries maintain inventories of crude oil, intermediate products and refined products, the value of each being subject to fluctuations in market prices. Our inventories of crude oil, unfinished products and finished products are recorded at the lower of cost on a first-in, first-out (“FIFO”) basis or market prices. As a result, a rapid and significant increase or decrease in the market prices for crude oil or refined products could have a significant short-term impact on our earnings and cash flow.

Our profitability is affected by crude oil differentials, which may decline and accordingly decrease our profitability.

The light/heavy crude oil differentials that we report is the average differential between the benchmark West Texas Intermediate (“WTI”) crude oil priced at Cushing, Oklahoma (ConocoPhillips WTI crude oil posting plus) and the heavy crude oil priced as delivered to our Cheyenne Refinery or El Dorado Refinery, respectively. The WTI/WTS (sweet/sour) crude oil differential is the average differential between benchmark WTI crude oil priced at Cushing, Oklahoma and West Texas sour crude oil priced at Midland, Texas. Our profitability at our Cheyenne Refinery is affected by the light/heavy crude oil differential, and our profitability at our El Dorado Refinery is affected by the WTI/WTS crude oil differential. Starting in March 2006, when our El Dorado Refinery began receiving heavy Canadian crude oil through the Spearhead Pipeline, its profitability also began benefiting from the light/heavy crude oil differential. We typically prefer to refine heavy sour crude oil at the Cheyenne Refinery and intermediate sour crude oil at the El Dorado Refinery because these crudes provide a higher refining margin than light or sweet crude oil does. Accordingly, any tightening of these crude oil differentials will reduce our profitability. The Cheyenne Refinery light/heavy crude oil differential averaged $18.55 per barrel in the year ended December 31, 2007, compared to $16.21 per barrel in the same period in 2006. The El Dorado Refinery light/heavy crude oil differential averaged $20.60 per barrel in the year ended December 31, 2007 compared to $18.13 per barrel in the ten months ended December 31, 2006. The WTI/WTS crude oil differential averaged $5.02 per barrel in the year ended December 31, 2007, compared to $5.22 per barrel in the same period in 2006. Crude oil prices were historically high during 2007, contributing to attractive light/heavy crude oil differentials and WTI/WTS crude oil differentials. However the crude oil differentials may decline in the future, which would have a negative impact on our earnings.

External factors beyond our control can cause fluctuations in demand for our products, our prices and margins, which may negatively affect income and cash flow.

Among these factors is the demand for crude oil and refined products, which is largely driven by the conditions of local and worldwide economies as well as by weather patterns and the taxation of these products relative to other energy sources. Governmental regulations and policies, particularly in the areas of taxation, energy and the environment, also have a significant impact on our activities. Operating results can be affected by these industry factors, by competition in the particular geographic areas that we serve and by factors that are specific to us, such as the success of particular marketing programs and the efficiency of our Refinery operations. The demand for crude oil and refined products can also be reduced due to a local or national recession or other adverse economic condition that results in lower spending by businesses and consumers on gasoline and diesel fuel, higher gasoline prices due to higher crude oil prices, a shift by consumers to more fuel-efficient vehicles or alternative fuel vehicles (such as ethanol or wider adoption of gas/electric hybrid vehicles), or an increase in vehicle fuel economy, whether as a result of technological advances by manufacturers, legislation mandating or encouraging higher fuel economy or the use of alternative fuel.

In addition, our profitability depends largely on the spread between market prices for refined petroleum products and crude oil prices. This margin is continually changing and may fluctuate significantly from time to time. Crude oil and refined products are commodities whose price levels are determined by market forces beyond our control. Due to the seasonality of refined products markets and refinery maintenance schedules, results of operations for any particular quarter of a fiscal year are not necessarily indicative of results for the full year. In general, prices for refined products are influenced by the price of crude oil. Although an increase or decrease in the price of crude oil may result in a similar increase or decrease in prices for refined products, there may be a time lag in the realization of the similar increase or decrease in prices for refined products. The effect of changes in crude oil prices on operating results therefore depends in part on how quickly refined product prices adjust to reflect these changes. A substantial or prolonged increase in crude oil prices without a corresponding increase in refined product prices, a substantial or prolonged decrease in refined product prices without a corresponding decrease in crude oil prices, or a substantial or prolonged decrease in demand for refined products could have a significant negative effect on our results of operations and cash flows.

We are dependent on others to supply us with substantial quantities of raw materials.

Our business involves converting crude oil and other refinery charges into liquid fuels. We own no crude oil or natural gas reserves and depend on others to supply these feedstocks to our Refineries. We use large quantities of natural gas and electricity to provide heat and mechanical energy required by our processing units. Disruption to our supply of crude oil, natural gas or electricity, or the continued volatility in the costs thereof, could have a material adverse effect on our operations. In addition, our investment in inventory is affected by the general level of crude oil prices, and significant increases in crude oil prices could result in substantial working capital requirements to maintain inventory volumes.

Our Refineries face operating hazards, and the potential limits on insurance coverage could expose us to significant liability costs.

Our operations could be subject to significant interruption, and our profitability could be impacted if either of our Refineries experienced a major accident or fire, was damaged by severe weather or other natural disaster, or was otherwise forced to curtail its operations or shut down. If a pipeline became inoperative, crude oil would have to be supplied to our Refineries through an alternative pipeline or from additional tank trucks to the Refineries, which could hurt our business and profitability. In addition, a major accident, fire or other event could damage our Refineries or the environment or cause personal injuries. If either of our Refineries experiences a major accident or fire or other event or an interruption in supply or operations, our business could be materially adversely affected if the damage or liability exceeds the amounts of business interruption, property, terrorism and other insurance that we maintain against these risks.

Our Refineries consist of many processing units, a number of which have been in operation for many years. One or more of the units may require additional unscheduled down time for unanticipated maintenance or repairs that are more frequent than our scheduled turnaround for such units. Scheduled and unscheduled maintenance could reduce our revenues during the period of time that our units are not operating.

We face substantial competition from other refining companies, and greater competition in the markets where we sell refined products could adversely affect our sales and profitability.

The refining industry is highly competitive. Many of our competitors are large, integrated, major or independent oil companies that, because of their more diverse operations, larger refineries and stronger capitalization, may be better positioned than we are to withstand volatile industry conditions, including shortages or excesses of crude oil or refined products or intense price competition at the wholesale level. Many of these competitors have financial and other resources substantially greater than ours.

We are not engaged in the petroleum exploration and production business and therefore do not produce any of our crude oil feedstocks. We do not have a retail business and therefore are dependent upon others for outlets for our refined products. Certain of our competitors, however, obtain a portion of their feedstocks from company-owned production and have retail outlets. Competitors that have their own production or extensive retail outlets, with brand-name recognition, are at times able to offset losses from refining operations with profits from producing or retailing operations, and may be better positioned to withstand periods of depressed refining margins or feedstock shortages. In addition, we compete with other industries, such as wind, solar and hydropower, that provide alternative means to satisfy the energy and fuel requirements of our industrial, commercial and individual consumers. If we are unable to compete effectively with these competitors, both within and outside our industry, there could be a material adverse effect on our business, financial condition and results of operations.

Our operations involve environmental risks that may require us to make substantial capital expenditures to remain in compliance or that could give rise to material liabilities.

Our results of operations may be affected by increased costs of complying with the extensive environmental laws to which our business is subject and from any possible contamination of our facilities as a result of accidental spills, discharges or other releases of petroleum or hazardous substances.

Our operations are subject to extensive federal, state and local environmental and health and safety laws and regulations relating to the protection of the environment, including those governing the emission or discharge of pollutants into the air and water, product specifications and the generation, treatment, storage, transportation, disposal or remediation of solid and hazardous waste and materials. Environmental laws and regulations that affect the operations, processes and margins for our refined products are extensive and have become progressively more stringent. Additional legislation or regulatory requirements or administrative policies could be imposed with respect to our products or activities. Compliance with more stringent laws or regulations or more vigorous enforcement policies of the regulatory agencies could adversely affect our financial position and results of operations and could require us to make substantial expenditures. Any noncompliance with these laws and regulations could subject us to material administrative, civil or criminal penalties or other liabilities.

We are a defendant in a series of lawsuits alleging, among other things, that emissions from an oil field or the production facilities thereon at the campus of the Beverly Hills High School, which were owned and operated by one of our subsidiaries between 1985 and 1995, caused the plaintiffs to develop cancers or various health problems. See “Litigation – Beverly Hills Lawsuits” in Note 9 in the “Notes to Consolidated Financial Statements” for more information on these lawsuits.

Our business is inherently subject to accidental spills, discharges or other releases of petroleum or hazardous substances. Past or future spills related to any of our operations, including our Refineries, pipelines or product terminals, could give rise to liability (including potential cleanup responsibility) to governmental entities or private parties under federal, state or local environmental laws, as well as under common law. This could involve contamination associated with facilities that we currently own or operate, facilities that we formerly owned or operated and facilities to which we sent wastes or by-product for treatment or disposal and other contamination. Accidental discharges could occur in the future, future action may be taken in connection with past discharges, governmental agencies may assess penalties against us in connection with past or future contamination and third parties may assert claims against us for damages allegedly arising out of any past or future contamination. The potential penalties and clean-up costs for past or future releases or spills, the failure of prior owners of our facilities to complete their clean-up obligations, the liability to third parties for damage to their property, or the need to address newly-discovered information or conditions that may require a response could be significant, and the payment of these amounts could have a material adverse effect on our business, financial condition and results of operations.

Our operations are subject to various laws and regulations relating to occupational health and safety, which could give rise to increased costs and material liabilities.

The nature of our business may result from time to time in industrial accidents. Our operations are subject to various laws and regulations relating to occupational health and safety. Continued efforts to comply with applicable health and safety laws and regulations, or a finding of non-compliance with current regulations, could result in additional capital expenditures or operating expenses, as well as fines and penalties.

We could incur substantial costs or disruptions in our business if we cannot obtain or maintain necessary permits and authorizations.

Our operations require numerous permits and authorizations under various laws and regulations, including environmental and health and safety laws and regulations. These authorizations and permits are subject to revocation, renewal or modification and can require operational changes, which may involve significant costs, to limit impacts or potential impacts on the environment and/or health and safety. A violation of these authorization or permit conditions or other legal or regulatory requirements could result in substantial fines, criminal sanctions, permit revocations, injunctions and/or refinery shutdowns. In addition, major modifications of our operations could require changes to our existing permits or expensive upgrades to our existing pollution control equipment, which could have a material adverse effect on our business, financial condition or results of operations.

Hurricanes along the Gulf Coast could disrupt our supply of crude oil and our ability to complete capital improvement projects in a timely manner.

In August and September of 2005, Hurricanes Katrina and Rita and related storm activity, such as windstorms, storm surges, floods and tornadoes, caused extensive and catastrophic physical damage in and to coastal and inland areas located in the Gulf Coast region of the United States (parts of Texas, Louisiana, Mississippi and Alabama) and certain other parts of the southeastern parts of the United States. Some of the materials we use for our capital projects are fabricated at facilities located along the Gulf Coast. Should other storms of this nature occur in the future, it is possible that the storms and their collateral effects could result in delays or cost increases for our planned capital projects.

In addition, supplies of crude oil to our El Dorado Refinery are sometimes shipped from Gulf Coast production or terminaling facilities. This crude oil supply source could be potentially threatened in the event of future catastrophic damage to such facilities.

We may have labor relations difficulties with some of our employees represented by unions.

Approximately 57 percent of our employees were covered by collective bargaining agreements at December 31, 2007. All of our union contracts expire in 2009, and there is no assurance that we will be able to enter into new contracts on terms acceptable to us or at all. A failure to do so may increase our costs or result in an interruption of our business. See Item 1 “Business-Employees.” In addition, employees may conduct a strike at some time in the future, which may adversely affect our operations.

Terrorist attacks and threats or actual war may negatively impact our business.

Terrorist attacks in the United States and the war in Iraq, as well as events occurring in response to or in connection with them, including future terrorist attacks against U.S. targets, rumors or threats of war, actual conflicts involving the United States or its allies, or military or trade disruptions affecting our suppliers or our customers, could adversely impact our operations. In addition, any terrorist attack could have an adverse impact on energy prices, including prices for our crude oil and refined products, and an adverse impact on the margins from our refining and marketing operations. As a result, there could be delays or losses in the delivery of supplies and raw materials to us, decreased sales of our products and extensions of time for payment of accounts receivable from our customers.

| Unresolved Staff Comments |

None.

Refining and Terminal Operations

We own the approximately 125 acre site on which the Cheyenne Refinery is located in Cheyenne, Wyoming and the approximately 1,000 acre site on which the El Dorado Refinery is located in El Dorado, Kansas. We lease the approximately two acre site in Henderson, Colorado on which the EMC products and blending terminal is located.

Other Properties

We lease approximately 6,500 square feet of office space in Houston, Texas for our corporate headquarters under a lease expiring in October 2009. We also lease approximately 28,000 square feet of office space in Denver, Colorado under a lease expiring in April 2012 for our refining, marketing and raw material supply operations.

See “Litigation” and “Environmental” in Note 9 in the “Notes to Consolidated Financial Statements.”

| Submission of Matters to a Vote of Security Holders |

None.

We file reports with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports from time to time. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, DC, 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We are an electronic filer, and the SEC’s Internet site at http://www.sec.gov contains the reports, proxy and information statements, and other information filed electronically.

As required by Section 402 of the Sarbanes-Oxley Act of 2002, we have adopted a code of ethics that applies to our chief executive officer, chief financial officer and principal accounting officer. This code of ethics is posted on our web site. Our web site address is: http://www.frontieroil.com. We make our web site content available for informational purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference in this Form 10-K. We make available on this web site under “Investor Relations,” free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the SEC.

We filed our 2007 annual CEO certification with the New York Stock Exchange (“NYSE”) on May 8, 2007. We anticipate filing our 2008 annual CEO certification with the NYSE on or about April 28, 2008. In addition, we filed with the SEC as exhibits to our Form 10-K for the year ended December 31, 2006 the CEO and CFO certifications required under Section 302 of the Sarbanes-Oxley Act of 2002.

| Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is listed on the New York Stock Exchange under the symbol FTO. The quarterly high and low sales prices (as adjusted for our June 26, 2006 stock split) as reported on the New York Stock Exchange for 2007 and 2006 are shown in the following table:

| 2007 | High | Low |

Fourth quarter Third quarter Second quarter First quarter | $ 49.13 49.10 45.75 33.75 | $ 39.54 31.61 31.95 25.47 |

| 2006 | High | Low |

Fourth quarter Third quarter Second quarter First quarter | $ 33.00 37.80 33.10 30.98 | $ 24.00 24.33 23.75 18.99 |

The approximate number of holders of record for our common stock as of February 20, 2008 was 939. The quarterly cash divided on our common stock was $0.02 per share for the quarters ended June 30, 2005 through March 31, 2006. In addition, a special cash dividend of $0.50 per share was declared for the quarter ended December 31, 2005 and paid on January 11, 2006, to shareholders of record on December 15, 2005. The quarterly cash dividend was $0.03 per share for the quarters ended June 30, 2006 through March 31, 2007. The quarterly cash dividend was $0.05 per share for the quarters ended June 30, 2007 through December 31, 2007. Our 6.625% Notes and our Revolving Credit Facility may restrict dividend payments based on the covenants related to interest coverage and restricted payments. See Notes 4 and 5 in the “Notes to Consolidated Financial Statements.”

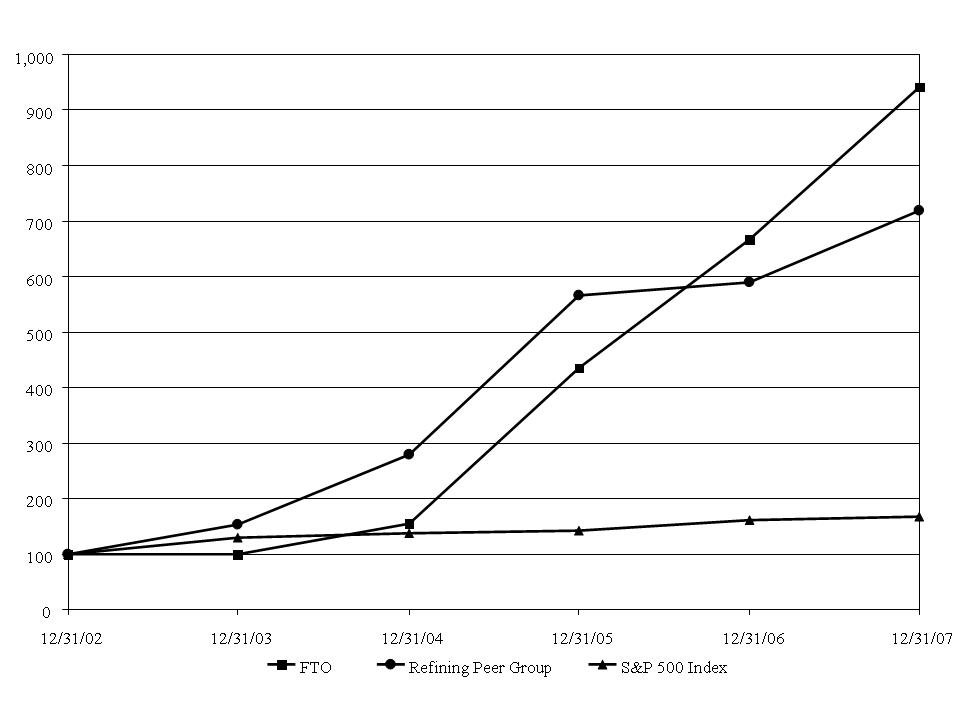

The following graph indicates the performance of our common stock against the S&P 500 Index and against a refining peer group which is comprised of Sunoco Inc., Holly Corporation, Valero Energy Corporation and Tesoro Corporation.

The following table sets forth information regarding equity securities that we have repurchased.

| Period | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) | | Maximum Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (2) |

| October 1, 2007 to October 31, 2007 | 435,500 | | $ 43.3475 | | 435,500 | | $ 81,767,994 |

| November 1, 2007 to November 30, 2007 | 258,900 | | 44.9867 | | 258,900 | | $ 70,120,933 |

| December 1, 2007 to December 31, 2007 | 326,200 | | 41.9630 | | 326,200 | | $ 56,432,616 |

| Total fourth quarter | 1,020,600 | | $ 43.3208 | | 1,020,600 | | $ 56,432,616 |

(1) In November 2006, our Board of Directors approved a new $100 million share repurchase program, which replaced all existing repurchase authorizations. The program has no expiration date but may be terminated by the Board of Directors at any time. In April 2007, our Board of Directors authorized the utilization of up to an additional $100 million for share repurchases, and in August 2007, our Board of Directors authorized the utilization of another $100 million for share repurchases. No shares were purchased during the periods shown other than through publicly-announced programs.

(2) Amounts shown in this column reflect approximate dollar value of shares remaining as of each month end which may be repurchased under the stock repurchase programs referenced in note 1 above.

| Five Year Financial Data | |

| (Unaudited) | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (Dollars in thousands, except per share amounts) | |

| Revenues | | $ | 5,188,740 | | | $ | 4,795,953 | | | $ | 4,001,162 | | | $ | 2,861,716 | | | $ | 2,170,503 | |

| Operating income | | | 755,795 | | | | 574,194 | | | | 450,013 | | | | 142,903 | | | | 53,437 | |

Cumulative effect of accounting change, net of income taxes (1) | | | - | | | | - | | | | (2,503 | ) | | | - | | | | - | |

| Net income | | | 499,125 | | | | 379,277 | | | | 275,158 | | | | 69,392 | | | | 4,200 | |

| Basic earnings per share: | | | | | | | | | | | | | | | | | | | | |

Before cumulative effect of accounting change | | $ | 4.67 | | | $ | 3.40 | | | $ | 2.51 | | | $ | 0.65 | | | $ | 0.04 | |

Cumulative effect of accounting change (1) | | | - | | | | - | | | | (.02 | ) | | | - | | | | - | |

Net income | | $ | 4.67 | | | $ | 3.40 | | | $ | 2.49 | | | $ | 0.65 | | | $ | 0.04 | |

| Diluted earnings per share: | | | | | | | | | | | | | | | | | | | | |

Before cumulative effect of accounting change | | $ | 4.62 | | | $ | 3.37 | | | $ | 2.44 | | | $ | 0.63 | | | $ | 0.04 | |

Cumulative effect of accounting change (1) | | | - | | | | - | | | | (.02 | ) | | | - | | | | - | |

Net income | | $ | 4.62 | | | $ | 3.37 | | | $ | 2.42 | | | $ | 0.63 | | | $ | 0.04 | |

Working capital (current assets less current liabilities) | | $ | 529,510 | | | $ | 479,518 | | | $ | 270,145 | | | $ | 106,760 | | | $ | 45,049 | |

| Total assets | | | 1,863,848 | | | | 1,523,925 | | | | 1,223,057 | | | | 770,177 | | | | 662,495 | |

| Long-term debt | | | 150,000 | | | | 150,000 | | | | 150,000 | | | | 150,000 | | | | 168,689 | |

| Shareholders’ equity | | | 1,038,614 | | | | 775,854 | | | | 478,692 | | | | 271,120 | | | | 200,656 | |

Dividends declared per common share | | $ | 0.180 | | | $ | 0.100 | | | $ | 0.575 | | | $ | 0.055 | | | $ | 0.050 | |

_______________

(1) As of December 31, 2005, we adopted FASB Interpretation No. 47, “Accounting for Conditional Asset Retirement Obligations.” See Note 2 in the “Notes to Consolidated Financial Statements.”

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

General

Frontier operates Refineries in Cheyenne, Wyoming and El Dorado, Kansas as previously discussed in Part I, Item 1 of this Form 10-K. We focus our marketing efforts in the Rocky Mountain and Plains States regions of the United States. We purchase crude oil to be refined and market refined petroleum products, including various grades of gasoline, diesel, jet fuel, asphalt and other by-products.

Results of Operations

To assist in understanding our operating results, please refer to the operating data at the end of this analysis which provides key operating information for our Refineries. Refinery operating data is also included in our quarterly reports on Form 10-Q and on our web site address: http://www.frontieroil.com. We make our web site content available for informational purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference in this Form 10-K.

Overview

Our Refineries have a total annual average crude oil capacity of approximately 162,000 bpd. The four significant indicators of our profitability, which are reflected and defined in the operating data at the end of this analysis, are the gasoline crack spread, the diesel crack spread, the light/heavy crude oil differential and the WTI/WTS crude oil differential. Other significant factors that influence our financial results are refinery utilization, crude oil price trends, asphalt and by-product margins and refinery operating expenses (including natural gas and maintenance). Under our first-in, first-out (“FIFO”) inventory accounting method, crude oil price trends can cause significant fluctuations in the inventory valuation of our crude oil, unfinished products and finished products, thereby resulting in FIFO inventory gains when crude oil prices increase and FIFO inventory losses when crude oil prices decrease during the reporting period. We typically do not use derivative instruments to offset price risk on our base level of operating inventories. See “Price Risk Management Activities” under Item 7A for a discussion of our utilization of futures trading.

Crude oil market fundamentals and geopolitical considerations have caused crude oil prices to be volatile and generally higher than historical averages. The increase in crude oil prices, along with additional production of heavy and/or sour crude oil, increased our crude oil differentials during the year ended December 31, 2007, when compared to the same period in 2006. Our 2007 gasoline and diesel crack spreads were the highest in our history, while 2006 gasoline and diesel crack spreads were the second highest in our history.

2007 Compared with 2006

Overview of Results

We had net income for the year ended December 31, 2007, of $499.1 million, or $4.62 per diluted share, compared to net income of $379.3 million, or $3.37 per diluted share, for the same period in 2006. Our operating income of $755.8 million for the year ended December 31, 2007, reflected an increase of $181.6 million from the $574.2 million operating income for the comparable period in 2006. The average diesel crack spread was higher during 2007 ($22.59 per barrel) than in 2006 ($21.35 per barrel). The average gasoline crack spread was also higher during 2007 ($18.39 per barrel) than in 2006 ($14.10 per barrel), and the light/heavy crude oil differentials improved.

Specific Variances

Refined product revenues. Refined product revenues increased $510.0 million, or 11%, from $4.8 billion to $5.3 billion for the year ended December 31, 2007 compared to the same period in 2006. This increase was due to an increase in average product sales prices ($9.05 higher per sales barrel) partially offset by lower product sales volumes in 2007 (1,890 fewer bpd). Sales prices increased primarily as a result of increased crude oil prices and improvements in the gasoline and diesel crack spreads.

Manufactured product yields. Manufactured product yields (“yields”) are the volumes of specific materials obtained through the distilling of crude oil and the operations of other refinery process units. Yields decreased 1,826 bpd at the El Dorado Refinery and 4,067 bpd at the Cheyenne Refinery for the year ended December 31, 2007 compared to 2006. Planned and unplanned shut downs at the Cheyenne Refinery during 2007 caused yields to be lower during 2007 than 2006. At the El Dorado Refinery, we processed more heavy crude oils during 2007 than in 2006, which resulted in decreased yields.

Other revenues. Other revenues decreased $117.2 million to an $80.9 million loss for the year ended December 31, 2007, compared to a $36.3 million gain for the same period in 2006, the sources of which were $86.4 million in net losses from derivative contracts in the year ended December 31, 2007 compared to net derivative gains of $34.6 million for the same period in 2006 offset by $4.8 million in gasoline sulfur credit sales in 2007 ($1.5 million in 2006). See “Price Risk Management Activities” under Item 7A and Note 11 in the “Notes to Consolidated Financial Statements” for a discussion of our utilization of commodity derivative contracts.

Raw material, freight and other costs. Raw material, freight and other costs include crude oil and other raw materials used in the refining process, purchased products and blendstocks, freight costs for FOB destination sales, as well as the impact of changes in inventory under the FIFO inventory accounting method. Raw material, freight and other costs increased by $188.3 million, or 5%, during the year ended December 31, 2007, from $3.9 billion in 2006 to $4.0 billion in 2007. The increase in raw material, freight and other costs when compared to 2006 was due to higher average crude prices, offset by lower crude oil charges and FIFO inventory gains in the year ended December 31, 2007 compared to FIFO inventory losses in the year ended December 31, 2006. We benefited from improved light/heavy crude oil differentials during the year ended December 31, 2007 compared to the same period in 2006. The average WTI crude oil priced at Cushing, Oklahoma (ConocoPhillips WTI crude oil posting plus) was $71.99 for the year ended December 31, 2007 compared to $64.94 for the year ended December 31, 2006. Average crude oil charges were 146,046 bpd for the year ended December 31, 2007, compared to 154,473 bpd for the comparable period in 2006. For the year ended December 31, 2007, we realized a decrease in raw material, freight and other costs as a result of net FIFO inventory gains of approximately $78.4 million after tax ($126.3 million pretax, comprised of an $84.9 million gain at the El Dorado Refinery and a $41.4 million gain at the Cheyenne Refinery) due to increasing crude oil and refined product prices during 2007. For the year ended December 31, 2006, we realized an increase in raw material, freight and other costs as a result of net FIFO inventory losses of approximately $16.1 million after tax ($25.7 million pretax, comprised of a $31.7 million loss at the El Dorado Refinery and a $6.0 million gain for the Cheyenne Refinery) due to decreasing crude oil and refined product prices during the latter part of 2006.

The Cheyenne Refinery raw material, freight and other costs of $62.08 per sales barrel for the year ended December 31, 2007 increased from $57.07 per sales barrel in the same period in 2006 due to higher crude oil prices partially offset by a FIFO inventory gain in 2007 compared to FIFO inventory loss in 2006, fewer crude oil charges in 2007 and the benefit of an improved light/heavy crude oil differential in 2007. Average crude oil charges of 41,778 bpd for the year ended December 31, 2007 were lower than the 45,999 bpd in the comparable period in 2006 because of a spring 2007 turnaround, a temporary shutdown of the FCCU in the third quarter, and a December 2007 fire in the coker unit at the Cheyenne Refinery. The heavy crude oil utilization rate at the Cheyenne Refinery expressed as a percentage of the total crude oil charge decreased to 72% in the year ended December 31, 2007, from 73% in 2006. The light/heavy crude oil differential for the Cheyenne Refinery averaged $18.55 per barrel in the year ended December 31, 2007 compared to $16.21 per barrel in the same period in 2006.

The El Dorado Refinery raw material, freight and other costs of $66.25 per sales barrel for the year ended December 31, 2007 increased from $63.15 per sales barrel in the same period in 2006 due to higher average crude oil prices partially offset by FIFO inventory gains in 2007 compared to FIFO inventory losses in 2006 and lower crude oil charges in 2007. Average crude oil charges were 104,268 bpd for the year ended December 31, 2007, compared to 108,475 bpd for the comparable period in 2006. Due to the favorable light/heavy differentials, we ran more heavy crude oil in 2007 which limited the overall crude rate. We realized a light/heavy crude oil differential of $20.60 per barrel during 2007. In 2006, our El Dorado Refinery began charging Canadian heavy crude oil and achieved a light/heavy crude oil differential of $18.13 per barrel. For the year ended December 31, 2007, the heavy crude oil utilization rate at our El Dorado Refinery expressed as a percentage of the total crude oil charge was approximately 15%, compared to 11% in 2006. The WTI/WTS crude oil differential decreased from an average of $5.22 per barrel in the year ended December 31, 2006 to an average of $5.02 per barrel for the same period in 2007.

Refinery operating expenses. Refinery operating expenses, excluding depreciation, include both the variable costs (energy and utilities) and the fixed costs (salaries, taxes, maintenance costs and other) of operating the Refineries. Refinery operating expenses, excluding depreciation, increased $23.4 million, or 8%, to $300.5 million in the year ended December 31, 2007 from $277.1 million in the comparable period of 2006.

The Cheyenne Refinery operating expenses, excluding depreciation, were $109.2 million in the year ended December 31, 2007, compared to $101.9 million in the comparable period of 2006. The increased expenses included higher maintenance costs ($5.6 million, with $3.8 million of the costs relating to repair from a coker unit fire in December 2007), higher salaries and benefits ($3.5 million, including $1.0 million in increased maintenance salaries and $1.1 million additional bonus costs due to an increased number of employees), higher turnaround amortization ($1.5 million) and higher consulting and legal expenses ($1.4 million.) These increases were partially offset by decreased environmental costs ($3.2 million, primarily related to an estimated waste water pond clean up accrual recorded in 2006 of $5.0 million offset by a $3.0 million increase in groundwater remediation accrual in 2007), electricity costs ($1.6 million) and natural gas costs ($1.0 million).

The El Dorado Refinery operating expenses, excluding depreciation, were $191.3 million in the year ended December 31, 2007, increasing from $175.3 million for the year ended December 31, 2006. The primary areas of increased costs were in higher property taxes ($6.0 million), increased chemicals and additives costs ($3.8 million), higher salaries and benefits ($2.6 million, including $1.2 million in increased bonus costs and $715,000 in increased stock-based compensation costs), higher consulting and legal expenses ($1.7 million), higher natural gas costs ($1.3 million) and higher environmental expenses ($1.2 million).

Selling and general expenses. Selling and general expenses, excluding depreciation, increased $2.9 million, or 5%, from $52.5 million for the year ended December 31, 2006 to $55.3 million for the year ended December 31, 2007, primarily due to a $1.3 million increase in salaries and benefits expense, which resulted from $4.3 million in additional stock-based compensation expense and general salary increases, offset by a $3.8 million reduction in cash bonus expense. See Note 7 under “Stock-based Compensation” in the “Notes to Consolidated Financial Statements” for a detailed discussion of our stock-based compensation. Stock-based compensation expense was $20.0 million for the year ended December 31, 2007 compared to $15.8 million for the comparable period in 2006. Beverly Hills litigation costs also increased by $641,000 in the year ended December 31, 2007, compared to the year ended December 31, 2006.

Depreciation, amortization and accretion. Depreciation, amortization and accretion increased $11.8 million, or 29%, from $41.2 million for the year ended December 31, 2006 to $53.0 million for the same period in 2007 because of increased capital investment in our Refineries, including the ultra low sulfur diesel projects placed into service in the middle of the second quarter of 2006 and our Cheyenne Refinery coker expansion project placed into service in the second quarter of 2007. We also had higher depreciation expense during the year ended December 31, 2007 due to changes in the estimated useful lives of certain assets that are expected to be retired in connection with certain of our capital projects in 2008 and 2009.

Gain on sale of assets. The $15.2 million gain on sale of assets during the year ended December 31, 2007 resulted from a gain of $17.3 million from the sale of our 34.72% interest in a crude oil pipeline in Wyoming and a 50% interest in two crude oil tanks in Guernsey, Wyoming in September 2007, partially offset by the buyout and sale of a leased aircraft.

Interest expense and other financing costs. Interest expense and other financing costs of $8.8 million for the year ended December 31, 2007 decreased $3.4 million, or 28%, from $12.1 million in the comparable period in 2006. The decrease was due to $8.1 million of interest cost being capitalized in the year ended December 31, 2007, compared to $3.8 million of interest cost being capitalized in the year ended December 31, 2006, offset by $2.4 million in accrued interest expense for income tax contingencies in 2007 ($1.5 million in 2006) and $2.2 million ($1.9 million in 2006) in facility costs and financing expenses related to the Utexam Master Crude Oil Purchase and Sale Contract entered into in March 2006 (“Utexam Arrangement”) (see “Leases and Other Commitments” in Note 9 in the “Notes to Consolidated Financial Statements”). Average debt outstanding (excluding amounts payable under the Utexam Arrangement) decreased to $150.0 million during the year ended December 31, 2007 from $151.7 million for the same period in 2006.

Interest and investment income. Interest and investment income increased $3.8 million, or 21%, from $18.1 million in the year ended December 31, 2006 to $21.9 million in the year ended December 31, 2007, due to larger cash balances and higher interest rates on invested cash.

Provision for income taxes. The provision for income taxes for the year ended December 31, 2007 was $269.7 million on pretax income of $768.9 million (or 35.1%) compared to $200.8 million on pretax income of $580.1 million (or 34.6%) for the same period in 2006. The American Jobs Creation Act of 2004 (“the Act”) benefited our 2006 current income taxes payable by allowing us an accelerated depreciation deduction of 75% of qualified capital costs incurred to achieve low sulfur diesel fuel requirements (See “Environmental” under Note 9 in the “Notes to Consolidated Financial Statements”). The Act also provides for a $0.05 per gallon federal income tax credit on compliant diesel fuel up to an amount equal to the remaining 25% of these qualified capital costs. The $0.05 per gallon federal income tax credit allowed us to realize an $8.5 million federal income tax credit ($5.5 million excess tax benefit) and a $22.4 million federal income tax credit ($14.5 million excess tax benefit) in the years ended December 31, 2007 and 2006, respectively. This credit reduced our 2007 and 2006 income taxes payable and reduced our overall effective income tax rate for those years. Another provision of the Act, the Section 199 production activities deduction for manufacturers, benefited our 2007 and 2006 income taxes payable by an estimated $16.0 million and $5.7 million, respectively, and reduced our overall effective tax rate in both of those years. See Note 6 in the “Notes to Consolidated Financial Statements” for detailed information on our deferred tax assets.

2006 Compared with 2005

Overview of Results

We had net income for the year ended December 31, 2006, of $379.3 million, or $3.37 per diluted share, compared to net income of $275.2 million, or $2.42 per diluted share, in the same period in 2005. Our operating income of $574.2 million for the year ended December 31, 2006, reflected an increase of $124.2 million from the $450.0 million operating income for the comparable period in 2005. The average diesel crack spread was higher during 2006 ($21.35 per barrel) than in 2005 ($17.13 per barrel). The average gasoline crack spread was also higher during 2006 ($14.10 per barrel) than in 2005 ($11.67 per barrel), and both the light/heavy and WTI/WTS crude oil differentials improved.

Specific Variances

Refined product revenues. Refined product revenues increased $759.7 million, or 39%, from $4.0 billion to $4.8 billion for the year ended December 31, 2006 compared to the same period in 2005. This increase was due to both an increase in average product sales prices ($8.81 higher per sales barrel) and an increase in product sales volumes in 2006 (1,657 more bpd). Sales prices increased primarily as a result of increased crude oil prices and improvements in the gasoline and diesel crack spreads.

Manufactured product yields. Yields increased 6,776 bpd at the El Dorado Refinery while decreasing 3,669 bpd at the Cheyenne Refinery for the year ended December 31, 2006 compared to 2005. A Cheyenne Refinery turnaround in April 2006 caused yields to be lower during 2006 than during 2005, and an El Dorado Refinery turnaround from March 1 through April 5, 2005 caused yields to be lower in 2005 than 2006.

Other revenues. Other revenues increased $35.1 million to a $36.3 million gain for the year ended December 31, 2006, compared to a $1.2 million gain for the same period in 2005, the sources of which were $34.6 million in net gains from derivative contracts in the year ended December 31, 2006 compared to net derivative gains of $1.0 million for the same period in 2005 and $1.5 million in gasoline sulfur credit sales in 2006 (none in 2005). We utilized more derivative contracts during the year ended December 31, 2006 than in the comparable period in 2005, primarily to hedge Canadian in-transit crude oil for our El Dorado Refinery. See “Price Risk Management Activities” under Item 7A and Note 11 in the “Notes to Consolidated Financial Statements” for a discussion of our utilization of commodity derivative contracts.

Raw material, freight and other costs. Raw material, freight and other costs increased by $603.6 million, or 19%, during the year ended December 31, 2006, from $3.2 billion in 2005 to $3.9 billion in 2006. The increase in raw material, freight and other costs when compared to 2005 was due to higher average crude prices, higher crude oil charges on an overall combined basis, and FIFO inventory losses in the year ended December 31, 2006. We benefited from slightly improved crude oil differentials during the year ended December 31, 2006 compared to the same period in 2005. The average WTI crude oil priced at Cushing, Oklahoma (ConocoPhillips WTI crude oil posting plus) was $64.94 for the year ended December 31, 2006 compared to $55.77 for the year ended December 31, 2005. Crude oil charges were 154,473 bpd for the year ended December 31, 2006, compared to 152,649 bpd for the comparable period in 2005. For the year ended December 31, 2006, we realized an increase in raw material, freight and other costs as a result of net FIFO inventory losses of approximately $16.1 million after tax ($25.7 million pretax, comprised of a $31.7 million loss at the El Dorado Refinery and a $6.0 million gain at the Cheyenne Refinery) due to decreasing crude oil and refined product prices during the latter part of 2006. For the year ended December 31, 2005, we realized a reduction in raw material, freight and other costs as a result of FIFO inventory gains of approximately $29.4 million after tax ($47.6 million pretax, comprised of $39.0 million for the El Dorado Refinery and $8.6 million for the Cheyenne Refinery) because of increasing crude oil and refined product prices.

The Cheyenne Refinery raw material, freight and other costs of $57.07 per sales barrel for the year ended December 31, 2006 increased from $48.49 per sales barrel in the same period in 2005 due to higher crude oil prices and a lower FIFO inventory gain, offset by fewer crude oil charges and the benefit of a slightly improved light/heavy crude oil differential. Crude oil charges of 45,999 bpd for the year ended December 31, 2006 were lower than the 46,922 bpd in the comparable period in 2005 because of the previously mentioned turnaround in 2006. The heavy crude oil utilization rate at the Cheyenne Refinery expressed as a percentage of the total crude oil charge decreased to 73% in the year ended December 31, 2006, from 82% in 2005 as we increased our charges of lighter crude oil to take advantage of favorable pricing opportunities for light crude purchases. The light/heavy crude oil differential for the Cheyenne Refinery averaged $16.21 per barrel in the year ended December 31, 2006 compared to $15.32 per barrel in the same period in 2005.

The El Dorado Refinery raw material, freight and other costs of $63.15 per sales barrel for the year ended December 31, 2006 increased from $54.01 per sales barrel in the same period in 2005 due to higher average crude oil prices and a FIFO inventory loss in 2006 compared to a FIFO inventory gain in 2005. Crude oil charges were 108,475 bpd for the year ended December 31, 2006, compared to 105,727 bpd for the comparable period in 2005 because of the previously mentioned turnaround in 2005. In 2006, our El Dorado Refinery began charging Canadian heavy crude oil and achieved a light/heavy crude oil differential of $18.13 per barrel. For the year ended December 31, 2006, the heavy crude oil utilization rate at our El Dorado Refinery expressed as a percentage of the total crude oil charge was approximately 11%. The WTI/WTS crude oil differential increased from an average of $4.51 per barrel in the year ended December 31, 2005 to $5.22 per barrel in the same period in 2006.

Refinery operating expenses. Refinery operating expenses, excluding depreciation, increased $35.7 million, or 15%, from $241.5 million in the year ended December 31, 2005 to $277.1 million in the comparable period of 2006.

The Cheyenne Refinery operating expenses, excluding depreciation, were $101.9 million in the year ended December 31, 2006, compared to $78.9 million in the comparable period of 2005. The increased expenses included higher maintenance costs ($8.1 million, with $3.0 million of the costs related to a plant-wide steam outage in February 2006, $1.2 million for slop oil centrifuging, $557,000 related to a September 2006 coker outage and $577,000 related to a butamer unit outage), increased environmental expenses ($5.8 million, including a $5.0 million accrual related to a potential waste-water pond clean up), higher salaries and benefits ($4.3 million, including $1.4 million in increased stock-based compensation costs and $787,000 additional bonus accruals), higher additive and chemical costs ($2.1 million, including increased wastewater treatment chemical use, cost of testing chemicals from a new vendor and increased usage of fresh fluid catalyst) and higher turnaround amortization ($1.0 million).