This Form 10-K contains “forward-looking statements” as defined by the Securities and Exchange Commission (“SEC”). Such statements are those concerning contemplated transactions and strategic plans, expectations and objectives for future operations. These include, without limitation:

Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this Form 10-K are reasonable, we can give no assurance that such plans, intentions or expectations will be achieved. These statements are based on assumptions made by us based on our experience and perception of historical trends, current conditions, expected future developments and other factors that we believe are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond our control. You are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements.

All forward-looking statements contained in this Form 10-K only speak as of the date of this document. We undertake no obligation to update or revise publicly any revisions to any such forward-looking statements that may be made to reflect events or circumstances after the date of this Form 10-K, or to reflect the occurrence of unanticipated events.

The terms “Frontier,” “we,” “us” and “our” as used in this Form 10-K refer to Frontier Oil Corporation and its subsidiaries, except where it is clear that those terms mean only the parent company. When we use the term “Rocky Mountain region,” we refer to the states of Colorado, Wyoming, western Nebraska, Montana and Utah, and when we use the term “Plains States,” we refer to the states of Kansas, Oklahoma, eastern Nebraska, Iowa, Missouri, North Dakota and South Dakota.

We are an independent energy company, organized in the State of Wyoming in 1977, engaged in crude oil refining and the wholesale marketing of refined petroleum products. We operate refineries (the “Refineries”) in Cheyenne, Wyoming and El Dorado, Kansas with a total annual average crude oil capacity of approximately 187,000 barrels per day (“bpd”). Both of our Refineries are complex refineries, which means that they can process heavier, less expensive types of crude oil and still produce a high percentage of gasoline, diesel fuel and other high value refined products. We focus our marketing efforts in the Rocky Mountain region and the Plains States, which we believe are among the most attractive refined products markets in the United States. The operations of refining an d marketing of petroleum products are considered part of one reporting segment.

For the most part, heavy crude oil tends to be sour and light crude oil tends to be sweet. When refined, light crude oil produces a higher proportion of high value refined products such as gasoline, diesel and jet fuel and, as a result, is more expensive than heavy crude oil. In contrast, heavy crude oil produces more low value by-products and heavy residual oils. The discount at which heavy crude oil sells compared to light crude oil is known in the industry as the light/heavy spread or differential, while the discount at which sour crude oil sells compared to sweet crude oil is known as the sweet/sour, or WTI/WTS, spread or differential. Coking units, such as the ones at our Refineries, can process certain by-products and heavy residual oils to produce additional volumes of gasoline and diesel , thus increasing the aggregate yields of higher value refined products from the same initial barrel of crude oil.

Refineries are frequently classified according to their complexity, which refers to the number, type and capacity of processing units at the refinery. Each of our Refineries possesses a coking unit, which provides substantial upgrading capacity and generally increases a refinery’s complexity rating. Upgrading capacity refers to the ability of a refinery to produce high yields of high value refined products such as gasoline and diesel from heavy and intermediate crude oil. In contrast, refiners with low upgrading capacity must process primarily light, sweet crude oil to produce a similar yield of gasoline and diesel. Some low complexity refineries may be capable of processing heavy and intermediate crude oil, but will generally produce large volumes of by-products, including heavy residual oils and a sphalt. Because gasoline, diesel and jet fuel sales generally achieve higher margins than are available on other refined products, we expect that these products will continue to make up the majority of our production.

During 2010, the El Dorado Refinery turnaround scope was limited to annual catalyst reformer regenerations and coker furnace cleaning. In addition, the final phase of the gofiner project was completed in December 2010. The year 2011 will be another moderate turnaround year for the El Dorado Refinery, with a third quarter turnaround scheduled on the aromatics recovery unit. Annual reformer regenerations, ongoing coker furnace piggings, and catalyst changes on the kerosene hydrotreater and one of the diesel hydrotreaters are also scheduled for 2011.

The Cheyenne Refinery also had a light turnaround year in 2010 as we deferred 2010 scheduled turnarounds associated with the fluid catalytic cracking unit (“FCCU”), alkylation unit, butamer unit and scanfiner into early 2011. The 2010 activity involved two reformer regenerations and a diesel hydrotreater catalyst change. The crude unit was shut down for repairs for 28 days following a fire in late July 2010. The Cheyenne Refinery will have significant turnaround activity in 2011 as we complete the turnarounds on the FCCU, alkylation unit, butamer unit, and scanfiner.

We sell refined products from our Cheyenne Refinery to a broad base of independent retailers, jobbers and major oil companies. Refined product prices are determined by local market conditions at distribution centers known as “terminal racks,” and prices at the terminal racks are posted daily by sellers. Our customers at the terminal rack typically supply their own truck transportation. In the year ended December 31, 2010, approximately 89% of the Cheyenne Refinery’s sales were made to its 25 largest customers compared to the year ended December 31, 2009, when approximately 90% of the Cheyenne Refinery’s sales were made to its 25 largest customers. Occasionally, volumes sold exceed the Refinery’s production, in which case we purchase product in the spot market as ne eded.

For the year ended December 31, 2010, Shell was the El Dorado Refinery’s largest customer, and our only customer which represented more than 10% of our total consolidated sales. For 2010, sales to Shell represented approximately 51% of the El Dorado Refinery’s total sales and 39% of our total consolidated sales. Under the offtake agreement, Shell purchases gasoline, diesel and jet fuel produced by the El Dorado Refinery at market-based prices through December 2014. In aggregate during 2010, we retained and marketed 60,000 bpd of the Refinery’s gasoline and diesel production while the remaining production was sold to Shell. Upon expiration of the offtake agreement, we intend to sell the gasoline and diesel produced by the El Dorado Refinery in the same general markets serv ed by Shell, as previously described.

The Suncor refinery located in Denver has lower product transportation costs to serve the Denver market than we do. However, the Cheyenne Refinery has lower crude oil transportation costs because of its proximity to the Guernsey, Wyoming hub, the major crude oil pipeline hub in the Rocky Mountain region. Moreover, unlike Sinclair and Suncor, we only sell our products to the wholesale market. We believe that our commitment to the wholesale market gives us certain marketing advantages over our principal competitors in the Eastern Slope area, all of which also have retail outlets, because we do not compete directly with independent retailers of gasoline and diesel.

We purchase crude oil from numerous suppliers, including major oil companies, marketing companies and large and small independent producers, under arrangements which contain market-responsive pricing provisions. Most of these arrangements are subject to cancellation by either party or have terms that are not in excess of one year and are subject to periodic renegotiation. We intend to continue purchasing crude oil from a variety of suppliers and typically under short-term commitments. In the event we become unable to purchase crude oil from any one of these sources, we believe that adequate alternative supplies of crude oil would be available. Crude oil charges are the quantity of crude oil and other feedstock processed through Refinery units.

We place significant emphasis on working and operating our plants safely. We are committed as a company to provide a safe workplace and have a culture and knowledge base that facilitates safe operation of our Refineries. As an employer, we are subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) and comparable state occupational safety statutes.

The Cheyenne Refinery’s employee OSHA recordable incident rate in 2010 was 2.9, which was an increase over the 2009 recordable rate of 2.0 and remains higher than the latest reported U.S. refining industry average of 1.0 as compiled by the United States Department of Labor. Although the overall rate was high in 2010, we realized a significant reduction of recordable injuries in the second half of 2010, with a July through December 2010 recordable rate of 1.3. We believe that our efforts have resulted in sustained improvement. The Cheyenne 2010 contractor recordable rate was 2.1, which represents one contractor injury.

The El Dorado Refinery sustained good safety performance with a 2010 recordable incident rate of 0.9, up slightly from the 2009 recordable rate of 0.6, and slightly better than the refining industry average of 1.0. Management and employees at the El Dorado Refinery remain committed to programs, processes and behaviors that drive safety excellence. A key initiative for the El Dorado Refinery during 2010 was to continue to facilitate an improvement in the safety performance of its contractors. This focus resulted in the contractor recordable rate at the El Dorado Refinery improving to 0.9, a solid reduction from the 2009 contractor recordable injury rate of 1.4.

During 2011, we will continue with the safety processes and initiatives that have proven to promote and sustain continued safety improvement in our Refineries. These efforts include programs in both areas of occupational and process safety and are comprehensive across all areas of the Refineries. Behavior-based safety programs have been in place at both Refineries for many years, and continue to evolve in response to our performance. Process safety became a more focused aspect of our safety management systems four years ago, with dedicated process safety departments at both Refineries. Our employees and management continue to dedicate their efforts to a balanced safety program that combines individual behavioral elements and risk-based process safety elements in a safety-coaching environment wi th structured, management-driven programs to improve the safety of our facilities. Our objective is to provide a safe working environment for employees and contractors and continue educating them about how to work safely. Encouraging all employees and contractors to contribute toward improving safety performance through personal involvement in safety-related activities is an industry-proven method of reducing injuries.

At December 31, 2010, we employed 811 full-time employees: 96 in the Houston and Denver offices, 276 at the Cheyenne Refinery, and 439 at the El Dorado Refinery. The Cheyenne Refinery employees included 97 administrative and technical personnel and 179 union members. The El Dorado Refinery employees included 149 administrative and technical personnel and 290 union members. The union members at our El Dorado Refinery are represented by the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union (“USW”). The union members at our Cheyenne Refinery are represented by six bargaining units, the largest being the USW and the others being various craft unions.

For our Cheyenne Refinery, the current contract between the Company, the USW, and its Local 11-0574 expires in March 2012. The current contract between the Company, the craft unions, and its various local chapters expires in July 2012.

At our El Dorado Refinery, the current contract between the Company, the USW, and its Local 241 expires in January 2012.

Crude oil prices and refining margins significantly impact our cash flow and may fluctuate substantially.

Our cash flow from operations is primarily dependent upon producing and selling refined products at margins that are high enough to cover our fixed and variable expenses. In recent years, crude oil costs and crack spreads (the difference between refined product sales prices and crude oil prices) have fluctuated substantially. Factors that may affect crude oil costs and refined product prices include:

Crude oil supply contracts are generally short-term contracts with price terms that change as market prices change. Our crude oil requirements are supplied from sources that include:

The price at which we can sell gasoline and other refined products is strongly influenced by the price of crude oil. Generally, an increase or decrease in the price of crude oil results in a corresponding increase or decrease in the price of gasoline and other refined products. However, if crude oil prices increase significantly, our operating margins would fall unless we could pass along these price increases to our customers.

Our profitability is affected by crude oil differentials, which may fluctuate substantially.

The light/heavy crude oil differentials that we report are the average differential between the benchmark West Texas Intermediate (“WTI”) crude oil priced on the New York Mercantile Exchange and the heavy crude oil priced as delivered to our Cheyenne Refinery or El Dorado Refinery, respectively. The WTI/WTS (sweet/sour) crude oil differential is the average differential between benchmark WTI crude oil priced on the New York Mercantile Exchange and West Texas sour crude oil priced at Midland, Texas. Our profitability at our Cheyenne Refinery is affected by the light/heavy crude oil differential, and our profitability at our El Dorado Refinery is affected by the WTI/WTS crude oil differential and the light/heavy crude oil differential. Traditionally, we have preferred to refine heavy sour crude oil at the Cheyenne Refinery and intermediate sour crude oil at the El Dorado Refinery because these crudes have provided a higher refining margin than light or sweet crude oil. Accordingly, the reduction of these crude oil differentials from 2008 to 2009 reduced our profitability, and an increase in these crude oil differentials during 2010 improved our profitability. The Cheyenne Refinery light/heavy crude oil differential averaged $11.79 per barrel in the year ended December 31, 2010, compared to $6.61 per barrel in the same period in 2009 and $17.15 per barrel in 2008. The El Dorado Refinery light/heavy crude oil differential averaged $8.60 per barrel in the year ended December 31, 2010 compared to $6.01 per barrel in 2009 and $17.85 per barrel in 2008. The WTI/WTS crude oil differential averaged $2.15 per barrel in the year ended December 31, 2010, compared to $1.65 per barrel in the same period in 2009 and $2.15 per barrel in 2008. Crude oil prices dropped dramatically during the latter part of 2008 and trended upward through 2009 and 2010, without a corresponding upward trend in crude oil differentials. This resulted in significant narrowing of the light/heavy crude oil differentials and WTI/WTS crude oil differentials from 2008 to 2009. In addition, the light/heavy crude oil differential has declined over the last three years due to the significant industry investment in equipment to process heavy/sour crude oil. The crude oil differentials could resume a negative trend, which would negatively impact on our profitability.

Our inventory risk management activities relating to hedging may generate substantial gains and losses.

In order to manage our price risk exposure on certain of our inventories, we from time to time enter into derivative contracts to make forward sales or purchases of crude oil and refined products. We may also use options or swaps to accomplish similar objectives. Our inventory risk management strategy is to hedge price risk on inventory positions in excess of our base level of operating inventories in order to minimize the impact of crude oil price fluctuations on our cash flows. This strategy generally produces losses when hedged crude oil or refined products increase in value and gains when hedged crude oil or refined products decrease in value. Consequently, our inventory hedging results may fluctuate significantly from one reporting period to the next depending on commodity price fluctuatio ns. For example, during the years ended December 31, 2010 and 2008 we incurred pre-tax hedging gains of $6.3 million and $146.5 million, respectively, which were recorded in “Other revenues” in the Consolidated Statements of Operations. During the year ended December 31, 2009, we incurred pre-tax hedging losses of $11.7 million, which was also recorded in “Other revenues” in the Consolidated Statements of Operations. To the extent we use progressively more Canadian crude oil at our Refineries, both our total crude oil inventories and the amount of hedged inventories are likely to increase in future periods. See “Quantitative and Qualitative Disclosures about Market Risk” in Part II, Item 7A.

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted into law. This financial reform legislation includes provisions that require over-the-counter derivative transactions to be executed through an exchange or centrally cleared. In addition, the legislation provides an exemption from mandatory clearing requirements based on regulations to be developed by the Commodity Futures Trading Commission (“CFTC”) and the Securities and Exchange Commission for transactions by non-financial institutions to hedge or mitigate commercial risk. At the same time, the legislation includes provisions under which the CFTC may impose collateral requirements for transactions, including those that are used to hedge commercial risk. Final rules on major provisions in t he legislation, like new margin requirements, will be established through rulemakings. Although we cannot predict the ultimate outcome of these rulemakings, new regulations in this area may result in increased costs and cash collateral requirements for the types of oil and gas derivative instruments we use to hedge and otherwise manage our financial risks related to volatility in oil and gas commodity prices.

Instability and volatility in the financial markets could have a negative impact on our business, financial condition, results of operations and cash flows.

The financial markets have recently experienced substantial and unprecedented volatility as a result of dislocations in the credit markets. Market disruptions in the United States and abroad may increase our cost of borrowing or adversely affect our ability to access sources of liquidity upon which we may rely to finance our operations and satisfy our obligations as they become due, and capital may not be available on terms that are reasonably acceptable to us, or at all. These disruptions may include turmoil in the financial services industry, including substantial uncertainty surrounding particular lending institutions with which we do business, reduction in available trade credit due to counterparties’ liquidity concerns, more strict lending requirements, unprecedented volatility in the markets where our ou tstanding securities trade, and general economic downturns in the areas where we do business. In addition, a general economic slowdown or the lack of liquidity may result in contractual counterparties with which we do business being unable to satisfy their obligations to us in a timely manner, or at all.

We maintain significant amounts of cash and cash equivalents at several financial institutions that are in excess of federally insured limits, which may result in losses if these financial institutions become financially troubled.

External factors beyond our control can cause fluctuations in demand for our products, prices and margins, which may negatively affect income and cash flow.

Among these factors is the demand for crude oil and refined products, which is largely driven by the conditions of local and worldwide economies as well as by weather patterns and the taxation of these products relative to other energy sources. Governmental regulations and policies, particularly in the areas of taxation, energy and the environment, also have a significant impact on our activities. Operating results can be affected by these industry factors and by competition in the particular geographic areas that we serve. The demand for crude oil and refined products can also be reduced due to a local or national recession or other adverse economic condition that results in lower spending by businesses and consumers on gasoline and diesel fuel, a shift by consumers to more fuel-efficient vehicles or alternative fu el vehicles (such as ethanol or wider adoption of gas/electric hybrid vehicles), or an increase in vehicle fuel economy, whether as a result of technological advances by manufacturers, legislation mandating or encouraging higher fuel economy or the use of alternative fuel.

In addition, our profitability depends largely on the spread between market prices for refined petroleum products and crude oil prices. This margin is continually changing and may fluctuate significantly from time to time. Crude oil and refined products are commodities whose price levels are determined by market forces beyond our control. Due to the seasonality of refined products markets and refinery maintenance schedules, results of operations for any particular quarter of a fiscal year are not necessarily indicative of results for the full year. In general, prices for refined products are influenced by the price of crude oil. Although an increase or decrease in the price of crude oil may result in a similar increase or decrease in prices for refined products, there may be a time l ag in the realization of the similar increase or decrease in prices for refined products. The effect of changes in crude oil prices on operating results therefore depends in part on how quickly refined product prices adjust to reflect these changes. A substantial or prolonged increase in crude oil prices without a corresponding increase in refined product prices, a substantial or prolonged decrease in refined product prices without a corresponding decrease in crude oil prices, or a substantial or prolonged decrease in demand for refined products could have a significant negative effect on our results of operations and cash flows. This potential negative impact on our income and cash flows from these external factors could result in an impairment of our property, plant and equipment or if significant enough the closure of one or both of our Refineries.

We are dependent on others to supply us with substantial quantities of raw materials.

Our business involves converting crude oil and other refinery charges into liquid fuels. We own no crude oil or natural gas reserves and depend on others to supply these feedstocks to our Refineries. We use large quantities of natural gas and electricity to provide heat and mechanical energy required by our processing units. Disruption to our supply of crude oil, natural gas or electricity, or the continued volatility in the costs thereof, could have a material adverse effect on our operations. In addition, our investment in inventory is affected by the general level of crude oil prices, and significant increases in crude oil prices could result in substantial working capital requirements to maintain inventory volumes.

Our operations could be subject to significant interruption, and our profitability could be impacted if either of our Refineries experienced a major accident or fire, was damaged by severe weather or other natural disaster, or was otherwise forced to curtail its operations or shut down. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Form 8-K filed on July 29, 2010, for more information on the fire at the Cheyenne Refinery. If a crude oil pipeline that supplies crude oil to our Refineries became inoperative, crude oil would have to be supplied to our Refineries through an alternative pipeline or from additional tank truck deliveries to the Refineries. Alternative supply arrangements could require additional capital expenditures, hurt our business and profitability and cause us to operate the affected Refinery at less than full capacity until pipeline access was restored or crude oil transportation was fully replaced. In addition, a major accident, fire or other event could damage our Refineries or the environment or cause personal injuries. If either of our Refineries experiences a major accident or fire or other event or an interruption in supply or operations, our business could be materially adversely affected if the damage or liability exceeds the amounts of business interruption, property, terrorism and other insurance that we maintain against these risks.

Our Refineries consist of many processing units, a number of which have been in operation for many years. One or more of the units may require additional unscheduled down time for unanticipated maintenance or repairs that are more frequent than our scheduled turnaround for such units. Scheduled and unscheduled maintenance could reduce our revenues during the period of time that our units are not operating.

We face substantial competition from other refining companies, and greater competition in the markets where we sell refined products could adversely affect our sales and profitability.

The refining industry is highly competitive. Many of our competitors are either large integrated oil companies or major independent refining companies, that because of their more diverse operations, larger refineries and stronger capitalization may be better positioned than we are to withstand volatile industry conditions, including shortages or excesses of crude oil or refined products or intense price competition at the wholesale level. Many of these competitors have financial and other resources substantially greater than ours.

We are not engaged in the petroleum exploration and production business and therefore do not produce any of our crude oil feedstocks. We do not have a retail business and therefore are dependent upon others for outlets for our refined products. Certain of our competitors, however, obtain a portion of their feedstocks from company-owned oil and gas production and also have retail outlets. Competitors that have their own crude oil production or extensive retail outlets, with brand-name recognition, are at times able to offset losses from refining operations with profits from producing or retailing operations, and may be better positioned to withstand periods of depressed refining margins or feedstock shortages. In addition, we compete with other industries, such as wind, solar and hydropower that provide alternative means to satisfy the energy and fuel requirements of our industrial, commercial and individual consumers. If we are unable to compete effectively with these competitors, both within and outside our industry, there could be a material adverse effect on our business, financial condition and results of operations.

Our operations involve environmental risks that may require us to make substantial capital expenditures to remain in compliance or that could give rise to material liabilities.

Our results of operations may be affected by increased costs of complying with the extensive environmental laws to which our business is subject and from any possible contamination of our facilities as a result of accidental spills, discharges or other releases of petroleum or hazardous substances.

Our operations are subject to extensive federal, state and local environmental and health and safety laws and regulations relating to the protection of the environment, including those governing the emission or discharge of pollutants into the air and water, product specifications and the generation, treatment, storage, transportation, disposal or remediation of solid and hazardous waste and materials. Environmental laws and regulations that affect the operations, processes and margins for our refined products are extensive and have become progressively more stringent. Additional legislation or regulatory requirements or administrative policies could be imposed with respect to our products or activities. Compliance with more stringent laws or regulations or more vigorous enforcement policies of the regula tory agencies could adversely affect our financial position and results of operations and could require us to make substantial expenditures. Any noncompliance with these laws and regulations could subject us to material administrative, civil or criminal penalties or other liabilities. For examples of existing and potential future regulations and their possible effects on us, please see “Environmental” in Note 13 in the “Notes to Consolidated Financial Statements.”

Our business is inherently subject to accidental spills, discharges or other releases of petroleum or hazardous substances. Past or future spills related to any of our operations, including our Refineries, pipelines or product terminals, could give rise to liability (including potential cleanup responsibility) to governmental entities or private parties under federal, state or local environmental laws, as well as under common law. This could involve contamination associated with facilities that we currently own or operate, facilities that we formerly owned or operated and facilities to which we sent wastes or by-product for treatment or disposal and other contamination. Accidental discharges could occur in the future, future action may be taken in connection with past discharges, governmental agencies may assess pen alties against us in connection with past or future contamination and third parties may assert claims against us for damages allegedly arising out of any past or future contamination. The potential penalties and clean-up costs for past or future releases or spills, the failure of prior owners of our facilities to complete their clean-up obligations, the liability to third parties for damage to their property, or the need to address newly-discovered information or conditions that may require a response could be significant, and the payment of these amounts could have a material adverse effect on our business, financial condition and results of operations.

Climate change legislation or regulations restricting emissions of “greenhouse gases” could result in increased operating costs and reduced demand for the refined petroleum products we produce.

In December 2009, the U.S. Environmental Protection Agency, or “EPA”, published its findings that emissions of carbon dioxide, methane and other greenhouse gases, or “GHGs,” present an endangerment to public health and the environment because emissions of such gases are, according to the EPA, contributing to the warming of the earth’s atmosphere and other climate changes. These findings allow the EPA to adopt and implement regulations that would restrict emissions of GHGs under existing provisions of the federal Clean Air Act. In response to the endangerment finding, the EPA adopted regulations that require a reduction in emissions of GHGs from motor vehicles and also could trigger permit review for GHG emission from certain stationary sources. The EPA has determined that the motor vehicle GHG emission standards triggered Clean Air Act construction and operating permit requirements for stationary sources beginning on January 2, 2011 when the motor vehicle standards took effect. In June 2010, the EPA published its final rule to address the permitting of GHG emissions from stationary sources under the Prevention of Significant Deterioration, or “PSD,” and Title V permitting programs. This rule “tailors” these permitting programs to apply to certain stationary sources of GHG emissions in a multi-step process, with the largest sources first subject to permitting. Those facilities required to obtain PSD permits for their GHG emissions also will be required to reduce those emissions according to “best available control technology” standards for GHG that have yet to be developed. In October 2009, the EPA also published a final rule requiring the reporting of GHG emissions from specified large GHG emission s ources in the United States, including refineries, on an annual basis, beginning in 2011 for emissions occurring after January 1, 2010. We are currently monitoring GHG emissions in anticipation of preparing and submitting reports on these emissions to the EPA in 2011 and 2012. Legislation to delay or reduce the EPA’s ability to proceed with the regulation of GHGs continues to be considered by the U.S. Congress.

The adoption of any legislation or regulations that requires reporting of GHGs or otherwise limits emission of GHGs from our equipment and operations could require us to incur costs to monitor and report on GHG emissions or reduce emissions of GHGs associated with our operations, and such requirements also could adversely affect demand for the refined petroleum products we produce.

Our operations are subject to various laws and regulations relating to occupational health and safety, which could give rise to increased costs and material liabilities.

The nature of our business may result from time to time in industrial accidents. Our operations are subject to various laws and regulations relating to occupational health and safety. Continued efforts to comply with applicable health and safety laws and regulations, or a finding of non-compliance with current regulations, could result in additional capital expenditures or operating expenses, as well as fines and penalties.

We could incur substantial costs or disruptions in our business if we cannot obtain or maintain necessary permits and authorizations.

Our operations require numerous permits and authorizations under various laws and regulations, including environmental and health and safety laws and regulations. These authorizations and permits are subject to revocation, renewal or modification and can require operational changes, which may involve significant costs, to limit impacts or potential impacts on the environment and/or health and safety. A violation of these authorization or permit conditions or other legal or regulatory requirements could result in substantial fines, criminal sanctions, permit revocations, injunctions and/or refinery shutdowns. In addition, major modifications of our operations could require changes to our existing permits or expensive upgrades to our existing pollution control equipment, which could have a material adverse effect on our business, financial condition or results of operations.

Hurricanes along the Gulf Coast could disrupt our supply of crude oil and our ability to complete capital investment projects in a timely manner.

In 2008 and 2005, tropical hurricanes and related storm activity, such as windstorms, storm surges, floods and tornadoes, caused extensive and catastrophic physical damage in and to coastal and inland areas located in the Gulf Coast region of the United States (parts of Texas, Louisiana, Mississippi and Alabama) and certain other southeastern parts of the United States. Some of the materials we use for our capital projects are fabricated at facilities located along the Gulf Coast. Should other storms of this nature occur in the future, it is possible that the storms and their collateral effects could result in delays or cost increases for our capital investment projects.

In addition, supplies of crude oil to our El Dorado Refinery are sometimes shipped from Gulf Coast production or terminalling facilities. This crude oil supply source could be potentially threatened in the event of future catastrophic damage to such facilities.

We may have labor relations difficulties with some of our employees represented by unions.

Approximately 58 percent of our employees were covered by collective bargaining agreements at December 31, 2010. Our El Dorado Refinery union contract expires in January 2012 and our Cheyenne Refinery union contracts expire March and July 2012, and there is no assurance that we will be able to enter into new contracts on terms acceptable to us or at all. A failure to do so may increase our costs or result in an interruption of our business. See Item 1 “Business-Employees.” In addition, employees may conduct a strike at some time in the future, which may adversely affect our operations.

Terrorist attacks and threats or actual war may negatively impact our business.

Terrorist attacks in the United States and the conflicts in the Middle East, as well as events occurring in response to or in connection with them, including future terrorist attacks against U.S. targets, rumors or threats of war, actual conflicts involving the United States or its allies, or military or trade disruptions affecting our suppliers or our customers, could adversely impact our operations. In addition, any terrorist attack could have an adverse impact on energy prices, including prices for our crude oil and refined products, and an adverse impact on the margins from our refining and marketing operations. As a result, there could be delays or losses in the delivery of supplies and raw materials to us, decreased sales of our products and extensions of time for payment of accounts receivable from our custom ers.

We may not be able to make dividend payments in the future.

Our ability to pay dividends on our common stock is dependent on our operating results and cash flows, which may be subject to certain economic, financial, competitive and other factors that are beyond our control. Restrictions in our credit agreement and senior notes indentures restrict, and similar restrictions in future debt agreements may restrict, our ability to make dividend payments if we do not meet certain financial performance measures. For example, during 2010, we were unable to declare dividends because of our inability to pass the incurrence of additional indebtedness test in our senior notes indentures. We may not be able to pay dividends in the future, or we may change the amount of our dividends or the frequency with which they are paid.

None.

We own an approximately 255 acre site on which the Cheyenne Refinery is located in Cheyenne, Wyoming and an approximately 1,000 acre site on which the El Dorado Refinery is located in El Dorado, Kansas. We lease the approximately two acre site in Henderson, Colorado on which our products and blending terminal is located. We own an approximately 17 acre site on which our products terminal in Sidney, Nebraska is located. We also own a 31 acre site on which a products terminal was previously located in North Platte, Nebraska.

We lease approximately 6,500 square feet of office space in Houston, Texas for our corporate headquarters under a lease expiring in October 2014. We also lease approximately 28,000 square feet of office space in Denver, Colorado under a lease expiring in August 2015 for our refining, marketing and raw material supply operations.

See “Litigation” and “Environmental” in Note 13 in the “Notes to Consolidated Financial Statements.”

We file reports with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports from time to time. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C., 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We are an electronic filer, and the SEC’s Internet site at http://www.sec.gov contains the reports, proxy and information statements, and other information filed electronically.

As required by Section 402 of the Sarbanes-Oxley Act of 2002, we have adopted a code of ethics that applies to our chief executive officer, chief financial officer and principal accounting officer. This code of ethics is posted on our web site. Our web site address is: http://www.frontieroil.com. We make our web site content available for informational purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference in this Form 10-K. We make available on this web site under “Investor Relations,” free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file those materials with, or furnish tho se materials to, the SEC.

Our common stock is listed on the New York Stock Exchange under the symbol FTO. The quarterly high and low sales as reported on the New York Stock Exchange for 2010 and 2009 are shown in the following table:

The approximate number of holders of record for our common stock as of February 18, 2011 was 837. The quarterly cash dividend was $0.05 per share for the quarters ended June 30, 2007 through March 31, 2008. The quarterly cash dividend was $0.06 per share for the quarters ended June 30, 2008 through December 31, 2009. Our 6.875% Senior Notes, our 8.5% Senior Notes and our Revolving Credit Facility may restrict dividend payments based on the covenants related to interest coverage and restricted payments. See Notes 6 and 8 in the “Notes to Consolidated Financial Statements.” During the year ended December 31, 2010, we were contractually unable to declare dividends under the restricted payments provision of our senior notes indentures. However, due to our positive results of operations for the year ended December 31, 2010, we are no longer under these contractual restrictions. On February 21, 2011, our Board of Directors declared a special dividend of $0.28 per share and a quarterly dividend of $0.06 per share, payable on March 21, 2011 to shareholders of record on March 7, 2011.

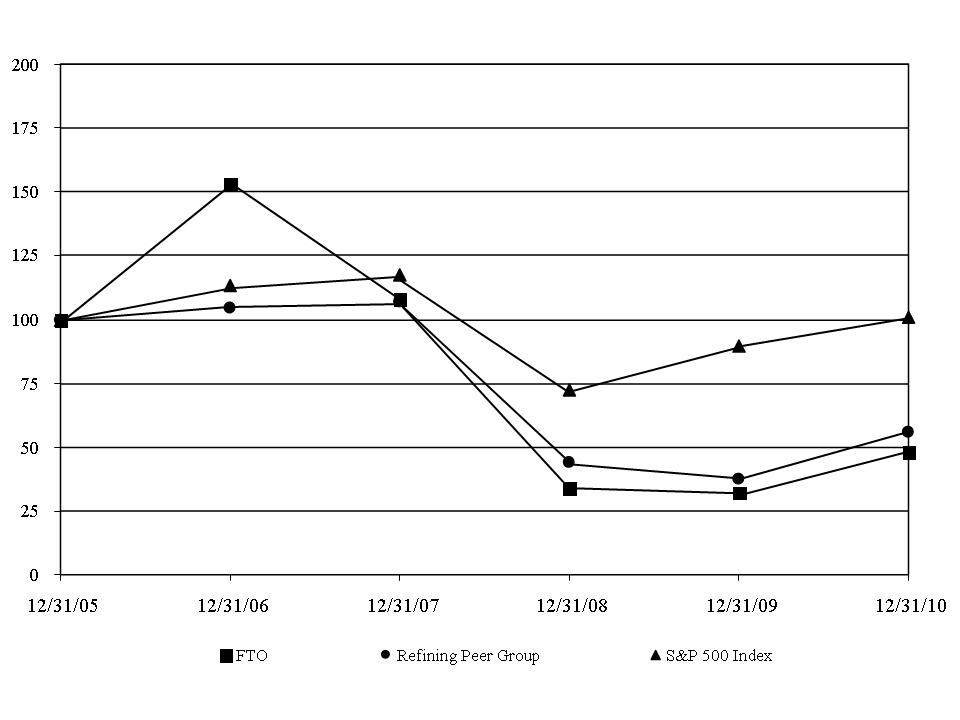

The following graph indicates the performance of our common stock against the S&P 500 Index and against a refining peer group which is comprised of Sunoco Inc., Holly Corporation, Valero Energy Corporation and Tesoro Corporation. The following information in this Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference into such a filing.

Frontier operates Refineries in Cheyenne, Wyoming and El Dorado, Kansas as previously discussed in Part I, Item 1 of this Form 10-K. We focus our marketing efforts in the Rocky Mountain and Plains States regions of the United States. We purchase crude oil to be refined and market refined petroleum products, including various grades of gasoline, diesel, jet fuel, asphalt and other by-products.

To assist in understanding our operating results, please refer to the operating data at the end of this analysis which provides key operating information for our Refineries. Refinery operating data is also included in our quarterly reports on Form 10-Q and on our web site at http://www.frontieroil.com. We make our web site content available for informational purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference in this Form 10-K.

Our Refineries have a total annual average crude oil capacity of approximately 187,000 bpd. The four significant indicators of our profitability, which are reflected and defined in the operating data at the end of this analysis, are the gasoline crack spread, the diesel crack spread, the light/heavy crude oil differential and the WTI/WTS crude oil differential. Other significant factors that influence our financial results are refinery utilization, crude oil price trends, asphalt and by-product margins and refinery operating expenses (including natural gas and maintenance). We typically do not use derivative instruments to offset price risk on our base level of operating inventories. See “Price Risk Management Activities” under Item 7A for a discussion of our utilization of futures trading.

In late 2009, we began taking actions to improve the profitability at our Cheyenne Refinery with the objective of improving profitability at the Refinery by $3 to $4 per barrel (compared to a historical average) by the end of 2011. These actions include a combination of operating expense reductions (including maintenance, personnel, consulting, legal, environmental and water treatment chemicals) and projects aimed at energy efficiency, yield improvements and enhancing the types of crude oil that can be processed at the Refinery. During 2010, in response to an increase in locally available light sweet crudes we have processed a higher percentage of light crude oils and reduced controllable Cheyenne Refinery operating expenses. We are proceeding with a liquefied petroleum gas (“LPG”) recovery ca pital project that will recover significant quantities of saleable propane and butane and other LPGs. We believe that we are on course to meet our objective; however, future profitability of the Cheyenne Refinery cannot be guaranteed and is dependent on factors outside our control, including the price of crude oil.

We had net income for the year ended December 31, 2010 of $37.8 million, or $0.36 per diluted share, compared to a net loss of $83.8 million, or $0.81 per diluted share, for the same period in 2009. Our operating income of $83.8 million for the year ended December 31, 2010 reflected an increase of $189.2 million from the $105.4 million operating loss for the comparable period in 2009. The increase in our results for the year ended December 31, 2010, compared to our net loss for 2009, was due to the improvement of certain profitability indicators during the year ended December 31, 2010, including the average diesel crack spread ($12.59 per barrel in 2010 compared to $8.25 per barrel in 2009), the average gasoline crack spread ($8.18 per barrel in 2010 compared to $7.60 per barrel in 2009), and increased gasoline and diesel yields. During the third quarter of 2010, we experienced a fire in the crude unit at the Cheyenne Refinery. The crude unit was down for 28 days with repair costs of approximately $6.4 million, during which time we also spent approximately $1.8 million on accelerated maintenance.

The Cheyenne Refinery raw material, freight and other costs of $78.10 per sales barrel for the year ended December 31, 2010 increased from $62.17 per sales barrel in the same period in 2009 due to higher average crude oil prices, partially offset by decreased overall crude oil charges, a higher average laid-in crude oil differential and lower purchased products costs. Average crude oil charges of 40,882 bpd for the year ended December 31, 2010 were lower than the 41,475 bpd in 2009 because of the unplanned downtime in the third quarter of 2010 due to the crude unit fire. The heavy crude oil utilization rate at the Cheyenne Refinery expressed as a percentage of the total crude oil charge decreased to 39% in the year ended December 31, 2010, from 50% in 2009. Despite the improvement in the light/heavy crude oil differential, market conditions during most of 2010 favored higher light sweet runs due in large part to the substantial growth of domestic light sweet crude oil supply from areas like the Bakken shale. The average laid-in crude oil differential for the Cheyenne Refinery increased to $6.89 per barrel for the year ended December 31, 2010, due to the widening of the light/heavy crude oil differential, compared to $4.28 per barrel in the same period in 2009. The light/heavy crude oil differential for the Cheyenne Refinery averaged $11.79 per barrel in the year ended December 31, 2010 compared to $6.61 per barrel in 2009.

The El Dorado Refinery raw material, freight and other costs of $77.85 per sales barrel for the year ended December 31, 2010 increased from $60.25 per sales barrel in the same period in 2009 due to higher average crude oil prices, increased overall crude oil charges, and a lower average laid-in crude oil differential. Average crude oil charges were 128,965 bpd for the year ended December 31, 2010, compared to 112,312 bpd in 2009 because of better crude unit utilization and no significant turnarounds. The average laid-in crude oil differential decreased to $2.61 per barrel for the year ended December 31, 2010 compared to $3.31 per barrel in the same period in 2009, despite improved light/heavy and WTI/WTS crude oil differentials, due to a stronger contango market in 2009. We realized a light/heavy crude oi l differential of $8.60 per barrel during 2010 compared to $6.01 per barrel in 2009. For the year ended December 31, 2010, the heavy crude oil utilization rate at our El Dorado Refinery expressed as a percentage of the total crude oil charge was approximately 18%, compared to 15% in 2009. The WTI/WTS crude oil differential increased from an average of $1.65 per barrel in the year ended December 31, 2009 to an average of $2.15 per barrel in 2010.

The Cheyenne Refinery operating expenses, excluding depreciation, were $100.0 million in the year ended December 31, 2010 compared to $109.1 million in 2009. The primary areas of decreased costs were: lower salaries and benefits ($3.3 million) and environmental costs ($11.0 million). The environmental cost decrease is primarily due to a $6.8 million EPA proposed penalty accrual recorded in 2009 and upon settlement in 2010, a reversal of $5.8 million of the penalty accrual partially offset by $1.9 million of pond cleanup and closure costs related to the EPA complaint. These decreased costs were partially offset by increased natural gas costs ($2.5 million due to higher prices and volumes), and increased maintenance costs ($6.4 million attributable to repairs for the crude unit fire in July 2010).The El Dorado Refinery operating expenses, excluding depreciation, were $181.8 million in the year ended December 31, 2010, decreasing from $186.4 million for the year ended December 31, 2009. Cost decreases were realized in lower maintenance costs ($7.0 million), lower environmental expenses ($1.6 million), reduced consulting and legal expenses ($1.1 million), reduced insurance costs ($954,000) and lower additive and chemicals costs ($824,000). The maintenance costs for the year ended December 31, 2009 included $5.8 million for demolition costs related to several capital projects and $1.2 million for repair work related to a spring 2009 storm. Primary areas of increased costs and variance amounts for the 2010 period compared to the 2009 period were: natural gas costs ($3.3 million due to higher prices an d significantly higher volumes), increased electricity costs ($2.0 million due to higher prices and volumes) and higher salaries and benefits ($1.9 million).

Selling and general expenses. Selling and general expenses, excluding depreciation, decreased $11.5 million, or 20%, from $58.7 million for the year ended December 31, 2009 to $47.2 million for the year ended December 31, 2010, due to a decrease in salaries and benefits ($4.5 million), a decrease in stock-based compensation expense ($4.4 million), and $5.3 million net proceeds received in 2010 from insurance related to prior years’ litigation expenses. These decreases were partially offset by higher aircraft maintenance costs ($2.0 million, primarily related to a major engine overhaul), and a $646,000 increase in professional, consulting and other outside services primarily related to litigation costs which resulted in the $5.3 milli on insurance recovery.

Depreciation, amortization and accretion. Depreciation, amortization and accretion includes depreciation on property, plant and equipment, amortization of deferred turnaround and catalyst costs and accretion expenses for asset retirement obligation liabilities. For the year ended December 31, 2010, depreciation, amortization and accretion increased $4.7 million, or 5%, to $104.8 million from $100.1 million in 2009.

Depreciation on property, plant and equipment for the year ended December 31, 2010 increased $7.8 million (including $6.7 million for the El Dorado Refinery and $914,000 for the Cheyenne Refinery) to $81.5 million from $73.7 million in 2009 because of increased capital investments in our Refineries, including the El Dorado Refinery’s catalytic cracker regenerator emission control and reliability projects placed into service in the fourth quarter of 2009 and the gasoil hydrotreater revamp placed into service in late 2009 and the final phase in December 2010.

Deferred turnaround and catalyst amortization for the year ended December 31, 2010 decreased a net $2.0 million (including a $3.6 million increase for the El Dorado Refinery offset by a $5.6 million decrease for the Cheyenne Refinery) to $23.8 million from $25.8 million in 2009. The decrease for the Cheyenne Refinery was primarily due to a deferral to 2011 of certain 2010 turnarounds and catalyst change-outs. The increase for the El Dorado Refinery was due to higher turnaround costs which were incurred in late 2009.

Accretion expense for the year ended December 31, 2010 decreased $1.2 million (including $969,000 for the Cheyenne Refinery and $191,000 for the El Dorado Refinery) to a negative $776,000 compared to positive $376,000 in 2009 due to lowering previous estimates during 2010 for asset retirement obligations.

Interest expense and other financing costs. Interest expense and other financing costs of $32.6 million for the year ended December 31, 2010 increased $4.4 million, or 16%, from $28.2 million in 2009. The increase in interest expense related to a $3.4 million reduction in the amount of capitalized interest, a $1.6 million increase in facility fees on our revolving credit facility, $872,000 increased interest on the Master Crude Oil Purchase and Sale Contracts with Utexam and BNP (“Crude Oil Purchase Arrangements”) (see “Leases and Other Commitments” in Note 13 in the “Notes to Consolidated Financial Statements”), and a $750,000 loss on the early extinguishment of our 6.625% Senior Notes. The increased expense relat ed to the Crude Oil Purchase Arrangements resulted from higher utilization of these arrangements during 2010 than during 2009 due to our increased Canadian crude oil purchases. Capitalized interest for the year ended December 31, 2010 was $1.9 million compared to $5.3 million in 2009. These increases were partially offset by our interest rate swaps which reduced our interest expense by a net $2.0 million from 2009, and a decrease of $850,000 due lower interest expense on income tax contingencies. Average debt outstanding (excluding amounts reflected as accounts payable under the Crude Oil Purchase Arrangements) increased to $353.5 million during the year ended December 31, 2010 from $350.0 million for the same period in 2009.

Interest and investment income. Interest and investment income during the year ended December 31, 2010 was $2.3 million and was an increase of $66,000, or 3%, compared to the year ended December 31, 2009. During the year ended December 31, 2010, we had $884,000 more interest income on federal and state tax refunds than in the comparable period of 2009. This was offset by $737,000 less interest income on our cash investments and other miscellaneous interest, resulting from decreased interest rates on invested cash. We also had $82,000 less investment income in 2010 compared to 2009.

Provision for income taxes. The provision for income taxes for the year ended December 31, 2010 was $15.8 million on pretax income of $53.6 million (or 29.5%) compared to a $47.5 million benefit on a pretax loss of $131.3 million (or 36.2%) in 2009. The change in the effective tax rate is due to a decrease of 10.6% in the state effective tax rate, partially offset by an increase in the federal effective tax rate of 3.9% for the year ended December 31, 2010 compared to 2009. The state effective tax rate of a negative 3.2% on pretax income for the year ended December 31, 2010 includes a 6.8% decrease from the benefit of Kansas income tax credits and the reversal of state income tax contingencies. The state effective tax benefit of 7.4% on a pretax loss for the year ended December 31, 2009 included a 3.4% benefit from Kansas income tax credits. The federal effective tax rate of 32.7% on pretax income for the year ended December 31, 2010 includes a 2.1% reduction from the Section 199 production activities deduction, a 1.3% reduction from permanent book-tax differences and a 1.1% increase from the state tax benefit. The federal effective tax benefit of 28.8% on a pretax loss for the year ended December 31, 2009 included reductions to the effective federal rate of 2.6% from the state income tax benefit, and 2.9% from permanent book-tax differences. The Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010, the American Recovery and Investment Act of 2009, the Housing and Economic Recovery Act of 2008 and the Energy Policy Act of 2005 which added Section 179C to the Internal Revenue Code, all provided accelerated deductions for our capital projects placed into service in both years. These ac celerated deductions, while not impacting the effective tax rate, were major factors in reducing our 2010 taxable income and contributing to our 2009 taxable loss. Our 2010 and 2009 income tax provisions included the benefit from $2.9 million and $4.5 million, respectively, of Kansas income tax credits for expansion projects at our El Dorado Refinery. See “Income Taxes” in Note 9 in the “Notes to Consolidated Financial Statements” for more information on our income taxes and detailed information on our deferred tax assets.

2009 Compared with 2008

Overview of Results

We had a net loss for the year ended December 31, 2009, of $83.8 million, or $0.81 per diluted share, compared to net income of $226.1 million, or $2.18 per diluted share, for the same period in 2008. Our operating loss of $105.4 million for the year ended December 31, 2009 reflected a decrease of $456.8 million from the $351.4 million operating income for the comparable period in 2008. The decrease in our results to a net loss for the year ended December 31, 2009, compared to our net income for 2008, was due to the decline of the average diesel crack spread ($8.25 per barrel in 2009 compared to $24.59 per barrel in 2008), and the crude oil differentials. The light/heavy crude oil differential decreased from $17.38 per barrel for the year ended December 31, 2008 to $6.34 per barrel for the comparable peri od of 2009. The WTI/WTS crude oil differential decreased from $3.92 per barrel for the year ended December 31, 2008 to $1.65 per barrel for the comparable period of 2009. Our results did benefit slightly from a higher average gasoline crack spread during the year ended December 31, 2009 ($7.60 per barrel) than in 2008 ($4.75 per barrel).

Product yields and sales volumes were higher during the year ended December 31, 2009 compared to 2008 because of a 25,000 bpd increase in capacity that resulted from the crude vacuum tower project and the major turnaround work completed at the El Dorado Refinery during the second quarter of 2008. In addition, during the first quarter of 2009, we received the benefit, primarily at our El Dorado Refinery, from purchasing discounted WTI crude oil versus a NYMEX WTI benchmark price because of the excess supply of crude oil at Cushing, Oklahoma. This crude benefit moderated during the remainder of 2009.

Specific Variances

Refined product revenues. Refined product revenues decreased $2.10 billion, or 33%, from $6.34 billion to $4.24 billion for the year ended December 31, 2009 compared to 2008. This decrease was due to a decrease in average product sales prices ($37.83 lower per sales barrel) partially offset by higher product sales volumes in 2009 (8,900 more bpd). Sales prices decreased primarily because of lower crude oil prices, and correspondingly lower refined product prices, during 2009 compared to 2008.

Manufactured product yields. Yields increased 9,314 bpd at the El Dorado Refinery (as described above) and decreased 1,940 bpd at the Cheyenne Refinery for the year ended December 31, 2009 compared to 2008.

Other revenues. Other revenues decreased $162.4 million to a $5.8 million loss for the year ended December 31, 2009 compared to a $156.6 million gain for 2008, the primary source of which was $11.7 million in net realized and unrealized losses from derivative contracts to hedge in-transit crude oil and excess inventories during the year ended December 31, 2009 compared to $146.5 million in net realized and unrealized gains from derivative contracts to hedge in-transit crude oil and excess inventories in 2008. See “Price Risk Management Activities” under Item 7A and Note 14 in the “Notes to Consolidated Financial Statements” for a discussion of our utilization of commodity derivative contracts. We had gasoline sulfur credit sal es of $1.9 million in 2009 compared to $4.6 million in 2008 and $4.6 million of ethanol RIN sales in 2009 compared to $4.5 million in 2008.

Raw material, freight and other costs. Raw material, freight and other costs decreased by $1.83 billion, or 32%, during the year ended December 31, 2009, from $5.72 billion in 2008 to $3.89 billion in 2009. The decrease in raw material, freight and other costs was due to lower average crude oil prices and decreased purchased products, partially offset by increased overall crude oil charges and lower crude oil differentials during the year 2009 compared to 2008. The average NYMEX WTI priced on the New York Mercantile Exchange was $61.82 per barrel for the year ended December 31, 2009 compared to $99.75 per barrel for the year ended December 31, 2008. Average crude oil charges were 153,786 bpd for the year ended December 31, 2009 compared to 142,938 bpd in 2008.

The Cheyenne Refinery raw material, freight and other costs of $62.17 per sales barrel for the year ended December 31, 2009 decreased from $89.29 per sales barrel in the same period in 2008 due to lower average crude oil prices and lower purchased products costs, partially offset by lower light/heavy crude oil differentials and decreased overall crude oil charges. Average crude oil charges of 41,475 bpd for the year ended December 31, 2009 were lower than the 43,590 bpd in 2008 because of the intentional reduction in charges during part of the year due to the low refined product margins. The heavy crude oil utilization rate at the Cheyenne Refinery expressed as a percentage of the total crude oil charge decreased to 50% in the year ended December 31, 2009, from 76% in 2008 because we chose to process more light crud e oils due to the narrowing of the light/heavy crude differential in 2009 (and thus the economic benefit of heavy crude oil). The light/heavy crude oil differential for the Cheyenne Refinery averaged $6.61 per barrel in the year ended December 31, 2009 compared to $17.15 per barrel in 2008.

The El Dorado Refinery raw material, freight and other costs of $60.25 per sales barrel for the year ended December 31, 2009 decreased from $95.84 per sales barrel in the same period in 2008 due to lower average crude oil prices, partially offset by increased overall crude oil charges and lower crude oil differentials. Average crude oil charges were 112,312 bpd for the year ended December 31, 2009, compared to 99,347 bpd in 2008. The increase in average crude oil charges was due to the 25,000 bpd increase in capacity that resulted from the crude vacuum tower project and the major turnaround work completed at the El Dorado Refinery in the second quarter of 2008. We realized a light/heavy crude oil differential of $6.01 per barrel during 2009 compared to $17.85 per barrel in 2008. For the ye ar ended December 31, 2009, the heavy crude oil utilization rate at our El Dorado Refinery expressed as a percentage of the total crude oil charge was approximately 15%, compared to 17% in 2008. The WTI/WTS crude oil differential decreased from an average of $3.92 per barrel in the year ended December 31, 2008 to an average of $1.65 per barrel in 2009.

Refinery operating expenses. Refinery operating expenses, excluding depreciation, decreased $2.9 million, to $295.5 million in the year ended December 31, 2009 from $298.4 million in 2008.

The Cheyenne Refinery operating expenses, excluding depreciation, were $109.1 million in the year ended December 31, 2009 compared to $105.4 million in 2008. The increased expenses for 2009 compared to 2008 included: increased environmental costs ($7.7 million, primarily due to an accrual for a proposed EPA penalty), increased salaries and benefits ($4.6 million, including $2.7 million of increased bonus expense), increased electricity costs ($852,000) and increased water costs ($859,000). These increases were partially offset by decreased maintenance costs ($5.4 million) as 2008 maintenance costs included various unplanned tank, coker repairs and outages, decreased natural gas costs ($2.5 million due to decreased prices partially offset by higher volumes), and decreased consulting and legal expenses ($1.2 million).

The El Dorado Refinery operating expenses, excluding depreciation, were $186.4 million in the year ended December 31, 2009, decreasing from $193.0 million for the year ended December 31, 2008. Natural gas costs decreased by $17.5 million due to lower volumes and prices, partially offset by increased costs in several areas. The primary areas of increased costs for the 2009 period compared to the 2008 period were: increased salaries and benefits ($5.5 million, including $2.0 million of increased bonus expense), increased electricity costs ($2.8 million), increased environmental costs ($1.5 million) and higher property taxes ($1.1 million).

Selling and general expenses. Selling and general expenses, excluding depreciation, increased $14.5 million, or 33%, from $44.2 million for the year ended December 31, 2008 to $58.7 million for the year ended December 31, 2009, primarily due to a $14.0 million increase in salaries and benefits (which included a $9.8 million increase in bonus expense and an increase in deferred compensation expense of $2.2 million).

Depreciation, amortization and accretion. Depreciation, amortization and accretion increased $11.4 million or 13%, to $100.1 million for the year ended December 31, 2009 from $88.7 million in 2008.

Depreciation on property, plant and equipment for the year ended December 31, 2009 increased $8.5 million (including $5.3 million for the El Dorado Refinery and $3.2 million for the Cheyenne Refinery) to $73.7 million from $65.2 million in 2008 because of increased capital investments in our Refineries, including the phase one completion of the gasoil hydrotreater revamp and the catalytic cracker reliability projects at the El Dorado Refinery placed into service in the fourth quarter of 2009 as well as the El Dorado Refinery’s crude unit and vacuum tower expansion project placed into service in the second quarter of 2008. The Cheyenne Refinery’s depreciation increased due to numerous projects placed into service in 2009, including facility site improvements and safety and environmental projects.

Deferred turnaround and catalyst amortization for the year ended December 31, 2009 increased $2.9 million (including a $1.2 million increase for the El Dorado Refinery and a $1.7 million increase for the Cheyenne Refinery) to $25.8 million from $22.9 million in 2008.

Interest expense and other financing costs. Interest expense and other financing costs of $28.2 million for the year ended December 31, 2009 increased $13.1 million, or 86%, from $15.1 million in 2008. The increase in interest expense primarily related to $12.1 million more interest expense on the 8.5% Senior Notes (issued in September 2008). Other increases included $1.2 million more of interest expense on income tax contingencies, $715,000 more of debt discount and finance cost amortization expense (due to the 8.5% Senior Notes) and $529,000 increased interest and facility fees on our revolving credit facility. Capitalized interest for the year ended December 31, 2009 was $5.3 million compared to $6.6 million in 2008. These ne gative variances were partially offset by $2.2 million less interest expense on the Utexam Master Crude Oil Purchase and Sale Contract (“Utexam Arrangement”) (see “Leases and Other Commitments” in Note 13 in the “Notes to Consolidated Financial Statements”). We utilized the Utexam facility less during 2009 than during 2008 as we purchased less Canadian crude oil. Average debt outstanding (excluding amounts reflected as accounts payable under the Utexam Arrangement) increased to $350.0 million during the year ended December 31, 2009 from $214.4 million for the same period in 2008.

Interest and investment income. Interest and investment income decreased $3.1 million, or 58%, from $5.4 million in the year ended December 31, 2008 to $2.3 million in the year ended December 31, 2009, due to $5.9 million less interest income resulting from lower interest rates on invested cash, offset by investment gains of $967,000 in 2009 compared to investment losses of $1.8 million in 2008.

Provision for income taxes. The benefit for income taxes for the year ended December 31, 2009 was $47.5 million on a pretax loss of $131.3 million (or 36.2%) compared to a $115.7 million provision on pretax income of $341.7 million (or 33.9%) in 2008. In 2009, we adopted the LIFO inventory method for GAAP purposes and retrospectively adjusted our previously reported financial statements. For income tax reporting purposes, the effective date of utilizing the LIFO inventory method was January 1, 2009, resulting in a book to tax basis difference in inventory. Utilizing the LIFO method of accounting for inventory for both GAAP and income taxes greatly contributed to the 2009 tax net operating loss, which we carried back to 2005 (as provided for under The Worker, Homeownership and Business Assistance Act of 2009) to offset previously reported taxable income which resulted in refunds received during 2010 of $73.5 million. Our estimated 2009 taxable loss also included accelerated deductions resulting from filing for a change in accounting method for income taxes for certain expenditures which are capitalized and depreciated under GAAP but which we will be allowed to deduct in the year incurred for income tax purposes. The Housing and Economic Recovery Act of 2008 and the American Recovery and Investment Act of 2009 also provided accelerated tax depreciation for our capital projects which were started after January 1, 2008 and which we placed into service in 2009 and 2008. This accelerated deduction allows an expense deduction of 50% of such costs in the year the qualified projects are placed in service with the remaining costs depreciable under regular tax depreciation rules. The Energy Policy Act of 2005 added Section 179C to the Internal Revenue Code which provides an accelerated deduction for qualified capital costs incurred to expand an existing refinery. This accelerated deduction allows an expense deduction of 50% of such costs in the year the qualified projects are placed in service with the remaining costs depreciable under regular tax depreciation rules. These accelerated deductions were major factors in our 2009 and 2008 taxable losses. Our 2009 and 2008 income tax provisions included the benefit from $4.5 million and $23.3 million, respectively, of Kansas income tax credits for expansion projects at our El Dorado Refinery. See “Income Taxes” in Note 9 in the “Notes to Consolidated Financial Statements” for more information on our income taxes and detailed information on our deferred tax assets.

Liquidity and Capital Resources

Cash flows from operating activities. Net cash provided by operating activities was $232.2 million for the year ended December 31, 2010 compared to net cash provided by operating activities of $140.9 million during the year ended December 31, 2009.

Working capital changes provided a total of $106.1 million in 2010 and $94.5 million of cash in 2009. The 2010 net working capital changes primarily resulted from decreased receivables of $79.0 million, increased payables of $29.6 million and decreased inventories of $12.6 million, offset by working capital usages of $16.7 million due to decreased current accrued liabilities. The net decrease in receivables during 2010 was comprised of decreases in income tax and other receivables of $128.8 million (income tax refunds received are discussed below) offset by an increase in trade receivables of $49.8 million. During 2009, the working capital changes provided $94.5 million which primarily resulted from a $171.5 million increase in payables and a $28.8 million decrease in other current assets, offset by a $57 .0 million increase in inventory and a $56.0 million increase in receivables.

We received income tax refunds of $137.1 million and made estimated federal and state income tax payments of $48.1 million and $74,000, respectively, during the year ended December 31, 2010. The federal income tax payments included $18.1 million made in connection with unresolved audit issues for 2005 and 2006 taxes regarding the deductibility for income tax purposes of certain stock-based compensation for executives. The Company filed a petition for a redetermination of this deficiency with the U.S. Tax Court on September 22, 2010. As of December 31, 2010, we had estimated receivables for federal income taxes of $48.9 million and state income taxes of $426,000. Of these income tax receivables, we expect to receive $16.0 million of the federal income tax receivables and have received all of the state income tax receivables during the first quarter of 2011. The timing for the receipt of $30.6 million of the federal income tax receivable is uncertain as these relate to the carryback of net operating losses to 2005 and 2006 and, as discussed above, these years are currently in the jurisdiction of the U.S. Tax Court.

At December 31, 2010, we had $558.6 million of cash and cash equivalents, working capital of $543.4 million and $208.0 million available for borrowings under our revolving credit facility. Our operating cash flows are affected by crude oil and refined product prices and other risks as discussed in Item 7A “Quantitative and Qualitative Disclosures About Market Risks.”

Cash flows used in investing activities. Capital expenditures during the year ended December 31, 2010 were $84.6 million, which included approximately $47.1 million for the El Dorado Refinery and $37.0 million for the Cheyenne Refinery. The $47.1 million of capital expenditures for our El Dorado Refinery included $21.6 million on the gasoil hydrotreater revamp (completed in December 2010 at a total cost of $94.4 million, including capitalized interest), as well as operational, payout, safety, administrative, environmental and optimization projects. The $37.0 million of capital expenditures for our Cheyenne Refinery included $9.7 million for the FCCU gas hydrotreater project, $7.7 million for the liquefied petroleum gas (“LPG”) recovery pr oject, $2.8 million on the groundwater boundary wall control system, as well as environmental, operational, safety, administrative and payout projects. We funded our 2010 capital expenditures with cash generated from our operations.

Cash flows from financing activities. During the year ended December 31, 2010, we paid $6.6 million in dividends. Treasury stock increased by 267,583 shares ($3.6 million) from stock surrendered by employees to pay minimum withholding taxes on 2010 vestings of stock-based compensation. During the fourth quarter of 2010 we paid $150.0 million to redeem the principal of our 6.625% Senior Notes and received net proceeds (after underwriting fees) of $147.0 million upon issuance of our $150.0 million 6.875% Senior Notes.

As of December 31, 2010, we had $347.8 million of long-term debt and no borrowings under our revolving credit facility. We had $292.0 million of outstanding letters of credit under our revolving credit facility. We were in compliance with the financial covenants of our revolving credit facility as of December 31, 2010. We had shareholders’ equity of $986.5 million as of December 31, 2010.

Our Board of Directors declared a regular quarterly cash dividend of $0.06 per share in November 2009, which was paid in January 2010. During the remainder of 2010, we were unable to declare dividends because of our inability to satisfy the incurrence of additional indebtedness test of our Senior Notes. However, because of our positive results from operations for the year ended December 31, 2010, we are no longer limited by these contractual restrictions. On February 21, 2011, our Board of Directors declared a special dividend of $0.28 per share and a quarterly dividend of $0.06 per share, payable on March 21, 2011 to shareholders of record on March 7, 2011.

Future Capital and Turnaround Expenditures