P.O. Box 370

KIRKLANDLAKE, ON, P2N 3J7

Symbol – TSX & AIM:KGI

August 2nd, 2006

KIRKLAND LAKE GOLD’S FISCAL 2006 RESULTS

GOLD RESERVES INCREASE TO OVER 1 MILLION OUNCES

Kirkland Lake Gold Inc (the “Company”) announces its financial results for the fourth quarter and fiscal year ended April 30th, 2006 and its year end gold reserve and resource estimates for its operations in Kirkland Lake, Ontario, Canada.

Financial Results and Reserve and Resource Overview

During the fourth quarter of 2006 operations processed 45,576 tons of ore grading 0.374 ounces of gold per ton for production of 16,597 ounces and 58,214 ounces for the fiscal year.

Operating revenue for the quarter based on ounces produced was $11,001,653 using a realized gold price of $662.87 per ounce (versus actual gold sales for the quarter of $10,607,889) and operating costs were $9,343,752 (with the negative impact of $1,438,418 of “exogenous” costs (related with power & gas issues, Amortization & Depletion correction and several other of minor consequence).

In the fourth quarter the Company expensed $1,379,114 of exploration costs and which were included in the loss of $2,463,054 for the fourth quarter. This loss in the fourth quarter brings the net loss for the year to $6,456,560 or $0.13 per share compared with $28,164,305 ($0.68 per share) for Fiscal 2005 in which all exploration expenditures for the year were expensed.

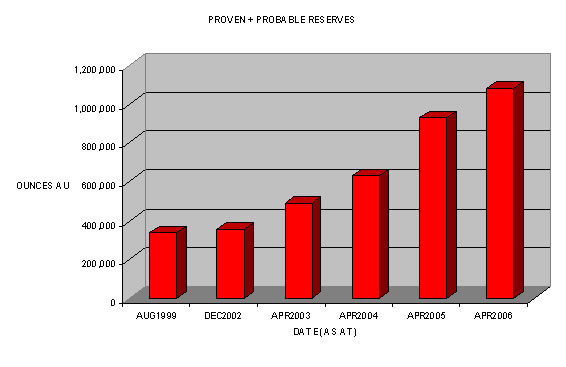

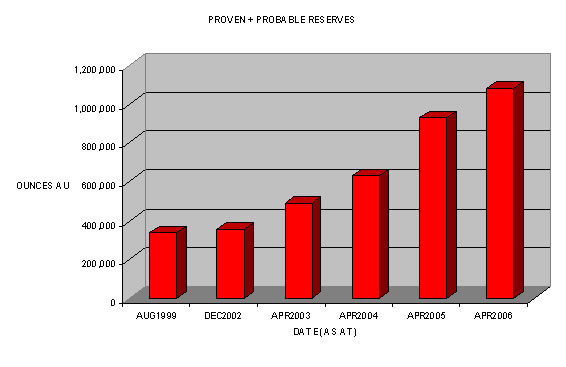

Proven and Probable gold reserves as at April 30th, 2006 are reported at 1,085,660 ounces, a more than three fold increase since December 2002. Measured and indicated gold resources now stand at 697,210 ounces and inferred gold resources are estimated at 525,000 ounces.

In fiscal 2006, exploration was responsible for a net increase of 131,860 ounces of gold in all categories except inferred resources and 331,100 ounces in the inferred resource category, and the drill cost per ounce found for these additional ounces is $5.34/ounce found.

The discovery of the New South Zone (the discovery hole contained 90.4 feet intersection assaying 2.3 ounces per ton of gold and a follow up hole contained a 124.4 foot intersection of 1.4 ounces per ton of gold) early in fiscal 2006 has been the most important new discovery to date in the 4 year exploration campaign. The decision to develop a production drift to this new zone from the 5300 level will establish a platform for significant increases to reserves and resources over the 14 gold zones now identified to the south of the Main Break due to more efficient drilling from this drift.

- 2 -

“While the Company is pleased with the annual exploration results, it has re-committed its management efforts to reduce its operating costs per ton to below $170 per ton of ore." said Brian Hinchcliffe, CEO. "The Company wishes to thank Bob Rodrique for his time as CFO and note the appointment of John Thompson as interim CFO. "

Production and Financial Detailed Review

Financial Results Update

Total gold production for the fiscal year was 58,314 ounces versus a forecast of 90,000 ounces, however this production exceeded fiscal 2005 by 27% or 12,450 ounces. Acute manpower shortages, periodic excessive dilution, mechanical problems and productivity shortfalls hampered ore and gold production during the fiscal year where the average grade of the ore processed by the mill was 0.374 ounces of gold per ton (which grade is below both the budgeted and historical grades). Steps taken during the year to address these problems include:

| | a) | Development of a Safety and Training department which has significantly improved the Company’s safety performance; and |

| | | |

| | b) | A formal 10 week training program to develop apprentice miners from qualified recruits, a vital requirement in today’s labour market shortage; and |

| | | |

| | c) | Expansion of last year’s program of increased underground mechanization which has included the design and development of custom equipment for drilling. |

The Company incurred a loss for the year ended April 30, 2006 of $6,456,560 or $0.13 per share, which compares with a loss of $28,159,185 or $0.68 per share reported for fiscal 2005. Gold revenues were 58.5% higher at $35,122,603, (2005- $22,156,105), with 63% of the increase due to gold price increases and 37% due to higher production. Operating costs reduced to $30,834,472, (2005- $36,217,949). This decrease was a function of volume and improved productivity from the considerable investments made in training, modernizing and upgrading infrastructure and equipment.

The Company continues an aggressive exploration program to fully develop the exploration potential of its mining properties, with annual exploration expenditures of $5,024,637 (2005-$8,127,896).

| Financial Highlights | | | |

| (all amounts in thousands of Canadian dollars, except shares and per share figures) |

| | | | |

| | 12 months | 12 months | 12 months |

| | ended | ended | ended |

| | April 30 | April 30 | April 30 |

| | 2006 | 2005 | 2004 |

| Revenue | 35,123 | 22,156 | 9,807 |

| Operating Costs | 30,834 | 36,218 | 25,045 |

| Exploration Expenditure | 5,025 | 8,127 | 3,124 |

| Net (loss) | (6,457) | (28,159) | (22,616) |

| Per share (basic and diluted) | (0.13) | (0.68) | (0.76) |

- 3 -

| Financial Highlights | | | |

| (all amounts in thousands of Canadian dollars, except shares and per share figures) |

| | | | |

| | 12 months | 12 months | 12 months |

| | ended | ended | ended |

| | April 30 | April 30 | April 30 |

| | 2006 | 2005 | 2004 |

| Cash Flow (used) for operating activities | (4,804) | (25,849) | (17,545) |

| Cash Flow from financing activities | 20,169 | 32,676 | 36,715 |

| Cash Flow (used) for investing activities | (14,586) | (9,915) | (11,114) |

| Net increase (decrease) in cash | 779 | (3,088) | 8,056 |

| Cash at end of period | 9,412 | 8,633 | 11,721 |

| Total Assets | 60,767 | 47,735 | 40,530 |

| Total Liabilities | 11,784 | 12,006 | 12,690 |

| Working Capital | 6,805 | 3,976 | 3,443 |

| Weighted average number of shares | | | |

| outstanding | 48,118,378 | 41,611,019 | 29,693,146 |

Exploration and Ore Reserve Update

The Company has estimated its gold reserves and resources as of April 30, 2006 are as follows:

| Summary | As at Dec, 2002 | As at 30 April, 2005 | As at April 30, 2006 |

| Reserves | PROVEN | PROBABLE | PROVEN | PROBABLE | PROVEN | PROBABLE |

| Tons | 432,000 | 368,000 | 1,151,000 | 872,000 | 1,164,000 | 1,147,000 |

Grade

(oz./ton) | 0.41

| 0.49

| 0.43

| 0.50

| 0.44

| 0.50

|

Ounces of

Gold | 176,700

| 179,600

| 492,000

| 435,000

| 509,000

| 574,000

|

| | | | | | | |

Resources

(excluding

inferred) | MEASURED

| INDICATED

| MEASURED

| INDICATED

| MEASURED

| INDICATED

|

| Tons | 876,000 | 2,192,000 | 921,000 | 1,029,000 | 911,000 | 1,055,000 |

Grade

(oz./ton) | 0.38

| 0.28

| 0.38

| 0.36

| 0.36

| 0.35

|

Ounces of

Gold | 329,600

| 615,100

| 349,000

| 372,000

| 331,000

| 369,000

|

| | | | | | | |

| Total | | | | | | |

| Tons | 3,868,000 | 3,972,100 | 4,275,700 |

| Grade | 0.34 | 0.41 | 0.42 |

Ounces of

Gold | 1,301,000

| 1,647,800

| 1,782,500

|

| Inferred Resources as at April 30 | | | |

| 2005 | 732,000 | 0.44 | 322,000 |

| 2006 | 1,054,000 | 0.50 | 523,000 |

- 4 -

Since resumption of production in January, 2003, the Company increased reserves plus resources (excluding inferred) by 47% to 1,782,500 ounces of gold, including production of approximately 128,500 ounces over that period.

Ounces in proven plus probable reserves:

The full breakdown of the reserves and resources can be seen on the Company’s website. An independent audit of the reserve and resource estimate as at April 30, 2006 has been undertaken by Glenn R. Clark, P. Eng., of Glenn R. Clark & Associates Limited (an independent ‘Qualified Person’ for the purposes of National Instrument 43-101), and his report dated July 18, 2006 can be viewed on the Company’s website (www.klgold.com) and on SEDAR (www.sedar.com).

Notes:

| | 1. | The reserves and resources are estimated using the polygonal method. |

| | 2. | All intersections are calculated out to a 5.0 foot minimum horizontal mining width. |

| | 3. | Dilution is added to reserves at varying rates depending on mining method, and the width of the ore. Dilution in the reserve estimate overall averages 28.4% at 0.02 ounces of gold per ton. All higher grades are cut to 3.50 ounces of gold per ton. The cut-off is 0.25-0.30 ounces of gold per ton over the horizontal mining width. Cut-off grades of 0.25 oz/ton Au and 0.35 oz/ton Au are used for reserves depending on the location, and economics of the block. Generally, a cut-off of 0.32 is required on a whole-block basis to achieve profitability. It is possible to have sub-blocks within an ore reserve block that assay less than any cut-off which have been incorporated for mining or geotechnical reasons. Ore blocks that grade between 0.20 and the cut-off have been classified as resource. |

| | 4. | The area of influence of the proven and measured categories are 30 feet from development chip samples, probable and indicated categories are 50 feet of radius from a known sample point (drill holes); inferred is another 50 feet of influence. |

| | 5. | A 94% tonnage recovery is used. Continuity of the veins appears very good. |

| | 6. | The assumptions used include $490.00 U.S. per ounce of gold, and an exchange rate of $1.19 Canadian=U.S. $1.00 ($584.00 Canadian per ounce = 3 year average). |

| | 7. | The Company is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing or other issue that may materially affect its estimate of mineral resources. |

| | 8. | Mineral resources which are not mineral reserves do not have demonstrated economic viability. |

- 5 -

| | 9. | The mineral reserves are not part of the mineral resources. |

FISCAL 2006 EXPLORATION UPDATE

The goal of the original 3-year exploration program was to drill large structures at 500-1000 foot centres to identify areas that would have the potential to host up to 15 million tons of ore (using 25% of the total area). Follow-up drilling would be required to elevate ore discovered to resources (200 foot centres) and additional follow-up drilling would be required to elevate ore discovered to reserves (30 to 100 foot centres). Upon successful intersection of ore-grade, resource and reserve drilling would immediately proceed.

The most significant result from the drilling in the 2006 fiscal year was the discovery of the New South Zone on the Macassa Property. The discovery hole, and follow-up wedged hole, intersected 90.4 feet assaying 2.3 ounces (uncut) and 1.43 (uncut) ounces of gold per ton over 124.5 feet of core length (uncut) respectively. The dimensions at this time indicate a potential dip component of 1,300 feet for the zone between the 5100 and 5500 elevations, and a strike component of 500 feet. The LK Zone discovery hole 45-911A, which intersected 26.21 ounces of gold per ton (uncut, or 1.43 ounces per ton cut) over a core length of 6.0 feet appears to be an extension of the new discovery, adding an additional 200 feet of potential strike length.

To date, 14 mineralized zones have been identified south of the mine workings, eight of which are in the area encompassing the New South/LK Zone. In house metallurgical testing on core samples submitted from the New South Zone indicates that a 96.2% recovery may be achieved by using standard milling procedures.

As of July 22, 2006, the new 5300 exploration drift has been driven 1452 feet to the south with drill bays completed and closer spaced drilling at 100 foot centers using smaller air machines has started on the Lower D Zone. This program is designed to both convert inferred resources to indicated resources and further expand the Lower D Zone north.

At its closest point, the Lower D Zone is located 1200 feet south of the operational workings on 5025 level and the #6 Splay is 900 feet to the south. A new drift is planned to be driven in fiscal 2007. At the 5025 level, the Lower D is now known to be virtually continuous ore for 1050 feet, followed by a further 850 feet of unexplored distance to the next drill hole that is also ore. Plans are also underway to advance a new drift on 5025 level in fiscal 2007. This will allow for the mining of the Lower D and #6 Splay. The additional ore that will be added to production, as a result of this development, will further decrease the mine’s cost per ton

Queenston Mining Inc. and the Company have a 50%-50% joint venture to explore the Kirkland Lake West (“KLW”) property owned by Newmont Mining Corporation of Canada Limited (“Newmont”). The KLW property, which adjoins the western boundary of the Company’s properties, is thought to contain the extension of the western side of a major north/south fault of the Main/04 Break ore horizon which produced 24 million ounces of gold over the previous 90 years. The two properties are separated by a major north-south structural fault.

An exploration drill program was undertaken in the Corporation’s 2006 fiscal year, primarily funded by ‘flow-through’ investments made by Canadian investors which entitle the investors to certain tax write-offs. A total of $3.25 million was spent on drilling (2005- $7.23 million), with $1.92 million in exploration drilling (2005- $5.7 million), with a further $1.66 million spent in exploration development and rehabilitation (2005- $1.3 million). A total of 113,000 feet of exploration drilling took place. The average cost was $15.79 per foot.

- 6 -

Positive exploration results also continued to be obtained from the Upper D, Lower D, #2 Shaft area, ’04 Break above the 38 level towards surface, and the '05 Zone. The Company was successful on all underground drilling, with a success ratio at or better than the projected 25%.

FISCAL 2007 EXPLORATION – LOOKING FORWARD

Looking forward, the Company plans to focus its exploration efforts on underground drilling delineating the newly discovered areas and zones to the south. This and other newly-discovered mineralized zones, and extensions of those found through this successful exploration, will increase the ore resources and reserves of the Corporation.

About the Company

The Company purchased the Macassa Mine and the 1,500 ton per day mill along with four former producing gold properties – Kirkland Minerals, Teck-Hughes, Lake Shore and Wright Hargreaves – in December 2001. These properties, which have historically produced some 22 million ounces of gold, extend over seven kilometres between the Macassa Mine on the east and Wright Hargreaves on the west and, for the first time, are being developed and explored under one owner. This camp is located in the Abitibi Southern Greenstone Belt of Kirkland Lake, Ontario, Canada.

The results of the Company’s underground diamond drilling program have been reviewed, verified (including sampling, analytical and test data) and compiled by the Company's geological staff (which includes a ‘qualified person’, Michael Sutton P.Geo., the Company’s Chief Geologist, for the purpose of National Instrument 43-101,Standards of Disclosure for Mineral Projects, of the Canadian Securities Administrators).

The Company has implemented a quality assurance and control (QA/QC) program to ensure sampling and analysis of all exploration work is conducted in accordance with the best possible practices. The drill core is sawn in half with half of the core samples shipped to the Swastika Laboratories in Swastika, Ontario or to the Macassa mine laboratory for analysis. The other half of the core is retained for future assay verification. Other QA/QC includes the insertion of blanks, and the regular re-assaying of pulps/rejects at alternate certified labs (Polymet, Accurassay). Gold analysis is conducted by fire assay using atomic absorption or gravimetric finish. The laboratory re-assays at least 10% of all samples and additional checks may be run on anomalous values.

The Company’s Kirkland Lake properties are the subject of a report prepared by Roland H. Ridler, B.A.Sc.(hons.), M.A.Sc., Ph.D.(Econ.Geol.), P.D., entitledKirkland Lake Mineral Properties (Macassa Mine, Kirkland Lake Gold, Teck-Hughes, Lake Shore, Wright-Hargreavesdated November 30, 2001. The reserve and resource estimates for the Macassa Property as at April 30, 2006 were made by Glenn R. Clark, P.Eng. of Glenn R. Clark & Associates Limited. The estimates are contained in his report dated July 18, 2006 entitledReview of Resources and Reserves, Macassa Mine, Kirkland Lake, Ontario. Both of these technical reports have been filed on SEDAR (www.sedar.com).

- 7 -

For further information, please contact:

| Brian Hinchcliffe | Scott Koyich |

| President | Investor Relations |

| Phone 1 705 567 5208 | Phone 1 403 215 5979 |

| Fax 1 705 568 6444 | E-mail:info@klgold.com |

| E-mail:bhinchcliffe@klgold.com | |

| Website-www.klgold.com | |

Neither the Toronto Stock Exchange nor the AIM Market of the London Stock Exchange

has reviewed and neither accepts responsibility for the adequacy or accuracy of this news release.

The reserves and resources disclosed in this news release have been estimated using definitions and procedures which conform to National Instrument 43-101Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. These reserves and resources were completed internally by the Company’s personnel, and were audited by Glenn R. Clark & Associates Limited (an independent geological and mining consulting firm). The reserves are not part of the resources. For details on the calculation of reserves and resources, please refer to the disclosure on the Company’s website.

Cautionary Note to U.S. investors concerning estimates of Measured and Indicated Resources

This news release uses the terms “measured” and “indicated resources.” We advise U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Cautionary Note to U.S. investors concerning estimates of Inferred Resources

This news release uses the term “inferred resources.” We advise U.S. investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable.

Cautionary Note to U.S. Investors- The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms is press release, such as “measured,” “indicated,” and “inferred” ”resources,” that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20F, File No. 01-31380, which may be secured from us, or from the SEC’s website athttp://www.sec.gov/edgar.sht.