UNITED STATES

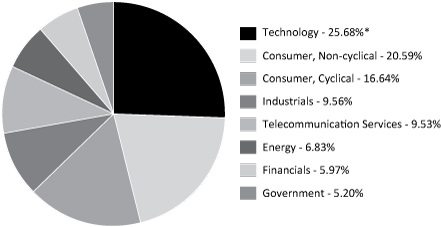

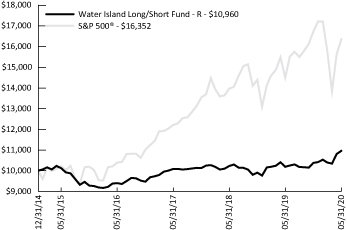

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09815

the arbitrage funds

(exact name of registrant as specified in charter)

41 Madison Avenue, 42nd Floor, New York, NY 10010

(Address of principal executive offices) (Zip code)

John S. Orrico

Water Island Capital, LLC

41 Madison Avenue

42nd Floor

New York, NY 10010

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-295-4485

Date of fiscal year end: May 31

Date of reporting period: May 31, 2020

Item 1. Reports to Stockholders.

Annual Report

May 31, 2020

Arbitrage Fund

Water Island Diversified Event-Driven Fund

Water Island Credit Opportunities Fund

Water Island Long/Short Fund

Paper copies of The Arbitrage Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from The Arbitrage Funds or from your financial intermediary, such as a broker — dealer or bank. Instead, the reports will be made available on a website (https://artbitragefunds.com/restricted/content/downloads.html) and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive your shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from The Arbitrage Funds electronically by sending a request in writing to: Arbitrage Funds, PO Box 219842, Kansas City MO 64121-9842 or by calling 1-800-295-4485.

You may also elect to receive all future reports in paper free of charge. You can inform The Arbitrage Funds [or your financial intermediary] that you wish to continue receiving paper copies of your shareholder reports by sending a request in writing to: Arbitrage Funds, PO Box 219842, Kansas City MO 64121-9842 or by calling 1-800-295-4485. Your election to receive reports in paper will apply to all Arbitrage Funds you hold directly in an account with The Arbitrage Funds. You must provide separate instructions to each of your financial intermediaries.

TABLE OF CONTENTS

Shareholder Letter | | | 1 | | |

Arbitrage Fund | |

Manager Commentary | | | 3 | | |

Portfolio Information | | | 6 | | |

Portfolio of Investments | | | 8 | | |

Water Island Diversified Event-Driven Fund | |

Manager Commentary | | | 16 | | |

Portfolio Information | | | 18 | | |

Portfolio of Investments | | | 20 | | |

Water Island Credit Opportunities Fund | |

Manager Commentary | | | 30 | | |

Portfolio Information | | | 32 | | |

Portfolio of Investments | | | 34 | | |

Water Island Long/Short Fund | |

Manager Commentary | | | 44 | | |

Portfolio Information | | | 46 | | |

Portfolio of Investments | | | 48 | | |

Statements of Assets and Liabilities | | | 58 | | |

Statements of Operations | | | 62 | | |

Statements of Changes in Net Assets | | | 66 | | |

Financial Highlights | |

Arbitrage Fund - Class R | | | 70 | | |

Arbitrage Fund - Class I | | | 71 | | |

Arbitrage Fund - Class C | | | 72 | | |

Arbitrage Fund - Class A | | | 73 | | |

Water Island Diversified Event-Driven Fund - Class R | | | 74 | | |

Water Island Diversified Event-Driven Fund - Class I | | | 75 | | |

Water Island Diversified Event-Driven Fund - Class C | | | 76 | | |

Water Island Diversified Event-Driven Fund - Class A | | | 77 | | |

Water Island Credit Opportunities Fund - Class R | | | 78 | | |

Water Island Credit Opportunities Fund - Class I | | | 79 | | |

Water Island Credit Opportunities Fund - Class C | | | 80 | | |

Water Island Credit Opportunities Fund - Class A | | | 81 | | |

Water Island Long/Short Fund - Class R | | | 82 | | |

Water Island Long/Short Fund - Class I | | | 83 | | |

Notes to Financial Statements | | | 84 | | |

Report of Independent Registered Public Accounting Firm | | | 111 | | |

Disclosure of Fund Expenses | | | 112 | | |

Additional Information | | | 115 | | |

Approval of Investment Advisory Agreements | | | 116 | | |

Liquidity Risk | | | 121 | | |

Trustees & Officers | | | 122 | | |

The Arbitrage Funds Shareholder Letter

Dear Fellow Shareholders,

The past fiscal year – and the past few months in particular – has been an unprecedented time not just for investors but for much of humanity. Nearly a year ago, most conversations regarding financial markets focused on the US/China trade war, concerns about inflation and slowing global growth, and whether the Federal Reserve ("Fed") would reverse course after more than two years of small but steady interest rate hikes and cut rates for the first time in over a decade. Not only did the Fed implement a 25-basis-point cut in August 2019, but scarcely more than six months later the Fed Funds rate was back at zero, where it was mired for seven years following the Financial Crisis. In the face of widespread uncertainty and the potential for massive economic losses stemming from the COVID-19 pandemic, the Fed had swiftly cut rates to zero and embarked on a massive stimulus program to bolster the economy and financial markets. Further stimulus programs from Congress were also passed to help turn the tide. Though March 2020 officially saw the end of the longest bull run in history, with the S&P 500 Index having traded down nearly 34% at one point, investors responded with confidence. Through April and May markets in the US began to recover just as quickly as they declined. Optimism around progress on coronavirus vaccines and the potential re-opening of economies across the nation may have played a part, but one must also remember the adage, "Don't fight the Fed."

What does such a challenging and unpredictable environment mean for us as event-driven investors? We are cautious not to say that broader market moves are entirely inconsequential for our event-driven strategies, but in general the idiosyncratic nature of our funds' return drivers was maintained throughout the volatility. During the worst moments of the downturn, when levered investors and panicked sellers sought liquidity wherever it was available, we did see correlations converge – even in our most idiosyncratic, most definitive investment opportunities (such as merger arbitrage investments). This is not unexpected in an extreme bear market as these types of positions are often both less impacted by market moves and easier to sell, and we saw many parallels in 2020 to our experiences during 2008. While periods of market stress can lead to a spike in short-term volatility in the strategy, they can also present attractive opportunities to initiate or scale up positions at favorable rates of return, and as of May 31, each of our funds had generated positive returns for both the fiscal year and the calendar year-to-date period.

Looking ahead, we believe we are by no means out of the woods yet – neither for event-driven strategies nor markets overall. We expect to encounter bouts of volatility in the months ahead. Not only has the ultimate outcome of the COVID-19 pandemic yet to be written, but we have the added wrinkle of a presidential election year in the US. Merger arbitrage returns could be challenged in the short term as interest rates are subdued, the pace of newly announced mergers and acquisitions (M&A) is likely to abate before it picks up again, and M&A targets and acquirers are more likely to attempt to abandon a definitive transaction during a time of economic distress and uncertainty. That said, the current slate of announced deals has provided plenty of opportunity and – as always – a definitive merger agreement is a binding contract. With few exceptions (such as a material adverse change in a company's business or failure to secure financing, a shareholder vote, or regulatory approval for a deal) a definitive transaction, once announced, must close. Our job as arbitrageurs is to discern which transactions are at greatest risk of incurring these exceptions – the deals to avoid – and which warrant adding to the portfolio. Furthermore, despite potential headwinds for merger arb, we also have reason to be optimistic. Following a period in which asset prices have been depressed, after an initial slowdown in M&A, consolidation activity typically resumes quickly. Companies in a position of strength seek to make opportunistic acquisitions while companies in a position of weakness must combine to survive.

Annual Report | May 31, 2020

1

The Arbitrage Funds Shareholder Letter (continued)

We also tend to see an increase in competitive bidding situations where multiple topping bids can still result in a takeout price far below where a target had been trading mere months prior. Topping bids are a boon to returns and we witnessed such a scenario in 2009, coming out of the Financial Crisis, when competitive bidders emerged in multiple deals throughout the course of the year. Outside of our merger arbitrage strategy, we intend to remain focused on the types of catalysts that can best help isolate portfolios from broader market moves – i.e., shorter duration investments with more definitive outcomes. This includes a robust pipeline of spin-offs as well as speculative M&A opportunities in several transactions that were rumored to have been underway yet were called off in light of the pandemic, but which we now believe are more likely to resume. The portfolios have also begun investing in special purpose acquisition companies, which are specifically designed to engage in an acquisition as a means to take public the target company.

Regardless of the specific flavor of event-driven investing, whether it be pure-play merger arbitrage, long/short equity and credit investing, or a multi-strategy approach combining all of the above, we will continue to seek to generate returns from the outcomes of idiosyncratic corporate catalysts rather than broad market direction, while also striving to preserve capital during times of market stress. Above all else, throughout the ongoing health crisis we hope that you and your families remain safe, and you may rest assured that our goal is to steward our clients' assets with the same care that we safeguard the health of our own colleagues and families. Thank you for your continued support.

Sincerely,

The Investment Team

Water Island Capital

The discussion of market trends and companies throughout this commentary are not intended as advice to any person regarding the advisability of investing in any particular security. Some of our comments are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. Our views are a reflection of our best judgment at the time of the commentary and are subject to change any time based on market and other conditions, and we have no obligation to update them.

Glossary

Basis Point: An amount equal to 1/100 of 1%.

Fed Funds Rate: The interest rate at which a depository institution lends funds maintained at the Federal Reserve to another depository institution overnight.

Long/Short: A strategy that invests both long (i.e., purchases securities, typically with an expectation that their prices will go up) and short (i.e., sells securities, typically with an expectation that their prices will go down).

www.arbitragefunds.com | 1-800-295-4485

2

Arbitrage Fund Manager Commentary

Arbitrage Fund | Tickers: ARBNX, ARBFX, ARBCX, ARGAX

The Fund's Goal and Main Investments

The Fund seeks to achieve capital growth by engaging in merger arbitrage. Merger arbitrage is a sub-set of a broader event-driven investment strategy, which seeks to profit from investing in securities that are involved in corporate events such as mergers and acquisitions. Typically, merger arbitrage is a low volatility strategy pursued by absolute-return-minded investors. At Water Island Capital, our goal is to capture a return stream with a low correlation to the overall markets.

Investment Strategy

The strategy's focus is to capture returns from corporate events, generate market neutral capital growth, preserve capital, generate consistent and positive returns, and achieve low correlation and low volatility. The Fund generally engages in active and frequent trading of portfolio securities to achieve its principal investment objective. In attempting to achieve its investment strategy, the Fund plans to invest at least 80% of its net assets in equity securities of companies (both U.S. and foreign) that are involved in publicly announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations, and other corporate reorganizations. The Fund's investment adviser uses investment strategies designed to minimize market exposure, including short selling along with purchasing and selling options. The most common merger arbitrage activity, and the approach generally used by the Fund, involves purchasing the shares of an announced acquisition target company at a discount to their expected value upon the acquisition's completion. That difference, or "spread," is the primary driver of returns for this investment strategy. There is no limit to the number of stocks the Fund can hold; however, the Fund typically invests in 40 to 80 deals at any given time. Each deal will have one, or perhaps two, equity positions (a long and short position in a stock-for-stock deal) and, in many cases, associated derivative positions for hedging purposes.

Fiscal Year Highlights

Arbitrage (ARBNX) returned 3.27% for the fiscal year ending May 31, 2020. Returns were generated predominantly in the Americas region, though Europe contributed as well. The Asia Pacific region detracted from returns slightly. The top performing sectors in the Fund were information technology and consumer discretionary. Real estate and consumer staples were the only sectors that detracted from returns over the period.

The Fund's top performing deal for the period was our position in the acquisition of Caesars Entertainment by Eldorado Resorts. In June 2019, Eldorado Resorts – a US-based holding company for casino hotels – agreed to acquire Caesars Entertainment – a local peer – for $10.0 billion in cash and stock. During Q1 2020, casinos across the nation were forced to shutter due to the novel coronavirus outbreak, causing the share prices of casino operators to plummet. This led many investors to question the desire of Caesars and Eldorado to consummate their transaction, sending the deal spread wider. In our analysis, the merger agreement and the strategic rationale for the transaction remained strong, and with the financing for the deal already committed, we believed there was still a high likelihood of reaching a successful conclusion. The volatility in the deal spread allowed us to increase our position at favorable rates of return. The portfolio benefited from a tightening in the deal spread as the market rallied in April and May, casino operator share prices began to recover, and the deal progressed through the regulatory approval process – providing confidence to investors that the transaction was increasingly likely to close. We anticipate the deal will close in mid-2020 after the receipt of all required regulatory approvals.

The second-best performer was our position in AbbVie's merger with Allergan. In June 2019, pharmaceutical companies Allergan and AbbVie announced their intent to merge. The terms of

Annual Report | May 31, 2020

3

Arbitrage Fund Manager Commentary (continued)

the deal call for AbbVie to pay $85.0 billion in cash and stock to acquire Allergan. We had developed a high degree of conviction in this transaction and built a core position in the deal coming into 2020. Based on the deal timeline, our initial expectation for completion was in early 2020. The deal spread widened amidst the extreme market volatility of Q1, and the widespread quarantining stemming from the global coronavirus pandemic led to slight delays in the regulatory approval process. This provided us an opportunity to increase our position at very favorable rates of return as we did not believe any of these developments would derail the transaction, and we were rewarded when the deal closed successfully in May.

Conversely, the top detractor in the portfolio for the period was our position in Illumina's attempted acquisition of Pacific Biosciences. In November 2018, Illumina – a US developer of tools for DNA sequencing and analysis – agreed to acquire Pacific Biosciences – a US DNA sequencing technology firm – for $1.1 billion in cash. The transaction encountered objections from multiple global regulators over the course of a long, fraught antitrust review process, primarily on a novel basis of potential competition – that is, despite limited overlap between the companies' businesses at the current time, it was feared Illumina was trying to take out a nascent competitor before it could grow. Ultimately, the companies decided to terminate the transaction shortly into 2020 rather than fight the regulators in court. We maintained our exposure to Pacific Biosciences as we believed the company remained an attractive takeout candidate – indeed, the UK regulatory authority's investigation revealed Illumina believed no fewer than four of its major competitors were potential suitors of Pacific Biosciences. While this position detracted from returns amidst widespread market volatility in Q1 2020, we continue to believe Pacific Biosciences is likely to be acquired and we are monitoring the situation closely.

The Fund's second-worst performer was Simon Property Group's planned acquisition of Taubman Centers. In February 2020, Taubman Centers – a US-based real estate investment trust focused on shopping centers – agreed to be acquired by local peer Simon Property Group for $3.2 billion in cash. As the novel coronavirus pandemic spread and malls shuttered or saw their traffic plummet amidst mass quarantines, investors began to fear Simon Property may attempt to abandon the transaction and Taubman shares plummeted as much as 24% from their peak during the quarter. We maintained our exposure to the deal as we believe the definitive merger agreement in this transaction is one of the strongest contracts in our space today, and we believe Simon has very few – if any – avenues to escape its obligation to complete the merger. In June, Simon filed to terminate the transaction, claiming Taubman has been disproportionately impacted by the pandemic and has breached its obligations under the merger agreement. Taubman in turn claimed Simon's termination is invalid and without merit, and the company believes Simon continues to be bound to the transaction in all respects. Our conviction in our position has not wavered, as we believe Taubman by far has the stronger case for several reasons. The merger agreement carves out pandemics as reasons by which a material adverse change (MAC) may be claimed. Furthermore, Taubman's obligations under the agreement only call for the company to exercise "commercially reasonable" efforts in conducting its ordinary course of business. There are no financing contingencies on this deal, and it is being funded solely from Simon's balance sheet. We have reviewed Simon's court filing, which we believe makes what are at best dubious claims to support the company's argument for termination (even more so as malls reopen and foot traffic resumes). Lastly, the case was filed in Michigan, where Taubman is both domiciled and headquartered. In our experience through similar court cases and appraisal rights processes, a "home court" advantage in such proceedings is very much a real thing. Taubman is a highly strategic asset for Simon, and there is a chance the lawsuit is simply an attempt by Simon to convince Taubman to agree to a cut in deal terms to avoid lengthy, costly litigation – but if the

www.arbitragefunds.com | 1-800-295-4485

4

Arbitrage Fund Manager Commentary (continued)

case does go to trial, we are confident that Taubman can emerge victorious and require Simon to complete the deal on its original terms.

Glossary

Commercially Reasonable Efforts: A legal concept with varying definitions in different jurisdictions, but generally understood to mean acting reasonably and not against one's own interests (a level below "best efforts").

Deal Spread: The difference between the price at which a target company's shares currently trade and the price an acquiring company has agreed to pay

Annual Report | May 31, 2020

5

Arbitrage Fund Portfolio Information

Performance (annualized returns as of May 31, 2020)

| | | One

Year | | Five

Year | | Ten

Year | | Since

Inception* | |

Arbitrage Fund, Class R | | | 3.07 | % | | | 2.25 | % | | | 2.30 | % | | | 3.91 | % | |

Arbitrage Fund, Class I | | | 3.27 | % | | | 2.51 | % | | | 2.55 | % | | | 3.03 | % | |

Arbitrage Fund, Class C** | | | 2.24 | % | | | 1.48 | % | | | N/A | | | | 1.25 | % | |

Arbitrage Fund, Class A*** | | | 3.00 | % | | | 2.24 | % | | | N/A | | | | 2.24 | % | |

ICE BofA Merrill Lynch U.S. 3-Month Treasury

Bill Index**** | | | 1.84 | % | | | 1.19 | % | | | 0.64 | % | | | 1.62 | % | |

S&P 500® Index | | | 12.84 | % | | | 9.86 | % | | | 13.15 | % | | | 5.85 | % | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance and the investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown above include the reinvestment of all dividends and capital gains. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

* Class R inception: 9/18/00; Class I inception: 10/17/03; Class C inception: 6/1/12; Class A inception: 6/1/13. The "Since Inception" returns for securities indices are for the inception date of Class R shares.

** Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed within 12 months of purchase.

*** Class A shares are subject to a maximum front-end sales load of 2.75% on purchases up to $250,000. The shares are also subject to a deferred sales charge of up to 1.00% on purchases of $250,000 or more purchased without a front-end sales charge and redeemed within 18 months of purchase.

**** Merger arbitrage and event-driven investing are market neutral investment strategies, which typically exhibit low betas and low correlations to broad equity and credit market indices. As such, the adviser has determined that a more appropriate benchmark for Arbitrage Fund is a measure of the risk-free rate, in this case the ICE Bank of America (BofA) Merrill Lynch U.S. 3-Month Treasury Bill Index.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 1.99%, 1.74%, 2.74% and 1.99%, respectively. These expense ratios are as stated in the current prospectus and may differ from the expense ratios disclosed in the financial highlights in this report.

The ICE BofA Merrill Lynch U.S. 3-Month Treasury Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

The S&P 500® Index is an unmanaged index consisting of 500 stocks.

An investor may not invest directly in an index.

www.arbitragefunds.com | 1-800-295-4485

6

Arbitrage Fund Portfolio Information (continued)

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Sector Weighting

The following chart shows the sector weightings of the Arbitrage Fund's investments (including short sales and excluding derivatives) as of the report date.

* Concentration Risk: The Fund may invest a large proportion of the Fund's assets in securities of issuers in a single sector over a given time. During such a period of concentration, the Fund may be subject to greater volatility with respect to its portfolio securities than a fund that is more broadly diversified.

Annual Report | May 31, 2020

7

Arbitrage Fund Portfolio of Investments

| | | Shares | | Value | |

COMMON STOCKS - 66.60% | |

Auto Parts & Equipment - 1.23% | |

Delphi Technologies Plc(a) | | | 1,321,984 | | | $ | 17,027,154 | | |

Banks - 1.33% | |

IBERIABANK Corp. | | | 432,845 | | | | 18,356,956 | | |

Biotechnology - 1.40% | |

Pacific Biosciences of California, Inc.(a)(b) | | | 2,841,492 | | | | 10,002,052 | | |

Stemline Therapeutics, Inc.(a) | | | 779,725 | | | | 9,263,133 | | |

| | | | 19,265,185 | | |

Computers & Computer Services - 0.43% | |

Ingenico Group SA | | | 42,904 | | | | 5,915,100 | | |

Distribution/Wholesale - 4.43% | |

Anixter International, Inc.(a) | | | 638,341 | | | | 61,095,617 | | |

Diversified Financial Services - 14.10% | |

Bolsas y Mercados Espanoles SHMSF SA | | | 653,721 | | | | 23,888,834 | | |

E*TRADE Financial Corp.(b) | | | 1,222,072 | | | | 55,653,159 | | |

Legg Mason, Inc.(b) | | | 1,074,711 | | | | 53,552,849 | | |

TD Ameritrade Holding Corp.(b) | | | 1,649,558 | | | | 61,479,027 | | |

| | | | 194,573,869 | | |

Electrical Components & Equipment - 0.70% | |

OSRAM Licht AG(a) | | | 214,289 | | | | 9,657,586 | | |

Electronics - 5.75% | |

Isra Vision AG | | | 142,190 | | | | 7,891,903 | | |

KEMET Corp.(b) | | | 2,051,583 | | | | 55,454,288 | | |

Tech Data Corp.(a) | | | 117,778 | | | | 16,046,075 | | |

| | | | 79,392,266 | | |

Entertainment - 0.72% | |

Flutter Entertainment Plc(a) | | | 78,425 | | | | 9,956,662 | | |

Healthcare - Products - 4.76% | |

QIAGEN N.V.(a) | | | 327,727 | | | | 14,300,722 | | |

Wright Medical Group N.V.(a) | | | 1,737,101 | | | | 51,331,334 | | |

| | | | 65,632,056 | | |

Insurance - 2.81% | |

TOWER Ltd.(a) | | | 9,485,696 | | | | 3,591,831 | | |

Willis Towers Watson Plc | | | 173,364 | | | | 35,175,556 | | |

| | | | 38,767,387 | | |

Internet - 0.25% | |

Meet Group, Inc.(a) | | | 566,523 | | | | 3,501,112 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

8

Arbitrage Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 66.60% (Continued) | |

Lodging - 5.34% | |

Caesars Entertainment Corp.(a)(b) | | | 6,476,350 | | | $ | 73,765,626 | | |

Pharmaceuticals - 1.29% | |

Portola Pharmaceuticals, Inc.(a) | | | 987,904 | | | | 17,732,877 | | |

Real Estate Investment Trusts - 2.71% | |

Front Yard Residential Corp. | | | 366,925 | | | | 2,751,938 | | |

Taubman Centers, Inc. | | | 839,174 | | | | 34,691,453 | | |

| | | | 37,443,391 | | |

Retail - 5.96% | |

Tiffany & Co.(b) | | | 641,915 | | | | 82,248,569 | | |

Semiconductors - 2.14% | |

Adesto Technologies Corp.(a) | | | 609,153 | | | | 7,352,477 | | |

AVX Corp.(a)(c) | | | 1,022,500 | | | | 22,239,375 | | |

| | | | 29,591,852 | | |

Software - 4.39% | |

Instructure, Inc.(a)(c) | | | 249,706 | | | | 12,235,594 | | |

MINDBODY, Inc., Class A(a)(c) | | | 843,793 | | | | 30,798,444 | | |

Onemarket Ltd.(a)(c) | | | 111,800 | | | | 72,285 | | |

RIB Software SE(a) | | | 542,175 | | | | 17,453,406 | | |

| | | | 60,559,729 | | |

Telecommunications - 6.86% | |

Cincinnati Bell, Inc.(a) | | | 701,576 | | | | 10,334,215 | | |

Gilat Satellite Networks Ltd.(a) | | | 600,640 | | | | 5,021,350 | | |

LogMeIn, Inc. | | | 934,820 | | | | 79,366,218 | | |

| | | | 94,721,783 | | |

TOTAL COMMON STOCKS

(Cost $931,572,475) | | | 919,204,777 | | |

RIGHTS - 0.06% | |

Elanco Animal Health, Inc. CVR(c) | | | 1,124,589 | | | | — | | |

Media General, Inc. CVR(c) | | | 613,589 | | | | — | | |

NewStar Financial, Inc. CVR(c) | | | 1,514,945 | | | | 840,340 | | |

TOTAL RIGHTS

(Cost $394,097) | | | 840,340 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2020

9

Arbitrage Fund Portfolio of Investments (continued)

| | | Maturity

Date | | Rate | | Principal

Amount | | Value | |

CORPORATE BONDS - 0.73% | |

Entertainment - 0.73% | |

Stars Group Holdings B.V. /

Stars Group

US Co-Borrower LLC(d) | | 07/15/2026 | | | 7.000 | % | | $ | 9,542,000 | | | $ | 10,114,520 | | |

TOTAL CORPORATE BONDS

(Cost $10,289,641) | | | 10,114,520 | | |

| | | Shares | | Value | |

MUTUAL FUNDS - 4.80% | |

Water Island Diversified Event-Driven Fund, Class I(e) | | | 6,589,384 | | | $ | 66,223,311 | | |

TOTAL MUTUAL FUNDS

(Cost $60,459,409) | | | 66,223,311 | | |

| | | Yield | | Shares | | Value | |

SHORT-TERM INVESTMENTS - 19.05% | |

Money Market Funds | |

Morgan Stanley Institutional Liquidity Fund

Government Portfolio, Institutional Class | | | 0.094 | %(f) | | | 131,427,234 | | | $ | 131,427,234 | | |

State Street Institutional U.S. Government

Money Market Fund, Premier Class | | | 0.249 | %(f) | | | 131,427,234 | | | | 131,427,234 | | |

| | | | | | | | 262,854,468 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $262,854,468) | | | 262,854,468 | | |

Total Investments - 91.24%

(Cost $1,265,570,090) | | | 1,259,237,416 | | |

Other Assets in Excess of Liabilities - 8.76%(g) | | | 120,938,282 | | |

NET ASSETS - 100.00% | | $ | 1,380,175,698 | | |

Portfolio Footnotes

(a) Non-income-producing security.

(b) Security, or a portion of security, is being held as collateral for short sales or forward foreign currency exchange contracts. At May 31, 2020, the aggregate fair market value of those securities was $156,327,060, representing 11.33% of net assets.

(c) Security fair valued using significant unobservable inputs and classified as a Level 3 security. As of May 31, 2020, the total fair market value of these securities was $66,186,038, representing 4.80% of net assets.

(d) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of May 31, 2020, these securities had a total value of $10,114,520 or 0.73% of net assets.

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

10

Arbitrage Fund Portfolio of Investments (continued)

(e) Affiliated investment.

(f) Rate shown is the 7-day effective yield as of May 31, 2020.

(g) Includes cash held as collateral for short sales and written option contracts.

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (7.34%) | |

Banks - (2.96%) | |

First Horizon National Corp. | | | (1,984,490 | ) | | $ | (18,554,982 | ) | |

Morgan Stanley | | | (505,806 | ) | | | (22,356,625 | ) | |

| | | | (40,911,607 | ) | |

Distribution/Wholesale - (0.19%) | |

WESCO International, Inc. | | | (78,961 | ) | | | (2,629,401 | ) | |

Electronics - (0.07%) | |

Comtech Telecommunications Corp. | | | (50,603 | ) | | | (901,240 | ) | |

Entertainment - (2.22%) | |

Eldorado Resorts, Inc. | | | (582,224 | ) | | | (20,645,663 | ) | |

Flutter Entertainment Plc | | | (78,427 | ) | | | (9,956,891 | ) | |

| | | | (30,602,554 | ) | |

Environmental Control - (0.72%) | |

Advanced Disposal Services, Inc. | | | (317,259 | ) | | | (9,892,136 | ) | |

Insurance - (0.75%) | |

Aon Plc, Class A | | | (52,632 | ) | | | (10,365,872 | ) | |

Real Estate Investment Trusts - (0.07%) | |

American Homes 4 Rent, Class A | | | (17,991 | ) | | | (454,093 | ) | |

Invitation Homes, Inc. | | | (18,860 | ) | | | (496,018 | ) | |

| | | | (950,111 | ) | |

Software - (0.36%) | |

Worldline SA | | | (67,421 | ) | | | (5,023,308 | ) | |

TOTAL COMMON STOCKS

(Proceeds $93,554,854) | | | (101,276,229 | ) | |

EXCHANGE-TRADED FUNDS - (0.12%) | |

Equity Funds - (0.12%) | |

Consumer Discretionary Select Sector SPDR® Fund | | | (4,835 | ) | | | (600,459 | ) | |

iShares Russell Mid-Cap Growth ETF | | | (1,402 | ) | | | (216,777 | ) | |

iShares U.S. Real Estate ETF | | | (6,256 | ) | | | (484,339 | ) | |

VanEck Vectors Semiconductor ETF | | | (2,735 | ) | | | (385,717 | ) | |

| | | | (1,687,292 | ) | |

TOTAL EXCHANGE-TRADED FUNDS

(Proceeds $1,546,604) | | | (1,687,292 | ) | |

TOTAL SECURITIES SOLD SHORT

(Proceeds $95,101,458) | | $ | (102,963,521 | ) | |

See Notes to Financial Statements.

Annual Report | May 31, 2020

11

Arbitrage Fund Portfolio of Investments (continued)

EQUITY SWAP CONTRACTS

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Paid | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Goldman

Sachs &

Co./

Monthly

| | DP World

Plc

| | Paid

1 Month+

2BD-

LIBOR

plus

95 bps

(1.121%) | |

02/24/2021 | | $ | — | | | $ | — | | | $ | — | | | $ | (3,226,462 | ) | | $ | — | | |

Goldman

Sachs &

Co./

Monthly

| | Morgan

Stanley

| | Received

1 Month

LIBOR

Minus

40 bps

(-0.070%) | |

04/30/2021 | | | — | | | | — | | | | — | | | | 33,998,065 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | Aon Plc

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.350%) | |

08/12/2021 | | | — | | | | — | | | | — | | | | 26,509,667 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | Borgwarner,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.350%) | |

08/12/2021 | | | — | | | | — | | | | — | | | | 18,326,690 | | | | — | | |

Morgan

Stanley &

Co./

Monthly

| | Charles

Schwab

Corp.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.350%) | |

08/12/2021 | | | — | | | | — | | | | — | | | | 64,197,420 | | | | — | | |

| | | | | | | | | | | | | $ | — | | | $ | 139,805,380 | | | $ | — | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

12

Arbitrage Fund Portfolio of Investments (continued)

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | |

CAD | 50,164,900 | | | USD | 35,830,117 | | | Goldman Sachs & Co. | | 06/15/2020 | | $ | 604,658 | | |

EUR | 20,860,800 | | | USD | 22,836,822 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 325,729 | | |

USD | 67,014,234 | | | EUR | 59,511,800 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 935,985 | | |

GBP | 11,143,600 | | | USD | 13,136,067 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 626,931 | | |

USD | 21,464,337 | | | GBP | 17,010,600 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 455,251 | | |

NZD | 3,225,100 | | | USD | 1,926,232 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 75,669 | | |

USD | 59,020 | | | NZD | 94,900 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 113 | | |

USD | 21,389,598 | | | ZAR | 361,211,200 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 838,276 | | |

ZAR | 361,211,200 | | | USD | 20,359,200 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 192,122 | | |

| | | $ | 4,054,734 | | |

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Depreciation | |

USD | 68,651 | | | AUD | 108,400 | | | Goldman Sachs & Co. | | 06/15/2020 | | $ | (3,604 | ) | |

USD | 35,998,773 | | | CAD | 50,164,900 | | | Goldman Sachs & Co. | | 06/15/2020 | | | (436,003 | ) | |

EUR | 681,800 | | | USD | 766,236 | | | Goldman Sachs & Co. | | 06/15/2020 | | | (9,207 | ) | |

USD | 31,250,792 | | | EUR | 28,682,200 | | | Goldman Sachs & Co. | | 06/15/2020 | | | (596,161 | ) | |

GBP | 5,867,000 | | | USD | 7,286,204 | | | Goldman Sachs & Co. | | 06/15/2020 | | | (40,116 | ) | |

USD | 5,450,731 | | | NZD | 8,916,500 | | | Goldman Sachs & Co. | | 06/15/2020 | | | (83,964 | ) | |

| | | $ | (1,169,055 | ) | |

The following is a summary of investments classified by country exposure:

Country | | % of Net Assets(a) | |

Netherlands | | | 5.49 | % | |

United Kingdom | | | 3.78 | % | |

Germany | | | 2.53 | % | |

Spain | | | 1.73 | % | |

Ireland | | | 0.72 | % | |

France | | | 0.43 | % | |

Israel | | | 0.36 | % | |

New Zealand | | | 0.26 | % | |

United States Virgin Islands | | | 0.20 | % | |

Australia | | | 0.01 | % | |

United States | | | 75.73 | % | |

Other Assets in Excess of Liabilities | | | 8.76 | % | |

| | | | 100.00 | % | |

(a) These percentages represent long positions only and are not net of short positions.

Abbreviations:

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

AUD - Australian dollar

bps - Basis Points. 100 Basis Points is equal to 1 percentage point.

See Notes to Financial Statements.

Annual Report | May 31, 2020

13

Arbitrage Fund Portfolio of Investments (continued)

CAD - Canadian dollar

CVR - Contingent Value Rights

ETF - Exchange-Traded Fund

EUR - Euro

GBP - British pound

LIBOR - London Interbank Offered Rate

LLC - Limited Liability Company

Ltd. - Limited

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

NZD - New Zealand dollar

Plc - Public Limited Company

SA - Generally designates corporations in various countries, mostly those employing civil law. This translates literally in all languages mentioned as anonymous company.

SE - SE Regulation. A European Company which can operate on a Europe-wide basis and be governed by Community law directly applicable in all Member States

SPDR - Standard & Poor's Depositary Receipt

USD - United States Dollar

ZAR - South African rand

The following table summarizes the Arbitrage Fund's investments and derivative financial instruments categorized in the fair value hierarchy as of May 31, 2020:

Investments in Securities at Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets | |

Common Stocks | |

Auto Parts & Equipment | | $ | 17,027,154 | | | $ | — | | | $ | — | | | $ | 17,027,154 | | |

Banks | | | 18,356,956 | | | | — | | | | — | | | | 18,356,956 | | |

Biotechnology | | | 19,265,185 | | | | — | | | | — | | | | 19,265,185 | | |

Computers & Computer

Services | | | 5,915,100 | | | | — | | | | — | | | | 5,915,100 | | |

Distribution/Wholesale | | | 61,095,617 | | | | — | | | | — | | | | 61,095,617 | | |

Diversified Financial Services | | | 194,573,869 | | | | — | | | | — | | | | 194,573,869 | | |

Electrical Components &

Equipment | | | 9,657,586 | | | | — | | | | — | | | | 9,657,586 | | |

Electronics | | | 79,392,266 | | | | — | | | | — | | | | 79,392,266 | | |

Entertainment | | | 9,956,662 | | | | — | | | | — | | | | 9,956,662 | | |

Healthcare - Products | | | 65,632,056 | | | | — | | | | — | | | | 65,632,056 | | |

Insurance | | | 38,767,387 | | | | — | | | | — | | | | 38,767,387 | | |

Internet | | | 3,501,112 | | | | — | | | | — | | | | 3,501,112 | | |

Lodging | | | 73,765,626 | | | | — | | | | — | | | | 73,765,626 | | |

Pharmaceuticals | | | 17,732,877 | | | | — | | | | — | | | | 17,732,877 | | |

Real Estate Investment Trusts | | | 37,443,391 | | | | — | | | | — | | | | 37,443,391 | | |

Retail | | | 82,248,569 | | | | — | | | | — | | | | 82,248,569 | | |

Semiconductors | | | 7,352,477 | | | | — | | | | 22,239,375 | | | | 29,591,852 | | |

Software | | | 17,453,406 | | | | — | | | | 43,106,323 | | | | 60,559,729 | | |

Telecommunications | | | 94,721,783 | | | | — | | | | — | | | | 94,721,783 | | |

Rights | | | — | | | | — | | | | 840,340 | | | | 840,340 | | |

Corporate Bonds** | | | — | | | | 10,114,520 | | | | — | | | | 10,114,520 | | |

Mutual Funds | | | 66,223,311 | | | | — | | | | — | | | | 66,223,311 | | |

Short-Term Investments | | | 262,854,468 | | | | — | | | | — | | | | 262,854,468 | | |

TOTAL | | $ | 1,182,936,858 | | | $ | 10,114,520 | | | $ | 66,186,038 | | | $ | 1,259,237,416 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

14

Arbitrage Fund Portfolio of Investments (continued)

Other Financial Instruments*** | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets | |

Forward Foreign Currency

Exchange Contracts | | $ | — | | | $ | 4,054,734 | | | $ | — | | | $ | 4,054,734 | | |

Equity Swaps | | | 0 | | | | — | | | | — | | | | 0 | | |

Liabilities | |

Common Stocks** | | | (101,276,229 | ) | | | — | | | | — | | | | (101,276,229 | ) | |

Exchange-Traded Funds | | | (1,687,292 | ) | | | — | | | | — | | | | (1,687,292 | ) | |

Forward Foreign Currency

Exchange Contracts | | | — | | | | (1,169,055 | ) | | | — | | | | (1,169,055 | ) | |

TOTAL | | $ | (102,963,521 | ) | | $ | 2,885,679 | | | $ | — | | | $ | (100,077,842 | ) | |

* Refer to footnote 2 where leveling hierarchy is defined.

** Refer to Portfolio of Investments for sector information.

*** Other financial instruments are instruments such as securities sold short, equity swaps and forward foreign currency exchange contracts.

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund's assets and liabilities during the period ended May 31, 2020:

Investments

in Securities | | Balance as of

May 31, 2019 | | Realized

Gain

(Loss) | | Change in

Unrealized

Appreciation

(Depreciation) | | Purchases | | Sales

Proceeds | | Transfers

into

Level 3 | | Transfers

out of

Level 3 | |

Balance as of

May 31, 2020 | | Net change in

Unrealized

(Depreciation)

included in the

Statement of

Operations

attributable to

Level 3

investments

held at

May 31, 2020 | |

Common

Stocks | | $ | 33,540,061 | | | $ | 140,664 | | | $ | 1,339,574 | | | $ | 87,939,061 | | | $ | (57,675,319 | ) | | $ | 61,657 | | | $ | — | | | $ | 65,345,698 | | | $ | 383,962 | | |

Rights | | | 1,125,511 | | | | (83,154 | ) | | | (16,914 | ) | | | — | | | | (185,103 | ) | | | — | | | | — | | | | 840,340 | | | | 78,020 | | |

Total | | $ | 34,665,572 | | | $ | 57,510 | | | $ | 1,322,660 | | | $ | 87,939,061 | | | $ | (57,860,422 | ) | | $ | 61,657 | | | $ | — | | | $ | 66,186,038 | | | $ | 461,982 | | |

The following table summarizes the quantitative inputs used for investments categorized as Level 3 of the fair value hierarchy as of May 31, 2020:

Investments in

Securities | | Fair Value at

May 31, 2020 | | Valuation

Technique | | Unobservable

Input | | Range of

Values | | Weighted

Average | |

Common Stocks

| | $ | 65,345,698

| | | Deal Value,

Last Trade

| | Final

determination

on Dissent, Final

Liquidation Value | | | $21.75-$49, .97 AUD

| | | | $33.78

| | |

Rights

| | $ | 840,340

| | | Discounted,

probability

adjusted value | | Discount Rate,

Probability

| | | 10%, 90%

| | | | 45%

| | |

See Notes to Financial Statements.

Annual Report | May 31, 2020

15

Water Island Diversified Event-Driven Fund Manager Commentary

Water Island Diversified Event-Driven Fund (formerly known as Arbitrage Event-Driven) |

Tickers: AEDNX, AEDFX, AEFCX, AGEAX

The Fund's Goal and Main Investments

The Fund seeks to provide capital growth by investing in credit and equity securities involved in specific corporate events, with a focus on low volatility and low correlation relative to the broader capital markets.

Investment Strategy

The Fund's investment process follows a disciplined, fundamental approach that values risk mitigation while identifying compelling risk/reward opportunities available to us as we screen catalyst-driven corporate events, such as mergers and acquisitions, restructurings, refinancings, recapitalizations, spin-offs, litigation, regulatory changes, and bankruptcy. We analyze these events through three core approaches: merger arbitrage, equity special situations, and credit opportunities. We seek to generate investment returns that have low volatility and low correlation compared to the broader capital markets. We do not manage against any particular benchmark and believe that capital preservation in difficult markets is as important as generating positive returns within our low correlated, low volatility event-driven investment strategy. This process and approach have been an integral part of the culture at Water Island Capital since the firm's inception.

Fiscal Year Highlights

Water Island Diversified Event-Driven (AEDNX) returned 5.83% for the fiscal year ending May 31, 2020. Both hard and soft catalysts investments contributed to returns overall, as did all three sub-strategies – merger arbitrage, credit opportunities, and equity special situations. Returns were driven predominantly by the Americas region, though both the European and Asia Pacific regions contributed slightly as well. The Fund's top-performing sectors were consumer discretionary and information technology. The only sector to detract from returns was real estate.

The Fund's top performing deal for the period was our merger arbitrage position in the acquisition of Caesars Entertainment by Eldorado Resorts. In June 2019, Eldorado Resorts – a US-based holding company for casino hotels – agreed to acquire Caesars Entertainment – a local peer – for $10.0 billion in cash and stock. During Q1 2020, casinos across the nation were forced to shutter due to the novel coronavirus outbreak, causing the share prices of casino operators to plummet. This led many investors to question the desire of Caesars and Eldorado to consummate their transaction, sending the deal spread wider. In our analysis, the merger agreement and the strategic rationale for the transaction remained strong, and with the financing for the deal already committed, we believed there was still a high likelihood of reaching a successful conclusion. The volatility in the deal spread allowed us to increase our position at favorable rates of return. The portfolio benefited from a tightening in the deal spread as the market rallied in April and May, casino operator share prices began to recover, and the deal progressed through the regulatory approval process – providing confidence to investors that the transaction was increasingly likely to close. We anticipate the deal will close in mid-2020 after the receipt of all required regulatory approvals.

The second-best performer was our merger arbitrage position in the AbbVie-Allergan tie-up. In June 2019, pharmaceutical companies Allergan and AbbVie announced their intent to merge. The terms of the deal call for AbbVie to pay $85.0 billion in cash and stock to acquire Allergan. We had developed a high degree of conviction in this transaction and built a core position in the deal coming into 2020. Based on the deal timeline, our initial expectation for completion was in early 2020. The deal spread widened amidst the extreme market volatility of Q1, and the widespread

www.arbitragefunds.com | 1-800-295-4485

16

Water Island Diversified Event-Driven Fund Manager Commentary (continued)

quarantining stemming from the global coronavirus pandemic led to slight delays in the regulatory approval process. This provided us an opportunity to increase our position at very favorable rates of return as we did not believe any of these developments would derail the transaction, and we were rewarded when the deal closed successfully in May.

Conversely, the top detractor in the portfolio for the period was our merger arbitrage position in Illumina's attempted acquisition of Pacific Biosciences. In November 2018, Illumina – a US developer of tools for DNA sequencing and analysis – agreed to acquire Pacific Biosciences – a US DNA sequencing technology firm – for $1.1 billion in cash. The transaction encountered objections from multiple global regulators over the course of a long, fraught antitrust review process, primarily on a novel basis of potential competition – that is, despite limited overlap between the companies' businesses at the current time, it was feared Illumina was trying to take out a nascent competitor before it could grow. Ultimately, the companies decided to terminate the transaction shortly into 2020 rather than fight the regulators in court. We maintained our exposure to Pacific Biosciences as we believed the company remained an attractive takeout candidate – indeed, the UK regulatory authority's investigation revealed Illumina believed no fewer than four of its major competitors were potential suitors of Pacific Biosciences. While this position detracted from returns amidst widespread market volatility in Q1 2020, we continue to believe Pacific Biosciences is likely to be acquired and we are monitoring the situation closely.

The Fund's second-worst performer was our merger arbitrage position in Simon Property Group's planned acquisition of Taubman Centers. In February 2020, Taubman Centers – a US-based real estate investment trust focused on shopping centers – agreed to be acquired by local peer Simon Property Group for $3.2 billion in cash. As the novel coronavirus pandemic spread and malls shuttered or saw their traffic plummet amidst mass quarantines, investors began to fear Simon Property may attempt to abandon the transaction and Taubman shares plummeted as much as 24% from their peak during the quarter. We maintained our exposure to the deal as we believe the definitive merger agreement in this transaction is one of the strongest contracts in our space today, and we believe Simon has very few – if any – avenues to escape its obligation to complete the merger. In June, Simon filed to terminate the transaction, claiming Taubman has been disproportionately impacted by the pandemic and has breached its obligations under the merger agreement. Taubman in turn claimed Simon's termination is invalid and without merit, and the company believes Simon continues to be bound to the transaction in all respects. Our conviction in our position has not wavered, as we believe Taubman by far has the stronger case for several reasons. The merger agreement carves out pandemics as reasons by which a material adverse change (MAC) may be claimed. Furthermore, Taubman's obligations under the agreement only call for the company to exercise "commercially reasonable" efforts in conducting its ordinary course of business. There are no financing contingencies on this deal, and it is being funded solely from Simon's balance sheet. We have reviewed Simon's court filing, which we believe makes what are at best dubious claims to support the company's argument for termination (even more so as malls reopen and foot traffic resumes). Lastly, the case was filed in Michigan, where Taubman is both domiciled and headquartered. In our experience through similar court cases and appraisal rights processes, a "home court" advantage in such proceedings is very much a real thing. Taubman is a highly strategic asset for Simon, and there is a chance the lawsuit is simply an attempt by Simon to convince Taubman to agree to a cut in deal terms to avoid lengthy, costly litigation – but if the case does go to trial, we are confident that Taubman can emerge victorious and require Simon to complete the deal on its original terms.

Annual Report | May 31, 2020

17

Water Island Diversified Event-Driven Fund Portfolio Information

Performance (annualized returns as of May 31, 2020)

| | | One

Year | | Five

Year | | Ten

Year | | Since

Inception* | |

Water Island Diversified Event-Driven Fund, Class R | | | 5.49 | % | | | 1.35 | % | | | N/A | | | | 1.78 | % | |

Water Island Diversified Event-Driven Fund, Class I | | | 5.83 | % | | | 1.62 | % | | | N/A | | | | 2.03 | % | |

Water Island Diversified Event-Driven Fund, Class C** | | | 4.74 | % | | | 0.61 | % | | | N/A | | | | 0.78 | % | |

Water Island Diversified Event-Driven Fund, Class A*** | | | 5.62 | % | | | 1.38 | % | | | N/A | | | | 1.33 | % | |

ICE BofA Merrill Lynch U.S. 3-Month Treasury Bill Index**** | | | 1.84 | % | | | 1.19 | % | | | N/A | | | | 0.65 | % | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 9.42 | % | | | 3.94 | % | | | N/A | | | | 3.63 | % | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance, and the investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown above include the reinvestment of all dividends and capital gains. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

* Class R and Class I inception: 10/1/10; Class C inception: 6/1/12; Class A inception: 6/1/13. The "Since Inception" returns for securities indices are for the inception date of Class R and Class I shares.

** Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed within 12 months of purchase.

*** Class A shares are subject to a maximum front-end sales load of 3.25% of the offering price and are also subject to a 1.00% contingent deferred sales load on purchases at or above $250,000 purchased without a front-end sales charge and redeemed within 18 months of purchase.

**** Merger arbitrage and event-driven investing are market neutral investment strategies, which typically exhibit low betas and low correlations to broad equity and credit market indices. As such, the adviser has determined that a more appropriate benchmark for Water Island Diversified Event-Driven Fund is a measure of the risk-free rate, in this case the ICE Bank of America (BofA) Merrill Lynch U.S. 3-Month Treasury Bill Index.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 2.62%, 2.37%, 3.37% and 2.62%, respectively. The Adviser has agreed to waive fees (not including the effects of interest, dividends on short positions, brokerage commissions, acquired fund fees and expenses, taxes, or other extraordinary expenses) in excess of 1.69%, 1.44%, 2.44% and 1.69% for Class R, Class I, Class C and Class A, respectively, until at least September 30, 2021. These expense ratios are as stated in the current prospectus and may differ from the expense ratios disclosed in the financial highlights in this report.

The ICE BofA Merrill Lynch U.S. 3-Month Treasury Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

The Bloomberg Barclays U.S. Aggregate Bond Index is a market value-weighted index of investment-grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

www.arbitragefunds.com | 1-800-295-4485

18

Water Island Diversified Event-Driven Fund Portfolio Information (continued)

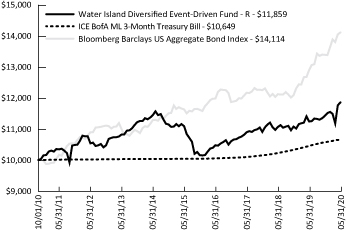

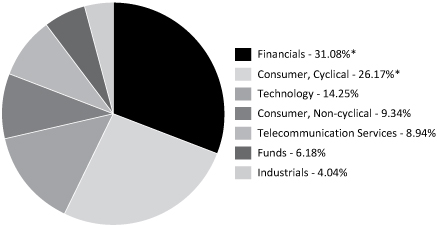

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

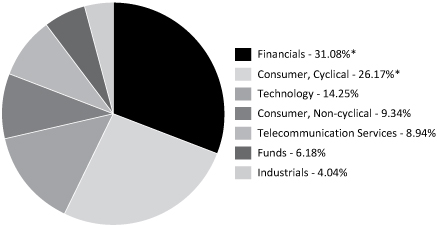

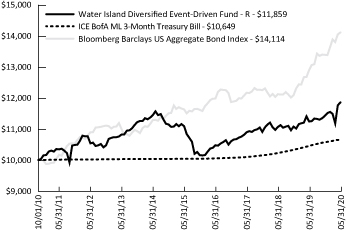

Sector Weighting

The following chart shows the sector weightings of the Water Island Diversified Event-Driven Fund's investments (including short sales and excluding derivatives) as of the report date.

* Concentration Risk: The Fund may invest a large proportion of the Fund's assets in securities of issuers in a single sector over a given time. During such a period of concentration, the Fund may be subject to greater volatility with respect to its portfolio securities than a fund that is more broadly diversified.

Annual Report | May 31, 2020

19

Water Island Diversified Event-Driven Fund Portfolio of Investments

| | | Shares | | Value | |

COMMON STOCKS - 69.08% | |

Auto Parts & Equipment - 2.27% | |

Delphi Technologies Plc(a) | | | 189,750 | | | $ | 2,443,980 | | |

Biotechnology - 3.01% | |

Pacific Biosciences of California, Inc.(a)(b) | | | 460,403 | | | | 1,620,618 | | |

Stemline Therapeutics, Inc.(a) | | | 135,912 | | | | 1,614,635 | | |

| | | | 3,235,253 | | |

Computers & Computer Services - 0.45% | |

HP, Inc. | | | 27,416 | | | | 415,078 | | |

Perspecta, Inc.(b) | | | 3,259 | | | | 72,252 | | |

| | | | 487,330 | | |

Diversified Financial Services - 9.37% | |

Bolsas y Mercados Espanoles SHMSF SA | | | 20,528 | | | | 750,152 | | |

E*TRADE Financial Corp. | | | 42,077 | | | | 1,916,187 | | |

Legg Mason, Inc. | | | 42,939 | | | | 2,139,650 | | |

TD Ameritrade Holding Corp.(b) | | | 141,195 | | | | 5,262,338 | | |

| | | | 10,068,327 | | |

Electronics - 1.16% | |

Tech Data Corp.(a) | | | 9,189 | | | | 1,251,909 | | |

Energy - Alternate Sources - 0.28% | |

Championx Corp.(a) | | | 33,175 | | | | 300,897 | | |

Engineering & Construction - 0.14% | |

AECOM(a)(b) | | | 3,912 | | | | 151,668 | | |

Entertainment - 1.48% | |

Flutter Entertainment Plc(a) | | | 12,548 | | | | 1,593,122 | | |

Healthcare - Products - 6.57% | |

Wright Medical Group N.V.(a) | | | 238,862 | | | | 7,058,372 | | |

Healthcare - Services - 0.16% | |

Metlifecare Ltd. | | | 64,168 | | | | 166,897 | | |

Holding Companies-Diversified - 3.14% | |

CC Neuberger Principal Holdings(a) | | | 46,018 | | | | 468,923 | | |

Collier Creek Holdings, Class A(a) | | | 43,259 | | | | 463,737 | | |

Foley Trasimene Acquisition Corp.(a) | | | 27,234 | | | | 279,149 | | |

Fortress Value Acquisition Corp.(a) | | | 35,134 | | | | 351,691 | | |

GigCapital3, Inc.(a) | | | 54,696 | | | | 543,678 | | |

Graf Industrial Corp.(a) | | | 32,802 | | | | 340,813 | | |

Live Oak Acquisition Corp.(a) | | | 53,988 | | | | 531,242 | | |

Sustainable Opportunities Acquisition Corp.(a) | | | 40,491 | | | | 400,861 | | |

| | | | 3,380,094 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

20

Water Island Diversified Event-Driven Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 69.08% (Continued) | |

Insurance - 2.55% | |

Willis Towers Watson Plc | | | 13,529 | | | $ | 2,745,034 | | |

Internet - 1.91% | |

Grubhub, Inc.(a) | | | 5,689 | | | | 322,794 | | |

IAC/interactivecorp(a) | | | 4,086 | | | | 1,104,732 | | |

Meet Group, Inc.(a) | | | 101,981 | | | | 630,242 | | |

| | | | 2,057,768 | | |

Lodging - 8.93% | |

Caesars Entertainment Corp.(a)(b) | | | 842,715 | | | | 9,598,524 | | |

Media - 0.41% | |

Madison Square Garden Entertainment Corp.(a)(b) | | | 5,515 | | | | 436,954 | | |

Pharmaceuticals - 2.15% | |

Paratek Pharmaceuticals, Inc.(a)(b) | | | 52,781 | | | | 234,348 | | |

Portola Pharmaceuticals, Inc.(a)(b) | | | 115,593 | | | | 2,074,894 | | |

| | | | 2,309,242 | | |

Real Estate Investment Trusts - 4.11% | |

Front Yard Residential Corp. | | | 28,550 | | | | 214,125 | | |

Taubman Centers, Inc.(b) | | | 101,628 | | | | 4,201,302 | | |

| | | | 4,415,427 | | |

Retail - 6.30% | |

Tiffany & Co.(b) | | | 52,854 | | | | 6,772,183 | | |

Software - 4.12% | |

Instructure, Inc.(a)(c) | | | 19,650 | | | | 962,850 | | |

MINDBODY, Inc., Class A(a)(c) | | | 48,463 | | | | 1,768,899 | | |

RIB Software SE(a) | | | 52,532 | | | | 1,691,082 | | |

| | | | 4,422,831 | | |

Telecommunications - 10.57% | |

Cincinnati Bell, Inc.(a)(d) | | | 109,283 | | | | 1,609,739 | | |

Gilat Satellite Networks Ltd.(a) | | | 140,004 | | | | 1,170,433 | | |

LogMeIn, Inc. | | | 101,029 | | | | 8,577,362 | | |

| | | | 11,357,534 | | |

TOTAL COMMON STOCKS

(Cost $73,892,218) | | | 74,253,346 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2020

21

Water Island Diversified Event-Driven Fund Portfolio of Investments (continued)

| | | Maturity

Date | | Rate | | Principal

Amount | | Value | |

CORPORATE BONDS - 6.97% | |

Commercial Services - 2.10% | |

Nielsen Co. Luxembourg SARL

(The)(b)(e) | | 10/01/2021 | | | 5.500 | % | | $ | 1,611,000 | | | $ | 1,613,014 | | |

Refinitiv US Holdings, Inc.(e) | | 05/15/2026 | | | 6.250 | % | | | 608,000 | | | | 649,040 | | |

| | | | | | | | | | 2,262,054 | | |

Entertainment - 1.56% | |

Stars Group Holdings B.V. /

Stars Group US

Co-Borrower LLC(e) | | 07/15/2026 | | | 7.000 | % | | | 1,585,000 | | | | 1,680,100 | | |

Household Products - 0.83% | |

Avon International Operations,

Inc.(b)(e) | | 08/15/2022 | | | 7.875 | % | | | 892,000 | | | | 888,673 | | |

Oil & Gas - 0.29% | |

Northern Oil and Gas, Inc.,

(8.50% Cash + 1.00% PIK) | | 05/15/2023 | | | 8.500 | % | | | 366,000 | | | | 307,440 | | |

Storage/Warehousing - 0.94% | |

Mobile Mini, Inc.(b) | | 07/01/2024 | | | 5.875 | % | | | 986,000 | | | | 1,010,650 | | |

Telecommunications - 1.25% | |

Cincinnati Bell, Inc.(e) | | 07/15/2024 | | | 7.000 | % | | | 1,305,000 | | | | 1,344,150 | | |

TOTAL CORPORATE BONDS

(Cost $7,617,322) | | | 7,493,067 | | |

CONVERTIBLE CORPORATE BONDS - 2.08% | |

Pharmaceuticals - 1.34% | |

Dermira, Inc.(b) | | 05/15/2022 | | | 3.000 | % | | | 1,430,000 | | | | 1,444,300 | | |

Semiconductors - 0.74% | |

Adesto Technologies Corp.(b)(e) | | 09/15/2024 | | | 4.250 | % | | | 674,000 | | | | 790,559 | | |

TOTAL CONVERTIBLE CORPORATE BONDS

(Cost $2,249,469) | | | 2,234,859 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

22

Water Island Diversified Event-Driven Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

WARRANTS - 0.02% | |

Investment Company Security - 0.02% | |

Graf Industrial Corp., Exercise

Price $11.50, Expires 12/31/2025(a) | | | 42,707 | | | $ | 21,353 | | |

Telecommunications - 0.00%(f) | |

Avaya Holdings Corp., Exercise

Price $25.55, Expires 12/15/2022(a) | | | 5,548 | | | | 2,164 | | |

TOTAL WARRANTS

(Cost $19,482) | | | | | 23,517 | | |

| | | Expiration

Date | | Exercise

Price | | Notional

Amount | | Contracts | | Value | |

PURCHASED OPTIONS(a) - 0.01% | |

Call Option Purchased - 0.01% | |

Cincinnati Bell, Inc. | | 08/2020 | | $ | 12.50 | | | $ | 82,488 | | | | 56 | | | $ | 7,840 | | |

TOTAL CALL OPTIONS PURCHASED

(Cost $1,104) | | | 7,840 | | |

TOTAL PURCHASED OPTIONS

(Cost $1,104) | | | 7,840 | | |

| | | Yield | | Shares | | Value | |

SHORT-TERM INVESTMENTS - 16.91% | |

Money Market Funds | |

Morgan Stanley Institutional Liquidity Fund

Government Portfolio, Institutional Class | | | 0.094 | %(g) | | | 9,085,428 | | | $ | 9,085,428 | | |

State Street Institutional U.S. Government

Money Market Fund, Premier Class | | | 0.249 | %(g) | | | 9,085,428 | | | | 9,085,428 | | |

| | | | | | | | | | | | 18,170,856 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $18,170,856) | | | 18,170,856 | | |

Total Investments - 95.07%

(Cost $101,950,451) | | | | | | | 102,183,485 | | |

Other Assets in Excess of Liabilities - 4.93%(h) | | | | | | | 5,295,924 | | |

NET ASSETS - 100.00% | | $ | 107,479,409 | | |

Portfolio Footnotes

(a) Non-income-producing security.

(b) Security, or a portion of security, is being held as collateral for short sales or forward foreign currency exchange contracts. At May 31, 2020, the aggregate fair market value of those securities was $29,539,966, representing 27.48% of net assets.

See Notes to Financial Statements.

Annual Report | May 31, 2020

23

Water Island Diversified Event-Driven Fund Portfolio of Investments (continued)

(c) Security fair valued using significant unobservable inputs and classified as a Level 3 security. As of May 31, 2020, the total fair market value of these securities was $2,731,749, representing 2.54% of net assets.

(d) Underlying security for a written/purchased call/put option.

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of May 31, 2020, these securities had a total value of $6,965,536 or 6.48% of net assets.

(f) Less than 0.005% of net assets.

(g) Rate shown is the 7-day effective yield as of May 31, 2020.

(h) Includes cash held as collateral for short sales and written option contracts.

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (11.19%) | |

Banks - (1.81%) | |

Morgan Stanley | | | (43,901 | ) | | $ | (1,940,424 | ) | |

Commercial Services - (0.01%) | |

Booz Allen Hamilton Holding Corp., Class A | | | (170 | ) | | | (13,559 | ) | |

Computers & Computer Services - (0.20%) | |

CACI International, Inc., Class A | | | (48 | ) | | | (12,037 | ) | |

Hewlett Packard Enterprise Co. | | | (4,814 | ) | | | (46,744 | ) | |

International Business Machines Corp. | | | (518 | ) | | | (64,698 | ) | |

Science Applications International Corp. | | | (141 | ) | | | (12,414 | ) | |

Seagate Technology Plc | | | (1,565 | ) | | | (83,008 | ) | |

| | | | (218,901 | ) | |

Electronics - (0.19%) | |

Comtech Telecommunications Corp. | | | (11,737 | ) | | | (209,036 | ) | |

Engineering & Construction - (0.11%) | |

Jacobs Engineering Group, Inc. | | | (464 | ) | | | (38,986 | ) | |

Stantec, Inc. | | | (1,472 | ) | | | (44,263 | ) | |

WSP Global, Inc. | | | (611 | ) | | | (39,433 | ) | |

| | | | (122,682 | ) | |

Entertainment - (3.36%) | |

Eldorado Resorts, Inc. | | | (56,802 | ) | | | (2,014,199 | ) | |

Flutter Entertainment Plc | | | (12,549 | ) | | | (1,593,238 | ) | |

| | | | (3,607,437 | ) | |

Environmental Control - (0.75%) | |

Advanced Disposal Services, Inc. | | | (24,685 | ) | | | (769,678 | ) | |

Tetra Tech, Inc. | | | (492 | ) | | | (38,819 | ) | |

| | | | (808,497 | ) | |

Insurance - (2.68%) | |

Aon Plc, Class A | | | (14,611 | ) | | | (2,877,637 | ) | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

24

Water Island Diversified Event-Driven Fund Portfolio of Investments (continued)

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (11.19%) (Continued) | |

Internet - (1.33%) | |

ANGI Homeservices, Inc., Class A | | | (15,200 | ) | | $ | (164,920 | ) | |

Match Group, Inc. | | | (9,729 | ) | | | (866,270 | ) | |

Uber Technologies, Inc. | | | (10,951 | ) | | | (397,741 | ) | |

| | | | (1,428,931 | ) | |

Real Estate Investment Trusts - (0.07%) | |

American Homes 4 Rent, Class A | | | (1,400 | ) | | | (35,336 | ) | |

Invitation Homes, Inc. | | | (1,467 | ) | | | (38,582 | ) | |

| | | | (73,918 | ) | |

Semiconductors - (0.44%) | |

Adesto Technologies Corp. | | | (38,931 | ) | | | (469,897 | ) | |

Telecommunications - (0.24%) | |

Cincinnati Bell, Inc. | | | (17,617 | ) | | | (259,498 | ) | |

TOTAL COMMON STOCKS

(Proceeds $10,710,822) | | | (12,030,417 | ) | |

EXCHANGE-TRADED FUNDS - (0.42%) | |

Equity Funds - (0.42%) | |

Consumer Discretionary Select Sector SPDR® Fund | | | (404 | ) | | | (50,173 | ) | |

iShares Russell Mid-Cap Growth ETF | | | (175 | ) | | | (27,058 | ) | |

iShares U.S. Real Estate ETF | | | (754 | ) | | | (58,375 | ) | |

VanEck Vectors Oil Services ETF | | | (2,422 | ) | | | (287,637 | ) | |

VanEck Vectors Semiconductor ETF | | | (213 | ) | | | (30,039 | ) | |

| | | | (453,282 | ) | |

TOTAL EXCHANGE-TRADED FUNDS

(Proceeds $436,601) | | | (453,282 | ) | |

TOTAL SECURITIES SOLD SHORT

(Proceeds $11,147,423) | | $ | (12,483,699 | ) | |

See Notes to Financial Statements.

Annual Report | May 31, 2020

25

Water Island Diversified Event-Driven Fund Portfolio of Investments (continued)

EQUITY SWAP CONTRACTS

Swap

Counterparty/

Payment

Frequency | | Reference

Obligation | | Rate

Paid/

Received

by the

Fund | | Termination

Date | | Upfront

Payments

Paid | | Upfront

Payments

Received | | Market

Value | | Notional

Amount | | Unrealized

Appreciation | |

Morgan

Stanley &

Co./

Monthly

| | Borgwarner,

Inc.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.350%) | |

08/19/2021 | | $ | — | | | $ | — | | | $ | — | | | $ | 2,630,674 | | | $ | — | | |

Morgan

Stanley &

Co./

Monthly

| | Charles

Schwab

Corp.

| | Received

1 Month-

Federal

Rate

Minus

40 bps

(-0.350%) | |

08/19/2021 | | | — | | | | — | | | | — | | | | 5,494,697 | | | | — | | |

| | | | | | | | | | | | | $ | — | | | $ | 8,125,371 | | | $ | — | | |

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | |

CAD | 5,965,300 | | | USD | 4,255,168 | | | Goldman Sachs & Co. | | 06/15/2020 | | $ | 77,432 | | |

EUR | 1,529,300 | | | USD | 1,667,668 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 30,373 | | |

USD | 3,552,692 | | | EUR | 3,156,800 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 47,575 | | |

GBP | 927,500 | | | USD | 1,099,208 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 46,308 | | |

USD | 1,170,339 | | | GBP | 927,500 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 24,822 | | |

NZD | 44,300 | | | USD | 26,848 | | | Goldman Sachs & Co. | | 06/15/2020 | | | 650 | | |

| | | $ | 227,160 | | |

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Depreciation | |

USD | 4,219,365 | | | CAD | 5,910,800 | | | Goldman Sachs & Co. | | 06/15/2020 | | $ | (73,652 | ) | |

USD | 628,270 | | | EUR | 572,900 | | | Goldman Sachs & Co. | | 06/15/2020 | | | (7,843 | ) | |

USD | 190,290 | | | NZD | 313,200 | | | Goldman Sachs & Co. | | 06/15/2020 | | | (4,119 | ) | |

| | | $ | (85,614 | ) | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

26

Water Island Diversified Event-Driven Fund Portfolio of Investments (continued)

The following is a summary of investments classified by country exposure:

Country | | % of Net Assets(a) | |

Netherlands | | | 8.13 | % | |

United Kingdom | | | 4.82 | % | |

Germany | | | 1.57 | % | |

Luxembourg | | | 1.50 | % | |

Ireland | | | 1.48 | % | |

Israel | | | 1.09 | % | |

Spain | | | 0.70 | % | |

United States Virgin Islands | | | 0.20 | % | |

New Zealand | | | 0.16 | % | |

United States | | | 75.42 | % | |

Other Assets in Excess of Liabilities | | | 4.93 | % | |

| | | | 100.00 | % | |

(a) These percentages represent long positions only and are not net of short positions.

Abbreviations:

bps - Basis Points. 100 Basis Points is equal to 1 percentage point.

CAD - Canadian dollar

ETF - Exchange-Traded Fund

EUR - Euro

GBP - British pound

LLC - Limited Liability Company

Ltd. - Limited

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

NZD - New Zealand dollar

PIK - Payment-in-kind

Plc - Public Limited Company

SA - Generally designates corporations in various countries, mostly those employing civil law. This translates literally in all languages mentioned as anonymous company.

SARL - Société Anonyme à Responsabilité Limitée is the French term for limited liability company.

SE - SE Regulation. A European Company which can operate on a Europe-wide basis and be governed by Community law directly applicable in all Member States

SPDR - Standard & Poor's Depositary Receipt

USD - United States Dollar

See Notes to Financial Statements.

Annual Report | May 31, 2020

27

Water Island Diversified Event-Driven Fund Portfolio of Investments (continued)

The following table summarizes the Water Island Diversified Event-Driven Fund's investments and derivative financial instruments categorized in the fair value hierarchy as of May 31, 2020:

Investments in Securities at Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets | |

Common Stocks | |

Auto Parts & Equipment | | $ | 2,443,980 | | | $ | — | | | $ | — | | | $ | 2,443,980 | | |

Biotechnology | | | 3,235,253 | | | | — | | | | — | | | | 3,235,253 | | |

Computers & Computer Services | | | 487,330 | | | | — | | | | — | | | | 487,330 | | |

Diversified Financial Services | | | 10,068,327 | | | | — | | | | — | | | | 10,068,327 | | |

Electronics | | | 1,251,909 | | | | — | | | | — | | | | 1,251,909 | | |

Energy - Alternate Sources | | | 300,897 | | | | — | | | | — | | | | 300,897 | | |

Engineering & Construction | | | 151,668 | | | | — | | | | — | | | | 151,668 | | |

Entertainment | | | 1,593,122 | | | | — | | | | — | | | | 1,593,122 | | |

Healthcare - Products | | | 7,058,372 | | | | — | | | | — | | | | 7,058,372 | | |

Healthcare - Services | | | 166,897 | | | | — | | | | — | | | | 166,897 | | |

Holding Companies-Diversified | | | 3,380,094 | | | | — | | | | — | | | | 3,380,094 | | |

Insurance | | | 2,745,034 | | | | — | | | | — | | | | 2,745,034 | | |

Internet | | | 2,057,768 | | | | — | | | | — | | | | 2,057,768 | | |

Lodging | | | 9,598,524 | | | | — | | | | — | | | | 9,598,524 | | |

Media | | | 436,954 | | | | — | | | | — | | | | 436,954 | | |

Pharmaceuticals | | | 2,309,242 | | | | — | | | | — | | | | 2,309,242 | | |

Real Estate Investment Trusts | | | 4,415,427 | | | | — | | | | — | | | | 4,415,427 | | |

Retail | | | 6,772,183 | | | | — | | | | — | | | | 6,772,183 | | |

Software | | | 1,691,082 | | | | — | | | | 2,731,749 | | | | 4,422,831 | | |

Telecommunications | | | 11,357,534 | | | | — | | | | — | | | | 11,357,534 | | |

Corporate Bonds** | | | — | | | | 7,493,067 | | | | — | | | | 7,493,067 | | |

Convertible Corporate Bonds** | | | — | | | | 2,234,859 | | | | — | | | | 2,234,859 | | |

Warrants | | | 21,353 | | | | 2,164 | | | | — | | | | 23,517 | | |

Purchased Options | | | 7,840 | | | | — | | | | — | | | | 7,840 | | |

Short-Term Investments | | | 18,170,856 | | | | — | | | | — | | | | 18,170,856 | | |

TOTAL | | $ | 89,721,646 | | | $ | 9,730,090 | | | $ | 2,731,749 | | | $ | 102,183,485 | | |

Other Financial Instruments*** | |

Assets | |

Forward Foreign Currency

Exchange Contracts | | $ | — | | | $ | 227,160 | | | $ | — | | | $ | 227,160 | | |

Equity Swaps | | | 0 | | | | — | | | | — | | | | 0 | | |

Liabilities | |

Common Stocks** | | | (12,030,417 | ) | | | — | | | | — | | | | (12,030,417 | ) | |

Exchange-Traded Funds | | | (453,282 | ) | | | — | | | | — | | | | (453,282 | ) | |

Forward Foreign Currency

Exchange Contracts | | | — | | | | (85,614 | ) | | | — | | | | (85,614 | ) | |

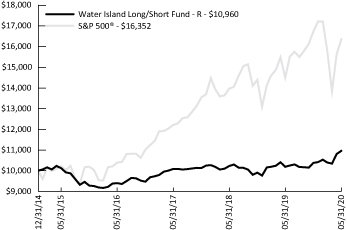

TOTAL | | $ | (12,483,699 | ) | | $ | 141,546 | | | $ | — | | | $ | (12,342,153 | ) | |